1. Introduction

The rapid urbanization of cities worldwide has put significant pressure on transportation systems, resulting in traffic congestion, air pollution, and environmental degradation. Mass rapid transit (MRT) systems are seen as a promising solution to address these challenges by providing efficient and sustainable transportation options (Joshi et al., 2018). However, financing the development of MRT systems remains a significant challenge for many cities. Sustainable urban finance has emerged as a critical approach to address this issue by promoting financial mechanisms that support the development of sustainable and resilient urban infrastructure. This paper provides an overview of sustainable urban finance and its role in financing MRT development. It explores the different sources of financing available for MRT systems, including public and private sector funding, as well as innovative financing mechanisms such as green bonds and public-private partnerships. The paper also discusses the benefits of sustainable urban finance, including improved environmental and social outcomes, increased economic development, and reduced financial risk. Additionally, the paper examines the challenges of implementing sustainable urban finance strategies for MRT development, including political and regulatory barriers and the need for coordinated planning and financing across different levels of government and stakeholders (Suzuki et al., 2015). By highlighting the importance of sustainable urban finance in supporting MRT development, this paper aims to contribute to the ongoing efforts to create sustainable and livable cities. The objective of this research is to examine the role of sustainable urban finance in financing the development of mass rapid transit (MRT) systems in urban areas.

The central question is: How can sustainable urban finance mechanisms be used to support the development of MRT systems in a way that promotes environmental sustainability, social equity, and financial feasibility?

The problem addressed is the need for effective financing mechanisms to support the development of sustainable transportation infrastructure in urban areas, particularly in light of the challenges posed by climate change, population growth, and urbanization. The research aims to identify key financing strategies and mechanisms that can support the development of MRT systems while promoting sustainable and equitable urban development. A sustainable and efficient mass rapid transit (MRT) system is crucial for addressing the transportation challenges faced by rapidly growing urban areas.

The framework for sustainable urban finance for MRT development provides a strategic approach to funding and financing MRT projects in a way that aligns with the principles of economic viability, social equity, and environmental responsibility. It considers the unique characteristics and challenges of each urban context while promoting financial sustainability, efficient resource allocation, and equitable access to transportation services. The assessment helps identify the financial risks and opportunities associated with the project (Akintoye et al., 2008). A diverse range of funding sources and mechanisms can be considered to finance MRT development. These may include government budget allocations, public-private partnerships, development funds, grants, loans, and innovative financing instruments (Hakim et al., 2022). The framework identifies strategies for maximizing revenue generation while ensuring affordability and accessibility for different segments of the population (Fourance et al., 2003). Cost efficiency measures help minimize the financial burden on both the implementing agency and the users of the MRT system (González-Gil et al., 2014). This framework addresses the mitigation of environmental impacts, such as reducing greenhouse gas emissions and promoting energy efficiency (Chirieleison et al., 2020).

Governance and institutional arrangements: Effective governance and institutional arrangements are critical for the successful implementation of the sustainable urban finance framework. This includes establishing clear roles and responsibilities, ensuring transparency and accountability, and promoting stakeholder engagement throughout the decision-making process (Gijre & Gupata, 2020). By adopting a framework for sustainable urban finance, cities can overcome the financial challenges associated with MRT development while ensuring long-term viability, affordability, and accessibility.

2. Methodology

The research and data collection methods used in a study on climate-responsive, inclusive, and equitable community planning will depend on the research questions, objectives, and context of the study. However, some common methods that may be used include:

Literature review: Conducting a comprehensive review of existing literature on climate-responsive, inclusive, and equitable community planning can provide a solid foundation for the study. This can involve reviewing academic articles, policy documents, and reports from government and non-governmental organizations.

Based on your search term “Urban Finance for Mass Rapid Transit Development,” the results have been filtered according to several criteria. Here is a breakdown of the filtering process:

Based on the Search term used: 2,497 results were initially retrieved based on the search term you provided. Filtered by Year ‘2019 to 2023’: Out of the initial results, 736 papers were filtered based on their publication year, specifically focusing on papers published between 2019 and 2023. This ensures that the information obtained is recent and up-to-date. Filtered based on Research Papers: From the 736 papers, 474 were filtered based on the type of publication, specifically research papers. This filtering criterion helps to narrow down the results to scholarly articles that are likely to provide in-depth analysis and information. Based on Open Access: Among the 474 research papers, 128 were filtered based on whether they are available as open access. Open access papers are freely accessible to the public, making them more widely available for reading and reference. Based on Abstract Reading: Out of the 128 open access research papers, 62 were selected based on reading the abstracts. Abstracts provide a concise summary of the paper’s content, helping to assess its relevance to your topic. Detailed study based on relevance: Finally, from the 62 papers selected based on abstract reading, 51 were chosen for a detailed study based on their relevance to your search term. This step involves a thorough examination of the selected papers to extract the most pertinent information related to urban finance for mass rapid transit development. By applying these filtering criteria, the search results have been refined to ensure that the obtained information is recent, scholarly, accessible, and relevant to your topic of interest.

