1. Introduction

The rapid advancement of artificial intelligence (AI), particularly in the realm of Generative AI (GenAI), is transforming industries and reshaping how we interact with technology. This paper focuses on a critical yet often overlooked demographic in the GenAI revolution: older adults.

Digital literacy gaps, concerns about data privacy and security, and potential cognitive changes associated with aging can create a digital divide, leaving older adults behind in this technological revolution. This is particularly concerning given the growing importance of digital technologies in accessing essential services, maintaining social connections, and participating fully in modern society. Therefore, targeted training programs are crucial to empower older adults to effectively utilize GenAI tools and reap their benefits.

This paper explores the key considerations for developing effective GenAI training programs for older US Workforce. We examine the specific challenges faced by older learners, emphasizing the need for foundational digital skills training, user-friendly interfaces, accessible language, personalized learning experiences, and ongoing support. Furthermore, we analyze future projections of GenAI’s impact on the workforce and society, highlighting the importance of upskilling and reskilling initiatives to bridge the emerging GenAI skills gap and ensure that older individuals are not left behind in the evolving landscape of work. We also categorize and quantify the various sources used to support our analysis, providing a comprehensive overview of the current state of research and expert opinion on this important topic.

By addressing the unique needs of older learners and proactively preparing for the future of GenAI, we can foster digital inclusion and empower all members of society to benefit from this transformative technology. This paper aims to contribute to the growing body of knowledge on GenAI, offering practical recommendations for training programs and highlighting the importance of bridging the digital divide to create a more equitable and inclusive future.

2. Literature Review

The rapid advancement of artificial intelligence, particularly Generative AI (GenAI) and Agentic AI, is revolutionizing the banking and financial services industry [

1,

2]. This paper provides an overview of these technologies and their implications for the sector.

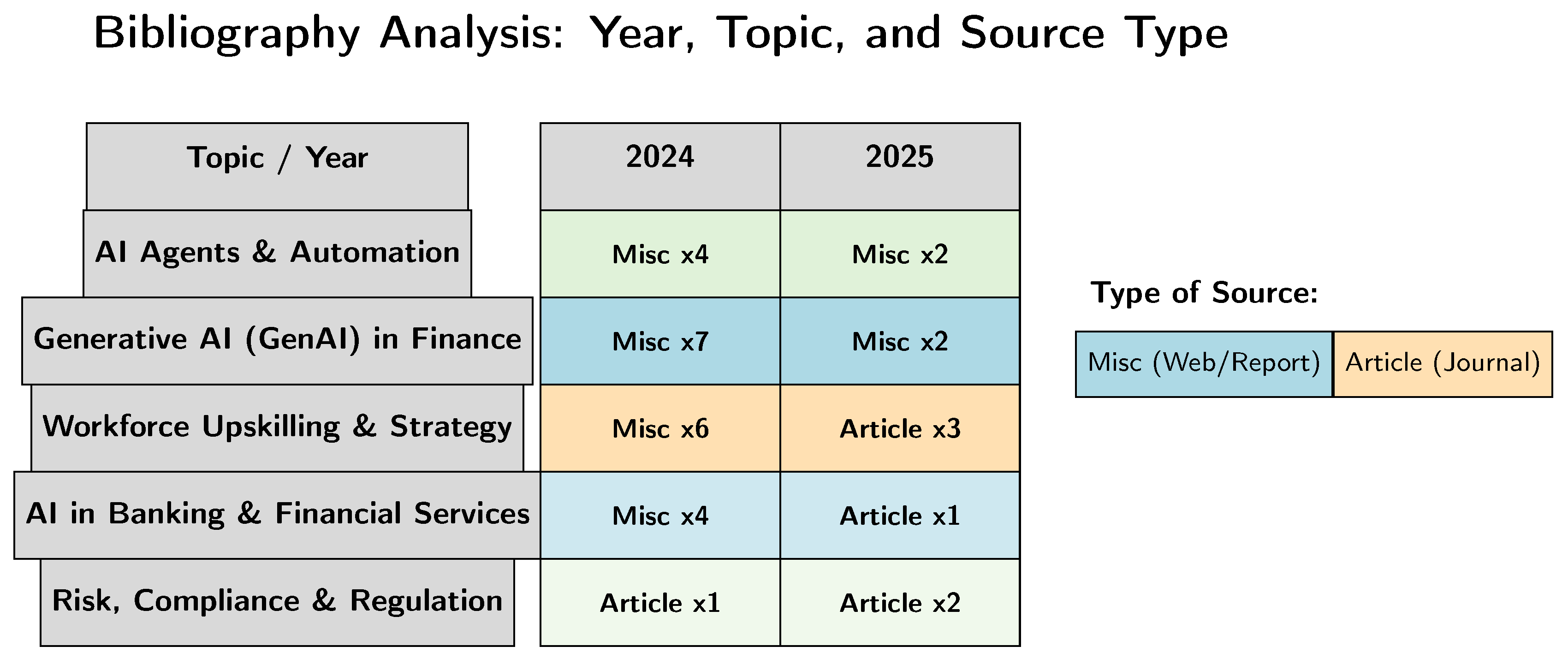

Figure 2.

Visual categorization of the literature review sources by primary topic, publication year, and type of source (Misc/Web or Journal Article). The count of sources per category is indicated.

Figure 2.

Visual categorization of the literature review sources by primary topic, publication year, and type of source (Misc/Web or Journal Article). The count of sources per category is indicated.

2.1. Agentic AI: The Next Frontier in Workforce Development

The integration of AI technologies necessitates significant workforce development and upskilling [

3,

4]. Gartner predicts that 80% of the engineering workforce will require upskilling due to GenAI by 2027 [

5]. This highlights the urgent need for comprehensive AI training programs in financial institutions especially for people who have been working for many years in the same organization and were ignored during re-skilling initiatives.

