Submitted:

19 May 2025

Posted:

20 May 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

1.1. Background

- Inadequate Funding: Many startups struggle to secure sufficient capital to sustain operations or scale effectively.

- Cash Flow Mismanagement: Poor budgeting, delayed receivables, or excessive spending can deplete cash reserves.

- Unsustainable Business Models: Revenue models that fail to generate consistent income undermine long-term viability.

- Over Reliance on External Funding: Startups that depend heavily on VC or loans may falter when funding dries up.

- Pricing and Cost Misalignment: Incorrect pricing strategies or high operational costs can erode profitability.

1.2. Problem Statement

1.3. Objectives of the Study

- To Identify Key Financial Causes of Startup Failure: This objective focuses on pinpointing the most common financial challenges, such as inadequate funding, cash flow mismanagement, and unsustainable business models. By analyzing case studies and empirical data, the study will highlight patterns in financial failure across industries and regions.

- To Examine the Role of Financial Management in Startup Outcomes: This objective explores how financial literacy, budgeting practices, and strategic decision-making influence startup success. It will assess the extent to which poor financial management contributes to failure and identify best practices for effective financial stewardship.

- To Analyze External Financial Pressures: This objective investigates how macroeconomic factors (e.g., interest rates, inflation) and market dynamics (e.g., competition, investor sentiment) impact startup finances. It will also examine the effects of funding availability and investor expectations on startup viability.

- To Propose Strategies for Mitigating Financial Risks: Based on the findings, this objective aims to recommend practical solutions for startups to overcome financial challenges. These may include improved financial planning, diversified funding strategies, and adaptive business models.

- To Contribute to the Literature on Startup Success: By synthesizing existing research and providing new insights, this study seeks to advance academic and practical knowledge on the financial aspects of startup failure. It aims to serve as a resource for future researchers and practitioners in the entrepreneurial ecosystem.

1.4. Scope of Study

- Financial Management Practices: Budgeting, cash flow management, and financial forecasting within startups.

- Funding Dynamics: The role of venture capital, angel investments, crowdfunding, and debt financing in startup success or failure.

- Business Model Viability: The impact of revenue models, pricing strategies, and cost structures on financial sustainability.

- External Financial Influences: Macroeconomic trends, market competition, and investor behavior as they relate to startup finances.

2. Financial Determinants of Startup Failure: A Comprehensive Literature Review

2.1. The Startup Failure Landscape: Context and Consequences

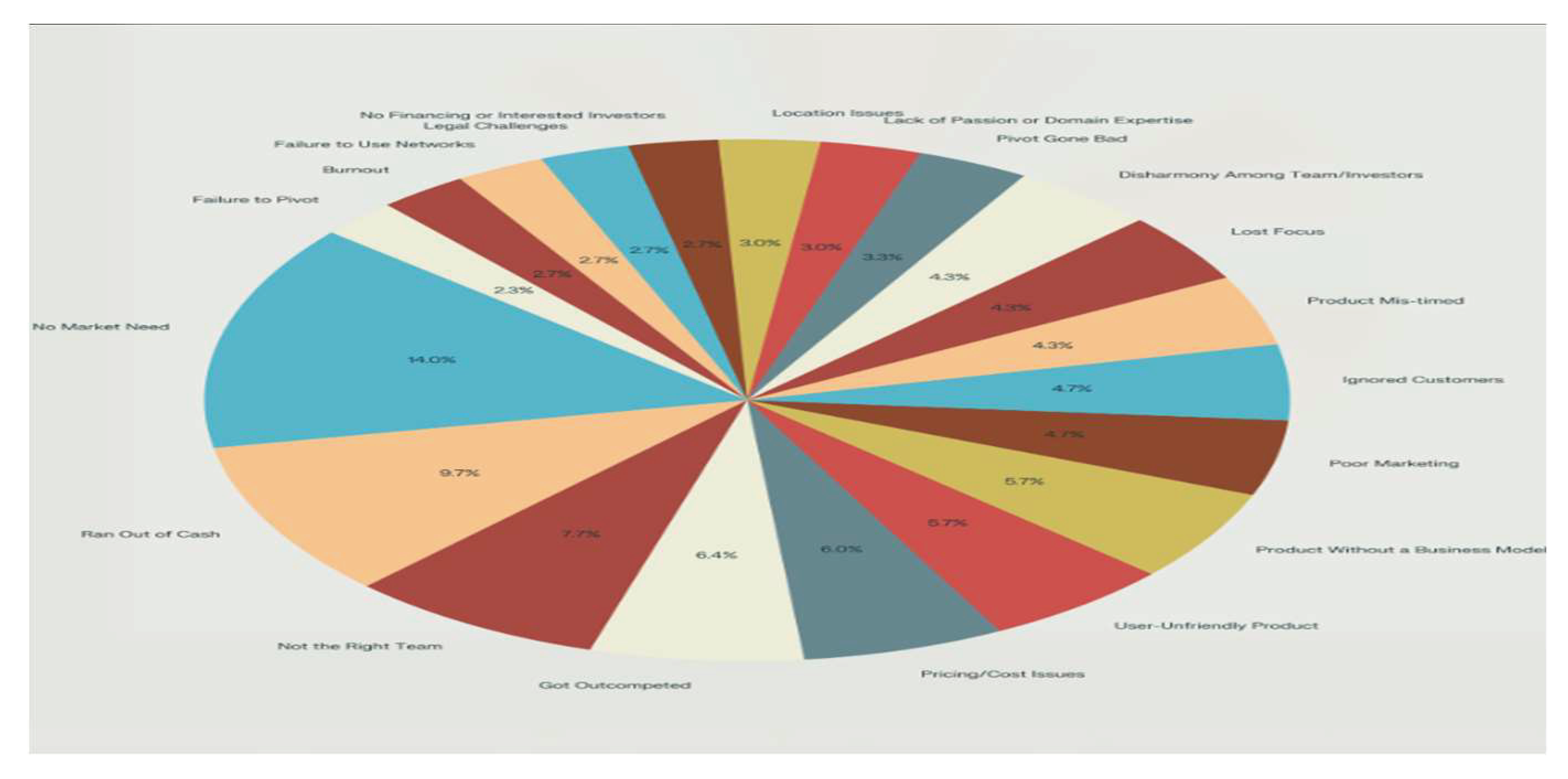

2.2. Analysis of Startup Failures: CB Insights' Research

2.3. Key Causes of Startup Failures

- No Market Need (42%)

- Ran Out of Cash (29%)

- Not the Right Team (23%)

- Got Outcompeted (19%)

- Pricing/Cost Issues (18%)

- User-Unfriendly Product (17%)

- Product Without a Business Model (17%)

- Poor Marketing (14%)

- Ignored Customers (14%)

- Product Mis-timed (13%)

- Lost Focus (13%)

- Disharmony Among Team/Investors (13%)

- Pivot Gone Bad (10%)

- Lack of Passion or Domain Expertise (9%)

- Location Issues (9%)

- No Financing or Interested Investors (8%)

- Legal Challenges (8%)

- Failure to Use Networks (8%)

- Burnout (8%)

- Failure to Pivot (7%)

