Submitted:

01 May 2023

Posted:

02 May 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction-Research Question

2. Literature Review

3. The Econometric Model for the Estimation of the Value of GDPG

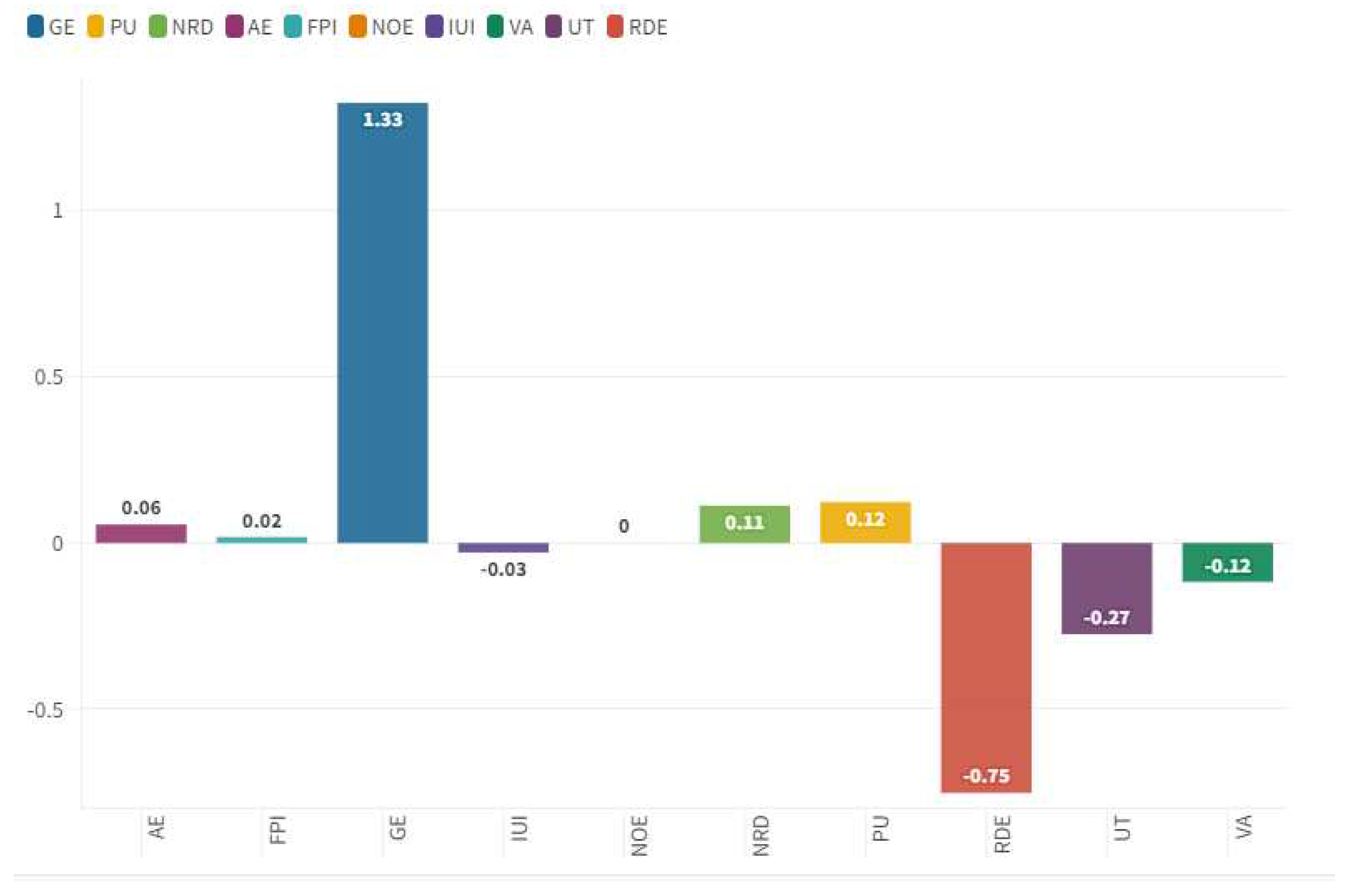

- GE: is a variable that considers the perceptions of the quality of public services, the quality of the civil service and the degree of independence from political pressure, the quality of the formulation and implementation of policies and the credibility of the government’s commitment to these policies The estimate provides the score of the country on the aggregate indicator, in units of a standard distribution, that is to say they range from about -2.5 to 2.5. There is a positive relationship between the value of GDPG and the value of GE. The motivation consists in the fact that the countries that have a public system that offers efficient services also have a positive GDPG trend. There is therefore no contrast between the development of the public sector and the development of the private sector. Indeed, on the contrary, the ability to develop the public economy is positively associated with GDPG.

- PU: is the percentage of the population whose habitual food consumption is insufficient to try the dietary energy levels that are required to maintain a normal active and healthy life. There is a positive relationship between PU value and the value of GDPG. This positive relationship is since the countries that grow most have reduced pro-capita incomes and therefore high values in terms of PU high as for example in the case of Bangladesh, Dominican Republic, Ethiopia, Ghana, Guinea, Malawi. However, this positive relationship tends to disappear if we consider the growth of the GDP in an absolute sense or per capita income. In fact, if there is an increase in the GDP per capita then the value of PU value tends to decrease. Although in the event of growth of the absolute pro-capita, the GDPG value would decrease, as the countries that have high per-capita incomes tend to have a reduced GDPG.

- NRD: is a variable that measures the exhaustion of natural resources is the sum of the exhaustion of the net forest, the exhaustion of energy and mineral exhaustion. There is a positive relationship between NRD and GDPG. This positive relationship is due to the fact that many countries that have high levels of GDPG are also countries that use large amount of natural resources to support economic growth. In fact, to promote economic growth, it is necessary improve the consumption of natural and energy resources with also negative effects in terms of emissions. It follows that countries that grow more in terms of GDP are also countries that have high values in terms of NRD.

- AE: is the percentage of population with access to electricity. Electrification data are collected from industry, national surveys, and international sources. There is a positive relationship between AE and GDPG. The countries that grow more in terms of GDPG also have a higher consumption of AE. In fact, to have a greater GDPG it is necessary that industries produce more. The growth of industrial production requires growth in electricity consumption. The consumption of electricity requires a growth in the distribution of the electrical network, and the increase in the percentage of the population that have access to electricity. In addition, it should be considered that a significant part of GDP is the consumption of families and individuals. The growth of electrification increases the level of consumption with a positive impact in terms of GDPG.

- FPI: covers food crops that are considered edible and that contain nutrients. Coffee and tea are excluded because, although edible, they have no nutritional value. There is a positive relationship between the FPI and GDPG. This relationship is since many of the countries that have high GDPG rates are also countries that have high levels of food production such as Senegal with 181.51, Mongolia with 173.71, Guinea with 135.81, the Tajikistan with 135.55, Mali with 134.57, Malawi with 132.97. Countries with high rates of economic growth are often countries with low per capita income, i.e. developing countries. In developing countries, the percentage of GDP deriving from agriculture tends to be high, in contrast to countries with a high GDP which focus more on the services sector.

- NOE: are emissions from agricultural biomass burning, industrial activities, and livestock management. There is a positive relationship between NOE and GDPG. The countries that grow more from an economic point of view also tend to have higher levels of pollution deriving from the industrial production systems. It therefore derives a growth of values also in terms of NOE. Among the countries that produce the greatest value of NOE there are at the top of Mongolia with 4.3, New Zealand with 3.0, Cameron and Australia with 2.4, and Uruguay with 2.3. The positive relationship between high levels of GDPG and high levels of NOE raises significant issues that refer to the relationship between ethics and the environment. Many of the environmental economic policies generate deleterious effects on low per-capita income countries by preventing them from growing in GDP. If higher GDPG rates are positively associated to pollution then the imposition of environmental constraints can reduce the ability of poor countries to develop their economy.

- IUI: it is a variable that measures the number of individuals who have used the Internet (from any location) in the last 3 months. The Internet can be used via a computer, mobile phone, personal digital assistant, games machine, digital TV etc. There is a negative relationship between IUI and GDPG. The reasoning is that countries that have high levels of economic growth are also countries that have low internet access. In fact, these are African or Asian countries with low per capita incomes that do not have internet coverage such as to allow the entire population to have the benefits of the digital economy. Countries with a high GDPG rate have low levels of digitization. These countries are growing thanks to Foreign Direct Investment-FDI, relocations, low labor costs, and the availability of raw materials useful for industrial production.

