1. Introduction

As knowledge expands and new technologies emerge, this study explores the trends of research regarding the subject of accounting for cryptocurrencies (CA) and the growing interest in specific concepts between the researchers and professionals. The paper aims to evaluate scholarly scientific performance by measuring the keywords with the greatest impact in the field of research. Considering that bibliometric indicators provide quantitative information, they are used to evaluate the impact and the productivity of different entities or categories.

Factually, it identifies collaboration patterns between authors, organizations, or countries, as well as research gaps. It also evaluates the authors’ productivity and highlights the period when the research for cryptocurrency accounting started being of interest for researchers. Based on the recent analysis trend, the authors can also predict future exploration areas.

Therefore, the bibliometric analysis of cryptocurrency in accounting consists of identifying and analysing academic research articles, papers, and other scholarly publications that explore the intersection of cryptocurrency and accounting. The dataset for this study was obtained from the Web of Science Core Collection database. A combination of software tools was employed: VOSviewer for visualization and network analysis, together with Biblioshiny from RStudio, for data manipulation and exploration, and Microsoft (MS) Excel for basic graphs and world maps.

In order to conduct this study, the authors investigate the answers to the potential research questions for the bibliometric analysis: 1. Which themes are of interest among the researchers? 2. What is the current publication trend? 3. Which are the most influential sources? 4. Who are the most prolific authors? 5. What is the current state of collaboration between countries, organizations, and authors?

In addition, the bibliometric analysis of cryptoassets in accounting would involve conducting a literature review of academic studies with the purpose of analysing trends, identifying key research gaps, and evaluating the impact and influence of different publications in the field.

The paper is structured in two major parts: the first part which delves into the literature review of the assessed articles and the second part which shapes a bibliometric analysis of the manuscripts from WoS the database. The second part starts with explaining the selection and research methods that were applied on the dataset and it continues with the outputs of the exploration. The analysis results encompassed four pivotal types of visualization: keyword analysis (1) and citation analysis of authors (2), countries (3), and institutions (4). Thus, the discussion and conclusion parts reveal the most important findings and offer other exploration suggestions.

2. Literature Review

Nowadays, CA represents an element of novelty that provokes the reasoning of professional accountants, economists, and researchers. Thus, the literature review includes a range of topics related to the accounting and management of this type of assets. The key themes from the reviewed scientific papers in the database, involve: the challenges of accounting for crypto assets under existing financial standards, the influence of regulatory changes on the cryptocurrency market, and the taxonomy and unique characteristics of cryptocurrencies considering the technological advancements.

In theory, financial accounting and managerial accounting are vital subjects in the reporting and decision-making infrastructure, each serving specific purposes and addressing to different audiences. If financial accounting’s primary interest lies into external reporting according to specific standards (IFRS) and providing transparency and trust, managerial accounting’s task is to offer internal reporting focusing on costs and strategic planning.

Starting from the blockchain technology on which the cryptocurrencies are constructed (Dai and Vasarhelyi 2017; Yu, Lin and Tang 2018; Smith 2018; Gomaa, Gomaa and Stampone 2019; Fuller and Markelevich 2020; Church, Smith and Kinory 2021; Lombardi et al. 2022), to their accounting and financial reporting implications, many authors have adopted topics such as recognition, measurement, disclosure, auditing considerations, and taxation.

Yatsyk and Shvets 2020 underline the novelty of cryptocurrencies, suggesting a taxonomy based on their functionaly. Also, Derun and Mysaka 2022 delve into the ontological nature of crypto assets, offering clear definitions that can help in correctly reflecting these assets in financial and accounting statements.

The characteristics of cryptocurrencies are explored by Ramassa and Leoni (2022), who describes them as descentralised, not regulated, not influenced by inflation, anonymous, very volatile and secure. The descentralised character and the fact that crypto are issued on a network is also mentioned by Alsalmi, Ullah and Rafique (2023), Makurin et al. (2023), and Yu, Lin and Tang (2018).

It is true that crypto assets accounting is complex because they have unique characteristics that differ from traditional financial assets. The lack of a unified approach to accounting for crypto transactions is a significant challenge for both financial accounting and managerial accounting scholars. Different articles, considering the existing financial standards (IFRS), propose treating cryptocurrencies as intangible assets, financial investment, stocks or, lastly, monetary means (Yatsyk and Shvets 2020; Hampl and Gyönyörová 2021; Blahušiaková 2021; Derun and Mysaka 2022; Niftaliyev 2023; Makurin et al. 2023).

The initial obtaining or mining of crypto assets is described as a laborious and costly process, affecting the accounting treatment (Murayskyi and Shevchuk 2018; Luo and Yu 2022; Zadorozhnyi, Murayskyi and Shevchuk 2018; Harrast, McGilsky and Sun 2022; Barros, Bertolai and Carrijo 2023; Makurin 2023). This ambiguity demands a clear indication of how cryptocurrencies should be accounted for in financial records.

The approach to accounting at reevaluation model, for the fair value of cryptocurrencies and addressing exchange rate differences is discussed by Yan, Yan and Gupta (2022), Beigman et al. (2023), and Hubbard 2023.

Moreover, some key aspects such as crypto-mining and taxation are adressed, suggesting that these are significant areas within the broader context of financial accounting for digital assets (Angeline et al. 2021). Makurin et al. (2023) assume that the rapidly developing digital markets display a lack of preparedness in the accounting and taxation field for reflecting transactions involving cryptocurrencies. Also, Gomaa, Gomaa and Stampone (2019) have a practical approach, explaining how a transaction is made, taking into consideration its tax implications.

Representing 34% of the 29 articles, auditing aspects have been approached by Ozeran and Gura (2020) who believe that auditors lack experience with cryptoassets and this is posing auditing challenges (Dai and Vasarhelyi 2017; Fuller and Markelevich 2020; Dyball and Seethamraju 2021).

Nonetheless, the literature can be analysed from the thematical point of view, in order to consolidate the prevalent discussions and to understand the different perspectives on CA. In addition, the originality of this study results from examining and categorizing the articles from the database in four pivotal research themes related to accounting: financial accounting, managerial accounting, taxation accounting and auditing. Thus, each article was assessed, through reading and searching for explicit key terms, such as: “accounting”, “financial”, “financial accounting”, “management accounting”, “managerial accounting”, “fair value”, “cost(s)”, “tax”, “taxation”, “tax accounting”, “taxation accounting”, “audit”, “auditing”, “internal auditing”.

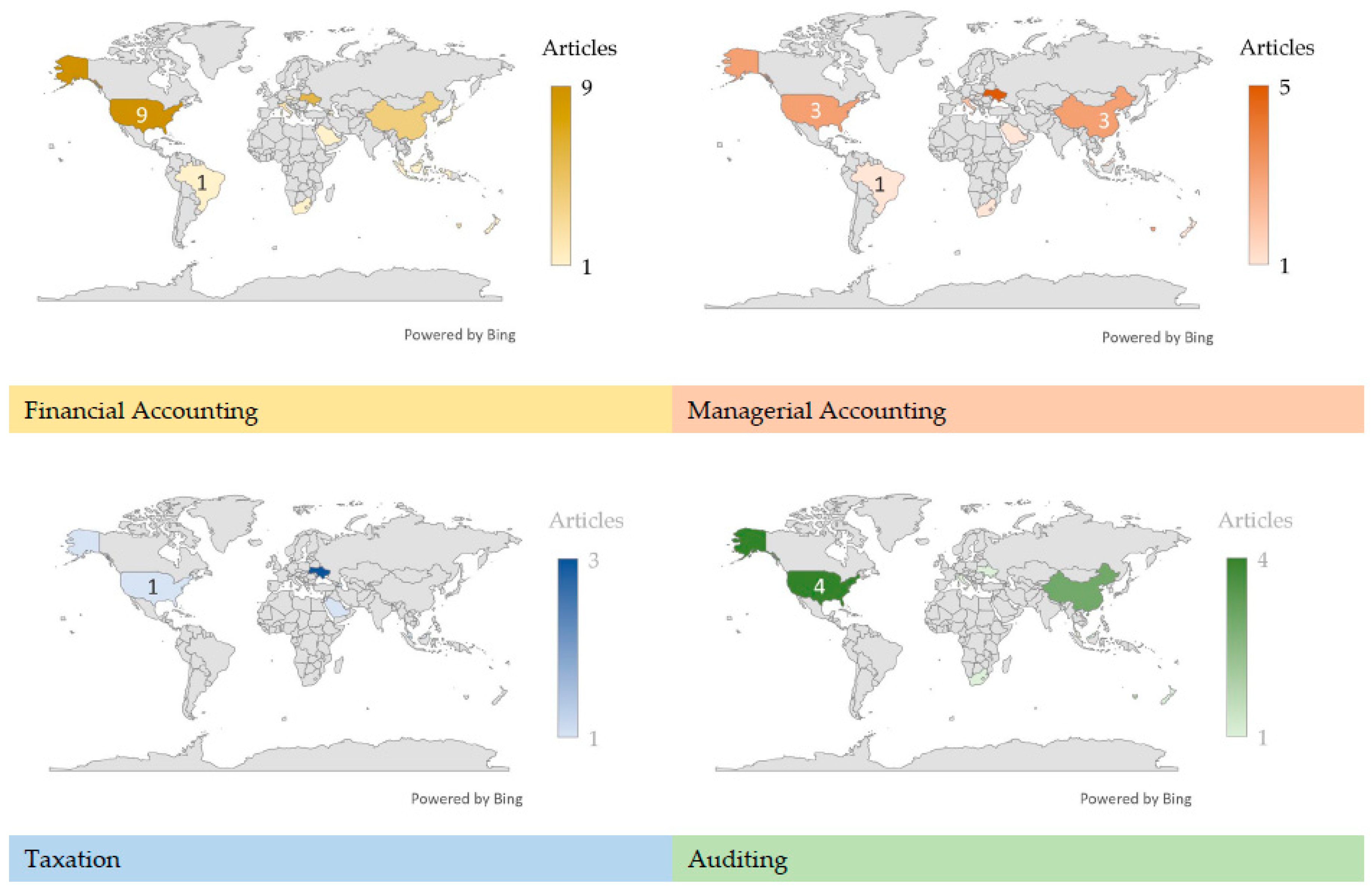

The findings of this exploration were materialized in

Table 1 which presents the authors that delved into the mentioned themes and the geographical regions of the research setting. Thus, the distribution of the 4 themes suggested is: “financial accounting” theme is represented in 100% of the articles, meaning all the 29 items in yellow shades; the “managerial accounting” theme appears in 62% of the papers, counting 18 orange items; 28% of the manuscripts write about “taxation” (8 articles in blue color), and 34% of the studies discuss about “auditing” (10 of the articles in green shades from the table).

From

Figure 1 results that most of the studies on financial accounting (9 articles) and auditing (4 articles) are from the USA. Henceforth, Ukraine manifested a higher interest in managerial accounting research (5 articles) and taxation matters (3 articles). The data from

Figure 1 was extracted from WoS analysis results; the information resulted was attentively inserted and processed into tables in MS Excel, following the plotting of the maps, with the facility the software has, to generate and insert this type of graphics.

Therefore, the literature review emphasizes the need for further research and development of accounting standards that can include the unique characteristics of cryptocurrencies. Additionally, understanding the impact of regulatory changes and market dynamics is crucial for the stakeholders from this ecosystem. As the digital economy continues to evolve, the accounting of crypto assets remains a critical area of study.

The contribution of this bibliometric study is reflected in providing a detailed summary of the present state of understanding on CA, consolidating the previous discussions in

Table 1, which points to the key insights from the literature regarding the accounting and auditing categories. Thus, it provides a quantitative overview using visualization techniques. To conduct the study, the authors accessed the database from Web of Science (WoS), which offers permission to a vast collection of academic and scientific literature. WoS is a precious tool for researchers, scientists, and scholars for literature searching, citation analysis, and monitoring research impact.

3. Research Method

For this analysis, the authors developed a search plan to identify the relevant literature using specific keywords or key terms. The selection criteria were customized to “Web of Science Core Collection”, using the term “cryptocurrency accounting” to search based on the topic. For all results, the timespan was from 2017 to 2023, and the sources included journal articles and review articles. Only English – language published content was included in the search.

