Submitted:

23 October 2023

Posted:

25 October 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

- (1)

- To assess the effectiveness of customer-centric marketing strategies in improving the tax-paying behavior of the citizens of Bangladesh.

- (1)

- To gauge the current tax-paying behavior of the citizens.

- (2)

- To understand the awareness level of citizens regarding their tax obligations and the benefits of compliance.

- (3)

- To analyze the potential and applicability of customer-centric marketing strate- gies in molding tax-paying attitudes and behaviors.

- (1)

- Increase its tax revenue without raising tax rates.

- (2)

- Enhance voluntary compliance, reducing the need for punitive measures.

- (3)

- Foster a culture of tax compliance among the citizens, aiding long-term fiscal sustainability.

2. Literature Review

2.1. Historical Overview of Taxation in Bangladesh

2.2. Tax Compliance and Behavior in Bangladesh

- (1)

- Socio-cultural Norms: In many societies, including Bangladesh, tax compliance is often linked to prevailing social and cultural norms. Communities where paying taxes is considered a civic duty tend to have higher compliance rates (13).

- (2)

- Trust in Government: The level of trust citizens have in their government and its institutions plays a crucial role. If taxpayers believe that their contributions are being used efficiently for public welfare, they’re more likely to comply (19).

- (3)

- Economic Conditions: Economic stability and growth influence taxpayers’ ability and willingness to comply. During economic downturns, compliance rates may drop due to reduced incomes or business losses (12).

- (4)

- Administrative Efficiency: A streamlined and transparent tax administration can encourage compliance. Inefficiencies, bureaucratic hurdles, or perceptions of corruption can deter taxpayers.

- (5)

- Tax Rates and Complexity: High tax rates or a complex tax code can discour- age compliance. Simplified tax structures and reasonable rates can encourage voluntary payment (14).

- (6)

- Penalties and Enforcement: The probability of being detected for non- compliance, combined with the severity of penalties, can act as deterrents. Ef- fective enforcement mechanisms are vital for ensuring compliance.

2.3. Common Reasons for Evasion or Non-compliance

- (1)

- Informal Economy: A substantial segment of Bangladesh’s economy operates informally, making it difficult to monitor and tax such entities (11).

- (2)

- Lack of Awareness: In rural and less urbanized areas, many taxpayers might not fully understand their tax obligations, resulting in unintentional non-compliance (6).

- (3)

- Perceived Inequity: A belief that the tax system is unfair or that others aren’t paying their due can deter compliance (7).

- (4)

- Corrupt Practices: Corruption within the tax administration can discourage hon- est taxpayers and perpetuate a culture of evasion. Additionally, there exists a segment of individuals who, driven by arrogance or a misguided belief in their cleverness, deliberately devise methods to evade paying income tax, thinking they can outsmart the system. Such attitudes further strain the system and undermine efforts to ensure fair and comprehensive tax compliance.

- (5)

- Complex Tax Procedures: Perceptions of cumbersome or intricate tax filing pro- cesses can deter or delay compliance.

- (6)

- Economic Hardships: Economic downturns or personal financial difficulties might drive individuals or businesses to evade taxes for financial relief.

- (7)

- Inadequate Resources of NBR: The National Bureau of Revenue (NBR), as the sole tax-collecting authority, faces significant challenges. The lack of resources for training and development, the absence of logistical support, and local offices operating in rented premises diminish its stature in the eyes of the public. Such operational constraints can cast a shadow over the NBR’s authority and efficacy.

- (8)

- Perception of NBR: The aforementioned operational challenges contribute to a psychological impact. The populace often doesn’t view the NBR with the same seriousness and reverence as other law enforcement agencies, undermining its authority and leading to reduced compliance.

- (9)

- Lack of penalty procedures.

2.4. Customer-Centric Marketing

2.4.1. Principles and Key Strategies

- (1)

- Understanding Customer Needs: Before designing any marketing strategy, it’s imperative to understand what the customer wants. This involves collecting data, market research, and direct interactions (4).

- (2)

- Personalization: Tailoring messages and services to individual customer needs or segments ensures relevance and can enhance engagement (5).

- (3)

- Consistent Value Delivery: Customer-centricity involves not just attracting but retaining customers by consistently delivering value.