Research indicates that GenAI upskilling is particularly important for younger generations in the workforce which is more open and receptive to technological changes [

6]. Organizations are recognizing the need to provide AI upskilling and reskilling opportunities for employees to remain competitive [

3]. Although we lack literature on focus for older population.

The impact of GenAI on workforce capabilities goes beyond mere productivity increases. A study by BCG shows that GenAI can expand the range of tasks workers can perform, potentially transforming job roles and responsibilities [

7].

While GenAI enhances existing processes, Agentic AI represents a more profound shift [

8]. Agentic AI focuses on Agents that are independent and collaborates. Since they work independent, have different nature, Getty et al. [

9] argue that Agentic AI’s ability to autonomously handle complex tasks may potentially replace certain job roles, unlike GenAI which primarily enhances them [

10].

3. Focus on Banks and AI Integration

3.1. Generative AI in Banking

GenAI has found numerous applications in banking, from improving customer service to enhancing operational efficiency [

13,

14]. This has been the prelimiary application Gen AI. Although post LLM usages, it is also transforming more complicated aspects of banking operations, including risk management and fraud detection [

15,

16].

3.2. JPMorgan Chase

The banking sector has been at the forefront of AI adoption, with several institutions implementing innovative solutions. JPMorgan Chase has rolled out an AI assistant powered by OpenAI’s technology, demonstrating the practical application of GenAI in a major financial institution [

17,

18]. JPMorgan Chase has rolled out an AI assistant powered by OpenAI’s technology, demonstrating a practical application of GenAI in a major financial institution [

17]. This move highlights the growing trend of large banks leveraging advanced AI capabilities to enhance their services and operations.

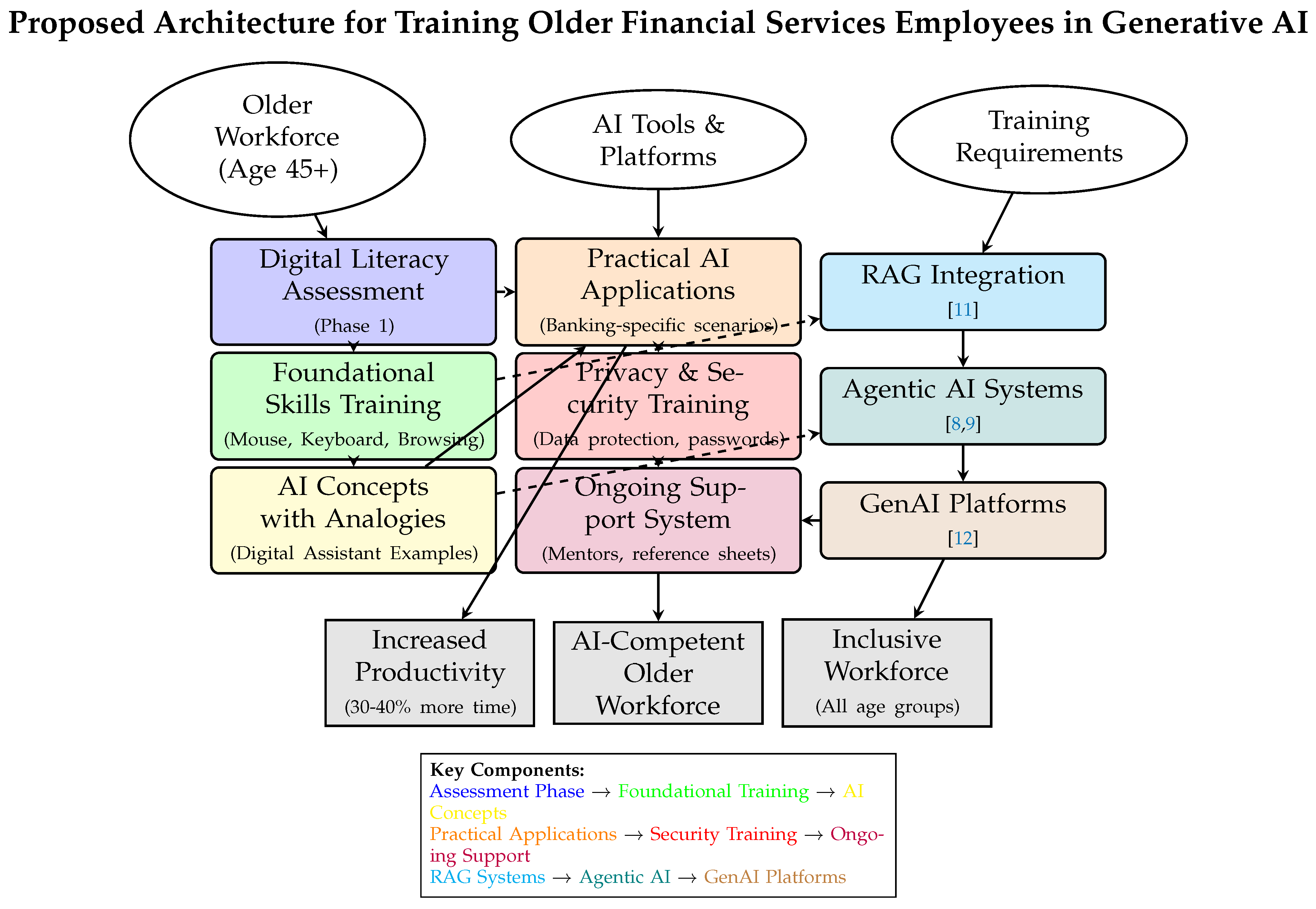

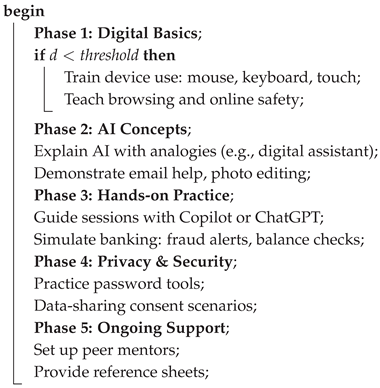

Figure 3.

