1. Introduction

Small and medium-sized firms (SMEs) are critical to promoting innovation and economic growth in today’s dynamic and linked world. However, SMEs frequently struggle to understand the intricacies of conventional payment methods, which can reduce their competitiveness and production [

1]. The emergence of digital payment systems has been a game-changer for SMEs, providing them with numerous advantages that can greatly improve their overall productivity and operational efficiency [

2]. The way businesses conduct transactions has been completely transformed by digital payment systems, which comprise a broad range of technologies like e-commerce platforms, online payment gateways, and mobile wallets [

3]. The use of digital payment systems by SMEs has created a wealth of options for businesses, allowing them to increase their reach, cut expenses, and streamline operations. SMEs can reduce their administrative load and free up important time for more productive work by using digital payment systems, which eliminate the need for manual processing of cash and checks.

In the modern-day Nigerian environment, the emergence of digital payment systems is a result of the need of organizations to ensure that consumers can purchase their products or services easily due to the unavailability of fiat money in the Nigerian economy, this builds trust within individuals and groups who may influence the success of the business. Thus, posing a great problem to the productivity of SMEs as consumers seek easier methods of making payments. Digital e-payment methods have also contributed to the financial inclusion of previously unbanked or underserved populations in Nigeria [

5]. Individuals with limited access to traditional banking services are getting the chance to take part in formal economic transactions and reap the advantages of financial services attributable to these alternative methods of payment [

4].

In addition to increasing productivity, automation of payment procedures reduces errors and guarantees timely reconciliations, all of which contribute to improved financial management and control [

6]. The financial resources of SMEs may be strained by the hidden fees and processing expenses associated with traditional payment methods. SMEs can maximize their financial resources and reinvest them in growth-oriented endeavors by using digital payment systems, which often provide lower transaction fees and processing charges [

7]. Digital payment systems are not limited by geography, giving SMEs a worldwide platform to engage with clients and broaden their market reach. More sales and revenue prospects for SMEs might result from this improved accessibility to a larger consumer base, supporting their growth and expansion [

8]. Digital payment systems have a beneficial impact on SME efficiency, as studies have regularly shown

Literature Review

Over the last several decades, the digital payment environment has evolved from primitive systems to complex, linked networks that enable smooth financial transactions globally [

9]. The development of digital payment systems has been a spectacular journey filled with ground-breaking inventions and revolutionary changes to the way we conduct financial transactions. The history of digital payments, from the earliest barter systems to the most advanced payment networks of today, is a monument to human creativity and the unwavering quest for ease and security [

10]. This overview digs into the rich history of digital payments, examining the important milestones and developments that have defined this game-changing business. The introduction of ATMs, or automated teller machines in the early 1970s revolutionized accessibility to money and laid the path for card-based transactions [

11]. The introduction of credit and debit cards in the 1970s and 1980s broadened the scope of digital payments even more. These cards offered a handy and secure alternative to carrying large quantities of cash, accelerating the expansion of card-based transactions both in-store and online

Digital payment systems are online platforms that let people send money to each other without using actual currency or cheques [

12]. They cover a broad spectrum of technologies, such as point-of-sale (POS) systems, internet payment gateways, and mobile wallets. With its ease, security, and speed, digital payment systems have completely changed the way we pay for products and services. Digital payment systems provide a wide range of choices to suit every taste. The traditionalists believe that credit, debit, prepaid, and contactless card payments are the best options. However, easy smartphone transactions are provided via mobile payment solutions such as peer-to-peer networks, wallet mobile applications, and banking apps for the tech-savvy [

13]. Furthermore, easy checkout processes are offered by safe portals and e-commerce platforms to those who enjoy online purchasing. Your financial life can be simplified by a digital payment solution, regardless of your preference for plastic, pixels, or a tap

The environment of digital payments is always changing due to legal developments, shifting customer preferences, and technology breakthroughs. Numerous innovations lie ahead in the world of digital payments, driven by disruptive developments such as third-party financial access and personalized solutions offered by Open Banking [

