1. Introduction

Today, the world is facing a serious threat that continues to grow in scope. Climate change affects every aspect of our lives, including social and economic stability, and one might even say that it puts in danger both our very existence as a human race and entire ecosystems.

As the globe recovers from the tyranny of the COVID-19 pandemic, the environmental, social and governance (ESG) factors of the organizations now become important yardsticks of measuring a resilient organization and therefore, a sustainable society (Krishnamoorthy R. 2021).

Hence, there has been an increase in stakeholder pressure on executives and boards of directors to prove that their enterprises are operated ethically and integrate green practices into their corporate image (Arduino et al., 2024).

In this respect, (Stoica O C, 2024) in the 7th International Conference on Economics and Social Sciences, outlined that the ESG reporting plays an essential role for the business environment.

Environmental, social, and governance (ESG) reporting gives a bird's-eye view of a company's performance in various environmental, social, and governance aspects. (Moussa 2023) highlighted that Environmental, Social, and Governance (ESG) reporting pertains to the disclosure of non-financial data related to a firm’s sustainability performance and its influence on diverse stakeholders. In addition, (Bergman et al. 2020) observed that the ESG reporting covers topics such as energy efficiencies, carbon footprints, greenhouse gas emissions, biodiversity, waste management, labor standards, workplace diversity, human rights, talent management, community relations, privacy, and health and safety, as well as governance factors like board composition, sustainability oversight, executive compensation, political contributions, lobbying, and corruption.

(Sulkowski, A and Jebe, R, 2022) outlined that that sustainability reporting can be seen as an attempt to bring improved environmental, social, and governance (ESG) practices to mainstream business. Furthermore, sustainability is no longer an option but a strategic necessity for companies that wish to thrive in a constantly evolving world (Elkington J, 1998).

This citation from one of the pioneers of corporate sustainability resonates with particular force in the current context. It highlights an unavoidable reality: companies can no longer afford to ignore Environmental, Social, and Governance (ESG) criteria if they want to ensure their sustainability and long-term success.

(Jain, Sharma & Srivastava, 2019) describe a sustainable investment as an investment strategy that aims to combine environmental, social, and governance advantages with financial gains. Companies have recently begun integrating this aspect into their business strategy due to its perceived impact on investments and performance.

In a world where the expectations of stakeholders, such as consumers, suppliers, shareholders, institutional investors, employees, regulators, and policymakers, are rapidly evolving, integrating ESG criteria is no longer just a beneficial practice but a strategic requirement.

Investors and stakeholders expect companies to disclose ESG reporting, as well as risks and opportunities, with the same rigor and discipline as they do for financial reporting.

Nowadays, financial reporting alone is insufficient to fully capture and reflect the impact of any company's activities on its environment. Studies and academic research show that companies must consider, evaluate, and communicate their stakeholder impacts.

Consequently, many frame references providing indicators and structures for ESG reporting have emerged in recent years, intending to elevate sustainability reporting to a standard comparable to financial reporting.

These standardization initiatives offer different approaches to ESG reporting: (Global Reporting Initiative -GRI-, Sustainability Accounting Standards Board -SASB-, Carbon Disclosure Project -CDP-, Climate Disclosure Standards Board -CDSB-, Task Force on Climate related Financial Disclosure -TCFD-, ISO 26000 Norm, International Integrated Reporting Council -IIRC-).

These studies have also shown that companies engaged in a Corporate Social Responsibility (CSR) approach benefit from more sustained and significant growth than others. The notion of performance must now go beyond financial performance to take into account extra-financial performance.

Several names for ESG (Environnement, Social and Governance) reporting have emerged, including sustainable reporting, ESG information disclosure, SRI (Socially Responsible Investment) disclosure, CSR criteria (Corporate Social Responsibility), and even extra-financial analysis criteria. Whatever its name, ESG reporting takes into account all elements other than the accounting and financial indicators used in traditional financial analysis. It emphasizes the level of the company's commitment to sustainable development. By integrating social, ethical, and environmental criteria, we can thus understand the overall performance of the company.

ESG reporting has also become a crucial data point for both shareholders and all stakeholders, complementing financial reporting to provide a comprehensive view of the company.

It has become an important feature of global capital markets, with companies rated according to ESG criteria now representing 78% of the total global market capitalization (Boffo and Patalano, 2020).

The tremendous rise in ESG reporting studies over the past few years makes it challenging to understand the present trends and trajectories. Additionally, we can employ a bibliometric analysis to identify and fill in the research gaps from previous investigations.

Scholars have used bibliometric analysis to organize and depict the framework of a particular area of study. In this aftermath, a bibliometric analysis offers a valuable analytical tool for mapping existing literature concerning a specific research theme broadly used as a trend assessment tool (Ahmed F and Hussainey K. 2023).

Moreover, by using bibliometric tools, researchers can uncover emerging trends in a specific domain and visualize the geographical spread, research focus, influential authors and publications, and emerging ideas.

Several studies have applied bibliometric analysis to various topics; however, there is a lack of bibliometric studies on ESG reporting, which is an important and emerging area of research. Therefore, the aim of the present study is to conduct a bibliometric analysis to explore research gaps in this field and propose a future research agenda.

In this study, we used datasets from the Web of Science (WoS) database spanning over 869 journals from 2014 to 2024 and quantitative bibliometric analysis to discover present and future research directions for ESG reporting.

The specific objectives of this analysis are: (1) to advance our understanding of ESG reporting; (2) to identify the scientific growth, publication, and citation trends of ESG reporting research over time; (3) to rank the most productive and influential countries, journals, authors and institutions finally (4) to visualize the most frequently used keywords and the conceptual structure of ESG reporting research.

Our research questions are:

RQ1. What are the current trends in the ESG reporting field regarding publications, citations, journals, authors, and affiliated countries?

RQ2. What are the current developments in this area of study?

RQ3. What are the main gaps and research questions that require future research in the ESG reporting field?

This paper is organized as follows:

Section 2 discusses the research methodology and the bibliometric analysis tool;

Section 3 shows the main findings of this study and the research gaps; finally, section 4 delineates the conclusion, the limitations, and future research directions.

2. Research Methodology: Procedure and Strategies

In order to answer our research questions and to analyze the current state-of-the-art research on ESG reporting, the study adopts a bibliometric literature review research design.

Bibliometric analysis is a systematic and exhaustive method for exploring and analyzing vast data (Donthu et al. 2021).

This type of review aims to report what is known and what the literature ignores, rather than producing descriptive reports (Briner R, et al. 2009).

We used the bibliometric analysis for its potential to introduce a transparent, rigorous, objective, and reproducible review process and thus to improve the quality of the review.

