Submitted:

18 April 2025

Posted:

18 April 2025

You are already at the latest version

Abstract

Keywords:

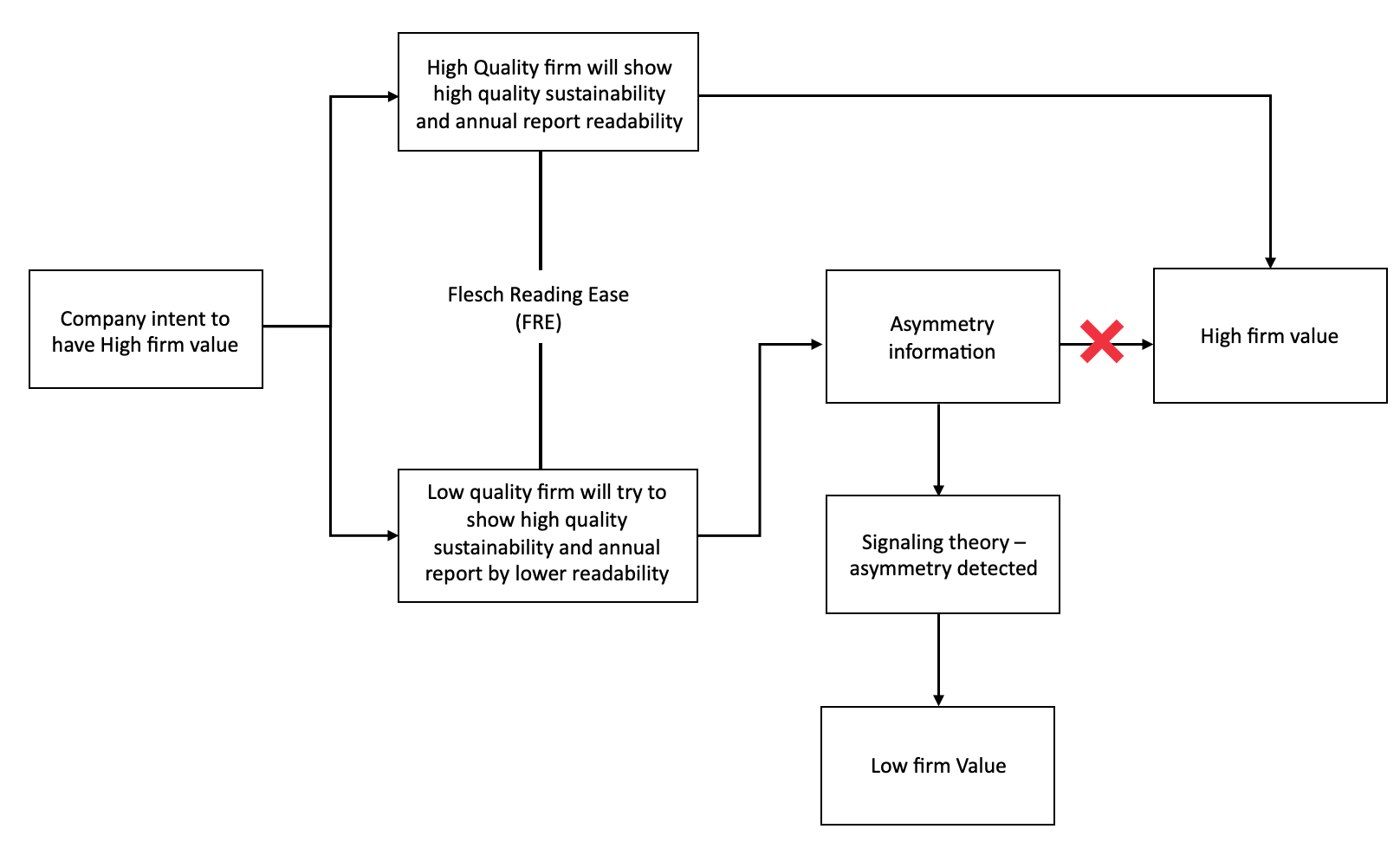

1. Introduction

2. Literature Review and Hypothesis Development

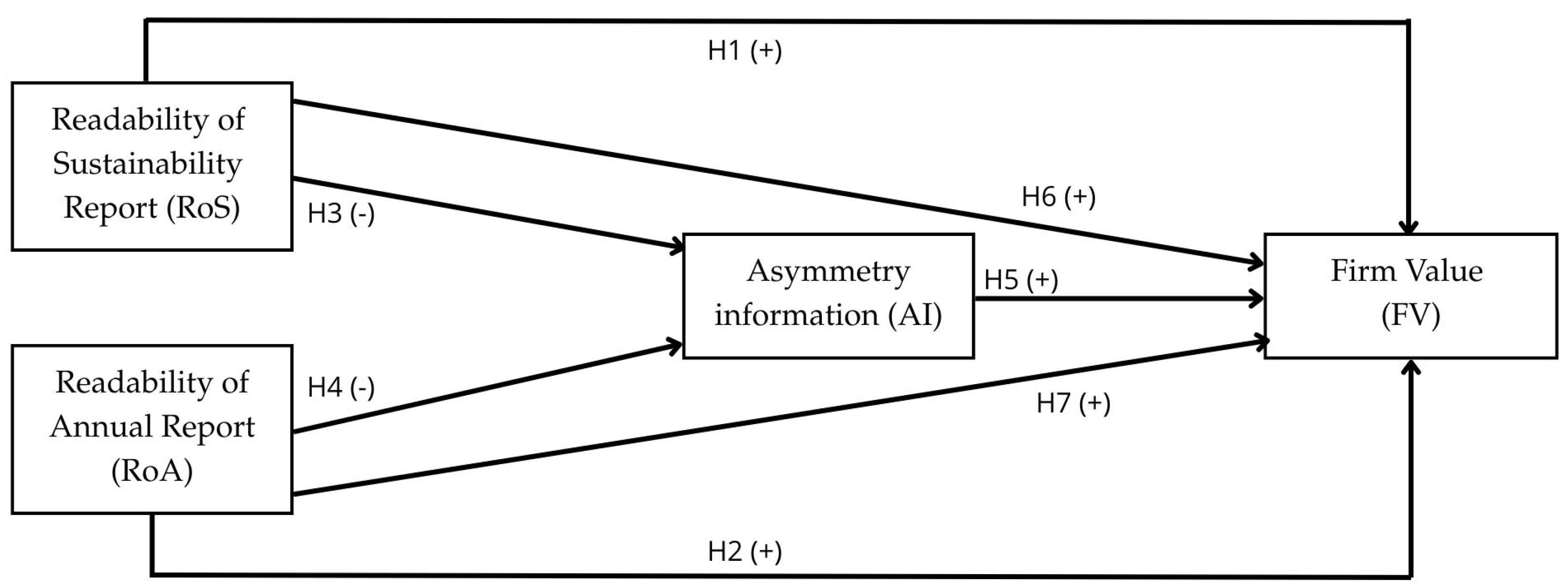

2.1. The Relationship Between the Readability of