1. Introduction

In the context of the new round of technological revolution, the digital economy has become both a fulcrum for the upgrading of traditional industries and an important engine for the construction of a modernized economic system. China’s economy has shifted from the stage of high-speed growth to the stage of high-quality development, and digital transformation has become an inevitable requirement for high-quality development of the economy, and at the same time, it has challenged the traditional business model of enterprises at the micro level [

1]. Although many enterprises have a strong willingness to promote digital transformation, but the results are not significant [

2], suffered from the digital transformation of the “cold start” predicament. For traditional enterprises, digital transformation faces challenges in technology, resources, capabilities, organization, culture and management [

3,

4,

5]. Based on previous studies, most of the existing literature focuses on firm organizational characteristics [

6,

7], executive characteristics [

8,

9,

10], and other internal characteristics and external characteristics such as government policies [

11,

12], and competitive pressures to explore the drivers of firms’ digital transformation[

13]. Less consideration has been given to the impact of firms' equity characteristics on digital transformation, especially exploring the governance effects on them from the perspective of equity linkage networks.

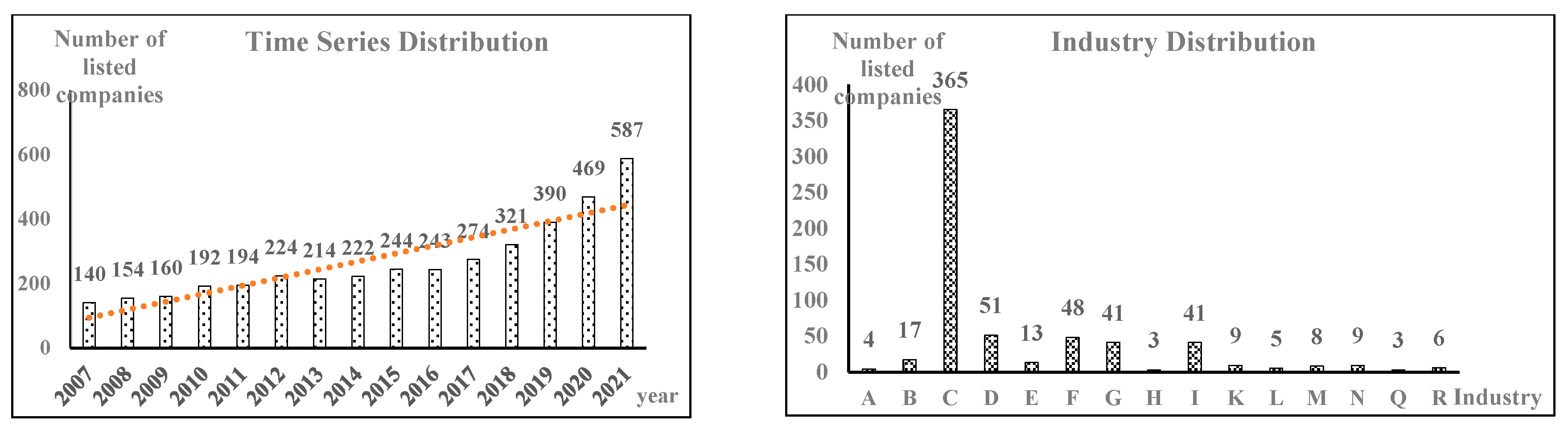

Common ownership is an equity linkage formed by institutional investors holding shares of multiple listed companies in the same industry [

14,

15], which has become common in capital markets [

16]. We collected and organized data on listed companies with common ownership in China from the CSMAR database from 2007 to 2021 and found that the number of subjects with common ownership increased year by year, with an average annual increase of 22.81% (As shown in

Figure 1). Compared with the social network established based on personal characteristics such as executives and independent directors, common ownership, as a key node of equity linkage among firms in the same industry, assumes an important information transmission role [

17], and its portfolio returns are highly correlated with the economic interests of the firms, which have strong motivation and ability to participate in corporate decision-making [

18,

19]. Common ownership helps to induce the formation of stable strategic cooperative relationships between shareholding firms [

18,

20], and increase the level of cooperation and operational efficiency of firms within the joint ownership linkage network state that the form of network linkage formed by common ownership helps to improve the transparency of firms’ financial information (He & Huang., 2017; He et al., 2019; Pawliczek & Skinner, 2018)[

14,

21,

22]. Antón et al. (2023) considered further that common ownership mitigates firms’ exposure to the risk of leakage of proprietary information and trade secrets[

23]. Information networking and data resourcefulness are the new features of the current economic globalization, and it is the inevitable choice of many enterprises to change the original organization and production structure through digital transformation to realize the transformation and upgrading of enterprises. In the context of enterprise digital transformation, a question worth discussing is what role does common ownership play in the process of enterprise digital transformation? Can common ownership utilize their diversified and heterogeneous information resources and play a positive role as a production factor, to promote enterprise digital transformation. Therefore, considering the unique attributes of common ownership in the context of enterprise digitalization theory can better explain and find the path and mechanism of its role in the context of enterprise digital transformation.

