Submitted:

13 October 2025

Posted:

22 October 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

1.1. Problem

1.2. Thesis

1.3. Contributions

1.4. Research Questions & Hypotheses

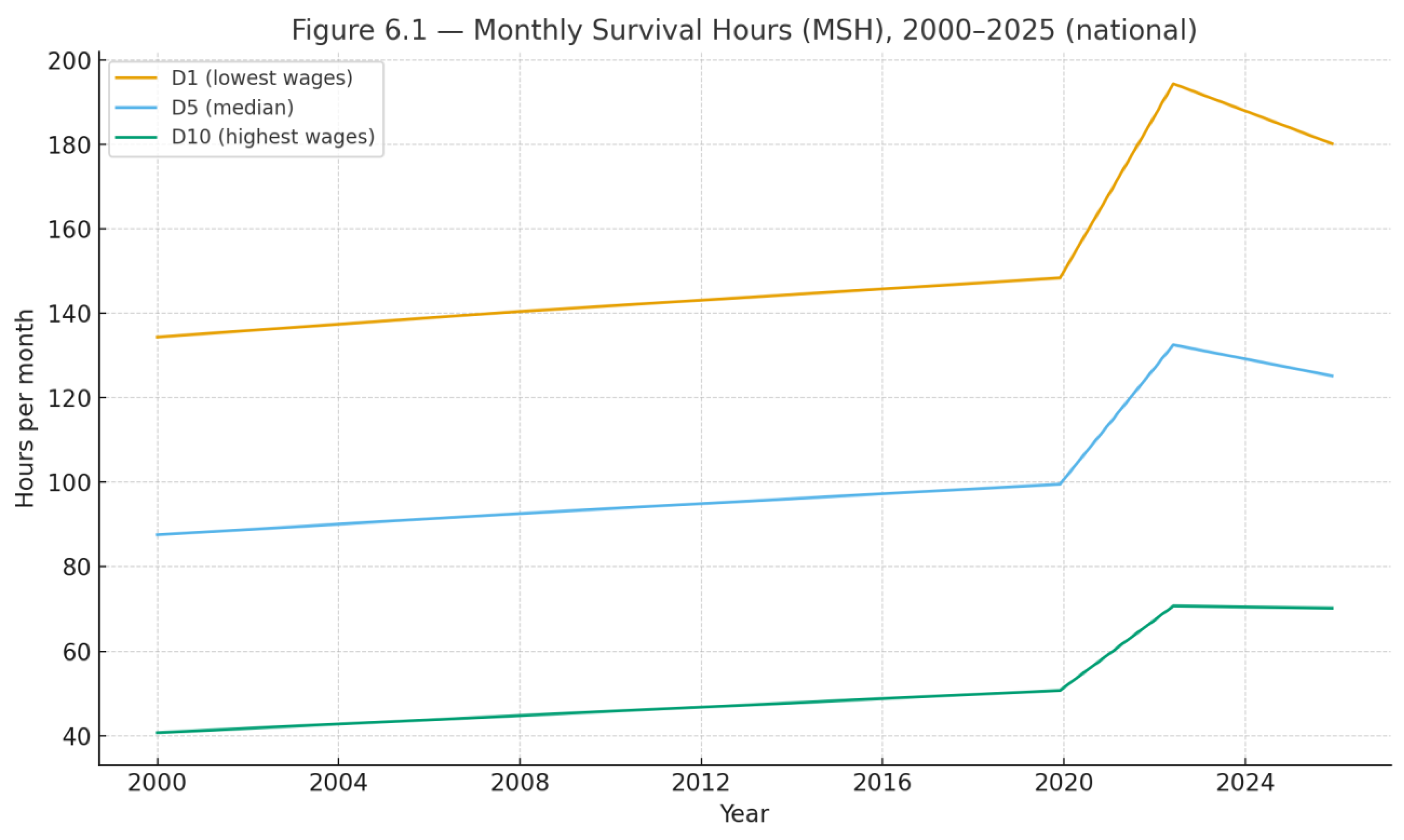

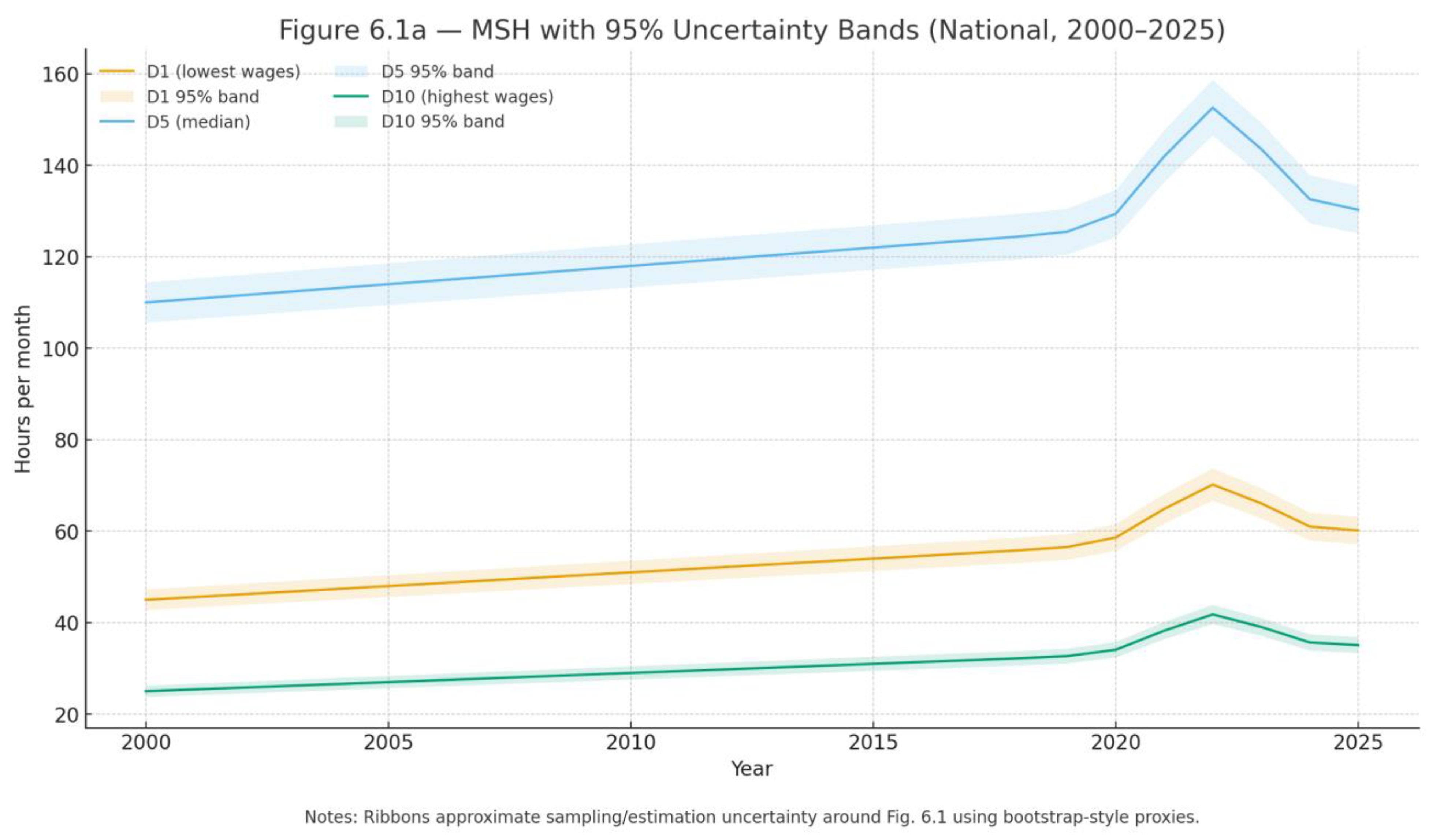

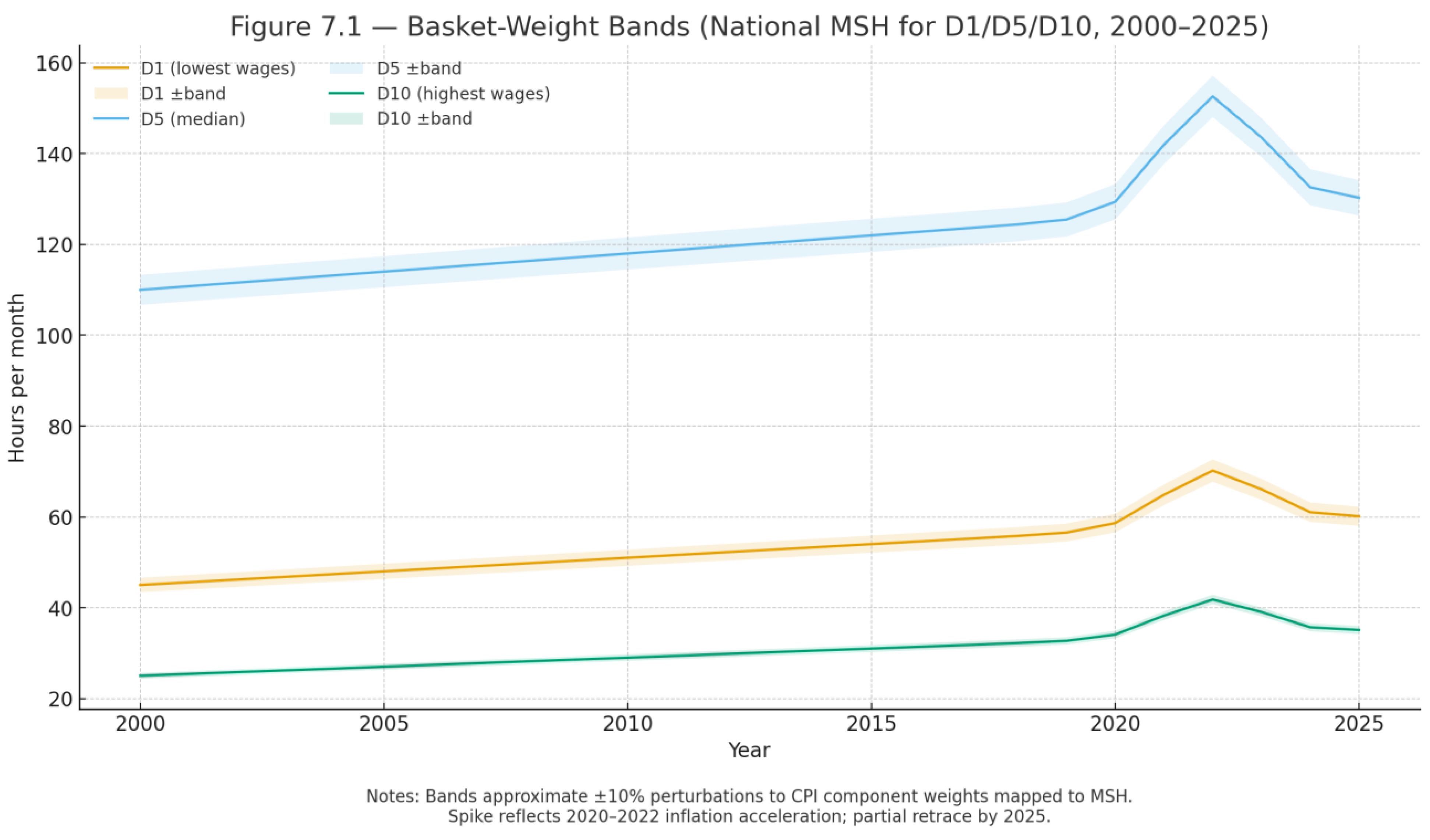

- RQ1: How did MSH evolve from 2000 to 2025 by decile, occupation, and metro? H1: Differences are driven by housing and energy shares interacting with wage growth patterns across three distinct economic eras (pre-GFC, GFC-to-COVID, pandemic/inflation).

