Submitted:

05 December 2023

Posted:

06 December 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

- How can the Markowitz framework’s uncertainty be explained?

- Does the model perform better when uncertainty is considered?

- How do these optimized allocations stack up against alternative tactics?

- Can the model do better with more data?

- Is it feasible to make a trustworthy performance prediction?

- Does performance improve when there are limitations on allocation?

2. Background: The Mean-Variance Model, Criticism and its Extensions

2.1. The Asset Allocation According to Markowitz

2.2. Mean-Variance Efficient Portfolios in a One-Fund Setting

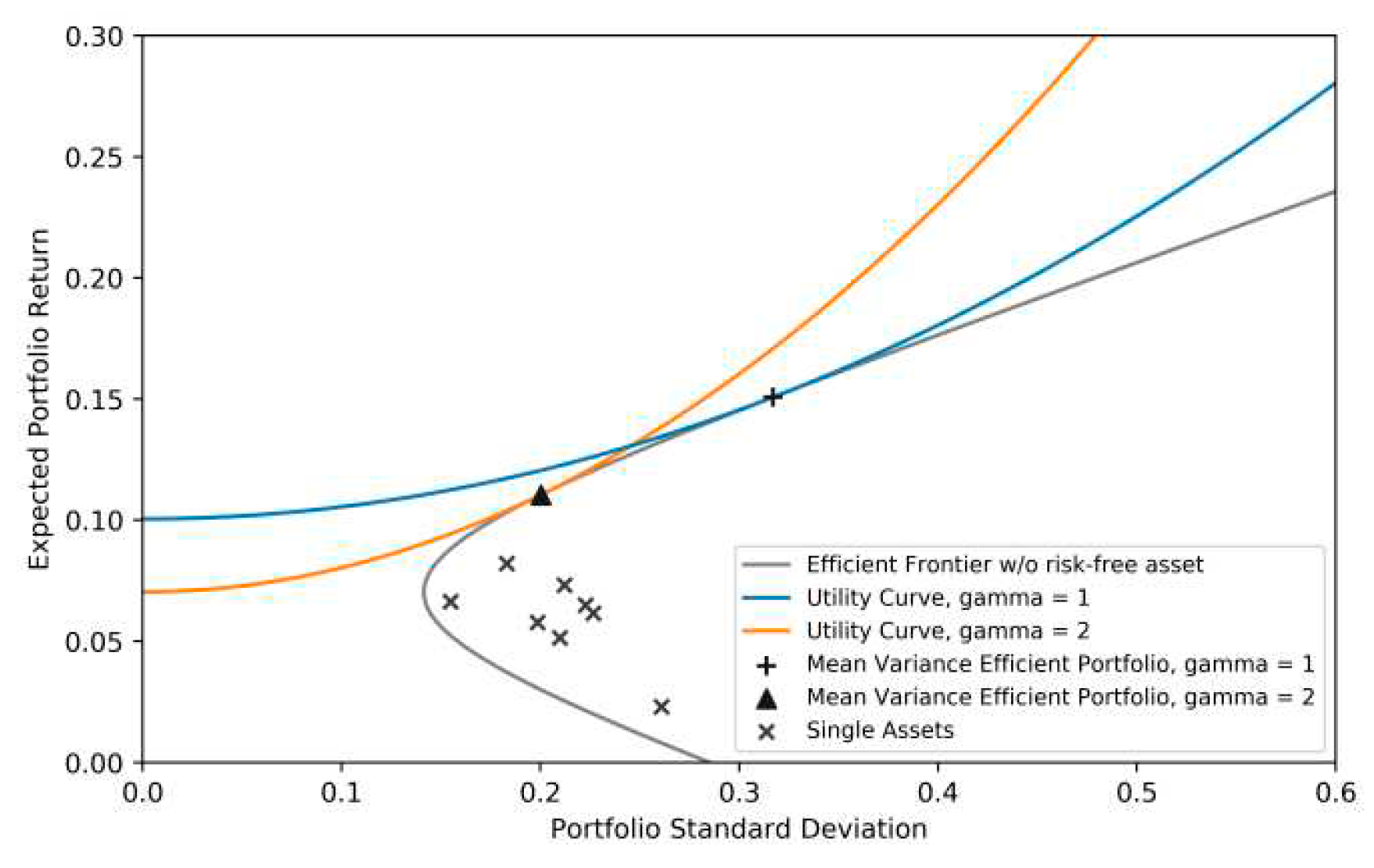

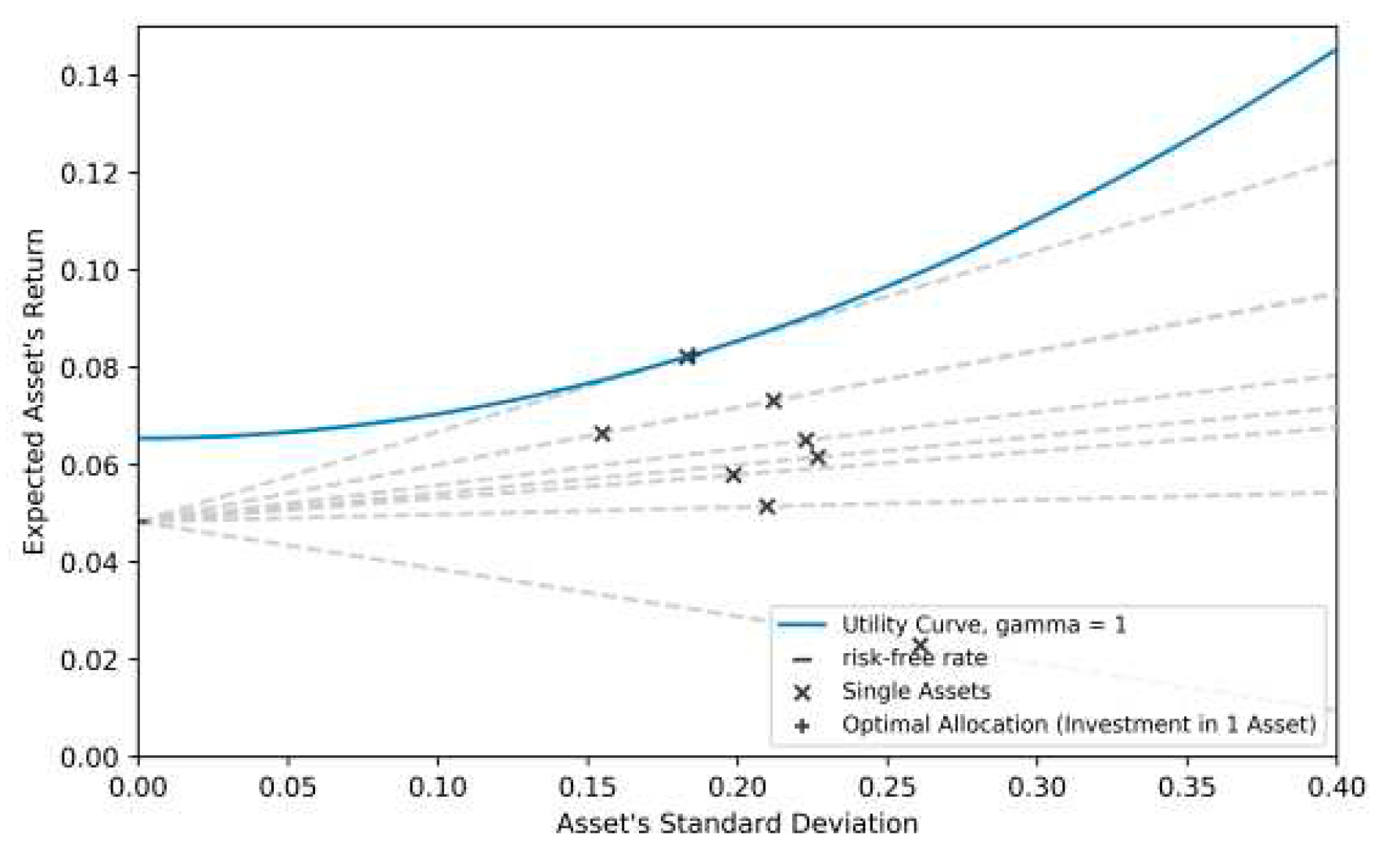

2.3. Optimal Portfolio under CARA Utility in a One-Fund Setting

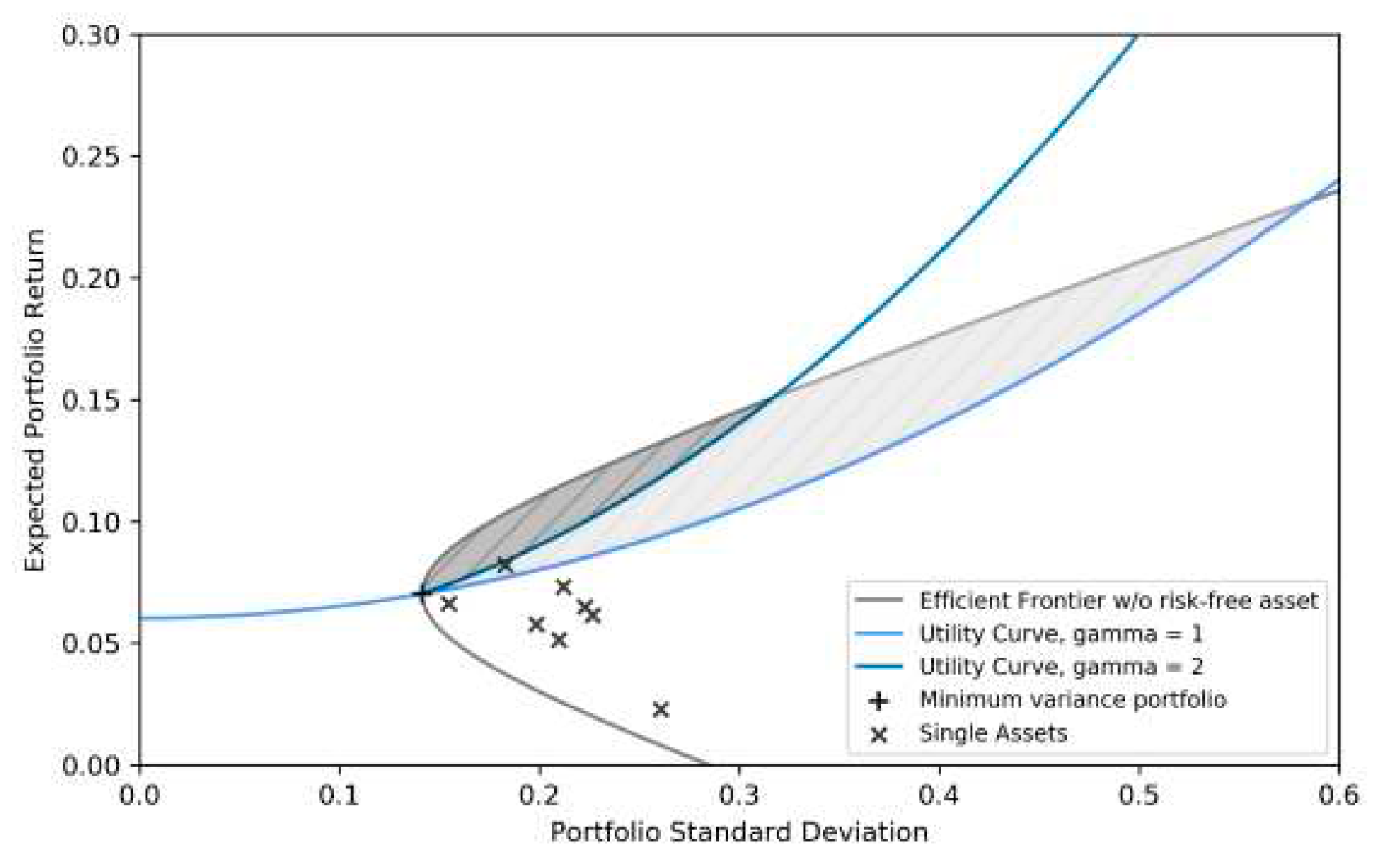

2.4. The Global Minimum Variance Portfolio

2.5. Mean-Variance Efficient Portfolios in a Two-Fund Setting

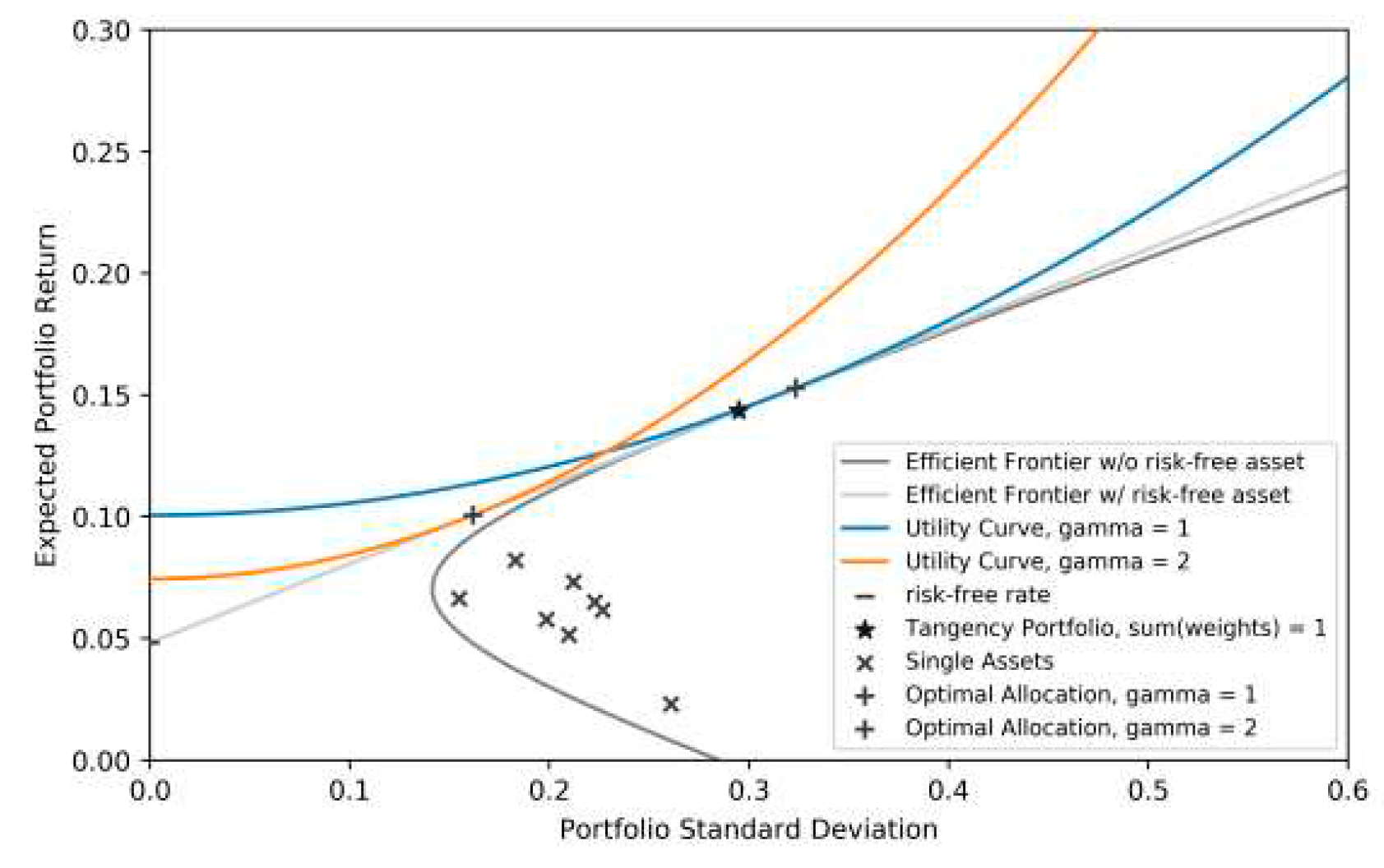

2.5.1. The Global Maximum Sharpe Ratio Portfolio/Tangency Portfolio

3. Related Works

4. Empirical Study: Improving the Mean-Variance Setting

4.1. Improving Parameter Estimation

4.2. Asset Allocation in a Downside Risk Setting

4.3. Introducing Ambiguity Aversion into Mean-Variance Setting

5. Methodology

5.1. Hypothesis

- The original tangency portfolio is outperformed by models that incorporate parameter uncertainty.

- Portfolios designed for utilities perform better than benchmark allocations.

- More accurate parameter estimations are produced by larger estimation windows, which lower uncertainty and improve performance.

- The performance of the out-of-sample analysis is consistent with the expected results (CER: Consistent with Expected Results).

- Compared to asset allocations without such restrictions, portfolios with short-sale restrictions show better performance under uncertainty.

