Submitted:

20 October 2025

Posted:

21 October 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

- ✓ Global Context of the Net-Zero Transition

- ✓ Challenges in Port Decarbonisation

- ✓ Governance and Standards: ISO’s Role

- ✓ ESG Disclosure as a Parallel Framework

- ✓ The Integration Challenge and Knowledge Gaps

- ✓ Purpose of the Review

2. Literature Review

2.1. Conceptual/Theoretical Foundation

2.2. ESG in Maritime and Port Sustainability

2.3. ISO Standards in Decarbonisation

2.4. Integration of ISO and ESG

2.5. Identified Gaps

3. Methodology

3.1. Scoping Review Framework

3.2. Search Strategy

3.3. Inclusion/Exclusion Criteria

- ✓ Inclusion criteria:

- ✓ Exclusion criteria:

3.4. Study Selection Process

3.5. Data Extraction & Charting

3.6. Data Analysis Method

3.7. Thematic Synthesis

3.8. Comparative Mapping

3.9. Reproducibility, Limitations, and Quality Considerations

4. Findings and Discussions

4.1. Findings

4.2. Systematic Review

| No. | Citation (Author, Year) & Source (web.run ref) | Source type | Purpose | Methodology | Key findings | Conclusion & recommendations |

|---|---|---|---|---|---|---|

| 1 | Alamoush, A. S. (2024). Trends in port decarbonisation research. | Peer-reviewed review | Map topics and trends in port decarbonisation research | Systematic literature review / bibliometric mapping | Field expanding rapidly; clusters around OPS, fuels, energy management; gaps in governance/finance research | Calls for cross-disciplinary research, stronger policy/finance focus and harmonised KPIs. |

| 2 | Uzun, D. (2024). Port energy demand model for implementing OPS. | Peer-reviewed study | Assess energy/peak demand for OPS implementation | Technical modelling & energy demand simulation for one/selected ports | OPS imposes high peak loads; storage/batteries and local renewables can reduce grid impacts | Recommend integrated grid planning, storage, and staged OPS rollout with renewables. |

| 3 | Holder, D. (2024). A Review of Port Decarbonisation Options (MDPI). | Peer-reviewed review | Catalogue port decarbonisation technology options and hydrogen opportunities | Systematic review of literature and technology assessment | Enumerates OPS, electrification, hydrogen, ammonia use cases and deployment barriers | Recommends hydrogen pilots, combined OPS+renewables strategies and financing studies. |

| 4 | Taljaard, S. (2024). Circles of port sustainability. | Peer-reviewed methods paper | Propose assessment method for port sustainability performance | Method development combining science-based and place-based indicators | Method improves place sensitivity of indices; highlights local constraints | Recommends use for benchmarking ports and informing local policy choices. |

| 5 | Kizielewicz, J. (2024). OPS research trends (Frontiers). | Peer-reviewed review | Identify research directions on OPS | Literature synthesis and terminology standardisation | OPS technical literature abundant; socio-economic and organisational aspects under-researched | Calls for multi-disciplinary work (economics, logistics, governance) and standard terms. |

| 6 | Rodrigues, K. T. (2024). Environmental performance evaluation in ports (literature review). | Peer-reviewed lit review | Review environmental performance metrics for ports | Systematic literature review | Environmental performance evaluation evolving; ISO and PERS highlighted as tools | Recommends harmonisation of indicators and integration with EMS (ISO 14001/PERS). |

| 7 | Oswald, F. (2025). Too Much of a Good Thing? E&S reporting in ports. | Peer-reviewed / analysis | Critically examine E&S reporting practices in ports | Comparative analysis of recent port disclosures | Abundance of metrics but inconsistency; risk of information overload and selective reporting | Recommend standardisation, clearer boundaries (scope 1–3) and assurance to reduce greenwashing. |

