1. Introduction

Sustainable development has become a global policy, agreed upon by the United Nations (UN) on Sustainable Development (SDG) and in international agreements to promote environmental taxes as a policy tool [

1,

2]. Environmental tax programs have supported climate action under SDG 13, affordable and clean energy under SDG 7, and responsible consumption and production under SDG 12 [

3,

4]. Environmental taxes aim to reduce greenhouse gas emissions, promote energy efficiency, and encourage sustainable industrial practices by integrating environmental costs within the scope of economic activity [

5,

6].

The Paris Agreement emphasizes the importance of market-based instruments, one of which is an environmental tax that aims to meet global climate targets. In addition, the Paris Agreement discusses increasing financial flows, technology transfer, and capacity building to achieve clean emissions by mid-century [

7,

8]. Carbon pricing and energy levies are integral to this strategy, incentivizing industries to adopt cleaner technologies and reduce their carbon footprint [

9,

10]. Alignment between national policies and global commitments allows countries to utilize environmental taxes to drive progress toward a low-carbon economy [

11,

12].

Achieving this requires compliance in paying the tax. Compliance can ensure that these policies' environmental and economic benefits are realized. Factors that encourage or hinder compliance, such as public perceptions of fairness, regulatory quality, and social acceptability of tax measures, are essential for successfully implementing environmental tax policies [

13,

14] . Van Vuuren et al [

15] study explained that achieving SDG targets and fulfilling international climate agreements requires balancing law enforcement, incentives, and community engagement.

In this bibliometric analysis, we explore tree main research inquiries:

What are the main factors influencing compliance behavior in environmental taxation, and how do these aspects change between nations and industries?

b. Which writers, organizations, and nations have contributed most significantly to the study of environmental tax compliance, and what are the well-known joint ventures in this area?

c. What are the most common research themes, patterns, and developing fields of study, and how have these topics changed over time?

By answering these queries, this study adds to the current discussion on the creation of efficient environmental policies by pointing out areas of need and potential for further investigation into environmental tax compliance.

2. Literature Review

2.1. Environmental Tax

Environmental taxation is a policy instrument that has gained significant attention in recent years due to its potential to address environmental challenges while influencing economic behavior. The implementation of environmental taxes, energy taxes, and carbon taxes has evolved from being primarily adopted by a few developed nations in Europe and the OECD to becoming more widespread across developed, developing, and emerging countries [

16]. These taxation policies are designed to have diverse effects on the economy, residents, and climate change, aiming to reduce carbon emissions by enhancing innovation and energy efficiency, which are crucial drivers of environmental sustainability [

17].

Research has shown that environmental tax changes may impact welfare and unemployment, especially in emerging nations with traits like a large informal economy and rural-urban mobility [

18]. Research on the influence of environmental taxes on businesses' green innovation has also been conducted, emphasizing the significance of integrating market-based tax policies such as environmental taxes with tax incentives for research and development to foster green innovation successfully [

19]. Moreover, environmental taxes has been extensively advocated in industrialized nations as the main tool for market-based policy [

20].

According to research, environmental tax incentives boost company investment and export growth, make it easier for companies to disclose their CSR information, and support environmentally conscious business practices [

21]. There is a need for accurate research and evaluation of the efficacy of environmental tax policies, nevertheless, since there have been cases when detrimental tax expenditures have outweighed environmental taxes [

22]. Furthermore, research has examined the inadvertent outcomes of environmental tax incentives, highlighting the need to comprehend the wider ramifications of these initiatives [

21].

Economic incentives and tax penalties have been recognized as driving policies in Spain regarding building and demolition waste management, showing the beneficial impacts of these policies on waste recycling and the market for recycled aggregates [

23]. In comparison, research on incentive policies for building and demolition waste recycling in China has shown how crucial it is to strike the correct mix between environmental taxes and subsidies to manage trash [

24]. Furthermore, it has been shown that tax incentives might inadvertently increase the energy efficiency of investments, highlighting the potential of tax incentives as a tool for accomplishing environmental objectives [

25].

The interaction between carbon taxes and innovation externalities has been examined to determine the optimal timing of climate change policy implementation, emphasizing the need for tailored R&D instruments and a combination of climate change and R&D policies to effectively target climate change goals [

26]. Furthermore, tax incentives have been found to enhance corporate Environmental, Social, and Governance (ESG) performance, contributing to the body of research on the relationship between tax incentives and corporate behavior [

27]. In the context of China, incentive-based environmental regulations have been shown to have a significant impact on carbon intensity reduction in certain provinces, highlighting the role of incentives in driving environmental outcomes [

28].

2.2. Tax Compliance Behavior

Global tax systems rely significantly on tax compliance behavior, which affects both revenue collection and the overall efficacy of fiscal policy. Policymakers and tax authorities must comprehend the factors influencing compliance behavior to create policies promoting voluntary conformity to tax laws. The complexity of tax compliance behavior has been the subject of several research, which have shed light on the different processes and elements that affect people's and companies' desire to abide by the law [

29,

30,

31]

The study conducted by Hikmah et al [

32] emphasizes the importance of tax knowledge and justice that can shape tax compliance behavior. Individuals or organizations that have a level of understanding of regulations and taxation can significantly affect compliance in paying taxes. Perceptions of fairness in the tax system play an important role in compliance. Taxpayers view tax regulations as fair and correct, so people tend to voluntarily comply with their tax obligations [

33].

Numerous research has focused on the voluntary nature of tax compliance behaviour, emphasizing the importance of elements including attitudes, societal norms, and intents in promoting compliance [

34,

35,

36]. People's intent to abide by tax rules, their views toward taxes, and societal norms influence their compliance. Comprehending these normative and psychological elements is essential to forecasting and encouraging tax compliance across various taxpayer categories.

Moreover, regulatory frameworks and enforcement instruments significantly influence encouraging tax compliance behaviour. Research has investigated the efficacy of enforcement tactics, including tax agent training and compliance model implementation, in raising tax compliance rates [

32]. Good enforcement influences taxpayer behaviour by signalling that tax authorities take compliance with tax legislation seriously and discourage non-compliance.

Several external elements, such as work competency, social perceptions, and financial performance, have also been studied related to tax compliance behaviour [

34]. Work competency affects how well employees follow safety guidelines, which may extend to how they behave when paying taxes in an organizational setting. The fact that people's inclination to abide by tax regulations can also be influenced by their opinions of the government, society, and their financial situation highlights the complex nature of tax compliance behaviour.

The impact of tax education, belief systems and early intervention on compliance behaviour has been studied extensively. Educating an individual about taxes at an early age has the potential to promote compliance at an early age that may influence future behaviour. In conclusion, the factors that influence individual and corporate tax compliance decisions have been identified in the literature on tax compliance behaviour. Normative, psychological and coercive external influences can drive compliance behaviour and ensure tax system effectiveness.

3. Materials and Methods

The systematic literature review was conducted using qualitative methods that provide a thorough and objective explanation of the literature on environmental tax compliance behavior. This approach reviews knowledge and identifies gaps in the literature [

37,

38]. Because it is evidence-based, this approach is suitable for making recommendations to policymakers.

This study uses bibliometric and scientometric analyses, which provide a solid basis for understanding the structure and dynamics of environmental tax compliance research. Both analyses are used to identify trends, patterns, and the impact of the literature on a field [

39,

40,

41]. The objectives of both analyses include identifying research gaps for the development of conceptual models or theoretical frameworks and deepening insights into the impact of research on environmental tax compliance behavior.

The bibliometric analysis focuses on collecting and mapping metadata from publications related to environmental taxes and compliance behavior [

42]. Meanwhile, scientometric analysis focuses more on measuring the scientific impact of the publications identified in the bibliometric analysis [

43,

44]. Outputs from scientometric analysis include; assessing the impact of research, such as the number of citations, the h-index, identifying collaborative networks between researchers or institutions, analyzing the evolution of concepts [

45,

46].

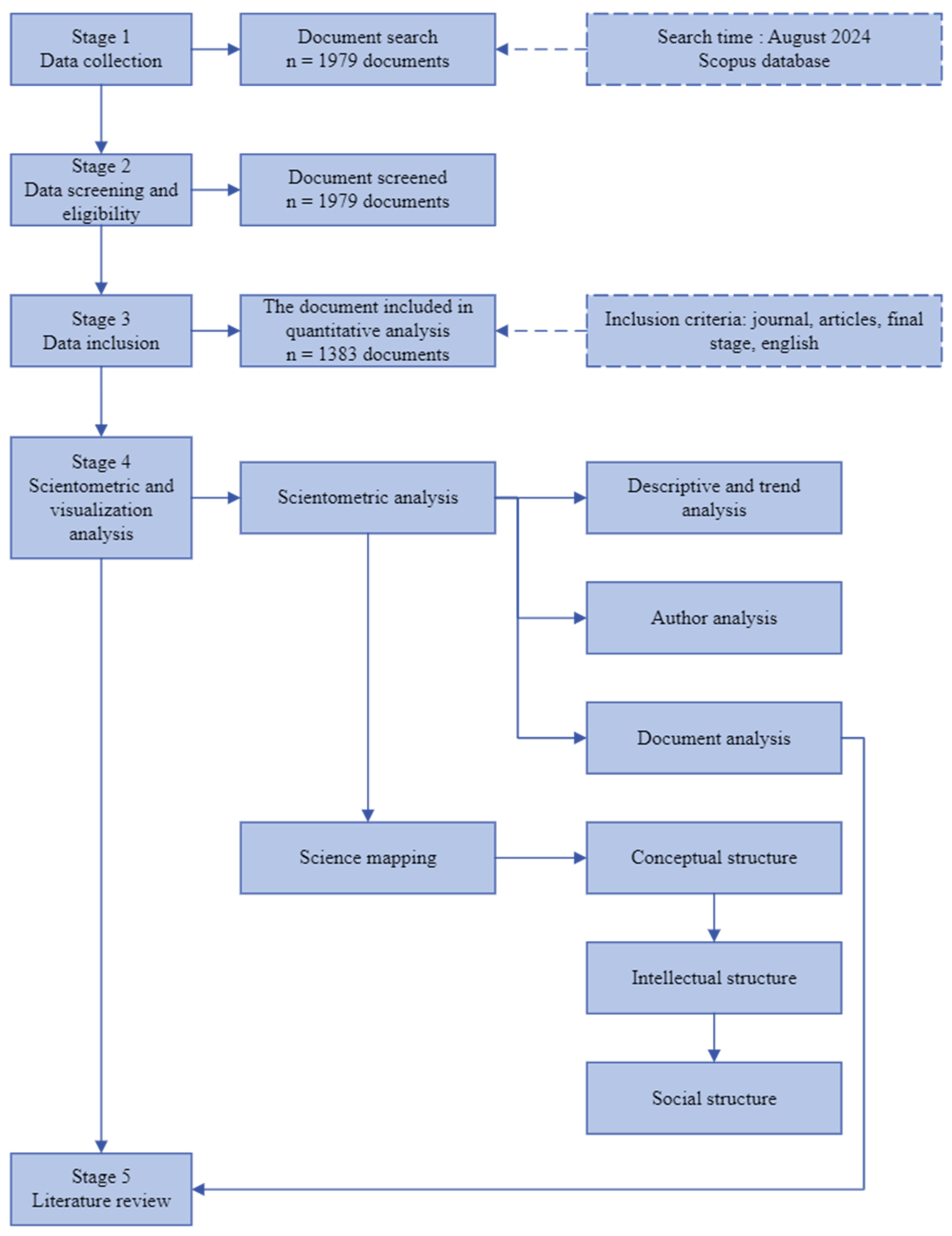

Figure 1 is an illustration of the methodology used in this study.

