1. Introduction

In recent decades, accounting has evolved beyond merely recording financial transactions to becoming a tool for management, performance measurement, and maximizing organizational profitability (Hardan & Shatnawi, 2013).

Regarding accounting information, the Portuguese Public Administration has followed the evolution of international public-sector standards and national private-sector regulations. In 2015, Decree-Law No. 192/2015 of September 11 approved the SNC-AP, which revoked the POCP and its sectoral plans. Supported by 27 Public Accounting Standards (NCPs), a multidimensional plan, and a conceptual framework, the implementation level of the SNC-AP is associated with the size of the entities where it is applied.

To address the challenges of allocating indirect costs to products, NCP 27 of the SNC-AP proposes the activity-based costing (ABC) system for calculating product/service costs and outlines the steps for its implementation. This model assumes that activities consume resources, making it "more suitable for the reality of public entities whose services are focused on citizens/users and their needs" (Jordan et al., 2011).

Thus, with the mandatory application of the SNC-AP, the implementation of a management accounting system is foreseen through the proposed use of the ABC method by public entities, as defined in NCP 27. In summary, NCP 27 does not mandate the implementation of the ABC method but recommends its use as a tool to improve cost management and efficiency in public sector entities. The decision to implement ABC should be made by each entity, considering its specific characteristics and the advantages and disadvantages of its application. Additionally, it is noteworthy that NCP 27 already includes an environmental management aspect.

Higher education institutions (HEIs), facing reductions in public funding, must monitor the performance of their activities, requiring management accounting to provide information on various management aspects, such as the cost per student, course, or training program, as well as the cost of each research project or external service provided (Améstica-Rivas et al., 2017). Some authors agree that tools like ABC and ABC/ABM budgeting (Hansen, 2011) are useful in enabling an organization’s management to achieve continuous improvement by reducing costs, increasing profitability, and establishing competitive advantages and strategies to achieve its objectives (López & Rodríguez, 2018; Ríos & Rodríguez, 2014).

Regarding management control, it presupposes the existence of planning, which must necessarily begin with a clear definition of objectives. To better understand the meaning of management control, it is useful to analyze the concepts of control and management separately. Control refers to the process of identifying deviations between what was originally planned and what was actually achieved, while management refers to the effective use of resources, whether material, human, financial, informational, or technological (El Filali & Hassainate, 2018).

A strong connection between Management Accounting and Management Control is crucial for strategic decision-making (Brusca, 2019; Hutaibat & Alhatabat, 2020). The introduction of management control tools implies changes in procedures and the organization of HEIs, potentially leading to resistance from employees, particularly those concerned about new requirements or reduced autonomy (Bobe, 2020; Marlina, 2020; Vale, 2022).

Thus, the need for further research to better understand the challenges of implementing management control tools in HEIs represents a gap that should be addressed through studies analyzing the implementation of management control across various HEIs (Bhimani & Bromwich, 2009; Chaker & Mohammad, 2012; Pusat & Ozbay, 2014). Accordingly, this study aims to understand the main difficulties in implementing management control in HEIs, as well as to assess its use by administration. To achieve this, the research question is posed:

What challenges do managers face in implementing management control tools in HEIs?

To address this research question, an interview guide will be developed and applied to managers of Portuguese HEIs. The collected data will be transcribed and subsequently analyzed using the MAXQDA PRO 20 software.

This study is structured into six parts. The first part consists of the Introduction, which contextualizes the problem, identifies the research gap, and presents the study’s objective. The second part is the Literature Review, where the most discussed topics in this field of knowledge and research are analyzed. Subsequently, the Methodology section describes the method used, the participants, and the analysis process. This is followed by the Results and Discussion section, where the study’s findings are presented, analyzed, and interpreted. Finally, the study’s Conclusions, Limitations, and Suggestions for future research are outlined.

2. Literature Review

2.1. Difficulties in Applying the GCC

The transition to the SNC-AP introduced significant changes in accounting practices and internal control within organizations. The SNC-AP promotes standardization and transparency in financial reporting but requires organizations to adapt. It is crucial to train professionals for the correct application of the SNC-AP. To ensure greater comparability, validation, and control of information, the SNC-AP Implementation Manual provides a standardized chart of accounts for all entities and explanatory notes to assist with the movement and articulation between accounts (Rosa, 2017).

The transition to the SNC-AP mandates that public administration entities must apply three accounting systems: Budgetary Accounting, Financial Accounting, and Management Accounting (Esteves, 2022). The implementation of the SNC-AP has been delayed and inconsistent, suggesting that this system should have been designed and structured for medium-term application, which would have prevented postponements and gaps (Almeida, 2017).

These subsystems provide insight into activities and projects related to achieving objectives in terms of financial reporting. They also promote executive accountability for the resources used and the results achieved, rather than just legal. Likewise, in organizations, decisions are made daily to maximize profits, improve service delivery, and optimize resources, all of which require appropriate information to enhance decision-making efficiency. Additionally, the acceptance of implementing a method will always depend on the personnel responsible for its operation compliance (Santos et al., 2015).

In both Business Accounting and Public Accounting, entities have the possibility of developing a Management Accounting system with or without the use of a chart of accounts, utilizing class 9. Class 9 accounts reflect the expenses and revenues from class 6 and 7 accounts originating from Financial Accounting. Associated with the chart of accounts, the Implementation Manual provides indicative models of final reports that may be prepared to obtain the information required by NCP 27 (Rosa, 2017).

NCP 27 states that management accounting should also provide information on environmental management. In this regard, Souza and Campare (2014) analyzed how environmental accounting can contribute to environmental management by providing relevant information on the environmental impacts of business activities. The study discusses the concepts of environmental accounting and environmental management and examines their interconnection in promoting organizational sustainability.

Budgetary accounting defines the concepts, rules, and models of general-purpose budgetary statements (individual, separate, and consolidated), which are the main components of budgetary reporting for a public entity or a consolidation perimeter to ensure comparability (Rosa, 2017). One of the objectives of budgetary accounting is to enable organizations to control budget allocations approved by the competent legislative bodies (initial budget) through monitoring the budget execution of revenue and expenditure (recorded in class zero) (Custódio & Viana, 2019). Increasingly, in Public Administration, budgeting, beyond being a legal obligation, can also serve as a management tool (Miranda, 2021).

In a study, Coelho (2019) analyzes the Law of Commitments and Late Payments (LCPA) as a budgetary control instrument in the Portuguese Public Administration. Through a case study, he examines the impact of the LCPA on the financial management of public entities, assessing its effectiveness in controlling expenditures and promoting financial sustainability. He concludes that it is essential to develop internal control mechanisms and provide training for public managers to ensure the correct application of the LCPA.

Regarding management accounting, despite being mandatory, its implementation has been repeatedly postponed in Portuguese public administration, raising questions about the challenges hindering its application (Teixeira, 2016). Its adoption is crucial for more efficient management, as it enables the collection of detailed information, facilitates decision-making, reduces costs, and identifies non-value-adding activities for reduction or elimination (Kaplanog, 2008; Arora & Raju, 2018).

Portuguese accounting standards recommend that public entities use tools such as the ABC costing method, as it is believed to enhance organizational performance in various ways, including helping organizations become more efficient and effective, providing insight into resource expenditures and financial gains or losses, and identifying value-adding or non-value-adding activities in products or services.

According to Haroun (2015), the ABC method provides more accurate cost estimates since it is based on actual activities performed, allowing managers to estimate the effects of different production or service delivery processes on product or service costs. However, some authors highlight challenges, emphasizing that many organizations do not adopt the ABC system due to its complexity, difficulty, and the costs associated with its implementation and maintenance (Bornia, 2002; Askarany & Yazdifar, 2007; Stratton et al., 2009; Pietrzak et al., 2020). Kaplan and Anderson (2007) underline the difficulty and complexity of identifying various activity drivers.

Fito et al. (2018) point out conceptual issues, while Ouassini (2019) highlights the high software costs, requiring investment in staff training. Some authors even warn of the so-called "ABC paradox," noting that while academics and consultants emphasize the importance of the model, its adoption in companies remains low (Gosselin, 1997; Quesado & Silva, 2021). Nonetheless, identifying contextual factors may help explain the low adoption rates recorded in different countries (Rankin, 2020).

Another study conducted by Costa and Carvalho (2006) aimed to assess the level of implementation of the Management Accounting System (CCG) in 35 municipalities and five municipal services. The findings revealed that none of the entities had fully implemented the system, with only 40% having initiated the process, while the remaining 60% had yet to begin. The study identified the main barriers to implementation as the challenges faced by managers in establishing an appropriate system, the shortage of human resources, and the lack of staff training. However, the authors acknowledge the importance of a cost-tracking system for these institutions.

Teixeira et al. (2012) analyzed the information provided in the Management Reports of municipalities in the Setúbal district. Their study examined the types of indicators municipalities deemed most relevant, revealing a preference for budgetary and financial indicators, while management accounting indicators were considered less important. Additionally, three municipalities did not report any data related to management accounting indicators. The study concluded that this lack of reporting is primarily linked to the low implementation of management accounting, a reality that extends to the national level.

Given these critical aspects, it is essential for organizations, whether public or private, to carefully weigh the advantages and challenges before proceeding with the implementation of CCG. Various authors argue that its implementation is particularly justified in companies where indirect costs represent a significant share of total costs; in industries with substantial and diversified production of goods or services aimed at different consumers; and in organizations working with a diverse customer base that requires specific or additional services (Foster & Swenson, 1997; Järvinen & Väätäjä, 2018; Major & Hoque, 2005; Major & Vieira, 2017; Wegmann, 2019).

On the other hand, it is crucial for managers to be aware of the time required for this implementation and the importance of experience in using information technologies (Stefano et al., 2012). In this regard, it can be argued that the manager’s profile may hinder the implementation of CCG (Vicente et al., 2011).

Although numerous authors have debated the practical application of CCG over the past decades, many theoretical models have failed due to the disregard for the costs associated with its implementation (Baldvinsdottir et al., 2010; Bromwich & Scapens, 2016; Johnson & Kaplan, 1987; Scapens, 2006; Spicer, 1992).

The development of CCG systems has been widely studied across various industries, with greater emphasis on the private sector, while its application in the public sector is often overlooked. However, obtaining relevant cost-related information is also crucial in the public sector—not only because costs serve as a key source of information for both internal and external users of public entities but also due to the constant need to establish priorities in resource allocation and minimize costs amid resource constraints and budget pressures (Kurunmäki, 2009).

2.2. Difficulties in Applying the GCC at HEIs

Regarding higher education institutions (HEIs), the university system aims to achieve efficient financing of educational models, minimizing its economic needs to ensure success through proper management and decision-making. This is where the importance of CCG lies, as it helps determine the break-even point, which serves as a useful tool for analyzing institutional innovations (Améstica-Rivas et al., 2017).

