Submitted:

24 June 2025

Posted:

25 June 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

- RQ1:

- How does agent banking influence the accessibility and financial performance of commercial banks in Bangladesh?

- RQ2:

- What is the impact of agent banking outlets on the financial performance of commercial banks in Bangladesh?

- RQ3:

- How does deposit mobilization influence the financial performance of commercial banks in Bangladesh?

- RQ4:

- What is the effect of credit disbursement through agent banking on the financial performance of commercial banks in Bangladesh?

2. Literature Review

2.1. Theories on Agent Banking Model

2.1. Empirical Literature

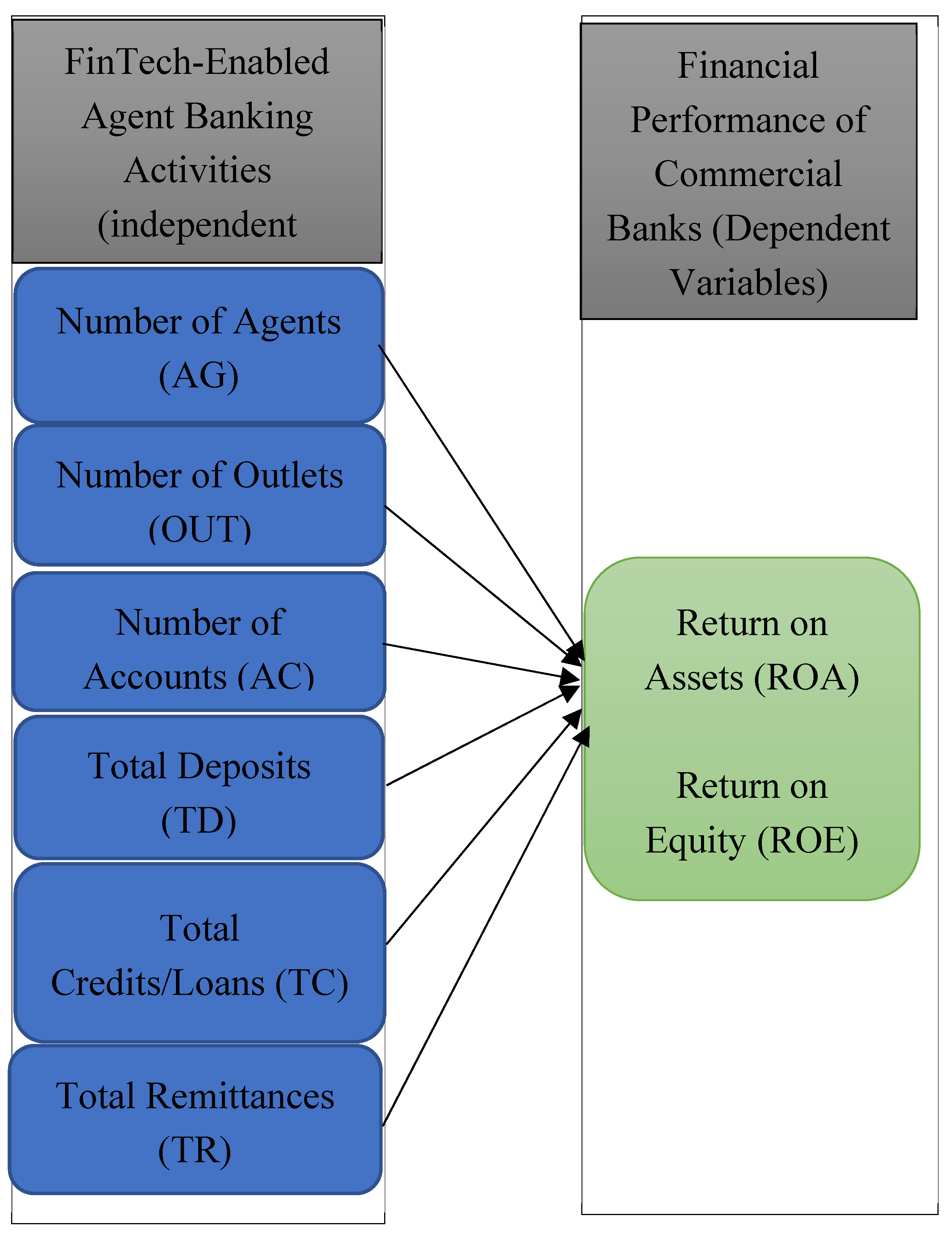

3. Conceptual Framework

3.1. Hypotheses Development

4. Empirical Design: Methodology, Data and Variables

4.1. Descriptive Statistics of the Variables

4.1. Model Specification

5. Results and Discussion

6. Robustness Check

7. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variables | Definition/Measures |

|---|---|

| Dependent Variables | |

| ROA | Net Profit after tax/Total Assets |

| ROE | Net Profit after tax/Total Equity |

| Independent Variables | |

| AG | Number of Agents |

| AC | Number of accounts |

| OUT | Number of Outlets |

| TC | Total Credit/loans |

| TD | Total Deposits |

| REM | Total Remittance |

| Dependent Variables |

| Name of the sample banks | Sample period |

|---|---|

| Bank Asia PLC | 2018Q1-2024Q4 |

| Dutch-Bangla Bank PLC | 2018Q1-2024Q4 |

| Al-Arafah Islami Bank PLC | 2018Q1-2024Q4 |

| Islami Bank Bangladesh PLC | 2018Q1-2024Q4 |

