I. Introduction

The rapid advancement of information technology and the increasing complexity of financial markets have fundamentally transformed stock trading practices[

1]. Traditional stock trading methods[

2,

3], which rely heavily on manual analysis and operations, have become insufficient in handling the massive volume of data generated by modern financial markets. This limitation is particularly evident in markets such as the A-share market, which encompasses between 2,000 to 4,000 stocks[

4] with historical trading data spanning half a century.

The emergence of big data analytics and machine learning technologies presents unprecedented opportunities for enhancing stock trading strategies[

5]. Machine learning algorithms have been widely adopted in financial market prediction[

6,

7]. These advanced computational methods offer the capability to process and analyze vast amounts of historical data, identify complex patterns, and generate predictive insights that would be impossible to achieve through traditional analysis methods[

8].

This research focuses on developing and evaluating a comprehensive stock prediction and trading system that leverages three distinct machine learning approaches: Linear Regression (LR), Long Short-Term Memory (LSTM)[

9], and Autoregressive Integrated Moving Average (ARIMA). Our work is motivated by several key objectives:

a) Development of Robust Prediction Models

We aim to create reliable stock price prediction models that can effectively process historical market data and generate accurate short-term price forecasts. This involves the implementation and optimization of multiple machine learning algorithms, each chosen for their specific strengths in handling time-series data.

b) Comparative Analysis of Methods

Through rigorous experimentation and analysis, we evaluate the performance of different prediction methods across various stocks and market conditions. This comparison provides valuable insights into the strengths and limitations of each approach.

c) Practical System Implementation

Beyond theoretical models, we develop a complete web-based trading system that integrates these prediction models into a user-friendly platform. This system provides real-time predictions, visualizations, and trading recommendations, bridging the gap between advanced analytics and practical application.

d) Trading Strategy Optimization

Based on the predictions generated by our models, we design and implement trading algorithms aimed at maximizing profitability through timely buy and sell decisions.

Our research contributes to both the theoretical understanding of stock price prediction methods and their practical application in real-world trading scenarios. The system we develop demonstrates the feasibility of utilizing machine learning approaches for financial decision-making, while our comparative analysis provides insights into the relative effectiveness of different prediction methods.

III. Data Collection and Processing

A. Dataset Description and Selection

This study employs historical stock price data from five major companies traded on the U.S. stock market, obtained through the Yahoo Finance platform. The selected companies - Apple (AAPL), Coca-Cola (KO), NVIDIA (NVDA), Pfizer (PFE), and Tesla (TSLA) - represent diverse market sectors and exhibit varying patterns of market behavior. These companies were specifically chosen due to their significant market presence, consistent trading volumes, and distinct market characteristics, providing an ideal testbed for evaluating our prediction models across different market conditions.

The primary dataset spans a three-year period, a timeframe carefully selected to balance data recency with sufficient sample size for model training. This duration provides enough historical data to capture meaningful market patterns while avoiding the potential noise from outdated market conditions that might not reflect current trading dynamics. For each trading day, the dataset includes six fundamental metrics: opening price, daily high, daily low, closing price, adjusted closing price, and trading volume. These metrics form the foundation for our predictive analysis and model development.

B. Data Preprocessing Methodology

Our preprocessing framework implements distinct strategies for each prediction model, recognizing that different algorithms require specific data representations for optimal performance. This targeted approach to preprocessing represents a key innovation in our methodology, significantly enhancing the prediction accuracy of each model.

1) Linear Regression Preprocessing

For Linear Regression analysis, we developed a structured approach to feature engineering based on temporal aggregation. The preprocessing involves combining five consecutive trading days into a single observation unit, with the closing price five days ahead serving as the prediction target. This creates a 25-dimensional input vector (5 features × 5 days) for each observation, with a single-dimensional output target. This structure enables the model to capture short-term price patterns while maintaining computational efficiency.

