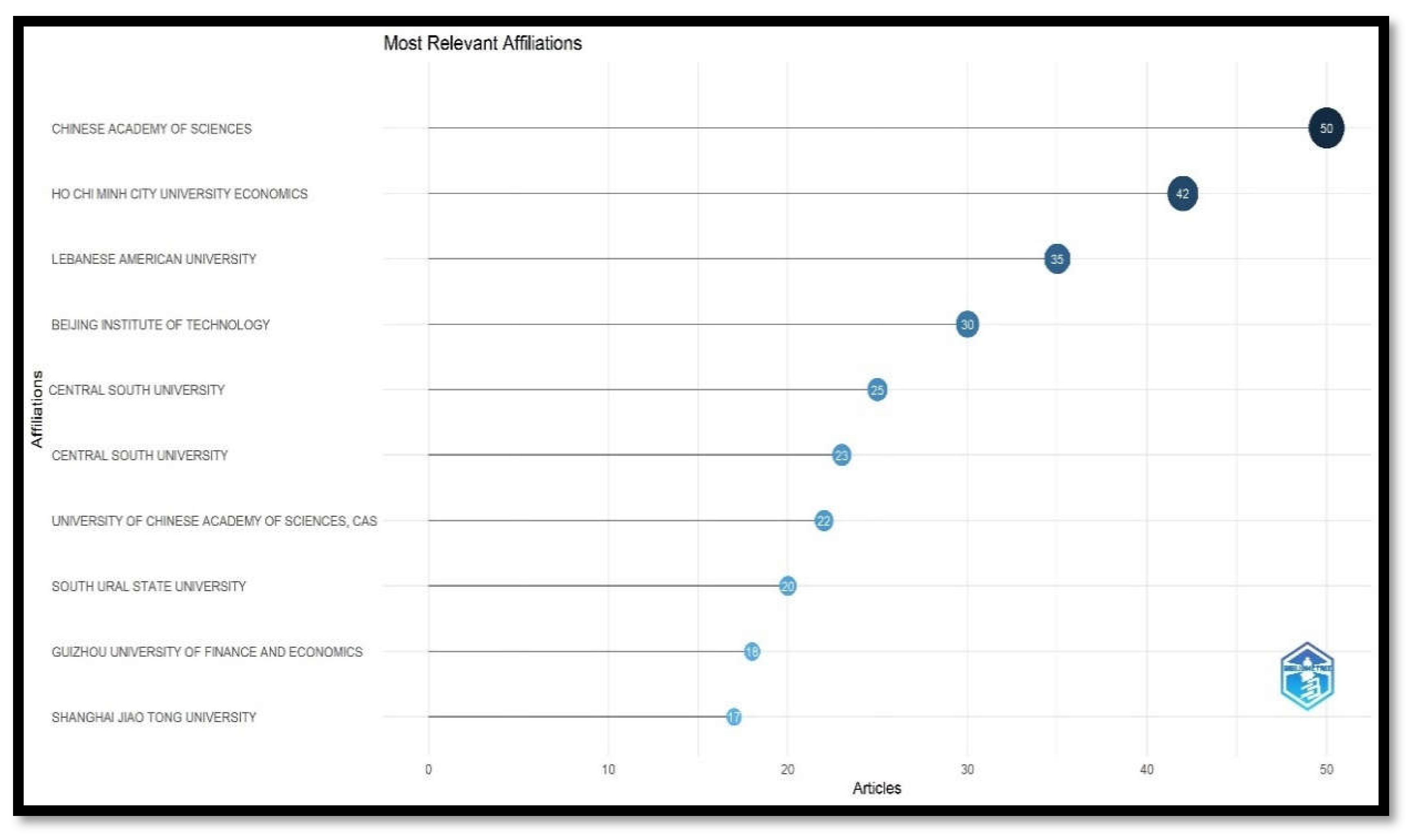

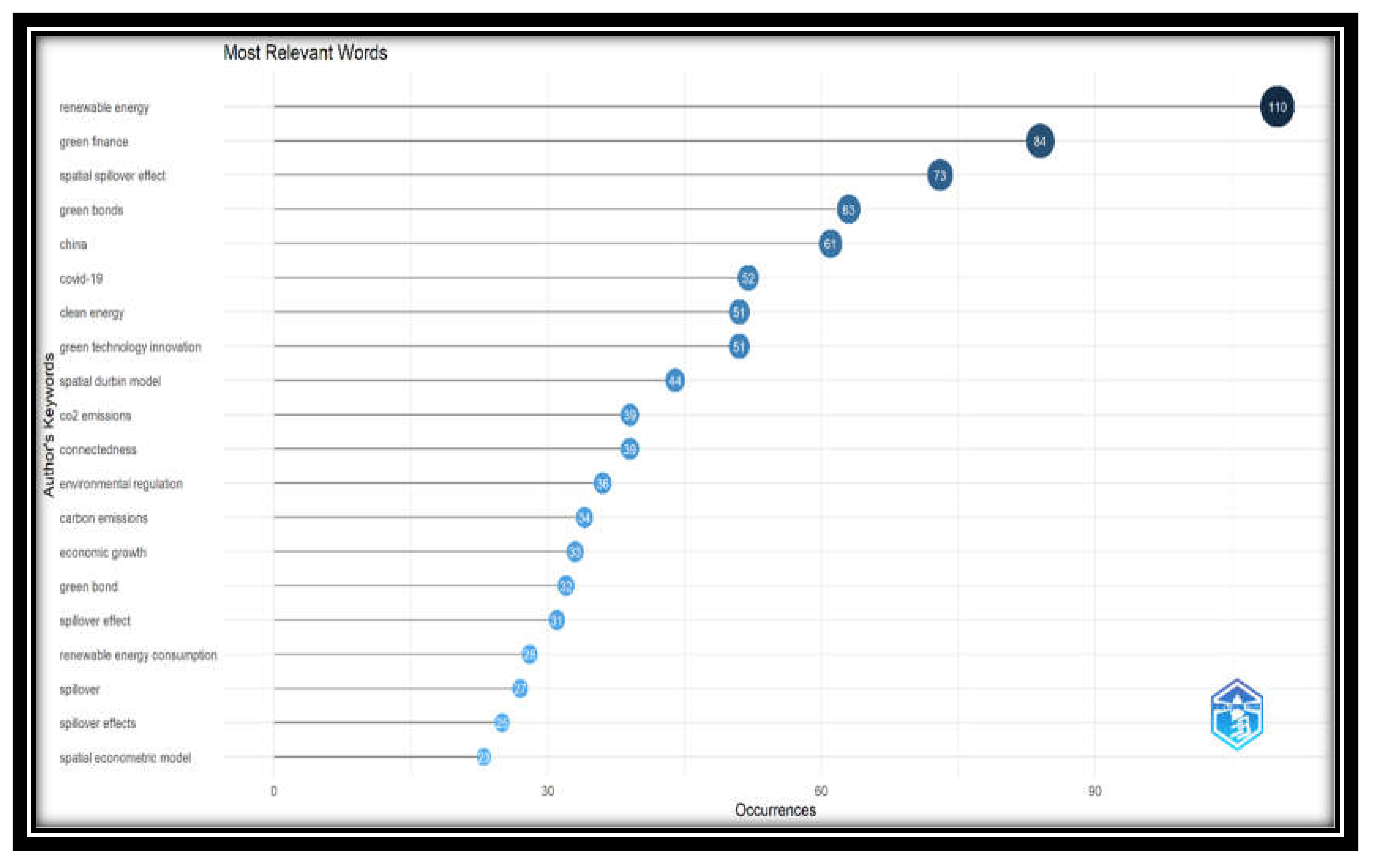

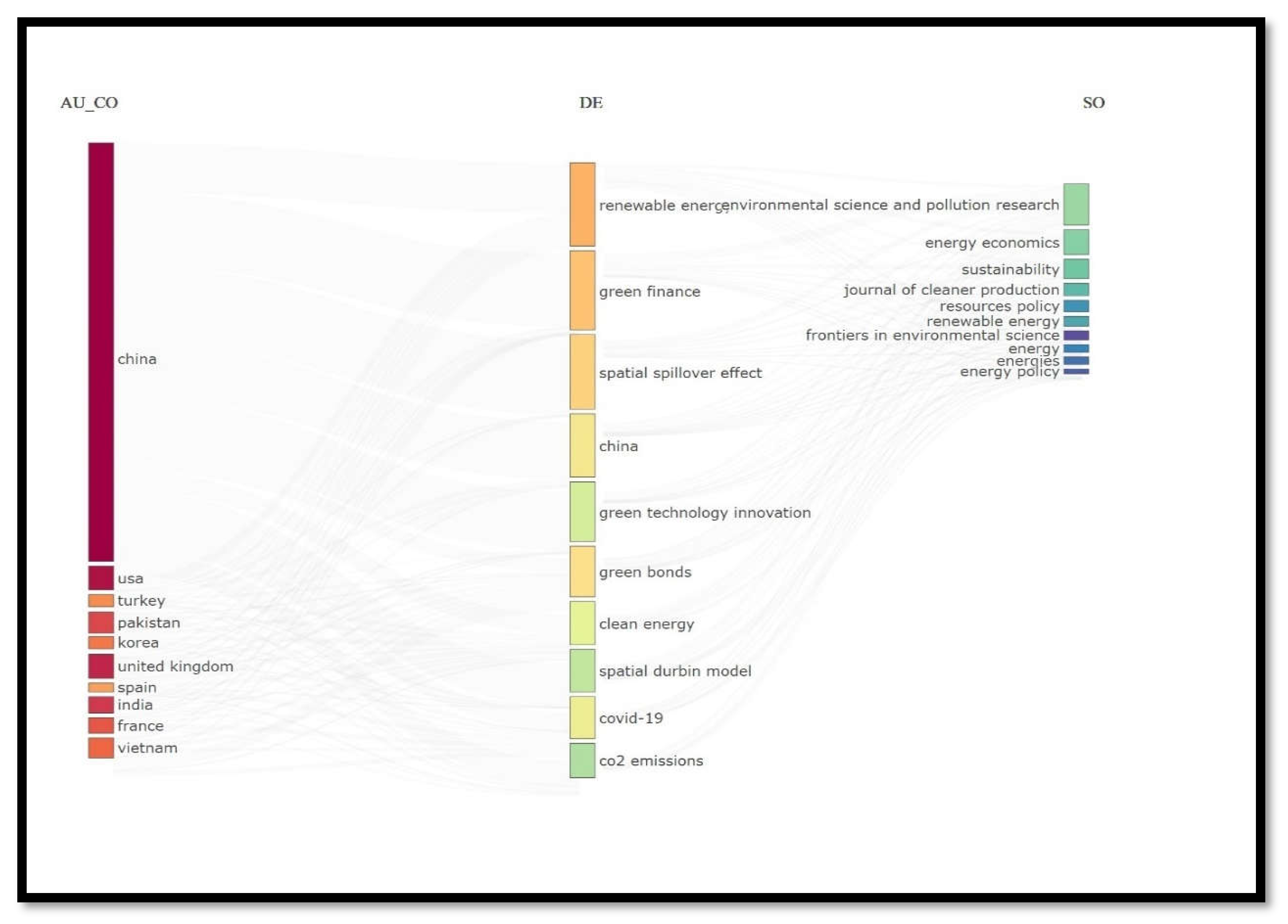

3.8. Most Important Words

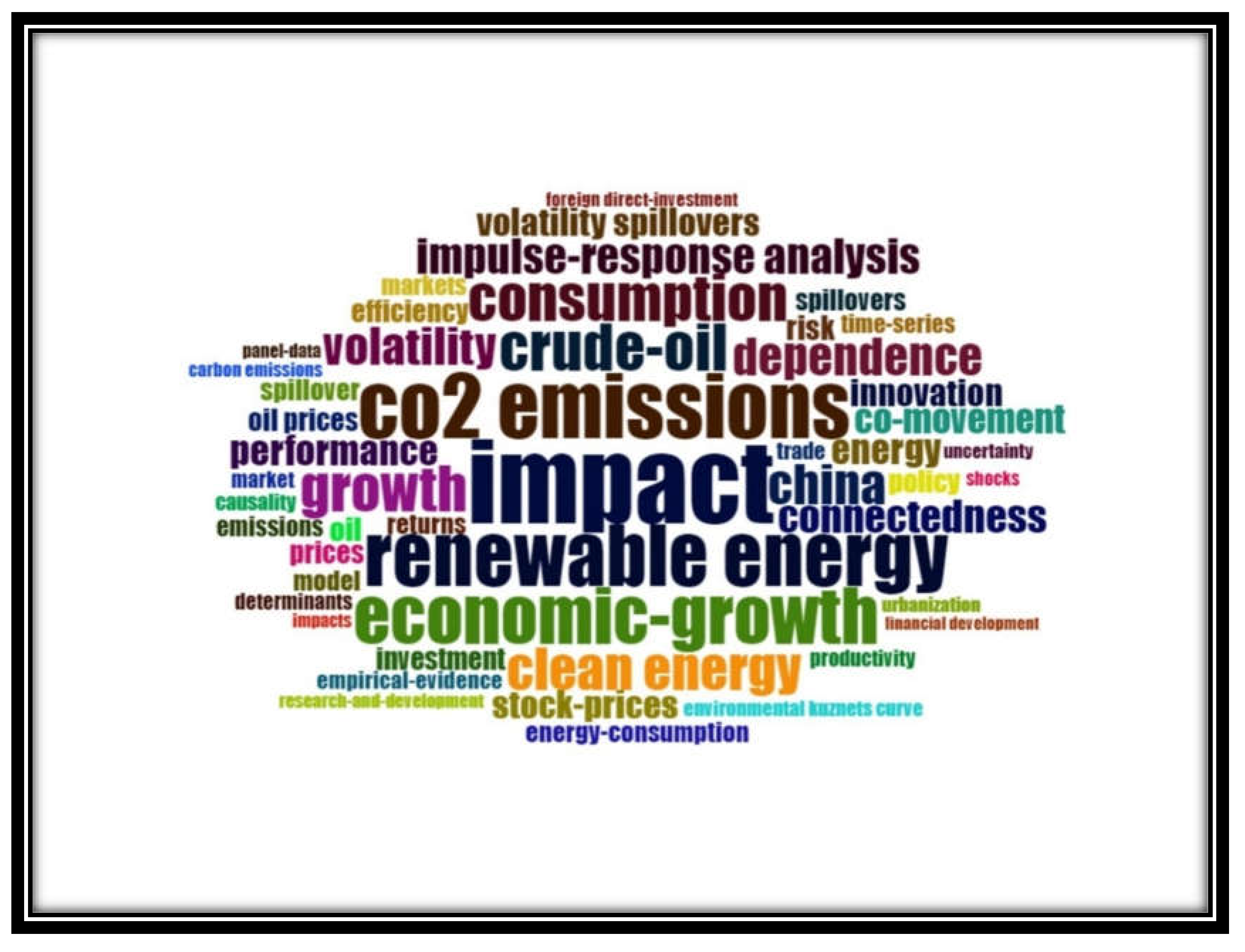

The occurrence of words serves as an indicator of the development and subject matter within a certain area of study (Kumar et al., 2021). This report provides valuable insights into the prevailing trends in research popularity. The top 20 most frequently used words by the authors, along with their frequencies, are shown in

Figure 14.

The most commonly used terminology in the literature on the interconnectedness of sustainable finance is “renewable energy,” “green finance,” “spatial