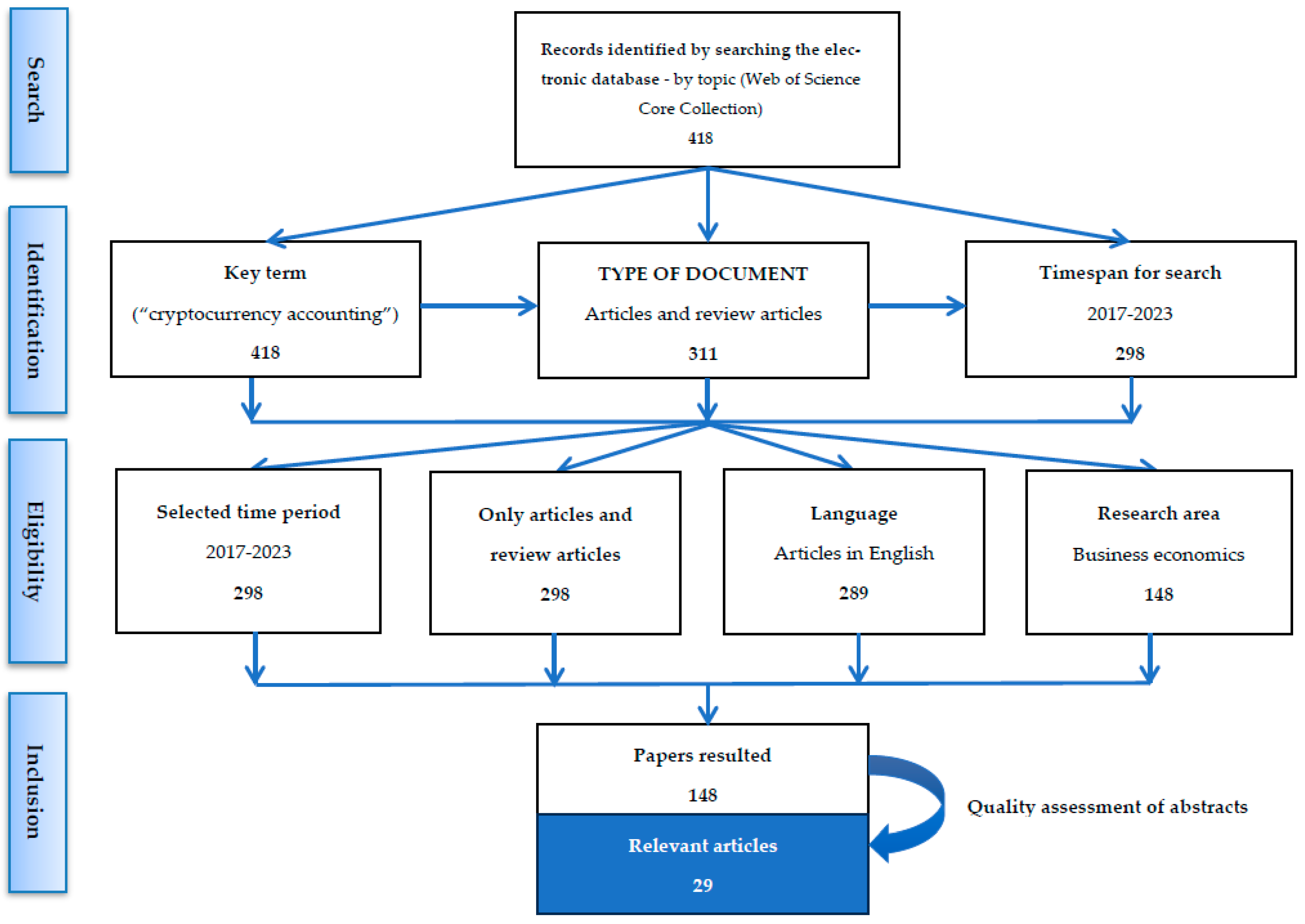

The search filters for this study were meticulously designed to target the available literature on “cryptocurrency accounting”, within the Business economics research area from different countries worldwide. As a result, out of a total of 418 scientific papers, 270 were not considered relevant, and excluded according to the eligibility steps described in

Figure 2. This scheme shows the selection of studies and the inclusion or exclusion criteria of papers at every stage. Therefore, the database included 148 research papers that were suitable, based on the inclusion standards.

Further, the authors assessed the quality of the papers included. In order to maintain the accuracy of the database it was checked for duplicates. There were not found any duplicates in the dataset. Hence, abstracts of the papers were analysed to ensure the relevance of academic literature included in the process. After reading the abstracts of the 148 papers, we conducted a thorough evaluation because either the key terms were absent, not related to our study, or did not appear together. By choosing manuscripts related to CA that contained both terms, through manual selection, the number of relevant articles reduced to 29, which were added to the Marked List results from WoS. This procedure was made to assure the accuracy of the samples from the database, because not all of the articles contained both keywords, or even if these terms appeared, the manuscripts were not relevant for the study, as the term “accounting” did not refer to “bookkeeping” or financial aspects of cryptocurrencies.

Consequently, in the data extraction phase, there were selected 29 papers with the following characteristics:

Original journal articles and review articles.

The scientific documents were published between 2017 - 2023.

The papers are in English and from the field of Business economics.

Included papers from all over the world.

Manuscripts related to the topic of “cryptocurrency accounting”.

Table 2 shows the scientific categories where the relevant articles can be found, and the number of articles released for each category. Thus, the discipline of “Business Finance” counts the highest record, of 20 documents, which means almost 69% of the articles from the dataset. The next discipline, with 9 recorded documents, is “Economics” (31% of the articles). The third area is “Business” which recorded 3 counts (10%). Other criteria researched, with 1 record each representing 3.448% of the articles, are from “Cultural Studies”, “Management”, “Mathematics Interdisciplinary Applications”, “Social Sciences Mathematical Methods” and “Sociology” fields.

Even if it corresponds to the “Cultural Studies” category, the manuscript of Soepriyanto et al. (2023) explores the interplay between the technological development, its influence on the financial market, and the accounting legislation. Furthermore, the article belonging to the “Sociology” field, written by Rella (2020), highlights the importance of the infrastructure of payments and accounting records in the sole form of material existence for cryptocurrencies.

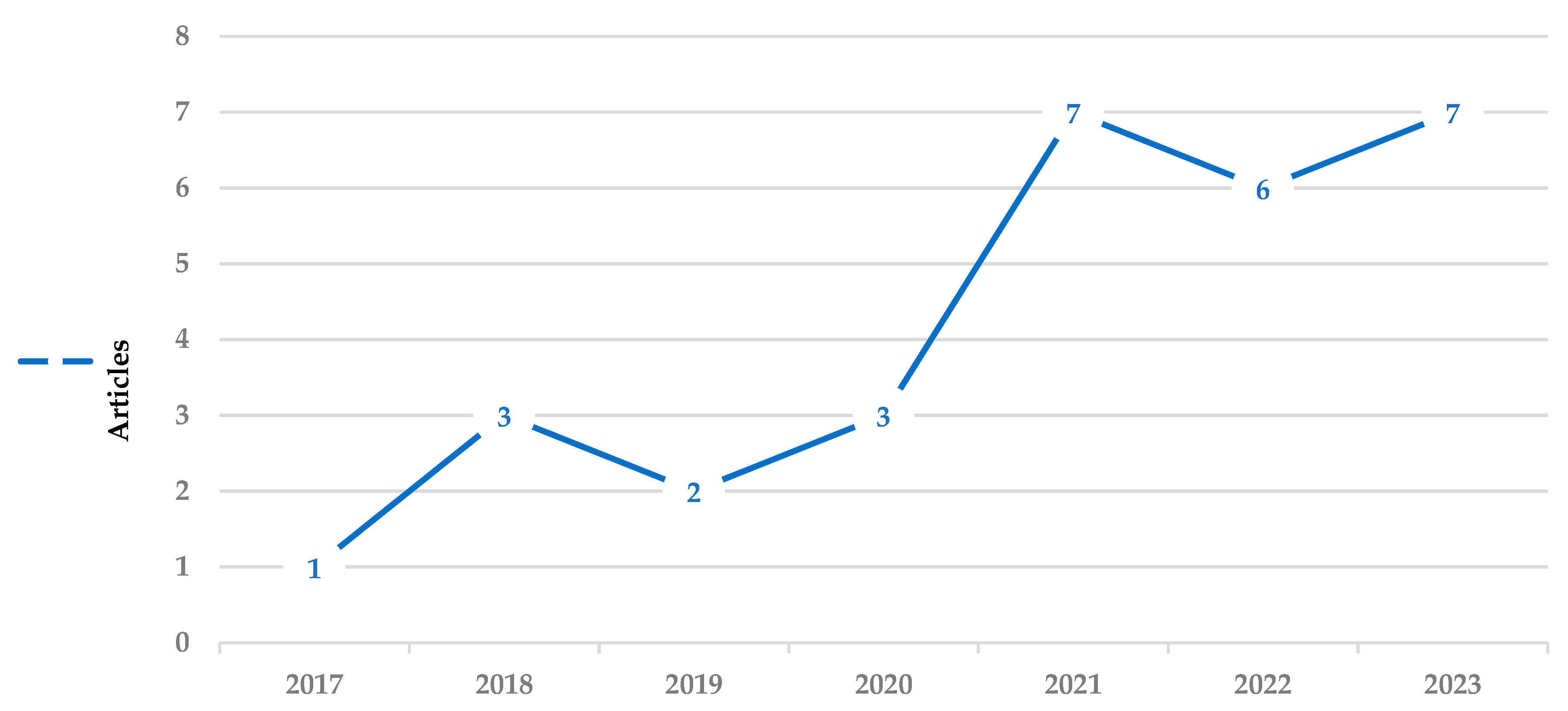

Besides the most important research fields, the authors consider it relevant for this study to observe the annual scientific production of documents on CA. The evidence from

Figure 3 suggests that the number of publications is continually growing due to the rising interest for this subject. Starting from 2017 when the first scientific paper from the database was available, the production of articles evolved until 2018 when 3 scholarly publications were recorded. Despite the low number of publications in 2019 and 2020 (2 and 3 articles), in 2021, 2022 and 2023 the production per year grew to 6 - 7 publications, a significant increase compared to the previous period. The growing trend might appear due to the intensification of online transactions during the Covid-19 pandemics and the development of blockchain technologies, therefore the necessity to study and legally recognize this type of activity.

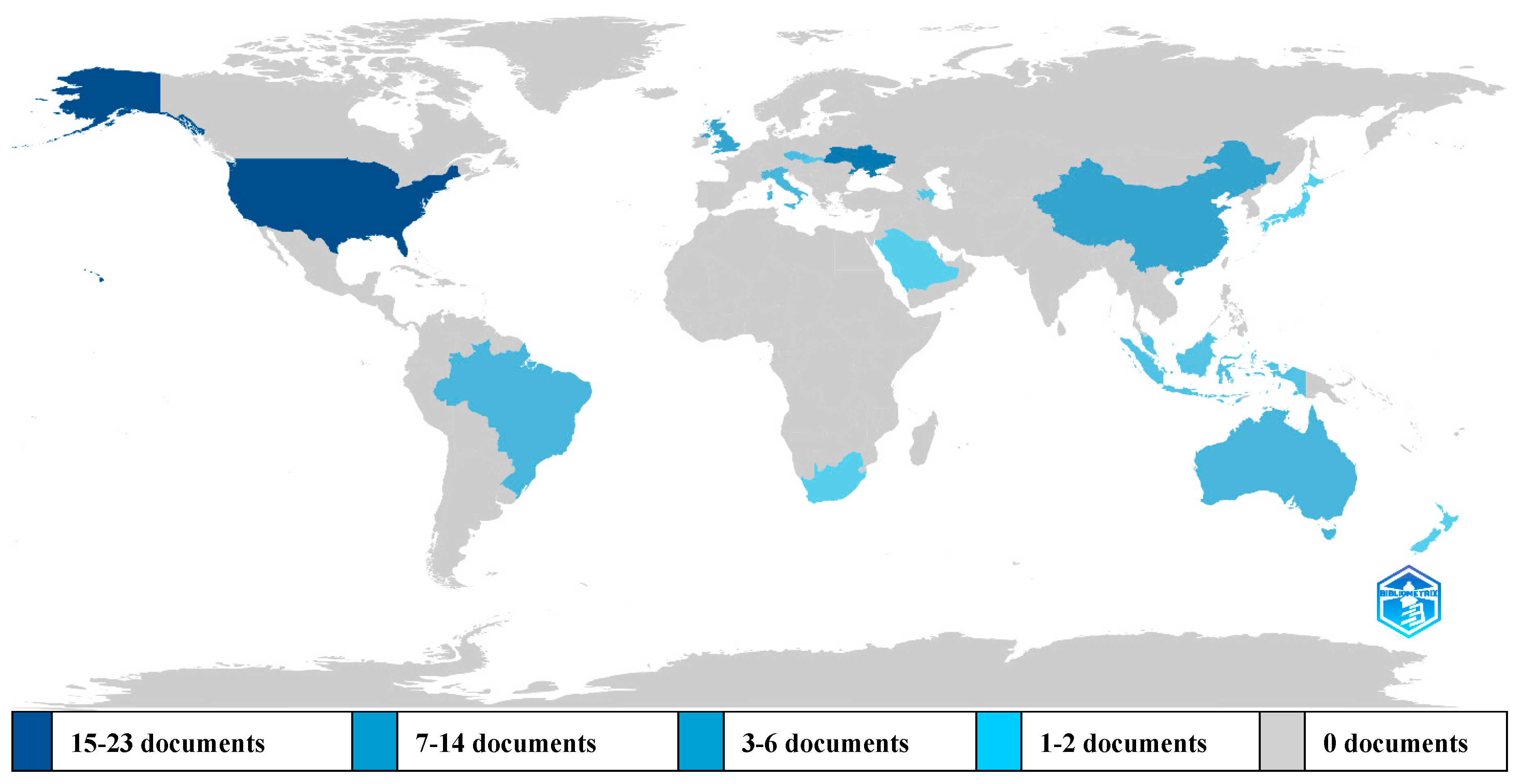

At macro level, regarding the country scientific production of articles, the authors projected, with the help of Biblioshiny, the map from

Figure 4, which illustrates the fact that the USA is the world leader in the research regarding CA, with 23 documents released. Ukraine follows with a frequency of 15 articles, indicating its growing interest in the study subject. Other important countries released equal number of articles: China (8 research papers), United Kingdom (8 documents). Australia, Brazil, and Italy each have 5 manuscripts on CA, while the Czech Republic has 4 articles. As follows, there are countries with less articles published: Indonesia and Malaysia (with 3 articles), Azerbaijan and Slovakia (2 documents), Japan, New Zealand, Saudi Arabia, and South Africa (1 article). Clearly, there continues to be interest in studying CA, as evidenced by the multiple countries involved in the research.

