1. Introduction

Portfolio can be defined as a collection of assets, which can include cash, real estate, stocks, or crypto. Portfolio optimization concerns about maximizing returns and minimizing risks. Returns are the expected profit from the investment, while risks are the possible changes in values of the investment. [

1] proposed using means and variances of the portfolio as the returns and risks measures. Good practice of portfolio optimization is very crucial in investment, since it greatly affects the outcome of the investment. In this paper, we focus on portfolio consisting of correlated stocks.

Model proposed by [

1] has been studied by many researchers over the years. Since its introduction, a lot of improvements have been made to the model. Some improvements add discrete and integral constraints. Hence, the resulting model becomes mixed-integer nonlinear programming (MINLP). For instance, [

2] and [

3] considered adding roundlot constraints, which means that shares must be bought in a multiple of some integers. [

2] used FortMP solver, while [

3] used DIRECT hybridized with Quasi Newton. With increasing complexity, various techniques also emerged. AUGMECON2 is the state of the art multi-objective MINLP solver. It was introduced by [

5] and has been shown to very effective in solving multi-objective MINLP. Recent use of AUGMECON2 in portfolio optimization can be found in [

6]. The lack of this method is its computational complexity. [

6] noted that for some large dimensional problems, AUGMECON2 did not give a converged solution after 7 days.

To get around the complexity of exact methods, an efficient optimizer is needed. One popular approach is to use metaheuristic algorithms. Metaheuristic algorithms are usually inspired by natural processes in biology, chemistry, physics, or society. Most of the time, it is expected that metaheuristic algorithms can produce near-optimal solutions. And later, exact method will be implemented to get more accuracy, such in [

3]. [

4] proprosed a series of modified metaheuristic algorithms that exploit the structure of MV model with cardinality and quantity constraints. The metaheuristic algorithms used are genetic algorithm (GA), tabu search (TS), and simulated annealing (SA). To handle the cardinality and quantity constraints, they implemented an algorithm to adjust the solutions.

