Submitted:

23 August 2024

Posted:

27 August 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

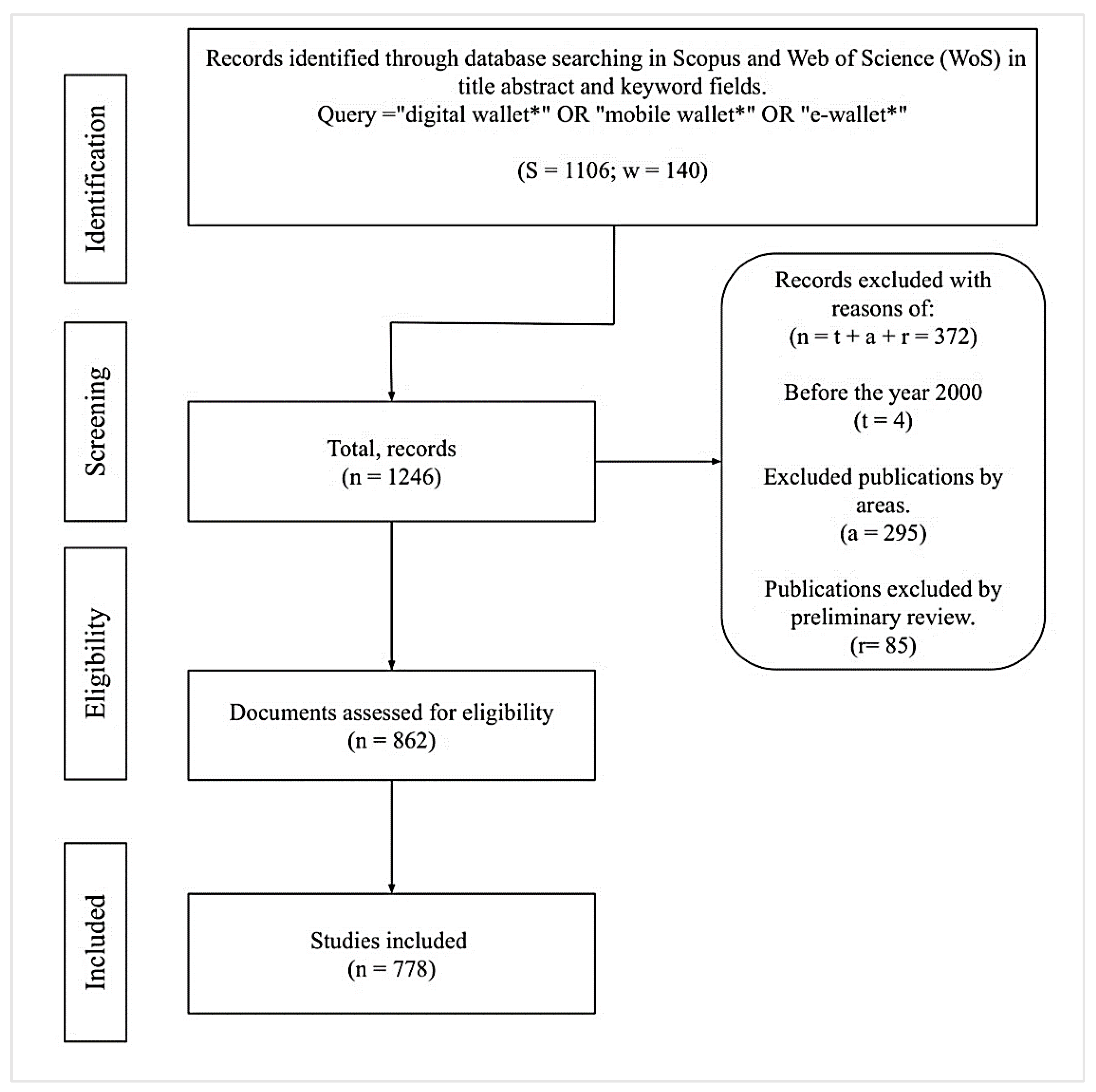

2. Materials and Methods

