1. Introduction

The most well-known method of economic analysis takes place with the use of numerical indicators [

1]. The significance of financial ratios lies in their ability to uncover the financial stability of a corporation, thereby ensuring its competitive standing through consistent growth and mitigating any potential financial hazards [

2]. Relative ratios offer essential information about a company's operations, helping investors and analysts make decisions [

2,

3,

4]. Predicting financial distress continues to be a research concern because of its impact on business. Moreover, through these forecasting models, potential business crises can be avoided. Thus, economic distress forecasting models and their information are valuable tools for decision-makers. The absence of use and correct evaluation of the results of these models can eventually lead to the bankruptcy of a company [

5].

Financial distress and bankruptcy prediction models are based on statistical analysis methods. Characteristic examples are linear, multivariate, discrete, probit, and logit analyses [

6]. Based on the literature, logistic regression is the most frequently used technique [

7]. On the other hand, Partial Least Squares Discriminant Analysis (PLS-DA) successfully addresses the problem of multicollinearity compared to other methods by incorporating data from principal component analysis (PCA) and multiple linear regressions [

8].

With the primary goal of optimizing the models and increasing the prediction accuracy, the models have undergone many adjustments. Using only traditional indicators can lead to wrong estimates to the company's detriment [

9]. For this reason, financial distress prediction models that incorporated indicators that yield more accurate predictions were developed [

10]. However, these models should be used cautiously since a financially troubled company does not imply a bankrupt company [

11,

12]. The financial difficulty of a company means bankruptcy or non-payment of loans [

13]. The purpose of this review is to record the behavior of numerical indicators in predicting the future bankruptcy of companies. By fully understanding the behavior of indicators, stakeholders are now equipped with a powerful tool that enhances their decision-making ability. This knowledge empowers members of organizations, enabling them to make informed choices about product development, marketing strategies, and investments. Consequently, this review serves as a cornerstone, closing the divide between theoretical understanding and real-world implementation within the field of business strategy. The research question is posed as follows:

Using statistical analysis methods, how much can the numerical indicators predict companies' future bankruptcy?

