1. Introduction

The crowdfunding in Africa thrives where community, trust, and innovation converge and turn dreams into realities. The community crowd has emerged as a pivotal source of financing for small and medium enterprises (SMEs) that operate within dynamic and innovative business environments. It is estimated that 95% of businesses worldwide employ more than 60% of the workforce, yet these businesses frequently struggle to access financing (Cowling, Brown, and Rocha, 2020). Entrepreneurs often face significant challenges in obtaining funds from traditional financial sources due to the risk-averse nature of many financial institutions (Noor, Hossain, and Shirazi, 2022). As an alternative, crowdfunding has gained traction as a viable solution to address the financial deficiencies that businesses encounter (Butticè and Colombo, 2020). In recent years, crowdfunding has become an essential component of project financing, attracting considerable interest regarding its performance and potential to foster new business ventures. Nevertheless, there remains a significant lack of knowledge and experience surrounding crowdfunding and its role in supporting the success of new projects (Noor, Hossain, and Shirazi, 2022).

Raising funds prior to initiating an entrepreneurial or creative venture presents one of the most formidable challenges. Crowdfunding allows individuals, referred to as the "crowd," to contribute financial resources transparently through internet-based platforms. The ongoing COVID-19 pandemic and the financial crisis of 2007-2008 have both contributed to the evolution of crowdfunding as a funding mechanism. The crucial role of entrepreneurs and SMEs in driving economic growth and job creation is well documented across various studies (Maow, 2021). Consequently, this study aims to identify the drivers of both successful and unsuccessful reward-based crowdfunding on the African continent.

Crowdfunding can serve as an effective means to bridge the funding gap, particularly during the early phases of new initiatives (McGuire, 2020). While crowdfunding has the potential to alleviate financial challenges for businesses, further research is needed to understand the factors that influence entrepreneurs’ acceptance of this model (Rončević and Šafarić, 2023). Modeled after concepts such as crowdsourcing and microfinance, crowdfunding enables entrepreneurs to finance their projects by gathering small contributions from numerous individuals via web-based portals.

Reward-based crowdfunding involves soliciting contributions from supporters in exchange for monetary or non-monetary rewards (Maiolini, Franco, Cappa, and Hayes, 2023). This model has been selected for the study due to its global popularity and growth trajectory. On the African continent, reward-based crowdfunding expanded from $3.17 million in 2015 to $4.17 million in 2016, representing 2.3% of the global crowdfunding volume in 2016 (Chao, Serwaah, Baah-Peprah, and Shneor, 2020). The overall crowdfunding industry experienced remarkable growth, increasing from $11 billion in 2013 to $419 billion in 2017, with China accounting for $258 billion, the USA and Canada for $44 billion, and Europe for $4 billion of the total (Ziegler, Shneor, and Zang, 2020). In Africa, the crowdfunding volume grew from $83 million in 2015 to $182 million in 2016 (Chao et al., 2020). Despite these strides, Africa still represents the smallest volume and lowest usage of crowdfunding compared to other global regions. However, the continent holds significant potential for growth in crowdfunding, which could ultimately help overcome the barriers to accessing finance for businesses (Chao et al., 2020).

There are no universally recognized successful or unsuccessful drivers of reward-based crowdfunding. Furthermore, the existing literature on crowdfunding in Africa remains limited, with most studies focusing on qualitative and conceptual aspects (Chao et al., 2020). Research exploring successful drivers in equity crowdfunding (Mochkabadi and Volkmann, 2020; Troise, Tani, and Jones, 2020), as well as the sustainability determinants of campaign business models, remains under-explored. This lack of comprehensive knowledge presents a significant gap in the literature. Therefore, this study seeks to illuminate the determinants of crowdfunding success in Africa. Despite the growing interest in crowdfunding on the continent, our understanding of the factors contributing to its success is still insufficient, underscoring the necessity to address this gap. Existing studies conducted in the African context have predominantly focused on conceptual themes (Berndt, 2016; Kuma, Yusoff, and Apreku-Djan, 2022; Kenworthy, 2019).

The findings of this study will advance the understanding of information asymmetry and signalling theories as they relate to crowdfunding. Additionally, the research will provide practical guidelines for entrepreneurs on how to effectively fundraise and design successful crowdfunding campaigns. In doing so, this study aims to contribute to the existing scholarship by addressing the gap in knowledge regarding successful drivers of crowdfunding campaigns in Africa.

Consequently, the primary research question guiding this study is: What are the determinants of crowdfunding success? The rest of the paper is structured as follows:

Section 2 provides an overview of the literature review and hypotheses development.

Section 3 introduces the research hypotheses and the conceptual framework, while

Section 4 and

Section 5 present the research method and a discussion of the findings respectively. Section 6 is the conclusion.

2. Literature Review and the Theoretical Framework

Crowdfunding is a new online communication technology that gives entrepreneurs worldwide access to finance (Fourkan, 2021). It is used to finance new ideas of businesses or entrepreneurs and entails raising a small amount of money from many people, known as backers. The backers who contribute to an internet-based platform receive incentives through product development, tickets, or another form of appreciation from the project creator or entrepreneur (Miller, 2019).