- VA: captures perceptions of the extent to which a country’s citizens are able to participate in selecting their government, as well as freedom of expression, freedom of association, and a free media. Standard error indicates the precision of the estimate of governance. Larger values of the standard error indicate less precise estimates. A 90 percent confidence interval for the governance estimate is given by the estimate +/- 1.64 times the standard error. There is a negative relationship between VA and GDPG. This negative relationship is since many countries that have a high GDPG value are countries with low per capita income that do not have the possibility to exercise democratic and civil freedoms. In fact, these are countries in which a profound democratic culture is not to be found and which experience questionable political regimes from a strictly democratic point of view. Conversely, Western countries in which the value of VA is high have low levels of GDPG rate. The negative relationship between VA and GDPG confirms that economic growth tends to be more marked for those countries that have low per capita incomes and are therefore in the early stages of economic, social, and institutional development.

- UT: refers to the share of the labor force that is out of work but available for and looking for work. There is a negative relationship between the UT model and the GDPG rate model. This relationship is since the growth of the GDP tends to generate a growth also in employment and therefore a reduction in unemployment. Increasing the level of economic activity allows countries to increase employment in both the public and private sectors with a significant reduction in unemployment. Countries that grow the most in terms of GDP are also those that have the largest share of agriculture and manufacturing as percentage of value added. The employment in agricultural and manufacture sectors do not require a high-skilled workforce. Therefore, the increase in the offer of labor in agriculture, construction and industry has an immediate impact in reducing unemployment even for non-educated workers.

- RDE: is a variable that measures the gross domestic expenditure on research and development (R&D), expressed as a percentage of GDP. They include both capital and current spending across the four major sectors: business, government, higher education, and private non-profits. R&D covers basic research, applied research and experimental development. There is a negative relationship between RDE and GDPG. This relationship is since countries with higher GDPG rates also have lower investment in research and development. Countries with a high GDPG rate are not countries with a high per capita income, with advanced economies from the point of view of services and therefore do not need to invest in R&D. Conversely, countries with a low GDPG rate and a high level of per capita income must invest in research and development to maintain the competitiveness of their businesses and their economy.

4. Clusterization with the k-Means Algorithm Optimized with the Elbow Method

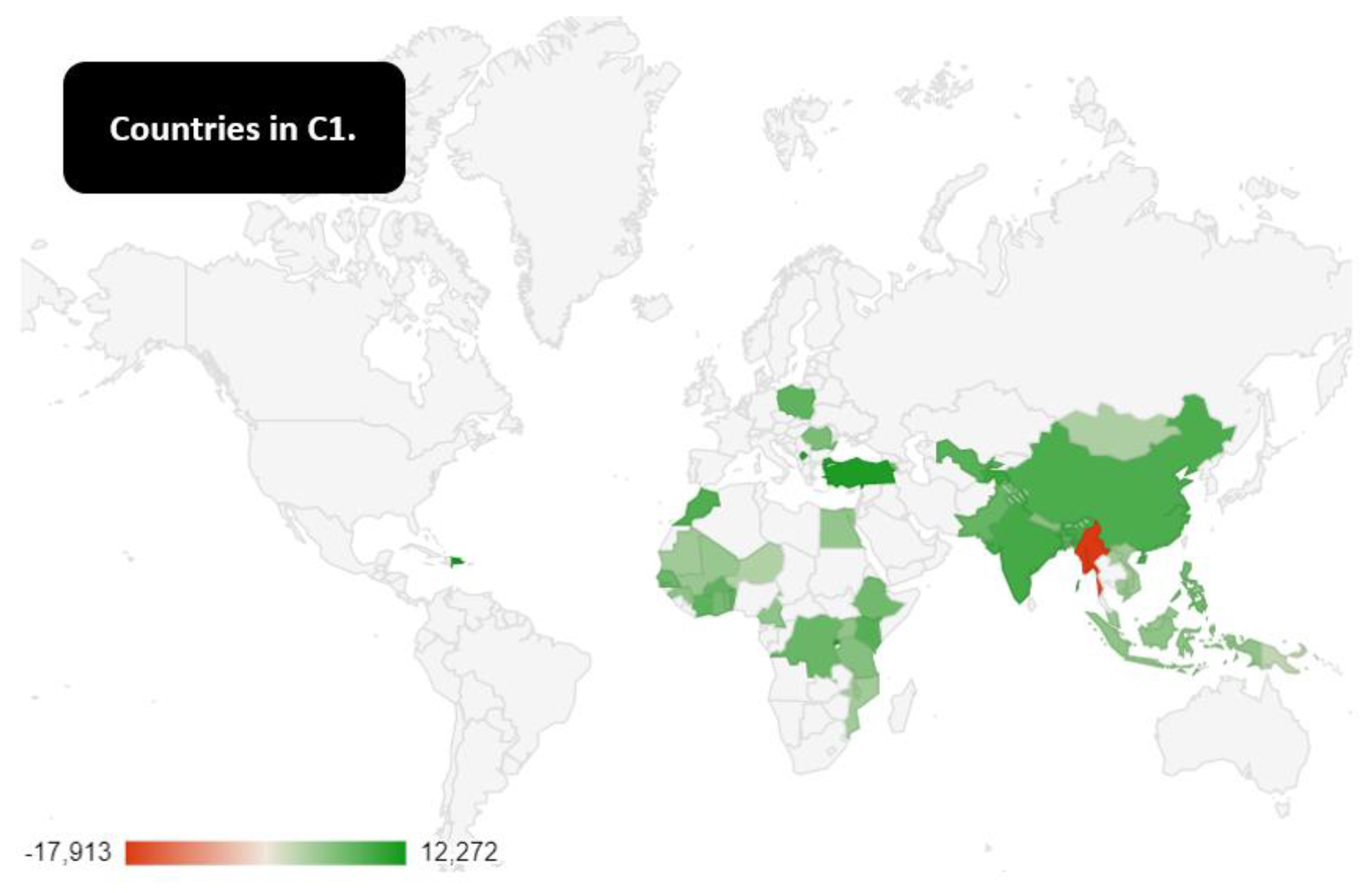

- Cluster 1: Armenia, Bangladesh, Benin, Bhutan, Burkina Faso, Cambodia, Cameroon, China, Congo, Dem. Rep., Cote d’Ivoire, Dominican Republic, Egypt, Arab Rep., Ethiopia, Ghana, Guinea, India, Indonesia, Kenya, Kosovo, Lao PDR, Malawi, Malaysia, Mali, Malta, Mauritania, Mongolia, Morocco, Mozambique, Myanmar, Nepal, Niger, Pakistan, Papua New Guinea, Philippines, Poland, Romania, Rwanda, Senegal, Tajikistan, Tanzania, Togo, Turkey, Tuvalu, Uganda, Uzbekistan, Vietnam. C1 is the cluster with the highest median value in terms of GDPG rate with an amount of 5.3%. However, within this cluster there are countries that in 2021 have had a much higher GDPG rate. The top ten of the C1 countries for the value of the GDPG rate in 2021 consists of Dominican Republic with 12.27%, Turkey with a value of 11.35%, Rwanda with 10.88%, Kosovo with 10.75%, Malta with 10.30%, Tajikistan with 9.20, India 8.68%, China with 8.11%, Morocco with 7.93%, Kenya with 7.52%. In the last place in the ranking of Cluster 1 countries there is Myanmar with a value of -17.91%. The quantitative trend of the GDPG rate of the Myanmar has a fluctuating trend. Between 2011 and 2020 the average GDPG rate in Myanmar was equal to a value of 6.60%. However, between 2020 and 2021 the GDPG rate went from 3.17% up to -17.91%. This reduction in Myanmar GDPG rate between 2020 and 2021 is due to the coup d’état in the country that laid President Aung San Suu Kyi and replaced the democratic government with a military dictatorship. This coup d’état cost about 21.08% of GDP between 2020 and 2021 to the country. C1 countries are all non -European countries except for Romania, Poland, and Kosovo. In the C1 it is possible to identify the presence of many of the economies that will certainly be the protagonists of the economy of the future such as China, India, and Turkey, Indonesia, Egypt, and Nigeria. The fact that these countries have a very high GDPG rate is due to a set of economic and institutional conditions. In fact, the countries that have low per capita incomes tend to grow quickly if they can attract Foreign Direct Investment-FDI. However, there are also favorable political conditions such as political stability, and the lack of terrorism or state strokes. Most C1 countries are Asian and African countries. However, there are doubts that the growth rate of these countries can continue to grow in the future. For example, in the case of China it is likely that the choice of an anti-western and isolationist turning point can lead to a reduction in the value of the GDPG rate which is very connected to the development of FDI and international supply chain. Similar considerations hold also for the other C1 countries that seem to be characterized by a basic political instability that could generate a return to low growth conditions and poverty preceding the development of commercial integration and globalization. It follows that the C1 countries are certainly the best in terms of GDPG rate. However, there are many political, economic, and institutional risks that could reduce the value of their economic growth in the future. Furthermore, it should be considered that the value of GDPG rate in C1 countries could be reduced by phenomena connected to mass immigration and the adverse effects of the climate change.