Market orientation drives the adoption of CCG practices in HEIs. CCG contributes to the effectiveness of university management, particularly when aligned with a market-oriented approach. It is essential to integrate strategy, management, and accounting within the higher education context (Marlina et al., 2023).

Several studies have investigated the implementation of CCG systems in HEIs (Vale et al., 2022). In one such study, Lutilsky and Dragija (2012) found that ABC has a low level of implementation in European universities, as only a very limited number fully apply the method. However, the authors note that a larger number of universities make partial use of the ABC method.

According to some researchers, the ideal costing system should combine traditional costing methods with the ABC method (Carvalho et al., 2008; Valderrama & Del Rio Sanchez, 2006). This so-called European approach assumes that each cost center encompasses various activities and that costs should be distributed among them. In the context of ABC application in HEIs, Hernández et al. (2010) propose an innovative approach that blends elements of traditional costing systems with the ABC analysis framework. Instead of a full ABC implementation—which can be complex and costly—the authors advocate for its partial use. This approach maintains the fundamental structure of traditional costing systems while incorporating ABC principles by breaking down cost centers, linking them to activities, allocating costs accordingly, and associating activities with products/services.

Alternatively, other ABC-based models, such as TDABC, can drive greater involvement of professionals in cost management and efficiency improvements (Campanale, 2014). The use of TDABC can help identify opportunities for cost reduction and process optimization in specific organizational areas (Laviana et al., 2016).

Martins (2005) conducted a study on Management Accounting in HEIs and found that 78% of institutions had not implemented this tool. The main reasons cited were a shortage of human resources, insufficient technical expertise among staff, and inadequate software programs. Institutions that had adopted the system reported difficulties in selecting allocation criteria for indirect costs and restructuring their organizational charts to meet new requirements. Although institutions acknowledged the benefits of implementation, the necessary human and material resources were not yet in place, which explains why CCG remains in an early development stage.

Using a questionnaire survey, Araújo (2007) studied the Autonomous Services of Central Administration, differentiating them by the healthcare, education, and other sectors that use the POCP. The responses indicated that the healthcare sector had the highest level of implementation of its plan. The same study identified the main reasons for the lack of Management Accounting implementation as the absence of adequate resources, such as IT systems compatible with new accounting requirements, and a shortage of personnel with specialized knowledge in the field.

At the beginning of this century, Carvalho et al. (2008) conducted a study involving 62 municipalities, 33 hospitals, 41 universities, polytechnic institutes, and higher education schools to analyze the state of CCG implementation, the reasons for its non-implementation, and its perceived importance. Regarding the implementation status, the study concluded that all hospitals surveyed had initiated the process, followed by higher education institutions (95.1%), while municipalities had the lowest implementation rate (48.4%). However, only 78.8% of hospitals had fully completed the system implementation. In higher education, the majority of institutions (71.8%) were still in the early stages, while 80% of municipalities remained in an initial, underdeveloped phase.

Regarding the main reasons for non-implementation, municipalities and higher education institutions cited the fact that the documents produced by this accounting system are not part of the required information set demanded by the Court of Auditors, as well as the difficulty in selecting allocation bases for distributing various indirect costs. Additionally, they pointed to a lack of human resources and the perception that Management Accounting is less important than Budgetary and Financial Accounting. Other reasons mentioned included a lack of time and "political will." In the case of hospitals, the most frequently cited obstacles were the shortage of human resources and the complexity of the accounting software (Costa & Carvalho, 2006).

More recently, Martins and Peixinho (2017) conducted a study on the development of the Management Accounting system at the University of Algarve. The study found that the main challenges in developing the Management Accounting model at the university were related to the institution's size and complexity, the subjectivity in selecting allocation criteria, and the significant weight of indirect costs.

Teixeira (2009), after conducting a survey of higher education institutions (HEIs) in Portugal between March and December 2006, concluded that Budgetary Accounting was already fully implemented, while Patrimonial Accounting had a 98% implementation rate. In contrast, Management Accounting had an implementation rate of only 25%. The difficulties in applying Management Accounting were linked to financial constraints, challenges in interpreting regulations, insufficiently qualified human resources, and the lack of suitable software. Additionally, it is worth noting that Management Accounting is the area where these institutions invest the least in employee training.

Carneiro and Teixeira (2022) focused their research on the context of Portuguese public administration and how Management Accounting (CCG) can help higher education institutions (HEIs) meet regulatory requirements and improve their internal control mechanisms. Additionally, they highlighted its potential as a valuable tool for enhancing accountability, transparency, and efficiency in the management of public resources in higher education.

Effective dissemination of Management Accounting information is essential for better management. Its importance is even greater in public administration since, in the business sector, Management Accounting is only disclosed to internal users, whereas in public administration, this information must not only be shared internally but also included in financial reporting documents for external disclosure (Martins, 2017).

Thus, financial reporting documents should provide information on performance evaluation and program-based assessments, as well as cost analyses based on the data provided by Management Accounting (NCP 27, 2015). For this purpose, NCP 27 specifies the elements to be included in the annual financial report, as well as the specific reporting requirements for the education, healthcare, and local government sectors (Martins, 2017).

The implementation of Management Accounting (CCG) in higher education institutions (HEIs) in Portugal faces several challenges. A lack of rigor in quality assurance processes, combined with low commitment from human resources, creates obstacles in quantifying and tracking progress toward continuous improvement (Dewi et al., 2021). Additionally, the economic recession and budget constraints in Portugal have increased pressure on HEIs to demonstrate their social, cultural, and economic impact on their communities (Alves et al., 2015). In this context, the implementation of strategic management accounting in HEIs is influenced by factors such as market orientation (Marlina et al., 2023).

The implementation of management accounting in Portuguese HEIs also faces other obstacles, ranging from the need to raise awareness among staff and ensure the proper allocation of resources to making strategic decisions that integrate sustainability. In Portuguese HEIs, a lack of awareness among managers and faculty members represents a significant barrier to the implementation of CCG (Silva & Costa, 2008). Additionally, the authors highlight a severe shortage of human, financial, and technological resources, which further complicates the adoption of CCG.

Martins (2014) identifies challenges in the allocation of indirect costs and the selection of appropriate costing methods. He also notes a lack of integration between management accounting and other institutional information systems.

The implementation of Management Accounting (CCG) in Portuguese higher education institutions (HEIs) faces several challenges, including resistance to change from some stakeholders. This resistance may stem from various factors, such as a lack of awareness about the benefits of management accounting, fear of the unknown, and the perception that implementing this system will require additional time and effort. To overcome these challenges, it is essential to actively manage resistance through strategies such as effective communication, training, and stakeholder engagement (Borges et al., 2017; Santos, 2020).

After analyzing the studies mentioned, it can be concluded that the prospects for the effective implementation of CCG are still not very promising. Therefore, public administration entities should make efforts to implement this system, as it serves as an important decision-making support tool in organizations (Silva et al., 2016).

Duarte et al. (2023) investigate the role of cost accounting in performance measurement in Portuguese HEIs through a case study that examines how cost information is used for performance evaluation and improvement. The integration of cost accounting with other information systems and the development of relevant performance indicators are necessary steps for enhancing institutional efficiency.

Therefore, implementing CCG tools requires investment in employee training, the acquisition of software and information systems, and the hiring of specialized professionals. A lack of resources can make the process impossible or significantly delay its implementation (Brusca, 2019; Heinicke, 2020; Hutaibat & Alhatabat, 2020). Integration among various areas within HEIs, such as administration, financial accounting, teaching, and research, is essential for the effective functioning of CCG. A lack of integration can hinder the collection of reliable data and the generation of crucial information for management (Bobe, 2020; Heinicke, 2020).

Moreover, a lack of knowledge in this field may lead to the failure to select the most relevant indicators or difficulties in interpreting results (Pilonato, 2020; Salemans & Budding, 2022). The absence of documented guidelines and challenges in executing cost calculation methods contribute to delays in CCG implementation. Deploying information systems to support management accounting requires expertise in information technology and data modeling, presenting a technical challenge. Choosing an inappropriate system or making errors in its application can render the tool impractical (Hutaibat, 2019; Marlina, 2020).

3. Methodology

3.1. Nature of the Study

The present study consisted of a survey conducted with representatives of Portuguese HEIs. It is a qualitative research study that, in this case, allows for a deep understanding of the nuances of human behavior, experiences, and meanings, providing valuable insights that quantitative methods simply cannot achieve. Interviews were conducted with a sample of twelve participants (Administrators and Financial Directors from selected HEIs) from a total population of 39 national HEIs. The interviews were collected between December 2022 and July 2023, both online and in person, following prior scheduling. They were recorded with the participants' consent, then transcribed and imported for analysis.

This approach is considered a valid research method, where data is represented not by numbers but by phrases (Taylor, 2005). These data are explored in depth, classified, and categorized, aiming to construct narratives that describe the studied phenomenon in detail (Taylor, 2005).

3.2. Population Studied

In this study, an attempt was made to obtain a representative sample of the phenomenon through theoretical sampling. The objective of this sampling method was to access diverse experiences (Ritchie & Lewis, 2003).

The participant group is homogeneous in the sense that all members are knowledgeable about the phenomenon, but variability was introduced by considering the participants’ roles and the institutions to which they are affiliated (Administrators and Service Directors). From a total population of 39 HEIs, a sample of 12 interviewees from 12 different institutions was obtained through a convenience sampling process, ensuring that all participants were directly involved in the studied phenomenon. For confidentiality reasons, the identity of the interviewees will be omitted, and a coding system will be used for identification purposes (

Table 1). A total of twelve interviews were conducted. The profile of the interviewees/key informants is presented in

Table 1.

The table provides detailed information about the study participants, including their roles as Directors and Administrators. The sample consists of 6 women and 6 men, with 20 to 28 years of professional experience, indicating a significant proportion (50%) with expertise primarily in management. The duration of the interviews ranged from 68 to 132 minutes, totaling 1,212 minutes, with an average of 101 minutes per interview.

3.3. Data Collection Process and Instrument

To address the research question: What challenges do managers face in implementing CCG tools in HEIs? This study adopted a qualitative research methodology, using semi-structured interviews as the data collection instrument.

The aim was to understand the phenomenon in question—why difficulties exist in implementing CCG in HEIs—as well as the motivations, beliefs, and values that drive HEI managers' actions, providing a holistic and contextualized perspective of the studied reality. To achieve this, semi-structured interviews were conducted, developed based on a review of previously published literature in this field.

The semi-structured interview serves as a bridge between the rigidity of structured interviews and the flexibility of open-ended interviews, allowing researchers to explore topics in depth without being strictly bound to a predefined script (Adeoye-Olatunde & Olenik, 2021). These interviews enable participants to express their opinions more openly and in greater detail, as interviewers have the freedom to explore emerging themes and issues during the conversation, enriching the information gathered. Another advantage of semi-structured interviews is the flexibility they offer both to the interviewer and the interviewee. The interviewer can adapt the questions based on responses and delve deeper into specific topics, while the interviewee has the freedom to share their experiences more openly (Blandford, 2013).

