1. Introduction

After falling off the cliff of the 2008 financial crisis, the global yacht market struggled for a decade and recovered to near pre-crisis levels in 2018. Unlike the financial crisis of 2008, COVID-19 in 2020 will have an impact on public health, with many industries experiencing a reduction in demand for orders on the one hand, and a reduction in supply on the other.

As is well known, yacht manufacturing from design, manufacturing to engines, outfitting, and yacht construction, is a global division of the labor industry, Europe is mainly luxury yachts and sailboats, and the United States is mainly small and medium sized motor yachts. As one of the world's leading producers of yachts, Taiwan's yacht market has been growing in recent decades, with increasing number of people renting and buying yachts.However, the transportation disruption caused by the 2020 epidemic has affected the global yacht manufacturing chain. When the outbreak occurred in early 2020, Taiwanese yacht manufacturers were forced to reduce production, which in turn affected exports and sales to Europe and the United States. According to Taiwan's regulations, a level 3 outbreak alert was implemented from May 19, 2021 to July 26, 2021, requiring people to wear masks throughout their outings, and religious venues were temporarily closed to the public. When the outbreak was initially controlled, it was announced that the alert level would be lowered to level 2 from July 27, 2021 to February 28, 2022, which would include temperature measurement of the public, self-health management of employees, and the provision of public hand-washing facilities and disinfectants for eating and drinking establishments.

As the global outbreak cooled further, Taiwan's Alert Level 2 was declared to have ended in March 2022, and many manufacturing industries, including the yacht industry, gradually resumed full production. Yachting is a type of outdoor activity at sea away from crowds, so during the outbreak of COVID-19, more people chose yachting as a leisure tool to reduce the chances of being infected by outdoor activities compared to the past. Ocean Alexander is one of the top-selling brands for large yachts in the US. Established in 1977 in Kaohsiung, Taiwan, Ocean Alexander is currently the largest and globally recognized luxury yacht company in Asia, with more than a dozen agents worldwide, including the Americas, Europe, Asia, and Australia. Ocean Alexander has been one of the best-selling large yacht brands in the United States in recent years.

AGRO is an emerging stock company in Taiwan that specializes in yacht production. Taiwan's Ministry of Finance (MOF) stated that the 2020 COVID-19 epidemic has caused dramatic social and economic changes, and in order to assist enterprises affected by the epidemic, the government has taken the initiative to provide "deferred tax policy", including the leniency of tax authorities in accepting extensions of time for taxpayers to extend their tax payments or pay their taxes in installments.

From January 15, 2020 to June 30, 2022, taxpayers who are affected by the epidemic and are unable to pay their taxes within the prescribed payment period may apply for deferred tax extension of time or payment in installments without being restricted by the amount of tax payable; the maximum extension period is one year, and the maximum installment period can be up to three years (36 installments).

In this paper, the largest yacht manufacturing company in Asia and another emerging Taiwan yacht manufacturing company are used as comparative research subjects to study how the government applies for extension or installment of tax payment for taxpayers who are unable to pay the tax within the prescribed payment period due to the impacts of the epidemic during the period of implementation of the Special Act for Relief of the World Epidemic in Taiwan (January 15, 2020-June 30, 2021) during the period of implementation of the Special Act for Relief of the World Epidemic. The maximum extension period is one year, and the maximum installment period is up to three years (36 installments). Impact of tax incentives on the two companies' revenues.

The chapters of this research article are as follows: Chapter 2 is the literature review; Chapter 3 is the research methodology; Chapter 4 is the econometric structure; Chapter 5 is the empirical analysis and results; and Chapter 6 is the conclusion.

2. Relative Literature

In response to COVID-19,governments scrambled with emergency actions,such as lockdown,travel restrictions,testing and quarantining, and economic packages (Ashraf, 2020). These measures have a significant influence on people’s daily lives,such as tourism and commute(Lang et al,2021).It has been acknowledged that intense tourist activity is likely to spread diseases in destinations affecting local communities, particular those with a higher average age (Gautret et al.,2012; MacIntyre, 2020). According to the WHO as of October 25, 2020, there were 43,341,451 confirmed cases and 1,157,509 deaths worldwide, and Kwon (2020) examines the companies that faced difficult challenges during the COVID-19 epidemic and how they responded. The airborne spread of the virus created disruptions in activities that required people to be in the same place.Acar (2020) and Zoğal Emekli (2020) assessed the impact of COVID-19 on tourism in Turkey; finding that tourists preferred rural destinations, such as summer resorts and highlands, where there was less interpersonal interaction and social distance.

As a yacht manufacturing company, coordinating external craftsmen with employees who need to work in the field and the mix of high-tech processes and procedures is a major challenge for yacht manufacturing companies (Ponticelli et al., 2013). Regarding the upstream and downstream relationships in the yacht production chain,Brun and Karaosman ( 2019) state that yacht manufacturing companies have many interdependent relationships with local and foreign suppliers, mostly comprising small and medium-sized enterprises (SMEs) and artisans. Most of which rely heavily on handmade craftsmen. Outbreaks of COVID-19 on several cruise ships, as well as the abrupt termination of hundreds of sailings, have severely affected the perception and promotion of cruise ships as a "safe" holiday (Baum and Hai (2020) and Holland et al. (2020)).

Çıtak and Çalış (2020) shows that the COVID-19 outbreak has had devastating economic impacts on the tourism industry, and these impacts are increasing. Although countries have provided important economic programs to mitigate these impacts, tourism is still affected as much as any other sector. However, after the outbreak, people returned to tourism with great enthusiasm (Kiper et al., 2020). Similarly, according to Alaeddinoğlu and Rol's (2020) study on the impact of the epidemic on the tourism industry, people mostly intend to go on vacation for six months or more after the epidemic is under control.

A study by Emre Ozan Aksoz and Ipek Itir (2023) compared consumer purchasing preferences in the yacht charter market before the COVID-19 pandemic (BCP) and during the COVID-19 pandemic (DCP). The study sample consisted of 404 tourists renting yachts in the Mulamarmaris region of Turkey. The results of the study found that consumers prioritized quality, cleanliness, and hygiene factors when purchasing or renting a yacht during the COVID-19 pandemic compared to the pre-COVID-19 pandemic. Regarding the payment of taxes on yachts, Russia also taxes yachts and sail boats. Paddle boats and motorboats with engines not exceeding 5 hp, as well as sea and river boats used for commercial fishing were exculded. (Jon Hellevig,2015). In Greece, as a country with a large harbor, a yacht tax is levied based on the size of the yacht. Revenues are generated from the yachts floating around the country, and these revenues have become Greece's budget for overseeing marine cleanup, facilities, and harbor development. In Thailand, according to the excise tariff tax, they exempt the collection of taxes on yachts. Moreover, for the customs tariff tax, they give the privilege to the tourist to bring the yacht into the country and do not have to pay tax for six months but the authority officer can extend the time period with no limit.( Ampika Jaroenchai,2009). In the EU, all EU residents who own a boat and use it within the EU are required to pay a 20% value-added tax (VAT), which will significantly increase the sales price, especially for higher-value yachts. Of course, when selling a vessel to an EU country, proof that VAT has been paid is required, similar to a federal tax clearance certificate in the United States. However, an off-shore registered yacht owned for commercial purposes in the Mediterranean is exempt from VAT if the boat was imported into the Med per the applicable regulations. In US tax law, there are three areas where TCJA can be most beneficial to yacht owners. If the owner of the yacht uses the vessel for “legitimate business purposes” and is registered as an entity (e.g. a corporation, a partnership or an LLC), the IRS considers the yacht as “listed property” and a business asset. The U.S. tax system allows state (or local) sales tax to be deducted from the purchase of a boat, but this varies depending on where the owner lives. In addition, if the owner classifies their yacht as a second home (to qualify, it must have a berth, galley and bow), it may be possible to deduct the interest on the loan. This is equivalent to allowing homeowners to deduct loan interests in their first and second homes. This deduction was available for up to $750,000. If U.S. citizens rent out a yacht for more than 50 percent use (and therefore qualify it as business-related), they can deduct 50 percent of vessel-related expenses, including fuel, maintenance, mooring fees, insurance, storage, and repairs.