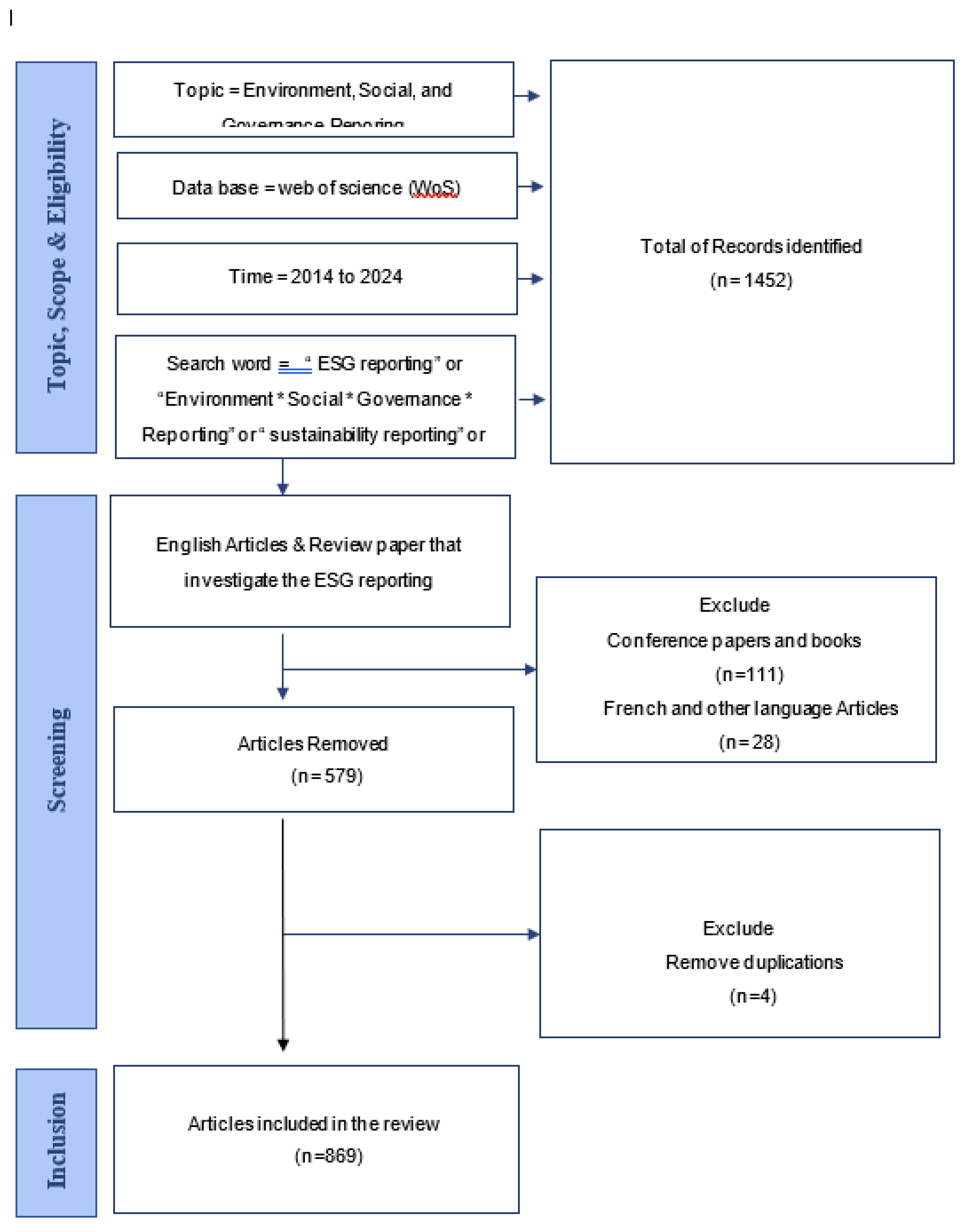

For this work, we have selected the PRISMA method, which we deemed most appropriate given our research objectives.

For our literature review, an initial dataset of 1452 articles were extracted from Web of Science (WoS) database as our source of articles. Many advantages of using this database for bibliometric analysis have been shown in earlier studies (Adriaanse L et al., 2013; Mengist W et al., 2020). We retain English articles published between 2014 and 2024, that investigate the search word “ESG reporting”.

Once we eliminate duplicates and categorize the document type and subject categories, we arrive at a final sample of 869 articles. The content was coded based on the publishing year, journal, research method, and main findings, The methodology flow is illustrated in

Figure 1.

In terms of software, we have chosen to utilize Bibliometrix or Biblioshiny, a popular R package for bibliometric research investigations, to create a mapping analysis of scientific publications. It provides numerous outcomes for importing, analyzing, and visualizing bibliographic databases. According to (Aria and Cuccurullo, 2017) the aforementioned software is written in R language and provides a set of tools for quantitative research in bibliometrics.

3. Findings and Discussion: Bibliometrics and Trends

This study conducts a bibliometric analysis of the current literature regarding ESG reporting. The review aims to examine and assess the existing research and identify the main contributors, topics, trends, and challenges that emerge in the literature on this issue.

Table 1 provides a summary of the information collected from the WoS database utilizing the search words "Environmental, Social and Governance" OR "ESG" AND "ESG reporting.". It presents data about authors, their collaborations, documents, and their contents.

3.1. List of Top Cited Articles and Most Productive Journals on “ESG Reporting”

The number of citations is a representation of the level of interest that researchers have exhibited in a particular scientific study and the potential impact this paper can make. Tables 2 list the top cited articles focused on ESG reporting based on their number of citations. As revealed, the top five articles with the highest citation count are with 391, 261, 254, 225, 194 citations, respectively. The paper published in the review of accounting studies by (Christensen, HB; et al. 2021) looked at the possible economic effects of mandatory disclosure and reporting standards for sustainability and corporate social responsibility (CSR) topics. Similarly (Persakis A, 2024) elucidates how ESG performance influences the relationship between climate policy uncertainty and both business performance and carbon dioxide emission performance, published in the environment development and sustainability, which is considered as the top two productive journal in relation to environment, social and governance reporting research (see table 3). Furthermore, (Sulkowski, A; et al,. 2022) identify the key obstacles to global consolidation of ESG reporting. (Jebe R, 2022) examined the consequences of Both financial reporting and ESG reporting streams to shape firms’ disclosure obligations. (Cao J; et al,. 2019) delineates the current state of Pacific accounting review’s topics to identify potential directions for future publications. The results of this study demonstrate the extensive nature of ESG research.

Table 3 illustrated the most productive journals in 2024 concentrated on ESG reporting and their number of publications over the entire period. Sustainability and journal of cleaner production are the most active journals with 131 and 28 publications, respectively.