The target goal amount (ln value) was shown to be negatively associated with campaign success likelihood in earlier research (Arifin, Widiyanti and Andriana, 2024; Djimesah, Zhao, Okine, Duah, Kissi Mireku and Adjei Budu, 2023; Liu, Ben and Zhang, 2023 and Ullah and Zhou (2020). In contrast, Jung, Lee and Hwang (2022) found a positive relationship between the targeted amount and the likelihood of success. Therefore, their results still need to be more conclusive. Studies also highlight that backers are most likely to fund projects when they feel that their contribution makes a difference in whether the project gets funded or not (Liang et al., 2019; Sauermann et al., 2019). For instance, crowdfunding projects that establish clear, realistic funding goals and prioritise backer-oriented rewards tend to enhance backers' perceptions of expectancy (the belief that their contribution will help achieve the goal) and instrumentality (the belief that achieving the goal will lead to desired outcomes) (Aideyan, 2023; Soltani et al., 2024). On the other hand, there is a delicate balance, given that overtly complicated rewards or vague reward fulfilment processes may erode the backers’ trust and hence diminish the chances of the campaign’s success (Li et al., 2022).Visual attributes, such as the number of pictures and videos and the quality of the photographs, are crucial indicators of crowdfunding success (Blanchard, Noseworthy, Pancer and Poole, 2022). The number of images and videos on a project page increases the probability of reaching the funding target (Zhang, 2022; Hou, Zhang and Zhang, 2023). Drawing from signal and information asymmetry theories, visuals in the form of video and images provide a better communication strategy for backers to make an appropriate decision. Hence, it is in line with signal theory. The presentation of visuals alleviates the problem of information asymmetry. However, Joenssen, Michaelis and Müllerleile (2014) and Huang, Uy, Liu, Foo and Li (2023) findings revealed a negative relationship between visuals and crowdfunding success. In crowdfunding pitch videos, peak unfavourable affective visual expression, particularly from individuals in the first half, has a greater negative impact on raising money than positive expression. Hence, there is no universal agreement.

Fourkan (2021) found that backers influence the success of crowdfunding in line with signal theory. However, from the crowdfunding literature, it can be concluded that the success of crowdfunding projects depends mainly on the number of backers (Ma, 2022). Interestingly, vicarious moral licensing, where people feel less required to contribute when associated with others who have already done so, allows supporter connections to have a detrimental impact on financing (Herd, Mallapragada and Narayan, 2022). Backers of crowdfunding projects commit to contributing a particular amount to a project, which is delivered to the founders by bakers once the project meets its goal amount stated before the project launch. Attribution theory may be applicable by revealing what is behind the motivation for the contribution to be made.

In communities, reward crowdfunding campaigns with smaller fundraising goals and more pledges are more likely to succeed. A longer duration of projects has decreased the probability of crowdfunding success (dos Santos Felipe, Mendes-Da-Silva, Leal and Santos, 2022; Silva, Silva, and Rosa, 2020). The longer duration signals the entrepreneur's confidence and shows the current status and progress of the funding project and the commitment to achieving the target. Inconsistent results showed a negative association between crowdfunding success (Deng, Ye, Xu, Sun, and Jiang, 2022; Buttice and Rovelli, 2020) and non-significant associations (Deng et al, 2022; Huang, Pickernell, Battisti, and Nguyen, 2022).

The presence of spelling mistakes indicates a low-quality crowdfunding campaign, an unprepared fund-seeking, and fewer committed fundraisers (Zhang, Tao, Ji, Wang and Sörensen, 2023; Chan, Pethe and Skiena, 2021). From information asymmetry, spelling errors create confusion and untrustworthiness concerning the project campaign, decreasing crowdfunding success. Additionally, the existence of spelling errors on the crowdfunding website signal lower quality and unpreparedness. It is vital to avoid spelling errors when designing a crowdfunding project campaign. The study examines whether equity crowdfunding draws better or worse entrepreneurs; it does not mention mistakes in spelling (Blaseg, Cumming and Koetter, 2021).

The academic literature has examined the drivers of crowdfunding success almost exclusively in the African continent. The determinants of crowdfunding success were focused on the following categories namely. Animal, Art, Charity, Comics and Graphic Novels, Community, Craft, Dance, Design, Education, Environment, Family, Fashion, Film, Food, Gaming, Health, Music, Photography, Publishing, Radio and podcast, Small Business, technology.

Much of the literature considers Africa a single, homogenous globe that ignores essential regional differences (Mamaro and Sibindi, 2023). More detailed research that examines differences between various African nations and areas is required. It is understudied how new technologies such as blockchain, mobile money, and artificial intelligence have shaped the success of crowdfunding in Africa (Ahmed, 2021; Molla and Biru, 2023). Studies on the effects of these technologies on efficiency, accessibility, and trust are needed (Abdelfattah, 2023; Ackah, 2021).

Theories used in the study and the development of research hypotheses.

Agency theory is used in this study because it deals with information asymmetry and applies to crowdfunding (Kuma, Effandi, Yusoff and Kuma, 2021). Efforts to access finance for the development of entrepreneurs may encounter the problem of information asymmetry between project creators and backers or investors (Hellmann and Stiglitz, 2000).

Information asymmetry will result in inefficient message exchange and, as a result, market failure. Signalling theory (Spence, 1978) indicates that the knowledgeable actor could send observable signals and disclose unobservable information to aid the actors' communications in information asymmetry. The less informed actor can help with successful communication. Following that, Courtney et al. (2017) propose that signaller qualities and behaviours can be two functional dimensions on which informed fundraisers might work to convey unambiguous signals to less informed contributors in the context of online crowdfunding. Following the reasoning, this study investigates the solutions to the information asymmetry problem in an online donation-based crowdfunding platform from the perspectives of signaller qualities and behaviours. Its goal is to contribute to fundraising success.

Based on the signalling theory, it provides signals that assist potential backers and investors in evaluating the credibility of crowdfunding campaigns to make an informed decision on whether to contribute (Courtney et al., 2017). High-quality projects are considered to achieve the targeted amount compared to low-quality projects. Therefore, designing a quality crowdfunding campaign and providing information disclosure is essential to increase the probability of success. Hence, visual tools like images and films encourage investment by bridging the informational gaps between donors and seekers (Courtney et al., 2017; Kim, Park, Pan and Zhang, 2022). Videos and pictures are effective psychological cues for influencing possible supporters, as Xu and Ni (2022) summarise. Fang, Xie, Yu, Huang and Zhang (2023) investigated video tonality and discovered a favourable correlation between warm, passionate videos and funding success.

