Submitted:

28 August 2024

Posted:

29 August 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Literature Review

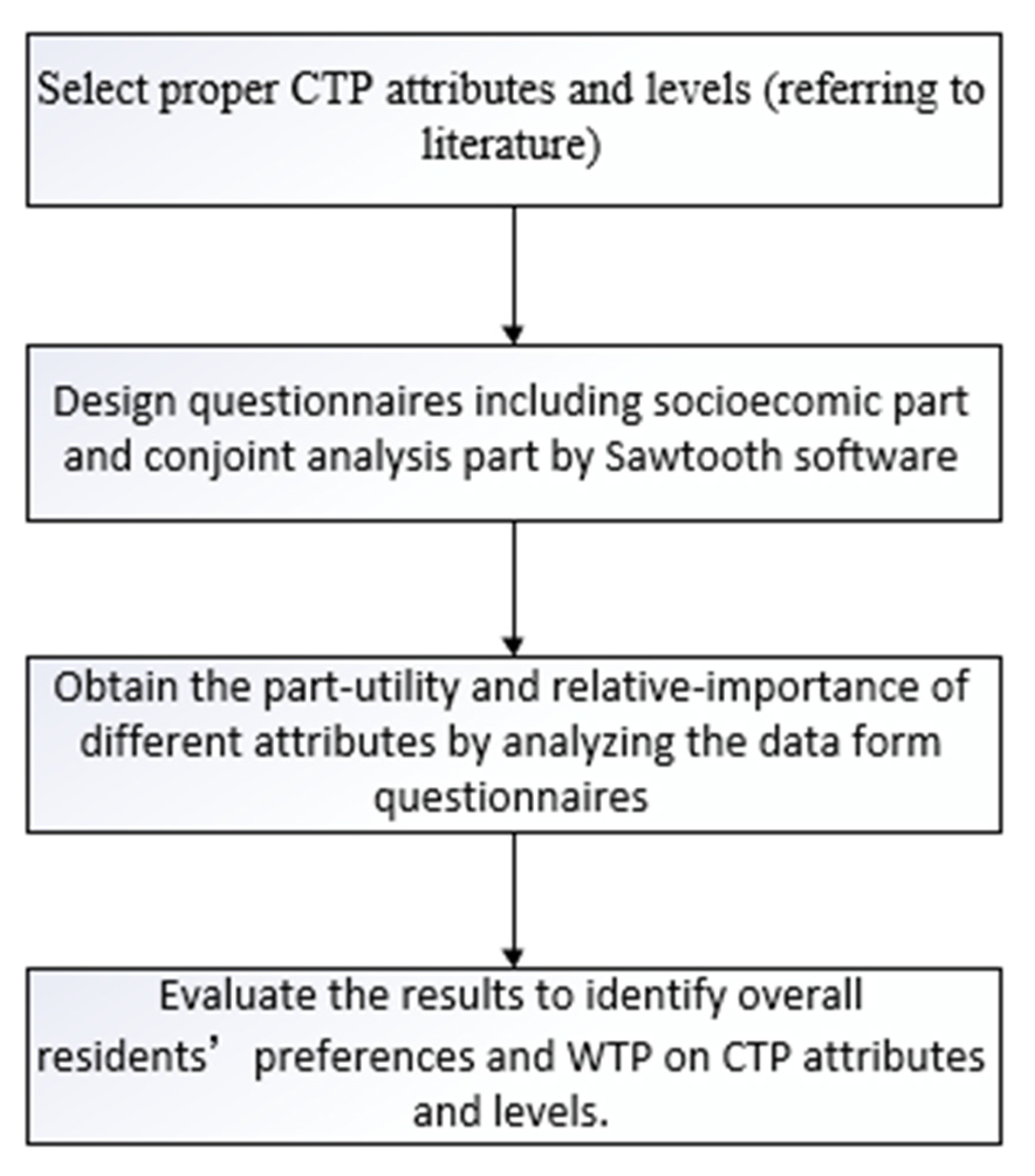

3. Methodology

3.1. Conjoint analysis method

3.2. Sampling process

3.3. Experimental process design

| Attributes | Levels |

| Use of carbon tax revenue | General tax budget |

| Subsidies/grants for clean energy technology | |

| Subsidies/grants for low-carbon technologies or CCUS | |

| Carbon tax policy implementers | Bank |

| Energy Supplier | |

| Government | |

| Transparency of carbon tax policy implementation process | No process report |

| Report regularly on the official website | |

| Regularly report on the official website under the supervision of an independent third party | |