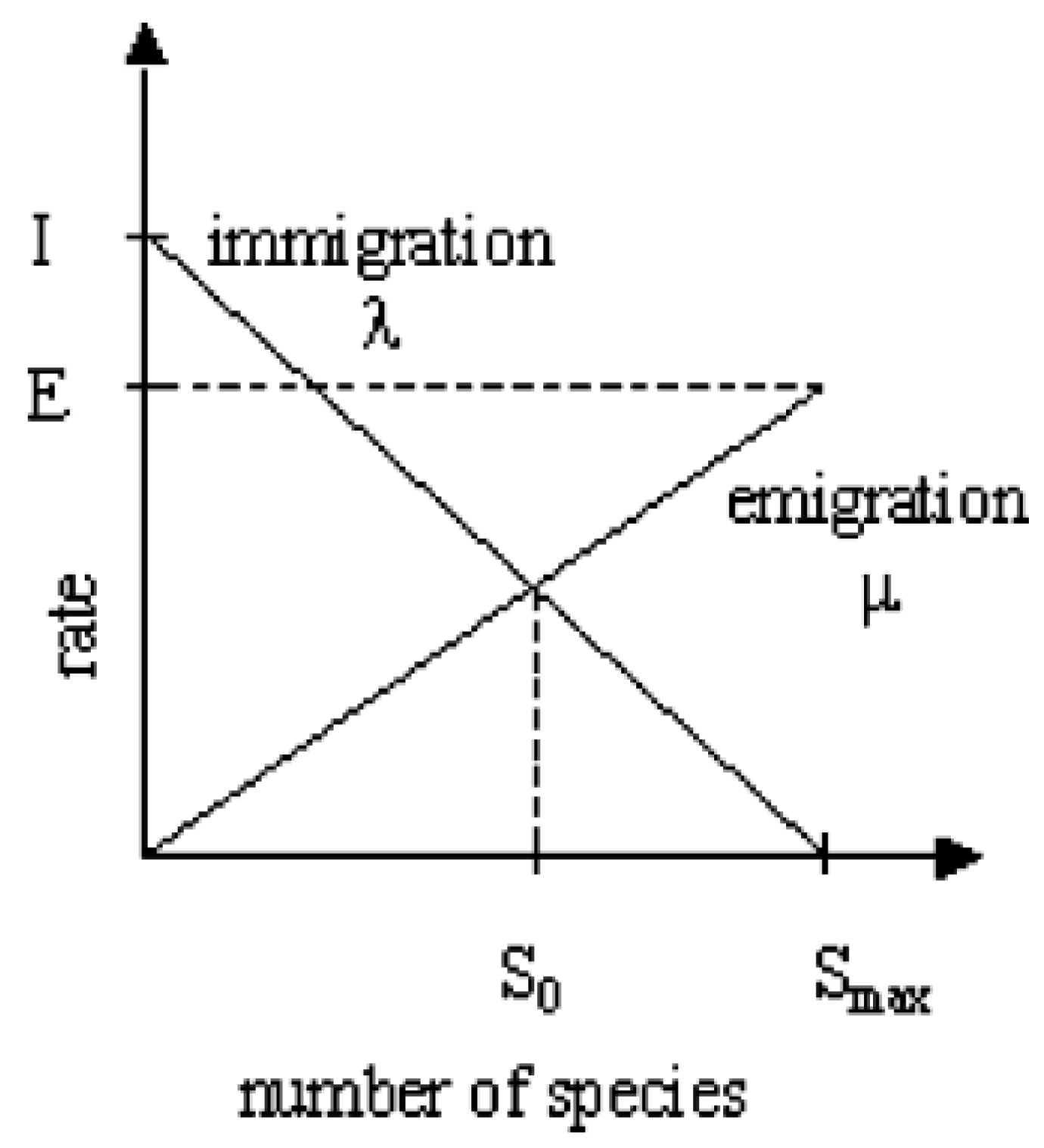

Another example of metaheuristic algorithm is biogeography-based optimization (BBO). It was developed by [

7]. The inspiration comes from the dynamics of the geography of habitats. It basically consists of migration and mutation. Elitism is also added to ensure faster convergence. BBO has been used to solve numerous optimization problems in real world. Some of the newer applications can be found in [

9] and [

8]. Those studies concluded that BBO is a very powerful optimizer. For MINLP, [

10] has shown the effeciency of BBO to solve reliability problems and the results demonstrated the superiority of BBO compared to other metaheuristics. In his approach, the integral and discrete constraints are treated as if they were continuous, but in the function evaluation they are rounded accordingly. This is sensical, since BBO is known for its effectiveness in continuous optimization. One of the reasons why we choose BBO is that its. It requires minimal parameters and is easy to implement.

For application in portfolio optimization, there are some literatures using BBO as the main optimizer. [

11] used BBO to solve a portfolio optimization with second-order stochastic dominance constraints. [

12] used a variant of BBO called laplacian biogeogeography-based optimization (LX-BBO) to find porfolio allocation from 10 assets in MV model. [

13] used BBO to solve constrained MV model and applied the results in forecasting via Monte Carlo. The number of asset used in that research was 15.

Over the time, the number of companies listed in the stock markets are increasing. There are a lot of markets with a really high number of companies. While this provides a good chance for investor to choose assets, this also provides a problem of choosing the suitable assets. [

19] studied on how to efficiently choose a subset of large set to optimise a portfolio. He considered a constrained portfolio optimization with cardinality constraint and quantity constraint. His method was inspired by quadratic programming techniques and later improved to worked very well in solving portfolio optimization. [

20] considered a multiobjective constrainted mean-variance model and used four methods to solve the problem. The methods he used are Normalized Multiobjective Evolutionary Algorithm based on Decomposition (NMOEA/D), Multiobjective Differential Evolution based on Summation Sorting (MODE-SS) and Multiobjective Differential Evolution based on Nondomination Sorting (MODE-NDS), Multiobjective Comprehensive Learning Particle Swarm Optimizer (MO-CLPSO), and Nondominated Sorting Genetic Algorithm II (NSGA-II). The constraint they added to the model was preselection constraint. They concluded that the methods were efficient for large scale portofolio optimization. They also suggested adding practical constraints such as cardinality constraint and quantity constraint for furthe research.