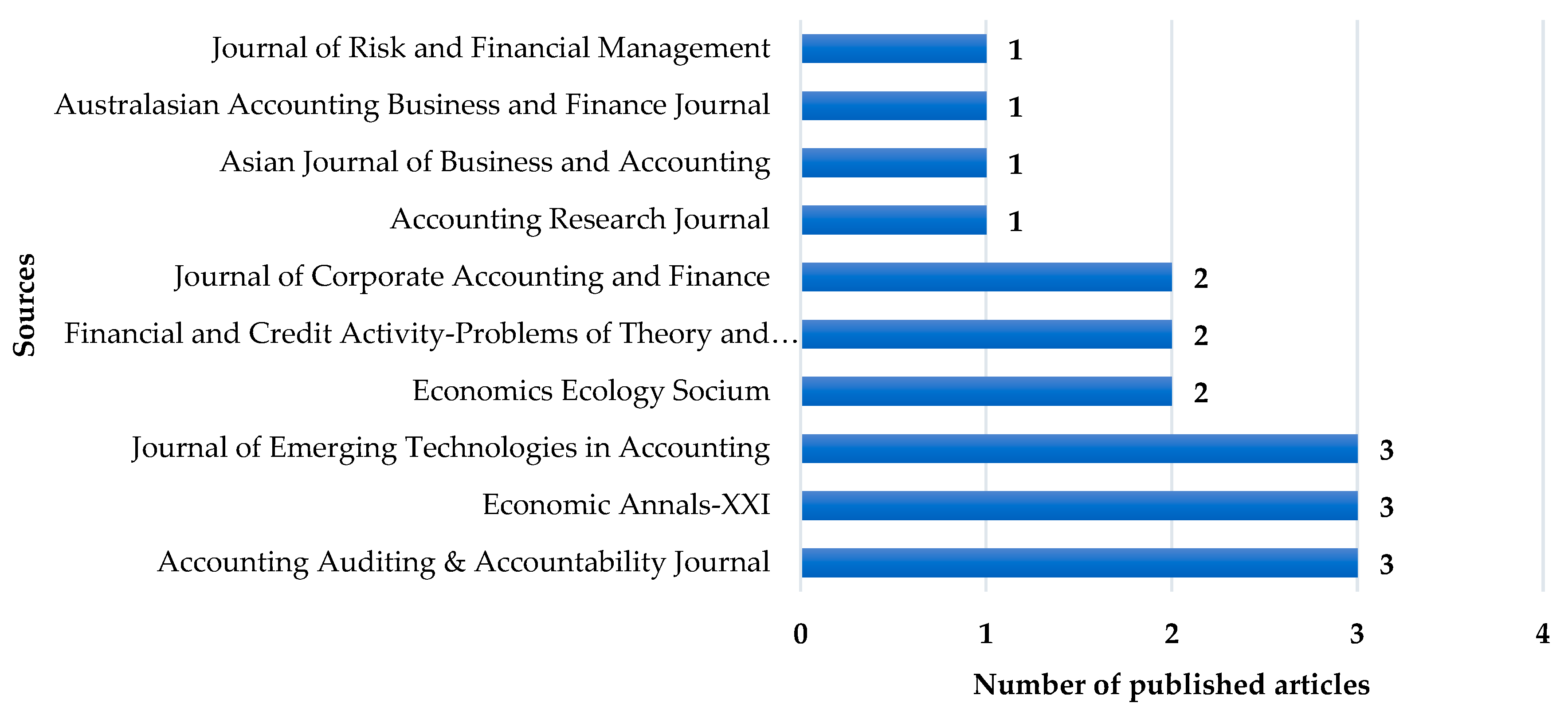

At micro level,

Figure 5 illustrates the top 10 of the most relevant sources where articles about CA were published. The sources are presented in an increasing order, from “Australasian Accounting Business and Finance Journal” and “Asian Journal of Business and Accounting” with 1 article published. Also, there are four journals with identical number of articles published (2 articles): “Journal of Risk and Financial Management”, “Journal of Corporate Accounting and Finance”, “Financial and Credit Activity - Problems of Theory and Practice” and “Economics Ecology Socium”. Other significant sources with 3 publications are: “Journal of Emerging Technologies in Accounting” and “Accounting Auditing & Accountability Journal”. The journal with the highest number of releases is “Economic Annals-XXI” with 4 articles published.

4. Analysis Results

The empirical results of the bibliometric analysis are based on the outputs from VOSviewer, Biblioshiny and Microsoft Excel. VOSviewer generates three distinct kinds of bibliometric maps, which include cluster visualization, “overlay visualization”, respectively “density visualization” (Van Eck and Waltman 2023). The graphics were employed to identify and illustrate the co-occurrence of the keywords the authors used in their publications, and the greatest number of citations generated by an author, an institution, and a country. As well, Biblioshiny is an instrument that uses data from bibliographic databases to perform bibliometric analysis or portray dynamic maps and graphs. Nonetheless, with MS Excel we studied the most relevant sources and generated different figures and maps.

4.1. Keyword Analysis

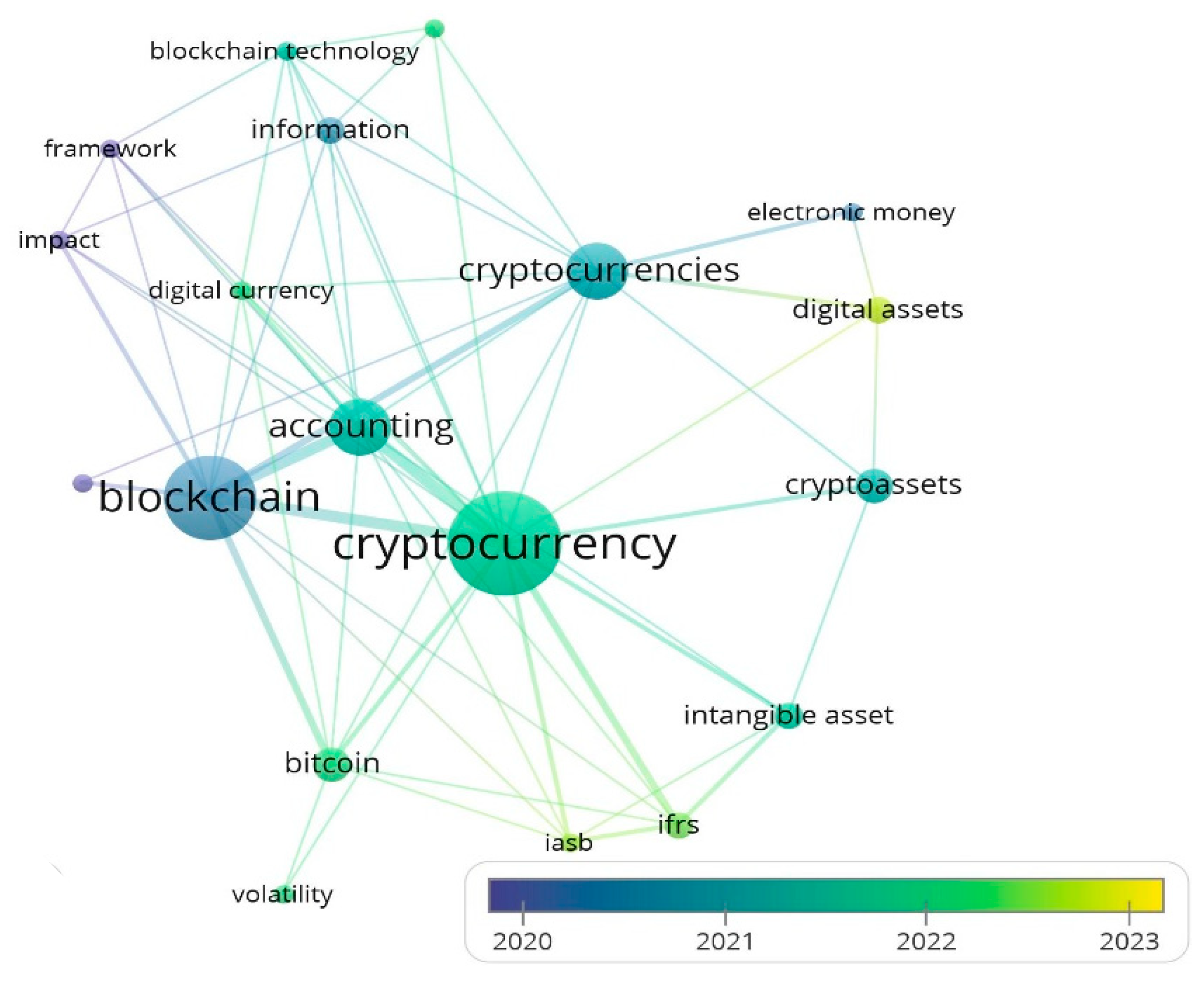

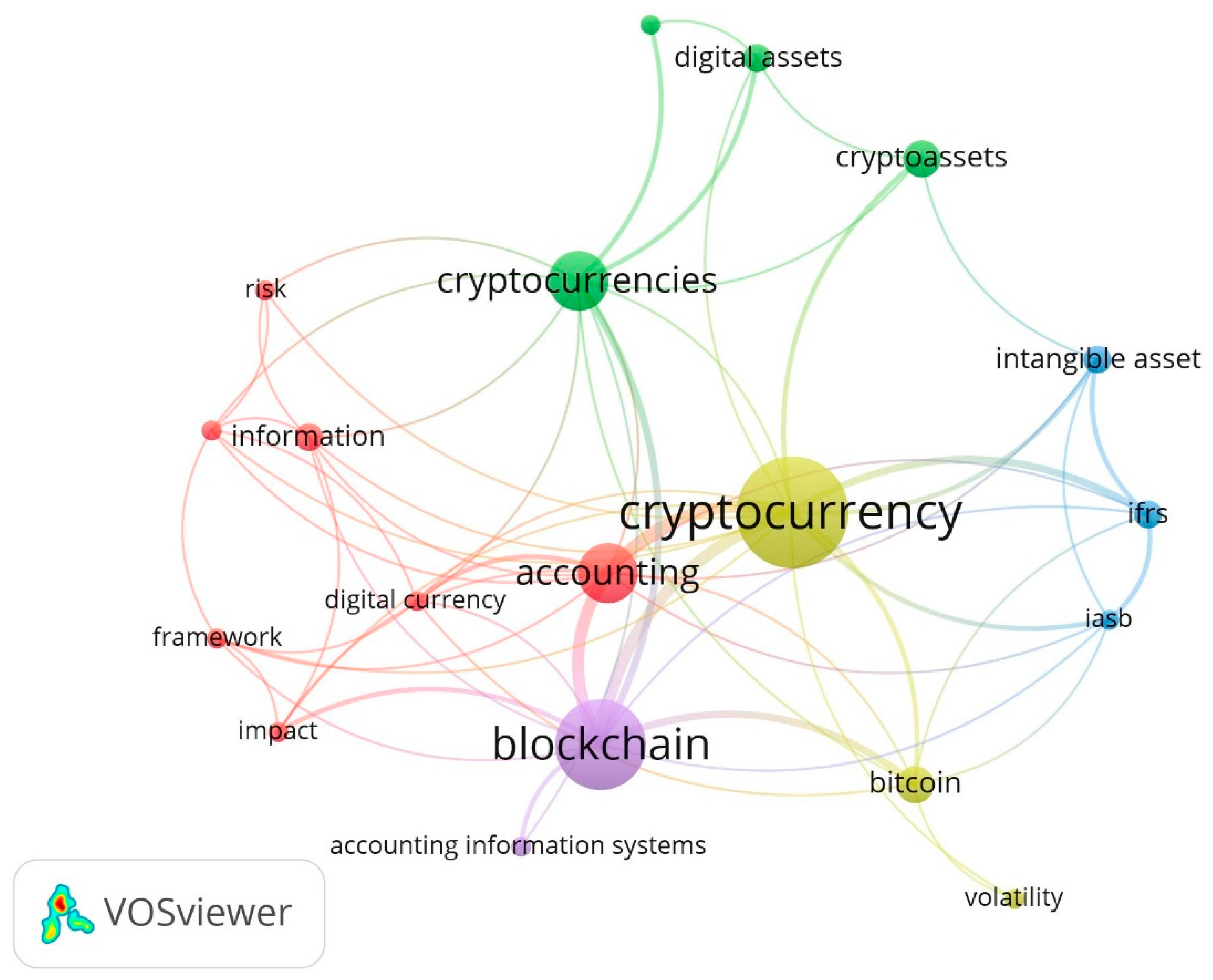

Keyword analysis is the process used to identify the key terms and words that are relevant to this topic. In this way the most important keywords are highlighted, and the researchers become aware of their importance. In this analysis the authors set a threshold of 2 keywords to appear together, because of the reduced number of studies on this subject now. As a result, after processing the database in VOSviewer, out of the total of 136 keywords, 20 met the limit. The word “smart contracts” was eliminated because it is not relevant for this study. Thereby, for all the 19 keywords included, the whole strength of the links between co-occurring keywords was computed. It is noteworthy the fact that between two words, can appear just one link of different thicknesses.

