Submitted:

18 May 2025

Posted:

19 May 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

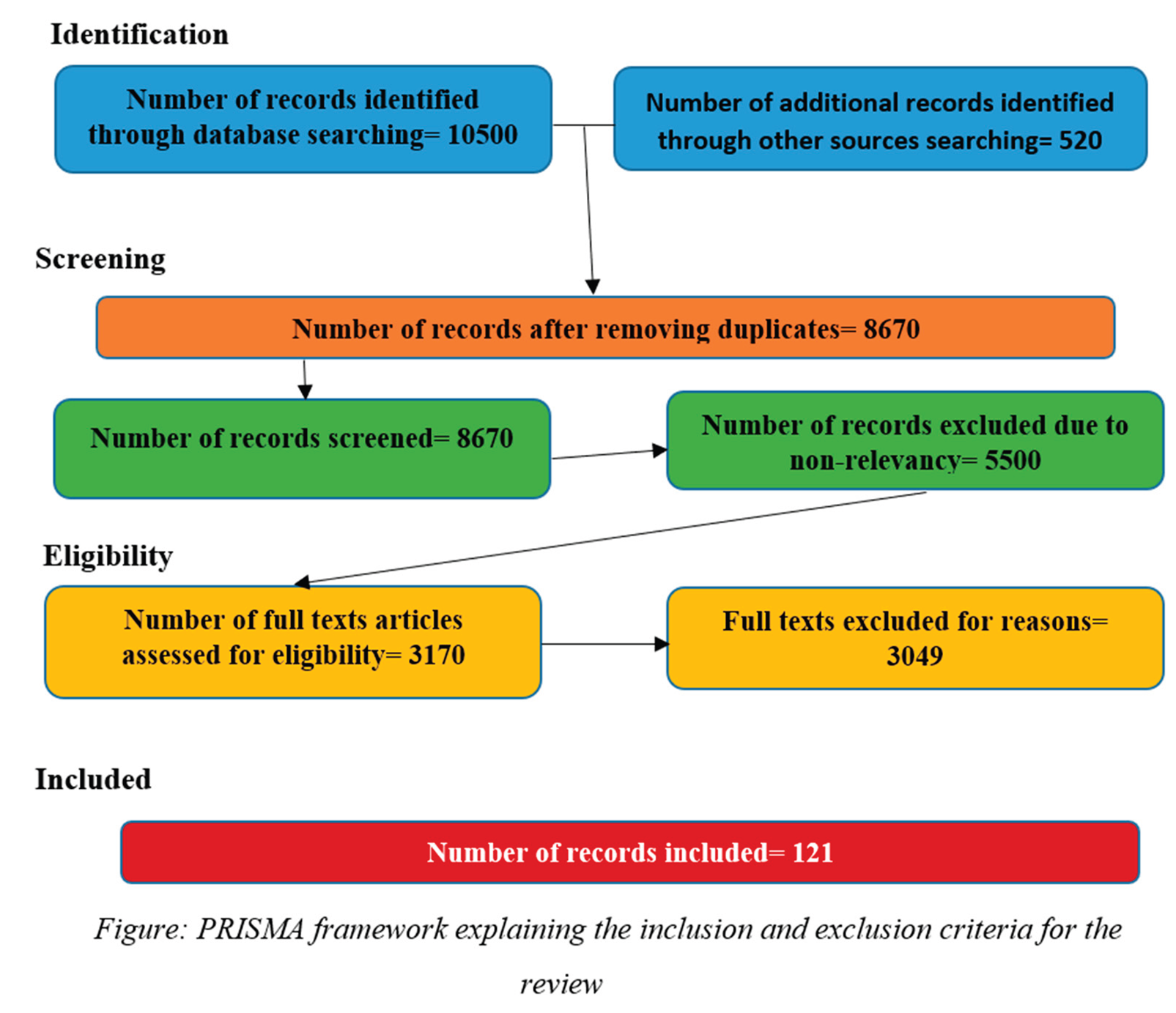

2. Methodology

3. Conceptualizing Strategic CSR and Sustainability in Emerging Economies

4. CSR Practices in the Financial Sector of Emerging Economies

Impact of CSR Strategies and Organizational Performance Outcomes: Context of Financial Sector of Emerging Economies

