Submitted:

05 July 2025

Posted:

07 July 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

- Specific Objectives

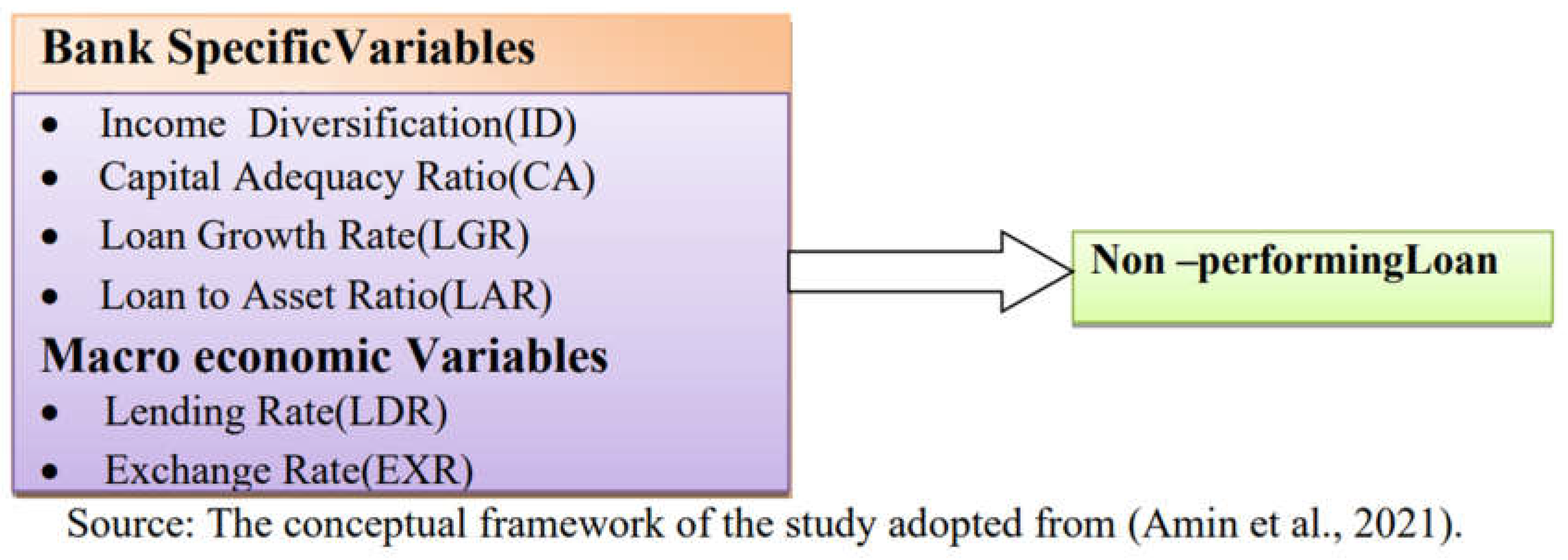

- To examine the impact of bank-specific variables on the NPLs of private commercial banks in Ethiopia;

- To examine the impact of macroeconomic variables on the NPLs of private commercial banks in Ethiopia;

- To examine the extent of the relationship that exists between bank-specific variables, macroeconomic variables, and the non-performing loans of private commercial banks in Ethiopia.

- 1.

- Literature Review

1.1. Bank Specific Factors

- 1)

- Income diversification: Portfolio theory suggests that diversifying portfolios can minimize firm-specific risk by compensating losses in certain products with gains in others (Berhanu, 2019). However, scholars argue that revenue diversification doesn’t guarantee low NPLs due to excessive operational components (Zelalem, 2013).

- 2)

- Capital Adequacy: refers to the amount of capital needed by banks to withstand risks such as credit, market, and operational risks in order to absorb potential losses and protect the bank’s debtors. A bank’s capital adequacy is a measure of its overall financial strength. The higher the capital adequacy ratio, the greater the amount of protection provided to depositors, and it is crucial for maintaining the banking system’s soundness since it acts as a buffer against panic, bank runs, and other dangers. (Abdelbary, 2019).