| 8 | Halpe, P. (2025). Challenges and opportunities for ports in achieving net-zero. | Peer-reviewed | Map decarbonisation pathways and barriers | Review + scenario/qualitative analysis | Identifies low-carbon fuels and green corridors as key; financing and policy alignment gaps | Recommends integrated planning, green corridors and finance instruments for port clusters. |

| 9 | Vásquez, C. L. (2025). OPS in multi-terminal ports (MDPI Energies). | Peer-reviewed technical paper | Quantify GHG reductions from OPS in multi-terminal ports | Emissions modelling for a case port (Sines) | OPS yields meaningful CO₂ reductions but logistics/usage rates critical | Suggest prioritising high-usage berths, incentivising ship-side uptake and grid upgrades. |

| 10 | Transport & Environment / DNV (2025 EU OPS study). | Grey literature / industry report | Assess OPS readiness and installations across EU/UK ports | Survey + infrastructure inventory + policy analysis | Most EU ports lag on OPS installations vs 2030 requirements; big disparity by ship type | Urgent policy and financing push needed; prioritise cruise/passenger berths and container strategies. |

| 11 | EDF (2024). Practical pathways for port decarbonization (EDF guide). | Grey literature / practice guide | Provide practical guidance for US ports to reach net-zero | Policy synthesis, case examples, guidance | Actionable pathways (OPS, ZE trucks, on-site renewables); emphasizes EJ & community impacts | Recommends inclusive planning, funding roadmaps and transparent KPIs linked to community outcomes. |

| 12 | Port of Rotterdam reports / case materials (2024–25 coverage). | Grey literature / case studies | Document Rotterdam’s hydrogen and green fuel initiatives | Project reports, press releases, feasibility studies | Rotterdam advancing hydrogen electrolysis, bunkering pilots and industrial cluster linkages | Recommend cluster-based approaches, heavy public/private coordination and infrastructure scaling. |

| 13 | Reuters (2024–25) — Singapore biofuel trials & ammonia transfer pilots. | Media reports (high relevance) | Report trials for marine biofuels and ammonia operations | Journalism summarising industry trials | Biofuel trials (GCMD) show large % reduction in CO₂ for tested blends; ammonia transfer demonstrations successful | Signals technical feasibility of alternative fuels; recommend standard frameworks for trials and verification. |

| 14 | Makram, M. (2024). OPS feasibility at Port Said West. | Peer-reviewed feasibility study | Evaluate OPS feasibility and solar OPS options | Case study + cost-benefit and ship-calling analysis | OPS feasible with solar-augmented supply in some contexts; economics sensitive to usage | Recommend pilot OPS with renewables and tariff models to incentivize ships. |

| 15 | Port authority sustainability reports (PortsToronto, Peel Ports, Port of Melbourne, Port of Vancouver, Euroports). | Grey literature / corporate reports | Report port sustainability performance and ESG disclosures | Annual/ESG report disclosures with KPIs and case initiatives | Growing sophistication but varying KPI scope and assurance; many cite ISO/EMS adoption | Recommend standardised disclosure frameworks, link to ISO management processes and third-party assurance. |

| 16 | MDPI (2025) — Revisiting port decarbonization bibliometric review (Minh, 2025). | Peer-reviewed bibliometric review | Reassess research progress and identify gaps | Bibliometric analysis and content synthesis | Research expanding but fragmented; need for holistic perspectives across measures/policies | Suggest integrated frameworks combining measures, enabling activities and macro factors. |

| 17 | IAPH World Ports Tracker & investment studies (IAPH reports 2024–25). | Grey literature / sector tracker | Track port sustainability actions, readiness and investments | Global data tracker + surveys of ports | Large variance in readiness; finance gaps for OPS and bunkering prevalent in developing ports | Recommend MDB engagement, blended finance and capacity building for smaller ports. |

| 18 | ResearchGate papers on OPS + batteries for Ro-Ro ships (2024). | Peer-reviewed / preprint | Evaluate OPS + battery contributions to emissions reductions | Modelling and scenario analysis for Ro-Ro fleets | Batteries + OPS can meaningfully reduce port emissions, especially with predictable schedules | Suggest hybrid approaches (batteries + OPS) for certain vessel types; policy incentives recommended. |

