Submitted:

24 October 2025

Posted:

27 October 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Construction of the Transition Finance Evaluation Indicator System and Research Methodology

2.1. Indicator Construction

2.2. Research Methodology

2.2.1. Entropy Weighting-TOPSIS Method

2.2.2. Theil Index

2.3. Data Sources

3. Analysis of Transition Finance Development Levels

3.1. Indicator Weight Analysis

3.2. Analysis of Transition Finance Development Level

3.2.1. Comprehensive Evaluation of Transition Finance Development Level

3.2.2. Sub-Item Evaluation of Transformational Financial Development Level

3.3. Disparities in Transition Finance Development Level

4. Conclusions and Implications

4.1. Conclusions

4.2. Implications

References

- Wang Yao, Zhang Guangxiao. Transition Finance: Definition, Framework, and Future Outlook [J]. Contemporary Economic Science, 2024, 46(3):1-17. [CrossRef]

- Huang Xiao. Cultivating New Quality Productivity and Managing Stranded Asset Risks: The Dual-Effect Mechanism of Transition Finance [J]. Regional Finance Research, 2024(4):32-39.

- Wei Tianlei, Wang Huiqing. Theoretical Foundations, Practical Experiences, and Policy Recommendations for Transition Finance [J]. Enterprise Economics, 2023, 42(1):141-149. [CrossRef]

- Wang Bangyan, Lin Lü. Domestic and International Progress and Lessons in Transition Finance Risk Management [J]. Modern Finance, 2024(9):22-2734.

- Kang Jianping. Theoretical Research and Mechanism Analysis of Transition Finance Risks [J]. Western Finance, 2024(5):27-3237. [CrossRef]

- Wei Hanmei, Liao Yao. Financial Risk Transmission Mechanisms and Empirical Simulation of Transition Finance [J]. Heilongjiang Finance, 2023(8):33-40.

- Shu Hao, Wei Ping, Bie Ao. Impact of Stranded Asset Risks on Corporate Value in the Context of Transition Finance [J]. Research in Financial Economics, 2023, 38(6): 66-81.

- Li Ruijie, Wang Can. Challenges and Countermeasures for Supporting Corporate Low-Carbon Transition through Linked Transition Finance Instruments [J]. China Environmental Management, 2024, 16(1):57-62. [CrossRef]

- Xu Hongfeng, Yi Lei. Innovation, Comparative Analysis, and Development Recommendations for Domestic and International Transition Finance Products [J]. Southwest Finance, 2023(9):15-31.

- Luo Ying, Gao Guangkuo. Study on the Impact of Transition Finance on Low-Carbon Transformation in China’s High-Carbon Industries: Based on Spatial Econometric Models [J]. China Prices, 2024(1):62-66.

- Ding Pan, Li Ling, Pan Qiurong, Chang Yingwei. Environmental Regulation, Transition Finance, and Corporate Carbon Reduction Effects [J]. Southern Finance, 2023(8):41-55.

- Yang T, Zhou B. Does transition finance policies persistently fuel green innovation in brown firms? Investigating the roles of ESG rating and bank connection [J]. Pacific-Basin Finance Journal, 2025, 90102674-102674.

- Du Zhengqi, Huang Huan, Huang Qian, Yuan Xia. Research on Measuring Transition Risks in High-Carbon Industries [J]. Finance and Economics, 2024(11): 60-69. [CrossRef]

- Ma Jun, Guo Jianwei, Zhao Gangzhu. Key Performance Indicators for Transition Finance Instruments [J]. China Finance, 2023, (15): 27-29.