14]. While new payment methods like voice commands and contactless gestures provide people with more options, biometric authentication methods including fingerprint and facial scans increase security and convenience [

15]. Digital payment methods have transformed several industries, but they are not without problems. Even though digital payments are convenient, there are still issues. It is still critical for users and authorities to protect sensitive financial data. Encouraging financial literacy and connecting the gap in technology is essential to guarantee that these systems are accessible to and beneficial to all. Building confidence in digital payments requires navigating the constantly changing regulatory landscape and protecting user data privacy. A competitive landscape that necessitates creativity and adaptability from established companies emerges as alternative financial services firms and fintechs flourish [

16]

Nigeria’s digital payment environment is changing quickly due to several causes, including the country’s efforts to promote financial inclusion, rising mobile phone usage, and government initiatives. Current studies point to important developments, advantages, and difficulties related to this change. Research indicates a noteworthy surge in electronic payments, specifically in mobile money transactions, which doubled from 2016 to 2022. The Central Bank of Nigeria’s cashless policy and the rising affordability of cell phones and internet connectivity are credited with this rise. Furthermore, studies indicate that agency banking is giving way to private company ownership of point-of-sale (POS) terminals, a sign of retailers’ increasing familiarity with online purchases. This change enables companies to take payments directly and maybe grow their clientele.

Theoretical Review

The term “innovation diffusion” describes the process by which a novel concept, method, or item becomes ingrained in a community or social structure. In his 1962 essay “Diffusion of Innovations,” Rogers created the Innovation Diffusion Theory, providing a comprehensive framework for comprehending how new ideas progressively spread throughout communities. Providing digital payment options makes it more convenient for customers, which increases their pleasure and loyalty. Customers that are happy with a company are more inclined to use it again and refer others to it.

Innovators: Those who are willing to take risks and attempt new things, and who are usually the first to take on new ideas.

Early Adopters: Esteemed and powerful people who accept the idea at its inception and lend it legitimacy.

Early Majority: The group of adopters who, before adoption, are cautious, relying on the customs of society and the advice of other early adopters.

The Late Majority: consists of sceptics who only embrace innovations that have gained widespread acceptance and demonstrated their worth.

Laggards: Those who accept innovations last, frequently as a result of custom, aversion to change, or restricted access to resources.

Empirical Review

In a study published in 2022, Park and Kim looked at how South Korea’s use of mobile wallets affected online retail sales and discovered a link between higher online sales and the use of mobile wallets. In a similar vein, Sharma’s (2023) analysis of the impact of mobile wallets on Indian restaurant sales found that mobile wallet purchases were linked to larger order values and more frequent patronage. Furthermore, adoption of mobile wallets enhanced market share and sales growth for e-commerce enterprises, according to a study by Wang and Chen (2023) examining the relationship between mobile wallets and e-commerce sales in China.

Studies investigating the possible effects of mobile wallets on small and medium-sized businesses’ (SMEs) profitability have been spurred by the devices’ rising popularity. Despite the complexity of the link, several potential benefits are highlighted by recent empirical investigations. One significant advantage is lower transaction costs, since mobile wallets frequently do away with the fees connected to using traditional credit cards, increasing SMEs’ profit margins (Nguyen et al., 2023; Awasthi & Chauhan, 2023). Better bottom lines may result directly from this cost decrease. Furthermore, mobile wallets’ speed and simplicity may draw in new clients and promote repeat business, which might ultimately boost revenue and profitability

According to a study by Adegbite and Ayo (2022), the use of POS terminals by SMEs in Nigeria was linked to higher profit margins, lower operational expenses, and increased sales. In a similar vein, Kyei and Opoku’s study from 2023, which looked at SMEs in Ghana, showed that the use of POS terminals boosted customer satisfaction, inventory control, and profitability. Furthermore, Uchenna et al.’s study from 2023, which concentrated on SMEs in South Africa, showed that the use of POS terminals lowered transaction mistakes, expedited checkout times, and raised customer satisfaction, all of which enhanced profitability.