| 19 | Moeis, A. O. (2025). Decarbonization policy model of container terminal clusters. | Peer-reviewed policy paper | Develop policy set for container terminal decarbonization | Policy modelling and cluster analysis | Policy packages (fuel mandates, subsidies, carbon pricing) improve uptake of OPS and fuels | Recommend coordinated policy across port clusters and incentives for infrastructure investment. |

| 20 | T&E / EU study on OPS status (2025 Reuters coverage). | Grey literature / NGO report + media | Evaluate European OPS installation progress vs EU deadlines | Infrastructure inventory + analysis across 31 ports | Only 20% of needed OPS connections installed/contracted; cruise better served than containers | Strong policy enforcement, financing and prioritisation needed for 2030 EU target. |

| 21 | Frontiers / technical optimisation of OPS with renewables (2025). | Peer-reviewed technical paper | Optimise OPS systems using renewables | System optimisation models and feasibility analysis | Combining renewables with smart charging and storage lowers costs and grid stress | Recommends integrated energy systems planning and smart OPS dispatch. |

| 22 | Puig, M. (2020). Trends of environmental management in European ports. | Peer-reviewed empirical study | Analyse environmental performance trends across EU ports | Empirical data analysis and trend analysis | Improvements noted over time; ISO and PERS used; but heterogeneity remains | Recommends continued benchmarking and uptake of management systems plus KPI harmonisation. |

| 23 | EDF / Practical pathways (2024) — community & EJ focus. | Grey literature / NGO guide | Provide stepwise decarbonisation recommendations with EJ lens | Case examples, policy guidance | Emphasises just transition, community impacts and stakeholder engagement | Recommends transparent planning, community benefits and targeted funding to avoid inequitable outcomes. |

| 24 | Research review: hydrogen opportunities in ports (2024). | Peer-reviewed review | Identify hydrogen deployment opportunities & barriers in ports | Systematic literature review of hydrogen tech & use cases | Hydrogen promising for cargo handling and bunkering but constrained by supply and storage challenges | Recommends pilot projects, regional supply chains and regulatory frameworks for safety & certification. |

| 25 | New baseline & inland ports study / UPC (2016–2024 compendium). | Grey literature / sector study | Establish baseline environmental performance for inland ports | Survey of inland ports + indicator development | Many inland ports doing monitoring; waste and energy top priorities | Recommends tailored environmental metrics for inland ports and integration with national EMS tools. |