As one of the most widely used qualitative research techniques, the semi-structured interview aims to achieve a comprehensive understanding of a social phenomenon through the personal experiences of interviewees (Batista et al., 2017).

To operate the interviews and address the research questions, an in-depth semi-structured interview guide was developed, based on the key themes identified in the literature review. The interview guide (

Appendix A) covered two main areas: (1) Sociodemographic data and (2) Specific questions related to the phenomenon under study. The guide was tailored to the target population, ensuring sufficient flexibility to adjust questions based on new information and participant availability.

The questions were formulated from a review of the literature, specifically drawing from scientific articles that explored the following topics: (1) Challenges in implementing accounting systems under the SNC-AP (Martins & Peixinho, 2017), (2) Main accounting systems implemented in HEIs (Teixeira, 2009; Lutilsky & Dragija, 2012), (3) Application of management control systems for decision-making (Marlina et al., 2023), (4) Environmental concerns and sustainability (Duarte et al., 2023), (5) Disclosure of information to stakeholders (Martins, 2017).

3.4. Analyzing the Interviews

Content analysis is a research technique that enables systematic examination and scientific analysis of verbal data, such as interviews. To conduct a scientific content analysis of the interviews, the process began with the preparation phase (Faria-Schützer et al., 2021).

Before initiating the content analysis, all collected material was organized, with interviews being fully transcribed and compiled into a database containing all available information. Once the data collection process was completed, the full transcription of the interviews was carried out, followed by a detailed reading of the material.

The data analysis and processing were conducted using MAXQDA, a software specifically designed for qualitative research, allowing the construction of comprehensive categories and subcategories. This qualitative analysis software ensures scientific rigor, facilitating a more explicit and organized systematization of data (Mozzato et al., 2016).

Next, the coding process was initiated. In this phase, central themes that emerged from the interviews were identified, and analysis categories were defined. The classification of analysis units (such as expressions, excerpts, phrases, etc.) was then carried out according to the predefined categories. Regarding the actual data analysis, the focus was on interpreting the collected data and identifying patterns and relationships between the analysis categories (Faria-Schützer et al., 2021).

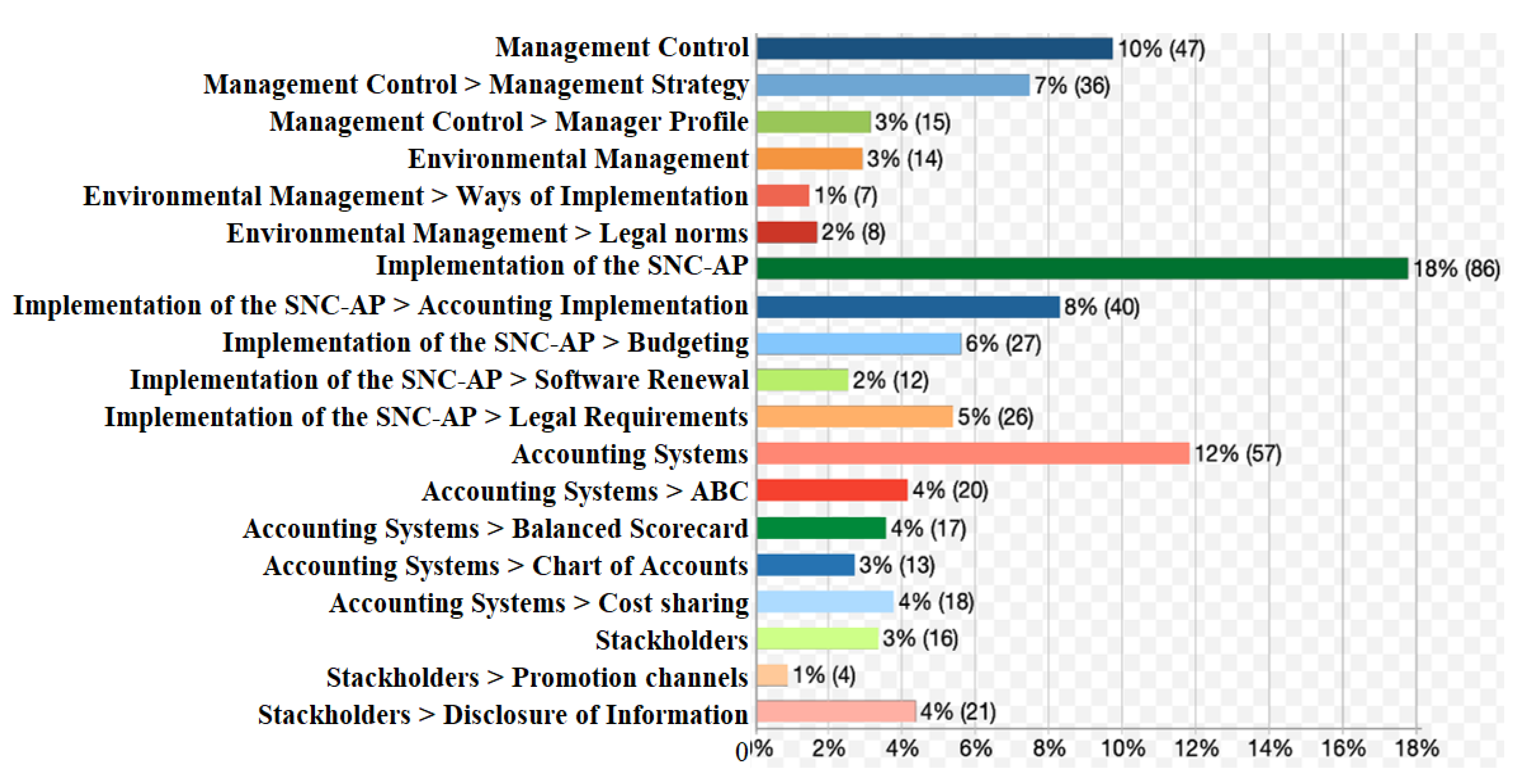

Figure 1 illustrates the analysis process adopted by the authors, following the development of the interview guide and the selection of key informants to be interviewed.

Figure 1 helps to understand the analysis process adopted by the authors:

After conducting the interviews, they were listened to and transcribed using Microsoft Word. Following the transcription, a systematic and thorough reading was carried out to select the most relevant and appropriate excerpts aligned with the study’s objectives. The reference units were coded to structure the data, which were later analyzed and validated.

Aiming to construct a conceptual framework for understanding the phenomenon based on the collected data, categorization was carried out following the Grounded Theory model (Strauss & Corbin, 1994). The goal was to achieve theoretical saturation, moving beyond a mere description of the phenomenon to discover a theory for a process (Creswell & Poth, 2017). Theoretical saturation was reached when it became evident that collecting additional data did not yield new elements (Lowe et al., 2018). The highest possible theoretical density was achieved based on the available data (Fontanella et al., 2011).

The connection between data and themes concluded when the analysis no longer generated new categories. The following categories emerged from the data, reinforcing the emergent theory (Petrini & Pozzebon, 2009).

The content of the interviews was interpreted based on the themes that emerged from the literature, establishing relationships between them through thematic coding in the MAXQDA software. By applying a predefined coding process for the main themes and subtopics, the aim was to enhance the consistency of the interview content, providing a clearer understanding of the topics related to Management Accounting and Control in Higher Education Institutions (HEIs). The use of this methodology ought to improve the clarity and robustness of the results.

4. Results

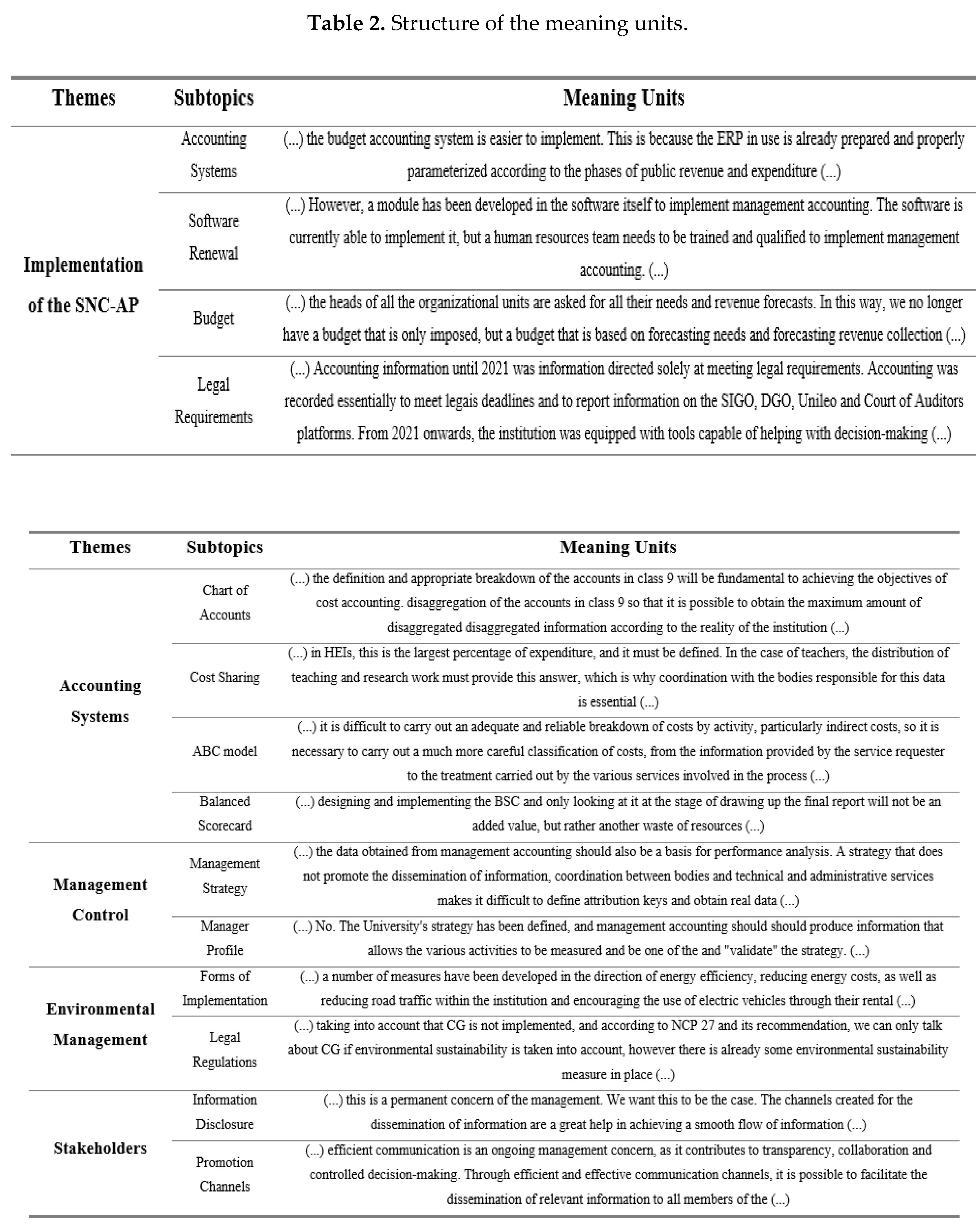

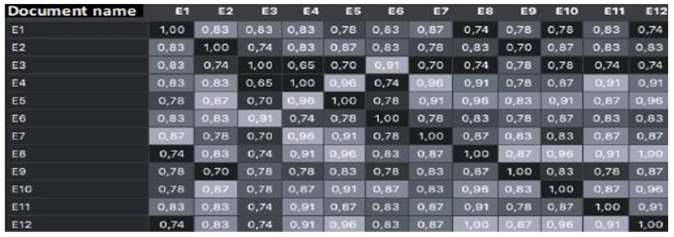

Using qualitative analysis software, the cohesion between participants' accounts was examined by analyzing the correlation between meaning units and emerging themes. According to the software results (

Table 2), there is a strong correlation (close to 1) between the various contributions of the interviewees to this study. The closer the correlation is to 1, the more significant the interviews' contribution to understanding the phenomenon under analysis (Kuckartz & Rädiker, 2019; Silva et al., 2021).