5.2. Benchmark Portfolios

5.3. Short Sale Constraint

6. Preliminary Analysis

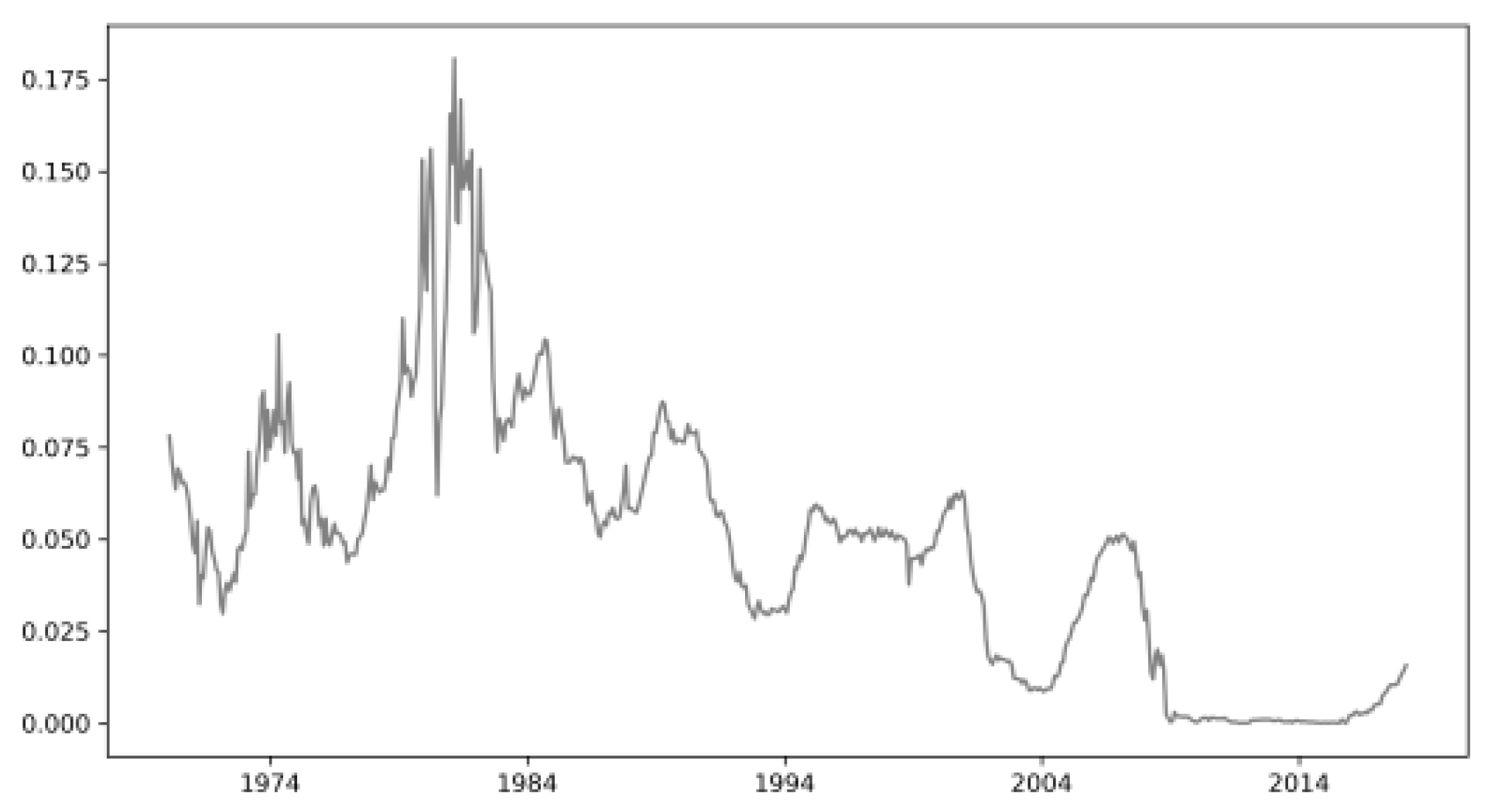

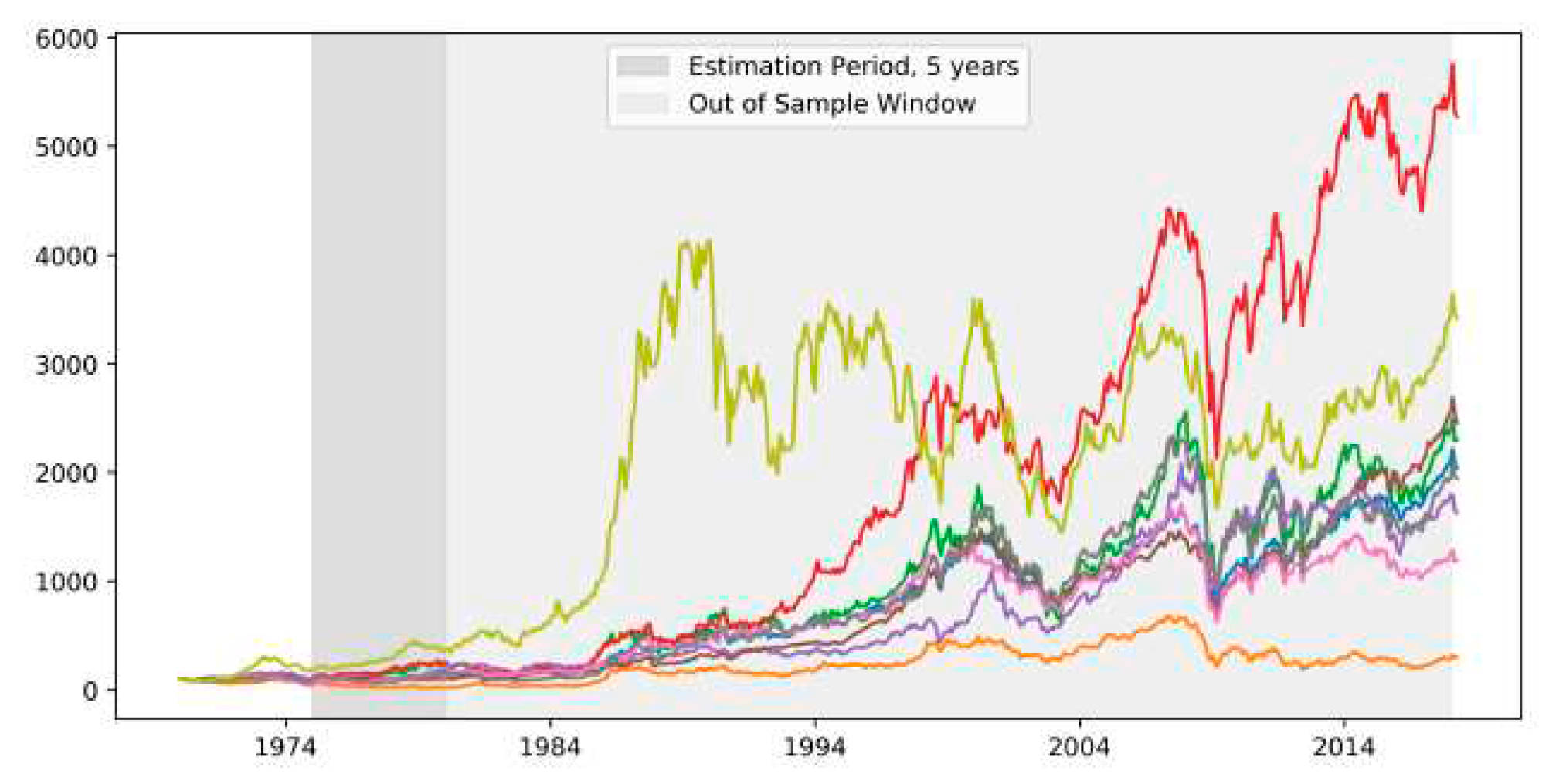

6.1. Dataset Description

6.2. Empirical Analysis of Expected Certainty Equivalent Return (CER)

6.3. Empirical Analysis of Out-of-Sample Performance

- Sharpe Ratio (SR): The Sharpe ratio is a common tool for evaluating risk-adjusted return. It assesses whether returns are generated due to excessive risk or smart investment decisions. The excess returns of asset i in period are calculated as the difference between the asset return and the risk-free rate . The Sharpe ratio for asset is then the ratio of the mean excess return to the standard deviation of excess returns.

- Turnover (TO): Turnover measures the amount of assets that need to be traded on average while implementing a trading strategy. It includes all rebalancing done to the portfolio over the considered period. The TO is calculated as the average sum of the absolute values of trades across all assets. It serves as an indicator for trading costs, which are proportional to the wealth traded.

