I. Introduction

Corporate governance is widely recognized as a cornerstone of firm performance and financial stability, providing the mechanisms through which managerial actions are aligned with the interests of shareholders and broader stakeholders. A vast body of literature has established that effective governance structures, particularly board design is able to mitigate agency problems, improve monitoring, and promote strategic decision-making (see Aguilera & Jackson, 2010; Claessens & Yurtoglu, 2013). Yet, despite decades of inquiry, the relationship between board characteristics and firm performance remains contested. Empirical evidence varies across institutional environments, with some studies stressing strong positive links (Anderson & Reeb, 2003; Adams & Ferreira, 2009), while others report weak or even negative associations (Bhagat & Bolton, 2019). This suggests that the governance–performance nexus is conditional, shaped by legal, cultural, and market contexts. Emerging and frontier economies offer particularly revealing settings for this debate.

Weak enforcement of shareholder rights, information asymmetries, and corruption can undermine the effectiveness of formal governance mechanisms, while globalization and foreign investment may create countervailing pressures for transparency (La Porta et al., 1998; Khanna & Palepu, 2010). Bangladesh illustrates this tension well.

Although governance reforms have accelerated since the early 2000s, enforcement remains uneven and corporate scandals have persisted. At the same time, reliance on foreign capital has grown, raising questions about how domestic governance practices interact with external monitoring forces.

Within this environment, the board of directors plays a pivotal role. Board attributes such as size, independence, leadership structure, gender diversity, and ownership concentration are theorized to influence firm outcomes by shaping oversight intensity, information flows, and decision-making efficiency. However, the extent to which these attributes matter in weak-governance environments remains unclear. In particular, non-bank financial institutions (NBFIs) in Bangladesh provide a critical test case: they are central to capital intermediation, subject to governance reforms, yet still exposed to institutional weaknesses.

This study contributes to the international corporate governance literature by examining how a set of board characteristics, including board size, CEO duality, managerial ownership, foreign ownership, board independence, and gender leadership, affect firm performance in Bangladeshi NBFIs. Rather than treating these attributes in isolation, we explore their relative and combined influence in a frontier market setting. Our findings shed light on the conditional effectiveness of governance mechanisms, illustrating how external forces such as foreign ownership may substitute for weak domestic governance, while concentrated leadership structures may either enhance or impair performance depending on context. In doing so, we extend the comparative corporate governance debate by demonstrating how institutional environments shape the governance–performance link, with implications for both policymakers and investors in emerging markets.

II. Related Literature and Hypothesis Development

The relationship between board characteristics and firm performance has been examined through several theoretical lenses, each emphasizing different managerial motivations and governance outcomes. Agency theory (Fama, 1980; Jensen & Meckling, 1976) highlights the inherent conflict between dispersed shareholders and self-interested managers, predicting that board mechanisms such as monitoring, ownership alignment, and leadership structure reduce agency costs and enhance performance.

In contrast, stakeholder theory (Freeman, 1984) broadens the focus beyond shareholders, arguing that firms create value by balancing the interests of multiple constituencies; governance effectiveness is therefore judged by inclusiveness and fairness, not solely shareholder wealth.

Meanwhile, stewardship theory (Donaldson & Davis, 1991; Muth & Donaldson, 1998) contends that managers, as stewards, are intrinsically motivated to act in the firm’s best interest, implying that empowerment and trust can sometimes be more effective than strict monitoring. Together, these perspectives suggest that the governance–performance nexus is context-dependent: mechanisms may function differently depending on institutional environment, ownership structure, and managerial culture.

Board Size

Board size is one of the most studied attributes, yet findings remain mixed. Larger boards may enhance decision quality through diverse expertise and improved monitoring (Jensen, 1993; Adams & Mehran, 2005), but they may also suffer from coordination problems, free-riding, and slower decision-making (Lipton & Lorsch, 1992). Meta-analyses suggest that the performance effect of board size varies by industry and institutional setting, with benefits more likely in complex environments but costs more pronounced in weak governance systems.

Hypothesis 1 (H1) : Board size is significantly associated with firm performance.

