Submitted:

23 September 2023

Posted:

26 September 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

1.1. Statement of the problem

1.2. The aim and objectives of the study

- Explore the PIA’s provisions linked to CSR and taxation in Nigeria's upstream oil and gas sector support for sustainable development.

- Identify the implementation challenges and improvement opportunities concerning the PIA’s provisions on CSR and taxation in Nigeria's upstream oil and gas sector.

- Propose an integrated framework for monitoring and evaluating the PIA’s impact on CSR and taxation in Nigeria's upstream oil and gas sector over time.

- Proffer recommendations for addressing the implementation challenges and using the improvement opportunities identified to enhance the PIA's impact on CSR and taxation support for sustainable development in Nigeria’s upstream oil and sector.

1.3. Research questions

- How do the PIA’s provisions link to CSR and taxation in Nigeria's upstream oil and gas sector support for sustainable development?

- What are the implementation challenges and improvement opportunities concerning the PIA’s provisions on CSR and taxation in Nigeria's upstream oil and gas sector?

- What is the proposed integrated framework for monitoring and evaluating the PIA’s impact on CSR and taxation in Nigeria's upstream oil and gas sector over time?

- What recommendations can be proffered for addressing the implementation challenges and using the improvement opportunities identified to enhance the PIA's impact on CSR and taxation support for sustainable development in Nigeria’s upstream oil and sector?

2. Literature review

2.1. Overview of Nigeria's upstream oil and gas sector

2.2. Previous studies on CSR and taxation related to Nigeria's oil and gas sector

2.3. Gaps in existing literature

2.4. Theoretical framework

2.4.1. Legitimacy theory

2.4.2. Stakeholder theory

2.5. Conceptual clarification

2.5.1. Petroleum industry act (PIA)

2.5.2. Corporate social responsibility (CSR)

2.5.3. Taxation

2.5.4. Sustainable development

3. Research methodology

3.1. Research design

3.2. Data sources and criteria for selection

3.3. Data extraction procedure

3.4. Thematic analysis

3.5. Ethical considerations

4. Results

4.1. Provisions of the PIA on corporate social responsibility (CSR) and taxation

4.1.1. PIA’s provisions linked to corporate social responsibility (CSR)

4.1.2. PIA’s provisions linked to taxation

4.1.3. Provisions of the PIA on CSR and taxation: Implications for sustainable development

4.2. Implementation challenges and improvement opportunities concerning PIA’s provisions

4.2.1. Implementation challenges concerning the PIA’s provisions on CSR and taxation

- Regulatory and standardization complexities: The PIA is a fiscal regulatory framework to govern the oil and gas sector operations, which its provisions are complex and subject to misinterpretations and confusions in many ways as the language of the Act appears imprecise and ambiguous [4]. Stakeholders may otherwise understand and interpret the PIA’s provisions on CSR and taxation; thus, implementation inconsistencies may occur. This is complicated by standardization inadequacies about implementation guidelines to clearly provide governments’ expectations and what the companies need to do towards simplifying compliance. The lack of PIA’s transparency and accountability can affect sustainable development drive in Nigeria’s upstream oil and gas sector regarding international best practices [5,8], as the Act’s implementation will be problematic [48].

- Awareness inadequacy: The upstream oil and gas companies may initially face the lack of awareness adequacy of the provisions of the PIA that has offered regulatory changes, likely to stimulate certain understanding, interpretation, and implementation challenges without extensive awareness across the sector [5]. An awareness inadequacy may make companies to find it difficult to satisfy the requirements for CSR and taxation practices and compliance. Since proper information disclosures may affect the efficiency of their operations, considering that such information have a timeframe for disclosures.

- Monitoring and strategic enforcement: The implementation of the PIA’s provisions on CSR and taxation requires adequate routine monitoring and strategic enforcement for deep stakeholders’ compliance to be attained. While tax allowances and incentives can promote CSR participation, if no mechanisms for monitoring and enforcement are put in place, then noncompliance with the provisions may be evitable [27].

- Limitations in investment resources: While companies need resources mainly finance to invest; the PIA has mandated CSR and taxation practices imposing the allocation of resources [2,25], that possibly can affect investment and business plans and operations. The companies if not big sizes, are likely to face limitations in resources to train experts, which may affect the implementation of the provisions of the PIA on CSR and taxation.