spillover effect,” “green bonds,” “clean energy,” “green technology innovation,” “connectedness,” “spillover effect,” “uncertainty,” “CO2 emissions,” “environmental regulations,” “renewable energy consumption,” and “economic growth.”

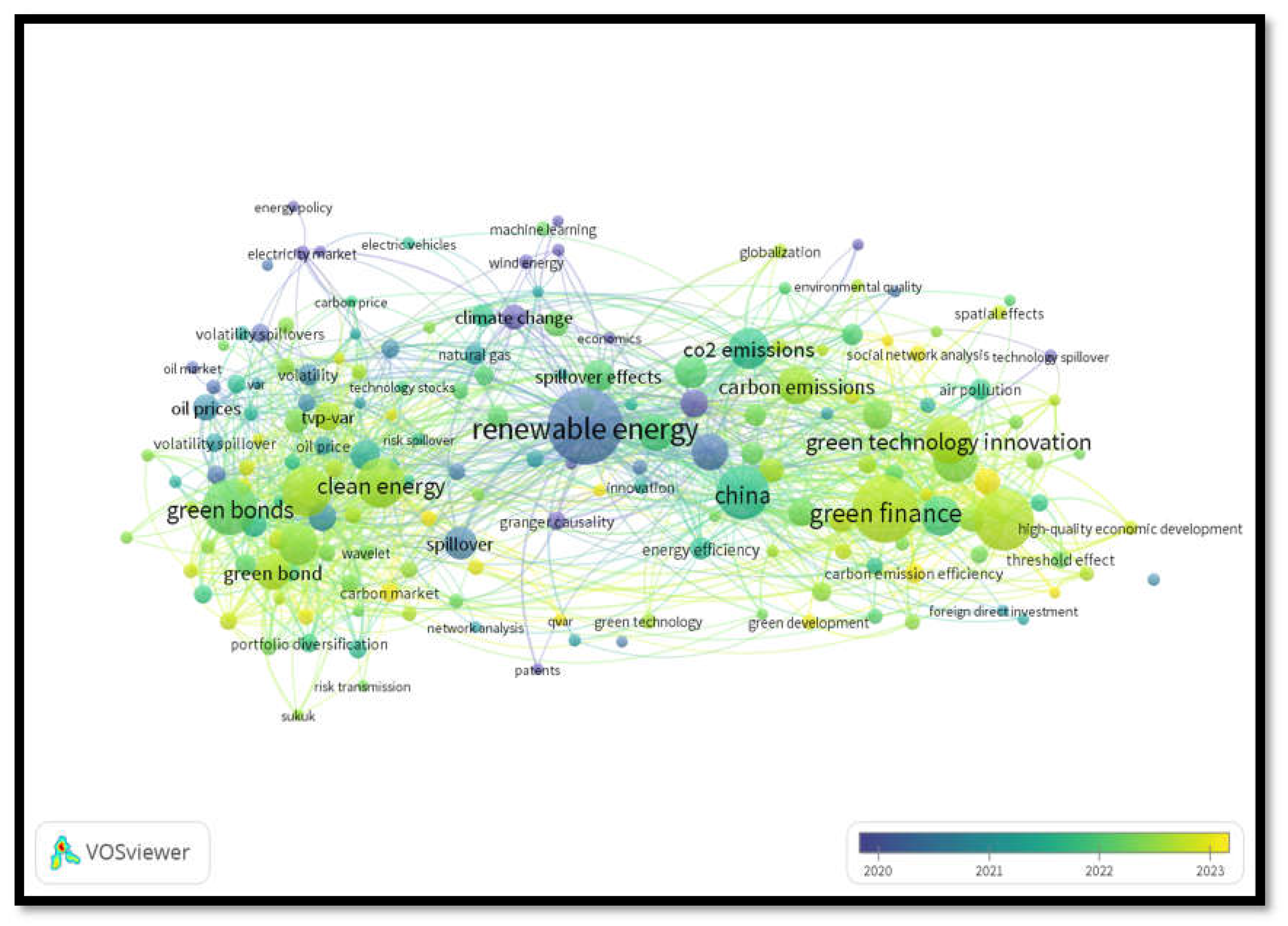

Co-occurrence Network of Author Keywords

Figure 14 and

Figure 15 display a map that shows the frequency of keywords.

Figure 14 presents the results of author keywords that meet the minimum occurrence criterion of 5. Out of a total of 3469 authors’ keywords, only 178 keywords matched the threshold criteria.

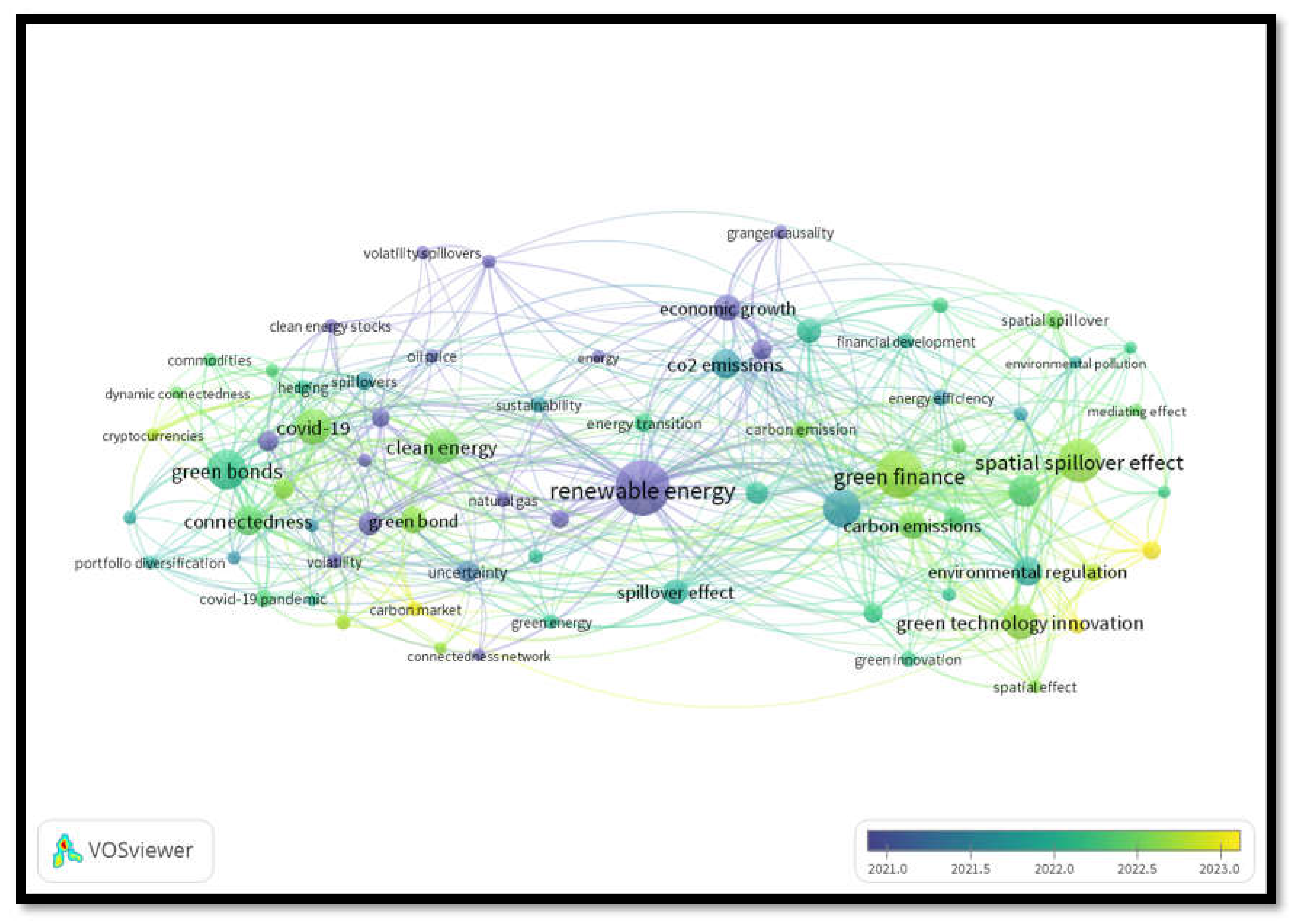

Figure 15 illustrates this trend in relation to time.