Gender Diversity and Female Leadership

Gender diversity is often linked to broader stakeholder representation and enhanced board deliberations (Adams & Ferreira, 2009). Some studies report positive effects of female directors on performance (Smith et al., 2006), while others document negative or insignificant relationships, often attributing results to tokenism or institutional bias (Agag & El-Ansary, 2011; Bohren & Strom, 2007; Ferreira, 2009). Similarly, evidence on female CEOs remains inconclusive: while gender-diverse leadership may improve stakeholder legitimacy, it does not consistently translate into higher financial outcomes in patriarchal or weakly institutionalized contexts.

Hypothesis 2 (H2) : The presence of female board members is significantly associated with firm performance.

Hypothesis 3 (H3) : The presence of a female CEO is significantly associated with firm performance.

CEO Duality

The dual role of CEO and chairperson concentrates power, raising competing predictions. Agency theory argues that CEO duality weakens board independence and monitoring, harming performance (Finkelstein & D’Aveni, 1994). Stewardship theory, however, suggests duality streamlines decision-making and enhances accountability, especially in uncertain environments (Donaldson & Davis, 1991). Empirical findings remain context-specific, reflecting this theoretical tension.

Hypothesis 4 (H4) : CEO duality has a significant impact on firm performance.

Managerial Ownership

Managerial ownership aligns managers’ incentives with shareholder wealth, thereby mitigating agency problems (Morck, Shleifer & Vishny, 1988). However, very high ownership can entrench managers, weakening governance and harming performance. Prior studies document non-linear relationships, suggesting that ownership concentration may improve performance up to a threshold, after which entrenchment dominates.

Hypothesis 5 (H5) : Managerial ownership has a significant impact on firm performance.

Foreign Ownership

Foreign shareholders often bring advanced monitoring practices, higher disclosure demands, and reputational incentives, potentially substituting for weak domestic governance (Khanna & Palepu, 2010). Cross-country studies find that foreign ownership generally improves transparency and performance, though its effectiveness may depend on the regulatory environment and investor protection laws.

Hypothesis 6 (H6) : Foreign ownership has a significant impact on firm performance.

Board Independence

Independent directors are expected to provide unbiased monitoring and protect minority shareholders (Fama & Jensen, 1983). While widely endorsed in governance codes, empirical evidence is inconsistent. In strong legal environments, independence improves performance; in weak systems, independent directors may lack incentives or capacity to challenge insiders (Bhagat & Bolton, 2019).

Hypothesis 7 (H7) : The proportion of independent directors has a significant impact on firm performance.

Executive Committee Size

Executive or audit committees enhance financial oversight, internal controls, and transparency (Klein, 2002; Kyereboah-Coleman, 2007). Larger committees may bring more expertise and reduce earnings manipulation, though excessively large committees can suffer from inefficiency.

Hypothesis 8 (H8) : Executive committee size has a significant impact on firm performance.