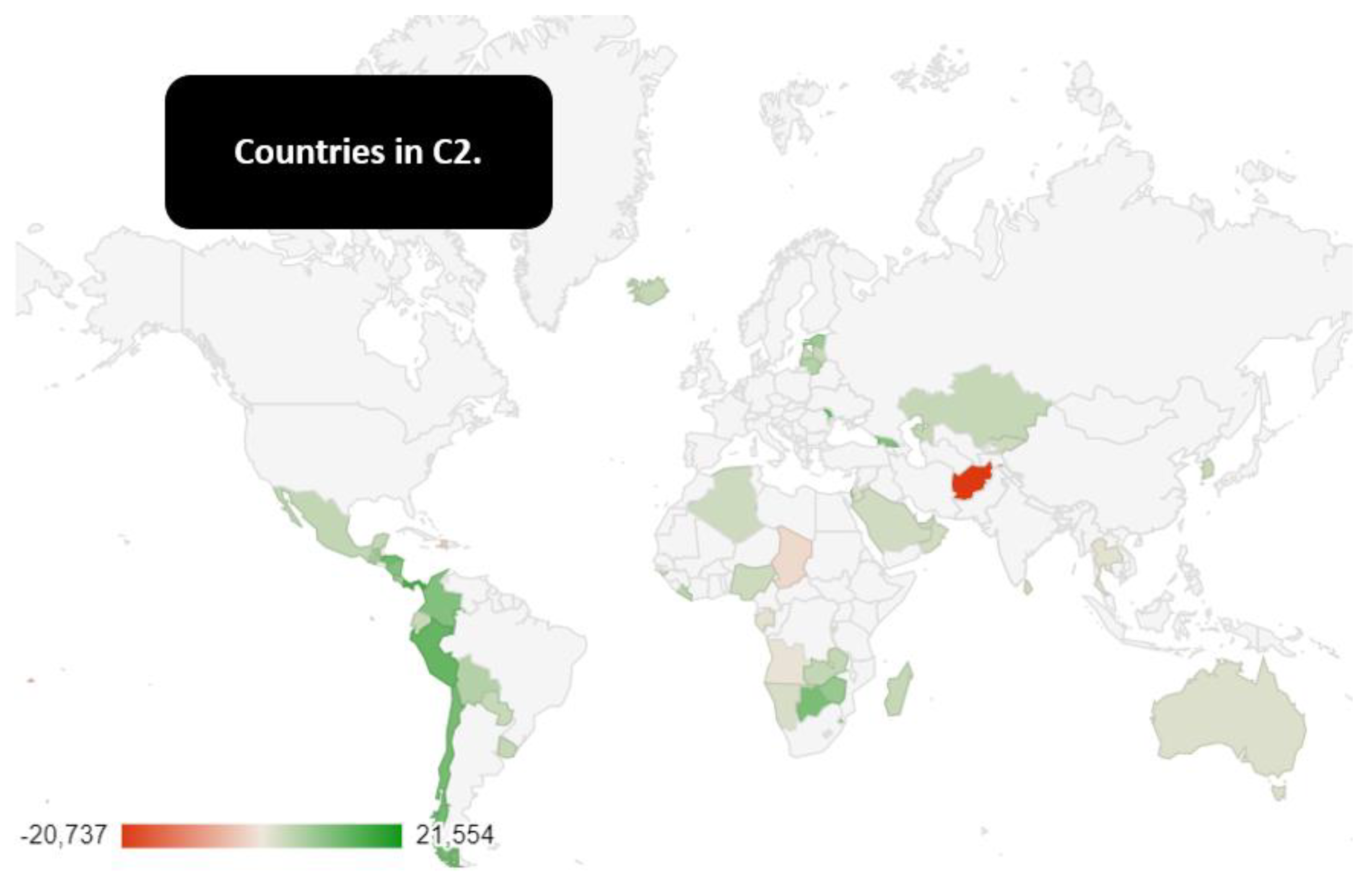

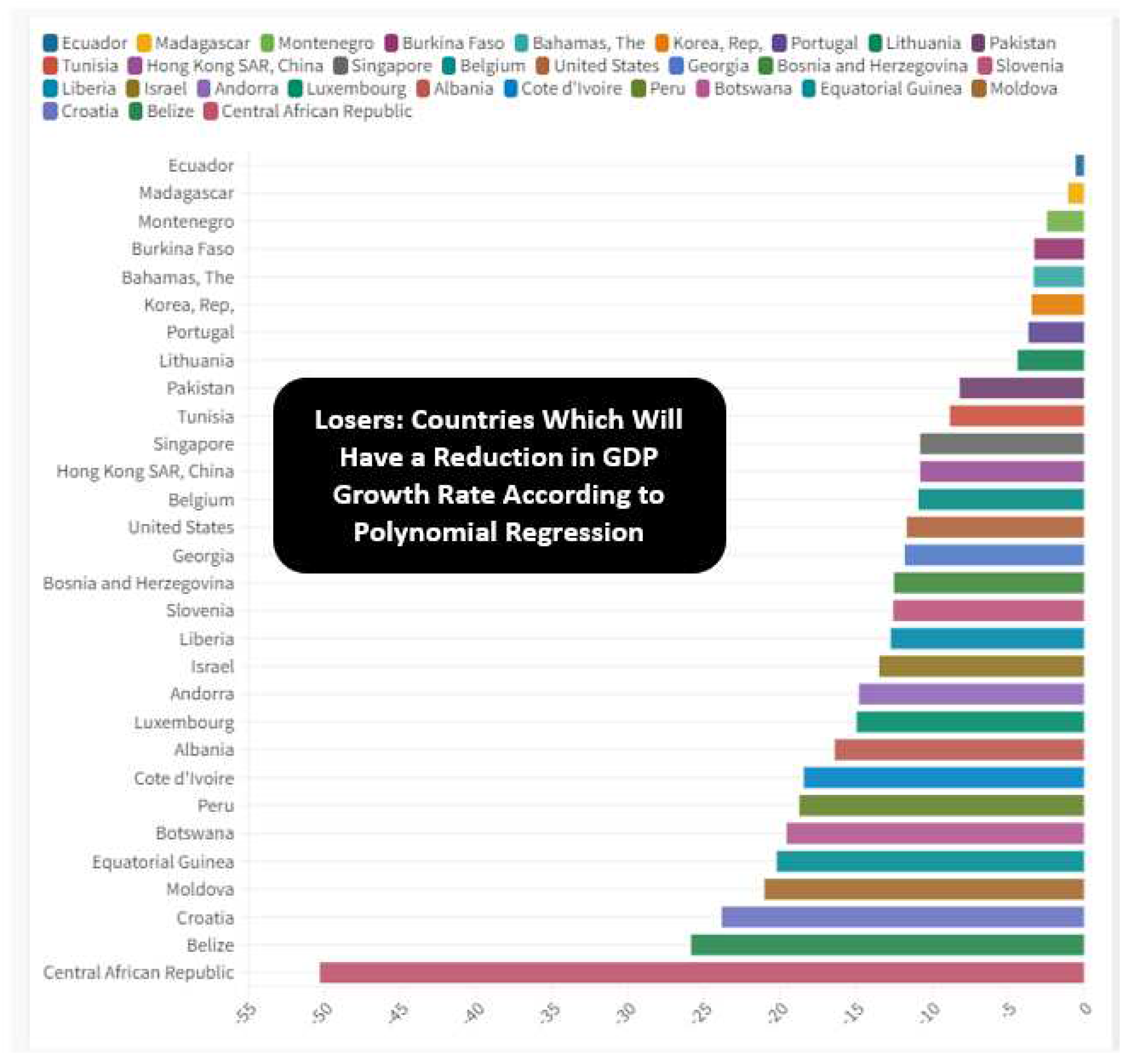

- Cluster 2: Afghanistan, Algeria, Angola, Australia, Bahrain, Bolivia, Botswana, Burundi, Chad, Chile, Colombia, Comoros, Costa Rica, Ecuador, Estonia, Eswatini, Fiji, Gabon, Georgia, Guatemala, Guinea-Bissau, Haiti, Honduras, Hong Kong, Iceland, Israel, Jordan, Kazakhstan, Kiribati, Korea, Rep., Kyrgyz Republic, Latvia, Lesotho, Liberia, Lithuania, Madagascar, Mauritius, Mexico, Moldova, Monaco, Namibia, New Zealand, Nicaragua, Nigeria, Oman, Panama, Paraguay, Peru, Qatar, Sao Tome and Principe, Saudi Arabia, Seychelles, Singapore, Solomon Islands, Sri Lanka, Thailand, Tonga, United Arab Emirates, Uruguay, West Bank and Gaza, Zambia, Zimbabwe. The C2 is the last cluster in terms of median value of the GDPG rate among the three identified clusters. The top ten of the countries by the value of the GDPG rate in 2021 consists of Monaco with a value of 21.55%, followed by Panama with a value of 15.34%, from Moldova with a value of 13.94%, from Peru with an amount of 13.35%, Honduras with a value of 12.53%, Chile with 11.67%, Botswana 11.37%, Colombia with 10.68%, Georgia with 10.47%, Nicaragua with 10.34%.