- Xiao Renqiao, Chen Xiaoting, Qian Li. Heterogeneous Environmental Regulation, Government Support, and Corporate Green Innovation Efficiency: A Two-Stage Value Chain Perspective [J]. Research on Finance and Trade, 2022, 33(9): 79-93. [CrossRef]

- Kong Dongmin, Wei Yongxi, Ji Mianmian. Study on the Impact of Environmental Fee-to-Tax Reform on Corporate Green Information Disclosure [J]. Securities Market Herald, 2021(8):2-14.

| Primary Indicators | Second-Level Indicators | Tertiary Indicators | Indicator Description |

|---|---|---|---|

| Driving Force (D) | Policy Support Intensity | Carbon Trading Market Participation (+) | Whether the province where the enterprise is registered has launched a carbon emissions trading market in the current year |

| Green Subsidy Intensity per Unit of Electricity Generated (+) | Total annual green subsidy received/Total electricity generation | ||

| Technological Innovation Capability | Carbon Performance (+) | The reciprocal of total carbon emissions per million yuan of net sales, measuring the enterprise’s ability to reduce carbon emissions | |

| Clean Technology R&D Expenditure Ratio (+) | Annual R&D expenditure/Total operating revenue | ||

| Digitalization Level | Digital Technology Application Level (+) | Frequency of the keyword “digital technology application” in the company’s annual report plus 1, then take the logarithm | |

| Status (S) | Carbon Pollution Intensity | Carbon Emission Intensity (-) | Total Carbon Emissions/Total Electricity Generation |

| Pollutant Emission Intensity (-) | Total Pollutant Emissions/Total Electricity Generation | ||

| Energy Utilization Efficiency | Power Generation Coal Consumption (-) | Standard coal consumption for power generation/Total power generation | |

| Green financing structure | Green Credit Ratio (+) | Green credit balance/Total credit balance, quantifying the extent of green financing in corporate structures | |

| Response (R) | Fund Allocation Efficiency | Proportion of Environmental Governance Expenditures (+) | Annual environmental governance expenditure/Total operating revenue |

| Green outcome conversion efficiency (+) | Efficiency of converting green patent indicators into final outputs | ||

| Quality of Information Disclosure | ESG Score (+) | Huazheng Corporate ESG Comprehensive Rating | |

| Quality of Green Information Disclosure (+) | ln(Sum of environmental project scores disclosed by 25 enterprises) | ||

| Emissions Reduction Effectiveness | Carbon Intensity Reduction Rate (+) | (1 - Current Period Carbon Intensity/Base Period Carbon Intensity) × 100%, quantifying the actual improvement in corporate carbon emission efficiency | |

| Carbon Asset Efficiency (+) | Total operating revenue/Total carbon emissions, measuring the economic value generated per unit of carbon emissions |

| Primary Indicator | Weight | Secondary Indicators | Weight | Tertiary Indicators | Weight |

|---|---|---|---|---|---|

| Driving Force (D) | 0.5330 | Policy Support Intensity | 0.3064 | Carbon Market Participation | 0.0994 |

| Green Subsidy Intensity per Unit of Electricity Generation | 0.2070 | ||||

| Technological Innovation Capacity | 0.2173 | Carbon Performance | 0.0988 | ||

| Clean Technology R&D Expenditure Ratio | 0.1186 | ||||

| Digitalization Level | 0.0092 | Digital Technology Application Level | 0.0092 | ||

| Status (S) | 0.0318 | Carbon Pollution Intensity | 0.0095 | Carbon Emission Intensity | 0.0023 |

| Pollutant Emission Intensity | 0.0073 | ||||

| Energy Utilization Efficiency | 0.0095 | Power Generation Coal Consumption | 0.0095 | ||

| Green Financing Structure | 0.0127 | Green Credit Ratio | 0.0127 | ||

| Response (R) | 0.4353 | Fund Allocation Efficiency | 0.3165 | Proportion of Environmental Governance Expenditures | 0.2942 |

| Green outcome conversion efficiency | 0.0223 | ||||

| Quality of Information Disclosure | 0.0190 | ESG Score | 0.0057 | ||

| Green Information Disclosure Quality | 0.0133 | ||||

| Emissions Reduction Implementation Effectiveness | 0.0998 | Carbon Intensity Reduction Rate | 0.0010 | ||

| Carbon Asset Efficiency | 0.0988 |

| Company | 2019 | 2020 | 2021 | 2022 | ||||

|---|---|---|---|---|---|---|---|---|

| Evaluation Index | Rank | Evaluation Index | Rank | Evaluation Index | Rank | Evaluation Index | Rank | |

