Submitted:

04 April 2025

Posted:

04 April 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Theoretical Background

2.1. ESG Management

2.2. Organizational Trust

2.3. Organizational Commitment

2.4. Organizational Performance

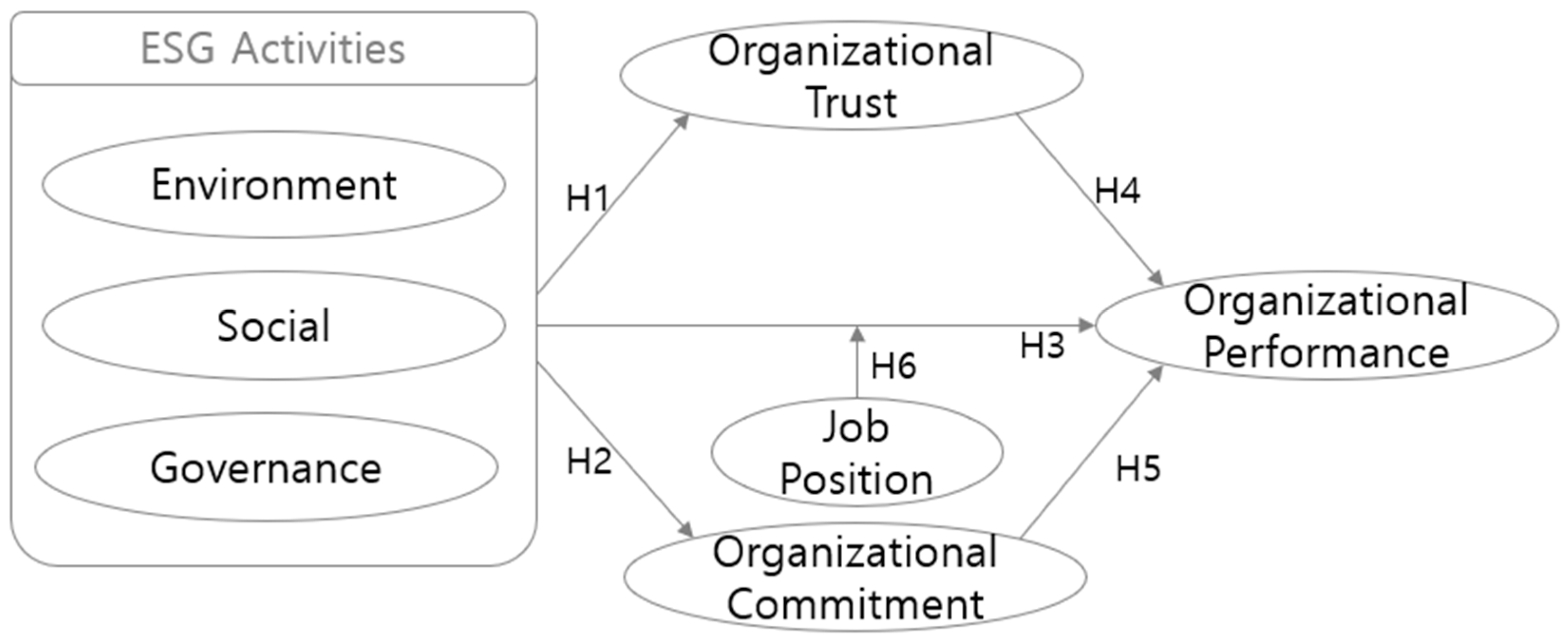

3. Research Model and Hypothesis

3.1. Research Model

3.2. Hypothesis

3.2.1. ESG Management Activities and Organizational Trust

3.2.2. ESG Management Activities and Organizational Commitment

3.2.3. ESG Management Activities and Organizational Performance

3.2.4. Organizational Trust and Organizational Performance

3.2.5. Organizational Commitment and Organizational Performance

3.2.6. Moderating Effect of Job Position Difference

3.3. Operational Definition of Variables

3.3.1. ESG Management Activities

3.3.2. Organizational Trust

3.3.3. Organizational Commitment

3.3.4. Organizational Performance

3.4. Data Collection and Research Methods

4. Empirical Analysis Results

4.1. Sample Characteristics

4.2. Reliability and Validity Testing

4.3. Hypothesis Testing

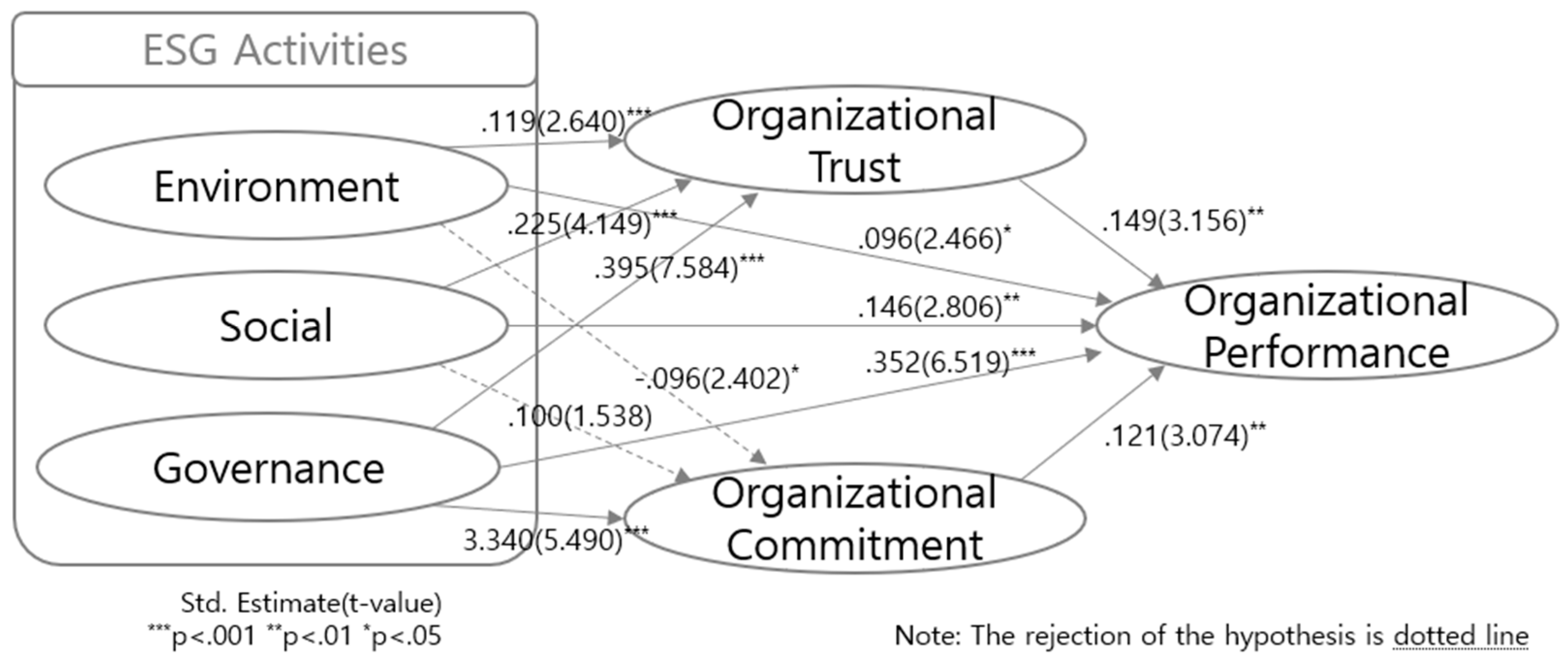

| Hypotheses: path | Std. Estimate |

S.E. | t-value | p-value | Results | |||

|---|---|---|---|---|---|---|---|---|

| H1-1: | Environment | → | Organizational trust |

.119 | 0.040 | 2.640** | 0.005 | Accepted |

| H1-2: | Social | → | .225 | 0.057 | 4.149*** | *** | Accepted | |

| H1-3: | Governance | → | .395 | 0.066 | 7.584*** | *** | Accepted | |

| H2-1: | Environment | → | Organizational Commitment |

-0.096 | 0.041 | -2.402* | 0.016 | Accepted |

| H2-2: | Social | → | 0.100 | 0.056 | 1.538 | 0.124 | Rejected | |