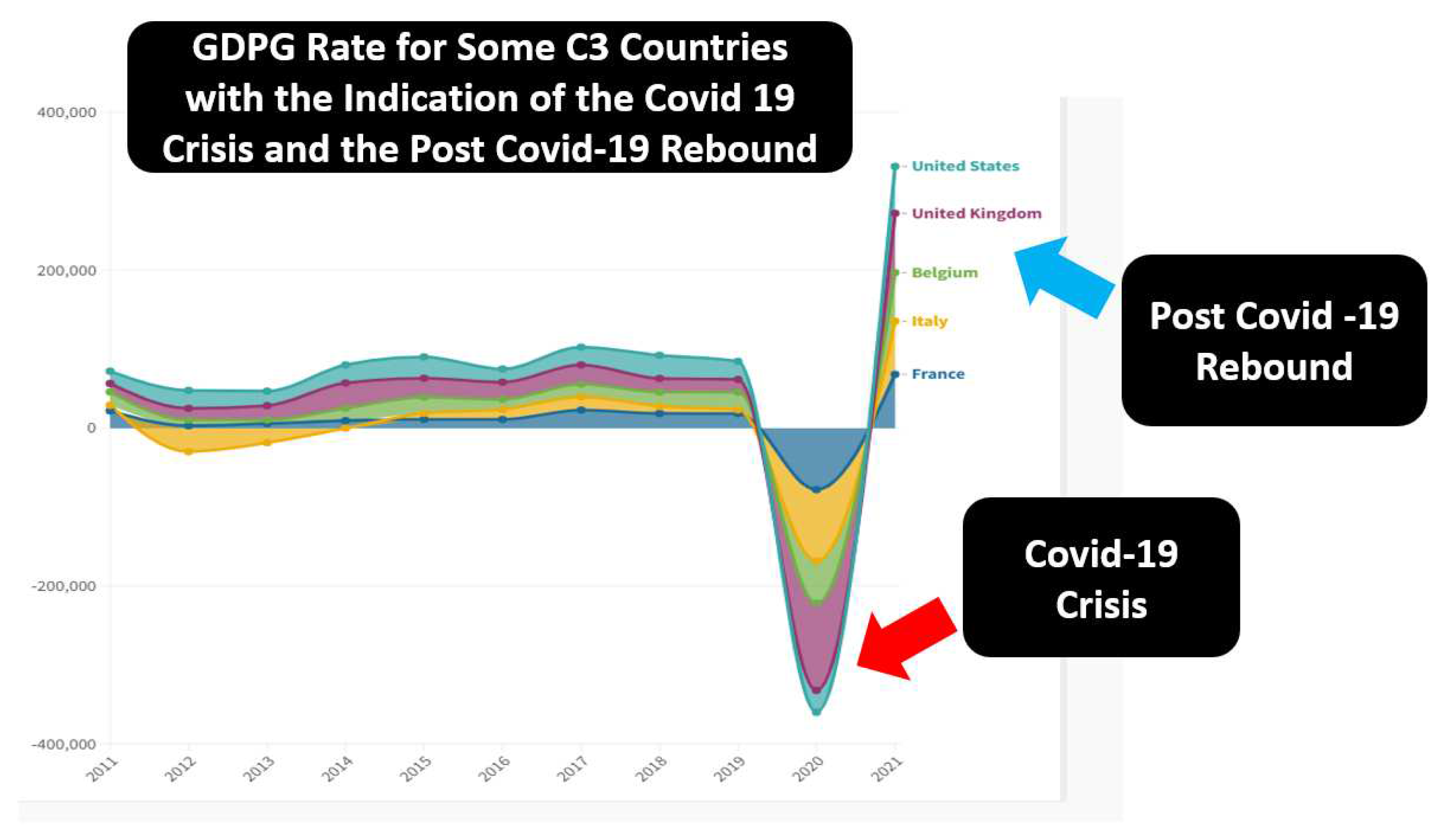

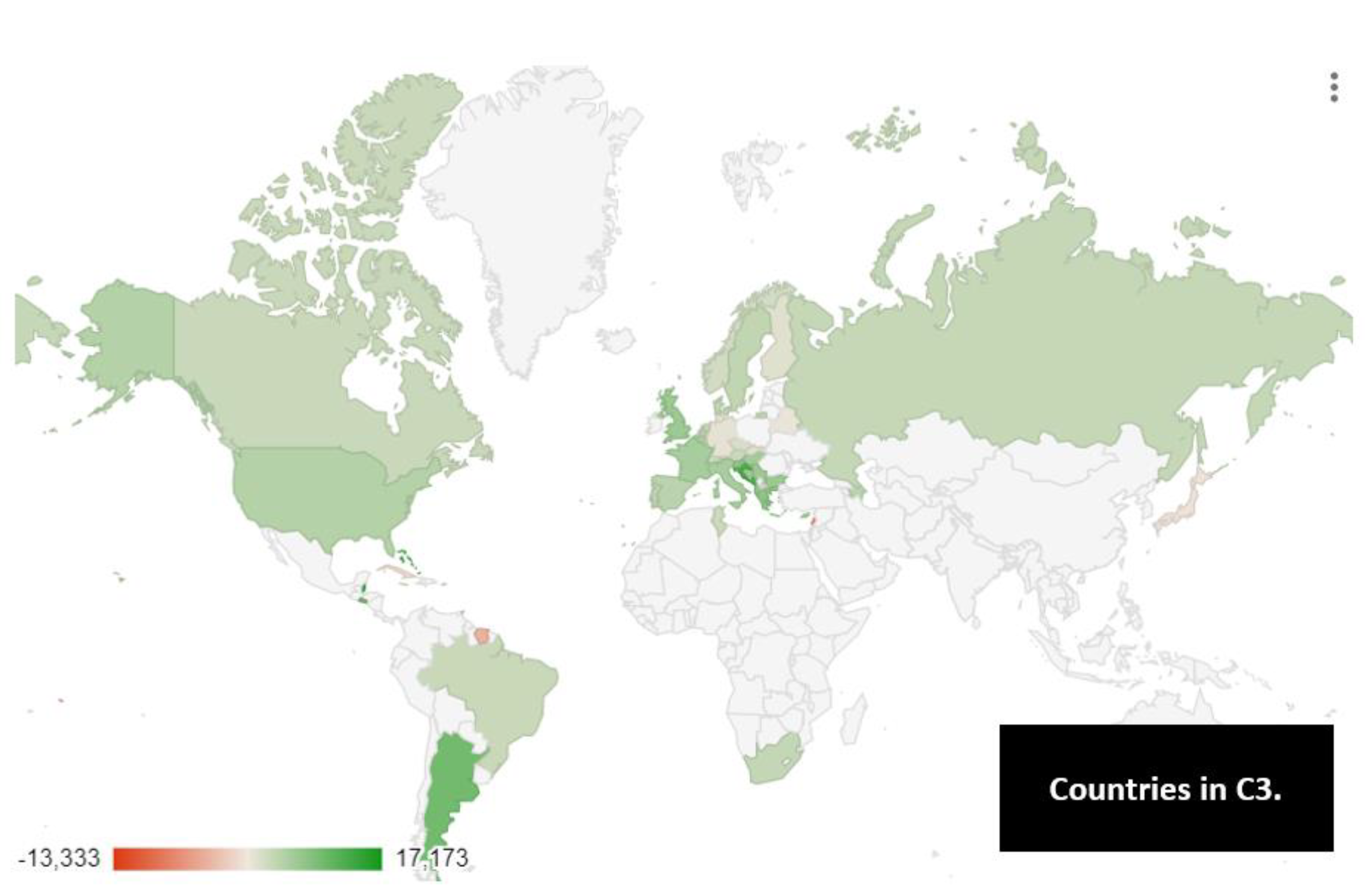

- Cluster 3: Albania, Andorra, Antigua and Barbuda, Argentina, Aruba, Austria, Azerbaijan, The Bahamas, Barbados, Belarus, Belgium, Belize, Bermuda, Bosnia and Herzegovina, Brazil, Brunei Darussalam, Bulgaria, Cabo Verde, Canada, Cayman Islands, Croatia, Cuba, Curacao, Cyprus, Czechia, Denmark, Dominica, El Salvador, Finland, France, French Polynesia, Germany, Greece, Grenada, Guam, Hungary, Italy, Jamaica, Japan, Lebanon, Luxembourg, Marshall Islands Micronesia Fed. Sts., Montenegro, Netherlands, North Macedonia, Norway, Palau, Portugal, Puerto Rico, Russian Federation, Samoa, Serbia, Slovak Republic, Slovenia, South Africa, Spain, St. Kitts and Nevis, St. Lucia, St. Vincent and the Grenadines, Suriname, Sweden, Switzerland, Trinidad and Tobago, Tunisia, United Kingdom, United States, Vanuatu. The C3 is the second cluster for the value of the GDPG rate with a median value equal to an amount of C3 = 4.8. The top ten of the GDPG rate countries consists of Belize with a value of 15.23%, The Bahamas with 13.72%, Croatia with 13.07%, Montenegro with 12.43%, St. Lucia with 12.23%, Argentina with 10.40%, El Salvador with 10.28%, Andorra with 8.95%, Albania with 8.52%, Greece with 8.43%. The C3 consists of a set of countries that essentially coincide with the western world, namely Europe, North America, Japan with the addition of some Latin America countries and South Africa. Russia is present in the C3. The GDPG rate of Russia was positive from 2011 to 2014, with a negative decline in 2015. Subsequently between 2016 and 2019 the value of the GDPG rate grew, and then decreased again in 2020 and grow in 2021 up to a value of 4.75%.

