1. Introduction

Around the world, it is essential to accelerate the energy transition towards long-term energy security, price stability and national resilience, with a greater focus on decarbonization, in order to reduce dependence on fossil fuels in electricity consumption [

1]. Portugal is making a bold effort to achieve carbon neutrality by 2050 (Net Zero). However, this shift to sustainable energy sources presents significant challenges.

Portugal has a high level of renewable energy contribution to electricity consumption, with renewable sources reaching shares of up to 88 % in wet years. However, these values heavily rely on a strong component of hydroelectric production [

2]. The goal of carbon neutrality by 2050 poses challenges for European countries, with electricity production aiming for approximately 95 % renewable energy production [

3]. Portugal has a significant hydroelectric power generation capacity. However, climate change is subjecting the Iberian Peninsula, particularly Portugal, to severe and prolonged droughts, which will delay future utilization of hydro resources for electricity production.

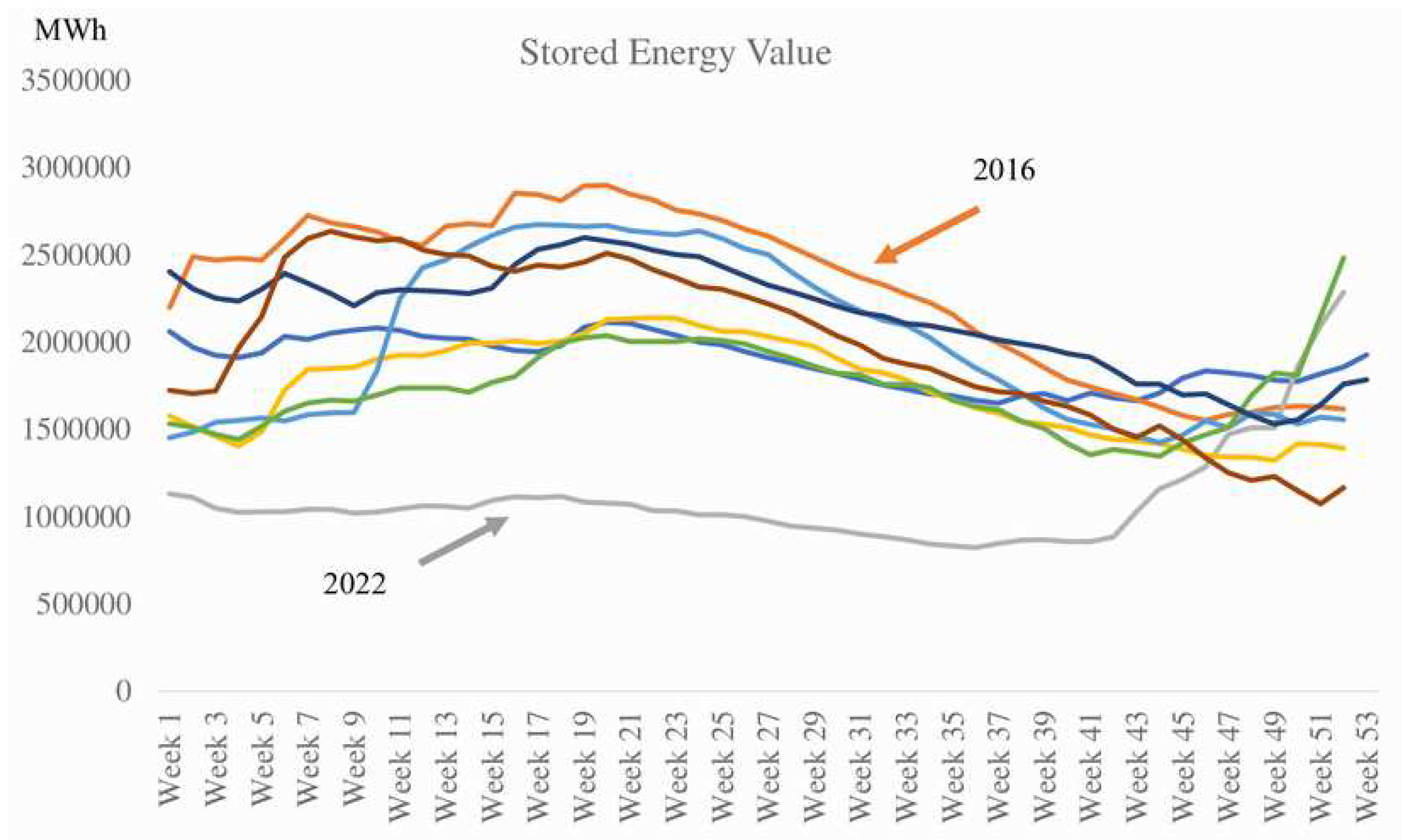

The decrease in hydroelectric production is evident, as seen in

Figure 1, which represents the stored hydroelectric energy in reservoirs [MWh] per week from 2015 to 2022 [

4].

Figure 1 clearly depicts the increasingly severe unavailability, with 2022 marking a year of severe drought for Portugal.

Given that Portugal and Spain share the same energy market, including major rivers such as the Tejo and Douro, which host the largest power plants in both countries, interdependence becomes crucial. Spain faces a similar situation. Notably, both countries experience a reduction in stored hydroelectric energy [

4].

Consequently, there will be a decrease in electricity production from this renewable resource, albeit never reaching zero. Production will continue with run-of-river power plants and pumping stations, with increased reliance on pumping during droughts. Turbines will operate during peak demand hours when this energy is most needed.

