Submitted:

28 February 2025

Posted:

03 March 2025

You are already at the latest version

Abstract

Keywords:

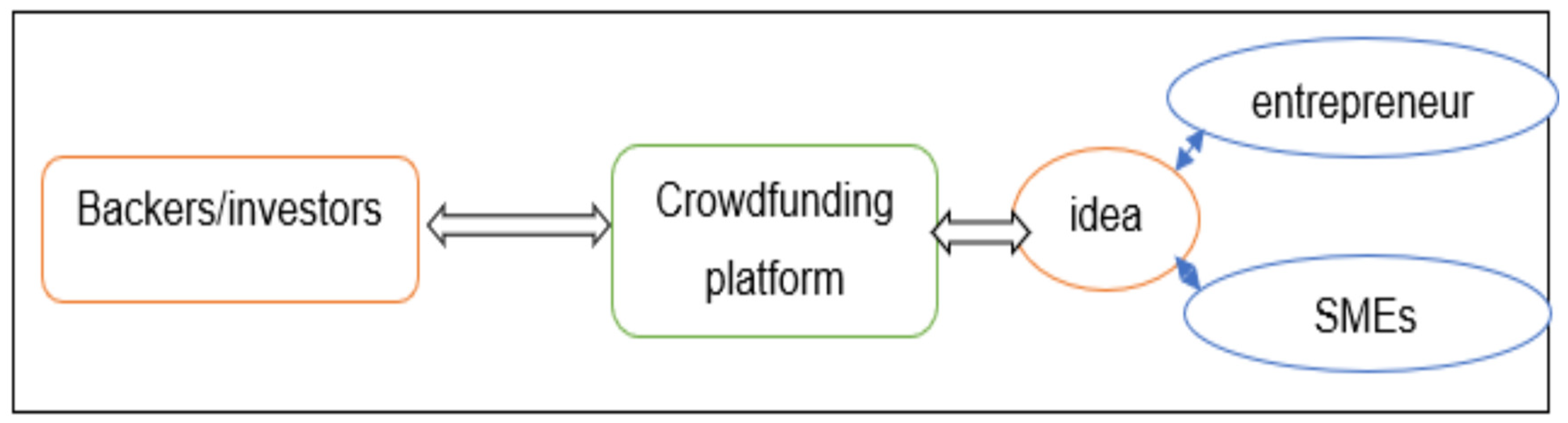

1. Introduction

- Incentives can play a varied role in crowdfunding success. Depending on the kind of campaign, they can be crucial, irrelevant, or even detrimental. The number of backers secured is the most consistent indicator of success across studies. The following questions are important: What is the impact of different kinds of incentive rewards, in other words, tangible products, exclusive experiences, and recognition, on the performance of crowdfunding campaigns in Africa? This question thus seeks to explore the relationship between various reward structures in securing backers and achieving campaign goals.

- To what extent do cultural, economic, and social factors play a role in the varying effect of incentive rewards on the performance of crowdfunding campaigns across different regions in Africa? This question addresses how regional and contextual issues affect the success of incentive-based crowdfunding strategies.