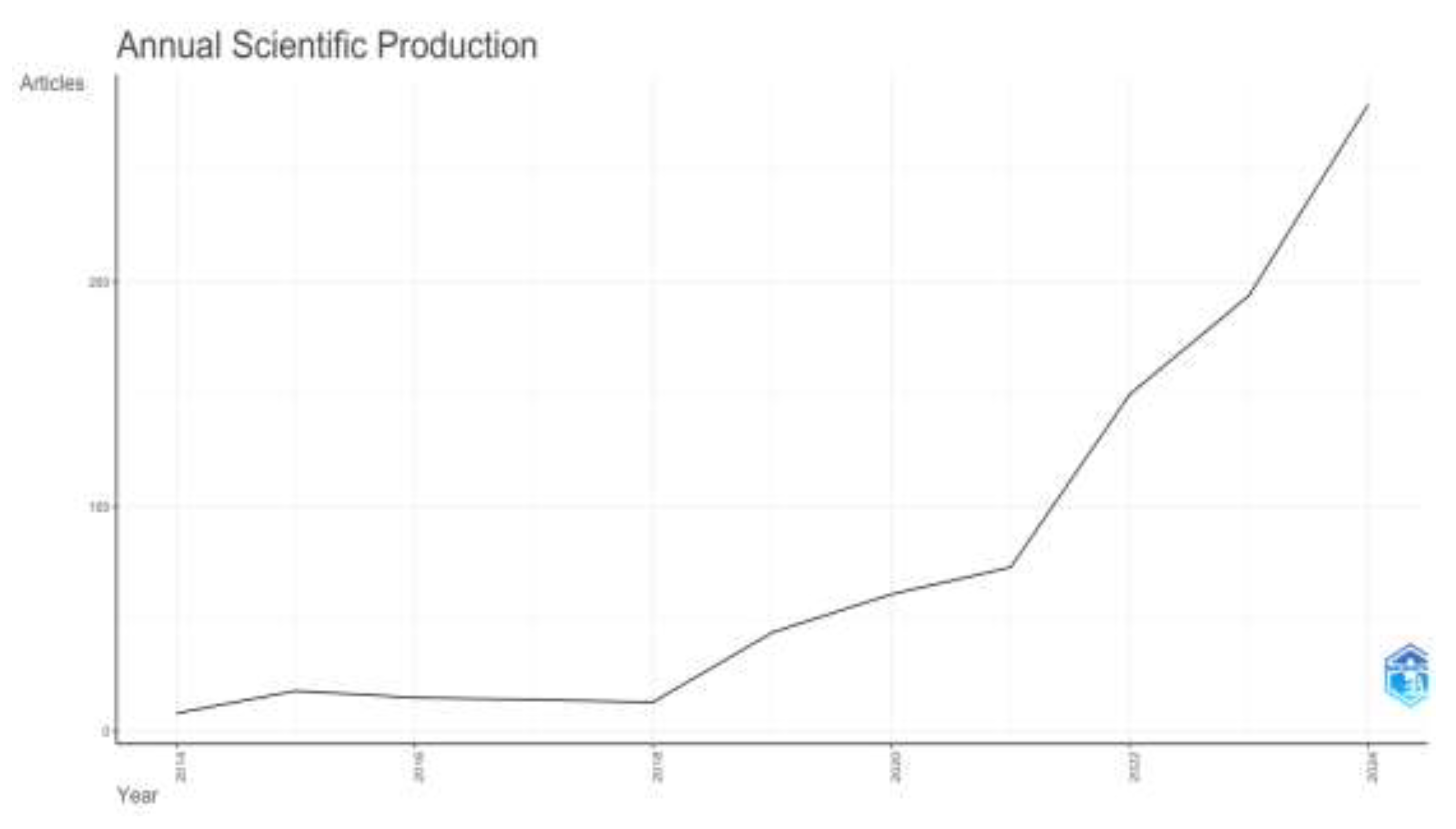

3.2. Research Production Over Years

The study reviewed bibliometric data, showing a significant increase in publications related to ESG reporting, particularly from 2018 to 2024, highlighting a growing academic interest.

Given the limited number of papers published annually, we might consider the period 2014-2018 as an embryonic stage.

The scientific literature has long addressed the topic of ESG reporting. The first article was published in 1993, focusing on various governance approaches, their relationship, the impact of environmental uncertainty, and their relational interactions (Gundlach and Achrol, 1993).