Sustainability and Annual Reports and Firm Value

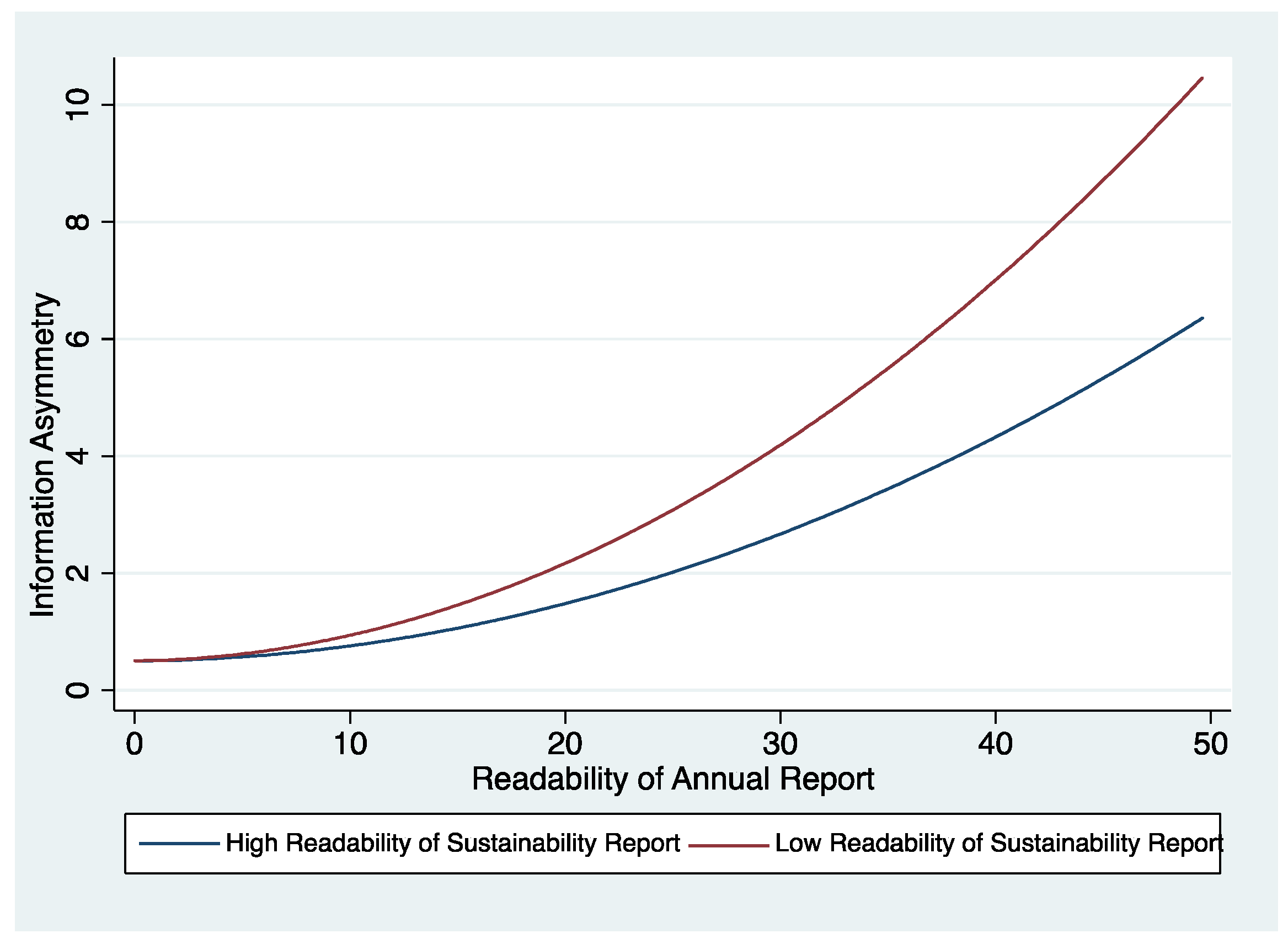

2.2. The Relationship Between the Readability of Sustainability and Annual Reports, and Asymmetric Information

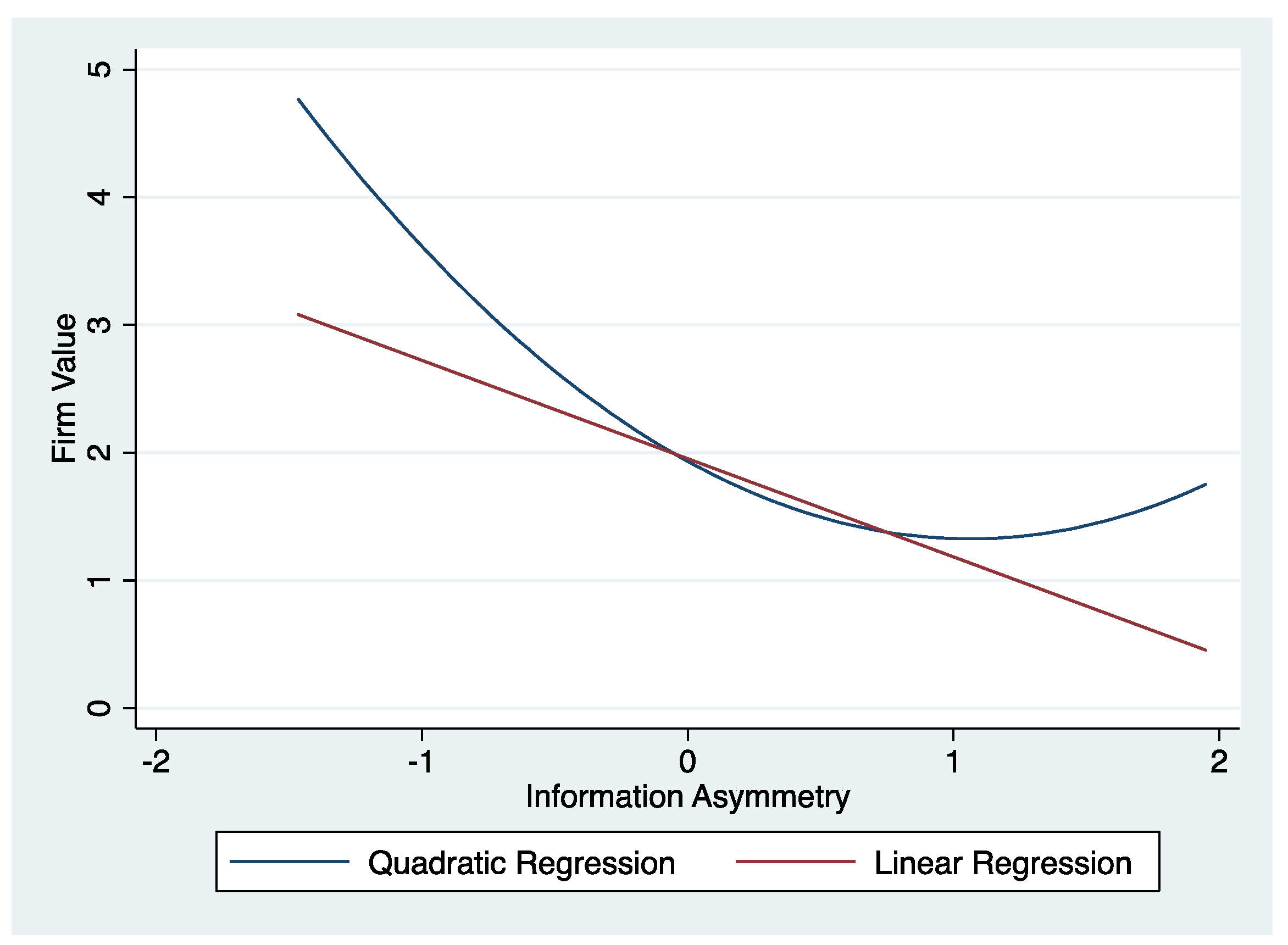

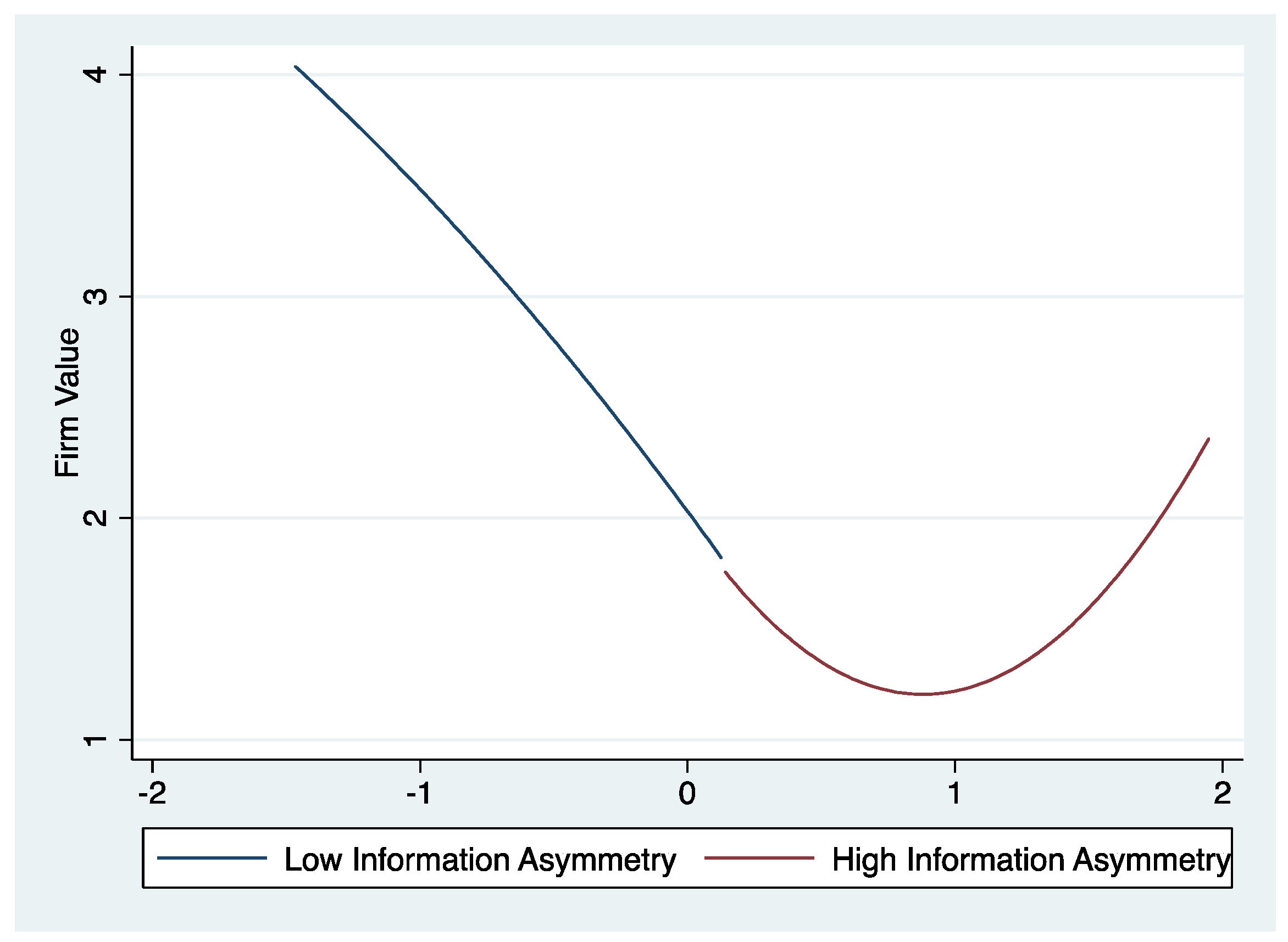