7. Result Analysis

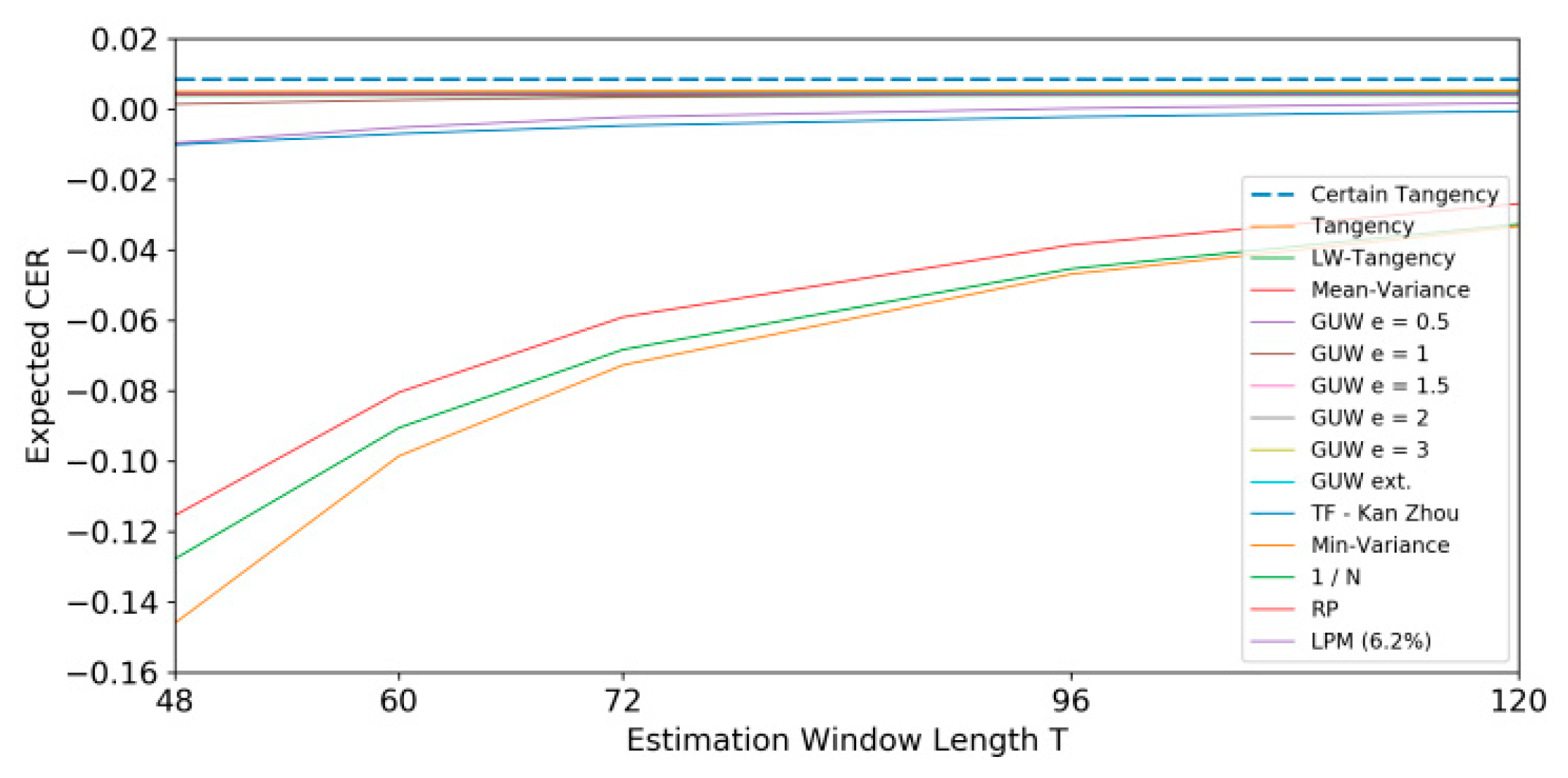

7.1. Expected CER Analysis

7.1.1. Expected CER Short Sale Allowed

- Hypothesis 1: Models that account for parameter uncertainty outperform the original tangency portfolio. The results support this hypothesis as the tangency portfolio performs notably lower under uncertainty (ranging between -14.60% and -3.33% depending on the observation length). In contrast, the LW-tangency, GUW, and the three-fund allocation outperform the tangency allocation under uncertainty. The GUW allocation shows a significant improvement, even though its intention is not to optimize performance. The positive effect decreases with increasing estimation window length.

- Hypothesis 2: Utility-optimized portfolios perform better relative to benchmark allocations. Contradictory findings emerge regarding this hypothesis. Among the utility-optimized models, GUW and the three-fund portfolios show the best performance, while the tangency, LW-tangency, and mean-variance allocation perform more modestly. Benchmark portfolios, including the minimum variance portfolio, show positive expected CER, with the minimum variance portfolio comparable to the GUW allocations.

- Hypothesis 3: Larger estimation windows lead to more accurate parameter estimates (less uncertainty) and, therefore, better performance. This pattern is confirmed for all utility-optimized portfolios and the minimum-variance portfolio. However, this trend is not observed for other portfolios, such as in the Lower Partial Moments (LPM) setting, where longer estimation windows do not consistently impact performance positively. The positive effect of longer estimation windows on performance improvement decreases as the estimation window length increases. This converging behavior suggests that further increasing the estimation length has a decreasing positive impact on expected performance improvement.

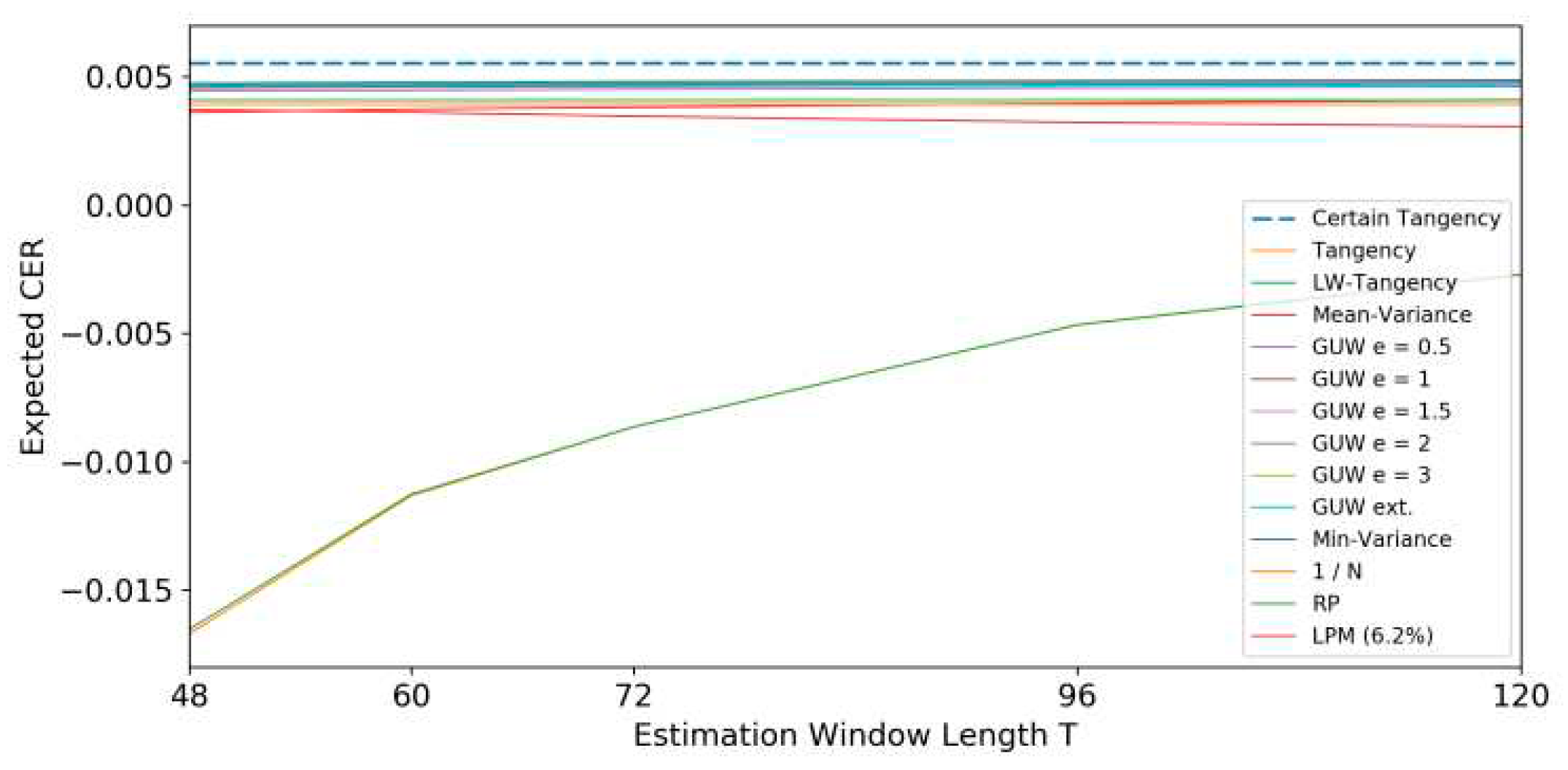

7.1.2. Expected CER: Short Sale Constrained

- Hypothesis 1: Models that account for parameter uncertainty outperform the original tangency portfolio. The GUW allocations still clearly outperform the tangency allocation for all levels of epsilon, although the advantage decreased notably compared to the unconstrained case. The positive impact of the shrunk covariance matrix fades out due to the constraint, leading to the tangency and LW-tangency performing equally well.

