Submitted:

16 July 2025

Posted:

17 July 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

1.1. Research Questions

- What machine learning algorithms show the most successful accuracy when predicting Turkish crowdfunding campaign results?

- What performance metrics reveal about the outcome of ensemble models against traditional and deep learning classifiers when measuring accuracy along with precision, recall, and F1-score?

- The analysis explores which features create the most impact on crowdfunding success prediction within Turkish crowdfunding campaigns and their influence on model’s predictive outcome.

- Does the development of a decision support system through machine learning provide enough effectiveness to help Turkish crowdfunding platforms in their campaign success forecasting efforts?

- The impact of unsuccessful campaign rates on model assessment results needs evaluation, and there are proven methods to minimize these adverse effects.

1.2. Contributions

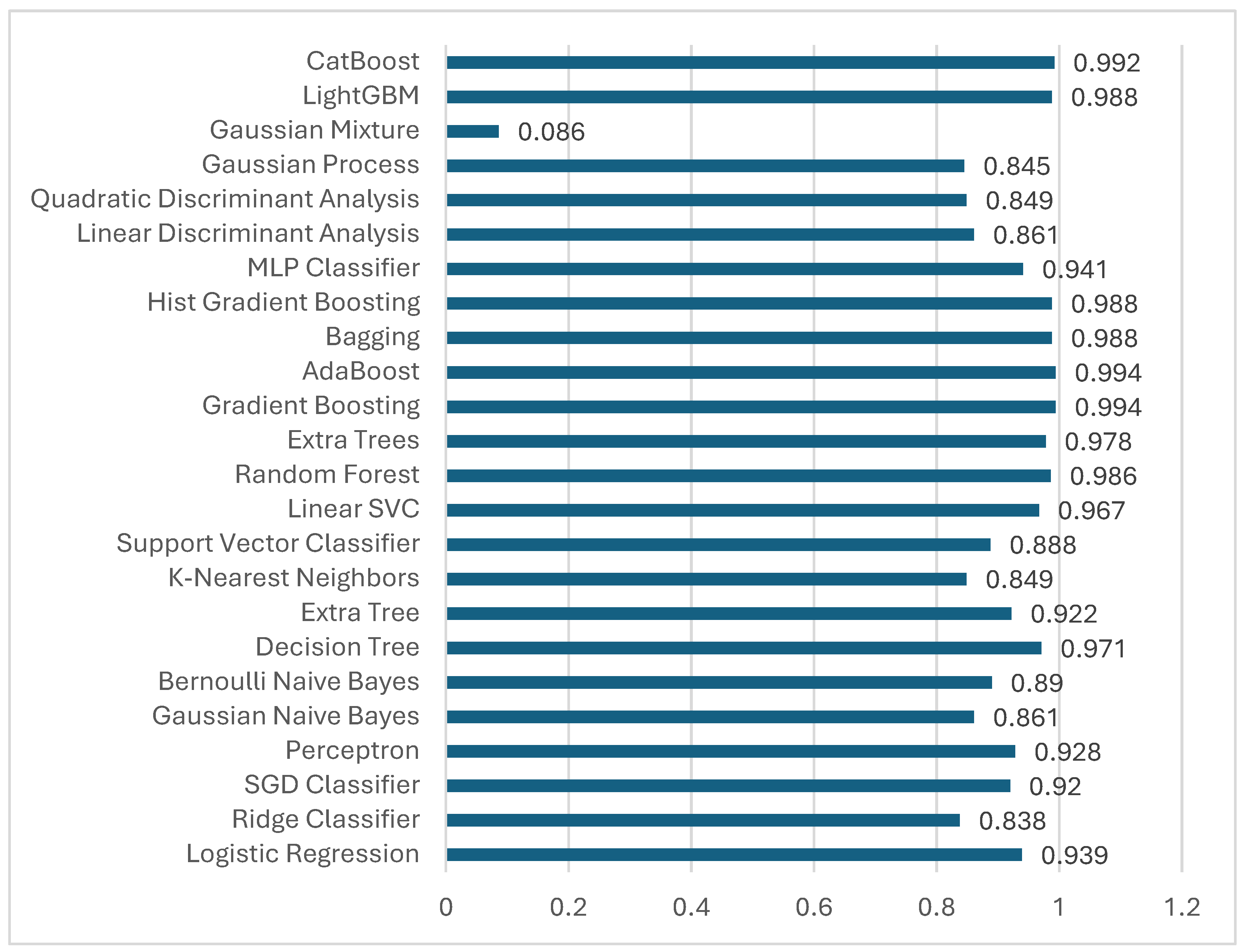

- The research implements a complete examination of 24 machine learning prediction algorithms used for crowdfunding campaign success, which incorporates traditional classifiers alongside ensemble techniques and deep learning architectures.