| Mutual Trust Bank PLC | 2018Q1-2024Q4 |

| The City Bank PLC | 2018Q1-2024Q4 |

| Brac Bank PLC | 2018Q1-2024Q4 |

| NRB Bank PLC |

2018Q1-2024Q4 |

| Modhumoti Bank PLC | 2018Q1-2024Q4 |

| ROA | ROE | |||

|---|---|---|---|---|

| FE | RE | FE | FE | |

| Number of Agents (AG) | -0.001 (0.004) |

-0.003** (0.001) |

-0.003 (0.052) |

-0.036** (0.018) |

| Number of Outlets (OUT) | 0.002 (0.006) |

0.005*** (0.002) |

0.011 (0.073) |

0.028 (0.023) |

| Total Credit (TC) | -0.000 (0.001) |

0.001*** (0.009) |

-0.010 (0.009) |

0.011*** (0.004) |

| Total Deposit (TD) | 0.001 (0.002) |

0.002 (0.001) |

0.005 (0.022) |

0.005 (0.014) |

| Number of Accounts (AC) | 0.000 (0.001) |

-0.001 (0.001) |

0.011 (0.019) |

0.008 (0.012) |

| Total Remittance (REM) | 0.001 (0.002) |

-0.002** (0.001) |

0.019 (0.024) |

-0.003 (0.011) |

| Constant | -0.004 (0.006) |

0.001 (0.003) |

-0.096 (0.078) |

-0.005 (0.034) |

| R-squared | 0.005 | 0.123 | 0.037 | 0.113 |

| Hausman test | =0.003:RE | =0.000:RE | ||

| Total observations | 234 | 234 | ||

| 1 | PSD Circular No. 05: Guidelines on Agent Banking for the Banks dated 09 December 2013. |

References

- Gupta, R. & Gupta, A. (2020), Agent banking in the FinTech era: opportunities for financial inclusion, Journal of Financial Technologies, 15(2), 25-38.

- Veniard, C. (2010). How agent banking changes the economics of small accounts. Available online: https://docs.gatesfoundation.org/documents/agent-banking.pdf.

- Buri, S., Cull, R., Gine, X., Harten, S. & Heitmann, S. (2018). Banking with agents: experimental evidence from Senegal, Washinton, DC: World Bank.

