Submitted:

16 October 2025

Posted:

16 October 2025

You are already at the latest version

Abstract

Keywords:

I. Introduction

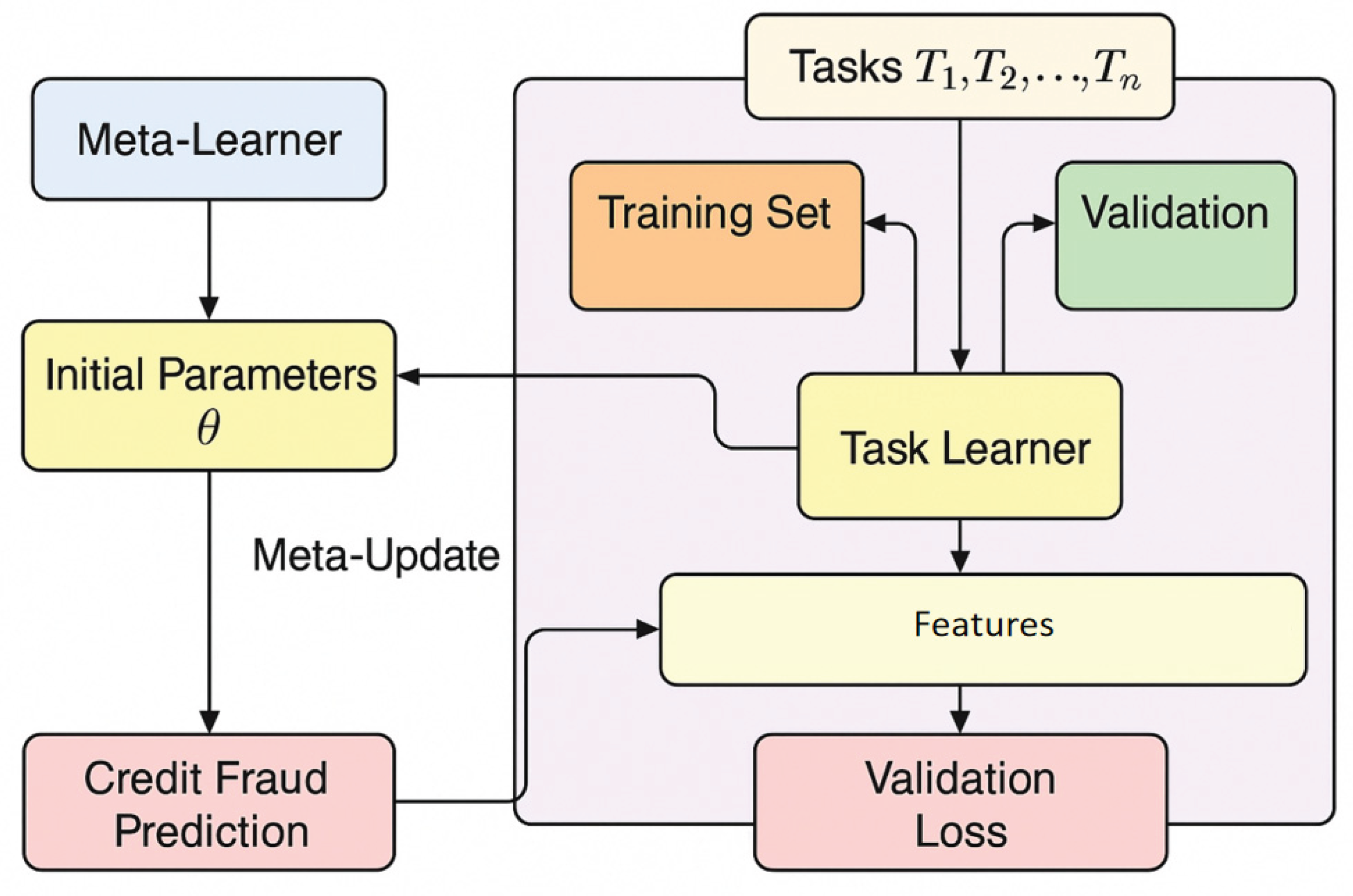

II. Method

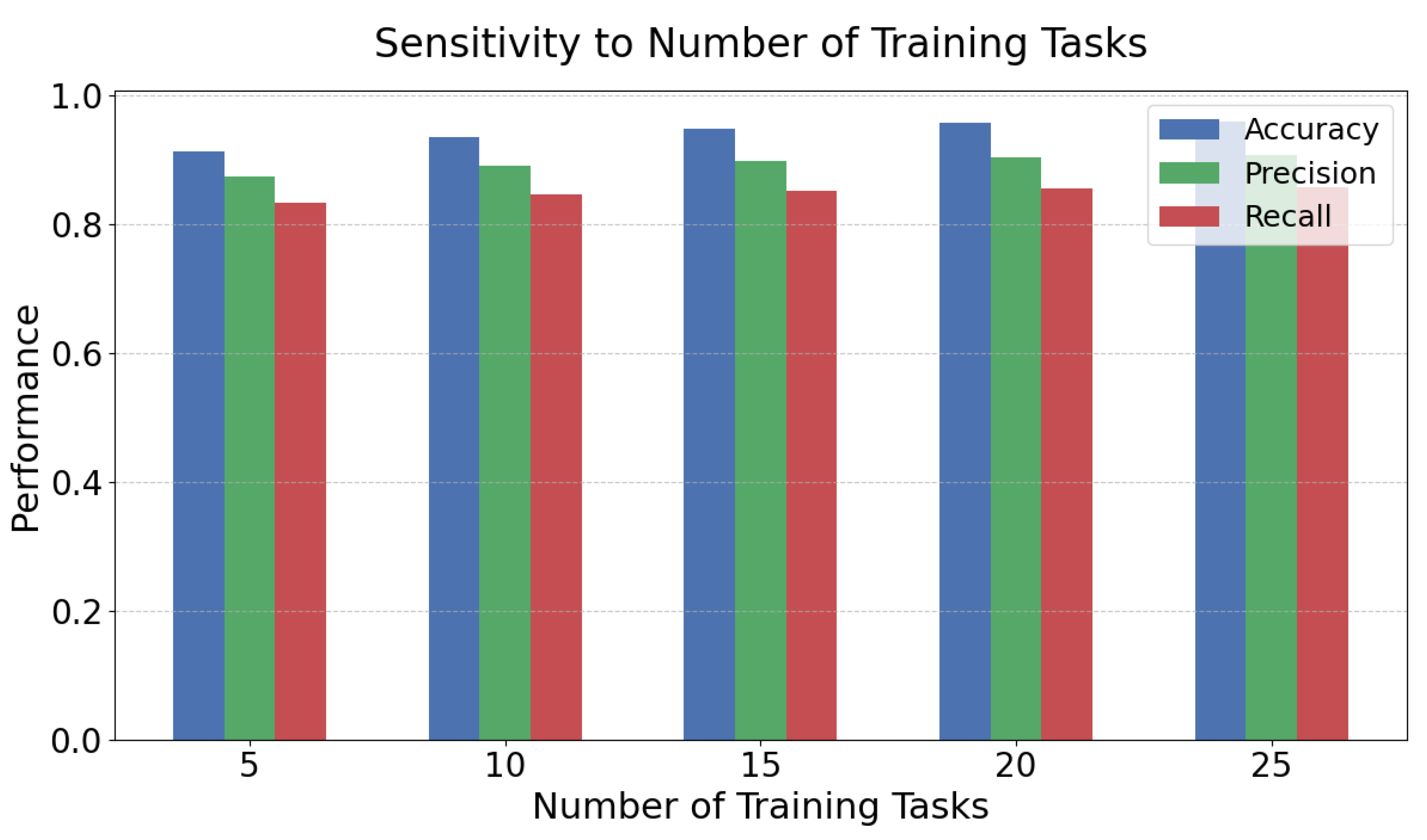