Conceptual Framework of the Study

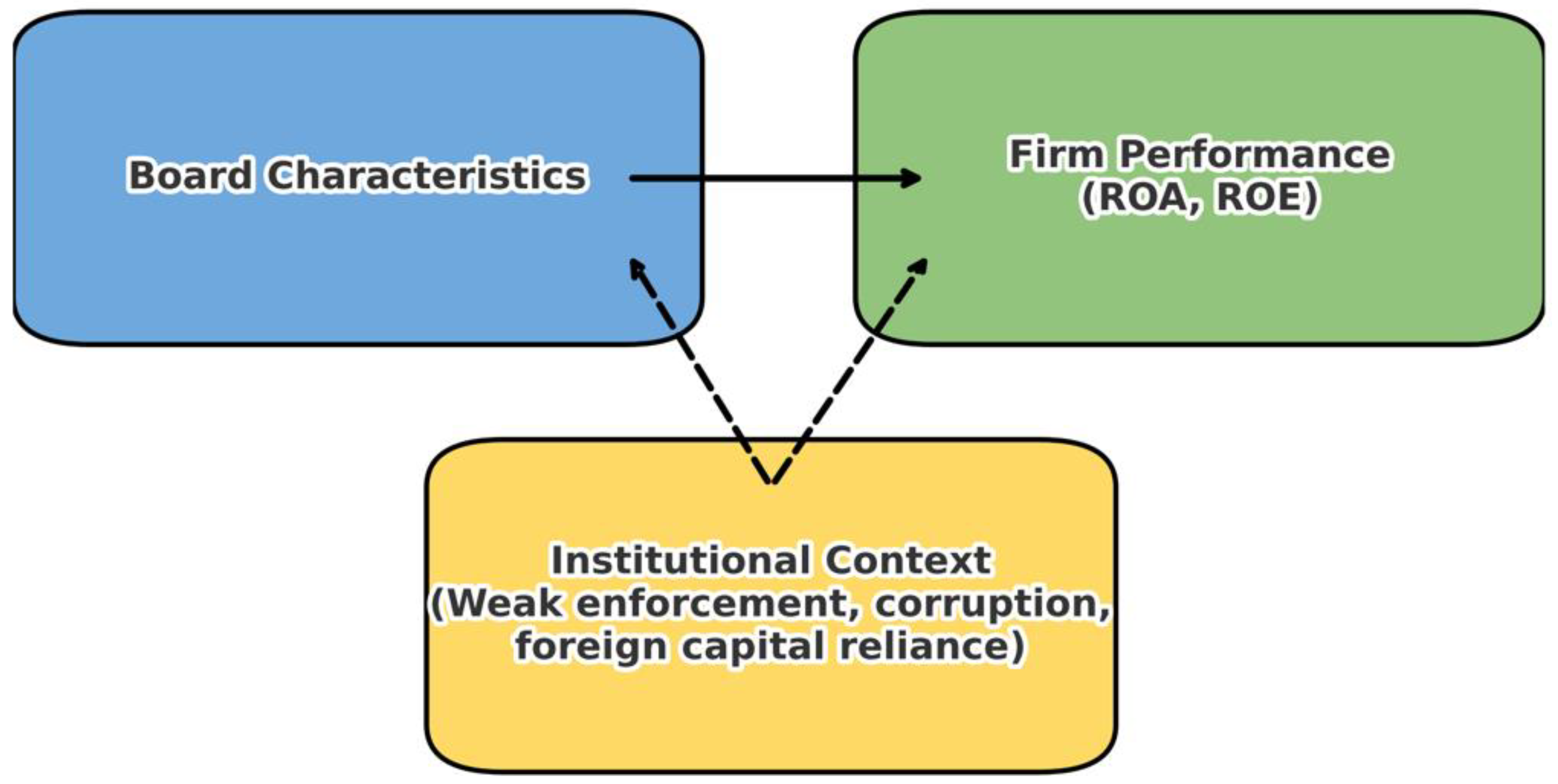

The conceptual framework of this study positions firm performance, measured by return on assets (ROA) and return on equity (ROE), as the primary outcome variable influenced by the characteristics of the board of directors.

Figure 1.

Conceptual Framework.

Figure 1.

Conceptual Framework.

Core attributes such as board size, independence, frequency of board meetings, managerial and insider ownership, gender diversity, CEO duality, and foreign ownership are theorized to shape organizational outcomes through their monitoring and advisory functions. While these attributes are expected to exert a direct effect on performance, their effectiveness is not uniform across contexts. The institutional environment, marked in Bangladesh by weak enforcement of corporate law, governance lapses, and dependence on foreign capital, mediates and conditions the strength of these relationships. Accordingly, the framework suggests that even theoretically sound governance mechanisms may yield attenuated or inconsistent results in institutional contexts where rule enforcement and transparency are limited. This integrated model therefore captures both the structural role of boards and the institutional contingencies that shape the governance–performance nexus.

Table 1.

Variable measures and predicted sign.

Table 1.

Variable measures and predicted sign.

| Variables |

Expected Sign |

| Board Size |

Positive |

| Women Member in BOD |

Negative |

| CEO Duality |

Positive |

| Executive Directors |

Positive |

| Managerial Ownership |

Positive |

| Foreign Ownership |

Positive |

| Women CEO |

Negative |

| Independent Directors |

Positive |

| Variables |

Measure of Variables |

| Return on Asset(ROA) |

Net Income/Total Asset |

III. Data Collection

Non-bank financial institutions (NBFIs) play a pivotal role in emerging financial markets by complementing traditional banks, particularly in higher-risk sectors that are typically underserved due to regulatory constraints. In Bangladesh, the NBFI sector has expanded rapidly, comprising 33 institutions as of June 2017, including leasing companies, merchant banks, investment banks, housing finance, and equity finance. Of these, 31 are listed on the Dhaka Stock Exchange (DSE), accounting for 5.9% of total market capitalization, highlighting the sector’s growing economic significance. The first NBFI, Industrial Promotion and Development Company of Bangladesh Limited (IPDC), began operations in 1981, marking the genesis of formal non-bank financial intermediation in the country.