Trust and reliability are the foundations of any successful crowdfunding campaign. Whenever potential supporters consider contributing to a project, they want to be sure that the project creator can fulfil their promises and that the funding is going to an important cause (Strausz, 2017). Success through crowdfunding is greatly affected by the fundraiser's credibility and level of trust. Trust is crucial for crowdfunding campaigns to succeed since potential backers contribute to trustworthy projects (Shneor, Mrzygłód, Adamska-Mieruszewska & Fornalska-Skurczyńska, 2022). The backers Supporters want to ensure that the projects or people they are funding are legitimate, not frauds or scams (Shneor et al., 2022). Consequently, if one wants to advertise a particular entrepreneurial idea, it is essential to thoroughly investigate the information disclosure strategies that foster confidence and inspire potential backers to make financial contributions (Butticè and Vismara, 2022).

Developing trust with potential investors requires effective communication. The project creators should be open and honest throughout the campaign about their goals, tactics, and developments. Establishing credibility and confidence can be facilitated by providing regular updates, being transparent about how funds will be used, and openly communicating with backers (Sendra-Pons, Garzon Revilla-Camacho, 2024). The crowdfunding campaign's shorter duration (maximum 30 days) is more trustworthy for potential investors. In contrast, a longer duration (60 days or more) implies a need for more confidence in potential backers (Piening, Thies, and Wessel, 2021). To create urgency and attract supporters, fundraisers must run shorter campaigns to establish credibility and an excellent track record. The relationship between duration and trust is crucial to the success of crowdfunding.

The current study seeks to examine reward-based crowdfunding on the African continent. The study expands the concept of information asymmetry, signal and trust theory. We suggest that crowdfunding success is influenced by information disclosure, trust and credibility. The following research hypotheses were developed based on the existing literature:

H_1: The presence of spelling errors on a crowdfunding page decreases the probability of success of the crowdfunding campaign.

H_2: A longer duration decreases the probability of success of a crowdfunding campaign.

H_3: A more considerable targeted amount negatively influences the success of a crowdfunding campaign.

H_4: Many backers increase the probability of success of a crowdfunding campaign.

H_5: The presence of videos positively influences the success of the crowdfunding campaign.

H_6: The presence of images positively influences the success of the crowdfunding campaign.

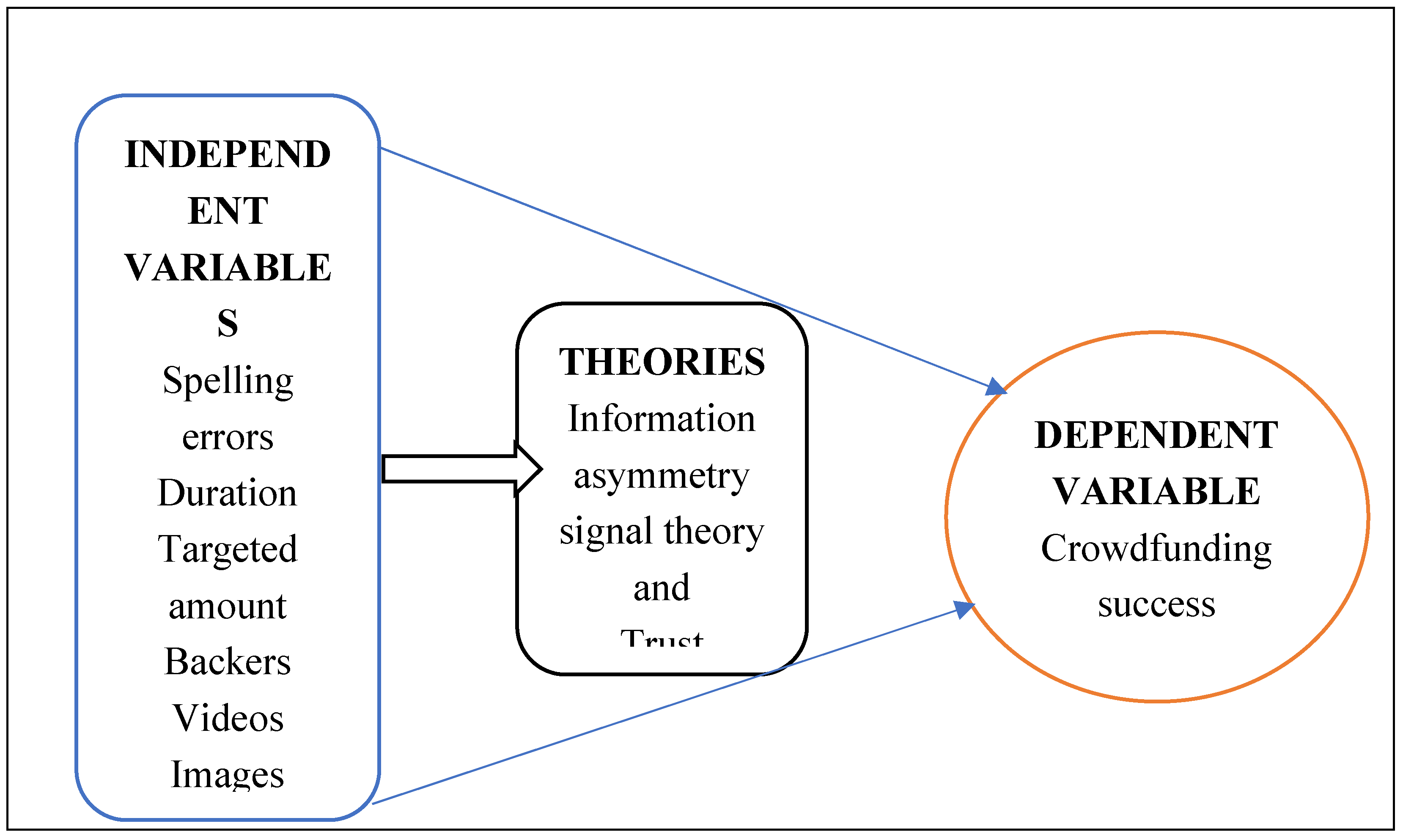

Figure 1.