(Source:IYC Yachts | Luxury Yachting Worldwide). The Asia-Pacific yachting market generated revenue of USD 1,707.8 million in 2023 and is expected to reach USD 2,763.4 million by 2030. According to Horizon Grand View research( Source:Asia Pacific Yacht Market Size & Outlook, 2030). In addition, the Asia-Pacific yachting market is expected to grow at a CAGR of 7.1% from 2024 to 2030. In Canada, in addition to the general sales tax, luxury tax is levied on luxury yachts , which can be as high as 25% of the purchase price.

Similarly, since June 2011, Taiwan has imposed a 10% luxury tax (also known as the Special Goods and Services Tax) on the sale, manufacture and import of yachts with an overall hull length of 30.48 meters within Taiwan. (source:Ministry of Finance,R.O.C.2015). To date, there is a paucity of comparative literature on the relationship between the compensation of managers of major world-class yacht companies and the quality of the financial statements of the yacht companies they operate during the epidemic. In the years following its end, this study seeks to explore the relationship between the level of compensation of managers and the quality of the financial statements of the companies they operate, particularly in the context of tax deferrals imposed on companies in some countries during the epidemic, using actual data. Therefore, this study aimed to explore this issue using empirical data.

3. Methodology and Data

3.1. Methodology

As the impact of a change in a country's tax system on the revenues and retained earnings of the yachting industry has been less well documented in the traditional literature, in particular, as the world experienced the impact of COVID-19 in 2020, the impact on the yachting industry both during and after the epidemic is a topic worthy of study and direction of research. Hence, this study examines the impact of the government's tax deferral policy on the yacht manufacturing industry during the Taiwanese epidemic. The study begins by identifying the research problem, discussing the historical background of yachts, conducting a literature review, and using the difference-in-difference(DID) model and the SUR-OLS method to measure the relationship between changes in rental tax policies and firms' revenues. An empirical analysis is presented and specific and demonstrable conclusions are drawn.

3.2. Research Design

This study focuses on the impact of four important tax changes affecting the yachting industry in Taiwan on the revenue and retained surplus of the yachting industry between 2018 and 2024: (1) The impact of the split tax at a single rate of 28% on income from dividends paid by corporations to their shareholders on the retained surplus of an experimental group of yachts implemented in 2018. (2) The effect of the increase in the tax rate on income from a for-profit business from 17% to 20% on the operating income of the experimental group in the industry since 2018. (3) The effect of the 2018 implementation of the reduction in the income tax rate on retained earnings of corporations from 10% to 5% on dividend payments in the experimental group yacht industry. (4) Impact of the Government's tax deferral policy in 2021 (from May 2021 to June 2022) on the income of the Yacht Experiment Group during the Covid-19 outbreak.

3.3. Sample

In this study, Ocean Alexander, Asia's largest yachting company, and AGRO, an emerging stock market yacht company in Taiwan, were used as the experimental and control groups to compare and analyze the key factors that determine the difference in revenue between the two companies. In particular, the difference in revenue performance between the two yacht companies during the period between the COVID-19 Alert Level 3 and Alert 2 (from May 2021 to February 2022) periods , as well as the impact of Taiwan's tax reform in 2018 on the dividend distribution and retention of earnings of Asia's largest yacht company. The methodology of this study begins with a DID time-series regression analysis to observe the difference in revenues between Asia's largest yacht company and another yacht company whose stock came out from the counter during and after the outbreak: the first period from May 2021 to February 2022 (the alert period for the announcement of the Taiwan outbreak) and the second period from March 2022 to March 2024 (the second period (the end of the second period runs from March 2022 to March 2024 (the second period (the end of the epidemic)). On July 31, 2020, the Ministry of Finance (MOF) announced that, to alleviate the pressure of paying income tax for profit-making businesses affected by the epidemic, the MOF would suspend the collection of income tax for profit-making businesses during the epidemic period. Taxpayers affected by the epidemic and unable to pay the full amount of tax within the payment period from January 15, 2020 to June 30, 2022 may apply for an extension of the payment period or pay the tax in installments without any limitation on the amount of tax to be paid, the extension period can be up to one year, and the installment period can be up to three years (36 installments). Finally, this study examines the impact of Taiwan’s tax changes on the dividend payments and retained earnings of Asia's largest yacht company in 2018. Information regarding the experimental and control groups in this study is shown in

Table 1:

Table 1.

Basic Information - Experimental and Control yachts.

Table 1.

Basic Information - Experimental and Control yachts.

Yacht

Group name |

Date of Establishment of Yacht Company |

Listing Date of the Public Offering |

Company Market Capitalization (NT$ million)

|

Whether the yacht company is a stock listed/over-the-counter company |

Is it the largest yacht company in Asia in terms of the total number of yachts produced each year? |

Main Businesses |

Ocean

Alexander

yacht |

1978/01/23 |

2017/12/11 |

26,378 |

stock listed/ |

Yes |

Manufacture and sale of luxury yachts and their spare parts. |

AGRO

yacht |

2014/07/16 |

2020/07/01 |

3392 |

over-the-counter |

No |

Yacht chartering, sales, escrow and maintenance, marina management |

3.4. Data Source

This study searches and obtains data from the Ocean Alexander and AGRO Yacht Corporation for the period from May 2021 to Mar 2024 using the Taiwan Economic News Database System of Tamkang University. (

http://tej.lib.tku.edu.tw), and the Taiwan Stock Exchange Corporation.(

https://www.twse.com.tw/zh/index.html),

4. Econometric Structure

In this study, we measure instrumental variables associated with important tax policy changes in Taiwan in 2018, as shown in

Table 2.

4.1. Variable Definitions

Table 2.

definition of variables.

Table 2.

definition of variables.

| The name of the variable |

Variable definitions |

|

monthly revenue of the experimental group (Ocean Alexander) minus control group(AGRO) |

| Section |

Dummy variable , with 1 represents the experimental group and 0 represents the control group |

| Time |

Dummy variable, 1 represents the third and second level epidemic alert periods, 0 represents the end of the third and second level epidemic alert periods. |

| Policy |

the interaction between the "Section" and "Year". |

|

initial difference (marginal effect of sector at T=0) |

|

baseline change over time (marginal effect of T at S=0) |

|

treatment effect |

|

experimental group Ocean Alexander monthly revenue during the

Taiwan tier 3 and tier 2 alert periods minus the average monthly

revenue during post-epidemic periods |

|

control group AGRO monthly revenue during the Taiwan tier 3

and tier 2 alert periods minus the average monthly revenue

during post-epidemic periods |

|

minus

|

| YachtEWV |

the total dollar value of all yachts (under 7.5 meters + over 7.5

meters + inflatables) exported to the world (in thousands of dollars)

over a time period ranging from May 2021 to Mar 2024. |

| YachtEWN |

all the yachts (under 7.5 meters + over 7.5 meters + inflatables)

exported to the world (international units), |

4.2. Unit Root Test

In this paper, we adopt yachts industry as a case study and use the DID method to analyze the monthly revenue of the experimental group (Ocean Alexander), the variable YachtEWN represent all yachts (under 7.5 meters + over 7.5 meters + inflatables) exported to the world (international units), and YachtEWV represents the total dollar value of all yachts (under 7.5 meters + over 7.5 meters + inflatables) exported to the world (in thousands of dollars) over a time period ranging from May 2021 to Mar 2024. To capture the simultaneous correlation between heterogeneity and residuals in the model, we measure the correlation between these variables and determined whether the random component contains a unit root. The results of the unit root test are shown in

Table 3, which indicate that all variables plateau at the first - form of the variance below the 5% significance level, describing the recorded variable as I(1).