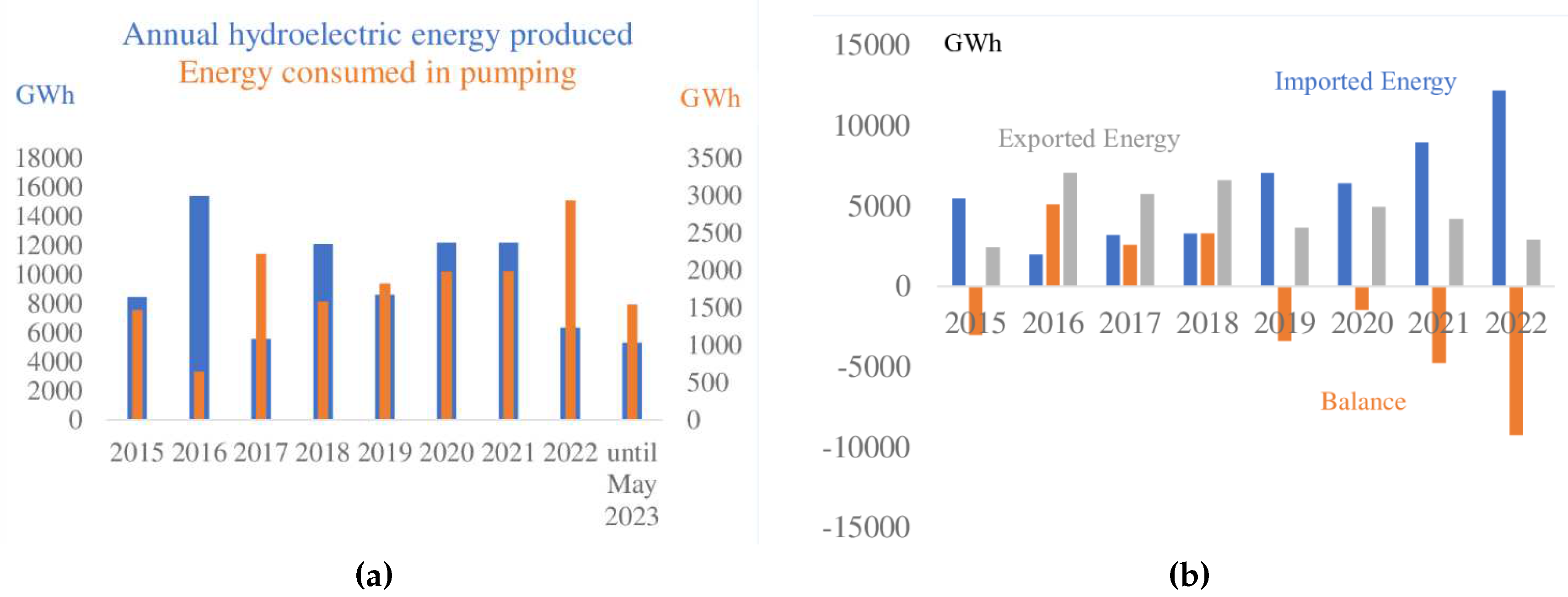

Analyzing the contribution of hydroelectric production to final consumption from 2015 to 2022 (

Figure 2), a reduced influence of hydro-based energy is observed, particularly in 2022. It is crucial to analyze the contribution of hydroelectric production over this period to observe the decreasing reliance on this technology for consumption satisfaction due to the predicted severe drought scenario.