| Cost of carbon tax (CNY) | 150 |

| 350 | |

| 700 | |

| 1200 | |

| 2000 |

3.4. Mathematical model & Data processing

4. Results and discussions

4.1. Socioeconomic characteristics of respondents

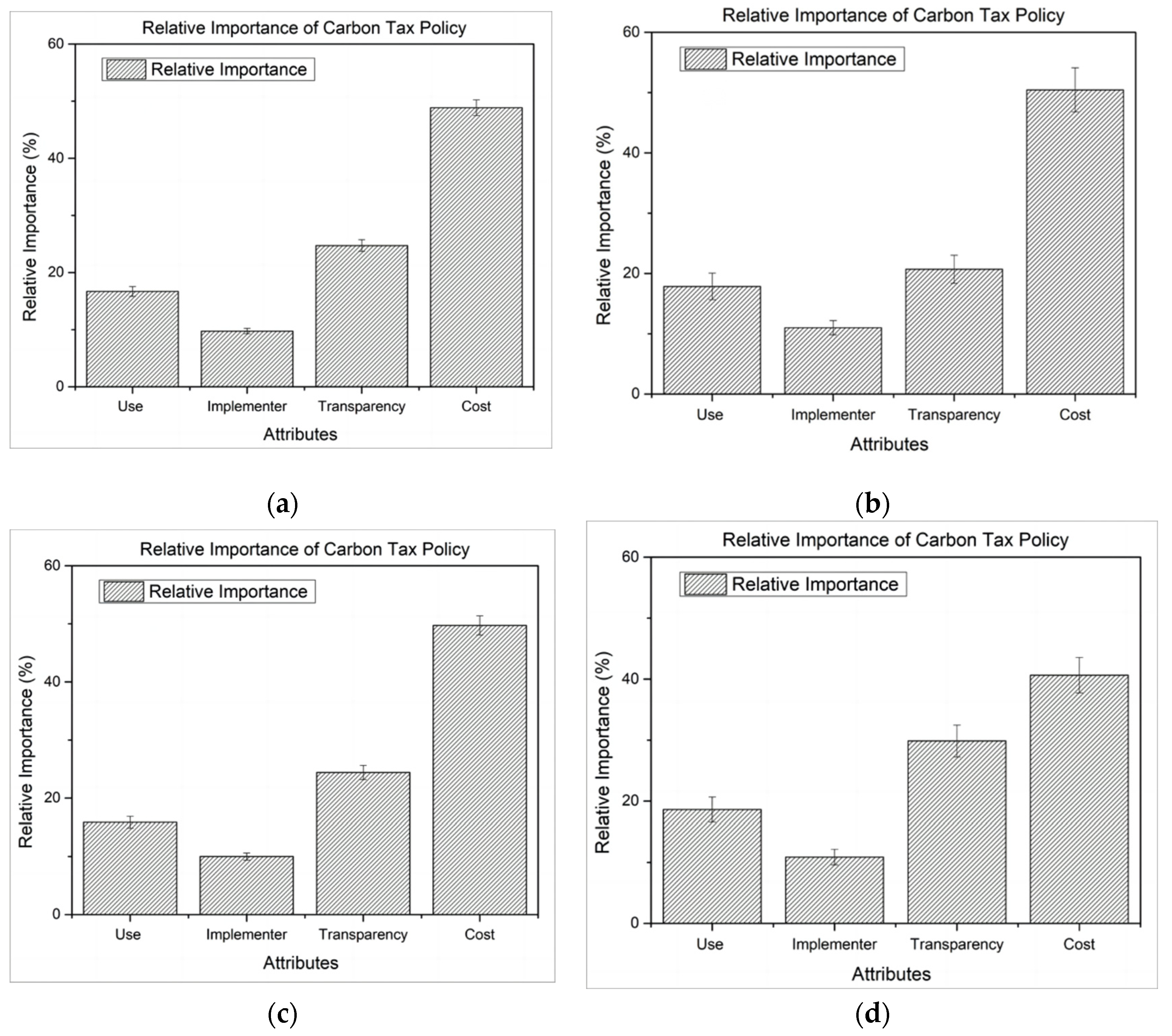

4.2. Relative Importance

4.3. Willingness to pay for CTP

| Attributes | Levels | Willingness to pay | |||

| Understanding of carbon tax (CNY) | |||||

| None | Some | Clear | |||

| Use of carbon tax revenue | General tax budget | 0 | 0 | 0 | |

| Subsidies/grants for clean energy technology | 442.13 | 455.66 | 979.07 | ||

| Subsidies/grants for low-carbon technologies or CCUS | 342.12 | 554.78 | 1749.54 | ||

| Carbon tax policy implementers | Bank | 0.00 | 0.00 | 0.00 | |

| Energy Supplier | 123.40 | 158.68 | 86.41 | ||

| Government | 335.19 | 420.21 | 478.93 | ||

| Transparency of carbon tax policy implementation process | No process report | 0.00 | 0.00 | 0.00 | |

| Report regularly on the official website | 850.72 | 1010.37 | 2847.26 | ||

| Regularly report on the official website under the supervision of an independent third party | 1122.91 | 1342.81 | 3597.32 | ||

| Total | Mean | 1072.16 | 1314.17 | 3246.18 | |

5. Conclusion a5. 5.Conclusion and Suggestions

Conflicts of Interest

Appendix A

- Sociodemographic characteristics part.

- 1.Gender: Female,Male

- 2.Age:16-30,31-45,46-60,>60

- 3.Marriage:married, single

- 4.Education level:Middle School, High School,Bachelor’s degree,Above bachelor’s degree

- 5.Number of family members: 1, 2, 3, 4, 5, 6, >6

- 6.Residence: Urban, Rural

- 7.Family disposable income per year (CNY): 0-30000, 30000-50000, 50000-100000, 100000-200000, >200000, Inconvenient

- 8.Annual electricity consumption: 0-1000, 1000-2500, 2500-5000, >5000

- 9.Annual gas consumption: 0-800, 800-1500, 1500-3000, >3000

- 10.Annual gasoline consumption: 0-2500, 2500-5000, 5000-10000, >10000

- 11.How to Consider the Impact of Climate Change on Your Life: None, little, some, huge.

- 12.How to evaluate your understanding on carbon tax: None, some, clearly.