Research points to a more nuanced relationship driven by several factors, notwithstanding the positive correlation between the adoption of online banking and sales growth. First off, Nguyen et al. (2023) found that successful digital marketing tactics that make use of online platforms to connect and interact with prospective clients can greatly increase the efficiency of online banking in generating revenue. According to Bhattacharya et al. (2024), there is a possibility that the impact could differ based on the target consumer base’s internet availability and online payment preferences. Lastly, different company models and industries may benefit from Internet banking differently, with e-commerce companies possibly standing to gain the most (Awasthi & Chauhan, 2023). The preceding factors underscore the necessity for additional investigation to delve into the subtleties of this correlation and devise tactics that empower enterprises to optimize the possibilities of Internet banking in fostering enduring sales expansion.

2. Materials and Methods

In this study, the descriptive survey methodology was used, and the quantitative method of research was applied through questionnaires for closed-ended questions. This strategy was chosen because it may highlight analytical data and objective measurements through a survey. The topic of the questionnaire statement is based on the responses of the organization’s employees. The descriptive survey research would comprehensively and accurately examine the link across each variable (digital payment systems and SME profitability) throughout the study. The questionnaire structure was used to collect data provided by the participants in this research.

The sample covers Small Businesses in Isolo, Lagos state, Nigeria. Considering the findings of the analysis would apply to the entire research population, the subset of the population for this study was selected at random from an infinite population within that area.

The sources of data of this research are the primary source which is the first-hand data obtained by the researcher with the use of questionnaires. The questionnaire is the most vital source of data, which is a method of observation that consists of a series of items given to some respondents in written form. The questionnaire will be shared into Section A and Section B. Section A includes the demographic profile responses, while Section B consists of questions that consist of all independent variables and dependent variables. The use of four Likert-scale questions used by Strongly Agree = 5, Agree =4, Undecided=3, Disagree =2, Strongly Disagree =1.

Tables of mean, percentage, and frequency are also part of the descriptive method of data analysis. The use of descriptive statistics will also help to offer demographic information on the respondents, as well as inferential statistics to assess the hypotheses. This study makes use of the statistical package for social sciences (SPSS) and a partial least square regression analysis will be carried out on SmartPLS software to prove the relationship between the independent and dependent variables.

3. Results

This section contains descriptive statistics that show the frequency distribution and interpretations of respondents’ replies from the selected respondents. Meanwhile, frequency distributions, were used to analyse the data gathered and coded.

3.1. Socio-Demographic Analysis and Interpretation

Table 1 represents the gender distribution of the respondents, the tables identify that 117 respondent with a percentage of (68.4%) are female, while (31.6%) with a frequency of 54 are male. Therefore, this analysis shows that the majority of responses falls on the female gender, therefore, this is not an equal distribution

Table 2 shows the distribution of educational qualification occupied by the respondents. Out of the 171 respondents 81 (47.4%) have either Hnd/B.sc, 43 (25.1%) have an SSCE, and 16 (9.4) have an OND, 22 (12.9%) have either an M.sc/Ph.d and 9 (5.3%) selected others. This reveals that the vast majority of the respondents are Hnd/B.sc holders.