- Hypothesis 2: Utility-optimized portfolios perform better relative to benchmark allocations. Contrary to the hypothesis, there is no clear evidence of better performance for utility-optimized allocations. The minimum variance portfolio, which is not dependent on , shows good performance, challenging the expectation that utility-optimized portfolios should outperform.

- Hypothesis 3: Larger estimation windows lead to more accurate parameter estimates (less uncertainty) and, therefore, better performance. Short-sell constrained portfolios exhibit a similar behavior regarding the length of the estimation window as in the non-constrained case. Utility-optimized portfolios and the minimum variance portfolio perform better with longer estimation windows.

- Hypothesis 4: Short-sale constrained portfolios perform better under uncertainty than non-constrained asset allocations. The short sell constraint has a dual impact. It improves the expected performance of the original tangency and mean-variance allocations, while portfolios considering uncertainty and the minimum variance portfolio perform slightly worse.

7.1.3. Different Values of γ

- Impact of Risk Aversion on Tangency and Mean-Variance Allocations: As risk aversion increases, the expected performance of the tangency and mean-variance allocations under uncertainty improves. This suggests that investors with higher risk aversion find these strategies more appealing. The expected performance for highly risk-averse investors is less dispersed compared to less risk-averse investors, indicating more consistency in outcomes for risk-averse individuals.

- Divergent Patterns Among Asset Allocations Considering Uncertainty: There is no common pattern among asset allocations when considering uncertainty. Different strategies exhibit varied behavior with changing risk aversion. The LW-tangency and three-fund allocation show an increasing expected CER with higher risk aversion (), suggesting that these strategies may be more suitable for risk-averse investors. The behavior of the GUW allocation is more nuanced, showing increasing expected CER for lower values of ambiguity aversion ( = 0.5) but a reversal of this trend for higher values of .

- Performance of Benchmark Portfolios: Interestingly, the minimum-variance allocation stands out as the best performer for risk aversion levels from γ = 1.5 onward, even though it decreases in performance as risk aversion decreases. This contradicts the trend observed in other benchmark portfolios.

7.1.4. Expected CER Using Control Data

- Hypothesis 1: The LW-tangency allocation demonstrates superior expected performance compared to the tangency allocation under uncertainty. This aligns with the hypothesis and reinforces the idea that incorporating parameter uncertainty can lead to improved outcomes. Similarly, the GUW and the three-fund allocation outperform the tangency portfolio, supporting the notion that considering uncertainty in parameter estimates enhances the performance of these portfolios.

- Hypothesis 2: Contrary to the hypothesis, utility-optimized portfolios do not consistently outperform benchmark allocations in the control data set. Among the utility-optimized portfolios, only those considering uncertainty show strong performance. Benchmark portfolios perform well in the control data set, challenging the idea that utility-optimized strategies consistently lead to better outcomes.

- Hypothesis 3: The control data set exhibits a similar pattern as the main data set, supporting the hypothesis. Utility-optimized portfolios and the minimum variance allocation benefit from larger estimation windows, leading to more accurate parameter estimates and better performance. The relationship does not hold for portfolios following 1/N, risk parity, and LPM, indicating that larger estimation windows may not uniformly improve the performance of all allocation strategies.

- Hypothesis 4: Consistent with the main data set, short-sale constrained portfolios in the control data set exhibit less dispersed results. Portfolios that performed modestly in the unconstrained case now show improved performance when short sales are restricted. The constrained portfolios, especially those that performed modestly without constraints, demonstrate a more consistent and favorable performance under uncertainty.

8. Conclusion

Funding

Data Availability Statement

Conflicts of Interest

References

- Marwah, N.; Singh, V.K.; Kashyap, G.S.; Wazir, S. An Analysis of the Robustness of UAV Agriculture Field Coverage Using Multi-Agent Reinforcement Learning. Int. J. Inf. Technol. 2023, 15, 2317–2327. [Google Scholar] [CrossRef]

- Wazir, S.; Kashyap, G.S.; Saxena, P. MLOps: A Review. 2023.

- Kanojia, M.; Kamani, P.; Kashyap, G.S.; Naz, S.; Wazir, S.; Chauhan, A. Alternative Agriculture Land-Use Transformation Pathways by Partial-Equilibrium Agricultural Sector Model: A Mathematical Approach. 2023.

- Kashyap, G.S.; Malik, K.; Wazir, S.; Khan, R. Using Machine Learning to Quantify the Multimedia Risk Due to Fuzzing. Multimed. Tools Appl. 2022, 81, 36685–36698. [Google Scholar] [CrossRef]

- Wazir, S.; Kashyap, G.S.; Malik, K.; Brownlee, A.E.I. Predicting the Infection Level of COVID-19 Virus Using Normal Distribution-Based Approximation Model and PSO. In; Springer, Cham, 2023; pp. 75–91.

- Kashyap, G.S.; Brownlee, A.E.I.; Phukan, O.C.; Malik, K.; Wazir, S. Roulette-Wheel Selection-Based PSO Algorithm for Solving the Vehicle Routing Problem with Time Windows. 2023.

- Michaud, R.O. The Markowitz Optimization Enigma: Is ‘Optimized’ Optimal? Financ. Anal. J. 1989, 45, 31–42. [Google Scholar] [CrossRef]

- Kolm, P.N.; Tütüncü, R.; Fabozzi, F.J. 60 Years of Portfolio Optimization: Practical Challenges and Current Trends. Eur. J. Oper. Res. 2014, 234, 356–371. [Google Scholar] [CrossRef]

- Fisher, K.L.; Statman, M. The Mean-Variance-Optimization Puzzle: Security Portfolios and Food Portfolios. Financ. Anal. J. 1997, 53, 41–50. [Google Scholar] [CrossRef]

- Best, M.J.; Grauer, R.R. On the Sensitivity of Mean-Variance-Efficient Portfolios to Changes in Asset Means: Some Analytical and Computational Results. Rev. Financ. Stud. 1991, 4, 315–342. [Google Scholar] [CrossRef]

- Lopez de Prado, M. Hierarchical Portfolio Construction: Dispelling Markowitz’s Curse. SSRN Electron. J. 2016. [Google Scholar] [CrossRef]

- Jobson, J.D.; Korkie, R.M. Putting Markowitz Theory to Work. J. Portf. Manag. 1981, 7, 70–74. [Google Scholar] [CrossRef]

- DeMiguel, V.; Garlappi, L.; Uppal, R. Optimal versus Naive Diversification: How Inefficient Is the 1/N Portfolio Strategy? Rev. Financ. Stud. 2009, 22, 1915–1953. [Google Scholar] [CrossRef]

- Chopra, V.K.; Ziemba, W.T. The Effect of Errors in Means, Variances, and Covariances on Optimal Portfolio Choice. In The Kelly Capital Growth Investment Criterion: Theory And Practice; 2011; pp. 249–257 ISBN 9789814293501.