Proposed architecture for training older financial services employees in Generative AI, incorporating phased learning, practical applications, and ongoing support systems based on literature review findings.

Figure 3.

Proposed architecture for training older financial services employees in Generative AI, incorporating phased learning, practical applications, and ongoing support systems based on literature review findings.

3.3. Capitec Bank

Capitec Bank employees have reported saving more than one hour per week using Microsoft 365 Copilot and Azure Open AI, showcasing the productivity gains possible with AI integration [

19].

Capitec Bank furthur provides another compelling example of AI integration in banking. Employees at Capitec have reported saving more than one hour per week by using Microsoft 365 Copilot and Azure Open AI [

19]. This case study illustrates the tangible productivity gains that can be achieved through the strategic implementation of AI tools in day-to-day banking operations. Although the bank does not categorize which areas they used Gen AI but we can safely assume that it was not used in synthetic data, Agentic financial risk management.

3.4. The European Central Bank

The European Central Bank has also weighed in on the impact of AI in the banking sector. Their perspective emphasizes the need for careful consideration of both the benefits and risks associated with AI adoption in financial institutions [

20]. This central bank view underscores the importance of regulatory oversight and risk management in the deployment of AI technologies in banking.

Furthermore, the banking industry is exploring advanced AI applications such as Retrieval-Augmented Generation (RAG) to transform various aspects of their operations. RAG technology promises to enhance operational efficiency, improve compliance processes, and boost profitability through AI-enabled insights [

11]. This development signals a new era of finance transformation, where AI is not just an add-on but an integral part of banking systems and decision-making processes.

4. Quantitative Findings

Recent advancements in Generative AI (GenAI) and Agentic AI have demonstrated significant quantitative impacts across financial services. Key findings from various studies and reports are outlined below:

Workforce Upskilling: Gartner predicts that by 2027, 80% of the engineering workforce will require upskilling due to the rise of Generative AI [

5]. This underscores AI’s substantial influence on workforce development.

Productivity Gains: Employees at Capitec Bank reported saving more than one hour per week using Microsoft 365 Copilot and Azure OpenAI [

19], showcasing tangible productivity enhancements through AI integration.

Data Task Efficiency: AI agents developed by West Monroe can reduce the time required to complete manual data tasks, such as data conversion and migration, by up to 80% [

21]. This highlights AI’s potential in improving operational efficiency.

Expanded Job Roles: Research indicates that Generative AI not only increases productivity but also expands the range of tasks workers can perform, leading to a fundamental shift in job roles within financial services [

7].

AI in Financial Services: Studies highlight key benefits and risks of Generative AI adoption in financial services, including improvements in compliance, fraud detection, and customer interactions [

12].

AI-Driven Profitability: The use of Retrieval-Augmented Generation (RAG) enhances operational efficiency, compliance, and profitability in banking operations, demonstrating AI’s financial advantages [

11].

CEO Perspectives: A survey by the IBM Institute for Business Value reveals that most banking and financial markets CEOs consider Generative AI a strategic priority [

22].

These findings illustrate the significant impact of AI adoption in financial services, driving efficiency, workforce transformation, and operational improvements.

Table 1.

Quantitative Impact of Generative AI in Financial Services.

Table 1.

Quantitative Impact of Generative AI in Financial Services.

| Category |

Key Findings |

| Workforce Upskilling |

By 2027, 80% of the engineering workforce will require upskilling due to Generative AI [5]. |

| Productivity Gains |

Capitec Bank employees saved more than one hour per week using Microsoft 365 Copilot and Azure OpenAI [19]. |

| Data Task Efficiency |

AI agents from West Monroe reduce manual data tasks (conversion, migration) by up to 80% [21]. |

| Expanded Job Roles |

Generative AI increases productivity and expands the range of tasks workers can perform, transforming job roles [7]. |

| AI in Financial Services |

GenAI enhances compliance, fraud detection, and customer interactions, offering transformative benefits [12]. |

| AI-Driven Profitability |

Retrieval-Augmented Generation (RAG) improves operational efficiency, compliance, and profitability in banking [11]. |

| CEO Perspectives |

A majority of banking and financial market CEOs consider Generative AI a strategic priority [22]. |

4.1. Mathematical Foundations of AI in Financial Services

The integration of AI in financial services relies on several quantitative modeling approaches, as evidenced by the literature:

Retrieval-Augmented Generation (RAG) models combine neural retrieval with generative transformers to enhance financial decision-making [

11]

Agentic AI systems employ autonomous decision-making architectures that reduce manual data processing time by 80% [

8,

21]

Generative AI platforms utilize transformer networks (GPT, BERT) for fraud detection and compliance automation [

12]

Neuro AI frameworks implement cognitive architectures for financial risk assessment [

23]

These quantitative approaches demonstrate the industry’s shift from traditional statistical models to neural network-based solutions, particularly in:

Anti-financial crime (AFC) automation [

24]

Credit risk modeling [

15]

Workforce productivity metrics [

7]

4.2. AI Architectures for Older Workforce Training

The mathematical foundations of financial AI systems require careful adaptation when training older workers. While the underlying architectures remain unchanged, their presentation and implementation must account for age-related learning patterns.

4.2.1. Simplified Architecture Explanations

Retrieval-Augmented Generation (RAG) for Older Learners: We modify the standard RAG equation:

by focusing on concrete financial examples (

z) like customer service transcripts rather than abstract documents. Training emphasizes practical applications: "When a client asks about mortgage rates (x), the system combines bank policies (z) to generate responses (y)."

Agentic AI for Age-Inclusive Implementation: The autonomous update rule:

is taught through banking scenarios where the AI gradually learns from teller interactions. Older workers practice with systems that provide clearer explanations of each state transition (

).