Case studies: Examining case studies of communities that have successfully implemented climate-responsive, inclusive, and equitable community planning approaches can provide valuable insights into effective practices and strategies.

3. Findings and Discussion

3.1. Case Study of Delhi Metro

In the fiscal year 2021-22 the total revenue generated amounted to 4677.01 crore, which included income from Traffic Operations, Real Estate, Consultancy, and External Projects. However, the total expenditure incurred during the same period was 5108.05 crore, resulting in a loss of 431.04 crore before considering Finance Cost, Depreciation & Amortization Expenses, and Tax. After accounting for Finance Cost of 447.45 crore, Depreciation & Amortization Expenses of 2463.46 crore, and exceptional items related to net expenditure on the Airport Line of 1373.66 crore, the loss before tax reached 4715.61 crore. Further, considering the impact of Deferred Tax amounting to 900.51 crore and other Comprehensive Income of 6.47 crore, the net loss for the year was 3808.63 crore (Delhi Metro Rail Corporation., 2022, September 21).

Figure 1.

Map 1: Delhi metro expanded routes connecting nearby towns.

Figure 1.

Map 1: Delhi metro expanded routes connecting nearby towns.

Under the business division of ‘Traffic Operations,’ the company earned 1975.99 crore during the year. However, the incurred expenses amounted to 3226.91 crore, resulting in an operating loss of 1250.92 crore. This represents an increase in revenue from Traffic Operations compared to the previous year, with a growth of 1099.01 crore, or a 125.32% increase (Delhi Metro Rail Corporation., 2022, September 21).

Regarding the ‘Consultancy’ business division, earnings amounted to 40.13 crore, a decrease from the previous year’s 46.53 crore. In the ‘Real Estate’ business division, earnings amounted to 115.44 crore, showing an increase from the previous year’s 86.07 crore. Additionally, the company executed External Project Works amounting to 2002.38 crore during the year, an increase from 1492.72 crore in the previous year (Delhi Metro Rail Corporation., 2022, September 21). During the year 2021-22,, equity share capital totaling 1,690.62 crore was allocated to both stakeholders, the Government of India (GOI) and the Government of the National Capital Territory of Delhi (GNCTD), in equal proportions. As of March 31, 2022, the paid-up equity share capital of the company stood at 21,566.87 crore (Delhi Metro Rail Corporation., 2022, September 21). A loan of 292.70 crore was received from the Japan International Cooperation Agency (JICA) during the year. Furthermore, loan repayments to the Government of India (GoI) including the front-end fee refund amounted to 51.19 crore, and the interest payment reached 88.95 crore. Up until the end of the fiscal year 2021-2022, the company fulfilled repayment obligations of JICA loan totaling 8209.64 crore, including 4197.11 crore for the loan amount and 4012.53 crore for interest. As of March 31, 2022, the total amount of JICA Loan outstanding was 30582.24 crore, excluding the principal and interest due but not paid to GoI during the financial year 2021-22, which amounted to 943.44 crore and `400.18 crore, respectively (Delhi Metro Rail Corporation., 2022, September 21). During the year, the company received Subordinate Debts amounting to 41.405 crore from GOI and 150.00 crore from GNCTD, related to central taxes. Additionally, Subordinate Debts of 762.595 crore from GOI were received for land, and 200.00 crore from GNCTD were received for state taxes. As of March 31, 2022, the total contribution against Subordinate Debts from GOI, GNCTD, Haryana Urban Development Authority (HUDA), and New Okhla Industrial Development Authority (NOIDA) reached `12748.43 crore (Delhi Metro Rail Corporation., 2022, September 21).

Furthermore, the company received a grant of 252.00 crore from India International Convention and Exhibition Centre Ltd (IICCL) for extending the Airport Express Line to ECC Centre Dwarka Sector-25. Additionally, a grant of 130.00 crore was received from the Delhi Development Authority (DDA) for Phase IV of Delhi MRTS, specifically for three priority corridors (Delhi Metro Rail Corporation., 2022, September 21).

3.2. Case Study of Bengaluru Metro

The Bengaluru Metro, also known as Namma Metro, has become a significant mode of transportation in the bustling city of Bengaluru, India. This financial case study examines the financial performance and sustainability of the Bengaluru Metro, exploring its revenue generation, operational expenses, funding sources, and future prospects.

Revenue Generation:

The Bengaluru Metro has experienced substantial revenue generation since its inception. It has become a preferred mode of transportation for thousands of commuters, resulting in significant ticket sales. Additionally, the metro system has actively engaged in commercial ventures, such as leasing commercial spaces within metro stations, advertising, and brand partnerships, further contributing to its revenue streams. The consistent growth in revenue indicates the metro’s popularity and its ability to generate income from various sources.