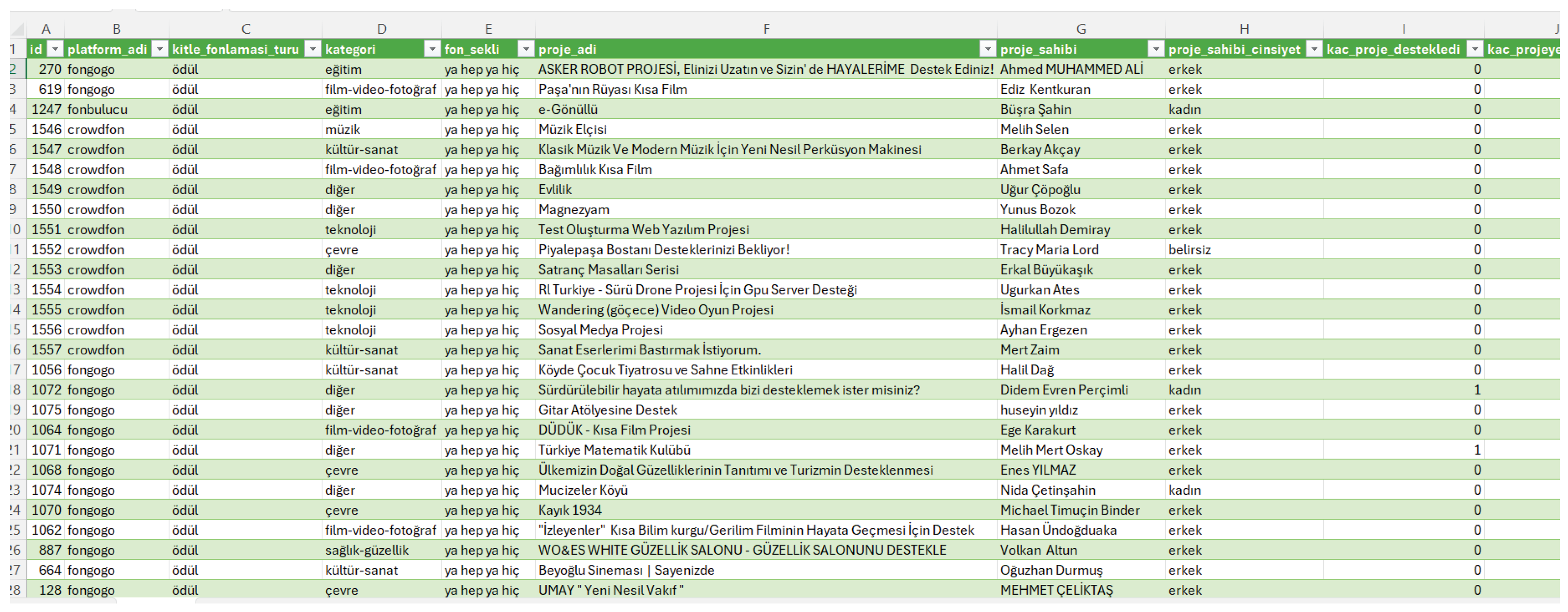

- The authors apply their developed models to 1628 Turkish crowdfunding campaigns for a first-hand assessment of machine learning effectiveness in this space.