- 3)

- Loan Growth: Banks should focus on lending within their trade area and avoid lending outside of it. Emphasizing loan growth can negatively impact credit quality. Loan officers should avoid lending to marginal borrowers, limited expertise, or geographic areas without market presence (Natnael, 2017). Good loan supervision can reduce credit risk and improve loan growth. Credit risk is crucial for bank performance, and loan growth is related to nonperformance loans. Kirui (2014) cited Addae-Korankye (2014).

- 4)

- Loan to Asset Ratio: It is the ratio between the total loan amount and the total assets. A higher loan-to-assets ratio represents a high credit level and an increasing chance of credit risk. Therefore, a positive coefficient of loan-to-asset ratio is expected, which has also been shown by .(Klein & Shingjergji, 2013). However, (Ekanayake & Azeez, 2013) found a significant positive association between non-performing loans and the loans-to-assets ratio.

1.2. Macroeconomic Factors

- 5)

- Lending Rates: Is a significant economic determinant of NPL. There is empirical evidence of a positive relationship between lending rates and NPLs. Banks anticipate normal loan portfolio performance in a healthy economy, as only a small percentage of loans default, and interest rates positively correlate with NPLs and bad loans(Sitina, 2018). A higher interest rate leads to even more adverse selection in this general situation; that is, a higher interest rate increases the possibility that the lender is lending to a risky credit risk, ultimately increasing NPLs (Rediet, 2020), (Sitina, 2018) and (Yonas, 2017).

- 6)

- Exchange Rate: A change in the exchange rate, like inflation, can affect borrowers’ debt service capacity through several routes, and its impact on NPLs can be positive or negative (Atanasijević & Božović, 2016). Currency depreciation can boost export-orientated enterprises’ competitiveness by reducing domestic currency value and increasing their debt-servicing capabilities. However, it can negatively impact import-orientated firms, as their production costs are covered in less valuable domestic currency and revenue is collected in more valuable foreign currency (Khemraj & Pasha, 2009).