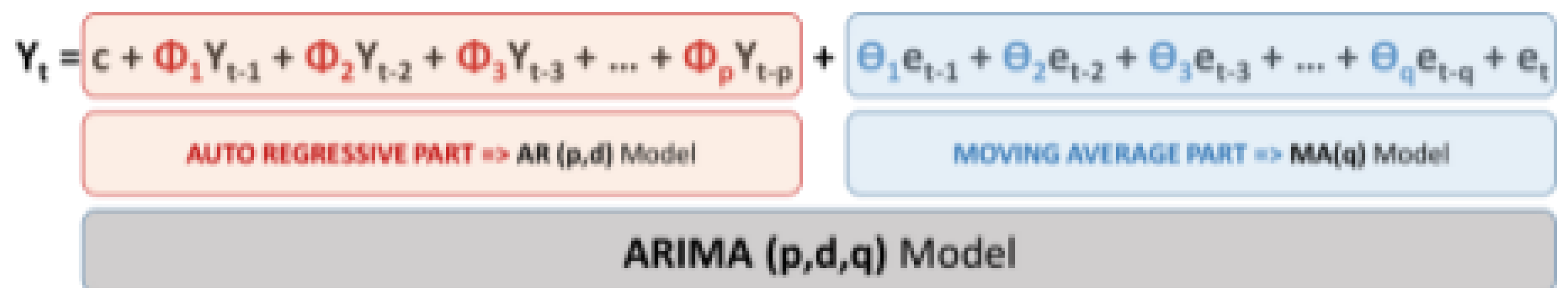

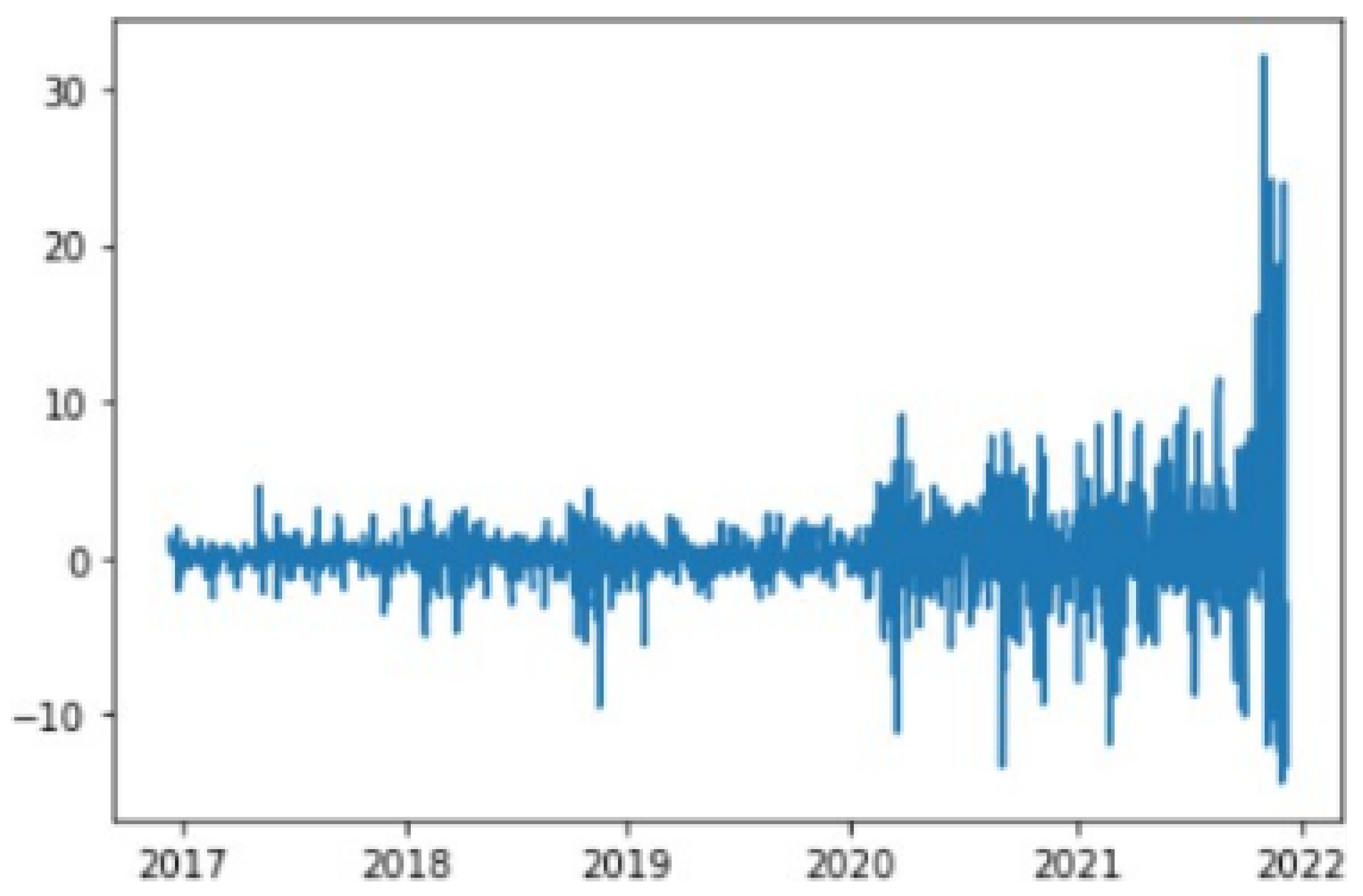

2) ARIMA Time Series Transformation

The ARIMA model implementation required careful attention to time series stationarity. We applied first-order differencing to the closing price sequence to generate a stationary time series, as illustrated in

Figure 4 and

Figure 5 using NVIDIA stock data as an example. The stationarity of the transformed series was rigorously validated through unit root testing, with all stocks showing p-values below

. This statistical validation confirmed that first-order differencing was sufficient to achieve stationarity, eliminating the need for higher-order transformations.