Conceptual framework. Source: Authors' compilation.

Figure 1.

Conceptual framework. Source: Authors' compilation.

3. Research Method and Materials

The study adopted a quantitative research approach characterised by a deductive research strategy, which seeks to test the research hypothesis using developed theory. Kickstarter and Indiegogo are two of the world's largest and most popular crowdfunding platforms, with global backers and greater exposure for African-based projects. They are favoured by most African entrepreneurs and creators because they are more visible, credible, and open to various sources of funds than locally available crowdfunding sites. Kickstarter and Indiegogo provide more official, publicly available datasets where one can conduct a systematic and comprehensive analysis of the determinants of successful crowdfunding. Conversely, most African-based sites lack data accessibility and variable reporting styles, making comparing difficult.

In this empirical study, we employed the logit estimation equation, as it effectively addresses our binary dependent variable, which can only take values of 0 or 1. The variables are described in

Table 1.

Logistic regression model 1 of an equation

For our equation, we utilized logit model estimation. The reason for using the logit model is that our dependent variable is binary with a 1,0 outcome. It is estimated using the maximum likelihood estimation method (Wooldridge, 2019), where the model takes the form as follows:

The logit regression was used to estimate model 2 and is expressed as follows:

The equation is as follows:

4. Research Findings and Discussion

The table 2 below discusses a descriptive statistic which include, mean, median, standard deviation, minimum, maximum. This section presents the results of the study.

Firstly, the summary statistics are presented in

Table 2. There were 215 crowdfunding projects employed for the study, of which 33 were successful and 182 failed. The total pledged amount was USD 1,040,234 from 9336 backers. It is important to note that each number of backers does not represent a unique project because an individual contributes to several projects. These projects generated 1430 comments and 333 updates in total. The total targeted amount is USD 20,047,395, whereas the average number of days per crowdfunding campaign is 43 days. A detailed descriptive statistic for a project is presented in

Table 2. The table 3 below explain the correlation matrix among the variables.

The correlation results of the study are summarized in

Table 3. The findings demonstrate a positive relationship between crowdfunding success and the independent variables examined. However, three independent variables—spelling errors, duration, and targeted amount—show a negative association with crowdfunding success. The correlation matrix confirms that there are no concerns regarding multicollinearity, as the threshold remains below 0.80. The econometric analysis indicates that the regressor variables are not strongly correlated, allowing us to confidently conclude that the model is free from multicollinearity issues.

Table 4 below presents the probit regression analysis.

The logistic model pseudo-R-squared value is 0.67, representing a goodness fit of the model as Domencich and McFadden (1975) recommended. Furthermore, the likelihood ratio statistic is significant at the 1% level. According to the logistic model guidelines, a value larger than 0.2–0.4 is deemed an excellent fit for the logistic model. The findings of logistic regression analysis indicated in

Table 5 reported that spelling errors (SPR) are negative but do not significantly affect crowdfunding success (β=-0,899). The findings are consistent with studies by Zhang, Tao, Ji, Wang and Sörensen (2023); Ho, Chiu, Mansumitrchai, Yuan, Zhao and Zou (2021). Therefore, spelling errors on the crowdfunding platform signal the failure of the crowdfunding campaign. The targeted amount is negative and significantly associated with success (β=-1.5134, p>0,01). These results are supported by Zhu (2022) and Li and Du (2020), which align with signalling theory. However, the duration and video positively influence crowdfunding success but are not significant (β=0.556 and β =0.317, respectively). These results are not in line with the findings obtained by Zhou, Lu, Fan and Wang (2018) but agree with the findings reached by Prasobpiboon, Ratanabanchuen, Chandrachai and Triukose (2021). The longer duration gives backers enough time to make decisions, signalling the crowdfunding success. However, Lagazio and Querci (2018) assert that a longer duration could offer some precious time for backers to make an informed decision about a prospective project. Presentation video also attracts backer’s contribution, signalling success and overcoming the information asymmetry.

The presence of the image is positive but not significantly associated with crowdfunding success (β=1.320). The findings are in line with Salvi, Raimo, Petruzzella and Vitolla (2021), which contradict the study by Buttice and Noonan (2019) and Blanchard et al. (2022). Therefore, the presentation of videos and images on the crowdfunding platform aligns with the signal theory and information asymmetry because it provides better communication to backers. Backers are positive and significantly associated with crowdfunding success (β =0.317, p>0,01). These findings were supported by Ge, Xin, Yi, Yee and Yin, (2019); Fourkan, (2021). Therefore, the large number of backers signals the crowdfunding success. Consequently, no universal findings exist on the relationship between video, images and duration on crowdfunding success performance.

Table 5 below describes the summary of the hypotheses and the decisions.

5. Conclusions

This study aimed to determine the factors influencing crowdfunding success in Africa. The findings demonstrated a significant impact of the targeted amount on crowdfunding success, which aligns with goal-setting theory. In particular, concerning information asymmetry, a positive video and image were used to provide clarification to potential backers. The longer duration provides enough time for potential investors or backers to contribute to the crowdfunding campaign, increasing the probability of success. Lastly, regarding communication strategy, spelling errors decrease the probability of success since they discourage potential backers. Consequently, the frequent communication between entrepreneurs and potential backers increases crowdfunding success.