Table 3.

Performance of unit root test.

Table 3.

Performance of unit root test.

| variable |

N-st difference |

(C,T,K) |

DW |

ADF |

5% |

1% |

Result |

|

1 |

(C,n,8) |

2.14 |

-5.15 |

-3.57 |

-4.30 |

I(1)*** |

|

1 |

(C,n,8) |

2.01 |

-8.49 |

-3.55 |

-4.26 |

I(1)*** |

|

1 |

(C,n,8) |

2.14 |

-4.64 |

-3.59 |

-4.35 |

I(1)*** |

4.3. Stationary Test

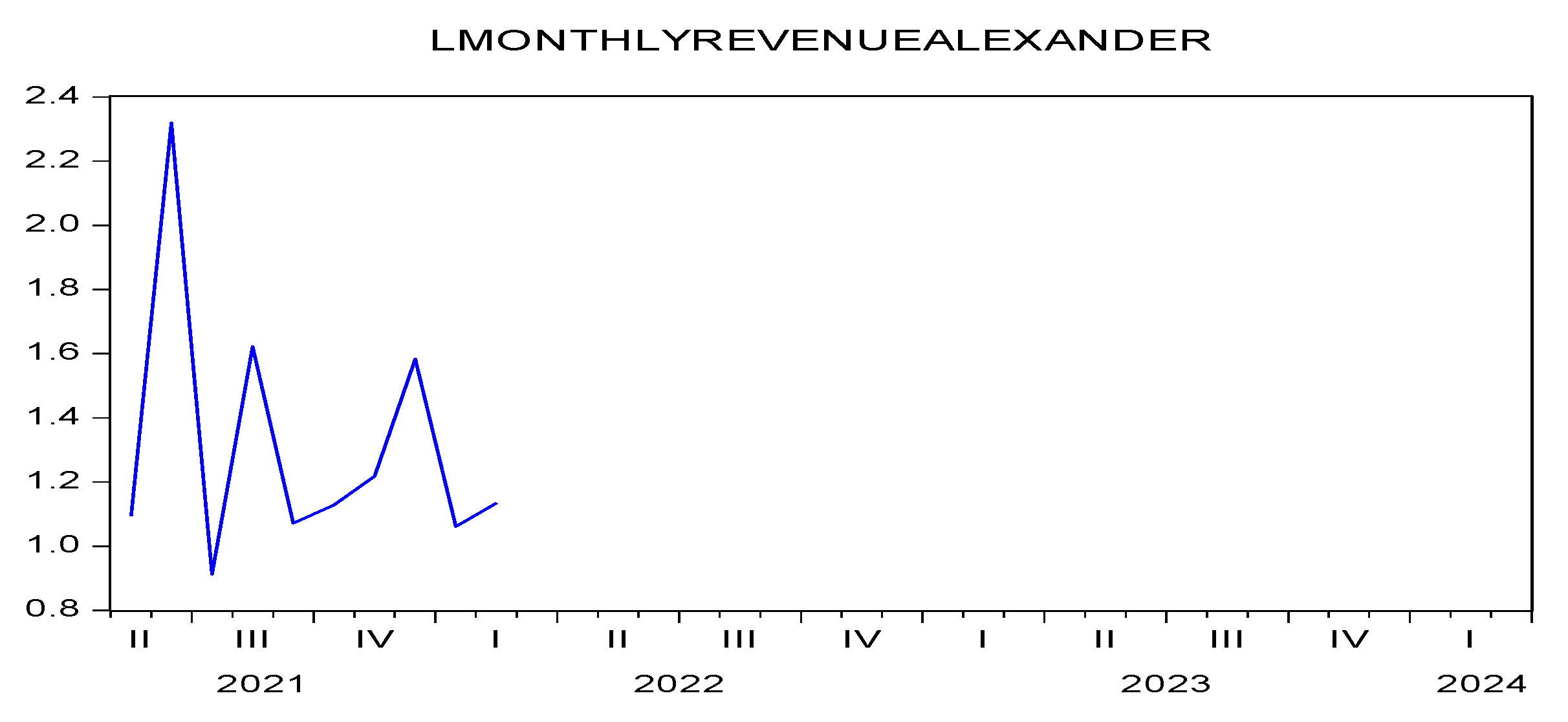

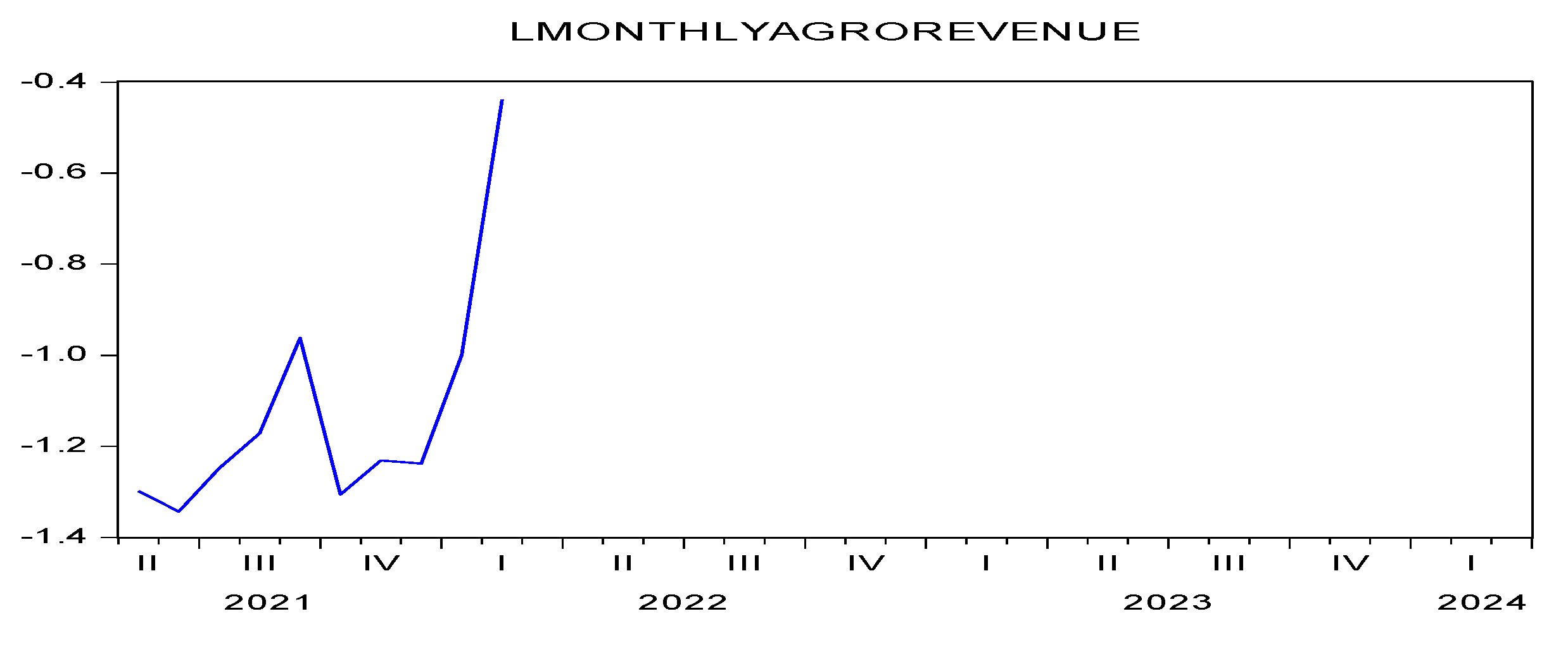

In addition to the unit root test described above, the stability test in

Figure 1 reveals that during the Covid-19 alert period (May 2021 to February 2022), the average monthly revenue of the Ocean Alexander Yacht Group remained stable, but the average monthly revenue of the AGRO Yacht Group showed an upward unstable time series(see

Figure 2).

