1. Introduction

Credit rating targets measure any entity's creditworthiness (corporation, organization, or country). It mostly concerns the ability to pay back the debt and the likelihood of default, via the evaluation of qualitative and quantitative information. They are assigned by credit rating agencies, where higher ratings indicate higher creditworthiness or lower probability of default or credit event. The ratings market has an oligopolistic structure internationally, with Fitch, Standard & Poor’s, and Moody’s making up most of the market. Rating agencies, via a through-the-cycle approach, use quantitative and qualitative information from financial statements, any published information about an entity, and judgments [

1]. They face governmental regulation [

2]. The official role of credit ratings is voluntary internationally [

2]. The unique informational set of ratings is as important for corporations as the publication of accounting data. As geographical economic entities, the USA and the EU have heavily emphasized the role of credit ratings in economies and financial markets internationally. The role of credit ratings in both the USA and the EU is depicted by policymakers and regulators [

3]. The 2000 Fair Disclosure regulation in the USA gave credit agencies access to more confidential information and made credit ratings more important for policymakers, regulators, and investors [

4]. Credit ratings inform investors about default and credit risks, while debt issuers refer to the magnitude of investment risk and transparency [

5,

6]. Any change (upgrade or downgrade) in credit rating results in changes in the entity’s cost of capital.

Apart from the role of credit ratings in default risk and the market reactions to changes in credit ratings, another important stream in the literature is the determinants of credit ratings. These determinants are financial and non-financial, as credit ratings incorporate financial and non-financial information [

7,

8]. The former concerns information from financial statements, and the latter concerns corporate social responsibility (CSR) [

9,

10]. The former are consistent mostly from firm-specific factors (as peroxided by financial ratios) and macroeconomic factors (like GDP growth) [

11,

12]; whereas, the latter refers to corporate CSR. The credit-risk and ratios literature started from the prediction of bankruptcy using financial ratios [

13]; to the prediction of credit ratings [

14]. There was a statistically significant effect of ratios on credit ratings; this effect varies with the ratios employed [

15]. Such a relation exists because ratings and ratios contain distinct information sets.

The relation of credit ratings with CSR has recently been evident in the literature. Both are important to policymakers, regulators, and investors. The EU’s 2018 Sustainable Finance Action Plan [

16] emphasized the incorporation of ESG (environment, social, and governance) activities to credit ratings. CSR activities decrease the risk of information asymmetry [

17]. Governance mechanisms that affect the ESG features of an entity can improve credit ratings [

18]. Corporate boards affect ratings, as they motivate and monitor management [

19]. Corporate governance may be expressed as rules, procedures, management philosophy, and organizational structure, among others [

10]. It enables the reduction of bankruptcy and credit event risks via an adequate internal environment and control system. Its impact on credit ratings is statistically significant and positive [

20].