This study followed the Preferred Reporting Items for Systematic Reviews and Meta-study (PRISMA) criteria to guarantee a fair and open scientometric study. This process had four steps: inclusion, eligibility, screening, and search.

In the first stage, the Scopus database was used because it has wide coverage, reliable citation data, and normalisation features [

47]. So, it was chosen as the determinant of search strings and databases in scientometric research on environmental tax compliance behaviour. From the data collection results, 1979 documents were found.

In the second and third stage, having a publication category in the form of journals, and duplication elimination. The final stage Is the English language, title suitability, abstract, and keywords. The database search using the keywords (TITLE-ABS-KEY ( ‘green tax’ OR ‘eco-tax’ OR ‘ecological tax’ OR ‘carbon tax’ OR ‘pollution tax’ OR ‘sustainability tax’ OR ‘environmental levy’ OR ‘climate tax’ OR ‘resource tax’ OR ‘energy tax’ OR ‘environmental duty’ OR ‘environmental charge’ OR ‘environmental fee’ OR ‘pigovian tax’ OR emissions AND tax) AND TITLE-ABS-KEY ( ABS-KEY ( ‘compliance’ OR ‘response’ OR ‘behaviour’ ) ) AND PUBYEAR > 1999 AND PUBYEAR < 2025 AND ( LIMIT-TO ( DOCTYPE , ‘ar’ ) AND ( LIMIT-TO ( PUBSTAGE , “final” ) AND ( LIMIT-TO ( LANGUAGE , “English” ) AND ( LIMIT-TO ( SRCTYPE , “j” ) ). This search returned 1,383 documents published between 2000 and 2024.

Fourth stage, The programs Biblioshiny and VOSviewer were used for the scientometric analysis. This step included science mapping through co-authorship co-citation network analysis and performance analysis (e.g. citation trends, most influential journals and authors). The main study themes in environmental tax compliance were identified using co-word analysis and thematic evolution to determine the conceptual framework.

4. Results

4.1. Descriptive and Trend Analysis

Bibliometric analysis in this study used 1383 articles from 531 sources with a publication time of 2000 to 2024. In general, the article's topic follows the theme of this research, namely environmental policy, corporate strategy, and regulatory effectiveness in encouraging behavior toward sustainability. The increase in the number of publications on behavior in environmental tax studies every year is 9.025%. The average age of the articles referenced in this study is 6.95 years. On average, each document has been cited 24.19 times; these results indicate that research on this theme is active and has a recognized contribution to the wider literature. In this analysis, the number 6157 shows that research on the theme of behavior in environmental tax is quite broad and covers a variety of diverse perspectives. Author's keywords (DE) indicates the total number of keywords assigned in all the articles analyzed covering a wide range of specific topics and subtopics [

48]; in this study, 3855 keywords were generated, which provided a basis for identifying trends and patterns. The total number of authors who contributed to the analysis of all articles in this study was 3346, and the number of authors who published articles without collaborating with other authors was 231, with a total of 242 articles. On average, each document on the compliance behavior in environmental tax theme was written by about 3 authors. Almost 25% of all documents in this research theme were written by authors from more than one country.

Table 1.

Summary of the descriptive information.

Table 1.

Summary of the descriptive information.

| Description |

Indicator |

Results |

| Main information |

Timespan |

2000:2024 |

| Sources (Journals, Books, etc) |

531 |

| Documents |

1383 |

| Annual Growth Rate % |

9,02 |

| Document Average Age |

6,95 |

| Average citations per doc |

24,19 |

| References |

59915 |

| Document Contents |

Keywords Plus (ID) |

6157 |

| Author's Keywords (DE) |

3855 |

| Authors |

Authors |

3346 |

| Authors of single-authored docs |

231 |

| Author Collaboration |

Single-authored docs |

242 |

| Co-Authors per Doc |

3,03 |

| International co-authorships % |

24,95 |

| Documen types |

Article |

1383 |

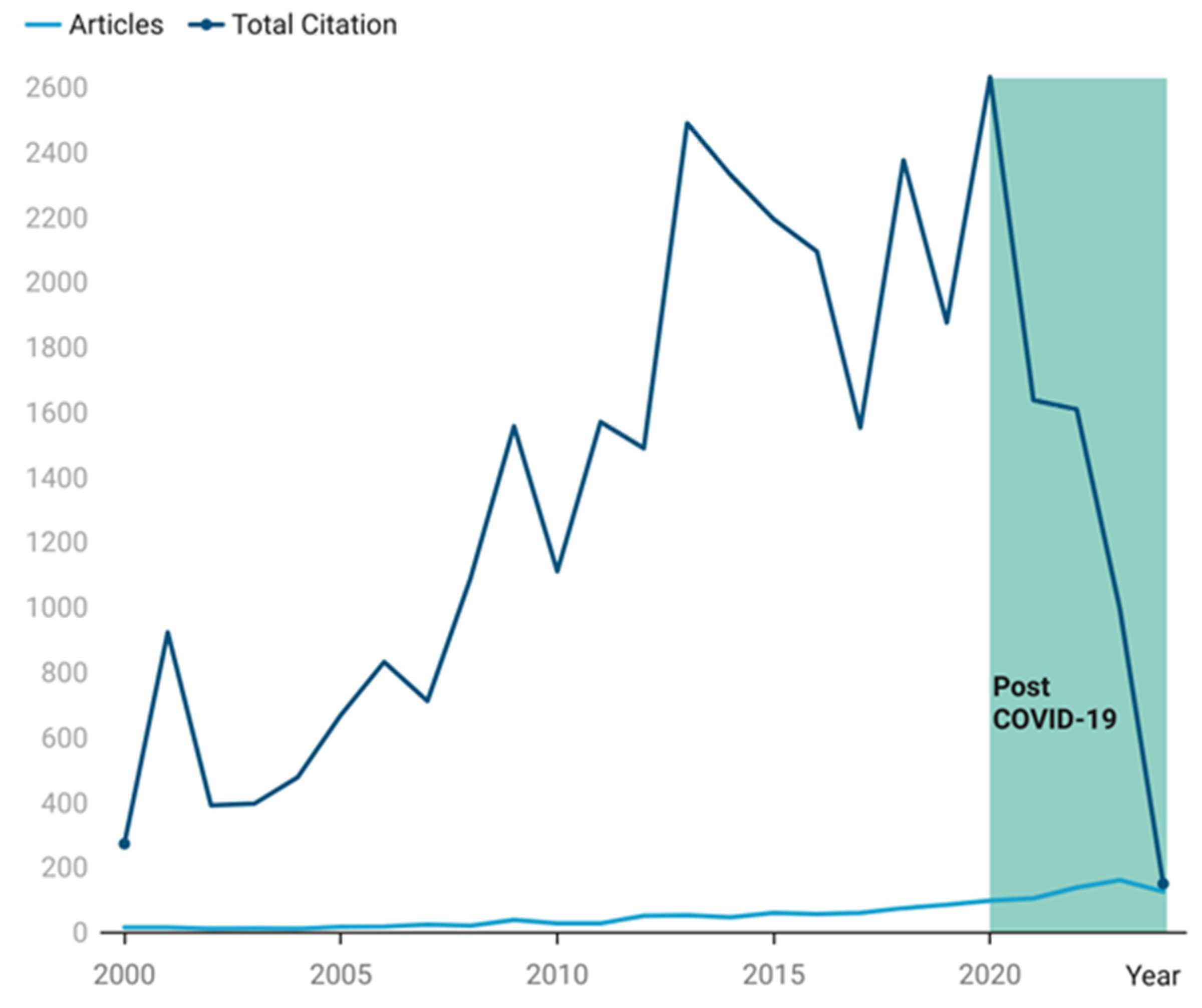

Figure 2 shows the trend of the number of publications and citations over 24 years (2000 - 2024). In the pre-COVID-19 period from 2000 to 2020, there was a significant and consistent increase with some fluctuations until it reached its peak in 2020 (2632 total citations and 99 articles) of total citations and number of articles published. The number of published articles increased significantly from 2021-2023 until the highest number of published articles was 162 in 2023. However, in 2024, there was a decrease in the number of articles published, namely 127. It is inversely proportional to the total citations decreasing after COVID-19 until it reaches its lowest point of 151 citations in 2024. The graph in

Figure 2 shows that although the number of publications increases significantly yearly, the total citations have decreased. There is an urgent need for relevant and influential research that provides a new perspective on environmental tax compliance challenges.