1.3. Conceptual Frame Work

2. Methodology

2.1. Research Design

2.2. Sources and types of data

2.3. Population and Sample Size

2.4. Model Specifications

2.5. Data Analysis Methods

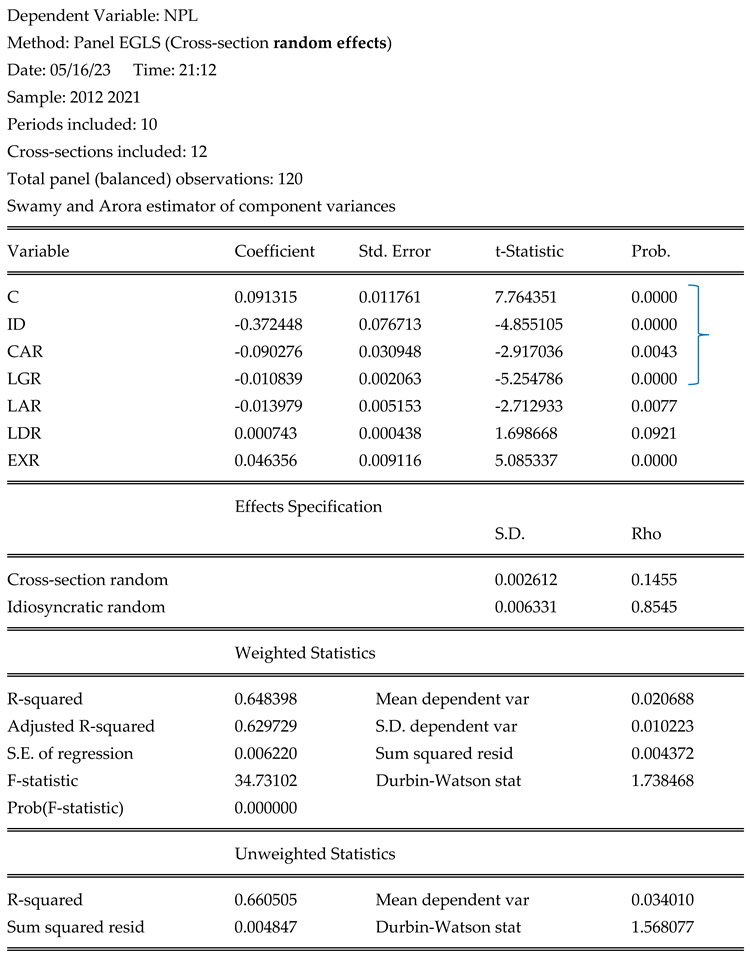

3. Empirical Results and Discussions

Diagnostic test

| NPL | ID | CAR | LGR | LAR | LDR | EXR | |

| Mean | 0.034010 | 0.034336 | 0.139614 | 4.07420 | 0.57661 | 5.9180 | 0.343208 |

| Median | 0.033355 | 0.035341 | 0.137580 | 4.07580 | 0.58100 | 5.3900 | 0.345367 |

| Maximum | 0.057200 | 0.053251 | 0.199800 | 4.74250 | 0.92300 | 8.0000 | 0.529487 |

| Minimum | 0.010700 | 0.015646 | 0.097371 | 3.25720 | 0.26900 | 4.0000 | 0.175511 |

| Std. Dev. | 0.010954 | 0.009205 | 0.022697 | 0.355367 | 0.147598 | 1.421462 | 0.081027 |

| Observations | 120 | 120 | 120 | 120 | 120 | 120 | 120 |

| Correlated Random Effects - Hausman Test | ||||

| Equation: Untitled | ||||

| Test cross-section random effects | ||||

| Test Summary | Chi-Sq. Statistic | Chi-Sq. d.f. | Prob. | |

| Cross-section random | 0.000000 | 6 | 1.0000 | |

| The cross-sectional test variance is invalid. Hausman statistic set to zero. | ||||

4. Conclusions

References

- Abdelbary, A. (2019). Changing The Game; New Framework Of Capital Adequacy Ratio.

- Akmel, D. (2019). Determinants of non-performing loan: The case of Ethiopian commercial banks.

- Amin, M. I., Ahsan, A., Al muktadir, M., Azad, M., & Rezanur, R. H. B. (2021). Macroeconomic and Firm-specific Factors Influencing Non-Performing Loans in Bangladesh: A Panel Data Regression Approach. The Journal of Asian Finance, Economics and Business, 8(12), 95–105.

- Atanasijević, J., & Božović, M. (2016). Exchange rate as a determinant of corporate loan defaults in a Euroized economy: Evidence from micro-level data. Eastern European Economics, 54(3), 228–250. [CrossRef]

- Ayele, F. (2017). Assesments Of Non-Performing Loans: A Study On Selected Commercial Banks In Ethiopia.

- Babu, B. S. (2018). Capping Of Commercial Bank Interest Rates and Its Impact on Number of Loan Advances Generated By Microfinance Institutions.

- Barr, R., Siems, T. (1994). “Predicting Bank Failure using DEA to quantify management quality” Federal Reserve Bank of Dallas, Financial industry Studies. 94.

- Belay, T. (2020).Determinants Of Non-Performingloans In Ethiopian Commercial BankS.

- Berhanu, B. B. (2019). Determinants of non- performing loan in commercial bank’s in Ethiopia. MSc Thesis, Addis Ababa University.

- Blanco, R., & Gimeno, R. (2012). Determinants of default ratios in the segment of loans toto households in spain.

- Bolt, W., Tieman, A. F. (2004). Banking Competition, Risk and Regulation. International Monetary Fund Working Paper WP/04/11.

- Boudriga, A., Taktak, N. B., &Jellouli, S. (2009). Banking supervision and nonperforming loans: A cross-country analysis. Journal of Financial Economic Policy.