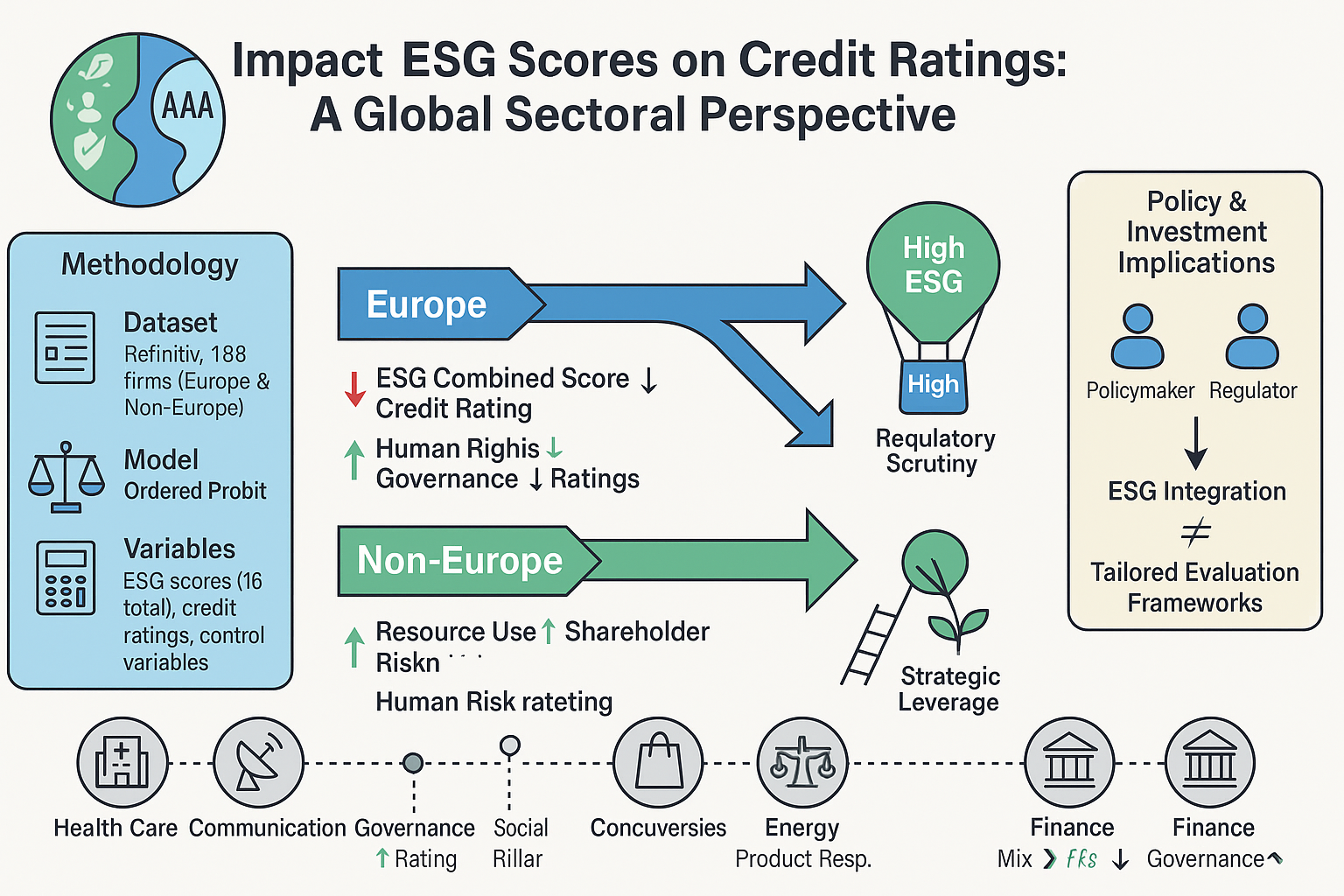

We contribute to the literature in the following ways. First, we examine the relation between ESG scores and credit ratings internationally. Second, we reveal the differences between Europe and non-Europe.

The remainder of the paper proceeds as follows:

Section 2 describes the literature, and

Section 3 explains the data.

Section 4 outlines the methodology,

Section 5 presents the empirical findings, and Section 6 offers the concluding remarks.

5. Empirical Findings

5.1. Descriptive Analysis

We begin by examining the descriptive statistics for credit ratings and ESG scores between Europe and non-Europe, which are presented in Table 2A in (

Appendix A1). The average credit rating is slightly higher in Europe (0.0011) than in non-Europe (-0.0074), suggesting a more favorable perception of creditworthiness in European companies. Additionally, the average ESG Combined Score is higher in Europe (66.61) than in non-Europe (61.48), indicating better ESG performance among European companies.

Table 2B-1 displays the average values of credit ratings and ESG scores across different sectors. The Basic Materials sector has one of the highest ESG Combined Scores (68.28), indicating strong ESG performance. In contrast, the Financial Services sector has the lowest ESG Combined Score (56.47). The health care sector demonstrates high scores in the Social Pillar Score (89.06) and Governance Pillar Score (75.07), indicating strong performance in these areas. Credit ratings vary significantly across sectors, with Energy showing positive average ratings (0.000652) and Financial Services showing negative average ratings (-0.0088).

Table 2B-2 shows the standard deviation of credit ratings and ESG scores across sectors. The standard deviation of ESG Combined Scores is highest in the Financial Services sector (19.11), indicating a wide range of ESG performance within this sector. In contrast, the Real Estate sector displays the lowest standard deviation (11.79), suggesting more uniform ESG performance. The standard deviation of credit ratings also varies, with the highest observed in the Energy sector (0.3204), indicating more dispersion in credit ratings.

Table 2B-3 provides the median values of credit ratings and ESG scores across sectors. Median values often align closely with averages, but the Real Estate sector stands out with a high median ESG Combined Score (75.00), indicating that more than half of the companies in this sector have strong ESG performance. Similarly, high medians in the Social Pillar Score for sectors like Health Care (100.00) reflect the sector’s focus on social responsibility.