Figure 1.

Stability Test, Ocean Alexander yacht (from May 2021 to February 2022).

Figure 1.

Stability Test, Ocean Alexander yacht (from May 2021 to February 2022).

Figure 2.

Stability Test, AGRO yacht ( from May 2021 to February 2022).

Figure 2.

Stability Test, AGRO yacht ( from May 2021 to February 2022).

4.4. Maximum Likelihood Estimator (MLE)

Next, we retrieve the variables from

Table 2,

is the explained variable, and represents the monthly revenue of the experimental group (Ocean Alexander). We define

as a nonlinear logistic function that can be expressed as

Further, This is done by setting

be the normal probability allocation function, and its probability allocation function

Next, we define Maximum Likelihood Estimator L as follows:

Then, we take the logarithm of L and obtain:

Unlike the traditional method of estimating the outcome by probability, Maximum Likelihood Estimator (MLE) primarily uses backward extrapolation to estimate the location of the most probable probability point that leads to the outcome

when

is given. We note that the Maximum Likelihood Estimator (MLE) of the simplified Student t-distribution method is used to analyze the relationship between cash dividend payout and the reduction of retained earnings tax rate from 10% to 5% in 2018, as shown in Eq.(7) and

Table 4. The above discussion indicates that the estimated results are almost the same as the normal distribution, except for C(3) = -0.166806 with a p-value of 0.0286. However, the p-values of the other parameters C(1) and C(2) are not statistically significant. Nevertheless, the results of the normal distribution were still better in terms of the rationality of the parameters.

Table 4.

Maximum Likehood Estimator Test.

Table 4.

Maximum Likehood Estimator Test.

| Sample:2014 2023 |

Coefficient |

Std. Error |

z-Statistic |

Prob. |

| C(1) |

4.69E+08 |

5.85E+08 |

0.802358 |

0.4223 |

| C(2) |

-1.89E+08 |

3.98E+08 |

-0.473893 |

0.6356 |

| C(3) |

-0.166806 |

0.076224 |

-2.188367 |

0.0286 |

| Log likelihood |

-355.3038 |

Akaike info criterion |

71.66075 |

| Avg. log likelihood |

-35.53038 |

Schwarz criterion |

71.75153 |

| Number of Coefs. |

3 |

Hannan-Quinn criter. |

71.56117 |

5. Econometric Result

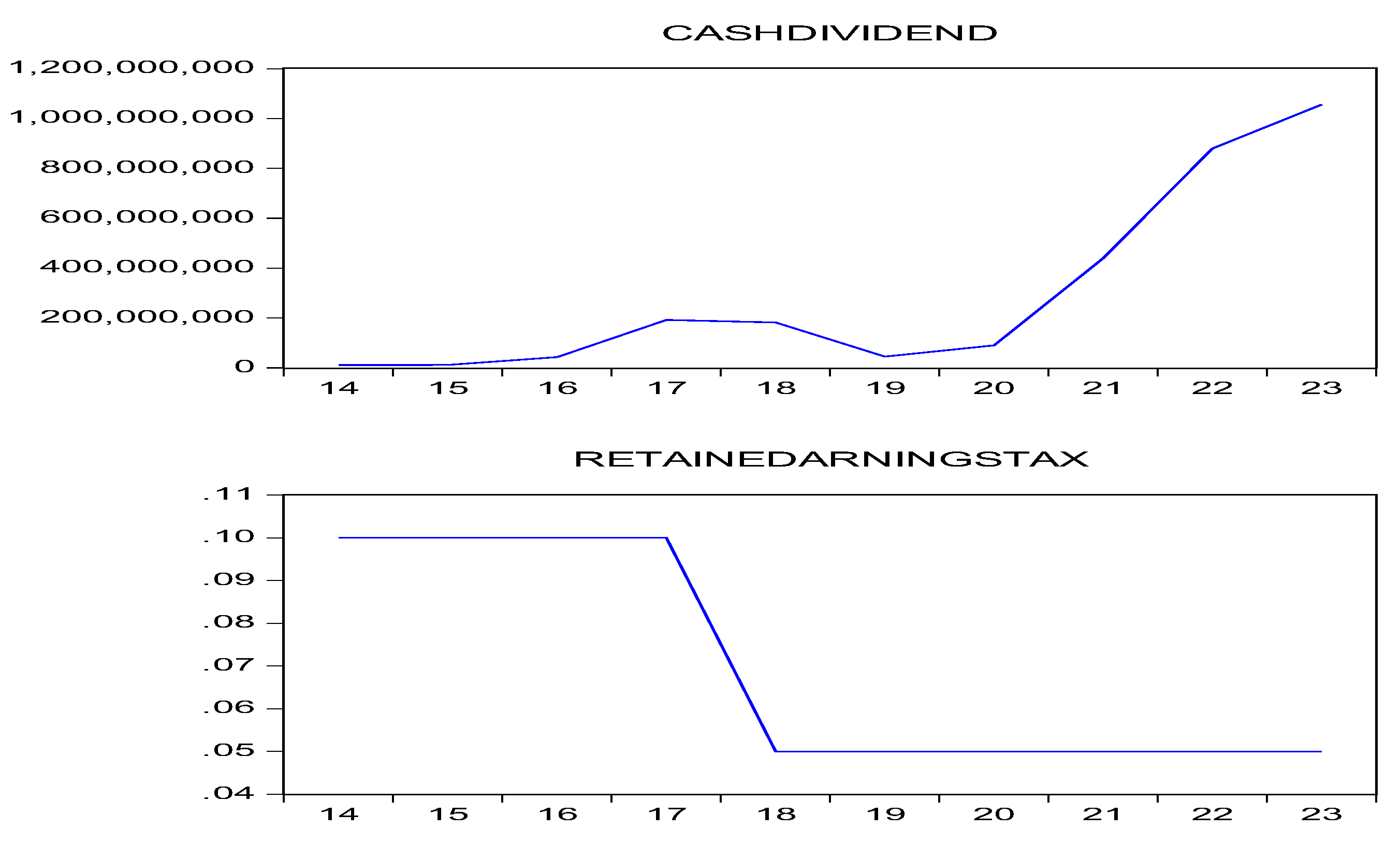

5.1. The Causality Between Retained Earnings Taxation and Cash Dividends

As mentioned above, since the implementation of the income tax system optimization plan in Taiwan in 2018, domestic shareholders can choose to calculate the tax separately at the 28% tax rate on cash dividends distributed by the company in the current year, and no longer need to consolidate the cash dividends into the comprehensive personal income for tax purposes. In addition, in 2018, in order to alleviate the investment momentum of small and medium-sized enterprises and start-ups, which are not easy to raise funds from outside, to accumulate investment energy for their future restructuring and upgrading and to increase their willingness to invest, the government lowered the value-added business tax rate from 10% to 5% on the undistributed surplus.