4.2. Source Analysis

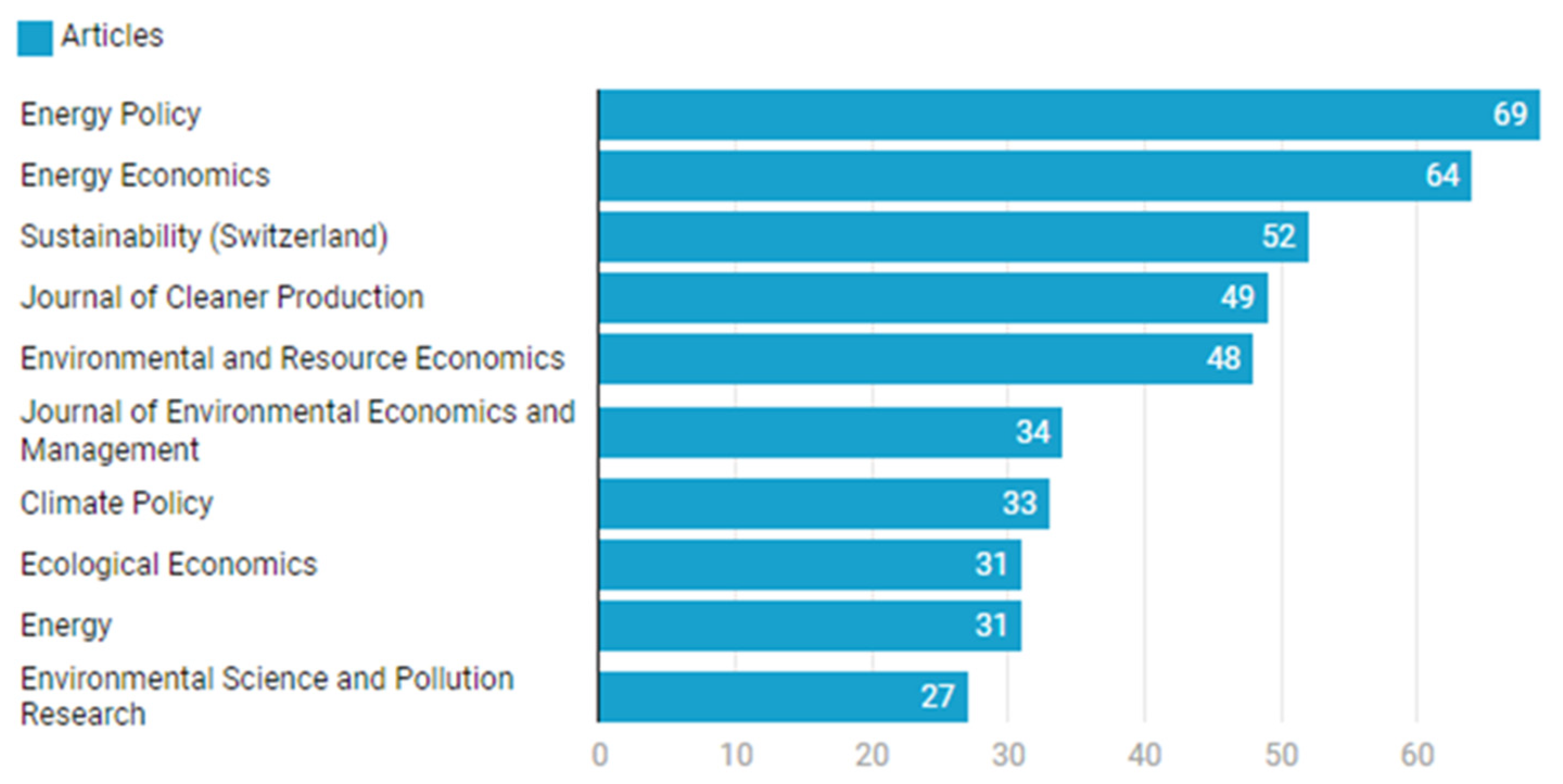

Figure 3 shows the list of journal sources most relevant to the research topic of behavior in environmental tax based on the number of published articles. Energy policy and economics dominate by producing 69 and 64 articles, respectively, where these publishers play a significant role in the analyzed literature. In addition to energy-focused journals, some journals cover sustainability issues [

49]. Published by Sustainability with 52 articles and the Journal of Cleaner with 49 articles, it shows that the research topic has a broad scope. The research also emphasizes economic analysis and environmental resource management, which are critical in understanding the impacts of environmental policies, such as research published in the journal Environmental and Resource Economics (48 articles) and Journal of Environmental Economics and Management (34 articles). The journals Climate Policy (33 articles) and Ecological Economics (31 articles) show that environmental policies, including mitigation and adaptation strategies, are a significant concern in the literature. The journals Energy and Environmental Science and Pollution Research published various aspects of environmental issues, with 31 and 27 articles, respectively. This research focuses on a multidisciplinary approach, including economics, public policy, and sustainability.

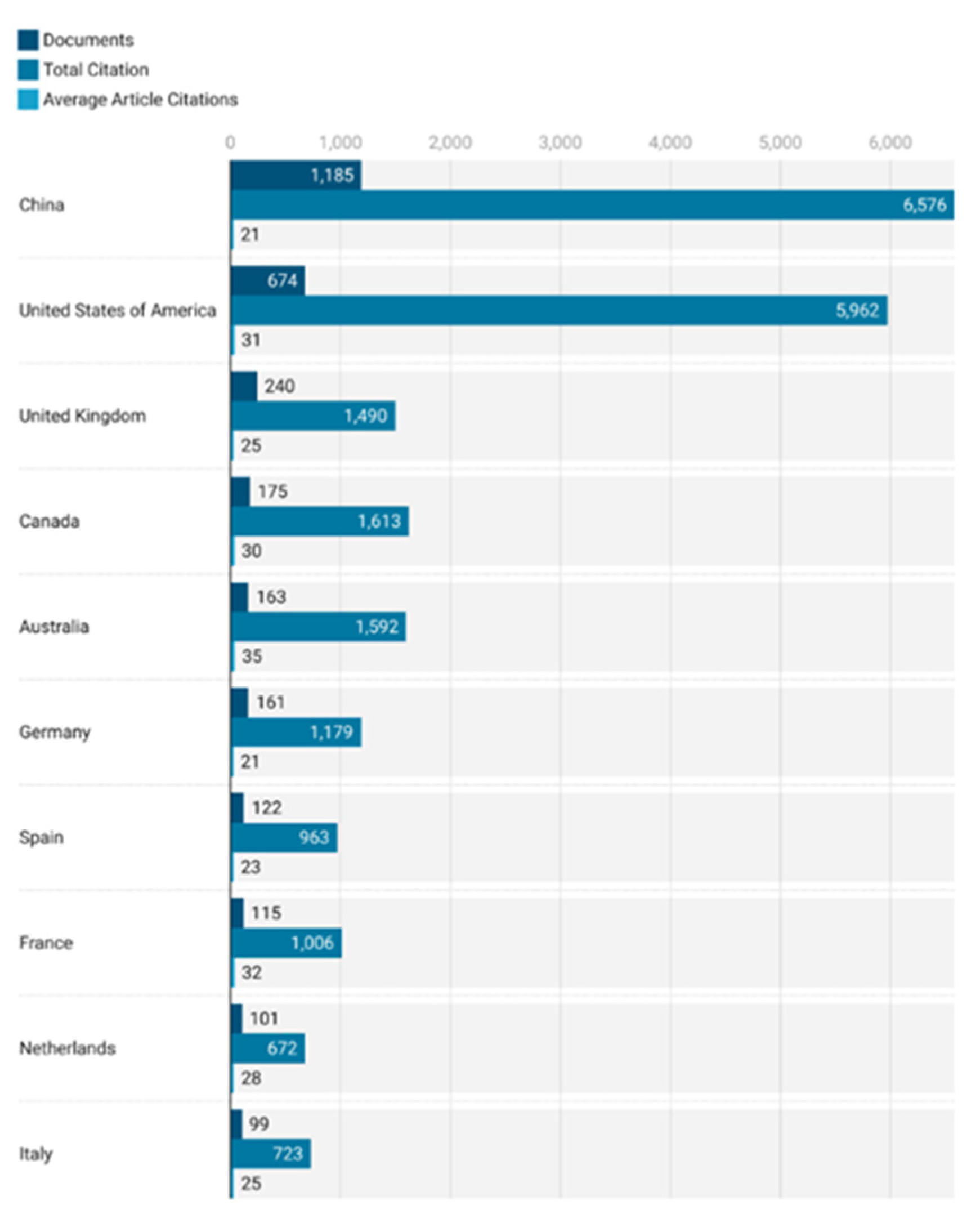

The most cited countries (

Figure 4) show each country's publications' quantity and quality. China's productivity in this research topic is very high, as evidenced by the number of articles published, as many as 1185 documents, followed by the United States with 674 papers. However, this country is still a significant contributor in numbers less than China. Other countries such as the UK (240 articles), Canada (175 articles) and Australia (163 articles) show significant contributions in the number of documents published. China also dominates in research impact based on total citations (6576). However, the United States almost matches the total citations with 5962 citations. In terms of average citations per article, Australia stands out with an average of 35 citations per article, followed by Canada with an average of 30 citations per article, indicating that although there are documents, the articles published in Australia are of high quality and often referenced. Supported by the data in

Table 2, it highlights that although China has many articles, most of the research is conducted nationally, or the SCP is greater than the MCP. In contrast, countries such as Australia and Canada have higher MCP ratios due to international collaborations, which are essential in improving research quality and global relevance.

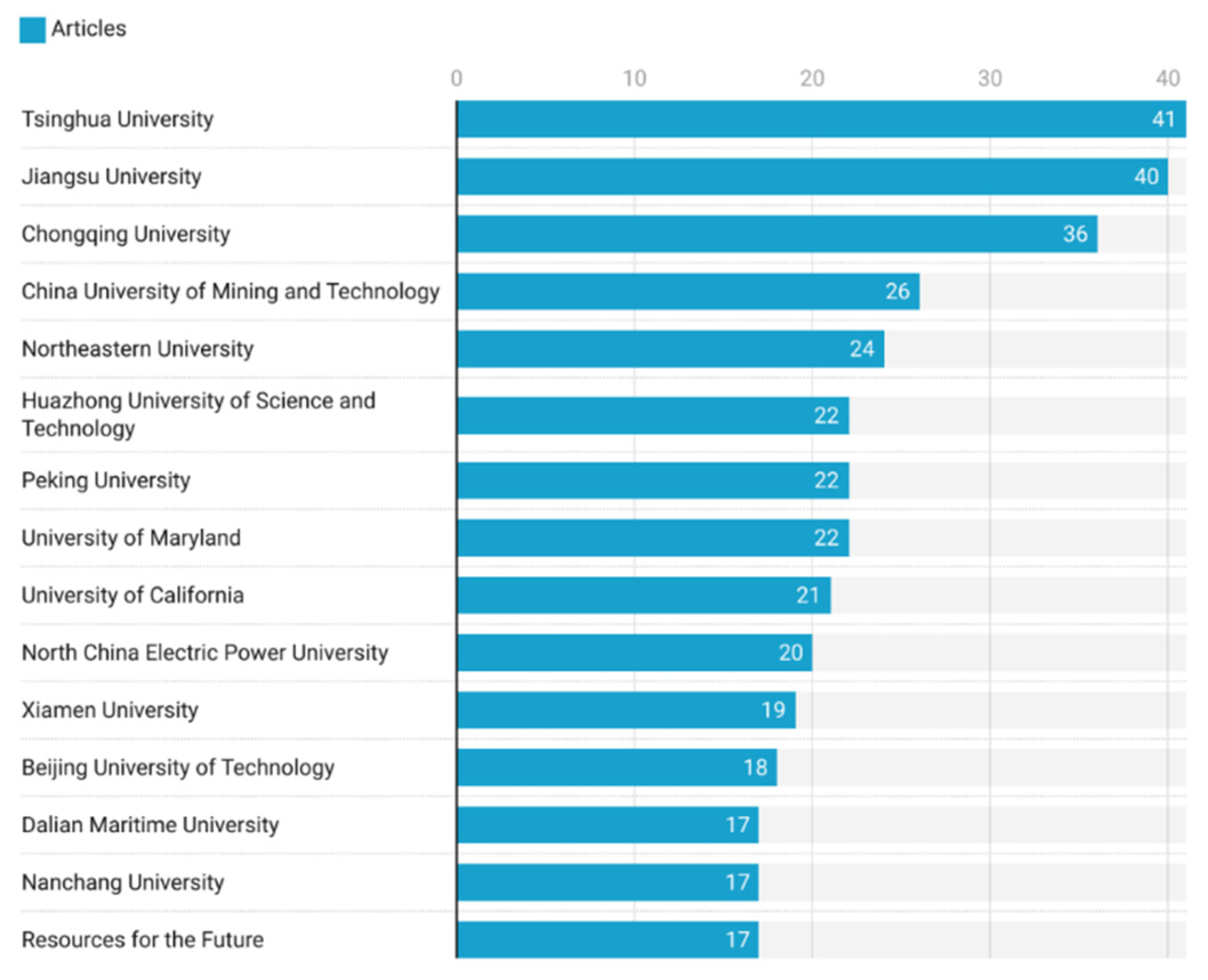

Tsinghua University, Jiangsu University, and Chongqing University are leading institutions in China that dominate in the publication of articles related to environmental tax research topics; China is one of the countries that is very active in formulating environmental policies and involving tax instruments as a way to reduce emissions and improve energy efficiency. Several universities in