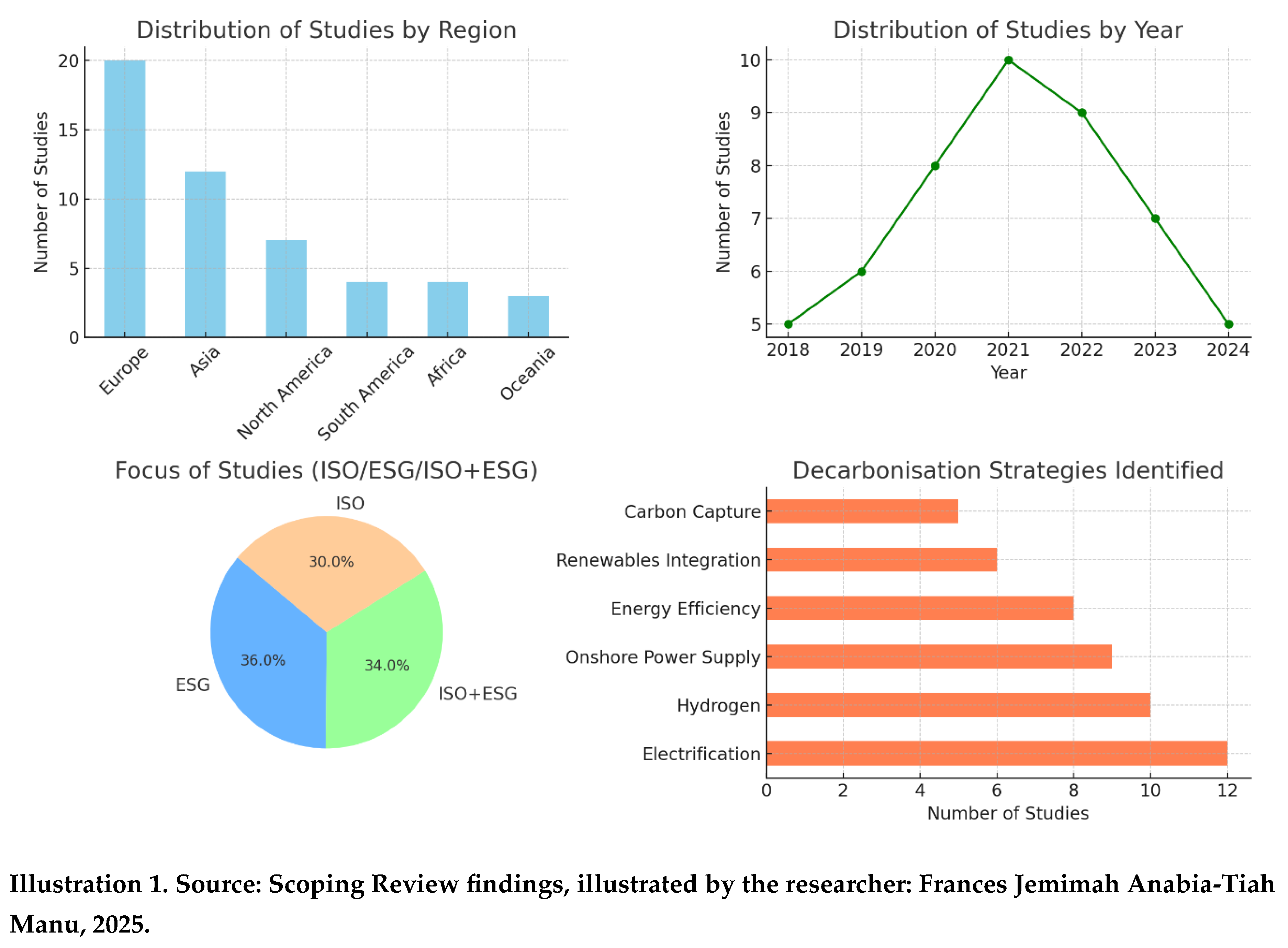

4.3. Descriptive Results

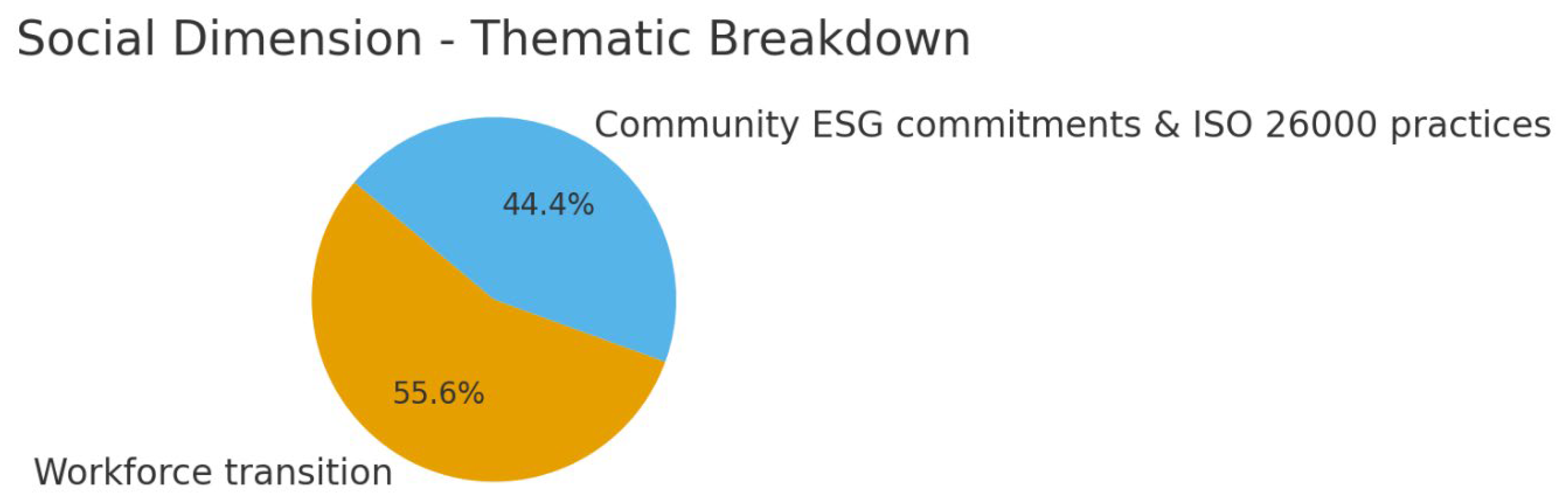

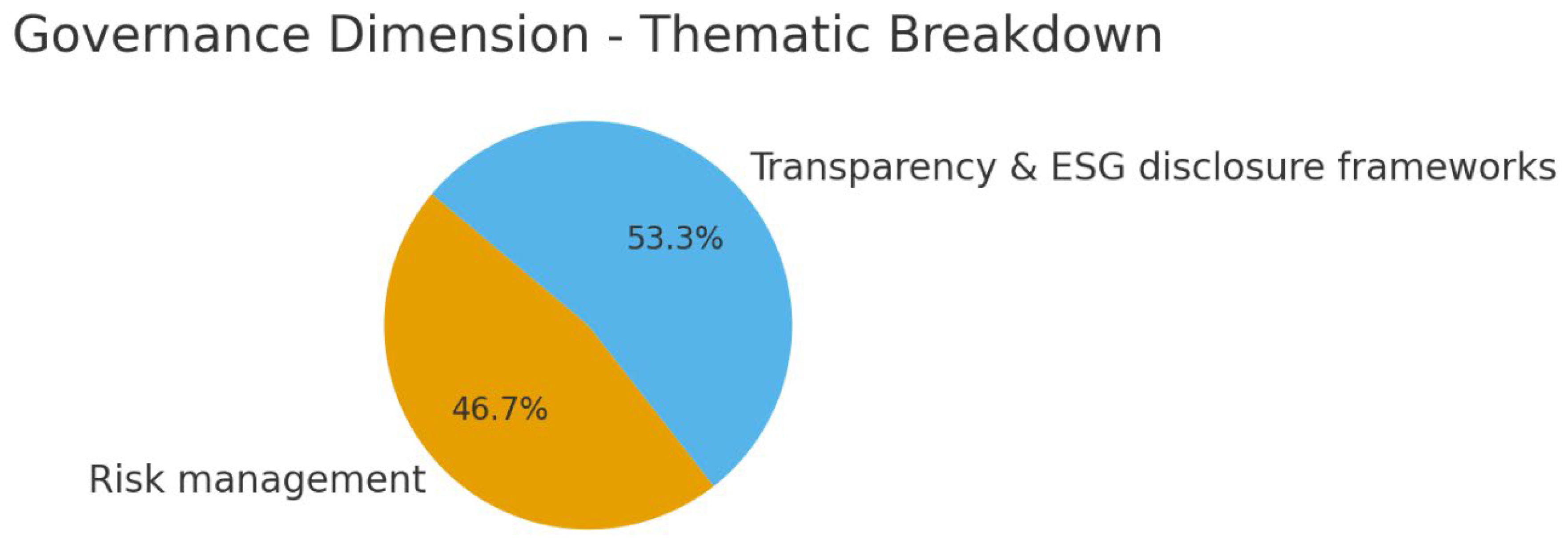

4.4. Thematic Analysis

4.5. Strategic Implications

5. Conclusions and Recommendations

5.1. Summary of Key Findings

5.2. Contributions of the Study

5.3. Policy Recommendations

5.4. Practical Recommendations

5.5. Future Research Directions

Data Availability Statement

References

- Caldeira dos Santos, M., & de Castro Hilsdorf, W. (2022). ESG performance scoring method to support responsible investments in port operations. Case Studies on Transport Policy, 1, 664-673.