- A explanation of policy attributes and classification is as follows:

- The purpose of Use of carbon tax revenue: 1. General tax budget (the income treasury is redistributed according to the will of the state)

- 2. Subsidies/grants for clean energy technology (to encourage the development of new technologies for low carbon dioxide emissions and new bases for absorbing and storing carbon dioxide in the air)

- 3. Subsidies/grants for low-carbon technologies or CCUS (encourage the development of new energy technologies that do not emit carbon dioxide and other pollutants)

- Carbon tax collectors: 1. Energy companies

- 2. Bank

- 3. Government

- The method of disclosure of the carbon tax policy implementation process:

- 1. No process report (the process and data will not be disclosed to the public throughout the process)

- 2. Report regularly on the official website (provide the relevant process and data of carbon tax collection by quarter or year)

- 3. Regularly report on the official website under the supervision of an independent third party (provide carbon tax collection-related progress and data on a quarterly or annual basis under the supervision of a non-interested third-party)

- Cost of carbon tax (CNY): the amount of additional fees paid on energy expenditures and other fee related to carbon emission each year

- Next part is Choice-based conjoint analysis part. Please pick one option from each question. And all of the options indicated four attributes as follow: Use of Carbon Tax Revenue, Carbon tax policy implementers, Transparency of carbon tax policy implementation process and Cost of Carbon Tax.

- 1.Which of the following carbon tax policies do you prefer?

- A. Subsidies/grants for low-carbon technologies or CCUS, Energy Supplier, No process report,700 CNY

- B. Subsidies/grants for clean energy technology, Energy Supplier, no process report, 150 CNY

- C. General tax budget, Government, Regularly report on the official website under the supervision of an independent third party, 1200 CNY

- D. Subsidies/grants for low-carbon technologies or CCUS, Bank, Regularly report on the official website under the supervision of an independent third party, 1200 CNY

- 2.Which of the following carbon tax policies do you prefer?

- A. General tax budget, Bank, Regularly report on the official website under the supervision of an independent third party, 150 CNY

- B. General tax budget, Government, Regularly report on the official website under the supervision of an independent third party, 150 CNY

- C. Subsidies/grants for clean energy technology, Government, No process report, 2000 CNY

- D. Subsidies/grants for low-carbon technologies or CCUS, Government, Report regularly on the official website, 700 CNY

- 3.Which of the following carbon tax policies do you prefer?

- A. Subsidies/grants for clean energy technology, Government, Report regularly on the official website, 700 CNY

- B. Subsidies/grants for clean energy technology, Bank, Regularly report on the official website under the supervision of an independent third party, 350 CNY

- C. Subsidies/grants for low-carbon technologies or CCUS, Energy Supplier

- Regularly report on the official website under the supervision of an independent third party, 2000 CNY

- General tax budget, Government, No process report, 150 CNY

- 4.Which of the following carbon tax policies do you prefer?

- A. Subsidies/grants for low-carbon technologies or CCUS, Government, Regularly report on the official website under the supervision of an independent third party, 2000 CNY

- B. General tax budget, Bank, Report regularly on the official website, 2000 CNY

- C. Subsidies/grants for low-carbon technologies or CCUS, Bank, No process report, 350 CNY

- D. General tax budget, Energy Supplier, No process report, 1200 CNY

- 5.Which of the following carbon tax policies do you prefer?

- A. Subsidies/grants for clean energy technology, Bank, No process report, 150 CNY

- B. Subsidies/grants for low-carbon technologies or CCUS, Government, No process report, 1200 CNY

- C. Subsidies/grants for clean energy technology, Energy Supplier, Report regularly on the official website, 1200 CNY

- D. Subsidies/grants for low-carbon technologies or CCUS, Energy Supplier, Regularly report on the official website under the supervision of an independent third party, 700 CNY

- 6.Which of the following carbon tax policies do you prefer?

- A. Subsidies/grants for clean energy technology, Government, Report regularly on the official website, 350 CNY

- B. Subsidies/grants for clean energy technology, Energy Supplier, Regularly report on the official website under the supervision of an independent third party, 1200 CNY

- C. General tax budget, Energy Supplier, Regularly report on the official website under the supervision of an independent third party, 150 CNY

- D. General tax budget, Bank, Report regularly on the official website, 150 CNY

- 7.Which of the following carbon tax policies do you prefer?

- A. General tax budget, Government, No process report, 350 CNY

- B. Subsidies/grants for clean energy technology, Bank, No process report, 700 CNY

- C. Subsidies/grants for clean energy technology, Energy Supplier, Regularly report on the official website under the supervision of an independent third party, 700 CNY

- D. Subsidies/grants for low-carbon technologies or CCUS, Government, Regularly report on the official website under the supervision of an independent third party, 1200 CNY

- 8. Which of the following carbon tax policies do you prefer?

- A. Subsidies/grants for low-carbon technologies or CCUS, Government, Report regularly on the official website, 1200 CNY

- B. Subsidies/grants for clean energy technology, Bank, No process report, 700 CNY

- C. Subsidies/grants for low-carbon technologies or CCUS, Bank, Regularly, Report on the official website under the supervision of an independent third party, 700 CNY

- D. General tax budget, Energy Supplier, No process report, 350 CNY

- 9.Which of the following carbon tax policies do you prefer?