The findings of the study contribute in the following ways. Firstly, it increases the limited knowledge of the determinants of crowdfunding success in Africa. In this regard, the study identified communication strategies and characteristics that may help crowdfunding success. Secondly, the study provides guidelines to entrepreneurs on designing a successful crowdfunding campaign since little is explored in the academic literature. Thirdly, the results advance the signal and information asymmetry theories, demonstrating their ability to explain the determinants of crowdfunding success. The findings have significant implications for entrepreneurs who launch crowdfunding campaigns in Africa. Based on our findings, they should pay special attention to the quality of communication of the project description, as it significantly impacts the campaign's likelihood of success. In this sense, entrepreneurs should first and foremost focus on communication completeness. In this regard, they should use extensive visuals, such as images and videos, to increase the probability of success.

However, there is no study without limitations. In particular, the study collected secondary data from crowdfunding projects in Africa. Therefore, the study's findings cannot be generalised in other developed countries owing to differences in cultural and economic activities. Future studies could examine the determinants of donation-based crowdfunding success owing to the popularity of this model on the African continent. A second limitation is that the study was based on reward-based crowdfunding types other than equity and lending-based. In this regard, a future study on lending-based crowdfunding using single-country data may be conducted. Other factors, such as frequently asked questions, Average funding, comments and updates, should be examined.

Further research on crowdfunding in Africa is necessary, especially about gender, economic status, and the differences between rural and urban dynamics. Understanding the challenges underrepresented groups face in participation can inform more equitable crowdfunding practices. Finally, considering the limited crowdfunding success projects in Africa, a future study needs to be conducted using qualitative analyses to provide a more in-depth understanding of the determinants of crowdfunding success.

Author Contributions

Conceptualisation: Lenny Phulong Mamaro, Athenia Bongani Sibindi Data curation: Lenny Phulong Mamaro. Formal analysis: Lenny Phulong Mamaro and Athenia Bongani Sibindi. Investigation: Ntwanano Jethro Godi, Lenny Phulong Mamaro, Athenia Bongani Sibindi. Methodology: Lenny Phulong Mamaro, Ntwanano Jethro Godi, Athenia Bongani Sibindi. Project administration: Lenny Mamaro; Athenia Bongani Sibindi. Supervision: Athenia Bongani Sibindi. Validation: Lenny Phulong Mamaro, Athenia Bongani Sibindi, Ntwanano Jethro Godi. Visualisation: Athenia Bongani Sibindi, Lenny Phulong Mamaro. Writing – original draft: Lenny Phulong Mamaro. Writing – review & editing: Athenia Bongani Sibindi, Ntwanano Jethro Godi. Funding acquisition: Athenia Bongani Sibindi; Lenny Mamaro; Ntwanano Jethro Godi

Funding

The APC of this study was funded by the University of South Africa (funding no: BAAP200401510931). The author of this study also received funding from the University of South Africa to present the conference paper associated with this study at the International Conference in Financial Services held in Emperors Palace in Johannesburg.

Data Availability Statement

The data will be made available upon request.

Acknowledgements

Attendees and anonymous referees who participated at the 3rd Alternative Finance Conference in Austria in June 2024 for their valuable input on this paper.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

Logistic regression results

| Dependent Variable: Success |

| Method: ML - Binary Logit (Newton-Raphson / Marquardt steps) |

| Variable |

Coefficient |

Std. Error |

z-Statistic |

Prob. |

| SPR |

-0.899021 |

0.922751 |

-0.974283 |

0.3299 |

| DR |

0.555500 |

0.798641 |

0.695556 |

0.4867 |

| BCK |

0.086827 |

0.019250 |

4.510372 |

0.0000 |

| VD |

0.316703 |

0.824335 |

0.384192 |

0.7008 |

| IM |

1.320547 |

1.140280 |

1.158090 |

0.2468 |

| TA |

-1.513360 |

0.399182 |

-3.791155 |

0.0001 |

| C |

5.587175 |

3.315316 |

1.685262 |

0.0919 |

| McFadden R-squared |

0.674197 |

Mean dependent var |

0.153488 |

| S.D. dependent var |

0.361299 |

S.E. of regression |

0.195133 |

| Akaike info criterion |

0.344468 |

Sum squared resid |

7.920018 |

| Schwarz criterion |

0.454209 |

Log likelihood |

-30.03027 |

| Hannan-Quinn criter. |

0.388808 |

Deviance |

60.06054 |

| Restr. deviance |

184.3464 |

Restr. log likelihood |

-92.17321 |

| LR statistic |

124.2859 |

Avg. log likelihood |

-0.139676 |

| Prob(LR statistic) |

0.000000 |

|

|

|

Source: Eviews.

References

- Abdelfattah, Rana Maged Mahmoud. 2023. The Impact of Fintech on Financial Inclusion in Egypt. Available online https://www.researchgate.net/profile/Rana-Maged/publication/371082526_The_Impact_of_Fintech_on_Financial_Inclusion_in_Egypt/links/647ddb17d702370600d69d74/The-Impact-of-Fintech-on-Financial-Inclusion-in-Egypt.pdf (Accessed on 16 March 2024).

- Ackah, Betty. 2021. Blockchain and gender digital inequalities in Africa: A critical Afrocentric analysis. Available at https://summit.sfu.ca/_flysystem/fedora/2022-08/input_data/21996/etd21486.pdf (Accessed on 16 September 2024).

- Ahmed, Shamira. 2021. A gender perspective on using artificial intelligence in the African fintech ecosystem: case studies from South Africa, Kenya, Nigeria, and Ghana. Doi. https://hdl.handle.net/10419/238002.

- Arifin, Firmansyah, Marlina Widiyanti, and Isni Andriana. 2024. Crowdfunding Success Factors: Financial Information and Advertising Finance. KnE Social Sciences, 702-717. [CrossRef]

- Berndt, Adele. 2016. Crowdfunding in the African context: A new way to fund ventures. Entrepreneurship and SME Management Across Africa: Context, Challenges, Cases, pp. 31–49. Available at http://www.springer.com/series/13889 (Accessed on 23 September 2024).