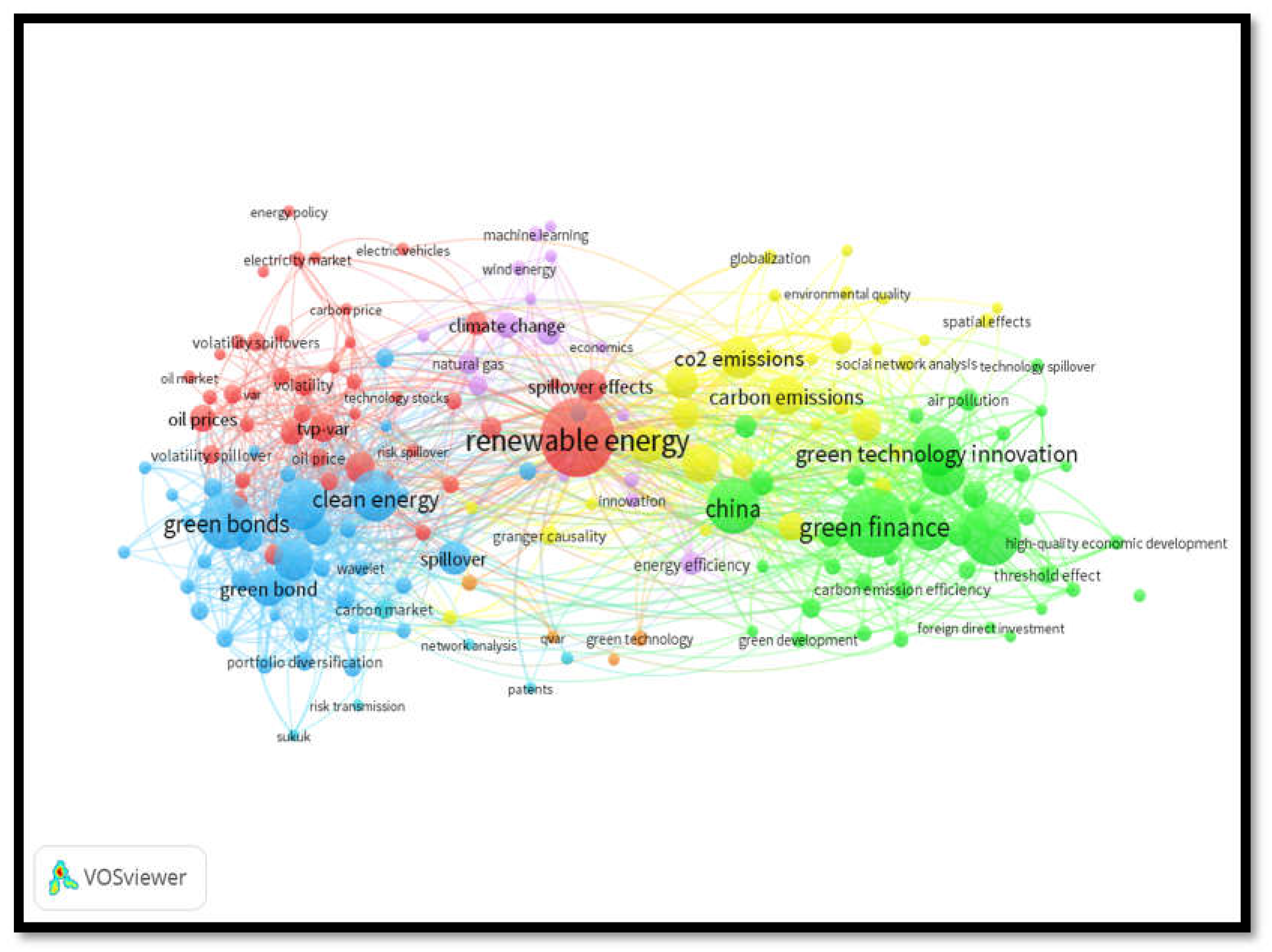

Figure 16 and

Figure 17 show the network diagram of only the 73 most frequent words that meet the minimum occurrence threshold of 10.

Figure 16.

Co-Occurrence Network-Min-5-178 Keywords over Time.

Figure 16.

Co-Occurrence Network-Min-5-178 Keywords over Time.

Figure 17.

Co-Occurrence Network-Min-10-73 Keywords.

Figure 17.

Co-Occurrence Network-Min-10-73 Keywords.

Figure 18.

Co-Occurrence Network-Min-10-73 Keywords over Time.

Figure 18.

Co-Occurrence Network-Min-10-73 Keywords over Time.

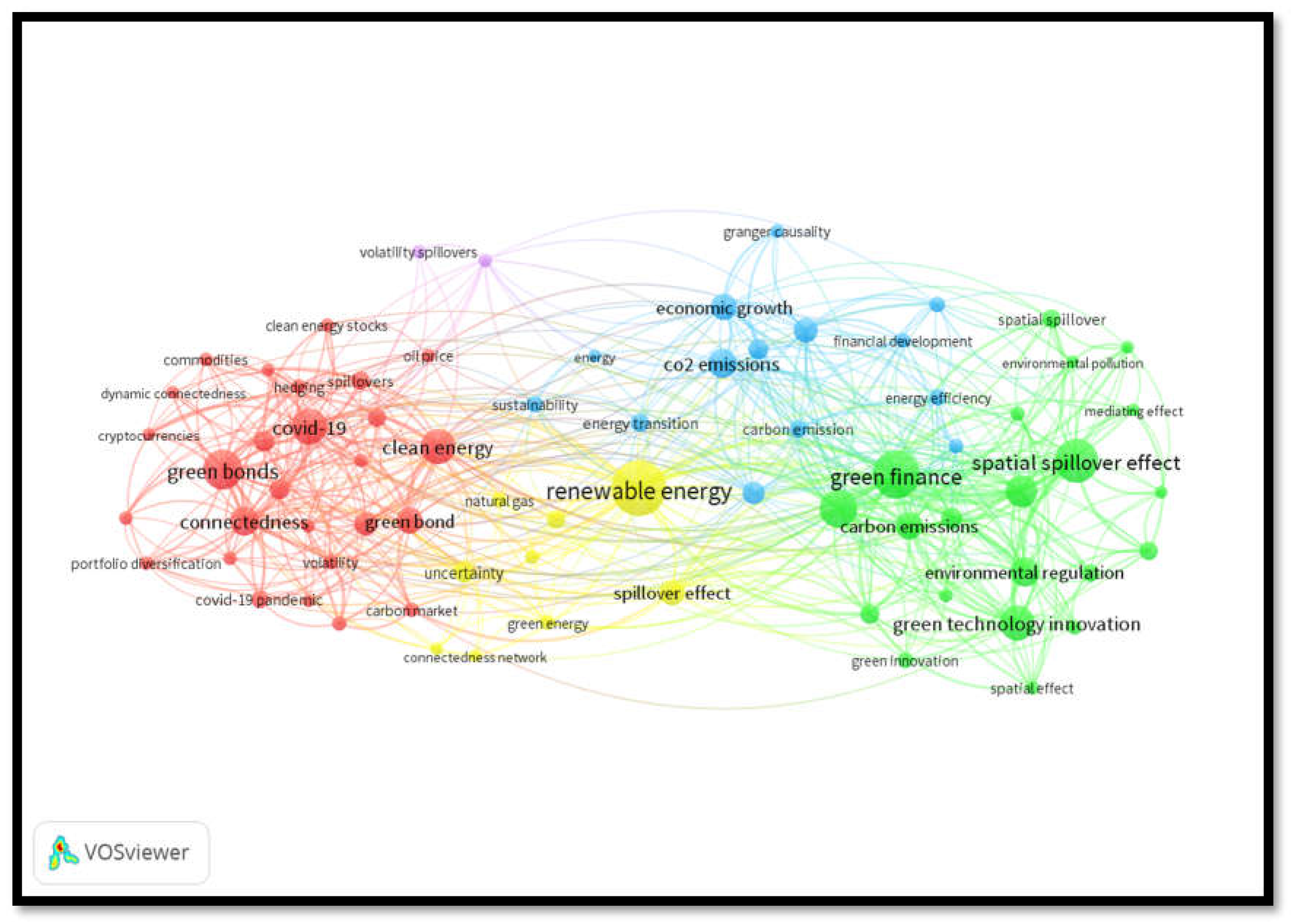

Figure 16 shows five distinct clusters of terms. Cluster 1 (red) has 27 keywords, Cluster 2 (green) contains 21 keywords, Cluster 3 (blue) comprises 14 keywords, and Cluster 4 (yellow) covers 9 keywords, and Cluster 5 (purple) has only two keywords. These clusters represent the prevailing pattern in the connectedness of sustainable financing. These clusters represent several research streams that focus on a specific dimension of connectedness in sustainable finance.

Cluster 1: Connectedness of Green Bond Market.

The dominant cluster, indicated by the red color, comprises 27 terms that encompass the studies related to the research on the risk transmission of the green bond market. The green bond market is the first green finance market where the greenest investment projects are financed, so scholars from several disciplines have been drawn to the topic of connectedness in sustainability finance; they choose the green bonds as a proxy for the green finance market. They examine and analyze related areas, including the connectedness of green finance, renewable energy, clean energy, CO2 emissions, and overall spillovers from green bonds to sustainable investment. This cluster primarily focuses on the significance of green investing using the funds generated through the bond market. The primary goal of the studies is to understand the advantages of diversifying into green markets. The scholars clearly identified the hedging benefits of green investing during the period of the Covid-19 pandemic. This cluster uses the following main keywords: dynamic connectedness, connectedness, volatility, connectedness, network hedging, portfolio diversification, spillovers, clean energy, green bonds, financial markets, and the COVID-19 pandemic. These issues of green finance study are closely interconnected and form the central focus of sustainability in finance. This group is also unified with other groups, indicating the incorporation of similar concepts throughout several facets of sustainable finance.

Cluster 2: Green Technology Innovation and Green Finance

The second green color cluster, known as the green innovation cluster, contains 21 keywords that are connected to green technology innovations and green finance tools utilized for sustainable financing. The cluster encompasses prominent concepts such as green finance, green technology innovation, green innovations, and the spatial spillover effect. This cluster encompasses the knowledge sphere of the sustainable economy. These clusters discuss the knowledge base of how sustainability can be achieved; only innovations of new energy sources can make possible the real transition to a sustainable future. This cluster includes additional studies on environmental regulation, environmental pollution, and air pollution, demonstrating that implementing clear regulations that prioritize green innovations is the only way to address the challenges posed by climate change. The correlation to other clusters is significant. The first cluster concentrates on the interconnectedness of green bonds, while this cluster investigates green finance as a source for green innovations and establishes the foundation for the digital economy, a crucial component of a sustainable economy. This cluster also identifies China as a hub for green innovations due to its effective environmental regulations, which support the green technological innovations.

Cluster 3: Sustainability, Energy Transition, and Economic Growth

The blue color cluster, having 14 keywords, is characterized by its focus on economic growth with sustainability. This cluster mostly includes terms related to the renewable energy transition aspects. This cluster concentrates on promoting economic growth while reducing carbon emissions and enhancing energy efficiency. The primary terms in this cluster are CO2 emissions, energy transition, sustainability, energy efficiency, technological innovations, economic growth, spillover effects, and Granger causality. This cluster illustrates ongoing research on the significance of sustainability. This group focuses on promoting economic growth to ensure the protection of the climate. All financial activities prioritize climate health. This cluster is closely interconnected with other clusters, particularly the second.

Cluster 4: Renewable Energy and Spillover Effect

The yellow color cluster on this network map is created exclusively using renewable energy and its spillover effects to the other sector of the economy. This cluster is central to all other clusters and has strong connections to other clusters’ energy sources. The cluster is mostly focused on the term’s renewable energy, renewable energy sources, green energy, spillover effect, uncertainty, connectedness network, and climate change. The finance and regulation of renewable energy are crucial for assuring the generation, distribution, and use of clean energy.

Cluster 5: Volatility Spillover during the Covid-19 Pandemic

The only two items in the purple color cluster identified a key volatility spillover effect of clean energy to oil prices during Covid-19.