The occurrence of similarity between interviews can be observed through the matrix cross-checking process. For instance, if E1 has a correlation of 0.83 with E2, it means that 83% of the content is very similar, requiring only the extraction of the differences between interviewees (

Table 2).

The content analysis of the semi-structured interviews identified the main categories to be considered, characterizing the interviews according to their occurrence.

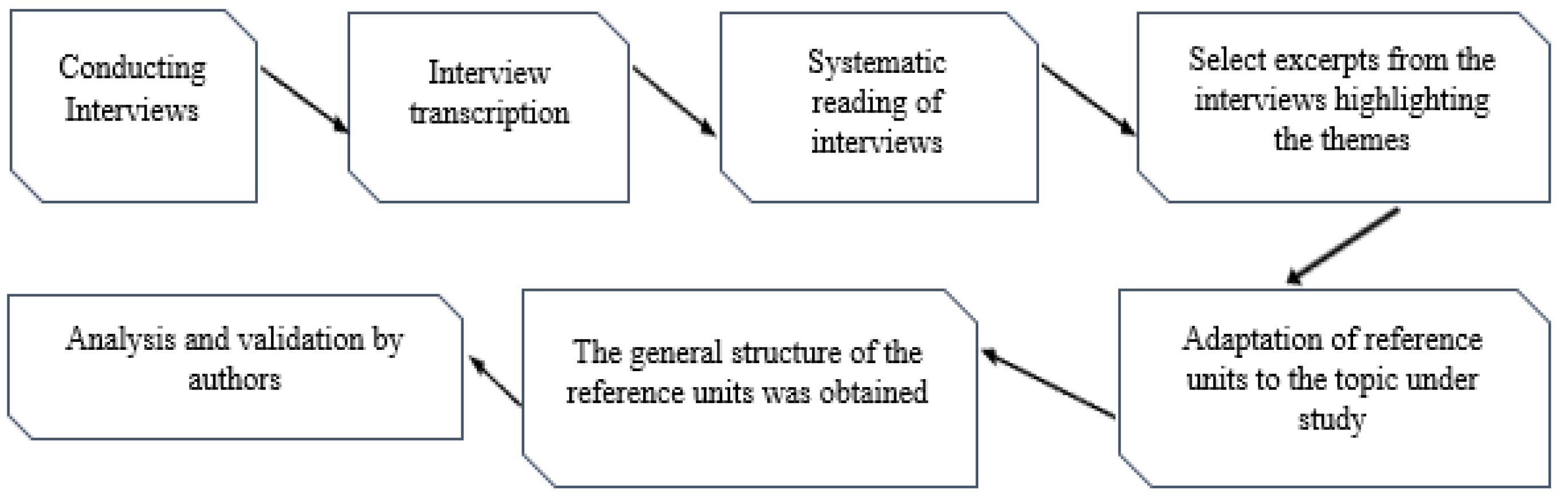

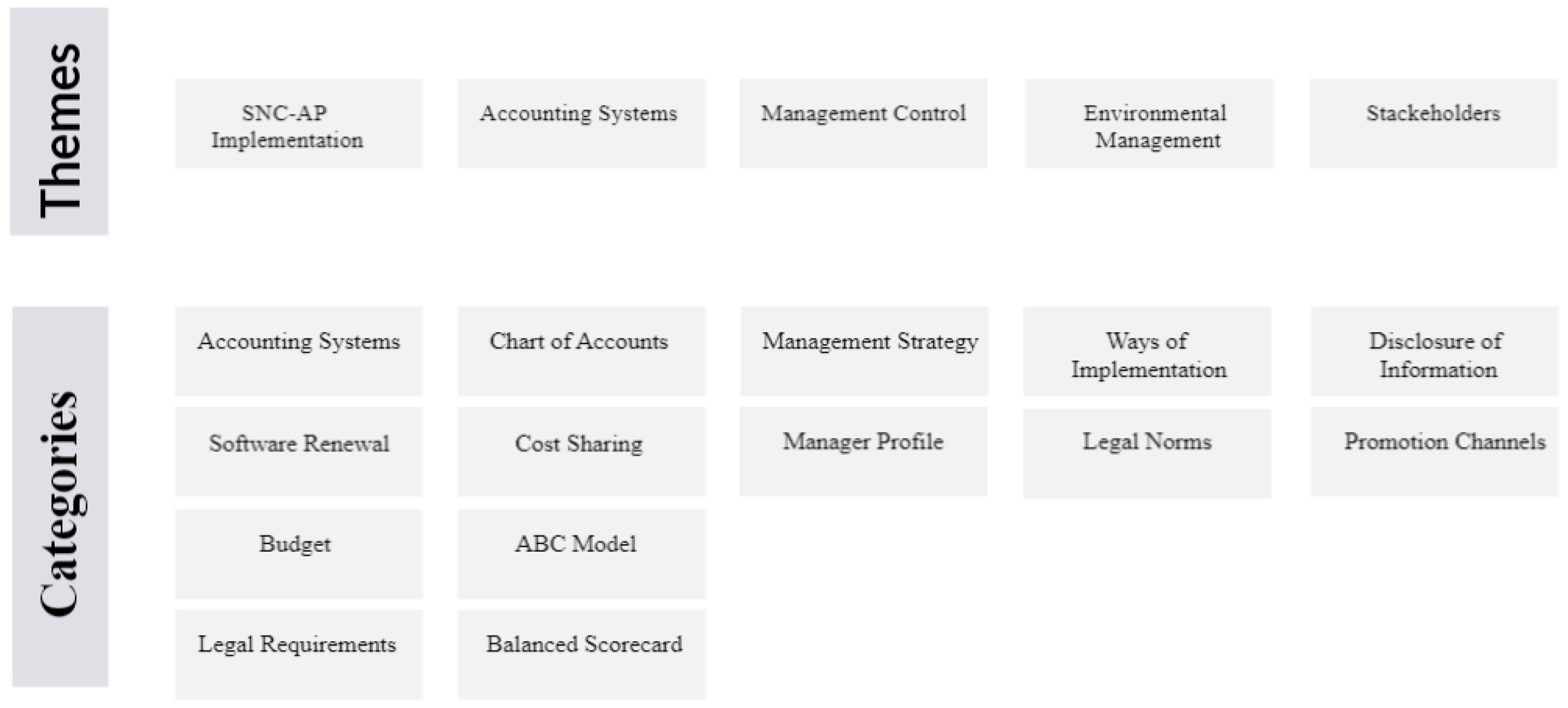

Figure 2 presents a hierarchy of code derived from the interview content. The global category map highlights the main thematic categories addressed by the interviewees and the hierarchical relationship between subthemes within each thematic category.

The figure illustrates how a Management Control and Accounting (CCG) system is structured within a Higher Education Institution (HEI). This hierarchy represents the organizational and functional structure of the system, dividing it into different levels with specific responsibilities: Theme 1: Implementation of the SNC-AP – Establishing the implementation of the National Public Accounting System (SNC-AP) within the HEI; Theme 2: Accounting Systems – Managing the institution’s accounting records efficiently and transparently, in compliance with current regulations and legislation. It also aims to determine the costs of each activity or project, providing essential information for strategic decision-making; Theme 3: Management Control – Supporting institutional management by providing financial and operational information to enable strategic and effective decision-making. A key aspect is cost allocation, ensuring a rational and fair distribution of costs across different departments or areas; Theme 4: Environmental Management – Providing information on legal regulations and their implementation process within the institution; Theme 5: Stakeholders – Addressing the needs and expectations of different stakeholder groups, such as students, faculty, staff, government, and the broader community.

The information flows between the different levels of the hierarchy are represented in

Figure 2. Information moves top-down, with the definition of policies and guidelines, and bottom-up, with data collection and report generation. It is essential to ensure that communication is clear, efficient, and transparent across all levels of the organization.