Figure 5 are experts in energy technology and policy, such as North China Electric Power University and Huazhong University of Science and Technology that study how environmental taxation can be integrated into the behaviour of companies and society in reducing emissions. Peking University, in seventh place in the number of published articles, focuses on the compliance behaviour of countries with high levels of industrialization. At the same time, the University of Maryland, with the same number of published articles, examines effective policies for encouraging environmentally friendly behaviour in developed countries. Although China dominates, the graph shows significant contributions from institutions in the United States and Europe.

4.3. Author Analysis

The number of cited articles indicates the level of contribution and influence of the authors in their work. It is an essential reference on the topic of behaviour in environmental tax [

50]. Three authors are very influential in the research topic of behaviour in environmental tax with the most article contributions. Among them, the article written by Goulder [

51] has the highest number of citations with 132 articles, in second place Nordhaus [

52] with 118 articles, and followed by B. Lin and Z. Jia [

53] the number of article citations is 112. C. Böhringer and T. F. Rutherford [

54] and C. Fischer and M. Springborn [

55] have 92 citations, followed by Y. Wang, L. Qi, and W. Cui [

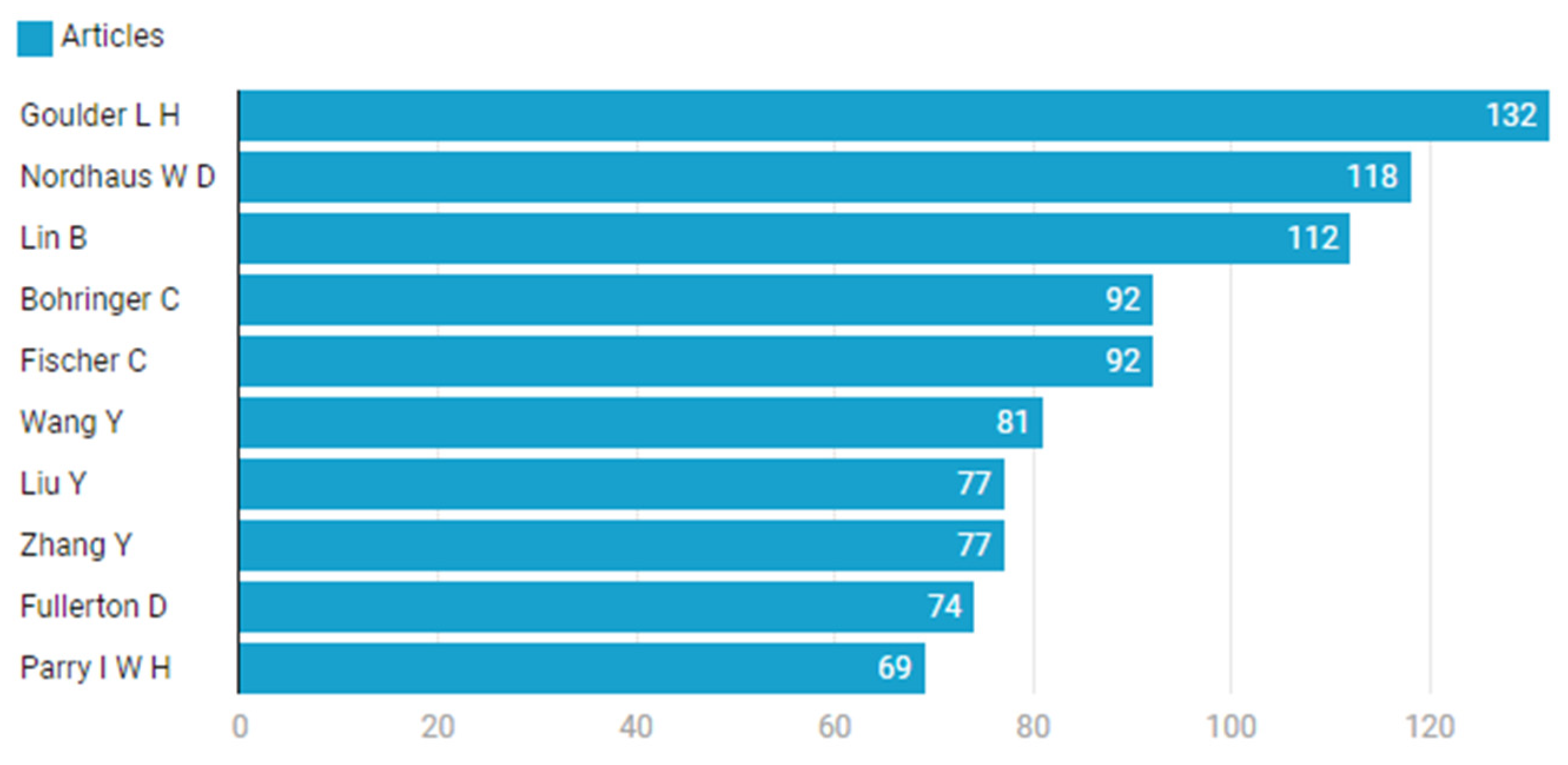

56] with 81. Authors ranked four to ten have a total number of article citations in the range of 69 to 92 articles, which shows a fairly even contribution among these authors.

In

Figure 6 and

Table 3, analysis has different purposes; author impact analysis provides impact and shows each author's relationship. Y. Zhang et al and L. Wang et al [

57,

63] are in the first position with the highest number of publications among other authors, publishing 17 and 9 articles, respectively. The high number of publications does not guarantee that it will impact the number of citations because it is the quality of the article and the relevance to the study. The author impact analysis will generate the h-index, m-index, and g-index values to show an article's many citations. Zhang et al [

57] owns the highest h-index with ten articles and significantly and consistently impacts this topic. In addition, Zhang et al [

57] has the highest g-index with a value of 15, followed by J. Li et al [

59] with 12 articles. The result shows that other authors widely cite articles written by both authors. Z. Li et al [

60] is the author with the fastest impact; in a relatively short time, he obtained an m-index value of 2.333 within two years (2022 to 2024). Y. Chen, T. A. I. I et al [

65] is the author who has the highest number of citations, namely 451; this shows that Y. Chen, T. A. I. I et al [

65]'s writing is very famous and has a broad impact. Author Y. Chen, T. A. I. I et al [

65] started publishing in 2008, and L. Liu and J. Xu [

58] published his articles in 2009.

4.4. Document Analysis

Table 4 shows that a multidisciplinary approach combining policy, technology, circular economy, and risk analysis is critical to understanding environmental tax compliance. Studies by W. Chen and Z. H. Hu [

67] and D. Krass, T. Nedorezov, and A. Ovchinnikov [

68] highlight how tax policies and incentives can influence green technology adoption and government and producer behavior. The important role of green technology in supporting environmental tax policy is evidenced by studies written by M. Binswanger [

69], G. Guandalini, S et al [

70], and S. Pinzi et al [

71]. Research conducted by Y. Geng et al [

72] highlights how the circular economy approach is important in sustainable development policies and resource efficiency. Z. Dai et al [

73] showed the importance of statistical modeling and simulation in understanding environmental risks, especially in compliance with carbon tax policies.

