Submitted:

21 February 2023

Posted:

24 February 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Technical path of NFT

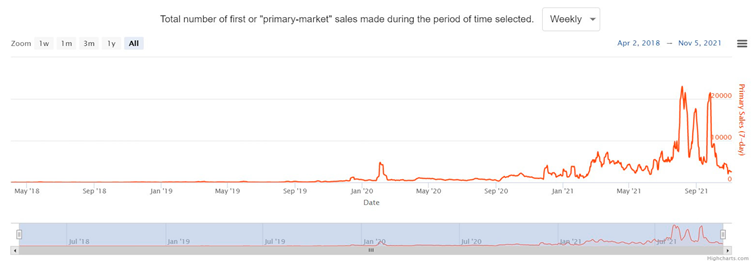

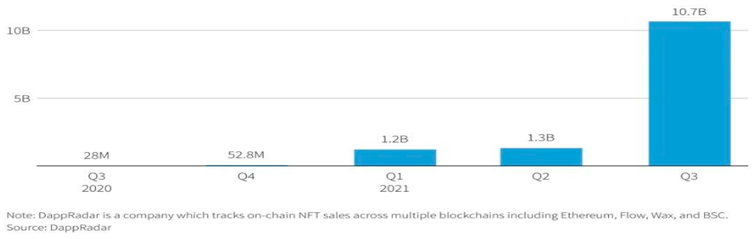

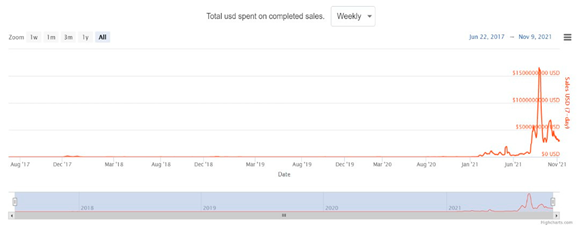

3. NFT Trends and Marketplace

Ten most popular NFT Marketplaces

- OpenSea

- Variable

- SuperRare

- Foundation

- AtomicMarket

- Myth Market

- BakerySwap

- KnownOrigin

- Enjoy Marketplace

- Portion12

NFT Implementation by the Field

- Collectible

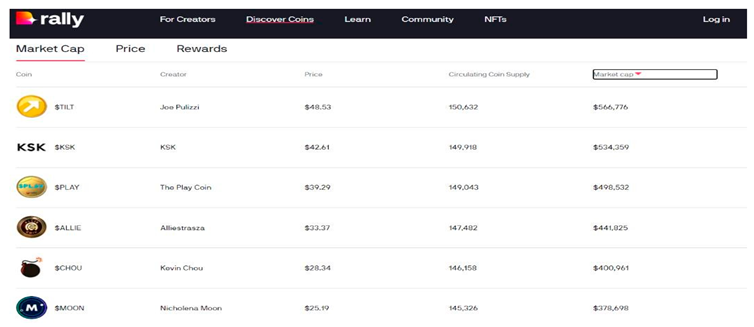

- Social Tokens

- Metaverse

- Game

- Arts

- Sports

- Utility

- DeFi15

4. General Trends and Pricing of NFTs

- > Value is a function of scarcity,

- > Utility,

- > Reputation,

- > and liquidity (NFTs And the Missing Layer of Utility by Samuel Huber for Forbes)

4.1. NFT hype as a tool for adaptation in traditional sectors

5. Issues and Challenges in Implementation

6. Conclusion

| 1 | Ateşler, H. (2021, April 13). Digital artist Murat Pak has released a new token that can be bought by burning NFT. Expertcoin. https://uzmancoin.com/murat-pak-nft-burn/

|

| 2 | Beard, Briar & Rose. (2013, January 31). Fumeur V. https://beardbriarandrose.tumblr.com/image/41963857518

|

| 3 | Binance Academy. (2021, April 29). Merkle trees and Merkle roots. https://academy.binance.com/en/articles/merkle-trees-and-merkle-roots-explained

|

| 4 | Braidotti, C. & Franceschet, M. (n.d.). Enhancing art with information: The case of blockchain art. Universita'Degli Studi di Udine. https://users.dimi.uniud.it/~massimo.franceschet/publications/jocch20.pdf