- Cull, R., Gine, X., Harten, S., Heitmann, S. & Rusu, A. B. (2018). Agent banking in a highly under-developed financial sector: evidence from Democratic Republic of Congo. World Development, 107, 54-74.

- Kumar, A., Nair, A., Parsons, A. & Urdapilleta, E. (2006). Expanding bank outreach through retail partnerships: correspondent banking in Brazil, Washington, D.C.: World Bank.

- Margaret, K. G. & Ruth, N. K. (2019). The effect of banking services on the business performance of bank agents in Kenya. Cogent Business & Management, 6(1), 16844420. [CrossRef]

- Nezianya, N. P., & Izuchukwu, D.(2014). Impact of agent banking on the performance of deposit money banks in Nigeria, Research Journal of Finance and Accounting 5(9), 35-41.

- Zaffar, M. A., Kumar, R. L., & Zhao, K. (2019). Using agent-based modelling to investigate diffusion of mobile-based branchless banking services in a developing country. Decision Support Systems, 117, 62-74.

- Bangladesh Bank (2024). Quarterly Report on Agent Banking, October-December. Financial Inclusion Department: Bangladesh Bank.

- Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360. [CrossRef]

- Siddiquie, M. R. (2014). Agent banking, the revolution in financial service sector of Bangladesh. IOSR Journal of Economics and Finance, 5(1), 28-32.

- Diamond, D. W. (1984). Financial intermediation and delegated monitoring. The review of economic studies, 51(3), 393-414.

- Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS quarterly, 319-340.

- Lyman, T., Ivatury, G., & Staschen, S. (2006). Use of agents in branchless banking for the poor: rewards, risks, and regulation. Focus note, 38(1), 1.

- Ogoti, K.I., & Omwenga, Q.J. (2023). Influence of agency banking on the financial performance of commercial banks in kisii county, kenya. International Journal of Social Sciences and Information Technology. ISSN 2412-0294, Vol IX(V), 172-181.

- Alam, M.M., Bhowmik, D. & Bhowmik, D. (2020). The impact of agent banking on financial performance of commercial banks in Bangladesh, IOSR Journal of Economics and Finance, 11(3), 13-20.

- Karangwa, F. & Mulyungi, D.P. (2018), Effect of agency banking services on financial performance of commercial banks: a case of equity bank, International Journal of Management and Commerce Innovations, 6(1), 758-765.

- Ndambuki, D. (2016). The effect of agency banking on profitability of commercial banks in Kenya (Doctoral dissertation, University of Nairobi).

- Idoko, E. C., & Chukwu, M. A. (2022). Does Agency Banking Trigger Financial Inclusion? Perspective of Residents in Rural Setting. Sch Bull, 8(6), 180-188.

- Mwando, S. (2013). Contribution of agency banking on financial performance of commercial banks in Kenya, Journal of Economics and Sustainable Development, 20(4), 26-34.

- Aduda, J., Kiragu, P. & Ndwiga, J. M. (2013). The relationship between agency banking and financial performance of commercial banks in Kenya. Journal of Finance and Investment Analysis, 2(4), 97- 117.

- Ayadi, O. F., Oke, B., Oladimeji, A., & Aladejebi, O. (2023). Agency Banking in Nigeria: Impact and Impediments. SEDME (Small Enterprises Development, Management & Extension Journal), 50(3), 227-247.

- Hossain, M. I., Al-Amin, M., & Toha, M. A. (2021). Are commercial agent banking services worthwhile for financial inclusion? Business Management and Strategy, 12(2), 206-227.

- Hasan, Z. (2019). The effects of agent banking on the profitability of commercial banks in Bangladesh (Doctoral dissertation, Brac University).

- Seda, M. A. (2016). Effects of agency banking on the financial performance of commercial banks in Kenya (Doctoral dissertation, University of Nairobi).