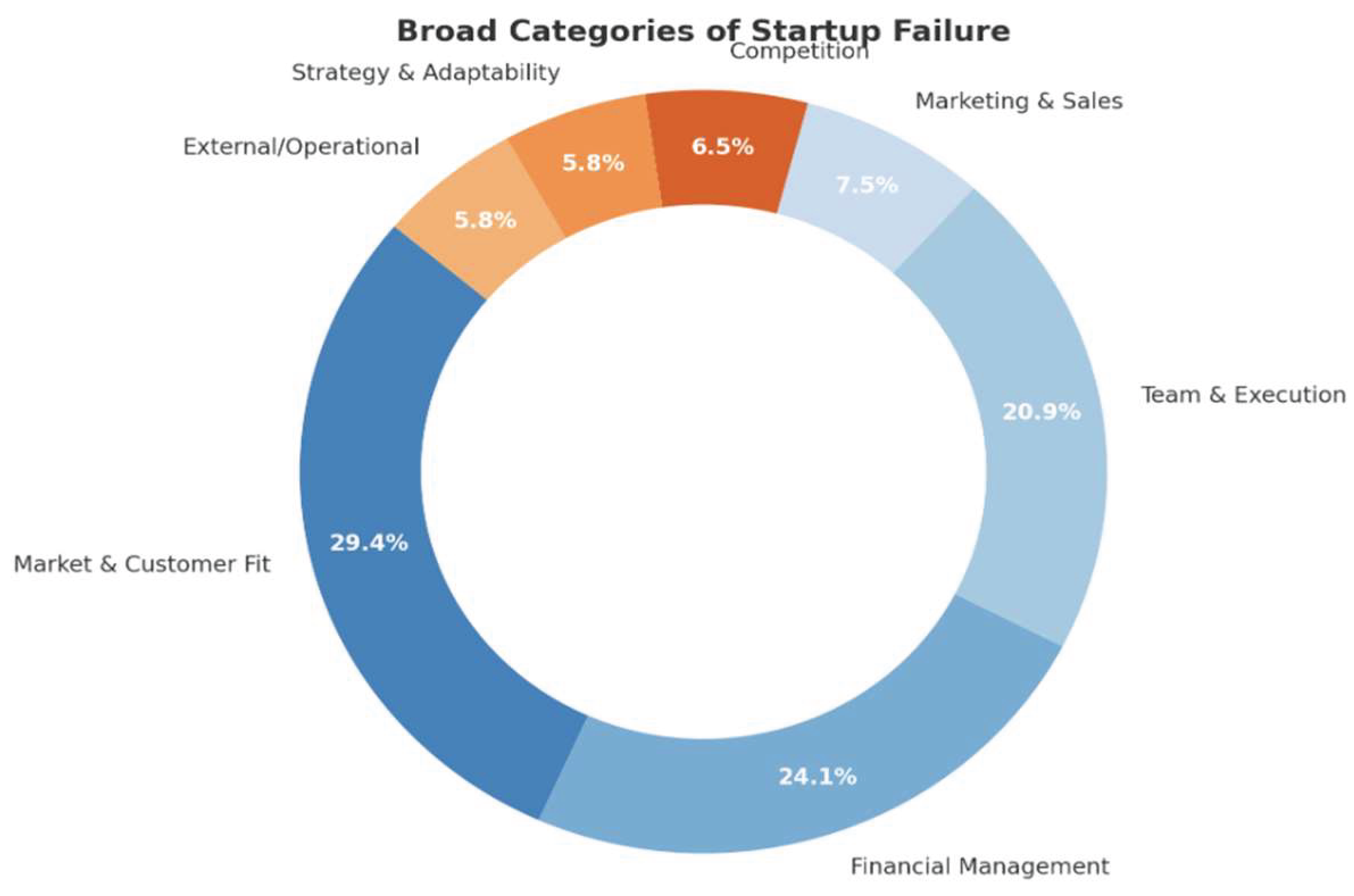

2.4. Categorising Them into Broad Areas

2.4.1. Financial Management

- Ran Out of Cash: Poor cash flow management and premature scaling.

- Pricing/Cost Issues: Unsustainable pricing models or high operational costs.

- Product Without a Business Model: A lack of clear monetization strategies.

- No Financing or Interested Investors: Challenges in securing adequate funding at critical growth stages.

2.4.2. Market & Customer Fit

- No Market Need: Developing a product for which there is no demand.

- Ignored Customers: Failing to incorporate customer feedback.

- Product Mis-timed: Launching too early or late, missing the market window.

- User-Unfriendly Product: Poor product design or usability deters adoption.

2.4.3. Team & Execution

- Not the Right Team: Gaps in skills or team cohesion.

- Disharmony Among Team/Investors: Internal conflicts disrupting operations.

- Lack of Passion or Domain Expertise: Founders not deeply invested or knowledgeable in their industry.

- Burnout: The high-pressure environment leading to mental and physical exhaustion.

- Lost Focus: Straying from core objectives due to diversification or distractions.

2.4.4. Competition

- Got Outcompeted: Losing market share to better-positioned competitors.

2.4.5. Strategy & Adaptability

- Pivot Gone Bad: Shifting directions without proper validation.

- Failure to Pivot: Resistance to change despite market signals.

2.4.6. Marketing & Sales

- Poor Marketing: Failing to promote the product effectively.

- Failure to Use Networks: Underutilizing personal and professional networks for growth.

2.4.7. External/Operational Factors

- Location Issues: Operating in a market or geography with limited opportunities.

- Legal Challenges: Regulatory compliance or legal disputes draining resources.