| H2-3: | Governance | → | 0.340 | 0.066 | 5.490*** | *** | Accepted | |

| H3-1: | Environment | → | Organizational Performance |

0.096 | 0.037 | 2.466* | 0.014 | Accepted |

| H3-2: | Social | → | 0.146 | 0.053 | 2.806** | 0.005 | Accepted | |

| H3-3: | Governance | → | 0.352 | 0.066 | 6.519*** | *** | Accepted | |

| H4: | Organizational trust | → | Organizational Performance |

0.149 | 0.053 | 3.156** | 0.002 | Accepted |

| H5: | Organizational Commitment | → | 0.121 | 0.045 | 3.074*** | 0.002 | Accepted | |

| Hypotheses: path | Lower Job Position Group(n=301) | High Job Position Group(n=260) |

|||||||

|---|---|---|---|---|---|---|---|---|---|

| Estimate | t-value | p-value | Estimate | t-value | p-value | ||||

| H6-1: | Environment | → | Organizational Performance |

0.105 | 2.071* | 0.038 | 0.067 | 1.650 | 0.099 |

| H6-2: | Social | → | 0.094 | 1.366 | 0.172 | 0.265 | 3.291*** | 0.000 | |

| H6-3: | Governance | → | 0.555 | 7.985*** | 0.000 | 0.176 | 1.530 | 0.126 | |

| Model | DF | CMIN | P | NFI | IFI | RFI | TLI |

|---|---|---|---|---|---|---|---|

| Delta-1 | Delta-2 | rho-1 | rho2 | ||||

| Constrained Model | 3 | 8.284 | .040* | .001 | .001 | .000 | .000 |

5. Conclusion and Discussion

5.1. Theoretical and Practical Implications

5.2. Limitations and Future Research Directions

References

- KIF. Korea Institute of Finance; KIF: Seoul, Republic of Korean, 2024; Volume 33, pp. 3–9. [Google Scholar]

- Jung, Y.S.; Kim, M.K.; Song, J.S.; Lee, P.Y.; Choi, I.K. & Park, J.W. A Study on the Impact of Corporate ESG Activities on Brand Image, Corporate Trust, and Corporate Performance. Korean Journal of Business Administration 2024, 37, 1451–1482. [Google Scholar]