5. Discussion

6. Conclusions

7. Future Scope of Research

References

- Abdullah, H. Corporate social responsibility and firm performance from developing markets: The role of audit committee expertise. Sustain. Futur. 2024, 8. [Google Scholar] [CrossRef]

- Cezarino, L.O.; Liboni, L.B.; Hunter, T.; Pacheco, L.M.; Martins, F.P. Corporate social responsibility in emerging markets: Opportunities and challenges for sustainability integration. J. Clean. Prod. 2022, 362. [Google Scholar] [CrossRef]

- Bhattacharyya, A.; Wright, S.; Rahman, L. Is better banking performance associated with financial inclusion and mandated CSR expenditure in a developing country? Account. Finance 2019, 61, 125–161. [Google Scholar] [CrossRef]

- Vishwanathan, P.; van Oosterhout, H. (.; Heugens, P.P.M.A.R.; Duran, P.; van Essen, M. Strategic CSR: A Concept Building Meta-Analysis. J. Manag. Stud. 2019, 57, 314–350. [Google Scholar] [CrossRef]

- Al-Mamun, A.; Seamer, M. Board of director attributes and CSR engagement in emerging economy firms: Evidence from across Asia. Emerg. Mark. Rev. 2021, 46. [Google Scholar] [CrossRef]

- Boubakri, Narjess, Sadok El Ghoul, Omrane Guedhami, and He Helen Wang. "Corporate social responsibility in emerging market economies: Determinants, consequences, and future research directions." Emerging Markets Review 46 (2021): 100758.

- Kashi, A.; Shah, M.E. Bibliometric Review on Sustainable Finance. Sustainability 2023, 15, 7119. [Google Scholar] [CrossRef]

- Sindhu, M.I.; Windijarto; Wong, W. -K.; Maswadi, L. Implications of corporate social responsibility on the financial and non-financial performance of the banking sector: A moderated and mediated mechanism. Heliyon 2024, 10, e30557. [Google Scholar] [CrossRef]

- Campbell, J.L. 2017 Decade Award Invited Article Reflections on the 2017 Decade Award: Corporate Social Responsibility and the Financial Crisis. Acad. Manag. Rev. 2018, 43, 546–556. [Google Scholar] [CrossRef]

- Afrin, Samina. "Traditional vs strategic corporate social responsibility: In pursuit of supporting sustainable development." Journal of Economics and Sustainable Development 4, no. 20 (2013): 1-6.

- Ślęzak, M. From Traditional to Strategic CSR: Systematic Literature Review. J. Corp. Responsib. Leadersh. 2020, 7, 39–53. [Google Scholar] [CrossRef]

- McCall, Andrei. "The Strategic Use of Corporate Social Responsibility (CSR) for Competitive Advantage and Stakeholder Engagement." (2024).

- Kalagond, Gouri. "Compliance to CSR Mandate: Heading Which Way?." Gouri Kalagond (2022).

- Abugre, J.B.; Anlesinya, A. Corporate social responsibility strategy and economic business value of multinational companies in emerging economies: The mediating role of corporate reputation. Bus. Strat. Dev. 2019, 3, 4–15. [Google Scholar] [CrossRef]

- Marques, Ana Cristina, and Padmini Srinivasan. "Corporate social responsibility involvement: Determinants and consequences in a mandatory setting." IIM Bangalore Research Paper 565 (2019).

- Baron, David P. "Private politics, corporate social responsibility, and integrated strategy." Journal of economics & management strategy 10, no. 1 (2001): 7-45.

- Ahen, F.; Zettinig, P. Critical perspectives on strategic CSR: what is sustainable value co-creation orientation? Crit. Perspect. Int. Bus. 2015, 11, 92–109. [Google Scholar] [CrossRef]

- Alizadeh, A. The Drivers and Barriers of Corporate Social Responsibility: A Comparison of the MENA Region and Western Countries. Sustainability 2022, 14, 909. [Google Scholar] [CrossRef]

- Doh, Jonathan P., Benjamin Littell, and Narda R. Quigley. "CSR and sustainability in emerging markets: Societal, institutional, and organizational influences." Organizational Dynamics 44, no. 2 (2015): 112-120.