Table 2B-4 indicates the skewness of credit ratings and ESG scores, which helps understand the asymmetry in the data distribution. Positive skewness in Emissions scores in the Energy sector (0.7599) suggests that more companies have lower emissions scores, with fewer companies having very high scores. Negative skewness in the Governance Pillar Score for Basic Materials (-2.1585) indicates that many companies have high governance scores, with fewer companies performing poorly.

Table 2B-5 presents kurtosis values. The high kurtosis value of 10.75 for Utilities credit ratings implies a distribution with a significant peak, indicating that a larger number of companies have ratings close to the average, while fewer companies have extreme values. Conversely, the lower kurtosis value of 1.68 for the Environmental Pillar Score in the Technology sector suggests a flatter distribution, which implies a broader range of values around the mean.

The descriptive statistics show considerable variability in the relationship between ESG scores and credit ratings across different regions and sectors. European companies generally exhibit higher average ESG scores and credit ratings, with less variability compared to non-European companies (see tables 2A, 2B-1, 2B-2, 2B-3, 2B-4, and 2B-5). Sectoral analysis reveals that sectors, such as Health Care and Basic Materials, perform better in ESG metrics, while others, like Financial Services, exhibit more variability and lower average scores. These disparities emphasize the need to consider regional and sector-specific contexts when evaluating ESG performance and its effect on credit ratings.

5.2. Correlation Analysis

This section presents the pairwise correlations between credit ratings and various ESG scores and control variables for European and non-European companies (Table 3). In Europe, the correlations between credit ratings and ESG scores are generally weak and mostly negative. The ESG Combined Score displays a very weak negative correlation of -0.0116, while the ESG Score has a negligible positive correlation of 0.0010. The Resource Use score shows a slight positive correlation of 0.0144 among the environmental scores, while Emissions is weakly negative at -0.0106. Social Pillar Scores, including Human Rights (-0.0472) and Community (-0.0228), exhibit weak negative correlations with credit ratings. The Governance Pillar Score and Management show almost no correlation with values of -0.00039 and 0.00049, respectively. Control variables such as Leverage (-0.0070), Size (-0.000625), and Profitability (-0.0319) also show weak correlations, suggesting a limited impact on credit ratings in Europe.

In non-European regions, the correlations are similarly weak but slightly more negative overall. The ESG Combined Score negatively correlates -0.0419 with credit ratings, while the ESG Score shows -0.0301. Environmental Pillar Scores like Resource Use and Emissions have weak negative correlations of -0.0050 and -0.0096, respectively. Social scores such as the Social Pillar Score and Human Rights display weak negative correlations of -0.0247 and -0.0351. The Governance Pillar Score and Management show weak negative correlations of -0.0477 and -0.0642, respectively. Among the control variables, Leverage (0.0205) and Sales Growth (0.0057) show weak positive correlations, whereas Size (-0.0237) and Profitability (-0.0135) show weak negative correlations.

As displayed in Table 4A, the pairwise correlations between credit ratings and ESG scores across different sectors are presented. In the Basic Materials sector, the ESG Combined and ESG Score exhibit weak negative correlations of -0.0837 and -0.0564, respectively. Additionally, the Environmental Pillar Score (0.0763) and Resource Use (0.0232) demonstrate a positive correlation, while Human Rights (-0.0496) and Governance Pillar Score (-0.1150) show weak negative correlations. The Communication Services sector reveals weak correlations with ESG scores, with the ESG Combined Score at 0.000098 and the ESG Score at 0.0254. Furthermore, Workforce (-0.1029) and Social Pillar Score (-0.0803) exhibit weak negative correlations, while Innovation (0.0582) displays a positive correlation.

In the Consumer Cyclical sector, the ESG Combined Score stands at -0.0188, and the ESG Score is 0.0341, demonstrating generally weak correlations. Social scores, such as Workforce (-0.1001), show a weak negative correlation. The ESG Combined Score (0.0443) and ESG Score (-0.0119) exhibit weak correlations in the Consumer Defensive sector. The Social Pillar Score (0.0224) and Workforce (-0.0489) reveal weak correlations, indicating minimal impact on credit ratings. In the Energy sector, the ESG Combined Score (0.0188) and ESG Score (0.0403) present weak positive correlations, while Human Rights (-0.0462) and Shareholders (-0.1623) show negative correlations. Also, the Financial Services sector exhibits weak negative correlations for the ESG Combined Score (-0.0338) and ESG Score (-0.0088), with governance scores such as Shareholders (-0.0467) and Management (0.0053) displaying varying correlations.