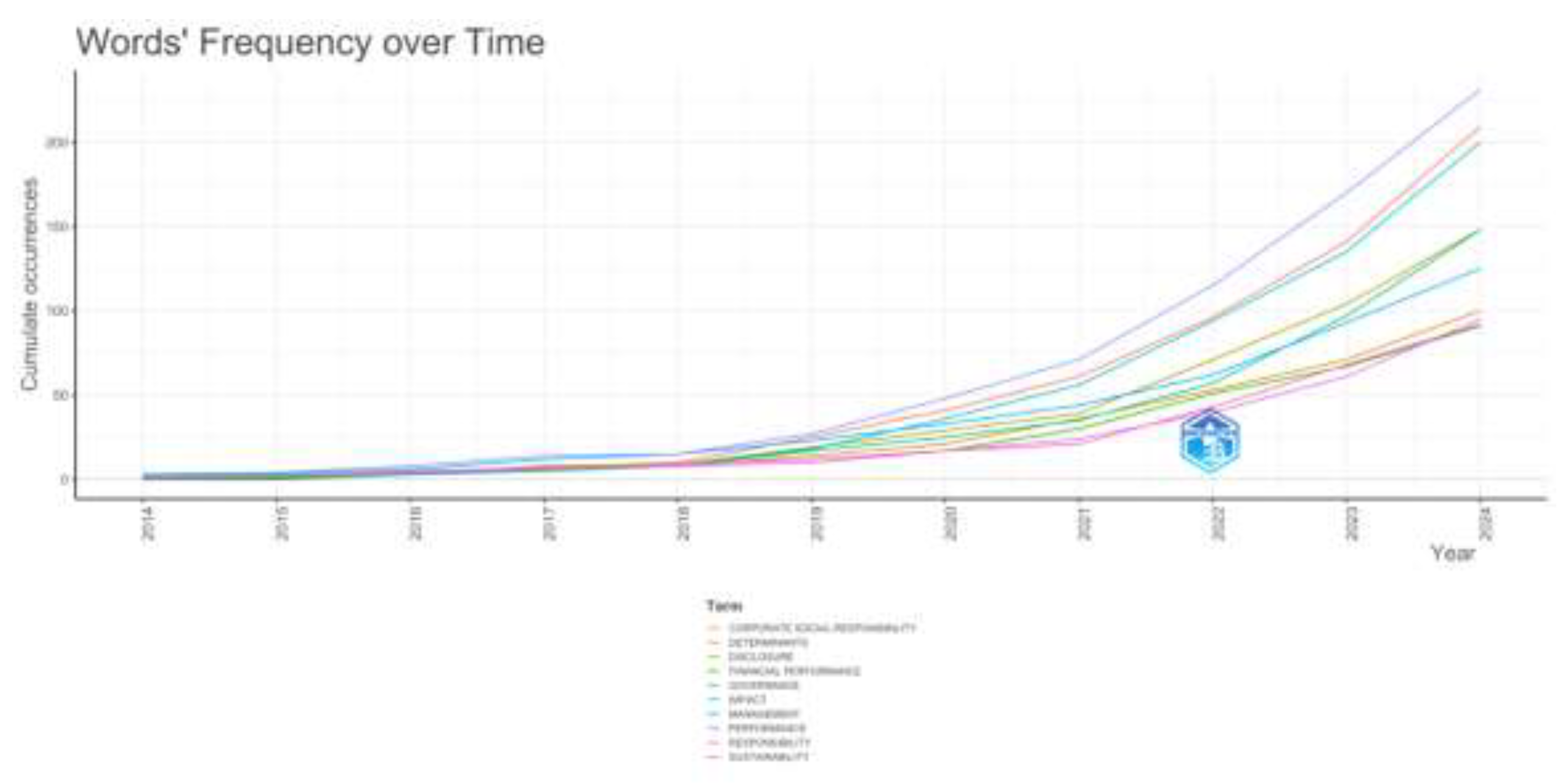

3.3. Trends Topic Over Time

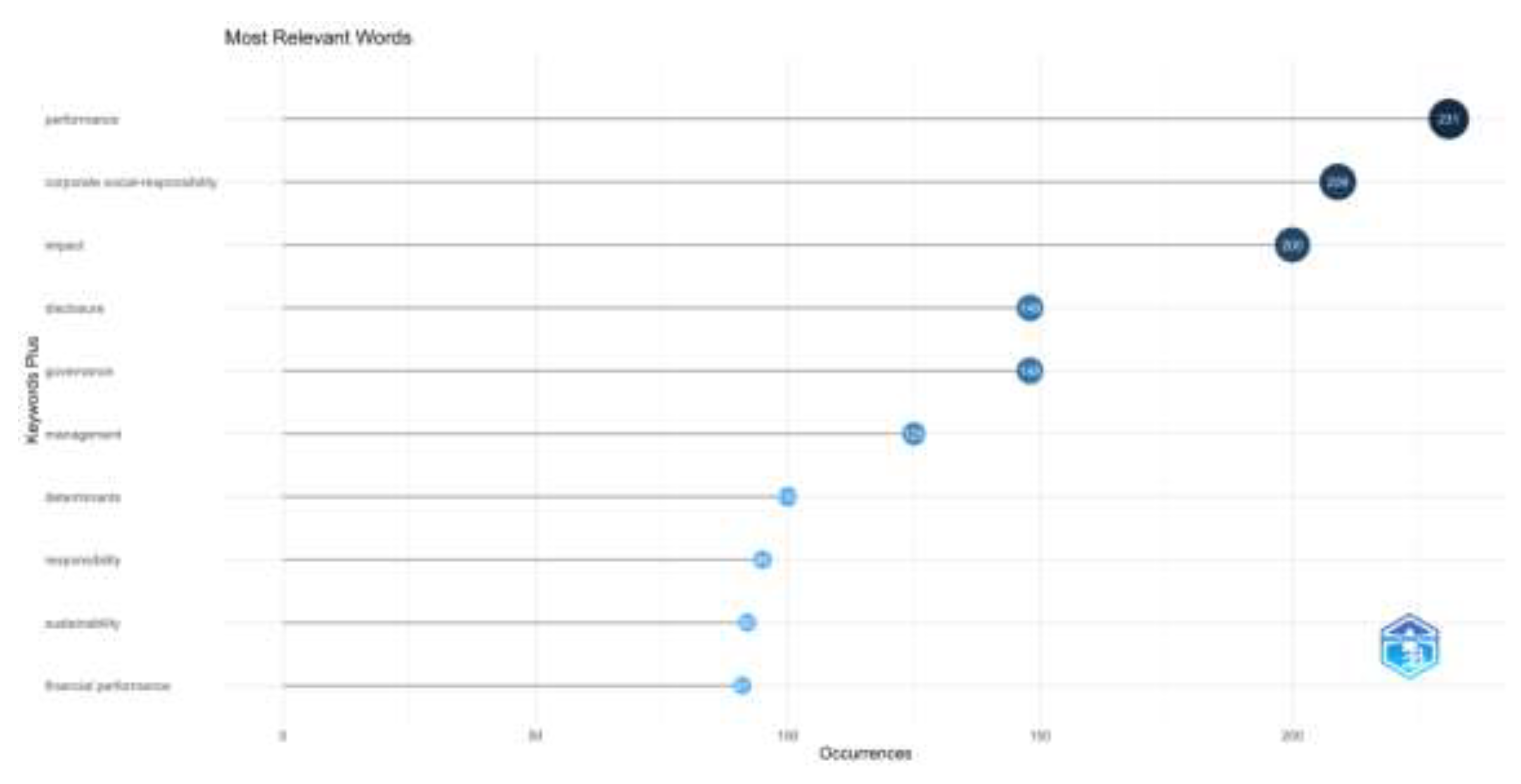

In order to analyze the abstracts, references, sources, and data taken from all 869 publications, the study utilized the R Bibliometrix package.

Figure 2 illustrates the trending topics and keywords in the current study. The data analysis provides keen insight into the popularity and temporal patterns of specific research topics. Primarily, "performance" emerges as the predominant keyword, occurring (231) times over the research period. Examining the relationship between financial performance and ESG characteristics is crucial and has garnered sustained interest. The acronym "CSR" ranks second with a total of 209 appearances. emphasizing the significance of social and environmental concerns within corporate practices. Other terms include "impact" (200) and "sustainability" (92), highlighting the growing importance of ESG impact in research.

According to the statistics, financial performance, corporate social responsibility, sustainability, and other ESG-related topics have recently attracted a lot of academic attention.

Figure 4.

Word frequency over time related to ESG reporting.

Figure 4.

Word frequency over time related to ESG reporting.

The graph reveals that financial performance and ESG reporting have been the focal points of current studies.