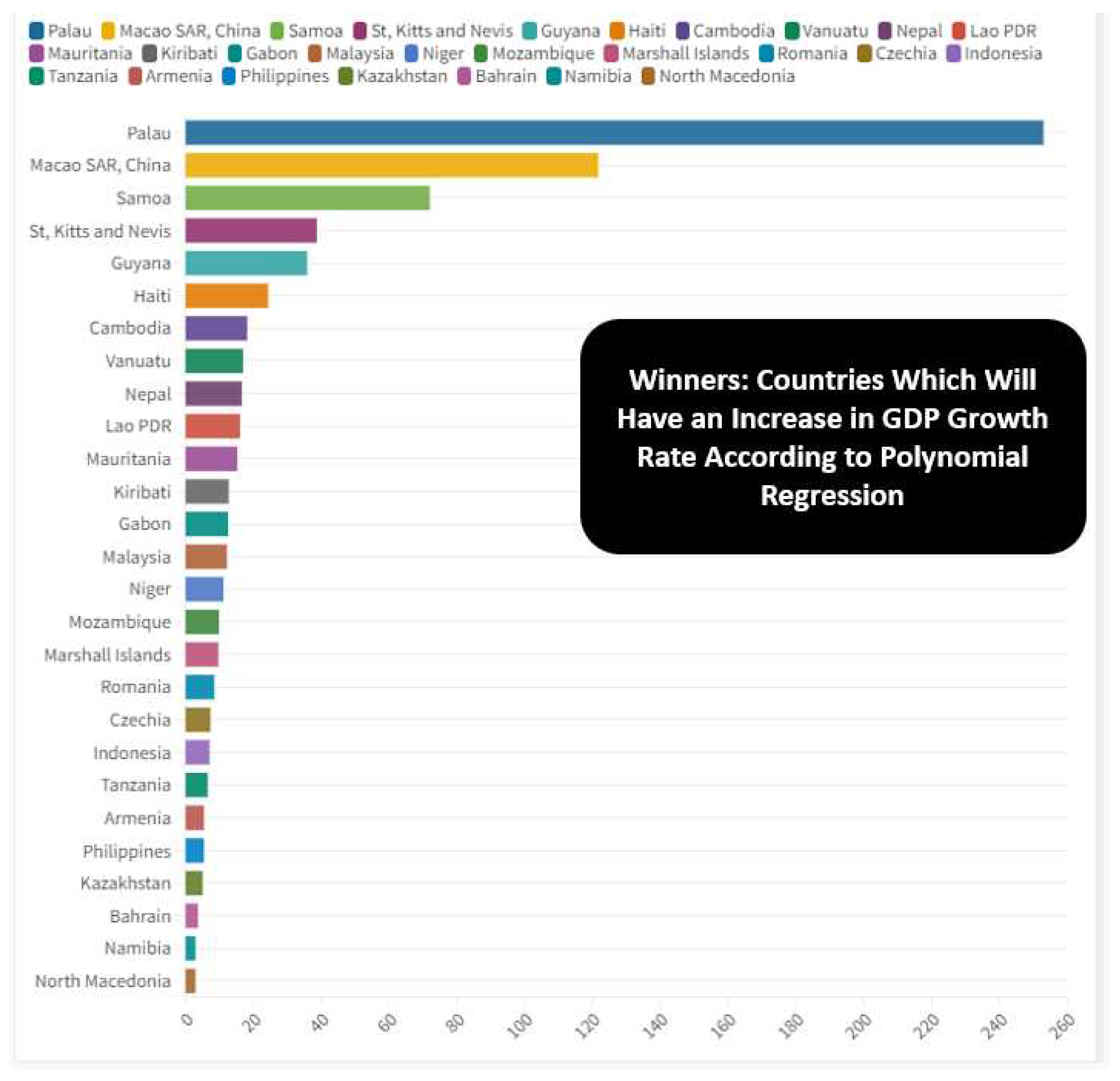

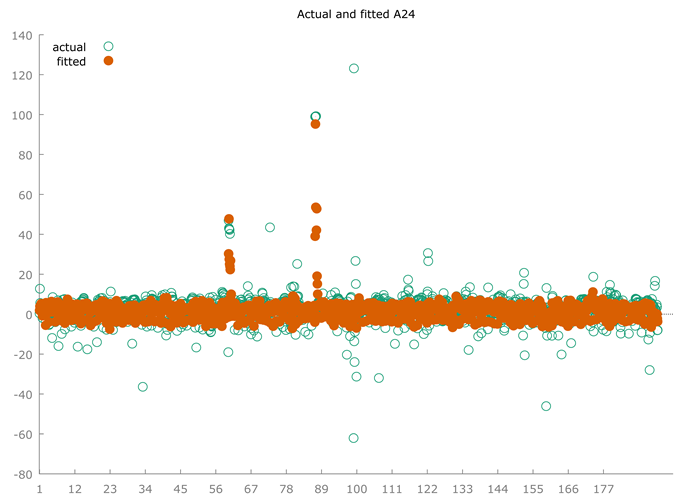

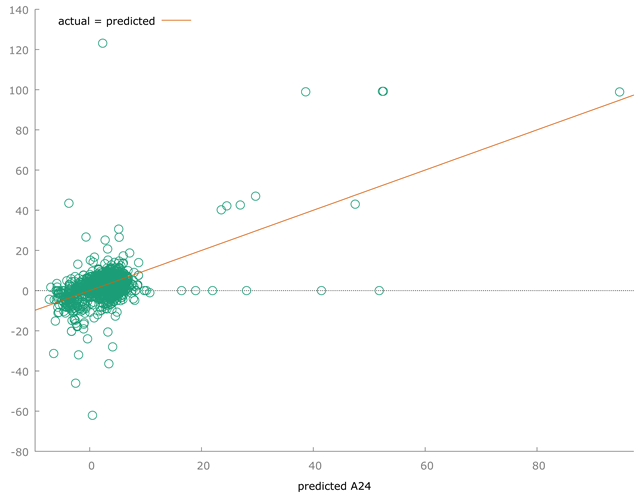

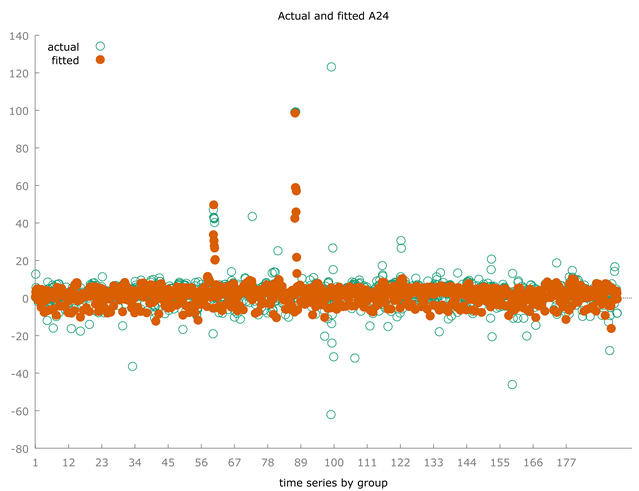

5. Machine Learning and Predictions for the Estimation of the Future Value of GDPG Rate

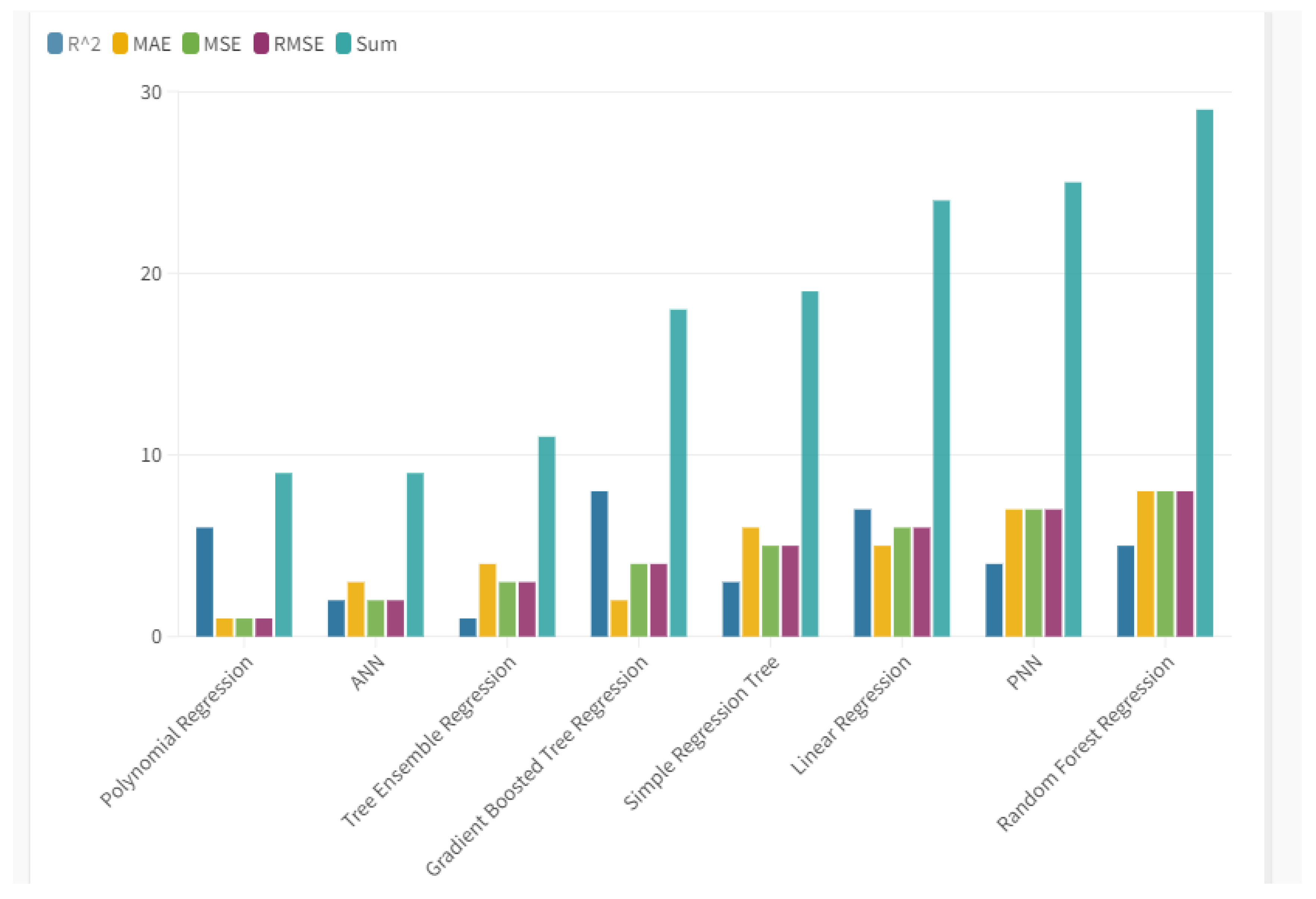

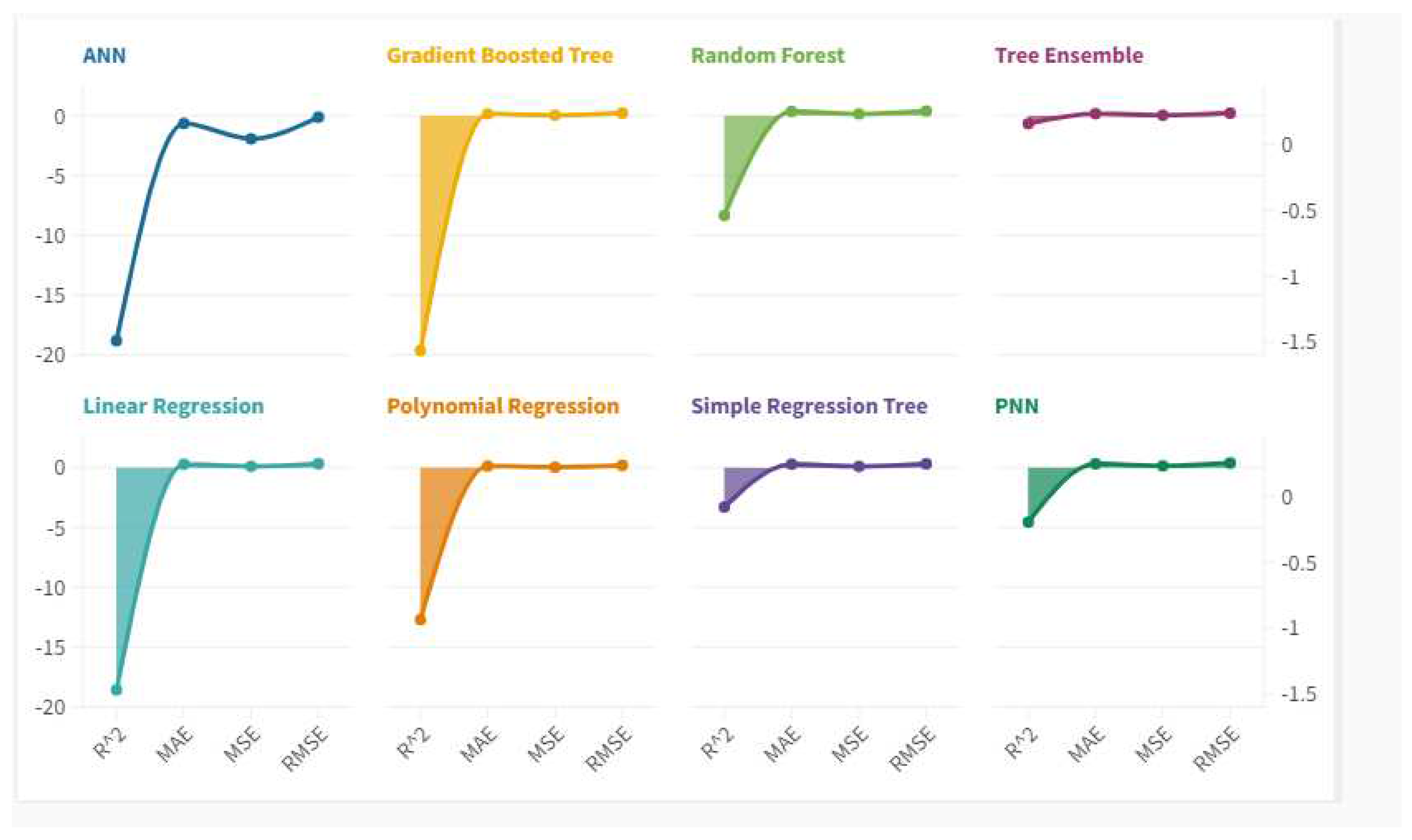

- Polynomial Regression and Ann-Artificial Neural Network with a payoff value of 9;

- Tree regression ensemble with a payoff value of 11;

- Gradient Boosted Tree Regression with a payoff value of 18;

- Simple Regression Tree with a payoff value of 19;

- Linear Regression with a payoff value of 24;

- PNN-Probabilistic Neural Network with a payoff value of 25;

- Random Forest Regression with a payoff value of 29.