On the other hand, the healthcare industry shows a negative correlation in the ESG Combined Score (-0.1173) and a positive correlation in emissions (0.0921). Human Rights (-0.0369) and Management (-0.0365) exhibit weak negative correlations. The industrial sector displays weak negative correlations for the ESG Combined Score (-0.0378) and the ESG Score (-0.0266). Innovation (0.0112) and Shareholders (0.0029) exhibit positive correlations. The Real Estate sector shows positive correlations in the ESG Combined Score (0.0070) and ESG Score (0.1223). In the Technology sector, the ESG Combined Score (-0.0634) and ESG Score (-0.1163) display weak negative correlations, while Management (-0.0351) and Shareholders (-0.0687) exhibit negative correlations. The Utilities sector reveals weak positive correlations in the ESG Combined Score (0.0189) and ESG Score (0.0630), and negative correlations in the Governance Pillar Score (-0.1359) and Management (-0.1647).

Table 4B shows the correlations between credit ratings and control variables across different sectors. The Basic Materials sector exhibits weak positive correlations for Leverage (0.0078) and Profitability (0.0183), while Dividend Yield (-0.0712) shows a negative correlation. The Communication Services sector displays weak negative correlations for Leverage (-0.0268) and Sales Growth (-0.0529), while Size (0.0158) and Dividend Yield (0.0692) exhibit weak positive correlations. In the Consumer Cyclical sector, Leverage (0.1078) shows a positive correlation, while Profitability (-0.0382) and Size (-0.0485) exhibit negative correlations. The Consumer Defensive sector displays weak negative correlations for Leverage (-0.0399) and Size (-0.0075), while Profitability (0.0504) and Dividend Yield (0.0147) exhibit positive correlations. The Energy sector exhibits a positive correlation for Leverage (0.1189), while Size (-0.0532) and Profitability (-0.1447) show negative correlations. The Financial Services sector shows weak positive correlations for Leverage (0.0146) and Size (0.0485), while Profitability (-0.0589) exhibits a weak negative correlation. The Health Care Sector displays a weak positive correlation for leverage (0.0250), while size (-0.0688) and profitability (-0.0337) have weak negative correlations. The Industrials sector exhibits weak positive correlations for Leverage (0.0200) and Size (0.0290), while Profitability (-0.0082) and Sales Growth (-0.0017) show weak negative correlations. The Real Estate sector shows weak negative correlations for Leverage (-0.0056) and Size (-0.0693) while Dividend Yield (0.10.

The examination of the correlation between credit ratings and ESG scores/control variables across Tables 3, 4A, and 4B indicates that the associations between these factors vary by region and sector. In Europe, the correlations are generally feeble and predominantly negative, while non-European regions exhibit somewhat stronger negative correlations. A detailed analysis of the sectors demonstrates that the Basic Materials and Technology sectors display more pronounced negative correlations with specific ESG scores. On the other hand, the Utilities sector displays significant positive correlations for certain control variables. This variability emphasizes considering regional and sectoral contexts when evaluating the influence of ESG factors and control variables on credit ratings.

5.3. Granger Causality

The probability values from the Granger causality test, which examines whether ESG (Environmental, Social, and Governance) scores and control variables have predictive power for credit ratings in European and non-European regions, are shown in Table 5. The analysis indicates that the ESG combined score shows a probability value of 0.6171 for Europe, suggesting no significant Granger causality. However, in non-European regions, the probability value is 0.0633, indicating a weak significance at the 10% level, implying that the ESG combined score can weakly predict credit ratings outside Europe. The Governance Pillar Score has a probability value of 0.0175 in Europe, indicating significance at the 5% level, whereas in non-European regions, the probability value is 0.4769, indicating no significant Granger causality. The Management score has a probability value of 0.0601 in Europe, indicating a weak significance at the 10% level, while in non-European regions, the probability value is 0.3587, showing no significant relationship. The Shareholders' score in Europe has a probability value of 0.035, indicating significance at the 5% level, whereas in non-European regions, the probability value is 0.8298, showing no significant relationship. The Controversies score has a probability value of 0.5361 in Europe, indicating no significant relationship, while in non-European regions, the probability value is 0.0844, showing weak significance at the 10% level. The control variables (Leverage, Size, Profitability, Sales Growth, and Dividend yield) do not exhibit significant Granger causality in either region, as all their probability values are above conventional significance levels (0.05 or 0.10.