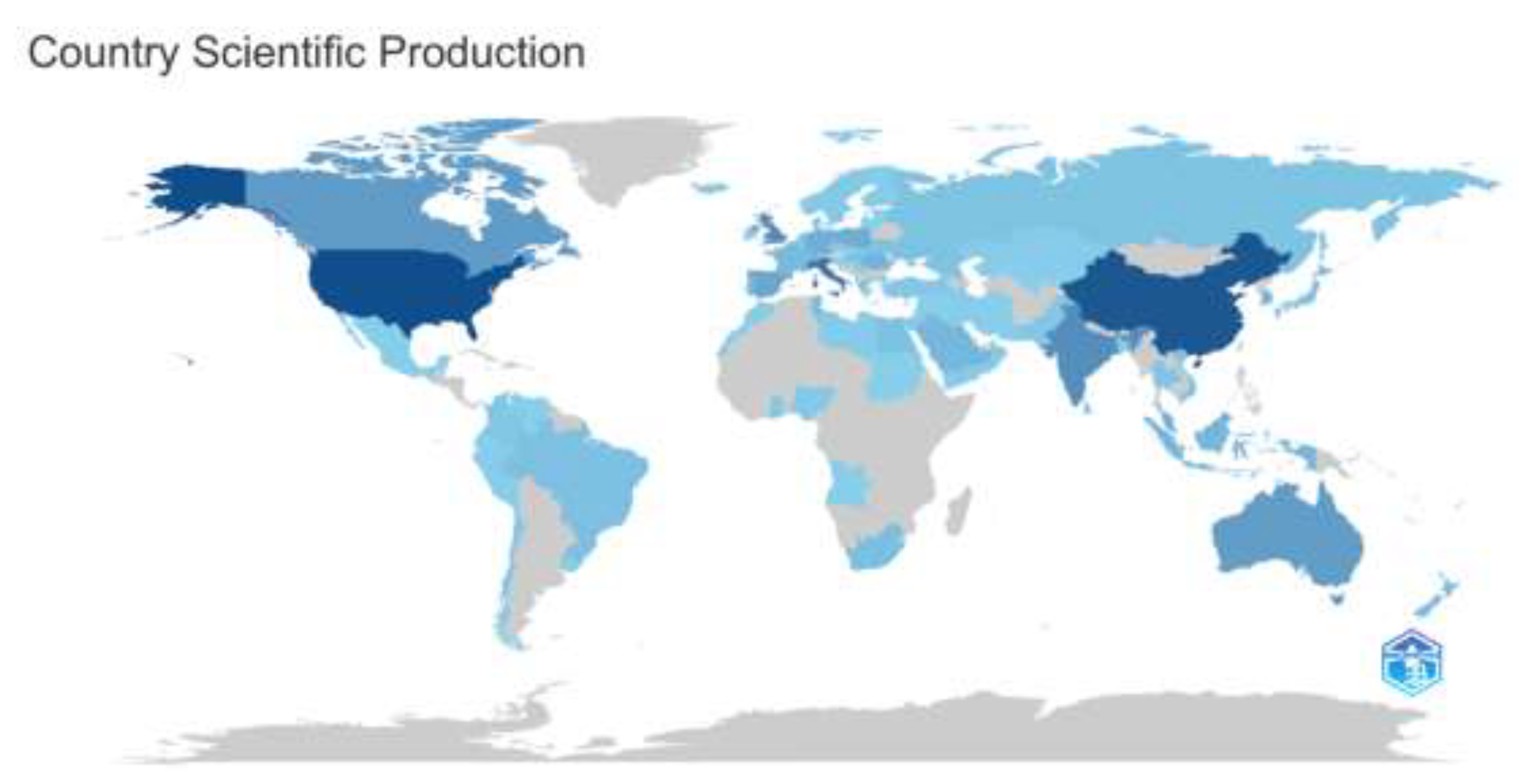

3.4. Top 10 Contributing Countries

Investing in research and development is crucial to a country's economic growth and development. In the WoS database for ESG reporting research, the USA ranks first among the top 10 countries, contributing 19% of total publications. followed by China follows with 18% and Italy with 13% of the total contributions.

Based on citations, the UK possesses the highest citation average (3700).

Table 4.

Top 10 most contributing countries.

Table 4.

Top 10 most contributing countries.

| Rank |

Country |

No. of articles and % (N = 1727) |

Total citation |

Average articles citation |

| 1 |

USA |

340 (19) |

2535 |

25.40 |

| 2 |

CHINA |

315 (18) |

723 |

8.80 |

| 3 |

ITALY |

227 (13) |

1838 |

25.90 |

| 4 |

UK |

172 (9,9) |

3700 |

77.10 |

| 5 |

INDIA |

163 (9,43) |

760 |

14.60 |

| 6 |

CANADA |

130 (7,52) |

551 |

15.30 |

| 7 |

AUSTRALIA |

124 (7,18) |

1141 |

27.20 |

| 8 |

SPAIN |

96 (5,55) |

280 |

26.20 |

| 9 |

POLAND |

83 (4,80) |

787 |

9.70 |

| 10 |

GERMANY |

77 (4,45) |

1283 |

44.20 |

| |

|

|

|

Figure 4.

Countries’ Production on ESG Reporting.

Figure 4.

Countries’ Production on ESG Reporting.

Figure 4 presents a global map indicating the nations that have published research on ESG reporting. Colors represent publishing frequency; deeper colors indicate more frequent publication, while lighter colors indicate less frequent publication for the countries.