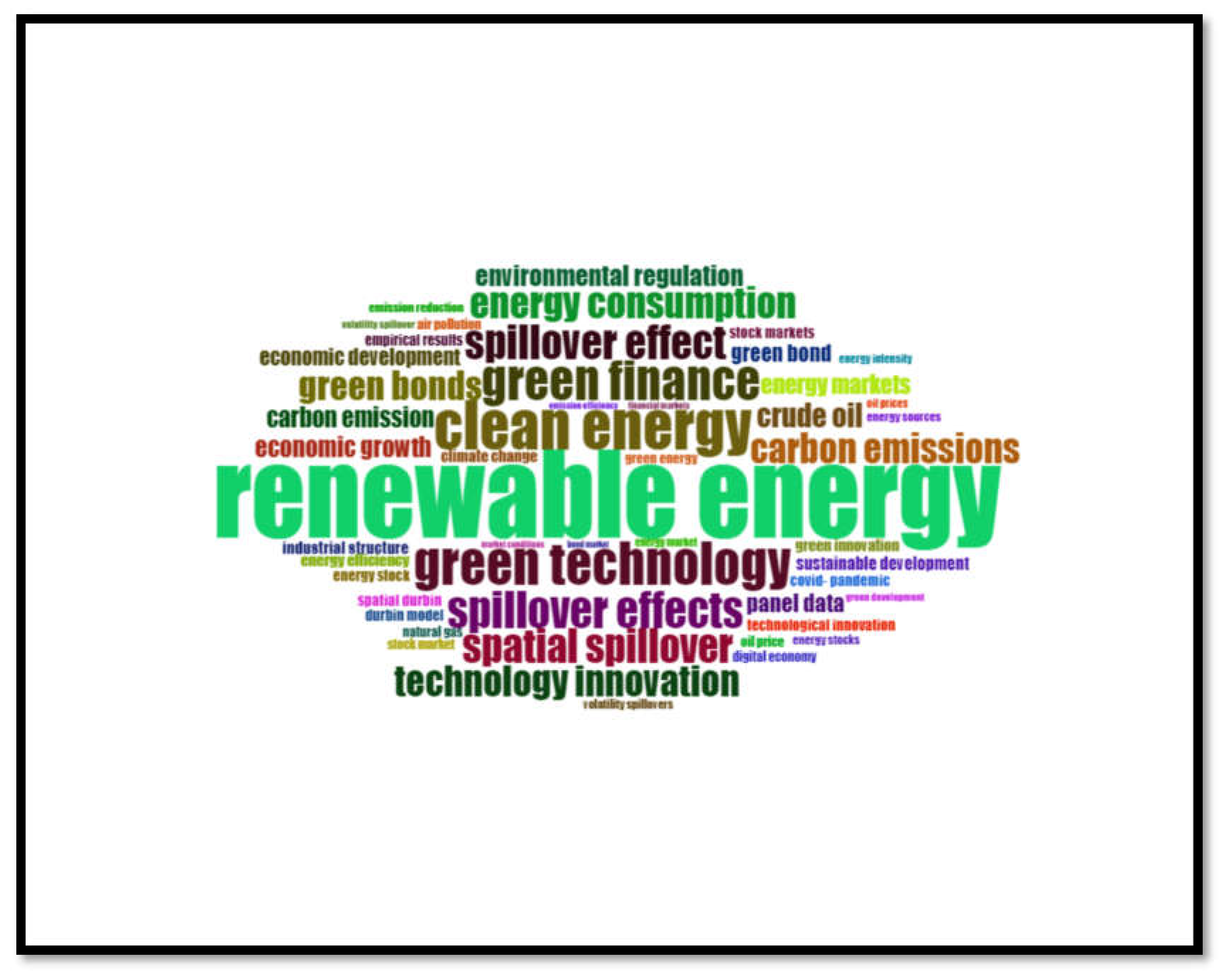

Figure 19.

Word Cloud of author Key words.

Figure 19.

Word Cloud of author Key words.

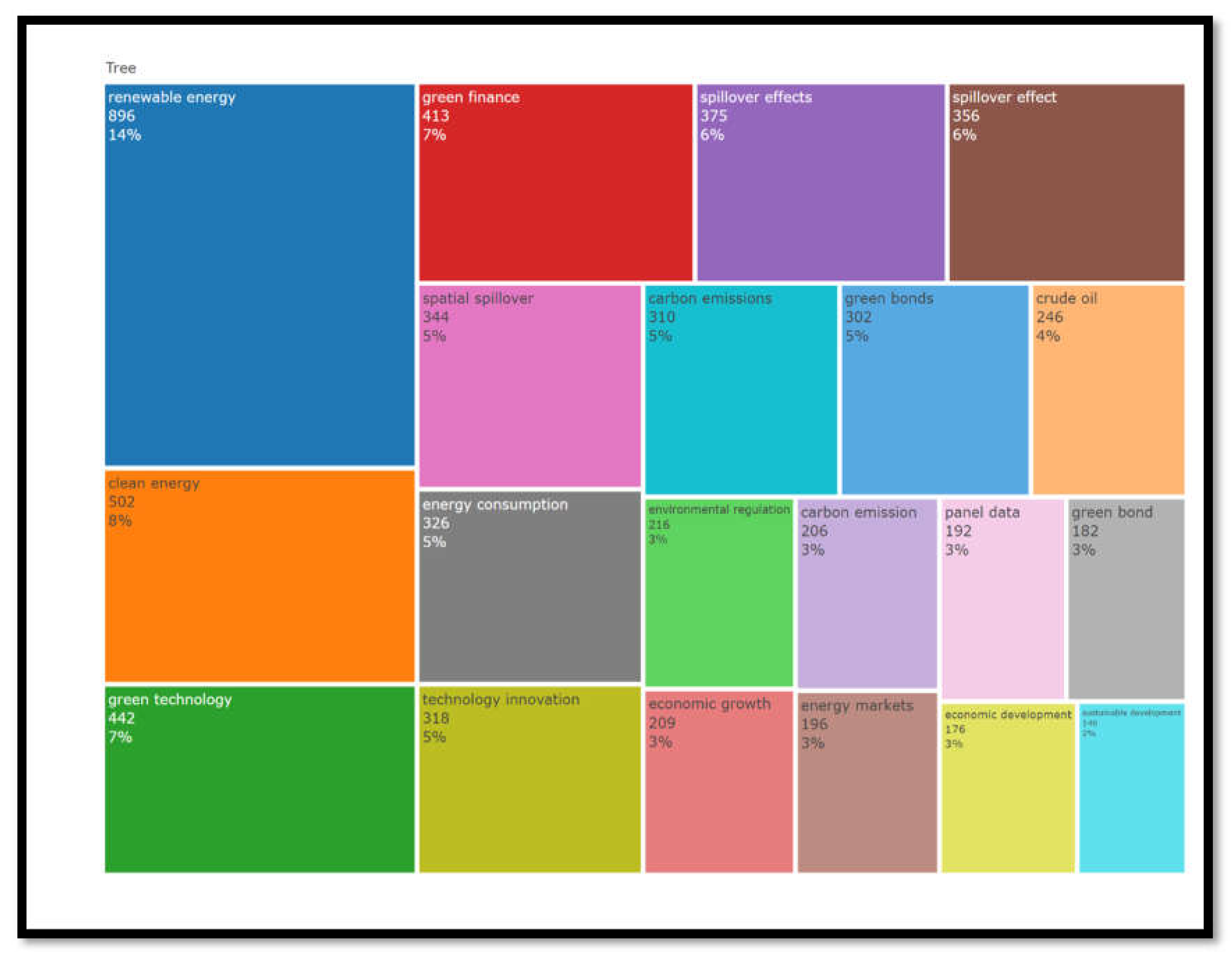

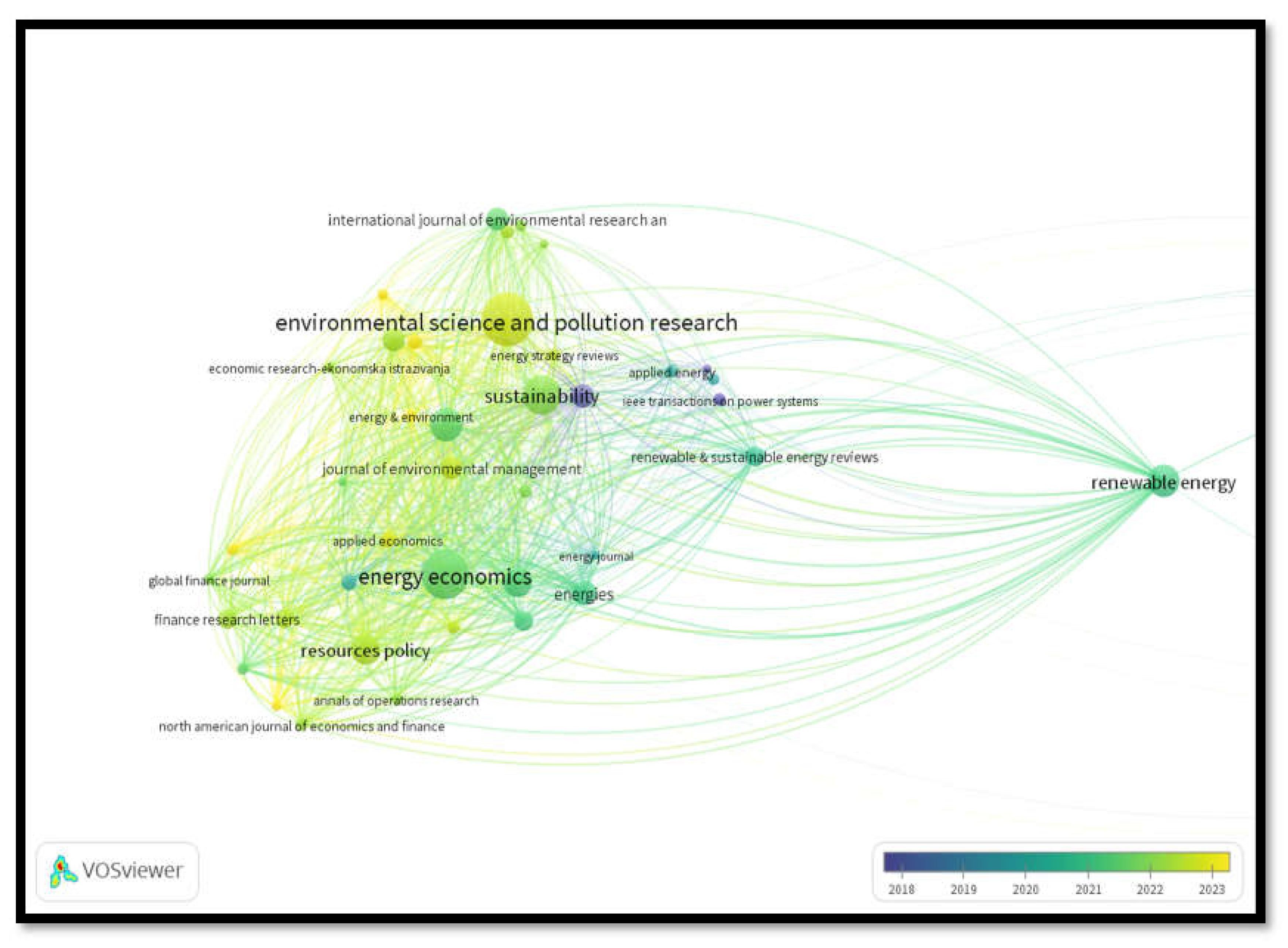

Figure 20.

Tree Map of Author Keywords.

Figure 20.

Tree Map of Author Keywords.