- Waithanji, M. N. (2012). The impact of agent banking as a financial deepening initiative in Kenya (Doctoral dissertation, University of Nairobi, Kenya). Available online: https://erepository.uonbi.ac.ke/handle/11295/6933?utm_source=chatgpt.com.

- Kambua, B. D. (2015). The effect of agency banking on financial performance of commercial banks in Kenya (Doctoral dissertation). Available online: https://erepo.usiu.ac.ke/bitstream/handle/11732/3198/SIMBOLEY%20BRENDA%20CHEMUTAI%20MBA%202017.pdf?sequence=1.

- Nisha, N., Nawrin, K., & Bushra, A. (2020). Agent banking and financial inclusion: The case of Bangladesh. International Journal of Asian Business and Information Management (IJABIM), 11(1), 127-141.

- Hasan, M.K. (2023). Agent banks make a notable contribution. The Financial Express, Bangladesh. Available online: https://thefinancialexpress.com.bd/views/reviews/agent-banks-make-a-notable-contribution.

- Das, B. (2021). Impact of Agent Banking on Bank Profitability in Bangladesh (Master of Business Administration dissertation, University of Dhaka, Bangladesh). Available online: https://www.scribd.com/document/745526778/IMPACT-OF-AGENT-BANKING-ON-BANK-PROFITABILITY-IN-BANGLADESH?

- Dotun, O. V. & Adesugba, A. K.(2022). The impact of agency banking on financial performance of listed deposit money banks in Nigeria, Journal of Corporate Finance Management and Banking System, 2, 14-24.

- Pasiouras, F., & Kosmidou, K. (2007). Factors influencing the profitability of domestic and foreign commercial banks in the European Union. Research in international business and finance, 21(2), 222-237.

- Balaylar, N. A., Karımlı, T., & Bulut, A. E. (2025). The effect of non-interest income on bank profitability and risk: Evidence from Turkey. Revista galega de economía: Publicación Interdisciplinar da Facultade de Ciencias Económicas e Empresariais, 34(1), 1.

- Oburu, K. N. (2018). Effect of agency banking on the financial performance of commercial banks in Kenya, Doctoral dissertation, University of Nairobi. Available online: https://erepository.uonbi.ac.ke/bitstream/handle/11295/94726/Kambua%2CBelita%20D_The%20effect%20of%20agency%20banking%20on%20financial%20performance%20of%20commercial%20banks%20in%20kenya.pdf?sequence=1.

- Hirtle, B. (2007). The impact of network size on bank branch performance. Journal of Banking & Finance, 31(12), 3782-3805.

- Hasan, M. S. A., Manurung, A. H., & Usman, B. (2020). Determinants of bank profitability with size as moderating variable. Journal of applied finance and banking, 10(3), 153-166.

- Hasan, J. (2025). Agent banking lending up 56pc, deposit 15.4pc in Q4’24. The Financial Express, Bangladesh. Available online: https://thefinancialexpress.com.bd/economy/agent-banking-lending-up-56pc-deposit-154pc-in-q424.

- Khan, T.A. (2024). Agent Banking’s Impact on Financial Inclusion in Bangladesh. Asian Banking & Finance. Available online: https://asianbankingandfinance.net/retail-banking/commentary/agent-bankings-impact-financial-inclusion-in-bangladesh?utm_source=chatgpt.com.

- Aggarwal, R., Demirgüç-Kunt, A., & Pería, M. S. M. (2011). Do remittances promote financial development? Journal of Development Economics, 96(2), 255–264. [CrossRef]

- World Bank. (2020). Migration and Development Brief 32: COVID-19 Crisis Through a Migration Lens. Migration and Development Brief 32. Available online: https://documents1.worldbank.org/curated/en/989721587512418006/pdf/COVID-19-Crisis-Through-a-Migration-Lens.pdf.