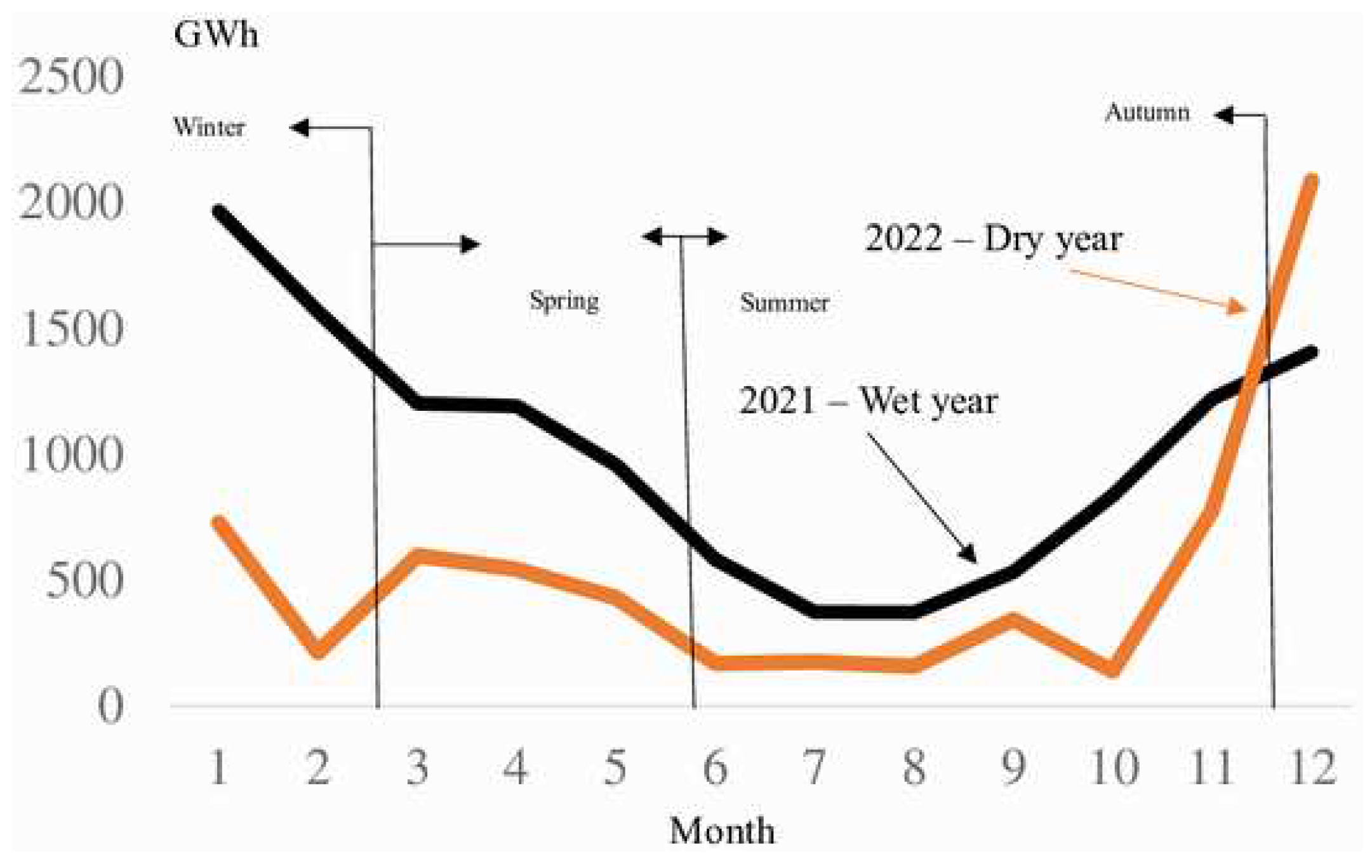

Comparing energy production in a wet year (2021) to a dry year (2022) (

Figure 3) highlights the difference. The portion suppressed in a dry year compared to a wet year amounts to approximately 6.000 GWh in a year (

Figure 3).

The reduction in hydroelectric production, along with the phasing out of coal-based production, has increased the reliance on energy imports. Analyzing the import trend (

Figure 2, above), a clear shift towards a stronger hydroelectric component during dry years is observed.

As referred in [

5], a resolute commitment emerges, driven by an unwavering determination to fortify the pursuit of renewable energies while concurrently diminishing the nation’s energy reliance, promoting the electrification of the economy and diversification of energy sources through the utilization of endogenous resources.

Portugal’s geographic restrictions, wind patterns and environmental limitations make it difficult to utilize onshore wind energy resources, making it imperative to operate offshore wind farms despite associated challenges such as high costs, ecological considerations and labor requirements. The growing offshore wind energy sector in Portugal aligns with the government’s ambitious plan to harness up to 10 GW of offshore wind capacity in the near future, targeting 2 GW by 2025 and a more ambitious 10 GW by 2030, as reported in previous studies [

6,

7,

8]. While these goals may seem ambitious, they are achievable with effective mitigation of offshore wind energy challenges. This venture not only has the potential to stimulate job creation and boost the economy, but also offers an opportunity to reduce Portugal’s dependence on imported fossil fuels, paving the way for sustainable energy independence.

The Windfloat Atlantic is currently in operation. Starting such a challenging effort is undeniably ambitious, particularly considering Portugal’s current reliance on a single offshore wind farm - Windfloat Atlantic, strategically positioned off the coast of Viana do Castelo [

9,

10]. Notably set apart by its innovative features, this groundbreaking enterprise stands as the global pioneer of a floating semi-submersible wind farm, showcasing an impressive installed capacity of 25 MW.

Offshore wind energy has significant potential to diversify the energy matrix and reduce greenhouse gas emissions (GGE). Portugal has comfortable maritime conditions, which makes the country an attractive place for the installation of these parks. However, the economic viability of these ventures is a crucial factor to be considered. Several studies, as stated below, have had the economic viability of offshore wind farms, providing valuable insights for decision makers, investors, and professionals in the energy sector.

The process of calculating costs typically involves the anticipation of two distinct cost categories, contingent upon the park’s distance from the coast and the depth of the water under consideration. These categories encompass investment costs and operation and maintenance costs as referred in [

11]. Reference [

12] evaluates the potential economic value of investing in offshore wind farms in the north of Portugal, Viana do Castelo. Economic results indicate the viability of offshore wind energy in this location. Floating platforms will play a vital role in achieving Net-Zero goals for many countries as they allow access to wind resources in deeper waters where fixed offshore turbines are impractical but are still in the early stages of development with various design options. A review about the evolution of floating offshore wind platforms is discussed in [

13]. Reference [

14] presents a method to determine the economic feasibility of floating offshore wind farms at Portugal continental coast. The findings identify the ideal floating offshore wind platform based on economic parameters and identify the most suitable area within the study region to implement a floating offshore wind platform. This study concludes that individual risk exposure must be considered, historical records may not predict future risk, and probabilistic methods are crucial for accurate financial valuation in offshore wind projects, while economic cycles and investor judgment must also be considered.

