Submitted:

31 December 2024

Posted:

03 January 2025

You are already at the latest version

Abstract

Keywords:

I. Introduction

II. Economic Systems in the Interstellar Era

III. The Transformative Role of Quantum Computing

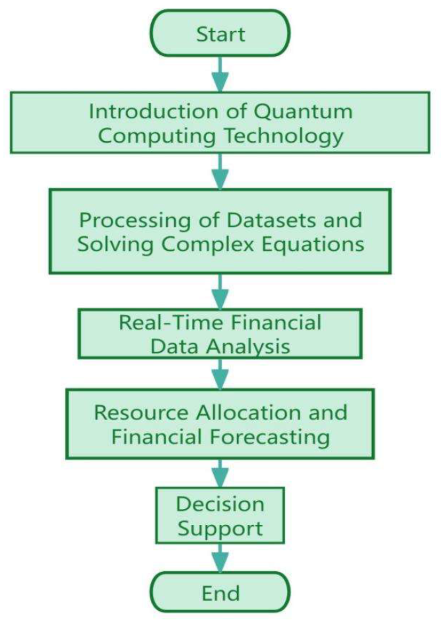

- Introduction of Quantum Computing Technology: This step highlights the foundation of incorporating cutting-edge quantum technology, emphasizing its transformative role in processing large datasets.

- Processing of Datasets and Solving Complex Equations: Quantum computing excels in handling vast datasets and solving intricate financial models efficiently, far surpassing classical methods.

- Real-Time Financial Data Analysis: Leveraging quantum capabilities for instantaneous analysis of evolving financial data, enabling proactive decision-making.

- Resource Allocation and Financial Forecasting: Quantum algorithms optimize resource distribution and predict future financial trends with heightened accuracy.

- Decision Support: Finally, the processed insights assist in strategic decision-making, enhancing overall financial outcomes.

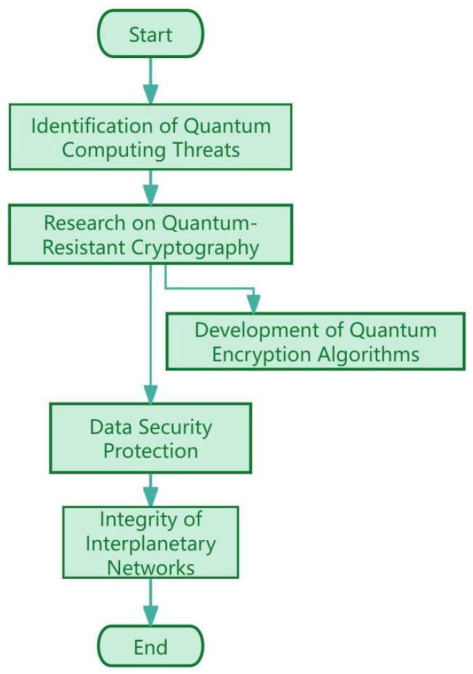

- Identification of Quantum Computing Threats: This stage focuses on assessing potential vulnerabilities in financial data posed by quantum computational capabilities.

- Research on Quantum-Resistant Cryptography: Rigorous research aims to discover and evaluate cryptographic techniques immune to quantum attacks.

- Development of Quantum Encryption Algorithms: Parallel development of robust encryption algorithms tailored to counteract quantum threats.

- Data Security Protection: Implementing the developed algorithms to ensure comprehensive financial data security.

- Integrity of Interplanetary Networks: Extending security protocols to safeguard communication across interplanetary networks, addressing the futuristic scope of quantum cryptography.

- End: Culminating in a secure, quantum-resistant financial infrastructure.