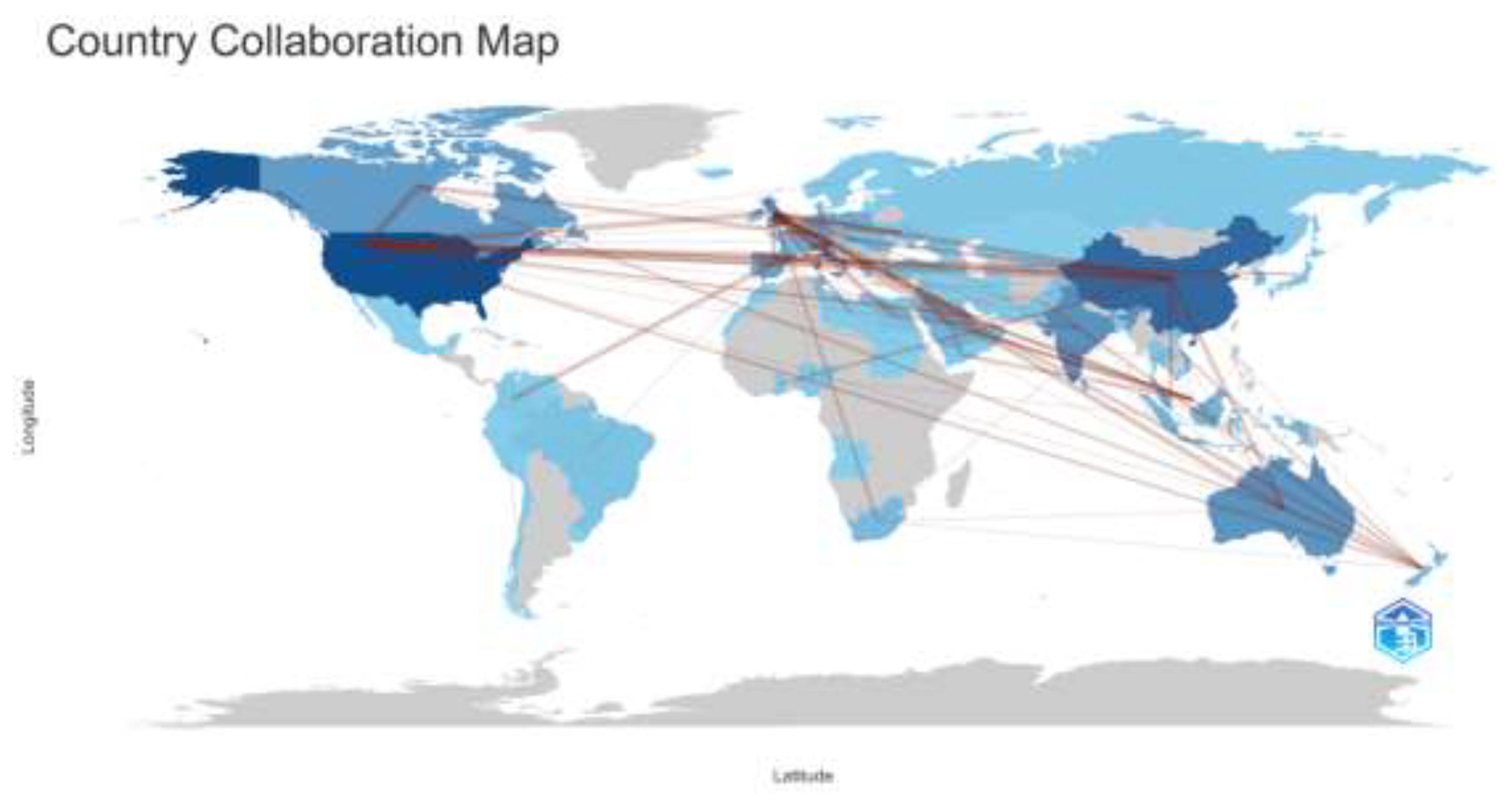

Figure 5.

Countries’ Collaboration Map on ESG Reporting.

Figure 5.

Countries’ Collaboration Map on ESG Reporting.

United Kingdom, USA, China, Canada, Australia, and Malaysia each own over 30 partnerships. The nations with the fewest connections include France, Morocco, Tunisia and Saudi Arabia, each having less than 10 collaborations.

3.5. Thematic evolution and trends linking

Keywords and thematic evolution are used to show the history and development of themes (Marzuki A, et al 2023).

3.5.1. Co-Occurrence Analysis

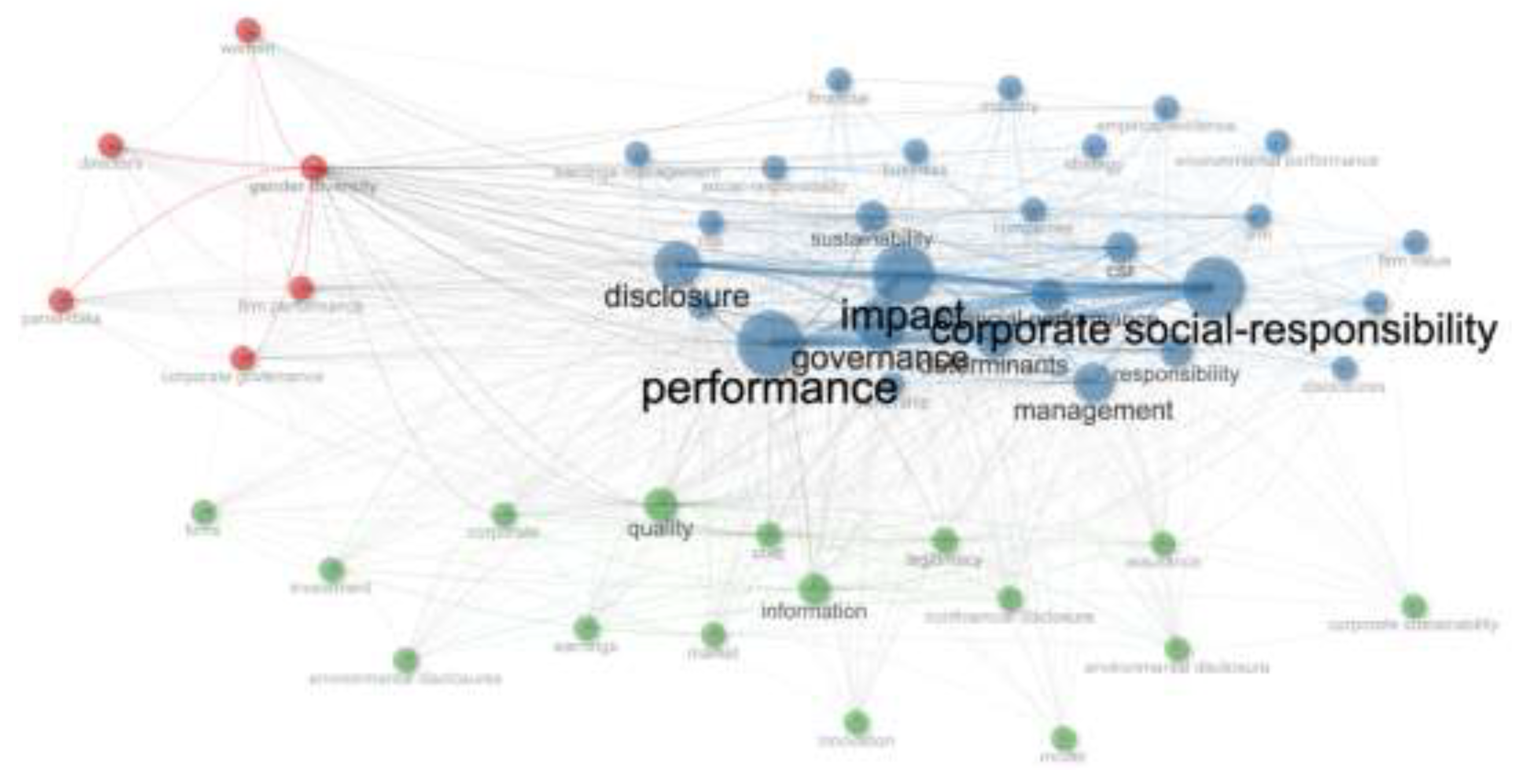

three clusters are formed from the analysis;

Figure 6 illustrates the co-occurrence network, which examines the publication content.

The blue, red, and green clusters in the keyword co-occurrence network represent the highly referenced terms in the literature on ESG reporting. One of the most often occurring words is performance (425 times) followed by “Corporate Social responsibility” (304 times), “Sustainability” (253 times), “Disclosure” (207 times), and “mpact” (196 times).

Various existing literatures have studied the impact of ESG reporting on firms’ performance (Landi and Sciarelli, 2018; Balatbat et al., 2012; Alareeni and Hamdan, 2020).

(Landi and Sciarelli, 2018) tackled the topic from a market return point of view. They analyzed the effect of sustainability reporting on the abnormal Financial Performance (FP). They studied the case of Italian firms listed on the FTSE Milano Indice di Borsa (MIB) index over a sample period from 2007 to 2015.

(Balatbat et al. 2012) also studied the same relationship for the top 300 firms listed in the Australian Securities Exchange from 2008 to 2010. They examine the influence of ESG score on Financial Performance using financial profitability ratios (ROA, ROE, ROIC, EBITDA margin).

Additionally, (Alareeni and Hamdan, 2020) investigated the impact of ESG on US S&P 505-listed firms’ Operational, Financial and Market performance for the period 2009-2018. They base their assessment on ROA for operational performance, ROE for financial performance and Tobin’s Q for market performance.