3.2. Hypothesis Testing

Hypothesis One

Mobile wallets have no significant influence on sales growth

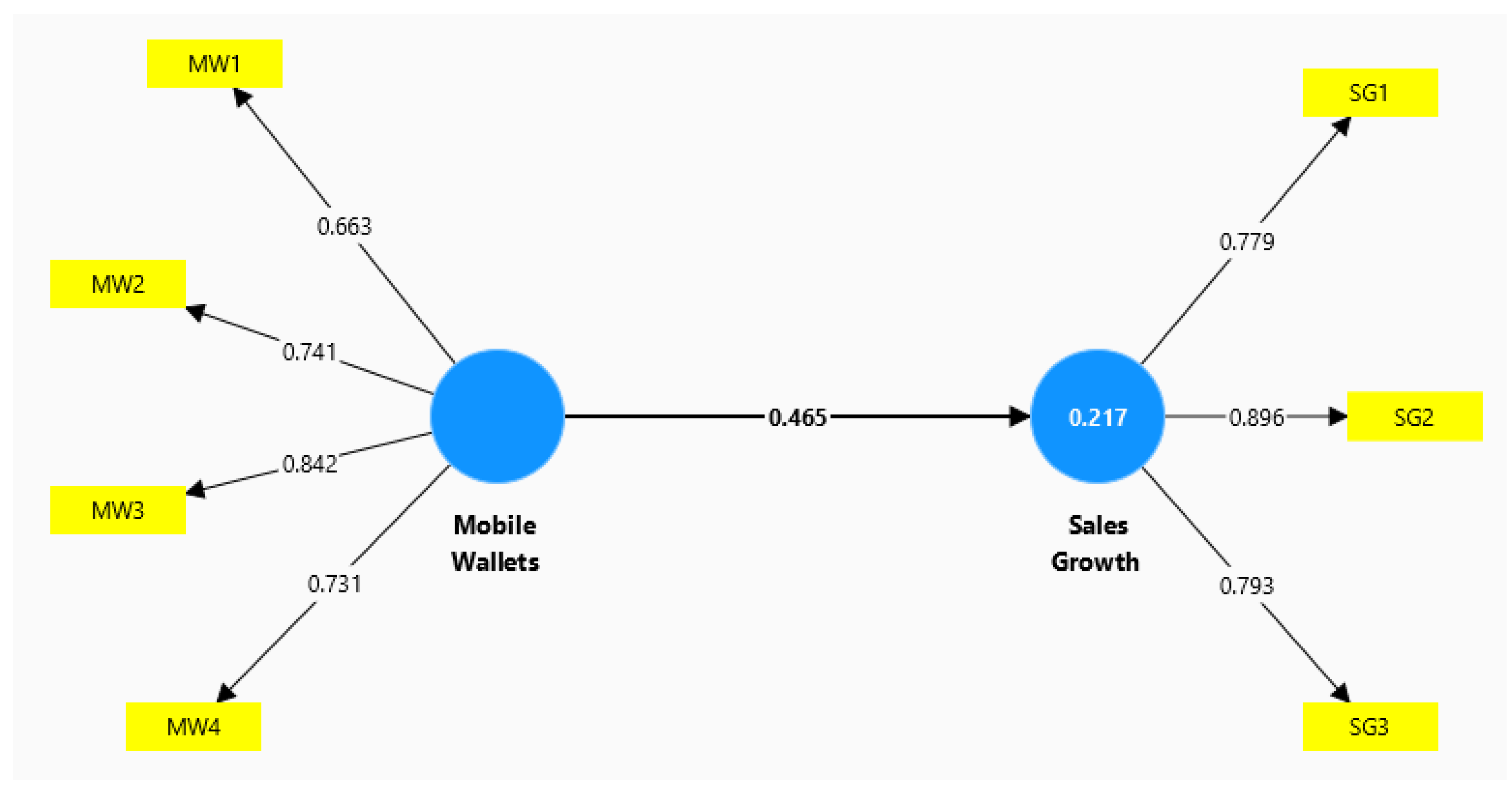

One exogeneous variable (Mobile wallets) and one endogenous variable (sales growth) are included in the hypothesis. The research variables were measured using a structured questionnaire with a 5 Likert scale. Mobile wallet was measured with four (4) indicators, and sales growth was measured with three (3) indicators as well, as shown in

Figure 1. the factor loadings for all items of mobile wallets and sales growth depicted in

Figure 1 are above the minimum threshold of 0.60 as suggested by (Fornell & Larcker, 1981, Newkirk & Lederer, 2006).