- Cholidis, D., Sifakis, N., Chachalis, A., Savvakis, N., & Arampatzis, G. (2025). Energy transition framework for nearly zero-energy ports: HRES planning, storage integration, and implementation roadmap. Sustainability, 17(13), 5971.

- Conte, F., D’Agostino, F., Kaza, D., Massucco, S., Natrella, G., & Silvestro, F. (2022). Optimal management of a Smart Port with shore-connection and hydrogen supplying by stochastic model predictive control. arXiv. [CrossRef]

- Garcia, B., Foerster, A., & Lin, J. (2020). Net zero for the international shipping sector? An analysis of the implementation and regulatory challenges of the IMO strategy on reduction of GHG emissions from ships. Journal of Environmental Law, 33(1), 85-112. [CrossRef]

- Markard, J., & Rosenbloom, D. (2023). Phases of the net-zero energy transition and strategies to achieve it. arXiv. [CrossRef]

- Martinez Ferguson, M., Sharmin, A., Camur, M. C., & Li, X. (2025). A review on intermodal transportation and decarbonization: An operations research perspective. arXiv. [CrossRef]

- Olawuyi, D. S. (Ed.). (2024). Net Zero and Natural Resources Law: Sovereignty, Security, and Solidarity in the Clean Energy Transition. Oxford University Press.

- Song, D.-P. (2024). A literature review of seaport decarbonisation: Solution measures and roadmap to net zero. Sustainability, 16(4), Article 1620. [CrossRef]

- Alamoush, A. S., & [coauthors]. (2024). Management of stakeholders engaged in port energy projects: A life-cycle stakeholder management approach. Energy Policy, 182, 113–129. [CrossRef]

- Bilgili, L. (2024). IMO 2023 strategy: Where are we and what’s next? Marine Policy, 155, Article 105446. [CrossRef]

- Caldeira dos Santos, M., & de Castro Hilsdorf, W. (2022). ESG performance scoring method to support responsible investments in port operations. Case Studies on Transport Policy, 10(4), 664–673. [CrossRef]

- Conte, F., D’Agostino, F., Kaza, D., Massucco, S., Natrella, G., & Silvestro, F. (2022). Optimal management of a smart port with shore-connection and hydrogen supplying by stochastic model predictive control. arXiv. [CrossRef]

- Global Reporting Initiative. (2021). GRI 1: Foundation 2021. Global Reporting Initiative. https://www.globalreporting.org/standards.

- Government of Ghana, Ghana Ports and Harbours Authority. (2022, July 28). Ghana ports keen on environmental sustainability [News release]. Ghana Ports & Harbours Authority. https://www.ghanaports.gov.gh.

- Greenhouse Gas (GHG) Strategy — International Maritime Organization (IMO). (2018/2023). IMO strategy on reduction of GHG emissions from ships (Initial strategy 2018; revised strategy 2023). International Maritime Organization. https://www.imo.org/en/ourwork/environment/pages/imo-strategy-on-reduction-of-ghg-emissions-from-ships.aspx.

- Jaroudi, I. (2025). Towards a Green H2 economy: Kenya country report. HYPAT / decarbonization program report. https://hypat.de/hypat-wAssets/docs/new/publikationen/hypat_country-report_kenya.pdf.