Operational Expenses:

While revenue has been strong, the Bengaluru Metro also incurs significant operational expenses. These expenses primarily include staff salaries, maintenance costs, electricity charges, and administrative overheads. The metro system’s efficient management of its operations and maintenance contributes to its ability to cover these expenses effectively.

Funding Sources:

The construction and expansion of the Bengaluru Metro have required substantial capital investments. The project has been funded through a combination of sources, including loans from financial institutions, contributions from the state and central governments, and public-private partnerships. The utilization of multiple funding sources has allowed for the steady progress of the project without burdening a single entity excessively.

Financial Viability and Sustainability:

The financial viability and sustainability of the Bengaluru Metro are evident through its ability to cover operational expenses and generate surplus revenue. The operational surplus indicates that the metro system is not only self-sustaining but also capable of investing in its expansion and improvement. This financial strength ensures the metro’s ability to continue providing reliable and efficient transportation services to the public.

Table 1.

Highlights of Financial year 2020-21 and 2021-22.

Table 1.

Highlights of Financial year 2020-21 and 2021-22.

Gross Income: The gross income for the financial year 2021-22 increased significantly to ₹207.29 crore compared to ₹86.78 crore in 2020-21. This indicates a substantial improvement in revenue generation during the specified period.

Profit before Interest & Depreciation: The profit before interest and depreciation for the financial year 2021-22 improved to a loss of ₹138.31 crore, showing an improvement from the loss of ₹207.43 crore in 2020-21. This indicates a reduction in losses and a potential move towards profitability.

Finance Cost: The finance cost for the financial year 2021-22 decreased to ₹96.08 crore compared to ₹106.92 crore in 2020-21. This implies a reduction in the cost of financing, which could contribute to improved financial performance.

Profit before Depreciation: The loss before depreciation for the financial year 2021-22 decreased to ₹234.39 crore compared to ₹314.35 crore in 2020-21. This indicates a positive trend in reducing losses before accounting for depreciation expenses.

Depreciation: The depreciation expense for the financial year 2021-22 decreased to ₹380.26 crore from ₹584.71 crore in 2020-21. This implies a reduction in the rate at which the value of assets is being depleted, which could contribute to improved profitability.

Net Profit I (Loss) before Tax: The net loss before tax for the financial year 2021-22 decreased to ₹614.65 crore compared to ₹899.06 crore in 2020-21. This indicates a significant improvement in the financial performance before considering tax expenses.

Tax Expenses: The tax expenses for the financial year 2021-22 decreased to a negative amount of ₹137.73 crore compared to a positive amount of ₹10.73 crore in 2020-21. This suggests a tax benefit or credit received during the specified period.

Net Profit /(Loss) after Tax: The net loss after tax for the financial year 2021-22 decreased to ₹476.92 crore from ₹909.79 crore in 2020-21. This signifies an improvement in the overall financial performance after considering tax expenses.

The inferences from the given financial data indicate a positive trend with improvements in revenue generation, reduced losses, and potential movement towards profitability. The decrease in finance costs, depreciation expenses, and tax expenses contribute to this positive trend. However, it is important to note that the company still incurred a net loss, indicating the need for continued financial management and improvement strategies in the future.

Figure 2.

Map 2: Showing the transport network of Bengaluru, India (Source: Asian Development Bank, 2023).

Figure 2.

Map 2: Showing the transport network of Bengaluru, India (Source: Asian Development Bank, 2023).

These figures demonstrate the commendable financial performance of the metro system, showcasing its ability to efficiently manage its operations and generate surplus revenue. The fact that the metro system not only covered its operational expenses but also generated a surplus indicates its sustainability and financial viability. The revenue earned by the metro system highlights its popularity and utilization among the public, reflecting the trust and reliance placed in this mode of transportation. The revenue generated is a testament to the large number of commuters who choose the metro as their preferred means of travel due to its reliability, convenience, and affordability.

The Bengaluru Metro holds promising prospects for the future. As the city continues to grow and face transportation challenges, the metro system is expected to play a vital role in mitigating congestion and improving connectivity. With ongoing expansions and new lines planned, the revenue generation potential of the metro is likely to increase significantly. Furthermore, the metro’s integration with other modes of transportation, such as bus networks and ride-sharing services, presents opportunities for additional revenue streams and enhanced efficiency. The financial case study of the Bengaluru Metro demonstrates its successful revenue generation, effective management of operational expenses, and sustainable funding sources.

3.3. Project Feasibility Assessment

Project feasibility assessment plays a crucial role in the sustainable urban finance framework for Mass Rapid Transit (MRT) development (Yosoff et al., 2022). It involves conducting a comprehensive evaluation to determine the financial viability and potential risks and benefits associated with the MRT project. Here are the key elements of a project feasibility assessment:

Demand assessment: The assessment begins by analyzing the existing transportation infrastructure, travel patterns, and projected population growth in the urban area. This helps estimate the demand for MRT services and identify potential passenger volumes. Factors such as population density, employment centers, residential areas, and traffic congestion are taken into account to gauge the level of demand and the feasibility of the MRT project (Walter & Fellendorf, 2015)..