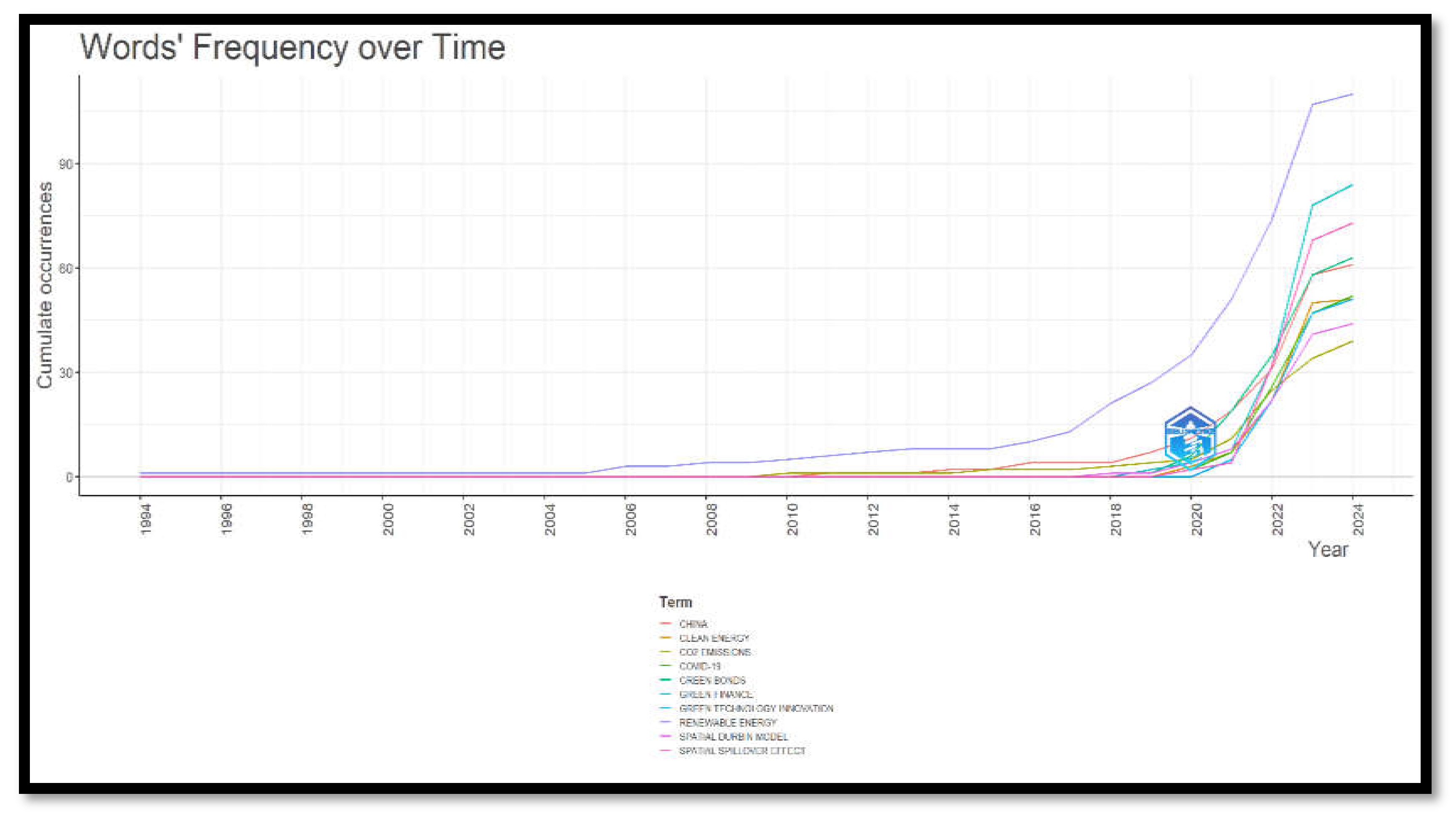

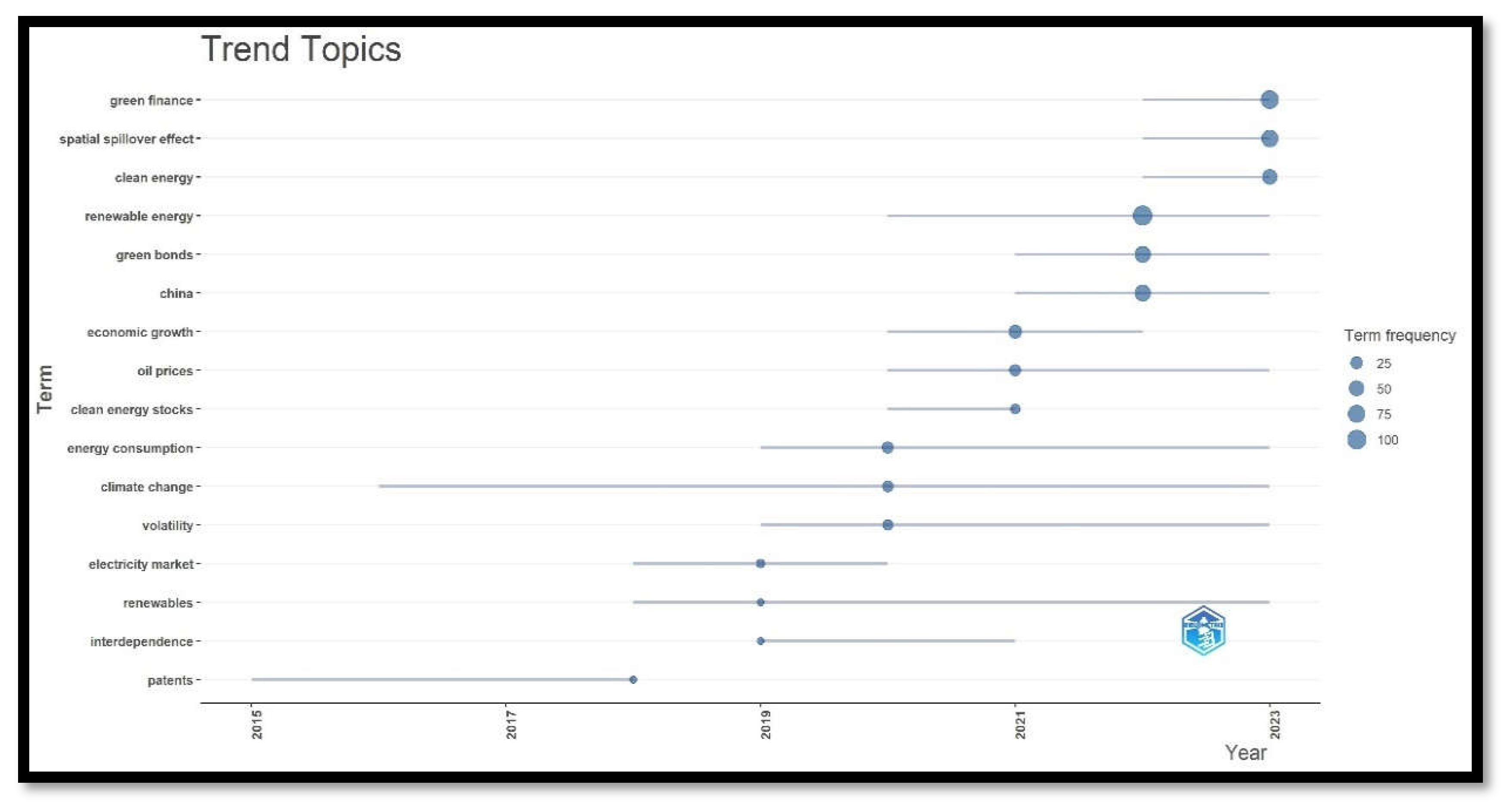

Figure 21.

Words’ Frequency over Time-author keywords.

Figure 21.

Words’ Frequency over Time-author keywords.

Figure 23.

Word Cloud-Abstract.

Figure 23.

Word Cloud-Abstract.

Figure 24.

Tree Map of Words-Abstract.

Figure 24.

Tree Map of Words-Abstract.