| Shenzhen Energy | 0.4071 | 2 | 0.2958 | 2 | 0.3367 | 2 | 0.3326 | 1 |

| Shennan Electric A | 0.2647 | 3 | 0.2113 | 5 | 0.3287 | 3 | 0.3235 | 2 |

| Gannan Energy | 0.5009 | 1 | 0.3588 | 1 | 0.3758 | 1 | 0.3187 | 3 |

| Suihengyun A | 0.2148 | 5 | 0.2117 | 4 | 0.2362 | 6 | 0.2969 | 4 |

| Disen | 0.2461 | 4 | 0.2480 | 3 | 0.2779 | 4 | 0.2903 | 5 |

| Meiyan Jixiang | 0.1988 | 6 | 0.2007 | 6 | 0.2436 | 5 | 0.2850 | 6 |

| … | … | … | … | … | ||||

| Electric Power Industry | 0.1406 | 0.1404 | 0.1489 | 0.1695 | ||||

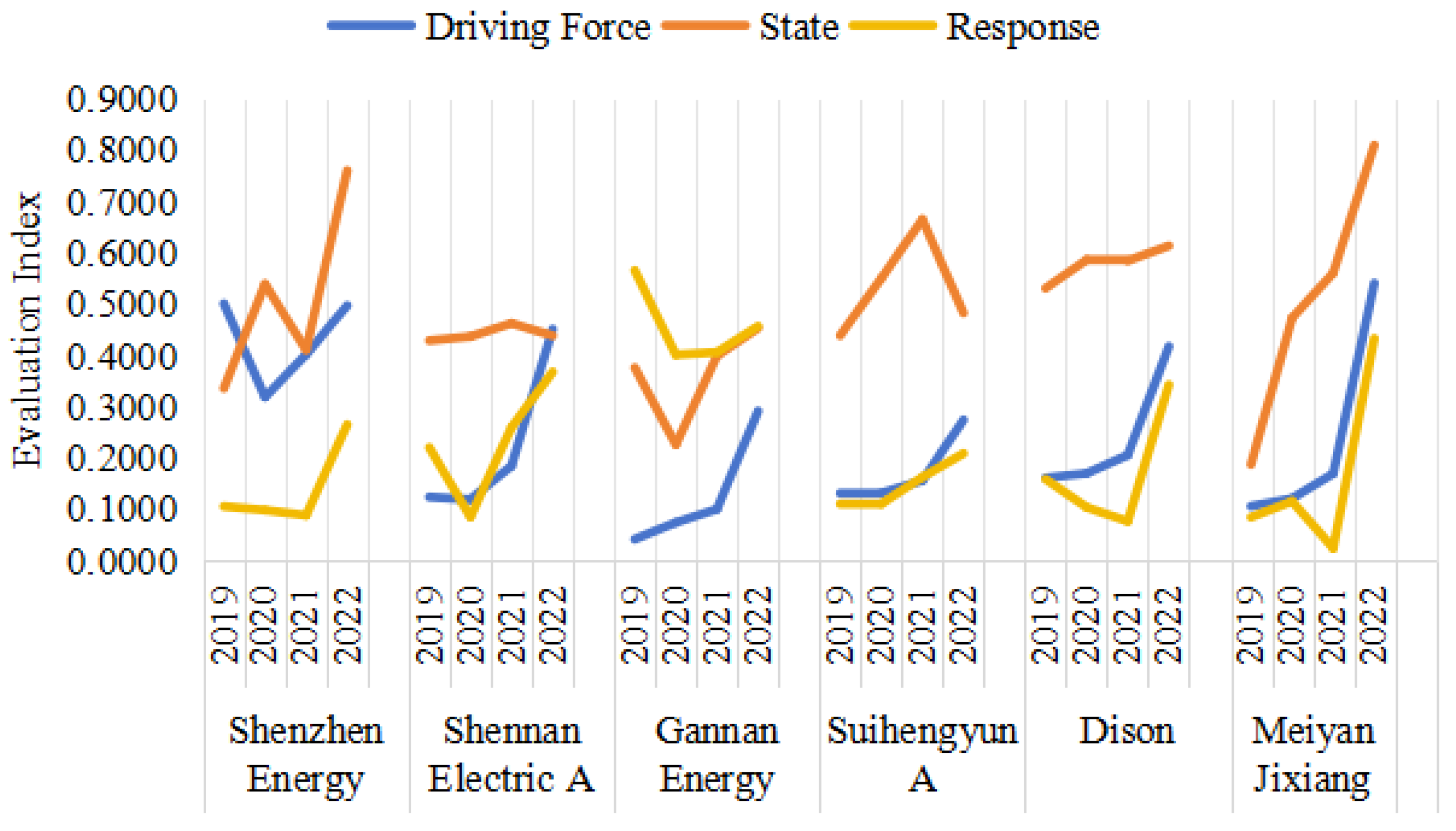

| Primary Indicator | Company | 2019 | 2020 | 2021 | 2022 | ||||

|---|---|---|---|---|---|---|---|---|---|

| Evaluation Index | Rank | Evaluation Index | Rank | Evaluation Index | Rank | Evaluation Index | Rank | ||

| Driving Force (D) | Shenzhen Energy | 0.5008 | 1 | 0.3188 | 1 | 0.4015 | 1 | 0.4971 | 2 |

| Shennan Electric A | 0.1238 | 4 | 0.1191 | 5 | 0.1847 | 3 | 0.4508 | 3 | |

| Gannan Energy | 0.0416 | 6 | 0.0740 | 6 | 0.1003 | 6 | 0.2912 | 5 | |

| Suihengyun A | 0.1311 | 3 | 0.1314 | 3 | 0.1557 | 5 | 0.2742 | 6 | |

| Disen | 0.1611 | 2 | 0.1700 | 2 | 0.2056 | 2 | 0.4175 | 4 | |

| Meiyan Jixiang | 0.1060 | 5 | 0.1208 | 4 | 0.1696 | 4 | 0.5405 | 1 | |

| Status (S) | Shenzhen Energy | 0.3360 | 5 | 0.5386 | 3 | 0.4110 | 5 | 0.7599 | 2 |