2.5. Financial Failures: The Underlying Thread

- Robust financial planning

- Effective cash flow management

- Sustainable funding strategies

- Realistic budgeting and capital allocation

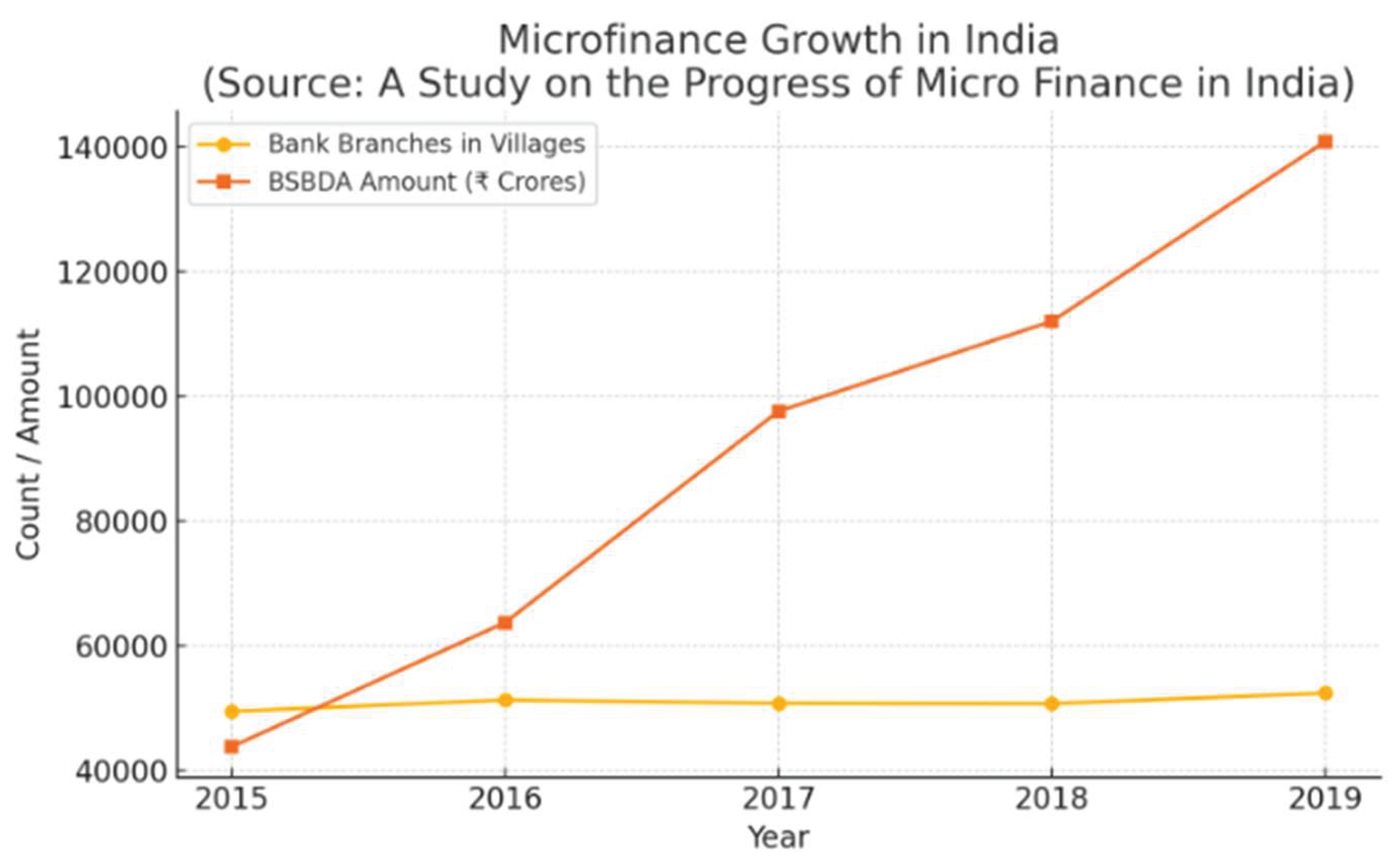

2.6. A Study on the Progress of MicroFinance in India

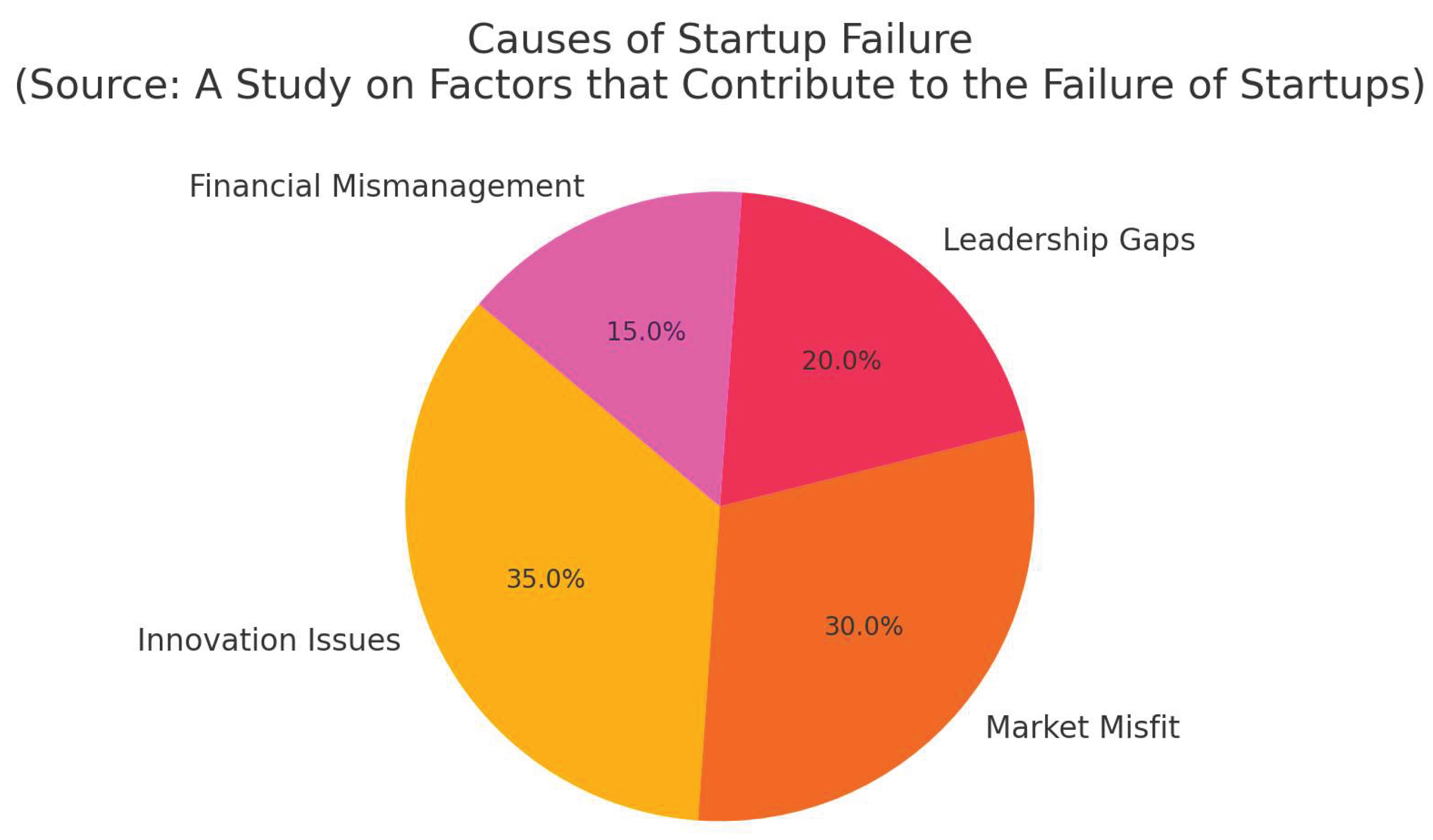

2.7. A Study on Factors that Contribute to the Failure of Startups

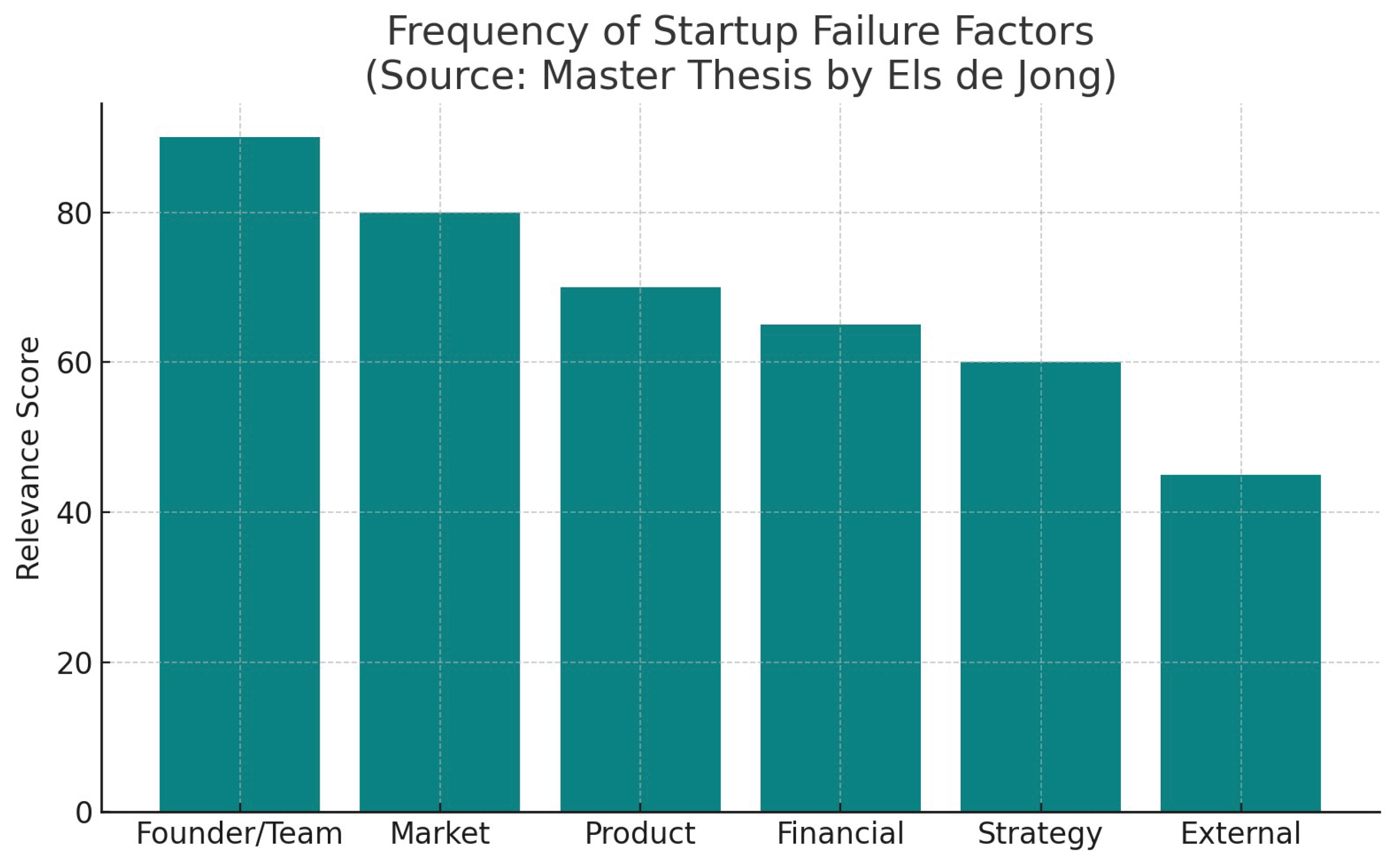

2.8. “They Have Not Failed, They Have Just Found Ways That Won’t Work” (Els de Jong)