- A. Subsidies/grants for clean energy technology, Government, Regularly, Report on the official website under the supervision of an independent third party, 2000 CNY

- B. Subsidies/grants for low-carbon technologies or CCUS, Energy Supplier, No process report, 150 CNY

- C. General tax budget, Government, Report regularly on the official website, 350 CNY

- D. General tax budget, Bank, No process report, 2000 CNY

- 10.Which of the following carbon tax policies do you prefer?

- A. Subsidies/grants for low-carbon technologies or CCUS, Energy Supplier, Report regularly on the official website, 2000 CNY

- B. Subsidies/grants for low-carbon technologies or CCUS, Bank, Report regularly on the official website, 350 CNY

- C. Subsidies/grants for clean energy technology, Government, No process report, 700 CNY

- D. General tax budget, Bank, Regularly report on the official website under the supervision of an independent third party, 700 CNY

- 11.Which of the following carbon tax policies do you prefer?

- A. Subsidies/grants for clean energy technology, Energy Supplier, Report regularly on the official website, 350 CNY

- B. Subsidies/grants for clean energy technology, Bank, Report regularly on the official website, 150 CNY

- C. General tax budget, Government, Report regularly on the official website, 2000 CNY

- D. General tax budget, Energy Supplier, Regularly report on the official website under the supervision of an independent third party, 1200 CNY

- 12.Which of the following carbon tax policies do you prefer?

- A. Subsidies/grants for low-carbon technologies or CCUS, Bank, Regularly report on the official website under the supervision of an independent third party, 2000 CNY

- B. Subsidies/grants for clean energy technology, Government, No process report, 350 CNY

- C. General tax budget, Energy Supplier, No process report, 150 CNY

- D. Subsidies/grants for clean energy technology, Bank, Regularly report on the official website under the supervision of an independent third party, 700 CNY

Appendix B

- Sociodemographic characteristics part.

- Gender: Female,Male

- Age:16-30,31-45,46-60,>60

- Marriage:married, single

- Education level:Middle School, High School,Bachelor’s degree,Above bachelor’s degree

- Number of family members: 1, 2, 3, 4, 5, 6, >6

- Residence: Urban, Rural

- Family disposable income per year (CNY): 0-30000, 30000-50000, 50000-100000, 100000-200000, >200000, Inconvenient

- Annual electricity consumption: 0-1000, 1000-2500, 2500-5000, >5000

- Annual gas consumption: 0-800, 800-1500, 1500-3000, >3000

- Annual gasoline consumption: 0-2500, 2500-5000, 5000-10000, >10000

- How to Consider the Impact of Climate Change on Your Life: None, little, some, huge.

- How to evaluate your understanding on carbon tax: None, some, clearly.

- A explanation of policy attributes and classification is as follows:

- The purpose of Use of carbon tax revenue: 1. General tax budget (the income treasury is redistributed according to the will of the state)

- 2. Subsidies/grants for clean energy technology (to encourage the development of new technologies for low carbon dioxide emissions and new bases for absorbing and storing carbon dioxide in the air)

- 3. Subsidies/grants for low-carbon technologies or CCUS (encourage the development of new energy technologies that do not emit carbon dioxide and other pollutants)

- Carbon tax collectors: 1. Energy companies

- 2. Bank

- 3. Government

- The method of disclosure of the carbon tax policy implementation process: 1. No process report (the process and data will not be disclosed to the public throughout the process)

- 2. Report regularly on the official website (provide the relevant process and data of carbon tax collection by quarter or year)

- 3. Regularly report on the official website under the supervision of an independent third party (provide carbon tax collection-related progress and data on a quarterly or annual basis under the supervision of a non-interested third-party)

- Cost of carbon tax (CNY): the amount of additional fees paid on energy expenditures and other fee related to carbon emission each year

- Next part is Choice-based conjoint analysis part. Please pick one option from each question. And all of the options indicated four attributes as follow: Use of Carbon Tax Funds, Carbon tax policy implementers, Transparency of carbon tax policy implementation process and Cost of Carbon Tax.

- Which of the following carbon tax policies do you prefer?

- A. Subsidies/grants for clean energy technology, Bank, Regularly report on the official website under the supervision of an independent third party, 700 CNY

- B. General tax budget, Government, No process report, 700 CNY

- C. General tax budget, Bank, No process report, 2000 CNY

- D. Subsidies/grants for low-carbon technologies or CCUS, Government, Report regularly on the official website, 150 CNY

- Which of the following carbon tax policies do you prefer?

- A. Subsidies/grants for low-carbon technologies or CCUS, Energy Supplier, Regularly report on the official website under the supervision of an independent third party, 350 CNY

- B. Subsidies/grants for low-carbon technologies or CCUS, Bank, No process report, 700 CNY

- C. Subsidies/grants for clean energy technology, Government, No process report, 150 CNY

- D. Subsidies/grants for clean energy technology, Energy Supplier, Report regularly on the official website, 350 CNY

- Which of the following carbon tax policies do you prefer?

- A. General tax budget, Bank, Report regularly on the official website, 1200 CNY

- B. Subsidies/grants for clean energy technology, Energy Supplier, No process report, 2000 CNY

- C. Subsidies/grants for clean energy technology, Bank, Regularly report on the official website under the supervision of an independent third party, 700 CNY

- D. Subsidies/grants for low-carbon technologies or CCUS, Bank, No process report, 350 CNY

- Which of the following carbon tax policies do you prefer?