- Gulema, T.F.; Roba, Y.T. Internal and external determinants of corporate social responsibility practices in multinational enterprise subsidiaries in developing countries: evidence from Ethiopia. Futur. Bus. J. 2021, 7, 1–19. [Google Scholar] [CrossRef]

- Lu, J.; Khan, S. Are sustainable firms more profitable during COVID-19? Recent global evidence of firms in developed and emerging economies. Asian Rev. Account. 2022, 31, 57–85. [Google Scholar] [CrossRef]

- Mahmood, A.; Naveed, R.T.; Ahmad, N.; Scholz, M.; Khalique, M.; Adnan, M. Unleashing the Barriers to CSR Implementation in the SME Sector of a Developing Economy: A Thematic Analysis Approach. Sustainability 2021, 13, 12710. [Google Scholar] [CrossRef]

- Zhang, K.; Hao, X. Corporate social responsibility as the pathway towards sustainability: a state-of-the-art review in Asia economics. Discov. Sustain. 2024, 5, 1–17. [Google Scholar] [CrossRef]

- Herndon, Dale, and Richard Baskerville. "Building Reputation in Emerging Markets through Corporate Social Responsibility." In Proceedings of the Eleventh International Conference on Engaged Management Scholarship-EMS. 2021.

- Cavusgil, S.T. Advancing knowledge on emerging markets: Past and future research in perspective. Int. Bus. Rev. 2021, 30. [Google Scholar] [CrossRef]

- Al Frijat, Yaser Saleh, and Ahmed A. Elamer. "Human capital efficiency, corporate sustainability, and performance: Evidence from emerging economies." Corporate Social Responsibility and Environmental Management 32, no. 2 (2025): 1457-1472.

- Nosratabadi, Saeed, Amir Mosavi, Shahaboddin Shamshirband, Edmundas Kazimieras Zavadskas, Andry Rakotonirainy, and Kwok Wing Chau. "Sustainable business models: A review." Sustainability 11, no. 6 (2019): 1663.

- Freudenreich, Brigitte, Florian Lüdeke-Freund, and Stefan Schaltegger. Sustainability-oriented Business Model Assessment: A Conceptual Foundation. Journal of Cleaner Production 2020, 267, 122051.

- Waheed, A.; Zhang, Q. Effect of CSR and Ethical Practices on Sustainable Competitive Performance: A Case of Emerging Markets from Stakeholder Theory Perspective. J. Bus. Ethic- 2020, 175, 837–855. [Google Scholar] [CrossRef]

- Lins, K.V.; Servaes, H.; Tamayo, A. Social Capital, Trust, and Firm Performance: The Value of Corporate Social Responsibility during the Financial Crisis. J. Finance 2017, 72, 1785–1824. [Google Scholar] [CrossRef]

- Velte, P. Meta-analyses on Corporate Social Responsibility (CSR): a literature review. Manag. Rev. Q. 2021, 72, 627–675. [Google Scholar] [CrossRef]

- Tiep Le, Thanh, Huan Quang Ngo, and Leonardo Aureliano-Silva. "Contribution of corporate social responsibility on SMEs' performance in an emerging market–the mediating roles of brand trust and brand loyalty." International Journal of Emerging Markets 18, no. 8 (2023): 1868-1891.

- Tauringana, V. Sustainability reporting challenges in developing countries: towards management perceptions research evidence-based practices. J. Account. Emerg. Econ. 2020, 11, 194–215. [Google Scholar] [CrossRef]

- Truong, T.H.D. Environmental, social and governance performance and firm value: does ownership concentration matter?. Manag. Decis. 2024, ahead-of-p. [CrossRef]

- Freeman, R.E.; Dmytriyev, S.D.; Phillips, R.A. Stakeholder Theory and the Resource-Based View of the Firm. J. Manag. 2021, 47, 1757–1770. [Google Scholar] [CrossRef]

- Barney, J.B. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Harjoto, M.A.; Hoepner, A.G.; Li, Q. A stakeholder resource-based view of corporate social irresponsibility: Evidence from China. J. Bus. Res. 2022, 144, 830–843. [Google Scholar] [CrossRef]

- Chen, S.; Ji, Y. Do Corporate Social Responsibility Categories Distinctly Influence Innovation? A Resource-Based Theory Perspective. Sustainability 2022, 14, 3154. [Google Scholar] [CrossRef]