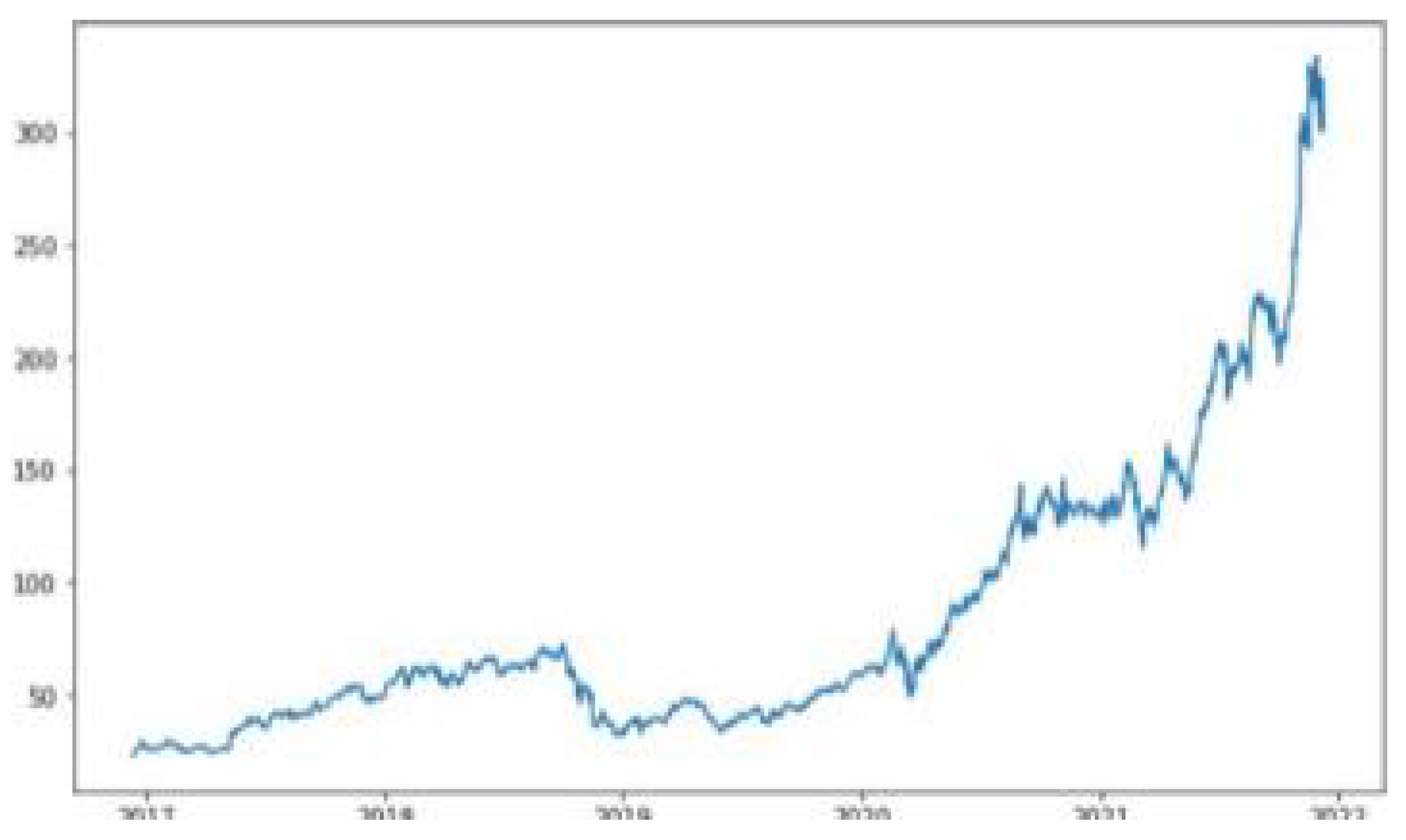

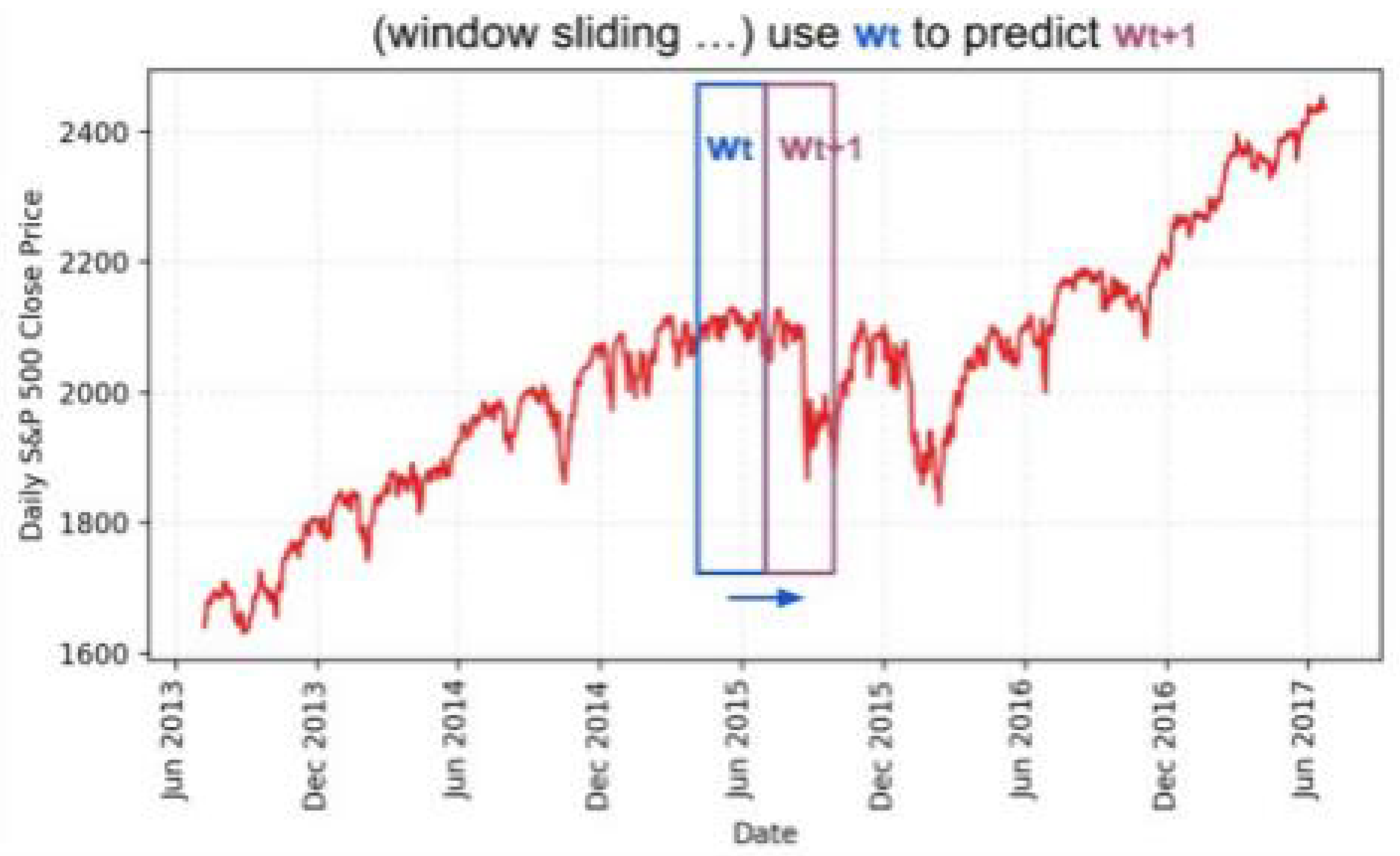

3) LSTM Sequential Data Processing

For the LSTM model, we implemented a sophisticated sliding window approach to maintain temporal relationships in the data. Each window contains several continuous trading days with a fixed size w, creating sequential data segments for training. We reserved the most recent 10% of the data for testing purposes, as shown in

Figure 6 using S&P 500 data[

4] as an illustration.

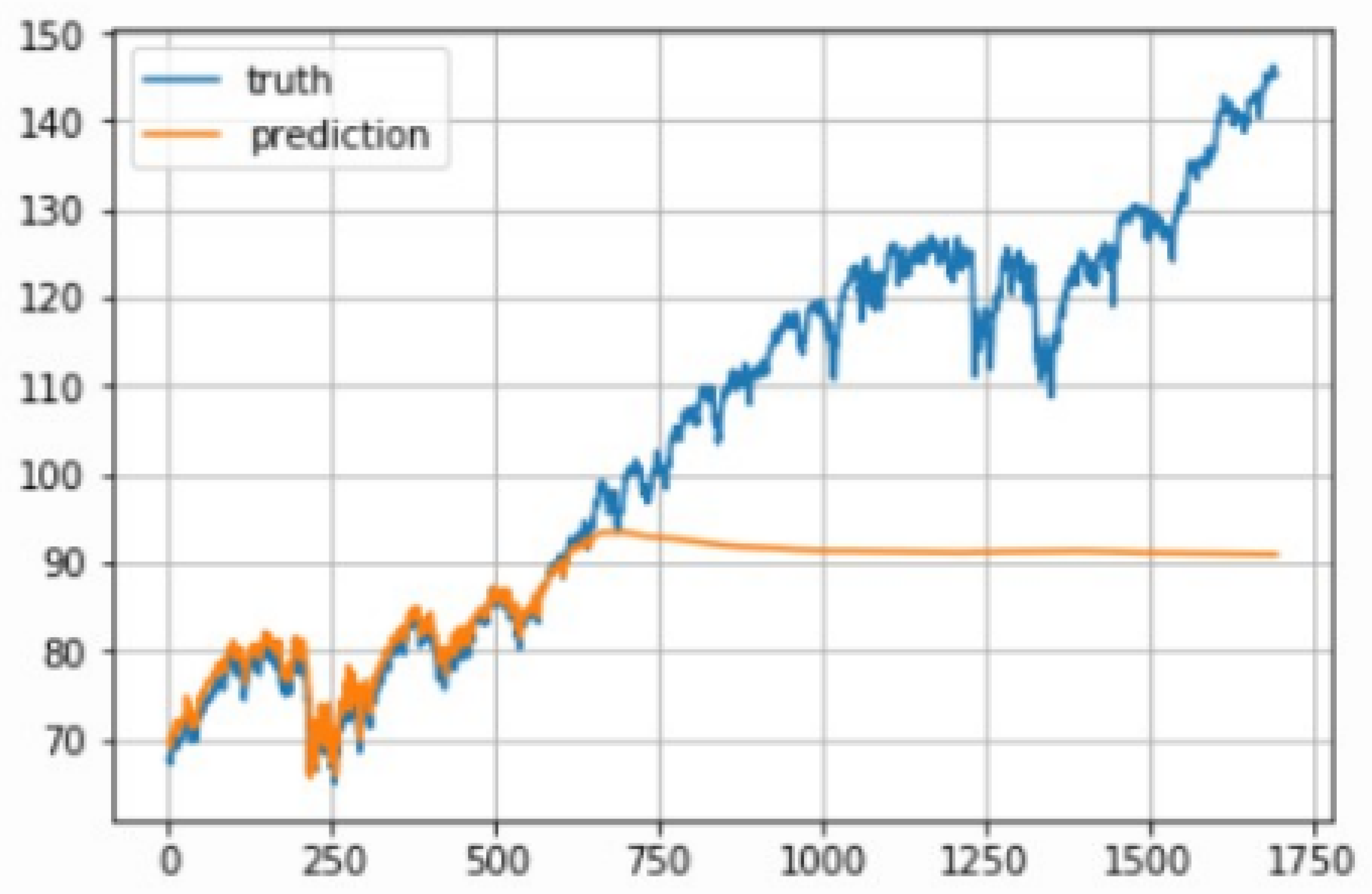

A critical innovation in our LSTM preprocessing was the implementation of window-specific normalization. This step proved essential due to the tendency of stock prices to increase over time, which can result in test data values significantly different from those seen during training.