2. Literature Review and the Theoretical Framework

2.1. Information Asymmetry Theory

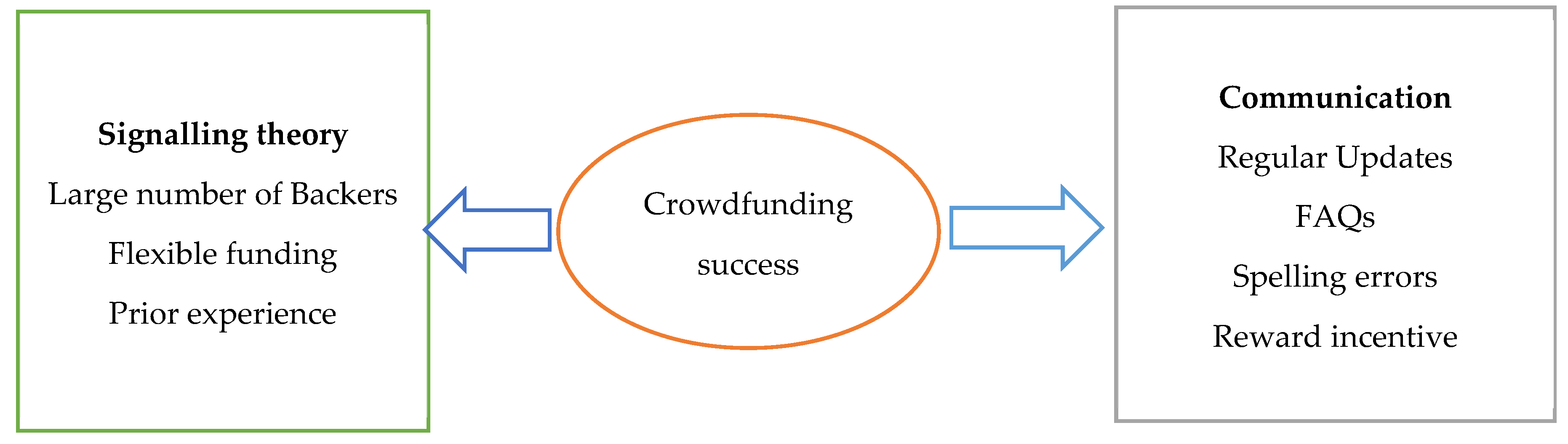

2.2. Signalling Theory

2.3. Expectancy Theory

2.4. Attribution Theory

3. Research Method and Materials

| Dependent variables | Measurements |

|---|---|

| Completion ratio (CR) | Ratio of the amount raised over the amount of money requested. |

| Success (SC) | The binary variable of 1 if the target amount was obtained and 0 otherwise. |

| Independent variables | |

| Reward incentive (REW) | The binary variable of 1 if a campaign provides rewards, and 0 otherwise. |

| Prior experience (EXP) | The dummy variable is 1 if the project creator has created more than two crowdfunding campaigns and 0 otherwise. |

| Spelling errors (SPR) | The dummy variable is 1 if there are spelling errors on the website and 0 otherwise. |

| Frequently ssked questions (FAQs) | Number of frequently asked questions on the project between the entrepreneur and the backers (transformed into a log). |

| Flexible funding (FXF) | The binary variable of 1 if is flexible funding and 0 if is fixed funding. |

| Regular updates (UPD) | The number of days for a campaign to raise funds (transformed into a log). |

| Large number of backers (BCK) | The number of supporters who contributed to the project (transformed into a log). |

4. Research Findings and Discussion

5. Implications of the Study

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgements

Conflicts of Interest

References

- Abbasi, Davood, Omid Mahdieh, and Fateme Shahsavari. 2024. "Identifying Factors Affecting the Success of Startups: A Phenomenological Study." Journal of Entrepreneurship Development 16, (4): 187-214. [CrossRef]

- Aideyan, Sarah Nnenna2023. Reward-Based Crowdfunding in Nigeria: Exploring the Mechanism of Trust. PhD thesis, Coventry University. Available at https://pure.coventry.ac.uk/ws/portalfiles/portal/82580062/Aideyan2023PhD.pdf (accessed on 19 February 2025).

- Baah-Peprah, Prince, and Rotem Shneor. 2022. A trust-based crowdfunding campaign marketing framework: theoretical underpinnings and big-data analytics practice. International Journal of Big Data Management, 2(1), pp.1-24. [CrossRef]

- Baber, Hasnan. 2021. Modelling the acceptance of e-learning during the pandemic of COVID-19: A study of South Korea. The International Journal of Management Education, 19(2), 1-15. [CrossRef]

- Badrova, A. Badrova, A., Ņečiporuka, M. and Lublóy, Á. (2024). Success factors of real estate crowdfunding projects: Evidence from Spain. Society and Economy, 46(2), 194-217. [CrossRef]

- Bagozzi, Richard P., Youjae Yi, and Lynn W. Phillips. 1991. Assessing construct validity in organisational research. Administrative Science Quarterly, 421-458. Available at https://www.jstor.org/stable/2393203 (Accessed on 21 February 2025).