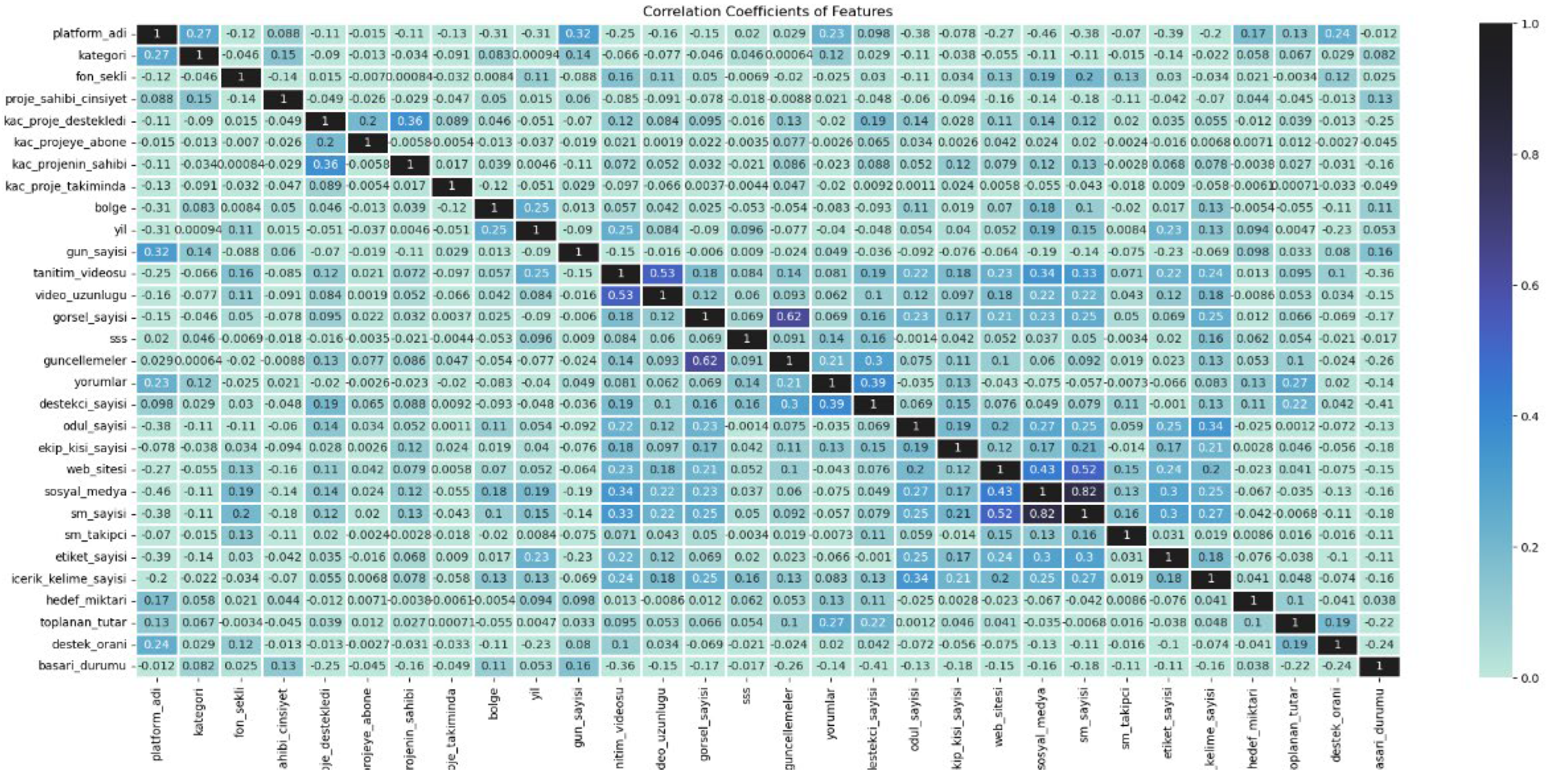

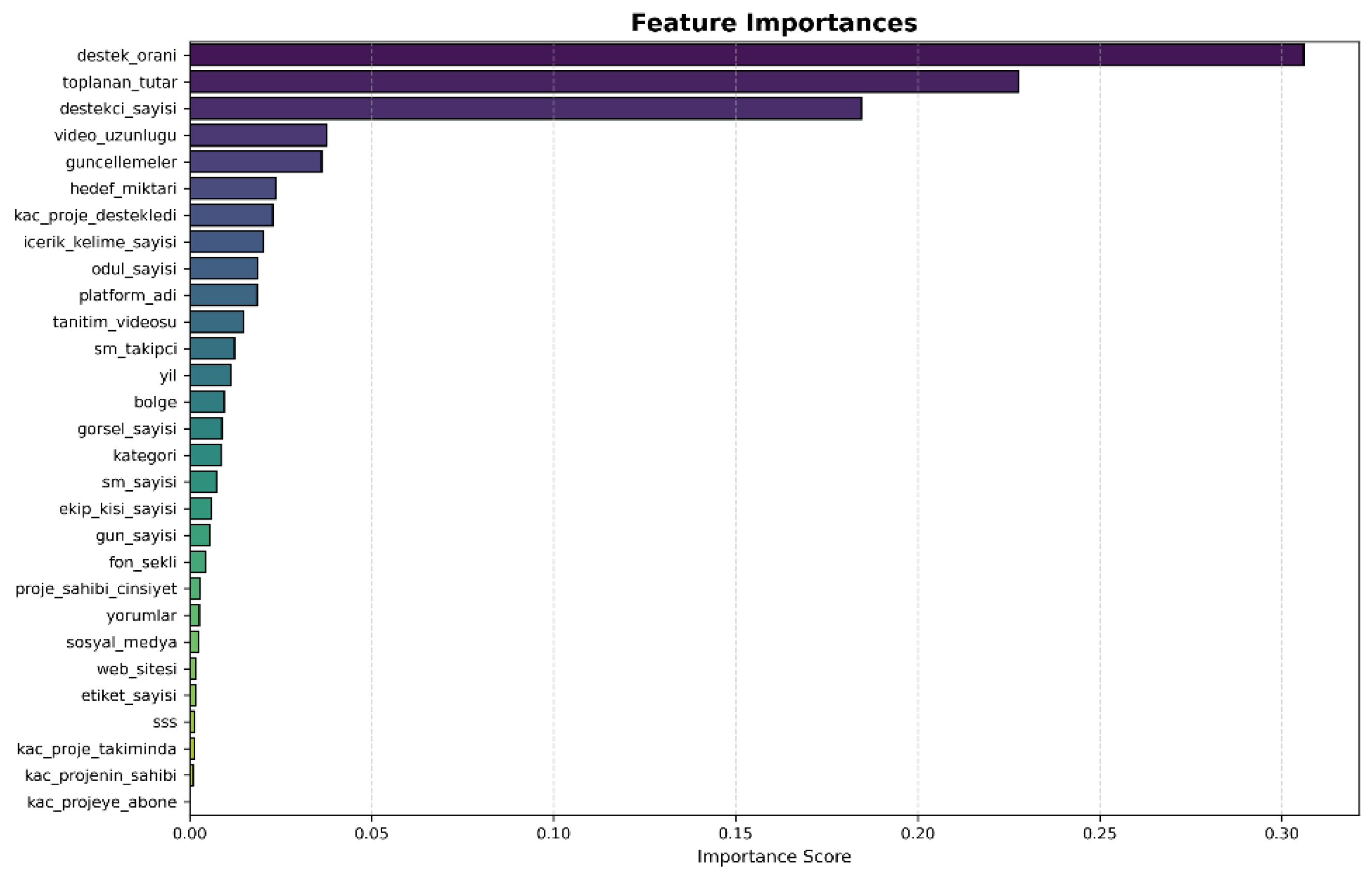

- The research determines which campaign determining factors drive success most effectively in Turkish crowdfunding through analysis of social engagement metrics, campaign acceptability levels and funding requirements.

- The paper introduces a decision support framework that unites SVM and CatBoost and Gradient Boosting with confidence interval mechanisms for operational readiness.

- The research delivers essential knowledge about model interpretability in addition to handling imbalanced data and improving performance, which benefits academic research and practical applications in FinTech.

2. Literature Review

| Article | Domain | Dataset | Methods & Techniques |

|---|---|---|---|

| [18] | Finance | P2P lending data from Indonesia’ s Financial Services Authority (OJK) | Evolving Connectionist System (ECoS), Neural Networks |

| [8] | Prediction /text mining | Kickstarter campaign blurbs | BERT, FastText, LSTM, Gradient Boosting Machine (GBM) |

| [21] | Finance | Conceptual analysis of sustainability metaphors from literature and policy documents | Qualitative content analysis, theoretical framework on environmental metaphors |

| [19] | Finance | 3,985 campaigns from Kickstarter | Empirical analysis, statistical regression |

| [20] | Crypto currency | Ethereum blockchain-based deployment and testing dataset | Smart contract implementation using Solidity, Ethereum blockchain testing, decentralized voting and funding mechanisms |

| [22] | Finance | Equity-based crowdfunding platforms | General survey model, document analysis |

| [23] | Renewable Energy | Microgrid project investments data | q-rung orthopair fuzzy sets (q-ROFSs), Multi-Stepwise Weight Assessment Ratio Analysis (M-SWARA), DEMATEL |

| [24] | Finance & Investment | Prosper Marketplace peer-to-peer lending data, Lottery jackpot data | Natural experiments, statistical analysis |

| [25] | Real estate | Case studies of real estate tokenization projects, legal frameworks, and blockchain implementations | Legal analysis, blockchain security token offering (STO) framework, smart contract evaluation |

| [9] | Crowdfunding & Alternative Finance | Kickstarter, Metacritic, Steamspy | Regression analysis |

| [7] | Islamic Finance | Stakeholder interviews in Qatar | Case study, qualitative analysis |

| [26] | Economy | Hand-collected reward-based crowdfunding data from Turkey (2013–2020) | Binary logistic regression, ordinary least squares (OLS) model |

| [11] | Energy | Renewable energy projects in Turkey | Comparative financial analysis, policy review |

| [27] | Management | Qualitative in-depth interviews and quantitative survey data from 360 entrepreneurs in Turkey | Mixed-method research (qualitative interviews + quantitative survey analysis) |

| [14] | Blockchain | Marine ranching projects data | Multi-level programming, backward induction method |

| [16] | Islamic Finance | 319 papers published in IMEFM from 2008-2019 | Bibliometric analysis, citation mapping |

| [28] | High Education Finance | Survey data from Turkish universities and alumni | Content analysis, data triangulation, behavioral economics model |

| [15] | Crowdfunding Success Factors | Crowdfunding projects from Turkey and the US | Signaling Theory, Social Network Theory, logistic regression |

| [29] | Finance | Public and private sector finance reports, biodiversity investment case studies | Review of biodiversity finance methodologies, investment gap analysis, global finance strategies |

| [6] | Crowdfunding | Case studies of five BIOFIN crowdfunding campaigns in marine and coastal protected areas (Belize, Costa Rica, Ecuador, Philippines, Thailand) | Comparative analysis of crowdfunding campaigns, economic impact assessment, review of finance strategies |

| [17] | Islamic Finance | Conceptual analysis of Islamic crowdfunding models, financial system comparison, regulatory challenges | Theoretical framework analysis, comparative study of Islamic vs. conventional crowdfunding, examination of Islamic P2P models |