- Bi, Sheng, Zhiying Liu, and Khalid Usman. 2017. The influence of online information on investing decisions of reward-based crowdfunding. Journal of Business Research, 71, 10-18. [CrossRef]

- Blanchard, Simon J., Theodore J. Noseworthy, Ethan Pancer, and Maxwell Poole. 2022. Extraction of Visual Information to Predict Crowdfunding Success. arXiv preprint arXiv:2203.14806., 1-23. [CrossRef]

- Blaseg, Daniel, Douglas Cumming, and Michael Koetter. 2021. Equity crowdfunding: High-quality or low-quality entrepreneurs? Entrepreneurship Theory and Practice, 45(3), 505-530. [CrossRef]

- Butticè, Vincenzo, and Douglas Noonan. 2020. Active backers, product 10ommercialization and product quality after a crowdfunding campaign: A comparison between first-time and repeated entrepreneurs. International Small Business Journal, 38(2), 111-134. [CrossRef]

- Buttice, Vincenzo, and Paola Rovelli. 2020. “Fund me, I am fabulous!” Do narcissistic entrepreneurs succeed or fail in crowdfunding? Personality and Individual Differences, 162, 1-7. [CrossRef]

- Chan, CS Richard, Charuta Pethe, and Steven Skiena. 2021. Natural language processing versus rule-based text analysis: Comparing BERT score and readability indices to predict crowdfunding outcomes. Journal of Business Venturing Insights, 16, 1–17. [CrossRef]

- Chao, Emmanuel James, Priscilla Serwaah, Prince Baah-Peprah, and Rotem Shneor. 2020. Crowdfunding in Africa: Opportunities and challenges. Advances in Crowdfunding, 319-339. [CrossRef]

- Courtney, Christopher, Supradeep Dutta, and Yong Li. 2017. Resolving information asymmetry: Signaling, endorsement, and crowdfunding success. Entrepreneurship Theory and Practice, 41(2), 265–290. [CrossRef]

- Cowling, Marc, Ross Brown, and Augusto Rocha. 2020. <? covid19?> Did you save some cash for a rainy COVID-19 day? The crisis and SMEs. International Small Business Journal, 38(7), 593–604. [CrossRef]

- Deng, Lingfei, Qiang Ye, DaPeng Xu, Wenjun Sun, and Guangxin Jiang. 2022. A literature review and integrated framework for the determinants of crowdfunding success. Financial Innovation, 8(1), 1-70. [CrossRef]

- Djimesah, Isaac Edem, Hongjiang Zhao, Agnes Naa Dedei Okine, Elijah Duah, Kingsford Kissi Mireku, and Kenneth Wilson Adjei Budu. 2023. What factor is essential in successful crowdfunding: a MULTIMOORA-EDAS approach to explore factors that influence the success of crowdfunding campaigns. Kybernetes. 1-27: Available at https://www.emerald.com/insight/0368-492X.htm (Accessed on the 16 October 2024).

- Domencich, Thomas A., and Daniel McFadden. 1975. Urban travel demand behavioural analysis (No. Monograph). Available at https://trid.trb.org/View/48594 (Accessed on the 19 September 2024).

- dos Santos Felipe, Israel José, Wesley Mendes-Da-Silva, Cristiana Cerqueira Leal, and Danilo Braun Santos. 2022. Reward crowdfunding campaigns: Time-to-success analysis. Journal of Business Research, 138, 214-228. [CrossRef]

- Fang, Xue, Chaowu Xie, Jun Yu, Songshan Huang, and Jiangchi Zhang. 2023. How do short-form travel videos trigger travel inspiration? Identifying and validating the driving factors. Tourism Management Perspectives, 47, 1–20. [CrossRef]

- Fourkan, Md. 2021. Crowdfunding: antecedents of a number of backers and success of a project. International Journal of Small Business and Entrepreneurship Research, 9(2), 1–13. Available at https://ssrn.com/abstract=3865312 (Accessed on 19 September 2024).

- Herd, Kelly B., Girish Mallapragada, and Vishal Narayan. 2022. Do backer affiliations help or hurt crowdfunding success? Journal of Marketing, 86(5), 117-134. [CrossRef]

- Hou, Jian-Ren, Jie Zhang, and Kunpeng Zhang. 2023. Pictures that are worth a thousand donations: How emotions in project images drive the success of online charity fundraising campaigns? An image design perspective. Management Information Systems Quarterly, 47(2), 535–584. Available at https://kpzhang.github.io/paper/MISQ-Web-Appendix.pdf (Accessed on 20 August 2024).

- Huang, Shuangfa, David Pickernell, Martina Battisti, and Thang Nguyen. 2022. Signalling entrepreneurs’ credibility and project quality for crowdfunding success: cases from the Kickstarter and Indiegogo environments. Small Business Economics, 1–21. [CrossRef]

- Huang, Yi, Marilyn A. Uy, Chang Liu, Maw-Der Foo, and Zhuyi Angelina Li. 2023. Visual totality of rewards-based crowdfunding pitch videos: Disentangling the impact of peak negative affective visual expression on funding outcomes. Journal of Business Venturing, 38(5), 1–23. [CrossRef]

- Jung, Eunjun, Changjun Lee, and Junseok Hwang. 2022. Effective strategies to attract crowdfunding investment based on the novelty of business ideas. Technological Forecasting and Social Change, 178, 1-16. [CrossRef]

- Kenworthy, Nora J. 2019. Crowdfunding and global health disparities: an exploratory conceptual and empirical analysis. Globalisation and Health, 15(1), 1–13. [CrossRef]

- Kim, Keongtae, Jooyoung Park, Yang Pan, Kunpeng Zhang, and Xiaoquan Zhang. 2022. Risk disclosure in crowdfunding. Information Systems Research, 33(3), 1023-1041. [CrossRef]