- A. General tax budget, Energy Supplier, Report regularly on the official website, 2000 CNY

- B. Subsidies/grants for clean energy technology, Government, Regularly report on the official website under the supervision of an independent third party, 350 CNY

- C. Subsidies/grants for low-carbon technologies or CCUS, Government, No process report, 350 CNY

- D. Subsidies/grants for low-carbon technologies or CCUS, Energy Supplier, Regularly report on the official website under the supervision of an independent third party, 150 CNY

- Which of the following carbon tax policies do you prefer?

- A. Subsidies/grants for clean energy technology, Energy Supplier, No process report, 1200 CNY

- B. General tax budget, Energy Supplier, Report regularly on the official website, 700 CNY

- C. Subsidies/grants for low-carbon technologies or CCUS, Government, Report regularly on the official website, 150 CNY

- D. General tax budget, Bank, Regularly report on the official website under the supervision of an independent third party, 350 CNY

- Which of the following carbon tax policies do you prefer?

- A. General tax budget, Government, No process report, 700 CNY

- B. Subsidies/grants for clean energy technology, Bank, No process report, 1200 CNY

- C. Subsidies/grants for low-carbon technologies or CCUS, Energy Supplier

- Report regularly on the official website, 350 CNY

- D. Subsidies/grants for low-carbon technologies or CCUS, Government, Report regularly on the official website, 2000 CNY

- Which of the following carbon tax policies do you prefer?

- A. General tax budget, Government, No process report, 350 CNY

- B. Subsidies/grants for clean energy technology, Bank, No process report, 700 CNY

- C. Subsidies/grants for clean energy technology, Energy Supplier, Regularly report on the official website under the supervision of an independent third party, 700 CNY

- D. Subsidies/grants for low-carbon technologies or CCUS, Government, Regularly report on the official website under the supervision of an independent third party, 1200 CNY

- Which of the following carbon tax policies do you prefer?

- A. General tax budget, Bank, No process report, 150 CNY

- B. Subsidies/grants for low-carbon technologies or CCUS, Energy Supplier

- No process report, 700 CNY

- C. Subsidies/grants for clean energy technology, Bank, Regularly report on the official website under the supervision of an independent third party, 1200 CNY

- D. Subsidies/grants for clean energy technology, Government, Regularly report on the official website under the supervision of an independent third party, 2000 CNY

- Which of the following carbon tax policies do you prefer?

- A. General tax budget, Energy Supplier, Regularly report on the official website under the supervision of an independent third party, 350 CNY

- B. Subsidies/grants for clean energy technology, Bank, Report regularly on the official website, 150 CNY

- C. Subsidies/grants for clean energy technology, Government, Regularly report on the official website under the supervision of an independent third party, 1200 CNY

- D. Subsidies/grants for low-carbon technologies or CCUS, Bank, Report regularly on the official website, 2000 CNY

- Which of the following carbon tax policies do you prefer?

- A. General tax budget, Government, No process report, 700 CNY

- B. Subsidies/grants for low-carbon technologies or CCUS, Bank, Regularly report on the official website under the supervision of an independent third party, 2000 CNY

- C. Subsidies/grants for low-carbon technologies or CCUS, Energy Supplier

- No process report, 1200 CNY

- D. General tax budget, Energy Supplier, Report regularly on the official website, 700 CNY

- Which of the following carbon tax policies do you prefer?

- A. Subsidies/grants for clean energy technology, Bank, Report regularly on the official website, 2000 CNY

- B. Subsidies/grants for low-carbon technologies or CCUS, Government, Regularly report on the official website under the supervision of an independent third party, 150 CNY

- C. General tax budget, Government, Report regularly on the official website, 1200 CNY

- D. Subsidies/grants for clean energy technology, Energy Supplier, Regularly report on the official website under the supervision of an independent third party, 350 CNY

- Which of the following carbon tax policies do you prefer?

- A. Subsidies/grants for low-carbon technologies or CCUS, Bank, Regularly report on the official website under the supervision of an independent third party, 2000 CNY

- B. Subsidies/grants for clean energy technology, Government, No process report, 350 CNY

- C. General tax budget, Energy Supplier, No process report, 150 CNY

- D. Subsidies/grants for clean energy technology, Bank, Regularly report on the official website under the supervision of an independent third party, 700 CNY

References

- Alriksson S, Öberg T.,2008, Conjoint analysis for environmental evaluation[J]. Environmental Science and Pollution Research, 15(3): 244-257. [CrossRef]

- Anna Alberini, Andrea Bigano, Milan Ščasný, Iva Zvěřinová,,2018, Preferences for Energy Efficiency vs. Renewables: What Is the Willingness to Pay to Reduce CO2 Emissions? Ecological Economics,Vol 144,Pages 171-185. [CrossRef]

- Awunyo-Vitor, D. , Ishak, S., & Seidu Jasaw, G., 2013. Urban Households' willingness to pay for improved solid waste disposal services in Kumasi Metropolis, Ghana. Urban Studies Research, 2013. [CrossRef]

- Beggs S, Cardell S, Hausman J. 1981, Assessing the potential demand for electric cars[J]. Journal of econometrics, 17(1): 1-19. [CrossRef]

- Benavente, J. M. G. ,2016. Impact of a carbon tax on the Chilean economy: A computable general equilibrium analysis. Energy economics, 57, 106-127. [CrossRef]

- Beuermann, C. , & Santarius, T. 2006. Ecological tax reform in Germany: handling two hot potatoes at the same time. Energy Policy, 34(8), 917-929. [CrossRef]

- Bigsby, H., L.K.J.F.P.J. Ozanne, 2002.The purchase decision: Consumers and environmentally certified wood products. 52(7/8): p. 100-105. https://www.researchgate.net/publication/279714262.