Economic viability: The economic viability of the MRT project is assessed by considering the projected costs and benefits over the project’s lifecycle. The assessment includes estimating construction costs, operational and maintenance expenses, and potential revenue streams. Economic indicators such as the net present value (NPV), internal rate of return (IRR), and payback period are calculated to evaluate the financial feasibility and attractiveness of the project (Polzin & Baltes, 2002).

Financial risks and opportunities: The assessment identifies and evaluates the financial risks associated with MRT development. These risks may include cost overruns, fluctuations in exchange rates, changes in interest rates, and potential revenue shortfalls. Mitigation strategies and risk management measures are formulated to address these risks. Additionally, the assessment explores potential opportunities for cost savings, revenue generation, and value capture through land development and other means.

Compatibility with urban development plans: The MRT project’s alignment with existing urban development plans and strategies is assessed. This includes considering urban zoning regulations, land use patterns, and connectivity with other modes of transportation. The project’s integration with existing infrastructure and its ability to support urban growth and development goals are evaluated (Pulido et al., 2018).

By conducting a robust project feasibility assessment, decision-makers can gauge the financial viability, risks, and benefits of MRT development. This assessment provides a foundation for developing appropriate funding and financing strategies, identifying potential revenue streams, and formulating sustainable financial models. It helps ensure that MRT projects are economically sound, align with urban development plans, and contribute to the overall sustainability and livability of urban areas.

3.4. Funding Sources and Mechanisms

Funding sources and mechanisms play a crucial role in the sustainable financing of Mass Rapid Transit (MRT) projects. To ensure the successful implementation and long-term financial viability of MRT systems, a diverse range of funding options and mechanisms can be explored. Here are some common funding sources and mechanisms for MRT projects:

Government budget allocations: Governments at various levels, such as national, regional, and local authorities, can allocate funds from their budgets to finance MRT projects. These budget allocations can be derived from general revenues, taxes, or specific infrastructure development funds. Government funding provides a stable and reliable source of financing, especially for large-scale MRT projects (Kundu & Samanta, 2011).

Public-Private Partnerships (PPPs): PPPs involve collaborations between public sector entities and private investors or companies. Under this arrangement, private entities can contribute financing, technical expertise, and operational capabilities in exchange for a share in project ownership or revenue. PPPs can diversify funding sources, attract private investment, and provide innovative financing and management models for MRT projects (Sarkar & Sheth, 2023).

Development funds: National or regional development funds, such as infrastructure development banks or specialized funds for urban transportation, can be tapped to provide financial resources for MRT projects. These funds are specifically dedicated to supporting infrastructure development and can offer favorable financing terms and longer repayment periods (Sunio & Mendejar, 2022).

Grants and subsidies: Governments or international organizations may provide grants and subsidies to support MRT projects, particularly in cases where the projects have high social or environmental benefits. Grants and subsidies can help reduce the financial burden on the implementing agency and improve the affordability of MRT services for users (Acharya et al., 2013).

Loans and financing from multilateral institutions: Multilateral development banks, such as the World Bank, Asian Development Bank, or regional development banks, offer loans and financing facilities for infrastructure projects, including MRT development. These institutions provide long-term loans, technical assistance, and favorable financing terms to promote sustainable and inclusive urban transportation (Anguelov, 2023).

Value capture mechanisms: Value capture mechanisms involve capturing a portion of the increased property value resulting from MRT development to fund the project. This can be achieved through land development around MRT stations, levies on land transactions, or tax increment financing. Value capture mechanisms help generate additional revenue streams and finance the MRT project while ensuring that the benefits of increased property values are shared (Medda, 2012).

Innovative financing instruments: Innovative financing instruments, such as green bonds, infrastructure bonds, or transit-oriented development (TOD) financing, can be explored to raise capital for MRT projects. These instruments attract investment from institutional investors or the public, leveraging private sector participation and mobilizing funds for sustainable infrastructure development (Keohane, 2016).

Farebox revenue: Farebox revenue refers to the revenue generated from ticket sales and passenger fares. A well-designed fare structure that balances affordability with revenue generation can contribute significantly to the financial sustainability of the MRT system. Farebox revenue can be supplemented with revenue from ancillary services, such as retail spaces, advertising, or station naming rights (Smith, 2009).

It is important to note that the choice of funding sources and mechanisms should align with the specific context, financial capacity, and regulatory framework of the city or region. A combination of these funding sources and mechanisms can be employed to optimize financial sustainability, diversify risk, and ensure the affordability and accessibility of MRT services.