Some economic evaluation methodologies for renewable energy projects are presented in [

15]. In addition, the authors of this research propose a new framework to facilitate economic analysis, assisting decision-makers in selecting the most appropriate methodology for investments before moving forward. An interesting review of the methods for financial evaluation of renewable energy projects is presented in paper [

16]. The two main objectives of this article are: firstly, to revise publications on the financial evaluation of renewable energy projects between the years 2011 and 2020 and, secondly, to provide a critical analysis of the literature under review. The main findings of this paper indicate that while traditional methods remain prevalent for evaluating the financial aspects of renewable energy projects, the significance of Levelized cost (LCOE) and real options approaches has been increasing to address the intricate aspects and comparisons of these projects. Reference [

17] presents a study of a risk model for evaluating offshore wind projects, using operational and macroeconomic data to analyze the project-specific risk premium, represented as stochastic variables, and conducting a probabilistic financial analysis through Monte Carlo Simulation. Another interesting review on life cycle cost modeling and economic analysis of wind energy is addressed in [

18]. This review provides a macro-level explanation of the entire life-cycle composition, economic analysis method and cost modeling process of wind energy, as well as summarizing the differences in cost composition and modeling between various types of wind farms and the applicability of different economic analysis methods and valuation indicators. The authors offer suggestions to achieve precise and dependable economic evaluation of wind power in diverse regions and environments, providing valuable references to enhance the economic efficiency of wind farms.

This paper proposes an optimization analysis of offshore wind production in a scenario where the production system faced a hydroelectric production crisis during an extreme drought, in the year 2022. Both hydroelectric and onshore wind production were very low. The solution involved resorting to importation and thermal production based on natural gas as the only means to compensate for this production deficit. One of the constraints is the limit on instantaneous power that can be imported, which, in the case under study, is set at 5.000 MW, according to the regulator. The utilization of this available power can, in certain situations, jeopardize the system’s integrity. Additionally, the article analyzes the impact of this type of resource on the spot market price. A methodology for optimization is developed to minimize the spot market price, as the introduction of offshore wind production implies an increase in the cost per MWh due to the high cost of deep-sea exploitation, which is typically priced in [€/MWh]. Although applied to a specific case study, the findings can be generalized to other regions or case studies.

This article is organized as follows:

Section 2 shows the methodology, starting by characterizing the wind resource and developing the models that support the case study.

Section 3 presents the simulation results and discusses their implications. Finally,

Section 4 presents the conclusions.

2. Methodology applied to the case study

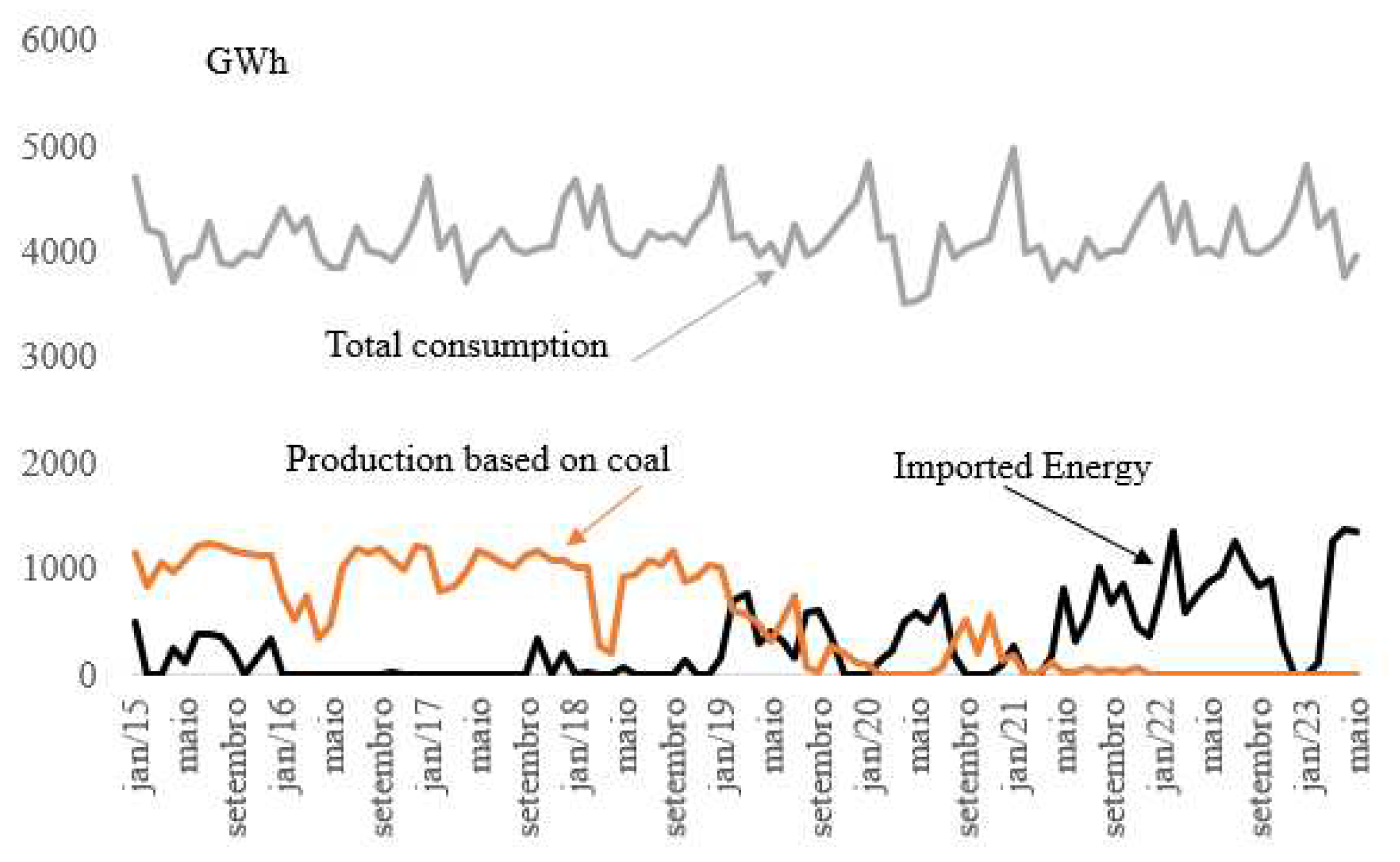

Electricity consumption in Portugal remained stable between 2015 and May 2023, as indicated in

Figure 4. In mainland Portugal, all coal-based power production units were deactivated, ceasing operations in 2020. This led to an increased need for energy imports, as depicted in

Figure 4. Simultaneously, there was a decrease in hydroelectric production due to the drought conditions that Portugal has been experiencing, particularly in the year 2022.

