Submitted:

04 September 2025

Posted:

05 September 2025

You are already at the latest version

Abstract

Keywords:

I. Introduction

II. Related Work and Foundation

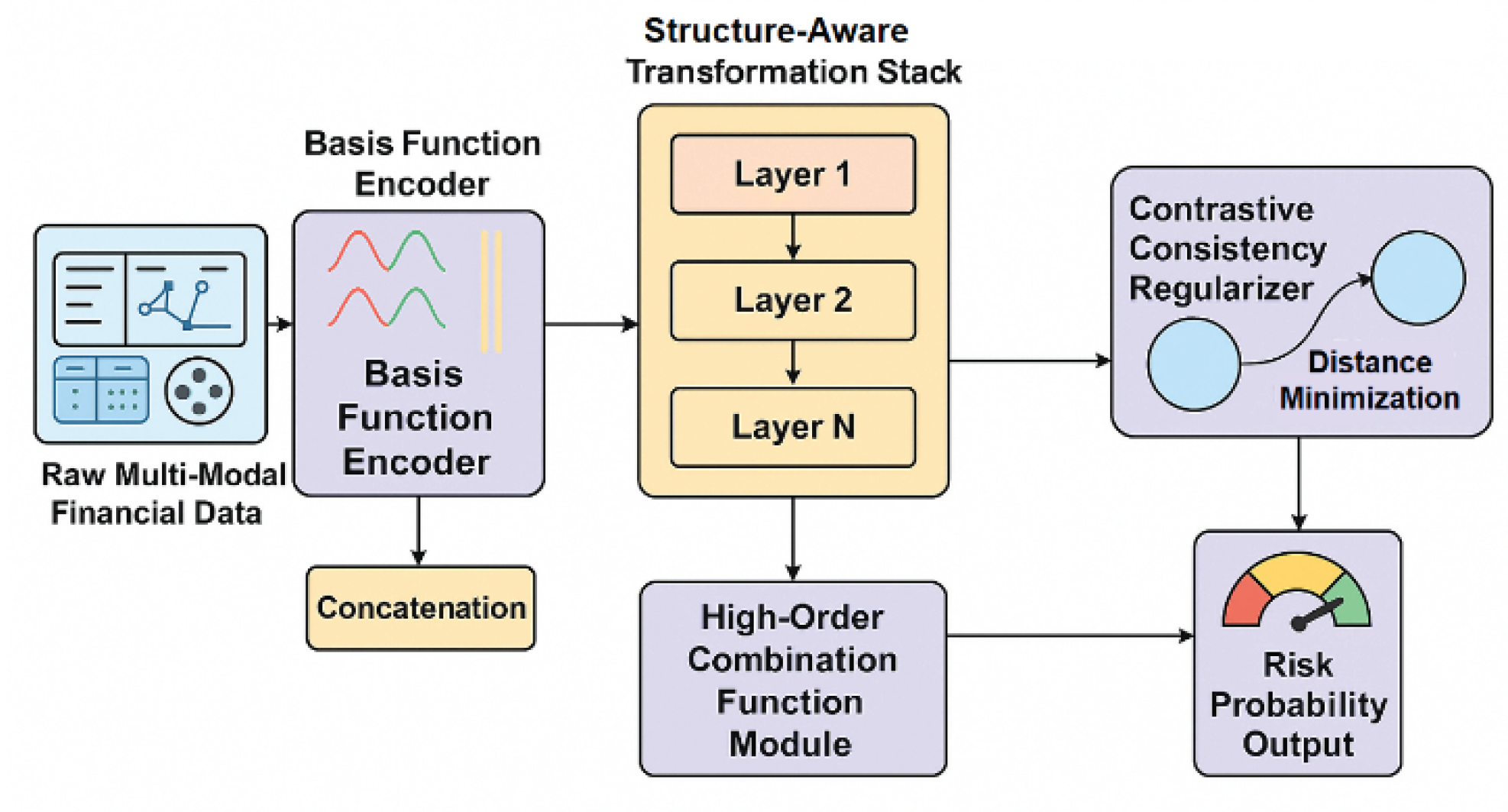