In this paper, we proposed the usage of [

4] heuristic ideas but implemented in BBO framework to solve constrained MV model. The reason we used [

4] ideas is that it worked really well on large scale portfolio in their research. The dimensions studied by that research was 31, 85, 89, 98, and 225. Their methods can solve a large scale portofolio optimization problem with high accuracy and in short time. It is clear that standard methods do not solve this problem effectively since the computation complexity is very big.

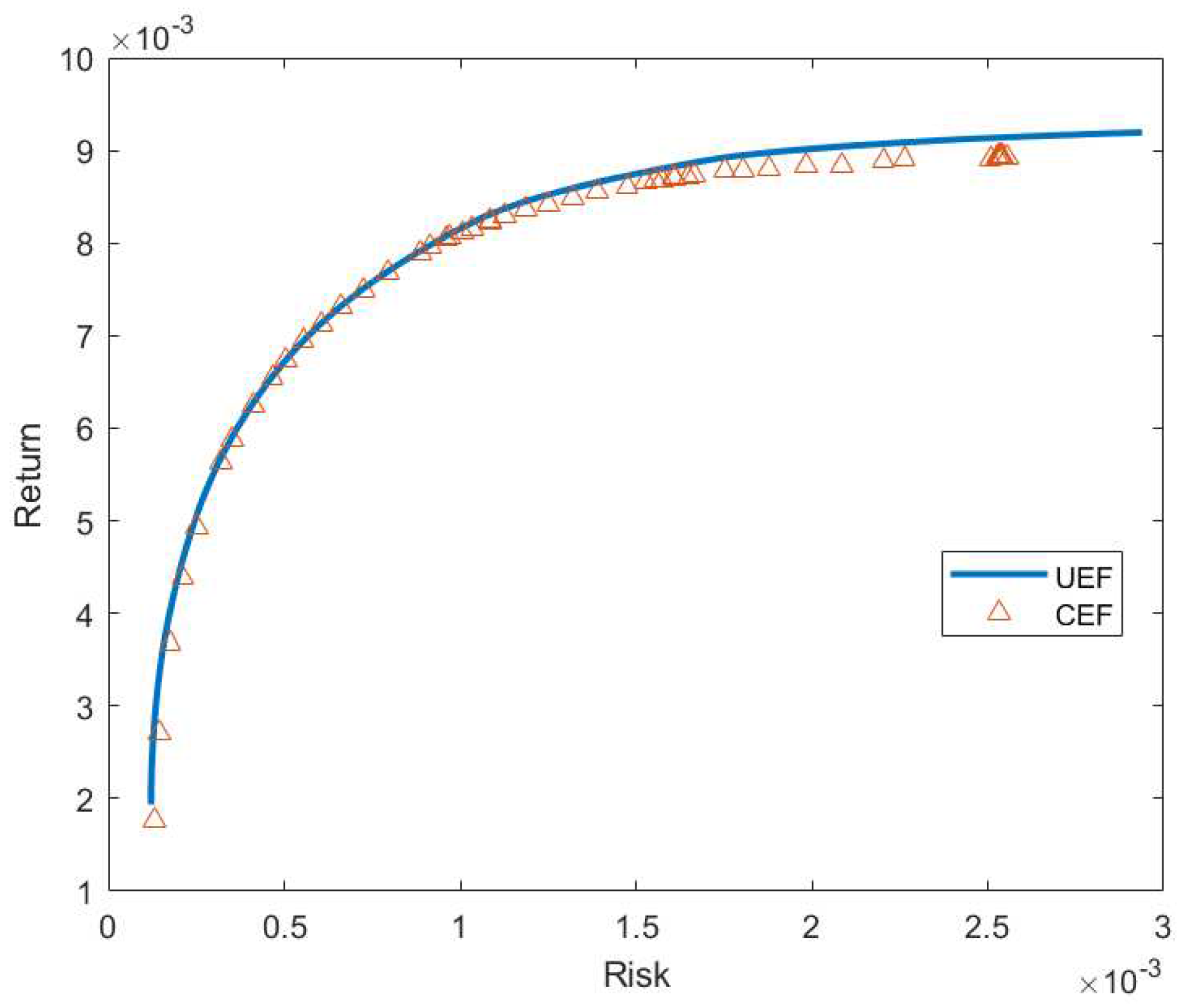

We use data from ORLibrary which is available online. The same data were used in [

4] and [

14]. We also compare our results with theirs using the same perfomance metric. Results show the competitiveness of BBO compared to other methods.