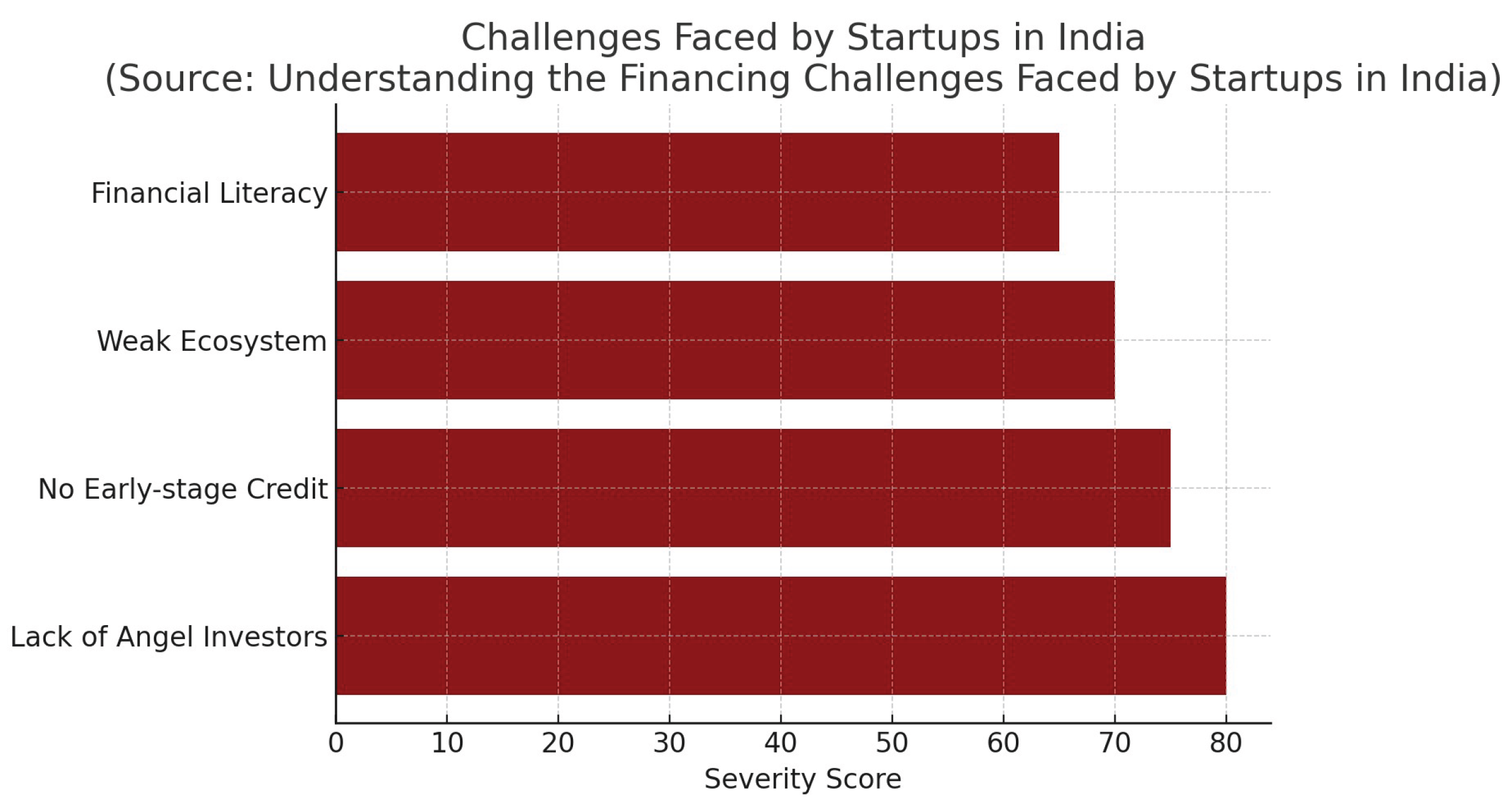

2.9. Understanding the Financing Challenges Faced by Startups in India

2.10. Research Gap Identified

3. Research Methodology

3.1. Rationale for Data Collection

- Identify financial pitfalls that most commonly lead to startup failures.

- Understand how founders and investors perceive and respond to financial challenges.

- Provide actionable insights for current and future entrepreneurs, investors, and policymakers.

3.2. Research Design

- (a) Secondary Research: To establish a theoretical foundation and identify knowledge gaps.

- (b) Primary Data Collection: Through structured questionnaires and semi-structured interviews with stakeholders in the startup ecosystem.

3.2.1. Objectives of the Design

- To investigate common financial planning and operational errors made by startup founders.

- To collect insights from multiple stakeholder categories—founders, investors, former startup employees, and researchers.

- To identify recurring financial themes such as:

- o Cash flow mismanagement

- o Unrealistic budgeting

- o Underpricing

- o Revenue overestimation

- o Lack of contingency planning

3.3. Secondary Data Analysis (Literature Review)

3.3.1. Themes Explored in Literature:

- Entrepreneurial Finance: The dynamics of early-stage investment, including angel investing and bootstrapping strategies.

- Risk Management and Budgeting: How budgeting frameworks and risk-mitigation strategies can make or break startups.

- General Causes of Startup Failure: Multi-factor analyses showing that while team and market fit are important, financial reasons are often the trigger point.

- Financial Planning and Sustainability: The role of strategic financial forecasting and capital allocation in ensuring long-term survival.

3.3.2. Identified Research Gap:

3.4. Primary Data Collection

3.4.1. Sampling Method and Respondent Profile:

- Sampling Method: Non-probability purposive sampling

- Sample Size: 30 to 45 participants

- Respondent Types:

- o Startup founders (active or previously failed)

- o Investors (angel investors and venture capitalists)

- o Former startup employees

- o Researchers and mentors in the startup ecosystem

3.4.2. Survey Instrument and Questionnaire Design:

3.4.3. Key Questions Included:

- Your Role

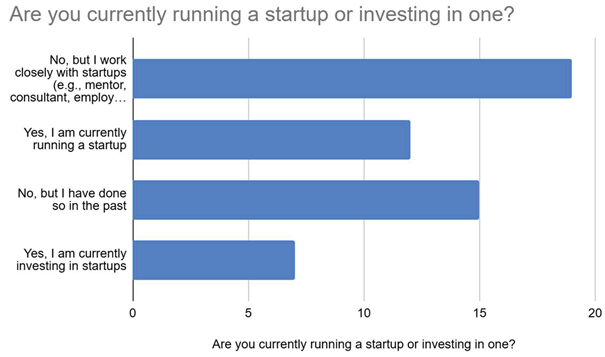

- Are you currently running a startup or investing in one?

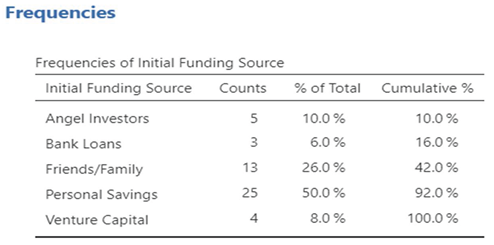

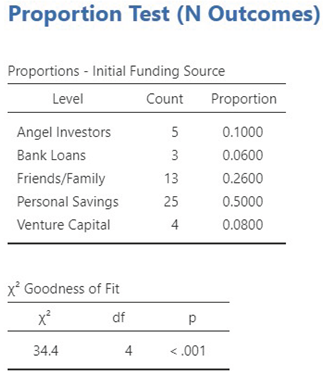

- What was your startup's initial source of funding?