- (4)

- Feedback Loops: Actively seeking and responding to feedback helps in refining strategies and building trust.

- (5)

- Building Long-term Relationships: Rather than focusing on transactional inter- actions, a customer-centric approach prioritizes long-term relationship building.

- (6)

- Holistic Experience: This approach looks at the entire customer journey, ensuring a seamless and positive experience from the first interaction to post-purchase support.

2.4.2. Success Stories from Other Sectors or Countries

- (1)

- E-commerce: Giants like Amazon and Alibaba prioritize customer experience. Their recommendation systems, easy return policies, and customer reviews are all tailored to enhance the customer journey.

- (2)

- Banking: Banks, especially in developed countries, have adopted customer- centric approaches to offer personalized financial products, enhance digital ex- periences, and improve customer support.

- (3)

- Telecom: Companies like T-Mobile in the U.S. have redefined their services around customer needs, leading to significant market share growth.

2.5. Behavioral Economics and Tax Compliance

2.5.1. Psychological Factors Affecting Tax Behavior

- (1)

- Loss Aversion: People tend to prefer avoiding losses over acquiring equivalent gains. If taxpayers perceive tax payments as a ’loss’, they might be more inclined to evade.

- (2)

- Social Norms: Individuals often align their behavior with what’s perceived as ’normal’ or ’acceptable’ in their community. If tax evasion is rampant and socially acceptable, more might indulge in it.

- (3)

- Trust in Authorities: The belief that authorities will use the tax revenues for pub- lic good can influence compliance. Conversely, mistrust or perceived corruption can deter individuals from paying.

- (4)

- Anchoring: Taxpayers might anchor their tax decisions based on certain reference points, like past tax bills or anecdotal information, even if these aren’t relevant.

- (5)

- Prospect Theory: People make decisions based on potential gains or losses rela- tive to a specific reference point, rather than absolute outcomes. The framing of tax communications can thus influence compliance.

2.5.2. Potential Interventions to Improve Compliance

- (1)

- Framing Effects: How tax information and obligations are presented can impact compliance. Emphasizing the public good achieved through taxes might motivate more people to comply.

- (2)

- Timely Reminders: Sending timely reminders, especially if personalized, can re- duce forgetfulness or intentional delays in tax payments.

- (3)

- Social Proof: Sharing data about how many people in a community or peer group comply with tax obligations can encourage others to follow suit.

- (4)

- Simplification: Reducing the cognitive load by simplifying tax forms, procedures, and communications can enhance voluntary compliance.

- (5)

- Feedback Loops: Informing taxpayers about how their previous year’s taxes were utilized can foster trust and a sense of contribution towards societal welfare.

2.6. Digital Interventions and Tax Collection

2.6.1. The Rise of Technology in Enhancing Tax Compliance

- (1)

- E-filing Systems: Digital platforms that allow taxpayers to file their returns on- line have made the process more convenient and efficient. Such systems reduce paperwork, human errors, and administrative burdens.

- (2)

- Digital Payment Gateways: The rise of digital payment solutions facilitates prompt and hassle-free tax payments, reducing delays and enhancing compli- ance.

- (3)

- Data Analytics: Tax authorities can leverage big data and analytics to identify patterns, forecast revenues, and detect potential cases of evasion or fraud.

- (4)

- Artificial Intelligence (AI) and Machine Learning: Advanced algorithms can be used to automate routine tasks, predict taxpayer behavior, and offer personalized services.

- (5)

- Mobile Apps: With the ubiquity of smartphones, tax authorities can engage taxpayers through mobile applications, offering services like payment reminders, tax calculators, and informational content.

2.6.2. Case Studies from Other Countries

- (1)

- Estonia: Known for its e-governance initiatives, Estonia’s e-Tax/e-Customs sys- tem allows citizens and businesses to declare taxes online. Nearly 95% of tax declarations in the country are filed electronically.

- (2)

- India: The introduction of the Goods and Services Tax Network (GSTN) has digitized tax filings and payments for businesses, providing a unified platform that integrates different state and central taxes.

- (3)

- Brazil: The country’s Receita Federal (tax authority) uses advanced data an- alytics to cross-reference taxpayer information, improving audit accuracy and reducing evasion.