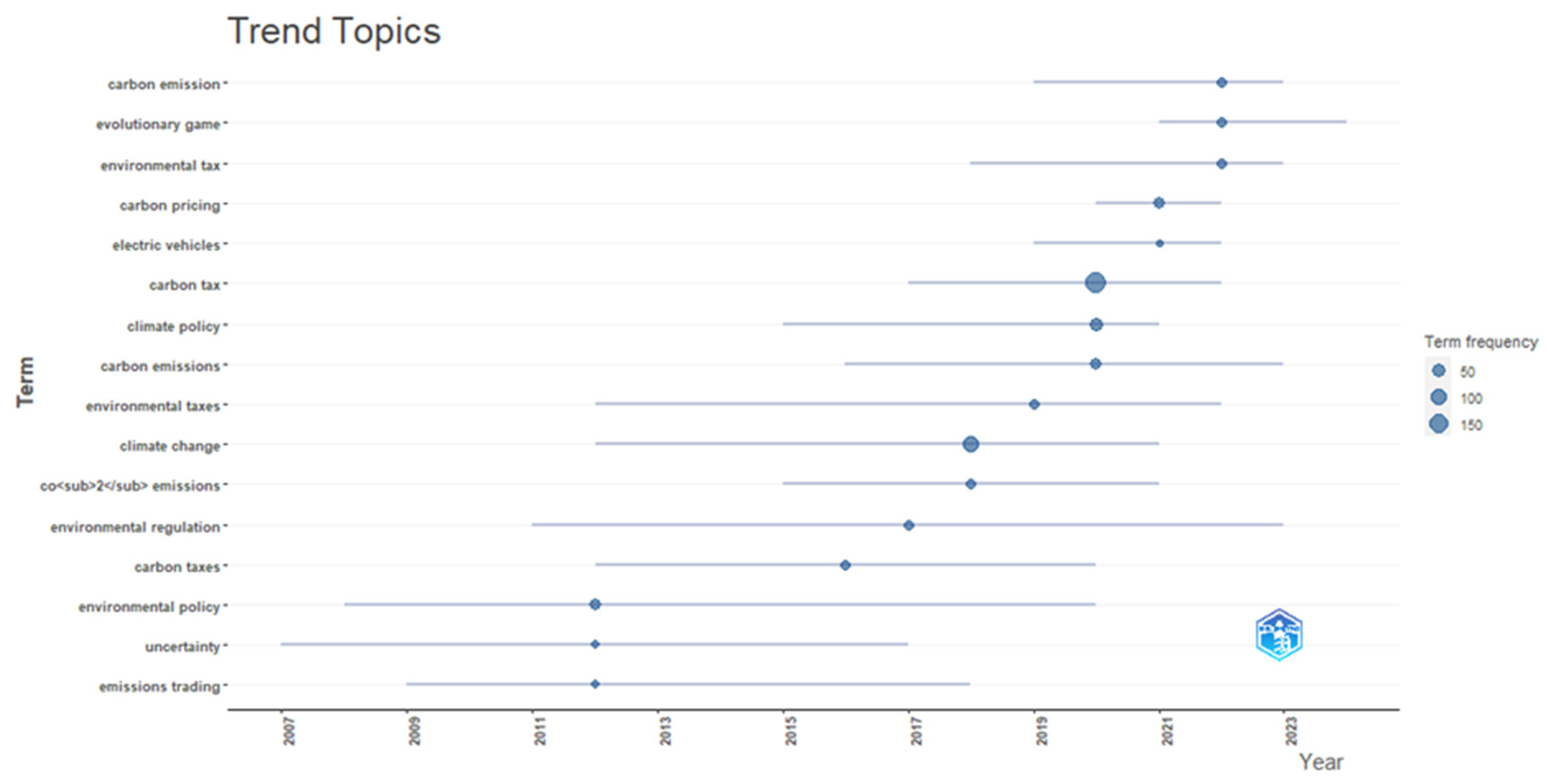

The graph in

Figure 7 shows that issues around carbon emissions, environmental taxes, and climate policy have remained a major research focus over the years. Environmental taxes and carbon taxes were the most discussed topics in 2011. The development of carbon pricing, climate policy, and electric vehicles increased from 2015 to 2023, in line with the growing global environmental concern. Environmental regulation and emissions trading have become frequently discussed in recent years (post-COVID-19), indicating a focus on applicable policy and regulatory mechanisms [

65]. Evolutionary games and uncertainty highlight human behavior in dealing with environmental policies, including ecological tax compliance behavior in 2013 – 2023 [

67]. This research is on a path that is highly relevant to current global issues and can significantly contribute to developing more effective policies in promoting environmental tax compliance.

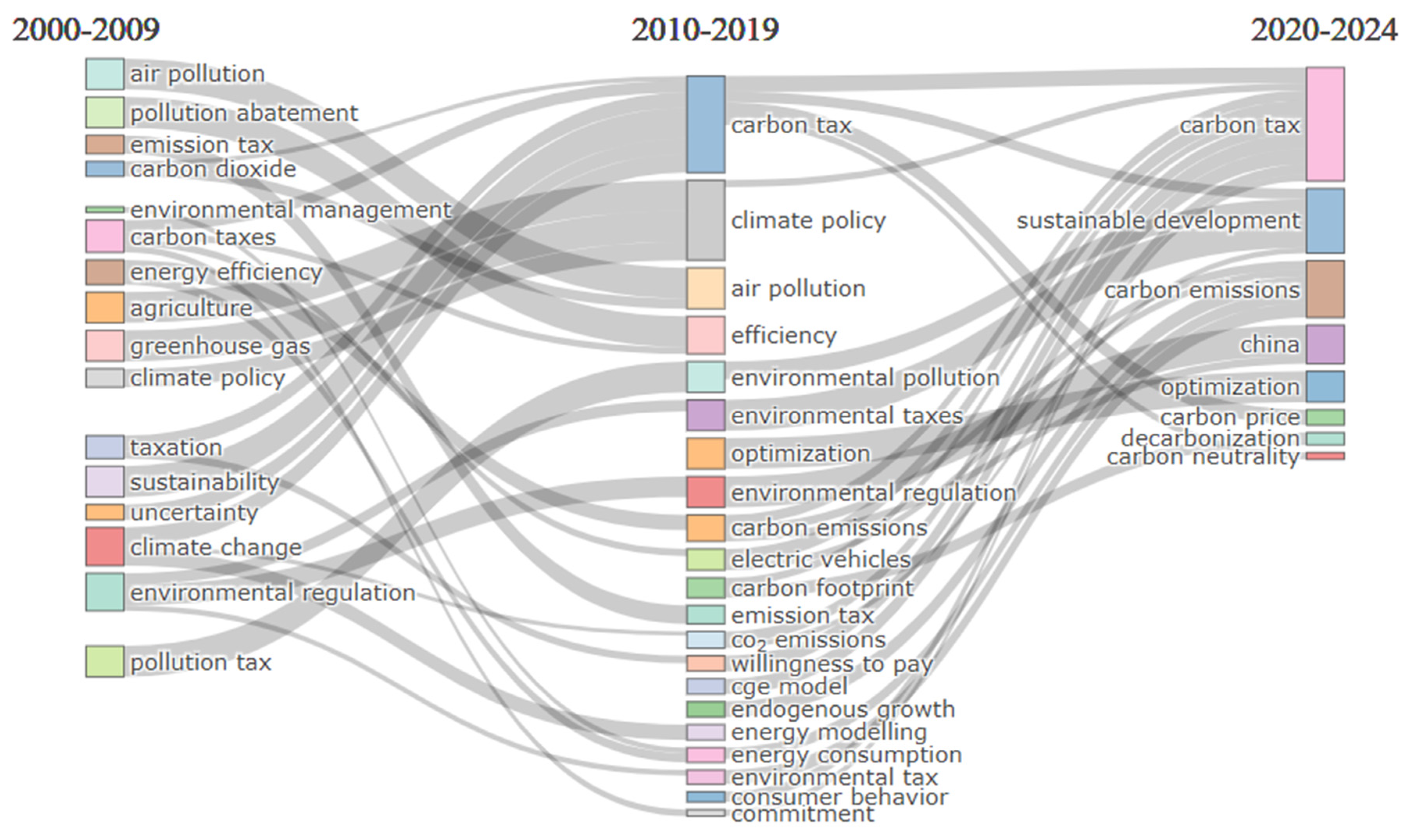

4.5. Conceptual Structure

Figure 8 shows the evolution of research topics from 2000 to 2024. From 2000 to 2009, the focus was on pollution mitigation and basic emission-related regulations, with research topics dominated by air pollution, pollution abatement, carbon taxes, and climate change. Meanwhile, the issues of sustainability and environmental regulation were introduced in this period in the form of a basic policy context. The period from 2010 to 2019 saw a shift, with topics becoming more specific (carbon taxes, environmental taxes, carbon emissions and efficiency). This period saw increased attention on carbon taxation and emission reduction strategies. The focus shifts to the latest trend (2020-2024), which is more complex such as sustainable development, carbon price, decarbonization, and carbon neutrality. This topic shows the integration of environmental policies aimed at long-term sustainability. Commitment and optimality in environmental policy are relevant to this research.