- Change resistance: There seems to be long period of industrial norms such as crude oil inaccurate measurement, not theft that is being practiced by the upstream companies in Nigeria’s upstream oil and gas sector. The PIA is introducing changes which can oppose some industrial norms, and this may affect adequate compliance with the Act. Because of the lack of political will, commitment, and problem-solving leadership [2,15].

- Community involvement: The PIA has mandated implementing CSR initiatives which entails effective community involvement that can pose likely challenges to companies: owing to the communities’ communication and language barriers, historical antecedents and cultural issues. Also, different expectations of the different people in Nigeria, which may be hard to understand and address, likely to affect the implementation of the PIA. Despite communities’ stakeholders should be involved in CSR projects for promoting cooperative existence [6,11,12,18] and implementation of the PIA [8].

- Short-term disruptions: The implementation of the PIA’s provisions concerning CSR and taxation may have a transition impact from its initiation to maturity period, likely to affect the financial positions of the companies. This may generate business disruptions in the short-term that strategic plans by added costs may be necessary to mitigate such disruptions. Complying with the PIA may pose challenges at the period.

- Government commitment and capacity: The upstream oil and gas sector is regulated by government in Nigeria. So, the government’s important role in monitoring the sector to ensure adequate compliance with the PIA cannot be overemphasized. Yet, government’s commitment and human capacity of its agencies [2,48] may be limited by the resources budgeted for monitoring [28], as training and retraining of employees are recommended to ensure that the PIA’s provisions are properly implemented [8].

- Taxation complexity: The PIA has presented changes in taxation provisions which may appear complex in view of the international nature of the transactions of the upstream oil and gas companies. When the changes in taxation provisions are not well understood and correctly applied, there are chances for noncompliance and many errors to occur.

- Collecting and reporting CSR data: CSR initiatives being implemented by the upstream oil and gas companies other than those achieved by the host communities development trust fund should be properly reported. So, data should be collected regarding such CSR projects for reporting purposes due to their tax effects. This may require the companies to fix systems robust enough to collect data accurately and reporting same timely [16].

4.2.2. Improvement opportunities concerning the PIA’s provisions on CSR and taxation

- Technological solution drive: The implementation of the PIA provisions can encourage innovative and technological solutions that may improve environmental protection and efficiency in operations. Using technological solutions to collect data, enable reporting, ensure monitoring and enforcement in real-time can foster compliance with the PIA to enhance accountability and transparency in Nigeria’s upstream oil and gas sector [16].

- Stakeholders’ collaborative commitment: The PIA provisions can enable the industry actors, civil society organizations, and government officials to collaborate for relevant opportunities to align mutual objectives and benefits as smoothly and committedly as possible. This can improve sharing of ideas and understanding of the PIA’s provisions for a consistent and effective implementation of the Act in Nigeria’s oil and gas sector in the spirit of stakeholders cooperative relationship [6,11,12,18].

- Stakeholders’ reputation and consultation: The implementation of the PIA’s provisions on CSR and taxation can enhance the reputation of companies for gaining access and legitimacy to societal resources. Also, effective community involvement and taxation practices can lift citizens’ trust for sustainable development. Equally, the involvement of stakeholders such as the oil host communities during consultations in designing CSR initiatives can help in evaluating and determining the effectiveness of such initiatives in addressing the needs of the oil host communities [11,17,18].

- Building capacity: The PIA has introduced changes in the fiscal framework of the oil and gas sector. This needs the building of capacity of the stakeholders through training and retraining sessions for fostering compliance with the Act and its successful impact. Regulatory bodies, oil companies, oil host communities, and civil society organizations can be trained to understand the PIA’s implementation regarding CSR and taxation [8,48].

- Incentive drive and recognition: The PIA provisions ask companies to behave socially responsible to attract potential investors support for sustainable development drive. So, incentives such tax allowances and tax breaks can be introduced to trigger compliance with the Act but to be monitored [27]. Besides, the companies that have exceptionally exhibit CSR efforts may be motivated to even do more through recognition events for excellent practices, that may persuade others to participate in doing CSR activities too.

- Long-term projects: The PIA provisions underline sustainable development consistent with the long-term objectives and interests of both the communities and companies. So, investment in sustainable development projects can well contribute to environmental preservation, social inclusion, and economic improvement benefits to all and sundry [11,14,30].