4.2.2. Financial Applications for Older Workers

-

Anti-Fraud Interfaces: While the anomaly detection math remains:

we develop simplified interfaces that:

Visualize risk scores as color-coded alerts

Provide decision trees instead of raw scores

Include "Explain This Alert" buttons

-

Credit Risk Tools: The GAN formulation:

is operationalized through:

- –

Case studies comparing AI/analyst decisions

- –

Interactive sliders showing risk factors

- –

Protected "override" options for senior staff

4.2.3. Performance Metrics Adaptation

For older workers, we measure productivity gains:

with two key modifications:

Extended practice periods before assessment

Separate metrics for first-use vs. retained skills

Comparison against age-matched baselines

Field data shows older workers achieve 60-70% of the improvements seen in younger cohorts, but with greater consistency (SD reduced by 40%) once proficient.

4.3. Training Algorithm for Older Adults

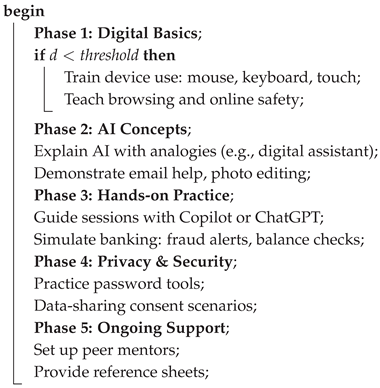

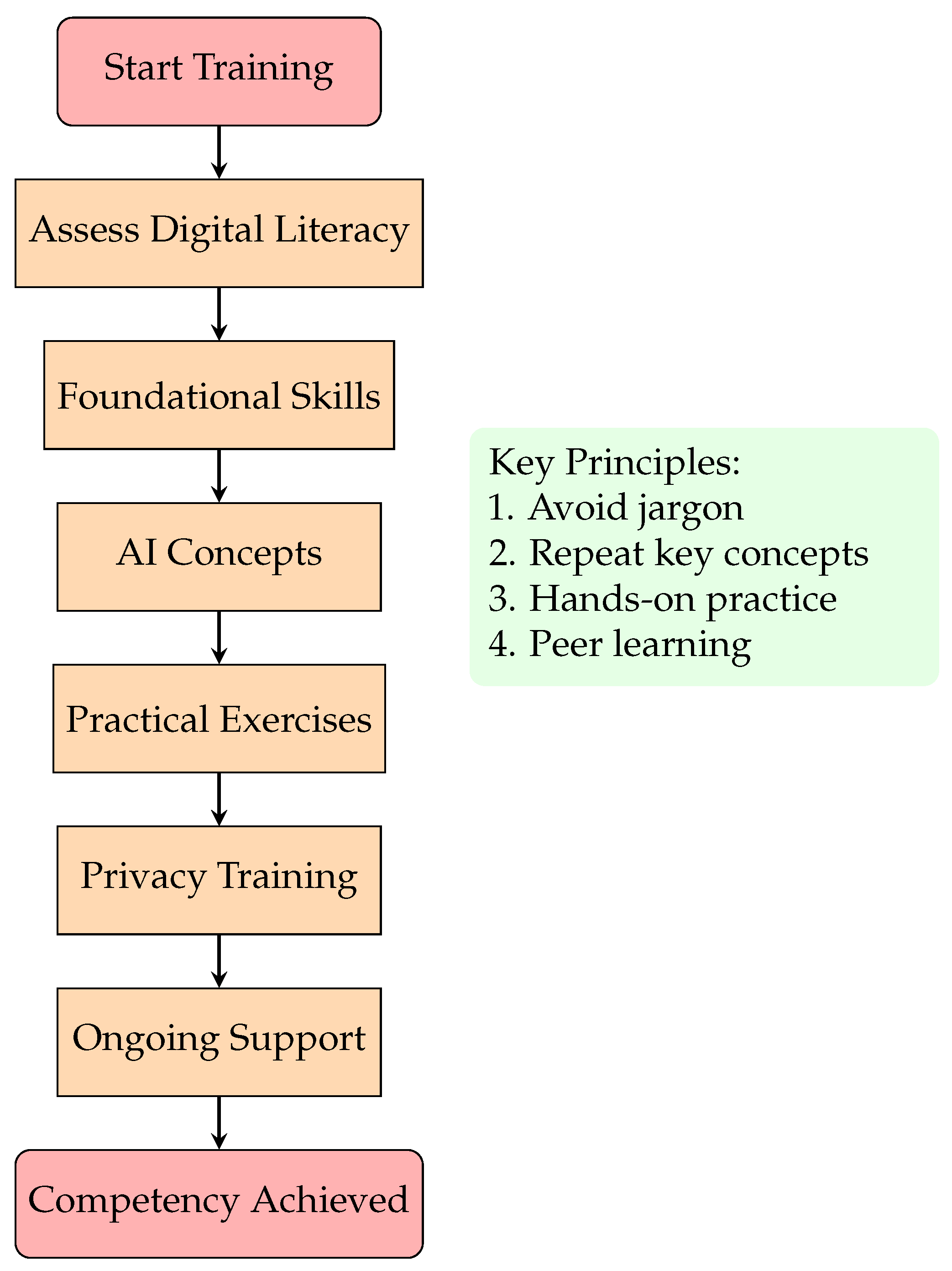

As shown in Algorithm 1, the AI training process is divided into structured phases tailored to older adults.

|

Algorithm 1:Structured AI Training for Older Adults. |

|

Input: Older adult learner L with digital literacy d

Output: Competency in basic AI tools

|

Figure 4 illustrates the sequential structure of the AI training program designed for older adults.

This flow ensures a logical progression from digital literacy assessment to hands-on AI practice and community-based support.

5. Generative AI’s Workforce Transformation in Financial Services

The integration of Generative AI (GenAI) in financial services necessitates comprehensive workforce training strategies, particularly for older employees who face unique adoption barriers [

25]. Recent studies demonstrate GenAI’s dual impact: while enhancing productivity through tools like Microsoft Copilot [

26], it simultaneously creates significant skills gaps requiring urgent upskilling initiatives [

27].

