Submitted:

10 October 2025

Posted:

29 October 2025

You are already at the latest version

Abstract

Keywords:

I. Introduction

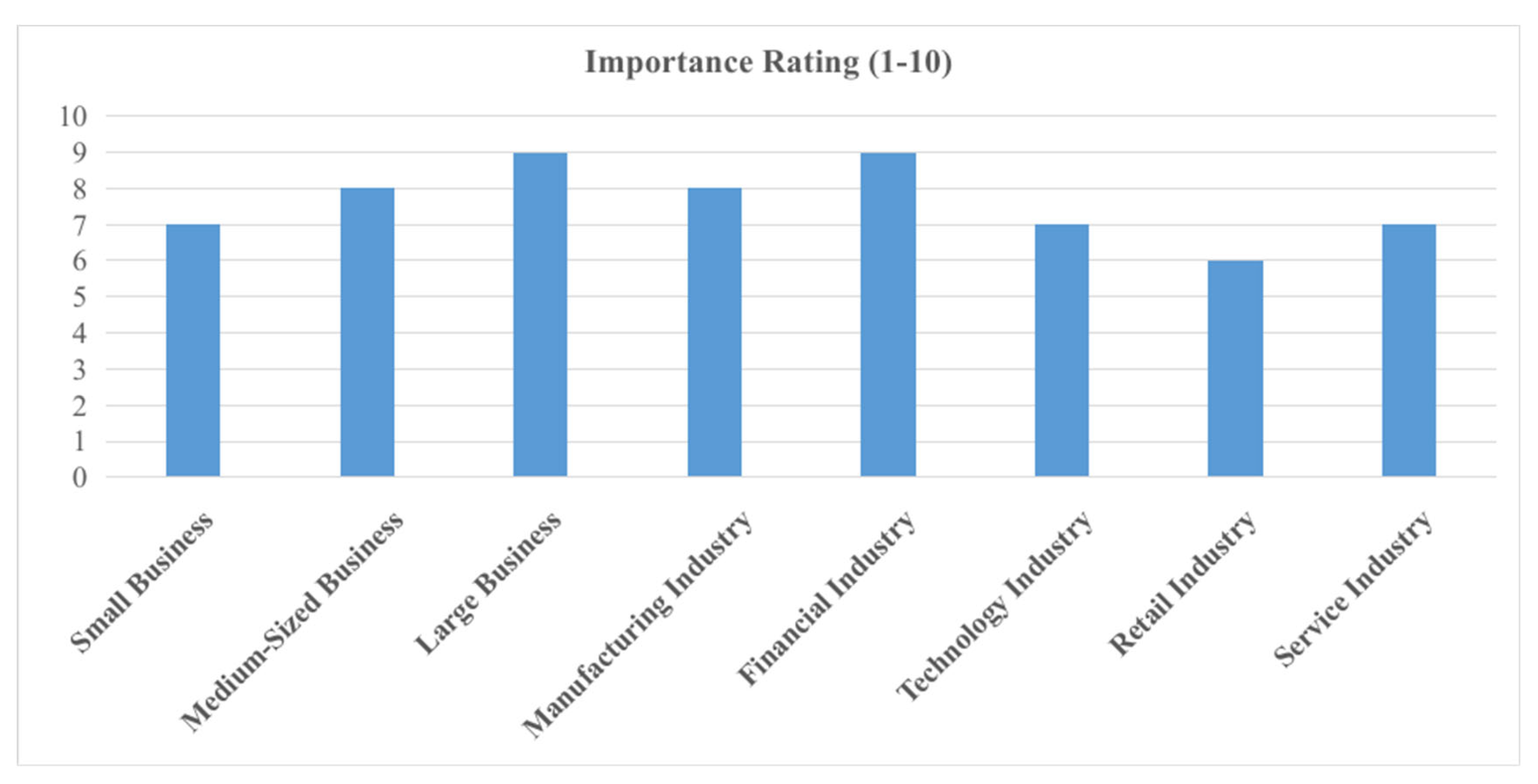

II. The Importance of Internal Control in Business Management

1. Definition and Objectives

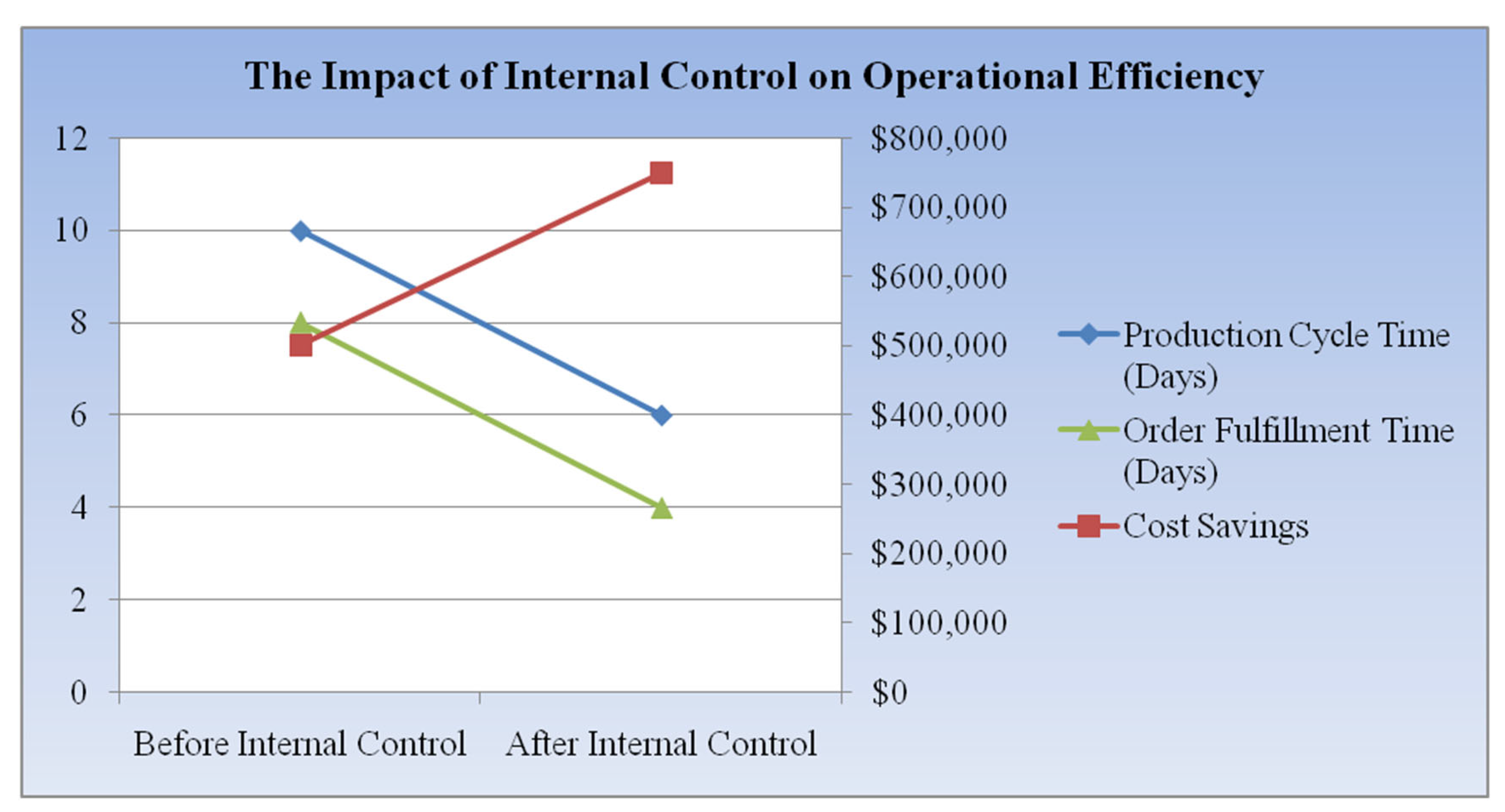

2. Operational Efficiency

3. Risk Management

4. Compliance and Governance

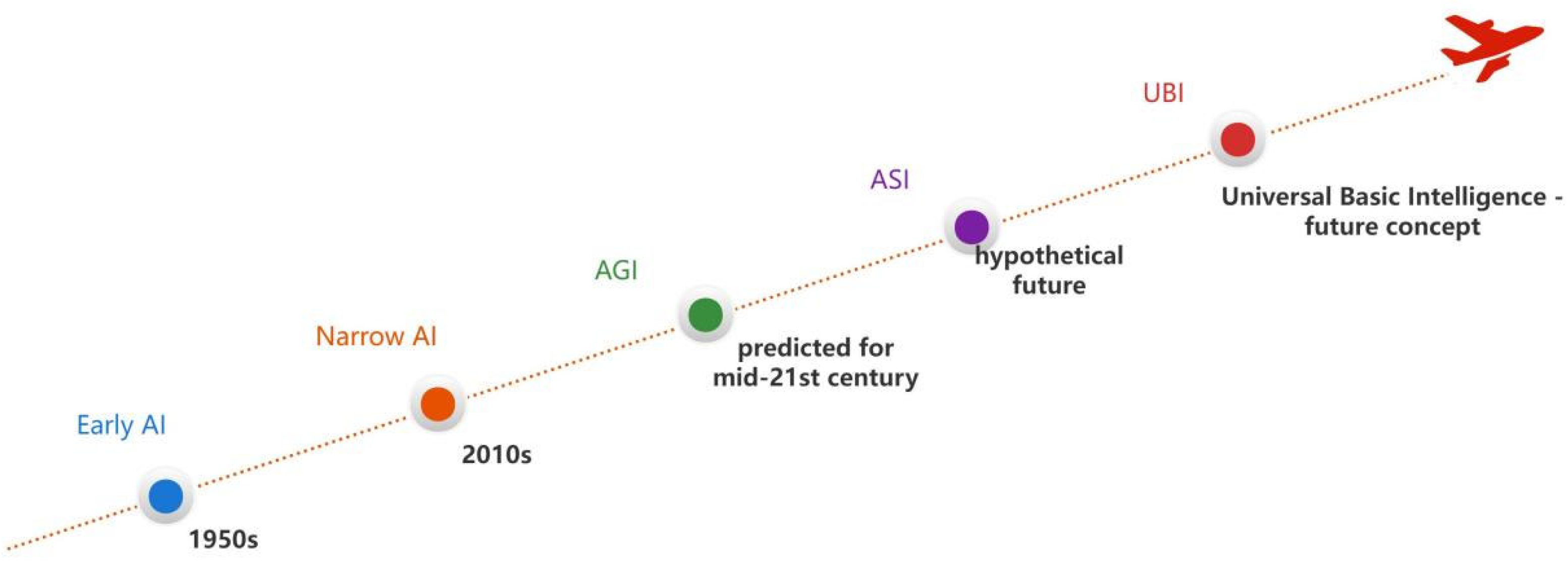

III. The Evolution of AI and Its Impact on Business

1. AI Technologies

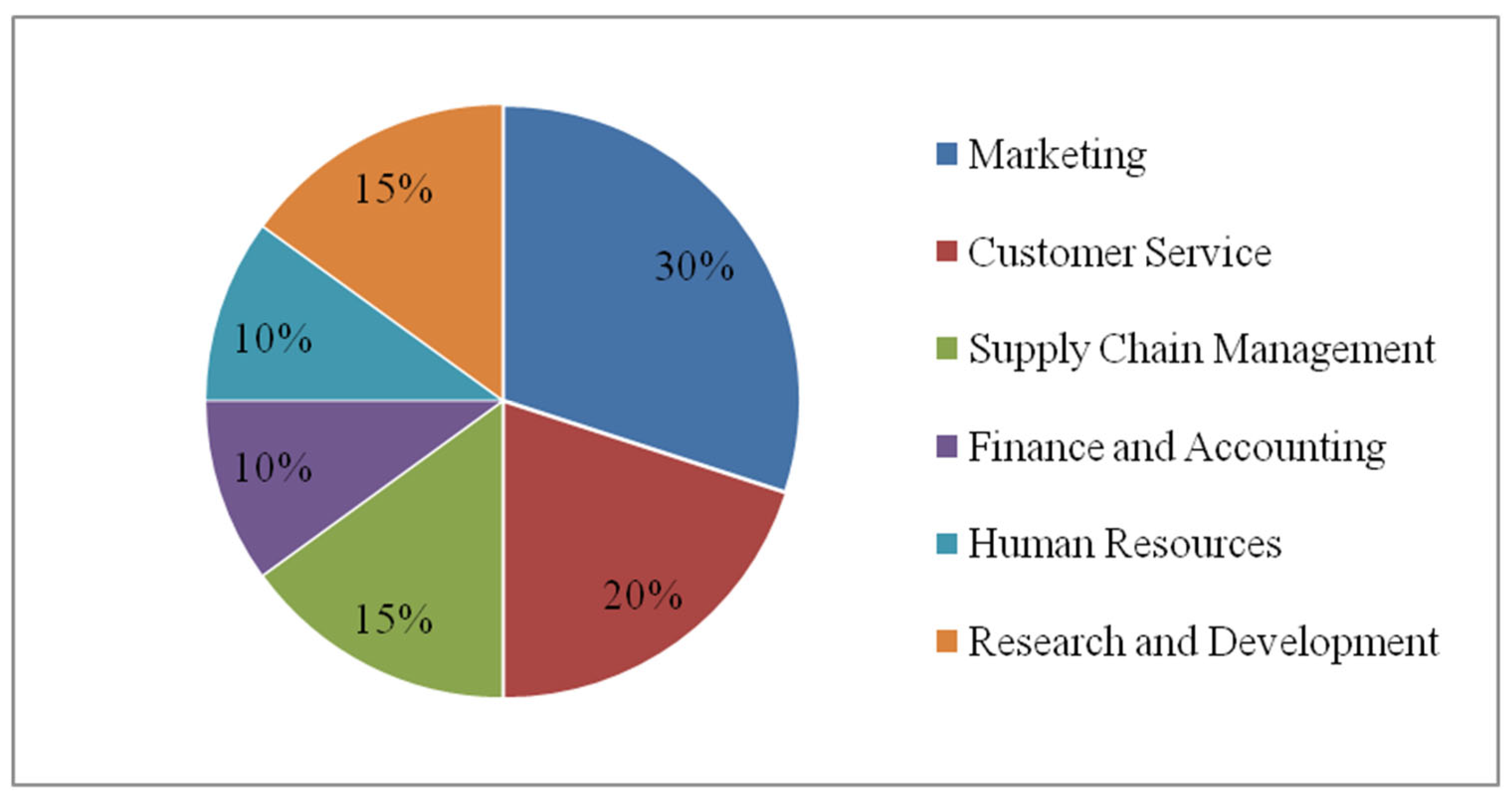

2. AI in Business

VI. AI in Internal Control: Theoretical Frameworks

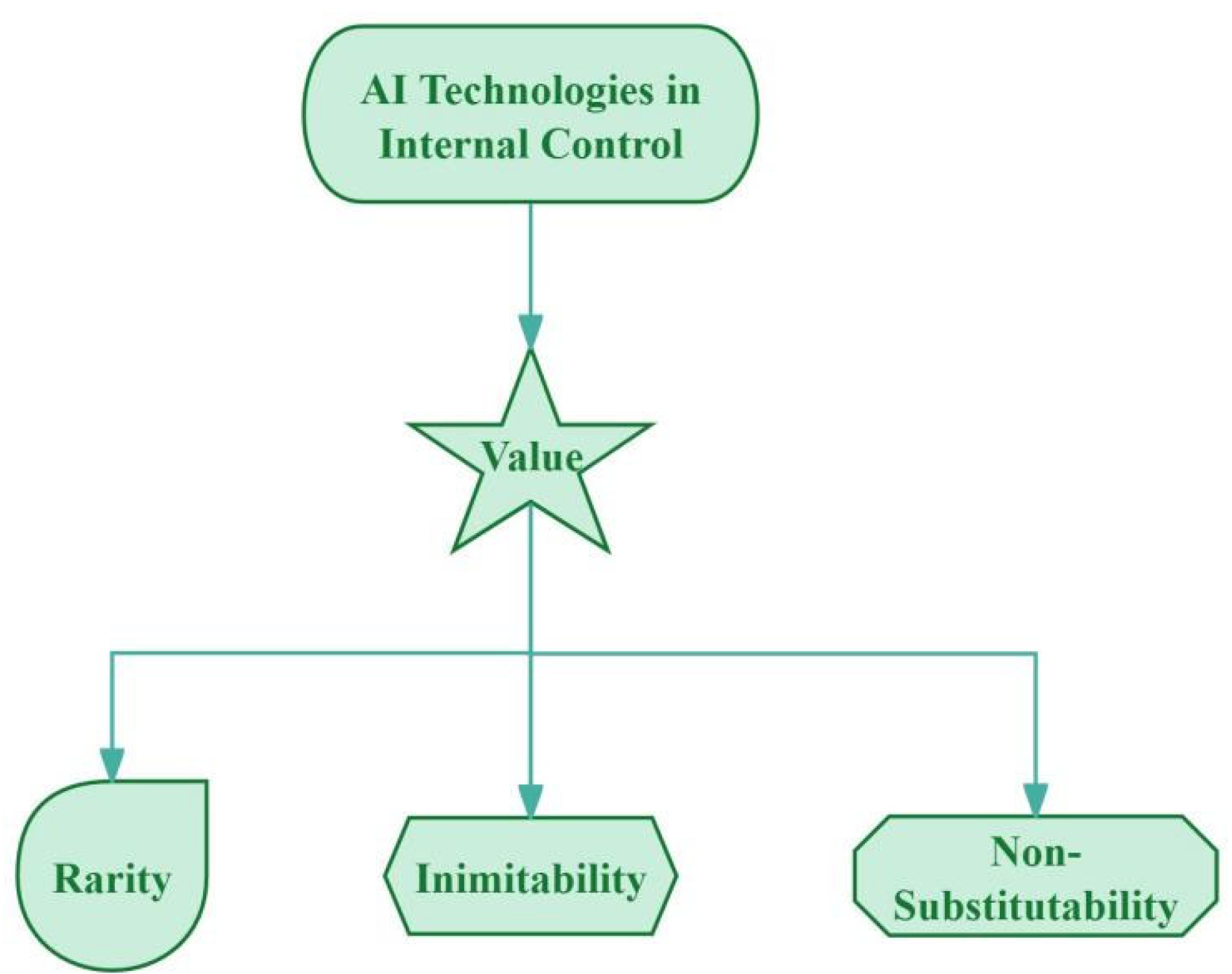

1. Resource-Based View (RBV)

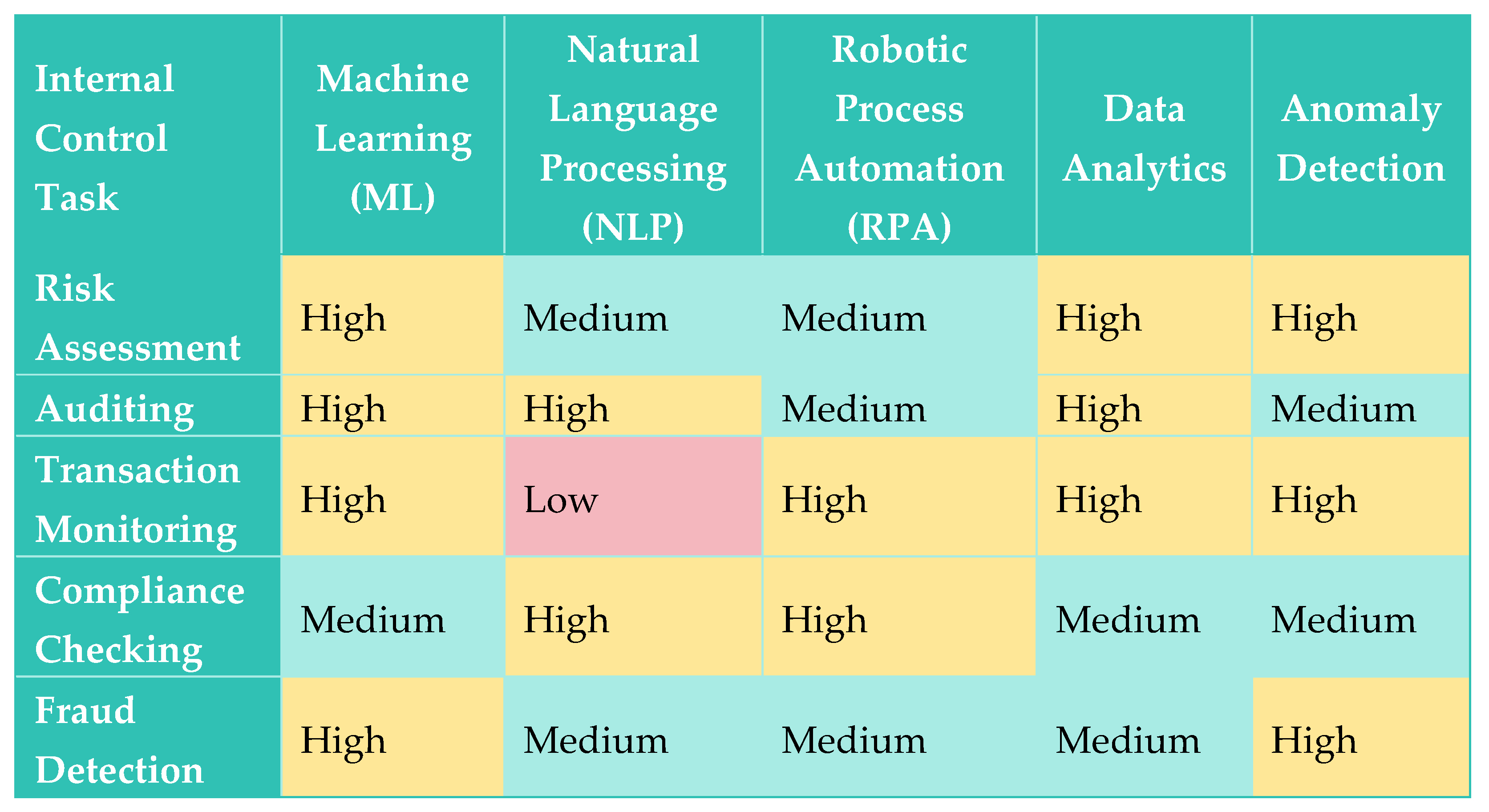

2. Task-Technology Fit (TTF)

3. COSO Framework

V. Practical Applications of AI in Internal Control