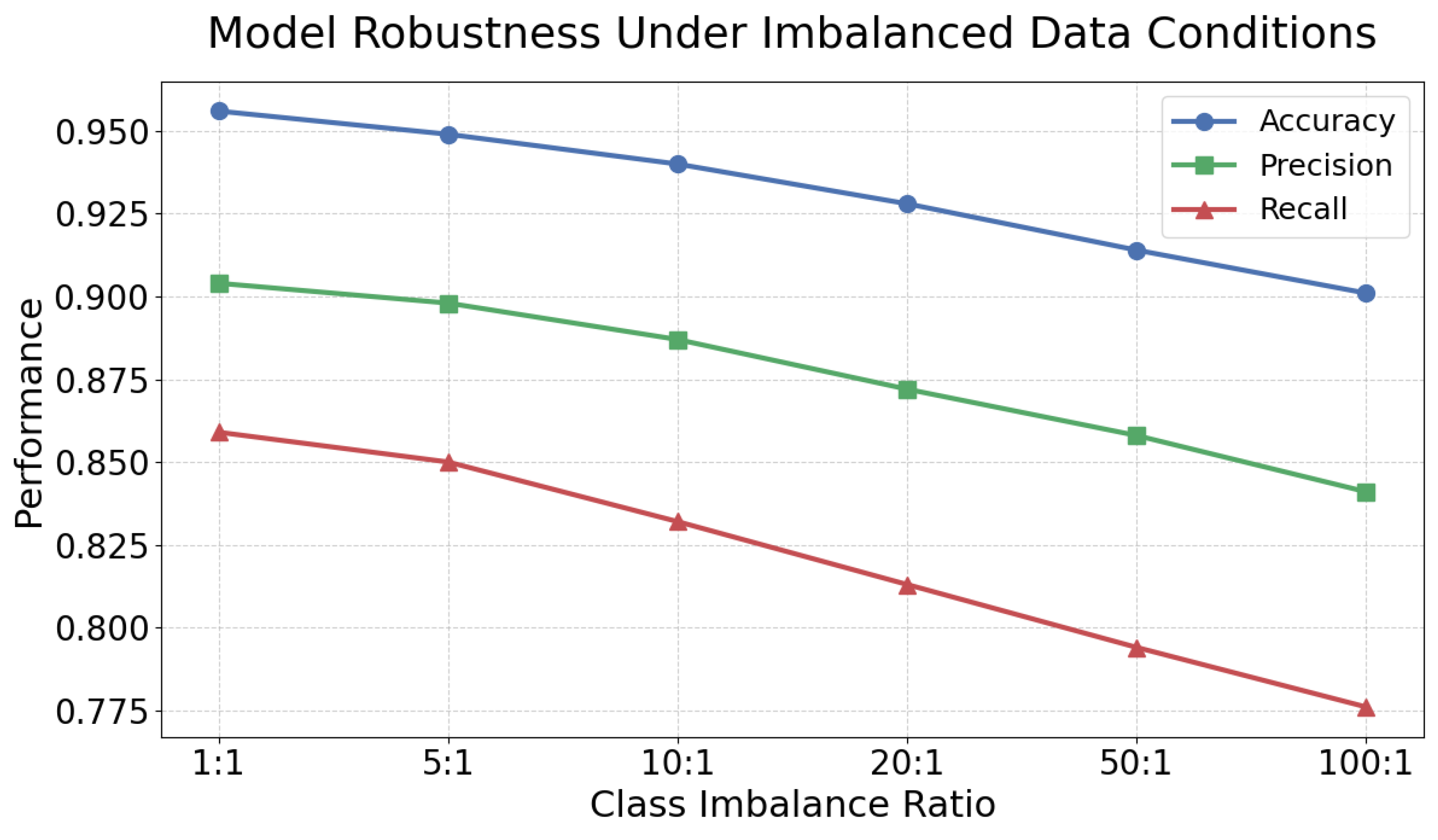

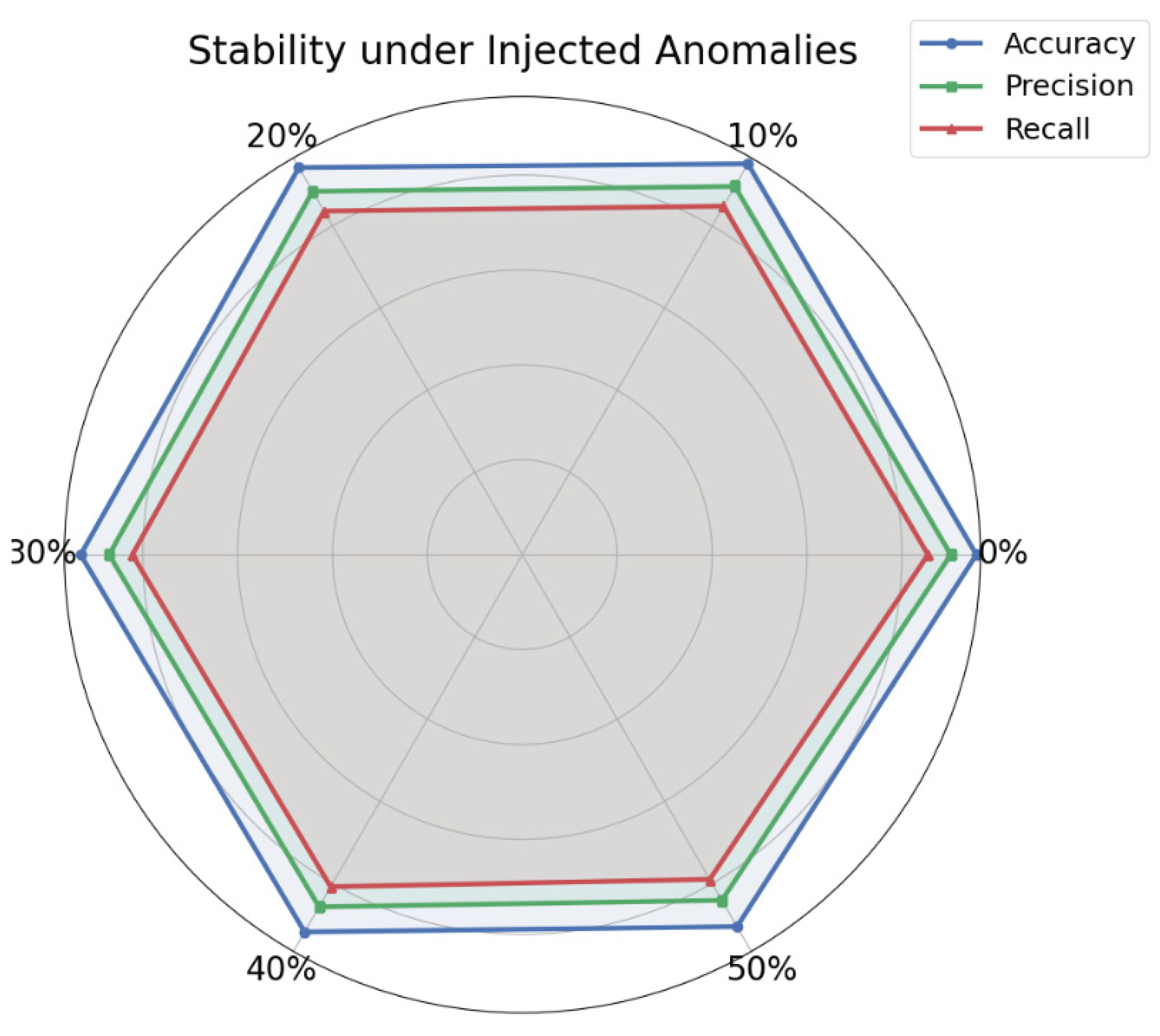

III. Experimental Results

A. Dataset

B. Experimental Results

| Method | Acc | Precision | Recall |

|---|---|---|---|

| CNN[41] | 0.931 | 0.842 | 0.781 |

| Transformer[42] | 0.938 | 0.861 | 0.805 |

| LSTM+CNN[43] | 0.943 | 0.872 | 0.824 |

| LSTM+Transformer[44] | 0.948 | 0.886 | 0.837 |

| Ours | 0.957 | 0.903 | 0.855 |

IV. Conclusion

References

- Y. Zhang, X. Yang, F. Zhu, Y. Chen and Z. Li, "Distributed meta-learning for large-scale multi-institution credit default risk prediction", Proceedings of the International Conference on Database Systems for Advanced Applications, Springer Nature Singapore, pp. 313-326, 2024.