2.3. The Relationship Between Information Asymmetric and Firm Value

2.4. The Relationship Between THE Readability of Sustainability and Annual Reports and Firm Value

3. Methodology

3.1. Data Collection and Sample

3.2. Operational Variables and Measurement

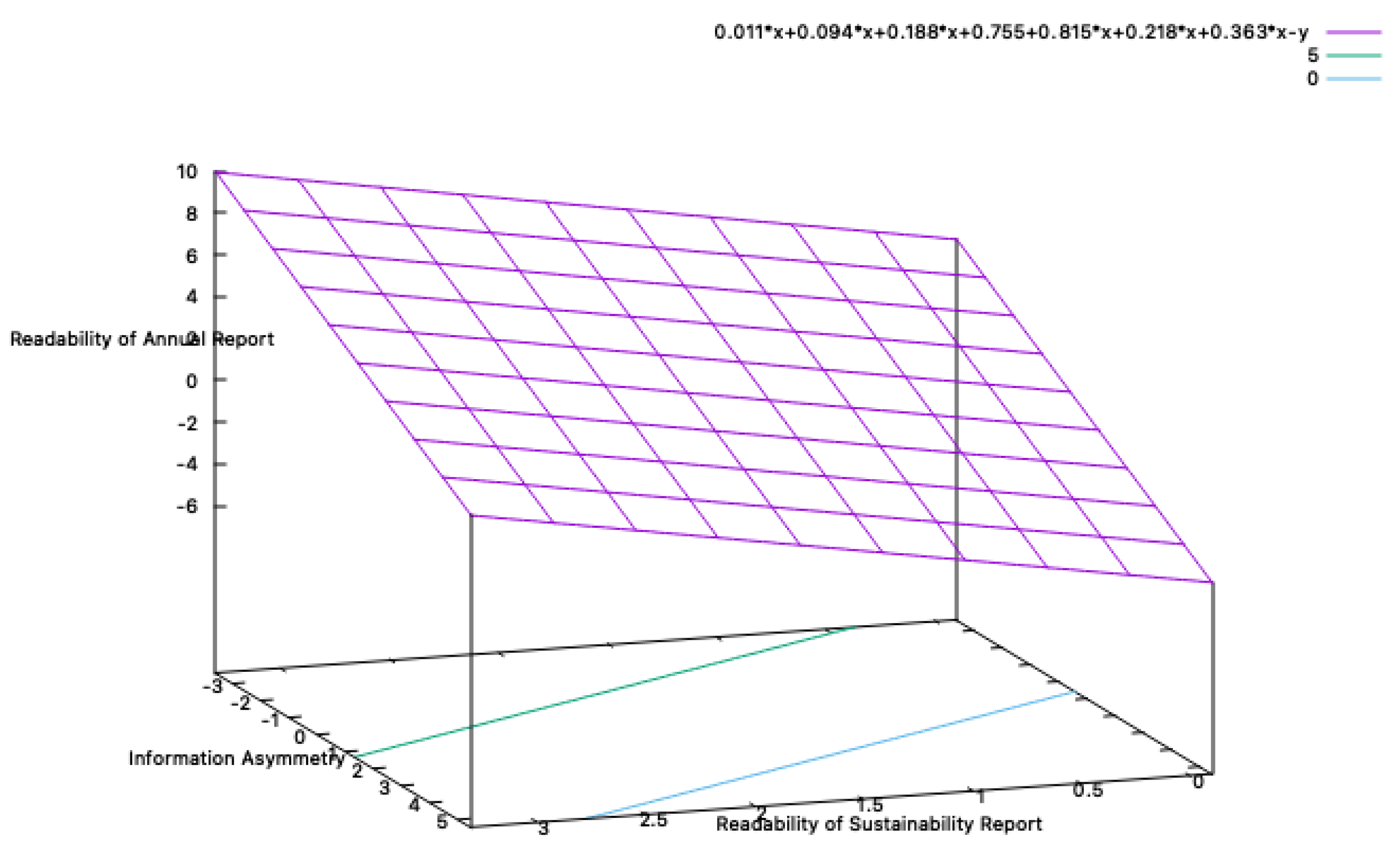

3.3. Regression Model

4. Methodology