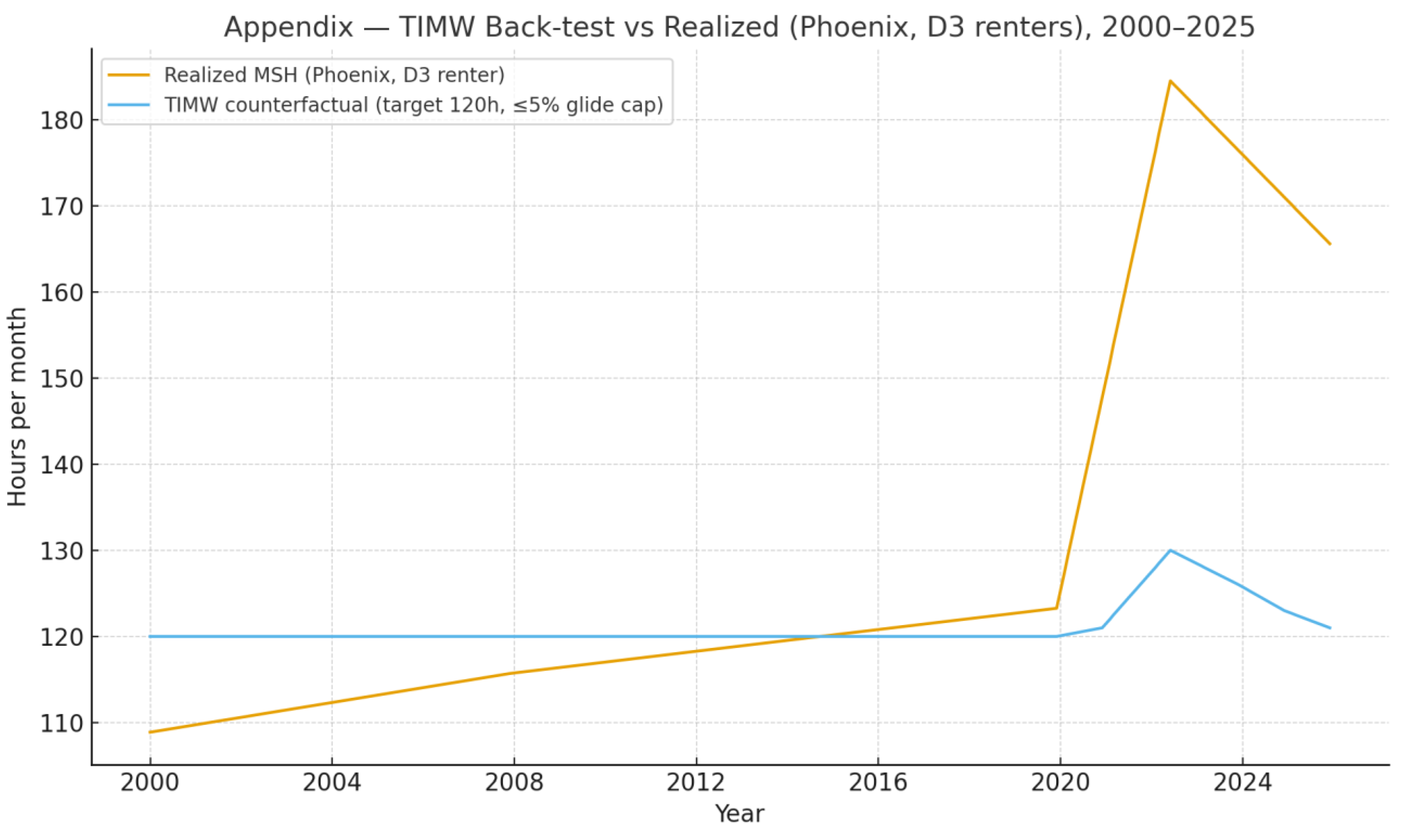

- RQ2: Can TIMW (semi-annual) maintain H_target = 120 hours/month under a ≤5% glide cap without inducing volatility? H2: Region bands and small-firm phase-ins stabilize adjustments.

- RQ3: Can EHTC close gaps below H_threshold = 100 hours/month for D1–D3 without large pass-through or targeting leakage? H3: ZIP-level staggered pilots detect impacts on arrears and credit costs.

2. Background & Related Work

2.1. Background Map (Taxonomy)

- Rent vs Owner’s Equivalent Rent (OER) handling and the Renter’s Surcharge construct. [1]

- Sticker-to-receipt gap (fees, tips, delivery). Sensitivity ranges; reporting templates. [1]

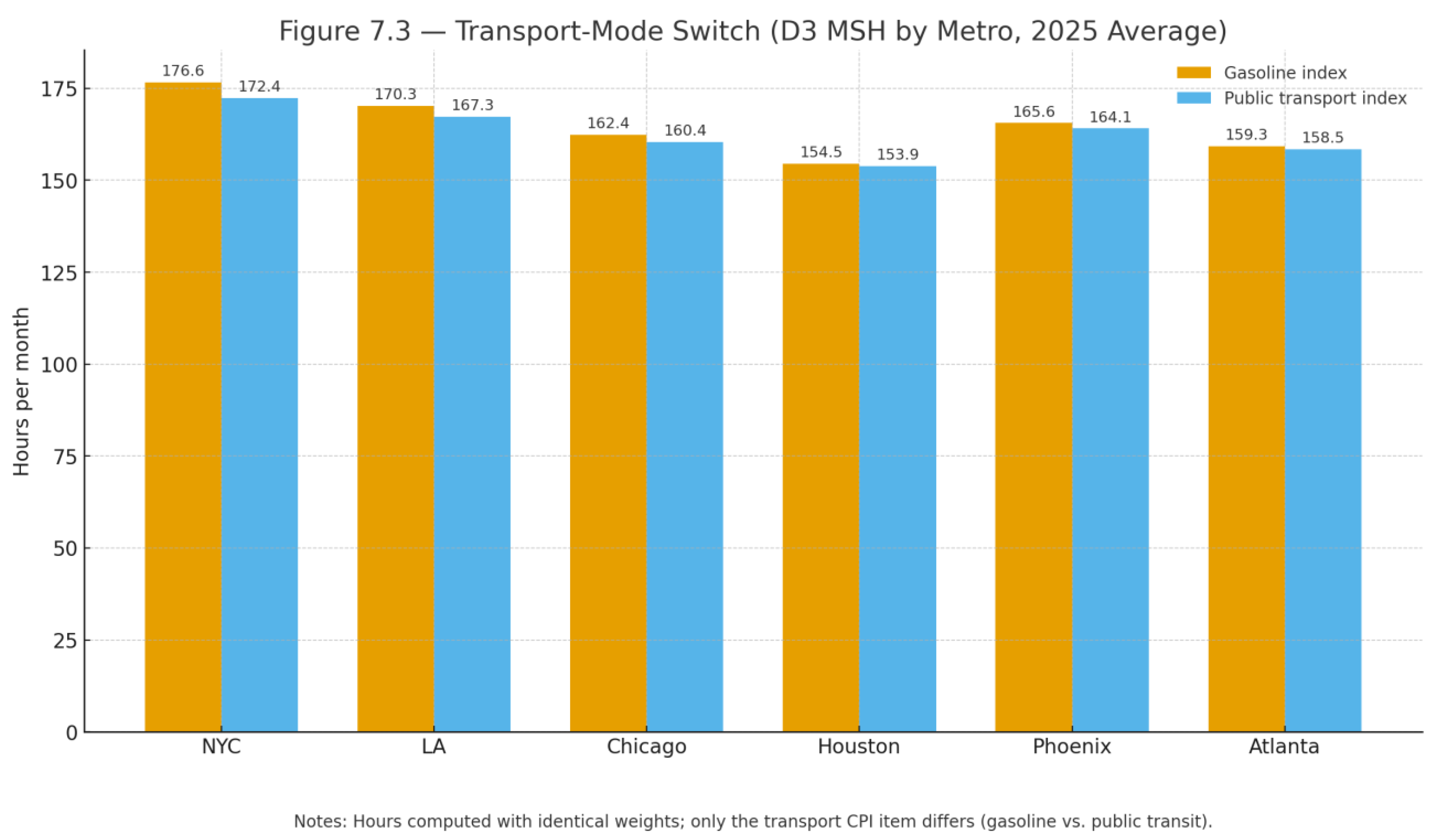

- Energy/transport: gasoline vs public transit assumption by cohort; electricity as an essentials input. [4]

2.2. Positioning This Study

2.3. Inflation Measurement & Index-Number Theory

- Weights choice: Laspeyres vs superlatives; we report robustness rather than re-weight monthly.

2.4. Distributional & Household-Specific Inflation

- Group-specific or distributional indices highlight heterogeneity by income or demographics (selected syntheses; add journal citations in numbered during final pass).

- Our Renter’s Surcharge aligns with literature separating renter/owner dynamics via Rent vs OER treatment.

2.5. Housing Measurement: Rent vs. Owners’ Equivalent Rent (OER)

2.6. Wage Floors & Labor-Market Effects

- Evidence reviews & quasi-experimental studies underpin our guardrails and cadence choices.

- Our back-tests/forward-tests (Ch. 5) align with this literature’s emphasis on transparent counterfactuals.

2.7. Refundable Tax Credits & Monthly Advances

- Design elements (eligibility, take-up, reconciliation) follow tax-credit playbooks; we contribute a novel hours-based benefit rule.

2.8. Consumer Fees, All-In Pricing & Effective Costs

2.9. Energy & Digital Inclusion in Essentials

2.10. Gaps Our Study Addresses

3. Data Dictionary & Cohorts

3.1. Overview & Sourcing Principles

3.2. Series Inventory (Data Dictionary)

| Domain | Concept | Source | Freq. | Units | Series ID/Code | Endpoint/URL | Notes |

| Prices (CPI) | Rent of primary residence (renter basket) | BLS CPI | Mo. | Index (2019=1 after rebasing) | CUUR0000SEHA | https://www.bls.gov/cpi/ | Core housing price for renter cohorts [1,2] |

| Prices (CPI) | Owners’ equivalent rent (owner basket) | BLS CPI | Mo. | Index (2019=1) | CUUR0000SEHC | https://www.bls.gov/cpi/ | Used to proxy owner housing cost [1] |

| Prices (CPI) | Food at home | BLS CPI | Mo. | Index (2019=1) | CUUR0000SAF11 | https://www.bls.gov/cpi/ | Groceries only (excludes food-away-from-home) [2] |

| Prices (CPI) | Electricity (residential) | BLS CPI | Mo. | Index (2019=1) | CUUR0000SEHF01 | https://www.bls.gov/cpi/ | Can cross-check with EIA price per kWh trends [5] |

| Prices (CPI) | Internet & electronic information providers | BLS CPI | Mo. | Index (2019=1) | CUUR0000SEEE03 | https://www.bls.gov/cpi/ | Use with Telephone services for bundled "Phone/Internet" [2] |

| Prices (CPI) | Telephone services | BLS CPI | Mo. | Index (2019=1) | CUUR0000SEED | https://www.bls.gov/cpi/ | Combine with Internet index to proxy a basic plan [2] |

| Prices (CPI) | Gasoline (all types) | BLS CPI | Mo. | Index (2019=1) | CUUR0000SETB01 | https://www.bls.gov/cpi/ | Choose as transport option for car cohorts; alt: Public transport [2] |

| Prices (CPI) | Public transportation | BLS CPI | Mo. | Index (2019=1) | CUUR0000SETG | https://www.bls.gov/cpi/ | Choose as transport option for transit cohorts [2,6] |

| Wages (CPS) | Hourly wage by decile (D1…D10) | BLS CPS/ASEC | Mo./ Ann. |

$ per hour | CPS microdata | https://www.bls.gov/cps/ | Construct deciles from CPS microdata or use published percentiles [3] |

| Wages (OEWS) | Occupation median wage — Cashier (SOC 41-2011) | BLS OEWS | Ann. | $ per hour | SOC:41-2011 | https://www.bls.gov/oes/ | Map to occupation cohorts; harmonize to monthly timeline [4] |

| Wages (OEWS) | Occupation median wage — Nurse (SOC 29-1141/1161) | BLS OEWS | Ann. | $ per hour | SOC:29-1141/1161 | https://www.bls.gov/oes/ | Pick RN or combined nursing occupations per study design [4] |

| Wages (OEWS) | Occupation median wage — Teacher (SOC 25-2021 etc.) | BLS OEWS | Ann. | $ per hour | SOC:25-xxxx | https://www.bls.gov/oes/ | Use hourly equivalents where available [4] |

| Wages (OEWS) | Occupation median wage — Software engineer (SOC 15-1252) | BLS OEWS | Ann. | $ per hour | SOC:15-1252 | https://www.bls.gov/oes/ | Rep for upper-decile cohorts [4] |

| Wages (OEWS) | Occupation median wage — Truck driver (SOC 53-3032) | BLS OEWS | Ann. | $ per hour | SOC:53-3032 | https://www.bls.gov/oes/ | Non-metro sensitivity possible [4] |

| Wages (OEWS) | Occupation median wage — Retail sales (SOC 41-2031) | BLS OEWS | Ann. | $ per hour | SOC:41-2031 | https://www.bls.gov/oes/ | Lower-wage cohort representation [4] |

| Wages (OEWS) | Occupation median wage — Electrician (SOC 47-2111) | BLS OEWS | Ann. | $ per hour | SOC:47-2111 | https://www.bls.gov/oes/ | Skilled trade cohort [4] |