Unlike existing research on common ownership based on the background of developed capital markets, this paper explores whether common ownership affects the digital transformation of enterprises from the realistic scenario of China’s digital economy shifting to a new stage of deepening application, standardized development, and inclusive sharing. It attempts to explore the phenomenon of enterprise digital transformation from the perspective of institutional collaboration and supervisory governance of common ownership, to clarify the relationship between common ownership and enterprise digital transformation. This has certain theoretical value and practical significance for enterprise digital transformation.

Combined with the actual situation of China’s capital market, this paper theoretically analyzes the impact of joint ownership on enterprise digital transformation and based on the data of China’s A-share listed companies from 2007 to 2021, explores the relationship between joint ownership and enterprise digital transformation. The empirical results show that joint ownership can promote enterprise digital transformation. Further mechanism analysis shows that common ownership promotes the digital transformation of enterprises by giving full play to the effects of institutional synergy and supervision and governance. At the same time, the effect of institutional synergy and supervision and governance of joint ownership is more obvious in the samples of rapid economic growth and state-owned enterprises.

This study may have the following contributions: (1) It is provided that a new perspective for the research of enterprise digital transformation. Break through the limitations of the existing research to explore the single or multiple major shareholders of a single enterprise in isolation, starting from the connection network established by the common owners among the enterprises in the same industry within the portfolio. The empirical results can provide evidence for the positive role of common ownership as a factor of production and enrich the research results in the field of economic consequences of common ownership. (2) Based on the research framework of “benchmark analysis mechanism analysis extended discussion”, this paper analyzes from two dimensions of institutional synergy effect and supervision and governance effect, to open the “black box” of the relationship between common ownership and enterprise digital transformation. In addition, based on the characteristics of differentiation at the macro level and organizational level, this paper tests the impact of cyclical changes in the macro economy and the nature of corporate equity, to expand the research on the boundary mechanism. (3) It has certain policy significance. We should correctly understand and grasp the characteristics and behavior laws of capital, and support and guide the standardized and healthy development of capital. Our research shows that common ownership can play a positive role as a factor of production in the process of enterprise digital transformation. Although there are controversies about the characteristics and behavior laws of joint ownership in academia, the government should play a good regulatory role, guide joint ownership to play a positive role, and create value for accelerating digital development and building a digital country.

2. Theoretical Analysis and Research Hypothesis

The digital transformation of enterprises is characterized by high investment and long cycle, which is an important driving force for enterprises to maintain long-term competitive advantage and promote sustainable economic development [

24]. However, the digital transformation of enterprises is constrained by the transformation power and transformation ability, fearing the risks that may be brought by high-risk digital transformation [

25], and lacking the technical support and talent accumulation of digital transformation [

26,

27]. Joint ownership is formed by one institution investing in multiple enterprises in the same industry. Its investment goal is to maximize the value of the investment portfolio [

28], which has a strong motivation to coordinate and govern the enterprises it holds.

2.1. Motivation of Enterprise Digital Transformation

From the perspective of the background of the times, the digital transformation of enterprises is the cutting-edge transformation mode in the new era, which is in line with the current development trend of the digital economy and maintains high consistency with the construction blueprint of “digital country” and “smart society”. Enterprises’ digital transformation is easily favored by the market in the era of high-quality development of the digital economy, because enterprises tend to release positive signals to the outside world by means of annual report information disclosure and actual production technology transformation investment, and market investors tend to have high expectations for enterprises that are in line with national policies and guidelines and economic practice guidance, which can improve the efficiency of enterprise knowledge and information search [

25].

From the perspective of production and operation, enterprises will accumulate a large amount of data and information of technology, capital and talents in the process of operation, which implies the law of enterprise development. Before the digital transformation, the use of this information can only remain in the original inefficient mode and precipitate inside the enterprise system. The digital transformation of enterprises can not only greatly improve the information processing ability and enhance the financial operation efficiency with the help of their own digital technology but also enable enterprises to reach the maximum capital use efficiency boundary under the constraint of limited financial resources. It can also drive the concentration of technology, capital and talents to areas with higher utilization efficiency, and correct the mismatch of resources [

30,

31,

32,

33]. While the strengthening of enterprise digital ability, it is conducive to reducing the probability of mistakes and mistakes in the business decision-making process of the company, to improve the business efficiency of the enterprise [

34].