- Measurable performance indicators: There is the need to clearly define CSR initiatives for measurable performance indicators that can help the companies to monitor progress, and evaluating impact to improve accountability, trust, transparency, and integrity [19].

- Simplicity and popularization: The PIA's provisions may gain from simplicity since the Act has repealed many laws regarding the oil and gas sector operations in one document for stakeholders to use. While this is expected to lower legal issues for companies with financial constraints to seek the PIA’s interpretation fostering some compliance level, but CSR and tax avoidance negative relationship [29] may call for intensive monitoring.

- Regulatory adaptability: The PIA's provisions can be revisited and further improved to be more adaptable for implementation given the diverse contexts which the upstream oil and gas companies operation in Nigeria. This can improve the Act’s impreciseness [4] to support sustainable development drive in Nigeria’s upstream oil and gas industry.

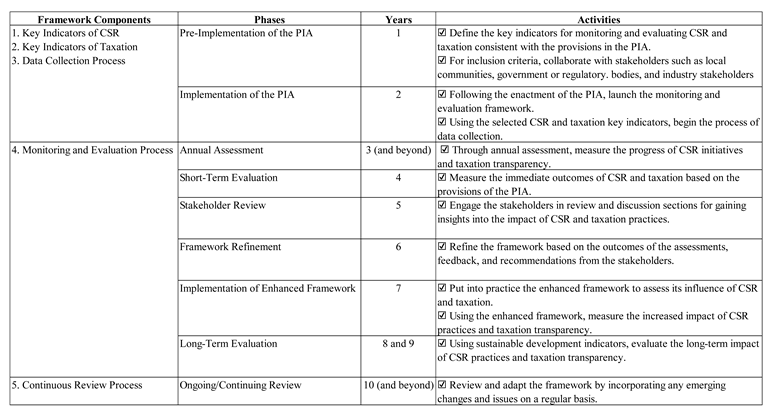

4.3. Proposed integrated framework for monitoring and evaluating the PIA’s impact

4.3.1. Key indicators for monitoring and evaluating CSR using the PIA

- Community development projects: This measures the projects’ number, extent, impact, and role in uplifting the living conditions of communities. Target projects must improve healthcare, infrastructure, education, etc. Number of recipients or beneficiaries and the length that benefits being provided can last must be evaluated. While the PIA underlines community participation; thus, this indicator is critical for evaluating real benefits.

- Conflict mitigation: This examines CSR effectiveness in addressing conflicts between the oil host communities and oil companies. Indicator include measuring the reductions in disputes or disruptions or protest incidents.

- Environmental protection: This assesses the extent to which the initiatives on CSR address environmental concerns due to the oil and gas operations by the companies. Indicators cover superior waste disposal practices, green-friendly technology adoptions, pollution reductions, reforestation projects, and habitation restorations.

- Human rights: This assesses the observance of human rights policies and standards such as labour rights including forced labour prevention or child labour. By this indicator, CSR policies and initiatives will uphold business ethical practices.

- Local content utilization: This assesses the extent that the local workers and companies benefit from the oil and gas sector activities. Indicators include workforce composition, local suppliers proportion, and skills and vocational development plans for example, to address unemployment and poverty for sustainable development drive.

- Long-term impact: This evaluates the extent to which CSR initiatives are durable and their long-term but not short-term impact as real commitment on environmental protection, social and community development.

- Social investment: This quantifies the financial contributions companies make to social programmes and projects such as in education (scholarships), healthcare (clinics), etc., mainly in the oil and gas host communities.

- Stakeholder engagement: This assesses inclusiveness, rate, effectiveness and quality of stakeholder engagement such as with regulatory bodies, civil society organizations, and local communities involvement and representation in the process of decision-making. Strong stakeholders’ engagements ensure CSR-based initiatives will address their true concerns and needs towards sustainable development.

4.3.2. Key indicators for monitoring and evaluating taxation using the PIA

- Anti-avoidance measures: This examines the adoption of anti-tax avoidance practice to mitigate tax revenue leakage consistent with the aim of the PIA's taxation transparency.

- Local content development levy: This measures the local content development fund and its funding as a commitment to building local capacity and sector’s development.

- Revenue utilization: This evaluates the application of tax revenues for the provision of sustainable development projects for infrastructure and community development.