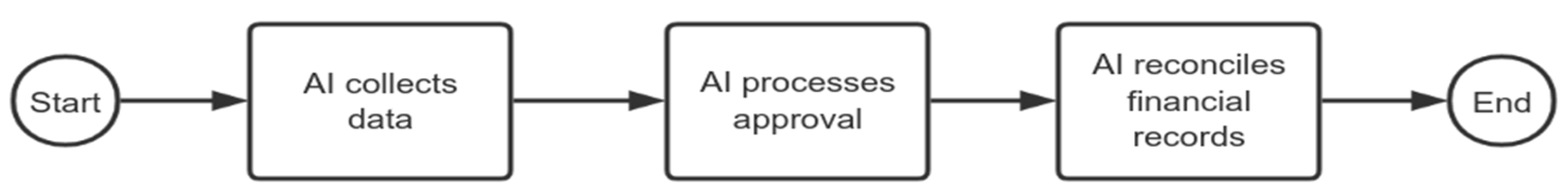

1. Automation of Routine Tasks

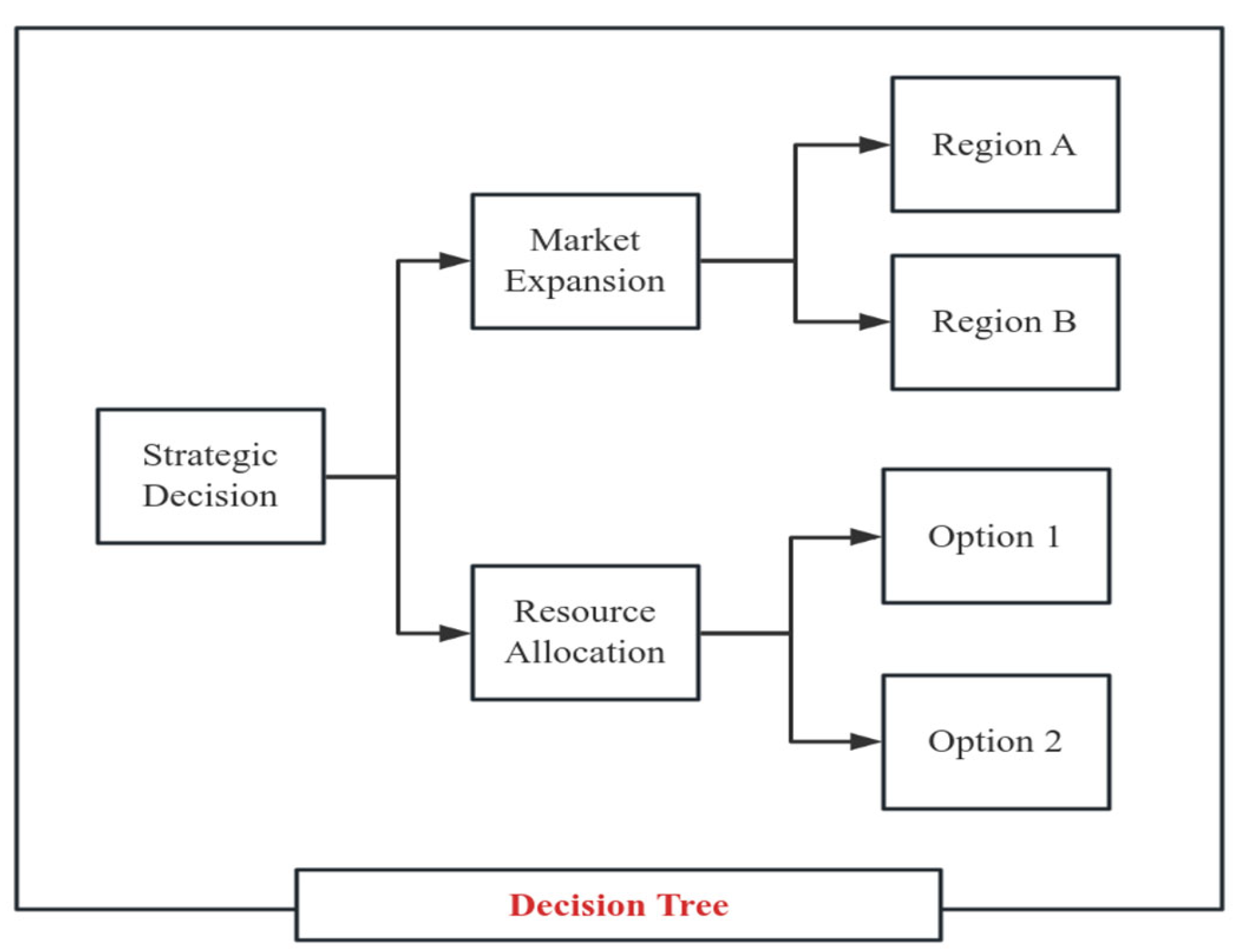

2. Enhanced Decision Support

3. Real-Time Monitoring and Alerts

VI. Case Studies

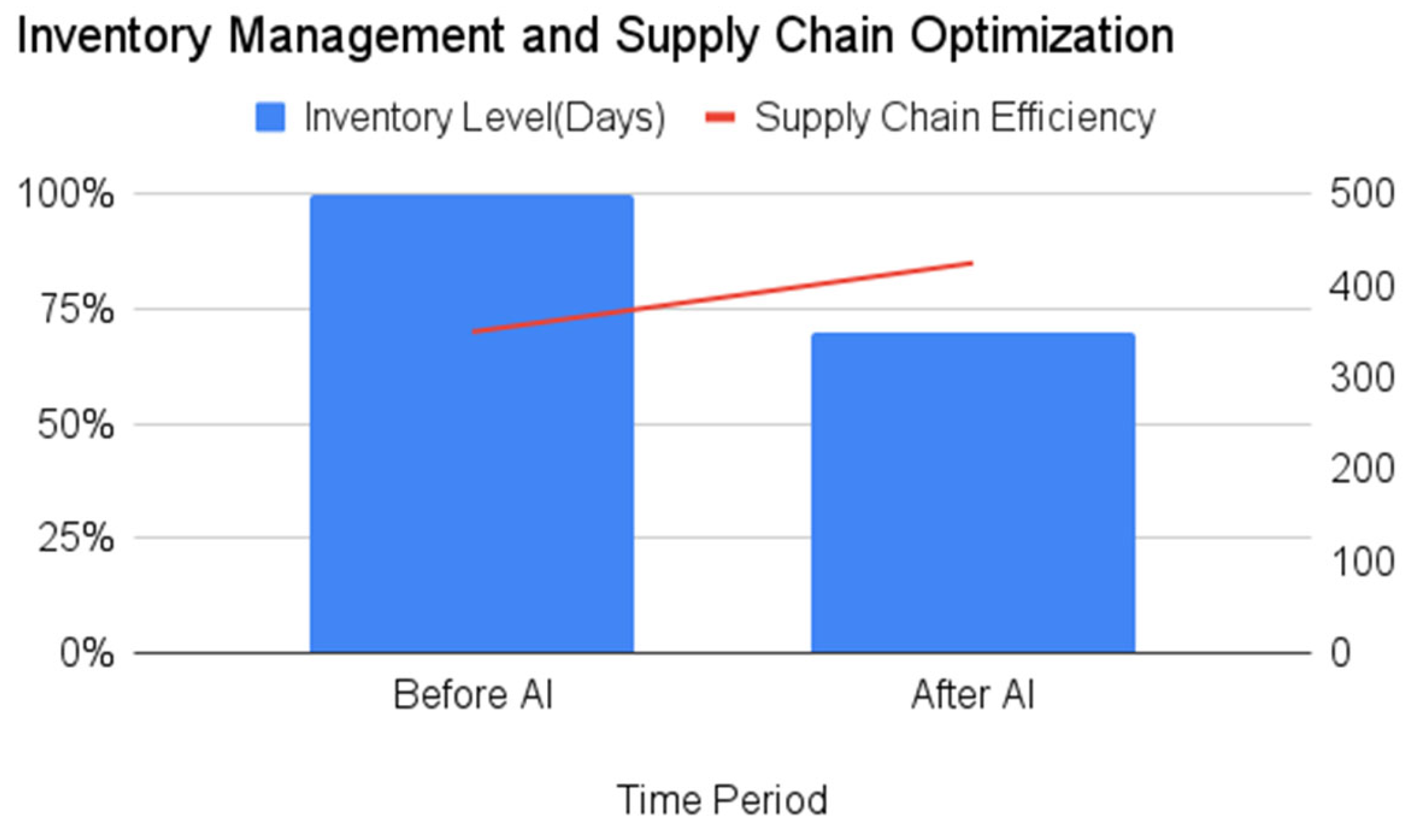

1. Case Study 1: Manufacturing Company - Inventory Management and Supply Chain Optimization

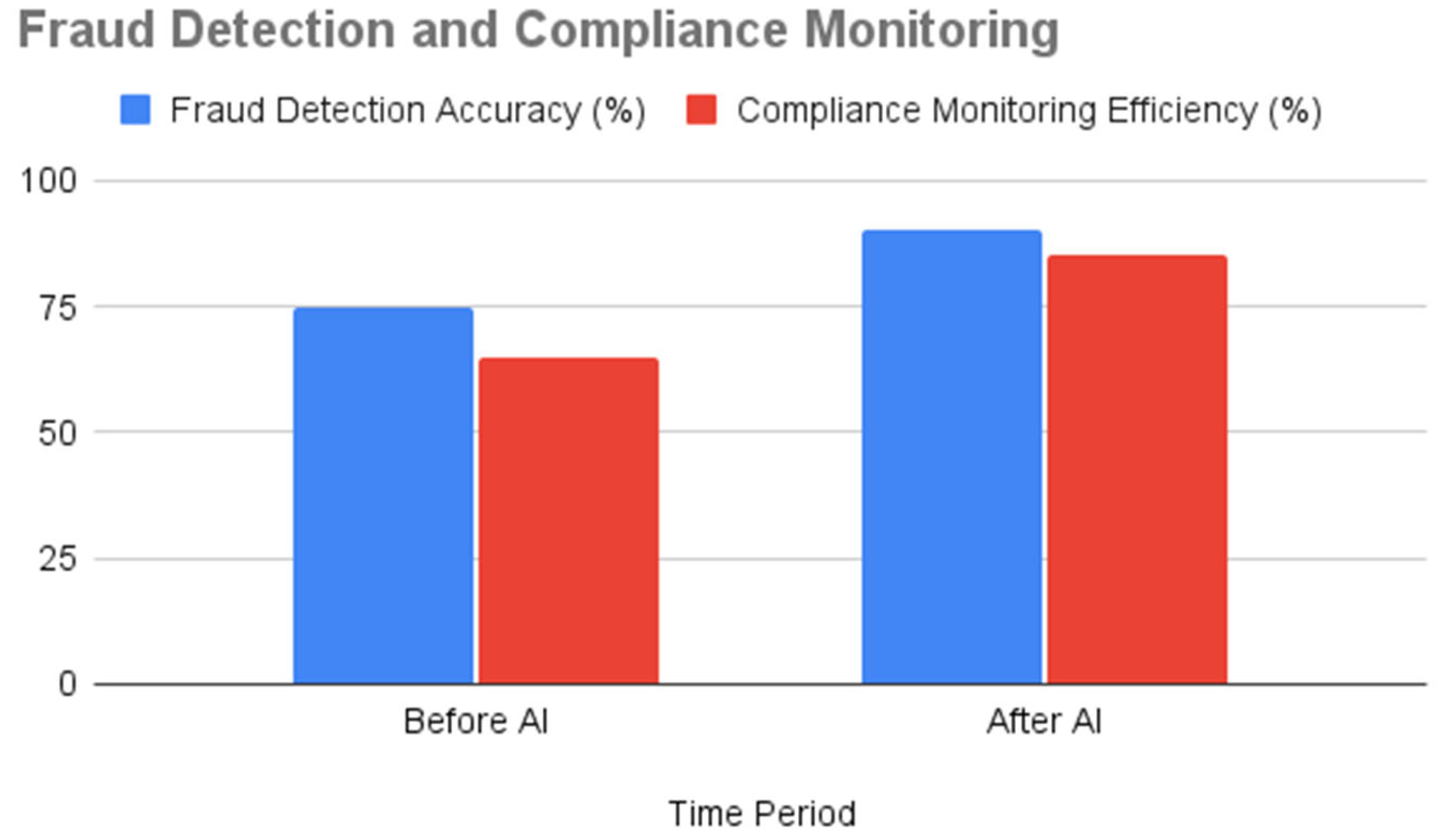

2. Case Study 2: Financial Institution - Fraud Detection and Compliance Monitoring

3. Case Study 3: Technology Firm - Employee Performance Evaluation and Resource Allocation

VII. Challenges and Limitations

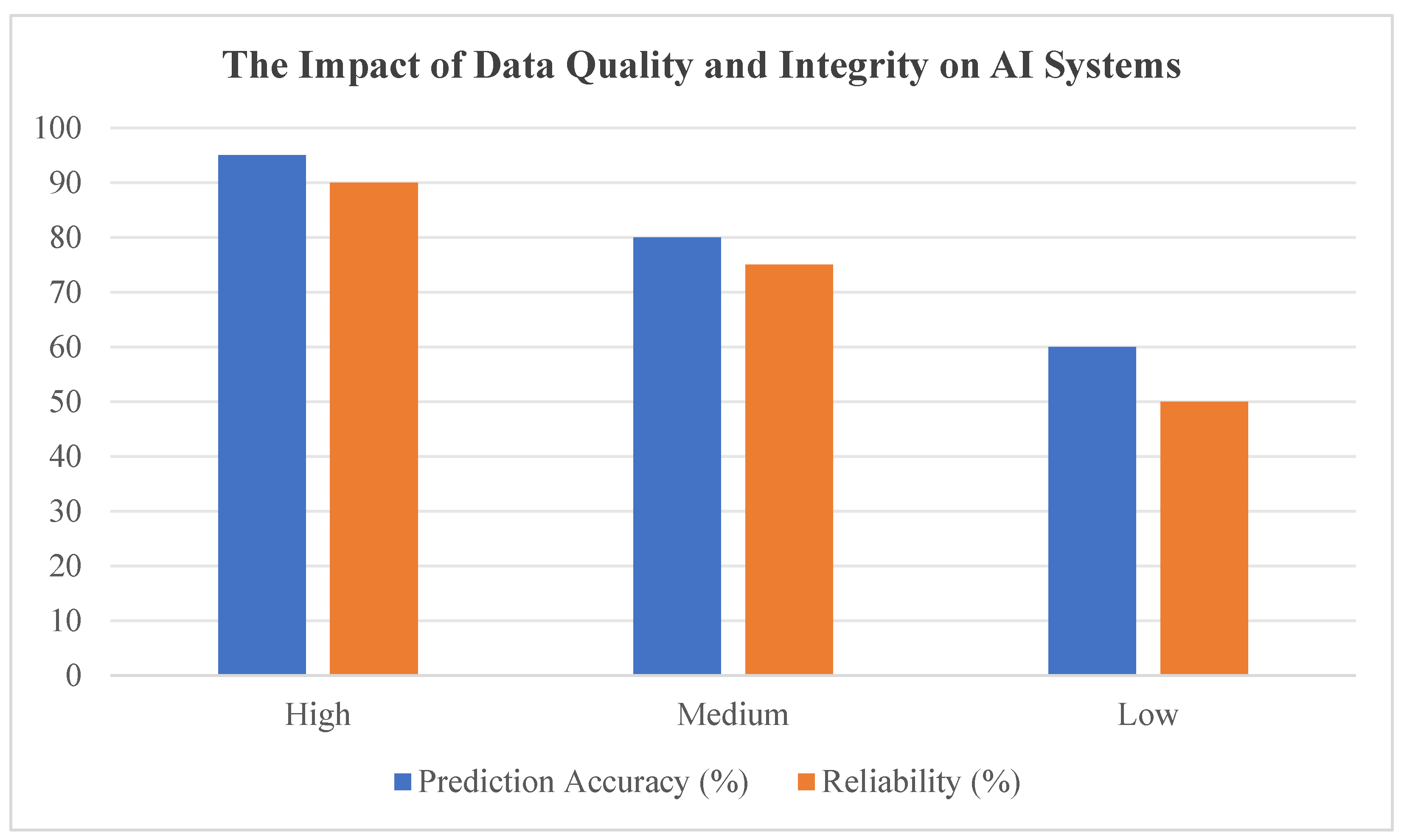

1. Data Quality and Integrity

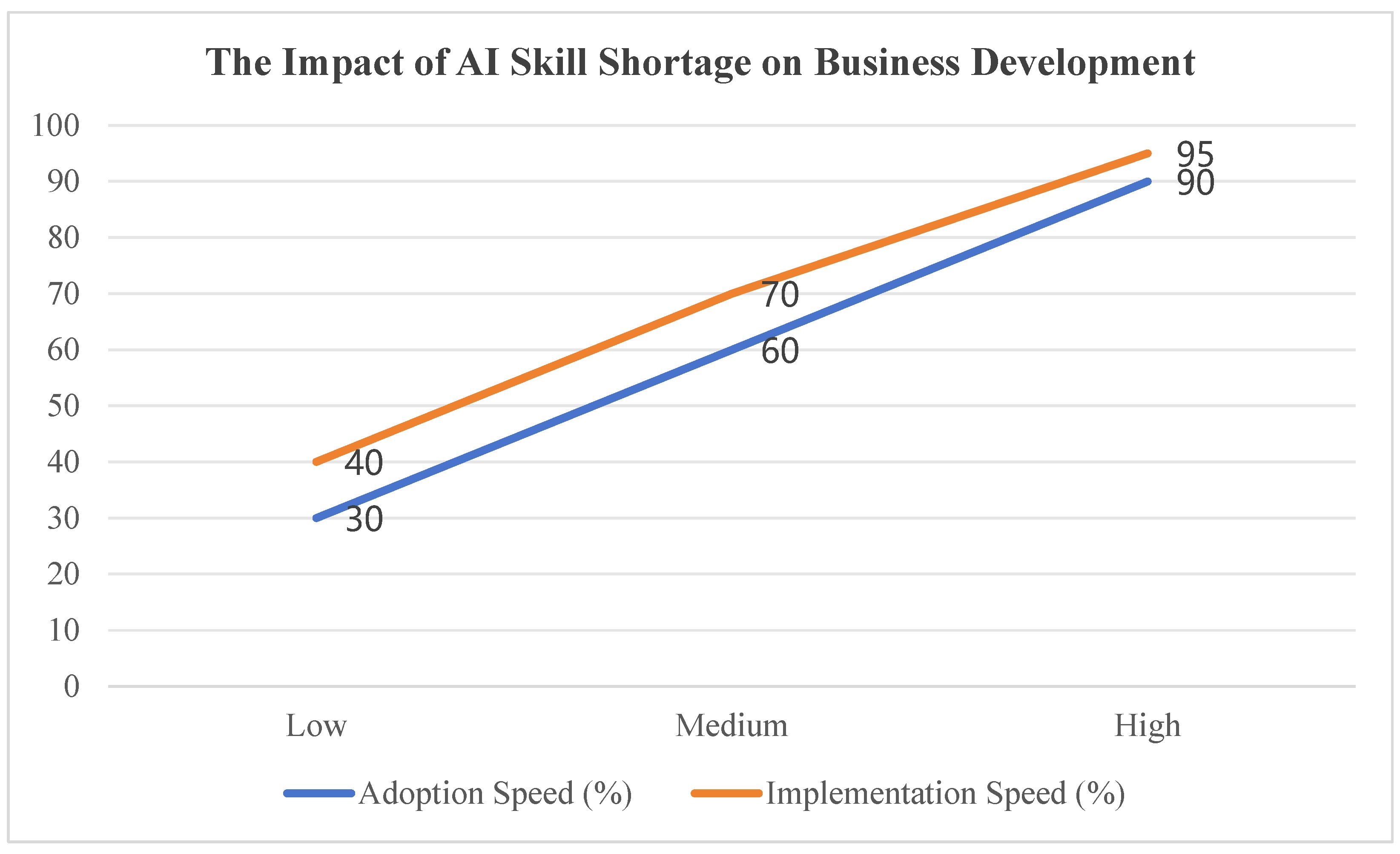

2. Skill Shortage

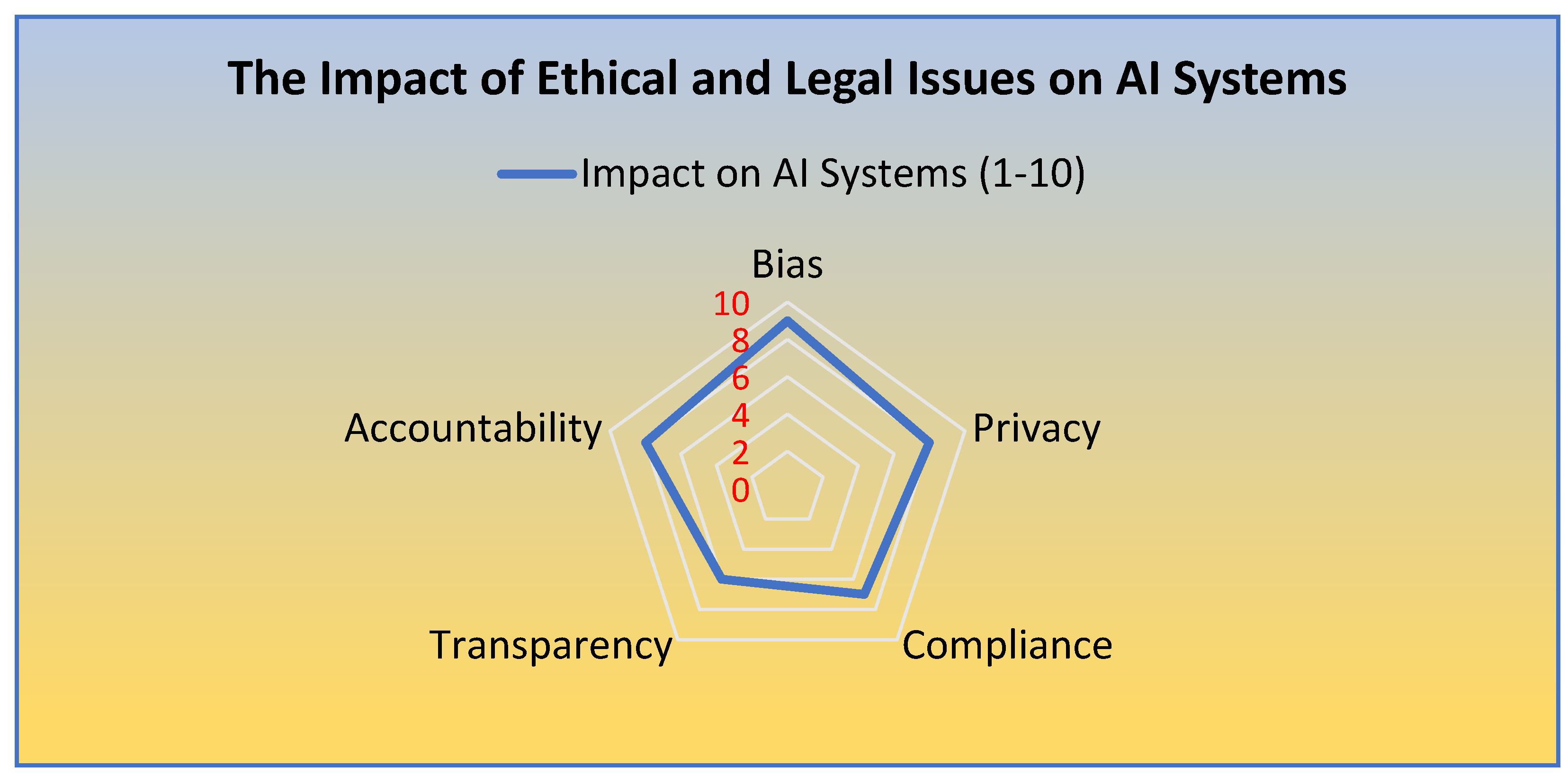

3. Ethical and Legal Issues

VIII. Future Directions