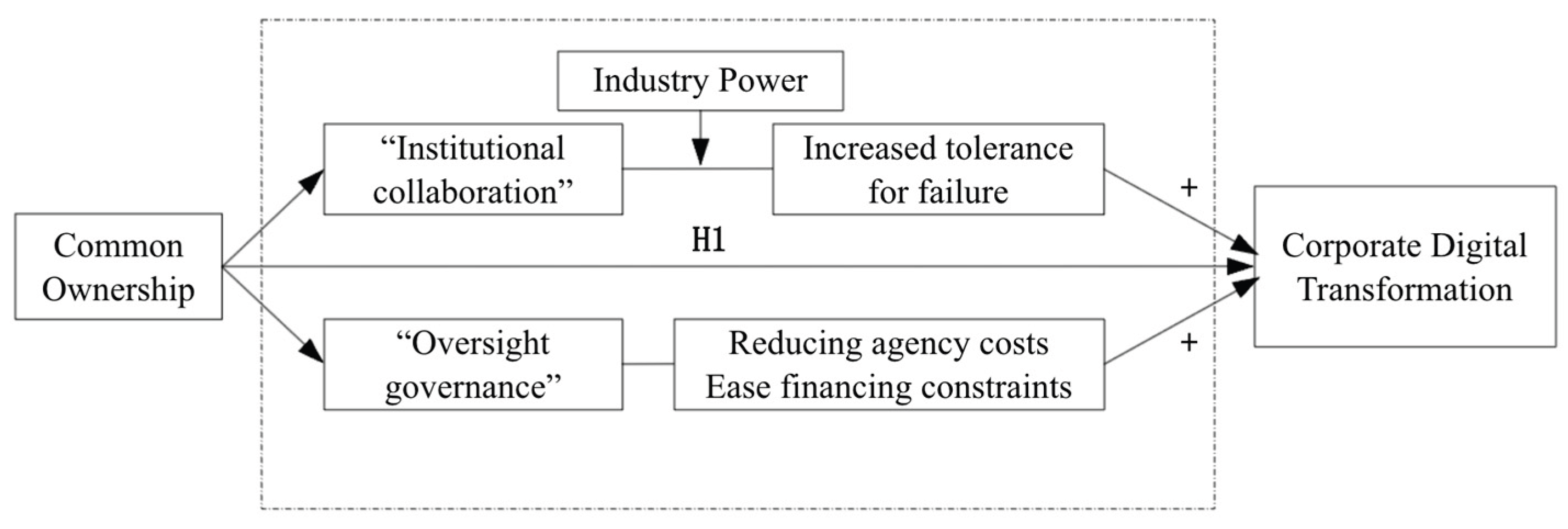

2.2. Institution Cooperative Effect of Common Ownership

Common ownership plays a key role as the nodes associated with the flow of information and resources among peer enterprises in the portfolio. They can promote the digital transformation of enterprises by giving full play to the advantages of information and resources. Firstly, in the production and operation of enterprises, joint ownership can bring rich and diverse heterogeneous information to enterprises [

14], quickly accumulate specific information and knowledge resources among enterprises in the same industry [

35] and cultivate large-scale collaborative development information network [

36,

37]. To weaken the risk caused by the lack of key decision-making information of the management and provide guarantee for the digital transformation of listed companies. Especially in terms of grasping the dynamic trend of the industry, the common ownership can rely on the accumulated industry development experience to provide industry-leading information for the enterprises in the same industry in their portfolio [

38], identify the failure factors of enterprise digitization, alleviate the professional anxiety of the management by improving the tolerance of enterprise digitization failure, and create an internal governance environment conducive to enterprise digitization activities, so as to promote enterprise digitization. Secondly, common ownership can also establish a connection between the same industry enterprises in the portfolio, coordinate the conflicts of interest in the process of cooperation between enterprises [

39], and improve the tactical alliance relationship between enterprises. The trust relationship based on this tactical alliance will reduce the risk of transaction and information asymmetry, making all parties more willing to share information. The greater the industry power of the common ownership, the more motivated they are to promote the exchange and sharing of proprietary digital technologies in the portfolio. Therefore, joint ownership can play an institutional synergy effect and promote the digital transformation of enterprises.

2.3. Supervision and Governance Effect of Ownership

Firstly, common owners have advantages in terms of information access, management experience and industrial policies, which enable them to reflect strong management and supervision functions in corporate governance [

40]. Faced with the agency problem between shareholders and executives, shareholders believe that digital transformation is an opportunity for enterprise development, and executives may make decisions that deviate from the goal of maximizing the company's value for reasons such as personal interests, such as enterprise digital transformation. Because executive compensation is closely related to enterprise performance, and the unpredictability and risk of digitalization itself will inhibit executives' willingness to make digital transformation decisions. At this time, the common owners can take advantage of their ownership advantages to actively perform the supervision function [

41], such as having a stronger voice on the governance proposal sponsored by shareholders [

42], voting against the proposal with differences between shareholders and management [

15], and even replacing incompetent managers [

43]. Secondly, the common owners can also cause the management to play an active role through the exit mechanism [

44]. To avoid passive resignation, the management will consider the interests of shareholders and promote the digital transformation of enterprises. In addition, enterprise digitalization will also be affected by financing constraints. There is information asymmetry in the input-output process of enterprise digitalization, which leads to serious external financing constraints. The information, knowledge, strategic resources and other social capital possessed by the common owners can affect the decision-making of enterprise digital transformation [

35]. As a professional institutional investor, its investment behavior is the recognition of the invested enterprise, which will attract the attention of bank credit and business credit. With its advantages of resource integration, it can effectively alleviate the financing constraints of enterprises and promote the digital transformation of enterprises. Based on the above analysis, we propose the following assumptions:

H1: Common ownership can promote the digital transformation of enterprises.

Figure 2.

Mechanism analysis of common ownership affecting corporate digital transformation.

Figure 2.

Mechanism analysis of common ownership affecting corporate digital transformation.