- Braun, B., & Koddenbrock, K. (2022). The three phases of financial power: Leverage, infrastructure, and enforcement.

- Breuer, J. B. (2006). Problem bank loans, conflicts of interest, and institutions.Journal of Financial Stability, 2, 266–285.

- Brooks, C. (2008a). Introductory Econometrics for Finance,. Ntroductory Econometrics for Finance, 2nd Edn, Cambridge University Press, New York.

- Brooks, C. (2008b). Introductory Econometrics for Finance, 2nd edn, Cambridge University Press, New York. Book.

- Brooks, C. (2008c). Introductory Econometrics for Finance Second Edition, New York, University of Reading.

- Calice, P., Chando, V., & Sekioua, S. (2012). Bank Financing to Small and Medium Enterprises in East Africa: Findings of a Survey in Kenya, Tanzania, Uganda and Zambia. African Development Bank Group Working Paper, March, 1–41.

- Ciukaj, R., & Kil, K. (2020). Determinants of the non-performing loan ratio in the European Union banking sectors with a high level of impaired loans. Economics and Business Review, 6(1), 22–45. [CrossRef]

- De la Torre, A., Pería, M. S. M., & Schmukler, S. L. (2010). Bank involvement with SMEs: Beyond relationship lending. Journal of Banking & Finance, 34(9), 2280–2293. [CrossRef]

- Delil, A. (2019). School of Graduate Studies Determinants of Non-Performing Loan: The Case of Ethiopian Commercial Banks Determinants of Non-Performing Loan: The Case of Ethiopian Commercial Banks.

- Demirguc-Kunt and Enrica Detragiache. (1998). “The Determinants of Banking Crises in Developing and Developed Countries”,. IMF Staff Paper, 45(1), 81–109. [CrossRef]

- El-Maude, J. G., Abdul-Rahman, A., & Ibrahim, M. (2017). Determinants of non-performing loans in Nigeria’s deposit money banks. Archives of Business Research, 5(1), 74–88. [CrossRef]

- Fernández de Lis, S., Martínez Pagés, J., & Saurina Salas, J. (2000).Credit growth, problem loans and credit risk provisioning in Spain. Banco de España. Servicio de Estudios.

- Fisher, I. (1933). The Debt Deflation Theory of Great Depressions.Econometrical, 1, 337–357. [CrossRef]

- Fofack, H., & Fofack, H. L. (2005). Nonperforming loans in Sub-Saharan Africa: Causal analysis and macroeconomic implications (Vol. 3769). World Bank Publications.

- GADISE, G. (2014). Determinants of nonperforming loans: Empirical study in case of Commercial banks in Ethiopia. MSc thesis, Jimma University.

- Garr, D. K. (2013). Determinants of credit risk in the banking industry of Ghana.Developing Country Studies, 3(11), 64–77.

- Gezu, G. (2014). Determinants of nonperforming loans: Empirical study in case of commercial banks in Ethiopia.

- Ghorbani&Jakobsson. (2019). Determinants of Non-Performing Loans.Econometrica, 77, 1229–1279.

- Ghosh, A. (2015). Banking-industry specific and regional economic determinants of non-performing loans: Evidence from US states. Journal of Financial Stability, 20, 93–104. [CrossRef]

- Gujarat, D. (2004).Basic Econometric, 4th edn. USA: McGraw–Hil.

- Gujarat, N. (2004). Basic Econometric, 4th edition, USA: McGraw–Hill. Boston. Books.

- Gulati, R. (2022). Global and local banking crises and risk-adjusted efficiency of Indian banks: Are the impacts really perspective-dependent? The Quarterly Review of Economics and Finance, 84, 23–39.

- Habtamu, N. (2012). Determinants of Bank Profitability: An Empirical Study on Ethiopian Private Commercial Banks: Published Thesis (MSC), Addis Ababa University.

- Hafer, R. (2005). „The Federal Reserve System‟, Greenwood Publishing Group.