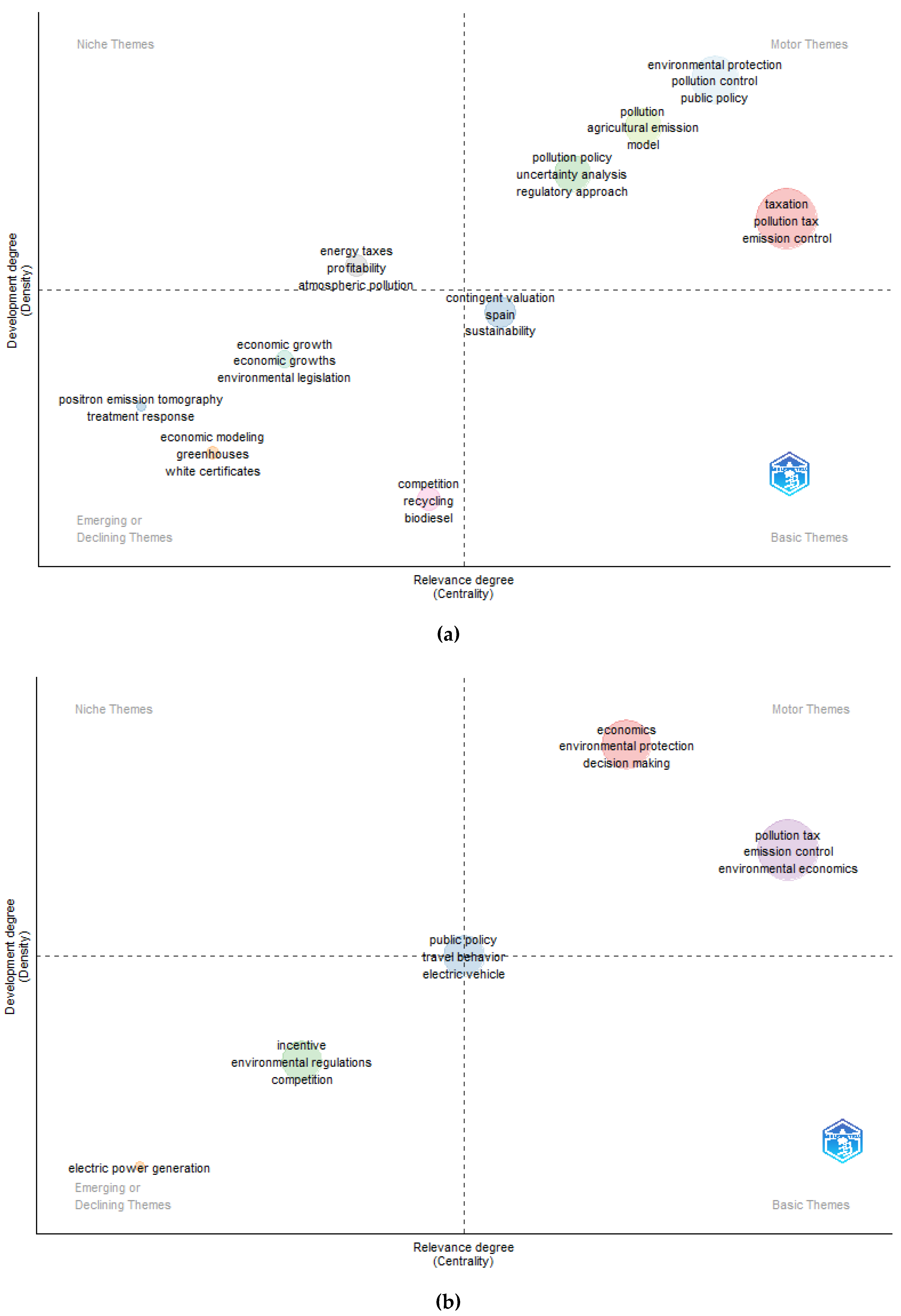

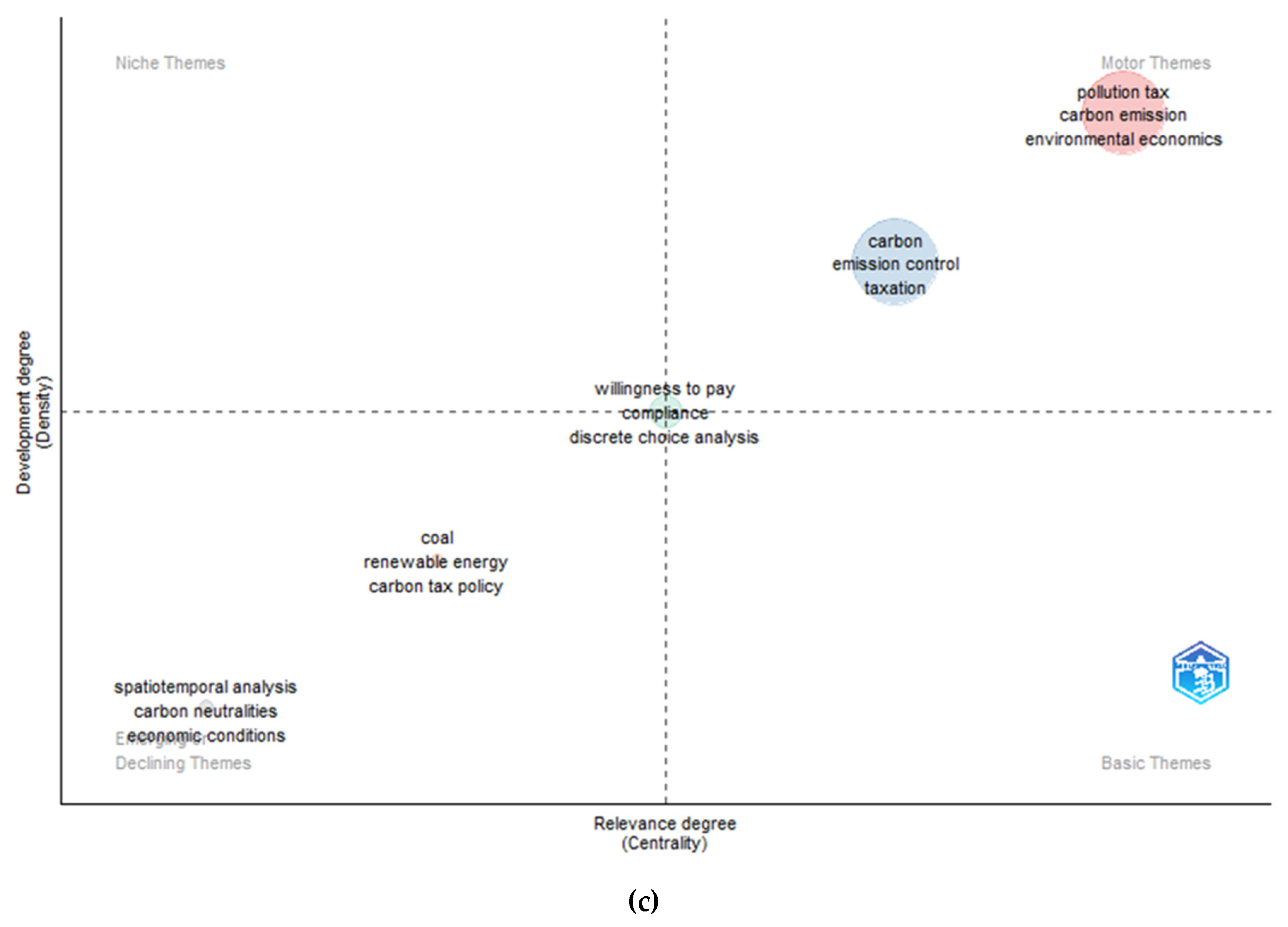

In thematic map analysis, the grouping of research topics is divided into two dimensions, namely density and centrality. Density is used to measure the development of a topic; if a topic has a high density, then the theory, methodology, and application are mature and broad. While centrality measures the relationship between issues in the field of study, high centrality will be the highlight. The thematic map is divided into four quadrants that show themes. The first theme is motor, which is in the top right and has the potential to grow and be highly relevant. The second theme is niche, which is on the top left and has high development and more specific relevance. The third theme is emerging or declining, which is in the bottom left and has less developed topics and low relevance. The fourth theme is basic in the bottom right, with a high level of main relevance but limited topic development [

39,

44].

Studies focusing on environmental protection, pollution control, and public policy were conducted from 2000 to 2010. This period saw increased public awareness of the environment, climate change, and regulation. In motor themes, the topics of environmental protection and pollution control are found, which shows that environmental management and emission control policies are very relevant. Topics that emerged in niche themes included energy taxes and profitability, which showed an effort to explore understanding the economic impact of environmental taxes. The issues of economic growth and environmental legislation show a shift in focus from traditional economic growth to regulation-based pollution control.

In the decade 2010-2020, there was a shift in research topics to be more specific and applicable to fiscal instruments in controlling emissions. In the motor themes section, pollution tax, emission control, and environmental economics dominate, relevant to the increasing international efforts to achieve climate targets through implementing carbon taxes. Niche themes such as economics and decision-making highlight the importance of economic analysis and decision-making in the context of environmental protection. At the same time, basic themes such as public policy and electric vehicles show that public policy is beginning to focus on transportation issues and adopting green technologies.

From 2021 to 2024, many studies have been on taxation, pollution tax, and emission control. The result shows an increasingly clear research direction on concrete strategies to control emissions through tax policies and strict regulations. The emergence of basic themes such as compliance, willingness to pay, and discrete choice analysis shows an increased interest in understanding environmental tax compliance that behavioural factors and individual preferences can influence. The relevance of behavioural research on environmental tax is increasingly apparent, as it shows that psychological and economic factors are key in determining the effectiveness of fiscal policy in the environmental field.

4.6. Intellectual Structure

Coupling authors is one of the tests in intellectual structure analysis. The analysis identifies a study's conceptual structure, domain themes, and topic evolution [

45,

48].

Figure 10 shows a network of frequently used keywords and how ideas and concepts can be interrelated. The colors of the clusters show the grouping of interconnected topics, aiming to identify the main themes and subthemes in the field of study. The size of the nodes represents the frequency of word usage, indicating the most studied concepts in the literature. The lines indicate how often two keywords co-occur on the same topic, thus providing insight into the conceptual relationships between topics [

40,

46]. According to the network structure and the relationship between issues (

Figure 10), the keywords carbon tax and climate change have the largest nodes, indicating that the two topics appear frequently and have a close relationship between the keywords and the visualization center.

The red cluster highlights the issues of carbon tax, carbon emissions, climate change, and sustainable development. These issues indicate a strong relationship between carbon tax policy and climate change mitigation efforts, with links to energy efficiency, carbon pricing, and the economic impact of environmental policies. The green cluster relates to environmental policy, environmental regulation, compliance, and environmental taxes. Environmental policy and regulation are thus important pillars in understanding how compliance levels can be affected by various regulative factors. The blue cluster leads to analytical and theoretical approaches related to evolutionary games, willingness to pay, and carbon leakage. The visualization of

Figure 10 highlights the importance of integrating policy approaches with behavioral analysis and economic theory to understand the dynamics of compliance and policy effectiveness.

4.7. Social Structure

Figure 11 provides a visualization of the influence of global research that conducts collaborative research between countries. China and the United States dominate the research theme of behavior on environmental tax because these countries experience rapid knowledge development (red cluster). In addition, the red cluster shows collaboration from several countries, such as the United States, China, Germany, the United Kingdom, and other European countries. In the green cluster, Asian countries such as Indonesia, India, Pakistan, and other countries are found. Japan, New Zealand, and Africa are found in the blue cluster. South Korea, Belgium, Mexico, Sweden, and Columbia are in the yellow and purple clusters.

5. Discussion

The purpose of analyzing environmental tax compliance behavior is to provide insights so as to formulate sustainable development policies. With increasing public focus on the SDGs, environmental taxes are becoming a tool to mitigate climate change and encourage environmentally friendly economic practices. However, the success of this program is highly dependent on tax compliance. Feelings of fairness, regulatory clarity, and social participation significantly influence it. An increase in publications on environmental taxes indicates academic interest in this area. However, the decline in citation rates post-COVID-19 suggests a gap between studies and applications. This gap has become a concern. There is a need for research that is not only theoretical but also insights that can be applied to address the complexities of environmental taxation in the context of cyberspace [

77,

78].

China and the US dominate the number of citations and publications due to their significant academic, economic, and environmental footprints. Both countries have extensive research infrastructures and want to address environmental challenges by creating innovative policies. Although China has the highest number of publications, Australia and Canada have high research quality and relevance due to their high level of international collaboration. This condition shows that cooperation between countries can lead to high-impact research as studies are prepared to face global challenges. The thematic evolution of research that began in the 2000s on pollution control and behavioral compliance in recent years reflects increasingly complex environmental governance.

A key finding of this research is the central role of perceived fairness and transparency in shaping environmental tax compliance. Economic theory explains that taxpayers will comply if the tax system is fair and rules are transparent and accountable. Public involvement and insight into paying taxes are very important because they can increase the legitimacy of environmental taxes and encourage voluntary compliance. A combination of incentives and enforcement mechanisms is vital in promoting compliance. These approaches help achieve economic and environmental outcomes expected to balance the carrot-and-stick dynamics in policy implementation.

In this study, we highlight the importance of international cooperation in improving research quality and environmental tax policies' effectiveness. In addition, developing an effective environmental tax policy requires a multidisciplinary approach that integrates economic analysis with behavioral science and technology insights. Future research should explore the interdisciplinary nexus, focusing on developing practical and context-specific strategies to improve the implementation and impact of environmental taxes on a global scale.

6. Conclusion

From the results of the analysis, it can be concluded that environmental taxes (carbon and energy) are needed to achieve sustainable development goals and mitigate climate change. Creating success in this policy requires compliance of environmental tax actors because several factors can affect compliance, such as perceptions of fairness, tax knowledge, regulatory quality, and social involvement. This study proves that the number of publications regarding compliance behavior in environmental tax has increased every year but has decreased the number of citations after the COVID-19 pandemic. The results of this analysis indicate that relevant and practical research is needed to overcome the challenges of environmental taxes. Countries such as China and the United States dominate the number of publications and citations, driven by active collaboration across countries.

Following this study, we can make several suggestions regarding policies to improve compliance with environmental taxes. Firstly, since people have perceptions of compliance, fairness and people's perceptions must be considered when designing regulations. This purpose will be achieved by being more transparent, such as educating the public about the purpose and benefits of environmental taxes and including communities, companies, and policymakers in the public consultation process.