- (4)

- South Africa: The South African Revenue Service (SARS) introduced eFiling, a digital platform enabling electronic submission of tax returns, payments, and other related services.

2.6.3. Challenges in Global Tax Collection

- (1)

- Economic Disparities: Nations with significant economic disparities often face challenges in tax collection, as large sections of the population might fall below the taxable income threshold.

- (2)

- Complex Tax Systems: Overly complex or frequently changing tax sys- tems can lead to confusion among taxpayers, resulting in unintentional non- compliance or evasion.

- (3)

- Informal Economies: Countries with large informal sectors face the challenge of bringing these segments into the tax net.

- (4)

- Cross-border Evasion: With globalization and the digital economy, cross- border tax evasion has emerged as a significant challenge, with entities leveraging tax havens or complex corporate structures to minimize tax liabilities.

- (5)

- Corruption and Trust Deficit: In countries where corruption within the tax administration is perceived to be high, voluntary compliance can be low due to a lack of trust in the system.

2.6.4. Successes in Global Tax Collection

- (1)

- Digital Transformation: Countries that have embraced the digital revolution, like Estonia and India, have witnessed improved compliance rates and streamlined tax administration processes.

- (2)

- Simplification of Tax Codes: Nations that have undertaken reforms to simplify their tax codes, making them more transparent and understandable, have ob- served better compliance.

- (3)

- Behavioral Interventions: Drawing from behavioral economics, countries like the UK have implemented ’nudges’ in their tax communications, resulting in im- proved taxpayer responses.

- (4)

- Broadening the Tax Base: By implementing policies that bring more entities into the tax net, especially from the informal sector, countries can enhance their revenue collections.

- (5)

- Strengthening International Cooperation: Global initiatives, like the Base Ero- sion and Profit Shifting (BEPS) project by the OECD, have aimed at ensuring that multinational enterprises pay their fair share of taxes, thereby addressing cross-border tax challenges.

3. Methodology

3.1. Research Design

3.1.1. Exploratory, Descriptive, and Causal Aspects

3.2. Data Collection Methods

3.2.1. Qualitative and Quantitative Approaches (Phase 1)

- (1)

- Age RangeGender

- (2)

- Occupation

- (3)

- Annual Income Range

- (4)

- How frequently do you file your taxes?

- (5)

- Do you believe paying taxes is a civic duty?

- (6)

- On a scale of 1 to 5, how confident are you in your understanding of the tax regulations and procedures?

- (7)

- Have you ever received any formal information or training on tax filing?

- (8)

- How do you primarily pay your taxes?

- (9)

- Would you be motivated to pay taxes if you received some form of public recog- nition?

- (10)

- Do you believe there are significant benefits to being tax compliant?

- (11)

- How trustworthy do you find the tax system in Bangladesh?

- (12)

- Do you believe social proof (knowing others are paying their taxes) would influ- ence your behavior?

- (13)

- Would you be more likely to pay taxes if the process was gamified, offering rewards or points for timely compliance?

- (14)

- On a scale of 1 to 5, how responsive do you believe the tax department is to taxpayer needs?

3.2.2. Qualitative Approach:

- Tax Enrollment Boost: By providing a tax redemption of 2%, we aim to incen- tivize taxpayers to join the system and remain compliant.

- Awareness Drive: The initiative will focus on educating citizens about the im- portance of tax payments, how they are calculated, and the subsequent benefits for social and national development.

- Age: The core focus will be on individuals aged between 24-40 years. Gender: Both males and females are included in the target group.

- Occupation: The campaign will primarily target those in business services, gov- ernment services, and government employees.

- Income Bracket: The target audience has a monthly income ranging from 50,000 to 100,000 BDT.

- Location: The campaign will be concentrated on the outskirts of Dhaka, prefer- ably in areas like Savar or Gazipur.

- Challenges: One of the main challenges is the lack of comprehensive information available to this group about the importance of taxes, the tax calculation process, and the procedure for tax payments.

- Strengths: Being a government body, there’s no competition. Offering tax re- demption is an added advantage. Providing a reliable portal for instant tax payments and genuine information.

- Weaknesses: Limited resources available for the campaign. Focus restricted to a smaller area and group. Prevalent lack of information among the target audience. Opportunities: The younger demographic is more eager and concerned about tax obligations compared to the older generation. No competitors in the field, ensuring sole attention.