To emphasize the role of the undistributed surplus tax link to cash dividends, this study examines the impact of the reduction in the VAT rate on the undistributed surplus from 10% to 5% on cash dividend payments in 2018. The empirical results show that the reduction in the tax rate on undistributed earnings in 2018 resulted in an increase in cash dividends paid to shareholders by the Ocean Alexander Yacht Group, primarily because of the concurrent governmental amendment in 2018 allowing cash dividends received by shareholders to be taxed at a 28% split, which is more favorable for higher dividend income with an applicable income tax rate of 30% or more because it is taxed at the relatively lower 28% tax rate. This resulted in an increase in cash dividends paid to shareholders. As shown

Figure 3, the shareholders' cash dividend severance tax implemented in 2018 and the reduction of the company's retained earnings from 10% to 5%, the system policy resulted in a significant increase in cash dividend distributions for this Ocean Alexander company, as shown in

Figure 3.

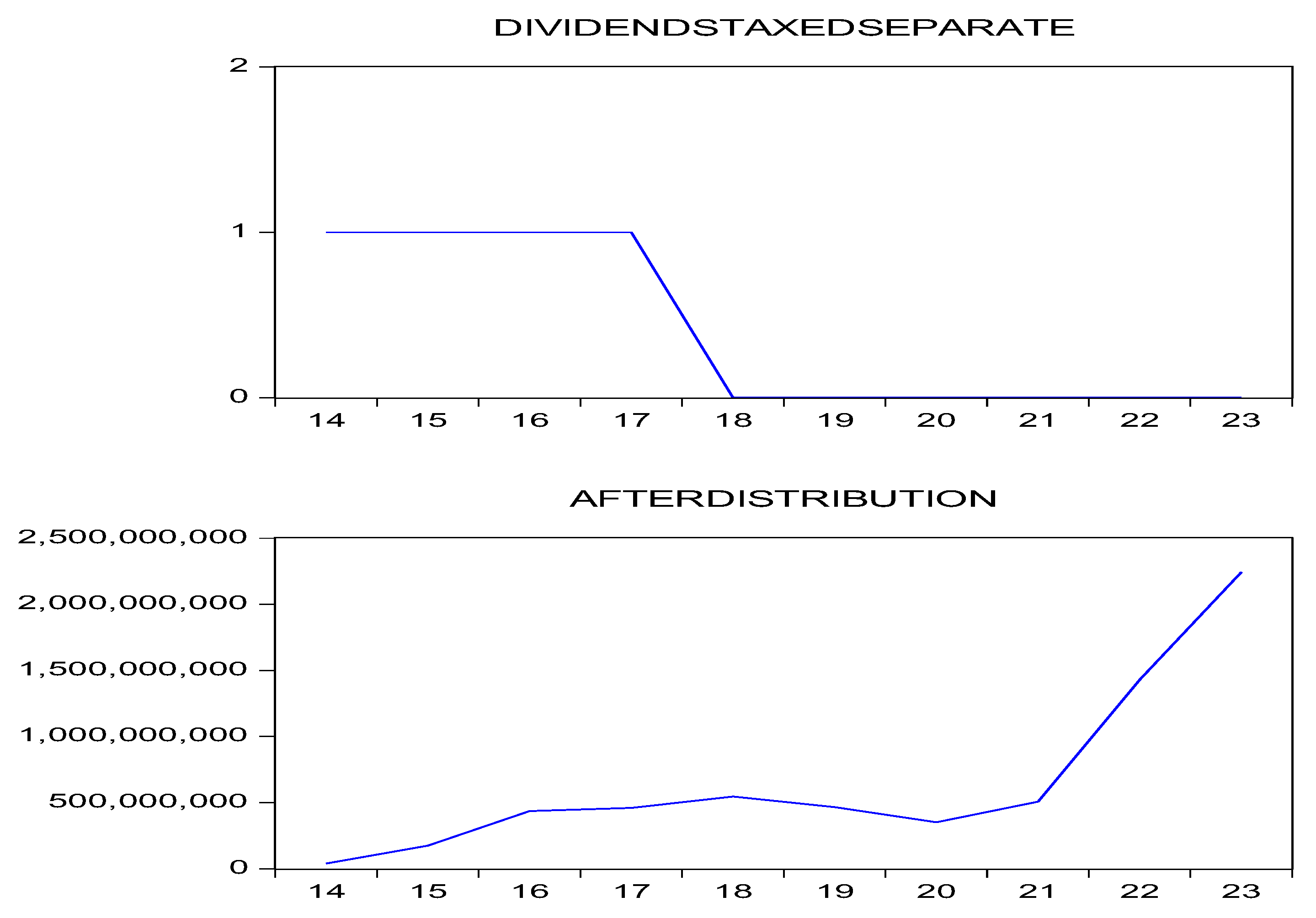

5.2. Causal analysis of undistributed earnings and cash dividends taxed at 28% for 2018

Following the same procedure, Eq.(8) and

Table 4 show that the implementation of the government's split tax on cash dividends at 28% in 2018 resulted in an increase in the retained earnings of the Ocean Alexander yacht group, mainly due to the government's announcement of a reduction in the rate of tax on retained earnings from 10% to 5% in 2018, which resulted in an increase in the company's willingness to retain its current net after-tax profit in the company's retained earnings account. Although the increase in cash dividend payments, the net effect still resulted in an increase in the company's retained earnings after the distribution of cash dividends.

where Afterdistribution is the Ocean Alexander yacht group’s retained earnings after distribution, and Dividendstaxedsparate represents the implementation of the government's split tax on cash dividends at 28% in 2018.

Figure 4.

Impact of split tax on cash dividends at 28% on retained earnings after distribution Ocean Alexander yacht.

Figure 4.

Impact of split tax on cash dividends at 28% on retained earnings after distribution Ocean Alexander yacht.

5.3. The Quasi- Experimental Analysis of Difference in Difference (DID) Model

The quasi- experimental method of Difference in Difference (DID) is a widely used quasi-experimental method for evaluating the difference between two groups before and after policy implementation (Li et al., 2018). In this study, we compare the changes in the treatment group and the control group before and after the tax policy, and discuss the empirical results between the monthly revenue of the experimental group (Ocean Alexander) minus the control group(AGRO) and the implementation of these tax policies, and the influences of other relative variables.

According to the DID, the following regression is constructed in Eq.(9):

In Eq.(9), μ is the sector-fixed effects, capturing all the characteristics in sectors that are time-invariant, such as Asia's largest yacht company,Ocean Alexander; and ν is the time-fixed effects, capturing the monthly influences that affect all yachts, such as the nationawide COVID-19 crisis in 2020 and the tax reform in 2018. Variable "Section" represents whether it is a Dummy variable in the experimental group or control group, with parameter 1 represents the experimental group and parameter 0 represents the control group, and coefficient is initial difference (marginal effect of sector at T=0). Variable "Time" represents whether it is a Dummy variable during the third and second level Covid-19 epidemic alert periods. Here, parameter 1 represents the third and second-level epidemic alert periods and parameter 0 represents the end of the third and second level epidemic alert periods. the coefficient is baseline change over time (marginal effect of T at S=0); is treatment effect, and Policy represents the interaction term between the two virtual variables, "Section" and "Year".