- Jahid, A.; Yaya, R.; Pratolo, S.; Pribadi, F. Institutional factors and CSR reporting in a developing country: Evidence from the neo-institutional perspective. Cogent Bus. Manag. 2023, 10. [Google Scholar] [CrossRef]

- Ebaid, I.E.-S. Corporate governance mechanisms and corporate social responsibility disclosure: evidence from an emerging market. J. Glob. Responsib. 2022, 13, 396–420. [Google Scholar] [CrossRef]

- Shabir, M.; Ping, J.; Işik, Ö.; Razzaq, K. Impact of corporate social responsibility on bank performance in emerging markets. Int. J. Emerg. Mark. 2024, ahead-of-p. [CrossRef]

- Pan, X.; Oh, K.-S.; Wang, M. Strategic Orientation, Digital Capabilities, and New Product Development in Emerging Market Firms: The Moderating Role of Corporate Social Responsibility. Sustainability 2021, 13, 12703. [Google Scholar] [CrossRef]

- Bedendo, M.; Nocera, G.; Siming, L. Greening the Financial Sector: Evidence from Bank Green Bonds. J. Bus. Ethic- 2022, 188, 259–279. [Google Scholar] [CrossRef]

- Hieu, V.M.; Hai, N.T. The role of environmental, social, and governance responsibilities and economic development on achieving the SDGs: evidence from BRICS countries. Econ. Res. Istraz. 2022, 36, 1338–1360. [Google Scholar] [CrossRef]

- Hasan, E.; Ahmed, A.; Akhi, R.A. The Exogenous Shock of COVID-19: An Evidence from Financial Sector of an Emerging Economy. Bus. Manag. Horizons 2021, 9, 27. [Google Scholar] [CrossRef]

- van Hierden, Y.T.; Dietrich, T.; Rundle-Thiele, S. A citizen-centred approach to CSR in banking. Int. J. Bank Mark. 2021, 39, 638–660. [Google Scholar] [CrossRef]

- Abdallah-Ou-Moussa, S.; Wynn, M.; Kharbouch, O.; Rouaine, Z. Digitalization and Corporate Social Responsibility: A Case Study of the Moroccan Auto Insurance Sector. Adm. Sci. 2024, 14, 282. [Google Scholar] [CrossRef]

- Katenova, M.; Qudrat-Ullah, H. Corporate social responsibility and firm performance: Case of Kazakhstan. Heliyon 2024, 10, e31580. [Google Scholar] [CrossRef]

- Kabir, M.A.; Chowdhury, S.S. Empirical analysis of the corporate social responsibility and financial performance causal nexus: Evidence from the banking sector of Bangladesh. Asia Pac. Manag. Rev. 2022, 28, 1–12. [Google Scholar] [CrossRef]

- Barone, M.; Bussoli, C.; Conte, D.; Fattobene, L.; Morrone, D. Perceptions of CSR initiatives as a strategic driver in strengthening relationships among banks and Italian consumers: an empirical approach in the Italian banking context. Int. J. Bank Mark. 2024, 43, 685–709. [Google Scholar] [CrossRef]

- Brammer, S.; Nardella, G.; Surdu, I. Defining and deterring corporate social irresponsibility: embracing the institutional complexity of international business. Multinatl. Bus. Rev. 2021, 29, 301–320. [Google Scholar] [CrossRef]

- Chikazhe, Lovemore, Farirayi Jecha, Brighton Nyagadza, Thomas Bhebhe, and Josphat Manyeruke. "Mediators of the effect of corporate social responsibility on product uptake: insights from the insurance sector in Harare, Zimbabwe." International Journal of Business and Emerging Markets 14, no. 4 (2022): 435-453.

- Ongena, S. Which banks for green growth? A review and a tentative research agenda. J. Sustain. Finance Account. 2024, 1. [Google Scholar] [CrossRef]

- Burki, M.A.K.; Burki, U.; Najam, U. Environmental degradation and poverty: A bibliometric review. Reg. Sustain. 2021, 2, 324–336. [Google Scholar] [CrossRef]

- Asare, Joseph. "The Role of Financial Institutions in Climate-Conscious Investments and Risk Preclusion in Africa Based on Five Core Sustainable Growth and Development Variables." Available at SSRN 5035726.