Figure 1 depicts that 0.217 or 21.7% of sales growth is explained by mobile wallets. It also indicated the predictive power of the relationship between the variables. The results establish that holding all the variables constant, that a unit change in mobile wallets will lead to an increase in the sales growth by 46.5%. This implies that accepting mobile wallet payments allows SMEs to reach a wider client base, especially those who prefer cashless transactions. This can lead to increased sales volume over time. To determine the significance level, a bootstrapping was conducted and demonstrated in Figure 4.3.2

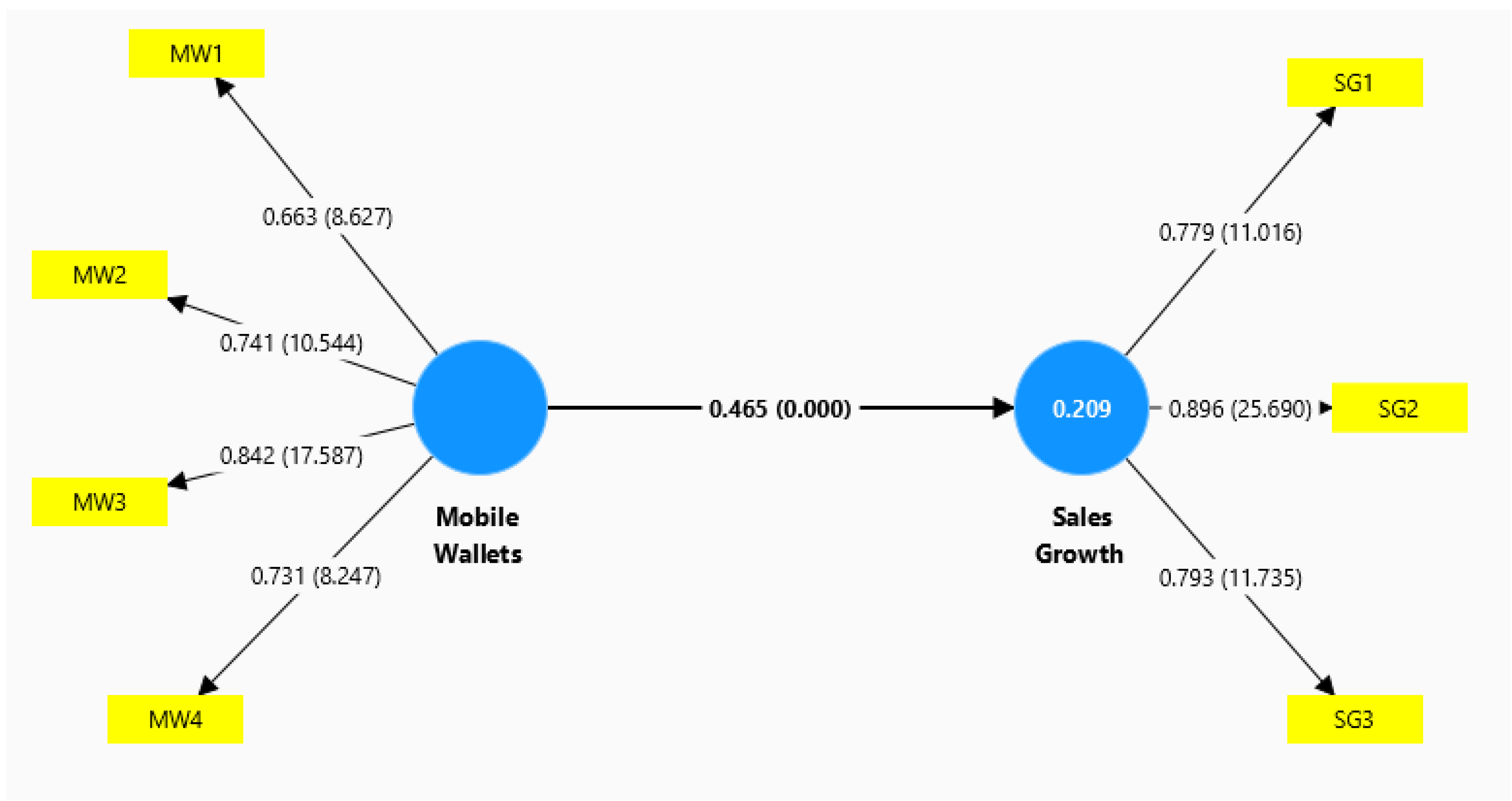

Figure 2 provides standardized analysis of bootstrapping for mobile wallets and sales growth. The Path co-efficient (B) and T-statistics estimation in the Partial Least Square (PLS). the significance of the hypothesis was tested through the B value. The higher the B value, the greater the substantial effect on the endogenous latent construct.

Figure 2 depicts that all the t-values of mobile wallets are greater than 1.69. However, this suggests that mobile wallets have a significant effect on sales growth.

Table 4.3.1 depicts the factor loadings which shows the standardized regression and correlation coefficients between the observed variable and latent common factors. The composite reliability, Average Variance Extracted (AVE) and Cronbach’s Alpha were also statistically verified to establish the validity and reliability of the research instruments. The recommended statistical values for the factor loading, composite reliability, AVE and Cronbach Alpha were all met.

Table 4 depicts the smart partial least squared statistical results of hypothesis one which focused on the relationship between mobile wallets and sales growth. The findings show that mobile wallets have a significant effect on sales growth. In specific terms, the results showed that there is a direct significant impact of mobile wallets on sales growth at (B= 0.465, R

2= 0.217, T-statistics= 6.041, P-values = 0.000<0.05). The path co-efficient of 0.465 indicates a moderate and positive relationship between mobile wallets and sales growth. The R

2 value of 0.217 indicates that 21.7% variance in sales growth can be explained by mobile wallets.

4. Discussion