In addition, compliance is strengthened by a combination of incentives and law enforcement. In its application, incentives such as subsidies or tax breaks can be given to industries and companies that have implemented environmental taxes, and strict sanctions will be imposed on violators. This approach can balance positive and negative factors, thus encouraging compliant behaviour.

International cooperation is necessary to improve the quality of research and policy implementation. China and the United States have strong research capacity, so they can share knowledge and experience with other countries in formulating and implementing more effective environmental tax policies.

In addition, the development of environmental tax policy needs to use a multidisciplinary approach by integrating technology, economics, and risk analysis to deal with the complexity of policy implementation and evaluate its effectiveness on an ongoing basis. This allows policymakers to respond quickly to challenges and adapt policies to the needs of the field. By applying these approaches, we hope that environmental tax policy can become an effective fiscal instrument and tool to influence behaviour and create more inclusive and participatory sustainable development.

7. Patents

This section is not mandatory but may be added if there are patents resulting from the work reported in this manuscript.

Author Contributions

Conceptualization, S.L.H., A.R., L.I.W., and M.A.N.; methodology, S.S.F; software, L.I.H.; validation, S.L.H., A.R., and L.I.W.; formal analysis, S.L.H; investigation, M.A.N.; resources, S.L.H.; data curation, L.I.H., and S.S.F.; writing—original draft preparation, S.L.H., A.R., L.I.W., L.I.H., M.A.N. and S.S.F.; writing—review and editing, S.L.H., L.I.H., and S.S.F.; visualization, L.I.H.; supervision, S.L.H., A.R., and L.I.W. ; project administration, M.A.N.

Data Availability Statement

The data that support the findings of this study are available on request from the corresponding author. The data are not publicly available due to privacy or ethical restrictions.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- W. Wang, W. Kang, and J. Mu, “Mapping research to the Sustainable Development Goals (SDGs) Mapping research to the Sustainable 1 Development Goals (SDGs) 2,” Res Sq, 2023. [CrossRef]

- Miceikiene, J. Lideikyte, J. Savickiene, and J. Cesnauske, “The Role of Environmental Taxes as a Fiscal Instrument for Mitigation of Environmental Pollution: Lithuanian Case,” European Scientific Journal ESJ, vol. 15, no. 25, Sep. 2019. [CrossRef]

- Zhang, C. F. Zou, W. Luo, and L. Liao, “Effect of environmental tax reform on corporate green technology innovation,” Front Environ Sci, vol. 10, Oct. 2022. [CrossRef]

- Ignat and M. Tache, “Transfer Pricing System of EU Countries: An Analysis in the Context of SDGS,” Transylvanian Review of Administrative Sciences, vol. 2023, no. 70E, pp. 45–66, 2023. [CrossRef]

- Y. H. Yusoff, I. Nadilah, M. Khoirul Anwar, R. A. Yustiansyah, R. H. Utama, and M. Dahlan, “Optimizing the Implementation of Carbon Tax in Reducing the Impact of Environmental Pollution,” Accounting and Finance Research, vol. 13, no. 2, p. 89, Apr. 2024. [CrossRef]

- Bambang Ahmad Indarto and D. A. Ani, “The Role of Green Accounting Through the Implementation of Carbon Taxes as an Instrument for Climate Change Mitigation in Indonesia,” The Accounting Journal of Binaniaga, vol. 8, no. 01, pp. 73–84, Jun. 2023. [CrossRef]

- Chang, A. Farsan, A. Carrillo Pineda, C. Cummis, and C. Weber, “Comment on ‘From the Paris Agreement to corporate climate commitments: Evaluation of seven methods for setting “science-based” emission targets,’” Mar. 01, 2022, IOP Publishing Ltd. [CrossRef]

- M. A. Basic, “Climate Dilemma: Link between Uncertainty and Success,” International Journal of Earth & Environmental Sciences, vol. 1, no. 108, pp. 3–5, 2016.

- Wags Numoipiri Digitemie and Ifeanyi Onyedika Ekemezie, “Assessing the role of carbon pricing in global climate change mitigation strategies,” Magna Scientia Advanced Research and Reviews, vol. 10, no. 2, pp. 022–031, Mar. 2024. [CrossRef]

- Febe Christine, D. F. Hakam, Y. A. Nainggolan, S. K. Wiryono, and L. I. Hakam, “Environmental, Social, and Governance (ESG) Impact on Corporate Financial Strategy of Energy and Utilities Companies,” SSRN, 2024, [Online]. Available: https://ssrn.com/abstract=4728055.

- M. Jakob et al., “How trade policy can support the climate agenda,” Science (1979), vol. 376, no. 6600, pp. 1401–1403, Jun. 2022. [CrossRef]

- M. Wijaya, “Complexity of Tax Aspects in Carbon Tax Implementation,” Jurnal Multidisiplin Madani, vol. 3, no. 12, pp. 2585–2595, Dec. 2023. [CrossRef]

- K. A. Oladimeji, “Impact of Revenue Administration on Revenue Performance in Nigerian Local Governments,” Journal of Techno-Social, vol. 15, no. 2, Dec. 2023. [CrossRef]

- Y. Mohammed Alkali, A. Masud, and A. A. Aliyu, “Mediating role of trust in the relationship between public governance quality and tax compliance,” Bussecon Review of Social Sciences (2687-2285), vol. 3, no. 4, pp. 11–22, Jan. 2022. [CrossRef]

- Van Vuuren et al., “Defining a Sustainable Development Target Space for 2030 and 2050,” 2021.

- Ghazouani, W. Xia, M. Ben Jebli, and U. Shahzad, “Exploring the role of carbon taxation policies on co2 emissions: Contextual evidence from tax implementation and non-implementation european countries,” Sustainability (Switzerland), vol. 12, no. 20, pp. 1–16, Oct. 2020. [CrossRef]

- R. Ulucak, Danish, and Y. Kassouri, “An assessment of the environmental sustainability corridor: Investigating the non-linear effects of environmental taxation on CO2 emissions,” Sustainable Development, vol. 28, no. 4, pp. 1010–1018, Jul. 2020. [CrossRef]

- K. Kuralbayeva, “Environmental Taxation, Employment and Public Spending in Developing Countries,” Environ Resour Econ (Dordr), vol. 72, no. 4, pp. 877–912, Apr. 2019. [CrossRef]

- Q. Zheng, J. Li, and X. Duan, “The Impact of Environmental Tax and R&D Tax Incentives on Green Innovation,” Sustainability (Switzerland), vol. 15, no. 9, May 2023. [CrossRef]

- K. Wang, J. Wang, K. Hubacek, Z. Mi, and Y. M. Wei, “A cost–benefit analysis of the environmental taxation policy in China: A frontier analysis-based environmentally extended input–output optimization method,” J Ind Ecol, vol. 24, no. 3, pp. 564–576, Jun. 2020. [CrossRef]

- S. Boubaker, F. Cheng, J. Liao, and S. Yue, “Environmental Tax Incentives and Corporate Environmental Behaviour: An Unintended Consequence from a Natural Experiment in China,” Europian Financial Management, vol. 30, no. 2, pp. 800–838, 2023. [CrossRef]

- S. de J. L. Pérez and X. Vence, “When harmful tax expenditure prevails over environmental tax: An assessment on the 2014 mexican fiscal reform,” Sustainability (Switzerland), vol. 13, no. 20, Oct. 2021. [CrossRef]

- N. Calvo, L. Varela-Candamio, and I. Novo-Corti, “A dynamic model for construction and demolition (C&D) waste management in Spain: Driving policies based on economic incentives and tax penalties,” Sustainability (Switzerland), vol. 6, no. 1, pp. 416–435, 2014. [CrossRef]

- Hua, C. Liu, J. Chen, C. Yang, and L. Chen, “Promoting construction and demolition waste recycling by using incentive policies in China,” Environmental Science and Pollution Research, vol. 29, no. 35, pp. 53844–53859, Jul. 2022. [CrossRef]

- Y. Song, X. Li, and X. Peng, “The Unintended Energy Efficiency Gain from Tax Incentives for Investment: Micro-Evidence from Quasi-Natural Experiments in China,” Rev Dev Econ, vol. 28, no. 1, pp. 310–338, 2023.

- R. Gerlagh, S. Kverndokk, and K. E. Rosendahl, “Optimal Timing of Climate Change Policy: Interaction Between Carbon Taxes and Innovation Externalities,” Environ Resour Econ (Dordr), vol. 43, no. 3, pp. 369–390, 2009. [CrossRef]

- C. Huang, H. Zhou, W. A. Norhayati, A. J. R. Saad, and X. Zhang, “Tax Incentives, Common Institutional Ownership, and Corporate ESG Performance,” Managerial and Decision Economics, vol. 45, no. 4, pp. 2516–2528, 2024. [CrossRef]

- B. Xu, “How to Efficiently Reduce the Carbon Intensity of the Heavy Industry in China? Using Quantile Regression Approach,” Int J Environ Res Public Health, vol. 19, no. 19, Oct. 2022. [CrossRef]

- Oladipo, T. Nwanji, D. Eluyela, B. Godo, and A. Adegboyegun, “Impact of tax fairness and tax knowledge on tax compliance behavior of listed manufacturing companies in Nigeria,” Problems and Perspectives in Management, vol. 20, no. 1, pp. 41–48, 2022. [CrossRef]

- S. A. Bin-Nashwan, A. M. Al-Hamedi, M. Marimuthu, and A. Ramadhan, “Study on system fairness dimensions and tax compliance in the Middle East context,” Problems and Perspectives in Management, vol. 18, no. 1, pp. 181–191, Mar. 2020. [CrossRef]

- M. Markonah and S. Manrejo, “Tax Compliance Model Based on Planned Behavior of Taxpayers Mediating Intention to Pay Taxes,” International Journal of Applied Economics, Finance and Accounting, vol. 14, no. 1, pp. 60–66, Aug. 2022. [CrossRef]

- H. Hikmah, P. H. Adi, S. Supramono, and T. W. Damayanti, “The Nexus Between Attitude, Social Norms, Intention to Comply, Financial Performance, Mental Accounting and Tax Compliance Behavior,” Asian Economic and Financial Review, vol. 11, no. 12, pp. 938–949, Nov. 2021. [CrossRef]

- Mas’ud, R. Yusuf, N. M. Udin, and R. Al-Dhamari, “Enforce environmental tax compliance model for the oil and gas industry,” International Journal of Energy Sector Management, vol. 14, no. 6, pp. 1073–1088, Jan. 2020. [CrossRef]

- Albert and R. A. Fadjarenie, “Early tax education: Could it change the future compliance behavior?,” International Journal of Evaluation and Research in Education, vol. 11, no. 4, pp. 1912–1922, Dec. 2022. [CrossRef]