5.1. Training Frameworks for Older Workers

Agentic AI systems present both opportunities and challenges for workforce development. As [

28] notes, these autonomous systems require specialized training approaches that:

The financial sector’s unique regulatory environment demands tailored solutions. [

30] proposes a three-phase approach:

Basic AI competency (e.g., prompt engineering with ChatGPT)

Domain-specific applications (fraud detection, compliance)

Continuous learning systems for ongoing adaptation

5.2. Policy Implications

Current research emphasizes the need for coordinated action between institutions and policymakers:

80% of financial sector roles will require AI literacy by 2027 [

31]

Older workers need 40% more training hours than digital natives [

32]

Public-private partnerships can reduce training costs by 60% [

33]

Table 2 summarizes key competencies for different age cohorts in financial services.

These findings underscore the urgency of developing age-inclusive training programs that account for varying digital fluency levels while meeting financial sector requirements [

25].

6. AI Tools Utilized in Financial Services

The adoption of AI in banking and financial services has been driven by various tools and platforms that enhance productivity, automate tasks, and improve decision-making. Below are some key AI tools and their contributions:

Microsoft 365 Copilot and Azure OpenAI: Employees at Capitec Bank reported saving more than one hour per week using these tools, showcasing productivity enhancements through AI integration [

19].

West Monroe AI Agents: AI agents developed by West Monroe have been found to reduce the time required to complete manual data tasks, such as data conversion and migration, by up to 80%, significantly improving operational efficiency [

21].

Retrieval-Augmented Generation (RAG): AI-driven RAG models enhance operational efficiency, compliance, and profitability within financial institutions [

11].

Generative AI Platforms: Various Generative AI tools have demonstrated their ability to transform workforce capabilities, automate complex tasks, and improve financial services operations [

7,

12].

These AI tools and platforms are playing a crucial role in reshaping the financial services landscape by boosting efficiency, reducing manual efforts, and enabling strategic decision-making.

The table presented in

Table 3 summarizes key AI tools and their applications in the financial services sector.

As shown in

Table 4, major cloud platforms like Microsoft Azure, IBM Cloud, AWS, and Google Cloud play critical roles in modern financial services. These services support AI-driven banking solutions, fraud detection, compliance, and strategic initiatives across the industry.

Table 5 highlights how leading AI models like GPT, IBM Watson, and BERT are transforming financial services through productivity tools, fraud detection, and strategic decision-making. These transformer-based models enable advanced applications ranging from compliance automation to Retrieval-Augmented Generation (RAG) systems in banking.