The study suggests that governance-related ESG scores, specifically the Governance Pillar Score and Shareholders, have a significant impact on European credit ratings. In contrast, the ESG combined score and controversies show weak significance in non-European countries. This implies that regional differences exist in how ESG factors affect credit ratings, emphasizing the need for tailored approaches when incorporating ESG factors into credit risk assessments. Table 6 also presents the probability values from the Granger causality test, which evaluates whether various ESG scores and control variables can predict credit ratings across different sectors. The analysis of the ESG Combined Score reveals that across all sectors, the probability values are above conventional significance levels, indicating no significant Granger causality of the ESG combined score on credit ratings in any sector. The ESG Score shows a weak significance at the 10% level in the Health Care sector, implying that the ESG score can weakly predict credit ratings in this sector. All sectors have probability values above significance levels for the Environmental Pillar Score, indicating no significant Granger causality. Regarding Resource Use, the Communication Services and Financial Services sectors show no significant relationship, with values of 0.6606 and 0.5101, respectively. The Health Care sector has a slightly more substantial but still insignificant relationship with a value of 0.4290.

The Emissions score serves as a significant predictor of credit ratings in the Health Care sector, exhibiting strong Granger causality at the 5% level. For Innovation, all sectors display varying degrees of insignificance, with values above 0.05, indicating no significant Granger causality across sectors.

The Social Pillar Score generally shows insignificant relationships across sectors, with all values above significance thresholds. Human Rights scores indicate no significant relationship across sectors, with the Financial Services, Industrials, and Health Care sectors displaying values of 0.3377, 0.6511, and 0.5254, respectively. The Community score has no significant Granger causality in any sector, with all values above significance levels. Similarly, Product Responsibility and Governance Pillar Scores display no significant relationship across sectors.

Management scores significantly predict credit ratings in the Communication Services sector, with a value of 0.0412, indicating strong Granger causality at the 5% level. Additionally, the Shareholders score is significant at the 5% level in the Communication Services sector with a value of 0.0442, and the Energy sector shows weak significance at the 10% level with a value of 0.0599.

CSR Strategy scores display no significant Granger causality across sectors. Controversy scores significantly predict credit ratings in the Consumer Defensive sector, with a value of 0.0061, indicating strong Granger causality at the 5% level. Furthermore, the Financial Services and industrial sectors show weak significance with values of 0.0339 and 0.0476, respectively. The control variables (Leverage, Size, Profitability, Sales Growth, and Dividend yield) generally display no significant Granger causality across most sectors, with values typically above conventional significance levels.

The evaluation presented previously suggests that emissions scores serve as important indicators for the Health Care industry, while management and shareholder scores have considerable predictive ability for credit ratings in the Communication Services sector. Controversy scores significantly impact credit ratings in the Consumer Defensive sector, demonstrating the diverse influence of ESG factors across different industries. This emphasizes the necessity of tailoring ESG considerations to specific sectors when assessing their impact on credit ratings.

5.4. Regression Output

Table 7 provides the regression coefficients for ESG scores and control variables that explain credit ratings, differentiating between European and non-European regions. In European regions, the ESG Combined and ESG Score coefficients are negative and significant, indicating that higher ESG scores are associated with lower credit ratings. Specifically, the ESG Combined Score has a coefficient of -1.22E-04**, and the ESG Score has a coefficient of -9.82E-05*\*. This suggests that higher overall ESG scores in Europe might negatively impact credit ratings. The Human Rights score is particularly notable, with a significant coefficient of -1.26E-04**, implying a strong negative relationship with credit ratings. Other significant factors include the Social Pillar Score (-9.03E-05*), Workforce (-8.26E-05*), and Management (-1.14E-04**), all showing negative relationships. The Governance Pillar Score also has a significant negative coefficient of -9.97E-05*. The control variable Size shows a significant negative coefficient of -0.0065*, indicating that larger firms tend to have lower credit ratings in Europe.

On the other hand, for non-European regions, the ESG Combined Score and the ESG Score both show positive but insignificant coefficients, suggesting no strong relationship with credit ratings. Resource Use and Shareholders have positive and significant coefficients (1.72E-05** and 2.08E-05**, respectively), indicating that better resource use and shareholder practices positively impact credit ratings. Human Rights, however, has a significant negative coefficient of -2.25E-05**, indicating a negative relationship. Profitability and Sales Growth also show significant negative relationships with credit ratings, with coefficients of -0.0010** and -9.00E-05**, respectively. The findings indicate that the model demonstrates a relatively higher fit for non-European regions, with the R-squared values suggesting that it explains 20.24% of the variance in credit ratings, as compared to 15.79% in Europe.