|

| 5 | Aysan, Ahmet Faruk, Abdelilah Belatik, Ibrahim Musa Unal, and Rachid Ettaai. 2022. "Fintech Strategies of Islamic Banks: A Global Empirical Analysis" FinTech 1, no. 2: 206-215. https://doi.org/10.3390/fintech1020016

|

| 6 | Brennan, A. (2018, January 18). You can only use cryptocurrency to buy art at this Mayfair exhibition. Evening Standard. https://www.standard.co.uk/culture/you-can-only-use- cryptocurrency-to-buy-art-at-this-mayfair-exhibition-a3736831.html

|

| 7 | See (https://eips.ethereum.org/EIPS/eip-721) for more details |

| 8 | Charlesworth, J. J. (2021, March 17). Why the artworld loves to hate nft art? Artreview. https://artreview.com/why-the-artworld-loves-to-hate-nft-art-beeple-christies-grimes/

|

| 9 | See (https://ethereum.org/en/developers/docs/gas/) for more details. |

| 10 | Aysan, Ahmet Faruk, Abdelilah Belatik, Ibrahim Musa Unal, and Rachid Ettaai. 2022. "Fintech Strategies of Islamic Banks: A Global Empirical Analysis" FinTech 1, no. 2: 206-215. https://doi.org/10.3390/fintech1020016

|

| 11 | Davis, B. (2021, March 17). I looked through all 5,000 images in Beeple's $69 million magnum opus. What I found isn't so pretty. artnet. https://news.artnet.com/opinion/beeple- everydays-review-1951656

|

| 12 | AF Aysan, AY Polat, H Tekin, AS Tunalı - Defence and Peace Economics, 2022 |

| 13 | Ducree, J. (2020). Research – a blockchain of knowledge? Blockchain: Research and applications. 1(1-2), 1- 4. https://doi.org/10.1016/j.bcra.2020.100005

|

| 14 | AF Aysan, AY Polat, H Tekin, AS Tunalı - Defence and Peace Economics, 2022 |

| 15 | Hawkins, J. (2021, August 31). Damien Hirst's dotty 'currency' art makes as much sense as Bitcoin. The Conversation. https://theconversation.com/damien-hirsts-dotty-currency-art- makes-as-much-sense-as-bitcoin-166958

|

| 16 | ledger. (2021, May 11). The blockchain generations. https://www.ledger.com/academy/blockchain/web-3-the-three-blockchain-generations

|

| 17 | Mattei, E. S. (2021, September 28). British Museum to sell NFTs of Hokusai works, including 'The Great Wave'. artnews. https://www.artnews.com/art-news/news/british- museum-hokusai-nfts-1234604998/

|

| 18 | Hussey, M. & Phillips, D. (2021, Jan. 8). What are smart contracts and how do they work? decrypt. https://decrypt.co/resources/smart-contracts

|

| 19 | GG Akin, AF Aysan, E ÖZER, L Yildiran - The Singapore Economic Review, 2022 |

| 20 | Lastovetska, A. (2021, November 12). Blockchain architecture basics: Components, structure, benefits & creation. MLSDev. https://mlsdev.com/blog/156-how-to-build-your- own-blockchain- architecture

|

| 21 | Aysan, Ahmet Faruk, Abdelilah Belatik, Ibrahim Musa Unal, and Rachid Ettaai. 2022. "Fintech Strategies of Islamic Banks: A Global Empirical Analysis" FinTech 1, no. 2: 206-215. https://doi.org/10.3390/fintech1020016

|

| 22 | M Yaş, AF Aysan, MESM Rasid - Journal of Asset Management, 2022 |

| 23 | Bolton, S. J. & Cora, J. R. (2021). Virtual equivalents of real objects (VEROs): A type of non-fungible token (NFT) that can help fund the 3d digitization of natural history collections. Megataxa Journal 6(2), 93-95. https://doi.org/10.11646/megataxa.6.2.2

|

| 24 | Çağala, C. (2016, May 16). What is the hash value? What does the hash value do? techworm. https://www.tech-worm.com/hash-degeri-nedir-hash-degeri-ne-ise-yarar/