- Royalty payments: This evaluates the adherence to the obligations to pay royalty in the PIA. This should be consistently monitoring for improved revenue generation.

- Tax compliance rate and reporting: This assesses the extent to which tax regulations and reporting accuracy are being complied with as provided in the PIA. Indicators comprise timely filing of tax return, accurate tax payment, proper business income reporting, and correct tax registration.

- Tax contribution to government revenue: This quantifies tax contributions of the sector to government revenue collection. Indicator evaluates how taxation may align with the sector’s economic importance and the tax revenue maximization objectives of the PIA.

- Tax incentives utilization: This examines how tax incentives as provided in the PIA are being used. It assesses whether or not the companies benefit from incentives for the growth of the sector and not compromising the revenue payable to the government.

- Tax revenue transparency: This assesses transparency levels of tax revenue disclosures and reporting based on what the oil and gas companies may have generated. Indicator is to ensure availability of information that can be truly accurate and often accessible.

- Transfer pricing: This assesses the intra-group transactions and mechanisms for pricing transparency. Proper controls should be set to mitigate tax avoidance and evasion risks for more revenue generation to finance sustainable development.

4.3.3. Integrated framework for monitoring and evaluating PIA’s impact in Nigeria

|

- Allowing for greater sensitivity of the sector’s changes and dynamisms.

- Ensuring that the framework continues to be effective and relevant over time.

- Allowing the integration of additional and new indicators, best practices, and data.

- Enriching ability of the framework in making contributions to sustainable development.

- Identification of events or trigger points that may explicitly prompt potential adjustment or review to the framework. Triggers may comprise industry trends, regulatory changes, stakeholders’ feedback, or major alterations in priorities of sustainable development.

- Having identified the trigger points, then a detailed assessment should be done to decide the need for the framework’s adaptation. Additional and new challenges, opportunities, and information should justify the necessity for the changes that may have occurred.

- Engagement of the stakeholders in the process of decision-making is necessary for their input. So, relevant stakeholders including the civil society organizations, government bodies, and industry professionals should be consulted for perspectives and insights on the framework’s likely adaptations.

- After stakeholders’ engagements, then specific changes to the framework are proposed with a plan of alignment of such changes with the initial objectives towards enhancing the effectiveness of the framework in adopting evolving issues.

- Proposed changes should be internally reviewed and the approval of the relevant bodies or authorities governing the implementation of the framework should be sought.

- Updated framework based on its adaptation should be properly communicated to the stakeholders including clear plans for implementation, rationale, and expected impacts.

4.4. Recommendations for addressing the implementation challenges and using the improvement opportunities identified to enhance the PIA's impact

4.4.1. Recommendations for addressing the implementation challenges of the PIA

- Simplification and regulatory standardization: The provisions of the PIA's should be further simplified and made clear while controlling for industry terminologies that can facilitate understanding and application of the Act. Thus, stakeholders in the oil and gas sector should be consulted to standardize the PIA’s application and interpretation. PIA’s vagueness and compliance can be improved by providing clear and succinct guidelines in it, defining specific CSR initiatives and taxation duties for the companies.

- Awareness promotion: Large-scale awareness should be promoted towards educating the oil and gas sector’s stakeholders mainly on the requirements of the PIA concerning CSR and taxation. Such awareness should emphasize the relevance of ethical business practices and the impact of CSR and taxation on oil host communities for sustainable development in Nigeria.

- Monitoring and strategic enforcement: A robust monitoring and strategic enforcement system should be created that can help in tracking CSR and taxation practices of the companies. Using technological solutions can support transparency in data collection, analysis, reporting, verification, sharing, and rapid remedial actions against differences in real-time. Thus, PIA’s help for establishing strong monitoring mechanisms to monitor CSR activities and taxation compliance should be sustained to ensure the timely double-checking of transactions on a daily basis.

- Initiate some incentives: It will be interesting to initiate some incentives as rewards for compliance with the PIA provisions and forms of mechanisms to encourage companies’ participation in effective CSR activities and complying their taxation obligations for sustainable development. Incentives including tax holidays, tax awards or credits, and forms of recognitions for unique performance and compliance can help the companies to show commitment to the success of the PIA.

- Tackle change resistance: The companies can be provided with help to better understand the PIA’s provisions for adequate compliance. Helplines or services can be arranged to give further guidance on the Act’s requirements towards tackling resistance to comply.