| [30] | Turism | 49 ICOs from tourism industry (2017-2021) | Logistic regression analysis |

| [31] | Clustering, Text mining | 7059 publications on crowdsourcing (2006—2019) | Scientometric analysis, text mining |

| [32] | Digital Platforms | Analysis of major online platforms (Uber, Airbnb, WeWork, Kickstarter) | Economic impact assessment, policy review |

| [13] | Economy | Survey data from emerging markets | Quantitative modeling, mediation analysis |

| [33] | Islamic Finance | Islamic fintech case studies | Comparative analysis, case study approach |

| [34] | Agriculture, Islamic Finance | Afghanistan agricultural finance sector | Triangulation approach (library research, interviews, document review) |

| [35] | Text mining, Clustering | 8021 crowdfunding projects (2009—2018) | Text mining, clustering, natural language processing (NLP) |

| [10] | ML, Feature selection | Crowdfunding projects from Fongogo (Turkey) | Feature selection (Pearson correlation, chi-square, Recursive Feature Elimination) |

| [36] | Clean Energy | Fintech-based clean energy investment projects | Pythagorean fuzzy DEMATEL, TOPSIS, VIKOR |

| [37] | Media | Interviews with Turkish documentary producers | Ethnographic research, narrative analysis |

| [12] | Wearable Technology | Case studies of wearable technology crowdfunding projects | Debt financing model analysis, incentive problem identification |

| [38] | Health | Philanthropy-based crowdfunding initiatives | Qualitative analysis, case studies |

| [39] | ML, prediction | Crowdfunding data from Turkish platforms (Fongogo, Fonbulucu, Crowdfon, Arıkovanı, Ideanest, Buluşum) | Machine learning (Random Forest, Decision Trees, SVM), web scraping |

| [40] | Management | Exploratory research on existing digital platforms and collaboration mechanisms | Conceptual framework development, exploratory research, innovation ecosystem analysis |

| [41] | Crowdfunding awareness | Survey data from university students in Istanbul | Quantitative research, logit regression models |