2. Methodology

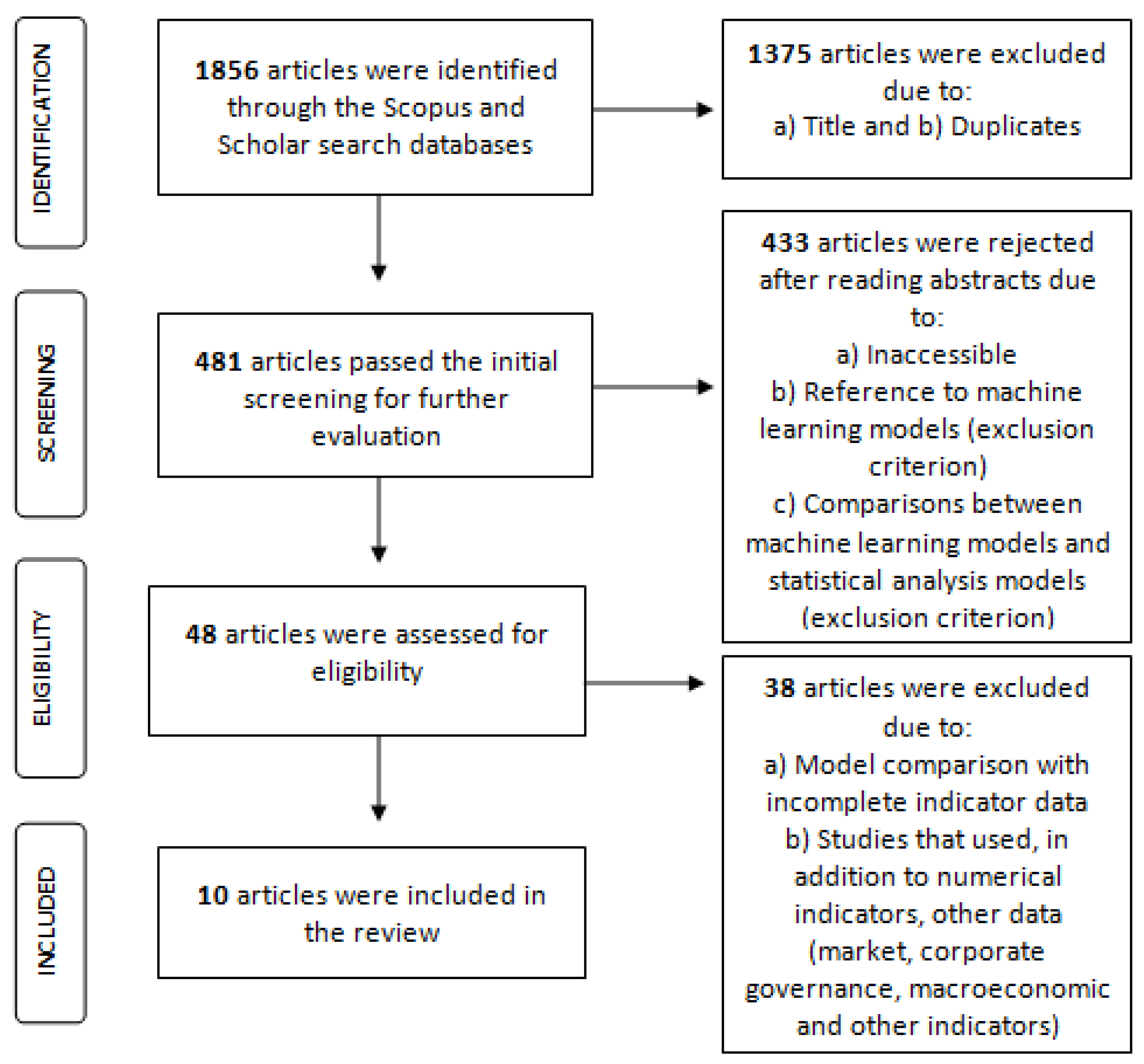

Primary studies from the international literature are sought, which use numerical indicators (either traditional or cash flow) in predicting the future bankruptcy of companies, with the help of statistical analysis in the online databases of Scopus and Scholar, following the PRISMA standard (

Figure 1) [

14]. The time frame is from 2013 to 2023, while the choice of English language is the most prevalent among researchers worldwide. Previous studies from the specified period are excluded since an increased volume of reviews was observed until 2015. This study does not consider models employing machine learning methods, such as neural networks. The focus is comparing traditional statistical analysis methods with machine learning approaches for bankruptcy prediction, excluding machine learning methodologies from our search and analysis.

More specifically, for the Scopus database, the advanced search engine is used, adopting the following algorithm:

TITLE (bankruptcy OR default OR "early warning" OR "failure prediction" OR "financial distress" OR "financial difficulty" OR insolvency) AND (model OR prediction OR forecast OR ratio OR indicator) AND PUBYEAR > 2012 AND PUBYEAR < 2025 AND (LIMIT-TO (OA, "all")) AND (LIMIT-TO (DOCTYPE, "ar")) AND (LIMIT-TO (LANGUAGE, "English")) AND (LIMIT-TO (EXACTKEYWORD, "Article")).

For the Scholar database, the same descriptors are used.

Figure 1.

Flow chart of the process followed to identify the articles included in the review [

14].

Figure 1.

Flow chart of the process followed to identify the articles included in the review [

14].