It is necessary to further analyze the low hydroelectric production recorded due to the situation of extreme drought, where reliance on hydroelectric production is decreasing. The hydroelectric production and coal-based production in 2018 amounted to 10.552 GWh. This energy quantity was subtracted from the system. Energy imports during the year 2022 reached 9.661 GWh. Traditionally, Portugal did not import such a significant amount of energy. In this study, we assume that this energy will need to be replenished in the system by being sourced from wind power platforms. There is no direct substitution, especially considering the increased energy production from photovoltaic units and other types of renewable units.

Investment in photovoltaics has been significant, and it is expected to grow substantially. The total installed capacity is projected to reach approximately 1.332 MW by the year 2023 [

3]. However, it is in the off-shore potential that the capacity to expand renewable production resides, since it is available on a continuous basis, although it has intermittency issues, which can be somewhat mitigated by increasing installed capacity.

2.1. Assessment of offshore wind potential

Portugal has a high offshore wind potential and is one of the European countries with the largest continental shelf. Although it is very extensive, the continental shelf is narrow. This apparent disadvantage, with its waters being deep at relatively short distances from the coast, motivated the search for offshore technological solutions different from those used in Northern Europe. Portugal was thus, out of necessity, a pioneer in operating wind turbines mounted on floating platforms and already operates a floating offshore wind farm consisting of three platforms off the coast of Viana do Castelo, with a total installed capacity of 25 MW, and the distance from the coast is about 20 km. The power in question and the distance from the coast allow for the establishment of the High Voltage Alternated Current (HVAC) connection [

9].

The three most advantageous areas in terms of wind potential are located in the north, center, and south of the country. These regions include Viana do Castelo, off the coast of Lisbon, and in the southern zone, Sagres (

Figure 5A,B).

The wind models used as the basis for this article were created using the WindAtlas database [

19]. This database is recognized in the scientific community and allows for data collection with an acceptable level of accuracy considering the analyses to be conducted. With this data, it was possible to determine the average wind speed (

Figure 5C).

The wind energy production on floating platforms in a marine environment has significant impacts on biodiversity, especially on birds [

20]. The selected areas safeguard the special protection zones that limit the placement of wind farms along the coast in order to minimize the impact that these new wind infrastructure may have on bird-life, especially on the migratory routes of seabirds (

Figure 5A,B).

Respecting these environmental restrictions, data were collected in three of these coastal areas of mainland Portugal (off Viana do Castelo, Figueira da Foz and Sines) for possible future locations of offshore parks (

Figure 5). It was possible to determine the average annual wind speed for a height of 100 m for each of the selected zones. WindAtlas [

19] allows visualization of the evolution of the average annual wind speed, allowing the construction of average wind models with hourly resolution.

Although floating offshore wind farms use turbine technology similar to onshore wind farms, offshore installations have the advantage of being able to exploit more constant and higher wind speeds, and with fewer restrictions on the area they occupy and the distance from the rotor to the water surface when compared to the onshore case. As a result, the areas of offshore farms and the dimensions of wind turbines can be larger, leading to generally better performance indicators for these farms. In Portugal, the offshore wind resource is generally characterized by average wind speeds, at 100 m height, of the order of

. However, the average wind speed is not constant over the years, therefore there is a randomness that must be taken into account when building wind models. With these premises in mind, wind models were built for all selected regions that allow, with an hourly resolution, to estimate the average wind speed that supports the wind turbine models to be used. These wind models allow us to determine the average wind profile for each of the selected marine regions. Therefore, it was decided to continue the use of turbines with a unitary power of 8 MW [

21]. In this study, the authors consider nine turbines distributed across three parks, strategically located in areas with lower environmental impact.

Two scenarios were established, one considered more favorable and the other less favorable. These scenarios were determined based on the average daily profiles of maximum and minimum wind speeds for the month in question (February). In the case study, we estimated the average daily production per turbine. It is possible to predict an average daily energy production per turbine, which on average can vary between 62 and 106 GWh.