- Bernardino, Susana, J. Freitas Santos, and Silvie Oliveira 2021. Financing nascent entrepreneurs by reward-based crowdfunding: Lessons from Indiegogo campaigns. In Handbook of research on nascent entrepreneurship and creating new ventures (pp. 228-252). IGI Global. [CrossRef]

- Bukhari, Farasat Ali Shah, Sardar Muhammad Usman, Muhammad Usman, and Khalid Hussain. 2020. The effects of creator credibility and backer endorsement in donation crowdfunding campaigns success. Baltic Journal of Management 15: 215–35. [CrossRef]

- Cai, Zhigang, Pengzhu Zhang, and Xiao Han. 2021. "The inverted U-shaped relationship between crowdfunding success and reward options and the moderating effect of price differentiation." China Finance Review International 11, (2): 230-258. Doi:. [CrossRef]

- Camilleri, Tania. 2018. Expectations, Self-Determination, Reward-Seeking Behaviour and Well-Being in Malta’s Financial Services Sector. Doctoral dissertation, University of Leicester. Available at https://figshare.le.ac.uk/articles/thesis/Expectations_Self-Determination_Reward-Seeking_Behaviour_and_Well-Being_in_Malta_s_Financial_Services_Sector/10235513 (Accessed on 21 February 2025).

- Cappa, Francesco, Federica Rosso, and Darren Hayes. 2019. Monetary and social rewards for crowdsourcing. Sustainability, 11(10), 1-14. [CrossRef]

- Carbonara, Nunzia. 2021. The role of geographical clusters in the success of reward-based crowdfunding campaigns. The International Journal of Entrepreneurship and Innovation, 22(1), 18-32. [CrossRef]

- Chao, Emmanuel James, Priscilla Serwaah, Prince Baah-Peprah, and Rotem Shneor. 2020. Crowdfunding in Africa: Opportunities and challenges. Advances in Crowdfunding: Research and Practice, 319-339. [CrossRef]

- Chen, Mu-Yen, Jing-Rong Chang, Long-Sheng Chen, and En-Li Shen. 2022. "The key successful factors of video and mobile game crowdfunding projects using a lexicon-based feature selection approach." Journal of Ambient Intelligence and Humanized Computing : 1-19. [CrossRef]

- Chen, Wendy D. 2023. Crowdfunding for social ventures. Social Enterprise Journal, 19(3), 256-276. https://www.emerald.com/insight/1750-8614.htm.

- Chen, Yuangao, Shasha Zhou, Wangyan Jin, and Shenqing Chen. 2023. "Investigating the determinants of medical crowdfunding performance: a signaling theory perspective." Internet Research 33, (3): 1134-1156. Doi:. [CrossRef]

- Connelly, Brian L., S. Trevis Certo, R. Duane Ireland, and Christopher R. Reutzel. 2011. "Signaling theory: A review and assessment." Journal of management 37, (1): 39-67. [CrossRef]

- Costello, Francis Joseph, and Kun Chang Lee. 2022. Exploring investors' expectancies and its impact on project funding success likelihood in crowdfunding by using text analytics and Bayesian networks. Decision Support Systems, 154, 1-12. [CrossRef]

- Dambanemuya, Henry K., and Emőke-Ágnes Horvát. 2021."A multi-platform study of crowd signals associated with successful online fundraising." Proceedings of the ACM on Human-Computer Interaction 5, no. CSCW1: 1-19. [CrossRef]

- Dehdashti, Yashar, Aidin Namin, Brian T. Ratchford, and Lawrence B. Chonko. 2022. The unanticipated dynamics of promoting crowdfunding donation campaigns on social media. Journal of Interactive Marketing, 57(1), 1-17. [CrossRef]

- Demiray, Melek, Sebnem Burnaz, and Yonca Aslanbay. 2019. The crowdfunding market, models, platforms, and projects. In Crowdsourcing: Concepts, Methodologies, Tools, and Applications (pp. 115-151). IGI Global. [CrossRef]