2.1. Data Source, Data Extraction, and Study Selection

2.2. Search Strategy

2.3. Data Analysis and Visualization

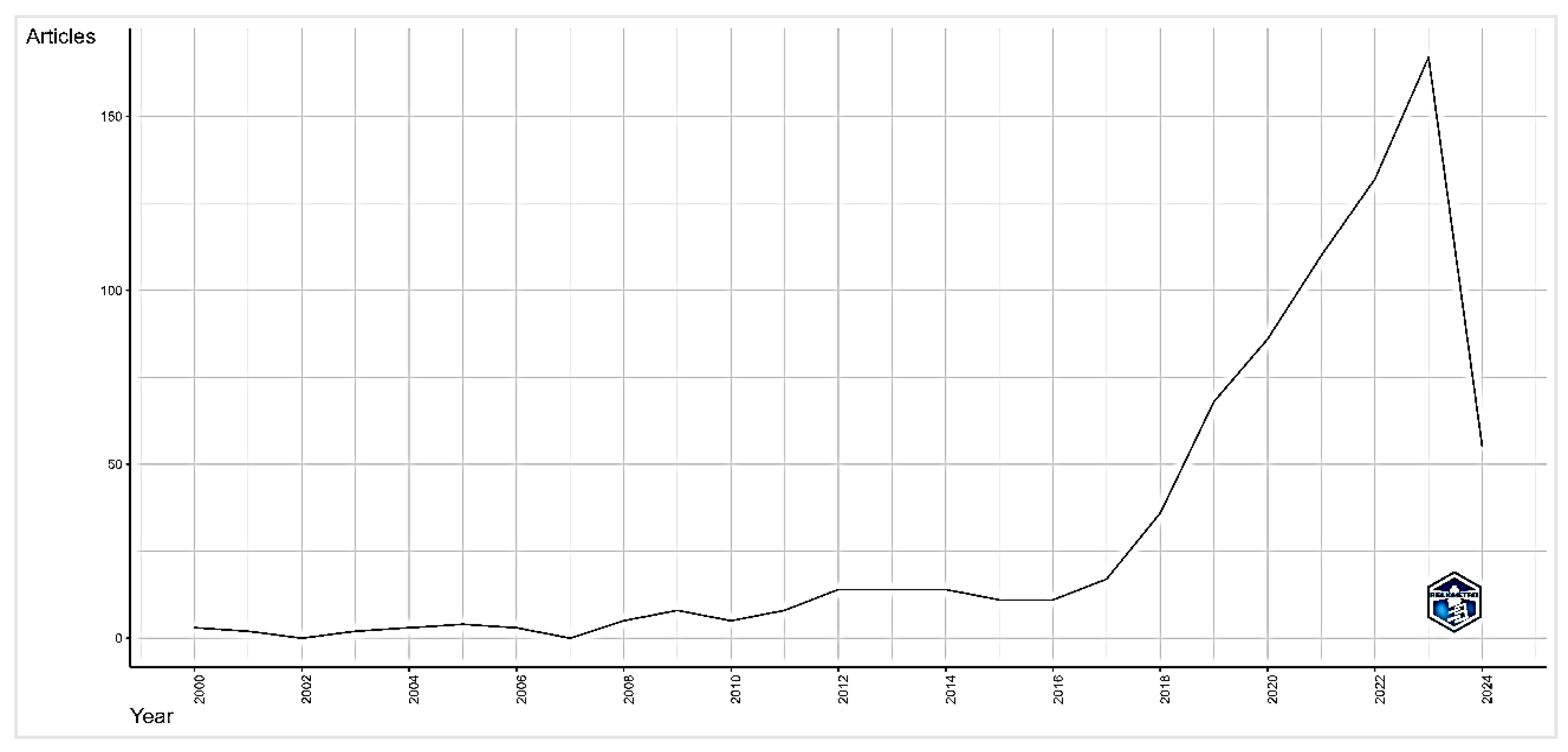