- P. Gambetti, F. Roccazzella and F. Vrins, "Meta-learning approaches for recovery rate prediction", Risks, vol. 10, no. 6, pp. 124, 2022. [CrossRef]

- J. Jeyalakshmi and C. Gowtham, "Adapting generative models with meta learning for financial applications", Generative AI in FinTech: Revolutionizing Finance Through Intelligent Algorithms, Springer Nature Switzerland, pp. 235-255, 2025.

- F. Zhou, X. Qi, C. Xiao, M. Li and J. Wang, "MetaRisk: Semi-supervised few-shot operational risk classification in banking industry", Information Sciences, vol. 552, pp. 1-16, 2021. [CrossRef]

- T. Yang, Y. Cheng, Y. Qi and M. Wei, "Distilling semantic knowledge via multi-level alignment in TinyBERT-based language models", Journal of Computer Technology and Software, vol. 4, no. 5, 2025.

- H. Zheng, Y. Ma, Y. Wang, G. Liu, Z. Qi and X. Yan, "Structuring low-rank adaptation with semantic guidance for model fine-tuning", 2025.

- Q. Wu, "Internal knowledge adaptation in LLMs with consistency-constrained dynamic routing", Transactions on Computational and Scientific Methods, vol. 4, no. 5, 2024.

- X. Quan, "Structured path guidance for logical coherence in large language model generation", Journal of Computer Technology and Software, vol. 3, no. 3, 2024.

- Y. Li, S. Han, S. Wang, M. Wang and R. Meng, "Collaborative evolution of intelligent agents in large-scale microservice systems", arXiv preprint arXiv:2508.20508, 2025.

- K. Aidi and D. Gao, "Temporal-spatial deep learning for memory usage forecasting in cloud servers", 2025.

- J. Zhan, "MobileNet compression and edge computing strategy for low-latency monitoring", Journal of Computer Science and Software Applications, vol. 4, no. 4, 2024. [CrossRef]

- M. Wei, "Federated meta-learning for node-level failure detection in heterogeneous distributed systems", Journal of Computer Technology and Software, vol. 3, no. 8, 2024.

- B. Fang and D. Gao, "Collaborative multi-agent reinforcement learning approach for elastic cloud resource scaling", arXiv preprint arXiv:2507.00550, 2025.

- W. Cui, "Vision-oriented multi-object tracking via transformer-based temporal and attention modeling", Transactions on Computational and Scientific Methods, vol. 4, no. 11, 2024. [CrossRef]

- T. Zhang, F. Shao, R. Zhang, Y. Zhuang and L. Yang, "DeepSORT-driven visual tracking approach for gesture recognition in interactive systems", arXiv preprint arXiv:2505.07110, 2025.

- X. Zhang and Q. Wang, "EEG anomaly detection using temporal graph attention for clinical applications", Journal of Computer Technology and Software, vol. 4, no. 7, 2025. [CrossRef]

- J. Zhan, "Single-device human activity recognition based on spatiotemporal feature learning networks", Transactions on Computational and Scientific Methods, vol. 5, no. 3, 2025.

- F. Roccazzella, P. Gambetti and F. D. Vrins, "Meta-learning approaches for recovery rate prediction", Available at SSRN 4067066,2022. [CrossRef]

- L. Wu, "A meta-learning network method for few-shot multi-class classification problems with numerical data", Complex & Intelligent Systems, vol. 10, no. 2, pp. 2639-2652, 2024. [CrossRef]

- G. Kavirathne, V. A. S. Perera, L. C. R. Karunathunge, S. Perera and A. Fernando, "A meta-learning approach to predict non-performing loans in Sri Lankan financial institutions", Proceedings of the 2022 13th International Conference on Computing Communication and Networking Technologies, pp. 1-6, 2022.

- M. Wei, H. Xin, Y. Qi, Y. Xing, Y. Ren and T. Yang, "Analyzing data augmentation techniques for contrastive learning in recommender models", 2025.

- H. Zheng, Y. Xing, L. Zhu, X. Han, J. Du and W. Cui, "Modeling multi-hop semantic paths for recommendation in heterogeneous information networks", arXiv preprint arXiv:2505.05989, 2025.

- W. Zhu, Q. Wu, T. Tang, R. Meng, S. Chai and X. Quan, "Graph neural network-based collaborative perception for adaptive scheduling in distributed systems", arXiv preprint arXiv:2505.16248, 2025.