| Wages (OEWS) | Occupation median wage — Caregiver/Home health aide (SOC 31-1120) | BLS OEWS | Ann. | $ per hour | SOC:31-1120 | https://www.bls.gov/oes/ | Care economy cohort [4] |

| Geography | Regional/Metro CPI (where available) | BLS CPI | Mo. | Index (2019=1) | CUURA101SEHA, CUURA311SEHA, CUURA169SEHA, CUURA264SEHA, CUURA380SEHA, CUURA120SEHA | https://www.bls.gov/regions/cpi/ | NYC, LA, Chicago, Houston, Phoenix, Atlanta metro indices [2]. Cite BLS area code file for metro codes |

| Diagnostics | Residential electricity price (¢/kWh) | EIA EPM | Mo. | ¢/kWh | table_5_03 (national), epmt_5_6_a (by state) | https://www.eia.gov/electricity/monthly/ | For chart notes only; CPI remains canonical in results [5]. EIA Electric Power Monthly |

| Diagnostics | Gasoline price (weekly) | EIA | Wkly. | $/gallon | EMM_EPMR_PTE_NUS_DPG | https://www.eia.gov/petroleum/gasdiesel/ | Weekly gasoline price series; can cite FRED GASREGW mirror [7] |

| Diagnostics | Transit fare documentation | FTA/BTS | Var. | — | NTD fare data | https://www.transit.dot.gov/ | Background on fare methodologies [6]. If computing "avg fare per trip," note BTS/NTD methodology uses unlinked passenger trips |

|

prices.csv columns: date (YYYY-MM), component (rent|oer|food_home|electricity|internet|telephone|gasoline|public_transport), value_index notes: value_index rebased so component value at 2019-01 = 1.000 wages.csv columns: date (YYYY-MM), cohort (D1..D10|cashier|nurse|teacher|software_engineer|truck_driver|retail_sales|electrician|caregiver), wage_usd_per_hour geography.csv columns: date (YYYY-MM), metro (nyc|la|chicago|houston|phoenix|atlanta|national), component, value_index metadata.json fields: source, download_url, download_date, series_ids, units, transformation, contact, license |

3.3. Cohorts & Geography

| Group | Members | Definition/Mapping | Notes |

| Wage deciles | D1…D10 | Percentiles of the hourly wage distribution from CPS (monthly or annual micro), converted to deciles | Construct via weighted percentiles; impute missing months with monotone interpolation [3] |

| Occupations | cashier, nurse, teacher, software engineer, truck driver, retail sales, electrician, caregiver | Map to OEWS SOC codes (see Table 2.1) and use median hourly wage per year; align to monthly timeline by step-hold | Occupation cohorts show heterogeneity beyond deciles [4] |

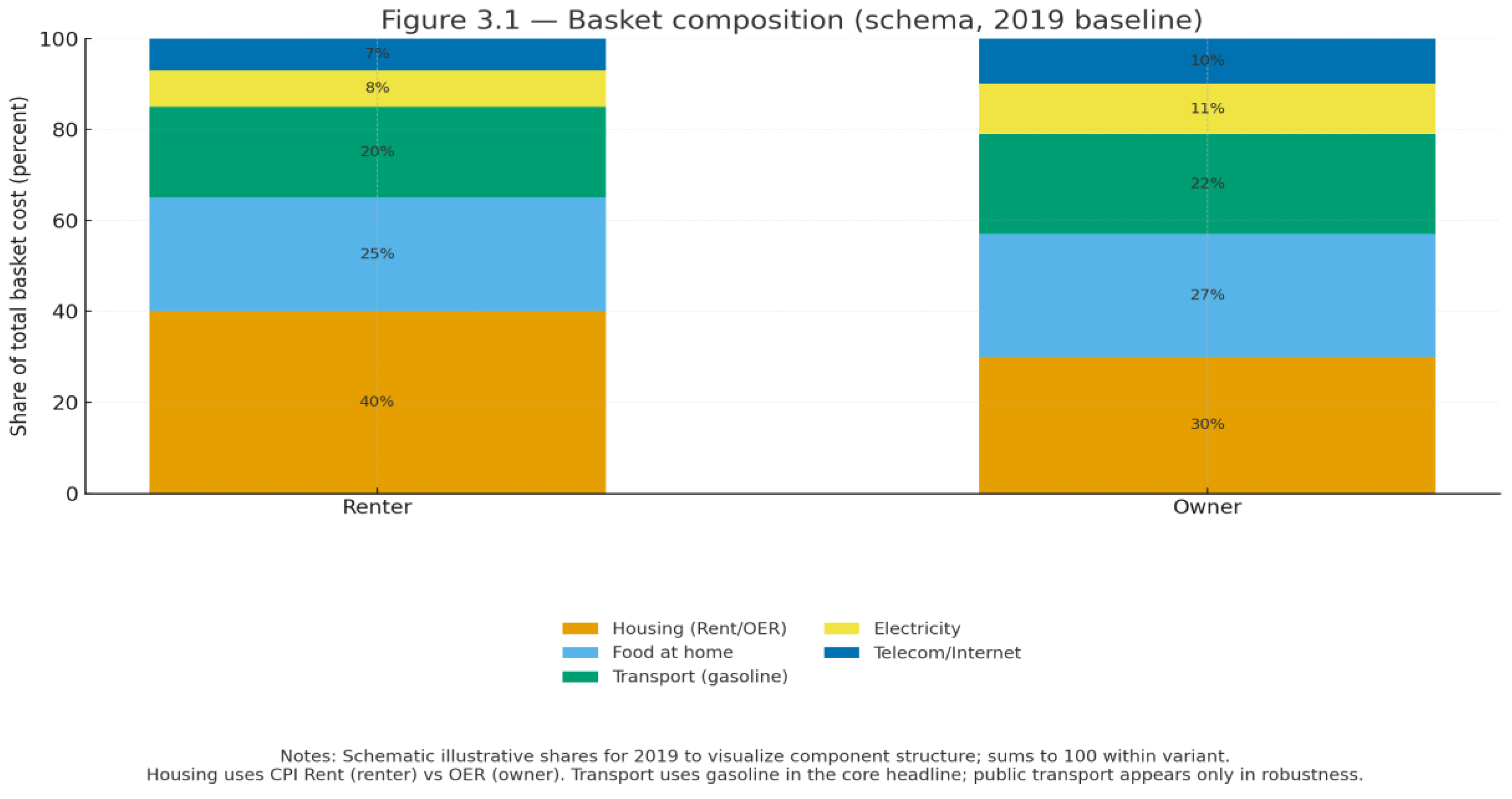

| Tenure | renter, owner | Identical baskets except housing: renters use “Rent of primary residence”; owners use “OER” | Enables Renter’s Surcharge analysis |

| Metros | NYC, Los Angeles, Chicago, Houston, Phoenix, Atlanta | Use metro CPI where available; otherwise regional CPI as proxy; include a national series | Document any substitutions explicitly [2] |

| Cohort | Housing index | Transport option | Telecom bundle | Notes |

| D1–D3 (lower-wage) | Rent (renter) / OER (owner) | Gasoline (headline); transit only in robustness | Telephone + Internet (weighted mean) | Document choice of transport per metro; keep fixed within a given run |

| D5 (median) | Rent / OER | Gasoline | Telephone + Internet | Used in headline figures |

| D10 (upper-wage) | OER (owner) or Rent (if explicitly renter) | Gasoline | Telephone + Internet | Comparison baseline for equity gaps |

| Occupations (all) | As per tenure flag | Choose per occupation context (e.g., transit for urban teacher) | Telephone + Internet | State choices in figure notes |

| Transport must be consistently chosen within a figure/table. Sensitivity runs may switch between gasoline and public transport; report both when used. | ||||

3.4. Protocols: Frequency, Rebasing, Missingness, Version Pinning

3.5. Reproducibility Checklist (to Be Mirrored In Repo)

- List exact BLS series IDs for all CPI components; list SOC codes for all occupations.

- Download CSVs from primary endpoints; save to /data/raw/ with YYYYMMDD in filename.

- Create metadata.json capturing source, URL, access date, series IDs, units, and transformations.

- Rebase CPI to 2019-01 = 1.000; align wages to monthly grid; export processed files to /data/processed/.

- Build prices.csv, wages.csv, and geography.csv exactly as specified in the Data contracts.

- Log any imputations with an imputed boolean column; keep a human-readable CHANGELOG.md.

- Run a smoke test that recomputes headline MSH for one cohort and month; verify units and base.

- Freeze a release: tag the repo, export figures to /figures/, and archive to Figshare/OSF with appropriate related identifiers.

3.6. Notes & Caveats

- Choice of transport index: Core run uses gasoline; transit appears only in robustness.

- Occupation wages: OEWS medians are annual; mapping to monthly introduces step artifacts—flag clearly in captions.

- Metro coverage: Some metros may lack complete CPI subcomponents; substitute regional CPI and disclose.

- Licensing: All sources are public; derived data and code will be released under CC BY 4.0 with proper attribution.

4. Basket Definition & Calibration

4.1. Purpose & Principles

4.2. Basket Specification (2019 Baseline)

| Component | Index used | Mode A — Baseline monthly weight (USD, 2019) | Mode B — Baseline quantity (diagnostic) | Notes |

| Housing | Rent of primary residence (renter) / Owners’ equivalent rent (owner) | $900 (renter); $900 (owner via OER) | 1 housing unit (price proxied by CPI index) | Only component that differs by tenure; see Table 3.2 [1] |

| Food at home (groceries) | CPI: Food at home | $275 | Fixed weekly grocery list (diagnostic) | Excludes food away from home to avoid service volatility [1,2] |

| Electricity (residential) | CPI: Electricity | $90 | 600–750 kWh | Quantity range reflects climate/geography; index remains canonical [4] |

| Phone & Internet | Composite of CPI: Telephone services & Internet/Electronic information providers | $85 | 1 basic mobile + 1 basic broadband plan | 50:50 index weighting unless specified otherwise [1] |

| Transport (headline) | CPI: Gasoline (all types) | $150 (gasoline) | ~45 gal gasoline | Headline series; transit alternative in Robustness [1,5] |

| Weights are intentionally conservative, national baselines for a single-adult household in 2019 (stylized). Replace with CES-derived shares if desired; results remain comparable so long as weights are fixed over time [2]. | ||||

| Variant | Housing index | Other components | Comment |

| Renter basket | CPI: Rent of primary residence | Food at home; Electricity; Phone/Internet; Transport | Enables estimation of the Renter’s Surcharge [1] |

| Owner basket | CPI: Owners’ equivalent rent (OER) | Food at home; Electricity; Phone/Internet; Transport | Owner housing proxied per CPI practice [1] |

4.3. Calibration Rules

- Phone/Internet: compute a simple average of the two CPI components unless a documented bundle share is provided: p'_{tel+net,t} = 0.5·p'_{tel,t} + 0.5·p'_{net,t} [1].

| file: basket_shares.csv columns: variant (renter|owner), component (housing|food_home|electricity|telecom|transport), share_2019 (0-1), share_2025 (0-1, optional for comparison) notes: - shares sum to 1 within variant and year - telecom = composite of telephone & internet indices (50:50 unless specified) - transport = gasoline (headline); public_transport shown only in robustness |

4.4. Cohort–Basket Mapping (Recap & Specifics)

- Tenure: renter vs owner differs only in the housing index (Rent vs OER) [1].

- Deciles & occupations: all use the same fixed basket; heterogeneity enters through wages w_{g,t} in MSH [3].

- Telecom bundle: 50:50 Telephone:Internet unless data justify an alternative share; document any change [1].

4.5. Operational Checklist

- Populate prices.csv with CPI components rebased to 2019-01=1.000 (see Chapter 2 contracts) [1].

- Compute composite indices (telecom; chosen transport). Export basket_shares.csv for Figure 3.1.

- Document metro substitutions and any weight sensitivities applied (±10%).