- Dakhli. Does Financial Performance Moderate the Relationship Between Board Attributes and Corporate Social Responsibility in French Firms? Journal of Global Responsibility 2021, 12, 373–399. [Google Scholar]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate Social and Financial Performance: A Meta-Analysis. Organization Studies 2003, 24, 403–441. [Google Scholar]

- Galbreath, J.; Charles, D.; Oczkowski, E. The Drivers of Climate Change Innovations, Evidence from the Australian Wine Industry. Journal of Business Ethics 2016, 135, 217–231. [Google Scholar]

- Oh, S.J. ESG Management and the Role of Outside Directors in Korean Listed Companies. Yonsei Law Journal 2021, 37, 401–433. [Google Scholar] [CrossRef]

- Seo, K.R. The Role of Finance to Promote ESG Management of SMEs. Global Financial Review 2021, 2, 171–204. [Google Scholar] [CrossRef]

- Min, J.H.; Kim, B.S.; Ha, S.Y. The Relationship between Firms` Environmental, Social, Governance Factors and Their Financial Performance: An Empirical Rationale for Creating Shared Value. Korean Management Science Review 2015, 32, 113–131. [Google Scholar] [CrossRef]

- Shin, H.C.; Yoo, S.W. A Comparative Study on Employee Communication between Two Companies with Different Cultural Background: Shared values, Clarity in Work and Communication Campaign. Journal of Public Relations 2004, 8, 125–161. [Google Scholar]

- KPMG Samjong Accounting Corp, What Should Companies Prepare for the Rise of ESG? , Samjong Insight 2021, 74.