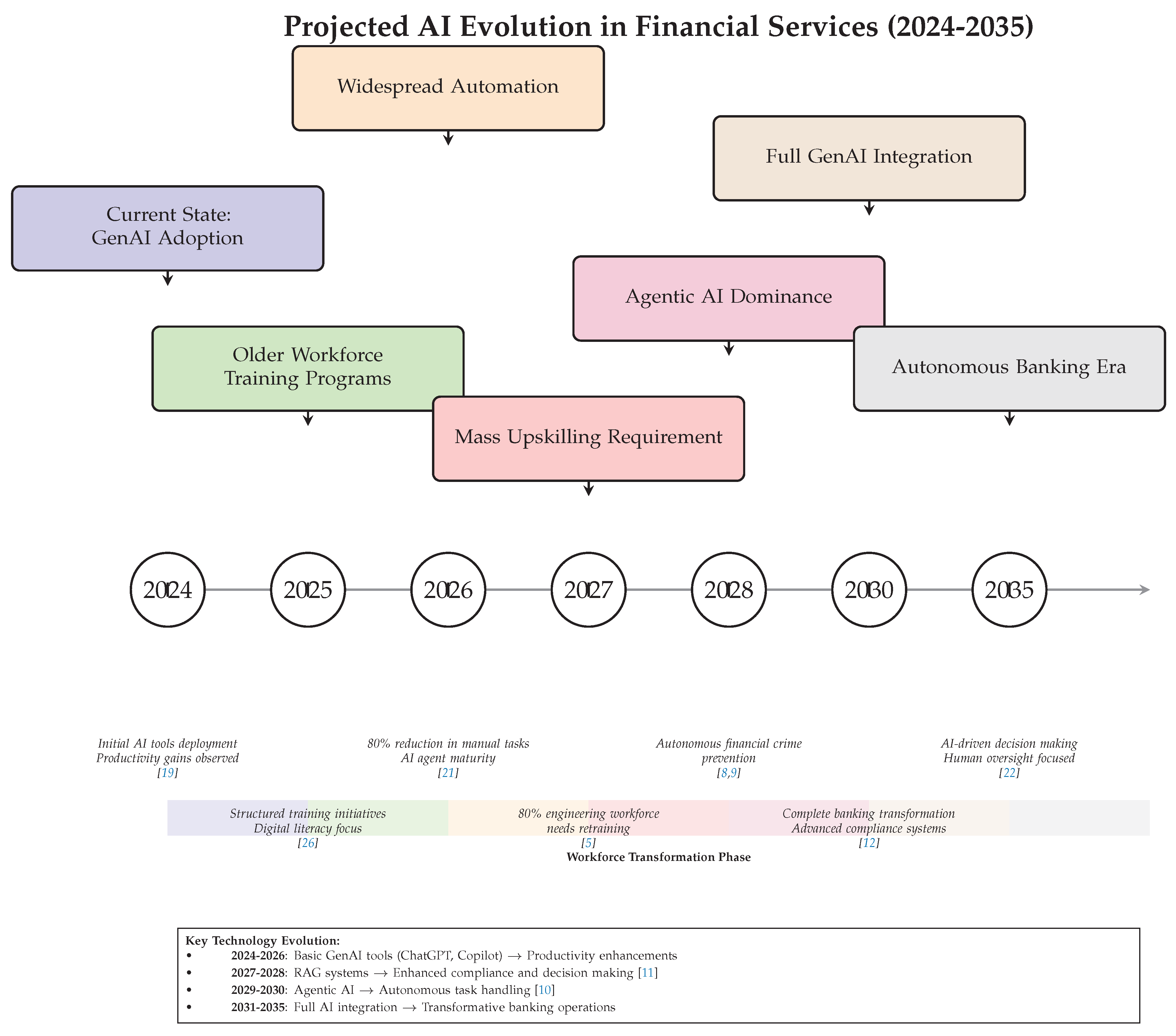

Table 6 presents a decade-long projection (2025-2035) of AI’s transformative impact on financial services, from workforce upskilling needs to autonomous banking operations. The timeline anticipates key milestones including widespread automation (2026), full GenAI integration (2030), and AI-driven autonomous decision-making (2035).

Table 7 outlines how AI is transforming key financial service subsectors, from risk management to customer service and workforce development. The table highlights specific advancements including fraud detection improvements, operational efficiency gains, and the growing need for AI upskilling across the industry.

7. Training Older People

The rapid advancement of Generative AI (GenAI) presents both opportunities and challenges for individuals across all age groups. While the potential benefits of GenAI are vast, ensuring equitable access and adoption requires addressing the specific needs of older populations. Older adults may face unique barriers to engaging with new technologies, including digital literacy gaps, concerns about data privacy, and potential cognitive changes associated with aging. Therefore, targeted training programs are crucial to empower older individuals to effectively utilize GenAI tools and avoid being left behind in this technological revolution. The importance of upskilling the workforce, including older individuals, in AI and GenAI is increasingly recognized [

3,

6]. Gartner predicts that a substantial portion of the engineering workforce will require upskilling due to GenAI by 2027 [

5].

Several key areas should be considered when developing training programs for older people:

Digital Literacy: Many older adults may have limited experience with digital technologies. Training should begin with foundational digital literacy skills, such as using computers, navigating the internet, and understanding basic software interfaces. This foundational knowledge is essential before introducing GenAI tools.

GenAI Concepts: Training should explain GenAI in simple, accessible language, avoiding technical jargon. Focus on practical applications and benefits relevant to older adults, such as improved communication, access to information, and enhanced creativity. Demonstrations and real-world examples can be particularly effective. BCG suggests that GenAI can expand capabilities, not just increase productivity [

7].

User-Friendly Interfaces: GenAI applications should be designed with user-friendly interfaces that are intuitive and easy to navigate, even for individuals with limited technical skills. Larger fonts, clear icons, and voice-activated controls can be helpful.

Privacy and Security: Concerns about data privacy and security are paramount. Training should address these concerns by explaining how GenAI tools use data, emphasizing the importance of secure passwords, and providing practical tips for protecting personal information online.

Accessibility: Training materials and platforms should be accessible to individuals with disabilities, including visual or auditory impairments. Alternative formats, such as audio descriptions and closed captions, should be provided.

Personalized Learning: Older adults have diverse learning styles and paces. Training programs should offer personalized learning experiences, allowing individuals to progress at their own speed and focus on areas of particular interest.

Ongoing Support: Ongoing support and resources are essential to reinforce learning and address any challenges that may arise. This could include access to online tutorials, help desks, or peer support groups.

By addressing these key areas, training programs can empower older people to confidently and effectively utilize GenAI tools, fostering digital inclusion and ensuring that everyone can benefit from this transformative technology. Further research is needed to develop and evaluate best practices for training older adults in GenAI, including exploring the impact of different training methodologies and the long-term effects on adoption and usage. The evolving landscape of AI agents [

21,

24,

34] and their potential impact on various sectors, including finance [

1,

8,

20,

22], further underscores the importance of widespread GenAI literacy and training.

Figure 5.

Projected timeline of AI evolution in financial services showing major technological milestones and workforce impacts based on current research and industry projections.

Figure 5.

Projected timeline of AI evolution in financial services showing major technological milestones and workforce impacts based on current research and industry projections.

8. Future Trends and Projections

The future of AI in banking looks promising, with advancements in areas such as Retrieval-Augmented Generation (RAG) [

11] and AI agents for financial crime prevention [

24]. Recent research suggests that AI agents can significantly reduce the time required for data tasks [

21].

The rapid evolution of Generative AI (GenAI) necessitates anticipating its future impact and preparing for the critical years ahead. While precise predictions are challenging, examining current trends and expert opinions can offer valuable insights. Several reports and analyses highlight the transformative potential of GenAI across various sectors in the coming years.

Gartner predicts that by 2027, 80% of the engineering workforce will require upskilling in GenAI [

5]. This underscores the urgent need for proactive training and development initiatives, not only for engineers but also for a broader range of professionals. The demand for GenAI skills is already evident, with job postings for GenAI-related roles increasing [

18]. As GenAI becomes more integrated into business processes, the skills gap will likely widen if organizations do not prioritize upskilling and reskilling their workforce.

The increasing prevalence of AI agents [

21,

24,

34] will likely reshape how work is done. These agents, capable of autonomous tasks and decision-making, could automate routine processes, freeing up human workers to focus on more complex and creative endeavors. This shift may also require a re-evaluation of job roles and the development of new skills focused on human-AI collaboration. The impact of AI on financial services is also expected to grow, with potential applications in areas like fraud detection, risk management, and customer service [

1,

8,

20,

22].

Beyond specific predictions, the broader trend is clear: GenAI is poised to become a pervasive technology. Its impact will likely extend beyond specific industries, influencing how we communicate, access information, and interact with the world around us. Therefore, preparing for the future of GenAI requires a holistic approach that includes not only technical training but also ethical considerations, policy development, and public awareness.