3.5. Revenue Generation Strategies

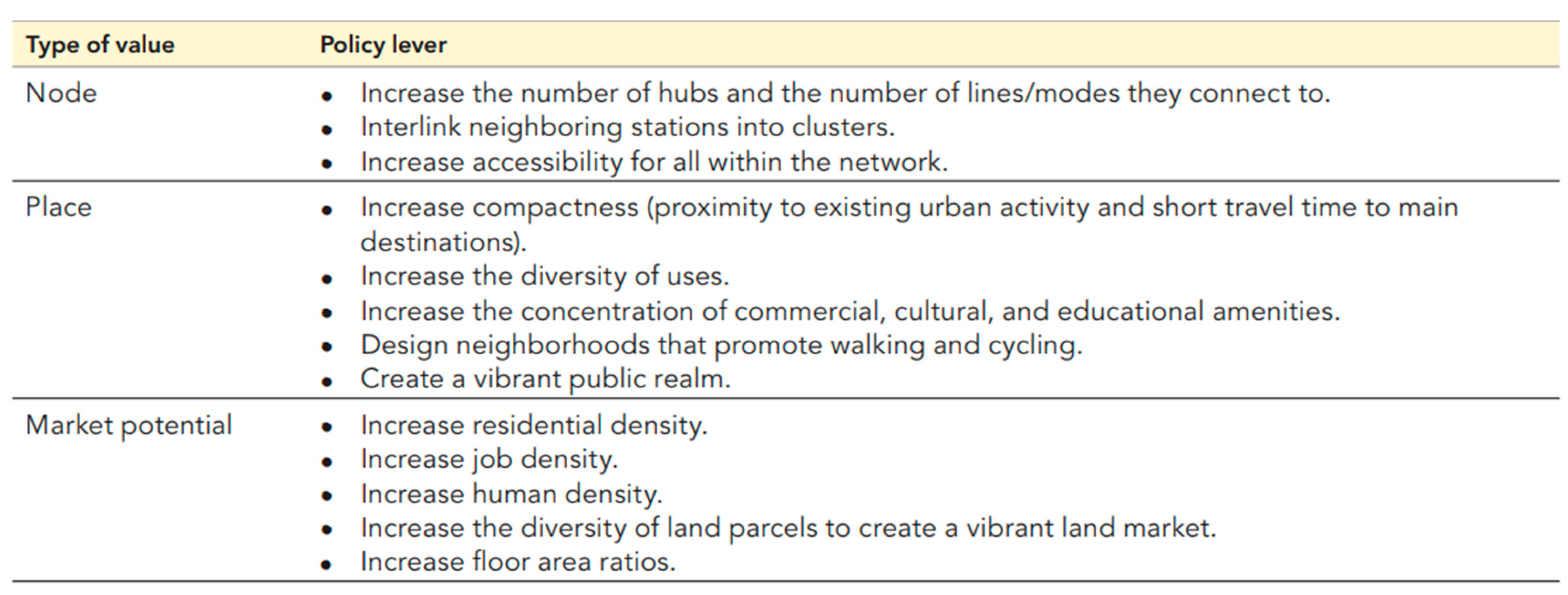

Table 1.

Levers to Increase Node, Place, and Market Potential Values.

Table 1.

Levers to Increase Node, Place, and Market Potential Values.

Revenue generation strategies play a critical role in ensuring the financial sustainability of Mass Rapid Transit (MRT) systems. These strategies aim to generate income that can contribute to the operational and maintenance costs of the MRT infrastructure. Here are some common revenue generation strategies for MRT projects:

| Sr. No. |

Revenue Geration Technique |

Brief |

Reference |

| 1 |

Farebox revenue |

Revenue collected from ticket sales contributes to covering the operating costs |

(Smith, 2009). |

| 2 |

Advertising and sponsorship |

Advertising can be sold to businesses and brands, generating revenue from advertisers |

(Hakino et al., 2018) |

| 3 |

Retail spaces |

Retail spaces, such as shops, kiosks, or food outlets can be leased to vendors, generating rental income |

(Ibrahim & Leng, 2003) |

| 4 |

Station naming rights |

Station naming rights offer an opportunity for revenue generation |

(Narayanaswami, 2017) |

| 5 |

Property development |

Property development and value appreciation in their vicinity |

Weinberger, 2001) |

| 6 |

Ancillary services |

Parking facilities at MRT stations, bike-sharing or scooter-sharing services, car rental services, or parcel delivery services |

Smith & Gihring, 2006 |

| 7 |

Non-farebox revenue |

Such as licensing fees, concession fees, or access charges for third-party services like Cell tower within the MRT system |

Looi & Tan, 2009 |

| 8 |

Value capture mechanisms |

Land value capture strategies, such as levies on land transactions, development charges, or tax increment financing |