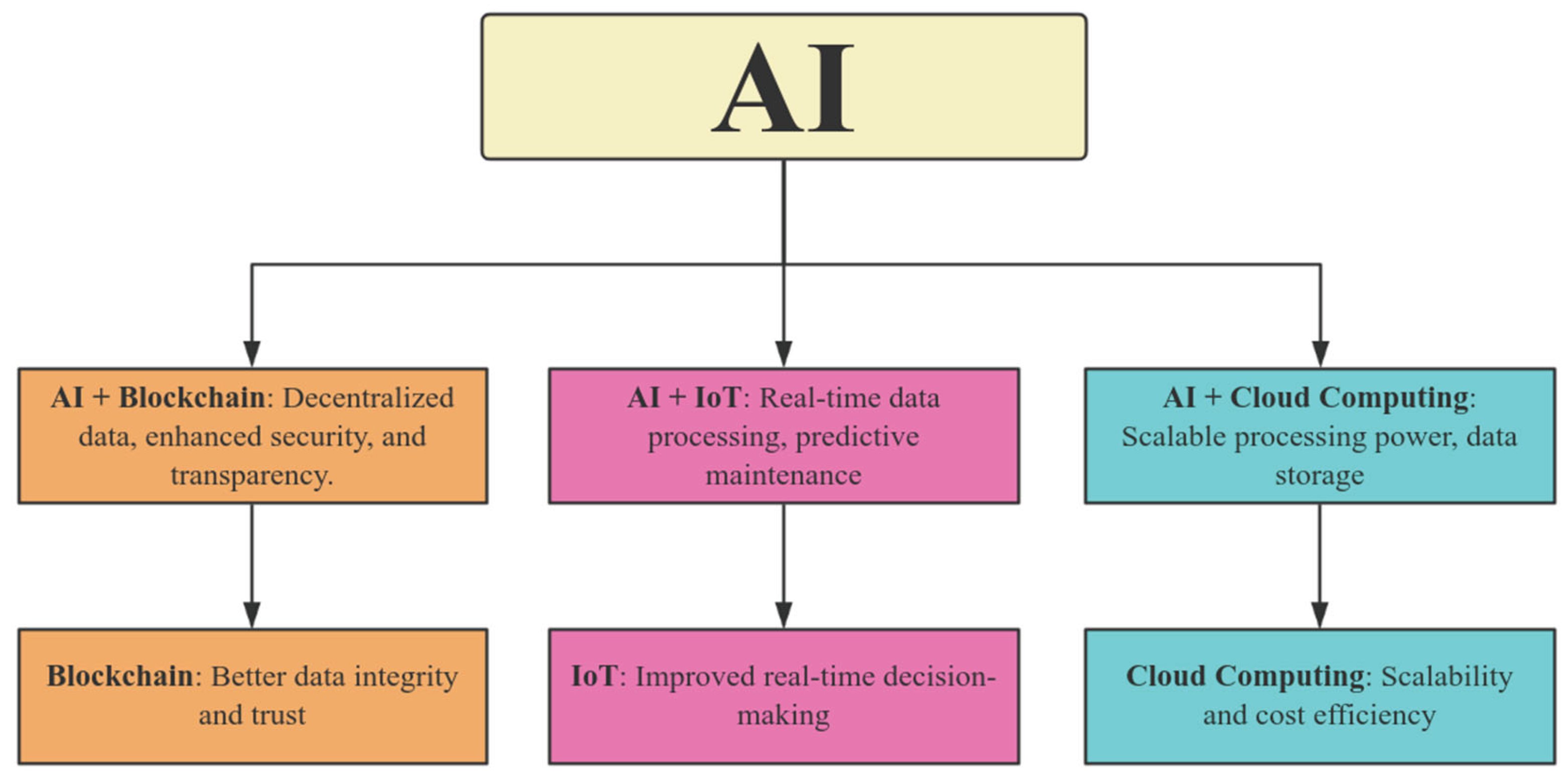

1. Integration with Other Technologies

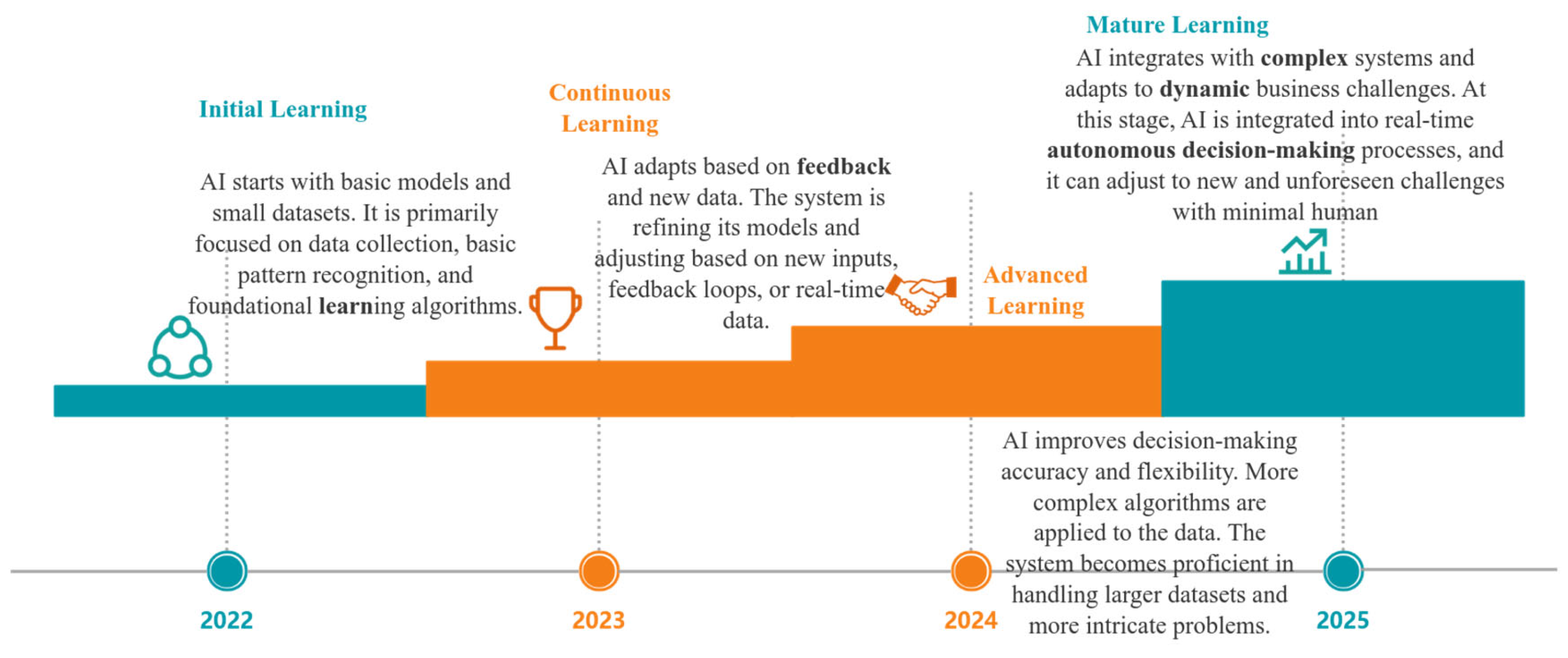

2. Continuous Learning and Adaptation

3. Global Standards and Regulations

IX. Conclusion

1. Summary

2. Implications

3. Call to Action

References

- Chen, B. The Role of Accounting and Financial Management in Humanity's Transition to the Interstellar Era. Economics and Management Innovation 2025, 2, 61–68. [Google Scholar] [CrossRef]

- Shi, S. , Zhang, L., Yin, Y., Yang, X., & Lee, H. A modified RIME algorithm with covariance learning and diversity enhancement for numerical optimization. Cluster Computing 2025, 28, 658. [Google Scholar]

- Yu, Q. , Yin, Y., Zhou, S., Mu, H., & Hu, Z. (2025, March). Detecting Financial Fraud in Listed Companies via a CNN-Transformer