3. Results

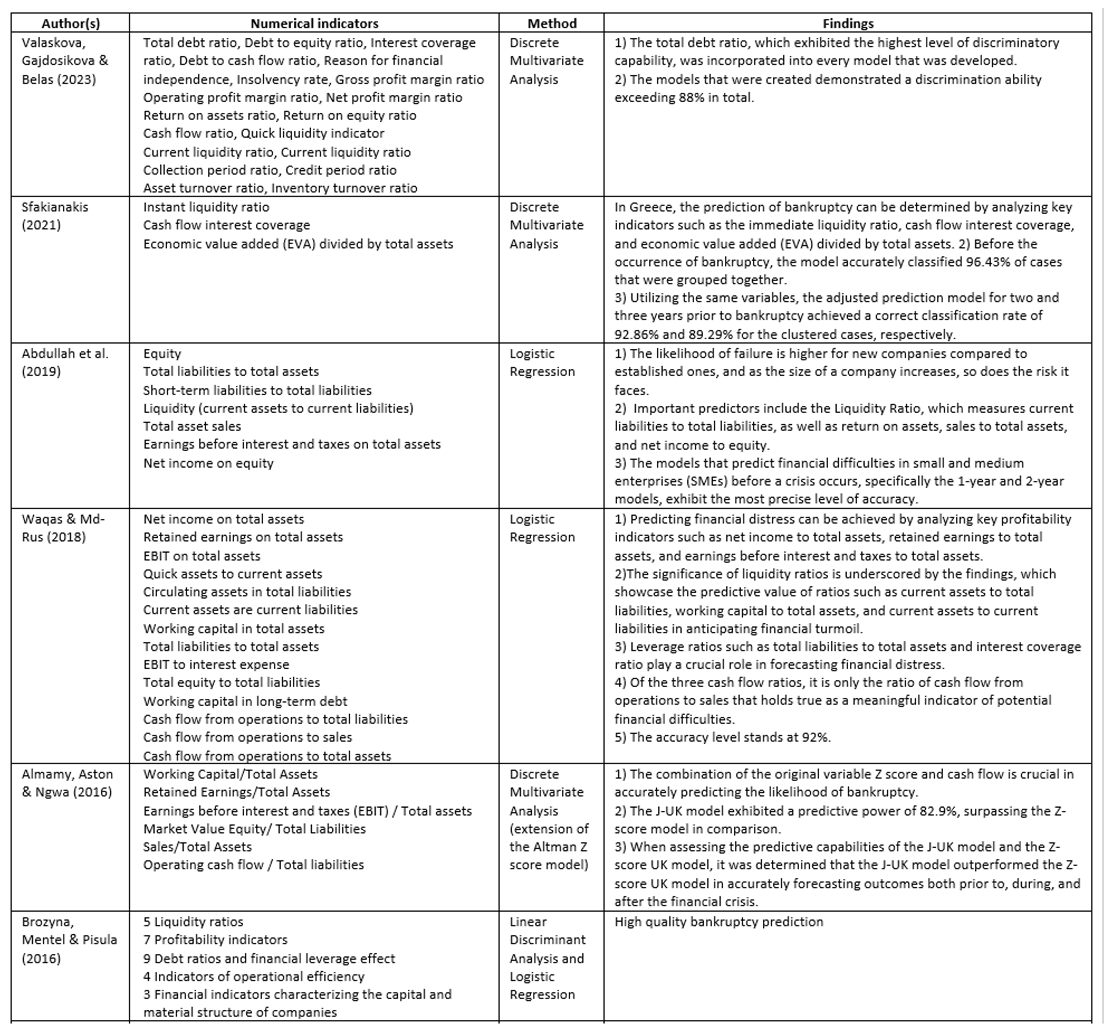

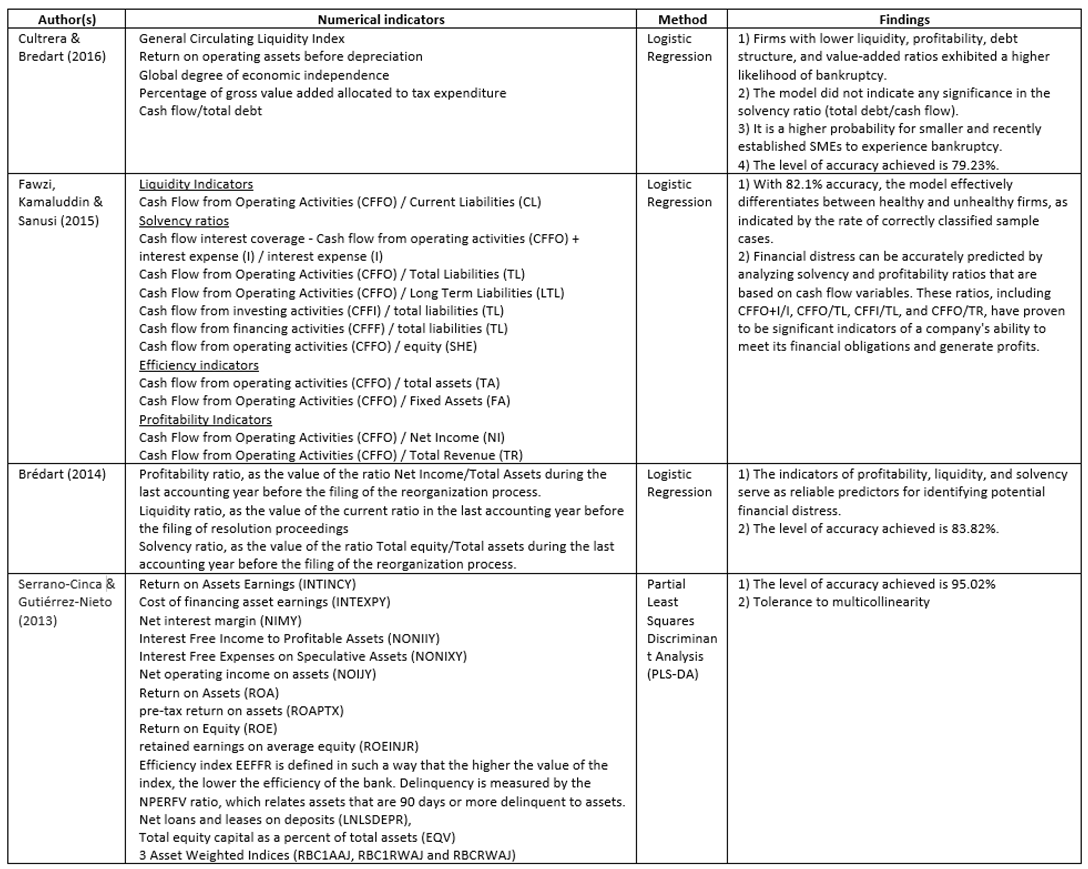

The review yielded a summary of the results, which can be found in

Table 1.

4. Discussion

The significance of profitability ratios, liquidity ratios, leverage ratios, and cash flow ratios in forecasting financial distress is emphasized in this review. This finding is corroborated by a previous study conducted by Adnan, Aziz, and Dar [

15], which analyzed 98 predictions of financial distress and concluded that these indicators play a crucial role in predicting financial distress. Additionally, this review demonstrates that statistical analysis supports the reliability of cash flow ratios for forecasting financial distress. The ability of cash flows to predict corporate bankruptcy was also highlighted in a study by Jooste [

16] who identified the cash flow to total debt ratio as the most effective indicator of bankruptcy. A higher ratio, calculated from the cash flow statement, corresponds to a lower probability of failure, and a favorable ratio indicates positive cash flows.