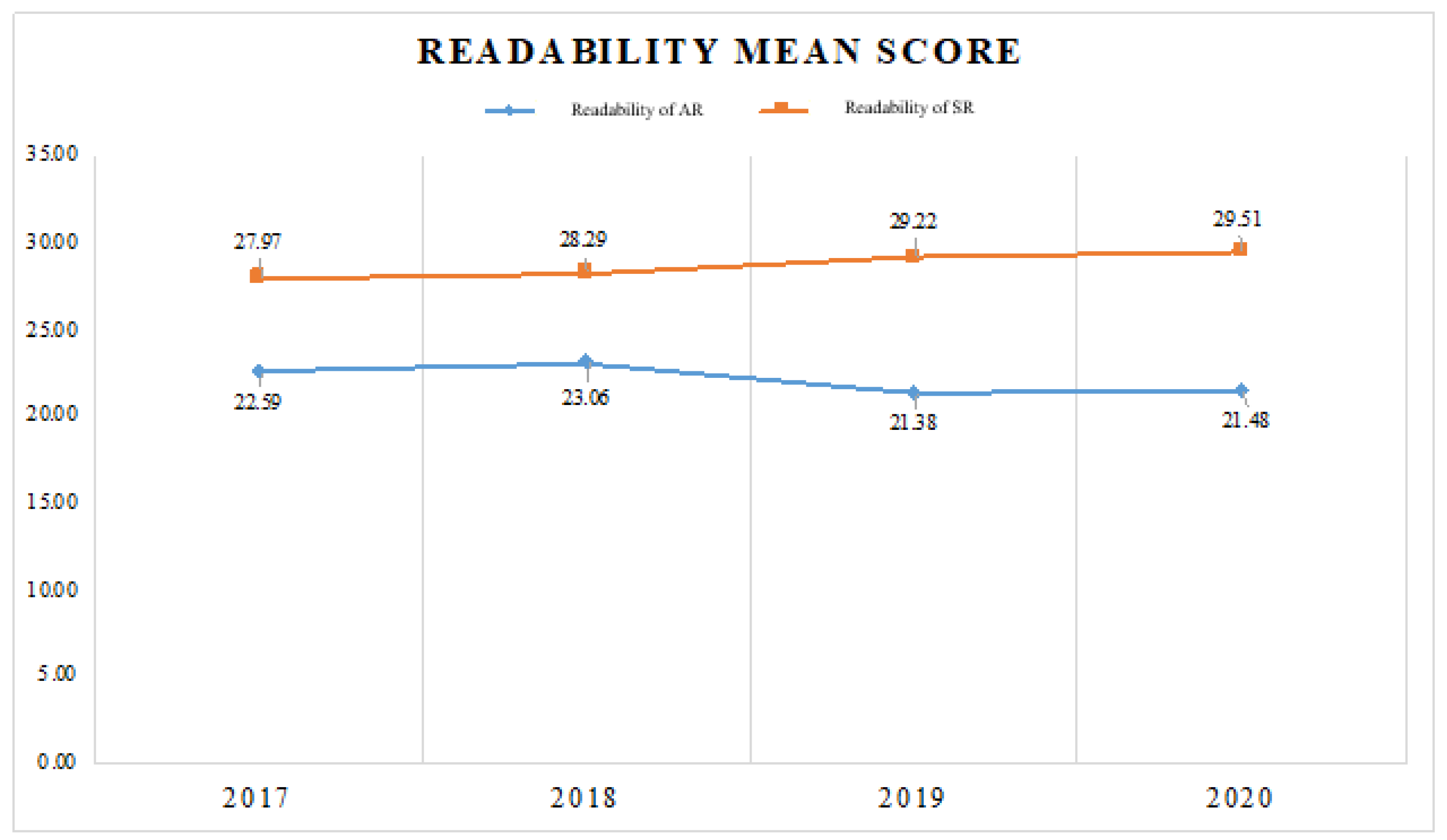

4.1. Descriptive Analysis

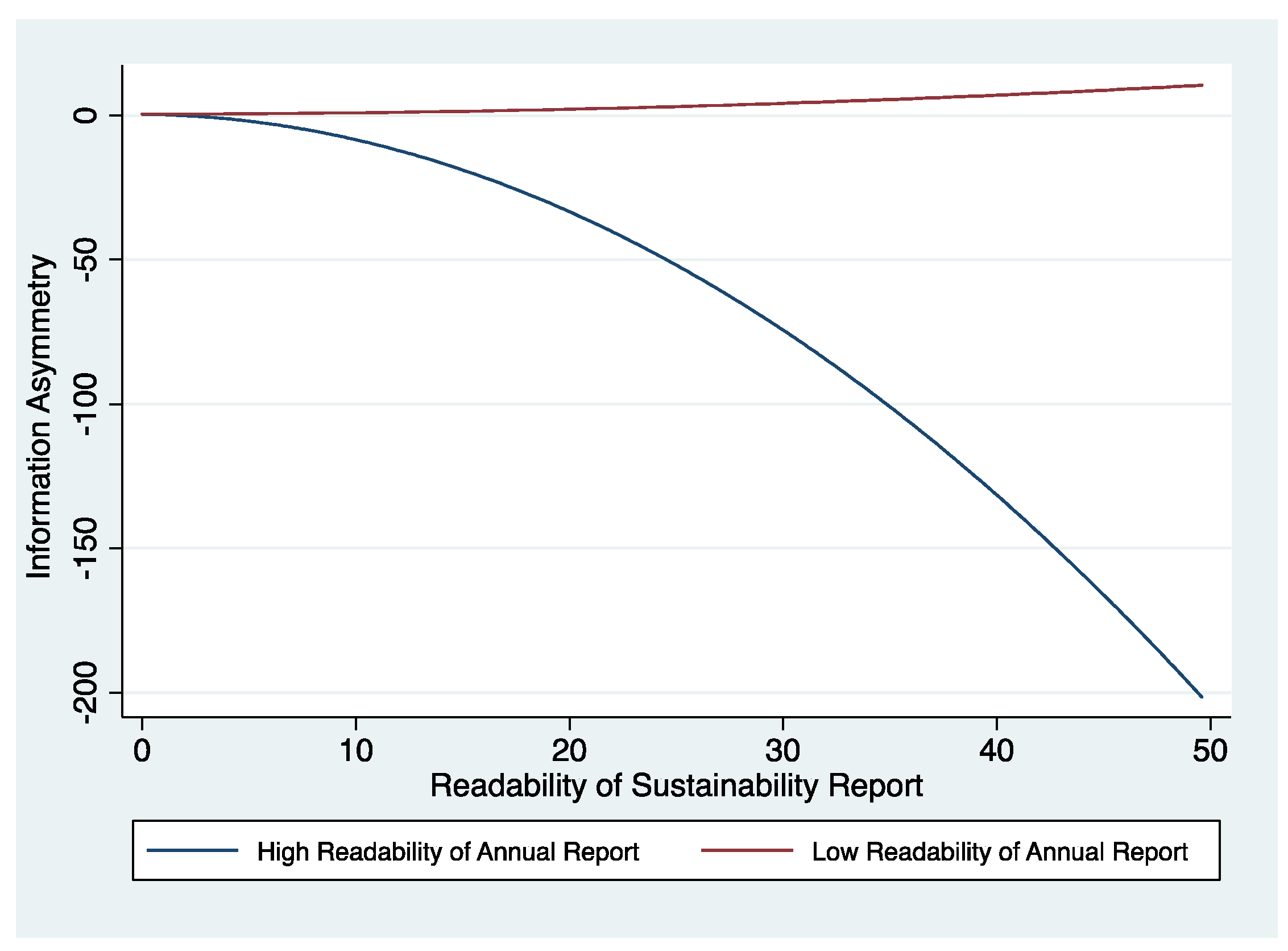

4.2. Hypothesis Analysis

5. Conclusions

5.1. Research Limitation

5.2. Suggestion for Future Research

5.3. Implication

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- T. Tiep Le and V. K. Nguyen, “The impact of corporate governance on firms’ value in an emerging country: The mediating role of corporate social responsibility and organisational identification,” Cogent Bus. Manag., vol. 9, no. 1, 2022. [CrossRef]

- E. Brigham and J. Houston, Basics of financial management. Salemba Empat, 2006.