2.2. Methodology for Optimizing Energy Source Combinations

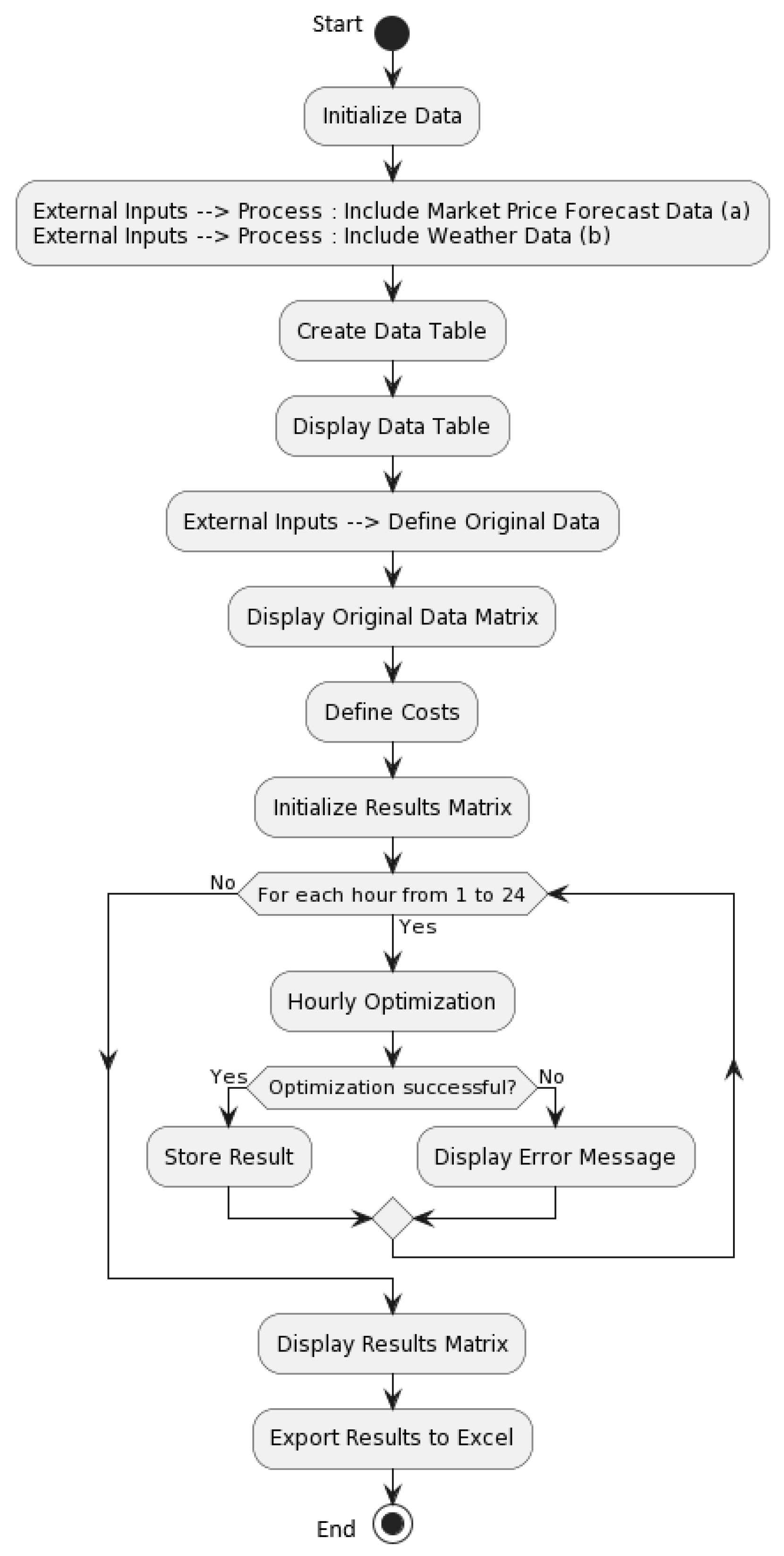

The suggested algorithm aims to perform an optimization to determine the optimal combination of a mix of energy sources, considering availability constraints and cost minimization. This methodology is represented through a basic flowchart displayed in

Figure 6.

The methodology is explained as follows:

Input Data: availability data for various power generation technologies, in MW, is available, as well as the costs associated with each technology, in [€/MWh] [

22]. In the flowchart, two external inputs are presented: (a) market price forecast data with a 24-hour lead time, and (b) the possibility of weather data for wind or offshore wind power forecast. The objective is to determine the amount of energy to be produced by each technology to meet a specific demand.

Formulation of the Optimization Problem:The problem is formulated as a linear programming, where the objective is to minimize the total cost of energy generation subject to availability constraints and equality of demand. The cost vector and constraints are defined according to the input data.

Call to linprog: The algorithm uses MatLab’s linprog function to solve the optimization problem. Linprog is a linear optimization function that finds the optimal values of the decision variables (amounts of energy to be produced by each technology) that minimize the objective function (total cost) subject to linear constraints. The authors choose the linprog function of MatLab [

23], among others, to implement in the algorithm due to its efficiency, ease of use, and flexibility to solve linear optimization problems, specifically to determine optimal power generation based on cost and availability constraints.

Convergence Check: After optimization, the algorithm checks whether the solution has converged successfully and, in that case, results are extracted.

Optimization Results: include both the amounts of energy produced by each technology and the minimum total cost, and are displayed as output.

3. Model simulations - main results and discussion

Multiple scenarios were simulated, and in this section, we will present only the most significant data. Thus, nine turbines were placed, divided into three parks in suitable locations according to the zones of lower environmental impact as previously referenced in

Section 2.1.

The scenarios of extreme and severe drought are becoming increasingly recurrent, prompting the use of the thermal component, particularly natural gas. As a non-producing country, Portugal is subject to the natural gas prices in international markets.