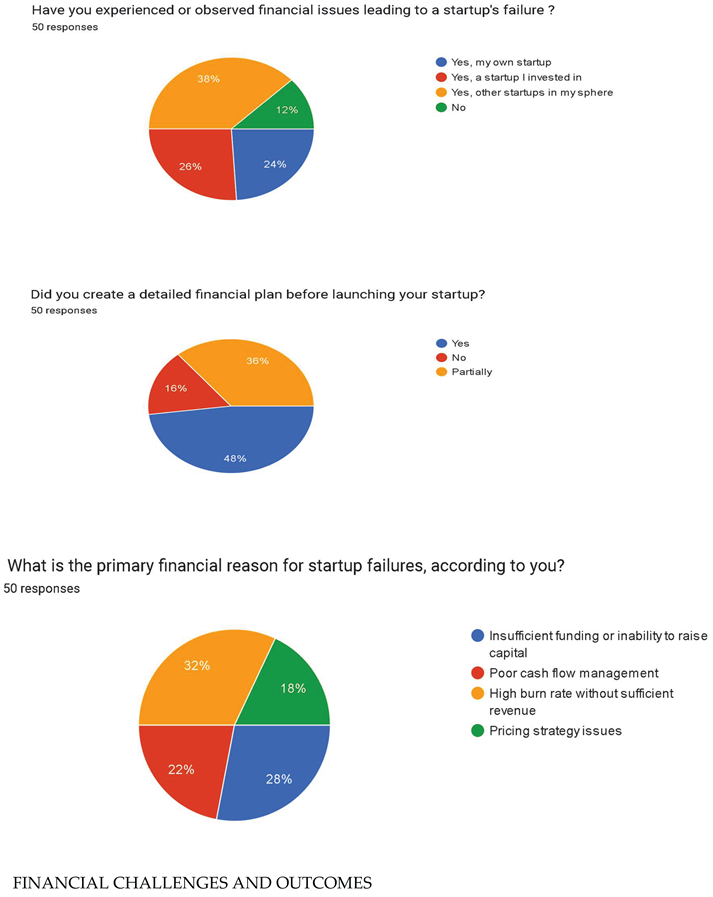

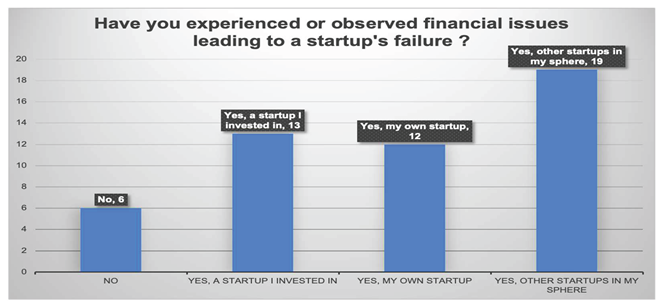

- Have you experienced or observed financial issues leading to a startup’s failure?

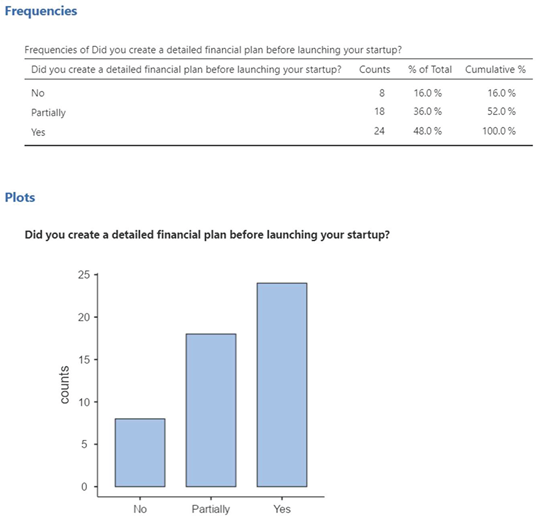

- Did you create a detailed financial plan before launching your startup?

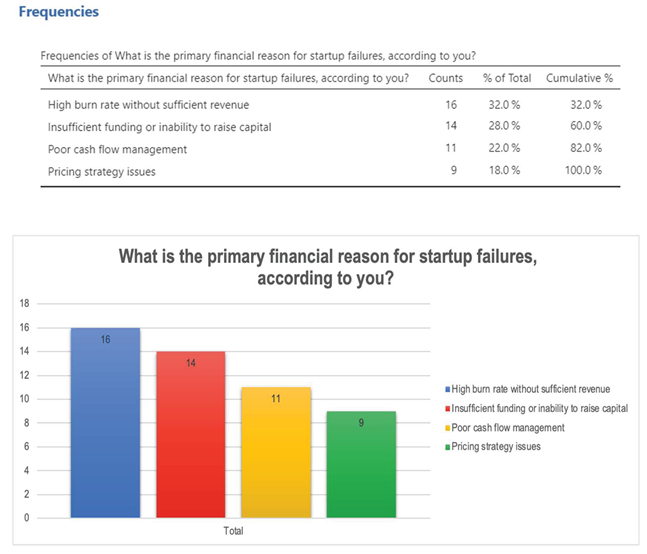

- What is the primary financial reason for startup failures, according to you?

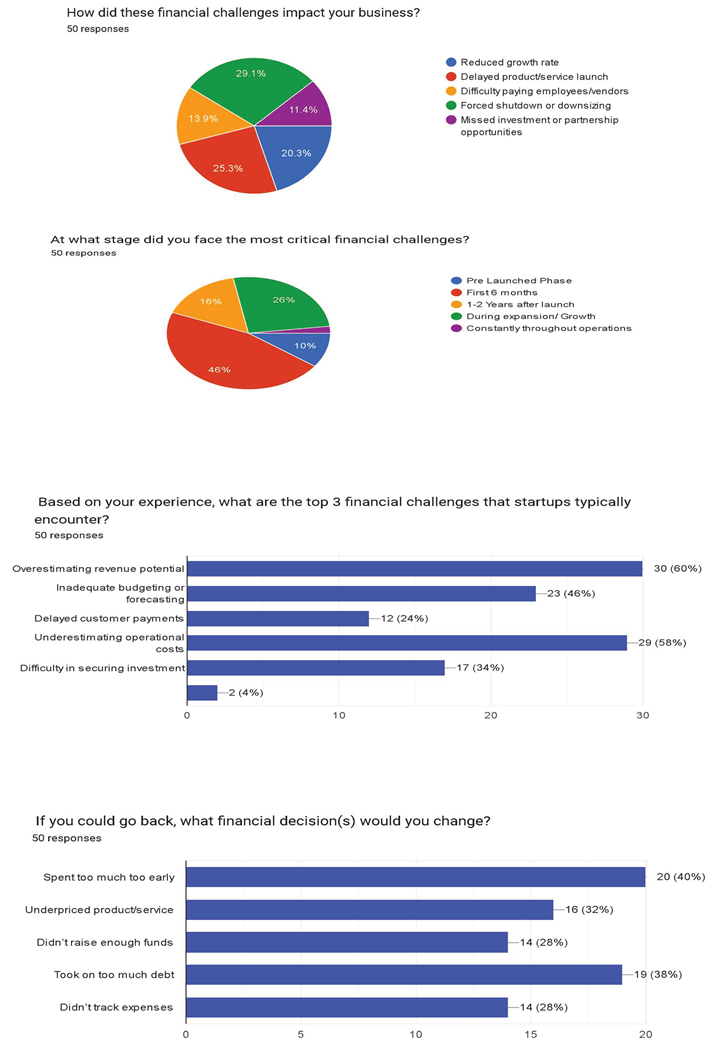

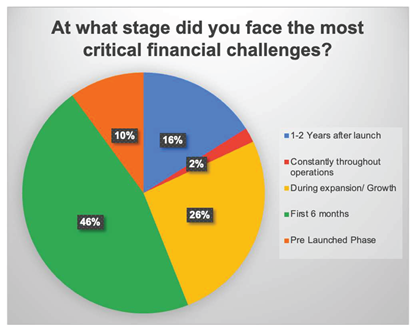

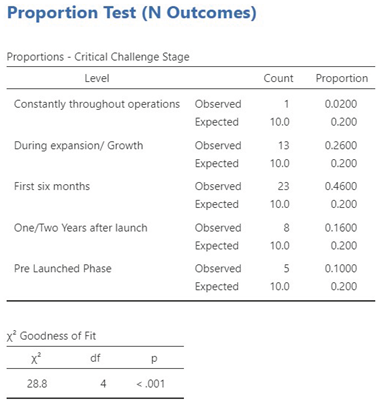

- At what stage did you face the most critical financial challenges?