III. Proposed Approach

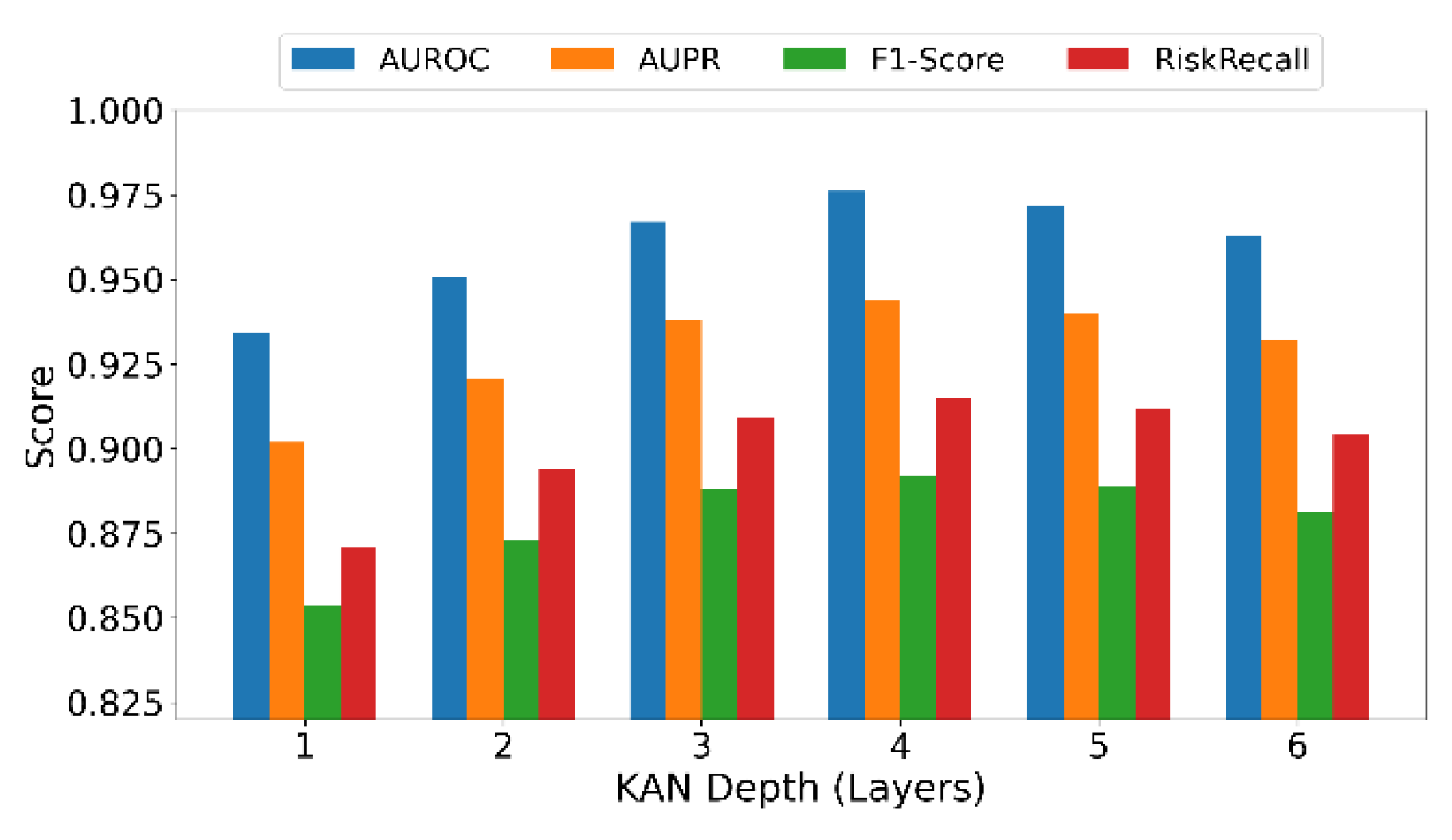

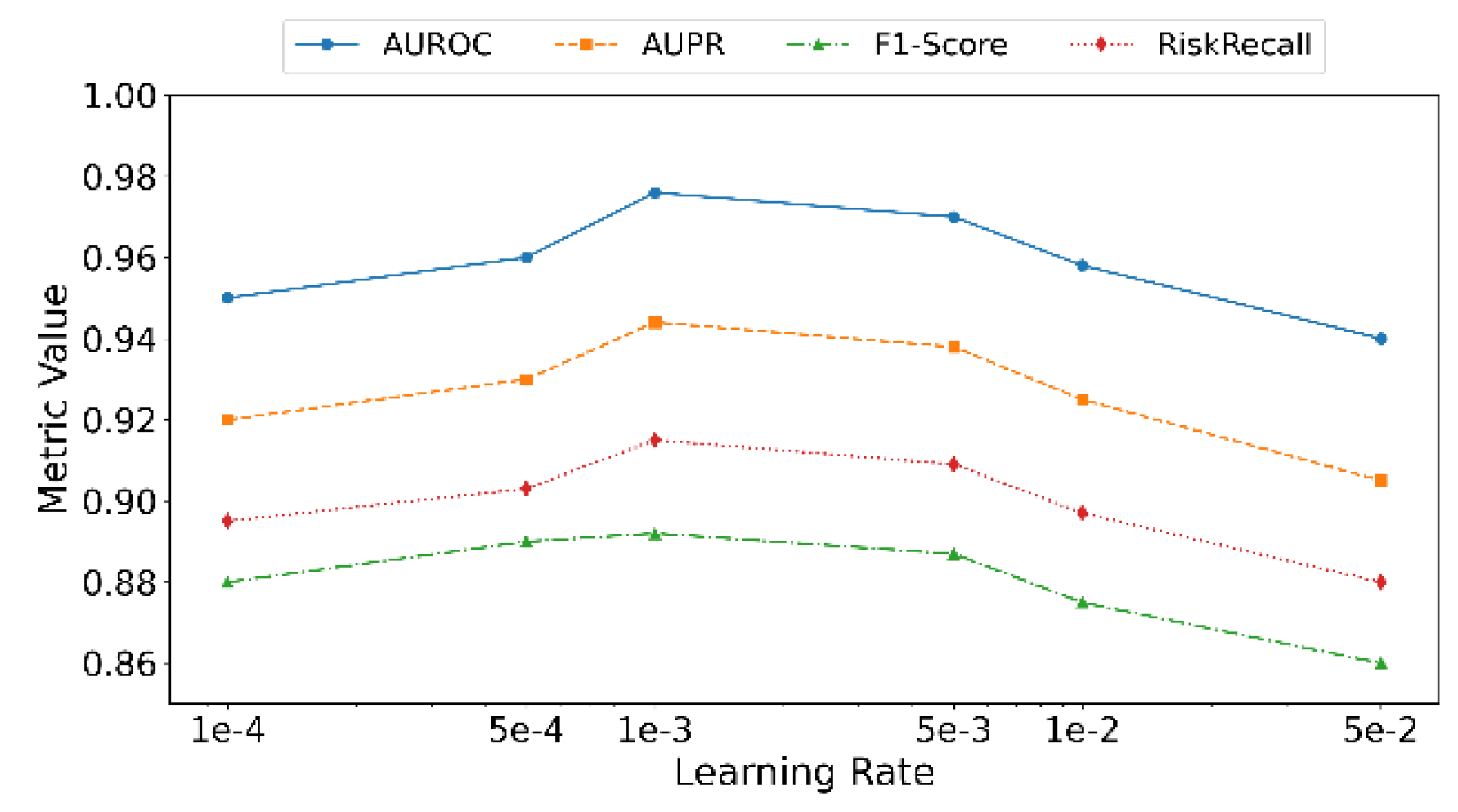

IV. Performance Evaluation

A. Dataset

B. Experimental Results

V. Conclusion

References

- Guo Y., Liang T., Chen Z., et al., "FinKENet: A Novel Financial Knowledge Enhanced Network for Financial Question Matching", Entropy, vol. 26, no. 1, p. 26, 2023.