- Bourgeois, C. , Giraudet, L. G., Quirion, P. 2021. Lump-sum vs. energy-efficiency subsidy recycling of carbon tax revenue in the residential sector: A French assessment. Ecological Economics, 184, 107006. [CrossRef]

- Capasso, S. , Cicatiello, L., De Simone, E., Gaeta, G. L., & Mourão, P. R., 2021. Fiscal transparency and tax ethics: does better information lead to greater compliance? Journal of Policy Modeling, 43(5), 1031-1050. [CrossRef]

- Carattini, S. , Kallbekken S. 2019, Orlov A. How to win public support for a global carbon tax. Nature, 565 (7739), pp. 289-29. [CrossRef]

- Carattini, S. , Baranzini, A., Thalmann, P., Varone, F., & Vöhringer, F., 2017. Green taxes in a post-Paris world: are millions of nays inevitable? Environmental and Resource Economics, 68(1), 97-128. [CrossRef]

- Carattini, S. , Carvalho, M., & Fankhauser, S. (2018). Overcoming public resistance to carbon taxes. Wiley Interdisciplinary Reviews: Climate Change, 9(5), e531. [CrossRef]

- Chang W Y, Wang S, Song X, et al. 2022. Economic effects of command-and-control abatement policies under China's 2030 carbon emission goal[J]. Journal of Environmental Management, 312: 114925. [CrossRef]

- Crowley K. 2017. Up and down with climate politics 2013–2016: The repeal of carbon pricing in Australia Wiley Interdiscip. Rev. Clim. Change, 8 (3) (2017), Article e458.

- Daniels R F, Hensher D A. ,2000, Valuation of environmental impacts of transport projects: The challenge of self-interest proximity[J]. Journal of transport economics and policy: 189-214. https://www.jstor.org/stable/20053839.

- Di Cosmo V, Hyland M. 2013, Carbon tax scenarios and their effects on the Irish energy sector[J]. Energy Policy, 59: 404-414. http://aei.pitt.edu/id/eprint/87947.

- Douenne, T. , Fabre, A, 2020, French attitudes on climate change, carbon taxation and other climate policies. Ecological Economics, 169, 106496. [CrossRef]

- Douenne, T. , Fabre, A. 2022. Yellow vests, pessimistic beliefs, and carbon tax aversion. American Economic Journal: Economic Policy, 14(1), 81-110. [CrossRef]

- Duan, H. X. , Yan-Li, L., & Yan, L., 2014. Chinese public’s willingness to pay for CO2 emissions reductions: A case study from four provinces/cities. Advances in Climate Change Research, 5(2), 100-110. [CrossRef]

- E. Saez. 2009. Tax Incidence and Efficiency Costs of Taxation[J]. https://eml.berkeley.edu/~saez/course131/taxincidence_ch19.pdf (accessed 18 October 2022).

- E.S. Shmelev, S.U. Speck, 2018, Green fiscal reform in Sweden: econometric assessment of the carbon and energy taxation scheme Renew. Sustain. Energy Rev., 90, pp. 969-981. [CrossRef]

- Eliasson J, Proost S. 2015. Is sustainable transport policy sustainable? [J]. Transport Policy, 37: 92-100. [CrossRef]

- Fabre, A. , Douenne T., 2019, Can We Reconcile French People with the Carbon Tax? Disentangling Beliefs from Preferences. https://ideas.repec.org/p/fae/wpaper/2019.10.html.

- Farrell, N. 2017, What factors drive inequalities in carbon tax incidence? Decomposing socioeconomic inequalities in carbon tax incidence in Ireland[J]. Ecological Economics, 142: 31-45. [CrossRef]

- Fu, K. , Li Y., Mao H., 2022. Firms’ production and green technology strategies: The role of emission asymmetry and carbon taxes[J]. European Journal of Operational Research. [CrossRef]

- Gao, S., M. Smits, and C. Wang, A conjoint analysis of corporate preferences for the sectoral crediting mechanism: a case study of Shanxi Province in China. Journal of Cleaner Production, 2016. 131: p. 259-269. [CrossRef]

- Green P E, Rao V R., 1971, Conjoint measurement-for quantifying judgmental data[J]. Journal of Marketing research, 8(3): 355-363. [CrossRef]

- Hammerle, M. , Best, R., & Crosby, P. 2021. Public acceptance of carbon taxes in Australia. Energy Economics, 101, 105420. [CrossRef]

- Hao J, Gao F, Fang X, et al. 2022. Multi-factor decomposition and multi-scenario prediction decoupling analysis of China's carbon emission under dual carbon goal[J]. Science of The Total Environment: 156788.

- Huang G, Xu Z, Qu X, et al. 2022. Critical climate issues toward carbon neutrality targets[J]. Fundamental Research, 2(13), 396-400 2022. [CrossRef]

- International Monetary Fund. 2019. Fiscal Monitor: How to Mitigate Climate Change https://www.imf.org/en/Publications/FM/Issues/2019/09/12/fiscal-monitor-october-2019 (accessed 18 October 2022).