- Intensify stakeholder involvement: The stakeholders should be adequately involved in the general process of the PIA and its implementation. Creating different platforms that can support discussions between stakeholders such as local communities, government and companies officials, and civil society organizations can be helpful. As the platforms can provide greater insights into the workability of the Act, its problem areas, and how improved strategies can be devised for effective implementation.

- Improve stakeholder capacity: The PIA’s compliance can be improved by developing adequate training courses for the effective implementation of CSR plans and complying with taxation responsibilities. The PIA provisions should be learnt to assist the stakeholders both the regulatory bodies and industry practitioners in the oil and gas sector to embrace initiatives for capacity building through seminars, forums, workshops, and training or short course sessions regarding CSR and taxation practices. The PIA encourages constant discussion and cooperation between stakeholders: civil society organizations, oil host communities, larger communities, and sector experts should be sustained. This can help in getting finer insights, building trust, and aligning CSR and taxation practices with sustainable development.

- Strengthen accountability and transparency: The PIA supports greater accountability and transparency in CSR and taxation practices by the stakeholders, which should be ensured for sustainable development. While information disclosures can be leveraged upon; the public should have access to such information on CSR and taxation, which digital solutions can make them timely available.

- Maintain cooperative relationships: The PIA’s support for cooperative relationships between the civil society organizations, oil and gas companies, oil host communities, and government regulatory bodies should be sustained for rising efforts in addressing social, economic, and environmental concerns of society for sustainable development.

- Perform routine audit: The regulatory bodies in the oil and gas sector should embark on routine audit to monitor compliance with CSR and taxation provisions in the PIA. Also, independent auditors can be engaged for enhancing audit reliability.

- Continuously perform review: A review process should not only be established but the review should be continuously performed, and improvement areas carefully addressed. This can ensure that the provisions of the PIA are updated in the light of the changes in the oil and gas sector while incorporating best or global practice.

4.4.2. Recommendations for using the improvement opportunities of the PIA

- Technological solutions adoption: The different technological solutions can be adopted for CSR initiatives’ effectiveness by improving monitoring support for transparency; also, tax payment improvement strategies.

- Strategic alignment: The CSR initiatives and tax revenue expenditure can be aligned with development objectives in Nigeria regarding their contributions to address societal concerns: social, economic, and environmental for more significant impact.

- Capacity and skill development: The design of CSR initiatives can embrace building capacity by training courses and skill development can include vocational training and knowledge for enhancing employability of the members of the oil host communities. Tracks of tax noncompliance behaviour can be integrated into the training programmes.

- Innovative impact investment: Different ways for innovative CSR initiatives financing including public-private-partnerships can be utilized to improve CSR projects’ benefits and impacts on the society. The use of tax payment platforms can be prioritized.

- Enduring community involvement: Design of CSR initiatives can be conceptualized to have enduring impacts on the oil host communities to uphold sustainable development. Tax education can be intensified in the host communities for greater support.

- Environmental preservation: Design of CSR initiatives can be used for environmental preservation while mitigating negative impacts in the oil and gas host communities.

- Reporting transparently and accountably: The improvement opportunities that support transparent and accountable reporting of CSR and taxation activities can be prioritized, to facilitate stakeholders’ assessment of environmental and social impacts in society.

- Introducing recycling practices: The CSR initiatives can be considered around recycling practices that can reassure efficient resource use and waste management and reduction, likely to reduce costs and improve environmental preservation. Then, tax can be fairly paid not as an additional cost to the companies.

- Cooperative stakeholders’ Partnerships: Partnerships between the research institutions, civil society organizations, oil host communities, government and company officials, and academia can be enhanced for effective CSR and taxation practices. This approach will support decision to be taken jointly for driving sustainable development.

- Replicate model: A workable model for CSR activities and taxation compliance in one location can be replicated in other locations for streamlining implementation strategies and emphasizing significant outcomes.

- Impact evaluation: Robust approaches poverty reduction and living conditions of the people can be used to evaluate the economic and social impacts of CSR and taxation. The integrated framework developed by this study is advised for use since it is designed to incorporate future new and additional indicators or issues that may evolve in the oil and gas sector. Thus, the framework’s adaptability is ensured.