Regulation and supervision of NBFIs are under the jurisdiction of Bangladesh Bank, which emphasizes risk-based oversight to support sector growth and financial stability. Core risk management areas include Credit Risk Management (CRM), Internal Control and Compliance (ICC), Asset and Liability Management (ALM), and Information and Communication Technology (ICT). Most NBFIs are now subject to system audits, reinforcing the integrity and reliability of financial reporting.

This study draws on a combination of primary and secondary data sources. Secondary data were collected from annual reports accessed via the DSE library, DSE website, Bangladesh Bank, and individual company websites. Complementary primary data were obtained through in-person interviews with key personnel from selected NBFIs. Firm performance is measured using Return on Assets (ROA), while governance and ownership characteristics: board size, women on the board, CEO duality, executive committee presence, managerial ownership, foreign ownership, women CEO, and independent directors, serve as predictors.

These governance and ownership variables were selected to examine their relationship with firm performance, enabling an analysis that contributes to the broader understanding of corporate governance mechanisms in emerging financial markets.

Research Design

This study adopts a positivist research philosophy to empirically examine the impact of corporate governance on firm performance in Bangladesh. A descriptive research design is employed, aligning with the study’s objective of systematically characterizing relationships between governance structures and performance outcomes. The analysis uses quantitative panel data, encompassing a 10-year period for 28 firms listed on the Dhaka Stock Exchange (DSE). Cross-sectional panel data were utilized to enable robust hypothesis testing across time and across firms.

Empirical evidence from prior studies emphasizes the relevance of corporate governance to firm performance. For instance, Tsalikis and Peralta (2016), analyzing 2,321 U.S. firms across eight sectors and 51 governance factors, found that well-governed firms consistently outperform poorly governed firms. Building on this literature, this study hypothesizes:

H₀: Board characteristics have no impact on firm performance in Bangladesh.

H₁: Board characteristics have a significant impact on firm performance in Bangladesh.

By situating the study within a global governance-performance discourse, the research contributes to understanding how board composition and ownership structures influence firm outcomes in emerging financial markets.

Methodology

To test the impact of corporate governance on firm performance, this study employs an Ordinary Least Squares (OLS) regression model, appropriate for panel data analysis (Henriques, 2016; Ferrell et al., 2015). The regression equation is specified as follows:

where:

ROA = Firm performance

BoS = Board size

WoBOD = Women on board

CEODu = CEO duality

ExDi = Executive directors

MgtOw = Managerial ownership

ForOw = Foreign ownership

WoCEO = Women CEO

IndDi = Independent directors

The analysis includes 28 listed Non-Banking Financial Institutions (NBFIs) in Bangladesh over the 2012–2016 period, resulting in 280 firm-year observations. This sample provides sufficient variation to test the relationships between board characteristics and firm performance.

IV. Result & Interpretation

This section presents the empirical findings of the study, including descriptive statistics, Analysis of Variance (ANOVA), and the significance of regression coefficients. These results provide the primary evidence to evaluate the impact of corporate governance on firm performance in Bangladesh’s Non-Banking Financial Institutions (NBFIs).

Descriptive Statistics

Table 4.1 summarizes the descriptive statistics for the governance variables across 280 firm-year observations. Board size ranges from 5 to 14 members, with a mean of 7.50, indicating moderately sized boards typical of emerging market NBFIs. Female representation on boards averages 2.47 members, with a standard deviation of 0.93, reflecting limited but non-negligible participation in governance decision-making.