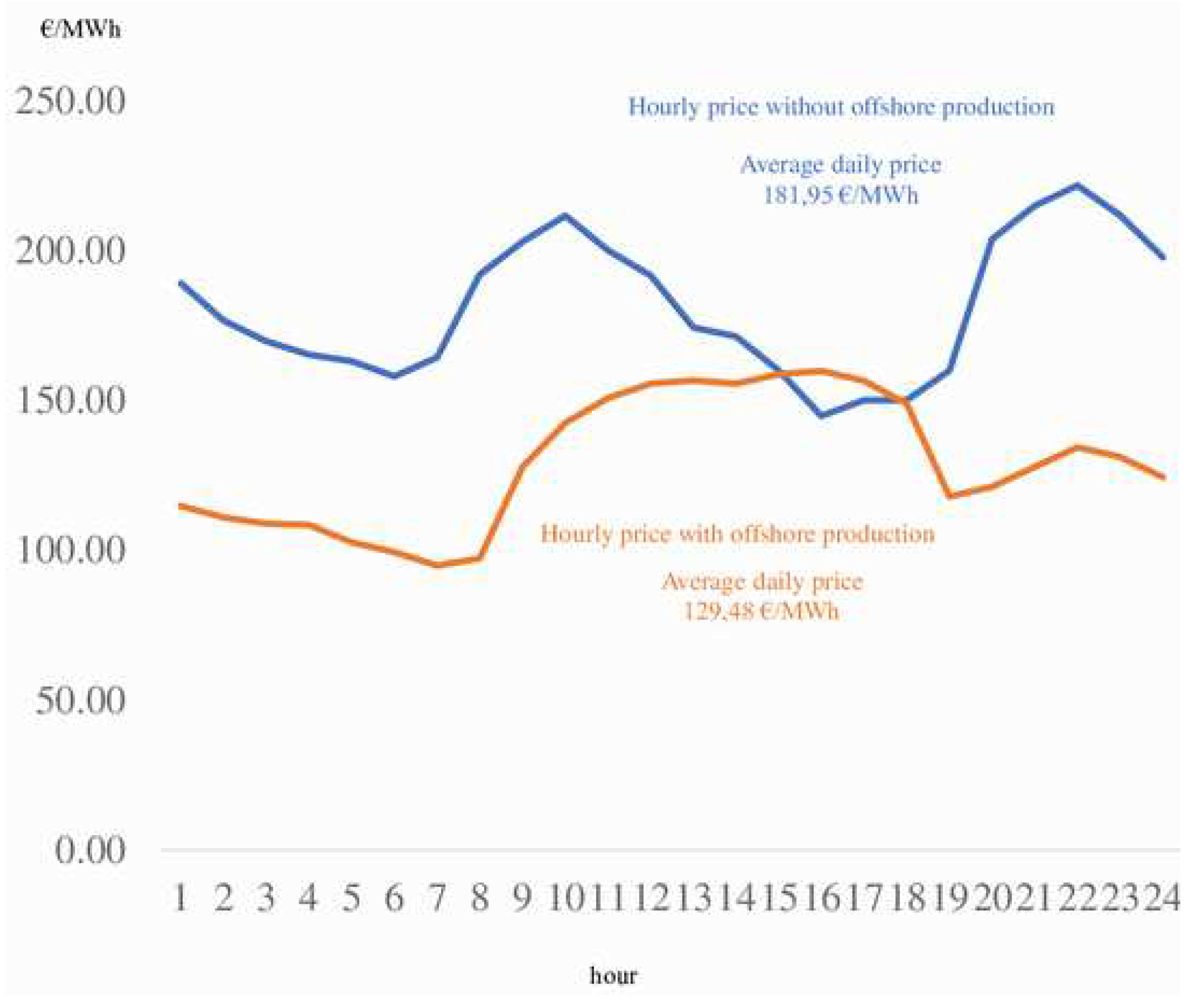

The introduction of offshore wind power (in deep waters) yields positive results. As displayed in

Figure 7, the introduction of offshore production leads to a reduction in the average energy price, in the spot market situation. Thus, despite the high unit cost of this technology, in a situation of severe drought where hydropower production is minimal, this is a viable solution.