Gihring, 2009 |

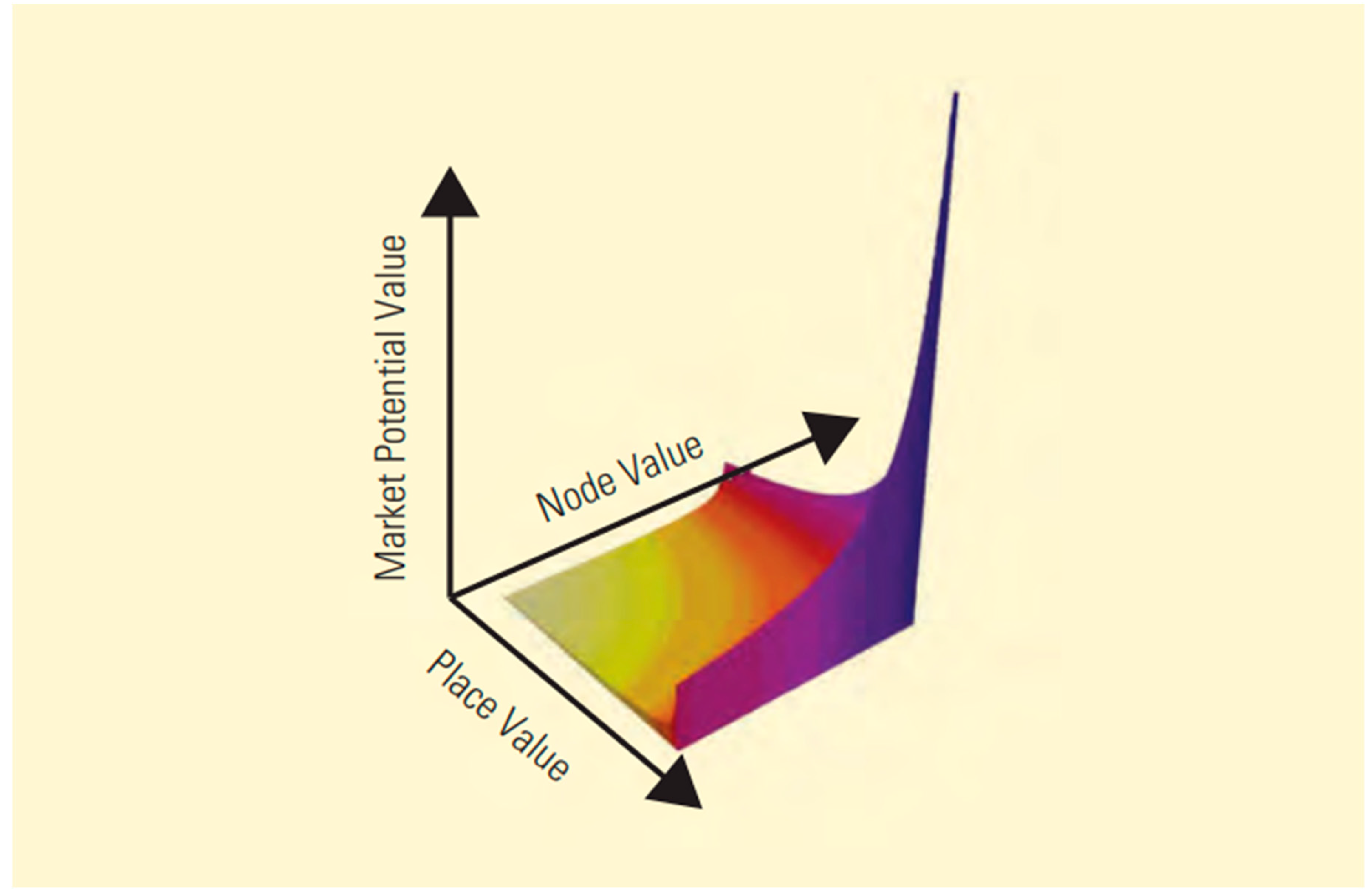

Figure 3.

Synchronization of Node, Place, and Market Potential Values (Source: Salat & Ollivier, 2017).

Figure 3.

Synchronization of Node, Place, and Market Potential Values (Source: Salat & Ollivier, 2017).

Successful revenue generation strategies require careful market analysis, understanding of customer preferences, and effective partnerships with advertisers, retailers, and property developers. The pricing of fares, advertising rates, and rental fees should be market-driven while considering the affordability and accessibility for the target users.

3.6. Cost Optimization and Efficiency Measures

Cost optimization and efficiency measures are crucial for the successful implementation and long-term financial sustainability of Mass Rapid Transit (MRT) projects. By optimizing costs and enhancing operational efficiency, MRT systems can reduce financial burdens and improve the overall effectiveness of their services. Here are some key cost optimization and efficiency measures for MRT projects:

| Sr. No. |

Optimisation and Efficieny Measures |

Brief |

Reference |

| 1 |

Robust project planning and design |

Feasibility studies, considering alternative alignment options, and selecting appropriate technology and construction methods |

Thong et al., 2005 |

| 2 |

Value engineering |

Savings in construction materials, design modifications, or operational efficiencies |