| Table 4.1. |

| Variable |

Minimum |

Maximum |

Mean |

Std. Dev. |

| BoS |

5.000 |

14.000 |

7.500 |

1.886 |

| WoBOD |

1.000 |

5.000 |

2.470 |

0.931 |

| CEODu |

0.000 |

1.000 |

0.860 |

0.351 |

| ExDi |

0.000 |

2.000 |

1.440 |

0.565 |

| MgtOw |

0.000 |

1.000 |

0.240 |

0.430 |

| ForOw |

0.000 |

0.400 |

0.032 |

0.076 |

| WoCEO |

0.000 |

1.000 |

0.190 |

0.395 |

| IndDi |

1.000 |

7.000 |

1.800 |

0.948 |

| Number of Observations 280 |

CEO duality, coded as a binary variable, shows a mean of 0.86, indicating that the majority of firms combine the roles of CEO and board chair, which may constrain board independence. The average number of executive directors per board is 1.44, suggesting that boards maintain at least one executive presence on average. Managerial ownership averages 24%, highlighting potential agency concerns if ownership is concentrated among insiders. Foreign ownership remains low, averaging 3.2% and reaching a maximum of 40%, suggesting limited external shareholder influence. Women CEOs account for approximately 19% of the sample, demonstrating incremental gender diversity at the executive level. Finally, boards include an average of 2 independent directors, reflecting partial adherence to international corporate governance standards.

These descriptive findings reveal structural patterns in board composition and ownership that are critical for interpreting the regression results. In particular, high CEO duality and modest independent director representation suggest potential governance challenges that may affect firm performance. Conversely, the presence of women directors and executive diversity offers avenues for enhanced oversight and decision-making quality.

|

Table 4.2. Model Summary. |

| Model |

R |

R Square |

Adj. R Square |

Std. Error of the Estimate |

| 1 |

0.365 |

0.133 |

0.107 |

0.049 |

| a. Predictors: (Constant), Independent Directors, Managerial Ownership, Foreign Ownership, Executive Directors, Women Member in BOD, CEO Duality, Women CEO, Board Size |

The multiple regression analysis indicates an R² value of 0.133 (13.3%), suggesting that the independent variables—board size, women on the board, CEO duality, executive committee, managerial ownership, foreign ownership, women CEO, and independent directors, collectively explain 13.3% of the variation in Return on Assets (ROA). The remaining 86.7% of variation is attributable to factors outside the model, reflecting the complexity of firm performance determinants in emerging market NBFIs. The adjusted R², which accounts for the number of predictors and provides a more conservative estimate of explanatory power, is 0.107 (10.7%). This indicates that the statistically significant independent variables explain approximately 10.7% of the variation in ROA, highlighting that while governance characteristics contribute meaningfully to firm performance, other internal and external factors also play a substantial role.

Overall, the model demonstrates moderate predictive capacity, consistent with prior empirical research on governance-performance relationships in emerging financial institutions.

According to Table 4.3, the ANOVA results partition the total variation in ROA into regression (SSR) and residual error (SSE) components. The total sum of squares (SST) is 0.780, with the variation explained by the regression (SSR) equal to 0.104 and the residual error (SSE) equal to 0.676.

|

Table 4.3. Analysis of Variance. |

| |

Sum of Squares |

Mean Square |

F |

Sig. |

| Regression |

0.104 |

0.013 |

5.195 |

.000b

|

| Residual |

0.676 |

0.002 |

|

|

| Total |

0.780 |

|

|

|

| a. Dependent Variable: ROA |

| b. Predictors: (Constant), Independent Directors, Managerial Ownership, Foreign Ownership, Executive Directors, Women Member in BOD, CEO Duality, Women CEO, Board Size |

The model’s significance value is 0.000, which is below the α = 0.05 threshold, indicating that the null hypothesis can be rejected. This demonstrates that the independent variables—board size, women on the board, CEO duality, executive committee, managerial ownership, foreign ownership, women CEO, and independent directors, jointly exert a statistically significant effect on firm performance in Bangladesh’s NBFI sector.

These findings confirm that board composition and ownership structures collectively influence ROA. It lends a voice on the relevance of corporate governance mechanisms in emerging market financial institutions.