- K. H. Titisari, Moeljadi, K. Ratnawati, and N. K. Indrawati, “The roles of cost of capital, corporate governance, and corporate social responsibility in improving firm value: Evidence from Indonesia,” Invest. Manag. Financ. Innov., vol. 16, no. 4, pp. 28–36, 2019. [CrossRef]

- S. N. Sulistyawati and A. W. Suryani, “Achieving Operational Efficiency through Risk Disclosure,” Asian J. Bus. Account., vol. 15, no. 1, pp. 149–178, 2022. [CrossRef]

- L. Loh, T. Thomas, and Y. Wang, “Sustainability reporting and firm value: Evidence from Singapore-listed companies,” Sustain., vol. 9, no. 11, pp. 1–12, 2017. [CrossRef]

- Ilyas, I.M.; Osiyevskyy, O., “Exploring the impact of sustainable value proposition on firm performance,” Eur. Manag. J., vol. 40, no. 5, pp. 729–740, 2022. [CrossRef]

- J. Cohen, L. Holder-webb, and D. Wood, “Retail Investors’ Perceptions Of The Decision-Usefulness Of Economic Performance, Governance And Corporate Social Responsibility Disclosures,” Behav. Res. Account., vol. 23, no. 1, pp. 109–129, 2011.

- D. S. Dhaliwal, S. Radhakrishnan, A. Tsang, and Y. G. Yang, “Nonfinancial disclosure and analyst forecast accuracy: International evidence on corporate social responsibility disclosure,” Account. Rev., vol. 87, no. 3, pp. 723–759, 2012. [CrossRef]

- Dwekat, A.; Meqbel, R.; Seguí-Mas, E.; Tormo-Carbó, G., “The role of the audit committee in enhancing the credibility of CSR disclosure: Evidence from STOXX Europe 600 members,” Bus. Ethics, Environ. Responsib., vol. 31, no. 3, pp. 718–740, 2022. [CrossRef]

- J. A. Nazari, K. Hrazdil, and F. Mahmoudian, “Assessing social and environmental performance through narrative complexity in CSR reports,” J. Contemp. Account. Econ., vol. 13, no. 2, pp. 166–178, 2017. [CrossRef]

- G. C. Biddle, G. Hilary, and R. S. Verdi, “How does financial reporting quality relate to investment efficiency?,” J. Account. Econ., vol. 48, no. 2–3, pp. 112–131, 2009. [CrossRef]

- S. Berthelot, C. Francoeur, and R. Labelle, “Corporate governance mechanisms, accounting results and stock valuation in Canada,” Int. J. Manag. Financ., vol. 8, no. 4, pp. 332–343, 2012. [CrossRef]

- J. hui Luo, X. Li, and H. Chen, “Annual report readability and corporate agency costs,” China J. Account. Res., vol. 11, no. 3, pp. 187–212, 2018. [CrossRef]

- Al Natour, A.R.; Meqbel, R.; Kayed, S.; Zaidan, H., “The Role of Sustainability Reporting in Reducing Information Asymmetry: The Case of Family-and Non-Family-Controlled Firms,” Sustain., vol. 14, no. 11, 2022. [CrossRef]

- Risman, A.; Salim, U.; Sumiati, S.; Indrawati, N.K., “Commodity prices, exchange rates and investment on firm’s value mediated by business risk: A case from Indonesian stock exchange,” Eur. Res. Stud. J., vol. 20, no. 3, pp. 511–524, 2017. [CrossRef]

- M. S. Y. Omran, M. A. A. Zaid, and A. Dwekat, “The relationship between integrated reporting and corporate environmental performance: A green trial,” Corp. Soc. Responsib. Environ. Manag., vol. 28, no. 1, pp. 427–445, 2021. [CrossRef]

- N. Shroff, A. X. Sun, H. D. White, and W. Zhang, “Voluntary disclosure and information asymmetry: Evidence from the 2005 securities offering reform,” J. Account. Res., vol. 51, no. 5, pp. 1299–1345, 2013. [CrossRef]

- M. Hirdinis, “Capital structure and firm size on firm value moderated by profitability,” Int. J. Econ. Bus. Adm., vol. 7, no. 1, pp. 174–191, 2019. [CrossRef]

- C. Arena, L. Ronald, and V. Petros, “Carrot or stick: CSR disclosures by Southeast Asian Companies,” Sustain. Accounting, Manag. anad Policy J., vol. 9, no. 4, pp. 422-454., 2018.

- F. Tocchini and G. Cafagna, “Institute of Indonesia Chartered Accountants. 2018”.

- D. van de Burgwal and R. J. O. Vieira, “Environmental disclosure determinants in Dutch listed companies,” Rev. Contab. Finanças - USP, vol. 25, no. 64, pp. 60–78, 2014.

- J. Roberts, “The possibilities of accountability,” Accounting, Organ. Soc., vol. 16, no. 4, pp. 355–368, 1991. [CrossRef]

- Tempo.com,.

- Nilipour, A.; De Silva, T.A.; Li, X., “The readability of sustainability reporting in new zealand over time,” Australas. Accounting, Bus. Financ. J., vol. 14, no. 3, pp. 86–107, 2020. [CrossRef]

- D. M. Patten, “Exposure, legitimacy, and social disclosure,” J. Account. Public Policy, vol. 10, no. 4, pp. 297–308, 1991. [CrossRef]

- J. Dowling and J. Pfeffer, “Pacific Sociological Association Organizational Legitimacy: Social Values and Organizational Behavior,” Source Pacific Sociol. Rev., vol. 18, no. 1, pp. 122–136, 1975.

- F. Hourneaux, M. L. da S. Gabriel, and D. A. Gallardo-Vázquez, “Triple bottom line and sustainable performance measurement in industrial companies,” Rev. Gest., vol. 25, no. 4, pp. 413–429, 2018. [CrossRef]

- Ioannou, I.; Serafeim, G., “The Consequences of Mandatory Corporate Sustainability Reporting,” SSRN Electron. J., pp. 1–49, 2012. [CrossRef]

- D. Adhariani and E. du Toit, “Readability of sustainability reports: evidence from Indonesia,” J. Account. Emerg. Econ., vol. 10, no. 4, pp. 621–636, 2020. [CrossRef]

- D. Sriani and D. Agustia, “Does voluntary integrated reporting reduce information asymmetry? Evidence from Europe and Asia,” Heliyon, vol. 6, no. 12, 2020. [CrossRef]

- Dadashi, I.; Norouzi, M., “Investigating the Mediating Effect of Financial Reporting Readability on the Relationship between Earnings Management and Cost of Capital,” J. Account. Knowl., vol. 11, no. 1, 2020. [CrossRef]

- R. Gray, M. Javad, D. M. Power, and C. D. Sinclair, “Social and environmental disclosure and corporate characteristics: A research note and extension,” J. Bus. Financ. Account., vol. 28, no. 3–4, pp. 327–356, 2001. [CrossRef]

- W. Przepiorka and J. Berger, “Teori Persinyalan Berkembang: Sinyal dan Tanda Dapat Dipercaya dalam Pertukaran Sosial,” Soc. Dilemmas, Institutions, Evol. Coop., pp. 373–392, 2017.