- Kan, R.; Zhou, G. Optimal Portfolio Choice with Parameter Uncertainty. J. Financ. Quant. Anal. 2007, 42, 621–656. [Google Scholar] [CrossRef]

- Garlappi, L.; Uppal, R.; Wang, T. Portfolio Selection with Parameter and Model Uncertainty: A Multi-Prior Approach. Rev. Financ. Stud. 2007, 20, 41–81. [Google Scholar] [CrossRef]

- Ledoit, O.; Wolf, M.N.; Honey, I. Shrunk the Sample Covariance Matrix. SSRN Electron. J. 2005. [Google Scholar] [CrossRef]

- Harlow, W.V. Asset Allocation in a Downside-Risk Framework. Financ. Anal. J. 1991, 47, 28–40. [Google Scholar] [CrossRef]

- Ellsberg, D. Risk, Ambiguity, and the Savage Axioms. Q. J. Econ. 1961, 75, 643–669. [Google Scholar] [CrossRef]

- Donald, Cooper, R.; Schindler, Pamela, S. Business Research Methods; 2013; ISBN 0077774434, 9780077774431.

- Benartzi, S.; Thaler, R.H. Naive Diversification Strategies in Defined Contribution Saving Plans. Am. Econ. Rev. 2001, 91, 79–98. [Google Scholar] [CrossRef]

- Hjalmarsson, E.; Österholm, P. Testing for Cointegration Using the Johansen Methodology When Variables Are Near-Integrated: Size Distortions and Partial Remedies. Empir. Econ. 2010, 39, 51–76. [Google Scholar] [CrossRef]

|

annualized |

Variance-covariance matrix of annualized returns Σ | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Asset 1 | Asset 2 | Asset 3 | Asset 4 | Asset 5 | Asset 6 | Asset 7 | Asset 8 | ||

| Asset 1 | 2.30% | 6.81% | 3.03% | 2.36% | 2.32% | 1.79% | 2.71% | 3.60% | 2.02% |

| Asset 2 | 6.50% | 3.03% | 4.96% | 2.96% | 2.41% | 2.04% | 2.70% | 3.72% | 1.99% |

| Asset 3 | 8.22% | 2.36% | 2.96% | 3.35% | 2.01% | 1.75% | 2.44% | 2.88% | 1.85% |

| Asset 4 | 5.79% | 2.32% | 2.41% | 2.01% | 3.94% | 2.30% | 2.52% | 2.56% | 1.59% |

| Asset 5 | 6.64% | 1.79% | 2.04% | 1.75% | 2.30% | 2.40% | 2.10% | 2.10% | 1.21% |

| Asset 6 | 5.14% | 2.71% | 2.70% | 2.44% | 2.52% | 2.10% | 4.40% | 3.07% | 1.92% |

| Asset 7 | 6.15% | 3.60% | 3.72% | 2.88% | 2.56% | 2.10% | 3.07% | 5.14% | 2.13% |

| Asset 8 | 7.32% | 2.02% | 1.99% | 1.85% | 1.59% | 1.21% | 1.92% | 2.13% | 4.50% |

| Asset i | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

|---|---|---|---|---|---|---|---|---|

| -92.35% | -27.61% | 173.13% | -32.26% | 96.97% - | 75.67% | 12.57% | 45.22% | |