- Expand impact Evaluation: Monitoring and evaluation impact should be expanded from the outcomes in the immediate timeline to long-term outcomes on the environment and society regarding CSR and taxation practices.

5. Discussion

5.1. Provisions of the PIA on corporate social responsibility (CSR) and taxation

5.2. Implementation challenges and improvement opportunities concerning PIA’s provisions

5.3. Proposed integrated framework for monitoring and evaluating the PIA’s impact

5.4. Recommendations for addressing the implementation challenges and using the improvement opportunities identified to enhance the PIA's Impact

5.5. Contributions of the study to Knowledge

6. Conclusions

6.1. Key findings

6.2. Limitations and future research directions

6.3. Final closing remark

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abdul-Rahamoh, O.A.; Taiwo, F.H.; Adejare, A.T. The analysis of the effect of petroleum profit tax on Nigerian economy. Asian J. Hum. Soc. Sci. 2013, 1, 25–36. [Google Scholar]

- Umenweke, M.N.; Chukwuma, W.A. An examination of the Petroleum Industry Act 2021 and the quest for a new Nigeria. Law Soc. Just. Rev. 2021, 2, 65–68. [Google Scholar]

- Akpan, M.J. Petroleum Industry Act in Nigeria: An analysis of the impact of the novel host communities development trusts provision. Global J. Polit. Law Res. 2021, 9, 30–46. [Google Scholar]

- Bielu, K.J. Legal framework for petroleum administration and taxation in Nigeria: A legal appraisal of conflicting legislations. Afr. Cust. Relig. Law Rev. 2022, 3, 70–80. [Google Scholar]

- Borha, D.O.E.; Olujobi, O.J. An examination of the Petroleum Industry Act 2021: Prospects, challenges, and the way forward [version 2; peer review: 2 approved]. F1000Research 2023, 12, 551. [Google Scholar] [CrossRef]

- Makinde, W.A. Corporate social responsibility in the extractive industries in Nigeria: The role of public administrators. In Corporate social responsibility in developing countries: Challenges in the extractive industry, Msosa, S.K., Mugova, S., Mlambo, C., Eds.; Springer International Publishing: Cham, Switzerland, 2023; pp. 237–253. [Google Scholar] [CrossRef]

- Bristol-Alagbariya, E.T. Costs and benefits of energy and major natural resources extractive industrial operations on communities: Spotlight on host communities development regime in Nigeria’s Petroleum Industry Act, 2021. Int. J. Dev. Econ. Sustain. 2023, 11, 1–36. [Google Scholar] [CrossRef]

- Ugoani, J. Managing multinational oil and gas companies and Petroleum Industry Act in Nigeria. Available at SSRN 4402790. 2023 Mar 28. https://ssrn.com/abstract=4402790. [CrossRef]

- Nigeria Extractive Industries Transparency Initiative. Oil and gas industry audit report. Abuja, Nigeria, 2018. https://eiti.org/sites/default/files/attachments/neiti-oga-2018-report.pdf.

- Cameron, P.D.; Stanley, M.C. Oil, gas and mining: A sourcebook for understanding the extractive industries. Washington, DC: The World Bank, 2017. http://hdl.handle.net/10986/26130 License: CC BY 3.0 IGO.

- Ansu-Mensah, P., Twum, K. K., Agyapong, G. K. Q., & Nimako, R. K. (2023). CSR and community development: A focus on firms in the extractive sector in Africa. In Corporate Social Responsibility in Developing countries: Challenges in the extractive industry, Msosa, S.K., Mugova, S., Mlambo, C., Eds.; Springer International Publishing: Cham, Switzerland, 2023; pp. 65-81. [CrossRef]

- Msosa, S.K. Corporate social responsibility challenges in the extractive industry: A summary. In Corporate social responsibility in developing countries: Challenges in the extractive industry, Msosa, S.K., Mugova, S., Mlambo, C., Eds.; Springer International Publishing: Cham, Switzerland, 2023a; pp. 281-287. [CrossRef]

- Msosa, S.K. Corporate social responsibility during the COVID-19 pandemic in the extractive sector. In Corporate social responsibility in developing countries Challenges in the extractive industry, Msosa, S.K., Mugova, S., Mlambo, C., Eds.; Springer International Publishing: Cham, Switzerland, 2023b; pp. 15-27. [CrossRef]