Figure 7 demonstrates the poor prediction performance when using non-normalized data, where the model struggles with previously unseen price levels.

To address this challenge, we normalized each sliding window’s prices by dividing the values by the last known price (the final price in the previous window

). This transformation converts the prediction task from absolute price forecasting to relative change rate prediction, significantly improving the model’s generalization capability. The normalized sliding window

at time

t is calculated as:

where

P(t-1) represents the last price in the previous window.

C. Quality Control and Validation

The reliability of our prediction models depends heavily on the quality of the input data. We implemented a comprehensive quality control framework that addresses common challenges in financial time series data. This framework includes systematic detection and handling of missing values, validation of extreme price movements, and verification of data consistency across multiple sources. Special attention was paid to trading volume validation, ensuring that our analysis focuses on periods of significant market activity.

Additionally, we developed a market calendar alignment procedure to synchronize trading days across all stocks, accounting for market holidays and special trading sessions. This alignment ensures consistency in our cross-stock analysis and model comparisons. The effectiveness of these preprocessing strategies is reflected in the experimental results, where we observe significant improvements in prediction accuracy across all models.

IV. Methodology

A. Algorithm Selection and Design

Our research implements three complementary approaches for stock price prediction: ARIMA, Linear Regression, and LSTM networks. These methods were selected based on their distinct capabilities in handling different aspects of financial time series analysis.

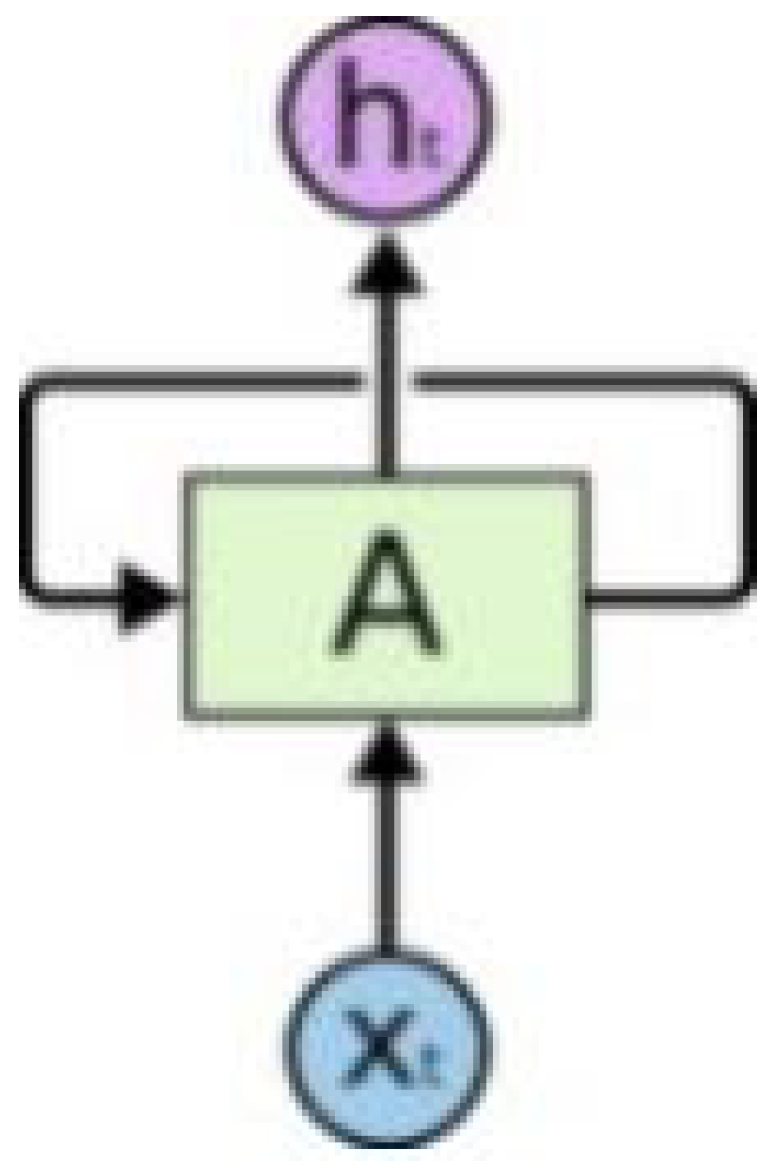

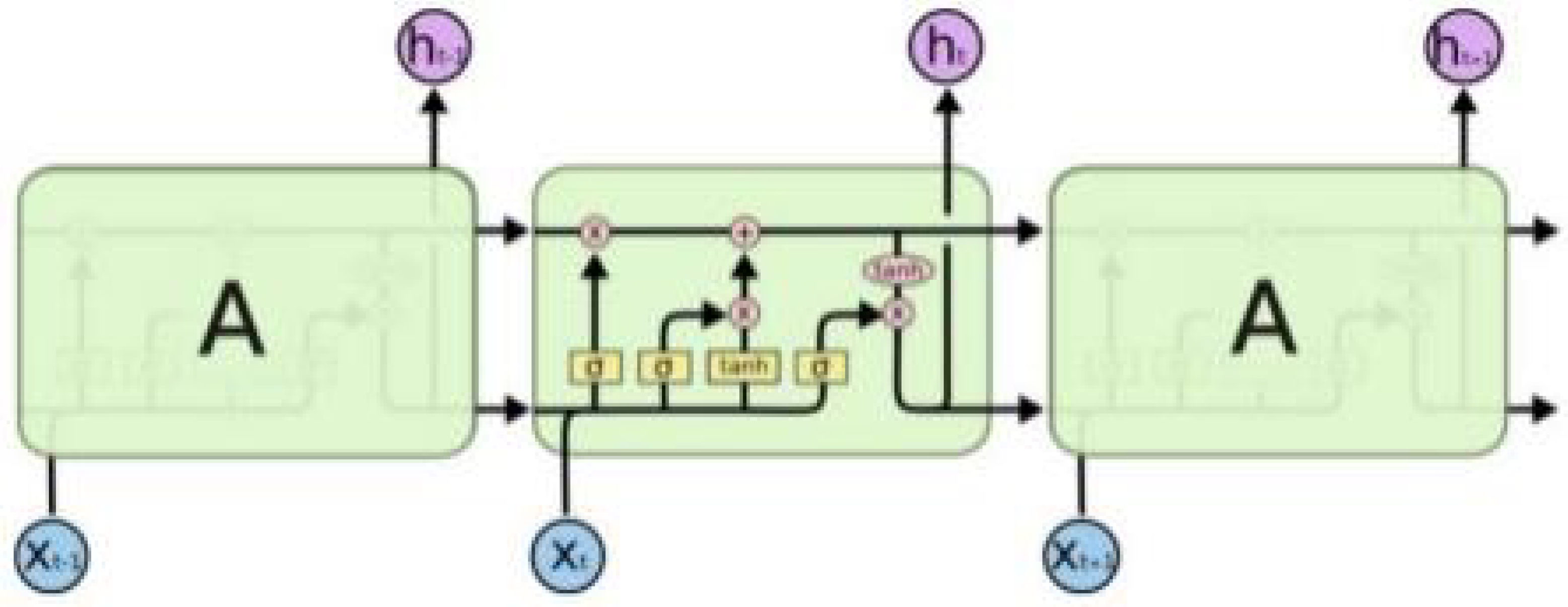

In the LSTM architecture, we leverage the sophisticated memory mechanism illustrated in

Figure 8, where each node contains four interacting neural network layers. This structure proves crucial for capturing market patterns across different time scales. The chain-like architecture, with its specialized memory cells containing input, forget, and output gates, enables our model to selectively retain and update information based on market conditions.