- Jung, J.H.; Park, H.S. A Study on the Effect of Corporate ESG Activities on Business Performance: Focusing on the Moderating Effect of Corporate Values Perception. Industry Promotion Research 2022, 7, 15–29. [Google Scholar]

- Bae, C.H.; Kim, T.D.; Shin, S.C. The Trend of Studies Using Non-financial Measures in the Field of Accounting and ESG Issue. Korea Accounting Journal 2021, 30, 235–276. [Google Scholar] [CrossRef]

- Lee, G.H.; Seo, J.I.; Nam, Y.S. The Relationship between ESG Management Legitimacy and Corporate Giving: the Moderating Role of Family Executives. Journal of the Korea Industrial Systems Research 2022, 27, 63–77. [Google Scholar]

- Papalexandris. N. Sustainable Development and the Critical Role of HRM. Studia Universitatis Babes-Bolyai Oeconomica 2022, 67, 27–36.

- Kim, K.M.; Ju, S.W. A Study on the Effects of Entrepreneurship Environment on Entrepreneurial Will of the MZ Generation and the Moderating Effect of ESG Awareness. Asia-Pacific Journal of Convergent Research Interchange 2023, 9, 157–168. [Google Scholar] [CrossRef]

- Park, M.S.; Seo, J.H. An Analysis of The Real Estate Value Influenced by The Characteristics of ESG Management. Journal of the Korea Real Estate Management Review 2021, 24, 245–271. [Google Scholar] [CrossRef]

- Ameer, R.; Othman, R. Sustainability Practices and Corporate Financial Performance: A Study Based on the Top Global Corporations. Journal of Business Ethics 2012, 108, 61–79. [Google Scholar] [CrossRef]

- Porter, M.E.; Vander, L.C. Green and Competitive: Ending the Stalemate; Harvard Business School Publishing: Boston, MA, USA, 1995. [Google Scholar]

- Mayer, R.C.; Davis, J.H.; Schoorman, D.F. An Integrative Model of Organizational Trust. Academy of Management Review 1995, 20, 709–734. [Google Scholar] [CrossRef]

- Hosmer, L.T. Trust: The Connecting Link between Organizational Theory and Philosophical Ethics. Academy of Management Review 1995, 20, 379–403. [Google Scholar] [CrossRef]

- Chung, Y.M.; Lee, M.H. The Impact of Social Responsibility CSR Has on Organizational Trust and Organizational Commitment in Travel Agencies. Journal of Tourism Management Research 2014, 58, 253–275. [Google Scholar]

- Tan, H.H.; Tan, C.S.F. Toward the Differentiation of Trust in Supervisor and Trust in Organization. Genetic, Social & General Psychology Monographs 2000, 126, 241. [Google Scholar]

- Cook, J.; Wall, T. New Work Attitude Measures of Trust, Organizational Commitment and Personal Need Non-Fulfillment. Journal of Occupational Psychology 1980, 53, 39–52. [Google Scholar] [CrossRef]

- March, J.G.; Simon, H.A. Organization; Wiley: New York, NY, USA, 1958. [Google Scholar]

- Becker, H.S. Notes on the Concept of Commitment. American Journal of Sociology 1960, 66, 32–42. [Google Scholar] [CrossRef]

- Bateman, T.S.; Organ, D.W. Job Satisfaction and The Good Soldier: The Relationship Between Affect And Employee “Citizenship”. Academy of Management Journal 1983, 26, 587–595. [Google Scholar] [CrossRef]

- Angle, H.L.; Perry, J.L. An Empirical Assessment of Organizational Commitment and Organizational Effectiveness. Administrative Science Quarterly 1981, 27, 1–14. [Google Scholar] [CrossRef]

- Allen, N.J.; Meyer, J.P. The Measurement and Antecedents of Affective, Continuance, and Normative Commitment to the Organization. Journal of Occupational Psychology 1990, 63, 1–18. [Google Scholar] [CrossRef]

- Meyer, J.P.; Herscovitch, L. Commitment in the workplace: Toward a general model. Human Resource Management Review 2001, 11, 299–326. [Google Scholar] [CrossRef]

- Li, L.; Zhu, Y.; Park, C.W. Leader-Member Exchange, Sales Performance, Job Satisfaction, and Organizational Commitment Affect Turnover Intention. Social Behavior and Personality 2018, 46, 1909–1922. [Google Scholar] [CrossRef]