- J. McEldowney, D. Salter, 2015. Environmental taxation in the UK: the climate change levy and policy making Denning Law[J], vol 28, pp. 37-65. [CrossRef]

- Johnson R, M. 1974, Trade-off analysis of consumer values[J]. Journal of marketing research, 11(2): 121-127. [CrossRef]

- Kallbekken, S. , Kroll, S., Cherry, T. L.,2011, Do you not like Pigou, or do you not understand him? Tax aversion and revenue recycling in the lab. Journal of Environmental Economics and Management, 62(1), 53-64. [CrossRef]

- Khastar, M. , Aslani, A., & Nejati, M., 2020. How does carbon tax affect social welfare and emission reduction in Finland?. Energy Reports, 6, 736-744. [CrossRef]

- Klenert, D. , Mattauch, L., Combet, E., Edenhofer, O., Hepburn, C., Rafaty, R., & Stern, N. 2018. Making carbon pricing work for citizens. Nature Climate Change, 8(8), 669-677. [CrossRef]

- Klok, J. , Larsen, A., Dahl, A., & Hansen, K. 2006. Ecological tax reform in Denmark: history and social acceptability. Energy Policy, 34(8), 905-916. [CrossRef]

- Kotchen, M. J. , Boyle, K. J., Leiserowitz, A. A.,2013. Willingness-to-pay and policy-instrument choice for climate-change policy in the United States. Energy Policy, 55, 617-625. [CrossRef]

- L. Ionescu, 2020, The economics of the carbon tax: environmental performance, sustainable energy, and green financial behavior Geopolit. Hist. Int. Relat., 12 (1), pp. 101-107. [CrossRef]

- Lieder M, Asif F M A, Rashid A, 2018, A conjoint analysis of circular economy value propositions for consumers: Using “washing machines in Stockholm” as a case study[J]. Journal of cleaner production, 172: 264-273. [CrossRef]

- Liu Y, Cirillo C. 2016, Evaluating policies to reduce greenhouse gas emissions from private transportation[J]. Transportation Research Part D: Transport and Environment, 44: 219-233. [CrossRef]

- Maestre-Andrés, S. , Drews, S., & van den Bergh, J. 2019. Perceived fairness and public acceptability of carbon pricing: a review of the literature. Climate policy, 19(9), 1186-1204. [CrossRef]

- Montag, J. 2015. The simple economics of motor vehicle pollution: A case for fuel tax[J]. Energy Policy, 85: 138-149. [CrossRef]

- Mori, K. 2012. Modeling the impact of a carbon tax: A trial analysis for Washington State[J]. Energy Policy, 48: 627-639. [CrossRef]

- Murray B, Rivers N. 2015. British Columbia’s revenue-neutral carbon tax: A review of the latest “grand experiment” in environmental policy[J]. Energy Policy, 86: 674-683. [CrossRef]

- OECD, Environmental Taxation: A Guide for Policy Makers[J]. URL: https://www.oecd.org/env/tools-evaluation/48164926.pdf, 2011.

- Olivier, J. G. J. , Bouwman, A. F., Van der Maas, C. W. M., & Berdowski, J. J. M. 1994. Emission database for global atmospheric research (EDGAR). Environmental Monitoring and Assessment, 31(1), 93-106. [CrossRef]

- Rafaty, R. , 2018. Perceptions of corruption, political distrust, and the weakening of climate policy. Global Environmental Politics, 18(3), 106-129. [CrossRef]

- Rausch, S. , Metcalf, G. E., Reilly, J. M. 2011, Distributional impacts of carbon pricing: A general equilibrium approach with micro-data for households. Energy economics, 33, S20-S33. [CrossRef]

- Raz, C. , Piper D., Haller R., Nicod H., Dusart N., Giboreau A., 2008. From sensory marketing to sensory design: How to drive formulation using consumers’ input? 19(8): p. 719-726. [CrossRef]

- Reaños, M. A. T. , 2021, Fuel for poverty: A model for the relationship between income and fuel poverty. Evidence from Irish microdata. Energy Policy, 156, 112444. [CrossRef]

- Reaños, M. A. T. , Lynch, M. Á., 2022, Measuring carbon tax incidence using a fully flexible demand system. Vertical and horizontal effects using Irish data. Energy Policy, 160, 112682. [CrossRef]

- Rivers N, Schaufele B. 2015. Salience of carbon taxes in the gasoline market[J]. Journal of Environmental Economics and management, 74: 23-36. [CrossRef]

- Saelim, S. , 2019, Carbon tax incidence on household demand: effects on welfare, income inequality and poverty incidence in Thailand. Journal of Cleaner Production, 234, 521-533. [CrossRef]

- Stram B, N. 2014. A new strategic plan for a carbon tax[J]. Energy Policy, 73: 519-523. [CrossRef]

- Sun, C. , Yuan, X., & Yao, X., 2016. Social acceptance towards the air pollution in China: evidence from public's willingness to pay for smog mitigation. Energy Policy, 92, 313-324. [CrossRef]

- Tsang, F. , Burge, P., 2011. Paying for carbon emissions reduction. Santa Monica, CA: RAND Corporation, 2011. https://www.rand.org/pubs/occasional_papers/OP312.html.

- Wesseh Jr, P. K. , Lin, B. (2016). Modeling environmental policy with and without abatement substitution: a tradeoff between economics and environment? Applied Energy, 167, 34-43. [CrossRef]

- Winden, M. , Jamelske, E., & Tvinnereim, E., 2018. A contingent valuation study comparing citizen’s willingness-to-pay for climate change Mitigation in China and the United States. Environmental Economics and Policy Studies, 20(2), 451-475. [CrossRef]

- World Bank, State and Trends of Carbon Pricing, 2019 https://openknowledge.worldbank.org/handle/10986/31755 (accessed 18 October 2022).