- Kholjigitov, Golib. "Sustainable Finance and Investments: Principles, Tools, and Effectiveness Assessment." Tools, and Effectiveness Assessment (August 15, 2023) (2023).

- Sadiq, M.; Nonthapot, S.; Mohamad, S.; Keong, O.C.; Ehsanullah, S.; Iqbal, N. Does green finance matter for sustainable entrepreneurship and environmental corporate social responsibility during COVID-19? China Finance Rev. Int. 2021, 12, 317–333. [Google Scholar] [CrossRef]

- Martin, Patrick, Zeinab Elbeltagy, Zenathan Adnin Hasannudin, and Masato Abe. "Factors affecting the environmental and social risk management of financial institutions in selected Asia-Pacific developing countries." (2021).

- Raisa, Khadija Khan. "Navigating Sustainable Finance in Bangladesh: The Role of Banks and Financial Institutions." (2024).

- Attah-Botchwey, Edward, Michael Gift Soku, and David Mensah Awadzıe. Sustainability reporting and the financial performance of banks in Africa. Journal of Business Economics and Finance 2022, 11, 43–57.

- Botchwey, E.A.; Soku, M.G.; Awadzie, D.M. SUSTAINABILITY REPORTING AND THE FINANCIAL PERFORMANCE OF BANKS IN AFRICA. Pressacademia 2022. [Google Scholar] [CrossRef]

- Dixit, S.K.; Priya, S.S. Barriers to corporate social responsibility: an Indian SME perspective. Int. J. Emerg. Mark. 2021, 18, 2438–2454. [Google Scholar] [CrossRef]

- Milhem, Marwan, Ali Ateeq, Ranyia Ali Ateeq, Dalili Izni Shafie, T. Santhanamery, and Ahmad Al Astal. "Bridging Worlds: Envisioning a Sustainable Future Through CSR in Developing Countries." In Business Sustainability with Artificial Intelligence (AI): Challenges and Opportunities: Volume 2, pp. 285-293. Cham: Springer Nature Switzerland, 2024.

- Wu, W.; Ji, Z.; Liu, J. Impact of green financing on CSR and environmental policies and procedures. Heliyon 2024, 10, e31101. [Google Scholar] [CrossRef] [PubMed]

- Qian, W.; Tilt, C.; Belal, A. Social and environmental accounting in developing countries: contextual challenges and insights. Accounting, Audit. Account. J. 2021, 34, 1021–1050. [Google Scholar] [CrossRef]

- Kuzey, C.; Uyar, A.; Nizaeva, M.; Karaman, A.S. CSR performance and firm performance in the tourism, healthcare, and financial sectors: Do metrics and CSR committees matter? J. Clean. Prod. 2021, 319. [Google Scholar] [CrossRef]

- Hariadi, Melia, and Kyle Bruce. "Contending Logics and CSR Practices in Mnes in Emerging Economies: Evidence from Indonesia." Available at SSRN 5169750.

- Baah, Charles, Yaw Agyabeng-Mensah, Ebenezer Afum, and Minenhle Siphesihle Mncwango. "Do green legitimacy and regulatory stakeholder demands stimulate corporate social and environmental responsibilities, environmental and financial performance? Evidence from an emerging economy." Management of Environmental Quality: An International Journal 32, no. 4 (2021): 787-803.

- Maqbool, Shafat, Nayan Mitra, and Asiya Chaudhury. "Corporate social responsibility reporting in the post-mandate period: an in-depth content analysis of indian top-listed companies." In Emerging Economic Models for Sustainable Businesses: A Practical Approach, pp. 9-24. Singapore: Springer Nature Singapore, 2022.

- Hieu, V.M.; Hai, N.T. The role of environmental, social, and governance responsibilities and economic development on achieving the SDGs: evidence from BRICS countries. Econ. Res. Istraz. 2022, 36, 1338–1360. [Google Scholar] [CrossRef]

- Arun, Thankom, Claudia Girardone, and Stefano Piserà. "ESG issues in emerging markets and the role of banks." In Handbook of banking and finance in emerging markets, pp. 321-344. Edward Elgar Publishing, 2022.