- Bui N., Nguyen H. T., Nguyen V. A., et al., "Explaining graph neural networks via structure-aware interaction index", arXiv preprint arXiv:2405.14352, 2024.

- Fang B. and Gao D., "Domain-Adversarial Transfer Learning for Fault Root Cause Identification in Cloud Computing Systems", arXiv preprint arXiv:2507.02233, 2025.

- Gao D., "Graph Neural Recognition of Malicious User Patterns in Cloud Systems via Attention Optimization", Transactions on Computational and Scientific Methods, vol. 4, no. 12, 2024.

- Lou Y., "RT-DETR-Based Multimodal Detection with Modality Attention and Feature Alignment", Journal of Computer Technology and Software, vol. 3, no. 5, 2024.

- Zhan J., "Elastic Scheduling of Micro-Modules in Edge Computing Based on LSTM Prediction", Journal of Computer Technology and Software, vol. 4, no. 2, 2025.

- Wei M., Xin H., Qi Y., Xing Y., Ren Y., and Yang T., "Analyzing data augmentation techniques for contrastive learning in recommender models", 2025.

- Xing Y., Wang Y., and Zhu L., "Sequential Recommendation via Time-Aware and Multi-Channel Convolutional User Modeling", Transactions on Computational and Scientific Methods, vol. 5, no. 5, 2025.

- Wang Y., "Structured Compression of Large Language Models with Sensitivity-aware Pruning Mechanisms", Journal of Computer Technology and Software, vol. 3, no. 9, 2024.

- Wang Y., Liu H., Long N., and Yao G., "Federated Anomaly Detection for Multi-Tenant Cloud Platforms with Personalized Modeling", arXiv preprint arXiv:2508.10255, 2025.

- Zhang X., Wang X., and Wang X., "A Reinforcement Learning-Driven Task Scheduling Algorithm for Multi-Tenant Distributed Systems", arXiv preprint arXiv:2508.08525, 2025.

- Lian L., Li Y., Han S., Meng R., Wang S., and Wang M., "Artificial Intelligence-Based Multiscale Temporal Modeling for Anomaly Detection in Cloud Services", arXiv preprint arXiv:2508.14503, 2025.

- Zhang R., "AI-Driven Multi-Agent Scheduling and Service Quality Optimization in Microservice Systems", Transactions on Computational and Scientific Methods, vol. 5, no. 8, 2025.

- Zhang R., Lian L., Qi Z., and Liu G., "Semantic and Structural Analysis of Implicit Biases in Large Language Models: An Interpretable Approach", arXiv preprint arXiv:2508.06155, 2025.

- Xing Y., Yang T., Qi Y., Wei M., Cheng Y., and Xin H., "Structured Memory Mechanisms for Stable Context Representation in Large Language Models", arXiv preprint arXiv:2505.22921, 2025.

- Zheng H., Zhu L., Cui W., Pan R., Yan X., and Xing Y., "Selective Knowledge Injection via Adapter Modules in Large-Scale Language Models", 2025.

- Zhang W., Tian Y., Meng X., Wang M., and Du J., "Knowledge Graph-Infused Fine-Tuning for Structured Reasoning in Large Language Models", arXiv preprint arXiv:2508.14427, 2025.

- Ghaleb F. A., Saeed F., Al-Sarem M., et al., "Ensemble synthesized minority oversampling-based generative adversarial networks and random forest algorithm for credit card fraud detection", IEEE Access, vol. 11, pp. 89694-89710, 2023.

- Du X., "Financial text analysis using 1D-CNN: Risk classification and auditing support", Proceedings of the 2025 International Conference on Artificial Intelligence and Computational Intelligence, pp. 515-520, 2025.

- Tang T., Yao J., Wang Y., Sha Q., Feng H., and Xu Z., "Application of Deep Generative Models for Anomaly Detection in Complex Financial Transactions", Proceedings of the 2025 4th International Conference on Artificial Intelligence, Internet and Digital Economy (ICAID), pp. 133-137, 2025.