3.5.2. Thematic Evolution

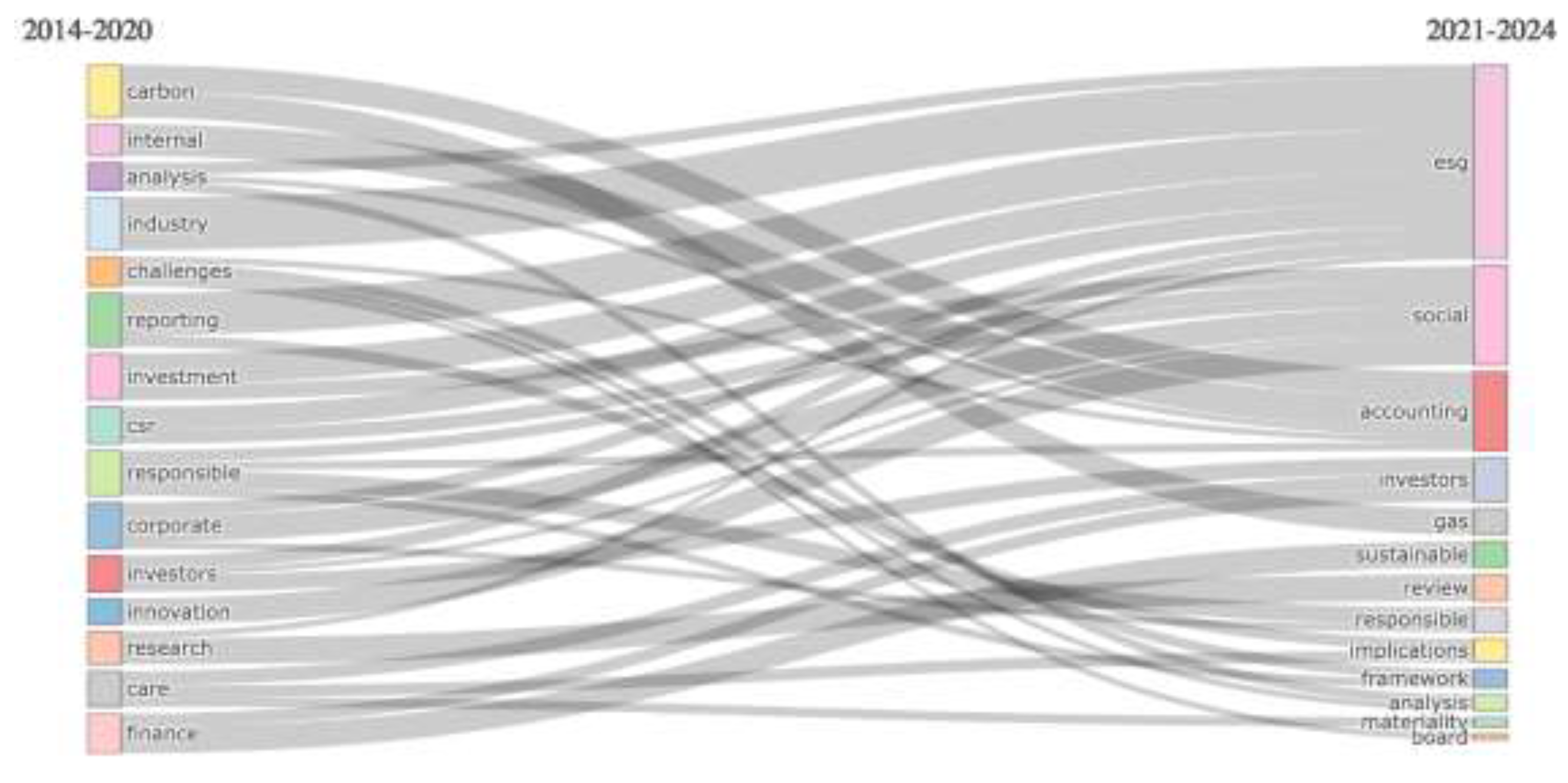

Figure 7 reveals thematic evolution in two different stages (2014-2020, 2020-2024); Interest in environmental, social and governance (“ESG”) reporting has surged in recent years, and the current economic, public health and social justice crises have only intensified this focus.

The first phase of this study (2014-2020) highlighted the main themes such as carbon emission and industry sectors, Corporate Financial Disclosure. Corporate Finance Corporate Social Responsibility (CSR).

The second phase of our research (2021-2024) examined the impact of sustainability and ESG reporting on financial performance. (Wang et al. 2024) highlighted that firms with higher ESG performance tend to be more resilient (Marzuki A, et al 2023) confirmed that companies with strong ESG reporting have a long-term and consistent positive association between ESG performance and financial success.

4. Conclusions and Future Research Directions

The research emphasized the field's bibliometric analysis, which focused on ESG reporting. We retrieved the data from Web of Science (WoS), the most prominent research database, which covers 869 research papers from 2014 to 2024, using the Bibliometrix package.

The current paper offers an overview and provides several insights regarding ESG reporting literature. According to the findings, the volume of research conducted on the topic of environment, social, governance reporting has attracted a lot of attention during the past several decades, especially period 2018–2024, had the largest number of publications. In addition, sustainability, journal of cleaner production, and environment development and sustainability are the top three productive journal on this topic. Furthermore, USA, China, Italy and UK are the most active countries-researchers in this field. The mapping and clustering analysis has revealed that they collaborated extensively with each other, but also with other countries.

This paper offers significant implications and delineates persuasive future research avenues for this field.

Like any research work, our study is not free from limits and it should be exposed in order to guide future research paths.

The first limitation of our work, the research paper is relied exclusively on English articles from the Web of Science, which might limit the scope and thoroughness of the literature review. Future research should incorporate bibliographic information from additional databases, such as Scopus in order to ensure a deeper examination. Furthermore, mapping and clustering techniques were the primary focus of the research. These methods helped shed light on developing themes, but it's possible that more associations and subthemes were unnoticed.

Future research may build upon this study's findings by utilizing varied analytical tools, refining search tactics, and merging data from other databases. This will enrich our understanding of the topic and reveal additional prospective areas of research.

Author Contributions

Each author made an equal contribution to the project.

Conflicts of Interest

The authors declare no conflicts of interest.

Funding

This paper received no external funding.

Data Availability

The data is available upon request.

Acknowledgments

We express our gratitude to the editing staff and reviewers for enhancing the quality of this paper.