- Van Caenegem, Arnaud. "Regulating Sustainability Communications in the Financial Services Sector: The Sustainable Finance Disclosure Regulation." A. Van Caenegem and T. van de Werve," Regulating Sustainability Communications in the Financial Services Sector: The Sustainable Finance Disclosure Regulation" in V. Colaert (ed.), Sustainable Finance in Europe and Belgium (Anthemis, 2021) (2021).

- Sorour, M.K.; Shrives, P.J.; El-Sakhawy, A.A.; Soobaroyen, T. Exploring the evolving motives underlying corporate social responsibility (CSR) disclosures in developing countries: the case of “political CSR” reporting. Accounting, Audit. Account. J. 2020, 34, 1051–1079. [Google Scholar] [CrossRef]

- AlAjmi, J.; Buallay, A.; Saudagaran, S. Corporate social responsibility disclosure and banks' performance: the role of economic performance and institutional quality. Int. J. Soc. Econ. 2022, 50, 359–376. [Google Scholar] [CrossRef]

- Rojas Molina, Leidy Katerine, José Ángel Pérez López, and María Soledad Campos Lucena. "Meta-analysis: associated factors for the adoption and disclosure of CSR practices in the banking sector." Management Review Quarterly 73, no. 3 (2023): 1017-1044.

- Ozili, Peterson K. "Effect of climate change on financial institutions and the financial system." In Uncertainty and challenges in contemporary economic behaviour, pp. 139-144. Emerald Publishing Limited, 2020.

- Forliano, C.; Battisti, E.; de Bernardi, P.; Kliestik, T. Mapping the greenwashing research landscape: a theoretical and field analysis. Rev. Manag. Sci. 2025, 1–50. [Google Scholar] [CrossRef]

- Abdelhalim, K.; Eldin, A.G. Can CSR help achieve sustainable development? Applying a new assessment model to CSR cases from Egypt. Int. J. Sociol. Soc. Policy 2019, 39, 773–795. [Google Scholar] [CrossRef]

- Aracil, Elisa. "Corporate social responsibility of Islamic and conventional banks: The influence of institutions in emerging countries." International Journal of Emerging Markets 14, no. 4 (2019): 582-600.

- Arun, Thankom, Claudia Girardone, and Stefano Piserà. "ESG issues in emerging markets and the role of banks." In Handbook of banking and finance in emerging markets, pp. 321-344. Edward Elgar Publishing, 2022.

- Platonova, E.; Asutay, M.; Dixon, R.; Mohammad, S. The Impact of Corporate Social Responsibility Disclosure on Financial Performance: Evidence from the GCC Islamic Banking Sector. J. Bus. Ethics 2018, 151, 451–471. [Google Scholar] [CrossRef]

- Siueia, T.T.; Wang, J.; Deladem, T.G. Corporate Social Responsibility and financial performance: A comparative study in the Sub-Saharan Africa banking sector. J. Clean. Prod. 2019, 226, 658–668. [Google Scholar] [CrossRef]

- Szegedi, K.; Khan, Y.; Lentner, C. Corporate Social Responsibility and Financial Performance: Evidence from Pakistani Listed Banks. Sustainability 2020, 12, 4080. [Google Scholar] [CrossRef]

- Zamir, F.; Saeed, A. Location matters: Impact of geographical proximity to financial centers on corporate social responsibility (CSR) disclosure in emerging economies. Asia Pac. J. Manag. 2018, 37, 263–295. [Google Scholar] [CrossRef]

- Li, T.; Trinh, V.Q.; Elnahass, M. Drivers of Global Banking Stability in Times of Crisis: The Role of Corporate Social Responsibility. Br. J. Manag. 2022, 34, 595–622. [Google Scholar] [CrossRef]

- Alizadeh, A. The Drivers and Barriers of Corporate Social Responsibility: A Comparison of the MENA Region and Western Countries. Sustainability 2022, 14, 909. [Google Scholar] [CrossRef]

- The Manager’s Vision of CSR in an Emerging Economy: From Implementation to Market Impact.

- Slimi, Houmem. "Enhancing Sustainable Performance in Financial Institutions: The Impact of Customerfocus, Internal Processes, Learning &Amp; Growth, Moderated by Management Commitment." Internal Processes, Learning &Amp.