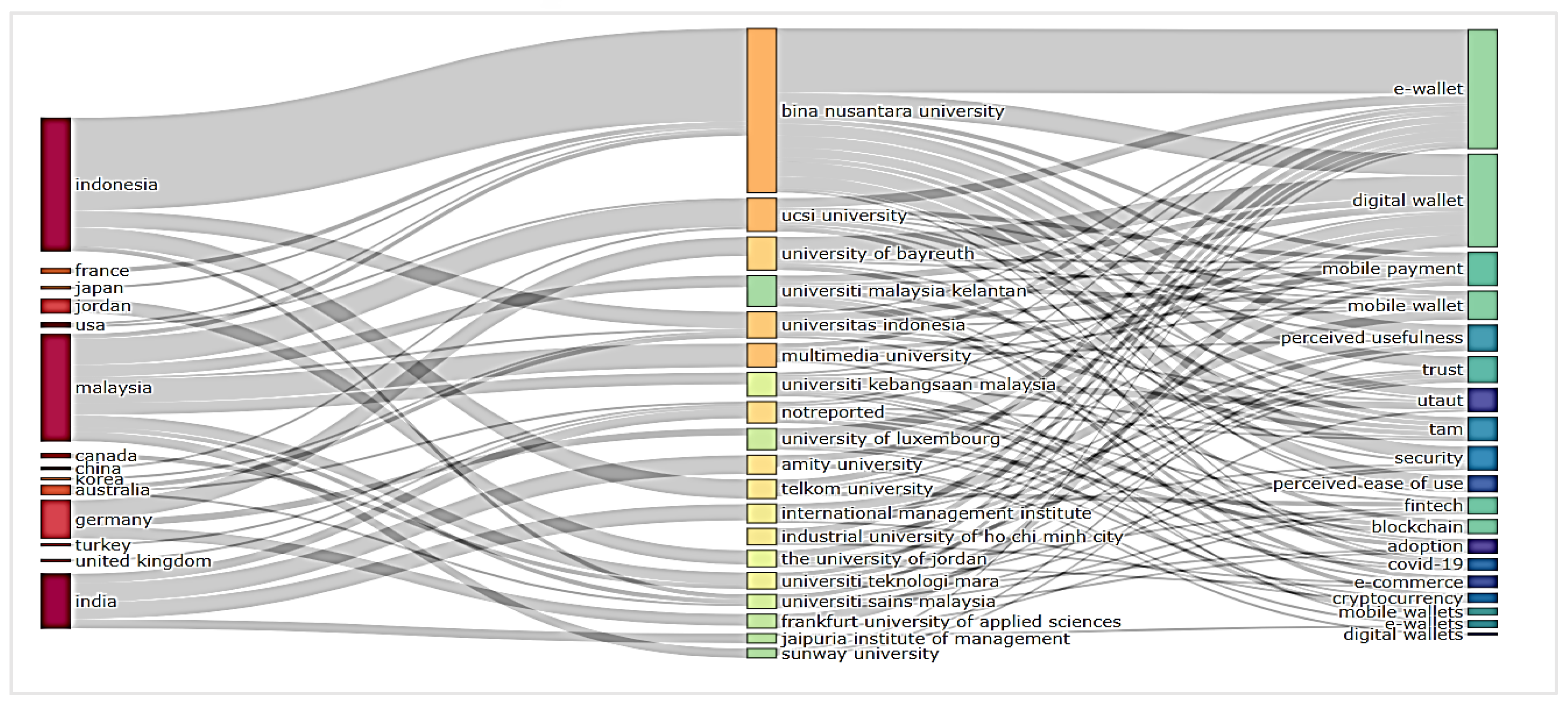

3. Results

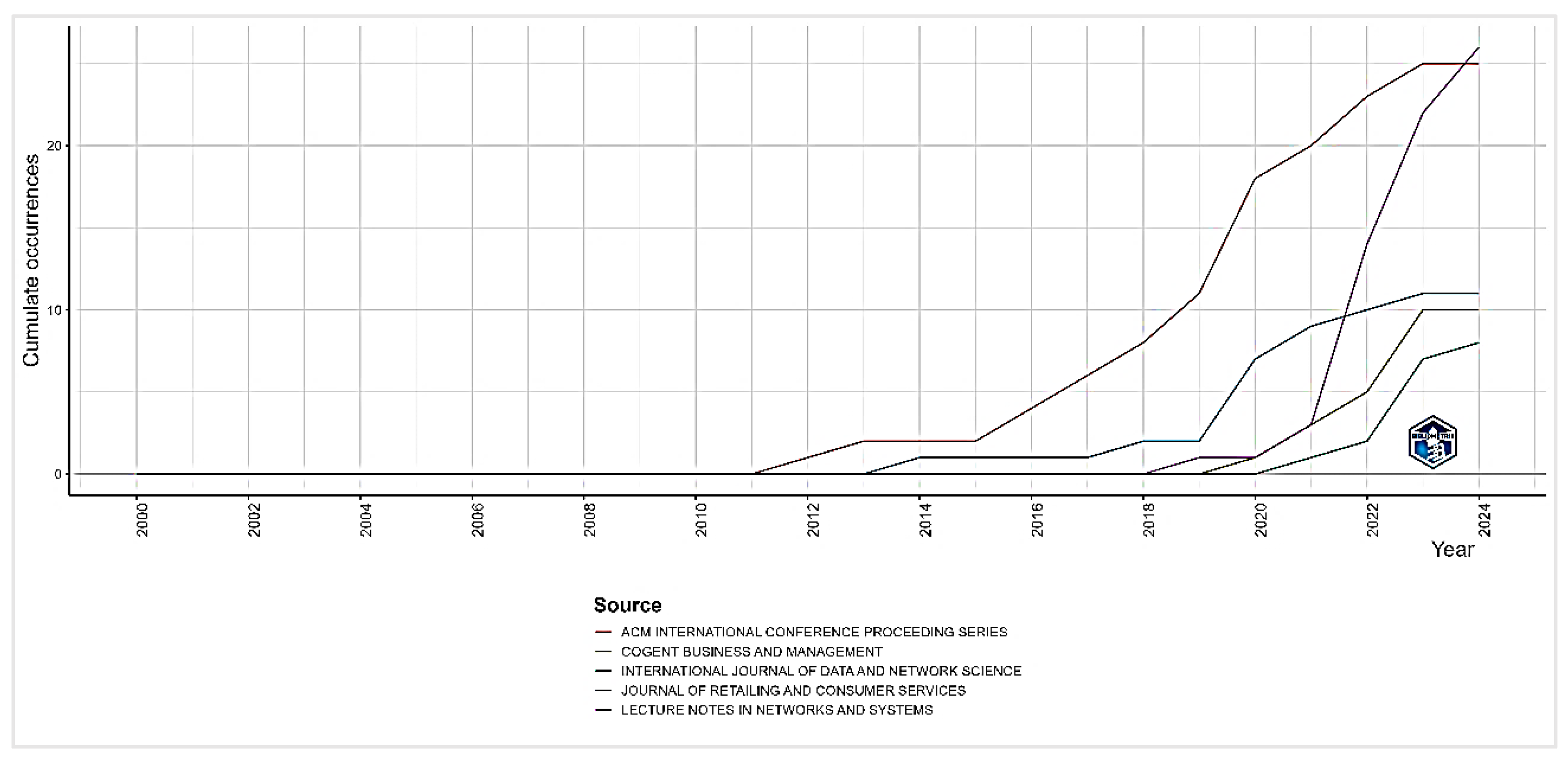