References

- Adriaanse, L.; Rensleigh, C. (2013), Web of science, scopus and google scholar: A content comprehensiveness comparison. Electron Libr. Emerald group publishing Limited, Leeds, Vol.31No.6, PP.727–744. [CrossRef]

- Ahmed, F.; Hussainey, K. (2023). A bibliometric analysis of political connections literature. Review of Accounting and Finance, Emerald group publishing Limited, Leeds, Vol.22 No.2, PP.206–226. [CrossRef]

- Alareeni, B.A. Alareeni, B.A. and Hamdan, A. (2020), "ESG impact on performance of US S&P 500-listed firms", Corporate Governance, Vol. 20 No. 7, pp. 1409-1428. [CrossRef]

- Almici, A, (2024), Does sustainability in executive remuneration matter? The moderating effect of Italian firms' corporate governance characteristics, Meditari accountancy research, Emerald group publishing Limited, Leeds, Vol. 31 No.7, PP.49-87. [CrossRef]

- Arduino, Francesca Romana, Bruno Buchetti, and Murad Harasheh. 2024. The veil of secrecy: Family firms’ approach to ESG transparency and the role of institutional investors. Finance Research Letters, Elsevier SCI LTD, London, Vol.62. [CrossRef]

- Aria, M., & Cuccurullo, C. (2017). bibliometrix: An R-tool for comprehensive science mapping analysis. Journal of informetrics, Elsevier SCI LTD, London, Vol. 11 No.4, PP. 959-975. [CrossRef]

- Balatbat M, Siew R, Carmichael D, (2012), ESG scores and its influence on firm performance: Australian evidence Australian School of Business School of Accounting, pp. 1-30.

- Bergman, Mark S., Ariel J. Deckelbaum, and Brad S. Karp. 2020. Introduction to ESG. The Harvard Law School Forum on Corporate Governance. Available online: https://corpgov.law.harvard.edu/2020/08/01/introduction-to-esg/ (accessed on 30 August 2024).

- Boffo, R., Patalano R. (2020) ESG Investing: Practices, Progress and Challenges. Open Access Library Journal, OECD Paris, Vol.11 No.1. [CrossRef]

- Briner, R.B.; Denyer, D.; Rousseau, D.M. (2009). Evidence-Based Management: Concept Cleanup Time? Academy of Management Perspectives, Vol.23, No 4, PP. 19-32. [CrossRef]

- Cao, June; Huang, Zijie; Kristanto, Ari Budi; Scott, Tom, (2024), Pacific accounting review in 2013-2023: A bibliometric analysis, Pacific accounting review, Emerald group publishing Limited, Leeds, Vol. 36 No.3/4, PP.297-347. [CrossRef]

- Chahed, Y, (2021), Words and Numbers: Financialization and Accounting Standard Setting in the United Kingdom, Contemporary accounting research, Wiley, Hoboken, Vol. 38 No.1, PP.302-337. [CrossRef]

- Christensen, HB; Hail, L; Leuz, C, (2021). Mandatory CSR and sustainability reporting: Economic analysis and literature review, Review of accounting studies, Springer, Dordrecht, Vol. 26 No.3. PP. 1176-1248. [CrossRef]

- Dilling, PFA; Harris, P; Caykoylu, S, (2024), The Impact of Corporate Characteristics on Climate Governance Disclosure, Sustainability, MDPI, Basel, Vol. 16 No.5. [CrossRef]

- Donthu, N., Kumar, S., Mukherjee, D., Pandey, N. and Lim, W.M. (2021), “How to conduct a bibliometric analysis: An overview and guidelines”, Journal of Business Research, Elsevier SCI LTD, London, Vol. 133, pp. 285-296. [CrossRef]

- El-Jourbagy, J; Gura, PP, (2022). In Space, No One Can Hear You're Green: Standardization of Environmental Reporting, the SEC's Proposed Climate Change Disclosure Rules, and Remote Sensing Technology, American business law journal, Wiley, Hoboken, Vol. 59 No.4, PP.333-820. [CrossRef]

- Elkington, J. (1998), "Accounting for the triple bottom line", Measuring Business Excellence, Emerald group publishing Limited, Leeds, Vol. 2 No. 3, pp. 18-22. [CrossRef]

- Gundlach, G.T., Achrol, R.S. (1993). Governance in exchange: Contract law and its alternatives. Journal of Public Policy & Marketing, JSTOR, New York, Vol.12, No.2, PP. 141-155.

- Jain, M.; Sharma, G.D.; Srivastava, M. (2019), Can Sustainable Investment Yield Better Financial Returns: A Comparative Study of ESG Indices and MSCI Indices. Risks, MDPI, Basel, Vo. l7, No.15. [CrossRef]

- Jebe, R, (2019). The Convergence of Financial and ESG Materiality: Taking Sustainability Mainstream, American business law journal, Wiley, Hoboken, Vol. 56 No.3, PP.645-702. [CrossRef]

- Krishnamoorthy, R. (2021) Environmental, Social, and Governance (ESG) Investing: Doing Good to Do Well. Open Journal of Social Sciences, Vol. 9, PP. 189-197, Scientific research, Chicago. [CrossRef]

- Landi G, Sciarelli M, (2018). "Towards a more ethical market: The impact of ESG rating on corporate financial performance," Social Responsibility Journal, Emerald Group Publishing Limited, vol. 15, No.1. [CrossRef]

- Persakis, A, (2024). The impact of climate policy uncertainty on ESG performance, carbon emission intensity and firm performance: Evidence from Fortune 1000 firms, Environment development and sustainability, Springer, Dordrecht, Vol. 26 No.9. PP.24031-2408. [CrossRef]

- Marzuki, Ainulashikin, Fauzias Mat Nor, Nur Ainna Ramli, Mohamad Yazis Ali Basah, and Muhammad Ridhwan Ab Aziz. 2023. The Influence of ESG, SRI, Ethical, and Impact Investing Activities on Portfolio and Financial Performance—Bibliometric Analysis/Mapping and Clustering Analysis. Journal of Risk and Financial Management Vol.16, 321. [CrossRef]

- Mengist W, Soromessa T, Legese G. (2020), Method for conducting systematic literature review and meta-analysis for environmental science research. Methods X, Elsevier SCI LTD, London, Vol.7. [CrossRef]

- Moussa, A S. (2023). The Cost Implications of ESG Reporting: An Examination of Audit Fees in the UK. International Journal of Accounting, Auditing and Performance Evaluation. Preprint, Vol.20, No.(3/4), pages 399-420. [CrossRef]

- Sulkowski, A; Jebe, R, (2022). Evolving ESG Reporting Governance, Regime Theory, and Proactive Law: Predictions and Strategies, American business law journal Wiley, Hoboken, Vol. 59 No.3, PP.449-503. [CrossRef]

- Wang, Haijun, Shuaipeng Jiao, and Chao Ma. 2024. The impact of ESG responsibility performance on corporate resilience. International Review of Economics & Finance Vol.93, PP.1115–1129. [CrossRef]

- Wen, Q; Shao, SP; Wang, YP; Hong, JK; Lu, K; Zhao, QY; Zheng, HR; Ma, L, (2023). Does creation-oriented culture promote ESG activities? Evidence from the Chinese market, Global environmental change-human and policy dimensions, Elsevier SCI LTD, London, Vol. 86 No.1, PP.254-607. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).