3. Research Design

3.1. Sample Selection and Data Sources

This study focuses on Chinese A-share listed companies from 2007 to 2021 as the initial research sample. The data source of dependent variable is CSMAR database, the source of independent variable is manually collected from CSMAR database at the quarterly level, and other data is from CSMAR database, and other financial data of the firms are obtained from the CSMAR database. It excludes companies in the financial industry, ST-type, PT-type companies, delisted companies, and those with gearing ratios exceeding 100%. To mitigate the impact of extreme values, we use Winsorisation of 1-99% to remove the outliers in the sample. The final sample comprises 30805 firm-year observations over the period 2007-2023. Data processing was performed using Statal6.

3.2. Modelling Definition of Variables

To verify the relationship between common ownership and the corporate digital transformation of listed companies, the following multiple regression model (1) is constructed:

where,

is regarded as the corporate digital transformation,

is regarded as the common ownership in listed companies,

is intercept term,

are the corresponding estimation coefficients.

is individual fixed effects in listed companies,

is a period fixed effect,

is random perturbation term.

3.2.1. Dependent Variable

Based on research results about indicators of the corporate digital transformation and data accessibility issues, in this paper, we set up the proportion of assets related to digital transformation in total intangible assets of intangible assets at the end of the year disclosed in the notes to the financial statements of listed companies to measure DCG. Specifically, when the details of intangible assets include keywords related to digital transformation technology such as “software”, “network”, “client”, “management system”, “intelligent platform” and related patents, the details are defined as “digital technology intangible assets”, and then a number of digital technology intangible assets of the same company in the same year are aggregated to calculate their proportion in the current year’s intangible assets. The higher the value of DCG, the higher the degree of digitalization of the enterprise

3.2.2. Independent Variable

Drawing on the studies of [

14,

15], furthermore, we construct three first-level indicators: common ownership (Coz1), association degree of common ownership (Coz2), shareholding ratio of common ownership.

3.2.3. Control Variables

Because the factors affecting the corporate digital transformation are very complex. Therefore, based on the existing research ideas, this paper introduces some control variables: enterprise size (Size), enterprise years (Age), asset liability ratio (Lev), operating cash flow (Cf)、fixed assets ratio (Ppe)、chairman and general manager are unified (Dual)、ownership concentration (Top).

Table 1 provides relevant explanations and the calculation method for this indicator.

3.3. Sample Distribution and Descriptive Statistics

Table 2 presents the descriptive statistics of the main variables. Among the sample companies, the mean value of DCG is 0.0915, the median is 0.0104, the standard deviation is 0.2195, and the highest observed value is 1, indicating that the level of investor management among Chinese listed companies generally requires improvement and digital transformation among listed companies varies greatly. Regarding the common ownership (Coz1), the mean value is 0.1189, with a minimum value of 0 and a maximum value of 1, and the standard deviation is 0.3237, suggesting a significant variation in the common ownership among the sample companies.

4. Empirical Results and Analyses

4.1. Regression Analysis

Table 3 presents the regression results of the impact of common ownership on corporate digital transformation. In column (1)-(3), the coefficient for Coz1, Coz2, Coz3 are 0.017, 0.024, 0.062 with fixed-year effects, which remains statistically significant at the 1% level. These findings indicate that common ownership carries substantial efficacy in enhancing corporate digital transformation, confirming Hl.

4.2. Endogeneity Test and Robustness Analysis

Common ownership may still have this issue of potential reverse causality on corporate digital transformation. The information advantage of common ownership may help them find companies with better digital transformation. Therefore, listed companies with better digital transformation attract common ownership, rather than common ownership to promote the digital transformation of enterprises. Therefore, this study adopts the following methods to examine the robustness of the conclusions.

4.2.1. Instrumental Variable 2SLS

Information related to explanatory variables may be included in the residual term due to missing variables, we considered that explanatory variables with a lag of one period (Coz_it-1) is employed as an instrumental variable, two stage least squares (2SLS) and gaussian mixture model (GMM) were used for analysis. Columns (1)-(6) in

Table 4 present the regression results using the instrumental variable (IV) approach, the results demonstrate that common ownership (Coz) improves corporate digital transformation (DCG), providing empirical support for the core conclusions of this study.

4.2.2. Heckman Two-Stage Model

Due to the investment preferences of co-owners in terms of operational capacity, profitability, and other aspects, the improvement of enterprise digitalization may be incomplete caused by common ownership and influenced by certain common characteristics of listed companies. To eliminate regression bias caused by sample self-selection, the Heckman two-stage model is used for testing in this paper.

In the first stage, the Probit regression model is constructed to examine whether the characteristic variables of the previous listed company will affect their joint ownership (Coz1). The specific model is as follows:

where

represented the dummy variable and indicated whether the company has common ownership,

represented the residual error,

represented the control variables with a lag of one period in model (1), considering that the co-owner of the company will make investment decisions based on the information already disclosed by the previous period, and finally estimate the Inverse Mills Ratio (IMR).

In the second stage, IMR is used as a control variable in model 1 to overcome the potential interference of selective bias on the basic conclusions in this paper. According to the regression results, IMR and DCG have statistical significance, indicating that there is a distribution bias in the sample explanatory variables. It is necessary to test the impact of sample self-selection on the conclusions of this article. After adding the variable of IMR, the regression coefficients of variables Coz2 and Coz3 were significantly positive at the 1% significance level in table 5, which is consistent with the basic regression results. It indicated that the conclusion of this study still holds true after controlling for selection bias and eliminating endogeneity issues to a certain extent.