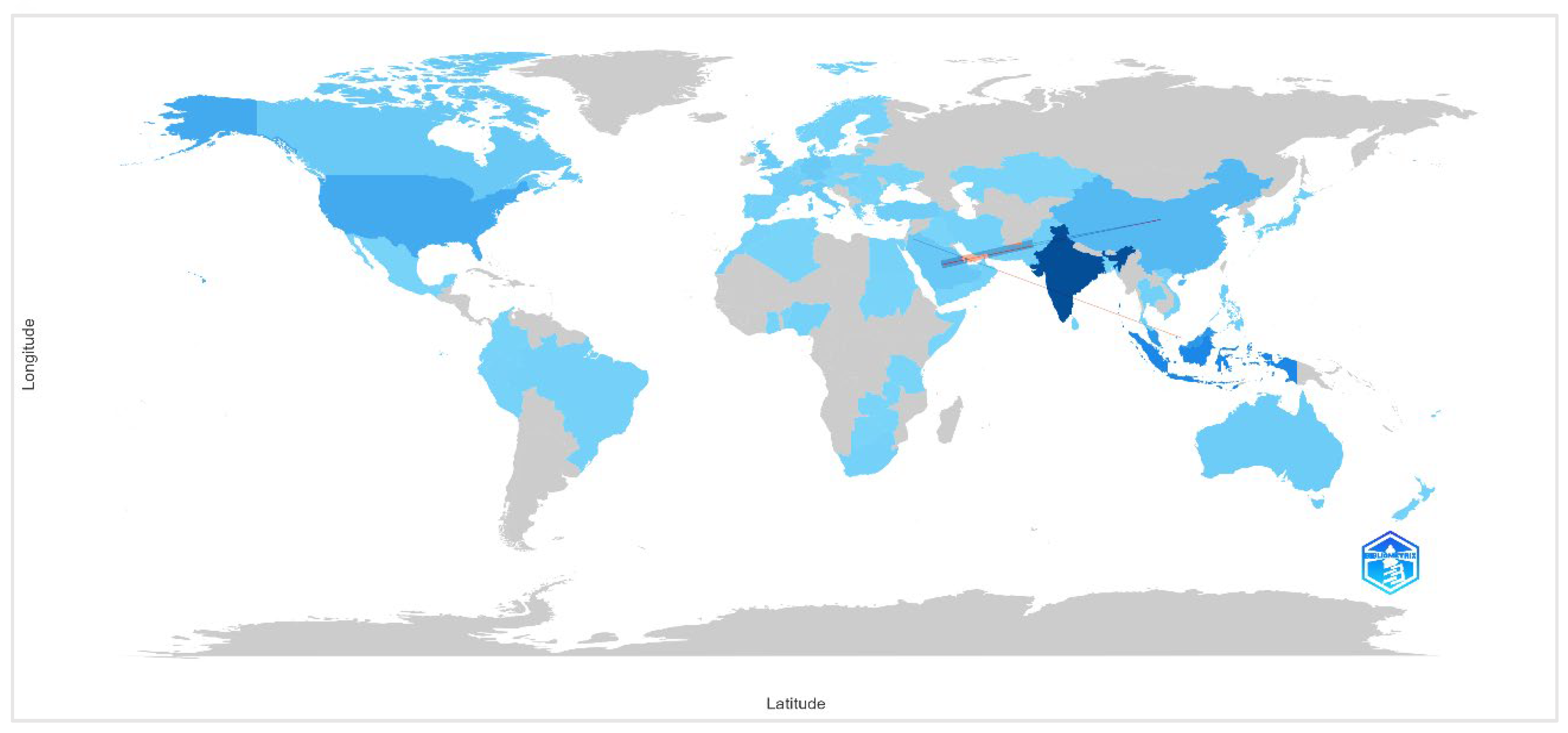

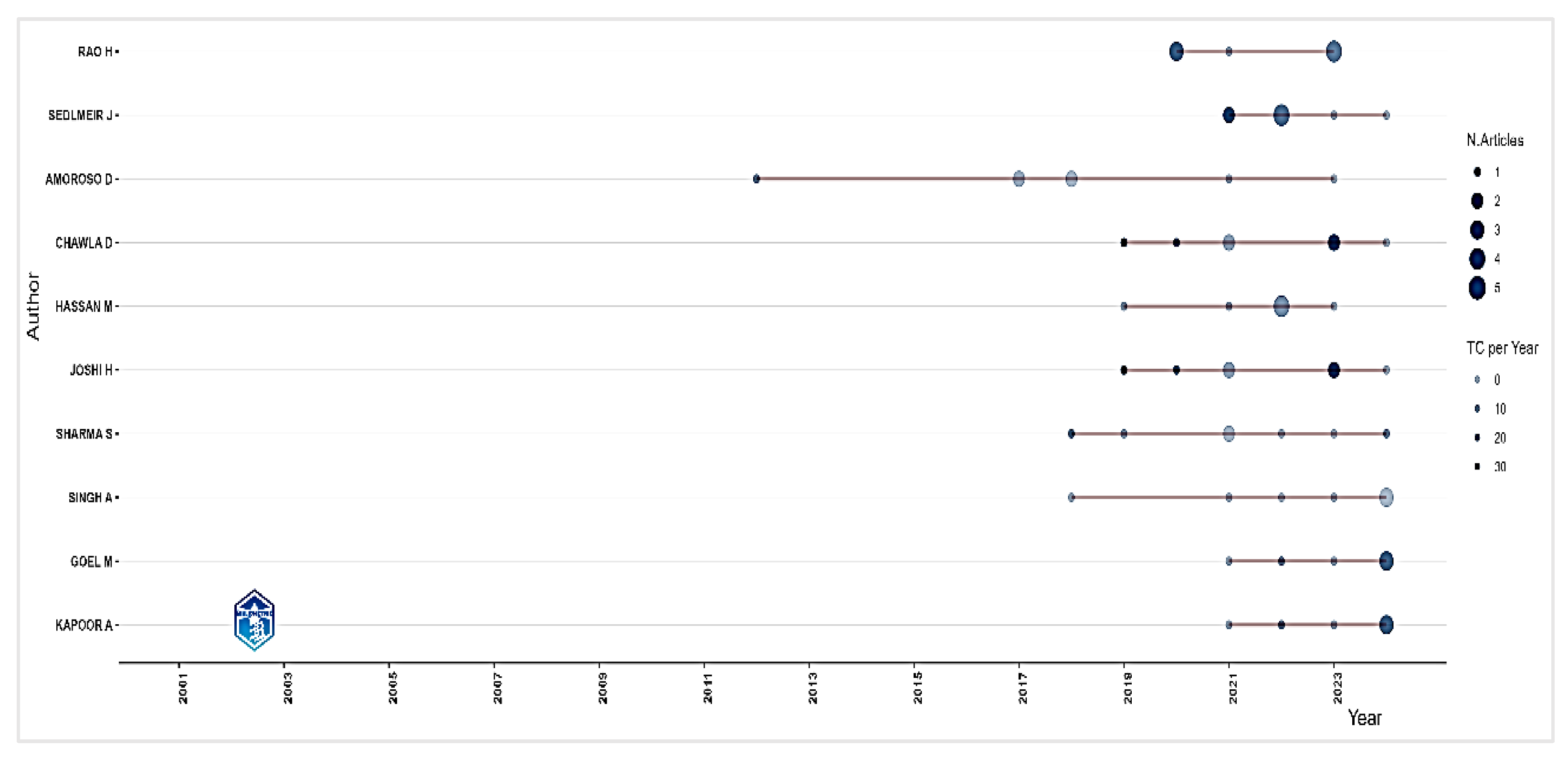