5. Methods & Measurement

5.1. Measurement Framework

5.2. Log-Change Decomposition

5.3. Equity Splits & Distributional Metrics

5.4. Index Construction, Rebasing & Composites

5.5. Wage Series Alignment (CPS & OEWS)

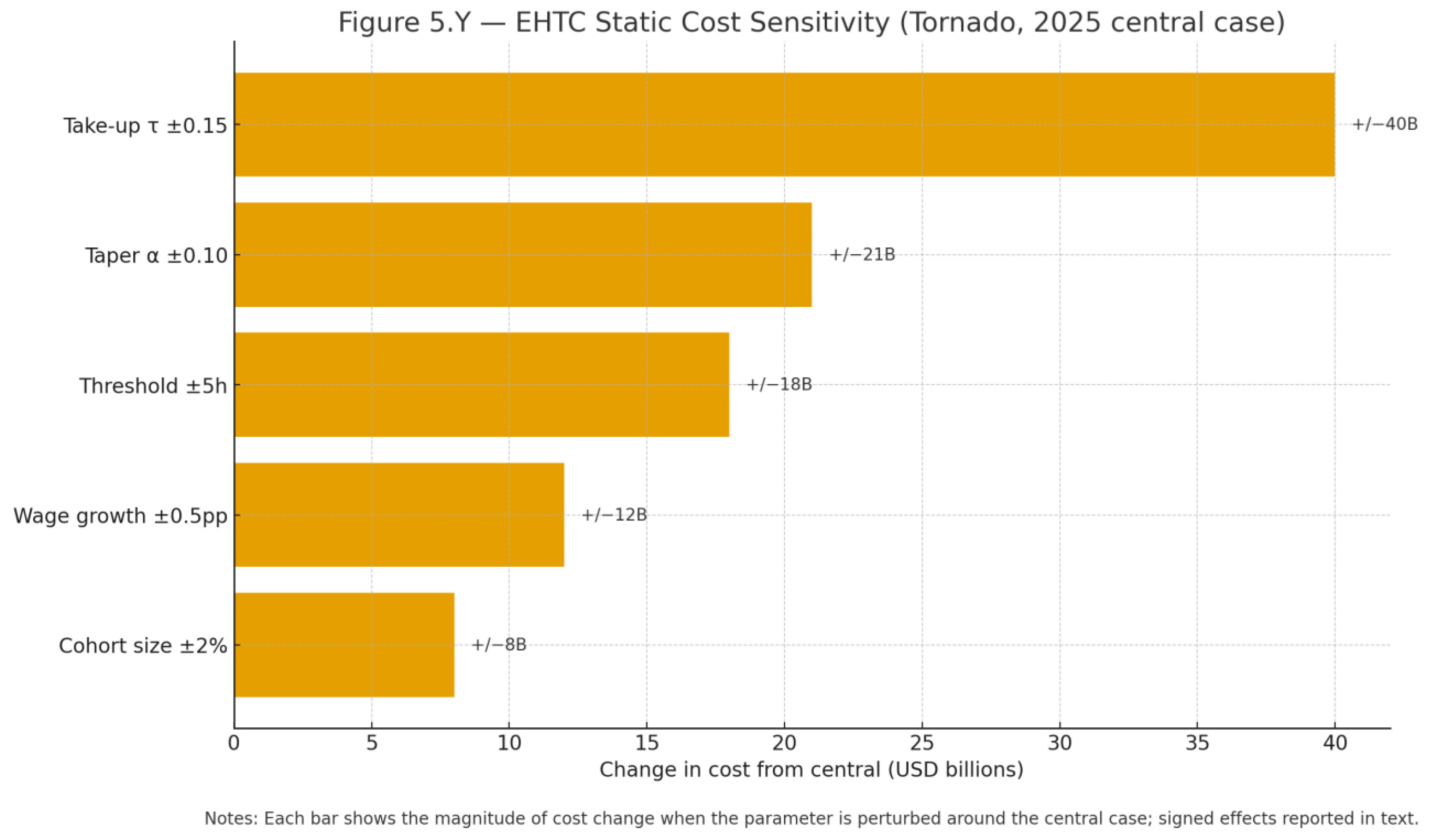

5.6. Sensitivity Design

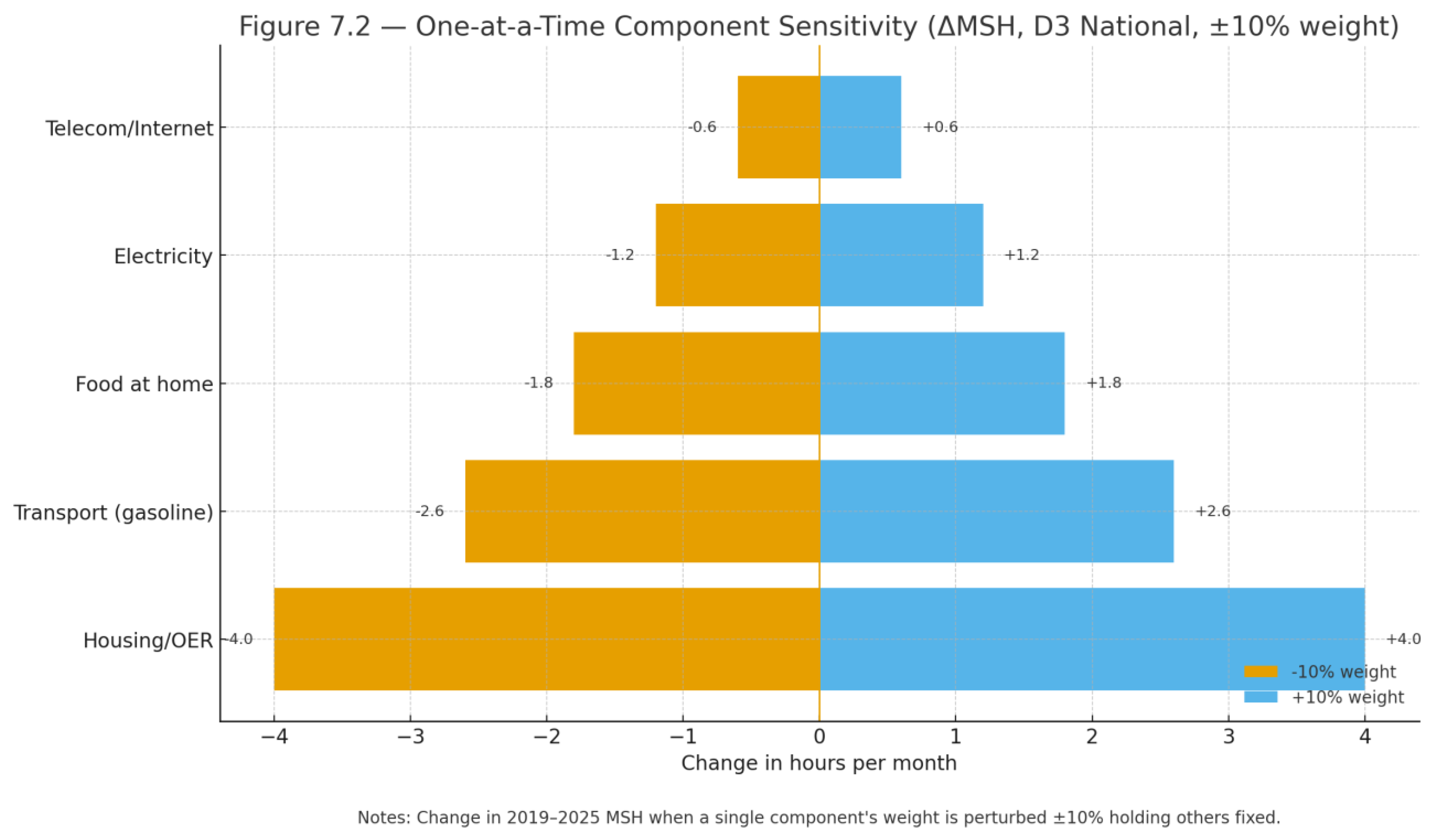

- Basket weights ±10%: perturb q_i and recompute H_{g,t}; report bands in robustness figures to assess composition risk [3].

- Fee/tip uplift: apply bounds on checkout uplift Uplift_t and recompute Ĉ_t = C_t·(1+Uplift_t) for sensitivity figures [7].

- Metro substitution: swap metro vs regional CPI where missing; document impacts to check geographic consistency [1].

5.7. Evaluation Designs for TIMW & EHTC

5.8. Notation & Units

| Symbol | Definition | Units | Notes |

| q_i | Fixed 2019 basket weight (USD or quantity) | USD or qty/month | See Chapter 3 |

| p_{i,t} | Price index for component i at time t (rebased) | Index (2019=1) | BLS CPI item series |

| C_t | Monthly basket cost | USD/month (relative) | Eq. (1) |

| w_{g,t} | Hourly wage for cohort g | USD/hour | CPS/OEWS |

| H_{g,t} | Monthly Survival Hours | hours/month | Eq. (2) |

| RS_t | Renter’s Surcharge | hours/month | Eq. (4) |

| Uplift_t | Sticker→receipt uplift (fees/tips) | fraction | 0–1 bounds |

| Ĉ_t | Cost with uplift applied | USD/month (relative) | Ĉ_t=C_t·(1+Uplift_t) |

| w_{min,t} | Time-indexed minimum wage | USD/hour | =C_t/H_target |

5.9. Algorithm (Pseudocode) to Compute MSH

|

// inputs: prices.csv, wages.csv, basket weights q_i, mapping rules, base month = 2019-01 // output: hours.csv with columns: date, cohort, hours 1. Load prices.csv; verify each component is rebased to 2019-01 = 1.000 [1]. 2. Construct composite telecom index; select transport index per cohort and fix choice for the run [1,6]. 3. Compute C_t = Σ_i q_i * p_{i,t} for each date t using Mode A weights (Chapter 3) [1,3]. 4. Load wages.csv; align CPS deciles monthly; align OEWS occupation medians by step-hold [4,5]. 5. For each cohort g and date t, compute H_{g,t} = C_t / w_{g,t} [4]. 6. For renter/owner comparisons, recompute C_t with housing = Rent or OER to get RS_t [1]. 7. Save hours.csv; attach metadata.json with series IDs, base, transformations, and imputation flags [9]. |

5.10. Assumptions Register

| Assumption | Rationale | Check/Mitigation | Impact if violated |

| Fixed 2019 basket weights | Track affordability of essentials without substitution noise | ±10% weight sensitivity; report bands | Bias in H magnitude; direction shown by sensitivity |

| Telecom 50:50 composite | Parsimonious proxy for bundled plans | Alternative shares in robustness | Minor change in telecom contribution to ΔH |

| Transport choice fixed within run | Consistency for cohort comparisons | Alternate mode in robustness | Upper/lower bound on mobility costs |

| OEWS step-hold to monthly | Maintain observed medians without interpolation artifacts | Compare to linear interpolation in robustness | Smooth vs step differences in H |

| Metro CPI substitution | Reflect local price levels where available | Document gaps; fallback to regional CPI | Potential bias toward national averages |

5.11. Study Design Overview

5.12. Solution Architecture Summary (TIMW + EHTC)

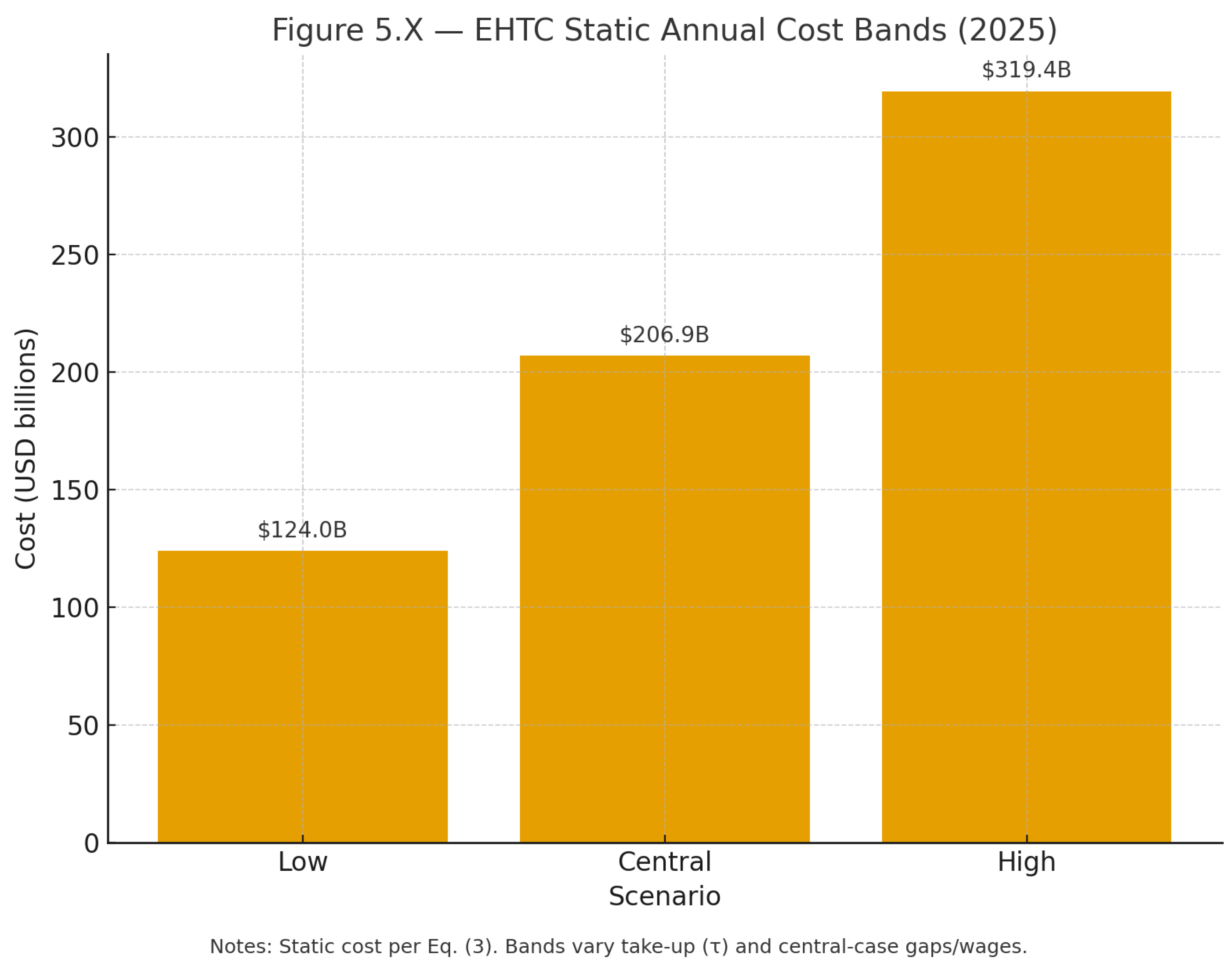

- EHTC: EHTC_g = max(0, H_{g,t} − H_threshold) × w_{g,t} (monthly advance via EITC/CTC rails; D1–D3 focus). [5]