- Y. Ren, "Strategic cache allocation via game-aware multi-agent reinforcement learning", Transactions on Computational and Scientific Methods, vol. 4, no. 8, 2024. [CrossRef]

- X. Zhang, X. Wang and X. Wang, "A reinforcement learning-driven task scheduling algorithm for multi-tenant distributed systems", arXiv preprint arXiv:2508.08525, 2025.

- G. Yao, H. Liu and L. Dai, "Multi-agent reinforcement learning for adaptive resource orchestration in cloud-native clusters", arXiv preprint arXiv:2508.10253, 2025.

- W. Zhu, "Adaptive container migration in cloud-native systems via deep Q-learning optimization", Journal of Computer Technology and Software, vol. 3, no. 5, 2024. [CrossRef]

- Y. Wang, H. Liu, G. Yao, N. Long and Y. Kang, "Topology-aware graph reinforcement learning for dynamic routing in cloud networks", arXiv preprint arXiv:2509.04973, 2025.

- X. Su, "Forecasting asset returns with structured text factors and dynamic time windows", Transactions on Computational and Scientific Methods, vol. 4, no. 6, 2024. [CrossRef]

- H. Xin and R. Pan, "Unsupervised anomaly detection in structured data using structure-aware diffusion mechanisms", Journal of Computer Science and Software Applications, vol. 5, no. 5, 2025. [CrossRef]

- Y. Qin, "Deep contextual risk classification in financial policy documents using transformer architecture", Journal of Computer Technology and Software, vol. 3, no. 8, 2024.

- Y. Wang, "Entity-aware graph neural modeling for structured information extraction in the financial domain", Transactions on Computational and Scientific Methods, vol. 4, no. 9, 2024.

- T. Tang, J. Yao, Y. Wang, Q. Sha, H. Feng and Z. Xu, "Application of deep generative models for anomaly detection in complex financial transactions", Proceedings of the 2025 4th International Conference on Artificial Intelligence, Internet and Digital Economy, pp. 133-137, 2025.

- Z. Liu and Z. Zhang, "Graph-based discovery of implicit corporate relationships using heterogeneous network learning", 2024.

- Q. Sha, "Hybrid deep learning for financial volatility forecasting: an LSTM-CNN-transformer model", Transactions on Computational and Scientific Methods, vol. 4, no. 11, 2024. [CrossRef]

- M. Wang, T. Kang, L. Dai, H. Yang, J. Du and C. Liu, "Scalable multi-party collaborative data mining based on federated learning", 2025.

- Y. Cheng, "Selective noise injection and feature scoring for unsupervised request anomaly detection", Journal of Computer Technology and Software, vol. 3, no. 9, 2024. [CrossRef]

- T. Kang, H. Yang, L. Dai, X. Hu and J. Du, "Privacy-enhanced federated learning for distributed heterogeneous data", 2025.

- Z. Liu and Z. Zhang, "Modeling audit workflow dynamics with deep Q-learning for intelligent decision-making", 2024.

- Y. Lin and P. Xue, "Multi-task learning for macroeconomic forecasting based on cross-domain data fusion", Journal of Computer Technology and Software, vol. 4, no. 6, 2025.

- B. Meng, J. Sun and B. Shi, "A novel URP-CNN model for bond credit risk evaluation of Chinese listed companies", Expert Systems with Applications, vol. 255, pp. 124861, 2024. [CrossRef]

- E. Siphuma and T. van Zyl, "Enhancing credit risk assessment through transformer-based machine learning models", Proceedings of the Southern African Conference for Artificial Intelligence Research, Springer Nature Switzerland, pp. 124-143, 2024.

- J. Li, C. Xu, B. Feng, W. Liu and Y. Zhao, "Credit risk prediction model for listed companies based on CNN-LSTM and attention mechanism", Electronics, vol. 12, no. 7, pp. 1643, 2023. [CrossRef]

- Y. Song, H. Du, T. Piao, M. Sun and X. Chen, "Research on financial risk intelligent monitoring and early warning model based on LSTM, transformer, and deep learning", Journal of Organizational and End User Computing, vol. 36, no. 1, pp. 1-24, 2024. [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).