- Deng, Lingfei, Qiang Ye, DaPeng Xu, Wenjun Sun, and Guangxin Jiang. 2022. "A literature review and integrated framework for the determinants of crowdfunding success." Financial Innovation 8, (1): 1-70. [CrossRef]

- Di Pietro, Francesca, and Francesca Tenca. 2024. "The role of entrepreneur’s experience and company control in influencing the credibility of passion as a signal in equity crowdfunding." Venture Capital 26, (2): 109-130. [CrossRef]

- dos Santos Felipe, Israel José, Wesley Mendes-Da-Silva, Cristiana Cerqueira Leal, and Danilo Braun Santos. 2022. Reward crowdfunding campaigns: Time-to-success analysis. Journal of Business Research, 138, 214-228. [CrossRef]

- Durojaiye, Aminat Tinuwonuola, Chikezie Paul-Mikki Ewim, and Abbey Ngochindo Igwe. 2024. "Developing a crowdfunding optimization model to bridge the financing gap for small business enterprises through data-driven strategies." International Journal of Scholarly Research and Reviews, 05(2), 052–069. [CrossRef]

- Efrat, Kalanit, Shaked Gilboa, and Arie Sherman. 2020. The role of supporter engagement in enhancing crowdfunding success. Baltic Journal of Management, 15(2), 199-213. [CrossRef]

- Eisenbeiss, Maik, Sven A. Hartmann, and Lars Hornuf. 2023. Social media marketing for equity crowdfunding: Which posts trigger investment decisions? Finance Research Letters, 52,1-9. [CrossRef]

- Fang, Xing. 2024. "Can crowdfunding creators learn from previous experiences to have a better future financing performance?." Journal of Business & Industrial Marketing 39, (2): 288-298. [CrossRef]

- Foster, Joshua. 2019. Thank you for being a friend: The roles of strong and weak social network ties in attracting backers to crowdfunded campaigns. Information Economics and Policy, 49, 1-10. [CrossRef]

- Ganguli, Ina, Marieke Huysentruyt, and Chloé Le Coq. 2021. How do nascent social entrepreneurs respond to rewards? A field experiment on motivations in a grant competition. Management Science, 67(10), 6294-6316. https://orcid.org/0000-0003-3523-6323.

- Gong, Jing, Paul A. Pavlou, and Zuyin Zheng. 2020. On the use of probabilistic uncertain rewards on crowdfunding platforms: The case of the lottery. Information Systems Research, 32(1), 115-129. [CrossRef]

- Gregoriades, Andreas, and Christos Themistocleous. 2025. "Improving Crowdfunding Decisions Using Explainable Artificial Intelligence." Sustainability 17, (4): 1-19. [CrossRef]

- Haasbroek, Francois, and Marius Ungerer. 2020. Theory versus practise: Assessing reward-based crowdfunding theory through a South African case study. South African Journal of Business Management, 51(1), 1-11. [CrossRef]

- Hackman, J. Richard, and Lyman W. Porter. 1968. "Expectancy theory predictions of work effectiveness." Organizational behavior and human performance 3, (4): 417-426. [CrossRef]

- Hair, Joseph F., Christian M. Ringle, and Marko Sarstedt. 2011. The use of partial least squares (PLS) to address marketing management topics. Journal of Marketing Theory and Practice, 19(2), 135-138. Available at https://ssrn.com/abstract=2228902 (Accessed on 21 February 2025).

- Ho, Han-Chiang, Candy Lim Chiu, Somkiat Mansumitrchai, Zhengqing Yuan, Nan Zhao, and Jiajie Zou. 2021."The influence of signals on donation crowdfunding campaign success during COVID-19 crisis." International journal of environmental research and public health 18, (14): 1-25. [CrossRef]

- Huang, Shuangfa, David Pickernell, Martina Battisti, and Thang Nguyen. 2022."Signalling entrepreneurs’ credibility and project quality for crowdfunding success: cases from the Kickstarter and Indiegogo environments." Small Business Economics : 1-21. [CrossRef]

