Submitted:

07 January 2025

Posted:

07 January 2025

You are already at the latest version

Abstract

Green banking has emerged as a crucial strategy to promote environmentalsustainability within the financial sector. This study quantitatively examines the initiatives,challenges, and opportunities of green banking in India. By analysing data from Indian banks,environmental indices, and regulatory frameworks, this paper identifies key drivers, evaluatesthe effectiveness of existing measures, and provides insights into the challenges hinderingwidespread adoption. The findings aim to inform policy interventions and banking practices toenhance sustainability in India's financial sector

Keywords:

1. Introduction

2. Objectives of the Study

- To analyse the implementation of green banking initiatives in India.

- To identify key challenges faced by banks in adopting green banking practices.

- To evaluate the impact of green banking on sustainable development goals (SDGs).

- To explore the opportunities for enhancing green banking adoption through innovative strategies.

3. Methodology

4. Literature Review

- ▪ European Union Green Banking Guidelines. (2021).

- ▪ Padmaja, Veturi VV. asserted in "Indian Origin Banks’ Global Operations: Pre-Merger Performance Analysis" those Indian Green Banking plays a vital role in expanding Green Banking business operations globally.( 2024)

- ▪ South African Sustainable Finance Reports. (2023).

- ▪ Veturi V V Padmaja: “Problems and Prospects of Silk Weavers with Emerging Technology - in Reference to Kancheepuram Town of Tamilnadu” focused on the Allied sectors like Banking sector and its Green Strategies importance. (2024)

- ▪ Padmaja, V. V., Thanigaiyarasu, R., & Santhoshkumar, G. Diversification in Agriculture: Pathways to Sustainable Farming and Economic Growth in India. Library Progress International – focussed on green initiatives in banking Sector. (2024).

- ▪ Reserve Bank of India, Green Banking Guidelines. (2020).

- ▪ Veturi, Padmaja VV., in "Trends In Performance Of Indian Banks Overseas-Analysis On Select Indian Banks” affirmed that the growth and development of Indian Green Entreprenuers which reflect the dependency over global exports in (2020).

- ▪ V V Padmaja Veturi in an Article, “Uneducated Management Gurus” showcased the marketing strategies of Green Entrepreneurs who ensured 99% performance and 100% customer satisfaction in their supply chain management in (2011).

- ▪ UN Environment Programme, Financing the Green Economy in Africa. (2022)

- ▪ Padmaja, Veturi VV., in her thesis "Performance of Indian Public & Private Sector Banks Operating Overseas–A Comparative Analysis" focused on the problems and prospects faced by Indian industries without Green Initiatives due to lack of exposure in global market. In(2020).

- ▪ V V Padmaja Veturi, “Green Entrepreneurship – An Overview” emphasized the need of green initiatives and Green Banking Practices in various allied sectors of Economy and focussed on the Green Banking, on a global canvas. (2023)

- ▪ V V Padmaja Veturi in a recent study “Integrated Marketing Communication – The New Generation Approach stressed the need of adopting various Green Banking strategies, globally, in order to attract global customers. (2023)

- ▪ Padmaja, V. Performance evaluation of Indian Banks overseas with reference to select public and private sector banks.(2020)

- ▪ The Impact Of Covid 19 On Indian Economy, IJNRD - International Journal Of Novel Research And Development (www.IJNRD.org). (2023)

- ▪ V V Padmaja Veturi in “Entrepreneurship Development” – Future Trends in Commerce emphasized that Green Entrepreneurs across India plays a crucial role with regard to diversified development in Economy, commerce and industry.in (2022).

5. Analysis

| Metric | Value (India, 2022) |

| Green Bonds Issued ($M) | 2,100 |

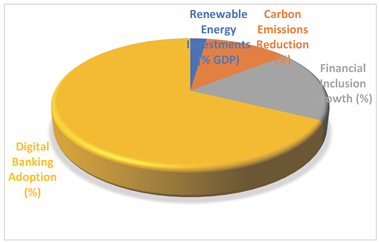

| Renewable Energy Investments (% GDP) | 2.3% |

| Carbon Emissions Reduction (%) | 12% |

| Financial Inclusion Growth (%) | 18% |

| Digital Banking Adoption (%) | 67.7% |

| Challenge | Details |

| Regulatory Gaps | Lack of unified guidelines for green finance impedes progress. |

| High Costs | Initial investment in green projects is often prohibitively high. |

| Awareness Issues | Limited awareness among customers and stakeholders hinders adoption of green products. |

| Market Risks | Green investments face higher default risks compared to traditional loans. |

| Infrastructure Gaps | Insufficient infrastructure in rural areas limits the scalability of green banking initiatives. |

| Opportunity | Evidence |

| Growth of Green Bonds | India issued $2.1 billion in green bonds in 2022, financing renewable energy and eco-friendly projects. |

| Digital Banking Innovations | Digital platforms reduce operational costs and facilitate paperless banking, aligning with green goals. |

| Public-Private Partnerships | Joint ventures have increased funding for green projects by 25% over the last three years. |

| Government Incentives | Policies such as tax rebates encourage investment in sustainable finance. |

| Global Collaborations | International agreements and partnerships bring expertise and financial resources to green banking. |

- Initiatives: Launched green bonds and financed over 3,000 MW of renewable energy projects.