4.2.3. Propensity Score Matching (PSM)

To alleviate the error caused by sample selection, we further use the Propensity Score Matching (PSM) for endogeneity testing. The main approach includes using listed companies with common owners (Coz1=1) as the treatment group, using control variables from benchmark regression as matching variables, and using one-to-one nearest neighbor matching to find a control group with similar features for the treatment group. The PSM test results showed that the average treatment effect of the variable DCG was 0.01, significant at the 1% level of significance. This indicates that listed companies with common owners have an average digitalization level 0.01 higher than other listed companies without common owners but with similar characteristics. On this basis, regression tests were conducted on the treatment group and the matched control group samples. The results in

Table 5 indicate that the coefficients of the Coz are significantly positive at the 1% level, which is consistent with the baseline regression conclusion.

4.3. Robustness Analysis

4.3.1. Alternative Measurement of Common Ownership

Based on existing research results, we will use institutional investors who hold no less than 5% of the shares of two or more listed companies in the same industry. This article lowers the threshold for shareholding to 3% and raises it to 10%, respectively, and recalculates two new explanatory variables (TCoz and HCoz). The results in column (1)-(6) of

Table 6 show that the coefficients are significant at the 1% level, confirming the reliability of the findings.

4.3.2. Sub-Sample Regression

We select some years as sub-samples to further test the robustness of the core findings. Considering the development of enterprise digital transformation in recent years, to avoid the influence of other factors on the measurement of enterprise digital indicators, samples from 2017 and before were selected for testing. The results are reported in

Table 6 column (7)-(9). The coefficient of explanatory variable is statistically positive at the 1% level, there by indicating that our findings remain unaffected.

4.3.3. Lagged Independent Variable

Due to certain characteristics of the company in the past that may affect its digitalization, and the impact on the company may arise in the following year when the co-owners hold shares in the listed company. Therefore, this study uses a lagged variable of shared ownership (Lag Coz) to replace Coz for robustness testing. As shown in

Table 7, the regression coefficient of the lagged variable (Lag Coz) of shared ownership is significantly positive at the 1% significance level, consistent with the baseline results, indicating the robustness of the research conclusions.

5. Mechanism Testing and Analysis

After the endogenous test and robustness test, it still shows that the common ownership can promote the digital transformation of enterprises. According to the theoretical analysis in the second part, common ownership promotes the digital transformation of enterprises by exerting the institutional cooperative effect and the supervision and governance effect.

5.1. Institution Cooperative Effect

The analysis in the second chapter shows that considering the goal of maximizing the overall value of the company, the common ownership will actively participate in the governance of listed companies and give play to the institutional synergy effect to alleviate the vicious competition among enterprises in the same industry. And based on the rich and diverse heterogeneous information of common ownership, it directly or indirectly strengthens the confidence of executives in the decision-making of enterprise digital transformation and improves the tolerance of failure. To verify the conjecture, we play the institutional synergy effect from the following two aspects.

5.1.1. Mandatory Change of Senior Management

Enterprise digital transformation is vital to the future development of enterprises. Compared with other business decisions, enterprise digital transformation needs a higher degree of failure tolerance. With their own advantages, common ownership can effectively identify the key factors of the failure of enterprise digital transformation, alleviate the professional anxiety of senior executives by improving the tolerance of digital failure, to enhance the motivation of senior executives for enterprise digital decision-making, and then promote enterprise digitization. To this end, this paper constructs a regression model between the forced change of executives and the company's operating performance to test the relationship between joint ownership and enterprise digitalization. The specific model is as follows:

where

represents the mandatory change of senior management. According to the types of dismissal, resignation, job transfer, individual or other resignation in the dynamics of senior executives disclosed by listed companies, it is classified as mandatory change of senior executives. Set the virtual variable

=1, otherwise

=0.

represents the business performance, measured by the growth rate of business income in this paper.

represents the interaction term the variable of common ownership (

) and

.

5.1.2. Industry Scale of Common Ownership

The effect of common ownership on institutional synergy among enterprises in the same industry to a certain extent depends on its size in the same industry. From the previous theoretical analysis, joint owners can bring rich and diverse heterogeneous information to enterprises, and the quality and quantity of information depend on the size of the joint owners’ peers in the portfolio. If the size of the peers is larger, the quality and quantity of information can be guaranteed, which can promote resource sharing and effective collaboration, and enhance the confidence and motivation of the executives of the enterprises they hold to make digital transformation decisions. In this paper, we constructed the scale index of common ownership in the same industry (), calculated the number of listed companies in the same industry held by all co-owners of each company quarterly, add 1 to the annual average to take the natural logarithm, and replace the in Model (1).

Table 8 reports our empirical results using Equations (6) to test the mechanism of the common ownership can promote the digital transformation of enterprises. In column (1)-(3) of

Table 8, the coefficients of interaction terms (

) are significant at the 1% level. The results support the enhanced institution cooperative effect. Moving to column (4), the coefficient of

is significant at the 1% level, which suggests that the higher the level of the same industry scale, the stronger the enhancement effect of the digital transformation of enterprises.