3. Materials and Methods

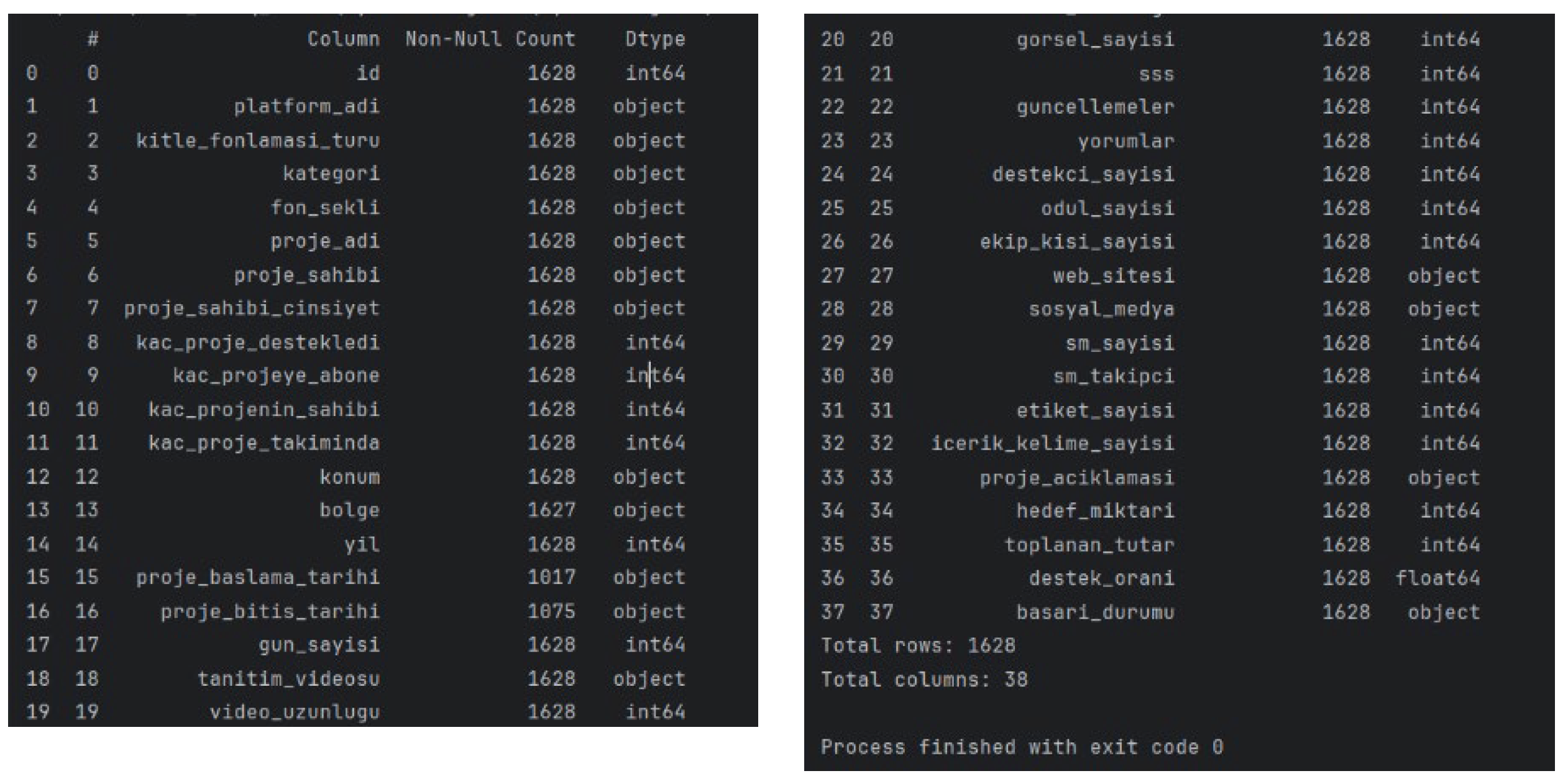

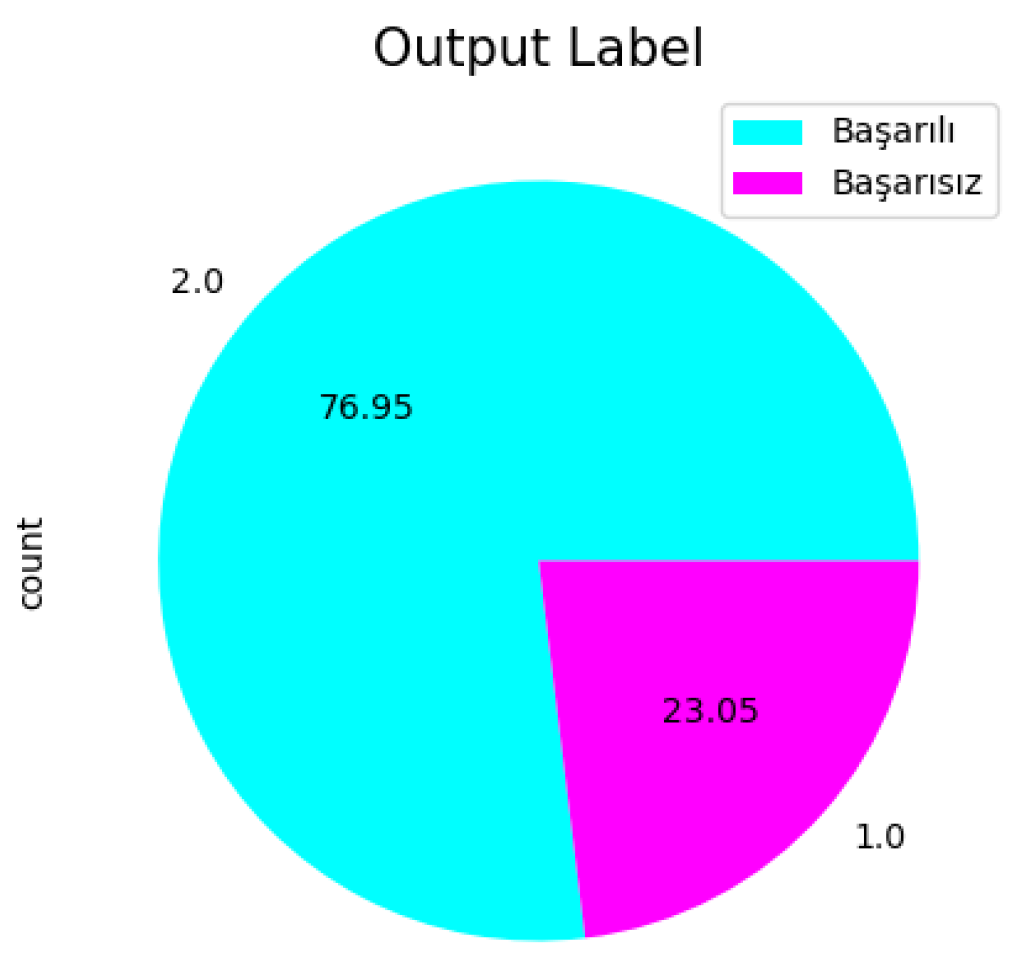

3.1. Data Description

Data Preprocessing

3.2. Machine Learning Methods

4. Experimental Results

5. Conclusions and Discussion

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

References

- [1] A. Marina, S. Imam Wahjono, S.-F. Fam, and I. Rasulong, “Crowdfunding to Finance SMEs: New Model After Pandemic Disease,” Sustainability Science and Resources, vol. 5, pp. 1–19, 2023. [CrossRef]

- [2] R. Elitzur, N. Katz, P. Muttath, and D. Soberman, “The power of machine learning methods to predict crowdfunding success: Accounting for complex relationships efficiently,” Journal of Business Venturing Design, vol. 3, p. 100022, Dec. 2024. [CrossRef]

- [3] J. Y. Yeh and C. H. Chen, “A machine learning approach to predict the success of crowdfunding fintech project,” Journal of Enterprise Information Management, vol. 35, no. 6, pp. 1678–1696, 2022. [CrossRef]

- [4] E. Mollick, “The dynamics of crowdfunding: An exploratory study,” J Bus Ventur, vol. 29, no. 1, pp. 1–16, 2014. [CrossRef]

- [5] M. S. Oduro, H. Yu, and H. Huang, “Predicting the Entrepreneurial Success of Crowdfunding Campaigns Using Model-Based Machine Learning Methods,” International Journal of Crowd Science, vol. 6, no. 1, pp. 7–16, 2022. [CrossRef]

- [6] A. Seidl, T. Cumming, M. Arlaud, C. Crossett, and O. van den Heuvel, “Investing in the wealth of nature through biodiversity and ecosystem service finance solutions,” Ecosyst Serv, vol. 66, no. November 2023, p. 101601, 2024. [CrossRef]

- [7] A. Al-Mulla, I. Ari, and M. Koç, “Sustainable financing for entrepreneurs: Case study in designing a crowdfunding platform tailored for Qatar,” Digital Business, vol. 2, no. 2, p. 100032, 2022. [CrossRef]

- [8] H. Gunduz, “Comparative analysis of BERT and FastText representations on crowdfunding campaign success prediction,” PeerJ Comput Sci, vol. 10, 2024. [CrossRef]

- [9] O. Aygoren and S. Koch, “Community support or funding amount: Actual contribution of reward-based crowdfunding to market success of video game projects on kickstarter,” Sustainability (Switzerland), vol. 13, no. 16, 2021. [CrossRef]

- [10] M. Kilinc and C. Aydin, “Feature selection for Turkish Crowdfunding projects with using filtering and wrapping methods,” Electron Commer Res Appl, vol. 62, no. June, p. 101340, 2023. [CrossRef]

- [11] S. M. Altunkaya and M. Özcan, “Yenilenebilir Enerji Yatırımlarının Finansmanında Kullanılabilecek Yeni Nesil Finansman Mekanizmaları,” no. November 2020, pp. 35–43, 2021.

- [12] F. Tanrisever and K. A. Wismans-Voorbraak, “Crowdfunding for financing wearable technologies,” Proceedings of the Annual Hawaii International Conference on System Sciences, vol. 2016-March, pp. 1800–1807, 2016. [CrossRef]

- [13] Z. Yousaf, O. Shakaki, N. Isac, A. Cretu, and A. Hrebenciuc, “Towards Crowdfunding Performance through Crowdfunding Digital Platforms: Investigation of Social Capital and Innovation Performance in Emerging Economies,” Sustainability (Switzerland), vol. 14, no. 15, 2022. [CrossRef]

- [14] X. Wan, Z. Teng, Q. Li, and M. Deveci, “Blockchain technology empowers the crowdfunding decision-making of marine ranching,” Expert Syst Appl, vol. 221, no. December 2022, p. 119685, 2023. [CrossRef]

- [15] B. Akyildiz, S. Metin-Camgöz, and K. B. Atici, “An Investigation on Factors Affecting Crowdfunding Project Success,” Sosyoekonomi, vol. 29, no. 50, pp. 521–545, 2021. [CrossRef]

- [16] M. Özdemir and M. Selçuk, “A bibliometric analysis of the International Journal of Islamic and Middle Eastern Finance and Management,” International Journal of Islamic and Middle Eastern Finance and Management, vol. 14, no. 4, pp. 767–791, 2021. [CrossRef]

- [17] B. Saiti, M. H. Musito, and E. Yucel, “Islamic Crowdfunding: Fundamentals, Developments and Challenges,” Islamic Quarterly, vol. 62, no. 3, pp. 469–485, 2018.