In other words, coefficient of S × T in Eq. (9) and Eq. (10) is the most important policy effect we want to observe.

In Eq.(9), the variable represents all yachts (under 7.5 m+ over 7.5 m+ inflatable boats) exported to the world (number of international units ),and represents all yachts (under 7.5 m + over 7.5 m + inflatable) exported to the global total value of U.S. dollars (unit: thousands of dollars)” over a time period ranging from May 2021 to Mar 2024. Here, parameter d stands for the number of days, parameter h stands for the number of yacht manufacturers that export to the world, and parameter g stands for the number of yacht companies that export to the world. Likewise, and variable represents the difference between control group AGRO's monthly revenue during the “Taiwan tier 3 and tier 2 alert periods” minus the “average monthly revenue during post-Covid-19 periods”. represents the difference between experimental group (Ocean Alexander) monthly revenue during the “Taiwan tier 3 and tier 2 alert periods” minus the “average monthly revenue during post-epidemic periods”. represents the difference between the experimental group difference and the control group difference between the COVID-19 alert period and the post Covid-19 period.That is, the variable minus the equals is the difference in difference(DID) variable. In addition, we assume that the government's tax deferral regulation for firms during the COVID-19 epidemic must itself be exogenous,that is, the implementation of the tax deferral regulation is not affected by other endogenous variables. Our main regression results illustrate that the experimental group (Ocean Alexander yacht) performs significantly better in terms of operational efficiency both during the epidemic and the tax reform than the control group (Agro yacht).

5.4. Mechanism Analysis

Following the practice of existing literature (Li et al., 2018; Zhou & Liu, 2020), the DID mechanism tests regress the control variables using the policy variables:

where

represents the five control variables;

is a year dummy variable representing the time of policy implementation;

is a dummy variable representing the representative yach,

η is the year fixed effect,

is the sector fixed effect,and δ is the stochastic disturbance term. The results of the mechanistic analysis are presented in

Table 5.

To investigate the impact of COVID-19 during the “Taiwan tier 3 and tier 2 alert periods upon the revenue of two representative yacht group. In this section, a quantitative model is established using the DID method to observe the effect of the independent variables, including tax deferral regulation on the dependent variable, that is, the monthly revenue of the yacht groups. The SUR-OLS equation is expressed as Eq.(9) and Eq.(10), the empirical results are presented in

Table 5.

Table 5.

Results of empirical SUR-OLS analysis of DID models for Ocean Alexander and ARGO yachts .

Table 5.

Results of empirical SUR-OLS analysis of DID models for Ocean Alexander and ARGO yachts .

Dependent

Variable:

|

Interactiondid |

|

|

lnyachtewn |

lnyachtewv |

DDEfe Deferred Tax |

| Model 1 |

0.382381***

(2.927651) |

|

|

|

|

|

Model 2

|

-0.152584***

(-4.768556) |

0.192676***

(27.43176) |

|

|

|

|

| Model 3 |

-0.143107***

(-4.542309)

|

0.083160

(1.193468) |

0.109689

(1.579225) |

|

|

|

Model 4

|

|

|

|

-0.027378

(-0.691441) |

|

|

| Model 5 |

|

|

|

|

0.176689**

(2.388156) |

|

| Model 6 |

|

|

|

|

|

-0.269235**

(-2.037650) |

5.5. Discussion

Proposition 1: Ocean Alexander yacht’s revenues increase rather than decrease during COVID-19 alert period

In Model 2 of

Table 5, we show the regression coefficient of matching variable" POLICY", representing the interaction between the two virtual variables,"Section" and "Time"is 0.382381, the coefficient passes the the 1% significance test. Similiarly, we denote the regression coefficient of

is 0.192676, which passes the 1% significance test, depicting the increase of the

where

represents “the experimental group Ocean Alexander monthly revenue during the Taiwan tier 3 and tier 2 alert periods minus the average monthly revenue during post-epidemic periods results in the increase of

, where

denotes the “monthly revenue of the experimental group (Ocean Alexander) minus control group(AGRO)”.

In Model 3 of

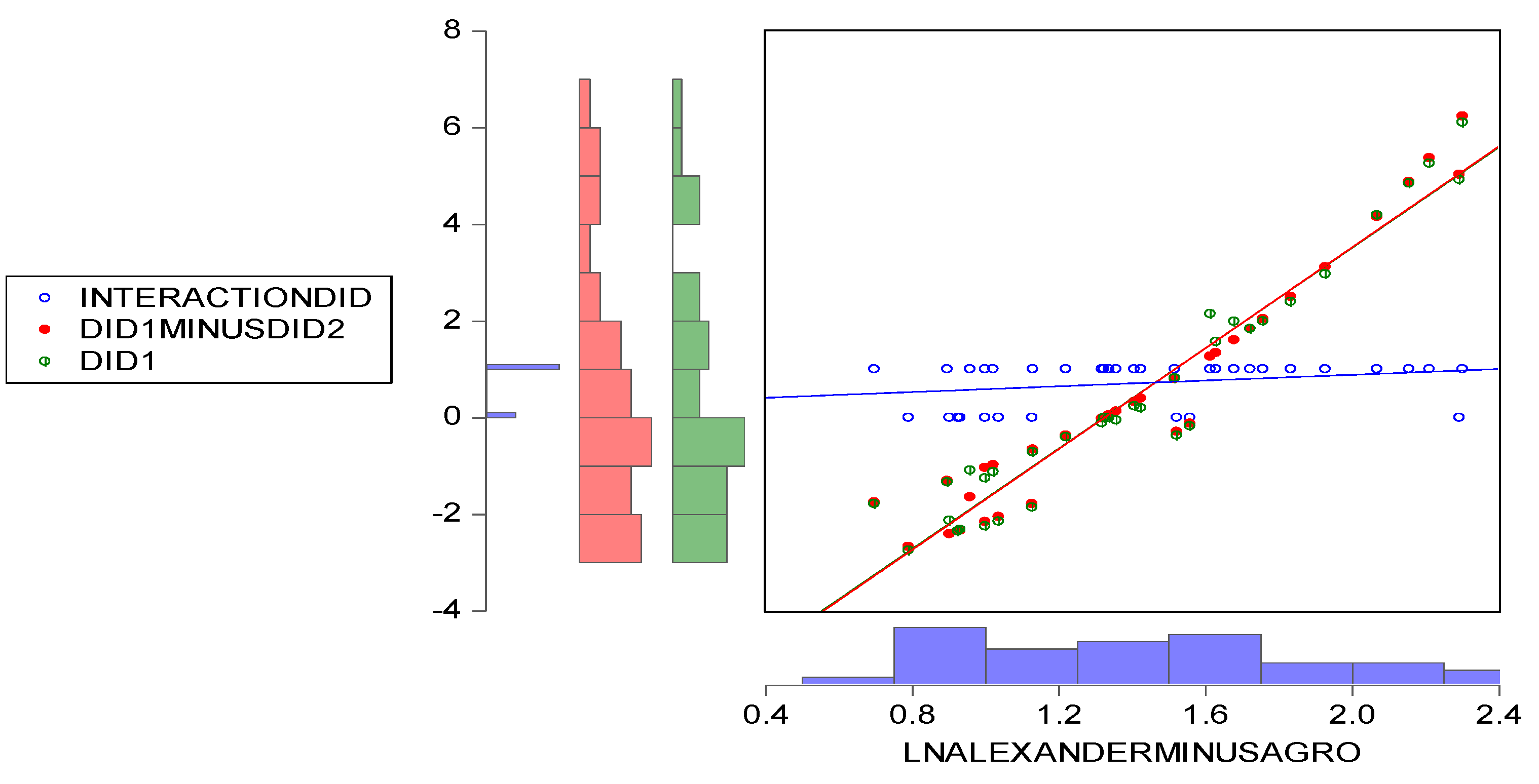

Table 5, we add the variable "DID1MINUSDID2", which shows that during the alert period of COVID-19, the net value of monthly operating income of Ocean Alexander yacht minus monthly operating income of AGRO yacht is positively related to "DID1MINUSDID2", and the p-value of the coefficient is 0.1192, which is close to the significance level of 10%. The linear scattering graphs regarding the three variables are shown in

Figure 5

Figure 5.