Phang, 2007 |

| 3 |

Lifecycle cost analysis |

Long-term costs associated with the MRT project |

Zoeteman, 2001 |

| 4 |

Procurement and tendering strategies |

Competitive bidding |

Phang, 2007 |

| 4 |

Sustainable materials and technologies |

Using energy-efficient systems, renewable energy sources, and recycled or locally sourced materials can reduce energy consumption and minimize resource costs |

Zoeteman, 2001 |

| 5 |

Operational efficiency measures |

maximize passenger loads, efficient ticketing and fare collection systems |

Johnson & Lee, 2012 |

| 6 |

Energy management and conservation |

Energy-efficient lighting, regenerative braking systems, and smart grid technologies, |

Thong et al., 2005 |

| 7 |

Training and capacity building |

enhance operational efficiency and reduce costs |

Johnson & Lee, 2012 |

| 8 |

Asset management |

Regular inspections, condition monitoring, and timely maintenance activities |

Van der Westhuizen, 2012 |

Implementing these cost optimization and efficiency measures requires a collaborative approach among stakeholders, including MRT operators, engineers, designers, and maintenance teams. Continuous monitoring and evaluation of costs, performance, and efficiency indicators are essential to identify areas for improvement and implement necessary adjustments.

3.7. Social and Environmental Considerations

Social and environmental considerations play a significant role in securing funding for Mass Rapid Transit (MRT) projects. Funding institutions and investors increasingly prioritize projects that demonstrate a commitment to social well-being, environmental sustainability, and the overall enhancement of the urban fabric. Here are some key social and environmental considerations that can influence funding decisions for MRT projects:

Social equity and inclusivity: MRT projects should aim to enhance social equity and inclusivity by providing affordable, accessible, and reliable transportation options for all segments of society. Funding institutions look for projects that prioritize the needs of underserved communities, improve connectivity to areas with limited transportation options, and address social disparities in mobility (Lee et al., 2023).

Community engagement and participation: Meaningful community engagement and participation are vital for securing funding for MRT projects. Demonstrating a transparent and participatory planning process, conducting public consultations, and incorporating community feedback into the project design and implementation are crucial. Funding institutions value projects that have actively involved stakeholders and considered their concerns and aspirations.