| -43.50% | -15.75% | 97.92% | -17.70% | 82.01% - | -38.93% | 1.91% | 33.83% |

| = 1 | = 2 | |

|---|---|---|

| 15.07% | 11.05% | |

| 31.71% | 20.04% |

| Asset i | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

|---|---|---|---|---|---|---|---|---|

| 5.35% | -3.90% | 22.72% | -2.74% | 67.05% - | -2.19% | -8.74% | 22.74% |

| Asset i | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

|---|---|---|---|---|---|---|---|---|

| -83.74% | -25.52% | 159.87% | -29.66% | 94.34% - | -69.19% | 10.69% | 43.22% |

| = 1 | = 2 | |

|---|---|---|

| 109.66% | 54.83% | |

| 15.29% | 10.06% | |

| 32.34% | 16.17% |

| Countries | Ticker | Abbreviation | Currency |

|---|---|---|---|

| Italy | MSITALL | ITA | EUR (ITL) |

| Germany | MSGERML | GER | EUR (DEM) |

| Switzerland | MSSWITL | SWI | CHF |

| Canada | MSCNDAL | CAN | CAD |

| USA | MSUSAML | USA | USD |

| UK | MSUTDKL | UK | GBP |

| France | MSFRNCL | FRA | EUR (FF) |

| Japan | MSJPANL | JPN | JPY |

| World | MSWRLD | WRLD | USD |

| Asset | Min | Max | Skew | Kurtosis | ||

|---|---|---|---|---|---|---|

| ITA | 0.191% | 7.53% | -52..91% | 26.39% | -0.68 | 4.57 |

| GER | 0.542% | 6.43% | -24.92% | 29.67% | -0.44 | 2.02 |

| SWI | 0.685% | 5.28% | -19.14% | 23.31% | -0.36 | 1.73 |

| CAN | 0.482% | 5.73% | -30.05% | 20.72% | -0.78 | 3.19 |

| USA | 0.553% | 4.47% | -24.36% | 16.17% | -0.71 | 2.95 |

| UK | 0.429% | 6.06% | -24.09% | 44.01% | 0.35 | 5.47 |

| FRA | 0.513% | 6.54% | -31.35% | 22.05% | -0.55 | 1.83 |

| JPN | 0.610% | 6.12% | -28.11% | 22.20% | -0.02 | 1.28 |

| WRLD | 0.521% | 4.37% | -20.84% | 14.14% | -0.70 | 2.29 |

| Asset | W | p-value | Reject |

|---|---|---|---|

| ITA | 0.96 | 1.3E-10 | YES |

| GER | 0.97 | 2.8E-09 | YES |

| SWI | 0.97 | 6.7E-09 | YES |

| CAN | 0.96 | 4.2E-12 | YES |

| USA | 0.96 | 5.8E-11 | YES |

| UK | 0.95 | 1.2E-12 | YES |

| FRA | 0.98 | 4.7E-08 | YES |

| JPN | 0.99 | 2.8E-04 | YES |

| WRLD | 0.9625 | 5.4E-11 | YES |

| All Assets | 0.9661 | 2.5E-33 | YES |

| Asset | ITA | GER | SWI | CAN | USA | UK | FRA | JPN | WRLD |

|---|---|---|---|---|---|---|---|---|---|

| ITA | 6.81% | 3.03% | 2.36% | 2.32% | 1.79% | 2.71% | 3.60% | 2.02% | 2.29% |

| GER | 3.03% | 4.96% | 2.96% | 2.41% | 2.04% | 2.70% | 3.72% | 1.99% | 2.45% |

| SWI | 2.36% | 2.96% | 3.35% | 2.01% | 1.75% | 2.44% | 2.88% | 1.85% | 2.07% |

| CAN | 2.32% | 2.41% | 2.01% | 3.94% | 2.30% | 2.52% | 2.56% | 1.59% | 2.32% |

| USA | 1.79% | 2.04% | 1.75% | 2.30% | 2.40% | 2.10% | 2.10% | 1.21% | 2.08% |

| UK | 2.71% | 2.70% | 2.44% | 2.52% | 2.10% | 4.40% | 3.07% | 1.92% | 2.44% |

| FRA | 3.60% | 3.72% | 2.88% | 2.56% | 2.10% | 3.07% | 5.14% | 2.13% | 2.54% |

| JPN | 2.02% | 1.99% | 1.85% | 1.59% | 1.21% | 1.92% | 2.13% | 4.50% | 2.14% |

| WRLD | 2.29% | 2.45% | 2.07% | 2.32% | 2.08% | 2.44% | 2.54% | 2.14% | 2.29% |

| 2.30% | 6.50% | 8.22% | 5.79% | 6.64% | 5.14% | 6.15% | 7.32% | 6.25% |

| Estimation window length T | |||||

|---|---|---|---|---|---|

| Utility-Optimized Portolios | 48 | 60 | 72 | 96 | 120 |

| Certain Tangency | 0.855% | 0.855% | 0.855% | 0.855% | 0.855% |

| Tangency | -14.603% | -9.856% | -7.274% | -4.690% | -3.334% |

| LW-Tangency | -12.776% | -9.056% | -6.835% | -4.540% | -3.271% |

| Mean-Variance | -11.542% | -8.047% | -5.912% | -3.863% | -2.691% |

| = 0.5 | -0.966% | -0.528% | -0.233% | 0.016% | 0.016% |

| = 1 | 0.137% | 0.251% | 0.336% | 0.401% | 0.443% |

| = 1.5 | 0.397% | 0.434% | 0.466% | 0.491% | 0.508% |

| = 2 | 0.462% | 0.482% | 0.500% | 0.515% | 0.526% |

| = 3 | 0.493% | 0.504% | 0.517% | 0.526% | 0.534% |

| GUW ext. | 0.433% | 0.438% | 0.452% | 0.457% | 0.466% |

| TF - Kan Zhou | -1.016% | -0.704% | -0.475% | -0.227% | -0.064% |

| Benchmark Portfolios | |||||

| Min-Variance | 0.492% | 0.496% | 0.500% | 0.501% | 0.502% |

| 1 / N | 0.393% | 0.393% | 0.393% | 0.393% | 0.393% |

| RP | 0.408% | 0.408% | 0.409% | 0.409% | 0.409% |

| LPM (6.2%) | 0.436% | 0.434% | 0.430% | 0.430% | 0.402% |

| . | Estimation window length T | ||||

|---|---|---|---|---|---|

| Utility-Optimized Portolios | 48 | 60 | 72 | 96 | 120 |

| Certain Tangency | 0.555% | 0.555% | 0.555% | 0.555% | 0.555% |

| Tangency | -1.670% | -1.132% | -0.865% | -0.466% | -0.271% |

| LW-Tangency | -1.652% | -1.126% | -0.864% | -0.467% | -0.271% |

| Mean-Variance | 0.361% | 0.374% | 0.381% | 0.397% | 0.410% |

| = 0.5 | 0.5 0.444% | 0.448% | 0.452% | 0.457% | 0.462% |

| = 1 | 1 0.457% | 0.460% | 0.463% | 0.469% | 0.473% |

| = 1.5 | 1.5 0.463% | 0.466% | 0.470% | 0.474% | 0.478% |

| = 2 | 2 0.466% | 0.470% | 0.473% | 0.478% | 0.482% |

| = 3 | 3 0.471% | 0.474% | 0.478% | 0.482% | 0.485% |

| GUW ext. | 0.462% | 0.464% | 0.466% | 0.469% | 0.472% |

| TF - Kan Zhou | - | - | - | - | - |

| Benchmark Portfolios | |||||

| Min-Variance | 0.474% | 0.478% | 0.481% | 0.485% | 0.487% |

| 1 / N | 0.393% | 0.393% | 0.393% | 0.393% | 0.393% |

| RP | 0.408% | 0.408% | 0.408% | 0.408% | 0.408% |

| LPM (6.2%) | 0.372% | 0.362% | 0.346% | 0.323% | 0.306% |

| Risk aversion coefficient γ | |||||

|---|---|---|---|---|---|

| Utility-Optimized Portolios | 0.5 | 1.0 | 1.5 | 2.0 | 3.0 |

| Certain Tangency | 1.320% | 0.855% | 0.700% | 0.622% | 0.545% |

| Tangency | -20.102% | -9.856% | -6.441% | -4.733% | -2.165% |

| LW-Tangency | -18.501% | -9.056% | -5.907% | -4.333% | -2.019% |

| Mean-Variance | -16.552% | -8.047% | -5.247% | -3.871% | -1.823% |

| = 0.5 | -1.339% | -0.528% | -0.307% | -0.230% | -0.074% |

| = 1 | 0.203% | 0.251% | 0.219% | 0.174% | 0.136% |

| = 1.5 | 0.518% | 0.434% | 0.361% | 0.295% | 0.213% |

| = 2 | 0.564% | 0.482% | 0.409% | 0.343% | 0.249% |

| = 3 | 0.573% | 0.504% | 0.440% | 0.378% | 0.281% |

| GUW ext. | 0.533% | 0.438% | 0.360% | 0.291% | 0.192% |

| TF - Kan Zhou | -1.798% | -0.704% | -0.340% | -0.158% | 0.025% |

| Benchmark Portfolios | |||||

| Min-Variance | 0.543% | 0.496% | 0.449% | 0.402% | 0.315% |

| 1 / N | 0.448% | 0.393% | 0.339% | 0.284% | 0.175% |

| RP | 0.461% | 0.408% | 0.356% | 0.304% | 0.199% |

| LPM (6.2%) | 0.500% | 0.434% | 0.367% | 0.300% | 0.166% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).