Framework. In 2025 8th International Conference on Advanced Algorithms and Control Engineering (ICAACE) (pp. 1047–1051). IEEE.

- Zhongyin Law Firm. Lawyer's Perspective on Corporate Internal Control and Compliance Innovation - Taking the Application of Artificial Intelligence and Other Technologies as the Entry Point. 2024-03-06.

- NetEase, Application and Practice of Artificial Intelligence in Compliance Management - Financial Supervision. Internal Control Compliance Digitalization. 2024-12-24.

- On the Innovation and Development of Complex Adaptive Systems and Enterprise Management Research. Journal of Modern Business Administration. 2022-09-20.

- Modern Green Logistics Management and Its Optimization Path Research. Journal of Modern Business Administration". 2022-09-20.

- OuYang, K. , Wei, D., Sha, X., Yu, J., Zhao, Y., Qiu, M.,... & Chen, H. (2025). Beaver behavior optimizer: A novel metaheuristic algorithm for solar PV parameter identification and engineering problems. Journal of Advanced Research.

- Zhang, Z. , Shen, Q., Hu, Z., Liu, Q., & Shen, H. Credit risk analysis for SMEs using graph neural networks in supply chain. arXiv 2025, arXiv:2507.07854. [Google Scholar]

- On the Innovation and Development of Complex Adaptive Systems and Enterprise Management Research. Journal of Modern Business Administration. 2022.

- Aleksandra Przegalinska & Tamilla Triantoro. Collaborative AI in the workplace: Enhancing organizational performance through resource-based and task-technology fit perspectives. International Journal of Information Management 2025, 81, 102853.