- Huang, Zhengwei, Jing Ouyang, Xiaohong Huang, Yanni Yang, and Ling Lin. 2021. "Explaining donation behavior in medical crowdfunding in social media." Sage Open 11, (2): 1-12. [CrossRef]

- Ismaila, Bouba. 2023. The state of crowdfunding in Africa and its potential impact: a literature review. International Journal of Research in Business and Social Science (2147-4478), 12(5), 258-268. [CrossRef]

- Jáki, Erika, Gábor Csepy, and Nikolett Kovács. 2022."Conceptual framework of the crowdfunding success factors–Review of the academic literature." Acta Oeconomica 72, (3): 393-412. [CrossRef]

- Jiang, Han, Zhiyi Wang, Lusi Yang, Jia Shen, and Jungpil Hahn. 2021. How rewarding are your rewards? A value-based view of crowdfunding rewards and crowdfunding performance. Entrepreneurship Theory and Practice, 45(3), 562-599. [CrossRef]

- Katseli, Louka T., and Paraskevi Boufounou. 2020. Crowdfunding: An innovative instrument for development finance and financial inclusion. In Recent advances and applications in alternative investments (pp. 259-285). IGI Global. Available at https://www.igi-global.com/chapter/crowdfunding/250468 (Accessed on 21 February 2025).

- Kock, Ned. 2015. Common method bias in PLS-SEM: A full collinearity assessment approach. International Journal of e-Collaboration (ijec), 11(4), 1-10. [CrossRef]

- Kreilkamp, Niklas, Sascha Matanovic, Maximilian Schmidt, and Arnt Wöhrmann. 2023. How executive incentive design affects risk-taking: a literature review. Review of Managerial Science, 17(7), 2349-2374. 374. [CrossRef]

- Li, Gen, and Jing Wang. 2019. Threshold effects on backer motivations in reward-based crowdfunding. Journal of Management Information Systems, 36(2), 546-573. [CrossRef]

- Li, Qingxiang, and Nianxin Wang. 2024."Fundraiser engagement, third-party endorsement and crowdfunding performance: A configurational theory approach." Plos one 19, (8): 1-31. [CrossRef]

- Li, Yijing, Fei Liu, Wenjie Fan, Eric TK Lim, and Yong Liu. 2022. Exploring the impact of initial herd on overfunding in equity crowdfunding. Information & Management, 59(3) 546-573. [CrossRef]

- Li, Yuanqing, Nan Xiao, and Sibin Wu. 2021. "The devil is in the details: The effect of nonverbal cues on crowdfunding success." Information & Management 58, (8): 1-18. Https://doi.org/10.1016/j.im.2021.103528 Liang Yang, Meng Zhao, Miyan Liao, and Yunzhong Cao. 2022. Exploring the success determinants of crowdfunding for cultural and creative projects: An empirical study based on signal theory. Technology in Society 70: 1-13. Https://doi.org/10.1016/j.techsoc.2022.102036.

- Liang, Ting-Peng, Shelly Ping-Ju Wu, and Chih-chi Huang. 2019. Why funders invest in crowdfunding projects: Role of trust from the dual-process perspective. Information & Management, 56(1), 70-84. Doi :. [CrossRef]

- Liu, Zhunzhun, Shenglin Ben, and Ruidong Zhang. 2023. Factors affecting crowdfunding success. Journal of Computer Information Systems, 63(2), 241-256. [CrossRef]

- Mamaro, Lenny Phulong, and Athenia Bongani Sibindi. 2023."Role of Social Networks in Crowdfunding Performance During the COVID-19 Pandemic in Africa." Journal of Risk Analysis and Crisis Response 13, (3): 117-135. [CrossRef]

- Ma, Shuang, Ying Hua, Dahui Li, and Yonggui Wang. 2022. "Proposing customers economic value or relational value? A study of two stages of the crowdfunding project." Decision Sciences 53, (4): 712-749. [CrossRef]

- Mosca, Fabrizio, Serena Bianco, and Claudia Pescitelli. 2019. Integrated Communication for Start-Ups Toward an Innovative Framework. The Future of Risk Management, Volume II: Perspectives on Financial and Corporate Strategies, 361-401. [CrossRef]