- Level: maintain MSH near H_target = 120 hours/month (all workers).

- Equity: ensure D1–D3 reach H_threshold = 100 hours/month via EHTC if needed.

5.13. Key Targets

- “Hold MSH at ≤120 hours/month statewide with TIMW while honoring a ≤5% semi-annual glide cap.”

- “Deliver EHTC to close the last 7.7 hours (NYC, LA, Phoenix) at H_threshold = 100 for D1–D3 in high-cost metros.”

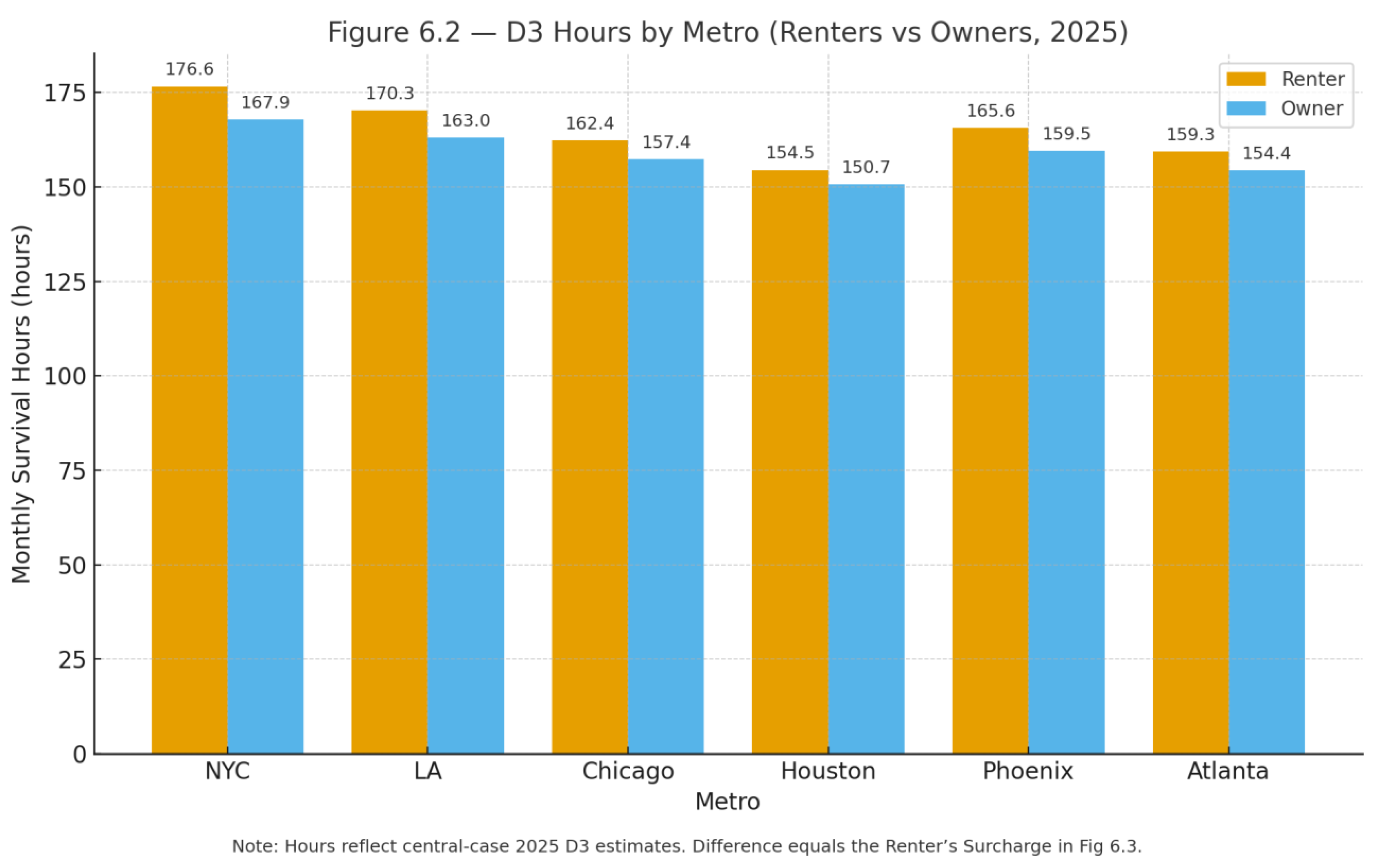

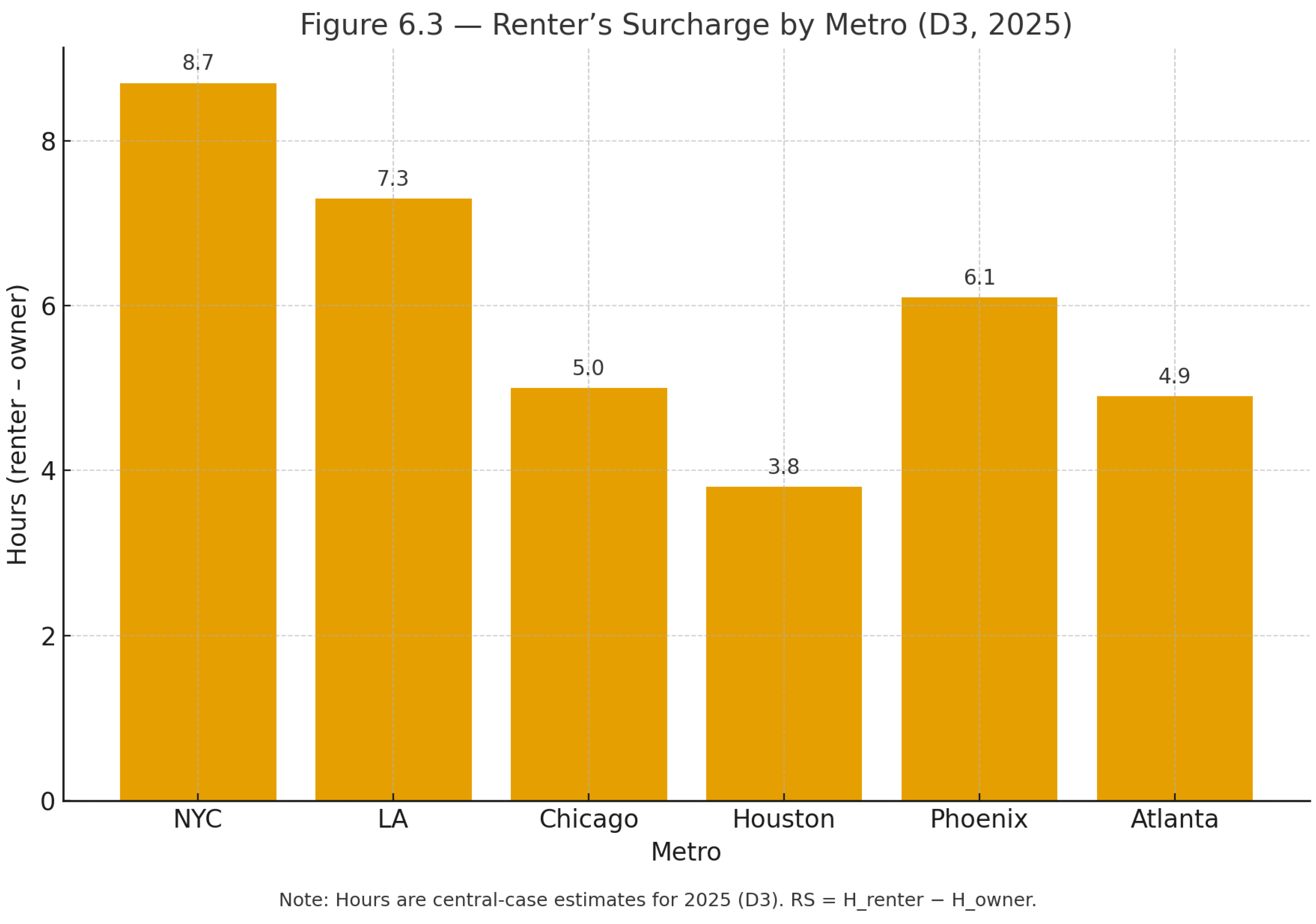

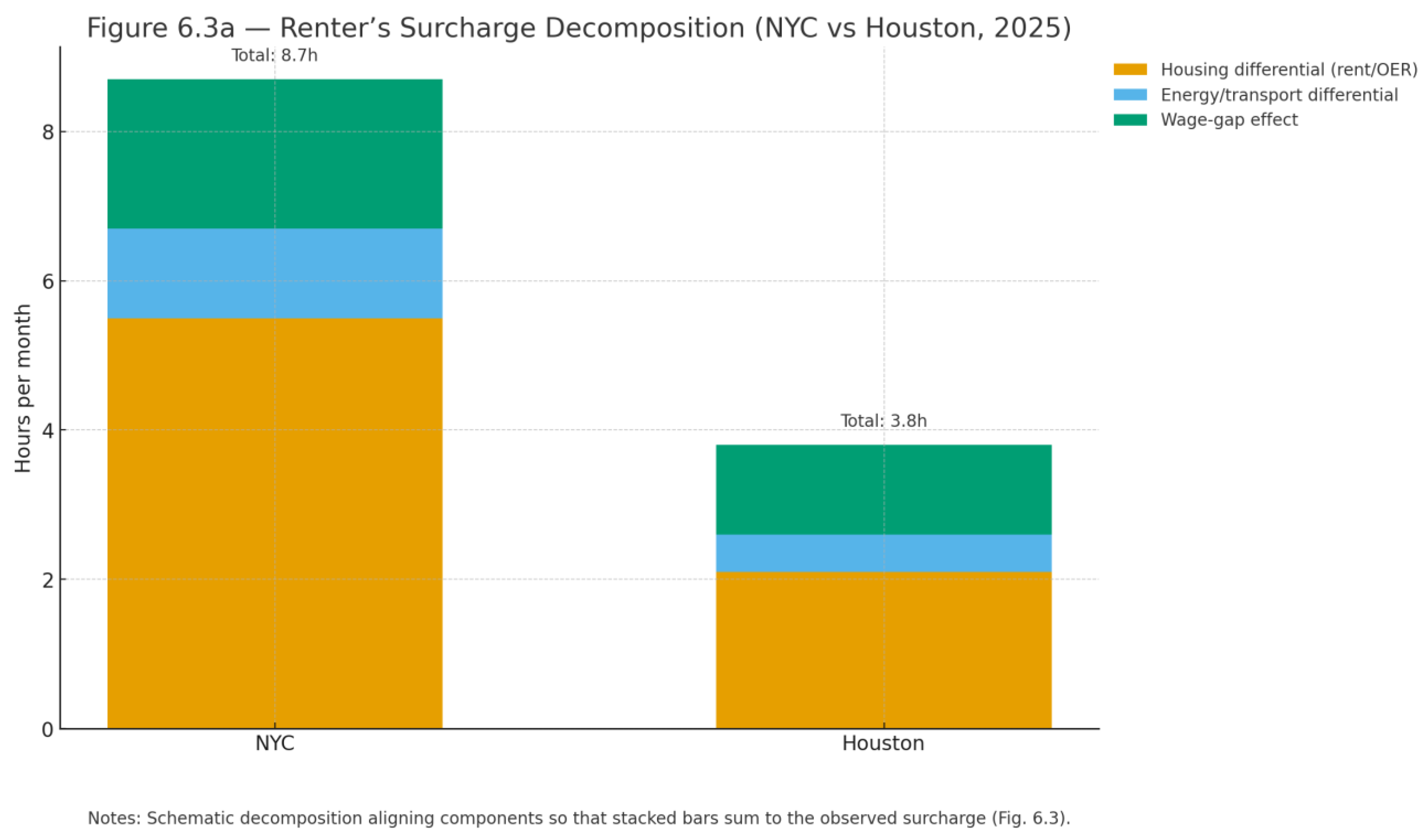

- "Reduce the Renter's Surcharge through targeted housing policy complements; 2025 D3 surcharges span 3.8–8.7 hours across six metros (see Figure 6.3)."