6. Conclusions

Funding

Data Availability Statement

Declaration of Competing Interest

Software

Acknowledgements

Appendix A

| List of Variables | |||

| Acronym | Variables | Description | |

| GDPG | GDP growth | Annual percentage growth rate of GDP at market prices based on constant local currency. Aggregates are based on constant 2015 prices, expressed in U.S. dollars. GDP is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. It is calculated without making deductions for depreciation of fabricated assets or for depletion and degradation of natural resources. | |

| GE | Government Effectiveness: Estimate | Government Effectiveness captures perceptions of the quality of public services, the quality of the civil service and the degree of its independence from political pressures, the quality of policy formulation and implementation, and the credibility of the government's commitment to such policies. Estimate gives the country's score on the aggregate indicator, in units of a standard normal distribution, i.e. ranging from approximately -2.5 to 2.5. | |

| PU | Prevalence of undernourishment (% of population) | Prevalence of undernourishments is the percentage of the population whose habitual food consumption is insufficient to provide the dietary energy levels that are required to maintain a normal active and healthy life. Data showing as 2.5 may signify a prevalence of undernourishment below 2.5%. | |

| NRD | Adjusted savings: natural resources depletion (% of GNI) | Natural resource depletion is the sum of net forest depletion, energy depletion, and mineral depletion. Net forest depletion is unit resource rents times the excess of roundwood harvest over natural growth. Energy depletion is the ratio of the value of the stock of energy resources to the remaining reserve lifetime (capped at 25 years). It covers coal, crude oil, and natural gas. Mineral depletion is the ratio of the value of the stock of mineral resources to the remaining reserve lifetime (capped at 25 years). It covers tin, gold, lead, zinc, iron, copper, nickel, silver, bauxite, and phosphate. | |

| AE | Access to electricity (% of population) | Access to electricity is the percentage of population with access to electricity. Electrification data are collected from industry, national surveys and international sources. | |

| FPI | Food production index (2014-2016 = 100) | Food production index covers food crops that are considered edible and that contain nutrients. Coffee and tea are excluded because, although edible, they have no nutritive value. | |

| NOE | Nitrous oxide emissions (metric tons of CO2 equivalent per capita) | Nitrous oxide emissions are emissions from agricultural biomass burning, industrial activities, and livestock management. | |

| IUI | Individuals using the Internet (% of population) | Internet users are individuals who have used the Internet (from any location) in the last 3 months. The Internet can be used via a computer, mobile phone, personal digital assistant, games machine, digital TV etc. | |

| VA | Voice and Accountability: Estimate | Voice and accountability captures perceptions of the extent to which a country's citizens are able to participate in selecting their government, as well as freedom of expression, freedom of association, and a free media. | |

| UT | Unemployment, total (% of total labor force) (modeled ILO estimate) | Unemployment refers to the share of the labor force that is without work but available for and seeking employment. | |

| RDE | Research and development expenditure (% of GDP) | Gross domestic expenditures on research and development (R&D), expressed as a percent of GDP. They include both capital and current expenditures in the four main sectors: Business enterprise, Government, Higher education and Private non-profit. R&D covers basic research, applied research, and experimental development. | |