- Prior, F.; Argandoña, A. Credit accessibility and corporate social responsibility in financial institutions: the case of microfinance. Bus. Ethic- A Eur. Rev. 2009, 18, 349–363. [Google Scholar] [CrossRef]

- Logsdon, Jeanne M., Douglas E. Thomas, and Harry J. Van Buren. "Corporate social responsibility in large Mexican firms." In Corporate Citizenship in Latin America: New Challenges for Business, pp. 51-60. Routledge, 2022.

- Mesta-Cabrejos, V.F.; Huertas-Vilca, K.S.; Wong-Aitken, H.G.; Cordova-Buiza, F. Corporate social responsibility in the banking sector: a focus on Latin America and the Caribbean. Humanit. Soc. Sci. Commun. 2023, 10, 1–6. [Google Scholar] [CrossRef]

- Usman, Berto, Ridwan Nurazi, Intan Zoraya, and Nurna Aziza. "CSR Performance and Profitability of the Banking Industry in Southeast Asia Nations (ASEAN)." Capital Markets Review 31, no. 2 (2023): 55-68.

- Tran, M.; Beddewela, E.; Ntim, C.G. Governance and sustainability in Southeast Asia. Account. Res. J. 2021, 34, 516–545. [Google Scholar] [CrossRef]

- Al-Samman, E.; Al-Nashmi, M.M. Effect of corporate social responsibility on nonfinancial organizational performance: evidence from Yemeni for-profit public and private enterprises. Soc. Responsib. J. 2016, 12, 247–262. [Google Scholar] [CrossRef]

- Bhuiyan, F.; Baird, K.; Munir, R. The association between organisational culture, CSR practices and organisational performance in an emerging economy. Meditari Account. Res. 2020, 28, 977–1011. [Google Scholar] [CrossRef]

- Platonova, E.; Asutay, M.; Dixon, R.; Mohammad, S. The Impact of Corporate Social Responsibility Disclosure on Financial Performance: Evidence from the GCC Islamic Banking Sector. J. Bus. Ethics 2018, 151, 451–471. [Google Scholar] [CrossRef]

- Balon, V.; Kottala, S.Y.; Reddy, K. Mandatory corporate social responsibility and firm performance in emerging economies: An institution-based view. Sustain. Technol. Entrep. 2022, 1. [Google Scholar] [CrossRef]

- Shanyu, L. Corporate social responsibilities (CSR) and sustainable business performance: evidence from BRICS countries. Econ. Res. Istraz. 2022, 35, 6105–6120. [Google Scholar] [CrossRef]

- Singhania, M.; Saini, N. Institutional framework of ESG disclosures: comparative analysis of developed and developing countries. J. Sustain. Finance Invest. 2021, 13, 516–559. [Google Scholar] [CrossRef]

- Tarczynska-Luniewska, Malgorzata, Saule Maciukaite-Zviniene, Ninditya Nareswari, and Udisubakti Ciptomulyono. "Analysing the Complexity of ESG Integration in Emerging Economies: An Examination of Key Challenges." In Exploring ESG Challenges and Opportunities: Navigating Towards a Better Future, vol. 116, pp. 41-60. Emerald Publishing Limited, 2024.

- Mathebula, Andzani George. "An analysis of the relationship between corporate carbon disclosure and financial performance: a study of companies listed in the FTSE/JSE responsible investing index." PhD diss., 2023.

- Solomons, Ruth. "Assessing the business case for environmental, social and corporate governance practices in South Africa." PhD diss., Stellenbosch: Stellenbosch University, 2018.

- Taneja, Pawan, Ameeta Jain, Mahesh Joshi, and Monika Kansal. "Mandatory corporate social responsibility in India: reporting reality, issues and way forward." Meditari Accountancy Research 30, no. 3 (2022): 472-494.

- Retamal Ferrada, Lorena, Melita Vega, Jaime Alberto Orozco-Toro, and Caroline Ávila. "The sdgs in sustainability reports among companies in ecuador, colombia, and chile." Contratexto 40 (2023): 117-147.