- Ha, A.N.; Lee, H.S. The Effects of Organizational Culture within Airline`s Crew Team on Organizational Commitment the Team and Customer Orientation. Tourism Research, 2017, 42, 193–220. [Google Scholar]

- Collins, C.J.; Smith, K.G. Knowledge Exchange, and Combination: The Role of Human Resource Practices in The Performance of High-Technology Firms. Academy of Management Journal 2006, 49, 544–560. [Google Scholar] [CrossRef]

- Quinn, R.E.; McGrath, M.R. The Transformation of Organizational Cultures: A Competing Values Perspective. In Organizational Culture; Frost, P.J., Moore, L.F., Louis, M.R., Lundberg, C.C., Martin, J., Eds.; Sage Publications, Inc.: New York, NY, USA, 1985. [Google Scholar]

- Won, H.S.; Hong, J.H.; Cha, J.H. An Effect on Business Performance of S&M Business CEOs' Enterpreneurship. The Journal of Business Education 2015, 29, 309–340. [Google Scholar]

- Friede, G.; Busch, T.; Bassen, A. ESG and Financial Performance: Aggregated Evidence from more than 2000 Empirical Studies. Journal of Sustainable Finance & Investment 2015, 5, 210–233. [Google Scholar]

- Eliwa, Y.; Ahmed, A.; Ahmed, S. ESG Practices and The Cost of Debt: Evidence from EU Countries. Critical Perspectives on Accounting 2021, 79, 102097. [Google Scholar] [CrossRef]

- Lu, B.; Ding, J.; Lee, E.S. The Impact of ESG Investments on Corporate Value and Performance-A Comparative Study of Clothing Manufacturing and Service Industries in China. Journal of Industrial Innovation 2023, 39, 50–66. [Google Scholar]

- Barrymore, N.; Sampson, R.C. ESG Performance and Labor Productivity: Exploring Whether And When ESG Affects Firm Performance. Academy of Management Proceedings 2021, 1, 13997. [Google Scholar] [CrossRef]

- Turker, D. Measuring Corporate Social Responsibility: A Scale Development Study. Journal of Business Ethics 2009, 85, 411–427. [Google Scholar] [CrossRef]

- Qiang, H.; Park, J.C. The Effect of Corporate Environmental Responsibility Activities on Corporate Performance: Focusing on the Mediating Effect of Trust Types. Journal of Product Research 2022, 40, 7–14. [Google Scholar]

- Chang, S.I. The Effect of ESG Management Activities of Organizational Members of SMEs on Organizational Effectiveness through Organizational Trust and Corporate Entrepreneurship: Focusing on the Electrical and Electronic Industries in Chungnam and Sejong. Innovation Enterprise Research, 2023, 8, 329–358. [Google Scholar] [CrossRef]

- Kim, Y.H.; Kim, Y.O. The Effect of ESG Management Activities of Food Service Companies on Job Satisfaction and Organizational Commitment. Journal of Industrial Innovation 2023, 39, 132–142. [Google Scholar]

- Choi, Y.R.; Kim, H.D. The Effect of Service Orientation Effort on Job Satisfaction, Organizational Commitment, and Turnover Intention in Logistics Firms. Journal of Korea Port Economic Association 2017, 33, 33–52. [Google Scholar] [CrossRef]

- Koller, T.; Nuttall, R.; Henisz, W. Five Ways that ESG Creates Value. The McKinsey Quarterly 2019, 1–12. [Google Scholar]

- Kim, S.S.; Lee, Y.M. The Influence of Employees' Perceived Corporate Social Responsibility Motives on their Organizational Commitment. Korea Business Review 2020, 24, 117–140. [Google Scholar] [CrossRef]

- Shakil, M.H. Environmental, Social and Governance Performance and Financial Risk: Moderating Role of ESG Controversies and Board Gender Diversity. Resources Policy 2021, 72, 102144. [Google Scholar] [CrossRef]

- Park, Y.N.; Han, S.L. The Effect of ESG Activities on Corporate Image, Perceived Price Fairness, and Consumer Responses. Korean Management Review 2021, 50, 643–664. [Google Scholar] [CrossRef]