- Ngalim, Lawrence, and Asli Togan. 2023. Private Equity Industry in Africa: Firm Survival and Growth.1, 1-29 Available at SSRN: https://ssrn.com/abstract=4340228 (Accesses on 16 October 2025) or. [CrossRef]

- Omenguélé, René Guy, and Yimpi Cédric Mbouolang. 2022. When the social networks and internet come to the rescue of entrepreneurs: The problematic of crowdfunding in Africa. The Journal of Entrepreneurial Finance (JEF), 24(1), 44-66. [CrossRef]

- Ozili, Peterson K. 2023. "The acceptable R-square in empirical modelling for social science research." In Social research methodology and publishing results: A guide to non-native english speakers, pp. 134-143. IGI global. [CrossRef]

- Petit, Aurélien, and Peter Wirtz. 2022."Experts in the crowd and their influence on herding in reward-based crowdfunding of cultural projects." Small Business Economics 58, (1): 419-449. [CrossRef]

- Pinkow, Felix. 2022. The impact of common success factors on overfunding in reward-based crowdfunding: An explorative study and avenues for future research. Journal of Entrepreneurship, Management and Innovation, 18(1), 131-167. [CrossRef]

- Posch, Lisa, Andreas Mladenow, and Christine Strauss. 2022. "Reward-based Crowdfunding: successful signaling from an entrepreneur." In COLINS, pp. 999-1014. Available at https://www.researchgate.net/profile/Christine-Strauss-2/publication/362861372_Reward-based_Crowdfunding_successful_signaling_from_an_entrepreneur/links/63049d57aa4b1206facf1fed/Reward-based-Crowdfunding-successful-signaling-from-an-entrepreneur.pdf (Accessed on 18 February 2025).

- Regner, Tobias, and Paolo Crosetto. "The experience matters: participation-related rewards increase the success chances of crowdfunding campaigns." Economics of Innovation and New Technology 30, (8): 843-856. [CrossRef]

- Ribeiro-Navarrete, Samuel, Daniel Palacios-Marqués, Carlos Lassala, and Klaus Ulrich. 2021. Key factors of information management for crowdfunding investor satisfaction. International Journal of Information Management, 59, 1-10. [CrossRef]

- Šamić Šarić, Marija. 2021. Determinants of crowdfunding success in Central and Eastern European countries. Management Journal of Contemporary Management Issues, 26(2), 99-113. https://www.ceeol.com/search/article-detail?id=1035415.

- Sauermann, Henry, Chiara Franzoni, and Kourosh Shafi. 2019. Crowdfunding scientific research: Descriptive insights and correlates of funding success. PloS One, 14(1),1-26. [CrossRef]

- Scaife, Wendy. 2023."Disaster fundraising: readiness matters." In Philanthropic Response to Disasters, 44-75. Policy Press,. [CrossRef]

- Shen, Feiyang, Lijun Ma, Tsan-Ming Choi, and Weili Xue. 2021."Quality and pricing decisions for reward-based crowdfunding: Effects of moral hazard." Available at SSRN 3925914. 1-31. [CrossRef]

- Shneor, Rotem, and Amy Ann Vik. 2020. Crowdfunding success: A systematic literature review 2010–2017. Baltic Journal of Management 15: 149–182. [CrossRef]

- Shneor, Rotem, Liang Zhao, and Jann Fabian Michael Goedecke. 2023. "On relationship types, their strength, and reward crowdfunding backer behavior." Journal of Business Research 154: 1-12. [CrossRef]

- Silva, Lafaiet, Nádia Félix Silva, and Thierson Rosa. 2020. Success prediction of crowdfunding campaigns: a two-phase modeling. International Journal of Web Information Systems, 16(4), 387-412. [CrossRef]

- Solodoha, Eliran. 2024."How Much Is Too Much? The Impact of Update Frequency on Crowdfunding Success." Administrative Sciences 14, (12): 1-13. [CrossRef]