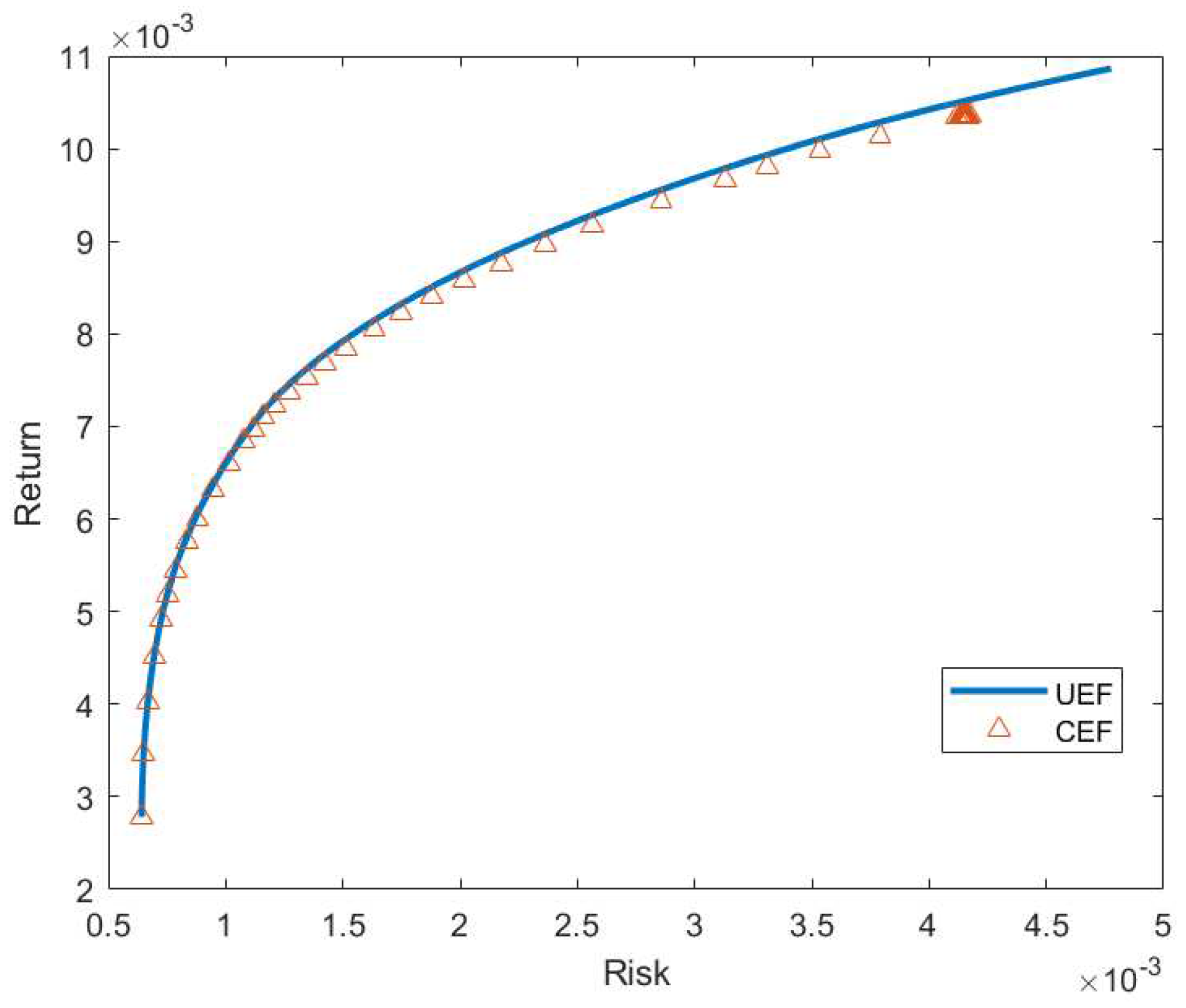

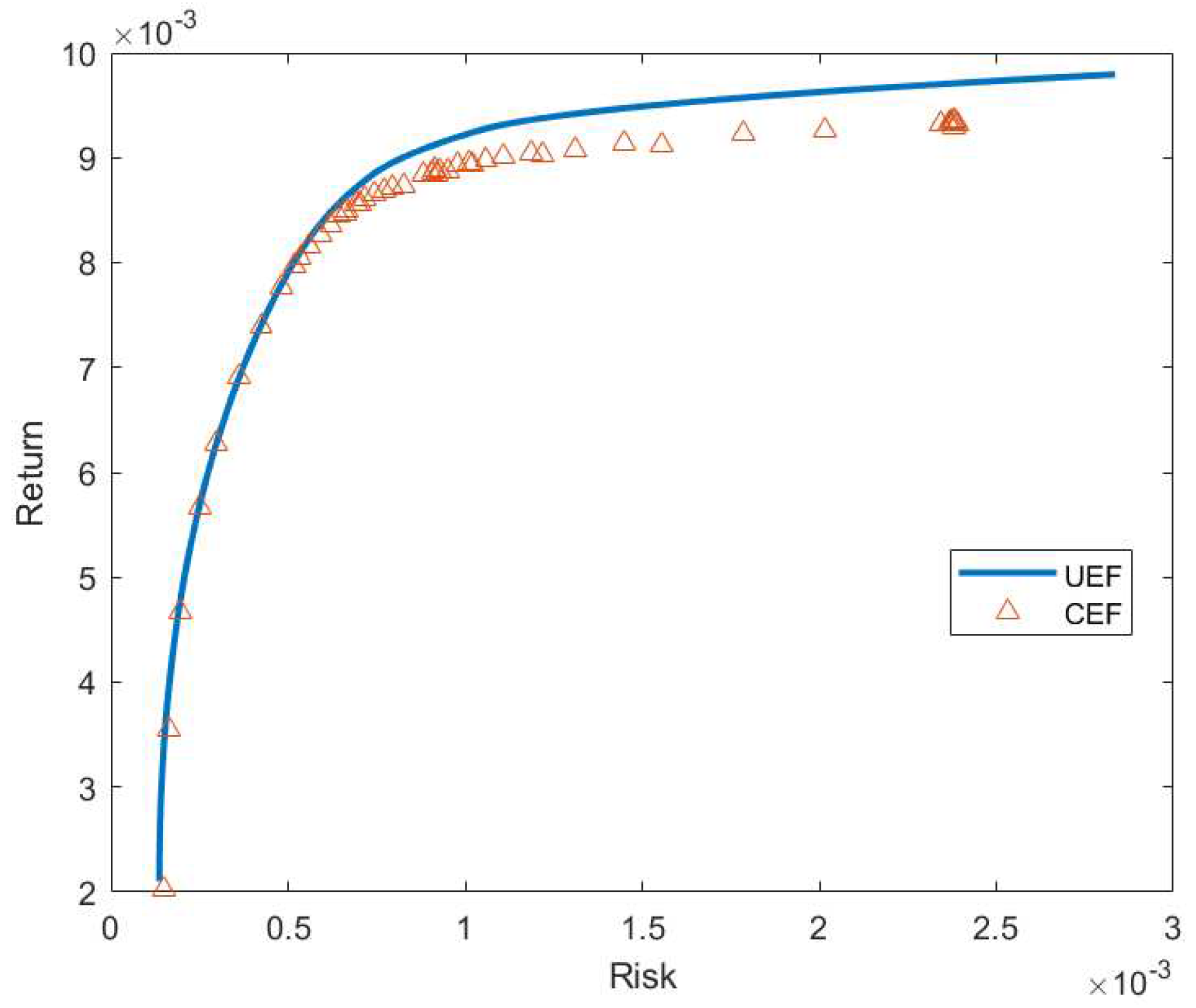

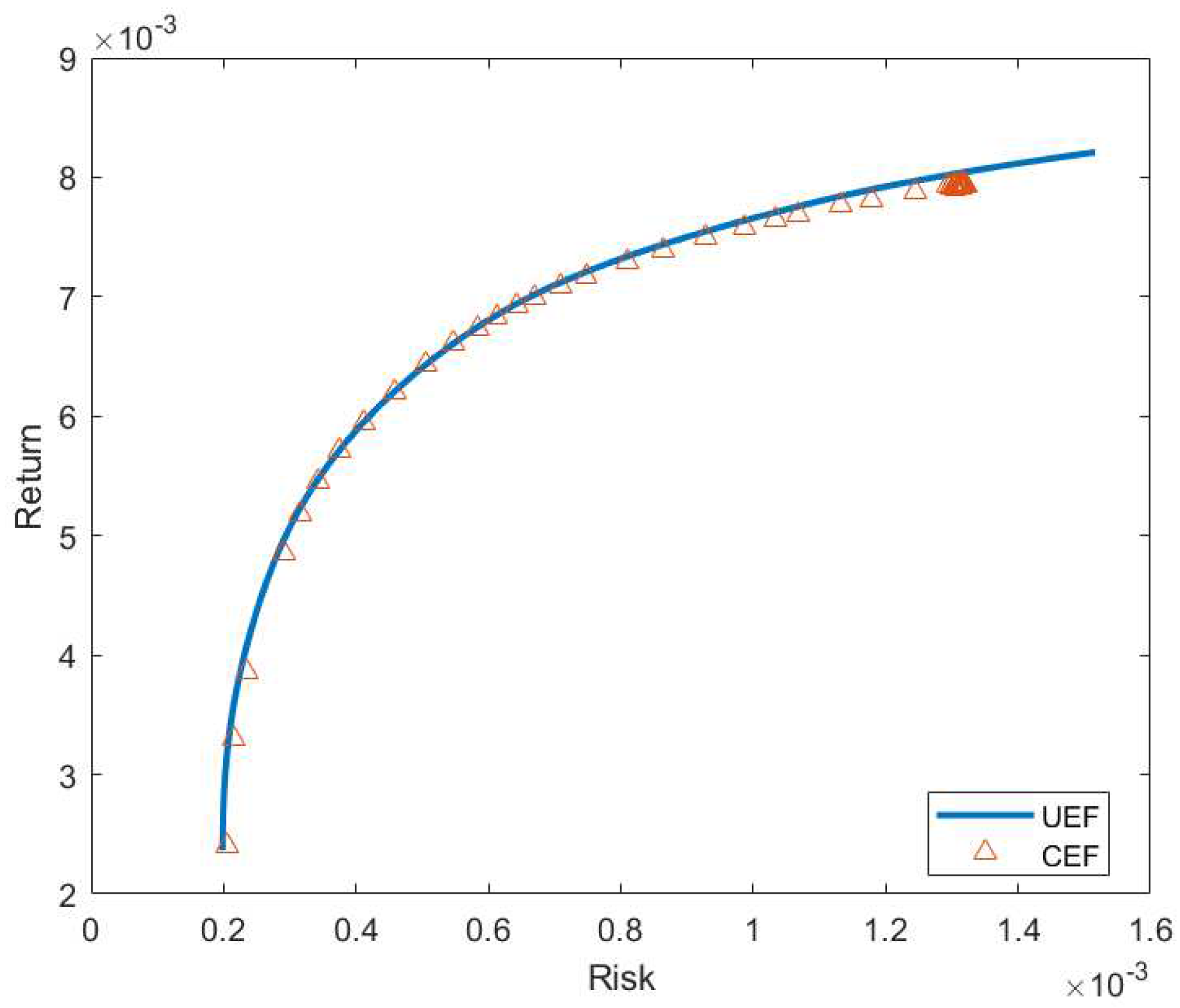

The organization of this paper is as follows.

Section 2 introduces the problem we solve in this paper and how we solve them. The problem is multiobjective constrained portfolio optimization. Then, we make some introduction about biogeography-based optimizaton (BBO) before detailing the method we propose.

Section 3 contains the results of our proposed approach and its comparison with other studies. Conclusions and further improvements are also included in that section.