|

| 25 | Cummings, S. (2019, February 2). The four blockchain generations. medium. https://medium.com/the-capital/the-four-blockchain-generations-5627ef666f3b

|

| 26 | Criddle, C. (2021, March 9). Banksy art burned, destroyed and sold as token in 'money- making stunt'. bbc. https://www.bbc.com/news/technology-56335948

|

| 27 | L Gunduz, IH Genc, AF Aysan - Housing Policy Debate, 2022 |

| 28 | Fritts, M. (2021, August 9). Destroy the 'Mona Lisa' for an NFT? The Prindle Post. https://www.prindlepost.org/2021/08/destroy-the-mona-lisa-for-an-nft/

|

| 29 | Fritts, M. (2021, August 9). Destroy the 'Mona Lisa' for an NFT? The Prindle Post. https://www.prindlepost.org/2021/08/destroy-the-mona-lisa-for-an-nft/

|

| 30 | Fritts, M. (2021, August 9). Destroy the 'Mona Lisa' for an NFT? The Prindle Post. https://www.prindlepost.org/2021/08/destroy-the-mona-lisa-for-an-nft/

|

| 31 | Mattei, E. S. (2021, September 28). British Museum to sell NFTs of Hokusai works, including 'The Great Wave'. artnews. https://www.artnews.com/art-news/news/british- museum-hokusai-nfts-1234604998/

|

| 32 | ledger. (2021, May 11). The blockchain generations. https://www.ledger.com/academy/blockchain/web-3-the-three-blockchain-generations

|

| 33 | ledger. (2021, May 11). The blockchain generations. https://www.ledger.com/academy/blockchain/web-3-the-three-blockchain-generations

|

| 34 | Lastovetska, A. (2021, November 12). Blockchain architecture basics: Components, structure, benefits & creation. MLSDev. https://mlsdev.com/blog/156-how-to-build-your- own-blockchain- architecture

|

| 35 | Lastovetska, A. (2021, November 12). Blockchain architecture basics: Components, structure, benefits & creation. MLSDev. https://mlsdev.com/blog/156-how-to-build-your- own-blockchain- architecture

|

References

- Ateşler, H. (2021, April 13). Digital artist Murat Pak has released a new token that can be bought by burning NFT. Expertcoin. https://uzmancoin.com/murat-pak-nft-burn/.

- Aysan, Ahmet Faruk, Abdelilah Belatik, Ibrahim Musa Unal, and Rachid Ettaai. 2022. “Fintech Strategies of Islamic Banks: A Global Empirical Analysis” FinTech 1, no. 2: 206-215. [CrossRef]

- Beard, Briar & Rose. (2013, January 31). Fumeur V. https://beardbriarandrose.tumblr.com/image/41963857518.

- Binance Academy. (2021, April 29). Merkle trees and Merkle roots. https://academy.binance.com/en/articles/merkle-trees-and-merkle-roots-explained.

- Bitlo (n.d.). What is Bitcoin (BTC)? https://www.bitlo.com/guide/bitcoin-nedir.

- Braidotti, C. & Franceschet, M. (n.d.). Enhancing art with information: The case of blockchain art. Universita’Degli Studi di Udine. https://users.dimi.uniud.it/~massimo.franceschet/publications/jocch20.pdf.

- Brennan, A. (2018, January 18). You can only use cryptocurrency to buy art at this Mayfair exhibition. Evening Standard. https://www.standard.co.uk/culture/you-can-only-use- cryptocurrency-to-buy-art-at-this-mayfair-exhibition-a3736831.html31.

- Bolton, S. J. & Cora, J. R. (2021). Virtual equivalents of real objects (VEROs): A type of non-fungible token (NFT) that can help fund the 3d digitization of natural history collections. Megataxa Journal 6(2), 93-95. [CrossRef]

- Charlesworth, J. J. (2021, March 17). Why the artworld loves to hate nft art? Artreview. https://artreview.com/why-the-artworld-loves-to-hate-nft-art-beeple-christies-grimes/.