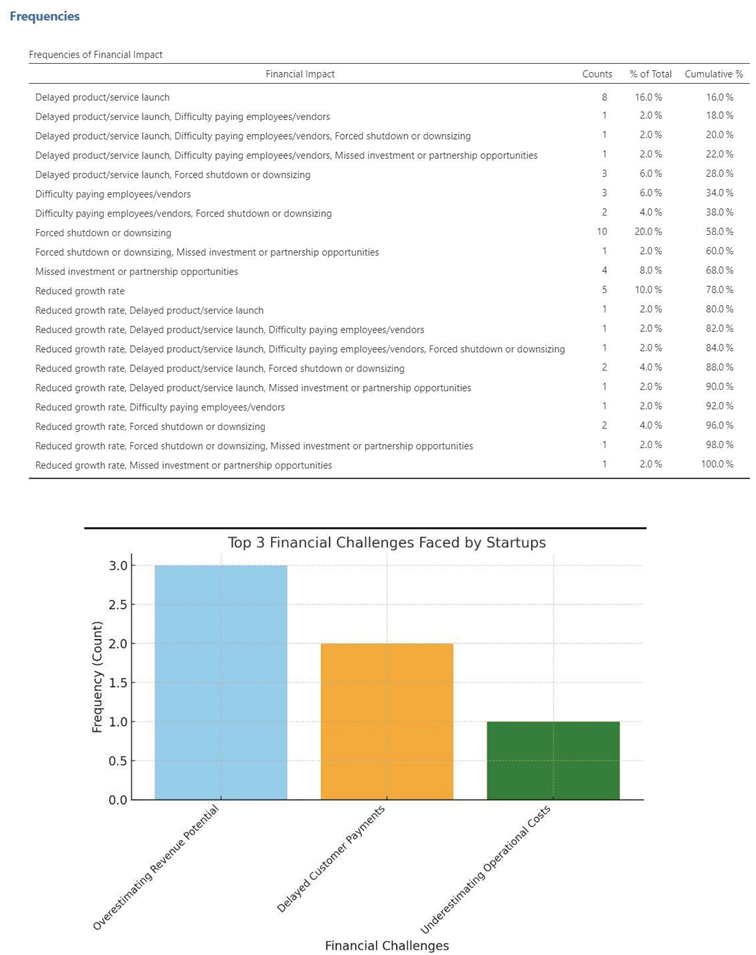

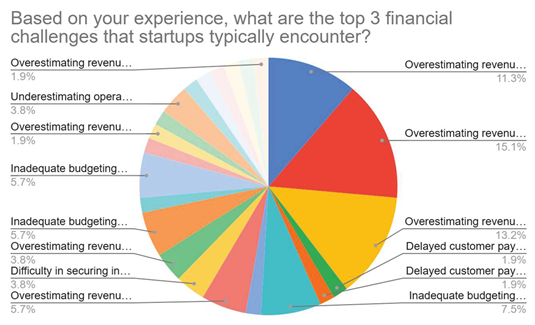

- Based on your experience, what are the top 3 financial challenges that startups typically encounter?

- How did these financial challenges impact your business?

- If you could go back, what financial decision(s) would you change?

3.4.4. Interview Strategy

3.4.5. Topics Explored in Interviews:

- How financial decisions were made and by whom

- Emotional toll of financial crises and failures

- Learnings about investor relationships and funding structures

- Thoughts on what could have been done differently

3.5. Interview Documentation:

4. Analysis, Discussion and Recommendation

4.1. Data Collection

4.1.1. Quantitative Data Analysis (Survey Responses)

4.1.2. Key Analytical Techniques:

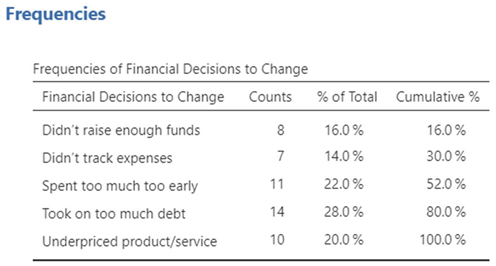

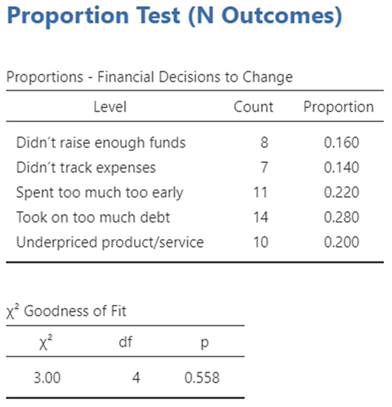

- Frequency Distribution: To understand how often specific financial challenges were reported (e.g., cash flow issues, lack of planning).

- Cross-tabulation: To correlate startup stages (early, growth, maturity) with types of financial challenges faced.

- Thematic Coding of Open-Ended Responses: To cluster similar narrative responses and extract dominant themes (e.g., poor pricing strategy, investor conflict)

4.2. Data Analysis

4.2.1. Interpretation and visualization from Excel and Jamovi

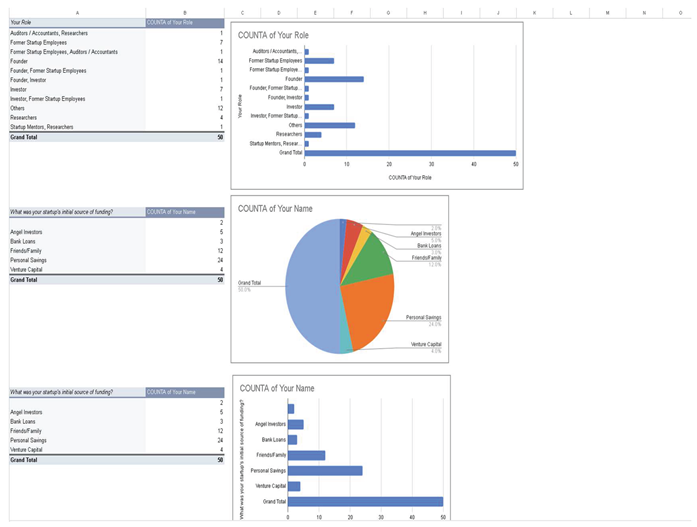

- Role Distribution: The majority of respondents were startup founders, providing direct, experience-based insights into financial challenges. A diverse mix of former employees, investors, and researchers also contributed to a broader perspective.

- The sample size involved the majority of the respondents who work closely with startups (mentors, consultants, etc) 34% as well as those who have done startups in the past (30%).Along with them are various founders and investors at 22% and 12% respectively.

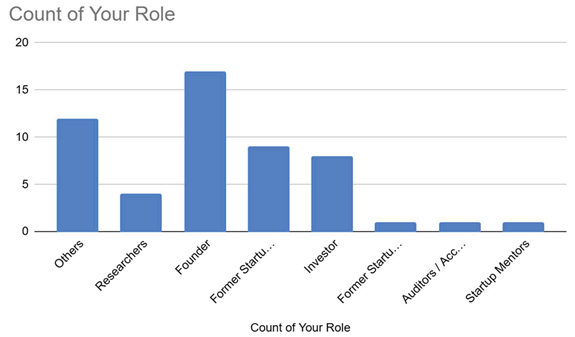

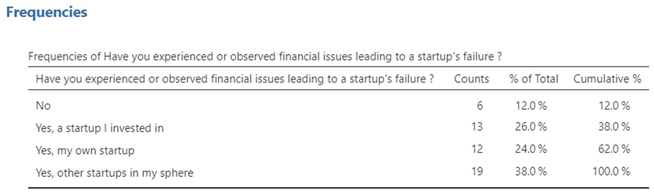

- Funding Sources: Nearly 72% of startups were initially funded through personal savings or friends and family, with only a small share receiving venture capital (8%) or angel investment (10%). This indicates a heavy reliance on informal funding and limited early access to institutional capital.

- Founders, with the highest count (n = 16), accounting for the majority of responses. This suggests strong firsthand insights into the operational and financial challenges faced by startups.

- Others follow with around 11 responses, representing participants whose roles may not fall into traditional startup categories, possibly including consultants, educators, or general professionals.

- Former Startup Employees and Investors are also well represented, with 9 and 8 respondents respectively, indicating valuable retrospective and financial perspectives.