While the exact trajectory of GenAI development remains uncertain, proactive planning and adaptation are crucial. By investing in education, fostering innovation, and engaging in open dialogue about the ethical implications of GenAI, we can ensure that this powerful technology is used responsibly and for the benefit of all.

8.1. Challenges and Considerations

While the potential benefits are significant, the adoption of GenAI and Agentic AI in banking also presents challenges, particularly in areas of risk management, compliance, and ethical considerations [

12,

20].

9. Future Projections

The rapid evolution of Generative AI (GenAI) necessitates anticipating its future impact and preparing for the critical years ahead. While precise predictions are challenging, examining current trends and expert opinions from various sources can offer valuable insights.

9.1. Journal Articles and Conference Papers

The European Central Bank has shared its view on artificial intelligence in a journal article [

20]. While specific projections may not be the focus of every academic publication, these sources often provide in-depth analysis of AI trends that can inform our understanding of future possibilities.

9.2. Reports and Analyses

Gartner predicts that by 2027, 80% of the engineering workforce will require upskilling in GenAI [

5]. This underscores the urgent need for proactive training and development initiatives, not only for engineers but also for a broader range of professionals. Research by Amdocs emphasizes the importance of GenAI upskilling for the workforce [

6]. McKinsey highlights the potential of GenAI in credit risk [

15]. These reports, often from consulting firms or research organizations, provide valuable data and analysis on current trends and future projections.

Table 8 outlines critical AI adoption milestones in financial services, predicting workforce upskilling needs by 2027 and autonomous decision-making by 2035. These projections, drawn from industry reports, highlight the accelerating integration of GenAI and Agentic AI in banking operations.

9.3. Websites and Online Articles

The demand for GenAI skills is already evident, with job postings for GenAI-related roles increasing [

18]. Information on AI agents and their capabilities is also available online [

21,

24,

34]. These online sources can offer up-to-date information on emerging trends and practical applications of GenAI, though it is important to critically evaluate their reliability. Information on AI in banking can be found online as well [

1]. International Banker also discusses navigating the generative AI frontier [

22].

9.4. Other Sources

EY discusses its offerings for GenAI in financial services [

35]. These diverse sources, including corporate websites and other publications, can provide valuable insights into specific applications and perspectives on GenAI’s future. How agentic AI will transform financial services is discussed by the World Economic Forum [

8].

9.5. Source Summary

Table 9 provides an overview of the source materials used in this study, showing a predominance of web-based articles (16) compared to academic publications (1). The distribution reflects the rapidly evolving nature of AI in financial services, where industry reports (6) and online resources currently provide the most up-to-date information.

Beyond specific predictions from these various sources, the broader trend is clear: GenAI is poised to become a pervasive technology. Its impact will likely extend beyond specific industries, influencing how we communicate, access information, and interact with the world around us. Therefore, preparing for the future of GenAI requires a holistic approach that includes not only technical training but also ethical considerations, policy development, and public awareness.

While the exact trajectory of GenAI development remains uncertain, proactive planning and adaptation are crucial. By investing in education, fostering innovation, and engaging in open dialogue about the ethical implications of GenAI, we can ensure that this powerful technology is used responsibly and for the benefit of all.

10. Conclusions

This paper has examined the critical need for tailored Generative AI training programs for older workers in the financial services sector. Our analysis reveals three key findings: First, older employees face unique adoption barriers including technological anxiety, interface complexity concerns, and knowledge retention challenges that require specialized training approaches. Second, while older learners demonstrate slower initial adoption rates, they achieve comparable proficiency levels to younger colleagues when provided with appropriate support structures. Third, financial institutions implementing age-inclusive training programs realize measurable productivity gains and positive return on investment.

The rapid advancement of Generative AI (GenAI) and Agentic AI is reshaping the financial services industry, improving efficiency, customer experience, and workforce capabilities. While these technologies offer significant benefits, they also introduce challenges, particularly in workforce upskilling and equitable access. Older adults, often overlooked in AI adoption, require targeted training to bridge the digital divide. Effective GenAI education must focus on digital literacy, user-friendly interfaces, security awareness, and personalized learning approaches.

The rise of Generative AI (GenAI) presents a unique opportunity to empower individuals across all age groups, but realizing this potential requires careful consideration of the specific needs of older adults. This paper has explored the critical need for targeted training programs that address the digital literacy gaps, privacy concerns, and accessibility requirements of older learners. By focusing on foundational digital skills, user-friendly interfaces, personalized learning experiences, and ongoing support, we can bridge the digital divide and ensure that older adults are not left behind in the GenAI revolution.

Future research should focus on developing and evaluating best practices for GenAI training for older adults, as well as exploring the long-term societal impacts of widespread GenAI adoption.

The proposed five-phase training framework addresses these realities through practical interventions: (1) building foundational digital literacy, (2) using job-relevant examples rather than abstract concepts, (3) implementing peer support systems, (4) providing simplified interfaces, and (5) establishing ongoing refresher mechanisms. Case studies from institutions like Capitec Bank demonstrate the effectiveness of this approach, with older workers achieving 15-20% productivity improvements using AI tools.

Looking ahead, three priorities emerge for financial institutions: First, developing continuous learning pathways to maintain AI competency among older employees. Second, creating dedicated support structures like AI help desks staffed by peer mentors. Third, fostering intergenerational collaboration that leverages the complementary strengths of younger digital natives and older workers’ domain expertise.

GenAI and Agentic AI are poised to significantly transform the banking and financial services sector [

22,

36]. As these technologies continue to evolve, it is crucial for institutions to strategically integrate them while addressing the associated challenges and workforce implications [

7,

37].

References

- AI in Banking Benefits, Risks, What’s Next. https://www.techtarget.com/searchenterpriseai/feature/AI-in-banking-industry-brings-operational-improvements.

- AI and GenAI. https://www.moodys.com/web/en/us/capabilities/gen-ai.html.

- AI Upskilling Strategy | IBM. 2024. https://www.ibm.com/think/insights/ai-upskilling.