Figure 1 demonstrates this internal structure, where each gate plays a specific role in processing financial data streams.

ARIMA models offer sophisticated time series analysis capabilities through the integration of autoregressive and moving average components. Our implementation focuses on systematic parameter optimization, utilizing statistical validation techniques including unit root testing and information criteria analysis to establish optimal model configurations for varying market conditions.

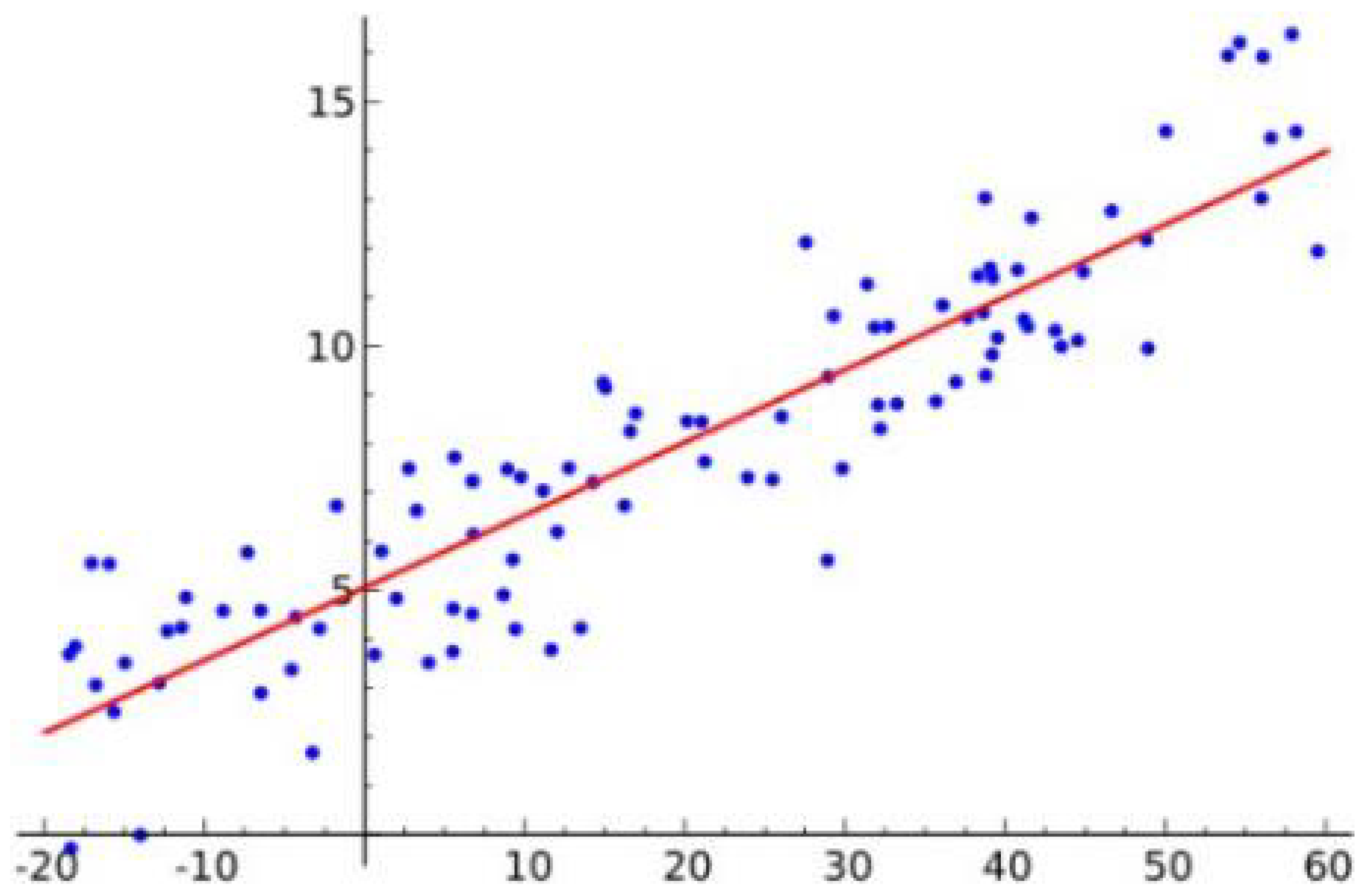

Linear Regression in our framework extends beyond basic linear models to encompass multiple optimization approaches. The implementation incorporates least squares estimation, gradient descent optimization, and regularization techniques through Lasso and Ridge regression. This comprehensive approach enables effective feature selection while maintaining model interpretability, crucial for practical trading applications.

B. Model Selection Rationale

The selection of these three approaches is justified through both theoretical foundations and practical considerations in financial forecasting. ARIMA’s statistical foundation provides robust handling of time series characteristics, particularly valuable for capturing seasonal patterns and trends in market data. The model’s ability to handle non-stationary data through differencing makes it particularly suitable for stock price analysis.

Linear Regression offers computational efficiency and interpretability, with its various implementations providing flexibility in handling different types of market data. The inclusion of regularization techniques addresses the critical challenge of overfitting, while gradient descent optimization enables effective handling of high-dimensional feature spaces.

LSTM’s sophisticated architecture addresses the limitations of traditional neural networks in handling sequential data. The model’s memory cells and gate mechanisms enable capture of both short-term and long-term dependencies in price movements, making it particularly suitable for markets with complex temporal patterns.

C. Comparative Framework

Our evaluation framework emphasizes both theoretical capabilities and practical performance metrics. The assessment considers prediction accuracy through standard metrics such as MSE and RMSE, while also evaluating model robustness across different market conditions. This comprehensive approach enables systematic comparison while ensuring practical relevance for trading applications.

The implementation incorporates specific optimizations for each method, with ARIMA parameters dynamically adjusted based on market conditions, Linear Regression models adapting feature selection and regularization strength, and LSTM implementations managing sequence length and batch size for optimal performance[

22].

Through this methodological framework, we establish a systematic approach to stock price prediction that leverages the complementary strengths of statistical analysis and machine learning techniques. The integration of these methods provides a robust foundation for accurate price prediction across various market conditions and time horizons.