Accordingly, in their literature review, Bellovary, Giacomino, and Akers [

6] summarize bankruptcy prediction studies for 1965-2004. The authors examine 165 bankruptcy prediction models and conclude that specific characteristics such as model sizes vary dramatically, from 1 to 57 variables, and that the analysis methods of the studies included in their review vary widely. Although very few studies have used bankruptcy or risk prediction models with variables consisting of cash flow ratio information, they have demonstrated that forecasts using operating cash flows have informative value. In his study, Rodgers [

17] investigated the effectiveness of Multivariate Discrete Analysis (MDA), logistic regression analysis, and operating cash flow analysis as tools for predicting corporate bankruptcy. Specifically, he focused on the 20 most prominent bankruptcy cases in the United States. The cash flow variables in his research included cash flow to current assets, cash flow before interest and taxes on current assets, and cash flow to current liabilities. The results of this review indicated that the cash flow indicators have a significant predictive ability of the financial situation of the companies by categorizing the healthy from the unhealthy ones with considerable accuracy.

The research of Barua and Saha [

18] agrees with this review's findings, emphasizing the suitability of cash flow ratios in accurately evaluating companies. These ratios offer valuable information about a company's financial condition and serve as an early warning system for potential financial distress and bankruptcy, helping investors make informed decisions. Accordingly, Agarwal and Taffler [

19] highlighted the importance of liquidity ratios in predicting financial distress. The same authors underlined that the higher the liquidity levels of a company, the lower the chances of the company facing financial problems. However, the financial soundness and understanding of a company's financial situation are based on more than just numerical indicators. Instead, a comprehensive analysis that incorporates financial ratios and other financial information is required. Moreover, an index that performs well in one industry may not perform as well in another, as different industries operate in different buying environments, with different economic conditions and buying public characteristics [

20].

This review also highlights the ability of simple models to predict bankruptcy through the use of numerical indicators and statistical analysis [

21,

22], a finding that is consistent with previous studies by Jones, Johnstone & Wilson [

23,

24]. More specifically, the models developed using Multivariate Discriminant Analysis in this review showed an overall discriminating ability greater than 82.9%, a percentage that is also confirmed in an earlier study by Yap, Yong & Poon [

25]. Even though Multivariate Discrete Analysis is commonly used for bankruptcy prediction, it presents some disadvantages related to statistical assumptions, such as the need for normality, linearity, and independence between variables [

26,

27]. On the other hand, Verma and Raju [

28] argue that logistic regression models, compared to Multivariate Discrete Analysis, offer a more robust approach to predicting bankruptcy by examining the probability of bankruptcy without imposing restrictive assumptions. This view is also supported by Ul Hassan, Zainuddin, and Nordin [

29]. Thus, the studies above agree with the results of this review, further underlining the superiority of logistic regression models over Multivariate Discriminant Analysis models in predicting corporate bankruptcy.

Also worth mentioning is the pioneering approach to predicting bankruptcy, using Partial Least Square Discriminant Analysis (PLS-DA) to address the issue of multicollinearity [

30]. According to pioneers Serrano-Cinca and Gutiérrez-Nieto [

30], while the descriptive statistics findings align with other commonly used bankruptcy models, PLS-DA addresses multicollinearity. However, this does not mean that if a researcher chooses Linear Discriminant Analysis (LDA) or Linear Regression (LR) and uses an appropriate variable selection procedure, the results will not be as effective in predicting bankruptcy as those obtained with PLS- Yes. This conclusion is supported by the literature review of Devi and Radhika [

31].

valaNyitrai [

32], aiming to optimize the prediction accuracy of bankruptcy models, conducted a comparative study and found that incorporating past financial ratios of companies as benchmarks can be effective. To assess the companies' current financial performance comprehensively, the same authors used the minimum and maximum financial ratios from the previous period as benchmarks. The study compared popular bankruptcy prediction methods such as discriminant analysis and logistic regression. It concluded that using minimum and maximum economic indicators significantly improves the predictive ability of bankruptcy prediction models compared to models based solely on static economic indicators. These results highlight that assessing firms' past financial performance is a valuable benchmark for assessing the risk of future insolvency.

The results of this review could act as a compass in the hands of professionals, protecting the financial stability of businesses and promoting an environment conducive to innovation and growth. With knowledge as an ally, organizations can pivot faster to market dynamics, thus gaining a competitive advantage.