- Gouthier, M.H.; Rhein, M. Organizational Pride and Its Positive Effects on Employee Behavior. Journal of Service Management 2011, 22, 633–649. [Google Scholar] [CrossRef]

- Chae, J.S.; Choi, Y.J. A Study on the Organizational Citizenship Behavior of Court Security Officials. Korean Journal of Industry Security 2020, 10, 175–207. [Google Scholar] [CrossRef]

- Bong, J.H.; Lee, S.H. The Effects Of Trust on Customer Orientation and Job Performance in Foodservice Industry: Focused On Contingent Workers. Korean Journal of Hospitality and Tourism 2017, 26, 131–142. [Google Scholar]

- Wagner, S.L.; Rush, M.C. Altruistic Organizational Citizenship Behavior: Context, Disposition, and Age. The Journal of Social Psychology 2000, 140, 379–391. [Google Scholar] [CrossRef]

- Fu, W.; Deshpande, S.P. The Impact of Caring Climate, Job Satisfaction, and Organizational Commitment on Job Performance of Employees In A China’S Insurance Company. Journal of Business Ethics 2014, 124, 339–349. [Google Scholar] [CrossRef]

- Seo, J.S. A Study on the Impact of Organizational Commitment on Workers’ Turnover Intention and Organizational Performance: Based on Analysis of Welfare Organizations in Busan, Korea. Asia-Pacific Journal of Business Venturing and Entrepreneurship 2016, 11, 215–225. [Google Scholar] [CrossRef]

- Kwon, M.Y. The Effects of Fun Management on the Organizational Commitment and Service Innovation Performance in Food Service Industry. Regional Industry Review 2017, 40, 149–168. [Google Scholar]

- Lee, S.A.; Eom, W.Y. Perceptual Difference in the Competences and Performance of Roles of HRD Practitioner at Small and Medium Business by Position, Work experience and Educational level. Journal of Corporate Education and Talent Research 2013, 15, 51–77. [Google Scholar]

- Kim, J.H.; Kim, S.Y.; Oh, S.Y.; Park, S.M. A Study on the Relationship between Transformational Leadership in Public Sector and Active Administration of Public Officials: Focused on Behavioral Mediating Effects, Moderating Effects of Recruitment System and Grade. Korean Society and Public Administration 2020, 31, 163–197. [Google Scholar] [CrossRef]

- Cohen, D.A.; Ridgeway, C.L. Decision Making Groups and Teams: An Information Perspective. Business & Economics 2006, 22, 1–29. [Google Scholar]

- Kim, I.K.; Kang, S.K. A Study on the Factors Affecting Organizational Innovation Behavior of SMEs: Focused on the Moderate Effect of Work Experience and Rank. Asia-Pacific Journal of Business Venturing and Entrepreneurship 2019, 14, 75–89. [Google Scholar]

- Piao, X.; Xie, J.; Managi, S. Environmental, Social, And Corporate Governance Activities with Employee Psychological Well-Being Improvement. BMC Public Health 2022, 22, 1–12. [Google Scholar] [CrossRef] [PubMed]

- Daugaard, D. Emerging New Themes in Environmental, Social and Governance Investing: A Systematic Literature Review. Accounting & Finance 2020, 60, 1501–1530. [Google Scholar]

- Ji, S.G. The Effects of Corporate Social Responsibility on Organizational Trust and Commitment to Customer Service in Service Corporate. Korea Journal of Business Administration 2006, 19, 1867–1893. [Google Scholar]

- Jun, S.H. An Empirical Study on the Effects of SMEs Competition, ESG Management Activities and Organizational Justice on Job Satisfaction: Focusing on Mediating Effects of Self-efficacy. Journal of Venture Innovation 2023, 6, 41–62. [Google Scholar]

- Mostafa, A.M.S.; Bottomley, P.; Gould-Williams, J.; Abouarghoub, W.; Lythreatis, S. High-Commitment Human Resource Practices and Employee Outcomes: The Contingent Role of Organisational Identification. Human Resource Management Journal 2019, 29, 620–636. [Google Scholar] [CrossRef]