- [18] Al-Khowarizmi, M. J. Watts, S. Efendi, and A. A. Kamil, “Financial technology forecasting using an evolving connectionist system for lenders and borrowers: ecosystem behavior,” IAES International Journal of Artificial Intelligence, vol. 13, no. 2, pp. 2386–2394, 2024. [CrossRef]

- [19] B. Yasar, I. Sevilay Yılmaz, N. Hatipoğlu, and A. Salih, “Stretching the success in reward-based crowdfunding,” J Bus Res, vol. 152, no. July, pp. 205–220, 2022. [CrossRef]

- [20] A. Alimoglu and C. Ozturan, “Design of a smart contract based autonomous organization for sustainable software,” Proceedings—13th IEEE International Conference on eScience, eScience 2017, pp. 471–476, 2017. [CrossRef]

- [21] A. Napari, R. Ozcan, and A. U. I. Khan, “the Language of Sustainability: Exploring the Implications of Metaphors on Environmental Action and Finance,” Appl Ecol Environ Res, vol. 21, no. 5, pp. 4653–4675, 2023. [CrossRef]

- [22] V. Altundal, “Can equity-based crowdfunding be a fast and effective financing model for early-stage startups?,” Journal of the International Council for Small Business, vol. 5, no. 3, pp. 304–329, 2024. [CrossRef]

- [23] X. Wu, H. Dinçer, and S. Yüksel, “Analysis of crowdfunding platforms for microgrid project investors via a q-rung orthopair fuzzy hybrid decision-making approach,” Financial Innovation, vol. 8, no. 1, 2022. [CrossRef]

- [24] T. Demir, A. Mohammadi, and K. Shafi, “Crowdfunding as gambling: Evidence from repeated natural experiments,” Journal of Corporate Finance, vol. 77, no. August 2019, p. 101905, 2022. [CrossRef]

- [25] G. Avci and Y. O. Erzurumlu, “Blockchain tokenization of real estate investment: a security token offering procedure and legal design proposal,” Journal of Property Research, vol. 40, no. 2, pp. 188–207, 2023. [CrossRef]

- [26] O. Ekici and Y. Aytürk, “The role of consumer confidence and inflation in crowdfunding success,” International Journal of Entrepreneurial Venturing, vol. 15, no. 4, pp. 295–316, 2023.

- [27] M. Demiray, S. Burnaz, and D. Li, “Effects of Institutions on Entrepreneurs’ Trust and Engagement in Crowdfunding,” Journal of Electronic Commerce Research, vol. 22, no. 2, pp. 95–109, 2021.

- [28] S. Son-Turan, “Reforming higher education finance in Turkey: The alumni-crowdfunded student debt fund ‘a-CSDF’ model,” Egitim ve Bilim, vol. 41, no. 184, pp. 267–289, 2016. [CrossRef]

- [29] A. Seidl et al., “Crowdfunding marine and coastal protected areas: Reducing the revenue gap and financial vulnerabilities revealed by COVID-19,” Ocean Coast Manag, vol. 242, no. June, p. 106726, 2023. [CrossRef]

- [30] E. Bulut, “Blockchain-based entrepreneurial finance: success determinants of tourism initial coin offerings,” Current Issues in Tourism, vol. 25, no. 11, pp. 1767–1781, 2022. [CrossRef]

- [31] S. Ozcan, D. Boye, J. Arsenyan, and P. Trott, “A Scientometric Exploration of Crowdsourcing: Research Clusters and Applications,” IEEE Trans Eng Manag, vol. 69, no. 6, pp. 3023–3037, 2022. [CrossRef]

- [32] Y.-J. Chen et al., “Innovative Online Platforms: Research Opportunities,” SSRN Electronic Journal, pp. 1–31, 2018. [CrossRef]

- [33] Y. Demirdöğen, “New Resources For Islamıc Fınance: Islamıc Fıntech,” Hitit Theology Journal, vol. 20, no. 3, pp. 29–56, 2021. [CrossRef]

- [34] B. Saiti, M. Afghan, and N. H. Noordin, “Financing agricultural activities in Afghanistan: a proposed salam-based crowdfunding structure,” ISRA International Journal of Islamic Finance, vol. 10, no. 1, pp. 52–61, 2018. [CrossRef]

- [35] D. Boye, S. Ozcan, and O. Fajana, “Text Mining Approach for Identifying Product Ideas and Trends Based on Crowdfunding Projects,” IEEE Trans Eng Manag, vol. 71, pp. 7112–7127, 2024. [CrossRef]

- [36] Y. Meng, H. Wu, W. Zhao, W. Chen, H. Dinçer, and S. Yüksel, “A hybrid heterogeneous Pythagorean fuzzy group decision modelling for crowdfunding development process pathways of fintech-based clean energy investment projects,” Financial Innovation, vol. 7, no. 1, 2021. [CrossRef]

- [37] S. Koçer, “Social business in online financing: Crowdfunding narratives of independent documentary producers in Turkey,” New Media Soc, vol. 17, no. 2, pp. 231–248, 2015. [CrossRef]

- [38] V. Özdemir, J. Faris, and S. Srivastava, “Crowdfunding 2.0: the next-generation philanthropy,” EMBO Rep, vol. 16, no. 3, pp. 267–271, 2015. [CrossRef]

- [39] M. Kilinc, C. Aydin, and C. Tarhan, “CFTest: Web Based Business Intelligence Application That Measures Crowdfunding Success,” Proceedings—2022 Innovations in Intelligent Systems and Applications Conference, ASYU 2022, pp. 1–5, 2022. [CrossRef]

- [40] A. Çubukcu, T. Ulusoy, and E. Y. Boz, “Crowdfunding and Open Innovation Together: A Conceptual framework of a hybrid crowd innovation model,” International Journal of Innovation and Technology Management, vol. 17, no. 08, p. 2150003, 2020.