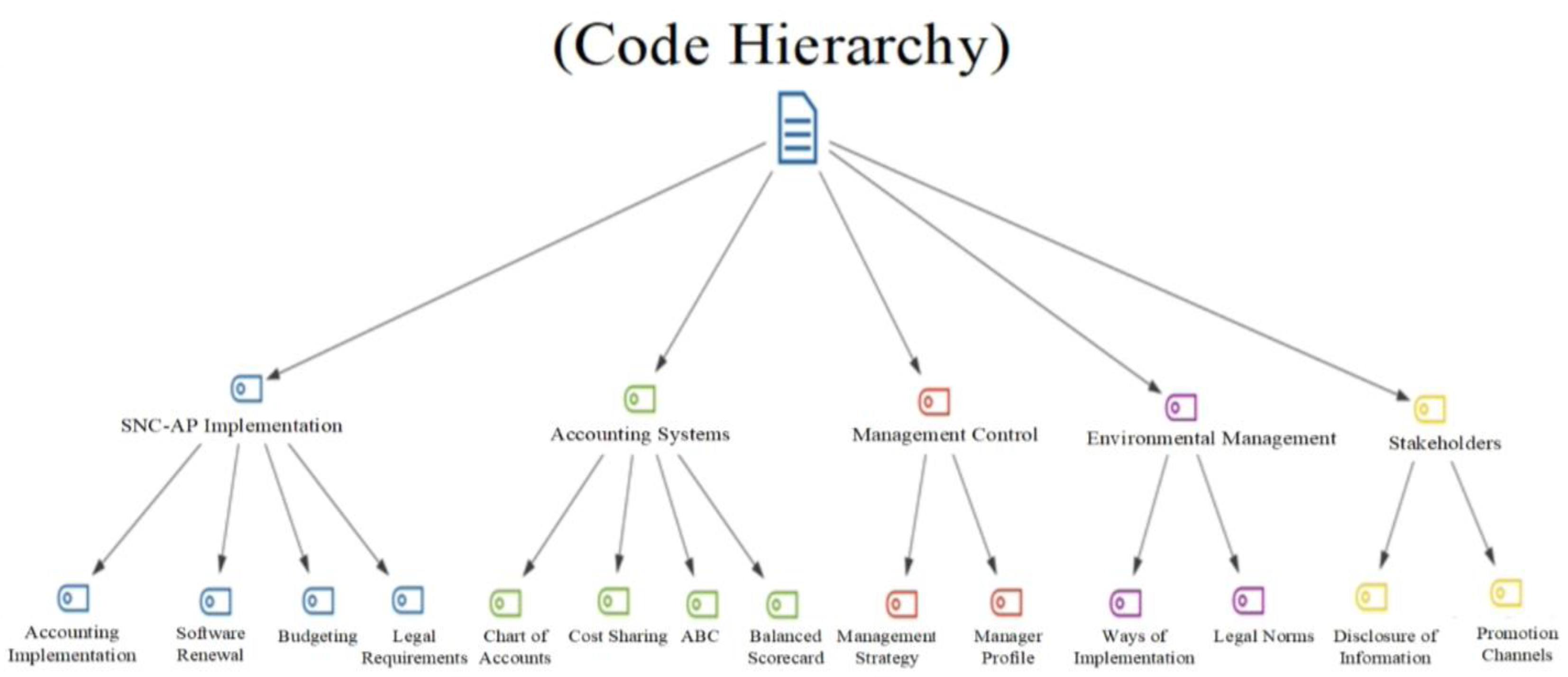

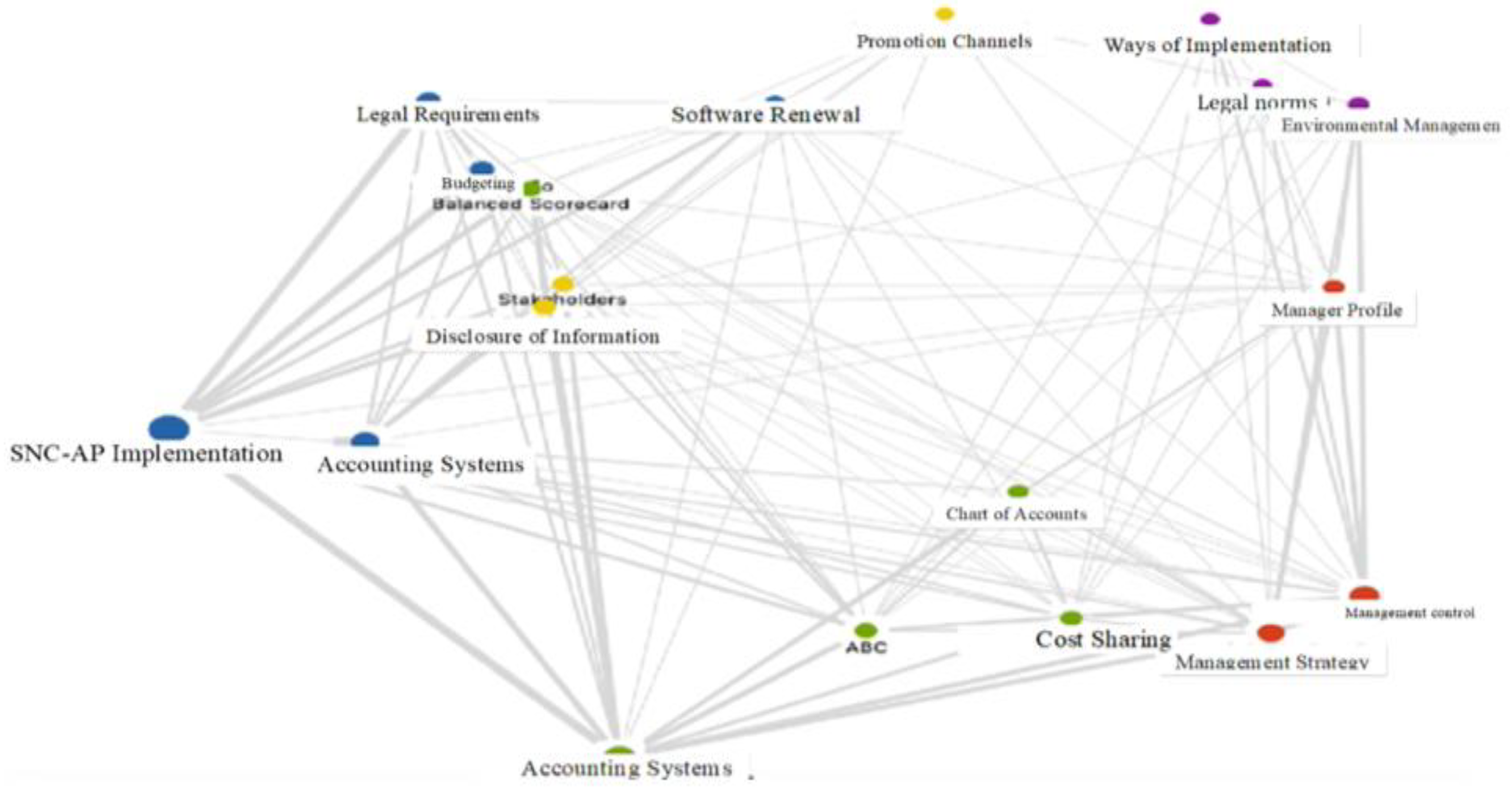

Figure 3 summarizes the content of the units of meaning (interview dimensions) assigned to the content analysis of the interviews. After a detailed and systematic analysis of the collected data, it was observed that participants provided direct, open, and straightforward responses regarding the main challenges in implementing Management Control and Accounting (CCG) systems in HEIs. The key themes identified include (1) Challenges in implementing the accounting systems outlined in the SNC-AP; (2) Main accounting systems adopted by HEIs; (3) Application of management control systems to support decision-making; (4) Environmental concerns and sustainability; (5) Disclosure of information to stakeholders.

Figure 2 and

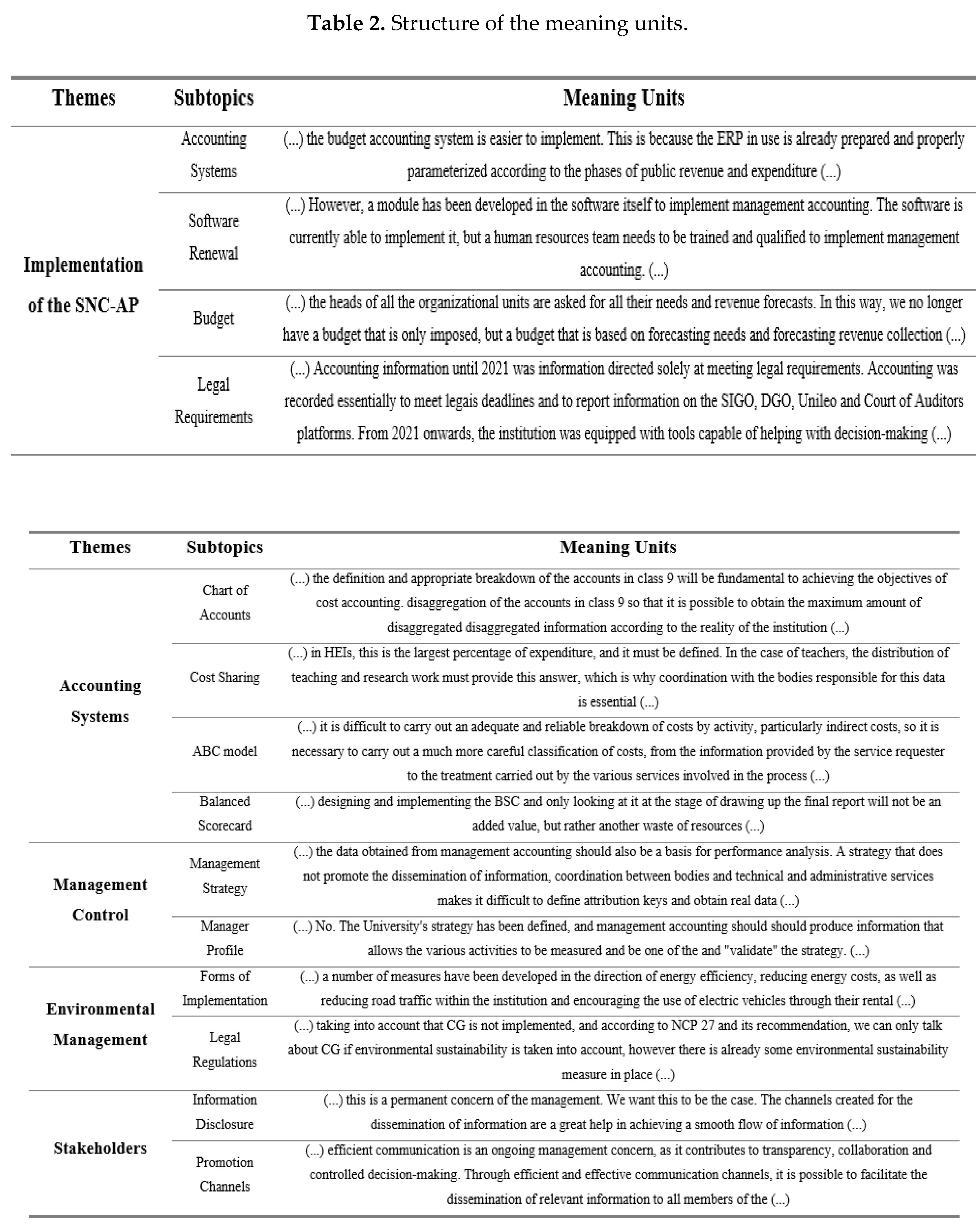

Figure 3 summarize the content of the units of meaning assigned to the interview analysis. These two outputs present a hierarchy of codes created using MAXQDA, a qualitative data analysis software. The structure suggests the existence of five main themes: Implementation of SNC-AP, Accounting Systems, Management Control, Environmental Management, and Stakeholders, highlighting the key areas of analysis.

Each main theme includes subcategories that detail specific aspects under investigation. For example, within the Implementation of SNC-AP theme, the subcategories are Accounting Systems, Software Renewal, Budget, and Legal Requirements. The color-coding of categories helps with the organization and visualization of data during the analysis.

After a detailed and systematic content analysis, it was confirmed that participants provided a direct approach to the main themes associated with the implementation of SNC-AP, accounting systems, management control, environmental management, and stakeholders.

The table above identifies the key topics addressed by the interviewees, based on the interview guide. For example, regarding the implementation of SNC-AP, participants highlighted various implementation challenges related to accounting systems, the need for software renewal, budgeting, and legal requirements. The analysis of this table should follow the example provided above.