Figure 6 reveals the most important keywords according to the selections made, reflected by the nodes, the frequency of the keywords shown by the size of the vertex and the relationship between the terms illustrated by the edges. The stronger is the relationship, the thicker and the shorter is the line between the words. The edge weight indicates the number of articles in which two items occur together. Hence, a network, or a cluster, is constructed by a set of nodes of the same color with links between them. VOSviewer 1.6.20 Manual explains that each cluster has a specific color and a number, to be easily identified (van Eck and Waltman 2023).

Evaluating the distance between the yellow cluster, where the principal word is “cryptocurrency” and the red cluster, which comprises the second term of the analysis, “accounting”, it can be remarked that the two clusters are positioned next to each other. The thickness of the edge between “cryptocurrency” which is directly connected to “accounting” explains the necessity of this analysis.

For a more detailed explanation, in Tabel 3 are presented the most relevant key terms which appear in the network visualization figure. In the biggest nodes (yellow, purple, green, and red) can be identified the three important words “cryptocurrency”, “blockchain”, and “accounting”. Consequently, these vertex form clusters with other keywords of the same color, which means that they are more likely to co-occur in the same scientific paper, covering together a specific topic.

The co-occurrence overlay visualization map (

Figure 7) depicts the key terms according to the period in which they were published. Therefore, as it can be seen, terms such as “digital assets”, “iasb”, “ifrs” colored with yellow, were used in recent publications, around 2023. Next on the timescale, with light green shades, in the period from 2022 to the beginning of 2023, it is noticeable that the most frequently used words were: “bitcoin”, “volatility”, “cryptocurrency”, “intangible asset” and “accounting”. This suggests that during this time, discussions and research on the accounting and reporting of cryptocurrency as an intangible asset were prevalent. Before 2021, keywords such as “cryptoassets”, “blockchain technology” highlighted with darker green and blue, were frequently used. Hence, it is likely that these words will be interrelated to subjects on the impact of cryptocurrencies on specialised markets and the emergence of new regulations.

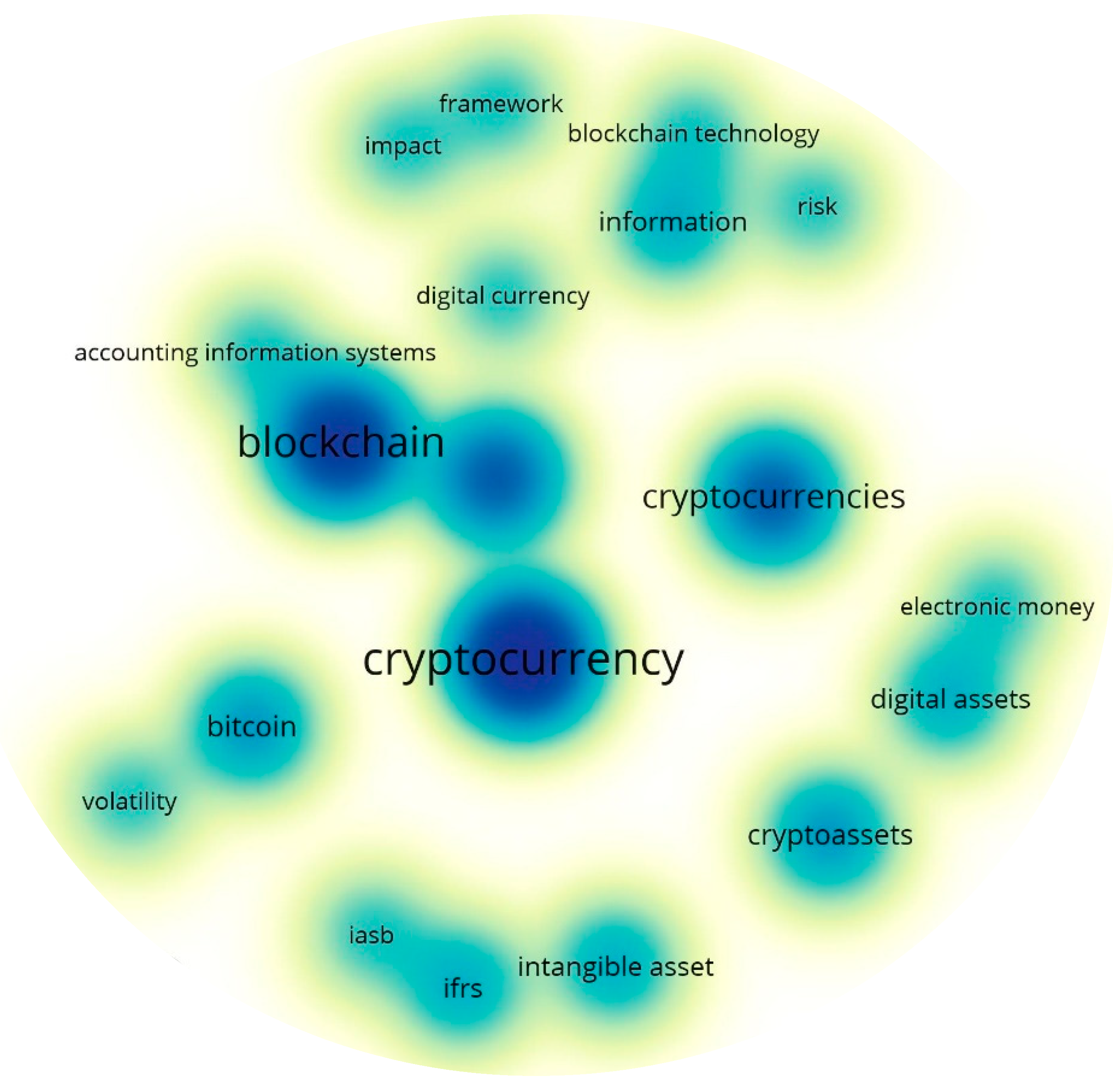

Moreover, the co-occurrence density visualization map (

Figure 8) exhibits the most concentrated areas regarding the usage of the key-terms. The standard gradient of colors varies from shades of blue to green, ending with yellow. When an item has a higher density and its weight is increased, the color is dark blue and when the density is lower, the shade is light yellow. Thus, the densest zones, with dark blue shades, are the ones around the terms: “cryptocurrency” with 14 occurrences, “blockchain” with 11 apparitions, “cryptocurrencies” which appears 7 times, and “accounting” with 7 occurrences. Near the paramount zone, in light blue shades, but also important, are displayed connected items: “ifrs” with 3 materializations, “intangible assets” which appears 3 times and “iasb” with 2 occurrences. From this illustration it can be observed that “cryptocurrency” and “accounting” are neighboring items, emphasizing the fact that accounting practices need to evolve and ensure accurate and transparent reporting for cryptocurrency activities.

Table 3.

Keyword clusters for CA in VOSviewer.

Table 3.

Keyword clusters for CA in VOSviewer.

| Clusters |

Most relevant key-terms |

Occurrences |

Total link strength |

Main topic |

Cluster 1 red

(7 items)

|

accounting |

7 |

21 |

Crypto accounting framework |

| blockchain technology |

2 |

7 |

| digital currency |

2 |

8 |

| framework |

2 |

6 |

| impact |

2 |

6 |

| information |

3 |

7 |

| risk |

2 |

4 |

Cluster 2 green

(4 items)

|

cryptoassets |

4 |

5 |

Types of digital assets |

| cryptocurrencies |

7 |

16 |

| digital assets |

3 |

5 |

| electronic money |

2 |

3 |

Cluster 3 blue

(3 items)

|

iasb |

2 |

8 |

Crypto assets financial standard recognition |

| ifrs |

3 |

10 |

| intangible asset |

3 |

7 |

Cluster 4 yellow

(3 items)

|

bitcoin |

4 |

11 |

Crypto assets characteristics |

| cryptocurrency |

14 |

30 |

| volatility |

2 |

2 |

| Cluster 5 purple (2 items) |

accounting information systems |

2 |

3 |

Technology |

| blockchain |

11 |

25 |

Figure 7.

Co-occurrence overlay visualization of author keywords for CA. Source: Authors’ projection with VOSviewer.

Figure 7.

Co-occurrence overlay visualization of author keywords for CA. Source: Authors’ projection with VOSviewer.

Figure 8.

Co-occurrence density visualization of author keywords for CA. Source: Authors’ projection with VOSviewer.

Figure 8.

Co-occurrence density visualization of author keywords for CA. Source: Authors’ projection with VOSviewer.

In fine, it can be concluded that the relationship between the two topics continues to be of great importance and relevance, as the accounting and auditing of digital assets is in the phase of development and discovery.

4.2. Citation Analysis of Authors, Organizations and Countries

The citation analysis shows the bibliography impact and the most relevant documents that study CA, which is reflected in the total number of citations of a scientific work. Therefore, this study focuses on specifying the number of times a certain author, institution, or country has been cited. These techniques would help identify the most influential organizations and collaboration networks between authors and countries.

4.2.1. Citation Analysis of Authors

In order to be more specific, the citation analysis of authors involves identifying how many times writers have been cited by counting the references for each document in the dataset and analysing how often different pairs are cited together. The study exposes the total link strength attributed to a specific author. Therefore, it can help identify highly cited, influential scientists and their interconnections within the research, or their most significant contribution.