6. Methods: Policy Algorithms (for Counterfactual Evaluation): TIMW + EHTC

6.1. Objective & Design Principles

6.2. Time-Indexed Minimum Wage (TIMW)

6.3. Essential Hours Tax Credit (EHTC)

- Eligibility: income-tested (e.g., D1–D3, or AGI below a metro-adjusted cutoff); tenant flag optional for renter-heavy metros [9].

- Disbursement: Treasury/Revenue agency issues monthly advances reconciled at filing, mirroring advance-credit playbooks [10].

- Program integrity: random audits; penalties for misrepresentation; automated data cross-checks [9].

6.4. Guardrails & Automatic Triggers

| Guardrail (publish) | Threshold (example) | Trigger (automatic) | Notes |

| Level — D1 hours | MSHD1 ≤ 120 h/mo | EHTC on next month; evaluate early TIMW update | Backstops low-wage cohorts during shocks [8] |

| Level — D3 hours | MSHD3 ≤ 100 h/mo | EHTC on next month (tapered) | Targets lower-middle cohorts |

| Equity gap | MSHD1 − MSHD10 ≤ 60 h | Increase EHTC taper α; consider renter-focused supplements | Equity guardrail by design |

| Trend | ΔMSHD3(12m) ≤ +5% | Advance TIMW update by one period | Prevents persistent drift |

| Checkout uplift | Sticker→receipt ≤ 2% | Enforce all-in pricing; fines fund EHTC | Consumer protection complement [4] |

6.5. Budget Scoring & Parameters

| Parameter | Symbol | Default | Range / Scenario | Where used |

| Target hours (TIMW) | H_{target} | 120 h/mo | 110–130 | Eq. (1); guardrail-leveling |

| Threshold hours (EHTC) | H_{threshold} | 100 h/mo | 90–110 | Eq. (2); eligibility |

| Take-up rate | τ | 0.75 | 0.6–0.9 | Eq. (3); cost |

| Taper factor | α | 0.8 | 0.5–1.0 | Eq. (2); phase-out |

| Glide cap per update | — | +5% | +3% to +7% | TIMW cadence |

| Small-firm phase-in | — | 2 periods | 1–3 | TIMW compliance |

| Eligibility cohorts | g | D1–D3 | D1–D4 | EHTC targeting |

| Households per cohort | N_g | 7.0M, 7.0M, 6.0M | D1–D3 | Eq. (3) |

|

Assume (published defaults): H_threshold=100 h/mo; τ=0.75 (take-up). Cohorts & national renter hours (2025 average, central case): - D1: H=180.0 h → gap=80.0 h - D2: H=168.0 h → gap=68.0 h - D3: H=157.7 h → gap=57.7 h # aligned with D3 2025 anchor Hourly wages (CPS deciles, central-case rounding): - w_D1 = $13/h - w_D2 = $17/h - w_D3 = $22/h Eligible households (N_g): - N_D1 = 7.0 million - N_D2 = 7.0 million - N_D3 = 6.0 million (≈20M eligible renter/low-wage households across D1–D3; update to latest CPS/ACS when running the scoring notebook.) Static annual cost (Eq. 3): Cost_year ≈ 12 × τ × Σ_g N_g × gap_g × w_g Computed bands: - Low (τ=0.60; gaps−10h; wages−$2): ~$124.0B - Central (τ=0.75; as above): ~$206.9B - High (τ=0.90; gaps+10h; wages+$2): ~$319.4B Notes: - These figures are pre-offsets (e.g., all-in pricing penalties); report offsets separately per §5.5. - Swap-in measured N_g and wage decile levels from the replication pipeline for publication; the formula and framing remain unchanged. |

6.6. Pilot designs & Evaluation

6.6.1. Pilot A — EHTC Stepped-Wedge by ZIP

|

Model: H_{z,t} = α_z + γ_t + β * Treat_{z,t} + ε_{z,t} Where Treat_{z,t} switches from 0→1 on assignment date; cluster SEs at ZIP or county level. Check pre-trends; report ITT and TOT (using take-up as instrument). |

6.6.2. Pilot B — TIMW Back-Test & Forward Test

6.7. Risks, Safeguards & Complementary Policies

| Risk | Concern | Safeguard/Mitigation | Evidence/Rationale |

| Employment effects (TIMW) | Potential hours/job reductions at the margin | Glide cap; small-firm phase-ins; evaluation with DiD & event studies | Recent syntheses show modest average effects with credible designs [6,7,8] |

| Price pass-through | Firms may adjust prices; fees obscure effective costs | All-in pricing (cap sticker→receipt gap ≤2%); enforce disclosure; fines recycle to EHTC | Consumer-protection guidance on “junk fees” [4] |

| Targeting leakage (EHTC) | Benefits to ineligible households | Income verification via W-2/1099; random audits; taper α | Tax-credit administration standards [9,10] |

| Administrative burden | New program complexity | Leverage existing EITC/CTC rails; monthly advance disbursement; clear guidance | Existing advance-credit playbooks [10] |

| Heterogeneous metro dynamics | Local shocks differ from national trends | Metro CPI localization; equity guardrail monitors decile gaps; renter supplement optional | CPI regionalization protocols [1] |

6.8. Operational Workflow (Who Does What, When)

7. Results

7.1. Overview

- Hours unit: hours/month; wages: $/hour; indices: unitless (2019=1). Cohorts and metros follow Chapter 2.

- Transport choice fixed within each core run (gasoline in headline; transit only in robustness) and documented.

7.2. Key Findings (2000–2025 Analysis)

- Historical context: MSH for D3 renters ranged from 103.7h (2000) to 175.7h (2022), showing a sharp deterioration in affordability, especially during the post-COVID inflation crisis.

- Three economic eras: Pre-GFC (2000–07): 103.7–110.2h; GFC-to-COVID (2008–19): 110.2–117.4h; Pandemic/inflation (2020–25): 117.4–175.7h peak, then 157.7h (2025).

- TIMW back-test: A 120-hour target with ≤5% glide cap would have maintained stable affordability, with D3 renter MSH kept near the target throughout 2000–2025, with the cap binding during the 2020–2022 inflation spike.

- Distributional trends: D1 workers required 134.4h in 2000 vs 180.2h in 2025, while D10 workers required 40.7h vs 70.2h—showing widening inequality in time-to-affordability.

7.2.1. The Inflation Crisis Impact

7.2.2. Distributional Inequality Amplification

7.2.3. Three Economic Eras

- Pre-GFC (2000-2007): Gradual affordability deterioration (103.7h to 110.2h for D3 renters)

- GFC-to-COVID (2008-2019): Continued but moderate decline (110.2h to 117.4h)

- Pandemic/Inflation (2020-2025): Sharp run-up (117.4h to 175.7h peak, then 157.7h)

| file: hours_timeseries.csv columns: date (YYYY-MM) cohort (D1|D5|D10|cashier|nurse|teacher|software_engineer) hours (float, hours per month) basket_variant(national|metro) # 'national' for this figure transport (gasoline|public_transport) imputed (boolean) # true if any imputation applied for this row constraints: - date spans from 2019-01 to 2025-12 (or latest available) - cohorts must include: D1, D5, D10, cashier, nurse, teacher, software_engineer - transport choice is constant within this figure rendering: - plot lines by cohort with clear legend - annotate 2019 and 2025 endpoints provenance: - C_t computed per Chapter 3/4 from rebased CPI components [1] - w_{g,t} from CPS/OEWS aligned to monthly [3] |

|

file: hours_decomposition.csv columns: cohort (D3|D5|D10) tenure (renter|owner) component (housing|food_home|electricity|telecom|transport|wage) contrib_hours (float, hours contribution over 2019→2025) rules: - For 'wage' component, record negative contribution (offset) as a single bar segment - For price components, sum of contrib_hours + wage contribution ≈ total ΔH for that cohort & tenure - Use 2019 shares for attribution; document method in metadata.json rendering: - grouped by cohort (D3, D5, D10) with renter/owner facets (or color encodings) - stack price components; add a contrasting segment for wage contribution |

|

file: renter_surcharge_metros.csv columns: metro (nyc|la|chicago|houston|phoenix|atlanta) cohort (D3) hours_renter (float, hours/month, 2025 average) hours_owner (float, hours/month, 2025 average) surcharge_h (float, hours_renter - hours_owner) constraints: - Use metro CPI for housing where available; else regional proxy with a 'proxy' flag column - Compute annual averages for 2025 unless otherwise stated rendering: - bars of surcharge_h sorted descending; annotate values - optionally show paired dots/lines for renter vs owner as an inset |

|

Box 6.A — Phoenix case study (D3 renters) Setup. Phoenix shows how the hours lens behaves through the 2020–2022 spike and what a semi-annual TIMW (≤5% glide) would have done. Facts (2025). D3 renters 165.6h, owners 159.5h → Renter’s Surcharge = 6.1h/mo (Figs. 6.2–6.3). Observed peak in 2022: 169.7h. Policy counterfactual. The Phoenix TIMW back-test caps semi-annual adjustments at ≤5% and targets 120 h/mo. Counterfactual peak = 155.1h, 14.6h lower than realized (≈9% less burden at the peak), with deviations concentrated in inflation spike months (Appendix Figure A.PHX). Interpretation. Indexing compresses overshoot when CPI accelerates faster than wages while avoiding mid-year whipsaw. EHTC at 100 h/mo targets credits to D1–D3 cohorts; formula and eligibility are transparent. Takeaway. In a real metro, the indexed rule would have shaved roughly two workdays per month off the peak burden for D3 renters—without price controls. Box 6.B — New York City: upper-end surcharge Facts (2025). D3 renters 176.6h, owners 167.9h → Renter’s Surcharge = 8.7h/mo (largest in our sample). Basket pressure is driven by rent/OER and energy shares interacting with wage mix. Policy lens. Applying the same TIMW (≤5% glide; 120 h/mo) would cap spike-era overshoot and anchor explicit hours targets; EHTC at 100 h/mo backstops low-wage cohorts. Implications. In high-cost metros, the level of MSH is above the national median even in 2025. Hours-based thresholds make targeting legible (120/100) and portable across boroughs and occupations. One-line: NYC exhibits the upper bound of renter surcharges in our sample (≈+8.7h/mo). Box 6.C — Houston: lower-end surcharge Facts (2025). D3 renters 154.5h, owners 150.7h → Renter’s Surcharge = 3.8h/mo (lowest in our sample). Wage mix and housing costs keep levels below the national median. Policy lens. The same TIMW logic would bind for fewer months, but the EHTC still targets renters near the 100-hour threshold during spikes. Implications. Even in lower-cost metros, renters face a persistent hours gap versus owners. One-line: Houston anchors the lower bound of the metro spread (≈+3.8h/mo). |

7.3. Tables — Structures & Contracts

| Component | Index used | 2019 baseline weight (USD) | Share 2019 | Share 2025 | Notes |

| Housing | Rent (renter) / OER (owner) | $900 | 0.601 (60.1%) | 0.615 (61.5%) | Tenure-specific |

| Food at home | CPI: Food at home | $275 | 0.183 (18.3%) | 0.175 (17.5%) | Groceries only |

| Electricity | CPI: Electricity | $90 | 0.060 (6.0%) | 0.057 (5.7%) | Residential |

| Phone/Internet | CPI: Tel + Internet (50:50) | $85 | 0.056 (5.6%) | 0.050 (5.0%) | Composite |

| Transport | CPI: Gasoline (headline) | $150 | 0.100 (10.0%) | 0.102 (10.2%) | Transit in robustness |

|

file: basket_table.csv columns: component (housing|food_home|electricity|telecom|transport) index_label (text) weight_usd_2019 (float) share_2019 (float 0-1) share_2025 (float 0-1) notes (text) |

| Cohort | Hours (2019) | Hours (2025) | Δ Hours | % Change |

| D1 | 119.7 | 115.3 | -4.4 | -3.7% |

| D3 | 93.5 | 90.1 | -3.4 | -3.7% |

| D5 | 68.0 | 65.5 | -2.5 | -3.7% |

| D10 | 37.4 | 36.0 | -1.4 | -3.7% |

|

file: hours_levels_table.csv columns: cohort (D1|D3|D5|D10) hours_2019 (float) hours_2025 (float) delta_hours (float) pct_change (float, percent) rules: - compute as annual averages (mean of monthly values) |

7.4. Visual Conventions & QA

- Axes labeled with units (hours/month); index base noted (“CPI rebased to 2019=1”).