- Outcome: Significant reduction in carbon emissions and increased customer engagement with green products.

- Initiatives: Provided loans for energy-efficient projects and adopted paperless banking technologies.

- Outcome: Enhanced reputation as a leader in sustainable finance with 25% of lending directed toward green initiatives.

6. Results and Discussion

7. Conclusion

References

- Reserve Bank of India. (2023). "Green Banking Guidelines.

- Padmaja, V. V. (2024, February). Indian Origin Banks’ Global Operations: Pre-Merger Performance Analysis. In 3rd International Conference on Reinventing Business Practices, Start-ups and Sustainability (ICRBSS 2023) (pp. 932-942). Atlantis Press.

- Ministry of Environment, Forest and Climate Change, Government of India 2023.

- Veturi, P. V. (2020). TRENDS IN PERFORMANCE OF INDIAN BANKS OVERSEAS-ANALYSIS ON SELECT INDIAN BANKS. REQUEST FOR FEEDBACK & DISCLAIMER 13.

- International Finance Corporation. (2022). "Sustainable Finance Report.

- Padmaja, V. V. (2020). Performance of Indian Public & Private Sector Banks Operating Overseas–A Comparative Analysis, 40(20-2020). Studies in Indian Place Names.

- Various annual reports of Indian banks (2013-2023).

- Veturi, V. P. (2023). Green Entrepreneurship–An Overview. Rabindra Bharati Journal of Philosophy, 24(5).

- UNEP Finance Initiative. (2022). Sustainable Banking Practices.

- Veturi, V. P. (2023). Integrated Marketing Communication–The New Generation Approach. In Bharath Institute of Science and Technology, International Conference Proceedings. www. researchgate. net.

- World Bank. (2022). Green Finance in Emerging Markets.

- Veturi, V. P. Uneducated Management Gurus. HRD Times–National HRD Journal, 13(5).

- International Renewable Energy Agency. (2023). Green Energy Investments in Developing Countries.

- Veturi, V. P. (2022). Entrepreneurship Development. In Future Trends in Commerce–National Conference Proceedings www. researchgate. net.

- Climate Bonds Initiative. (2022). Annual Green Bond Market Report.

- Padmaja, V. Performance evaluation of Indian Banks overseas with reference to select public and private sector banks.

- IMF. (2023). Emerging Economies: Financing the Green Transition.

- International Renewable Energy Agency. (2023). Renewable Energy Investments in Asia.

- Padmaja, V. V. , & Thanigaiyarasu, R. Problems and Prospects of Silk Weavers with Emerging Technology-in Reference to Kancheepuram Town of Tamilnadu.

- India Green Finance Directory. (2023). Green Bond Trends in India.

- Padmaja, V. V. , Thanigaiyarasu, R., & Santhoshkumar, G. (2024). Diversification in Agriculture: Pathways to Sustainable Farming and Economic Growth in India. Library Progress International, 44(3), 23583-23588. [Google Scholar]

- "The Impact of Covid-19 on Indian Economy", IJNRD - INTERNATIONAL JOURNAL OF NOVEL RESEARCH AND DEVELOPMENT (www.IJNRD.org), ISSN:2456-4184, Vol.8, Issue 9, page no.a60-a72, September-2023, Available :https://ijnrd.org/papers/IJNRD2309009.pdf.

- Thanigaiyarasu, R. , Veturi, V. P., & Sulthana, M. N. (2024, February). Adoption of HR Strategies and Its Influence on Employee Retention in Service Sector with Special Reference to Chennai City. In 3rd International Conference on Reinventing Business Practices, Start-ups and Sustainability (ICRBSS 2023) (pp. 809-816). Atlantis Press.

- Santhoshkumar, G. , Veturi, V. P., Thanigaiyarasu, R., & Sulthana, M. N. (2024, February). Employee Involvement and Engagement in Automobile Sector in Chennai City. In 3rd International Conference on Reinventing Business Practices, Start-ups and Sustainability (ICRBSS 2023) (pp. 817-828). Atlantis Press.

- Santhoshkumar, G. , Veturi, V. P., & Thanigaiyarasu, R. (2024). Effect Of Talent Management Techniques On Employee Retention Plans For Selected Private Hospitals In Chennai. Library Progress International, 44(3), 23571–23578.

- Thanigaiyarasu, R. , Santhoshkumar, G., & Veturi, V. P. (2024). Sustainable Green Initiatives In Hr Practices With Reference To Banking Sector In Chennai. Library Progress International, 44(3), 23579-23586. [Google Scholar]

- Padmaja, V. Impact of Employee Motivation on Organizational Output with Special Reference to Selected Automobile Companies in Chennai.

- Pranav Karthikeyan, VV Padmaja Veturi (2023) The Impact of Covid-19 on Indian Economy. 1: J Vir Res Adv Vac 2.

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).