- Kuma, Francis Kwaku, M. Effandi, B. Yusoff, and F. K. Kuma. 2021. Resolving information asymmetric and social network theories challenges in crowdfunding campaigns. Resolving Information Asymmetric and Social Network Theories Challenges in Crowdfunding Campaigns., 1(4), 89-102. [CrossRef]

- Kuma, Francis Kwaku, Mohd Effandi Bin Yusoff, and Paul Kwasi Apreku-Djan. 2022. A Synthesis of Crowdfunding Concepts in the Ghanaian Context: Crowdfunding Information Challenges in Ghana. Journal of the Knowledge Economy, 15, 435-460. [CrossRef]

- Li, Yaokuang, and Junjuan Du. 2020. What drives the rapid achievement of a funding target in crowdfunding? Evidence from China. Agricultural Economics, 66(6), 269-277. [CrossRef]

- Liu, Zhunzhun, Shenglin Ben, and Ruidong Zhang. 2023. Factors affecting crowdfunding success. Journal of Computer Information Systems, 63(2), 241-256. [CrossRef]

- Ma, Zecong. 2023. Early backers' social and geographic influences on the success of crowdfunding. Journal of Research in Interactive Marketing, 17(4), 510–526. [CrossRef]

- Maiolini, Riccardo, Stefano Franco, Francesco Cappa, and Darren Hayes. 2023. Optimizing Reward-Based Crowdfunding. IEEE Engineering Management Review, 51(2), 55-62. [CrossRef]

- Mamaro, Lenny Phulong, and Athenia Bongani Sibindi. 2023. The drivers of successful crowdfunding projects in Africa during the COVID-19 pandemic. Journal of Risk and Financial Management, 16(7), 1-17. [CrossRef]

- Maow, Bashir Ahmed. 2021. The impact of small and medium enterprises (SMEs) on economic growth and job creation in Somalia. Journal of Economic Policy Researches, 8(1), 45–56. [CrossRef]

- Markas, Ruhaab, and Yisha Wang. 2019. Dare to Venture: Data Science Perspective on Crowdfunding. SMU Data Science Review, 2(1), 1-17. Available at https://scholar.smu.edu/datasciencereview/vol2/iss1/19 (Accessed on 17 November 2024).

- McGuire, Erin. 2020. Can equity crowdfunding mitigate the gender gap in startup finance? Available at SSRN 3233809. [CrossRef]

- Miller, Tim. 2019. Explanation in artificial intelligence: Insights from the social sciences. Artificial intelligence, pp. 267, 1–38. [CrossRef]

- Mochkabadi, Kazem, and Christine K. Volkmann. 2020. Equity crowdfunding: a systematic review of the literature. Small Business Economics, 54, 75-118. [CrossRef]

- Molla, Alemayehu, and Ashenafi Biru. 2023. The evolution of the Fintech entrepreneurial ecosystem in Africa: An exploratory study and model for future development. Technological Forecasting and Social Change, 186, 122123. [CrossRef]

- Noor, A., Tanjela Hossain, and Hasan Shirazi. 2022. Crowdfunding: A New Approach to Entrepreneurship's Startup Phase. ABC Journal of Advanced Research, 11(2), 83–96. [CrossRef]

- Prasobpiboon, Somboon, Roongkiat Ratanabanchuen, Achara Chandrachai, and Sipat Triukose. (2021). Success factors in project fundraising under the reward-based crowdfunding platform. Academy of Entrepreneurship Journal, 27, 1-20. Availablee at https://www.proquest.com/info/openurldocerror?accountid=14648 (Accessed on 15 September 2024).

- Rončević, Ante, and Petra Furdi Šafarić. 2023. Crowdfunding as a Financing Alternative for Entrepreneurial Ventures. Croatian Regional Development Journal, 4(1), 34-55. [CrossRef]

- Salvi, Antonio, Nicola Raimo, Felice Petruzzella, and Filippo Vitolla. 2022. The financial consequences of human capital disclosure as part of integrated reporting. Journal of Intellectual Capital, 23(6), 1221-1245. [CrossRef]

- Schraven, Etienne Pierre. 2022. Crowdfunding: Perceptions of Campaign Success. Available at https://research.vu.nl/en/publications/crowdfunding-perceptions-of-campaign-success (Accessed on 20 September 2024).

- Semykina, Anastasia, and Jeffrey M. Wooldridge. 2018. Binary response panel data models with sample selection and self-selection. Journal of Applied Econometrics, 33(2), 179–197. [CrossRef]

- Sendra-Pons, Pau, Dolores Garzón, and María-Ángeles Revilla-Camacho. 2024. Catalysing success in equity crowdfunding: trust-building strategies through signalling. Review of Managerial Science, 1-23. [CrossRef]

- Shneor, Rotem, Urszula Mrzygłód, Joanna Adamska-Mieruszewska, and Anna Fornalska-Skurczyńska. 2022. The role of social trust in reward crowdfunding campaigns’ design and success. Electronic Markets, 1-16. [CrossRef]

- Silva, Lafaiet, Nádia Félix Silva, and Thierson Rosa. 2020. Success prediction of crowdfunding campaigns: a two-phase modeling. International Journal of Web Information Systems, 16(4), 387-412. [CrossRef]

- Spence, Michael. 1978. Job market signalling. In Uncertainty in Economics (pp. 281–306). Academic Press. [CrossRef]

- Troise, Ciro, and Mario Tani. 2020. Exploring entrepreneurial characteristics, motivations and behaviours in equity crowdfunding: some evidence from Italy. Management Decision, 59(5), 995-1024. [CrossRef]

- Ullah, Saif, and Yulin Zhou. 2020. Gender, anonymity and team: What determines crowdfunding success on Kickstarter. Journal of Risk and Financial Management, 13(4), 1-26. [CrossRef]

- Wooldridge, Jeffrey M. 2016. Introductory Econometrics: A Modern Approach 6rd ed. Cengage learning, Available at http://dspace.kottakkalfarookcollege.edu.in:8001/jspui/bitstream/123456789/3869/1/Introductory%20econometrics.%20A%20modern%20approach%20%28%20PDFDrive%20%29%20%281%29.pdf (Accessed on 04 April 2025).