- Hox, J. J., & Boeije, H. R. (2005). Data collection, primary versus secondary.

- IMF. (2010). Determinations of NPL in Developing countries.Of Engineering Economics, 23(5), 496–504.

- Jeong, S., Jung, H. (2013). Bank Wholesale Funding and Credit Procyclicality: Evidence from Korea. Pano-economicus,. 60(5), 615–631. [CrossRef]

- Jovovic, J. (2014). Determinants of Non-Performing Loans: Econometric Evidence Based on 25 Countries. Master Thesis, City University London.

- Khemraj, T., & Pasha, S. (2009). The determinants of non-performing loans: An econometric case study of Guyana.

- Kindleberger, C. P. (2015). A financial history of Western Europe. Routledge.

- Kithinji, A. M. (2010). Credit risk management and profitability of commercial banks in Kenya.

- Kolapo, T. F., Ayeni, R. K., &Oke, M. O. (2012). Credit Risk And Commercial Banks’performance In Nigeria.Australian Journal of Business and Management Research,2(2), 3.

- Kirui, Simion. (2014). The effect of non-performing loans on profitability of commercial.

- banks in Kenya. (Master’s Degree Thesis), University of Nairobi, Kenya.

- Kwambai,.D.K .&Wandera, M. (2013). Effects of credit information sharing on nonperforming loanscommercial bank kenya. 9(13), 168–193.

- Louzis, P. D., Vouldis, A. T., Metaxas, V. L. (2012). Macroeconomic and Bank-Specific Determinants of Non-Performing Loans in Greece: A Comparative Study of Mortgage, Business and Consumer Loan Portfolios. Journal of Banking and Finance, 36(4), 1012–1027. [CrossRef]

- Machiraju, H. (2001). Modern Commercial Banking, India: VIKAS Publishing House Pvt. Ltd. Co.

- Makri et al. (2014). Determinants of Nonperforming Loans: The Case of Eurozone. Panoeconom, 2, 193–206.

- Marshal, I., & Onyekachi, O. (2014). Credit risk and performance of selected deposit money banks in Nigeria: An empirical investigation. European Journal of Humanities and Social Sciences Vol, 31(1).

- Mazreku, I., Morina, F., Misiri, V., Spiteri, J. V., & Grima, S. (2018). Determinants of the level of non-performing loans in commercial banks of transition countries. [CrossRef]

- Mehari, M. (2012). Credit risk management in Ethiopia banking industry‟, MBA thesis, Addis Ababa University.

- Mesay, T. (2017a). Determinant of non performing loan. THESIS.

- Mesay, T. (2017b). Determinant of non-performing loan in Ethiopian private commercial banks: With emphasis on manufacturing sector. MSc thesis, Addis Ababa University.

- Mesele, B. (2016). Determinants of nonperforming loans of ethiopian commercial banks.

- Meseret, H. (2018). Determinants of nonperforming loan: Evidence from private commercial banks in Ethiopia.MSc thesis, St. Mary’s university.

- Mileris, R. (2012a). Macroeconomic Determinants of Loan Portfolio Credit Risk in Banks.IzerineEkonomika-Engineering. Economics, 23(5), 496–504. [CrossRef]

- Mileris, R. (2012b). Macroeconomic Determinants of Loan Portfolio Credit Risk in Banks.IzerineEkonomika-Engineering Economics,. 23(5), 496–504. [CrossRef]

- Monicah W AnjruMuriithi. (2013). The Causes of Non-Performing Loans in Commercial Bank in Kenya.

- Moradi, Z. S., Mirzaeenejad, M., & Geraeenejad, G. (2016). Effect of bank-based or market-based financial systems on income distribution in selected countries. Procedia Economics and Finance, 36, 510–521. [CrossRef]

- Muriithi, J. G., Waweru, K. M., & Muturi, W. M. (2016). Effect of credit risk on financial performance of commercial banks Kenya. [CrossRef]

- Natnael, Tefera. (2017). Factors Affecting Non-Performing Loans In Banking Industry In.