In recent years, the usage of mobile wallets for payment has increased substantially, providing customers with a quick and safe option to purchase products and services. Adoption of mobile wallet payments can have a significant influence on sales growth for small and medium-sized businesses (SMEs). One of the primary benefits of mobile wallets is the ease they provide clients. Customers may pay fast and conveniently using a mobile wallet, which eliminates the need for cash or paper cards. This convenience can boost sales for SMEs since customers are more inclined to make impulse purchases or finish transactions on the spot. This theory is consistent with the findings of Gurung, A., Adhikari, R., and Adhikari, D. (2021), who conducted empirical research on mobile payment systems and their influence on SMEs: Evidence from Nepal. The paper includes an empirical analysis of mobile payment systems’ impact on Nepalese SMEs, with an emphasis on sales growth and company success.

5. Conclusions

It was concluded from the findings that the use of digital payment system has a significant effect on the productivity of small medium enterprise. This explains that the high level of adoption of these payment devices amongst SMEs in Nigeria. The use of digital payment systems also enables SMEs to remain competitive in today’s digital economy, recruiting new clients and increasing their market reach. Overall, the research indicates that digital payment systems play an important role in raising SMEs’ productivity, allowing them to flourish and succeed in an increasingly digital environment. Generally, the study achieved the research objectives and answered the research questions subsequently. The results of the analysed data showed that the three null hypotheses were rejected. The result gotten from this research can aid as references for future studies for both academic and governmental institutions willingly to gather literature on the relevance of multiple taxation.

6. Recommendation

SMEs should examine their present payment procedures and find places where digital payment solutions might boost efficiency and production. Consider the transaction volume, payment frequency, and client preferences.

Small and medium-sized businesses (SMEs) should choose a digital payment system that is appropriate for their needs and operations. Consider considerations such as usability, compatibility with existing systems, security features, and cost-effectiveness.

Regularly assess and analyse your digital payment system’s performance to discover opportunities for improvement. Use this information to improve your payment operations and productivity.

SMEs should keep up with current advancements and trends in digital payment technology. Consider adding new features or processes that will boost your efficiency and client pleasure.