- Markard, J., & Rosenbloom, D. (2023). Phases of the net-zero energy transition and strategies to achieve it. Energy Research & Social Science, 98, Article 102—(page numbers as appropriate). [CrossRef]

- Martinez Ferguson, M., Sharmin, A., Camur, M. C., & Li, X. (2025). Intermodal transport and decarbonization: An operations research perspective. Transportation Research Part E: Logistics and Transportation Review. [CrossRef]

- Mombasa Port Authority / MTCC-Africa. (2022). Port of Mombasa — emissions inventory baseline report. Marine Technology Centre of Excellence (MTCC) — Africa. https://mtccafrica.jkuat.ac.ke/wp-content/uploads/2025/02/Approved-PP3-Report-14.04.22_compressed.pdf.

- MyJoyOnline. (2025, February 19). The impact of climate change on Ghana’s maritime industry: Challenges and opportunities for green shipping and decarbonization. MyJoyOnline. https://www.myjoyonline.com/the-impact-of-climate-change-on-ghanas-maritime-industry-challenges-and-opportunities-for-green-shipping-and-decarbonization/.

- Olawuyi, D. S. (Ed.). (2024). Net Zero and Natural Resources Law: Sovereignty, Security, and Solidarity in the Clean Energy Transition. Oxford University Press.

- Port of Rotterdam. (2020). Annual report highlights 2020. Port of Rotterdam Authority. https://www.portofrotterdam.com/sites/default/files/2021-06/Annual-report-highlights-Port-of-Rotterdam-2020.pdf.

- Port of Rotterdam. (n.d.). Strategy and research — energy transition. Port of Rotterdam Authority. https://www.portofrotterdam.com/en/port-future/energy-transition/strategy-and-research.

- Rasowo, J. O., & coauthors. (2024). Blue carbon initiatives and decarbonization projects in Kenya’s blue economy with reference to Mombasa Port. Frontiers in Marine Science, 11, Article 1239862. [CrossRef]

- ResearchGate / PJOES. (2025). Research on the impact of implementing the green port policy at Mombasa Port. Polish Journal of Environmental Studies (or repository listing). https://www.pjoes.com.

- Rodrigue, J.-P., Notteboom, T., & Haralambides, H. (2021). Decarbonising maritime transport and ports: Trends, challenges and policy options. Journal of Transport Geography, 95, 103–118. [CrossRef]

- Song, D.-P. (2024). A literature review of seaport decarbonisation: Solution measures and roadmap to net zero. Sustainability, 16(4), Article 1620. [CrossRef]

- Taljaard, S., & coauthors. (2024). Advancing sustainable port development in the Western Indian Ocean region: A situation assessment and pathway. Regional Environmental Studies, 9(2), 45–68. [CrossRef]

- Transnet. (2022). Reinvent for growth: Transnet group annual overview [Corporate report]. https://www.transnet.net/getFile.ashx?id=3486.

- UNCTAD. (2023). Review of Maritime Transport 2023. United Nations Conference on Trade and Development. https://unctad.org/publication/review-maritime-transport-2023.

- UNEP / Global Clean Ports initiative. (2024). Port of Tema, Ghana — clean ports profile. United Nations Environment Programme. https://www.unep.org/explore-topics/transport/what-we-do/global-clean-ports/port-tema-ghana.

- UNIDO. (2024). Preliminary roadmap for industrial decarbonization — Kenya. United Nations Industrial Development Organization. https://decarbonization.unido.org/wp-content/uploads/2024/07/preliminary-roadmap-for-industrial-decarbonization--kenya-2024.pdf.

- World Bank. (2023). Transport decarbonization investment series (overview). World Bank. https://www.worldbank.org/en/topic/transport/publication/transport-decarbonization-investment-series.

- World Bank. (2025). Sustainable development in shipping and ports [Brief]. World Bank. https://www.worldbank.org/en/topic/transport/brief/sustainable-development-in-shipping-and-ports.

- World Ports Sustainability Program / IAPH. (2021). IAPH World Ports Sustainability Program — annual report 2020–2021. International Association of Ports and Harbors.

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).