Scatter Regression plot of

Table 5,Model 3 period:May 2021- March 2024.

Figure 5.

Scatter Regression plot of

Table 5,Model 3 period:May 2021- March 2024.

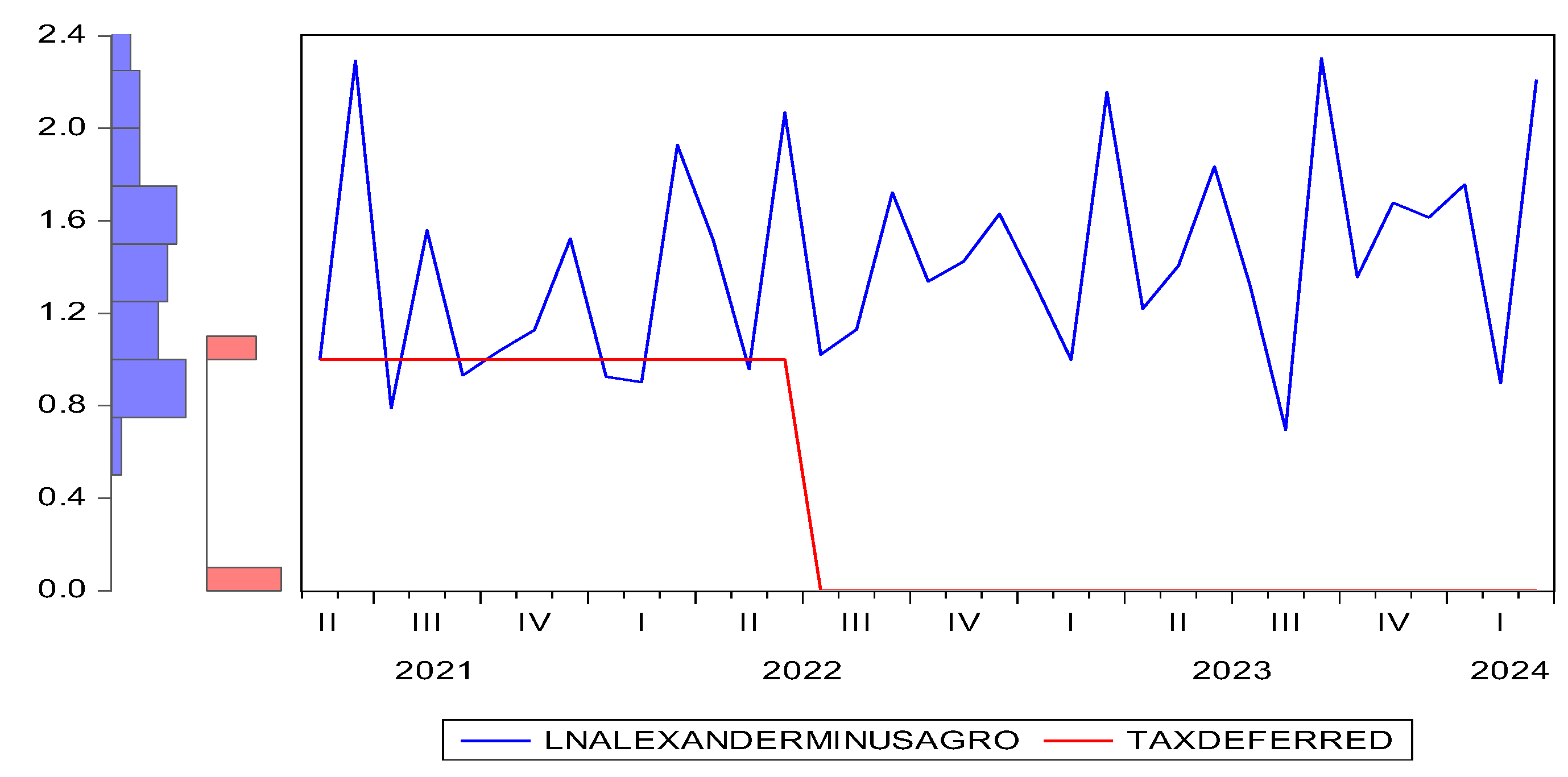

Proposition 2: During the COVID-19 outbreak, the government's tax deferral policy (from May 2021 to June 2022) was relatively favorable to AGRO yacht

According to Model 6 in

Table 5, the coefficient of influence of the independent variable Ocean Alexander yacht on the corresponding variable

, where

denotes the "monthly revenue of the experimental group (Ocean Alexander) minus control group(AGRO)", is -0.269235, which reaches a statistically significant level of 5%, and it can be seen that the government's tax deferral policy (from May 2021 to June 2022) during the COVID-19 outbreak resulted in a narrowing of the gap between Ocean Alexander yacht and AGRO yacht revenues. In other words, the tax deferral policy is more favorable for the AGRO yacht.(see

Figure 6)

Figure 6.

Impact of the government's tax deferral policy in 2021 (from May 2021 to June 2022) upon the revenue of the Ocean Alexander yacht and AGRO yacht during and after the COVID-19 outbreak.

Figure 6.

Impact of the government's tax deferral policy in 2021 (from May 2021 to June 2022) upon the revenue of the Ocean Alexander yacht and AGRO yacht during and after the COVID-19 outbreak.

6. Conclusions

In this article, we use the SUR-OLS and DID methods to assess the impact of major tax changes on the economic operating efficiency of experimental and control group companies during and after the epidemic in 2018. The advantage of the DID approach is its ability to control for unobserved confounding factors that remain constant over time, thus isolating the disturbing variables that really affect the model.

Our research contributes several intriguing findings and provides a new perspective by comparing the recent situation of Asia's largest ranked yacht company with that of another comparison group of stock-emerging yacht companies. First, the empirical results show that the reduction in the tax rate on undistributed earnings in 2018 resulted in an increase in cash dividends paid to shareholders by the Ocean Alexander Yacht Group, primarily because of the concurrent governmental amendment in 2018 allowing cash dividends received by shareholders to be taxed at a 28% split, which is more favorable for higher dividend income with an applicable income tax rate of 30% or more because it is taxed at the relatively lower 28% tax rate. This resulted in an increase in cash dividends paid to shareholders. Second, we show that the implementation of the government's split tax on cash dividends at 28% in 2018 resulted in an increase in the retained earnings of the Ocean Alexander Yacht Group, mainly due to the government's announcement of a reduction in the rate of tax on retained earnings from 10% to 5% in 2018, which resulted in an increase in the company's willingness to retain its current net after-tax profit in the company's retained earnings account. Although the increase in cash dividend payments, the net effect still resulted in an increase in the company's retained earnings after the distribution of cash dividends. Third, this paper depicts the Ocean Alexander yacht’s revenues increase rather than decrease During COVID-19 alert period. Finally, we find that the government's tax deferral policy (from May 2021 to June 2022) during the COVID-19 outbreak was relatively favorable to the AGRO yacht.