- Xu, Yan, and Jian Ni. 2022. Entrepreneurial learning and disincentives in crowdfunding markets. Management Science, 68(9), 6819–6864. [CrossRef]

- Zhang, Xinfang. 2022, March. The Role of Images in the Performance of Crowdfunding Projects. In 2022 7th International Conference on Financial Innovation and Economic Development (ICFIED 2022) (pp. 2279–2283). Atlantis Press. [CrossRef]

- Zhang, Xupin, Xinqi Tao, Bingxiang Ji, Renwu Wang, and Silvia Sörensen. 2023. The success of cancer crowdfunding campaigns: project and text analysis. Journal of Medical Internet Research, 25, 1-23. [CrossRef]

- Zhu, Xun. 2022. Proximal language predicts crowdfunding success: Behavioral and experimental evidence. Computers in Human Behavior, 131, 1–13. [CrossRef]

- Ziegler, Tania, Rotem Shneor, and Bryan Zheng Zhang. 2020. The global status of the crowdfunding industry. In Advances in Crowdfunding (pp. 43-61). Palgrave Macmillan, Cham. [CrossRef]

Table 1.

Description of variables and measurement.

Table 1.

Description of variables and measurement.

| Crowdfunding success (SP) |

Whether the targeted amount of the project/ campaign was reached |

The binary variable of 1 if the targeted amount was obtained and 0 otherwise |

| Duration (DR) |

The number of days for the project/campaign to raise funds |

Transformed as log |

| Spelling errors (SPR) |

Whether spelling errors appear on the project page and 0 otherwise |

The binary variable of 1 if there are spelling errors on the project page and 0 otherwise |

| Targeted amount (TA) |

The amount requested by the fund seeker or entrepreneur |

Transformed as log |

| Backers (BCK) |

The number of supporters who contributed to the project/campaign |

Transformed as log |

| Videos (VD) |

The presence of videos

on the project/ campaign website |

Dummy variable of 1 if a video is available on the website and 0 otherwise |

| Images (IM) |

The presence of images or visuals on the project/ campaign website |

Dummy variable of 1 if a video is available on the website and 0 otherwise |

Table 2.

Descriptive statistics.

Table 2.

Descriptive statistics.

| |

SP |

SPR |

DR |

BCK |

VD |

IM |

TA |

| Mean |

0.1535 |

0.1814 |

3.6217 |

1.3932 |

0.5535 |

0.7581 |

9.2926 |

| Median |

0.0000 |

0.0000 |

3.7136 |

0.6931 |

1.0000 |

1.0000 |

9.2103 |

| Maximum |

1.0000 |

1.0000 |

4.2047 |

7.7989 |

1.0000 |

1.0000 |

15.944 |

| Minimum |

0.0000 |

0.0000 |

1.0986 |

0.0000 |

0.0000 |

0.0000 |

5.8861 |

| Std. Dev. |

0.3613 |

0.3862 |

0.5414 |

1.7754 |

0.4983 |

0.4292 |

1.7965 |

| Observations |

215 |

215 |

215 |

215 |

215 |

215 |

215 |

Table 3.

Correlation matrix.

Table 3.

Correlation matrix.

| |

CS |

SPR |

DR |

VD |

IM |

TA |

BCK |

| CS |

1.000 |

|

|

|

|

|

|

| SPR |

-0.066 |

1.0000 |

|

|

|

|

|

| DR |

-0.1324** |

0.0369 |

1.000 |

|

|

|

|

| VD |

0.1488** |

0.180*** |

0.0703 |

1.000 |

|

|

|

| IM |

0.1501** |

0.0685 |

0.1022 |

0.170*** |

1.000 |

|

|

| TA |

-0.188*** |

-0.0550 |

0.296*** |

0.235*** |

0.0054 |

1.000 |

|

| BCK |

0.416*** |

-0.0666 |

-0.157** |

0.1582** |

-0.051503 |

0.1036 |

1.0000 |

Table 4.

Probit regression analysis.

Table 4.

Probit regression analysis.

| Variables |

Regression coefficient |

Standard errors |

P value |

| Constant |

5.5871 |

3.3153 |

0.091* |

| SPR |

-0.8990 |

0.9227 |

0.329 |

| DR |

0.5555 |

0.7986 |

0.486 |

| BCK |

0.0868 |

0.0192 |

0.000*** |

| VD |

0.3167 |

0.8243 |

0.700 |

| IM |

1.3205 |

1.1402 |

0.246 |

| TA |

-1.5133 |

0.3991 |

0.000*** |

| McFadden R-squared |

0.6741 |

|

|

| LR statistic |

124.28 |

|

|

| Prob(LR statistic) |

0.0000 |

|

|

Table 5.

Summary of hypothesis testing.

Table 5.

Summary of hypothesis testing.

| |

Hypothesis |

Results |

|

Spelling error Hypothesis |

The presence of spelling errors on a crowdfunding page decreases the probability of success of the crowdfunding campaign. |

Supported |

|

Duration Length Hypothesis |

The longer duration decreases the probability of success of a crowdfunding campaign. |

Not supported |

|

Targeted amount Hypothesis |

A more considerable targeted amount negatively influences the success of a crowdfunding campaign. |

Supported |

|

Backers Hypothesis |

The large number of backers increases the probability of success of a crowdfunding campaign. |

Supported |

|

Videos Hypothesis |

The availability of video is positively associated with the likelihood of success of a crowdfunding project. |

Supported |

|

Image Hypothesis |

The availability of images is positively associated with the likelihood of success of a crowdfunding project. |

Supported |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).