5. Limitations

A significant limitation is that different researchers use different methodologies and indicators. This heterogeneity makes concluding difficult. In addition, the absence of standardized criteria for evaluating the quality of the developed forecast models and the indicators' appropriateness is a significant limitation [

33]. Also, the indicators are dynamic and depend on the economic and regulatory conditions and the current market situation [

20]. Τhus, investigations in different time frames are not easily comparable [

34,

35]. Therefore, interested parties should consider these limitations during the decision-making process.

6. Conclusions

The results of the present systematic review highlight:

1) The ability of numerators, through simple statistical analysis models, to predict the bankruptcy of businesses and companies.

2) Cash flow ratios are reliable for predicting financial distress through statistical analysis.

3) Models are built with indicators from a specific economy; it is impossible to consider them stable and unchanging because their predictive ability could be affected by changes in a country's economic conditions.

Author Contributions

Conceptualization, B.D. and S.D.; methodology, B.D.; and S.D software, B.D.; validation, B.D. and S.D.; formal analysis, B.D..; investigation, B.D. and S.D.; resources, B.D. and S.D.; data curation, B.D. and S.D.; writing—original draft preparation, B.D.; writing—review and editing, B.D.; S.D. and S.A.; visualization, B.D.; supervision, S.A.; project administration, S.A. All authors have read and agreed to the published version of the manuscript.”.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Sfakianakis E. An Alternative Model for Bankruptcy Prediction under Stressed Conditions: The Case of Listed Companies in Greece and Cyprus. CR [Internet]. 2022 [cited 2023 Dec 18];34(2):91–116. Available from: https://www.cyprusreview.org.

- Kliestik T, Valaskova K, University of Žilina, Faculty of Operation and Economics of Transport and Communications, Lazaroiu G, Spiru Haret University, Faculty of Social and Human Sciences, Kovacova M, et al. Remaining Financially Healthy and Competitive: The Role of Financial Predictors. JOC [Internet]. 2020 Mar 31 [cited 2023 Dec 18];12(1):74–92. Available from: https://www.cjournal.cz/index.php?hid=clanek&bid=archiv&cid=356&cp=.

- Czerwińska-Kayzer D, Florek J, Staniszewski R, Kayzer D. Application of Canonical Variate Analysis to Compare Different Groups of Food Industry Companies in Terms of Financial Liquidity and Profitability. Energies [Internet]. 2021 Jan [cited 2023 Dec 18];14(15):4701. Available from: https://www.mdpi.com/1996-1073/14/15/470.

- Dahiyat AA, Weshah SR, Aldahiyat M. Liquidity and solvency management and its impact on financial performance: Empirical evidence from Jordan. The Journal of Asian Finance, Economics and Business. 2021;8(5):135–41. [CrossRef]

- Voda AD, Dobrotă G, Țîrcă DM, Dumitrașcu DD, Dobrotă D. CORPORATE BANKRUPTCY AND INSOLVENCY PREDICTION MODEL. Technological and Economic Development of Economy [Internet]. 2021 Aug 19 [cited 2023 Dec 18];27(5):1039–56. Available from: https://journals.vilniustech.lt/index.php/TEDE/article/view/15106.

- Bellovary JL, Giacomino DE, Akers MD. A Review of Bankruptcy Prediction Studies: 1930 to Present. Journal of Financial Education [Internet]. 2007 [cited 2023 Nov 18];33:1–42. Available from: https://www.jstor.org/stable/41948574.