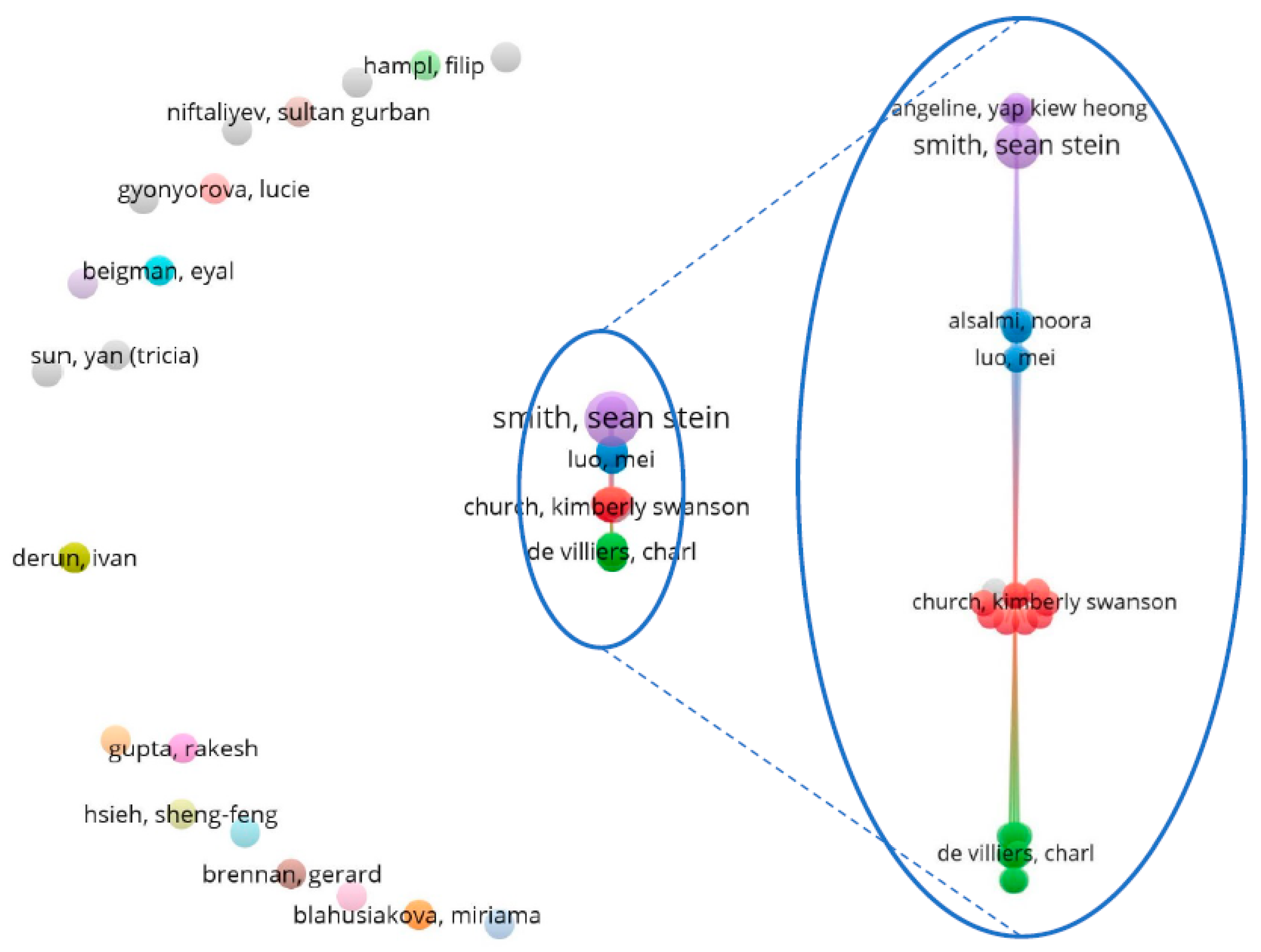

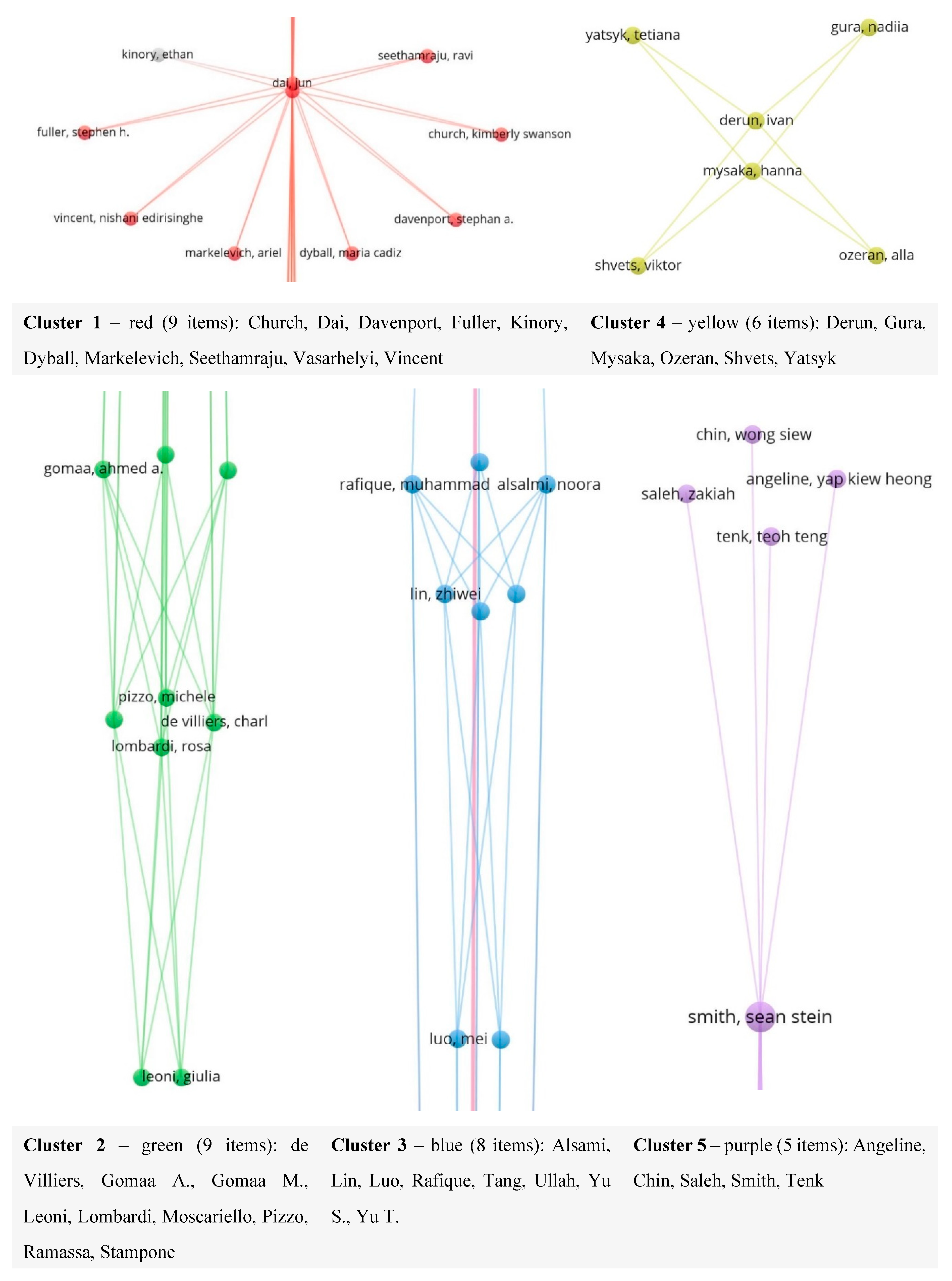

For this analysis we chose a threshold of 1 citation of a document written by an author as a minimum requirement for inclusion in the research. An explanation for choosing this threshold would be that the more an author is cited, the more comparable and of interest the scientific paper would be, but in this case, we want to have an image of the authors who wrote on the subject, knowing that new ideas take time to get recognised. Hence, from 67 authors comprised by the database, there were extracted 57 authors that met the limit. VOSviewer calculates the strength of citation links between all authors and identifies the ones with the highest power (van Eck and Waltman 2023). Even if so, only 32 items are connected to each other. This means that the items which are not connected, are not cited between the others from their cluster.

The analysis’ normalization is conducted through the method of strength association. As a result, in

Figure 9, the 57 items representing the authors from the database were grouped in 25 clusters, with 92 links between them. Even if the collaboration between the authors is not very developed, the novelty and notoriety of the subject could raise the interest of other scientists.

The implication of this type of analysis is that it exposes the relationships between the cited authors, and it delves into the prolific research themes that concentrate on the key term “cryptocurrency accounting”. Additionally, VOSviewer generates maps that illustrate collaborations between authors, by visualizing their network in a graphical format. These maps also indicate the density and centrality of specific researchers within a particular research area.

Therefore, from

Figure 9,

Figure 10, and

Table 4, it can be discovered that Dai and Vasarhelyi (2017) from the red cluster, were co-authors and received the most citations (288 citations), with a total edge power of 22, for 1 document published. Their article was made public in the “Journal of Information Systems”, indexed in SSCI – Business, Finance, which has as publisher the “American Accounting Association”.

On the second place there are three co-authors, from the red cluster, Yu, Lin and Tang (2018) who published in “Journal of Corporate Accounting and Finance” an article that received 49 acknowledgements with a total link strength of 5. The Journal in which they published is indexed ESCI in the Business, Finance category, with Wiley as publisher. Also, Fuller and Markelevich (2020) published their manuscript (29 citations) in this Journal.

Another outstanding journal is the “Accounting Auditing & Accountability Journal”, indexed SSCI – Business, Finance, publisher “Emerald Group Publishing”, in which the following authors chose to make public their research: Ramassa and Leoni (2022) (11 recognitions), Lombardi et al. (2022) (27 citations), Dyball and Seethamraju (2021) (10 citations).

Surely, Rella (2020) chose for the article which received 26 quotes, the “Journal of Cultural Economy”, indexed SSCI – Cultural Studies, Economics, Sociology and AHCI – Cultural Studies, publisher “Routledge Journals, Taylor & Francis”.

Ergo, the clusters from the citation of authors network are more dispersed, conducting to the fact that the connection between the authors of the studies included is not very tight, but the collaborations are promising.

4.2.2. Citation Analysis of Countries

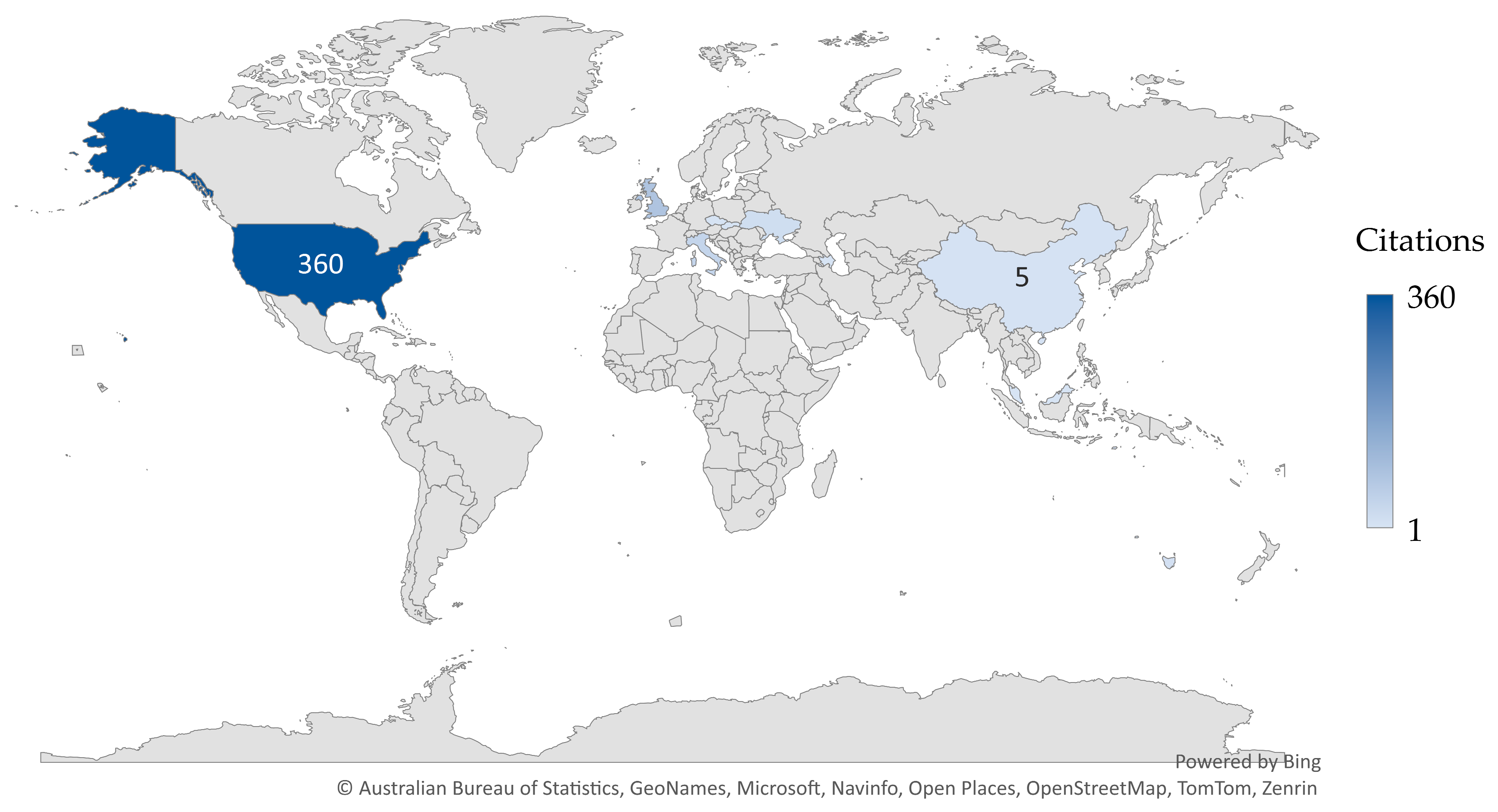

The citation of countries analysis reveals the most common collaborations between countries, and it offers quantitative insights into the research output affiliated with those states. The authors of this article generated the map of most cited countries choosing the formatting Miller map projection in MS Excel, from the data retrieved from Biblioshiny.

Observing

Figure 11, it can be easily seen that USA is the paramount when exploring the CA, with 360 citations of scientific scripts. The following countries are United Kingdom with 81 quotations and Italy with 38 credits. We can also mention Ukraine which is in the top 5 of the most cited countries with 17 papers quoted. The following countries have each a total citation below 20: Australia (10 citations), China (5 citations), Czech Republic and Slovakia (4 citations), Azerbaijan and Malaysia (1 citation).

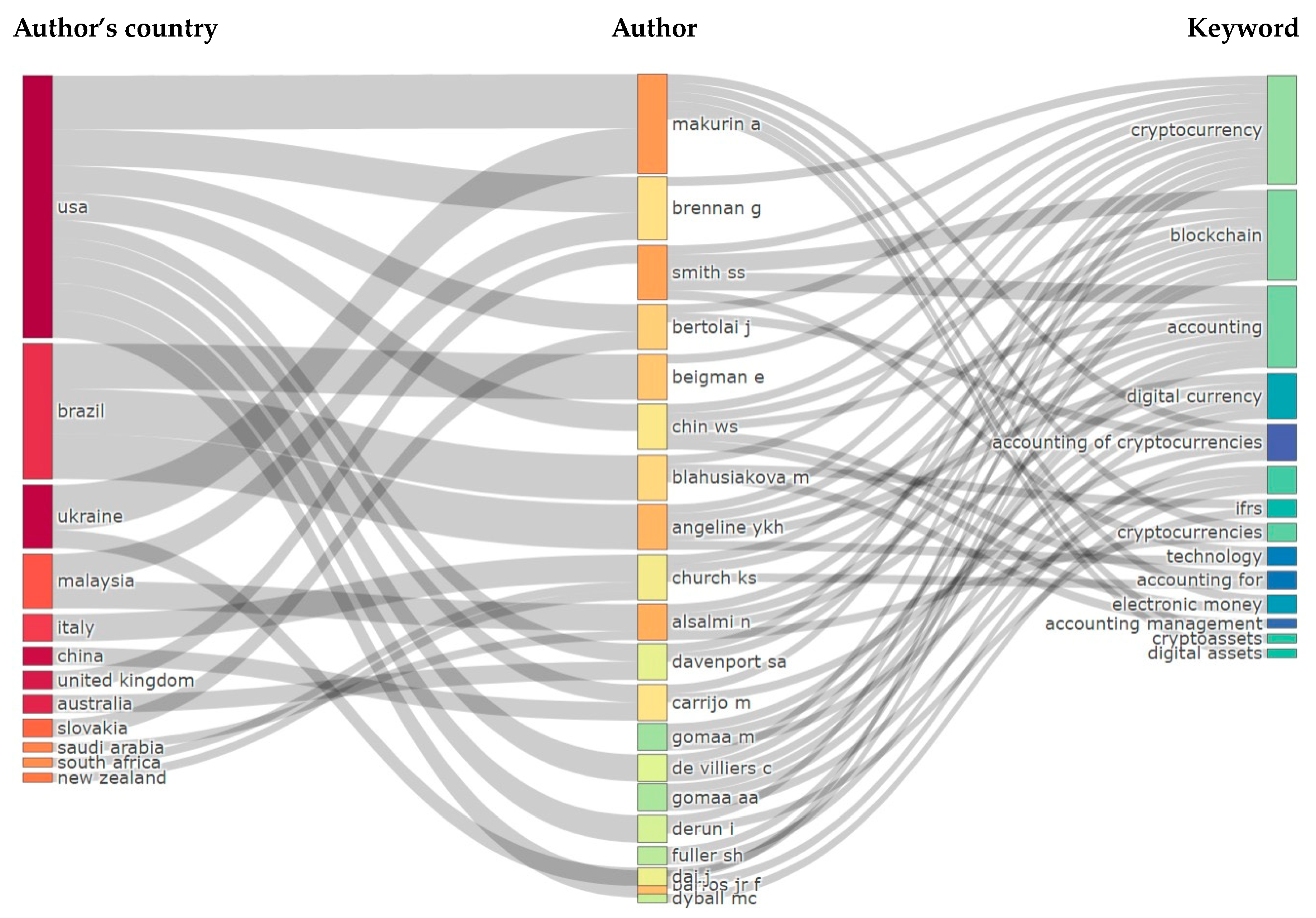

To connect the authors with their countries and the keywords used, we generated the three-field plot with Biblioshiny (