IV. The Evolving Role of Accountants and Finance Professionals

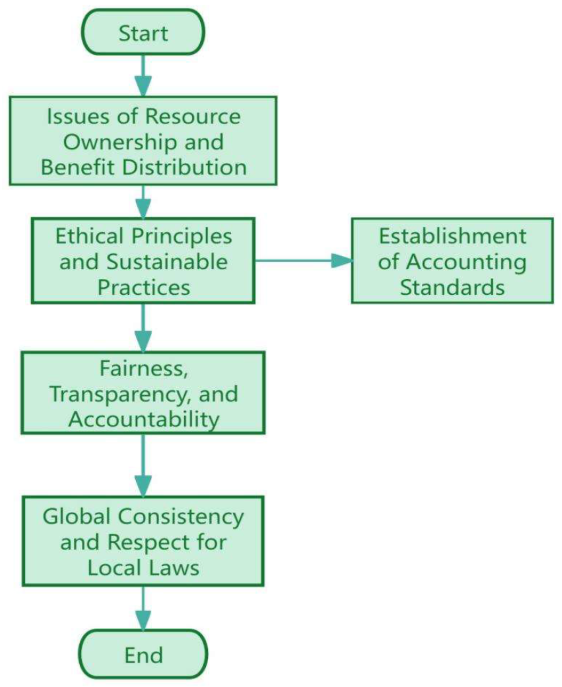

- Start: Initiates the process, signaling the recognition of ethical governance as critical in the space age.

- Issues of Resource Ownership and Benefit Distribution: Addresses the core challenges of who owns and benefits from space resources, ensuring equitable solutions.

- Ethical Principles and Sustainable Practices: Establishes guidelines rooted in ethical behavior and long-term sustainability for space exploration and exploitation.

- Establishment of Accounting Standards: Parallel development of specialized accounting frameworks tailored to address the complexities of interplanetary activities.

- Fairness, Transparency, and Accountability: Implements these ethical standards to ensure decisions and operations remain fair, open, and responsible.

- Global Consistency and Respect for Local Laws: Balances global governance frameworks with the legal and cultural values of individual nations, promoting harmony and cooperation.

- End: Culminates in the adoption of comprehensive global standards, ensuring ethical governance in the space age.

V. The Impact of AI and Automation

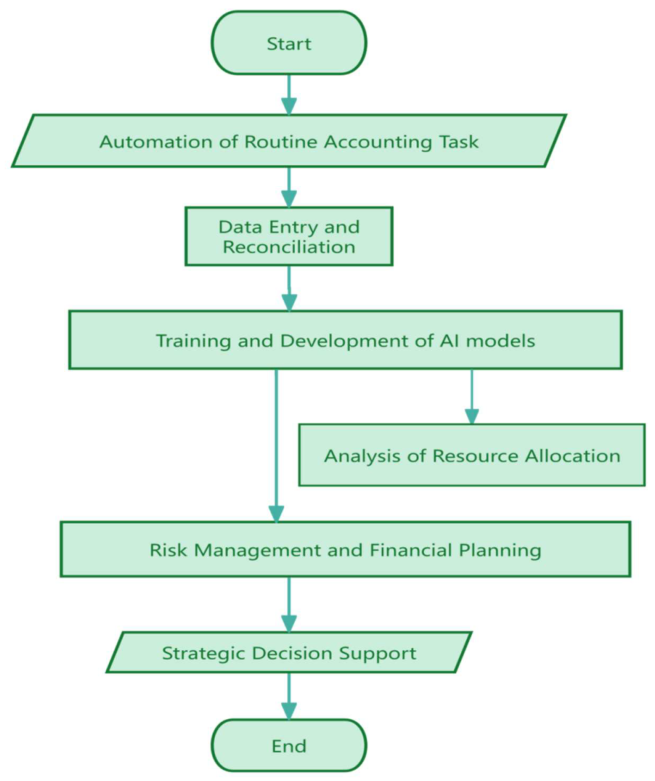

- Start: Marks the beginning of the AI integration journey in accounting.

- Automation of Routine Accounting Tasks: AI systems automate repetitive tasks such as invoice generation, payroll management, and expense tracking. Enhances efficiency and minimizes human error.

- Data Entry and Reconciliation: AI tools streamline the process of inputting data and identifying discrepancies in financial records. Reduces time and effort in maintaining accurate financial statements.

- Training and Deployment of AI Models: Advanced AI models are trained to handle complex accounting scenarios. Enables machine learning systems to adapt and improve over time based on financial data patterns.

- Branching into Analysis of Resource Allocation: AI tools analyze resource allocation for cost optimization. Ensures efficient use of financial resources for maximum profitability.