- Mowday, R.T.; Porter, L.W.; Steers, R.M. Employee-organizational linkages: The psychology of commitment, absenteeism, and turnover; Academic Press: New York, NY, USA, 1982. [Google Scholar]

- Hackett, R.D.; Lapierre, L.M.; Hausdorf, P.A. Understanding The Links between Work Commitment Constructs. Journal of Vocational Behavior 2001, 58, 392–413. [Google Scholar] [CrossRef]

- Kang, N.Y. The Dual Mediating Effect of Lmx And SNS Information Sharing in The Relationship between E-Leadership and Organizational Commitment; Graduate School Dankook University: Yongin-si, Republic of Korean, 2023. [Google Scholar]

- Kang, I.T. A Study on the Effect of ESG Management on Financial Performance in Hotel Companies: Focused on Mediating Effects of Authentic Leadership and Affective Organizational Commitment; Graduate School Kyonggi University: Seoul, Republic of Korean, 2022. [Google Scholar]

- Kang, N.Y. The Dual Mediating Effect of LMX and SNS Information Sharing in the Relationship between E-leadership and Organizational Commitment; Graduate School Dankook University: Yongin-si, Republic of Korean, 2023. [Google Scholar]

- Park, J.Y. A Study on The Mediating Effect of Intrapreneurship Between CEO Entrepreneurship and Performance of Manufacturing Enterprise; Graduate School Soongsil University: Seoul, Republic of Korean, 2018. [Google Scholar]

- Kaplan, R.; Norton, D. The Balanced Scorecard—Measures That Drive Performance. Harvard Business Review 1992, 79. [Google Scholar]

- Kim, Y.H. Effect of Digital Transformation and ESG Management on Corporate Performance; Dankook University,: Yongin-si, Republic of Korean, 2023. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. Journal of Marketing Research 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Park, S.M.; Jeong, H.I. A Study on ESG Management Strategy Case and Promotion Policy– Focusing on the Construction Industry. Logos Management Review 2023, 21, 169–190. [Google Scholar]

- Wright, P.; Ferris, S.P. Agency Conflict and Corporate Strategy: The effect of Divestment on Corporate value. Strategic Management Journal 1997, 18, 77–83. [Google Scholar] [CrossRef]

- Yu, J.M.; Yang, D.H. Does Firm's ESG Performance Mitigate the Negative Impact of Agency Costs on Firm Value? Korea International Accounting Review 2022, 104, 135–167. [Google Scholar]

- Eum, S.B.; Kim, H.D.; Kim, D.S. The Relations between Korean KOSDAQ-listed Firm's ESG Activities, Corporate Performance, and Firm Value. Korean Management Consulting Review 2023, 23, 219–232. [Google Scholar]

- Kim, S.H. Legal Issues on the Operation System of Electronic Administrative in Germany. Distribution Law Review 2021, 8, 203–236. [Google Scholar]

- Huh, J.H.; Hong, J.W. The Impact of ESG Management on Customer's Trust and Satisfaction: Focusing on the Moderating Effect of ESG Concern. Journal of Business Research 2023, 38, 125–138. [Google Scholar]

- Noh, J.H. The Impact of ESG Management on Job Satisfaction in Transportation Logistics Companies: The Mediating Effects of Organizational Commitment and Self-Efficacy. Korea Trade Review 2024, 49, 89–109. [Google Scholar] [CrossRef]

- Werther, W.B.; Chandler, D. Strategic Corporate Social Responsibility: Stakeholders in a Global Environment, 2nd ed; SAGE: Los Angeles, CA, USA, 2011. [Google Scholar]

- Ahn, J.S.; Chung, S.H.; Lee, S.R.; Park, J.W. The Effect of ESG Activities on the Business Performance. Journal of the Korean Society for Aviation and Aeronautics 2022, 30, 92–108. [Google Scholar] [CrossRef]

- Kang, H.; Lim, S.H. A Study on the Impact of ESG (Environmental, Social, and Governance) Management Activities of Small and Medium-sized Enterprises on the Organization's Non-financial Performance. Industry Promotion Research 2024, 9, 23–28. [Google Scholar]