5.2. Supervision and Governance Effect

In the previous theoretical analysis, common ownership can play the role of supervision and governance by virtue of their advantages in information access, management experience and industrial policies, effectively alleviate the agency problem and stimulate the motivation of executives to make digital transformation decisions. Therefore, this paper will analyze the effect of supervision and governance from two aspects: reducing agency costs and alleviating external financing constraints.

5.2.1. Reducing Agency Costs

Considering the avoidance of professional risks, executives’ motivation to promote the digital transformation of enterprises is insufficient, but shareholders will be willing to promote the digital transformation of enterprises for long-term development, and shareholders and management will have agency problems. The common ownership can effectively alleviate the agency problem between shareholders and senior executives by taking advantage of the information resources to play the role of supervision and governance, thus promoting the digital transformation of enterprises. The specific model is as follows:

where

represents the agency costs between shareholders and executives, measured by total asset turnover (operating income/total assets). As the turnover rate of total assets is a reverse indicator, the higher the value, the lower the agency cost.

Table 9 reports our empirical results using Equations (7) (8) to test the mechanism of the common ownership can promote the digital transformation of enterprises. In column (1)-(3) of

Table 9, variable

passed the mediation effect test, the coefficients of

are significant at the 1% level. It showed that common ownership reduces the agency cost, and the agency cost plays a partial intermediary role between common ownership and enterprise digitalization. It proves that joint ownership can effectively reduce the agency cost and promote the digital transformation of enterprises by playing the role of supervision and governance.

5.2.2. Alleviating External Financing Constraints

Common ownership can play the role of supervision and governance, through virtue of its resource advantages, it can promote the exchange and sharing of information resources among enterprises in the same industry, promote market resources to enterprises, and create more low-cost financing channels and cooperation opportunities for enterprises, to ease the external financing constraints of enterprises and promote the digital transformation of enterprises. Construct Digital Input-Cash flow sensitivity model to test the financing constraints of joint ownership and enterprise.

where

represents the enterprise digital investment,

represents the internal free cash flow, the coefficient

indicates the impact of common ownership on the financing constraints of digital investment.

Table 10 reports our empirical results using Equations (9) to test the mechanism of the common ownership can promote the digital transformation of enterprises. In column (1)-(3) of

Table 10, variable

and

are significantly positively correlated, the coefficients of interaction terms (

) are significantly negative at the 1% level. It shows that common ownership can alleviate the constraints of enterprise digital financing and promote enterprise digitization.

5.2.3. The Moderating Role of Property Right

Although common ownership can play the role of institutional coordination and supervision and governance, improve the tolerance of enterprises’ digital failure, coordinate the vicious competition among enterprises in the same industry, enhance the confidence of executives in making digital decisions, reduce agency costs, ease financing constraints, and promote enterprise digitization, will the promotion effect differ due to the nature of property rights? The basic economic system implemented in China is that the public ownership is the main body and the economy of various forms of ownership develops together. Therefore, there are many state-owned enterprises and private enterprises in the capital market. With the increasing influence of non-state-owned shareholders on state-owned enterprises, the institutional synergy effect and supervision and Governance effect of joint ownership can play a significant role.

In this paper, we set dummy variable of property right nature (

) for grouping regression, when the enterprise is a state enterprise, the value of the variable (

) is 1, otherwise it is 0. Column (2) of

Table 11 reports that the coefficient of

is significantly positive in state enterprise. However, the coefficient of variable (

) fails to pass the significance test in private enterprises. These empirical findings indicate that the role of common ownership in promoting the digital transformation of enterprises is more obvious in state-owned enterprises.

6. Conclusions

The emerging “Entity enterprise and Digital economy” model in the capital market has become the internal driving force for high-quality economic development. As common ownership becomes more active in the capital market, academia and industry have shown great interest in its effects. In the context of China’s vigorous development of the digital economy, from the perspective of corporate common ownership, finds that common ownership can promote the digital transformation of enterprises by giving full play to the effects of institutional coordination and supervision and governance. The main contents of this paper include: (1) Common ownership plays the positive role of capital as a factor of production, realizes the digital transformation of enterprises through the dual role of institutional coordination and supervision and governance, and plays the dual role of resource provider and effective supervisor in the capital market. After a series of endogenous and robustness tests, the regression results are still significant. (2) Common ownership can play an institutional synergy effect by improving the management’s tolerance of digital transformation failure, and the forces in the same industry have strengthened this mechanism. It can also play the role of supervision and governance by reducing agency costs and financing constraints and promote the digital transformation of enterprises. (3) The effect of common ownership on the institutional synergy and supervision and governance of enterprise digitalization is more obvious in the samples of rapid economic growth and state-owned enterprises.

The conclusions of this paper have the following important implications: (1) Objectively understand the advantages of common ownership in the digital transformation of enterprises. Our results show that common ownership can not only alleviate the vicious competition in the industry but also improve the agency conflict within the enterprise. Listed companies should recognize the positive role of common ownership in coordinating corporate behavior and improving corporate governance mechanism, actively introduce common ownership effectively and fully use their own advantages and achieve the strategic goal of enterprise digital transformation. (2) Common ownership should actively play the role of institutional coordination and supervision and governance. Our findings support the positive role of common ownership. In the context of economic globalization, listed companies will face more competitive pressure from enterprises in developed markets. The information resources and other advantages owned by common ownership should play a role to help listed companies improve their core competitiveness and provide impetus for high-quality economic development. (3) As a special informal system, common ownership can make up for the absence of formal system to a certain extent, promote enterprises to comply with the development trend of digital economy and deal with the “cold start” dilemma of digital transformation. Therefore, government regulators can optimize the capital market environment and create a good investment atmosphere for common ownership, but at the same time, they should prevent the disorderly expansion of capital and maintain market equity. Although common ownership can play a positive role in the capital market, government departments should still be vigilant against the pressure of common ownership rights on shareholding enterprises with their ownership advantages, which will damage the fair market competition environment. Therefore, government departments should attach equal importance to both regulation and development and create a good environment for the development of the capital market.