- COBO. (2021, March 12). Wrapping up the art world: a blazing crypto-craze, vast V&A job cuts, re-opening of museums, and more. https://www.cobosocial.com/dossiers/art- news-crypto-va-museums-reopening/.

- Coinmarketcap (n.d.). What is ERC-721? https://coinmarketcap.com/alexandria/glossary/erc-721.

- Congar, K. (2021, July 15). A first in auction history: Picasso’s painting blockchain asset will be sold in ‘tokens’. Euronews. https://tr.euronews.com/2021/07/15/ac-k-art-rma- tarihinde-bir-ilk-picasso-nun-tablosu-blokzincir-varl-g-tokenlere-sat-acak.

- Criddle, C. (2021, March 9). Banksy art burned, destroyed and sold as token in ‘money- making stunt’. bbc. https://www.bbc.com/news/technology-56335948.

- CryptoKitties. (n.d.). press. https://www.cryptokitties.co/press.

- Cummings, S. (2019, February 2). The four blockchain generations. medium. https://medium.com/the-capital/the-four-blockchain-generations-5627ef666f3b.

- Çağala, C. (2016, May 16). What is the hash value? What does the hash value do? techworm. https://www.tech-worm.com/hash-degeri-nedir-hash-degeri-ne-ise-yarar/.

- Davis, B. (2021, March 17). I looked through all 5,000 images in Beeple’s $69 million magnum opus. What I found isn’t so pretty. artnet. https://news.artnet.com/opinion/beeple- everydays-review-1951656.

- De Carlo, F. (2020). The intersection between copyright protection and blockchain technology: The case of cryptoart. [Single Cycle Master’s Degree Thesis] Luiss Guido Carli University. https://tesi.luiss.it/id/eprint/30173.

- Dickson, B. (2016, Oct. 8). How blockchain can change the music industry? TechCrunch. https://techcrunch.com/2016/10/08/how-blockchain-can-change-the-music-industry/.

- Ducree, J. (2020). Research – a blockchain of knowledge? Blockchain: Research and applications. 1(1-2), 1- 4. [CrossRef]

- Ennis, P. D. (2021, March 5). NFT art: The bizarre world where burning a Banksy can make it more valuable. The Conversation. https://theconversation.com/nft-art-the-bizarre- world-where-burning-a-banksy-can-make-it-more-valuable-156605.

- Farago, J. (2021, March 14). Beeple has won. Here’s what we’ve lost. New York Times. https://www.nytimes.com/2021/03/12/arts/design/beeple-nonfungible-nft-review.html.

- Fritts, M. (2021, August 9). Destroy the ‘Mona Lisa’ for an NFT? The Prindle Post. https://www.prindlepost.org/2021/08/destroy-the-mona-lisa-for-an-nft/.

- Hawkins, J. (2021, August 31). Damien Hirst’s dotty ‘currency’ art makes as much sense as Bitcoin. The Conversation. https://theconversation.com/damien-hirsts-dotty-currency-art- makes-as-much-sense-as-bitcoin-166958.

- Howcroft, E. (2021, January 10). ‘CryptoPunk’ NFT sells for $11.8 million at Sotheby’s. Reuters. https://www.reuters.com/technology/cryptopunk-nft-sells-118-million-sothebys- 2021-06-10/.

- Hussey, M. & Phillips, D. (2021, Jan. 8). What are smart contracts and how do they work? decrypt. https://decrypt.co/resources/smart-contractscrypt.

- Kugler, L. (2021). Non-Fungible Tokens and the future of art. Communications of the Acm 64(9), 19-20. [CrossRef]

- Lastovetska, A. (2021, November 12). Blockchain architecture basics: Components, structure, benefits & creation. MLSDev. https://mlsdev.com/blog/156-how-to-build-your- own-blockchain- architecturemlsdev.

- Ledger. (2021, May 11). The blockchain generations. https://www.ledger.com/academy/blockchain/web-3-the-three-blockchain-generations.

- Mattei, E. S. (2021, September 28). British Museum to sell NFTs of Hokusai works, including ‘The Great Wave’. artnews. https://www.artnews.com/art-news/news/british- museum-hokusai-nfts-1234604998/.

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).