Figure 12). The plot aims to visualize the relationship between authors, their affiliated countries, and the keywords used in their publications. The authors’ country is colored in red shades, the author alone is colored in yellow and green shades and the keywords field is green and blue shaded. The plot shows the strength of collaboration between authors of different countries on specific topics. By analysing the plot, USA (9 outgoing flows) and Brazil (3 outgoing authors) are the regions with multiple authors who used most of the keywords. The following countries with important impact and great potential are Ukraine (2 authors), Malaysia (2 outgoing flows), Italy, China, United Kingdom, Australia, Slovakia (1 outgoing author each). We mention that in this explanation, authors represent outgoing authors or outgoing flows, all three terms describing the geographic distribution of authorship.

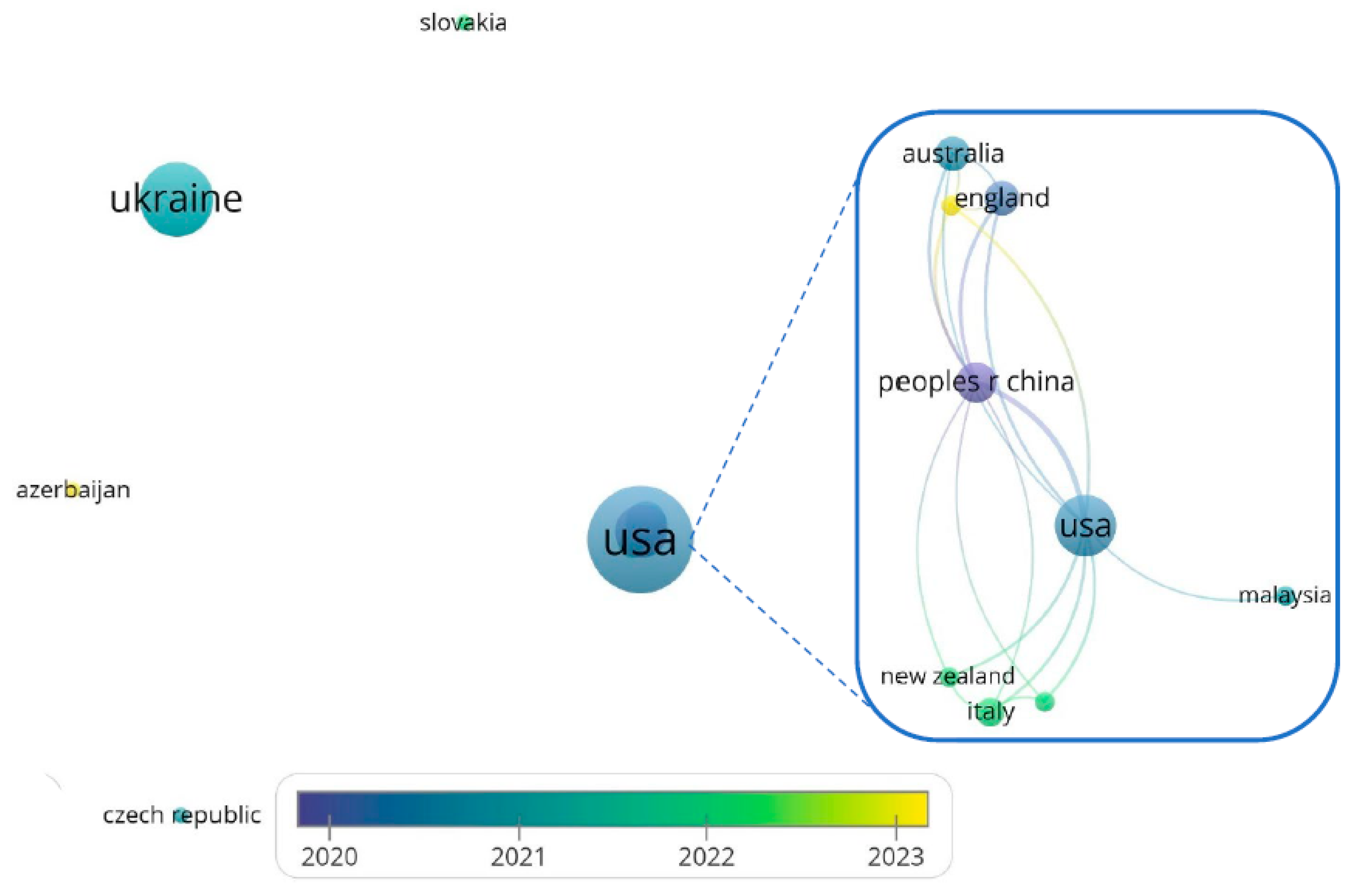

Besides, the authors generated a map with VOSviewer (

Figure 13) to visualize the international collaboration networks across countries and highlight the research areas where countries contribute the most. By comparing different countries’ citation impact and cooperation networks, academic institutions and policymakers can benchmark their research outputs and identify areas for improvement. It was selected a threshold of minimum 1 document published by a country and cited, and as a result, from the 16 countries explored, 13 met the limit and 9 of the states are connected. We consider that when analysing an emerging subject, such as CA, employing lower thresholds is a well-suited approach, because key areas of research might still be forming. Additionally, standard limits might exclude relevant studies due to their lower citation counts in a new field. Thus, lower thresholds can provide a more inclusive view of the research landscape, potentially uncovering hidden connections.

Consequently, in

Figure 13, nodes represent the countries, and the lines indicate the relations, with the thickness of the lines reflecting the frequency of citations. Moreover, the visualization reveals 3 clusters among which the pair USA (9 documents, 360 citations, 18 overall link strength) and China (4 documents, 342 citations, 16 total link strength) are two central nodes in the network, indicating a significant role in international research and a strong partnership. Besides these two major powers, Ukraine (6 documents, 17 citations, 0 links), England (3 documents, 81 citations, 7 link strength), Australia (3 documents, 60 citations, 5 link strength) and Italy (2 documents, 38 citations, 5 link strength) also added their contribution to the research topic between 2021-2022. Nonetheless, the other countries from the map released only 1 article in this area of investigation in the last two years.