Regression Analysis & Hypothesis Testing

The regression analysis tested the relationship between board characteristics, ownership variables, and firm performance (ROA) in Bangladesh’s NBFI sector. Board size is not statistically significant (β = 0.077; t=1.131; p = 0.259), indicating no measurable effect on ROA. Women on the board also show no significant effect (p = 0.348). CEO duality is statistically significant at the 1% level (β = - 0.216; t = -3.466; p = 0.001), indicating a negative association with ROA. Executive directors do not show a significant effect (p = 0.299), nor does managerial ownership (p = 0.803). Foreign ownership is statistically significant at 1% (β = 0.319; t = 5.171, p = 0.000), indicating a positive association with ROA. Women CEOs are not significant (p = 0.344), and independent directors also show no significant effect (p = 0.239). These results indicate that among the governance and ownership variables examined, only CEO duality and foreign ownership are statistically significant predictors of ROA, while the other variables: board size, women on the board, executive directors, managerial ownership, women CEOs, and independent directors are not statistically significant.

|

Table 4.4. OLS Regression Output. |

| Variable |

Beta |

t |

Sig. |

| (Constant) |

0.0001** |

2.217 |

0.027 |

| BoS |

0.077 |

1.131 |

0.259 |

| WoBOD |

0.057 |

0.940 |

0.348 |

| CEODu |

-0.216*** |

-3.466 |

0.001 |

| ExDi |

-0.061 |

-1.041 |

0.299 |

| MgtOw |

0.016 |

0.250 |

0.803 |

| ForOw |

0.319*** |

5.171 |

0.000 |

| WoCEO |

0.060 |

0.949 |

0.344 |

| IndDi |

-0.083 |

-1.181 |

0.239 |

V. Discussion

This study examined the influence of board characteristics and ownership structures on firm performance (ROA) in Bangladesh’s Non-Banking Financial Institutions. The analysis provides layered insights into how corporate governance mechanisms operate within an emerging market context characterized by light regulation and concentrated ownership.

Contrary to theoretical predictions and some prior evidence (Jensen, 1993; Adams & Mehran, 2005), board size did not exhibit a statistically significant relationship with firm performance. This finding aligns with research suggesting that the benefits of larger boards may be offset by coordination challenges and decision-making inefficiencies, particularly in environments with weak institutional enforcement (Lipton & Lorsch, 1992). Similarly, the presence of female board members and women CEOs did not significantly affect performance, reflecting mixed outcomes documented in both emerging and developed markets (Adams & Ferreira, 2009; Agag & El-Ansary, 2011; Ferreira, 2009). These results may indicate that gender diversity and female leadership, while important for stakeholder representation, do not automatically translate into measurable financial gains in patriarchal or less formalized governance settings.

CEO duality emerged as a significant determinant of firm performance, with a negative coefficient. This supports agency theory predictions that concentration of executive power may weaken board oversight and monitoring (Finkelstein & D’Aveni, 1994). The result emphasizes the importance of separating the roles of CEO and chairperson in enhancing accountability and protecting shareholder interests in emerging markets. In contrast, executive committee size and managerial ownership were not significant, suggesting that internal governance structures and ownership alignment mechanisms may have limited marginal impact in the NBFI sector, potentially due to low managerial entrenchment or the scale of operations.

Foreign ownership had a strong and positive effect on ROA, consistent with cross-country evidence that foreign investors enhance monitoring, transparency, and access to best-practice governance (Khanna & Palepu, 2010). This finding highlights the potential of foreign participation to substitute for weaker domestic governance mechanisms, providing an avenue for improved firm performance in lightly regulated emerging markets. Conversely, the proportion of independent directors was not statistically significant, reflecting the broader debate that independence may be insufficient to influence performance when legal enforcement and incentives for monitoring are weak (Bhagat & Bolton, 2019).

Overall, the results suggest that in emerging market NBFIs, specific governance mechanisms, particularly those affecting executive power and external shareholder influence, have the most pronounced impact on firm performance, whereas other conventional board composition and diversity measures show limited direct financial effect. These findings contribute to the global corporate governance literature by emphasizing context-specific effectiveness of governance practices, particularly highlighting how institutional and regulatory environments modulate the performance relevance of board and ownership structures.

VI. Conclusion

This study investigated the impact of board characteristics and ownership structures on the performance of Non-Banking Financial Institutions (NBFIs) in Bangladesh. The findings indicate that among the governance mechanisms examined, CEO duality negatively affects firm performance, while foreign ownership exerts a positive influence. Other variables, including board size, gender diversity, executive directors, managerial ownership, women CEOs, and independent directors, were not statistically significant predictors of performance.