- A smaller number of responses came from Researchers (n = 4), and very few from Former Startup Founders, Auditors/Accountants, and Startup Mentors (each contributing 1–2 responses).

4.2.2. First 6 Months

- A Chi-square goodness-of-fit test was conducted to examine whether the distribution of critical financial challenges faced by respondents varied across different startup stages. The stages considered were: Pre-Launch Phase, First Six Months, One/Two Years after Launch, During Expansion/Growth, and Constantly throughout Operations. The results indicated a statistically significant difference in the distribution of responses, χ²(4) = 28.8, p < .001.

- This suggests that financial challenges are not evenly experienced across all stages. Notably, the First Six Months emerged as the most critical period, with 46% of respondents reporting major financial difficulties during this time—more than double the expected proportion (20%). In contrast, only 2% reported facing consistent financial challenges throughout operations, indicating that acute financial strain is more common in the early stages of a startup’s lifecycle.

5. Key Findings: Common Financial Planning and Projection Mistakes Among Startups

5.1. Overestimating Revenue Growth

5.2. Underestimating Operational Costs

5.3. Ignoring Worst-Case Scenarios

5.4. Inconsistent or Inaccurate Cash Flow Forecasting

5.5. Misalignment Between Financial and Business Strategy

5.6. Lack of Regular Financial Monitoring

6. Recommendations

6.1. Recommendations

- 1.

- Founders Should Prioritise Financial Planning Early On

- ∘

- Many startups begin operations without a structured financial plan. It is crucial for founders to create detailed budget forecasts, cash flow statements, and break-even analyses before launching.

- ∘

- Training in basic financial management should be encouraged, especially for first-time entrepreneurs.

- 2.

- Diversify Initial Funding Sources

- ∘

- With over 70% of startups relying on personal savings or friends/family, there is a need to explore alternative funding such as government grants, incubator programs, and crowdfunding to reduce over-dependence on informal capital.

- 3.

- Encourage Financial Transparency and Regular Reviews

- ∘

- Regular financial audits, performance tracking, and forecasting updates can help detect early warning signs of financial distress.

- ∘

- Tools like expense trackers and automated dashboards should be adopted by early-stage startups.

- 4.

- Build Investor Readiness from Day One

- ∘

- Many startups fail to attract external investment due to weak financial documentation and unclear business models.

- ∘

- Startups should work on investor pitch readiness, which includes clear unit economics, customer acquisition cost (CAC), lifetime value (LTV), and profit margins.

- 5.

- Mentorship Programs Should Include Financial Advisory

- ∘

- Startup mentorship programs should incorporate financial planning modules with expert advisors or CFO-on-demand models to support early financial decisions.

6.2. Limitations of the Study

6.2.1. Sectoral Concentration

6.2.2. Sample Size and Sampling Bias

6.2.3. Reliance on Self-Reported Data

6.2.4. Limited Longitudinal Data

6.2.5. Data Access Constraints

6.2.6. Geographic Centralization

7. Conclusions

7.1. Key Takeaways from Data Analysis

- Demographics of Respondents: A significant proportion of our respondents were startup founders (over 50%), followed by investors, former employees, and startup mentors. This respondent distribution ensured that the responses were grounded in practical experience and covered a wide spectrum of stakeholder perspectives.

- Initial Funding Sources: One of the most compelling findings from the Excel analysis was the over-reliance on personal savings (48%) and friends/family (24%) as startup funding sources. Only 8% and 10% of respondents had access to venture capital and angel investment, respectively. This demonstrates that most startups begin with informal and often insufficient capital, leaving them vulnerable to financial shocks and incapable of sustaining longer growth cycles.

- Lack of Financial Planning: A recurring theme in both the questionnaire and interviews was the absence of formal financial planning at the early stages. Many founders admitted to operating without detailed budgets or financial forecasts. Consequently, when startups encountered unplanned expenses or revenue delays, they had little financial cushion or strategy to mitigate the crisis.

- Stages of Financial Stress: Respondents commonly identified the scaling phase as the most financially challenging, primarily due to increased operational costs, marketing spend, and workforce expansion—all of which require accurate forecasting and reliable funding. Many startups failed at this point due to cash flow mismanagement or delayed investor funding.

- Common Financial Mistakes: Insights from both survey responses and interviews highlighted frequent mistakes such as overestimating revenue, underestimating expenses, inconsistent cash inflows, and lack of clear unit economics (e.g., customer acquisition cost vs. lifetime value). These align with patterns identified in secondary sources, including the Upmetrics article on financial projection errors.

7.1.1. Interpretation and Contextualization

7.2. Broader Implications

- Access to Institutional Funding: The limited access to venture capital and angel investment shown in the data suggests that early-stage founders either do not meet the investment criteria or lack investor networks. Addressing this gap requires policy-level initiatives and better founder-investor matchmaking platforms.

- Financial Mentorship: Startup ecosystems, including accelerators and incubators, should offer mandatory financial planning workshops or “CFO-as-a-service” models to early-stage companies. Our interviews revealed that when financial advisors were involved early, the chances of survival improved significantly.

- Investment Readiness: Founders must be educated not only on product-market fit but also on preparing robust financial models, understanding terms of funding, and presenting compelling financial narratives to investors.

- Academic and Training Institutions: The findings make a strong case for integrating entrepreneurial finance as a core subject in entrepreneurship programs and business courses.

- 1.

- CB Insights (2024):

- ∘

- Context: Referenced multiple times (e.g., pages 8, 10, 15–16) for statistics on startup failure rates, such as “38% of startups fail due to running out of cash” and “90% of startups fail within their first five years.” The document also cites CB Insights’ analysis of 483 startup post-mortems (page 15).

- ∘

- Details Provided: The document mentions “CB Insights (2024)” but does not provide a specific report title, URL, or publication details.

- ∘

- Assumed Source: Likely a CB Insights report or blog post, such as their recurring “The Top Reasons Startups Fail” series, which analyzes startup post-mortems.

- ∘

- Citation Format (APA):

- ■

- CB Insights. (2024). The top reasons startups fail. Retrieved from [URL if available, e.g., https://www.cbinsights.com/research/startup-failure-reasons/]

- ■

- Note: The exact URL or report title is not specified in the document. You should locate the 2024 edition of this report for a precise citation.

- 2.

- U.S. Small Business Administration (2023):

- ∘

- Context: Cited on page 8 for the statistic that “small businesses employ nearly 47.5% of the private workforce” in the United States.

- ∘

- Details Provided: The document mentions “U.S. Small Business Administration (2023)” but lacks specifics like a report title or publication details.

- ∘

- Assumed Source: Likely an annual report or economic bulletin from the SBA, such as the Small Business Profile or Economic Impact Report.

- ∘

- o Citation Format (APA):

- ■

- U.S. Small Business Administration. (2023). Small business economic profile. Washington, DC: Office of Advocacy, U.S. Small Business Administration.

- ■

- Note: You should verify the exact report title and publication details via the SBA website (e.g., https://www.sba.gov).

- 3.

- Startup Genome (2023):

- ∘

- Context: Cited on page 8 for the statistic that “74% of startup failures were linked to premature scaling.”

- ∘

- Details Provided: The document mentions “Startup Genome (2023)” without specifying a report title or publication details.

- ∘

- Assumed Source: Likely a Global Startup Ecosystem Report by Startup Genome, which annually analyzes startup trends and failure factors.

- ∘

- Citation Format (APA):

- ■

- Startup Genome. (2023). Global startup ecosystem report 2023. Retrieved from [URL if available, e.g., https://startupgenome.com/reports]

- ■

- Note: The exact report title and URL need confirmation from Startup Genome’s 2023 publications.

- 4.

- A Study on the Progress of MicroFinance in India:

- ∘

- Context: Discussed on pages 19–20 as a source reviewing the growth of India’s microfinance sector and its role in financial inclusion. It notes that by 2019, the sector had 9.79 crore loans outstanding, totaling ₹2,01,724 crore.

- ∘

- Details Provided: The document does not provide the author(s), publication year, journal, or publisher. It only references the study title and key findings.

- ∘

- Assumed Source: Likely a peer-reviewed article or industry report on microfinance in India, possibly published in a journal like Journal of Microfinance or by an organization like the Microfinance Institutions Network (MFIN).