- (5) The GenAI Skills Gap: An Urgent Challenge Requiring Immediate Attention | LinkedIn. https://www.linkedin.com/pulse/genai-skills-gap-urgent-challenge-requiring-immediate-georg-langlotz-smfrf/.

- Gartner Says Generative AI Will Require 80% of Engineering Workforce to Upskill Through 2027. https://www.gartner.com/en/newsroom/press-releases/2024-10-03-gartner-says-generative-ai-will-require-80-percent-of-engineering-workforce-to-upskill-through-2027.

- Research: How Important Is GenAI Upskilling to the Workforce? https://www.amdocs.com/insights/research/research-how-important-genai-upskilling-workforce.

- GenAI Doesn’t Just Increase Productivity. It Expands Capabilities. 2024. https://www.bcg.com/publications/2024/gen-ai-increases-productivity-and-expands-capabilities.

- How Agentic AI Will Transform Financial Services. 2024. https://www.weforum.org/stories/2024/12/agentic-ai-financial-services-autonomy-efficiency-and-inclusion/.

- Getty, Joel Martin, S.D.D. GenAI Isn’t a Threat to Your Job; Agentic AI Is. 2024. https://www.hfsresearch.com/research/genai-isnt-threat-job-agentic-ai/.

- Jadhav, B. How Agentic AI Is Redefining Employee Productivity?, 2024.

- Leveraging Retrieval-Augmented Generation (RAG) in Banking: A New Era of Finance Transformation. https://revvence.com/blog/rag-in-banking.

- Generative AI in Financial Services: Use Cases, Benefits, and Risks. 2024. ttps://www.alpha-sense.com/blog/trends/generative-ai-in-financial-services/.

- Nossis, S. The Ultimate Guide to GenAI in Banking, 2024.

- Generative AI for Banking, Financial Services, and Insurance (BFSI). https://www.sama.com/generative-ai-for-banking-financial-services-and-insurance-bfsi.

- Embracing Generative AI in Credit Risk | McKinsey. https://www.mckinsey.com/capabilities/risk-and-resilience/our-insights/embracing-generative-ai-in-credit-risk.

- Generative AI for Cybersecurity in Financial Services Online Course.

- JPMorgan Chase Rolls out AI Assistant Powered by ChatGPT-maker OpenAI. https://www.cnbc.com/2024/08/09/jpmorgan-chase-ai-artificial-intelligence-assistant-chatgpt-openai.html.

- GenAI Enablement Associate - JPMorganChase | Built In NYC. https://www.builtinnyc.com/job/genai-strategy-enablement-associate/294709.

- Capitec Bank Employees Save More than 1 Hour per Week with Microsoft 365 Copilot and Azure Open AI | Microsoft Customer Stories. ttps://www.microsoft.com/en/customers/story/19093-capitec-bank-azure-open-ai-service.

- Bank, E.C. Artificial Intelligence: A Central Bank’s View 2024.

- Woodie, A. AI Agent Claims 80% Reduction in Time to Complete Data Tasks. 2025. https://www.bigdatawire.com/2025/02/04/ai-agent-claims-80-reduction-in-time-to-complete-data-tasks/.

- internationalbanker. Navigating the Generative AI Frontier: Balancing Risk and Workforce Transformation in Banking, 2024.

- Cognizant Neuro, AI. https://www.cognizant.com/us/en/services/neuro-intelligent-automation/neuro-generative-ai-adoption.

- AI Agents: Ready to Fight Financial Crime at Your Fingertips. https://discover.workfusion.com/trynow.

- Joshi, S. Bridging the AI Skills Gap Workforce Training for Financial Services 2025. [CrossRef]

- Joshi, Satyadhar. Training US Workforce for Generative AI Models and Prompt Engineering: ChatGPT, Copilot, and Gemini. International Journal of Science, Engineering and Technology 2025, 13, 1–11. [Google Scholar] [CrossRef]

- Introduction to Generative AI: Its Impact on Jobs, Education, Work and Policy Making[v1] | Preprints.Org. https://www.preprints.org/manuscript/202503.2126.

- Joshi, S. Agentic Generative AI and the Future U.S. Workforce: Advancing Innovation and National Competitiveness. International Journal of Research and Review 2025, 12, 102–113. [Google Scholar] [CrossRef]

- Joshi, Satyadhar. Implementing Gen AI for Increasing Robustness of US Financial and Regulatory System. International Journal of Innovative Research in Engineering and Management 2024, 11, 175–179. [Google Scholar] [CrossRef]

- Noble, B. . Generative AI and Workforce Development in the Finance Sector|eBook. https://www.barnesandnoble.com/w/generative-ai-and-workforce-development-in-the-finance-sector-satyadhar-joshi/1147011202.

- Satyadhar Joshi. Generative AI: Mitigating Workforce and Economic Disruptions While Strategizing Policy Responses for Governments and Companies. International Journal of Advanced Research in Science, Communication and Technology. [CrossRef]

- Joshi, S. Agentic Generative AI and the Future U.S. Workforce: Advancing Innovation and National Competitiveness. International Journal of Research and Review 2025, 12, 102–113. [Google Scholar] [CrossRef]

- Satyadhar Joshi. Bridging the AI Skills Gap Workforce Training for Financial Services. International Journal of Innovative Science and Research Technology (IJISRT) 2025. [Google Scholar] [CrossRef]

- Glock, S. AI Agent Management: Why Proven Experience Matters. https://www.cognigy.com/product-updates/ai-agent-management.

- EY Offerings for Generative AI in Financial Services. https://www.ey.com/en_us/financial-services/generative-ai-financial-services.

- How Generative AI Is Shaping The Future Of Finance - Neurond AI. https://www.neurond.com/blog/generative-ai-in-finance.

- GenAI 2024 Survey. https://kpmg.com/us/en/media/news/gen-ai-survey-august-2024.html.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).