| Random-effects (GLS), using 1930 observations | |||||||||

| Included 193 cross-sectional units | |||||||||

| Time-series length = 10 | |||||||||

| Dependent variable: A24 | |||||||||

| Coefficient | Std. Error | z | p-value | ||||||

| const | −1.02421 | 0.450902 | −2.271 | 0.0231 | ** | ||||

| A2 | 0.0508179 | 0.00509079 | 9.982 | <0.0001 | *** | ||||

| A3 | 0.110081 | 0.0224437 | 4.905 | <0.0001 | *** | ||||

| A21 | 0.0201331 | 0.00391075 | 5.148 | <0.0001 | *** | ||||

| A27 | 1.24176 | 0.115788 | 10.72 | <0.0001 | *** | ||||

| A32 | −0.0336362 | 0.00582231 | −5.777 | <0.0001 | *** | ||||

| A42 | 0.000253546 | 2.95637e-05 | 8.576 | <0.0001 | *** | ||||

| A52 | 0.120953 | 0.0158723 | 7.620 | <0.0001 | *** | ||||

| A58 | −0.725966 | 0.0859671 | −8.445 | <0.0001 | *** | ||||

| A65 | −0.166348 | 0.0276719 | −6.011 | <0.0001 | *** | ||||

| sq_A67 | −0.113606 | 0.0244670 | −4.643 | <0.0001 | *** | ||||

| Mean dependent var | 2.752729 | S.D. dependent var | 7.551392 | ||||||

| Sum squared resid | 73037.27 | S.E. of regression | 6.167677 | ||||||

| Log-likelihood | −6244.830 | Akaike criterion | 12511.66 | ||||||

| Schwarz criterion | 12572.88 | Hannan-Quinn | 12534.18 | ||||||

| rho | −0.044700 | Durbin-Watson | 1.780619 | ||||||

| 'Between' variance = 1.42031 | |||||||||

| 'Within' variance = 34.3654 | |||||||||

| theta used for quasi-demeaning = 0.158831 | |||||||||

| Joint test on named regressors - | |||||||||

| Asymptotic test statistic: Chi-square(10) = 900.44 | |||||||||

| with p-value = 5.12031e-187 | |||||||||

| Breusch-Pagan test - | |||||||||

| Null hypothesis: Variance of the unit-specific error = 0 | |||||||||

| Asymptotic test statistic: Chi-square(1) = 35.4053 | |||||||||

| with p-value = 2.67755e-09 | |||||||||

| Hausman test - | |||||||||

| Null hypothesis: GLS estimates are consistent | |||||||||

| Asymptotic test statistic: Chi-square(10) = 114.382 | |||||||||

| with p-value = 6.95445e-20 | |||||||||

| Pooled OLS, using 1930 observations | |||||||||

| Included 193 cross-sectional units | |||||||||

| Time-series length = 10 | |||||||||

| Dependent variable: A24 | |||||||||

| Coefficient | Std. Error | t-ratio | p-value | ||||||

| const | −0.728472 | 0.426348 | −1.709 | 0.0877 | * | ||||

| A2 | 0.0456025 | 0.00487707 | 9.350 | <0.0001 | *** | ||||

| A3 | 0.104757 | 0.0208237 | 5.031 | <0.0001 | *** | ||||

| A21 | 0.0228313 | 0.00389345 | 5.864 | <0.0001 | *** | ||||

| A27 | 1.25541 | 0.108039 | 11.62 | <0.0001 | *** | ||||

| A32 | −0.0363034 | 0.00541884 | −6.699 | <0.0001 | *** | ||||

| A42 | 0.000256959 | 3.02624e-05 | 8.491 | <0.0001 | *** | ||||

| A52 | 0.107801 | 0.0144890 | 7.440 | <0.0001 | *** | ||||

| A58 | −0.710193 | 0.0788078 | −9.012 | <0.0001 | *** | ||||

| A65 | −0.153762 | 0.0242095 | −6.351 | <0.0001 | *** | ||||

| sq_A67 | −0.109099 | 0.0247975 | −4.400 | <0.0001 | *** | ||||

| Mean dependent var | 2.752729 | S.D. dependent var | 7.551392 | ||||||

| Sum squared resid | 72937.05 | S.E. of regression | 6.165050 | ||||||

| R-squared | 0.336926 | Adjusted R-squared | 0.333471 | ||||||

| F(10, 1919) | 97.50964 | P-value(F) | 2.9e-163 | ||||||

| Log-likelihood | −6243.505 | Akaike criterion | 12509.01 | ||||||

| Schwarz criterion | 12570.23 | Hannan-Quinn | 12531.53 | ||||||

| rho | 0.134672 | Durbin-Watson | 1.481766 | ||||||

| Fixed-effects, using 1930 observations | |||||||||

| Included 193 cross-sectional units | |||||||||

| Time-series length = 10 | |||||||||

| Dependent variable: A24 | |||||||||

| Coefficient | Std. Error | t-ratio | p-value | ||||||

| const | −0.212097 | 0.863193 | −0.2457 | 0.8059 | |||||

| A2 | 0.0701063 | 0.00669856 | 10.47 | <0.0001 | *** | ||||

| A3 | 0.122665 | 0.0358979 | 3.417 | 0.0006 | *** | ||||

| A21 | 0.0106832 | 0.00423368 | 2.523 | 0.0117 | ** | ||||

| A27 | 1.47789 | 0.188431 | 7.843 | <0.0001 | *** | ||||

| A32 | −0.0155919 | 0.00865741 | −1.801 | 0.0719 | * | ||||

| A42 | 0.000239513 | 2.89026e-05 | 8.287 | <0.0001 | *** | ||||

| A52 | 0.141313 | 0.0312518 | 4.522 | <0.0001 | *** | ||||

| A58 | −0.821873 | 0.150486 | −5.461 | <0.0001 | *** | ||||

| A65 | −0.504057 | 0.0933865 | −5.398 | <0.0001 | *** | ||||

| sq_A67 | −0.128323 | 0.0247580 | −5.183 | <0.0001 | *** | ||||

| Mean dependent var | 2.752729 | S.D. dependent var | 7.551392 | ||||||

| Sum squared resid | 59349.05 | S.E. of regression | 5.862201 | ||||||

| LSDV R-squared | 0.460455 | Within R-squared | 0.284820 | ||||||

| LSDV F(202, 1727) | 7.296266 | P-value(F) | 1.2e-127 | ||||||

| Log-likelihood | −6044.560 | Akaike criterion | 12495.12 | ||||||

| Schwarz criterion | 13624.87 | Hannan-Quinn | 12910.69 | ||||||

| rho | −0.044700 | Durbin-Watson | 1.780619 | ||||||

| Joint test on named regressors - | |||||||||

| Test statistic: F(10, 1727) = 68.7778 | |||||||||

| with p-value = P(F(10, 1727) > 68.7778) = 3.02506e-118 | |||||||||

| Test for differing group intercepts - | |||||||||

| Null hypothesis: The groups have a common intercept | |||||||||

| Test statistic: F(192, 1727) = 2.05936 | |||||||||

| with p-value = P(F(192, 1727) > 2.05936) = 6.03502e-14 | |||||||||

References

- Costantiello e A. Leogrande, «The Determinants of CO2 Emissions in the Context of ESG Models at World Level,» 2023.

- L. Laureti, A. Massaro, A. Costantiello e A. Leogrande, «The Impact of Renewable Electricity Output on Sustainability in the Context of Circular Economy: A Global Perspective,» Sustainability, vol. 3, n. 2160, p. 15, 2023.

- L. Laureti, A. Costantiello e A. Leogrande, «The Role of Renewable Energy Consumption in Promoting Sustainability and Circular Economy. A Data-Driven Analysis.,» 2022.

- Costantiello e A. Leogrande, «The Role of Political Stability in the Context of ESG Models at World Level,» University Library of Munich, Germany, 2023.

- Costantiello e A. Leogrande, «The Impact of Voice and Accountability in the ESG Framework in a Global Perspective,» SSRN , n. 4398483, 2023.

- Costantiello e A. Leogrande, «The Regulatory Quality and ESG Model at World Level,» 2023.

- Leogrande, «The Rule of Law in the ESG Framework in the World Economy,» University Library of Munich, Germany, n. 116293, 2023.

- L. Laureti, A. Costantiello e A. Leogrande, «The Role of Government Effectiveness in the Light of ESG Data at Global Level,» University Library of Munich, Germany, n. 115998, 2023.

- L. Laureti, A. Costantiello e A. Leogrande, «The Fight Against Corruption at Global Level. A Metric Approach,» 2023.

- Costantiello e A. Leogrande, «The Ease of Doing Business in the ESG Framework at World Level,» 2023.

- Costantiello e A. Leogrande, «The Impact of Research and Development Expenditures on ESG Model in the Global Economy,» 2023.

- G. Cohen, «ESG risks and corporate survival.,» Environment Systems and Decisions, pp. 1-6, 2022.

- Morgenstern, G. Coqueret e J. Kelly, «International market exposure to sovereign ESG,» Journal of Sustainable Finance & Investment, pp. 1-20, 2022.

- P. Naomi e I. Akbar, «Beyond sustainability: Empirical evidence from OECD countries on the connection among natural resources, ESG performances, and economic development,» Economics & Sociology, vol. 14, n. 4, pp. 89-106, 2021.

- W. Puttachai, R. Phadkantha e W. Yamaka, «The threshold effects of ESG performance on the energy transitions: A country-level data,» Energy Reports, vol. 8, pp. 234-241, 2022. [CrossRef]

- T. H. Ng, C. T. Lye, K. H. Chan, Y. Z. Lim e Y. S. Lim, «Sustainability in Asia: The roles of financial development in environmental, social and governance (ESG) performance,» Social Indicators Research, vol. 150, pp. 17-44, 2020.

- H. Al Amosh e S. F. Khatib, «ESG performance in the time of COVID-19 pandemic: cross-country evidence,» Environmental Science and Pollution Research, pp. 1-16, 2023. [CrossRef]

- V. Cherkasova e I. Nenuzhenko, «Investment in ESG Projects and Corporate Performance of Multinational Companies,» Journal of Economic Integration, vol. 37, n. 1, pp. 54-92, 2022. [CrossRef]

- S. H. Ho, R. Oueghlissi e R. El Ferktaji, «The dynamic causality between ESG and economic growth: Evidence from panel causality analysis,» 2019.

- Ye, X. Song e Y. Liang, «Corporate sustainability performance, stock returns, and ESG indicators: fresh insights from EU member states,» Environmental Science and Pollution Research, vol. 58, n. 87680-87691, p. 29, 2022.

- G. Ferri e A. Leogrande, «Was the Crisis Due to a Shift from Stakeholder to Shareholder Finance? Surveying the Debate. No. 1576.,» Euricse (European Research Institute on Cooperative and Social Enterprises), n. 176, 2015.

- G. Ferri e A. Leogrande, «Stakeholder Management, Cooperatives, and Selfish-Individualism,» Journal for Markets and Ethics, vol. 9, n. 2, pp. 61-75, 2021.

- G. Ferri e A. Leogrande, «The Founding Role of Cooperative Banking Within the European Variety of Capitalism,» in Contemporary Trends in European Cooperative Banking: Sustainability, Governance, Digital Transformation, and Health Crisis Response , vol. Springer International Publishing., Cham , Springer International Publishing., 2022, pp. 29-54.

- G. Birindelli, S. Dell’Atti, A. P. Iannuzzi e M. Savioli, «Composition and activity of the board of directors: Impact on ESG performance in the banking system,» Sustainability, vol. 12, n. 4699, p. 10, 2018.

- Buallay, «Is sustainability reporting (ESG) associated with performance? Evidence from the European banking sector,» Management of Environmental Quality: An International Journal, vol. 30, n. 1, pp. 98-115, 2019. [CrossRef]

- M. M. Miralles-Quirós, J. L. Miralles-Quirós e J. Redondo Hernández, «ESG performance and shareholder value creation in the banking industry: International differences,» Sustainability, vol. 5, n. 1404, p. 11, 2019. [CrossRef]

- H. Maama, «Institutional environment and environmental, social and governance accounting among banks in West Africa,» Meditari Accountancy Research, vol. 6, n. 1314-1336, p. 29, 2021. [CrossRef]

- X. Zhou, B. Caldecott, E. Harnett e K. Schumacher, «The effect of firm-level ESG practices on macroeconomic performance,» University of Oxford| Working Paper, vol. 20, n. 03, 2020.

- Breedt, S. Ciliberti, S. Gualdi e P. Seager, «Is ESG an equity factor or just an investment guide?,» SSRN, 2019. [CrossRef]

- M. Alandejani e H. Al-Shaer, «Macro Uncertainty Impacts on ESG Performance and Carbon Emission Reduction Targets,» Sustainability, vol. 5, n. 4249, p. 15, 2023. [CrossRef]

- H. Al Amosh e S. F. Khatib, «ESG performance in the time of COVID-19 pandemic: cross-country evidence,» Environmental Science and Pollution Research, pp. 1-16, 2023. [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).