- Yang, J. , Zou, L., Lin, T., Wu, Y., & Wang, H., 2014. Public willingness to pay for CO2 mitigation and the determinants under climate change: A case study of Suzhou, China. Journal of Environmental Management, 146, 1-8. [CrossRef]

| Socioeconomic Characteristics | Percentage | |

|---|---|---|

| Gender | Male | 41.24% |

| Female | 58.76% | |

| Age | 16-30 | 53.17% |

| 31-45 | 42.48% | |

| 46-60 | 3.85% | |

| >60 | 0.50% | |

| Marriage | Married | 67.58% |

| Single | 32.42% | |

| Educational level | Middle school or below | 2.48% |

| High school | 62.86% | |

| Bachelor | 30.93% | |

| Master or above | 3.73% | |

| Family members | 1 | 1.12% |

| 2 | 3.73% | |

| 3 | 39.63% | |

| 4 | 27.70% | |

| 5 | 20.50% | |

| 6 | 5.84% | |

| >6 | 1.49% | |

| Residence | Urban | 85.84% |

| Rural | 14.16% | |

| Family disposable income | 0-30,000 | 2.11% |

| 30,000-50,000 | 8.70% | |

| 50,000-100,000 | 19.38% | |

| 100,000-200,000 | 40.37% | |

| >200,000 | 27.08% | |

| Inconvenient | 2.36% | |

| Annual electricity consumption | 0-1000 | 33.17% |

| 1000-2500 | 42.24% | |

| 2500-5000 | 20.99% | |

| >5000 | 3.60% | |

| Annual gas consumption | 0-800 | 41.86% |

| 800-1500 | 37.14% | |

| 1500-3000 | 18.14% | |

| >3000 | 2.86% | |

| Annual gasoline consumption | 0-2500 | 35.78% |

| 2500-5000 | 30.43% | |

| 5000-10000 | 26.46% | |

| >10000 | 7.33% | |

| Climate change impact | None | 3.23% |

| Little | 20.75% | |

| Some | 59.01% | |

| Huge | 17.02% | |

| Understanding of carbon tax | None | 17.39% |

| Some | 67.08% | |

| Clear | 15.53% | |

| Attributes | Levels | Annal willingness to pay (CNY) |

|---|---|---|

| Use of carbon tax revenue | General tax budget | 0.00 |

| Subsidies/grants for clean energy technology | 503.90 | |

| Subsidies/grants for low-carbon technologies or CCUS | 611.81 | |

| Carbon tax policy implementers | Bank | 0.00 |

| Energy Supplier | 160.55 | |

| Government | 424.81 | |

| Transparency of carbon tax policy implementation process | No process report | 0.00 |

| Report regularly on the official website | 1122.74 | |

| Regularly report on the official website under the supervision of an independent third party | 1482.05 | |

| Total | Mean | 1435.28 |

| Attributes | Levels | Willingness to pay | ||

| Educational level (CNY) | ||||

| High school | Bachelor’s degree | Master’s degree or above | ||

| Use of carbon tax revenue | General tax budget | 0.00 | 0.00 | 76.72 |

| Subsidies/grants for clean energy technology | 698.28 | 297.40 | 0.00 | |

| Subsidies/grants for low-carbon technologies or CCUS | 743.72 | 443.06 | 392.44 | |

| Carbon tax policy implementers | Bank | 0.00 | 0.00 | 0.00 |

| Energy Supplier | 163.26 | 119.92 | 65.99 | |

| Government | 495.88 | 338.70 | 283.56 | |

| Transparency of carbon tax policy implementation process | No process report | 0.00 | 0.00 | 0.00 |

| Report regularly on the official website | 1246.08 | 977.76 | 1521.10 | |

| Regularly report on the official website under the supervision of an independent third party | 1608.80 | 1344.60 | 2033.16 | |

| Total | Mean | 1652.00 | 1173.81 | 1457.65 |

| Attributes | Levels | Willingness to pay | |||

| Family disposable income per year (CNY) | |||||

| 0-30,000 | 30,000-50,000 | 100,000-200,000 | >200,000 | ||

| Use of carbon tax revenue | General tax budget | 108.95 | 0.00 | 0.00 | 0.00 |

| Subsidies/grants for clean energy technology | 0.00 | 1070.62 | 501.02 | 472.23 | |

| Subsidies/grants for low-carbon technologies or CCUS | 118.10 | 1320.41 | 541.81 | 681.99 | |

| Carbon tax policy implementers | Bank | 0.00 | 0.00 | 0.00 | 0.00 |

| Energy Supplier | 188.23 | 385.03 | 183.64 | 43.75 | |

| Government | 470.71 | 441.62 | 387.75 | 395.71 | |

| Transparency of carbon tax policy implementation process | No process report | 0.00 | 0.00 | 0.00 | 0.00 |

| Report regularly on the official website | 456.71 | 907.38 | 1067.22 | 1489.62 | |

| Regularly report on the official website under the supervision of an independent third party | 575.60 | 1064.44 | 1333.90 | 2048.86 | |

| Total | Mean | 639.43 | 1729.83 | 1338.45 | 1710.72 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).