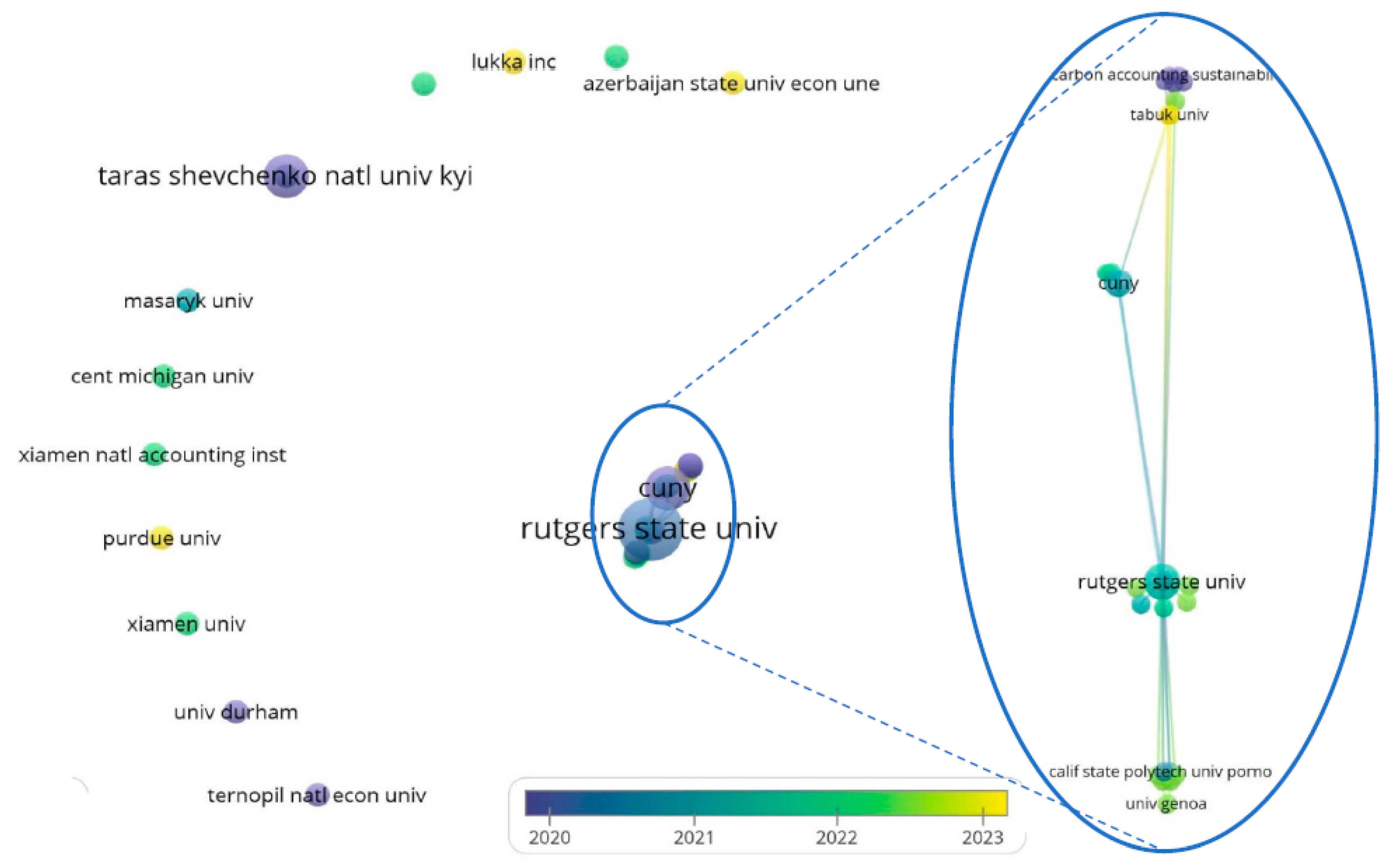

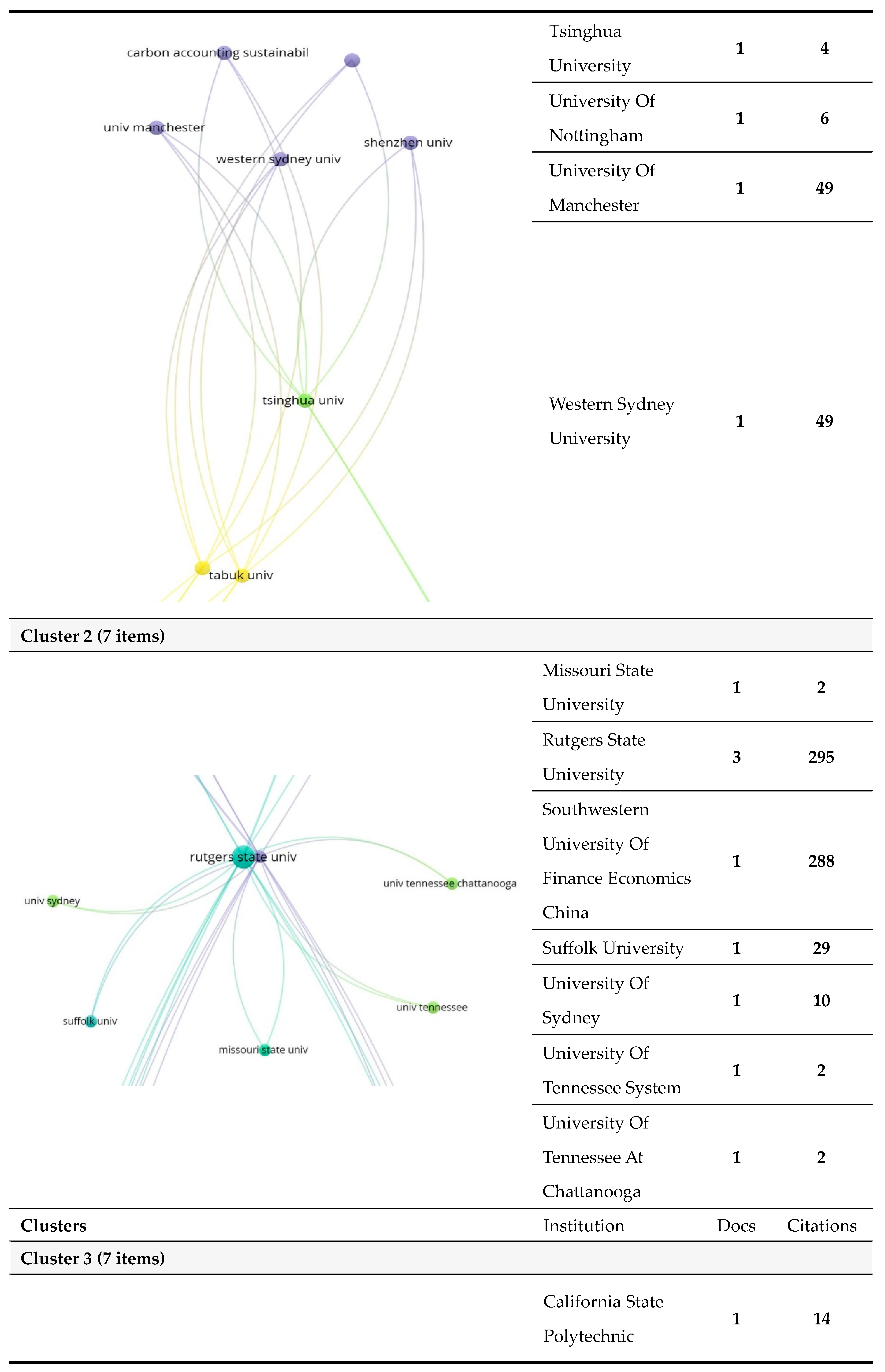

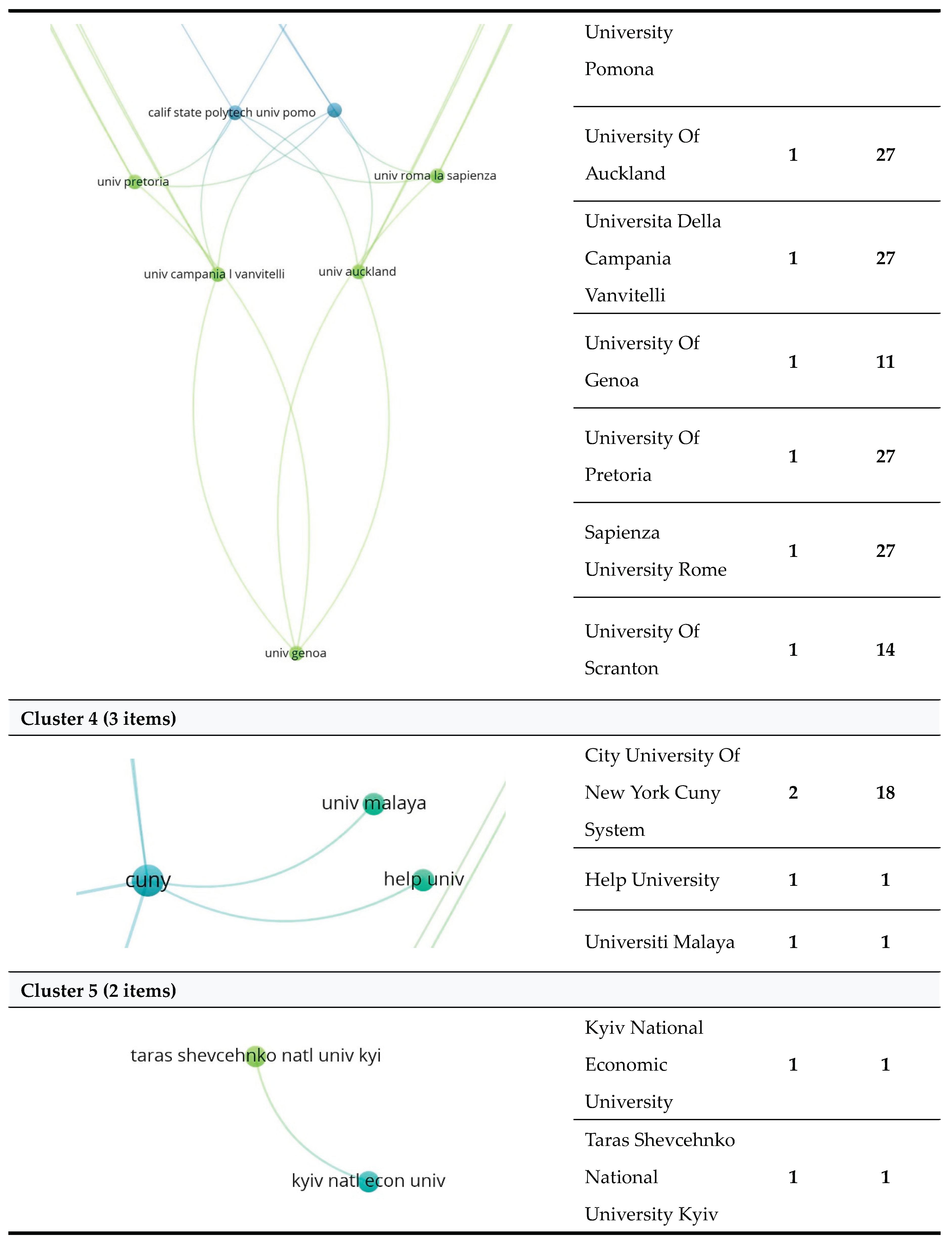

4.2.3. Citation Analysis of Institutions

The citation analysis on organizations or institutions with VOSviewer includes authors and their corresponding organizations. The plan of the analysis involves identifying the impact and influence of academic institutions and research organizations, as well as the frequency of their collaboration. Therefore, the most active organizations in terms of research partnership will be visually evidenced.

Figure 14 and

Table 5 illustrates the distribution of the 39 organizations, that released at least 1 article, with nodes and the relations between them with lines. The map also indicates the density and the centrality of specific institutions within the research field. As it can be seen, there are few collaborations between institutions, and the linked ones includes 25 items out of 38 that meet the threshold (the authors eliminated the duplicate of Taras Shevcehnko National University Kyiv). From the connected institutions cluster, the most prolific is Rutgers State University with 3 documents published, 295 citations and 17 total link strength. This remarkable university is followed by the Southwestern University of Finance and Economy through which was published 1 document, with 288 citations and 17 link strength. The interest in CA research is also seen at Taras Shevcehnko National University Kyiv (2 link strength) and City University Of New York Cuny System (8 link strength), which both published their research in 2 articles.

5. Discussion

According to the literature review, there is a need for further research and development of accounting standards that can include the unique characteristics of cryptocurrencies. It is crucial for stakeholders to understand the impact of regulatory changes and market dynamics in this ecosystem. As the digital economy evolves, accounting for crypto assets remains a critical area of study.

This analysis provides a foundational understanding of the collaboration dynamics within the dataset. The technique helps identify the most influential publications, key authors and institutions, collaboration networks, thematic clusters, and trends in research on cryptocurrency accounting. Based on the network visualizations and the data extracted for citation analysis, the authors of this article draw conclusions related to the bibliometric analysis.

The findings of this exploration present the authors that delved into CA. Thus, the distribution of the 4 themes suggested is: “financial accounting” theme is represented in 100% of the articles, the “managerial accounting” theme appears in 62% of the papers, 28% of the manuscripts write about “taxation”, and 34% of the studies discuss about “auditing”.

Firstly, through the keyword analysis were identified five major clusters covering important topics related to the blockchain and crypto environment: 1) crypto accounting framework; 2) types of digital assets; 3) crypto assets financial standard recognition; 4) crypto assets characteristics; 5) technology. Analysing topics such as “crypto assets characteristics”, or “crypto accounting framework”, it is suggested that the crypto phenomenon is of novelty between the scholars and the research in this field is just in the beginning phase.

Secondly, from the authors citation network, it can be observed that even if the collaboration between the authors is not very developed, the novelty and notoriety of the subject could raise the interest of other scientists. There are associations between the authors which are gradually spreading, in groups of maximum 4 authors.

Thirdly, the country and organization citation network, follow the same path as the authors citation network. The cooperations are at the beginning, and the strongest couples are USA and China, USA and the United Kingdom, USA and Italy, China and Australia, China and England, China and Italy, Australia, and England.

Fourthly, regarding the institutions involved in the process of publishing, we would like to highlight the connected ones from the most significant cluster: Rutgers State University, Southwestern University of Finance Economics China, Taras Shevcehnko National University Kyiv, University of Auckland, Universita Della Campania Vanvitelli, University of Pretoria, School of Social Sciences, University of Manchester, and Sapienza University Rome.

In the light of these, regulation is a major ongoing discussion about this type of assets. Therefore, this topic can allow other researchers to explore how pseudo anonymity interacts with regulation, and how financial reporting of cryptocurrencies can comply with the existing standards or explore whether new standards are necessary.

6. Conclusions

Overall, citation analysis using VOSviewer and Biblioshiny reported the same data, and can offer valuable insights for researchers, academics, and policymakers to understand academic output, collaboration networks, and research trends in CA. It can help benchmark research outputs and identify areas for improvement, for example the collaboration between authors that also impacts the cooperation of institutions at country level.

Authors consider that a limitation of the study could be that the chosen dataset might not cover all relevant academic publications on the topic of CA. Also, the period selected might miss early or recent developments in the research field. Other future bibliometric studies could be made at a different period. Considering that the cryptocurrency and CA landscape is constantly changing, this review might need periodic updates.

Author Contributions

Conceptualization, G.-I.L. and O.-C.B.; methodology, G.-I.L.; software, G.-I.L.; validation, G.-I.L. and O.-C.B.; formal analysis, G.-I.L.; investigation, G.-I.L.; resources, G.-I.L.; data curation, G.-I.L.; writing—original draft preparation, G.-I.L.; writing—review and editing, G.-I.L.; visualization, G.-I.L.; supervision, O.-C.B.; project administration, G.-I.L.; funding acquisition, G.-I.L. and O.-C.B.. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on the Web of Science Core Collection or upon request from the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Alsalmi, Noora, Subhan Ullah, and Muhammad Rafique. 2023. “Accounting for digital currencies.” Research in International Business and Finance 64 (101897). Accessed 2024. [CrossRef]

- Angeline, Yap Kiew Heong, Wong Siew Chin, Teoh Teng Tenk, and Zakiah Saleh. 2021. “Accounting Treatments for Cryptocurrencies in Malaysia: The Hierarchical Component Model Approach.” Asian Journal of Business and Accounting 14 (2): 137-171. Accessed 2024.

- Aria, M., and C. Cuccurullo. 2017. “bibliometrix: An R-tool for comprehensive science mapping analysis.” Journal of Inometrics (11(4)): 959-975. Accessed 2024. https://www.bibliometrix.org/home/.

- Barros, Fernando Jr., Jefferson Bertolai, and Matheus Carrijo. 2023. “Cryptocurrency is accounting coordination: Selfish mining and double spending in a simple mining game?” Mathematical Social Sciences 123: 25-50. Accessed 2024. [CrossRef]

- Beigman, Eyal, Gerard Brennan, Sheng-Feng Hsieh, and Alexander J. Sannella. 2023. “Dynamic Principal Market Determination: Fair Value Measurement of Cryptocurrency.” Journal of Accounting Auditing and Finance 38 (4): 731-748. Accessed 2024. [CrossRef]

- Blahušiaková, Miriama. 2022. “Accounting for Holdings of Cryptocurrencies in the Slovak Republic: Comparative Analysis.” Contemporary Economics 16 (1): 16-31. Accessed 2024. [CrossRef]

- Church, Kimberly Swanson, Sean Stein Smith, and Ethan Kinory. 2021. “Accounting Implications of Blockchain: A Hyperledger Composer Use Case for Intangible Assets.” Journal of Emerging Technologies in Accounting 18 (2): 23-52. Accessed 2024. [CrossRef]

- Dai, Jun, and Miklos A. Vasarhelyi. 2017. “Toward Blockchain-Based Accounting and Assurance.” Journal of Information Systems 31 (3): 5-21. Accessed 2024. [CrossRef]

- Derun, Ivan, and Hanna Mysaka. 2022. “Digital assets in accounting: the concept formation and the further development trajectory.” Economic Annals-XXI 195 (1-2): 59-70. Accessed 2024. [CrossRef]

- Dyball, Maria Cadiz, and Ravi Seethamraju. 2021. “Client use of blockchain technology: exploring its (potential) impact on financial statement audits of Australian accounting firms.” Accounting Auditing & Accountability Journal 35 (7 (SI)): 1656-1684. Accessed 2024. [CrossRef]

- Fuller, Stephen H., and Ariel Markelevich. 2020. “Should accountants care about blockchain?” Journal of Corporate Accounting and Finance 31 (2 (SI)): 34-46. Accessed 2024. [CrossRef]

- Gomaa, Ahmed A., Mohamed I. Gomaa, and Ashley Stampone. 2019. “A Transaction on the Blockchain: An AIS Perspective, Intro Case to Explain Transactions on the ERP and the Role of the Internal and External Auditor.” Journal of Emerging Technologies in Accounting 16 (1): 47-64. Accessed 2024. [CrossRef]