The regression analysis suggests that, in Europe, higher ESG scores generally have a negative impact on credit ratings. On the other hand, in non-European regions, specific ESG metrics, such as Resource Use and Shareholders, demonstrate positive impacts.

Table 8 provides a detailed breakdown of the regression coefficients for ESG scores and control variables, explaining credit ratings across various sectors. In the Basic Materials sector, the coefficients for ESG scores are generally positive but insignificant, indicating no strong relationship with credit ratings. Conversely, the Communication Services sector shows negative coefficients for the ESG Combined Score and other ESG metrics, with the Social Pillar Score having a significant negative coefficient of -4.85E-04**, suggesting that higher social performance negatively impacts credit ratings in this sector.

The Consumer Cyclical sector exhibits a significant negative coefficient for the ESG Combined Score (-7.95E-05*), indicating a negative relationship with credit ratings. The Consumer Defensive sector also shows significant negative coefficients for several ESG metrics, such as the Social Pillar Score (-8.49E-05**) and Governance Pillar Score (-9.06E-05**), indicating negative impacts on credit ratings.

The impact of environmental, social, and governance (ESG) factors on credit ratings varies significantly across different sectors, as demonstrated by the results of this analysis. The Energy sector has a positive relationship between the Human Rights score and credit ratings (1.01E-04*). Conversely, the Financial Services sector exhibits negative relationships for various ESG metrics, including the Social Pillar Score (-2.06E-04**) and Product Responsibility (-2.42E-04**).

In the Health Care sector, the ESG Combined Score (-8.36E-05**) and other ESG metrics have significant negative coefficients, indicating negative impacts on credit ratings. The Industrials sector does not show significant relationships for most ESG scores. Furthermore, the Real Estate sector shows significant negative coefficients for various ESG scores, particularly the Management score (-2.51E-04**). The Technology sector has significant negative relationships for several ESG scores, such as the Human Rights score (-1.20E-04*). Finally, the Utilities sector demonstrates significant positive coefficients for some ESG scores, indicating positive impacts on credit ratings.

The R-squared values differ significantly across sectors, with the Utilities sector having the highest R-squared value of 0.6262, suggesting that the model explains a substantial portion of the variance in credit ratings for this sector.

These results emphasize the importance of considering regional and sectoral contexts when assessing the impact of ESG factors on credit ratings. The findings indicate that some sectors show significant negative relationships between ESG scores and credit ratings, while others exhibit positive or insignificant relationships.

5. Conclusions

The formal tone analysis of this paper demonstrates the substantial effect of ESG scores on credit ratings across diverse geographical regions and sectors. Our results indicate that the relationship between ESG factors and credit ratings is intricate and varies considerably between European and non-European regions and among different industry sectors.

In European regions, the analysis unveils that higher ESG scores usually correspond to lower credit ratings, particularly for combined ESG scores and specific components such as the Human Rights and Governance Pillar scores. This suggests a potential risk aversion or heightened scrutiny by credit rating agencies towards higher ESG-rated entities, possibly due to stringent regulatory environments or greater stakeholder expectations regarding sustainability practices.

Conversely, specific ESG metrics like Resource Use and Shareholder engagement exhibit a positive relationship with credit ratings in non-European regions. This indicates that credit rating agencies favor better resource management and shareholder engagement in these regions, enhancing firms' creditworthiness. The significant negative coefficients for Human Rights in non-Europe suggest that poor performance in this area can negatively impact credit ratings, highlighting regional differences in the prioritization of ESG components.

The sectoral analysis further emphasizes the diversity of ESG impacts. For instance, the Health Care sector exhibits considerable negative coefficients for emissions scores, indicating that improved environmental performance may positively influence credit ratings. Management and shareholder scores are significant predictors of credit ratings in the Communication Services sector, emphasizing the importance of governance practices. The Consumer Defensive sector's credit ratings are conspicuously influenced by controversy scores, suggesting that public perception and controversy management are crucial in this sector.

These findings suggest that incorporating ESG factors into credit rating assessments requires a nuanced approach, considering regional and sectoral contexts. Policymakers, regulators, and investors must be mindful of these differences when developing strategies and making decisions based on credit ratings. The substantial influence of specific ESG scores on credit ratings implies that firms must strategically manage their ESG performance to enhance their creditworthiness, tailored to the expectations and priorities of their respective regions and sectors.

Future research may explore the role of stakeholder pressure, including investors, customers, and advocacy groups, on the relationship between ESG scores and credit ratings. Investigating how external pressures shape corporate ESG practices and their subsequent credit ratings can inform corporate strategy and policy decisions.