- Threats: Existing trust issues among potential taxpayers. Risks associated with misinformation and potential mistreatment by authorities.

- Unique Selling Proposition (USP): Authentic and reliable information on tax obligations.

- Offer of tax redemption.

- A trustworthy portal for instant tax payments.

- Data Collection: A registration log will maintain a record of all individuals suc- cessfully reached.

- Feedback Collection: Questionnaires will capture demographic details and gauge the perceptions of the target audience on government tax facilities.

- Outreach Target: The aim is to engage with 1000 individuals within a span of 3 days.

3.3. Sampling Techniques

3.3.1. Criteria for Selecting Participants and Data Sources

3.41. Data Analysis Methods

3.4.1. Tools and Techniques for Analyzing Collected Data

- Descriptive Statistics: The preliminary analysis of the Taxpayer Survey dataset will focus on metrics of central tendency, dispersion, and frequency dis- tributions. These metrics will illuminate general trends and patterns.

- Inferential Statistics: To probe deeper, tools like T-tests, ANOVA, or regres- sion analyses may be invoked, especially when navigating the causal dynamics between marketing strategies and tax compliance.

- Qualitative Analysis: Data from FGDs and interviews will be subjected to the- matic analysis. Common themes, narratives, and sentiments will be spotlighted, serving as a qualitative counterpart to the quantitative findings, ensuring a com- prehensive grasp of taxpayer behaviors and motivations.