- W. M. W. Mohammad and S. Wasiuzzaman, “Environmental, Social and Governance (ESG) disclosure, competitive advantage and performance of firms in Malaysia,” Clean. Environ. Syst., vol. 2, no. January, p. 100015, 2021. [CrossRef]

- B. Tjahjadi, N. Soewarno, and F. Mustikaningtiyas, “Good corporate governance and corporate sustainability performance in Indonesia: A triple bottom line approach,” Heliyon, vol. 7, no. 3, p. e06453, 2021. [CrossRef]

- Z. Wang, T. S. Hsieh, and J. Sarkis, “CSR Performance and the Readability of CSR Reports: Too Good to be True?,” Corp. Soc. Responsib. Environ. Manag., vol. 25, no. 1, pp. 66–79, 2018. [CrossRef]

- J. Cheng, J. Zhao, C. Xu, and H. Gong, “Annual Report Readability and Earnings Management: Evidence from Chinese Listed Companies,” vol. 181, no. Icsshe, pp. 794–797, 2018. [CrossRef]

- J. S. Hughes, J. Liu, J. Liu, and E. Org, “UCLA Recent Work Title Information, Diversification, and Cost of Capital Permalink https://escholarship.org/uc/item/82j2d59r Publication Date,” 2005, [Online]. Available: https://escholarship.org/uc/item/82j2d59r.

- Rehman, I.U.; Naqvi, S.K.; Shahzad, F.; Jamil, A., “Corporate social responsibility performance and information asymmetry: the moderating role of ownership concentration,” Soc. Responsib. J., vol. 18, no. 2, pp. 424–440, 2022. [CrossRef]

- M. Noh, “Culture and annual report readability,” Int. J. Account. Inf. Manag., vol. 29, no. 4, pp. 583–602, 2021. [CrossRef]

- Harymawan, I.; Nasih, M.; Putra, F.K.G., “External Assurance On Sustainability Report Disclosure And Firm Value: Evidence From Indonesia And Malaysia,” Entrep. Sustain. Issues, vol. 7, no. 3, pp. 1484–1499, 2020. [CrossRef]

- D. S. adillah Maylawati, Y. J. Kumar, F. B. Kasmin, and M. A. Ramdhani, “Readability Evaluation Metrics for Indonesian Automatic Text Summarization: A Systematic Review,” J. Eng. Sci. Technol. Rev., vol. 17, no. 5, pp. 199–210, 2024. [CrossRef]

- Habib, A.; Bhatti, M.I.; Khan, M.A.; Azam, Z., “Cash Holding and Firm Value in the Presence of Managerial Optimism,” J. Risk Financ. Manag., vol. 14, no. 8, 2021. [CrossRef]

- C. Clarkson, “Covariant approach for perturbations of rotationally symmetric spacetimes,” Phys. Rev. D - Part. Fields, Gravit. Cosmol., vol. 76, no. 10, 2007. [CrossRef]

- E. Su and K. Tokmakcioglu, “A comparison of bid-ask spread proxies and determinants of bond bid-ask spread,” Borsa Istanbul Rev., vol. 21, no. 3, pp. 227–238, 2021. [CrossRef]

- T. M. Almomani, M. I. S. Obeidat, M. A. Almomani, and N. M. A. M. Y. Darkal, “Capital Structure and Firm Value Relationship: The Moderating Role of Profitability and Firm Size Evidence from Amman Stock Exchange,” WSEAS Trans. Environ. Dev., vol. 18, pp. 1073–1084, 2022. [CrossRef]

- H. Hasbi, “Islamic Microfinance Institution: The Capital Structure, Growth, Performance and Value of Firm in Indonesia,” Procedia - Soc. Behav. Sci., vol. 211, pp. 1073–1080, 2015. [CrossRef]

- S. Gu and R. N. A. Dodoo, “The Impact of Firm Performance on Annual Report Readability,” Int. Res. J. Bus. Stud., vol. 14, no. 1, pp. 59–68, 2021. [CrossRef]

- H. Muhammad, S. Migliori, and A. Consorti, “Corporate governance and R&D investment: does firm size matter?,” Technol. Anal. Strateg. Manag., vol. 36, no. 3, pp. 518–532, 2024. [CrossRef]

- L. G. R. V. De Silva and Y. K. W. Banda, “Impact of CEO Characteristics on Capital Structure: Evidence from a Frontier Market,” Asian J. Bus. Account., vol. 15, no. 1, pp. 71–101, 2022. [CrossRef]

- Ghozali, I., “Aplikasi Analisis Multivariate Dengan Pogram IBM SPSS,” Sembilan. Universitas Diponegoro Semarang, 2018.

- W. H. DuBay, “The principles of readability: A brief introduction to readability research,” Impact Inf., no. 949, pp. 1–72, 2004.

- C. Kim, K. Wang, and L. Zhang, “Readability of 10-K Reports and Stock Price Crash Risk,” Contemp. Account. Res., vol. 36, no. 2, pp. 1184–1216, 2019. [CrossRef]

- S. Wang, X. Liu, and J. Zhou, Readability is decreasing in language and linguistics, vol. 127, no. 8. Springer International Publishing, 2022. [CrossRef]

- M. Jayasree and R. Shette, “Readability of Annual Reports and Operating Performance of Indian Banking Companies,” IIM Kozhikode Soc. Manag. Rev., vol. 10, no. 1, pp. 20–30, 2021. [CrossRef]

- D. Kong, T. Xiao, and S. Liu, “Asymmetric information, firm investment and stock prices,” China Financ. Rev. Int., vol. 1, no. 1, pp. 6–33, 2011. [CrossRef]

- M. Hair, J. F., Hult, G. T. M., Ringle, C. M., & Sarstedt, “A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM). Thousand Oaks,” Sage, p. 165, 2017.