- Prakash, N.; Hawaldar, A. Moderating role of firm characteristics on the relationship between corporate social responsibility and financial performance: evidence from India. J. Econ. Dev. 2024, 26, 346–361. [Google Scholar] [CrossRef]

- Singhal, N.; Paul, P.; Giri, S.; Taneja, S. Corporate Social Responsibility: Impact on Firm Performance for an Emerging Economy. J. Risk Financial Manag. 2024, 17, 171. [Google Scholar] [CrossRef]

- Maqbool, S.; Zameer, M.N. Corporate social responsibility and financial performance: An empirical analysis of Indian banks. Futur. Bus. J. 2018, 4, 84–93. [Google Scholar] [CrossRef]

- Tulcanaza-Prieto, A.B.; Shin, H.; Lee, Y.; Lee, C.W. Relationship among CSR Initiatives and Financial and Non-Financial Corporate Performance in the Ecuadorian Banking Environment. Sustainability 2020, 12, 1621. [Google Scholar] [CrossRef]

- Salam, M.A.; Abu Jahed, M. CSR orientation for competitive advantage in business-to-business markets of emerging economies: the mediating role of trust and corporate reputation. J. Bus. Ind. Mark. 2023, 38, 2277–2293. [Google Scholar] [CrossRef]

- Roque, Ana Filipa Marques. "ESG in the Sustainability Report and the Impact on Investors' Choices: A Literature Review." (2024).

- Al-Samman, E.; Al-Nashmi, M.M. Effect of corporate social responsibility on nonfinancial organizational performance: evidence from Yemeni for-profit public and private enterprises. Soc. Responsib. J. 2016, 12, 247–262. [Google Scholar] [CrossRef]

- Saeed, M.M.; Mudliar, M.; Kumari, M. Corporate social responsibility and financial performance nexus: Empirical evidence from Ghana. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 2799–2815. [Google Scholar] [CrossRef]

- Guang-Wen, Z.; Siddik, A.B. Do Corporate Social Responsibility Practices and Green Finance Dimensions Determine Environmental Performance? An Empirical Study on Bangladeshi Banking Institutions. Front. Environ. Sci. 2022, 10. [Google Scholar] [CrossRef]

- Sekhon, A.K.; Kathuria, L.M. Analyzing the impact of corporate social responsibility on corporate financial performance: evidence from top Indian firms. Corp. Governance: Int. J. Bus. Soc. 2019, 20, 143–157. [Google Scholar] [CrossRef]

- Mai, Ngoc Khuong, Khoa Truong An Nguyen, Thanh Tung Do, and Long Nhat Phan. "Corporate Social Responsibility Strategy Practices, Employee Commitment, Reputation as Sources of Competitive Advantage." SAGE Open 13, no. 4 (2023): 21582440231216248.

- Deng, B.; Ji, L.; Liu, Z. The Effect of Strategic Corporate Social Responsibility on Financial Performance: Evidence from China. Emerg. Mark. Finance Trade 2021, 58, 1726–1739. [Google Scholar] [CrossRef]

- Hui, Z.; Li, H.; Elamer, A.A. Financing sustainability: How environmental disclosures shape bank lending decisions in emerging markets. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 3940–3967. [Google Scholar] [CrossRef]

- Benlemlih, M.; Jaballah, J.; Peillex, J. Does it really pay to do better? Exploring the financial effects of changes in CSR ratings. Appl. Econ. 2018, 50, 5464–5482. [Google Scholar] [CrossRef]

- Tripathi, V.; Kaur, A. Does Socially Responsible Investing Pay in Developing Countries? A Comparative Study Across Select Developed and Developing Markets. FIIB Bus. Rev. 2021, 11, 189–205. [Google Scholar] [CrossRef]

- Orazayeva, A.; Arslan, M. Effect of Financial Indicators on Corporate Social Responsibility: Evidence from Emerging Economies. J. Risk Financial Manag. 2025, 18, 110. [Google Scholar] [CrossRef]

- Singh, Rubee, J. DSilva, and R. S. Kumar. "Modelling the CSR initiatives on firm performance: a context of emerging economies." Empirical Economic Letters 20, no. 3 (2021): 221-228.

- Abdullah, H. Corporate social responsibility and firm performance from developing markets: The role of audit committee expertise. Sustain. Futur. 2024, 8. [Google Scholar] [CrossRef]

- KPMG. “Big Shifts, Small Steps: Survey of Sustainability Reporting”. (2022).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).