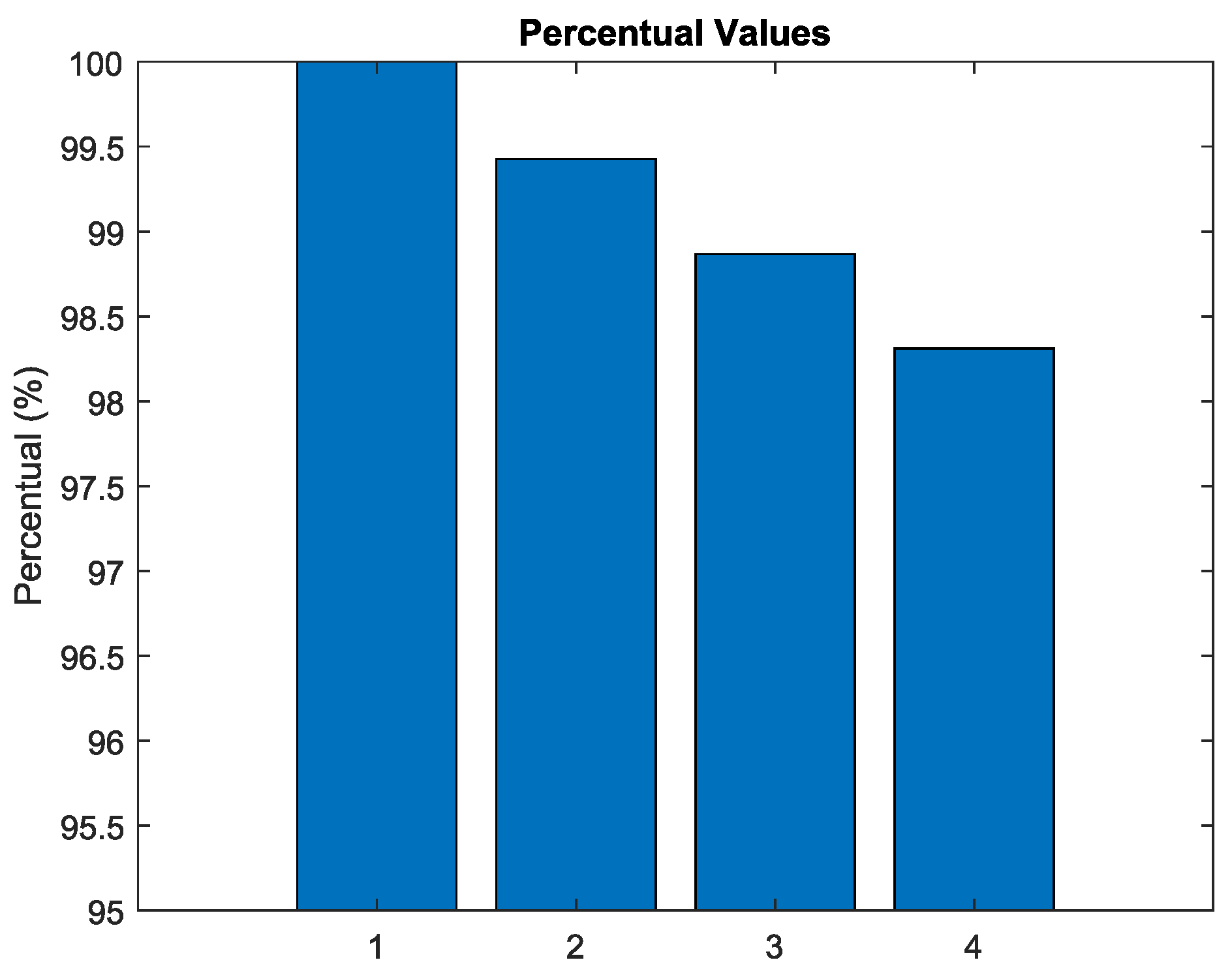

The results of the developed methodology enable the placement and management of offshore wind energy in order to minimize costs throughout the forecast period. Another crucial aspect is that the reduction is greater with increasing installed capacity to minimize the price (see

Figure 8).

Figure 8 presents four scenarios. Bar 1 is the base-case scenario, without offshore wind energy. Bars 2 to 4 illustrate three distinct wind parks, each characterized by a varying number of turbines. Bar 4 features nine turbines, representing the maximum threshold considered for our analytical study.

According to what was demonstrated throughout the study, despite the high price of the technology, this type of production (off-shore on deep waters) proves to be an alternative when the electrical energy system is subject to extreme dry weather conditions. Portugal under normal conditions can satisfy consumption only with the water and wind components. Energy production in wet years reaches around 40 % of daily energy consumption. However, with the worsening of drought scenarios, the water component is practically reduced to values around 10 %, thanks to the contribution of units that have pumping. In this way, it was possible to optimize the amount of offshore wind production in order to overcome this production deficit without increasing the average price of daily energy. The intermittency of this resource can be overcomed depending on a minimum number of wind turbines that can ensure a minimum production; in the case study, they are nine in number. For a wet scenario the contribution of this type of production, i.e., production surpluses can be used in storage situations in places where the network is under more pressure, that is, at interconnection points with the European network, as well as being used in pumping.

4. Conclusions

The decarbonization of the electrical energy production sector poses challenges to operators of electrical energy systems. In the present case study we are faced with a situation in which initially the accommodation of the extinction of coal-based production only represented 8.3 % of the total installed power, a value that in itself does not represent a major problem. However, in this case study, the installed power from non-renewable sources reaches around 35 %.

In the case study, two scenarios are presented: one of severe drought in which hydropower-based production was minimal in contrast to a scenario where hydropower-based energy production was abundant. In a scenario with ample rainfall, there is no need to resort to thermal production. However, profound climate changes bring about scenarios of extreme drought. The hydropower component in this case represents a reduction in the availability of installed capacity by 31 %. In this situation, reliance on energy imports is higher, which poses challenges to the operator since the available power is pre-agreed and depends on the connection point. For this case study, the value of this limitation was 5.000 MW in terms of instantaneous power.

In parallel with the extreme drought scenario, in this case there was a decrease in onshore wind production, which resulted in greater stress on the system. Offshore wind production presents itself as the only viable alternative to solve this problem. The greatest amount of energy is consumed at nighttime, and therefore, peak demand normally occurs at this period, which makes the scenario challenging.

Despite the high costs of offshore technology [€/MWh], this type of technology is the only solution in adverse scenarios. As demonstrated in this article through optimization algorithms, positioning this type of production in order to minimize the daily average cost of energy in the spot market is essential.

Due to the more consistent wind patterns, electricity production based on offshore technology exhibits regularity and lower intermittency when compared to onshore production. In scenarios of severe drought, it represents an important source of production allowing costs to be minimized by relieving production based on natural gas and energy imports. In scenarios with lower demands on the production system, it acts as an energy source that can be used in storage to reinforce the electrical energy network. Even during non-peak periods, it is a valuable aid for hydroelectric power plants with the possibility of pumping, and acts in a complementary way with photovoltaic-based production.

This research emphasizes the significance of offshore wind technology in addressing the challenges related to decarbonization in the electricity sector. However, the authors acknowledge that this study has limitations and suggest that further analysis is needed to evaluate the high costs associated with offshore technologies. This evaluation aims to determine their profitability in the medium and long term. Consequently, in future research, the authors aim to carry out a more in-depth economic evaluation to identify strategies for mitigating the costs associated with offshore technology, contributing, in this way, to its integration into the electrical energy system.