- Ethiopia: A Case of Dashen Bank, MA Thesis, St. Mary’s University, School of Graduate Studies, Addis Abba, Ethiopia.

- NBE. (2008). Asset classification and Provisioning for development financial institution Directive. 43.

- NBE. (2012). Asset classification and Provisioning for development financial institution Directive , Addis Ababa Ethiopia. SBB, 52.

- Ogar, A., Nkamare, S., & Effiong, C. (2014). Commercial bank credit and its contributions on manufacturing sector in Nigeria. Research Journal of Finance and Accounting, 5(22), 188–196.

- Onyango, W. A., & Olando, C. O. (2020). Analysis on influence of bank specific factors on non-performing loans among commercial Banks in Kenya. Advances in Economics and Business, 8(3), 105–121. [CrossRef]

- Rajaraman, I., &Vasishtha, G. (2002). Non-performing loans of PSU banks: Some panel results. Economic a, 429–435.

- Ramadhani, R. (2020). Legal Consequences of Transfer of Home Ownership Loans without Creditors’ Permission. International Journal Reglement & Society (IJRS), 1(2), 31–37. [CrossRef]

- Rawlin Rajveer , M. Shwetha M., S. and P. B. L. (2012). Modeling the NPA of Midsized Indian Nationalized Bank as Function of Advances. European Journal of Business and Management, 4(5).

- Rediet, G. . (2020). Determinants of Non-performing loan: A case of Development bank of Ethiopia.

- Rhodes, C. J. (2014). Mycoremediation (bioremediation with fungi)–growing mushrooms to clean the earth. Chemical Speciation & Bioavailability, 26(3), 196–198. [CrossRef]

- Ruozi, R., Ferrari, P., Ruozi, R., & Ferrari, P. (2013). Liquidity risk management in banks: Economic and regulatory issues. Springer.

- Saba, I. (2018a). Determinants of Non-Performing Loans. Case of US Banking Sector, 44(3), 81–121.

- Saba, I. (2018b). Determinants of Non-Performing Loans: Case of US Banking Sector. 44(3), 81–121.

- Saba, I., Kouser, R., & Azeem, M. (2012). Determinants of non performing loans: Case of US banking sector. The Romanian Economic Journal, 44(6), 125–136.

- Sitina, A. (2018).Determinants of Non-performing Loans in Ethiopian Commercial Banks By: MSc thesis, Addis Ababa University College.

- Soedarmono, W., Machrouh, F., & Tarazi, A. (2011). Bank market power, economic growth and financial stability: Evidence from Asian banks. Journal of Asian Economics, 22(6), 460–470. [CrossRef]

- Spaseska, T., Hristoski, I., Odzaklieska, D., & Risteska, F. (2022). Macroeconomic Determinants of Non-Performing Loans in the Republic of North Macedonia. 190–204.

- Spuchľáková, E., Valašková, K., & Adamko, P. (2015). The credit risk and its measurement, hedging and monitoring. Procedia Economics and Finance, 24, 675–681.

- Tamang, B. (2022).Impact of Credit Performance on the Profitability of Commercial Banks in Nepal.

- Tseganesh. (2012). Determinants of Banks Liquidity and Their Impact on Financial Performance: Published thesis (MSc), University Addis Ababa, Ethiopia.

- Uppal, R. K. (2009). sector advances: Trends, issues and strategies. Journal of Accounting and Taxation, 1(5), 79–89.

- Yonas, A. B. (2017). Assessment of the determinants of non-performing loans: The case of commercial banks in Ethiopia. MSc thesis, Addis Ababa University.

- Yosef, F. (2018). “ Determinants of Non-Performing Loans: Evidence from Commercial Banks in Ethiopia.MSc thesis, Addis Ababa university. 1–88.

- Zelalem, T. . (2013). No TitleDeterminants of Non-performing Loans: Empirical Study on Ethiopian Commercial Banks. 66(1997), 37–39.

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).