- Bateni L, Asghari F. Bankruptcy Prediction Using Logit and Genetic Algorithm Models: A Comparative Analysis. Comput Econ [Internet]. 2020 Jan 1 [cited 2023 Dec 18];55(1):335–48. [CrossRef]

- Barker M, Rayens W. Partial least squares for discrimination. Journal of Chemometrics [Internet]. 2003 [cited 2023 Dec 18];17(3):166–73. [CrossRef]

- Bragoli D, Ferretti C, Ganugi P, Marseguerra G, Mezzogori D, Zammori F. Machine-learning models for bankruptcy prediction: do industrial variables matter? Spatial Economic Analysis [Internet]. 2022 Apr 3 [cited 2023 Dec 18];17(2):156–77. [CrossRef]

- Jandaghi G, Saranj A, Rajaei R, Ghasemi A, Tehrani R. Identification of the Most Critical Factors in Bankruptcy Prediction and Credit Classification of Companies. Iranian Journal of Management Studies. 2021;14(4).

- Grice JS, Dugan MT. The limitations of bankruptcy prediction models: Some cautions for the researcher. Review of Quantitative Finance and Accounting [Internet]. 2001 [cited 2023 Dec 18];17(2):151–66. Available from: http://link.springer.com/10.1023/A:1017973604789.

- Nicolescu L, Tudorache FG. The Evolution of Non-Banking Financial Markets in Hungary: The Case of Mutual Funds. Management Dynamics in the Knowledge Economy [Internet]. 2016 [cited 2023 Dec 19];4(4):591–621. Available from: https://ideas.repec.org//a/nup/jrmdke/v4y2016i4p591-621.html.

- Bruynseels L, Willekens M. The effect of strategic and operating turnaround initiatives on audit reporting for distressed companies. Accounting, Organizations and Society [Internet]. 2012 May 1 [cited 2023 Dec 18];37(4):223–41. Available from: https://www.sciencedirect.com/science/article/pii/S036136821200025. [CrossRef]

- Page MJ, McKenzie JE, Bossuyt PM, Boutron I, Hoffmann TC, Mulrow CD, et al. The PRISMA 2020 statement: an updated guideline for reporting systematic reviews. International journal of surgery. 2021;88:105906. [CrossRef]

- Adnan Aziz M, Dar HA. Predicting corporate bankruptcy: where we stand? Corporate Governance: The international journal of business in society [Internet]. 2006 Jan 1 [cited 2023 Nov 18];6(1):18–33. [CrossRef]

- Jooste L. An evaluation of the usefulness of cash flow ratios to predict financial distress. Acta Commercii. 2007;7(1):1–13. [CrossRef]

- Rodgers CS. Predicting corporate bankruptcy using multivariant discriminate analysis (MDA), logistic regression and operating cash flows (OCF) ratio analysis: A cash flow-based approach. Golden Gate University; 2011.

- Barua S, Saha AK. Traditional Ratios vs. Cash Flow based Ratios: Which One is Better Performance Indicator? Advances in Economics and Business [Internet]. 2015 Jun [cited 2018 Mar 6];3(6):232–51. Available from: http://www.hrpub.org/journals/article_info.php?aid=2731.

- Agarwal V, Taffler R. Comparing the performance of market-based and accounting-based bankruptcy prediction models. Journal of Banking & Finance [Internet]. 2008 Aug 1 [cited 2023 Nov 18];32(8):1541–51. Available from: https://www.sciencedirect.com/science/article/pii/S037842660700386X. [CrossRef]

- Atieh SH. Liquidity Analysis Using Cash Flow Ratios as Compared to Traditional Ratios in the Pharmaceutical Sector in Jordan. International Journal of Financial Research [Internet]. 2014 [cited 2022 Apr 12];5(3):146–58. Available from: https://ideas.repec.org/a/jfr/ijfr11/v5y2014i3p146-158.html. [CrossRef]

- Sfakianakis E. Bankruptcy prediction model for listed companies in Greece. Investment Management and Financial Innovations [Internet]. 2021 May 27 [cited 2023 Dec 18];18(2):166–80. Available from: https://www.businessperspectives.org/index.php/journals/investment-management-and-financial-innovations/issue-381/bankruptcy-prediction-model-for-listed-companies-in-greece.