- ∘

- Citation Format (APA):

- ■

- [Author(s)]. ([Year]). A study on the progress of microfinance in India. Journal Name, Volume(Issue), Page Range. DOI or URL if available.

- ■

- Note: Without author or publication details, this citation is incomplete. You should search for the study using the title or key statistics on Google Scholar or JSTOR to find the full reference.

- 5.

- A Study on Factors that Contribute to the Failure of Startups (Deena and Gupta):

- ∘

- Context: Discussed on pages 20–21, published in the International Journal of Aquatic Science. It analyzes external and internal factors of startup failure, emphasizing poor market fit and innovation over funding issues.

- ∘

- Details Provided: Authors (Deena and Gupta), journal (International Journal of Aquatic Science), but no publication year, volume, issue, or page range.

- ∘

- Assumed Source: A peer-reviewed article, though the journal’s relevance to startup research is unclear, as International Journal of Aquatic Science typically focuses on aquatic studies.

- ∘

- Citation Format (APA):

- ■

- Deena, [Initial], & Gupta, [Initial]. ([Year]). A study on factors that contribute to the failure of startups. International Journal of Aquatic Science, Volume(Issue), Page Range. DOI or URL if available.

- ■

- Note: The journal name seems unusual for this topic. Verify the journal and search for the article using the authors’ names and title on Google Scholar. The year and other details need to be sourced.

- 6.

- “They Have Not Failed, They Have Just Found Ways That Won’t Work” (Els de Jong):

- ∘

- Context: Discussed on pages 21–22, a master’s thesis by Els de Jong from Utrecht University. It identifies financial failure factors like undercapitalization and limited funding availability, citing Battistella et al. (2017) and Vesper (1990).

- ∘

- Details Provided: Author (Els de Jong), thesis title, institution (Utrecht University), but no specific year or URL.

- ∘

- Assumed Source: A master’s thesis available through Utrecht University’s repository or open-access platforms.

- ∘

- Citation Format (APA):

- ■

- de Jong, E. ([Year]). They have not failed, they have just found ways that won’t work [Master’s thesis, Utrecht University]. Utrecht University Repository. URL if available.

- ■

- Note: The year is not specified. Search Utrecht University’s thesis repository or contact the library to confirm the publication year and access details.

- 7.

- Understanding the Financing Challenges Faced by Startups in India (Banudevi & Shiva):

- ∘

- Context: Discussed on pages 22–23, published in the Journal of Management and Science. It highlights funding hurdles in India, such as a shortage of angel investors and tight credit.

- ∘

- Details Provided: Authors (Banudevi and Shiva), journal (Journal of Management and Science), but no publication year, volume, issue, or page range.

- ∘

- Assumed Source: A peer-reviewed article in a management-focused journal.

- ∘

- Citation Format (APA):

- ■

- Banudevi, [Initial], & Shiva, [Initial]. ([Year]). Understanding the financing challenges faced by startups in India. Journal of Management and Science, Volume(Issue), Page Range. DOI or URL if available.

- ■

- Note: Search for the article using the authors’ names and title on Google Scholar or the journal’s website to complete the citation.

- 8.

- Battistella et al. (2017):

- ∘

- Context: Cited in Els de Jong’s thesis (page 21) to support the claim that “having lack of finances enhances the chances of failure.”

- ∘

- Details Provided: Authors (Battistella et al.), year (2017), but no title, journal, or other publication details.

- ∘

- Assumed Source: A peer-reviewed article on startup failure or innovation management, likely in a business or entrepreneurship journal.

- ∘

- Citation Format (APA):

- ■

- Battistella, C., [Other Authors]. (2017). [Article Title]. Journal Name, Volume(Issue), Page Range. DOI or URL if available.

- ■

- Note: The full citation requires the article title and journal details. Search for Battistella’s 2017 publications on Google Scholar or Scopus.

- 9.

- Vesper (1990):

- ∘

- Context: Cited in Els de Jong’s thesis (page 21) alongside Battistella et al. (2017) to support the financial failure factor claim.

- ∘

- Details Provided: Author (Vesper), year (1990), but no title or publication details.

- ∘

- Assumed Source: Likely a book or article by Karl H. Vesper, a known scholar in entrepreneurship, such as New Venture Strategies.

- ∘

- Citation Format (APA):

- ■

- Vesper, K. H. (1990). New venture strategies (2nd ed.). Englewood Cliffs, NJ: Prentice Hall.

- ■

- Note: Confirm whether Vesper (1990) refers to this book or another publication. Search for Vesper’s works from 1990 to verify.

- 10.

- Upmetrics Article:

- ∘

- Context: Mentioned on page 49 as a secondary source highlighting common financial projection errors in startups.

- ∘

- Details Provided: Refers to an “Upmetrics article” without a title, author, year, or URL.

- ∘

- Assumed Source: Likely a blog post or guide from Upmetrics, a business planning software company, discussing financial mistakes in startups.

- ∘

- Citation Format (APA):

- ■

- [Author or Upmetrics]. ([Year]). [Title of article, e.g., Common financial projection mistakes startups make]. Upmetrics. Retrieved from [URL, e.g., https://upmetrics.co/blog]

- ■

- Note: Search Upmetrics’ blog for articles on financial projections to identify the specific post and complete the citation.

- ■

- Additional Implied Sources

- ■

- The document mentions other data or studies without explicit citations, which may require further investigation:

- ∙

- OECD Data (Page 15): States that startups account for “40% of net new job creation in OECD nations.” This likely comes from an OECD report on entrepreneurship or economic growth, such as Entrepreneurship at a Glance.

- ∘

- Suggested Citation (APA):

- ■

- Organisation for Economic Co-operation and Development. ([Year]). Entrepreneurship at a glance. Paris: OECD Publishing. DOI or URL if available.

- ■

- Note: Verify the exact report and year via the OECD website (https://www.oecd.org).

- ∘

- General Literature (Page 13): The literature review claims to draw from “127 peer-reviewed studies, industry analyses, and longitudinal research conducted between 2010 and 2025.” No specific titles or authors are listed.

- ∘

- Note: This broad claim suggests a synthesis of sources, but you should compile a list of these 127 studies if they were referenced in your research. Check your literature review notes or database searches (e.g., Google Scholar, JSTOR).

- ∙

- Academic Studies (Page 46): Secondary data support for the lack of contingency planning in startups is attributed to “academic studies” without specific citations.

- ∘

- Note: Identify these studies by reviewing your research notes or searching for articles on startup financial planning.

- Banudevi, [Initial], & Shiva, [Initial]. ([Year]). Understanding the financing challenges faced by startups in India. Journal of Management and Science, Volume(Issue), Page Range. DOI or URL if available.

- Battistella, C., [Other Authors]. (2017). [Article Title]. Journal Name, Volume(Issue), Page Range. DOI or URL if available.

- CB Insights. (2024). The top reasons startups fail. Retrieved from [URL, e.g., https://www.cbinsights.com/research/startup-failure-reasons/]

- de Jong, E. ([Year]). They have not failed, they have just found ways that won’t work [Master’s thesis, Utrecht University]. Utrecht University Repository. URL if available.

- Deena, [Initial], & Gupta, [Initial]. ([Year]). A study on factors that contribute to the failure of startups. International Journal of Aquatic Science, Volume(Issue), Page Range. DOI or URL if available.

- [Author(s)]. ([Year]). A study on the progress of microfinance in India. Journal Name, Volume(Issue), Page Range. DOI or URL if available.

- Organisation for Economic Co-operation and Development. ([Year]). Entrepreneurship at a glance. Paris: OECD Publishing. DOI or URL if available.

- Startup Genome. (2023). Global startup ecosystem report 2023. Retrieved from [URL, e.g., https://startupgenome.com/reports]

- U.S. Small Business Administration. (2023). Small business economic profile. Washington, DC: Office of Advocacy, U.S. Small Business Administration.

- Vesper, K. H. (1990). New venture strategies (2nd ed.). Englewood Cliffs, NJ: Prentice Hall.

- [Author or Upmetrics]. ([Year]). [Title of article, e.g., Common financial projection mistakes startups make]. Upmetrics. Retrieved from [URL, e.g., https://upmetrics.co/blog]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).