V. Experiments

Our experimental study presents a systematic evaluation of three prediction approaches across diverse market conditions and stock characteristics. We focused on comparing the performance of Linear Regression, LSTM, and ARIMA models across five representative stocks: Apple (AAPL), Coca-Cola (KO), NVIDIA (NVDA), Pfizer (PFE), and Tesla (TSLA). The analysis encompasses multiple dimensions of model performance, from feature engineering effectiveness to architectural optimization, revealing significant insights into the relative strengths and limitations of each method.

A. Linear Regression Experiments

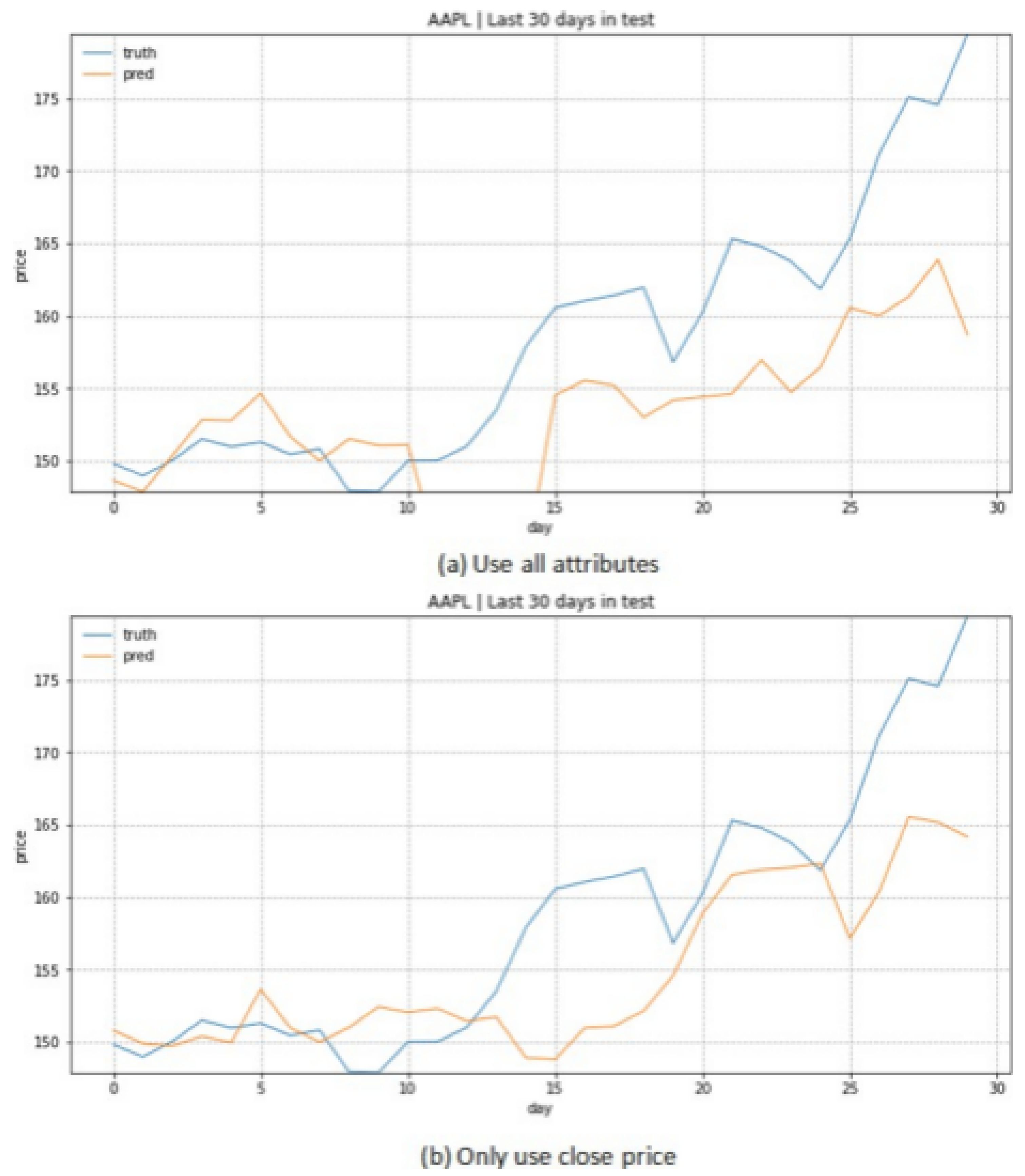

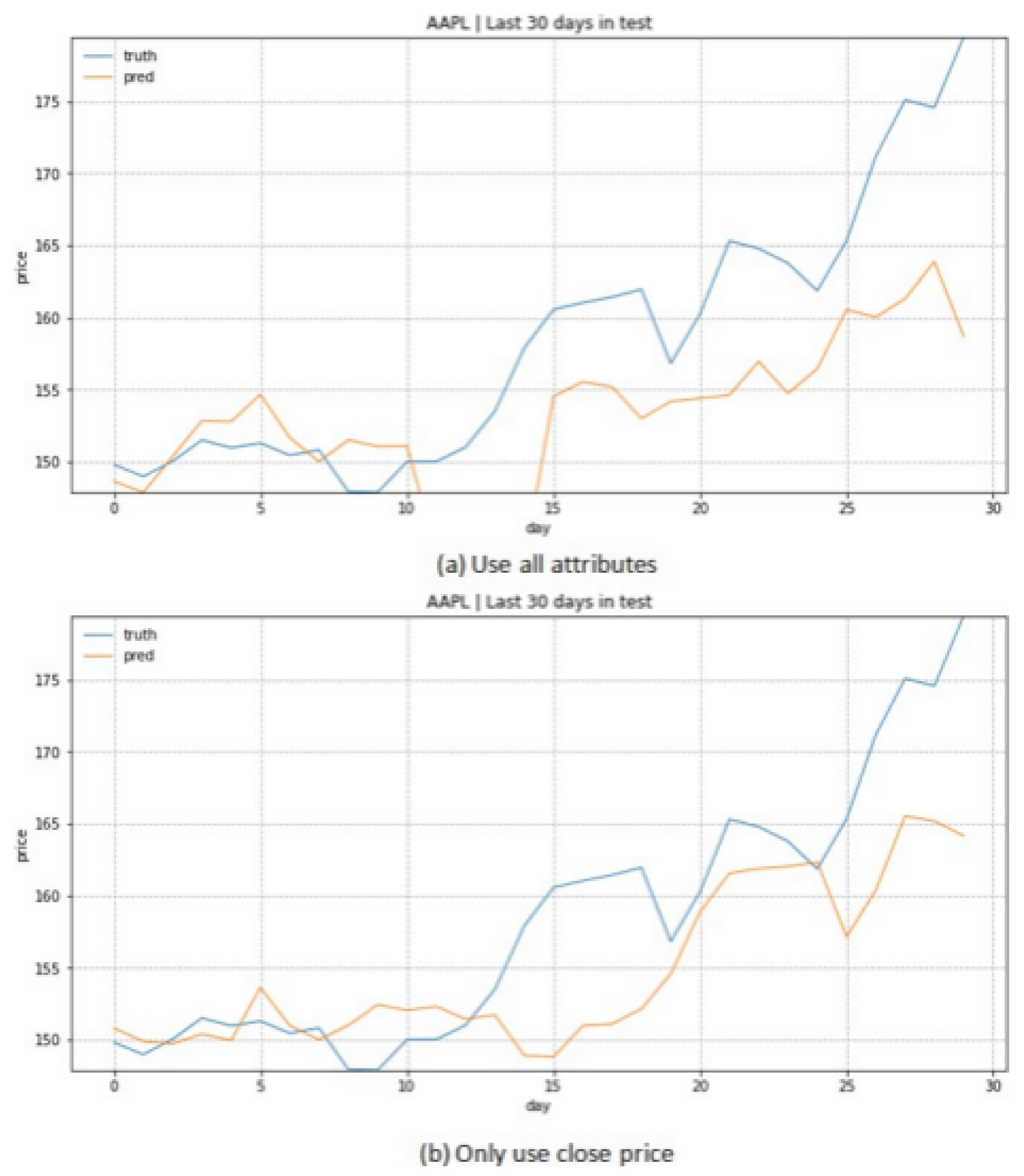

Our initial experiments with Linear Regression focused on the impact of feature selection on prediction accuracy. We investigated two distinct approaches: using all available price metrics versus using only closing prices. This comparison revealed unexpected insights into the relationship between feature complexity and prediction accuracy.

Table 1 presents our comprehensive analysis of prediction accuracy across different feature configurations, incorporating both price ranges and trading volumes to contextualize the improvements observed.

As evidenced by the data, technology sector stocks demonstrated particularly notable improvements with feature reduction, with AAPL showing a 36.27% improvement in prediction accuracy when using only closing prices. This pattern of improved performance with simplified feature sets persisted across different market sectors, though with varying magnitudes. The sole exception was PFE, where additional price metrics contributed positively to prediction accuracy, suggesting unique characteristics in pharmaceutical sector price movements.

B. LSTM Model Optimization