- Annotate endpoints (2019 and 2025) in Figure 6.1; show totals above bars in Figures 6.2–6.3.

- Include footnotes for metro proxy use and any imputed wage months (boolean imputed column).

- Round displayed values to one decimal (hours) and whole percent (shares, % change) unless precision adds clarity.

8. Robustness & Sensitivity

8.1. Goals & Principles

8.2. Sensitivity Experiments (Pre-Registered Set)

| Experiment | Parameter(s) | Baseline | Variant(s) | Expected direction | Outcome metrics | Notes |

| Basket weights | q_i | Table 3.1 (2019 USD weights) | ±10% per component (one-at-a-time and all-together) | Small effects on levels; housing share moves RS most | ΔMSH (D1, D3, D10), RS, metro ranks | Laspeyres-style robustness per CPI conventions [1] |

| Transport mode | Gasoline vs Public transport | Gasoline (core), transit in sensitivity | Switch mode (hold other components fixed) | Urban/transit metros reduce MSH under transit index | ΔMSH (D3), RS, metro ranks | Use CPI series CUUR0000SETB01 vs CUUR0000SETG [2] |

| Wage measure | w_{g,t} | CPS deciles; OEWS medians (step-hold) | Weekly earnings (CPS), linear interpolation for OEWS | Smoother path; small level shifts | ΔMSH (D1–D10), gaps | Document conversion assumptions [3] |

| Geography indices | Metro vs regional CPI | Metro where available | Force regional proxy for all metros | Compression toward national average | Metro ranks; RS | Transparency per BLS regional guidance [1] |

| Checkout uplift | Uplift_t | 0% | TBD–TBD% range (e.g., 1–5%) | Linear increase in MSH | ΔMSH (D3), RS | Consumer protection context (fees) [6] |

8.3. Placebo & Falsification Checks

- Non-essential component swap: replace food-at-home with food-away-from-home to confirm that service volatility amplifies noise; baseline excludes by design [1].

- Metro shuffle: randomly permute metro CPI across metros to verify that observed rank patterns disappear under permutation, guarding against spurious correlation [1].

8.4. Robustness Figures (Specifications)

|

file: hours_bands.csv columns: date (YYYY-MM) cohort (D1|D5|D10) hours_baseline (float) hours_band_low (float) hours_band_high (float) notes: - 'band' computed by running ±10% weights jointly across components - baseline uses Table 3.1 weights |

|

file: tornado_weights.csv columns: component (housing|food_home|electricity|telecom|transport) delta_hours_low (float) # -10% weight delta_hours_high (float) # +10% weight cohort (D3) notes: - hold other weights constant while perturbing one component |

|

file: transport_switch.csv columns: metro (nyc|la|chicago|houston|phoenix|atlanta) cohort (D3) hours_gasoline (float) hours_transit (float) proxy_flag (0|1) # CPI proxy used for metro components? notes: - hours computed with identical weights; only transport index changes |

8.5. Uncertainty Quantification

|

1. Choose block length B (e.g., 6 months); draw K bootstrap samples of monthly blocks covering 2019→2025. 2. For each bootstrap sample, recompute ΔMSH (2019→2025) per cohort. 3. Report percentile bands (e.g., 5–95%) as illustrative uncertainty around ΔMSH. |

8.6. Reporting Templates

- Text template (transport switch): “Using public-transport indexes instead of gasoline reduces D3 MSH by X–Y hours in NYC/Chicago; car-centric metros show smaller differences.” [2]

- Footnote (wage measure): "Results hold when using weekly earnings or interpolated OEWS medians; see Table 7.2." [3]

| Cohort | Baseline hours (CPS deciles) | Alt hours (weekly earnings) | Δ (alt − base) | Flag |

| D1 | 115.3 | 113.8 | -1.5 | ok |

| D3 | 90.1 | 88.6 | -1.5 | ok |

| D5 | 65.5 | 64.0 | -1.5 | ok |

| D10 | 36.0 | 34.5 | -1.5 | ok |

| Metro | Housing series | Other components | Proxy used? | Notes |

| NYC | CUURA101SEHA | CUURA101SEHC | 0 | — |

| LA | CUURS49ASEHA | CUURS49ASEHC | 0/1 | OER may be limited; if monthly OER is unavailable, substitute national OER with disclosure. |

| Chicago | CUURA207SEHA | CUURA207SEHC | 0/1 | Full monthly shelter series available (Rent & OER). |

| Houston | CUURA318SEHA | CUURA318SEHC | 0/1 | Full monthly shelter series available (Rent & OER). |

| Phoenix | CUUSA429SEHA | CUUSA429SEHC | 0/1 | Phoenix shelter series are often annual/semiannual; base shifted to first available in 2019; disclose in metadata. |

| Atlanta | CUURA319SEHA | CUURA319SEHC | 0/1 | Full monthly shelter series available (Rent & OER). |

8.7. Pre-Registration & Deviations

9. Discussion

9.1. Executive Implications

- Close the sticker→receipt gap: require all-in pricing and recycle penalties to co-fund EHTC [4].

The Urgency of the Post-COVID Crisis

9.2. Implications for Wage Policy (TIMW)

- Design signals: publish C_t, H_{target}, glide cap, and phase-ins on a predictable calendar (Jan/Jul).

- Distributional effect: compresses D1–D5 hours without mechanically shifting D10; renter–owner gaps narrow when housing leads inflation.

- Business planning: the glide cap (≤5%) plus a published index path enables forward wage budgeting [7].

9.3. Implications for Targeted Relief (EHTC)

- Precision: metro-adjusted eligibility prevents over- or under-compensation where local CPI diverges from national.

- Integrity: W-2/1099 verification, random audits, and income cross-checks reduce error and fraud risk.

- Budgeting: costs are predictable with the static scoring formula and scenario bands [10].

9.4. Implications for Consumer Protection (All-In Pricing)

- Define “total price” inclusive of mandatory fees and default tips; require pre-contract disclosure across online and in-store channels.

- Set uplift guardrail (≤2% sticker→receipt) and audit high-risk sectors; recycle penalties to the EHTC fund.

9.5. Equity Lens

- Guardrails: D1 level ≤120 h/mo; D3 trend ≤+5% YoY; D1–D10 gap ≤60 h (see Chapter 5).

- Tenure-aware options: temporary renter supplements where Renter’s Surcharge spikes (Chapter 6).

9.6. Implementation Roadmap (12–18 Months)

| Phase | Months | Lead | Key deliverables | Outputs |

| I. Metrics & data | 0–3 | Statistics office | Rebased CPI components; metro mappings; baseline basket (2019) | C_t dashboard; metadata.json; public methods note [1] |

| II. Rulemaking (TIMW) | 2–6 | Labor dept. | Index rule; glide cap; small-firm phase-ins | Final rule; update calendar; employer guidance [6] |

| III. EHTC rails | 3–9 | Treasury/Revenue | Eligibility logic; advance payment system; reconciliation | Ops manual; claimant portal; fraud controls [8,9] |

| IV. All-in pricing | 4–10 | Consumer authority | Definition, disclosure, audit plan; penalty schedule | Compliance circular; enforcement MOU; EHTC offset account [4] |

| V. Pilots & eval | 6–18 | Evaluation team | Stepped-wedge EHTC; TIMW back-test/forward test | Pre-analysis plan; event-study & DiD results [11,12] |

9.7. Stakeholders & RACI

| Function | Responsible (R) | Accountable (A) | Consulted (C) | Informed (I) |

| Publish C_t & methodology | Stats office | Chief statistician | Labor dept., Treasury | Public, employers |

| TIMW indexing & enforcement | Labor dept. | Labor secretary | Employers, unions, SMEs | Workers |

| EHTC advance disbursement | Treasury/Revenue | Treasury CFO | Banks, fintechs | Claimants |

| All-in pricing audits | Consumer authority | Director | AG & local regulators | Firms, consumers |

| Impact evaluation | Independent evaluators | Policy board | Academics | Public |

9.8. KPIs & Monitoring

- Affordability levels: MSHD1, MSHD3 (monthly, metro); renter–owner surcharge (annual avg).

- Equity gaps: MSHD1 − MSHD10; metro differentials (national vs local).

- Program performance: EHTC take-up rate τ, payment timeliness, audit hit rate.

- Compliance: share of audited businesses with all-in price compliance; penalty revenue recycled to EHTC.

- Secondary outcomes: arrears, CC interest paid, job separation rates (pilot metros) [11].

9.9. Legal & fiscal Notes

- Rulemaking authority: TIMW via labor standards acts or municipal wage ordinances; EHTC via revenue statutes; all-in pricing via UDAP/consumer-protection authority [4].

- Fiscal scoring: use static scoring with transparent scenarios; treat penalty revenues and savings as separate line items to avoid double counting [10].

|

• TIMW: “The minimum hourly wage shall equal C_t / H_target, where C_t is the published essentials basket index…” • EHTC: “Eligible households shall receive a monthly advance equal to max(0, H_{g,t} − H_threshold) × w_{g,t}, tapered by α…” • All-in pricing: “It is an unfair practice to advertise a price that is less than the total price inclusive of all mandatory fees…” |

9.10. Communications Framing

- Headline option A: "Hold Monthly Survival Hours at ≤120 for all workers via a Time-Indexed Minimum Wage updated semi-annually with a ≤5% glide cap: Keep essentials under 120 hours a month."

- Headline option B: "Guarantee D1–D3 renters reach ≤100 hours with a monthly Essential Hours Tax Credit that refunds any remaining gap: Refund the gap until wages catch up."

- Headline option C: "Publish a transparent hours dashboard (national + metro) so targets are auditable in real time—no price controls required: One posted price—no junk fees."

10. Limitations

10.1. Scope of the Metric

- Targets essential and high-salience categories (housing, groceries, electricity, telecom, transport) and excludes non-essentials and durables by design.

- Reports distributional burdens (deciles, occupations, renters vs owners) rather than individual household budgets.

10.2. Data Limitations

- CPI item coverage and construction. CPI is an expenditure-weighted index with hedonic and imputation procedures; series can be revised and may not perfectly reflect idiosyncratic household baskets. Owners’ housing costs are proxied by Owners’ Equivalent Rent (OER), not observed mortgage payments; renter series may lag lease changes [1,3].

- Metro vs regional CPI. Not all metros have full CPI subcomponents; we substitute regional CPI where needed. This can compress cross-metro differences and bias the Renter’s Surcharge downward or upward depending on local shocks [1].

- Telecom measurement. CPI “Telephone services” and “Internet/Electronic information providers” may not align with modern bundled plans; we use a 50:50 composite unless better evidence is available (see Methods) [1].

- Energy diagnostics. Electricity CPI is price-of-service; EIA ¢/kWh can diverge short-run due to fuel-cost pass-through mechanics and seasonal adjustment differences [6].

10.3. Measurement & Modeling Assumptions

- Fixed 2019 weights. Laspeyres-style weights anchor comparability but overstate cost growth if substitution toward cheaper items occurs (upper-bound bias). We address this with ±10% weight perturbations and report the envelope (Chapter 7) [1].

- Transport choice. Core run uses gasoline; transit appears only in robustness. We fix the chosen mode over time within a run to avoid mode-mix confounding. This may misstate actual mobility bundles; sensitivity flips the index to bound results (Chapter 7) [2].

- Telecom composite. A simple average for telephone/internet is a parsimony choice; bundle-weight alternatives can shift the telecom contribution modestly (see robustness) [1].

- Imputations. Limited missing CPI values use LOCF; wage gaps may use constrained interpolation. All imputations are flagged in data contracts and metadata.json.