The interviewees recognize that the direct relationship between the subsystems—implementation of SNC-AP and Management Control—is essential, as evidenced by their responses. Since SNC-AP is the current regulatory framework in force in Public Administration, the two accounting subsystems, budgetary and financial, are the easiest to implement due to their direct relationship with legal requirements and certified software. The ease of implementation is attributed to the fact that "(...) the ERP in use is already prepared and properly configured according to the phases of public revenue and expenditure, and because it was a system that already existed before the application of POCP and later SNC-AP (...)" (E2).

Within the interviews conducted, the management accounting subsystem is identified as the most challenging to implement, mainly due to its complexity. According to NCP 27, its implementation requires designing the entire system, defining various activities and cost centers, establishing allocation criteria, and specifying the expected outputs. As one interviewee highlighted: "(...) With a careful approach, proper planning, and leadership support, it is possible to overcome difficulties and successfully implement management accounting, maximizing its benefits for the institution's strategic management (...)" (E7).

Before implementation, it is essential to define how the system will be structured and deployed.

The accounting information produced must first and foremost comply with legal obligations. However, it is also constantly analyzed to identify potential deviations and serve as a decision-making support tool: “(...) this cultural shift regarding accounting information tends to bring benefits to the institution, enabling a more proactive management approach and a greater ability to adapt to emerging changes and challenges (...)” (E11).

Financial information is crucial for making better-informed, more adjusted, and safer decisions. It holds three key roles: fulfilling legal obligations, acting as a financial control tool, and supporting decision-making: “(...) providing clear and concise information to the administration is a valuable resource. These dashboards allow for a quick and easy visualization of relevant accounting data, enabling more efficient analysis and highlighting important trends and patterns (...)” (E11).

According to the interviewees' responses, it is essential that budget preparation is carried out carefully and properly supported by the entity’s activity plan and strategic plan, using reliable revenue and expenditure forecasting criteria. This ensures comparability both with financial statements from previous periods and with those of other entities.

Here, “(...) involving the heads of organizational units in budget preparation fosters greater control across different areas of the institution, allowing for a more integrated view of needs and priorities (...)” (E6).

It was found that only about 60% of Higher Education Institutions (HEIs) have implemented the Evaluation and Accountability Framework (QUAR), a management and performance assessment support document. The QUAR outlines the organization’s mission, strategic objectives, and operational goals, including its performance indicators, targets, and available human and financial resources.

“(...) At present, the Evaluation and Accountability Framework (QUAR) exists as a management and performance assessment support document. The QUAR defines the organization’s mission, strategic objectives, and operational goals, including performance indicators, targets, and available human and financial resources (...)” (E5).

Another instrument analyzed was the existence of the Balanced Scorecard (BSC). It was found that 85% of respondents stated that they are developing the model with the aim of sustainability, cost containment, and revenue growth.

"(...) We have not yet developed a BSC system, but we have already experimented with quality systems in some university units. When we commit to evaluation through any model, it is because we are aware that we have the conditions to go through its different phases. We have achieved several positive results (...)” (E3).

Regarding the relationship with stakeholders, all respondents agree that information disclosure aims to inform all HEI stakeholders about the institution’s activities. From a public financial management perspective, the main objectives of information disclosure are accountability, ensuring adequate scrutiny of public activities and transparency in financial reporting, transparency in the use of public resources and the efficiency of public policies, and control, based on sustainability and the quality of public finance management.

"(...) That is what we aim for. The channels created for information disclosure greatly contribute to ensuring a smooth flow of information (...)” (E8).

Regarding the implementation of management accounting, respondents perceive that its implementation does not require changes to the institution’s organizational structure. However, management accounting is still in its early stages, with only activities, cost centers, and responsibility centers having been defined.

According to the respondents, full implementation requires extensive prior preparation, particularly ensuring the existence of an ERP system properly configured for the implementation and execution of management accounting.

Additionally, respondents believe that all stakeholders in the process—not just financial staff but all HEI employees—should receive specific training. Naturally, for employees outside the financial area, the training should be more generalized. This approach ensures the effective implementation of the system.

“(...) Therefore, software is very important, but it is also essential that the existing human resources have the know-how to operate these systems, and the necessary knowledge required for their roles. Additionally, ongoing training is crucial to ensure continuous knowledge updates and skill development (...)” (E3).

It is generally understood that traditional models and those derived from the ABC model, such as the TDABC model, should also be considered. In this regard, it is emphasized that the Administration must define the type of costs they want to calculate to better serve and manage the institution while always considering stakeholder satisfaction.

“(...) There are different approaches to cost calculation and allocation, and the choice will depend on the institution’s specific objectives and needs (...)” (E11).

It is observed that for higher education institutions (HEIs), the proper definition and breakdown of class 9 accounts is essential for meeting cost accounting objectives. This breakdown allows for the maximum extraction of information in alignment with the institution's reality. In other words, this class should be

"(...) reserved for recording costs and benefits by nature, and its reclassification for cost determination by activities or products is a crucial step in obtaining more specific and useful information for the institution's management (...)" (E10).

Regarding the profile of managers, the interviewees believe that it does not hinder the implementation of management accounting, provided that strong teams are in place, working collaboratively and aligned with HEI’s strategy. Managers should be capable of distinguishing between higher short-term resource consumption that aligns with the institution’s strategic policy and unjustified expenditures, which can be identified through the information provided by management accounting.

"(...) A manager with training or experience in accounting will have a stronger understanding of accounting principles and best financial management practices, which can be an advantage in implementing management accounting (...)" (E12).

Finally, the interviewees conclude by stating that the implementation of NCP 27 will provide information on environmental costs. Special attention should be given to defining the various criteria necessary for its implementation.

"(...) Providing information on environmental costs requires careful definition of the various criteria essential for implementation. This information is also relevant in the context of green public procurement, supporting decision-making in procurement procedures based on the ENCPE – National Strategy for Green Public Procurement (...)" (E2).

To enhance the study’s understanding,

Figure 4 illustrates the relationship between the emerging themes and how they are reflected in the interviewees’ discourse. It is evident that the central themes highlighted by the interviewees were the implementation of SNC-AP, accounting systems, and management control and strategy.

This image displays a code map generated in MAXQDA, visually representing the connections between different themes analyzed from qualitative data.

Unlike the hierarchical structure seen earlier in

Figure 2, this map illustrates the complex and interdependent relationships between the themes. In the figure, thicker lines indicate stronger connections between themes, suggesting a higher co-occurrence in the analyzed data. For example, Accounting Systems and Management Control are strongly related.

The centrality of SNC-AP Implementation reinforces its role as the core element of the analysis. The strong link between Accounting Systems and Management Control suggests that the implementation of SNC-AP significantly impacts these areas. The cluster analysis reveals patterns and insights into the relationship between different aspects of SNC-AP implementation.

From another perspective,

Figure 4 helps to understand, in a segmented manner, the contribution of participants to the identification of emerging themes based on their statements.

Individually, it is evident that the most frequently discussed themes were SNC-AP Implementation, Accounting Systems, Management Control, and Strategy.

The figure presents both the absolute frequency (number in parentheses) and the relative frequency (percentage) of each theme. SNC-AP Implementation is the most frequent theme (18%), followed by Accounting Systems (12%) and Management Control (10%).

The main themes—SNC-AP Implementation, Accounting Systems, Management Control, Environmental Management, and Stakeholders—and their subcategories are the same as those in the previously discussed code map.

The table allows for a comparison of subcategory frequencies within each main category. For example, within SNC-AP Implementation, Accounting Implementation (8%) is more frequent than Budgeting (6%).

The high frequency of SNC-AP Implementation confirms its central role in the analysis, indicating that a significant portion of the coded data relates to this theme. Comparing subcategory frequencies helps identify the most relevant aspects within each main category.

The low frequency of Environmental Management and Stakeholders suggests that interviewee responses were more focused on the accounting and management control dimensions of the SNC-AP.

In summary, the theme frequency table provides a quantitative perspective on the importance of each theme in the analysis, complementing the qualitative insights from the theme map. Its use allows for the identification of dominant themes and areas that require greater attention, contributing to a more comprehensive and robust analysis of the data.

Figure 5.

Occurrence of emerging themes. Source: prepared by the author.

Figure 5.

Occurrence of emerging themes. Source: prepared by the author.

5. Discussion

Regarding the implementation of SNC-AP, it is observed that the easiest accounting systems to implement are budgetary and financial accounting, while management accounting is the most complex.

"(...) With NCP 27, it is necessary to design the entire system, defining various activities and cost centers, establishing allocation criteria and expected outputs. By nature, this process requires prior decision-making and planning for its implementation, which entails the allocation of resources—both human and financial (...)" (E2), in line with the study by Teixeira et al. (2012).

This difficulty arises from the fact that institutions are not equipped to redesign their entire structure to adopt NCP 27 (Rosa, 2017). The terms "SNC-AP implementation" and "accounting systems" stand out in the responses of administrators and directors.

The interviewees acknowledge that the available accounting information is important for decision-making. However, while its use is evolving, it is still primarily driven by legal compliance. Most respondents indicate that institutions rely on accounting information mainly to meet legal requirements. Nevertheless, over time, there has been a shift in behavior, with organizations increasingly using this information to support decision-making and strategic planning.

As one interviewee (E5) stated: "Until 2021, accounting information was primarily used to comply with legal requirements. Accounting records were kept mainly to meet legal deadlines and to report data on platforms such as SIGO, DGO, Unileo, and the Court of Auditors. From 2021 onwards, the institution adopted tools capable of assisting in decision-making (...)" This aligns with the findings of Martins and Peixinho (2017).

According to the interviewees, a budget based on historical data and poorly aligned with activity reports is a reality in many institutions, making both its analysis and use as an information source more challenging. The high volume of budget amendments reflects this issue.

However, this reality is changing as budget preparation techniques and their importance are evolving. Currently, budgeting is more precise, aiming for a forecast that is closer to reality (E5):

"All organizational unit managers are asked to provide their needs and revenue forecasts. As a result, budgeting is no longer just a formality but rather a process based on actual needs and expected revenue collection (...)" This aligns with Coelho’s (2019) study.

Regarding management tools, higher education institutions (IES) opt for the implementation of the Balanced Scorecard (BSC). Surprisingly, only two of the interviewed institutions have not yet implemented it. However, both acknowledge its usefulness, provided it is properly utilized (E1):

"Designing and implementing the BSC only to revisit it during the final report stage will not add value but rather result in wasted resources (...)" This highlights its importance, as noted by Brusca (2019) and Hutaibat & Alhatabat (2020).

All interviewees agree that information disclosure is crucial for the smooth operation of the institution (E3): "It is a constant concern for management. That’s exactly how we want it to be. The channels established for information dissemination play a key role in ensuring a smooth and effective flow of information (...)" as noted by Martins (2017).

The implementation of management accounting requires both software adaptation and specialized training. Interviewees emphasize the importance of institution-wide involvement and continuous training (E5): "A module was developed within the software itself to implement management accounting. The software is now fully capable of supporting this implementation, but it is essential to train and equip a team of professionals to carry it out (...)" This aligns with the findings of Bobe (2020), Marlina (2020), and Vale (2022).