- Giuliano, P., & Ruiz-Arranz, M. (2009). Remittances, financial development, and growth. Journal of Development Economics, 90(1), 144–152. [CrossRef]

- Demirgüç-Kunt, A., López Córdova, E., Martínez Pería, M. S., & Woodruff, C. (2011). Remittances and banking sector breadth and depth: Evidence from Mexico. Journal of Development Economics, 95(2), 229–241.

- Mundaca, B. G. (2009). Remittances, financial market development, and economic growth: The case of Latin America and the Caribbean. Review of Development Economics, 13(2), 288–303. [CrossRef]

- Ramadugu, R. (2023). Fintech, Remittances, And Financial Inclusion: A Case Study Of Cross-Border Payments In Developing Economies. Journal of Computing and Information Technology, 3(1).

- Zins, A., & Weill, L. (2016). The determinants of financial inclusion in Africa. Review of Development Finance, 6(1), 46–57. [CrossRef]

- Irura, N., & Munjiru, M. (2013). Technology Adoption and the Banking Agency in Rural Kenya. Journal of Sociological Research, 4(1), 249-266. [CrossRef]

- Darda, A. (2024). From Shops to Service Centers: The Rise of Agent Banking in Africa. Available online: https://amitdarda.com/from-shops-to-service-centers-the-rise-of-agent-banking-in-africa/?utm_source.

| Variable | Mean | S.E | Min | Max |

|---|---|---|---|---|

| Dependent Variables | ||||

| Return on Assets (ROA) | 0.005 | 0.004 | -0.011 | 0.019 |

| Return on Equity (ROE) | 0.061 | 0.055 | -0.149 | 0.323 |

| Independent Variables | ||||

| No. of Agents | 2.693 | 0.584 | 0 | 3.725 |

| No. of Outlets | 2.811 | 0.626 | 0 | 3.790 |

| Total accounts | 5.407 | 0.948 | 1.204 | 6.848 |

| Total Deposit | 4.177 | 0.872 | 1.079 | 5.905 |

| Total loans/credits | 3.058 | 1.268 | 0 | 5.409 |

| Remittance | 4.278 | 1.252 | 0.903 | 6.608 |

| ROA | ROE | |||

|---|---|---|---|---|

| Coefficient | S.E. | Coefficient | S.E. | |

| No. of Agents (AG) | -0.003* | 0.001 | -0.036* | 0.018 |

| No. of Outlets (OUT) | 0.005** | 0.002 | 0.028 | 0.023 |

| Total Credit (TC) | 0.001*** | 0.000 | 0.011*** | 0.004 |

| Total Deposit (TD) | 0.002 | 0.001 | 0.005 | 0.014 |

| No. of Accounts (AC) | -0.001 | 0.001 | 0.008 | 0.012 |

| Total Remittance (REM) | -0.002* | 0.001 | -0.003 | 0.011 |

| Constant | 0.001 | 0.003 | -0.005 | 0.034 |

| R-squared | 0.123 | 0.113 | ||

| Wald Chi-square | 13.71 | 24.77 | ||

|

Prob |

0.033 |

0.000 |

||

| Total Observations | 234 | 234 | ||

| ROA | ROE | |||

|---|---|---|---|---|

| Coefficient | S.E. | Coefficient | S.E. | |

| No. of Agents (AG) | -0.004*** | 0.001 | -0.038** | 0.017 |

| No. of Outlets (OUT) | 0.005*** | 0.002 | 0.029 | 0.024 |

| Total Credit (TC) | 0.001*** | 0.000 | 0.011*** | 0.003 |

| Total Deposit (TD) | 0.002 | 0.001 | 0.004 | 0.015 |

| No. of Accounts (AC) | -0.001 | 0.001 | 0.008 | 0.013 |

| Total Remittance (REM) | -0.002** | 0.001 | -0.003 | 0.010 |

| Constant | 0.001 | 0.003 | -0.004 | 0.037 |

| R-squared | 0.126 | 0.113 | ||

| Probability (F) | 0.000 | 0.000 | ||

| Total Observations | 234 | 234 | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).