The LSTM implementation revealed complex relationships between network architecture and prediction performance, as detailed in

Figure 9 &

Table 2. Our analysis focused on both architectural configuration and sequence length optimization, with results demonstrating unexpected patterns across different market conditions.

The relationship between network size and prediction accuracy exhibited clear patterns across different stock characteristics. High-volatility stocks showed stronger correlations between trading volume and prediction error, with TSLA demonstrating the highest sensitivity (correlation coefficient: 0.93). This pattern suggests that market volatility amplifies the of network architecture choices on prediction accuracy.

Sequence length optimization revealed equally significant patterns, as shown in

Table 3. The optimal sequence length varied systematically with stock characteristics, suggesting a relationship between market behavior and required historical context.

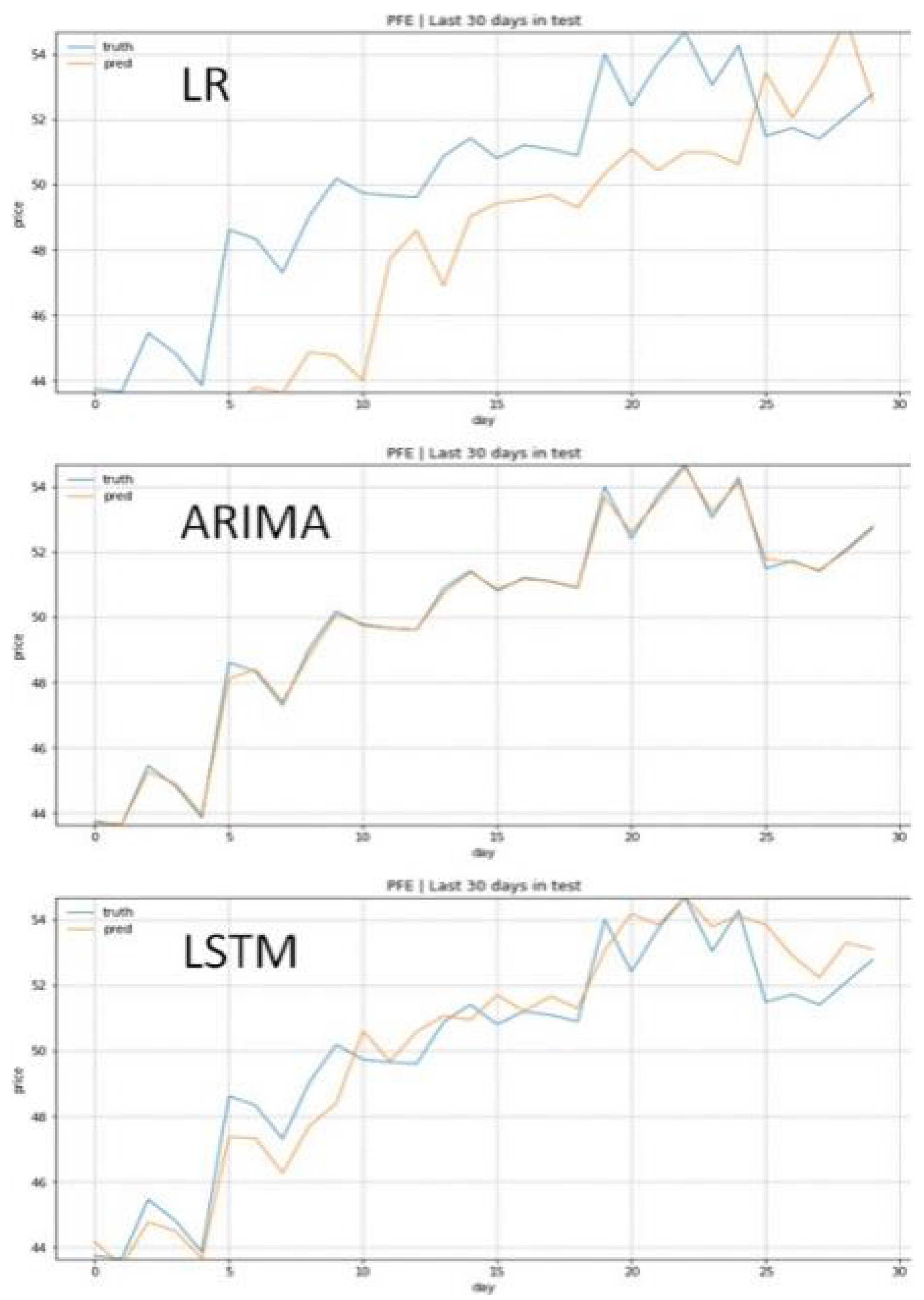

D. Comparative Analysis

The comprehensive comparison of all three approaches revealed unexpected patterns in prediction accuracy across different market conditions.

Table 5 presents the cross-model performance analysis, incorporating both prediction accuracy metrics and market characteristic indicators. And the test prediction graphs are shown in

Figure 10.

The superior performance of ARIMA across all stocks challenges conventional assumptions about the relationship between model complexity and prediction accuracy. ARIMA’s consistent outperformance of both LSTM and Linear Regression suggests that traditional time series methods, when properly implemented and optimized, can capture essential price dynamics more effectively than more complex approaches.