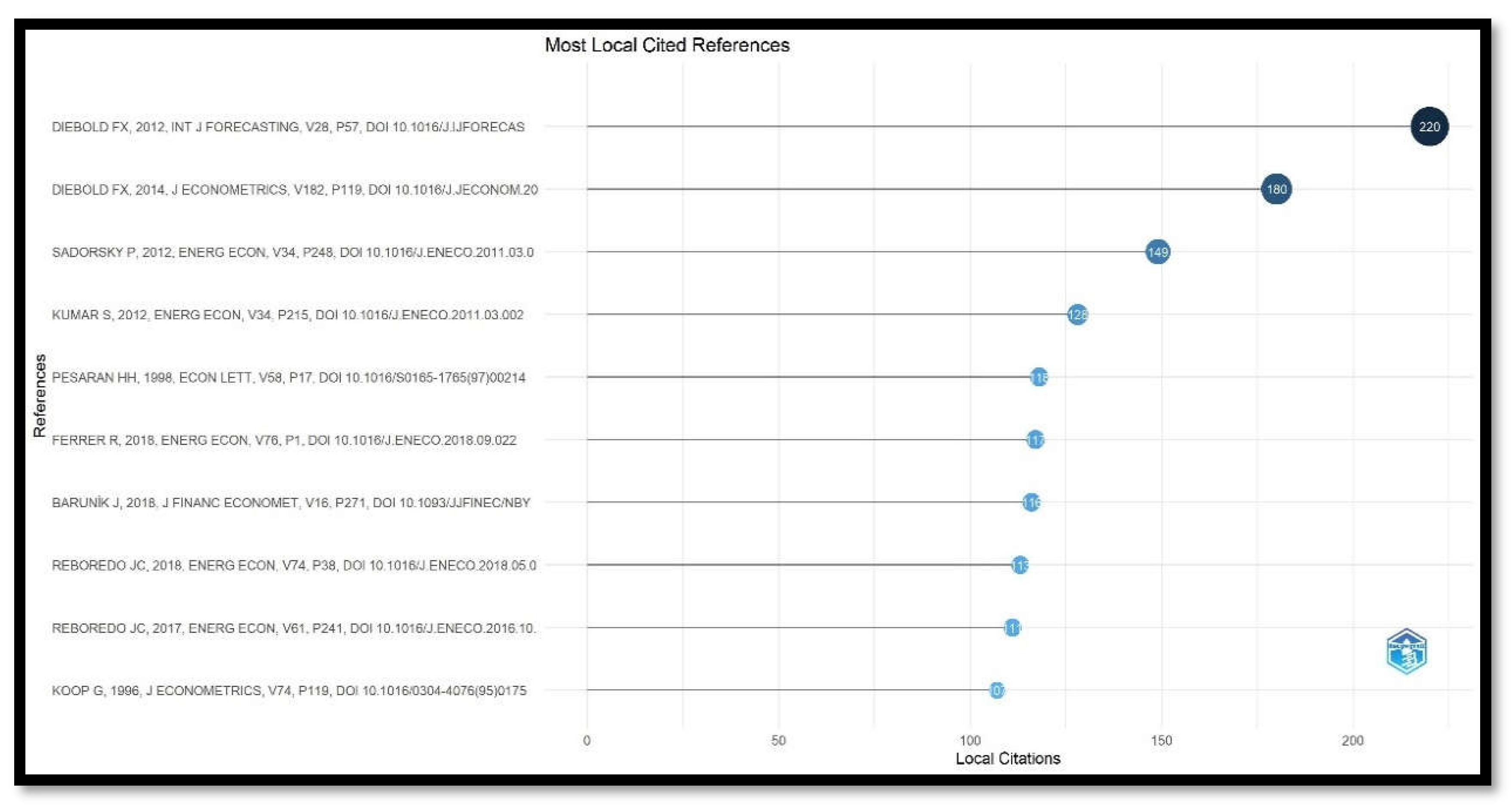

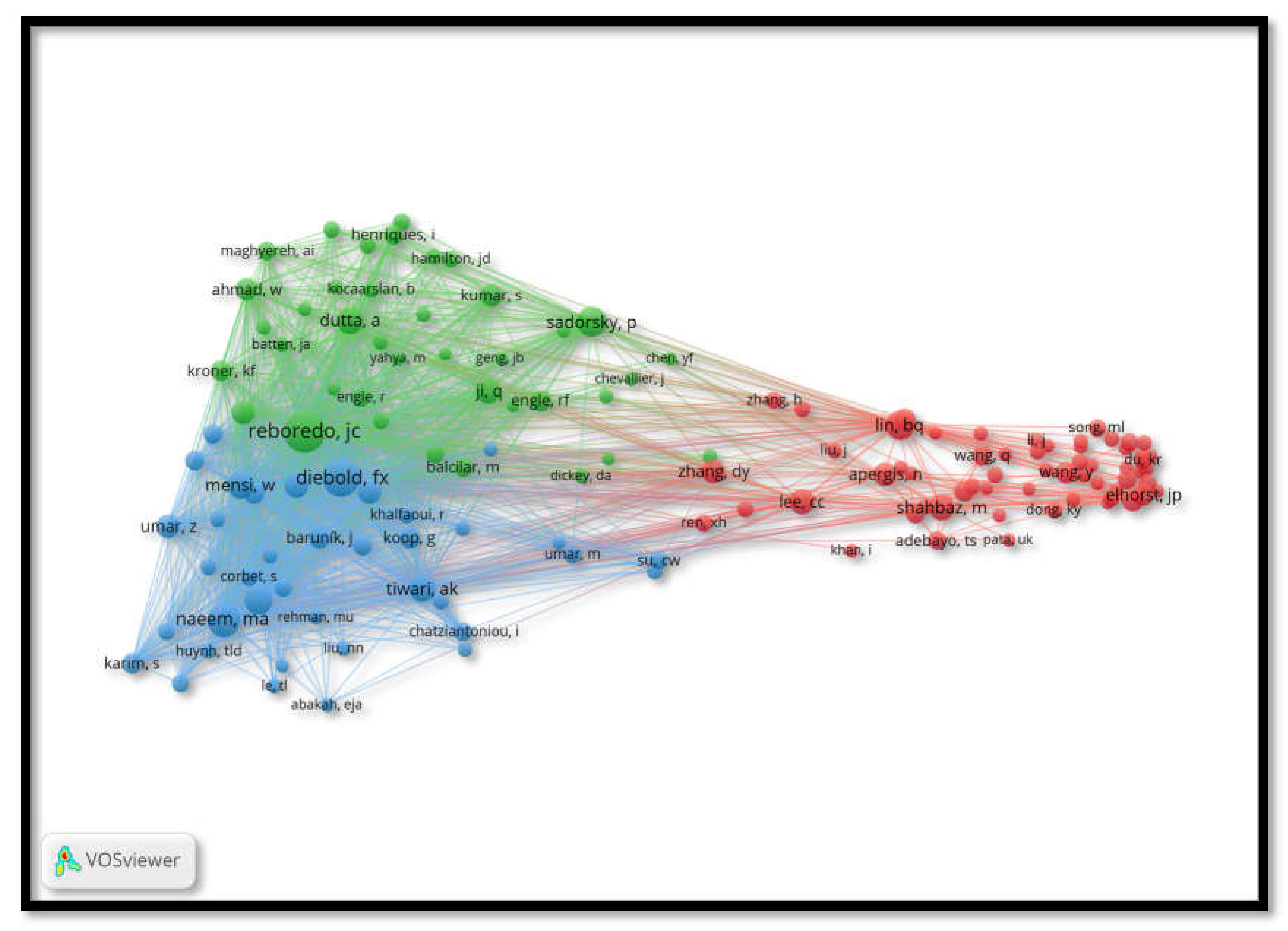

3.9. Co-Citation Analysis

Co-citation analysis is a technique employed to assess the intellectual framework and similarity among authors’ works. The emphasis is exclusively on the number of citations, disregarding the substance of the citations themselves. Clusters form when authors with similar citation patterns reference one another. The clustering of two authors suggests the utilization of similar references by both parties.

Figure 25 illustrates a co-citation map analysis, wherein the criterion for inclusion is that an author must possess at least 50 citations. Among 3540 writers, only 137 authors satisfy this criterion, categorized into three distinct clusters. Cluster one (red) comprises 60 authors. Cluster two contains 39 items, whereas cluster three comprises 38 items. The clusters represent the magnitude of the domain’s intensity and the concentration of its density. The authors reference the same work.

The red-colored Cluster 1, which is the most extensive cluster on the map, represents publications related to green investment. Green financial investment research has largely concentrated on socially responsible investment, according to the keyword map. Portfolio selection, risk and return, investor behavior, and institutional attitude are the main areas of focus in the study. This cluster has been significantly advanced by Leys et al. (2009), Palacio and García (2017), and Rossi et al. (2019), who are the principal authors. These writers have the highest level of connectivity inside the cluster and possess strong links in the network.

Cluster 2, green color, is dedicated to addressing inquiries on the appropriateness of financial instruments and their analysis. This cluster has conducted research on issues pertaining to green banking, green bonds, and Sukuk. Alonso-Conde and Rojo-Suarez (2020), Ngwenya and Simatele (2020), and Tuhkanen and Vulturius (2020) investigated various aspects of green banking and bonds in relation to sustainability... The writers exhibit a strong link within their cluster but have limited connections outside of it.

Cluster 3: blue shade Researchers (Cadman, 2014; Jakob et al., 2016; Zhu et al., 2013) have investigated the importance of carbon and climate finance. These studies focus on climate policy, modeling, and their impact on the long-term sustainability of the environment. Clearly, this cluster is currently expanding and lacks significant connections both internally and externally. The research on climate and carbon finance is still in its early stages, focusing on a crucial part of sustainability.