Author Contributions

This work was carried out in collaboration among three authors. Author EvaChiaHua Chiu designed the study, performed the statistical analysis, wrote the protocol and wrote the first draft of the manuscript. Author Chi-Cheng Wu and Yu kun Wang managed the literature rsearches. All authors read and approved the final manuscript.

Data Availability Statement

No data were generated in this work that cannot be shared for ethical, privacy, or security concerns.

Acknowledgements

All authors disclosed no relevant relationships and this research received no specific grant from any funding agency in the public, commercial, or not-for-profit sectors.

References

- Acar, Y. Yeni Koronavirüs (COVID-19) Salgını ve Turizm FaaliyetlerineEtkisi. Güncel Turizm Araştırmaları Dergisi 2020, 4, 7–21. [Google Scholar] [CrossRef]

- Alaeddinoğlu, F. & Rol, S. Covid-19 pandemisi ve turizm sektörü üzerindeki etkileri. Van Yüzüncü Yıl Üniversitesi Sosyal Bilimler Enstitüsü Dergisi, Salgın Hastalıklar Özel Sayı, 2020, 233-258.

- Baum, T. and Hai, N. T.T. “Hospitality, tourism, human rights and the impact of COVID-19”,International Journal of Contemporary Hospitality Management 2020, 32, 2397–2407. [Google Scholar]

- Ashraf, B.N. Economic impact of government interventions during the Covid-19 pandemic international evidence from financial markets,J. Behav.Exp,Financ 2020, 27, 100371. [Google Scholar] [CrossRef] [PubMed]

- Brun, A. & Karaosman, H. (2019). Customer influence on supply chain management strategies: An exploratory investigation in the yacht industry. Business Process Management Journal. [CrossRef]

- Bureau of Economic Analysis, U.S. Department of Commerce. http: U.S. Bureau of Economic Analysis (BEA).

- Çıtak, N. , & Çalış, Y. E. COVID-19 Salgının Turizm Sektörü Üzerine Olan Finansal Etkileri. Ida Academia Muhasebe ve Maliye Dergisi 2020, 3, 110–132. [Google Scholar]

- Demir, M. , Günaydın, Y. , & Demir, Ş. Ş. Koronavirüs (Covid-19) Salgınının Türkiye’de Turizm Üzerindeki Öncülleri, Etkileri ve Sonuçlarının Değerlendirilmesi. International Journal of Social Sciences and Education Research 2020, 6, 80–107. [Google Scholar]

- Dogan, E. ,and Smyth R. Board Remuneration, Company Performance, and Ownership Concentration: Evidence from Publicly Listed Malaysian Companies, ASEAN Economic Bulletin 2002, 19, 319–347. [Google Scholar]

- Emre Ozan Aksoz and Ipek Itir Can.(2023). Comparing Consumer Purchasing Preferences in Yacht Charter Market Before and During COVID-19: The Case of Marmaris. University of South Florida (USF) M3 Publishing.123.

- Gautret, P. , Botelho-Nevers, E. , Brouqui, P., & Parola, P. The spread of vaccine-preventable diseases by international travelers: A public health concern. Clinical Microbiology and Infection 2012, 18, 77–84. [Google Scholar] [CrossRef] [PubMed]

- Heckman, J. J. , Ichimura, H. , Smith, J., and Todd, P. Characterizing selection bias using experimental data, Econometrica 1998, 66, 10171098. [Google Scholar]

- Heckman, J.J. , Ichimura, H. , and Todd, P. Matching as an econometric evaluation estimator: Evidence from evaluating a job training programme, The Review of Economic Studies 1997, 64, 605654. [Google Scholar]

- Holland, L. Can the Principle of the Ecological Footprint be Applied to Measure the Environmental Sustainability of Business? Corporate Social Responsibility and Environmental Management 2003, 10, 224–232. [Google Scholar] [CrossRef]

- Jon Hellevig,2015,Awara Russian Tax Guide: Transport Tax in Russia. Source: Transport Tax in Russia.

- Kiper, V. O. , Saraç, Ö. , Çolak, O., & Batman, O. COVID-19 Salgınıyla Oluşan Krizlerin Turizm Faaliyetleri Üzerindeki Etkilerinin Turizm Akademisyenleri Tarafından Değerlendirilmesi.Balıkesir Üniversitesi Sosyal Bilimler Enstitüsü Dergisi 2020, 23, 527–551. [Google Scholar]

- Kwon, O.K. How is the COVID-19 pandemic affecting global supply chains, logistics, and transportation? . Journal of International Logistics and Trade 2020, 18, 107–111. [Google Scholar] [CrossRef]

- Lang Xu,Jia shi,Jihong Chen,Li Li. Estimating the effect of Covid-19 epidemic on shipping trade:An empirical analysis using panel data. Marine Policy 2021, 133, 104768.

- Li, G. , He, Q. , Shao, S., Cao, J. Environmental non-governmental organizations and urban environmental governance: evidence from China. J. Environ. Manage. 2018, 206, 1296–1307. [Google Scholar]

- MacIntyre, C. R. Global spread of Covid-19 and pandemic potential. Global Biosecurity 2020, 2. [Google Scholar] [CrossRef]

- Ministry of Finance,R.O.C. 2015; https://www.mof.gov.tw/singlehtml/384fb3077bb349ea973e7fc6f13b6974?cntId=e99c971b3eea40fb84e76d00c0c22026.

- NMMA,2021. N: https.

- Ohama, Y. , Fukumura, N., & uno, Y. (2005). A simplified forward-propagation learning rule applied to adaptive closed-loop control. in W. Duch, J. Kacprzyk, E. Oja, & S. Zadrozny (Eds.), Artificial neural networks: Formal models and their applications—ICANN 2005 (Vol. 3697, pp. 437–443). Heidelberg: Springer.

- Ponticelli, S. , Mininno, V. , Dulmin, R. & Aloini, D. Supply chain implications for one-off luxury products: cases from the yacht industry. International Journal of Retail & Distribution Management, 2013, 41, 1008–1029. [Google Scholar] [CrossRef]

- SantAnna, P. H. , and Zhao, J. Doubly robust di erence-in-di erences estimators, Journal of Economet rics 2020, 219, 101122. [Google Scholar]

- Statistics on severe special infectious pneumonia in Taiwan by the Ministry of Health and Welfare. https://nidss.cdc.gov.tw/nndss/disease?id=19cov.

- TKYGM (Tersaneler ve Kıyı Yapıları Genel Müdürlüğü).(2020). COVID-19 Küresel Salgınının Sektörümüze Etkisi. T.C. Ulaştırma ve Altyapı Bakanlığı, Tersaneler ve Kıyı Yapıları Genel Müdürlüğü.

- UNWTO(2020a), “Tourism and COVID-19”, available at: ww.unwto.org/news/covid-19-internationaltourist-numbers-could-fall-60-80-in-2020 (accessed 13 June 2020).

- U.S. Bureau of Economic Analysis (BEA). U.S. Bureau of Economic Analysis (BEA).

- World Health Organization (WHO), weekly epidemiological and operational updates, 2020(October 25,2020).

- Zhou, D. , Liu, Y. Impact of China’s carbon emission trading policy on the performance of urban carbon emission and its mechanism. China Environ. Series 2020, 40, 453–464. [Google Scholar]

- Zoğal, V. , & Emekli, G. Türkiye’de COVID-19 Salgını Sürecinde İkinci Konutların Değişen Anlamları. International Journal of Geography and Geography Education 2020, 42, 168–181. [Google Scholar]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).