- Mohammad, W.M.W.; Wasiuzzaman, S. Environmental, Social and Governance(ESG) Disclosure, Competitive Advantage and Performance of Firms in Malaysia. Cleaner Environmental Systems 2021, 2, 100015. [Google Scholar] [CrossRef]

- Nisar, Q.A.; Haider, S.; Ali, F.; Jamshed, S.; Ryu, K.; Gill, S.S. Green Human Resource Management Practices and Environ-Mental Performance in Malaysian Green Hotels; The Role of Green Intellectual Capital and Pro-Environmental Behavior. Journal of Cleaner Production 2021, 311, 127504. [Google Scholar] [CrossRef]

- Lee, S.H.; Olshfski, D. Employee Commitment And Firefighters: It`s My Job. Public Administration Review 2002, 62, 108–114. [Google Scholar]

- Lee, S.H.; Cho, J.Y. The Study On Receptiveness To Performance Appraisal System Based On BSC Among Public Employees At The Local Level Governments. Korean Society And Public Administration 2010, 20, 269–291. [Google Scholar]

| Categories | n(%) | Categories | n(%) | ||

|---|---|---|---|---|---|

| Gender | Male | 359(64.0) | Department | Planning Team | 40(7.1) |

| Female | 202(36.0) | Sales(Marketing) Team | 154(27.5) | ||

| Age | Twenties | 90(16.0) | Production Control Team | 148(26.4) | |

| Thirties | 82(14.6) | R&D Team | 50(8.9) | ||

| Forties | 164(29.2) | HR Team | 24(4.3) | ||

| Fifties | 176(31.4) | Finance&Accounting Dept | 61(10.9) | ||

| Above Fifties | 49(8.7) | Others | 84(15.0) | ||

| Academic background | High school graduate | 118(21.0) | Years of service |

less than 5 years | 109(19.4) |

| College graduate | 380(67.7) | 5 years or more∼ less than 10 years |

158(28.2) | ||

| Above Graduate school | 63(11.2) | ||||

| Job Position | Associate | 133(23.7) | 10 years or more∼ less than 15 years |

79(14.1) | |

| (Rank) | Assistant | 168(29.9) | |||

| Manager | 112(20.0) | 15 years or more | 215(38.3) | ||

| Senior Manager | 72(12.8) | Authenticity | Y | 381(67.9) | |

| Above General Manager | 76(13.5) | N | 180(32.1) | ||

| Total | 561(100) |

| Construct | Estimate | t-value | Cronbach‘s ɑ | C.R. | AVE | ||

|---|---|---|---|---|---|---|---|

| Std. Estimate |

S.E. | ||||||

| Environment | a4 | .766 | 0.875 | 0.977 | 0.731 | ||

| a2 | 1.027 | .075 | 16.952*** | ||||

| Social | a8 | .931 | 0.904 | 0.975 | 0.712 | ||

| a7 | .903 | .040 | 27.299*** | ||||

| Governance | a12 | .742 | 0.920 | 0.977 | 0.731 | ||

| a10 | .947 | .051 | 23.355*** | ||||

| a9 | .932 | .050 | 23.094*** | ||||

| Organizational trust | b4 | .802 | 0.917 | 0.977 | 0.727 | ||

| b2 | .906 | .048 | 24.505*** | ||||

| b1 | .893 | .049 | 24.187*** | ||||

| Organizational Commitment |

b8 | .553 | 0.824 | 0.976 | 0.720 | ||

| b7 | .815 | .120 | 12.199*** | ||||

| b6 | .838 | .125 | 12.158*** | ||||

| Organizational Performance |

c6 | .813 | 0.958 | 0.982 | 0.741 | ||

| c4 | .922 | .040 | 26.825*** | ||||

| c3 | .932 | .041 | 27.106*** | ||||

| Construct | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| (1) Environment | (.855) | |||||

| (2) Social | .662** | (.844) | ||||

| (3) Governance | .517** | .630** | (.855) | |||

| (4) Organizational trust | .475** | .525** | .539** | (.853) | ||

| (5) Organizational Commitment | .157** | .262** | .383** | .249** | (.849) | |

| (6) Organizational Performance | .458** | .541** | .611** | .502** | .319** | (.861) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).