- Valaskova K, Gajdosikova D, Belas J. Bankruptcy prediction in the post-pandemic period: A case study of Visegrad Group countries. oc [Internet]. 2023 Mar 25 [cited 2023 Dec 18];14(1):253–93. Available from: https://journals.economic-research.pl/oc/article/view/2264. [CrossRef]

- Jones S, Johnstone D, Wilson R. An empirical evaluation of the performance of binary classifiers in the prediction of credit ratings changes. Journal of Banking & Finance [Internet]. 2015 Jul 1 [cited 2023 Dec 18];56:72–85. Available from: https://www.sciencedirect.com/science/article/pii/S03784266150003. [CrossRef]

- Jones S, Johnstone D, Wilson R. Predicting Corporate Bankruptcy: An Evaluation of Alternative Statistical Frameworks. Journal of Business Finance & Accounting [Internet]. 2017 [cited 2023 Dec 18];44(1–2):3–34. [CrossRef]

- Yap BCF, Yong DGF, Poon WC. How well do financial ratios and multiple discriminant analysis predict company failures in Malaysia. International Research Journal of Finance and Economics. 2010;54(13):166–75.

- Amendola A, Giordano F, Parrella ML, Restaino M. Variable selection in high-dimensional regression: a nonparametric procedure for business failure prediction. Appl Stoch Models Bus & Ind [Internet]. 2017 Aug [cited 2023 Dec 18];33(4):355–68. [CrossRef]

- Marozzi M. Inter-industry financial ratio comparison with application to Japanese and Chinese firms [Internet]. University of Salento; 2016 [cited 2023 Dec 18]. Available from: http://siba-ese.unisalento.it/index.php/ejasa/article/view/14618/13750.

- Verma D, Raju M. A comparative study of default prediction mod-els. Pacific Business Review International. 2021;13(8):143–54.

- Hassan E ul, Zainuddin Z, Nordin S. A review of financial distress prediction models: logistic regression and multivariate discriminant analysis. Indian-Pacific Journal of Accounting and Finance (IPJAF) [Internet]. 2017 [cited 2023 Dec 19];1(3):13–23. Available from: http://ipjaf.omjpalpha.com/index.php/ipjaf/article/view/15. [CrossRef]

- Serrano-Cinca C, Gutiérrez-Nieto B. Partial least square discriminant analysis for bankruptcy prediction. Decision support systems. 2013;54(3):1245–55. [CrossRef]

- Devi SS, Radhika Y. A survey on machine learning and statistical techniques in bankruptcy prediction. International Journal of Machine Learning and Computing. 2018;8(2):133–9. [CrossRef]

- Nyitrai T. Dynamization of bankruptcy models via indicator variables. Benchmarking: An International Journal [Internet]. 2019 Jan 1 [cited 2023 Dec 18];26(1):317–32. [CrossRef]

- Jahan N, Naveed S, Zeshan M, Tahir MA. How to conduct a systematic review: a narrative literature review. Cureus. 2016;8(11). [CrossRef]

- Krulicky T, Horak J. BUSINESS PERFORMANCE AND FINANCIAL HEALTH ASSESSMENT THROUGH ARTIFICIAL INTELLIGENCE. EMS [Internet]. 2021 Dec 30 [cited 2023 Dec 18];15(2):38–51. Available from: https://ems.uniza.sk/wp-content/uploads/EMS_2_2021_04_Krulicky_Horak.pdf.

- Valaskova K, Nagy M, Zabojnik S, Lăzăroiu G. Industry 4.0 Wireless Networks and Cyber-Physical Smart Manufacturing Systems as Accelerators of Value-Added Growth in Slovak Exports. Mathematics [Internet]. 2022 Jan [cited 2023 Dec 18];10(14):2452. [CrossRef]

Table 1.

Summary of review studies.

Table 1.

Summary of review studies.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).