4. Result Analysis

4.1. Demographic Overview of Respondents

4.1.1. Age, Profession, Income Levels

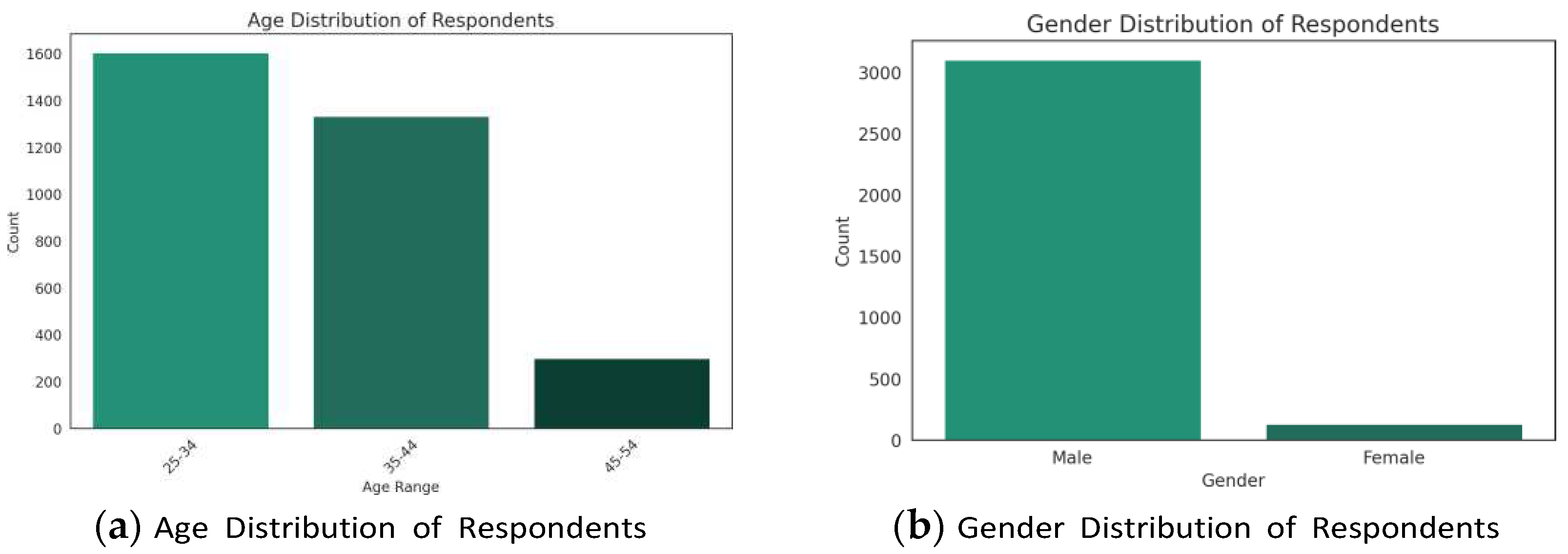

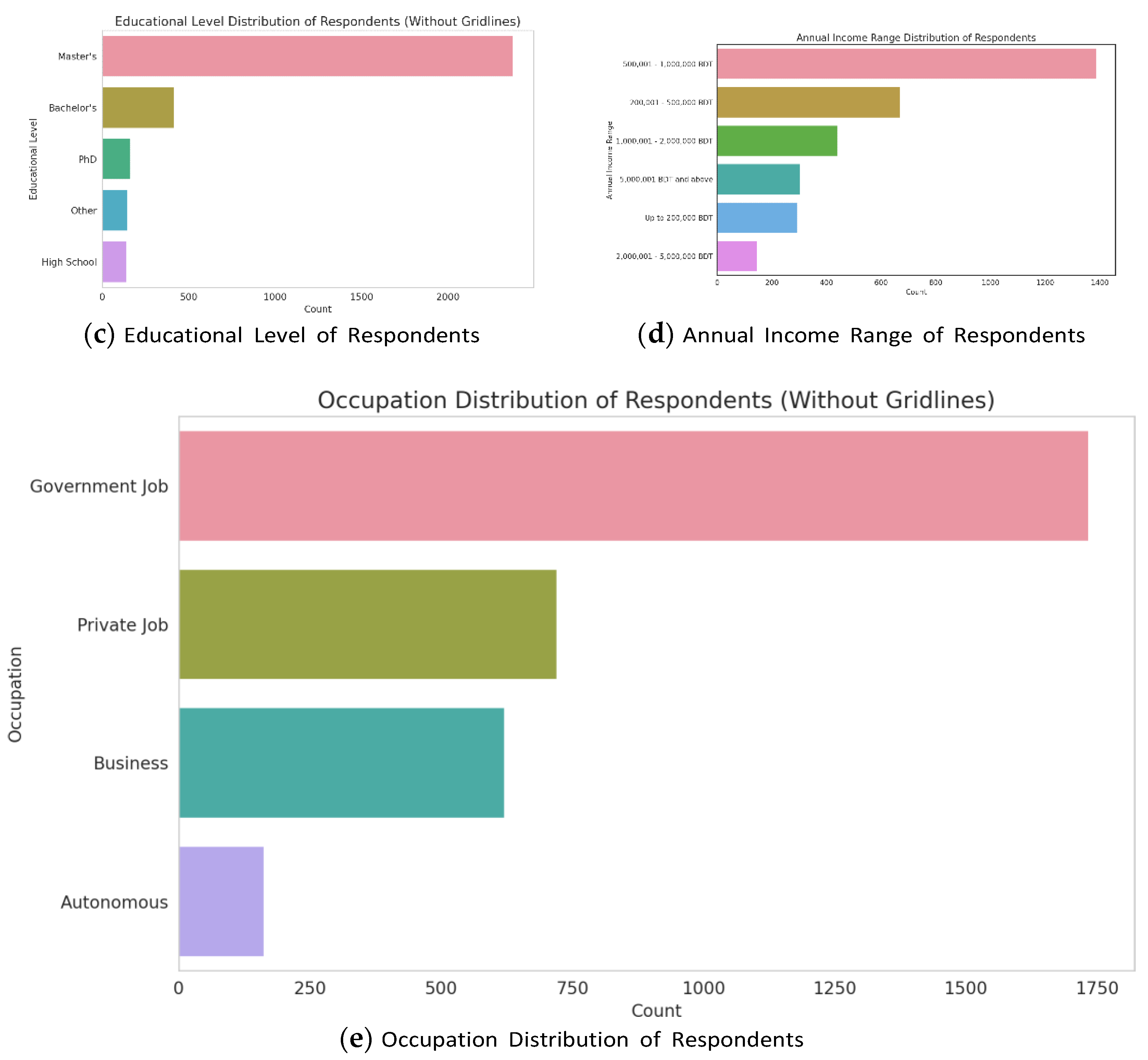

- Age Distribution: The majority of respondents fall within the age bracket of 25-34 years (1,605 respondents, 49.55% of total respondents) followed closely by the 35-44 age range (1334 respondents, 41.19%). This indicates that a signif- icant proportion of our sample represents the younger demographic, which is pivotal given their adaptability to newer tax compliance methods and digital innovations.