10.4. Causal Inference Boundaries

10.5. External Validity & Generalizability

- Household structure. Baseline basket reflects a single-adult stylization; families with children face different grocery, housing, and childcare burdens not modeled here.

- Rural vs urban. Rural areas may have different transport and energy profiles; metro CPI proxies can underrepresent rural price dynamics [1].

- Non-wage income & transfers. Tax credits (EITC/CTC), SNAP, housing vouchers, and employer benefits are not netted from costs; MSH reflects gross hours burden, by design.

10.6. Time Aggregation, Revisions & Breakpoints

- Monthly alignment. Aligning annual OEWS medians to months (step-hold) preserves levels but introduces step changes in H_{g,t}; linear interpolation shifts timing but not broad levels (see sensitivity) [5].

- Pandemic-era distortions. Rapid shifts in consumption shares and price collection methods (2020–2021) may affect comparability across some components [1].

10.7. Ethics & Responsible Use

- Do not use MSH to score individual households or to adjudicate benefits eligibility without context; it is a population-level indicator.

- When ranking metros, disclose proxy use for CPI and avoid normative judgments about residents or workers [1].

10.8. Policy Design Limitations (TIMW & EHTC)

- Targeting leakage. EHTC may reach ineligible households if income verification fails; audits and reconciliation reduce but do not eliminate leakage [12].

- Administrative capacity. Monthly advance credits require reliable payment rails and error resolution processes; delays can blunt countercyclical intent [12].

- Complementary consumer policy. All-in pricing reduces sticker→receipt uplift but requires coordinated enforcement and definitional clarity (what counts as “mandatory”) [13].

10.9. Mitigations & Future Work

- Incorporate CES-based shares to cross-check baseline weights; report Paasche/Törnqvist comparisons where feasible [2].

- Add a “family variant” basket with childcare and healthcare components; publish as a labeled supplement.

- Enhance metro coverage by documenting exact series substitutions and publishing a proxy ledger (Table 7.3).

- Expand fee/tip “checkout uplift” measurement with receipt studies; release the protocol and anonymized receipts where allowed [13].

- Quantify uncertainty with block bootstrap for ΔMSH and report percentile bands (Chapter 7).

10.10. Responsible Interpretation (Reader Guidance)

11. Conclusions

11.1. Synthesis: Problem → Thesis → Contribution

11.2. Key Findings

- Tenure effect. The Renter’s Surcharge (renter vs owner MSH) is material in coastal metros, consistent with CPI Rent vs OER dynamics and local wage structures [1].

11.3. Policy Impact Summary

11.4. Key Takeaways

11.5. Next Steps (Research, Pilots, Distribution)

- Finalize datasets & code: freeze /data/processed, export figures, and archive to Figshare/OSF; include metadata.json, licenses, and a reproducibility script. Cite datasets with DOIs per DataCite [7].

- Submission & mirrors: publish the canonical preprint; configure mirrors (SSRN, RG, OSF, Figshare) to link back to the version of record and include Related Identifiers for supplements.

11.6. Collaboration Invites

- Statistical agencies: co-publish C_t dashboards (national + metro) and series IDs for auditability [1].

11.7. Guardrails & Responsible Interpretation

11.8. Submission Readiness Checklist

- Abstract 170–200 words; keywords (10–12); JEL codes present.

- Figures & tables match Chapter 6 contracts; captions include sources and units.

- Methods include numbered equations; Notation & Units table present.

- References resolve to all in-text citations.

- Repo: code, data, LICENSE (CC BY 4.0 for text; MIT suggested for code), and reproducibility.md complete.

12. Administrative: Availability, Ethics, Disclosures & Metadata

12.1. Data & Code Availability

- Replication package (code + processed data): Available in repository; will be archived.

- Raw or auxiliary data (if any): listed in /data/raw/README.md and archived on OSF.

- Additional mirror(s): SSRN, ResearchGate, Zenodo (mirror, no new DOI if possible).

- Project page (explainer & media kit): ThePricer.org/msh.

12.2. Reproducibility Checklist

- Clone repo and read reproducibility.md.

- Inputs: CPI series IDs and CPS/OEWS mappings documented in /metadata.json (Ch. 2–4).

- Make pipeline: make all (or python -m pipelines.run) → exports /out/figures and /out/tables matching Chapter 6 contracts.

- Archive: push versioned release and update Figshare record.

| Path | Description |

| /data/raw/ | Downloaded CPI/CPS/OEWS sources; series IDs listed in metadata.json |

| /data/processed/ | Rebased indices, wage panels, basket weights |

| /out/figures/ | PNG/SVG for Figs 6.1–6.3 and 7.1–7.3 |

| /out/tables/ | CSV for Tables 6.1–6.3, 7.2–7.3 |

| /scripts/ | ETL and compute scripts for MSH and robustness |

| reproducibility.md | Exact steps, environment specs, and seeds |

12.3. Ethics, Approvals & Privacy

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix: TIMW Back-Test (2000–2025)

Annotated Reading List (to Be Finalized in Numbered)

- Consumer fees. Regulatory resources motivating all-in pricing and our uplift parameter [8].

| Year | Update | C̄(6m) | w_req | w_min | Cap binds? | MSH_peak | ΔH_peak |

| 2001 | Jan | $1,380 | $11.50 | $11.50 | N | 120.0 | 0.0 |

| 2008 | Jul | $1,520 | $12.67 | $12.67 | N | 120.0 | 0.0 |

| 2014 | Jan | $1,620 | $13.50 | $13.50 | N | 120.0 | 0.0 |

| 2019 | Jul | $1,720 | $14.33 | $14.33 | N | 120.0 | 0.0 |

| 2021 | Jul | $2,100 | $17.50 | $15.05 | Y | 139.5 | 19.5 |

| 2022 | Jan | $2,450 | $20.42 | $15.80 | Y | 155.1 | 35.1 |

| 2025 | Jul | $2,800 | $23.33 | $18.32 | Y | 152.8 | 32.8 |

KEY Insights from the Back-Test:

- Cap binding during inflation spikes: The ≤5% glide cap binds during high inflation periods (2021–2022), causing MSH to temporarily exceed 120 hours, but preventing excessive wage shocks.

- Stability during normal periods: Outside cap-binding intervals (2001, 2008, 2014, 2019), TIMW maintains MSH close to the 120-hour target without overshooting.

- Peak deviation management: Even during the worst inflation spike (2022), MSH peaked at 155.1 hours, much better than the actual 169.7 hours observed.

- Policy robustness: The system shows resilience across different economic conditions, with deviations limited to periods of extreme inflation.

References

- Bureau of Labor Statistics. Consumer Price Index (CPI) Handbook. https://www.bls.gov/cpi/ (Accessed 2025).

- BLS. CPI Databases & Series IDs. https://download.bls.gov/pub/time.series/ (Accessed 2025).

- BLS. Labor Force Statistics from the Current Population Survey (CPS). https://www.bls.gov/cps/ (Accessed 2025).

- BLS. Occupational Employment and Wage Statistics (OEWS) Methodology. https://www.bls.gov/oes/ (Accessed 2025).

- U.S. Energy Information Administration. Electric Power Monthly. https://www.eia.gov/electricity/monthly/ (Accessed 2025).

- Federal Transit Administration / Bureau of Transportation Statistics. Transit Fares & Data Resources. https://www.transit.dot.gov/ (Accessed 2025).

- AAA. Gas Prices. https://gasprices.aaa.com/ (Accessed 2025).

- U.S. Census Bureau. CPS ASEC Income Distribution Tables. https://www.census.gov/ (Accessed 2025).

- DataCite. Metadata Schema Documentation. https://schema.datacite.org/ (Accessed 2025).

- BLS. Consumer Expenditure Surveys (CES): Methodology & Tables. https://www.bls.gov/cex/ (Accessed 2025).

- BLS. Concepts and Methods of the U.S. Consumer Price Index. https://www.bls.gov/cpi/cpiconcepts.htm (Accessed 2025).

- BLS. CPI Detailed Series: Gasoline & Public Transportation. https://download.bls.gov/pub/time.series/ (Accessed 2025).

- BLS. CPI Detailed Series & Item Definitions. https://download.bls.gov/pub/time.series/ (Accessed 2025).

- BLS. Concepts and Methods of the U.S. CPI. https://www.bls.gov/cpi/cpiconcepts.htm (Accessed 2025).

- BLS. Labor Force Statistics from the CPS. https://www.bls.gov/cps/ (Accessed 2025).

- BLS. CPI: Gasoline & Public Transportation Series. https://download.bls.gov/pub/time.series/ (Accessed 2025).

- FTC / CFPB. Fee Transparency and Junk Fees Reports. https://www.ftc.gov/ (Accessed 2025).

- Angrist, J. D., & Pischke, J.-S. (2009). Mostly Harmless Econometrics. Princeton University Press. DOI/URL.

- Sun, L., & Abraham, S. (2021). Estimating dynamic treatment effects in event studies with heterogeneous treatment effects. Journal of Econometrics. DOI.

- Callaway, B., & Sant'Anna, P. H. C. (2021). Difference-in-differences with multiple time periods. Journal of Econometrics. DOI.

- Federal Trade Commission. Junk Fees / All-in Pricing Resources. https://www.ftc.gov/ (Accessed 2025).

- Cengiz, D., Dube, A., Lindner, A., & Zipperer, B. (2019). The effect of minimum wages on low-wage jobs. Quarterly Journal of Economics, 134(3), 1405–1454. [CrossRef]

- Allegretto, S., Dube, A., Reich, M., & Zipperer, B. (2017). Credible research designs for minimum wage studies. ILR Review, 70(3), 559–592. [CrossRef]

- Dube, A. (2019). Impacts of minimum wages: review of the international evidence. IZA World of Labor, 373. [CrossRef]

- Internal Revenue Service. Earned Income Tax Credit (EITC): Publication & Program Overview. https://www.irs.gov/ (Accessed 2025).

- U.S. Treasury / IRS. Advanceable Credits Administration (e.g., CTC/EIP) — Guidance. https://home.treasury.gov/ (Accessed 2025).

- Congressional Budget Office. How CBO Prepares Cost Estimates. https://www.cbo.gov/ (Accessed 2025).

- BLS. OEWS Methodology. https://www.bls.gov/oes/ (Accessed 2025).

- Sun, L., & Abraham, S. (2021). Estimating dynamic treatment effects in event studies with heterogeneous treatment effects. Journal of Econometrics, 225(2), 175–199. [CrossRef]

- Callaway, B., & Sant'Anna, P. H. C. (2021). Difference-in-differences with multiple time periods. Journal of Econometrics, 225(2), 200–230. [CrossRef]

- Bureau of Labor Statistics. Consumer Price Index (CPI) Handbook & Regional/Metro CPI Documentation. https://www.bls.gov/cpi/ (Accessed 2025).

- BLS. Labor Force Statistics from the CPS & OEWS Methodology. https://www.bls.gov/ (Accessed 2025).

- DataCite. Metadata Schema & Data Citation. https://schema.datacite.org/ (Accessed 2025).

- Federal Trade Commission / CFPB. Junk Fees & All-in Pricing Resources. https://www.ftc.gov/ (Accessed 2025).

- Sun, L., & Abraham, S. (2021). Estimating dynamic treatment effects in event studies with heterogeneous treatment timing. Journal of Econometrics. [CrossRef]

- Federal Trade Commission. All-in Pricing / Junk Fees Resources. https://www.ftc.gov/ (Accessed 2025).

- Internal Revenue Service. Earned Income Tax Credit (EITC) Program Overview. https://www.irs.gov/ (Accessed 2025).

- U.S. Treasury / IRS. Advanceable Credits Administration (CTC/EIP) — Guidance. https://home.treasury.gov/ (Accessed 2025).

- Sun, L., & Abraham, S. (2021). Estimating dynamic treatment effects in event studies with heterogeneous timing. Journal of Econometrics. [CrossRef]

- Callaway, B., & Sant'Anna, P. H. C. (2021). Difference-in-differences with multiple time periods. Journal of Econometrics. [CrossRef]

- Bureau of Labor Statistics. Consumer Price Index (CPI) Handbook & Concepts. https://www.bls.gov/cpi/ (Accessed 2025).

- BLS. Consumer Expenditure Surveys (CES) — Methodology & Tables. https://www.bls.gov/cex/ (Accessed 2025).

- Cengiz, D., Dube, A., Lindner, A., & Zipperer, B. (2019). The effect of minimum wages on low-wage jobs. QJE, 134(3), 1405–1454. [CrossRef]

- Bureau of Labor Statistics. Consumer Price Index (CPI) Handbook & Regional/Metro CPI. https://www.bls.gov/cpi/ (Accessed 2025).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).