- Liu, S. , & Zhu, M. Distributed inverse constrained reinforcement learning for multi-agent systems. Advances in Neural Information Processing Systems 2022, 35, 33444–33456. [Google Scholar]

- The Relationship between AI Adoption Intensity and Internal Control System and Accounting Information Quality. 2023-11-04. MDPI.

- INTERNAL CONTROL AND THE TRANSFORMATION OF ENTITIES KEY ACTIONS SUMMARY. 2022-04-01. ACCA Global.

- Internal Control System in Enterprise Management: Analysis and Interaction Matrices. European Research Studies Journal. 2018.

- Liu, S. , & Zhu, M. (2024, May). Meta inverse constrained reinforcement learning: Convergence guarantee and generalization analysis. International Conference on Learning Representations.

- Zhang, F. , Chen, G., Wang, H., & Zhang, C. CF-DAN: Facial-expression recognition based on cross-fusion dual-attention network. Computational Visual Media 2024, 10, 593–608. [Google Scholar]

- Artificial intelligence and the future of the internal audit function. Nature. 2024-03-11.

- Li, P. , Abouelenien, M., Mihalcea, R., Ding, Z., Yang, Q., & Zhou, Y. (2024, May). Deception detection from linguistic and physiological data streams using bimodal convolutional neural networks. In 2024 5th International Conference on Information Science, Parallel and Distributed Systems (ISPDS) (pp. 263–267). IEEE.

- Zhao, Peng, Xiaoyu Liu, Xuqi Su, Di Wu, Zi Li, Kai Kang, Keqin Li, and Armando Zhu. "Probabilistic Contingent Planning Based on Hierarchical Task Network for High-Quality Plans." Algorithms 18, no. 4 (2025): 214.

- Evaluating the impact of internal control systems on organizational effectiveness. LBS Journal of Management & Research. 2024-12-29.

- Wan, W. , Zhou, F., Liu, L., Fang, L., & Chen, X. Ownership structure and R&D: The role of regional governance environment. International Review of Economics & Finance 2021, 72, 45–58. [Google Scholar]

- Chen, B. The Pivotal Role of Accounting in Civilizational Progress and the Age of Advanced AI: A Unified Perspective. Economics and Management Innovation 2025, 2, 49–54. [Google Scholar] [CrossRef]

- Chen, B. Leveraging Advanced AI in Activity-Based Costing (ABC) for Enhanced Cost Management. Journal of Computer, Signal, and System Research 2025, 2, 53–62. [Google Scholar] [CrossRef]

- Chen, B. (2024). The Imperative Need for Tax Reform in China and Its Impact on Advancing Social Civilization. Available at SSRN 5129165.

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).