The relationship between model performance and market characteristics reveals interesting patterns. High-volatility stocks (TSLA, NVDA) show larger absolute errors across all models, but maintain consistent relative performance patterns. The influence of trading volume on prediction accuracy varies significantly across models, with LSTM showing particular sensitivity to volume fluctuations as evidenced by the correlation analysis presented in the previous sections.

E. Discussion and Implications

Our experimental results challenge several fundamental assumptions in stock price prediction. The consistent superior performance of ARIMA suggests that market prediction accuracy may depend more on appropriate model selection and optimization than on model complexity. The effectiveness of reduced feature sets in Linear Regression and simpler network architectures in LSTM further supports this conclusion.

The relationship between market characteristics and model performance provides valuable insights for practical implementation. High-volatility stocks benefit most significantly from proper model selection, while stable stocks show more consistent performance across different approaches. These findings have significant implications for the design of automated trading systems, suggesting that model selection should be dynamically adjusted based on market conditions rather than following a one-size-fits-all approach.

The experimental results also highlight the importance of proper data preprocessing and model optimization. The success of our stationarity transformation in ARIMA and the impact of sequence length optimization in LSTM demonstrate that careful attention to these technical details can significantly impact prediction accuracy. These findings provide practical guidance for implementing effective stock prediction systems in real-world trading environments.

VI. Conclusion

Our research develops an integrated stock prediction system that combines machine learning models with practical trading applications. Through systematic evaluation of ARIMA, LSTM, and Linear Regression approaches, we demonstrate that ARIMA consistently achieves superior prediction accuracy across diverse market conditions. This finding challenges the common assumption that complex deep learning models necessarily provide better financial predictions, suggesting that well-optimized traditional statistical methods remain highly effective for stock price forecasting.

However, our analysis also reveals the inherent challenges in stock prediction, as market movements are influenced by numerous factors beyond standard price metrics, including market sentiment, external events, and broader economic indicators.

These findings suggest that future developments in stock prediction should focus on effectively incorporating diverse information sources while maintaining model reliability. As market complexity continues to increase, the balance between model sophistication and practical applicability remains crucial for developing effective trading support systems.

References

- W. Jiang, “Applications of deep learning in stock market prediction: Recent progress,” Expert Systems with Applications, vol. 184, p. 115537, 2021. [Online]. Available: https://www.sciencedirect.com/science/article/pii/S0957417421009441.

- H. Yan and H. Ouyang, “Financial time series prediction based on deep learning,” Wireless Personal Communications, vol. 102, pp. 683–700, 2018.

- W. Long, Z. Lu, and L. Cui, “Deep learning-based feature engineering for stock price movement prediction,” Knowledge-Based Systems, vol. 164, pp. 163–173, 2019. [Online]. Available: https://www.sciencedirect.com/science/article/pii/S0950705118305264.

- N. Huck, “Pairs selection and outranking: An application to the s&p 100 index,” European Journal of Operational Research, vol. 196, no. 2, pp. 819–825, 2009. [Online]. Available: https://www.sciencedirect.com/science/article/pii/S0377221708003160.

- Y. Wang, Q. Li, Z. Huang, and J. Li, “Ean: Event attention network for stock price trend prediction based on sentimental embedding,” in Proceedings of the 10th ACM conference on web science, 2019, pp. 311–320.

- Z. Ke, J. Xu, Z. Zhang, Y. Cheng, and W. Wu, “A consolidated volatility prediction with back propagation neural network and genetic algorithm,” arXiv preprint arXiv:2412.07223, 2024.

- Q. Yu, Z. Ke, G. Xiong, Y. Cheng, and X. Guo, “Identifying money laundering risks in digital asset transactions based on ai algorithms,” 2025.

- Z. Zhang, X. Li, Y. Cheng, Z. Chen, and Q. Liu, “Credit risk identification in supply chains using generative adversarial networks,” 2025. [Online]. Available: https://arxiv.org/abs/2501.10348.

- S. Hochreiter, “Long short-term memory,” Neural Computation MIT-Press, 1997.

- A. Sherstinsky, “Fundamentals of recurrent neural network (rnn) and long short-term memory (lstm) network,” Physica D: Nonlinear Phenomena, vol. 404, p. 132306, 2020. [Online]. Available: https://www.sciencedirect.com/science/article/pii/S0167278919305974.

- K. Greff, R. K. Srivastava, J. Koutník, B. R. Steunebrink, and J. Schmidhuber, “Lstm: A search space odyssey,” IEEE Transactions on Neural Networks and Learning Systems, vol. 28, no. 10, pp. 2222–2232, 2017.

- Z. Fathali, Z. Kodia, and L. Ben Said, “Stock market prediction of nifty 50 index applying machine learning techniques,” Applied Artificial Intelligence, vol. 36, no. 1, p. 2111134, 2022.

- M. A. Hossain, R. Karim, R. Thulasiram, N. D. B. Bruce, and Y. Wang, “Hybrid deep learning model for stock price prediction,” in 2018 IEEE Symposium Series on Computational Intelligence (SSCI), 2018, pp. 1837–1844.

- G. E. Box, G. M. Jenkins, G. C. Reinsel, and G. M. Ljung, Time series analysis: forecasting and control. John Wiley & Sons, 2015.

- A. A. Ariyo, A. O. Adewumi, and C. K. Ayo, “Stock price prediction using the arima model,” in 2014 UKSim-AMSS 16th International Conference on Computer Modelling and Simulation, 2014, pp. 106–112.

- J.-J. Wang, J.-Z. Wang, Z.-G. Zhang, and S.-P. Guo, “Stock index forecasting based on a hybrid model,” Omega, vol. 40, no. 6, pp. 758–766, 2012, special Issue on Forecasting in Management Science. [Online]. Available: https://www.sciencedirect.com/science/article/pii/S0305048311001435.

- G. Zhang, “Time series forecasting using a hybrid arima and neural network model,” Neurocomputing, vol. 50, pp. 159–175, 2003. [Online]. Available: https://www.sciencedirect.com/science/article/pii/S0925231201007020.

- D. Bhuriya, G. Kaushal, A. Sharma, and U. Singh, “Stock market predication using a linear regression,” in 2017 International conference of Electronics, Communication and Aerospace Technology (ICECA), vol. 2, 2017, pp. 510–513.

- L.-C. Cheng, Y.-H. Huang, and M.-E. Wu, “Applied attention-based lstm neural networks in stock prediction,” in 2018 IEEE International Conference on Big Data (Big Data), 2018, pp. 4716–4718.

- S. Chen and L. Ge, “Exploring the attention mechanism in lstm-based hong kong stock price movement prediction,” Quantitative Finance, vol. 19, no. 9, pp. 1507–1515, 2019.

- L. Chen, Y. Chi, Y. Guan, and J. Fan, “A hybrid attention-based emd-lstm model for financial time series prediction,” in 2019 2nd International Conference on Artificial Intelligence and Big Data (ICAIBD), 2019, pp. 113–118.

- S. Siami-Namini, N. Tavakoli, and A. Siami Namin, “A comparison of arima and lstm in forecasting time series,” in 2018 17th IEEE International Conference on Machine Learning and Applications (ICMLA), 2018, pp. 1394–1401.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).