These results contribute to the global corporate governance literature by highlighting that the performance relevance of governance practices is context-specific, with executive power concentration and external shareholder influence playing pivotal roles in emerging market financial institutions. For policymakers, the findings support the importance of enforcing separation of CEO and board chair roles. It equally encourages foreign investor participation to enhance transparency and oversight. Investors and practitioners may benefit from prioritizing firms with governance structures that mitigate agency risks and leverage external monitoring mechanisms.

The study is subject to limitations. Data availability constrained the sample to 28 listed NBFIs, and the absence of instruments precluded formal testing for endogeneity, potentially affecting causal inference. Future research could expand the dataset, incorporate additional governance dimensions, and apply advanced econometric techniques to address endogeneity concerns.

References

- Agrawal, A.; Knoeber, C. R. Firm Performance and Mechanisms to Control Agency Problems Between Managers and Shareholders. Journal of Financial and Quantitative Analysis 1996, 31(3), 377–397. [Google Scholar] [CrossRef]

- Bathala, C.; Rao, R. P. The Determinants of Board Composition: An Agency Theory Perspective. Managerial and Decision Economics 1995, 16(1), 59–69. [Google Scholar] [CrossRef]

- Carcello, J. V.; Hermanson, D. R.; Neal, T. L.; Riley, R. A., Jr. Board Characteristics and Audit Fees. Contemporary Accounting Research 2002, 19(3), 365–384. [Google Scholar] [CrossRef]

- Chowdhury, M. U. Capital Structure Determinants: Evidence from Japan and Bangladesh. Journal of Business Studies 2004, XXV(1), 23–45. [Google Scholar]

- Cohen, A.; Loeb, R. Corporate governance; Practising Law Institute, 2016. [Google Scholar]

- Fama, E. F. Agency Problems and the Theory of the Firm. Journal of Political Economy 1980, 88(2), 288–307. [Google Scholar] [CrossRef]

- Fama, E. F.; Jensen, M. C. Separation of Ownership and Control. Journal of Law and Economics 1983, 26(2), 301–325. [Google Scholar] [CrossRef]

- Farrar, J. and Hanrahan, P. (2012). Corporate governance.

- Garrett, B. (1993). ‘Directing and the Learning Board in Corporate Governance’ in T. Clarke. (Ed.). Executive Development, 6(3), 21–27.

- Henriques, A. Good decision ? bad business? International Journal of Management and Decision Making 2016, 6(3/4), 273. [Google Scholar] [CrossRef]

- Keasey, K.; Thompson, S. Corporate governance; Cheltenham [etc.]; Elgar, 2016. [Google Scholar]

- Kiel, G.; Nicholson, G. Board Composition and Corporate Performance: How the Australian experience informs contrasting theories of corporate governance; Corporate Governance; An International Review, 2003; Volume 11, 3, pp. 189–205. [Google Scholar]

- Jensen, M. C. The Modern Industrial Revolution, Exit and the Failure of Internal Control Systems. Journal of Finance 1993, 48(3), 831–880. [Google Scholar] [CrossRef]

- Jensen, M. C. Value Maximisation, Stakeholder Theory and the Corporate Objective Function. European Financial Management 2001, 7(3), 297–317. [Google Scholar] [CrossRef]

- Lipton, M.; Lorsch, J. W. A Modest Proposal for Improved Corporate Governance. Business Lawyer 1992, 1(1), 59–77. [Google Scholar]

- Makhija, A.; John, K.; Hirschey, M. Corporate governance; Bingley; Emerald Group Publishing Limited, 2009. [Google Scholar]

- Mallin, C. (2013). Corporate governance.

- Muth, M. M.; Donaldson, L. Stewardship Theory and Board Structure: A contingency approach. Corporate Governance: An International Review 1998, 6(1), 5–28. [Google Scholar] [CrossRef]

- Smith, N.; Smith, V.; Verner, M. Do Women in Top Management Affect Firm Performance? A Panel Study of 2,500 Danish Firms. International Journal of Productivity and Performance Management 2006, 55(5), 569–593. [Google Scholar] [CrossRef]

- Tsalikis, J.; Peralta, A. Priming effects on business ethical decision making. Priming effects on business ethical decision making 2016, 01(01). [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).