- [41] İ. Sirma, O. Ekici, and Y. Aytürk, “Crowdfunding Awareness in Turkey,” Procedia Comput Sci, vol. 158, pp. 490–497, 2019. [CrossRef]

| Turkish Feature Name | English Translation |

|---|---|

| destek_oranı | support rate |

| toplanan_tutar | collected amount |

| destekci_sayısı | number of supporters |

| video_uzunlugu | video length |

| guncellemeler | updates |

| hedef_miktari | target amount |

| kac_proje_destekledi | how many projects supported |

| icerik_kelime_sayısı | content word count |

| odul_sayısı | number of rewards |

| platform_adi | platform name |

| tanıtım_videosu | promotional video |

| sm_takipçi | social media followers |

| yıl | year |

| bolge | region |

| gorsel_sayısı | number of visuals |

| kategori | category |

| sm_sayısı | number of social media platforms |

| ekip_kisi_sayısı | number of team members |

| gun_sayısı | number of days |

| fon_sekli | funding type |

| ID | Method | Description | Parameters | Advantages | Disadvantages |

|---|---|---|---|---|---|

| 1 | Logistic Regression (LR) | A linear model is used for classification problems. | Regularization term, solver | Simple, interpretable, and fast. | Limited in handling complexity. |

| 2 | Ridge Classifier (RIDGE) | Applies L2 regularization to logistic regression for robustness. | Regularization strength (alpha), solver type | Reduces overfitting, handles multicollinearity | May underperform when features are not correlated |

| 3 | SGD Classifier (SGD) | Stochastic Gradient Descent-based linear classifier for large-scale and sparse data. | Learning rate, penalty, loss function | Efficient for large datasets, supports many loss functions | Sensitive to feature scaling and parameter tuning |

| 4 | Perceptron (PER) | A simple linear binary classifier that updates weights based on misclassified samples. | Number of iterations, learning rate | Fast and easy to implement | Cannot solve non-linear problems |

| 5 | Gaussian Naive Bayes (GNB) | Probability-based classification using Bayes’ theorem, assuming independence between features. | Few default parameters | Simple, fast, and often successful in tasks like text classification. | The independence assumption may not hold in the real world. |

| 6 | Bernoulli Naive Bayes (BNB) | Naive Bayes variant designed for binary/Boolean features. | Alpha (smoothing), binarize threshold | Works well with text classification, especially binary features | Assumes binary input, the independence assumption |

| 7 | Decision Tree (TREE) | Used for classification/regression via tree structure. | Tree depth, min sample split | Easy to understand, minimal data preprocessing | Prone to overfitting |

| 8 | Extra Tree (EXTRA) | Similar to Random Forest, it selects split points more randomly. | Number of trees, feature selection | Resistant to overfitting, low variance | Complex internal structure |

| 9 | K-Nearest Neighbors (K-NN) | Classifies by using the class labels of nearest neighbors. | Number of neighbors (K) | Simple and effective | Computationally expensive for large datasets |

| 10 | Support Vector Classifier (SVC) | Tries to find the best separating hyperplane between two classes. | Kernel type, C (error tolerance) | Effective in high-dimensional data | Long training time for large datasets |

| 11 | Linear SVC (LSVC) | A linear version of SVM using liblinear. | Regularization parameter (C), loss, penalty | Faster than kernel SVMs | Does not support non-linear decision boundaries |

| 12 | Random Forest (FOREST) | Classifies by combining many decision trees. | Number of trees, feature selection | Strong generalization, resistant to overfitting | Complex internal structure |

| 13 | Extra Trees (EXTREME) | Ensemble of randomized decision trees. | Number of trees, max features | Faster than Random Forest, less variance | Less interpretable, more randomness |

| 14 | Gradient Boosting (GRADIENT) | Combines weak learners (often trees) to create a strong model. | Learning rate, number of trees | High generalization ability | May require more training time and tuning |

| 15 | AdaBoost (ADA) | Combines weak classifiers by focusing on misclassified examples. | Type of weak learner, learning rate | Resistant to overfitting, high generalization | Sensitive to tuning |

| 16 | Bagging (BGC) | Improves performance by training on different subsamples. | Base learner type, sampling strategy | Resistant to overfitting, low variance | Depends on base learner type |

| 17 | Hist Gradient Boosting (HGB) | Histogram-based gradient boosting for scalable learning. | Learning rate, max bins, iterations | Faster training, high accuracy | Requires preprocessing for categorical data |

| 18 | MLP Classifier (MLP) | Artificial neural network with multiple layers that update weights during learning. | Number of layers, hidden neurons | Learns complex relationships, good for large datasets | Long training time, risk of overfitting |

| 19 | Linear Discriminant Analysis (LDA) | Finds axes that best express class differences. | Few default parameters | Provides dimensionality reduction, emphasizes differences | Assumes equal covariances |

| 20 | Quadratic Discriminant Analysis (QDA) | Allows different covariance matrices for each class. | Few default parameters | Better with distinct class covariances | Sensitive to outliers, overfits on small data |

| 21 | Gaussian Process (GP) | Defines a distribution over functions, used for non-parametric modeling. | Kernel, alpha | Provides uncertainty estimates | Computationally expensive |

| 22 | Gaussian Mixture (GM) | Assumes data is from a mixture of Gaussians; used in clustering. | Number of components, covariance type | Model’s complex distributions | Sensitive to initialization and local optima |

| 23 | LightGBM (LGBM) | Gradient boosting framework optimized for speed and efficiency. | Learning rate, number of leaves, max depth | Very fast, supports categorical features | May overfit on small datasets |

| 24 | CatBoost (CAT) | Gradient boosting library optimized for categorical features. | Depth, learning rate, iterations | Handles categorical data natively | Slower than LightGBM |