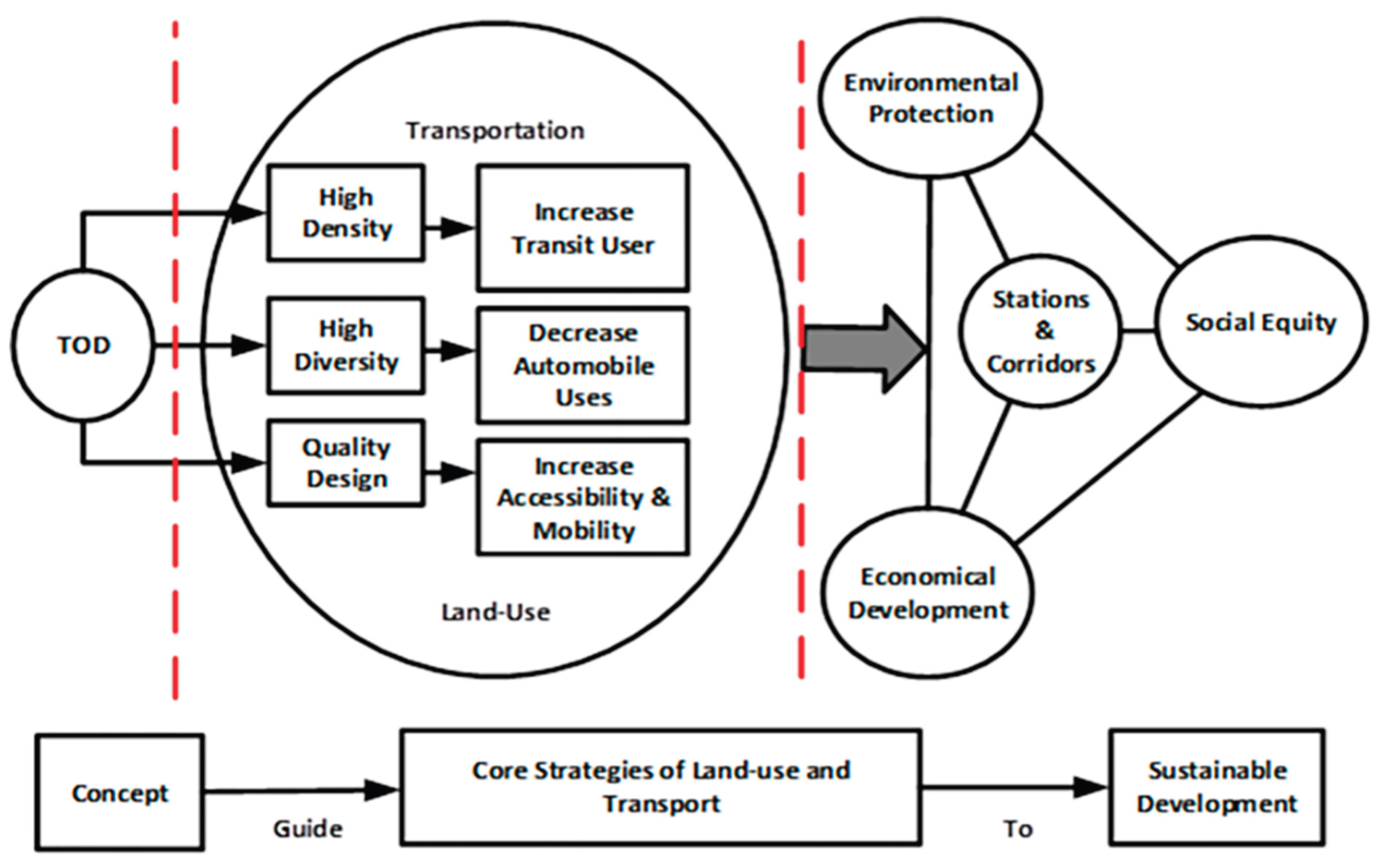

Figure 4.

TOD as a sustainable development. Source: (Uddin et al., 2023) & (Li & Lai, 2009).

Figure 4.

TOD as a sustainable development. Source: (Uddin et al., 2023) & (Li & Lai, 2009).

Environmental sustainability: MRT projects that prioritize environmental sustainability are more likely to attract funding. This includes minimizing greenhouse gas emissions, reducing energy consumption, promoting the use of renewable energy sources, and integrating green infrastructure into the project design. Environmental impact assessments, mitigation measures, and sustainability certifications contribute to the credibility and attractiveness of the project for funding.

Climate change resilience: Funding institutions increasingly consider climate change resilience as a key criterion for funding decisions. MRT projects should demonstrate strategies to adapt to climate change impacts and mitigate their contribution to greenhouse gas emissions. This can include incorporating climate-resilient design features, integrating flood management measures, and promoting low-carbon transportation modes in conjunction with the MRT system (Barnett, 2003).

Resettlement and displacement: MRT projects may require land acquisition and, in some cases, resettlement of affected communities. Funding institutions expect projects to adhere to international standards and guidelines for involuntary resettlement, ensuring fair compensation, livelihood restoration, and community support. Projects that demonstrate a commitment to minimizing displacement and providing adequate support to affected communities are more likely to receive funding (Modi, 2009).

3.8. Governance and Institutional Arrangements

Governance and institutional arrangements play a crucial role in securing funding for Mass Rapid Transit (MRT) projects. Funding institutions and investors often assess the governance structure and institutional arrangements to ensure effective project management, financial accountability, and long-term sustainability. Here are some key aspects of governance and institutional arrangements that influence funding decisions for MRT projects:

Clear governance structure: A well-defined governance structure is essential for efficient decision-making and accountability. This includes clearly delineating the roles and responsibilities of various stakeholders, such as government agencies, transit authorities, private sector partners, and regulatory bodies. Funding institutions prefer projects that have a transparent governance structure with clearly identified decision-making processes.

Regulatory framework: An effective regulatory framework provides clarity and stability to MRT projects. It establishes rules and standards for operations, safety, fare structures, and other key aspects. Funding institutions look for projects that operate within a supportive regulatory environment, ensuring compliance with applicable laws and regulations. A robust regulatory framework helps instill confidence in investors and lenders (Jong et al., 2010).

Institutional capacity: Funding institutions assess the institutional capacity of project proponents to effectively plan, implement, and manage MRT projects. This includes evaluating the technical expertise, project management capabilities, and financial management systems of the implementing agency. Demonstrating a track record of successfully delivering infrastructure projects and having qualified personnel enhances the project’s attractiveness for funding (Acharya et al., 2013). Effective collaboration between public and private partners and a clear delineation of responsibilities are essential for successful funding outcomes (Navalersuph & Charoenngam, 2021). Demonstrating a participatory approach, incorporating stakeholder feedback, and addressing social and environmental concerns positively impact funding decisions (Alade et al., 2022).

Legal and contractual frameworks: Clarity and enforceability of legal and contractual frameworks are important considerations for funding institutions. Well-drafted agreements, such as concession agreements, construction contracts, and operational contracts, provide the necessary legal certainty and protect the interests of all parties involved. Funding institutions assess the adequacy and effectiveness of legal and contractual frameworks to mitigate risks and ensure project viability.

Performance monitoring and reporting: Effective performance monitoring and reporting mechanisms enable transparency, accountability, and timely decision-making. Funding institutions expect MRT projects to have robust systems for monitoring key performance indicators, financial performance, and compliance with project milestones. Regular reporting on project progress, financial performance, and social and environmental impacts enhances the project’s credibility and supports funding efforts. Projects that show a commitment to long-term financial and operational sustainability are more likely to attract funding (Cervero & Dai, 2014).