References

- Ogbari, M.E.; Chima, G.U.K.; Olarewaju, F.O. (2021). Critical Factors of Doing Profitable Business in Three Tier Economies: A Case Study Approach.

- Balboa, E.; Ladesma, M.; Manguerra, A.N. Digital Financing Innovations and Their Impact on the Financial Performance of SMEs in the Digital Economy Era. JMM17: Jurnal Ilmu ekonomi dan manajemen 2024, 11, 88–98. [Google Scholar]

- Kaur, A.; Monga, S. (2021). Digital Transformation in Business Era. In Managerial Issues in Digital Transformation of Global Modern Corporations (pp. 1-15). IGI Global.

- Jameaba, M.S. (2020). Digitization revolution, FinTech disruption, and financial stability: Using the case of Indonesian banking ecosystem to highlight wide-ranging digitization opportunities and major challenges. FinTech Disruption, and Financial stability: Using the Case of Indonesian Banking Ecosystem to highlight wide-ranging digitization opportunities and major challenges.

- Babajide, A.A.; Oluwaseye, E.O.; Lawal, A.I.; Isibor, A.A. Financial technology, financial inclusion and MSMEs financing in the south-west of Nigeria. Academy of Entrepreneurship Journal 2020, 26, 1–17. [Google Scholar]

- Javaid, M.; Haleem, A.; Singh, R.P.; Suman, R.; Khan, S. A review of Blockchain Technology applications for financial services. BenchCouncil Transactions on Benchmarks, Standards and Evaluations 2022, 2, 100073. [Google Scholar] [CrossRef]

- Bwembya, J. (2022). Addressing challenges in accessing finance by small and medium enterprises (SMES) in Zambia: a pragmatic approach, (Doctoral dissertation, The University of Zambia).

- Ufua, D.E.; Olujobi, O.J.; Tahir, H.; Al-Faryan, M.A.S.; Matthew, O.A.; Osabuohien, E. Lean entrepreneurship and SME practice in a post COVID-19 pandemic era: a conceptual discourse from Nigeria. Global Journal of Flexible Systems Management 2022, 23, 331–344. [Google Scholar] [CrossRef] [PubMed]

- Sarkar, K.K.; Thapa, R. From Social and Development Banking to Digital Financial Inclusion: The Journey of Banking in India. Perspectives on Global Development and Technology 2021, 19, 650–675. [Google Scholar] [CrossRef]

- Lalchandani, N. (2020). Payments and Banking in Australia: From Coins to Cryptocurrency. How It Started, How It Works, and How It May Be Disrupted, Innovations Accelerated.

- Monye, O.F. (2021). Rethinking the legal and institutional framework for digital financial inclusion in Nigeria.

- Siddiqui, M.K.; Goyal, K.K. A Study the Use of E-Payment Systems Based on Artifical Intelligence. Computing & Intellegent Systems (SCTS), 2023; 1063–1076. [Google Scholar]

- Hopalı, E.; Vayvay, Ö.; Kalender, Z.T.; Turhan, D.; Aysuna, C. How do mobile wallets improve sustainability in payment services? A comprehensive literature review. Sustainability 2022, 14, 16541. [Google Scholar] [CrossRef]

- Vicente, J. Fintech disruption in Brazil: A study on the impact of open banking and instant payments in the Brazilian financial landscape. Social Impact Research Experience 2020, 86. [Google Scholar]

- Gupta, S.; Maple, C.; Crispo, B.; Raja, K.; Yautsiukhin, A.; Martinelli, F. A survey of human-computer interaction (HCI) & natural habits-based behavioural biometric modalities for user recognition schemes. Pattern Recognition 2023, 139, 109453. [Google Scholar]

- Muthukannan, P.; Tan, B.; Tan, F.T.C.; Leong, C. Novel mechanisms of scalability of financial services in an emerging market context: Insights from Indonesian Fintech Ecosystem. International Journal of Information Management 2021, 61, 102403. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).