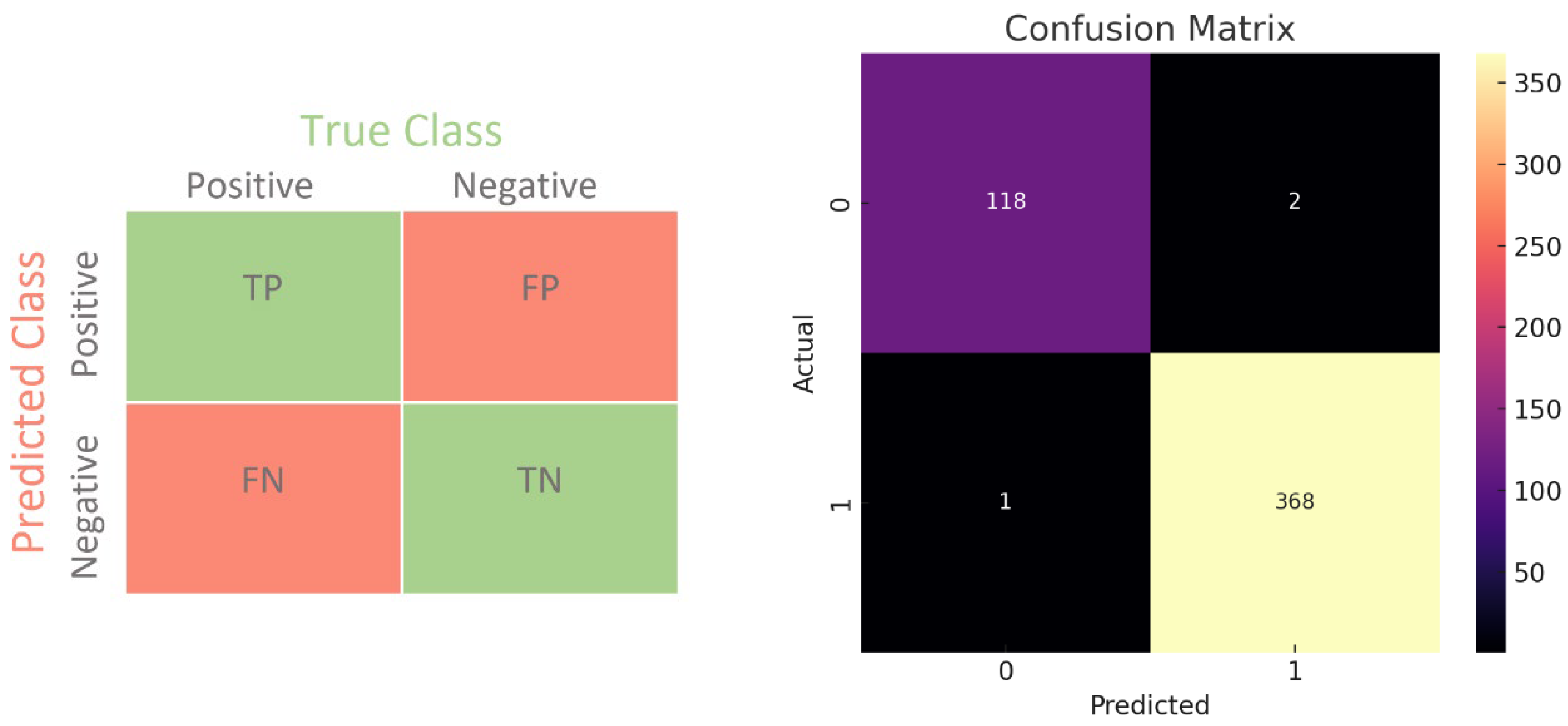

| Model | CONFUSION MATRIX | ACCURACY | PRECISION | RECALL | F1 | CONFIDENCE-Min | CONFIDENCE-Max |

|---|---|---|---|---|---|---|---|

| Logistic Regression | [100 20] [ 10 359] |

0.939 | 0.938 | 0.939 | 0.938 | 1 | 0.862 |

| Ridge Classifier | [ 49 71] [ 8 361] |

0.838 | 0.842 | 0.838 | 0.816 | 0.919 | 0.758 |

| SGD Classifier | [100 20] [ 19 350] |

0.92 | 0.92 | 0.92 | 0.92 | 0.996 | 0.845 |

| Perceptron | [ 96 24] [ 11 358] |

0.928 | 0.927 | 0.928 | 0.927 | 1 | 0.852 |

| Gaussian Naive Bayes | [ 62 58] [ 10 359] |

0.861 | 0.861 | 0.861 | 0.848 | 0.941 | 0.781 |

| Bernoulli Naive Bayes | [ 93 27] [ 27 342] |

0.89 | 0.89 | 0.89 | 0.89 | 0.965 | 0.814 |

| Decision Tree | [107 13] [ 1 368] |

0.971 | 0.972 | 0.971 | 0.971 | 1 | 0.895 |

| Extra Tree | [104 16] [ 22 347] |

0.922 | 0.924 | 0.922 | 0.923 | 0.997 | 0.847 |

| K-Nearest Neighbors | [ 64 56] [ 18 351] |

0.849 | 0.842 | 0.849 | 0.838 | 0.927 | 0.77 |

| Support Vector Classifier | [ 73 47] [ 8 361] |

0.888 | 0.889 | 0.888 | 0.879 | 0.966 | 0.809 |

| Linear SVC | [111 9] [ 7 362] |

0.967 | 0.967 | 0.967 | 0.967 | 1 | 0.892 |

| Random Forest | [115 5] [ 2 367] |

0.986 | 0.986 | 0.986 | 0.986 | 1 | 0.91 |

| Extra Trees | [112 8] [ 3 366] |

0.978 | 0.977 | 0.978 | 0.977 | 1 | 0.902 |

| Gradient Boosting | [118 2] [ 1 368] |

0.994 | 0.994 | 0.994 | 0.994 | 1 | 0.918 |

| AdaBoost | [118 2] [ 1 368] |

0.994 | 0.994 | 0.994 | 0.994 | 1 | 0.918 |

| Bagging | [116 4] [ 2 367] |

0.988 | 0.988 | 0.988 | 0.988 | 1 | 0.912 |

| Hist Gradient Boosting | [115 5] [ 1 368] |

0.988 | 0.988 | 0.988 | 0.988 | 1 | 0.912 |

| MLP Classifier | [101 19] [ 10 359] |

0.941 | 0.94 | 0.941 | 0.94 | 1 | 0.865 |

| Linear Discriminant Analysis | [ 60 60] [ 8 361] |

0.861 | 0.864 | 0.861 | 0.846 | 0.941 | 0.781 |

| Quadratic Discriminant Analysis | [ 55 65] [ 9 360] |

0.849 | 0.85 | 0.849 | 0.831 | 0.929 | 0.768 |

| Gaussian Process | [ 68 52] [ 24 345] |

0.845 | 0.837 | 0.845 | 0.837 | 0.922 | 0.767 |

| LightGBM | [115 5] [ 1 368] |

0.988 | 0.988 | 0.988 | 0.988 | 1 | 0.912 |

| CatBoost | [118 2] [ 2 367] |

0.992 | 0.992 | 0.992 | 0.992 | 1 | 0.916 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).