- Soltani Delgosha, Mohammad, Nastaran Hajiheydari, and Hossein Olya. 2024. A person-centred view of citizen participation in civic crowdfunding platforms: A mixed-methods study of civic backers. Information Systems Journal 34:1626–1663. [CrossRef]

- Song, Yang, Ron Berger, Abraham Yosipof, and Bradley R. Barnes. 2019. Mining and investigating the factors influencing crowdfunding success. Technological Forecasting and Social Change, 148, 1-10. [CrossRef]

- Soublière, Jean-François, and Joel Gehman. 2020. The legitimacy threshold revisited: How prior successes and failures spill over to other endeavors on Kickstarter. Academy of Management Journal, 63(2), 472-502. [CrossRef]

- Spence, Michael. 2002. Signaling in retrospect and the informational structure of markets. American Economic Review, 92(3), 434-459. Available at https://www.jstor.org/stable/3083350 (Accessed on 13 January 2025).

- Telve, Linda. 2019. Building a successful crowdfunding campaign: what marketing factors do really matter for your project? Doctoral dissertation. Catolica Lisbon Business Economic. Available at https://www.proquest.com/docview/2925087173?pq-origsite=gscholar&fromopenview=true (Accessed on 21 February 2025).

- Theerthaana, P. Theerthaana P., Hansa and Lysander Manohar. 2021. "How a doer persuade a donor? Investigating the moderating effects of behavioral biases in donor acceptance of donation crowdfunding." Journal of Research in Interactive Marketing 15, (1): 243-266. [CrossRef]

- Tian, Ying, and Yao Zhang. 2023. The impact of the reward scheme design on crowdfunding performance. Technological Forecasting and Social Change, 194, 1-18. [CrossRef]

- Verschoore, Jorge R., and Mariana DM Araújo. 2020."The effect of reward strategies on the success of crowdfunding campaigns." RAM. Revista de Administração Mackenzie 21, (4): 1-25. [CrossRef]

- Wachira, Virginia Kirigo. 2021. Crowdfunding in Kenya: Factors for Successful Campaign. Public Finance Quarterly 3: 413–28. Available at http://ir.kabarak.ac.ke/handle/123456789/901 (Accessed on 21 February 2025).

- Wang, Wei, Yuting Xu, Yenchun Jim Wu, and Mark Goh. 2022."Linguistic understandability, signal observability, funding opportunities, and crowdfunding campaigns." Information & Management 59, (2): 1-11. [CrossRef]

- Wessel, Michael, Rob Gleasure, and Robert J. Kauffman. 2021. "Sustainability of rewards-based crowdfunding: A quasi-experimental analysis of funding targets and backer satisfaction." Journal of Management Information Systems 38, (3): 612-646. [CrossRef]

- Woods, Clinton, Han Yu, and Hong Huang. 2020."Predicting the success of entrepreneurial campaigns in crowdfunding: a spatio-temporal approach." Journal of Innovation and Entrepreneurship 9: 1-23. [CrossRef]

- Yang, Jialiang, Yaokuang Li, Goran Calic, and Anton Shevchenko. 2020. "How multimedia shape crowdfunding outcomes: The overshadowing effect of images and videos on text in campaign information." Journal of Business Research 117: 6-18. [CrossRef]

- Yasar, Burze. 2021. "The new investment landscape: Equity crowdfunding." Central Bank Review 21, (1): 1-16. [CrossRef]

- Zhai, Yimeng, and Wangbing Shen. 2024."Signaling theory in charity-based crowdfunding: Investigating the effects of project creator characteristics and text linguistic style on fundraising performance." Heliyon 10, (4): 1-12. [CrossRef]

- Zhang, Xing, Xinyue Wang, Durong Wang, Quan Xiao, and Zhaohua Deng. 2024. "How the linguistic style of medical crowdfunding charitable appeal influences individuals' donations." Technological Forecasting and Social Change 203: 1-12. [CrossRef]