Author Contributions

Conceptualization, Xiao Zhang. and Peng Cao.; methodology, Peng Cao; software, Peng Cao; validation, Xiao Zhang and Peng Cao; formal analysis, Xiao Zhang; investigation, Peng Cao; resources, Xiao Zhang; data curation, Xiao Zhang; writing—original draft preparation, Peng Cao; writing—review and editing, Xiao Zhang; visualization, Xiao Zhang; supervision, Xiao Zhang; project administration, Xiao Zhang; funding acquisition, Peng Cao. All authors have read and agreed to the published version of the manuscript.

Funding

Please add: This research was funded by Philosophy and Social Science Planning Annual Project of Henan Province, Grant/Award Number: 2023CJJ138. and The APC was funded by 2023CJJ138.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- George, G.; Schillebeeckx, S. J. Digital transformation, sustainability, and purpose in the multinational enterprise. Journal of World Business 2022, 57(3), 101326. [Google Scholar] [CrossRef]

- Wu, L.; Hitt, L.; Lou, B. Data analytics, innovation, and firm productivity. Management Science 2020, 66(5), 2017–2039. [Google Scholar] [CrossRef]

- Ferreira, J. J.; Fernandes, C. I.; Ferreira, F. A. To be or not to be digital, that is the question: Firm innovation and performance. Journal of Business research 2019, 101, 583–590. [Google Scholar] [CrossRef]

- Gobble, M. M. Digital strategy and digital transformation. Research-Technology Management 2018, 61(5), 66–71. [Google Scholar] [CrossRef]

- Andriole, S. J. Five myths about digital transformation. MIT Sloan Management Review 2018, 58(3), 20–22. [Google Scholar]

- Matarazzo, M.; Penco, L.; Profumo, G.; Quaglia, R. Digital transformation and customer value creation in Made in Italy SMEs: A dynamic capabilities perspective. Journal of Business research 2021, 123, 642–656. [Google Scholar] [CrossRef]

- Leonardi, P. M.; Treem, J. W. Behavioral visibility: A new paradigm for organization studies in the age of digitization, digitalization, and datafication. Organization Studies 2020, 41(12), 1601–1625. [Google Scholar] [CrossRef]

- Hess, T.; Matt, C.; Benlian, A.; Wiesböck, F. Options for formulating a digital transformation strategy. MIS Quarterly Executive 2016, 15(2). [Google Scholar]

- Marabelli, M.; Galliers, R. D. A reflection on information systems strategizing: the role of power and everyday practices. Information Systems Journal 2017, 27(3), 347–366. [Google Scholar] [CrossRef]

- Firk, S.; Hanelt, A.; Oehmichen, J.; Wolff, M. Chief digital officers: An analysis of the presence of a centralized digital transformation role. Journal of Management Studies 2021, 58(7), 1800–1831. [Google Scholar] [CrossRef]

- Chen, Y.; Li, Q.; Ng, J.; Wang, C. Corporate financing of investment opportunities in a world of institutional cross-ownership. Journal of Corporate Finance 2021, 69, 102041. [Google Scholar] [CrossRef]

- Wang, S.; Li, X.; Li, Z.; Ye, Y. The effects of government support on enterprises’ digital transformation: Evidence from China. Managerial and Decision Economics 2023, 44(5), 2520–2539. [Google Scholar] [CrossRef]

- Müller, J. M.; Kiel, D.; Voigt, K. I. What drives the implementation of Industry 4.0? The role of opportunities and challenges in the context of sustainability. Sustainability 2018, 10(1), 247. [Google Scholar] [CrossRef]

- He, J.; Huang, J. Product market competition in a world of cross-ownership: Evidence from institutional block holdings. The Review of Financial Studies 2017, 30(8), 2674–2718. [Google Scholar] [CrossRef]

- Chen, Y.; Li, Q.; Ng, J. Institutional cross-ownership and corporate financing of investment opportunities. In Economics, Business; 2018; pp. 1–28. [Google Scholar]

- Chen, C. L.; Lin, Y. C.; Chen, W. H.; Chao, C. F.; Pandia, H. Role of government to enhance digital transformation in small service business. Sustainability 2021, 13(3), 1028. [Google Scholar] [CrossRef]

- Lewellen, K.; Lowry, M. Does common ownership really increase firm coordination? Journal of Financial Economics 2021, 141(1), 322–344. [Google Scholar] [CrossRef]

- Azar, J.; Schmalz, M. C.; Tecu, I. Anticompetitive effects of common ownership. Journal of Finance 2018, 73(4), 1513–1565. [Google Scholar] [CrossRef]

- Galeotti, A.; Ghiglino, C. Cross-ownership and portfolio choice. Journal of Economic Theory 2021, 192, 105194. [Google Scholar] [CrossRef]

- Freeman, K. The effects of common ownership on customer-supplier relationships; SSRN, 2019. [Google Scholar]

- He, J. J.; Huang, J.; Zhao, S. Internalizing governance externalities: The role of institutional cross-ownership. Journal of Financial Economics 2019, 134(2), 400–418. [Google Scholar] [CrossRef]

- Pawliczek, A.; Skinner, A. N. Available at SSRN 3002075; Common ownership and voluntary disclosure. 2018.