- Bao Q., "Advancing Corporate Financial Forecasting: The Role of LSTM and AI in Modern Accounting", Transactions on Computational and Scientific Methods, vol. 4, no. 6, 2024.

- Wu Y., Qin Y., Su X., and Lin Y., "Transformer-based risk monitoring for anti-money laundering with transaction graph integration", 2025.

- Qin Y., "Deep contextual risk classification in financial policy documents using transformer architecture", Journal of Computer Technology and Software, vol. 3, no. 8, 2024.

- Wang Y., Xu Z., Yao Y., Liu J., and Lin J., "Leveraging Convolutional Neural Network-Transformer Synergy for Predictive Modeling in Risk-Based Applications", Proceedings of the 2024 4th International Conference on Electronic Information Engineering and Computer Communication (EIECC), pp. 1565-1570, 2024.

- Wang Y., Sha Q., Feng H., and Bao Q., "Target-Oriented Causal Representation Learning for Robust Cross-Market Return Prediction", Journal of Computer Science and Software Applications, vol. 5, no. 5, 2025.

- Sheng Y., "Market Return Prediction via Variational Causal Representation Learning", Journal of Computer Technology and Software, vol. 3, no. 8, 2024.

- Xu Z., Sheng Y., Bao Q., Du X., Guo X., and Liu Z., "BERT-Based Automatic Audit Report Generation and Compliance Analysis", Proceedings of the 2025 5th International Conference on Artificial Intelligence and Industrial Technology Applications (AIITA), pp. 1233-1237, 2025.

- Ning X., Tian W., Yu Z., et al., "HCFNN: high-order coverage function neural network for image classification", Pattern Recognition, vol. 131, p. 108873, 2022.

- Du X., "Optimized convolutional neural network for intelligent financial statement anomaly detection", Journal of Computer Technology and Software, vol. 3, no. 9, 2024.

- Xue Z., Zi Y., Qi N., Gong M., and Zou Y., "Multi-Level Service Performance Forecasting via Spatiotemporal Graph Neural Networks", arXiv preprint arXiv:2508.07122, 2025.

- Wang M., Kang T., Dai L., Yang H., Du J., and Liu C., "Scalable Multi-Party Collaborative Data Mining Based on Federated Learning", 2025.

- Qin Y., "Hierarchical Semantic-Structural Encoding for Compliance Risk Detection with LLMs", Transactions on Computational and Scientific Methods, vol. 4, no. 6, 2024.

- Xu Q. R., "Capturing Structural Evolution in Financial Markets with Graph Neural Time Series Models", 2025.

- Zi Y., Gong M., Xue Z., Zou Y., Qi N., and Deng Y., "Graph Neural Network and Transformer Integration for Unsupervised System Anomaly Discovery", arXiv preprint arXiv:2508.09401, 2025.

- Yang H., Wang M., Dai L., Wu Y., and Du J., "Federated Graph Neural Networks for Heterogeneous Graphs with Data Privacy and Structural Consistency", 2025.

- Su X., "Deep Forecasting of Stock Prices via Granularity-Aware Attention Networks", Journal of Computer Technology and Software, vol. 3, no. 7, 2024.

- Yu C., Xu Y., Cao J., et al., "Credit card fraud detection using advanced transformer model", Proceedings of the 2024 IEEE International Conference on Metaverse Computing, Networking, and Applications (MetaCom), pp. 343-350, 2024.

- McDermott M., Zhang H., Hansen L., et al., "A closer look at auroc and auprc under class imbalance", Advances in Neural Information Processing Systems, vol. 37, pp. 44102-44163, 2024.

- Zhu M., Zhang Y., Gong Y., et al., "Enhancing credit card fraud detection: a neural network and smote integrated approach", arXiv preprint arXiv:2405.00026, 2024.

- Li F., Chen Z., "Dynamic quantification anti-fraud machine learning model for real-time transaction fraud detection in banking", Discover Computing, vol. 28, no. 1, p. 59, 2025.

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).