- Msosa, S.K.; Mugova, S. Corporate social responsibility challenges in the extractive industry: An introduction. In Corporate social responsibility in developing countries: Challenges in the extractive industry, Msosa, S.K., Mugova, S., Mlambo, C., Eds.; Springer International Publishing: Cham, Switzerland, 2023; pp. 1–14. [Google Scholar] [CrossRef]

- Haque, A. CSR Through responsible leadership for sustainable community development: A developing nation perspective. In Corporate social responsibility in developing countries: Challenges in the extractive industry, Msosa, S.K., Mugova, S., Mlambo, C., Eds.; Springer International Publishing: Cham, Switzerland, 2023; pp. 29–45. [Google Scholar] [CrossRef]

- Reddy, T.; Onwubu, S.C. Leveraging 4IR technologies as a corporate social responsibility to reduce environmental impact in the extractive industry. In Corporate social responsibility in developing countries: Challenges in the extractive industry, Msosa, S.K., Mugova, S., Mlambo, C., Eds.; Springer International Publishing: Cham, Switzerland, 2023; pp. 47–64. [Google Scholar] [CrossRef]

- Abuya, W. Does corporate social responsibility (CSR) actually develop mining communities? An examination of CSR programmes in Kenya’s mining sector. In Corporate social responsibility in developing countries: Challenges in the extractive industry, Msosa, S.K., Mugova, S., Mlambo, C., Eds.; Springer International Publishing: Cham, Switzerland, 2023; pp. 83–109. [Google Scholar] [CrossRef]

- Ekhator, E.O.; Iyiola-Omisore, I. Corporate social responsibility in the oil and gas industry in Nigeria: The case for a legalised framework. In Sovereign Wealth Funds, Local Content Policies and CSR: Developments in the Extractives Sector, Pereira, E.G., Spencer, R., Moses, J.W., Eds.; Springer International Publishing: Cham, Switzerland, 2021; pp. 439–458. [Google Scholar] [CrossRef]

- Nwoha, O. Whistleblowing measures and its implications in the Nigerian extractive industry. In Corporate social responsibility in developing countries: Challenges in the extractive industry, Msosa, S.K., Mugova, S., Mlambo, C., Eds.; Springer International Publishing: Cham, Switzerland, 2023; pp. 175–189. [Google Scholar] [CrossRef]

- Bande, H.M. Connivance in criminality: Corruption and corporate social responsibility in Nigeria’s oil sector. In Corporate social responsibility in developing countries: Challenges in the extractive industry, Msosa, S.K., Mugova, S., Mlambo, C., Eds.; Springer International Publishing: Cham, Switzerland, 2023a; pp. 191-204. [CrossRef]

- Uhumuavbi, I. An adaptive approach to reconceptualizing corporate social responsibility and corruption in Nigeria’s oil-rich Niger Delta. In Corporate social responsibility in developing countries: Challenges in the extractive industry, Msosa, S.K., Mugova, S., Mlambo, C., Eds.; Springer International Publishing: Cham, Switzerland, 2023; pp. 205–222. [Google Scholar] [CrossRef]

- Bande, H.M. Extending the frontier of agitations: Corporate social responsibility and resource control in Nigeria. In Corporate social responsibility in developing countries: Challenges in the extractive industry, Msosa, S.K., Mugova, S., Mlambo, C., Eds.; Springer International Publishing: Cham, Switzerland, 2023b; pp. 223-236. [CrossRef]

- Nwankwo, B.O. The politics of conflict over oil in the Niger Delta region of Nigeria: a review of the corporate social responsibility strategies of the oil companies. Am. J. Educ. Res. 2015, 3, 383–392. [Google Scholar] [CrossRef]

- Mbalisi, O.F.; Okorie, C.U. Implementation of corporate social responsibility by oil companies in the Niger Delta region of Nigeria: Myth or reality. Afr. Res. Rev. 2020. 14, 119–132. [CrossRef]

- Oruwari, H.O. Corporate social responsibility: A panacea for sustainable development in Niger Delta region of Nigeria. In SPE Nigeria Annual International Conference and Exhibition. 2022, August. OnePetro. [CrossRef]

- Khan, N.; Abraham, O.O.; Alex, A#. ; Eluyela, D.F.; Odianonsen, I.F. Corporate governance, tax avoidance, and corporate social responsibility: Evidence of emerging market of Nigeria and frontier market of Pakistan. Cogent Econ. Fin. 2022, 10, 1–22. [Google Scholar] [CrossRef]