- Antón, M.; Ederer, F.; Giné, M.; Schmalz, M. Common ownership, competition, and top management incentives. Journal of Political Economy 2023, 131(5), 1294–1355. [Google Scholar] [CrossRef]

- Matarazzo, M.; Penco, L.; Profumo, G.; Quaglia, R. Digital transformation and customer value creation in Made in Italy SMEs: A dynamic capabilities perspective. Journal of Business research 2021, 123, 642–656. [Google Scholar] [CrossRef]

- Chanias, S.; Myers, M. D.; Hess, T. Digital transformation strategy making in pre-digital organizations: The case of a financial services provider. The Journal of Strategic Information Systems 2019, 28(1), 17–33. [Google Scholar] [CrossRef]

- Swaminathan, A.; Meffert, J. Digital @ Scale: the playbook you need to transform your company; John Wiley & Sons, 2017. [Google Scholar]

- Vial, G. Understanding digital transformation: A review and a research agenda. In Managing digital transformation; 2021; pp. 13–66. [Google Scholar]

- Hansen, R. G.; Lott, J. R. Externalities and corporate objectives in a world with diversified shareholder/consumers. Journal of Financial and Quantitative Analysis 1996, 31(1), 43–68. [Google Scholar] [CrossRef]

- Leong, C. M. L.; Pan, S. L.; Ractham, P.; Kaewkitipong, L. ICT-enabled community empowerment in crisis response: social media in Thailand flooding 2011. Journal of the Association for Information Systems 2015, 16(3), 174–212. [Google Scholar] [CrossRef]

- Nwankpa, J. K.; Roumani, Y. IT capability and digital transformation: A firm performance perspective. International Conference on Interaction Sciences, 2016. [Google Scholar]

- Lyytinen, K.; Yoo, Y.; Boland, R. J., Jr. Digital product innovation within four classes of innovation networks. Information systems journal 2016, 26(1), 47–75. [Google Scholar] [CrossRef]

- Zhong, R. I. Transparency and firm innovation. Journal of Accounting and Economics 2018, 66(1), 67–93. [Google Scholar] [CrossRef]

- Ritter, T.; Pedersen, C. L. Digitization capability and the digitalization of business models in business-to-business firms: Past, present, and future. Industrial marketing management 2020, 86, 180–190. [Google Scholar] [CrossRef]

- Peng, Y.; Tao, C. Can digital transformation promote enterprise performance? —From the perspective of public policy and innovation. Journal of Innovation & Knowledge 2022, 7(3), 100198. [Google Scholar] [CrossRef]

- He, J. J.; Huang, J.; Zhao, S. Internalizing governance externalities: The role of institutional cross-ownership. Journal of Financial Economics 2019, 134(2), 400–418. [Google Scholar] [CrossRef]

- Kacperczyk, M.; Sialm, C.; Zheng, L. On the industry concentration of actively managed equity mutual funds. The Journal of Finance 2005, 60(4), 1983–2011. [Google Scholar] [CrossRef]

- Lin, Z.; Yang, H.; Arya, B. Alliance partners and firm performance: resource complementarity and status association. Strategic management journal 2009, 30(9), 921–940. [Google Scholar] [CrossRef]

- Ramalingegowda, S.; Utke, S.; Yu, Y. Common institutional ownership and earnings management. Contemporary Accounting Research 2021, 38(1), 208–241. [Google Scholar] [CrossRef]

- Park, J.; Sani, J.; Shroff, N.; White, H. Disclosure incentives when competing firms have common ownership. Journal of Accounting and Economics 2019, 67(2-3), 387–415. [Google Scholar] [CrossRef]

- Bar-Isaac, H.; Shapiro, J. Blockholder voting. Journal of Financial Economics 2020, 136(3), 695–717. [Google Scholar] [CrossRef]

- Albuquerque, R.; Fos, V.; Schroth, E. Value creation in shareholder activism. Journal of Financial Economics 2022, 145(2), 153–178. [Google Scholar] [CrossRef]

- Edmans, A.; Levit, D.; Reilly, D. Governance under common ownership. The Review of Financial Studies 2019, 32(7), 2673–2719. [Google Scholar] [CrossRef]

- Kang, J. K.; Luo, J.; Na, H. S. Are institutional investors with multiple block holdings effective monitors? Journal of Financial Economics 2018, 128(3), 576–602. [Google Scholar] [CrossRef]

- Hope, O. K.; Wu, H.; Zhao, W. Blockholder exit threats in the presence of private benefits of control. Review of Accounting Studies 2017, 22(2), 873–902. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2026 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).