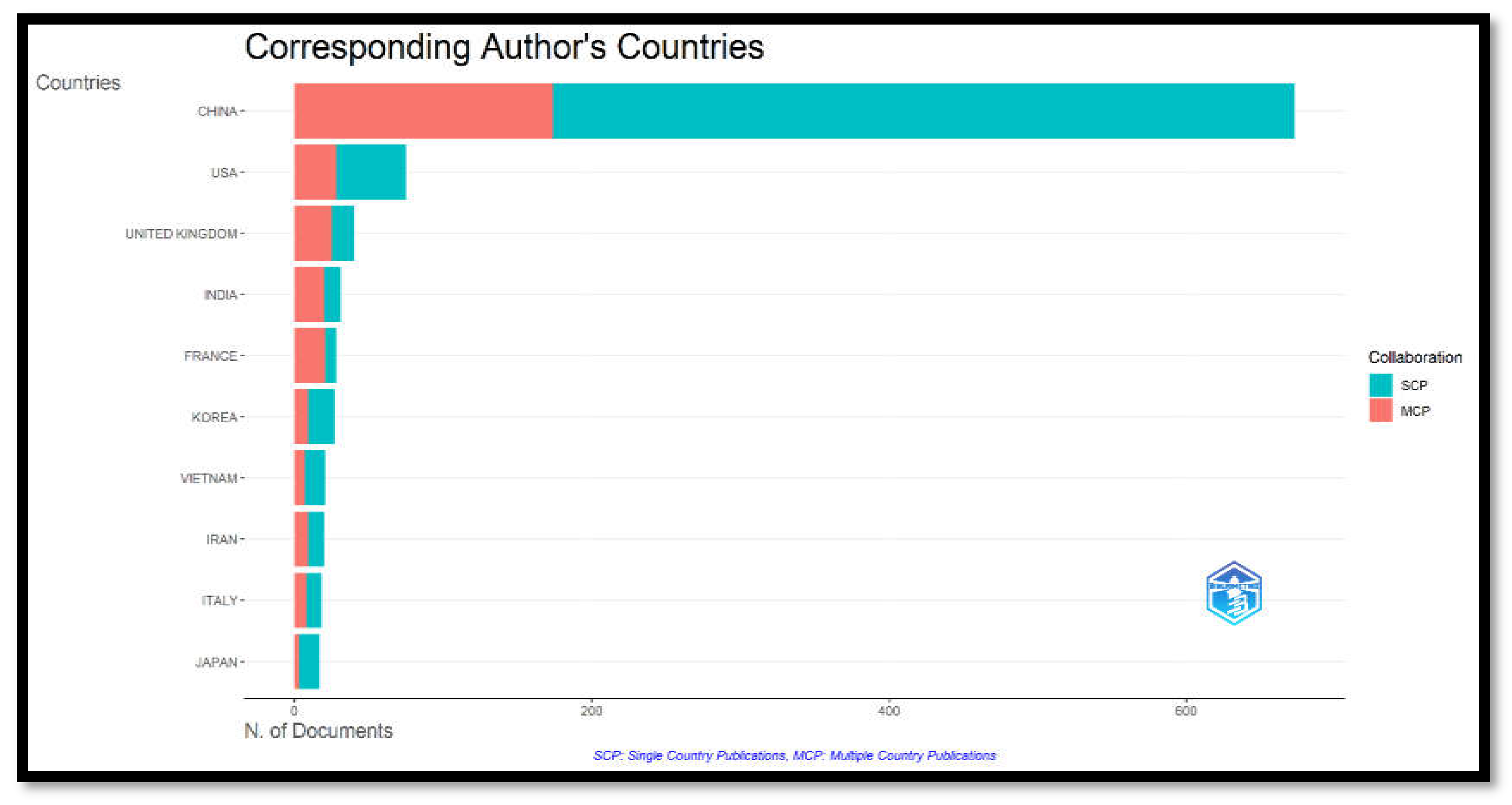

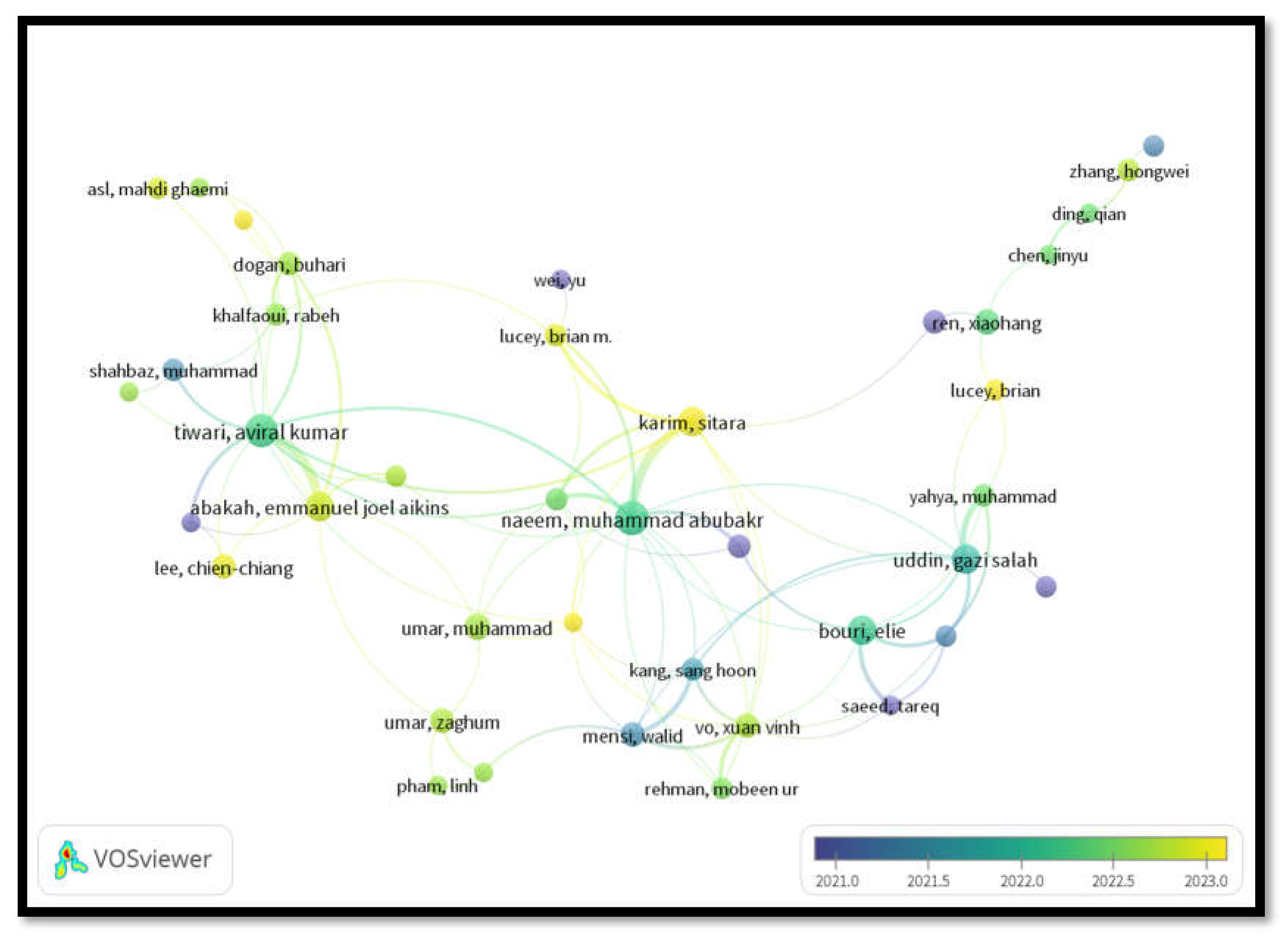

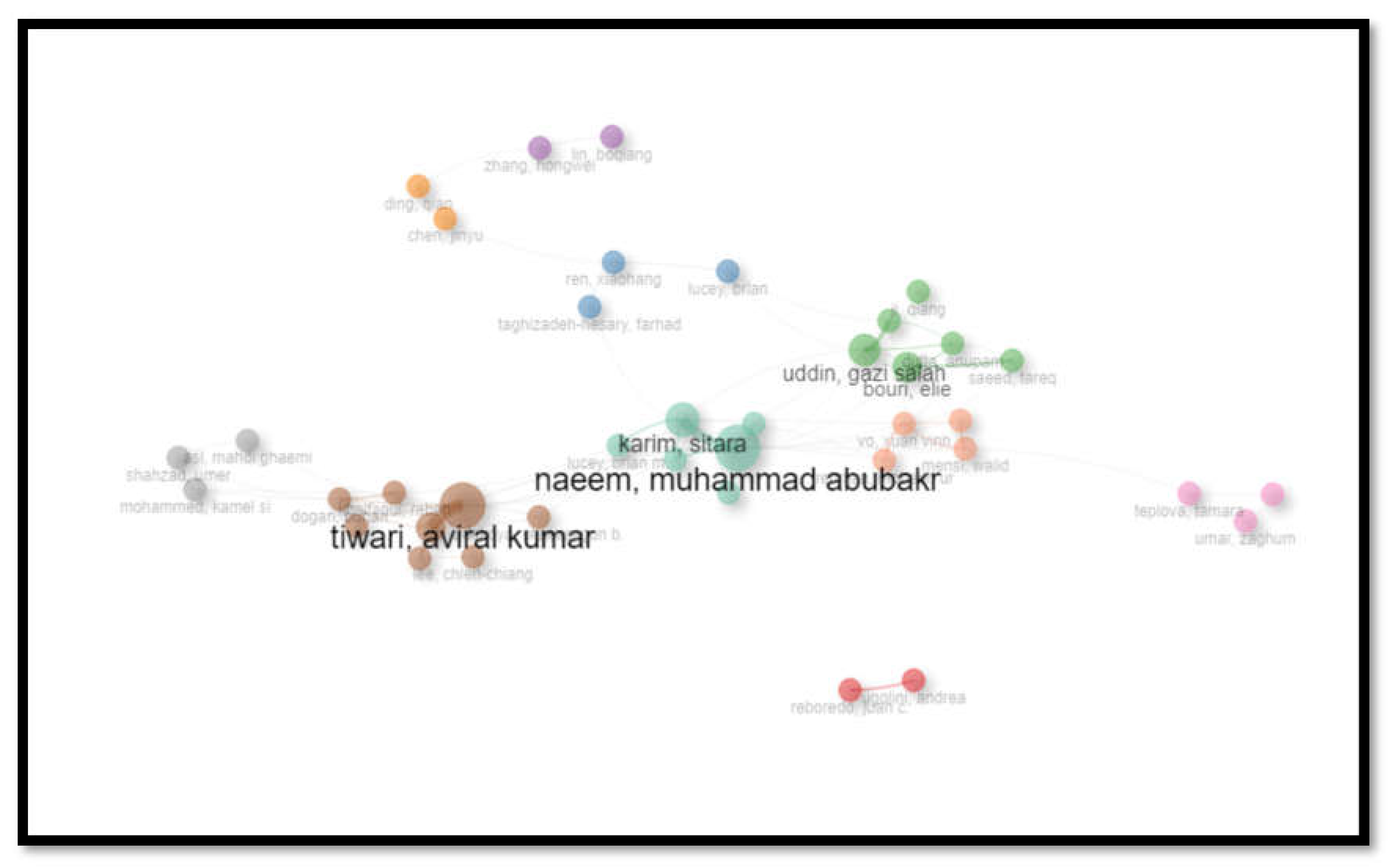

3.11. Collaboration Network Analysis

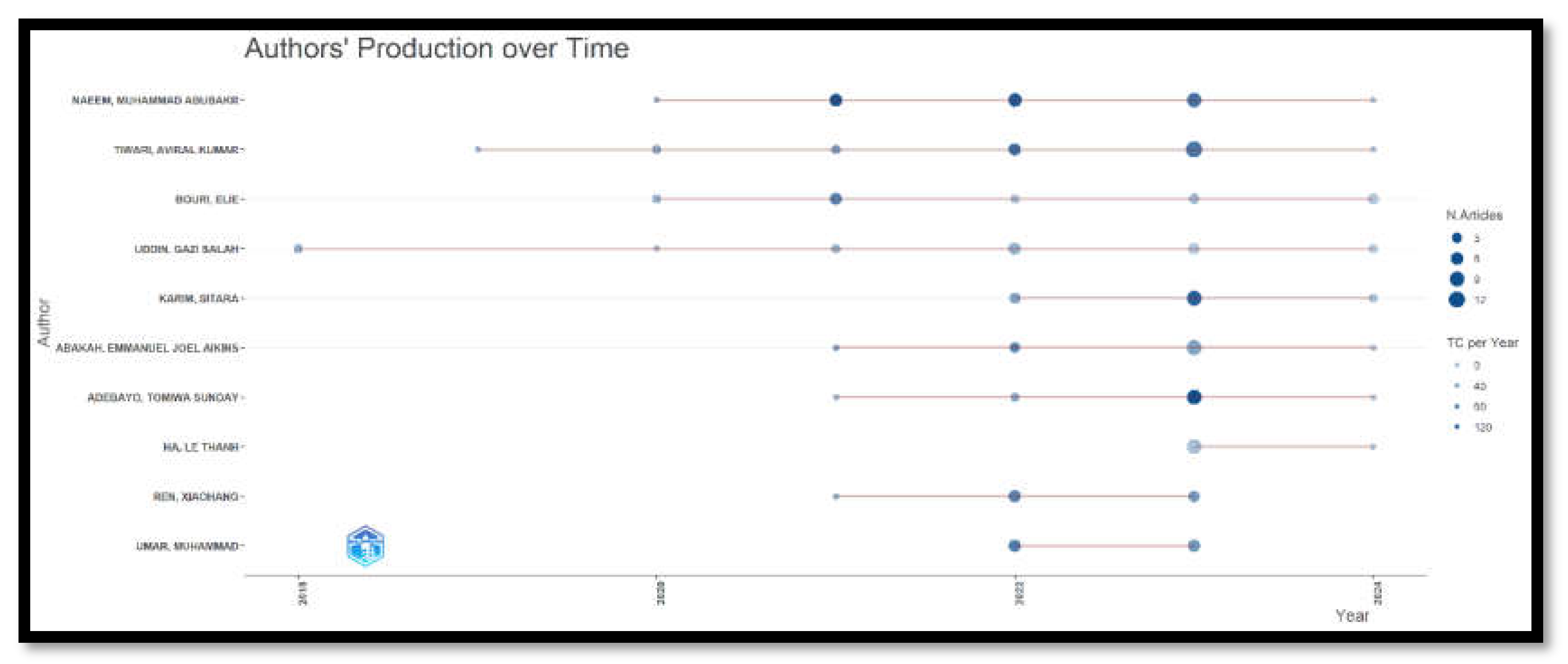

The collaboration network in sustainable finance, as represented by these ten clusters shown in

Table 8 and

Figure 28, highlights the diversity and complexity of research in this field. From foundational scholars in Cluster 1 to interdisciplinary bridge-builders in Cluster 2, and innovative fintech researchers in Cluster 10, each cluster contributes uniquely to the development of sustainable finance. Understanding the roles of key authors in these clusters helps identify the interdisciplinary nature of the field, the importance of regional and global contributions, and the emerging trends in sustainable finance research. As these clusters continue to evolve, they will drive both academic growth and policy advancements in addressing global sustainability challenges.

Cluster 1: Foundational Researchers and High Internal Collaboration

Key Authors: Juan C. Reboredo, Andrea Ugolini

Cluster 1 consists of foundational authors who have a high degree of internal collaboration within their research community. The low betweenness scores of authors like Juan C. Reboredo and Andrea Ugolini indicate that they are not key intermediaries between other clusters, but are central within their own group. These authors contribute to focused research topics in sustainable finance, collaborating extensively within their specialized areas. They likely work on specific issues such as climate finance or green bonds, maintaining close-knit relationships with other members of the cluster.

Cluster 2: Bridge-Building Authors with Cross-Cluster Influence

Key Authors: Xiaohang Ren, Farhad Taghizadeh-Hesary, lucey, brian

Cluster 2 includes authors with high betweenness scores, such as Xiaohang Ren and Farhad Taghizadeh-Hesary, indicating that they serve as bridge-builders between different research areas. These authors play a critical role in connecting various subfields of sustainable finance, such as green finance, renewable energy, and climate risk management. Their ability to collaborate across clusters makes them central to fostering interdisciplinary research and facilitating the flow of ideas between distinct research domains.

Cluster 3: Emerging Scholars and Specialized Research Areas

Key Authors: Bouri elie, Uddin gazi salah, Yahya Muhammad, Dutta Anupam, Ji, qiang, Saeed, tareq

Cluster 3 represents emerging scholars who focus on specialized or niche areas within sustainable finance. These authors might be early-career researchers contributing to innovative subfields such as impact investing, green fintech, or socially responsible investing. While their betweenness scores are moderate, indicating they are still establishing themselves as intermediaries, they bring new perspectives to the field. Over time, as their influence grows, they will likely expand their collaboration networks and become more integral to interdisciplinary efforts.

Cluster 4: Large Collaborative Teams and Multi-Institutional Research

Key Authors: Lin, boqiang, Zhang, Hongwei

Cluster 4 is composed of large, collaborative research teams that tackle complex and broad challenges within sustainable finance. These authors typically work across multiple institutions and countries, as indicated by their high betweenness scores. They facilitate collaboration among various academic and research communities, integrating diverse expertise from different parts of the world. The authors in this cluster contribute to large-scale research projects addressing global challenges such as energy transition, financial risk due to climate change, and green technology development.

Cluster 5: Influential Authors with Broad Global Impact

Key Authors: Chen, Jinyu, Ding, Qian

Cluster 5 is home to the most influential authors in the field of sustainable finance. These authors are recognized for their global impact in both academic research and policy development. With high PageRank and betweenness scores, authors in this cluster are at the center of the research network, connecting different clusters and shaping the future of sustainable finance research. They often lead large-scale research efforts, influencing the development of sustainable financial models and regulatory frameworks.

Cluster 6: Regional Leaders in Sustainable Finance

Key Authors: Tiwari, Aviral Kumar, Abakah Emmanuel Joel Aikins,

Lee, Chien-Chiang, Dogan Buhari, Khalfaoui Rabeh, Shahbaz Muhammad, Adekoya, Oluwasegun B., Nasreen Samia

Cluster 6 features regional leaders in sustainable finance, authors who contribute significantly to the field within specific geographic areas or economic contexts. These authors may focus on regional financial markets, economic policies, or climate finance challenges specific to certain countries or regions. Their research may be particularly relevant for policy makers and financial institutions operating in those regions. Though they may have lower betweenness than authors in other clusters, their contributions are essential for localized studies of sustainability.

Cluster 7: High-Impact Authors in Green and Social Finance

Key Authors: Umar, Zaghum, Pham, Linh, Teplova, Tamara

Authors in Cluster 7 focus on high-impact topics in green finance and socially responsible investing. These authors often work on studies that explore the intersections between finance and sustainability, especially in relation to corporate social responsibility (CSR), ESG investing, and social impact finance. Their collaboration networks are often cross-disciplinary, bringing together finance professionals, environmental scientists, and policy experts. With their high PageRank scores, these authors are often at the forefront of green bonds and climate-related financial innovations.

Cluster 8: Interdisciplinary Scholars with Diverse Contributions

Key Authors: Asl, Mahdi Ghaemi, Mohammed Kamel Si, Shahzad Umer

Cluster 8 includes interdisciplinary scholars whose work spans multiple domains, from finance and economics to environmental science and policy analysis. These authors contribute to bridging the gap between theoretical models in finance and practical applications in sustainability. Their betweenness scores suggest that they serve as intermediaries between different fields, allowing for a holistic approach to sustainable finance. Their work often integrates insights from socioeconomic factors, policy analysis, and market dynamics.

Cluster 9: Researchers in Policy and Regulatory Frameworks

Key Authors: Naeem, Muhammad Abubakr, Karim, Sitara, Umar Muhammad, Shahzad Syed Jawad Hussain, Farid Saqib, Lucey Brian M.

Cluster 9 is centered around authors who specialize in the policy and regulatory aspects of sustainable finance. These authors study the role of government regulations, financial policies, and international agreements in promoting sustainable finance. They work closely with governmental bodies, financial institutions, and NGOs to examine the effectiveness of regulations such as the Paris Agreement and climate risk disclosure frameworks. Their research directly impacts how sustainable finance can be integrated into national and international policy agendas.