- Umobong, A.; Agburuga, U.T. ). Corporate tax and corporate social responsibility of firms in Nigeria. Res. J. Finance Acc. 2018, 9, 8–25. [Google Scholar]

- Mgbame, C.O.; Chijoke-Mgbame, M.A.; Yekini, S.; Yekini, C.K. Corporate social responsibility performance and tax aggressiveness. J. Account. Tax. 2017, 9, 101–108. [Google Scholar] [CrossRef]

- Aronmwan, E.; Igbinoba, O. Corporate social responsibility and corporate tax planning: Does CSR/tax payment orientation matter? Int. J. Intellect. Discourse. 2021, 4, 120–135. [Google Scholar]

- Agundu, P.U.C.; Siyanbola, A.A. Tax aggressiveness and corporate social responsibility fluidity in Nigerian firms. J. Res. Natl. Dev. 2017, 15, 312–319. [Google Scholar]

- Suchman, M.C. Managing legitimacy: Strategic and institutional approaches. Acad. Manag. Rev. 1995, 20, 571–610. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic management: A stakeholder approach. Pitman Publishing Inc: Boston, USA, 1984.

- Nigeria: Petroleum Industry Act (PIA), 2021. Act No. 6.

- Carroll, A.B. Carroll’s pyramid of CSR: Taking another look. Int. J. Corp. Soc. Responsib. 2016, 1, 1–8. [Google Scholar] [CrossRef]

- Slemrod, J. Tax compliance and enforcement. J. Econ. Lit. 2019, 57, 904–954. [Google Scholar] [CrossRef]

- Idubor, R.; Asada, D.; Adefi, O.M. Appraising taxation and the Nigerian oil industry. J. Law Policy Glob. 2015, 37, 188–203. [Google Scholar]

- Nilsson, M.; Chisholm, E.; Griggs, D.; Howden-Chapman, P.; McCollum, D.; Messerli, P. ; .. Stafford-Smith, M. Mapping interactions between the sustainable development goals: Lessons learned and ways forward. Sustain. Sci. 2018, 13, 1489–1503. [Google Scholar] [CrossRef] [PubMed]

- Creswell, J.W.; Creswell, J.D. Research design: Qualitative, quantitative, and mixed methods approaches. 5th ed. Sage Publications: Los Angeles, USA, 2018.

- Kumar, R. Research methodology: A step-by-step guide for beginners. 5th ed. Sage Publications: Los Angeles, USA, 2019.

- Saunders, M.N.K.; Lewis, P.; Thornhill, A. Research methods for business students. 8th ed. Pearson Education Limited: New York, USA, 2019.

- Hart, C. Doing a literature review: Releasing the social science research imagination. Sage Publications: London, UK, 1998.

- Arksey, H.; O'Malley, L. Scoping studies: Towards a methodological framework. Int. J. Soc. Res. Methodol. 2005, 8, 19–32. [Google Scholar] [CrossRef]

- Given, L.M. The SAGE encyclopedia of qualitative research methods (Vol. 1-2). Sage Publications: Los Angeles, USA, 2008.

- Grant, M. J.; Booth, A. A typology of reviews: An analysis of 14 review types and associated methodologies. Health Info Libr. J. 2009, 26, 91–108. [Google Scholar] [CrossRef]

- Levac, D.; Colquhoun, H.; O'Brien, K.K. Scoping studies: Advancing the methodology. Implement. Sci. 2010, 5, 1–9. [Google Scholar] [CrossRef] [PubMed]

- Wilson, V. Research methods: Scoping studies. Evid. Based Libr. Inf. Pract. 2014, 9, 97–99. [Google Scholar] [CrossRef]

- Peters, M.D.; Marnie, C.; Colquhoun, H.; Garritty, C.M.; Hempel, S.; Horsley, T. . Tricco, A.C. Scoping reviews: Reinforcing and advancing the methodology and application. Syst. Rev. 2021, 10, 1–6. [Google Scholar] [CrossRef] [PubMed]

- Ele, M. Oil spills in the Niger Delta-Does the Petroleum Industry Act 2022 offer guidance for solving this problem? J. Sustain. Dev. Law Pol. 2022, 13, 130–161. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).