- Zribi, Sirine. 2022. Effects of social influence on crowdfunding performance: Implications of the COVID-19 pandemic. Humanities and Social Sciences Communications 9: 192. 1-8. [CrossRef]

| Variables | Obs | Mean | Median | SD | Minimum | Maximum | Skewness | Kurtosis |

|---|---|---|---|---|---|---|---|---|

| Success | 854 | 0.160476 | 0.000000 | 0.733397 | 0.000000 | 14.58500 | 12.61770 | 216.6589 |

| Reward | 854 | 0.866511 | 1.000000 | 0.340302 | 0.000000 | 1.000000 | -2.15529 | 5.645282 |

| EXP | 854 | 0.196721 | 0.000000 | 0.397753 | 0.000000 | 1.000000 | 1.525854 | 3.328231 |

| FAQ | 854 | 0.099532 | 0.000000 | 0.911397 | 0.000000 | 13.00000 | 10.55899 | 120.6652 |

| FXF | 854 | 0.761124 | 1.000000 | 0.426647 | 0.000000 | 1.000000 | -1.22479 | 2.500121 |

| BCK | 854 | 19.58197 | 0.000000 | 118.2678 | 0.000000 | 2438.000 | 13.63608 | 235.6418 |

| SPR | 854 | 0.281030 | 0.000000 | 0.449766 | 0.000000 | 1.000000 | 0.974276 | 1.949213 |

| UPD | 854 | 0.918033 | 0.000000 | 3.153045 | 0.000000 | 36.00000 | 5.603258 | 42.04372 |

| Observations | VIF | CR | REW | EXP01 | FAQ | FXF | BCK | SPR | UPD |

|---|---|---|---|---|---|---|---|---|---|

| SC | DV | 1.000 | |||||||

| REW | 1.1123 | 0.077** | 1.000 | ||||||

| EXP | 1.1077 | 0.0958** | 0.194*** | 1.000 | |||||

| FAQ | 1.0841 | 0.151*** | 0.0429 | 0.0591* | 1.000 | ||||

| FXF | 1.0910 | -0.209*** | -0.058* | -0.098*** | -0.195*** | 1.000 | |||

| BCK | 1.23132 | 0.422*** | 0.059* | 0.175*** | 0.195*** | -0.147*** | 1.000 | ||

| SPR | 1.08411 | -0.0278 | 0.245*** | 0.077** | -0.025 | 0.0936** | -0.0463 | 1.000 | |

| UPD | 1.36362 | 0.4765*** | 0.1143*** | 0.241*** | 0.296*** | -0.231*** | 0.4160*** | -0.027 | 1.000 |

| Hypothesis variables | Coefficient (β) | Std. Error | Prob |

|---|---|---|---|

| : Reward incentive | 0.202971 | 0.381730 | 0.5949 |

| : Prior experience | 0.218184 | 0.218931 | 0.3190 |

| : Frequently Asked questions | -0.034899 | 0.088288 | 0.6926 |

| : Flexible funding | -0.634501 | 0.192368 | 0.0010*** |

| : Large number of backers | 0.030202 | 0.003268 | 0.0000*** |

| : Spelling errors | -0.2145 | 0.01777 | 0.3429 |

| : Regular updates | 0.033746 | 0.027196 | 0.2147 |

| C | -1.958281 | 0.372702 | 0.0000 |

| 0.586165 | |||

| Number of observations | 856 | ||

| Prob(LR statistic) | 0.00000 |

| Hypothesis | Support |

|---|---|

| : A reward incentive has a positive effect on a crowdfunding campaign, increasing the probability of its success. | Supported |

| : An entrepreneur's prior experience has a positive effect on their crowdfunding campaign, increasing the probability of its success. | Supported |

| : The presence of spelling errors in presenting a crowdfunding project has a detrimental effect on its possible success. | Supported |

| : Frequently asked questions have a positive impact on a crowdfunding campaign, increasing the possibility of its success. | Not supported |

| : The flexible funding mechanism has a negative effect on potential crowdfunding success. | Supported |

| : Regular updates have a significant and positive effect on the success of a crowdfunding campaign. | Supported |

| : A large number of backers has a significant and positive effect on a crowdfunding campaign, increasing the probability of its success. | Supported |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).