- Occupation Distribution: The predominant occupation among the respon- dents is ‘Government Job’ (1,734 respondents, 53.54%), followed by ’Private Job’ (721, 22.26%) and ’Business’ (621, 19.17%). This distribution provides insights into the earning patterns and potential tax liabilities associated with different professions.

- Income Distribution: The annual income distribution indicates that the largest group of respondents earns between BDT 500,001 - 1,000,000 BDT (Mid- dle income) (1387, 42.82%). The second largest group falls in the BDT 200,001 - 500,000 BDT range (665, 20.53%). This provides a perspective on the economic capacities of the respondents and the potential tax brackets they might belong to.

4.2. Current Tax-Paying Behavior

4.2.1. Frequency, Amount, and Patterns

- Confidence in Understanding Tax Regulations: The majority of respon- dents indicate a low level of confidence in understanding tax regulations and pro- cedures, rating it as 1 out of 5. However, a notable percentage, nearly 18.86%, feel highly confident, rating their understanding as 5 out of 5. Additionally, about 18.34% of respondents have a moderate level of confidence, rating their understanding as 3 out of 5.

- Frequency of Seeking Tax Assistance: Most respondents seek assistance ’Sometimes’ when filing taxes, indicating some uncertainty or lack of clarity about the process. A noteworthy proportion of respondents seek assistance ’Of- ten’, highlighting the complexity of the tax filing process for a segment of the population.

- Primary Mode of Tax Payment: The vast majority of respondents, approx- imately 67.68%, primarily pay their taxes through manual or paper-based sub- missions, indicating a preference for traditional payment methods. However, a growing segment, nearly 12.99%, are adopting online or e-filing methods, show- casing the increasing trend and acceptance of digital payment avenues for tax compliance. Additionally, about 19.33% of respondents utilize tax agents for their tax payments.

4.3. Awareness and Perceptions

4.3.1. Knowledge about Tax Obligations

- (1)

- Receipt of Formal Information or Training on Tax Filing: A significant majority of respondents, approximately 68.54%, have not received any formal information or training on tax filing. This data highlights the critical need for increasing awareness initiatives and offering relevant training to taxpayers to potentially enhance tax compliance.

- (2)

- Confidence in Understanding Tax Regulations: While approximately 18.34% of respondents rate their confidence in understanding tax regulations as 3 out of 5, a combined 35.75% of participants rate their confidence as either 4 or 5. This suggests that, while many feel moderately confident about their understand- ing, there’s a significant segment that is highly confident in their grasp of tax regulations.

4.3.1. Attitudes Towards Taxation

- Trustworthiness of the Tax System: Trust is a critical factor in tax compli- ance. Approximately 36.46% of respondents perceive Bangladesh’s tax system as ”Trustworthy,” and an additional 4.82% regard it as ”Very Trustworthy.” Com- bined, this suggests that over 41% have a positive trust level towards the tax system. On the other hand, 26.18% of participants are neutral in their trust, in- dicating a moderate level of trust. However, it’s noteworthy that a sizable 32.54% find the system ”Distrustful,” pointing to areas that might need improvement to bolster public trust.

- Belief in Benefits of Being Tax Compliant: A substantial majority, cumu- latively 72% (48.75% who ”Agree” and 23.25% who ”Strongly Agree”), believe that there are considerable benefits to being tax compliant. This prevalent posi- tive perception can act as a driving force to boost tax compliance, as it signifies an inherent understanding and acknowledgment of the advantages linked with fulfilling tax responsibilities. However, it’s worth noting that a smaller segment, approximately 9.41%, either disagrees or strongly disagrees with the notion, sug- gesting areas that might require targeted awareness campaigns.