| Shennan Electric A | 0.4290 | 3 | 0.4366 | 5 | 0.4623 | 4 | 0.4384 | 6 | |

| Gannan Energy | 0.3758 | 4 | 0.2261 | 6 | 0.3989 | 6 | 0.4531 | 5 | |

| Suihengyun A | 0.4387 | 2 | 0.5500 | 2 | 0.6649 | 1 | 0.4827 | 4 | |

| Disen | 0.5306 | 1 | 0.5864 | 1 | 0.5843 | 2 | 0.6134 | 3 | |

| Meiyan Jixiang | 0.1874 | 6 | 0.4729 | 4 | 0.5606 | 3 | 0.8099 | 1 | |

| Response (R) | Shenzhen Energy | 0.1057 | 5 | 0.0984 | 5 | 0.0882 | 4 | 0.2650 | 5 |

| Shennan Electric A | 0.2201 | 2 | 0.0851 | 6 | 0.2597 | 2 | 0.3675 | 3 | |

| Gannan Energy | 0.5656 | 1 | 0.4011 | 1 | 0.4061 | 1 | 0.4566 | 1 | |

| Suihengyun A | 0.1106 | 4 | 0.1106 | 3 | 0.1625 | 3 | 0.2087 | 6 | |

| Disen | 0.1586 | 3 | 0.1038 | 4 | 0.0764 | 5 | 0.3427 | 4 | |

| Meiyan Jixiang | 0.0844 | 6 | 0.1156 | 2 | 0.0240 | 6 | 0.4329 | 2 | |

| Year | Intra-group Disparity | Inter-group Disparity | Total Theil Index | Group Disparity | |

|---|---|---|---|---|---|

| Thermal Power Group | Renewable Energy Group | ||||

| 2019 | 0.2065 | 0.0076 | 0.2142 | 0.2237 | 0.1836 |

| 2020 | 0.1850 | 0.0062 | 0.1912 | 0.1459 | 0.2340 |

| 2021 | 0.1845 | 0.0135 | 0.1980 | 0.1321 | 0.2558 |

| 2022 | 0.1285 | 0.0001 | 0.1285 | 0.1172 | 0.1395 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).