- Risk Management and Financial Planning: AI-driven predictive analytics identify potential risks and propose mitigation strategies. Assists in crafting robust and forward-looking financial plans.

- Strategic Decision Support: Provides actionable insights by analyzing large datasets in real time. Empowers leadership to make informed strategic decisions.

- End: Represents the culmination of an AI-driven, fully integrated accounting process that supports operational and strategic objectives.

VI. Challenges and Future Directions

VII. Conclusions

References

- Musk, E. (2017). Making Humans a Multi-Planetary Species. Presented at the International Astronautical Congress. [Accessed online] Discusses SpaceX's vision for interplanetary travel and human colonization of Mars, highlighting the economic and logistical implications of a multi-planetary civilization.

- Hu, Z., Lei, F., Fan, Y., Ke, Z., Shi, G., & Li, Z. (2024). Research on Financial Multi-Asset Portfolio Risk Prediction Model Based on Convolutional Neural Networks and Image Processing. arXiv preprint. arXiv:2412.03618.

- Baoyin, H. (2023). Economics of Space Resource Utilization. Published in the Journal of Space Commerce and Policy. Explores the potential valuation of extraterrestrial resources, including Helium-3 and asteroid mining, and their integration into interplanetary trade systems.

- Christidis, K., & Devetsikiotis, M. (2016). Blockchain and Smart Contracts for the Internet of Things. IEEE Access, 4, 2292–2303. Provides insights into the role of blockchain in facilitating secure, transparent trade and contract execution in complex systems like interplanetary economies.

- Ke, Z., & Yin, Y. (2024). Tail Risk Alert Based on Conditional Autoregressive VaR by Regression Quantiles and Machine Learning Algorithms. arXiv preprint. arXiv:2412.06193.

- Singh, P., Patel, R., & Zhou, Y. (2024). Quantum Cryptography in Decentralized Financial Systems. Journal of Future Economics, Vol. 9.Examines how quantum cryptography could underpin secure financial transactions across planetary jurisdictions in decentralized systems.

- Shor, P. W. (2022). Quantum Computing and Financial Applications: Opportunities and Threats. Keynote lecture at the Annual Quantum Technology Forum. Discusses the transformative potential of quantum computing in financial forecasting and accounting, alongside its implications for cybersecurity.

- Yu, Q., Xu, Z., & Ke, Z. (2024). Deep Learning for Cross-Border Transaction Anomaly Detection in Anti-Money Laundering Systems. arXiv preprint. arXiv:2412.07027.

- Chen, L. , Brunner, N., & Liang, Y. (2024). Quantum-Resistant Cryptography: Safeguarding Interplanetary Networks. Cybersecurity in Space Journal, Issue 3.Addresses the challenges of ensuring data security in quantum-powered systems, with implications for interplanetary financial management.

- Space Ethics Journal (2023). The Moral Imperative in Interplanetary Exploration. Volume 5.Discusses the ethical dimensions of resource utilization and governance in space, emphasizing the accountant's role in equitable economic systems.

- The article in the Journal of Space Policy and Regulation (2024) discusses the importance of frameworks like US GAAP in establishing transparency and consistency in financial reporting within multi-planetary jurisdictions. The piece emphasizes that principles derived from US GAAP can be adapted to promote accountability in managing interplanetary resources. By setting clear standards, these principles ensure uniform financial practices and equitable distribution of space-derived resources across stakeholders, balancing commercial and ethical imperatives.

- Ke, Z. , Xu, J., Zhang, Z., Cheng, Y., & Wu, W. (2024). A Consolidated Volatility Prediction with Back Propagation Neural Network and Genetic Algorithm. arXiv preprint. arXiv:2412.07223.

- MIT Space Initiative (2023). Integrative Curricula for the Interstellar Era. Available at MIT.edu.Highlights the emergence of educational programs designed to prepare professionals for the challenges of space economies and interstellar governance.

- Journal of Accounting Automation (2023). AI-Driven Innovations in Accounting: A Collaborative Future. Issue 8. Explores the intersection of AI and accounting, focusing on automation's role in enhancing decision-making and strategic financial management.

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).