- Motivational Factors in Tax Compliance: The idea of public recognition as a reward for tax compliance resonates with a significant portion of respondents. Specifically, 40.32% are ”Highly Motivated” by such a proposition, and an ad- ditional 50.85% feel ”Motivated.” This suggests that a public acknowledgment system could be a potential strategy for enhancing tax compliance. On the topic of social proof, the data indicates that citizens are considerably influenced by the tax compliance behavior of their peers. A combined total of approximately 83% of respondents show varying degrees of positive influence when aware of others paying taxes, emphasizing the power of societal norms and peer behavior in this context. The concept of gamification in the tax payment process also emerges as a strong motivator. Over 53% are ”More Likely” to pay taxes if the process involves rewards or points for timely compliance, and 37.39% would be ”Much More Likely” motivated by such a strategy. This underscores the potential of integrating gamified elements into the tax filing system to boost participation and punctuality in tax payments.

4.4. Introduction to Causal Research (Phase 2)

4.4.1. Results and Analysis

5. Conclusion

Conflicts of Interest

References

- Ahmed, S.U. Income visibility and tax compliance: Bangladesh perspective.

- Alam, M.F. Determinants of Tax Compliance Behavior in Bangladesh: The Case of Individual Tax Payers. PhD thesis, © University of Dhaka, 2021.

- Camilleri, M.A. The use of data-driven technologies for customer-centric marketing. International Journal of Big Data Management 1, 1 (2020), 50–63.

- Dadzie, K.Q., Dadzie, C.A., and Winston, E.M. The transitioning of marketing practices from segment to customer-centric marketing in the african business context: To- ward a theoretical research framework. In Contemporary Issues and Prospects in Business Development in Africa. Routledge, 2020, pp. 52–69.

- Habel, J., Kassemeier, R., Alavi, S., Haaf, P., Schmitz, C., and Wieseke, J. When do customers perceive customer centricity? the role of a firm’s and salespeople’s customer orientation. Journal of Personal Selling & Sales Management 40, 1 (2020), 25–42.

- Hossain, M.S., Ali, S., LING, D.C.C., and Fung, C.Y. Tax avoidance and tax evasion in bangladesh: Current insights and future research directions. Available at SSRN 4553962.

- Islam, T. Tax evasion by e-commerce businesses in bangladesh.

- Kotler, P., Kartajaya, H., and Setiawan, I. Marketing 5.0: Technology for human- ity. John Wiley & Sons, 2021.

- Mannan, D.K.A. Socio-economic factors of tax compliance: An empirical study of individual taxpayers in the dhaka zones, bangladesh. The cost and Management 48, 6 (2020).

- Miah, M.D., Hasan, R., and Uddin, H. Agricultural development and the rural economy: The case of bangladesh. Bangladesh’s Economic and Social Progress: From a Basket Case to a Development Model (2020), 237–266.

- Nurunnabi, M. Political influence and tax evasion in bangladesh: what went wrong? In Advances in Taxation. Emerald Publishing Limited, 2019, pp. 113–134.

- Rahaman, A., and Leon-Gonzalez, R. The effects of fiscal policy shocks in bangladesh: An agnostic identification procedure. Economic Analysis and Policy 71 (2021), 626–644.

- Rashid, M.H.U., and Ahmad, A. Business students’ perceptions of tax evasion: a study in bangladesh. International Journal of Accounting and Finance 10, 4 (2020), 233–247.

- Sadekin, M.N., Alam, M.M., Saha, S., et al. Analysis of trend and sources of government budget deficit financing in bangladesh. Journal of International Studies 16 (2020), 129–144.

- SARDER, M.F.R. The Tax Revenue Collection Performance Analysis in Bangladesh. PhD thesis, UNIVERSITY OF DHAKA, 2020.

- Saxena, D., Dhall, N., and Malik, R. Enhancing digital payments adoption through customer-centric marketing strategies: A conceptual framework. Manthan: Journal of Commerce and Management 8, 1 (2021), 60–78.

- Siddiquee, N., and Saleheen, A. Taxation and governance in bangladesh: a study of the value-added tax. International Journal of Public Administration 44, 8 (2021), 674–684.

- Submitter, G., and Alam, M.S. An examination of taxpayers attitude towards income tax: A case of bangladesh. Journals and Alam, Md Shahbub, An Examination of Taxpayers Attitude towards Income Tax: A Case of Bangladesh (September 30, 2021). Reference to this paper should be referred to as follows: Alam, MS (2021), 95–110.

- Titumir, R.A.M., and Titumir, R.A.M. Poverty and inequality in bangladesh. Numbers and narratives in Bangladesh’s economic development (2021), 177–225.

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).