At first glance, the implementation of management accounting will not require significant changes to institutional organizational structures. However, the current accounting system in public sector higher education institutions (IES) does not fully support the management accounting objectives outlined in the SNC-AP, as there are still gaps in meeting the requirements for implementing the ABC model. There is also missing information, preventing a more accurate cost calculation (E6): "It becomes challenging to properly and reliably allocate costs to activities, particularly indirect costs. This makes it necessary to establish a much more precise cost classification, from the information provided by the service requester to the processing carried out by the various departments involved in the process (...)" This aligns with the findings of Martins & Peixinho (2017).

According to the interviewees, Class 9, as defined by the SNC-AP, should be adapted to the institution's organizational structure to reinforce the role and importance of management accounting in improving the quality of information provided for decision-making. It is essential to understand and implement costing methods and systems that best align with the reality of the public sector.

According to NCP 27, Class 9 should support three phases: (i) reclassification of actual expenses and revenues by allocating resources to activities; (ii) determination of cost per product or service; (iii) calculation of deviations.

(E6) "(...) Defining and properly segmenting Class 9 accounts will be fundamental to achieving the objectives of cost accounting, allowing for the highest level of detailed and relevant information, aligned with the institution's reality (...)" as stated by Martins (2017).

Unlike the study by Silva Vicente et al. (2011), the interviewees do not agree that the manager's profile compromises the implementation of management accounting.

(E3) “No. The University’s strategy is well-defined, and management accounting should produce information that allows for measuring various activities and serves as a tool to track and ‘validate’ the strategy (…).”

The institution's strategic policy impacts the implementation of management accounting, (E1) “The data obtained from management accounting should also serve as a basis for performance analysis. A strategy that does not promote information sharing, coordination between governing bodies, and technical and administrative services makes it difficult to define allocation keys and obtain accurate data (…) this aligns with the findings of Marlina et al. (2023).

Environmental management is considered in the implementation of management accounting by the interviewed institutions, as higher education institutions are increasingly adopting measures to reduce actions that minimize environmental impact (E5) “(…) considering that management accounting is not yet fully implemented, and according to NCP 27 and its recommendations, we can only speak of management accounting if environmental sustainability is considered. However, some environmental sustainability measures have already been implemented (…)” Additionally, “Some measures have been developed to improve energy efficiency, reducing energy costs, as well as decreasing road traffic within the institution and encouraging the use of electric vehicles through rental programs (…)” This aligns with the findings of Souza & Campare (2014).

In summary, the responses from the interviewees indicate that all the topics discussed are present in the institutions they manage, or at least in their awareness, as they can either represent a problem or a solution for their institution. It also became clear that management accounting and its implementation are not directly related to the institution's strategic policy but rather to its complexity.

6. Conclusion

The overall objective of this research was to investigate whether higher education institution (HEI) managers use Accounting and Management Control tools, which management control models are employed, and the challenges faced in their implementation. After an extensive literature review on Accounting and Management Control (AMC) in Public Administration (PA), we identified that the main implementation challenges revolve around five key themes: Implementation of SNC-AP, Accounting Systems, Management Control, Environmental Management, and Stakeholders.

This study contributes to the advancement of scientific knowledge in this field, specifically regarding AMC, as the findings provide a deeper understanding of the main concerns of administrators and financial directors in these institutions—particularly those related to the implementation of AMC in public HEIs. Additionally, it was possible to identify subthemes within each central topic, including software renewal, budgeting, legal requirements, chart of accounts, cost allocation, the ABC model, the Balanced Scorecard (BSC), management strategy, manager profile, implementation methods, legal regulations, information disclosure, and communication channels.

Regarding the main challenges in implementing Management Accounting and Control (MAC), we found that the process is highly complex, requiring careful planning, activity definition, cost centers, allocation criteria, and output determination. This complexity can pose a significant obstacle to its effective implementation. Additionally, the need for both human and financial resources presents another major challenge for institutions.

In summary, management accounting is complex and difficult to implement, and it is still in its early stages. So far, institutions have only defined activities and cost centers, without establishing the necessary conditions to calculate costs per course, student, project, or service, as outlined in NCP 27 of the SNC-AP.

The findings of this study suggest that the lack of MAC implementation is not directly related to the manager’s profile, software renewal, or the institution’s political strategy. The interviewees unanimously agree that investment in training and capacity-building for human resources is crucial. Furthermore, they emphasize that for successful implementation, all employees and managers must be actively involved in the process.

The use of performance improvement tools, such as the Balanced Scorecard (BSC), is significant, at 85%. However, when it comes to environmental concerns, while institutions have adopted certain measures and initiatives, they are not yet aligned with NCP 27, which mandates the provision of environmental cost information. Special attention must be given to defining the necessary criteria for implementing management accounting in this context.

Thus, the implementation of MAC in public HEIs still has a long way to go and is currently in its early stages.

It is hoped that these findings and conclusions will contribute to a better understanding of the application of Management Accounting and Control (MAC) in Higher Education Institutions (HEIs), as a phenomenon of great economic and social importance. This topic is considered a fertile ground for future research, as the study of MAC in HEIs still has a long way to go to become more effective and scientifically robust.

7. Limitations and Suggestions for Future Research

No matter how rigorous and applied, any research faces two types of limitations: those arising from the choices made by the researcher throughout the investigation process and those that, although unintentional, result from factors beyond the researcher’s control.

For future research, it is suggested that more stakeholders involved in Management Accounting and Control (MAC) be analyzed to validate, enhance, and refine the findings of this case study. The insights obtained should be tested through quantitative approaches to help outline new directions for further investigations.

Although this study provides comprehensive and specific insights into the phenomenon under analysis, its results and conclusions cannot be generalized, especially given that the knowledge acquired is based on only 12 cases. Future research should consider multiple case studies across various HEIs in the country, including the archipelagos of Madeira and the Azores, to allow for a broader and more generalizable study.

Future studies should focus on conducting case studies in HEIs to test, through pilot projects, the effectiveness of implementing the ABC and TDABC methods. That is, case studies within HEIs could assess the effectiveness of these methods in terms of cost reduction, resource allocation optimization, and improved strategic decision-making. Specifically, it is essential to evaluate whether these methods can be effectively applied and tested, analyzing the practical cost-benefit results of their implementation.

Conducting future research of this nature will enable these institutions to put tested models into practice and understand their contribution to institutional strategic policy.

| Proposition |

Authors |

| Proposition 1: Implementation challenges of the SNC-AP accounting subsystems |

| Q1: Considering the challenges inherent in implementing the SNC-AP, which of the three subsystems is the most complex? |

Costa & Carvalho (2006); Teixeira et al (2012); Teixeira (2009); Martins (2005); Esteves, (2022); Lutilsky e Dragija (2012); Carvalho et al. (2008); Almeida (2017). |

| Proposition 2: Legal requirements for accounting information |

| Q1: Is the accounting information available used more to comply with legal requirements or to support decision-making? |

Teixeira et al (2012); Teixeira (2009); Martins e Peixinho (2017); Hardan e Shatnawi (2013); (López e Rodríguez (2018); Ríos e Rodríguez (2014); Santos et al., (2015); Améstica-Rivas et al, (2017). Carneiro e Teixeira (2022); (Silva et al, 2016). |

| Proposition 3: Budgeting |

| Q1: Is the way the budget is drawn up fundamental to the application, implementation and fulfillment of the objectives of the SNC-AP? |

Coelho (2019); Hansen (2011); Miranda (2021); Custódio & Viana (2019) |

| Proposition 4: Relationship between the implementation of the BSC and the Performance of the Institution |

| Q1: What management strategies and tools does the institution use to manage and improve performance, including the BSC or equivalent models? Q2: To what extent does the dissemination of information contribute to the smooth running of the institution? |

Silva et al. (2011), Martins (2017); Kurunmäki (2009); Brusca (2019); Hutaibat & Alhatabat (2020); Benabdelkrim et al (2018) |

| Proposition 5: Fulfillment of Management Accounting objectives |

| Q1: Does the existing accounting system contribute to meeting the management accounting objectives set out in the SNC-AP? |

Arora e Raju (2018); Kaplanog (2008); Haroun (2015); Costa & Carvalho (2006); Martins e Peixinho (2017); Martins (2005); Fito et al., (2018); Gosselin (1997); Quesado e Silva (2021). |

| Proposition 6: Implementation of the GCC in HEIs |

| Q1: Did the implementation of management accounting require/need software adaptation/renewal and specific training?Q2: Has the implementation of management accounting required changes to the organization chart of the institution? |

Bornia (2002); Askarany e Yazdifar (2007); Stratton et al. (2009); Pietrzak et al. (2020); Ouassini (2019); Costa & Carvalho (2006); Martins e Peixinho (2017); Teixeira (2009); Martins (2005); Dewi et al., (2021); Marlina (2020; Bobe, 2020; Vale et al (2022); (Stefano et al. (2012); Araújo (2007); Martins (2014); Brusca (2019); Heinicke (2020); Hutaibat & Alhatabat (2020). |

| Proposition 7: Bases for cost sharing |

| Q1: Does the use of the breakdown basis recommended by the SNC-AP require clarification and standardization of the way total working hours are calculated? |

Laviana (2016); Jordan e al. (2011); Améstica-Rivas et al (2017); Foster e Swenson (1997); Järvinen & Väätäjä (2018); Major e Hopper (2005); Major e Vieira (2017); Wegmann (2019); Carvalho et al. (2008); Valderrama e Del Rio Sanchez (2006); Hernández et al. (2010) |

| Proposition 8: Implementation of the Chart of Accounts |

| Q1: Did the implementation of a chart of accounts in class 9 require/require it to be adapted and adjusted? |

Martins (2017); NCP 27(2015§30); (Rosa, 2017); |

| Proposition 9: Comparability of Information |

| Q1: Does the comparability of information imply that procedures are standardized at the top? |

Marlina et al., (2023); Campanale (2014); McLaughLin (2014); Laviana et al (2016); Martins e Peixinho (2017); Bobe (2020); Marlina (2020); Vale (2022) |

| Proposition 10: Strategic Policies |

| Q1: Does the institution's strategic policy affect the implementation of management accounting? |

Costa & Carvalho (2006); Teixeira et al (2012); Borges et al (2017); Santos, 2020 Brusca (2019); Hutaibat e Alhatabat (2020); Teixeira (2016) |

| Proposition 11: Manager profile |

| Q1: Does the profile of the manager jeopardize the implementation of management accounting? |

Vicente et al (2011), Bressan (2004); Silva & Costa (2008). |

| Proposition 12: Environmental Management |

| Q1: Is environmental management taken into account when implementing management accounting? |

(Souza & Compare, 2014) ; Duarte et al., (2023) |

References

- Adeoye-Olatunde, O. A., & Olenik, N. L. (2021). Research and scholarly methods: Semi-structured interviews. Journal of the American College of Clinical Pharmacy, 4(10), 1358–1367. [CrossRef]

- Almeida (2017). A Adoção de uma Nova Reforma da Contabilidade Pública em Portugal: Estudo de Caso em Algumas Entidades Piloto (Master's thesis, ISCTE-Instituto Universitario de Lisboa (Portugal)).