- Trisna Yudi Asri and I. N. Angga Prabawa, “The Effect of Faith in The Law of Karma in The Relationship Between Tax Digitalization and Taxpayer Compliance of MSME Owners,” International Journal of Management Studies and Social Science Research, vol. 05, no. 04, pp. 88–97, 2023. [CrossRef]

- J. M. Wang, P. C. Liao, and G. B. Yu, “The mediating role of job competence between safety participation and behavioral compliance,” Int J Environ Res Public Health, vol. 18, no. 11, Jun. 2021. [CrossRef]

- S. J. Stratton, “Literature Reviews: Methods and Applications,” Aug. 01, 2019, Cambridge University Press. [CrossRef]

- H. Sucharew and M. Macaluso, “Methods for research evidence synthesis: The scoping review approach,” Jul. 01, 2019, Frontline Medical Communications. [CrossRef]

- L. Barbu, A. Horobeț, L. Belașcu, and A. G. Ilie, “Approaches to Tax Evasion: A Bibliometric and Mapping Analysis of Web of Science Indexed Studies,” Journal of Business Economics and Management, vol. 25, no. 1, pp. 1–20, Jan. 2024. [CrossRef]

- Y. K. Hong, Z. Y. Wang, and J. Y. Cho, “Global Research Trends on Smart Homes for Older Adults: Bibliometric and Scientometric Analyses,” Int J Environ Res Public Health, vol. 19, no. 22, Nov. 2022. [CrossRef]

- L. I. Hakam, E. Ahman, D. Disman, H. Mulyadi, and D. F. Hakam, “Exploring Trends in Innovation within Digital Economy Research: A Scientometric Analysis,” Economies, vol. 11, no. 11, p. 269, Nov. 2023. [CrossRef]

- M. Binti Ibrahim and A. Susilo Jahja, “A Scholarly Examination of Tax Compliance: A Bibliometric Analysis (1960-2021),” Journal of Indonesian Economy and Business, vol. 37, no. 1, pp. 52–72, 2022, [Online]. Available: https://journal.ugm.ac.id/v3/jieb.

- M. Qasim, “Sustainability and Wellbeing: A Scientometric and Bibliometric Review of The Literature,” J Econ Surv, vol. 31, no. 4, pp. 1035–1061, Sep. 2017. [CrossRef]

- V. Aryadoust, “Bibliometrics and scientometrics in applied linguistics: Epilogue to the special issue,” Studies in Second Language Learning and Teaching, vol. 13, no. 4, pp. 925–933, Dec. 2023. [CrossRef]

- J. Borgohain, M. K. Verma, and S. C. Daud, “Scientometric profile of fisheries research in saarc countrie,” DESIDOC Journal of Library and Information Technology, vol. 41, no. 6, pp. 429–437, 2021. [CrossRef]

- P. Waila, V. K. Singh, and M. K. Singh, “A Scientometric Analysis of Research in Recommender Systems,” Journal of Scientometric Research, vol. 5, no. 1, pp. 71–84, Apr. 2016. [CrossRef]

- M. Thelwall, “The influence of highly cited papers on field normalised indicators,” Scientometrics, vol. 118, no. 2, pp. 519–537, 2019. [CrossRef]

- Passas, “Bibliometric Analysis: The Main Steps,” Encyclopedia, vol. 4, no. 2, pp. 1014–1025, Jun. 2024. [CrossRef]

- D. F. Hakam et al., “Analyzing Current Trends in Career Choices and Employer Branding from the Perspective of Millennials within the Indonesian Energy Sector,” Energies , vol. 17, no. 11, Jun. 2024. [CrossRef]

- R. Ullah, S. Adnan, and A. S. Afzal, “Top-Cited Articles from Dental Education Journals, 2009 to 2018: A Bibliometric Analysis,” J Dent Educ, vol. 83, no. 12, pp. 1382–1391, Dec. 2019. [CrossRef]

- L. H. Goulder, “Mitigating the Adverse Impacts of CO2 Abatement Policies on Energy-Intensive Industries Mitigating the Adverse Impacts of CO 2 Abatement Policies on Energy-Intensive Industries,” AgEcon Search, pp. 02–22, 2002.

- W. Nordhaus, A Question of Balance Weighing the Options on Global Warming Policies. New Haven & London: Yale University Press, 2008.

- Lin and Z. Jia, “The energy, environmental and economic impacts of carbon tax rate and taxation industry: A CGE based study in China,” Energy, vol. 159, pp. 558–568, Sep. 2018. [CrossRef]

- Böhringer and T. F. Rutherford, “Integrated assessment of energy policies: Decomposing top-down and bottom-up,” J Econ Dyn Control, vol. 33, no. 9, pp. 1648–1661, 2009. [CrossRef]

- Fischer and M. Springborn, “Emissions targets and the real business cycle: Intensity targets versus caps or taxes,” J Environ Econ Manage, vol. 62, no. 3, pp. 352–366, 2011. [CrossRef]

- Y. Wang, L. Qi, and W. Cui, “Analysis of Multi-Stakeholder Behavioral Strategies in the Construction and Demolition Waste Recycling Industry through an Evolutionary Game Theory,” Buildings, vol. 14, no. 5, May 2024. [CrossRef]

- Y. Zhang, S. Fu, F. Ma, and B. Miao, “The complexity analysis of decision-making for horizontal fresh supply chains under a trade-off between fresh-keeping and carbon emission reduction,” Chaos Solitons Fractals, vol. 183, p. 114893, 2024. [CrossRef]

- L. Liu and J. Xu, “Multi-objective generation scheduling towards grid-connected hydro–solar–wind power system based the coordination of economy, management, society, environment: A case study from China,” International Journal of Electrical Power & Energy Systems, vol. 142, p. 108210, 2022. [CrossRef]

- J. Li, W. Du, F. Yang, and G. Hua, “The carbon subsidy analysis in remanufacturing closed-loop supply chain,” Sustainability (Switzerland), vol. 6, no. 6, pp. 3861–3877, 2014. [CrossRef]

- Z. Li et al., “Applications and technological challenges for heat recovery, storage and utilisation with latent thermal energy storage,” Appl Energy, vol. 283, Feb. 2021. [CrossRef]

- J. Zhang et al., “Climate change mitigation in energy-dependent regions—A carbon tax-based cross-system bi-layer model with equilibrium-optimization superposition effects,” Resour Conserv Recycl, vol. 200, Jan. 2024. [CrossRef]

- Y. Liu and Y. Yang, “Empirical examination of users’ adoption of the sharing economy in China using an expanded technology acceptance model,” Sustainability (Switzerland), vol. 10, no. 4, Apr. 2018. [CrossRef]

- L. Wang, P. Ma, Y. Song, and M. Zhang, “How does environmental tax affect enterprises’ total factor productivity? Evidence from the reform of environmental fee-to-tax in China,” J Clean Prod, vol. 413, p. 137441, 2023. [CrossRef]

- Alberini, L. Bezhanishvili, and M. Ščasný, “‘Wild’ tariff schemes: Evidence from the Republic of Georgia,” Energy Econ, vol. 110, p. 106030, 2022. [CrossRef]

- Y. Chen, T. A. I. I. Adams, and P. I. Barton, “Optimal Design and Operation of Flexible Energy Polygeneration Systems,” Ind Eng Chem Res, vol. 50, no. 8, pp. 4553–4566, Apr. 2021. [CrossRef]

- Z. Chen, J. Guo, and P. Nie, “Tax scheme for agricultural technology innovation incentive,” Paddy and Water Environment, vol. 21, no. 3, pp. 343–352, 2023. [CrossRef]

- W. Chen and Z. H. Hu, “Using evolutionary game theory to study governments and manufacturers’ behavioral strategies under various carbon taxes and subsidies,” J Clean Prod, vol. 201, pp. 123–141, Nov. 2018. [CrossRef]

- Krass, T. Nedorezov, and A. Ovchinnikov, “Environmental taxes and the choice of green technology,” Prod Oper Manag, vol. 22, no. 5, pp. 1035–1055, Sep. 2013. [CrossRef]

- M. Binswanger, “Technological progress and sustainable development: what about the rebound effect?,” 2001. [Online]. Available: www.elsevier.com/locate/ecolecon*Fax:+41-71-2242722.

- Guandalini, S. Campanari, and M. C. Romano, “Power-to-gas plants and gas turbines for improved wind energy dispatchability: Energy and economic assessment,” Appl Energy, vol. 147, pp. 117–130, Jun. 2015. [CrossRef]

- S. Pinzi, I. L. Garcia, F. J. Lopez-Gimenez, M. D. L. DeCastro, G. Dorado, and M. P. Dorado, “The ideal vegetable oil-based biodiesel composition: A review of social, economical and technical implications,” Energy and Fuels, vol. 23, no. 5, pp. 2325–2341, May 2009. [CrossRef]

- Y. Geng, Q. Zhu, B. Doberstein, and T. Fujita, “Implementing China’s circular economy concept at the regional level: A review of progress in Dalian, China,” Waste Management, vol. 29, no. 2, pp. 996–1002, Feb. 2009. [CrossRef]

- Z. Dai et al., “CO2 Accounting and Risk Analysis for CO2 Sequestration at Enhanced Oil Recovery Sites,” Environ Sci Technol, vol. 50, no. 14, pp. 7546–7554, Jul. 2016. [CrossRef]

- M. M. V. Leme, M. H. Rocha, E. E. S. Lora, O. J. Venturini, B. M. Lopes, and C. H. Ferreira, “Techno-economic analysis and environmental impact assessment of energy recovery from Municipal Solid Waste (MSW) in Brazil,” Resour Conserv Recycl, vol. 87, pp. 8–20, 2014. [CrossRef]

- D. J. Hardisty, E. J. Johnson, and E. U. Weber, “A dirty word or a dirty world? attribute framing, political affiliation, and query theory,” Psychol Sci, vol. 21, no. 1, pp. 86–92, 2010. [CrossRef]

- J. Seifert, M. Uhrig-Homburg, and M. Wagner, “Dynamic behavior of CO2 spot prices,” J Environ Econ Manage, vol. 56, no. 2, pp. 180–194, 2008. [CrossRef]

- Rahayu, M. Saparudin, and R. Hurriyati, “Factors Influencing Online Purchase Intention: The Mediating Role of Customer Trust (a Study Among University Students in Jakarta),” Advance in Economics, Business and Management Research, vol. 117, 2020.

- Savitri, R. Hurriyati, L. A. Wibowo, and H. Hendrayati, “The role of social media marketing and brand image on smartphone purchase intention,” International Journal of Data and Network Science, vol. 6, no. 1, pp. 185–192, Dec. 2021. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).