Cluster 10: Innovative Researchers in Financial Technology and Sustainability

Key Authors: Mensi, Walid, Vo, Xuan Vinh, Kang, Sang Hoon, Rehman, Mobeen Ur

Cluster 10 focuses on the intersection of financial technology (fintech) and sustainability. Authors in this cluster are exploring how technology can be used to drive green finance innovations. This includes the development of blockchain for sustainable investment, AI-driven financial models, and digital platforms for sustainable finance. Their research is critical for pushing the boundaries of what is possible in sustainable finance through technological advancements. These authors are at the cutting edge of fintech solutions that facilitate green bonds, carbon trading, and sustainable management.

Figure 29.

Collaboration Network-Authors-overtime.

Figure 29.

Collaboration Network-Authors-overtime.

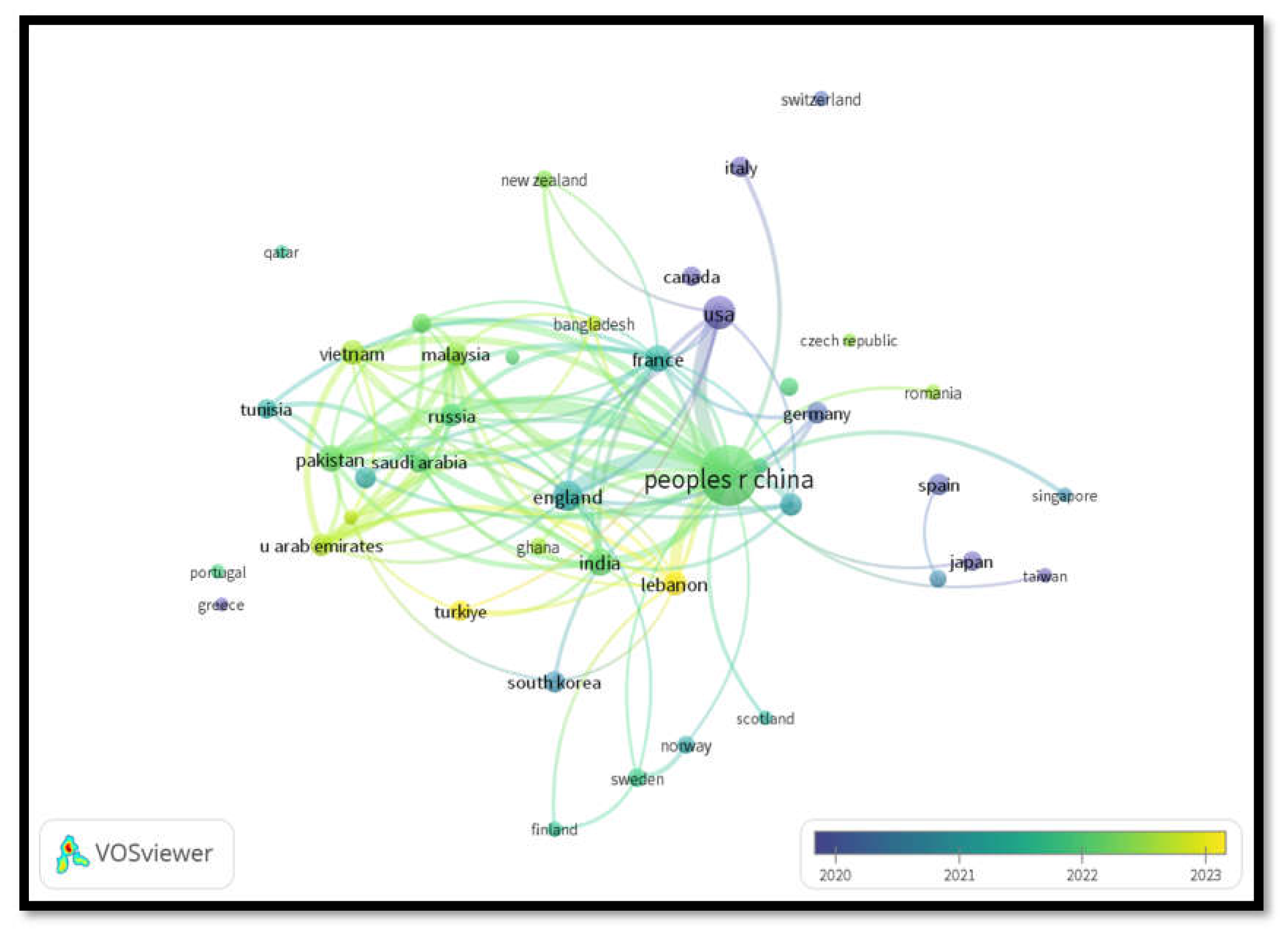

Figure 30.

Collaboration Network- Countries.

Figure 30.

Collaboration Network- Countries.

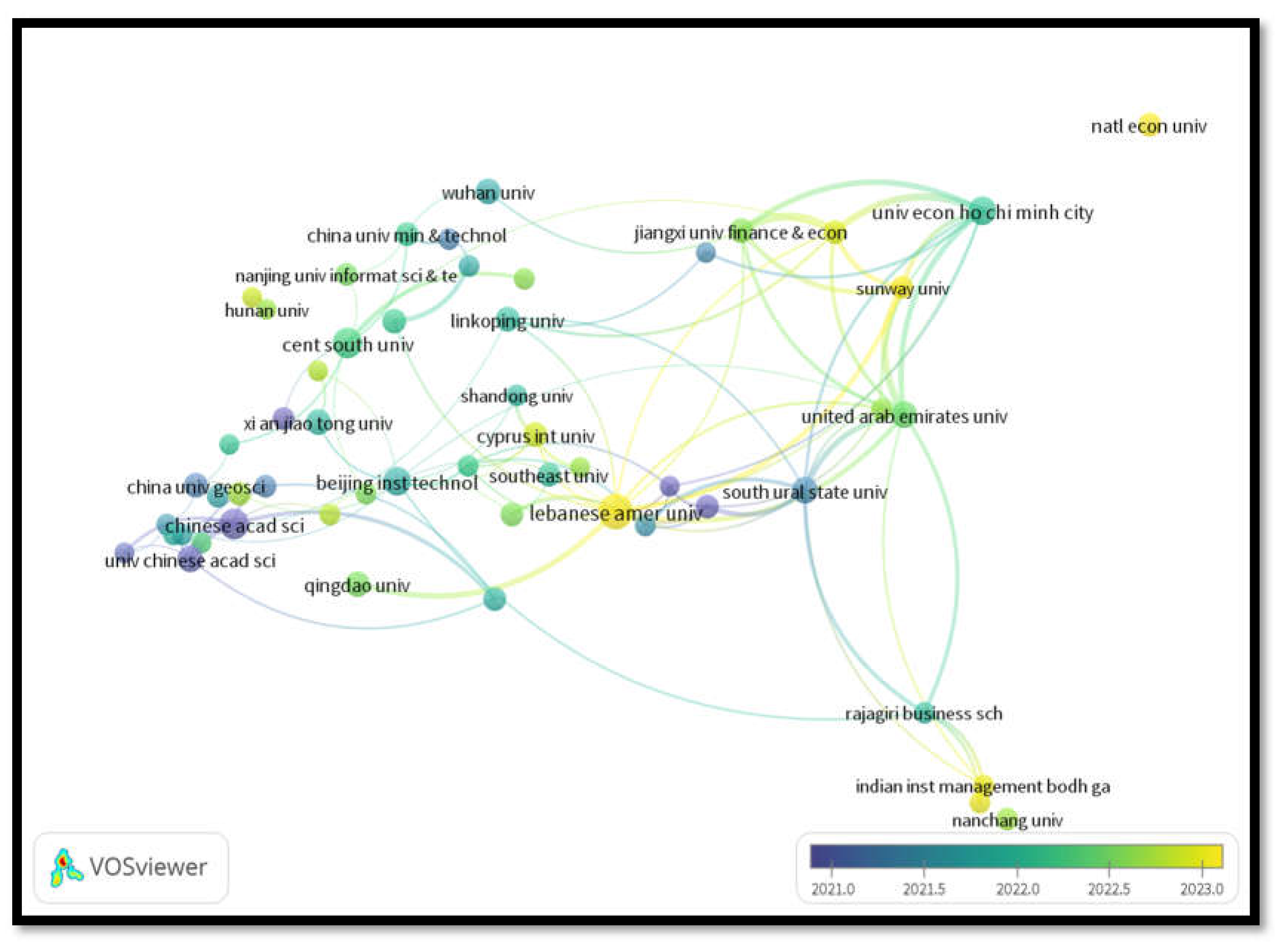

Figure 31.

Collaboration Network-Institutions.

Figure 31.

Collaboration Network-Institutions.

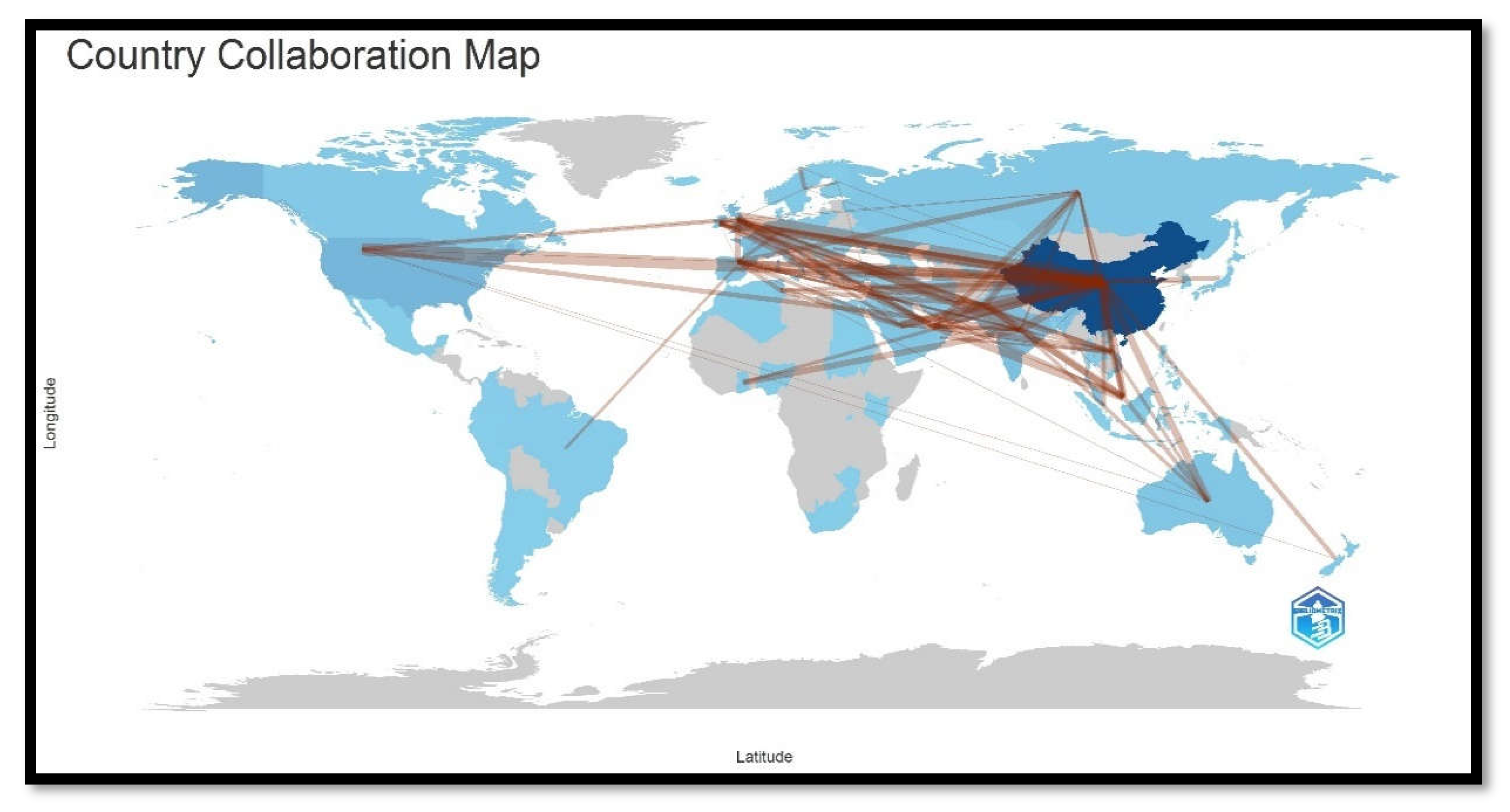

Figure 32.

Collaboration World Map.

Figure 32.

Collaboration World Map.