- Hampl, Filip, and Lucie Gyönyörová. 2021. “Can Fiat-backed Stablecoins Be Considered Cash or Cash Equivalents Under International Financial Reporting Standards Rules?” Australian Accounting Review 31 (3): 233-255. Accessed 2024. [CrossRef]

- Harrast, Steven A, Debra McGilsky, and Yan (Tricia) Sun. 2022. “Determining the Inherent Risks of Cryptocurrency: A Survey Analysis.” Current Issues in Auditing 16 (2): A10-A17. Accessed 2024. [CrossRef]

- Hubbard, Benjamin. 2023. “Decrypting crypto: implications of potential financial accounting treatments of cryptocurrency.” Accounting Research Journal 36 (4/5): 369-383. Accessed 2024. [CrossRef]

- Lombardi, Rosa, Charl de Villiers, Nicola Moscariello, and Michele Pizzo. 2022. “The disruption of blockchain in auditing - a systematic literature review and an agenda for future research.” Accounting Auditing & Accountability Journal 1534-1565. Accessed 2024. [CrossRef]

- Luo, Mei, and Shuangchen Yu. 2022. “Financial Reporting for Cryptocurrency.” Review of Accounting Studies. Accessed 2022. [CrossRef]

- Makurin, Andrii. 2023. “Technological Aspects and Environmental Consequences of Mining Encryption.” Economics Ecology Socium 7 (1): 61-70. Accessed 2024. [CrossRef]

- Makurin, Andrii, Andrii Maliienko, Olena Tryfonova, and Lyudmyla Masina. 2023. “Management of Cryptocurrency Transactions from Accounting Aspects.” Economics Ecology Socium 7 (3): 26-35. Accessed 2024. [CrossRef]

- Niftaliyev, Sultan Gurban. 2023. “Problems Arising in the Accounting of Cryptocurrencies.” FINANCIAL AND CREDIT ACTIVITY-PROBLEMS OF THEORY AND PRACTICE 3 (50): 76-86. Accessed 2024. [CrossRef]

- Ozeran, Alla, and Nadiia Gura. 2020. “Audit and accounting considerations on cryptoassets and related transactions.” Economic Annals-XXI 184 (7-8): 124-132. Accessed 2024. [CrossRef]

- Ramassa, Paola, and Giulia Leoni. 2022. “Standard setting in times of technological change: accounting for cryptocurrency holdings.” Accounting Auditing & Accountability Journal 35 (7 (SI)): 1598-1624. Accessed 2024. [CrossRef]

- Rella, Ludovico. 2020. “Steps towards an ecology of money infrastructures: materiality and cultures of Ripple.” Journal of Cultural Economy 13 (2): 236-249. Accessed 2024. [CrossRef]

- Smith, Sean Stein. 2018. “Implications of Next Step Blockchain Applications for Accounting and Legal Practitioners: A Case Study.” Australasian Acounting Business and Finance Journal 12 (4). Accessed 2024. [CrossRef]

- Soepriyanto, Gatot, Shinta Amalina Hazrati Havidz, and Rangga Handika. 2023. “Crypto goes East: analyzing Bitcoin, technological and regulatory contagions in Asia–Pacific financial markets using asset pricing.” International Journal of Emerging Markets. Accessed 2024. [CrossRef]

- van Eck, Nees Jan, and Ludo Waltman. 2023. VOSviewer Manual. Accessed 2023. https://www.vosviewer.com/documentation/Manual_VOSviewer_1.6.20.pdf.

- Vincent, Nishani Edirisinghe, and Stephan A. Davenport. 2022. “Accounting Research Opportunities for Cryptocurrencies.” Journal of Emerging Technologie in Accounting 19 (1): 79-93. Accessed 2024. [CrossRef]

- Yan, Huqin, Kejia Yan, and Rakesh Gupta. 2022. “A Survey of the Accounting Industry on Holdings of Cryptocurrencies in Xiamen City, China.” Journal of Risk and Financial Management 15 (4). Accessed 2024. [CrossRef]

- Yatsyk, Tetiana, and Viktor Shvets. 2020. “Cryptoassets as an emerging class of digital assets in the financial accounting.” Economic Annals-XXI 183 (5-6): 106-115. Accessed 2024. [CrossRef]

- Yu, Ting, Zhiwei Lin, and Qingliang Tang. 2018. “Blockchain: The Introduction and Its Application in Financial Accounting.” Journal of Corporate Accounting and Finance 29 (4): 37-47. Accessed 2024. [CrossRef]

- Zadorozhnyi, Z-M, V, VV Murayskyi, and OA Shevchuk. 2018. “Management Accounting of Electronic Transactions with the Use of Cryptocurrencies.” Financial and Credit Activity - Problems of Theory and Practice 3 (26): 169-177. Accessed 2024. [CrossRef]

Figure 1.

Geographical location of the articles from WoS by research themes. Source: Authors’ projection with MS Excel.

Figure 1.

Geographical location of the articles from WoS by research themes. Source: Authors’ projection with MS Excel.

Figure 2.

Flow diagram of systematic selection of studies on cryptocurrency accounting (CA). Source: Data processed by authors.

Figure 2.

Flow diagram of systematic selection of studies on cryptocurrency accounting (CA). Source: Data processed by authors.

Figure 3.

Annual scientific production of articles on CA. Source: Data processed by authors from WoS.

Figure 3.

Annual scientific production of articles on CA. Source: Data processed by authors from WoS.

Figure 4.

Country scientific production of articles on CA. Source: Own projection with Biblioshiny.

Figure 4.

Country scientific production of articles on CA. Source: Own projection with Biblioshiny.

Figure 5.

Top 10 of most relevant sources for CA. Source: Data processed by authors.

Figure 5.

Top 10 of most relevant sources for CA. Source: Data processed by authors.

Figure 6.

Co-occurrence cluster visualization of author keywords for CA studies. Source: Authors’ projection with VOSviewer.

Figure 6.

Co-occurrence cluster visualization of author keywords for CA studies. Source: Authors’ projection with VOSviewer.

Figure 9.

Citation of authors network for CA. Source: Authors’ projection with VOSviewer.

Figure 9.

Citation of authors network for CA. Source: Authors’ projection with VOSviewer.

Figure 10.

Citation of authors for CA, close-up, clusters 1, 2, 3, 4, 5. Source: Authors’ projection with VOSviewer.

Figure 10.

Citation of authors for CA, close-up, clusters 1, 2, 3, 4, 5. Source: Authors’ projection with VOSviewer.

Figure 11.

Citation of countries map for CA. Source: Authors’ projection with MS Excel.

Figure 11.

Citation of countries map for CA. Source: Authors’ projection with MS Excel.

Figure 12.

Three-field plot with author’s country, author, and keyword for CA. Source: Authors’ projection with Biblioshiny.

Figure 12.

Three-field plot with author’s country, author, and keyword for CA. Source: Authors’ projection with Biblioshiny.

Figure 13.

Citation of countries network for CA. Source: Authors’ projection with VOSviewer.

Figure 13.

Citation of countries network for CA. Source: Authors’ projection with VOSviewer.

Figure 14.

Citation of institutions network for CA. Source: Authors’ projection with VOSviewer.

Figure 14.

Citation of institutions network for CA. Source: Authors’ projection with VOSviewer.

Table 1.

Research themes according to accounting categories, by relevant authors and countries.

Table 1.

Research themes according to accounting categories, by relevant authors and countries.

| Authors |

Country |

Financial accounting |

Managerial accounting |

Taxation |

Auditing |

| Alsalmi, N; Ullah, S and Rafique, M (2023) |

England, Saudi Arabia |

|

|

|

|

| Angeline, YKH et al. (2021) |

Malaysia |

|

|

|

|

| Barros, F; Bertolai, J and Carrijo, M (2023) |

Brazil |

|

|

|

|

| Beigman, E et al. (2023) |

USA |

|

|

|

|

| Blahusiakova, M (2022) |

Slovakia |

|

|

|

|

| Church, KS; Smith, SS and Kinory, E (2021) |

USA |

|

|

|

|

| Dai, J and Vasarhelyi, MA (2017) |

USA, China |

|

|

|

|

| Derun, I and Mysaka, H (2022) |

Ukraine |

|

|

|

|

| Dyball, MC and Seethamraju, R (2022) |

Australia |

|

|

|

|

| Fuller, SH and Markelevich, A (2020) |

USA |

|

|

|

|

| Gomaa, AA; Gomaa, MI and Stampone, A (2019) |

USA |

|

|

|

|

| Hampl, F and Gyönyörová, L (2021) |

Czech Republic |

|

|

|

|

| Harrast, SA; McGilsky, D and Sun, Y (2022) |

USA |

|

|

|

|

| Hubbard, B (2023) |

USA |

|

|

|

|

| Lombardi, R; de Villiers, C and Pizzo, M (2022) |

Italy, New Zealand, South Africa |

|

|

|

|

| Luo, M and Yu, SC (2022) |

China |

|

|

|

|

| Makurin, A et al. (2023) |

Ukraine |

|

|

|

|

| Makurin, A (2023) |

Ukraine |

|

|

|

|

| Niftaliyev, SG (2023) |

Azerbaijan |

|

|

|

|

| Ozeran, A and Gura, N (2020) |

Ukraine |

|

|

|

|

| Ramassa, P and Leoni, G (2022) |

Italy |

|

|

|

|

| Rella, L (2020) |

England |

|

|

|

|

| Smith, SS (2018) |

USA |

|

|

|

|

| Soepriyanto, G; Havidz, SAH and Handika, R (2023) |

Indonesia, Japan |

|

|

|

|

| Vincent, NE and Davenport, SA (2022) |

USA |

|

|

|

|

| Yan, HQ; Yan, KJ and Gupta, R (2022) |

China, Australia |

|

|

|

|

| Yatsyk, T and Shvets, V (2020) |

Ukraine |

|

|

|

|

| Yu, T; Lin, ZW and Tang, QL (2018) |

China, Australia, England |

|

|

|

|

| Zadorozhnyi, ZMV; Murayskyi, VV and Shevchuk, OA (2018) |

Ukraine |

|

|

|

|

| Total article number |

|

29 |

18 |

8 |

10 |

| Total percentage |

|

100% |

62% |

28% |

34% |

Table 2.

Research areas related to cryptocurrency accounting (CA).

Table 2.

Research areas related to cryptocurrency accounting (CA).

| Nr.crt. |

Research Field – WoS Categories |

Record Count |

% of 29 Articles |

| 1 |

Business Finance |

20 |

68.966% |

| 2 |

Economics |

9 |

31.034% |

| 3 |

Business |

3 |

10.345% |

| 4 |

Cultural Studies |

1 |

3.448% |

| 5 |

Management |

1 |

3.448% |

| 6 |

Mathematics Interdisciplinary Applications |

1 |

3.448% |

| 7 |

Social Sciences Mathematical Methods |

1 |

3.448% |

| 8 |

Sociology |

1 |

3.448% |

Table 4.

Top 10 of the most cited authors and publications on CA.

Table 4.

Top 10 of the most cited authors and publications on CA.

| Publication title |

Authors |

Journal |

Year |

Citations |

Average / year |

| “Toward Blockchain-Based Accounting and Assurance” |

Dai, J and Vasarhelyi, MA |

“Journal of Information Systems” |

2017 |

288 |

36.00 |

| “Blockchain: The Introduction and Its Application in Financial Accounting” |

Yu, T; Lin, ZW and Tang, QL |

“Journal of Corporate Accounting and Finance” |

2018 |

49 |

7.00 |

| “Should accountants care about blockchain?” |

Fuller, SH and Markelevich, A |

“Journal of Corporate Accounting and Finance” |

2020 |

29 |

4.83 |

| “The disruption of blockchain in auditing – a systematic literature review and an agenda for future research” |

Lombardi, R; and Villiers, C & Pizzo, M |

“Accounting Auditing & Accountability Journal” |

2022 |

27 |

6.75 |

| “Steps towards an ecology of money infrastructures: materiality and cultures of Ripple” |

Rella, L |

“Journal of Cultural Economy” |

2020 |

26 |

5.20 |

| “Implications of Next Step Blockchain Applications for Accounting and Legal Practitioners: A Case Study” |

Smith, SS |

“Australasian Accounting Business and Finance Journal” |

2018 |

16 |

2.29 |

| “A Transaction on the Blockchain: An AIS Perspective, Intro Case to Explain Transactions on the ERP and the Role of the Internal and External Auditor” |

Gomaa, AA; Gomaa, MI and Stampone, A |

“Journal of Emerging Technologies in Accounting” |

2019 |

14 |

2.33 |

| “Standard setting in times of technological change: accounting for cryptocurrency holdings” |

Ramassa, P and Leoni, G |

“Accounting Auditing & Accountability Journal” |

2022 |

11 |

2.75 |

| “Client use of blockchain technology: exploring its (potential) impact on financial statement audits of Australian accounting firms” |

Dyball, MC and Seethamraju, R |

“Accounting Auditing & Accountability Journal” |

2022 |

10 |

2.50 |

| “Management Accounting of Electronic Transactions with the Use of Cryptocurrencies” |

Zadorozhnyi, ZMV; Murayskyi, VV and Shevchuk, OA |

“Financial and Credit Activity – Problems of Theory and Practice” |

2018 |

10 |

1.43 |

Table 5.

Distribution of linked institutions, interested in CA, clusters 1, 2, 3, 4, 5.

Table 5.

Distribution of linked institutions, interested in CA, clusters 1, 2, 3, 4, 5.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).