- R. Ramanathan, “Understanding Complexity: the Curvilinear Relationship Between Environmental Performance and Firm Performance,” J. Bus. Ethics, vol. 149, no. 2, pp. 383–393, 2018. [CrossRef]

- H. Scott Asay, W. Brooke Elliott, and K. Rennekamp, “Disclosure readability and the sensitivity of investors’ valuation judgments to outside information,” Account. Rev., vol. 92, no. 4, pp. 1–25, 2017. [CrossRef]

- E. Besuglov and N. Crasselt, “The effect of readability and language choice in management accounting reports on risk-taking: an experimental study,” J. Bus. Econ., vol. 91, no. 1, pp. 5–33, 2021. [CrossRef]

- T. Seufert, F. Wagner, and J. Westphal, “The effects of different levels of disfluency on learning outcomes and cognitive load,” Instr. Sci., vol. 45, no. 2, pp. 221–238, 2017. [CrossRef]

- Khatali, A., “Identifying Effects of Information Asymmetry on Firm Performance,” Int. J. Econ. Financ. Manag. Sci., vol. 8, no. 2, p. 75, 2020. [CrossRef]

- Santra, I.K.; Wirga, I.W.; Sanjaya, I.B.; Yasa, I.K.; Waelan, “How the Information Asymmetry Determine Firm Value? A Case Study on Real Estate Company in IDX 2020-2022,” Int. J. Business, Econ. Manag., vol. 6, no. 2, pp. 88–93, 2023.

- X. C. Cui, “Calisthenics with words: The effect of readability and investor sophistication on investors’ performance judgment,” Int. J. Financ. Stud., vol. 4, no. 1, pp. 1–14, 2016. [CrossRef]

- Anggara, A.A.; Aryoko, Y.P.; Dewandaru, R.O.; Kharismasyah, A.Y.; Fatchan, I.N., "Does Maintaining Resources, Diversification, and Internationalization Matter for Achieving High Firm Performance? A Sustainable Competitiveness Strategy for China Taipei Firms," Sustainability., vol. 17, no. 4, pp. 1576, 2025. [CrossRef]

- E. Handayani, A. A. Anggara, and I. Hapsari, "Developing an Instrument and Assessing SDGs Implementation in Indonesian Higher Education," International Journal of Sustainable Development & Planning., vol. 19, no. 2, 2024. [CrossRef]

- Anggara, A.A.; Weihwa, P.; Khananda, R.W.V.; Randikaparsa, I., "How Do Indonesia Firms Encounter Covid-19 Pandemic? An Evidence of Transformation of the Roots of Competitive Advantage from EMDE Country," Quality-Access to Success., vol. 25, no. 198, 2024. [CrossRef]

- F. Fatchan, P. H. P. Mahandani, I. N. Fatchan, and F. Achyani, "Family and Politics to Related Party Transaction in Indonesia’s Mining Companies: Does Corporate Governance Matter?", Riset Akuntansi dan Keuangan Indonesia, vol. 8, no. 2, pp. 202-217, 2023. https://doi.org/10.23917/reaksi.v8i2.2902.

- F. Achyani, L. Lovita, and E. Putri, "The Effect of Good Corporate Governance, Sales Growth, and Capital Intensity on Accounting Conservatism: Empirical Study on Manufacturing Companies Listed on the Indonesia Stock Exchange 2017-2019," Riset Akuntansi dan Keuangan Indonesia, vol. 6, no. 3, pp. 255-267, 2021. [CrossRef]

- F. H. Fatchan and A. K. Widagdo, "Perplexity in Accounting Conservatism: A Critical Review," Riset Akuntansi dan Keuangan Indonesia, vol. 6, no. 1, pp. 42-53, 2021. [CrossRef]

- Z. Zulfikar, A. D. B. Bawono, M. Mujiyati, and S. Wahyuni, "Sharia Corporate Governance and Financial Reporting Timeliness: Evidence of the Implementation of Banking Regulations in Indonesia," Banks and Bank Systems, vol. 15, no. 4 pp. 179, 2020. [CrossRef]

- R. Trisnawati, S. D. Wardati, and E. Putri, "The Influence of Majority Ownership, Profitability, Size of the Board of Directors, and Frequency of Board of Commissioners Meetings on Sustainability Report Disclosure," Riset Akuntansi Dan Keuangan Indonesia, vol. 7, no. 1, pp. 94-104, 2022. [CrossRef]

| Variable | Definition | Measurement |

|---|---|---|

| Readability of Annual Report (AR) and Sustainability report (SR) | How complicated to understand sustainability report refers to linguistic approach [48] | Flesch Reading Ease (FRE) on the environmental disclosure in the sustainability report and CSR disclosure in annual report [13] |

| Asymmetry information (AI) |

Imbalance perceptions between management and shareholders [45] | Relative bid-ask spread [34] |

| Firm Value (FV) | How investor perceptions on company according to economic measure [6] | Tobin’s Q ([34] |

| Firm Size (FS) | The scale of firm [49] | Ln (Total Assets) [49] |

| Capital Structure (CS) | the various funds as a capital [47]. | Debt to Equity Ratio (DER) [47]. |

| Market Growth (MG) | How good is the company's growth opportunities against its position in the stock market [30] | Market to book value [50] |

| Minimum | Maximum | Median | Mean | Heteroscedasticity | Multicollinearity | |

|---|---|---|---|---|---|---|

| RoA | .000 | 38.500 | 21.500 | 21.993 | Sig. 0.950 | VIF 1.275 |

| RoS | .000 | 49.600 | 30.000 | 28.889 | Sig. 0.340 | VIF 1.224 |

| IA | -1.470 | 1.950 | 0.142 | .195 | Sig. 0.755 | VIF 1.010 |

| FV | .000 | 8.600 | 1.281 | 1.801 | Sig. 0.685 | VIF 1.013 |

| FS | .000 | 67.850 | 0.885 | 1.761 | Sig. 0.204 | VIF 1.475 |

| MG | .000 | 9.870 | 1.589 | 2.340 | Sig. 0.066 | VIF 1.484 |

| CS | 5.970 | 14.020 | 10.444 | 10.533 | Sig. 0.950 | VIF 1.275 |

| Normality | Sig. 0.200 | |||||

| Autocorrelation | Sig. 0.528 | |||||

| Asymmetry information | Firm Value | |

|---|---|---|

| Readability of SR | -.000*** | -.927 |

| Readability of AR | -.961 | -.000*** |

| Asymmetry information | -.179** | |

| Firm Size | .000*** | |

| Market Growth | .000*** | |

| Capital Structure | -.000*** | |

| Indirect Effect | ||

| Readability of SR | -0.021** | |

| Readability of AR | -0.000*** | |

| R Square | 0.556 | 0.935 |

| F Statistic | .000*** | .000*** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).