- Alves, M., Teixeira, J., & Gomes, E. M. (2015). O papel das universidades no desenvolvimento regional: Uma análise do caso português. Revista de Administração Pública, 49(4), 737-757.

- Améstica-Rivas, L., Llinas-Audet, X., & Oriol Escardíbul, J. (2017). Costos de la Renovación Curricular: Una Propuesta Metodológica para la Valorización Económica de Carreras Universitarias. Formación Universitaria, 10(1), 89–100. [CrossRef]

- Araújo, M. B. S. (2007). Os sistemas de controlo de gestão e o desempenho organizacional nos Serviços Autónomos da Administração Central: Um estudo comparativo entre os sectores da saúde, educação e restantes sectores que utilizam o POCP.

- Arora, A. K., & Raju, M. S. S. (2018). An Analysis of Activity Based Costing Practices in Selected Manufacturing Units in India. Indian Journal of Finance, 12(12), 22. [CrossRef]

- Askarany, D., & Yazdifar, H. (2007). Why ABC is Not Widely Implemented? International Journal of Business Research, 7(1), 93–98.

- Baldvinsdottir, G., Mitchell, F., & Norreklit, H. (2010). Issues in the relationship between theory and practice in management accounting. Management Accounting Research, 21, pp. 79-82. [CrossRef]

- Batista, E. C., de Matos, L. A. L., & Nascimento, A. B. (2017). A entrevista como técnica de investigação na pesquisa qualitativa. Revista Interdisciplinar Científica Aplicada, 11(3), 23-38.

- Benabdelkrim, Y., Filali, E., & Hassainate, M. S. (2018). The Contribution of Management Control to the Improvement of University Performance. 2018. [CrossRef]

- Bhimani, A., & Bromwich, M. (2009). Management Accounting: retrospect and prospect. Elsevier.

- Blandford, A. E. (2013). Semi-structured qualitative studies. Interaction Design Foundation.

- Bobe, B. (2020). The impact of management accounting on performance management in higher education institutions. Accounting Research Journal, 43(5), 567-592.

- Borges, R., Ferreira, A. C., & Lacerda, L. D. (2017). Systematic planning and ecosystem-based management as strategies to reconcile mangrove conservation with resource use. Frontiers in Marine Science, 4, 353. [CrossRef]

- Bornia, A. (2002). Análise gerencial de custos em empresas modernas. Bookman.

- Bromwich, M., & Scapens, R. W. (2016). Management accounting research: 25 years on. Management Accounting Research, 31, pp. 1-9. 1–9.

- Brusca, I., Labrador, M., & Condor, V. (2019). Management Accounting Innovations in Universities: A Tool for Decision Making or for Negotiation? Public Performance \& Management Review, 42(5), 1138–1163.

- Campanale, C., Cinquini, L., & Tenucci, A. (2014). Time-driven activity-based costing to improve transparency and decision making in healthcare A case study. Qualitative Research in Accounting and Management, 11(2), 165–186. [CrossRef]

- Carneiro, B. T., & Teixeira, A. A. (2022). A CCG as a tool to demonstrate the effectiveness and economy in the management of public resources: Strengthening accountability and transparency in higher education institutions. In Anais do Congresso Brasileiro de Contabilidade (pp. 1–10).

- Carvalho, J., Carmo, T. & Macedo, N. (2008). A contabilidade analítica ou de custos no sector público. Revista dos Técnicos Oficiais de Contas, 96, 30-41.

- Chaker, M. N., & Mohammad, J. (2012). Activity-based costing system in higher education: a conceptual framework. International Journal of Business and Social Science, 3(7).

- Coelho, C. I. (2019). A Lei dos Compromissos e Pagamentos em Atraso como instrumento de controlo da execução do orçamento da despesa: um estudo de caso aplicado”. Dissertação de Mestrado. Instituto Politécnico de Setúbal.

- Costa, A., & Carvalho, B. (2006). Implementação de sistemas de contabilidade gerencial em órgãos públicos: Um estudo de caso. Revista de Contabilidade e Finanças, 17(2), 115-132.

- Custódio, C., & Viana, C. (2019). SNC-AP Sistema de Normalização Contabilística para as Administrações Públicas: visão pratica do SNC-AP. Almedina.

- Creswell, J. W., & Poth, C. (2017). Qualitative inquiry and research design: Choosing among five approaches (4ª ed.). Sage Publications.

- Decreto-Lei n.o 192/2015 de 11 de setembro do Ministério das Finanças, Pub. L. No. Diário da República n.o 178/2015, Série I (2015).

- Dewi, I., Silva, A. P., & Correia, J. S. (2021). The implementation of management accounting in higher education institutions in Portugal: Challenges and opportunities. Accounting, Organizations and Society, 68.

- Duarte, J. M., Silva, A. P., & Correia, J. S. (2023). The role of cost accounting in performance measurement in higher education institutions: A Portuguese case study. Journal of Accounting and Public Policy, 60.

- El Filali, B., & Hassainate, H. (2018). The role of management control systems in strategic performance management. Journal of Management and Organization Studies, 15(2), 223–242.

- Esteves, A. C. P. (2022). Práticas de Contabilidade e Controlo de Gestão em Organizações Híbridas.

- Faria-Schützer, D., Surita, F., Alves, V., Bastos, R., Campos, C., & Turato, E. (n.d.). Seven steps for qualitative treatment in health research: the Clinical-Qualitative Content Analysis. Cien Saude Colet, 26(1), 265–27. [CrossRef]

- Fito, M. A., Llobet, J., & Cuguero, N. (2018). The activity-based costing model trajectory: A path of lights and shadows. Intangible Capital, 14(1), 146. https://doi.org/10.3926/ic.1107. [CrossRef]

- Fontanella, C., Davis, A., & Savin-Baden, M. (2011). Fostering theoretical saturation in qualitative research: A grounded theory approach. The Qualitative Report, 16(4), 1-16.

- Foster, G., & Swenson, D. (1997). Measuring the success of activity-based cost management and its determinants. Journal of Management Accounting Research, 9, 109-141.

- Gosselin, M. (1997). The effect of strategy and organizational structure on the adoption and implementation of activity-based costing. ACCOUNTING ORGANIZATIONS AND SOCIETY, 22(2), 105–122. [CrossRef]

- Hansen, S. C. (2011). A Theoretical Analysis of the Impact of Adopting Rolling Budgets, Activity-Based Budgeting and Beyond Budgeting. European Accounting Review, 20(2), 289–319. [CrossRef]

- Hardan, A. S., & Shatnawi, T. M. (2013). Impact of Applying the ABC on Improving the Financial Performance in Telecom Companies. International Journal of Business and Management, 8(12). [CrossRef]

- Haroun, A. E. (2015). Maintenance cost estimation: application of activity-based costing as a fair estimate method. Journal of Quality in Maintenance Engineering, 21(3), 258–270. [CrossRef]

- Heinicke, X. (2020). The challenges of implementing management control systems in higher education institutions: A German perspective. European Journal of Accounting, 28(4), 543-568.

- Hernández, A. L., Díaz, D. C., Toledano, D. S., Ramos, D. Á., Angulo, J. G., Armenteros, J. H., & Martínez, V. J. (2010). Livro Blanco de Los Costes en Las Universidades.

- Hutaibat, K., & Alhatabat, Z. (2020). Management accounting practices’ adoption in UK universities. Journal of Further and Higher Education, 44(8), 1024–1038. [CrossRef]

- Hutaibat, K. (2019), The role of management accounting in decision making in higher education institutions. Journal of Accounting and Organizational Studies, 15(2), 1-17.

- Järvinen, J., & Väätäjä, K. (2018). Customer Profitability Analysis Using TimeDriven Activity-Based Costing: Three Interventionist Case Studies Nordic. Journal of Business, 67(1), 27-47.

- Johnson, H. T., & Kaplan, R. S. (1987). The rise and fall of management accounting. IEEE Engineering Management Review, 15(3), 36-44. [CrossRef]

- Jordan, H., Neves, J. C., & Rodrigues, J. A. (2011). O Controlo de Gestão - Ao Serviço da Estratégia e dos Gestores (9a ed.). Áreas Editora.

- Kaplan, R. & Anderson, S. R. (2007). Time-driven activity-based costing: a simpler and more powerful path to higher profits. Harvard business press.

- Kaplanog, V. (2008). Application of activity-based costing to a land transportation company: A case study. International Journal of Production Economics, 116, 308–324.

- Kuckartz, U., & Rädiker, S. (2019). Analyzing Qualitative Data with MAXQDA. In Analyzing Qualitative Data with MAXQDA. [CrossRef]

- Kurunmäki, L. (2009). Management Accounting, Economic Reasoning and the New Public Management Reforms (pp. 1371–1383). [CrossRef]

- Laviana, A. A., Ilg, A. M., Veruttipong, D., Tan, H. J., Burke, M. A., Niedzwiecki, D. R.,... & Saigal, C. S. (2016). Utilizing time-driven activity-based costing to understand the short-and long-term costs of treating localized, low-risk prostate cancer. Cancer, 122(3), 447-455.

- López, M. e Rodríguez, JA (2018). Peculiaridades de custo nas universidades. [Particularidades do custo nas universidades]. Scientific Journal of Accounting, 103-115.

- Lowe, A., Saunders, B., Flower, R., & Munford, R. (2018). Towards a process for establishing theoretical saturation in qualitative research. Qualitative Research, 18(1), 115–130.

- Lutilsky, I. D., & Dragija, M. (2012). Activity based costing as a means to full costing - possibilities and constraints for european universities [Abc metoda kao metoda obračuna potpunih troškova-mogućnosti i ograničenja europskih sveučilišta]. Management (Croatia), 17(1), 33–57.

- Major, M., & Hoque, Z. (2005). Activity-Based Costing: Concepts, Issues and Practice. In Z. Hoque (Ed.). Handbook of Cost and Management Accounting (pp. 83-103). London: Spiramus.

- Major, M., & Vieira, R. (2017). Activity-Based Costing/Management. In M; Escolar Editora: J. Major & R. Vieira (Eds.). Contabilidade e Controlo de Gestão: Teoria, Metodologia e Prática (pp. 297- 329). Lisboa.

- Marlina, E. Marlina, E. (2020). Strategic costing models as strategic management accounting techniques at private universities in Riau, Indonesia. Journal of Higher Education Policy and Management, 35(2), 123-145.

- Marlina, E., Putri, A. A., & Suriyanti, L. H. (2023). Determinants of strategic management accounting implementation in Higher Education Institutions (HEIs) in Indonesia. Journal of Accounting and Investment, 24(2), 306-322.

- Martins, A. L. (2017). Contabilidade de gestão nas administrações públicas.