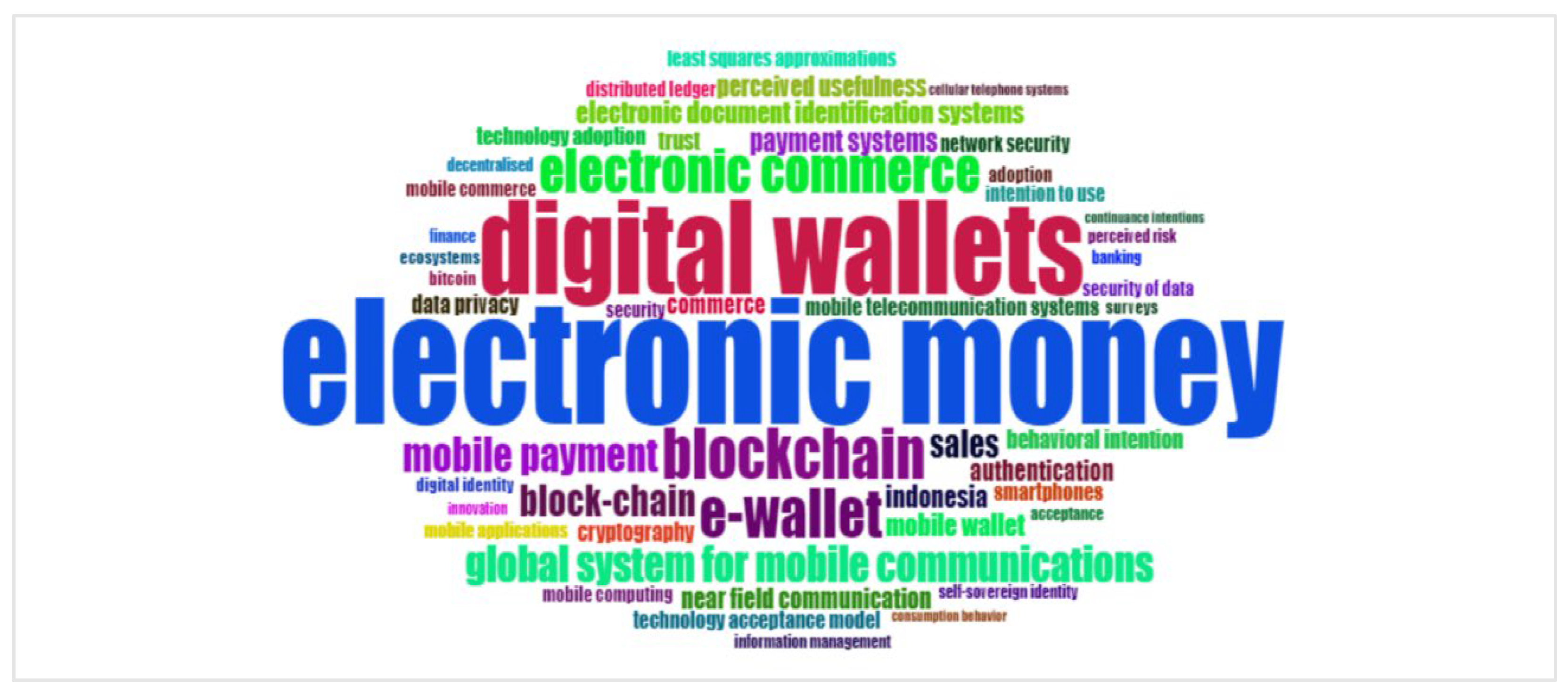

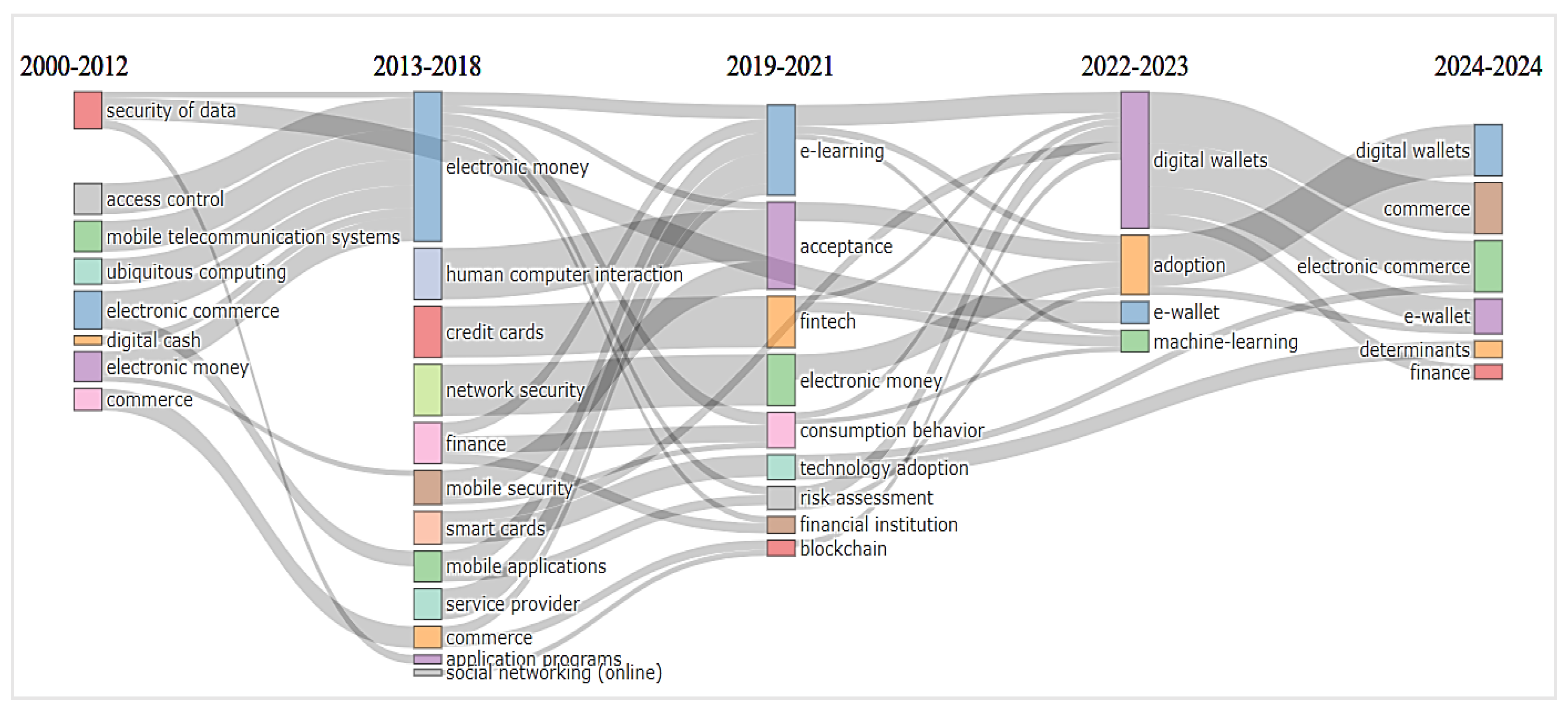

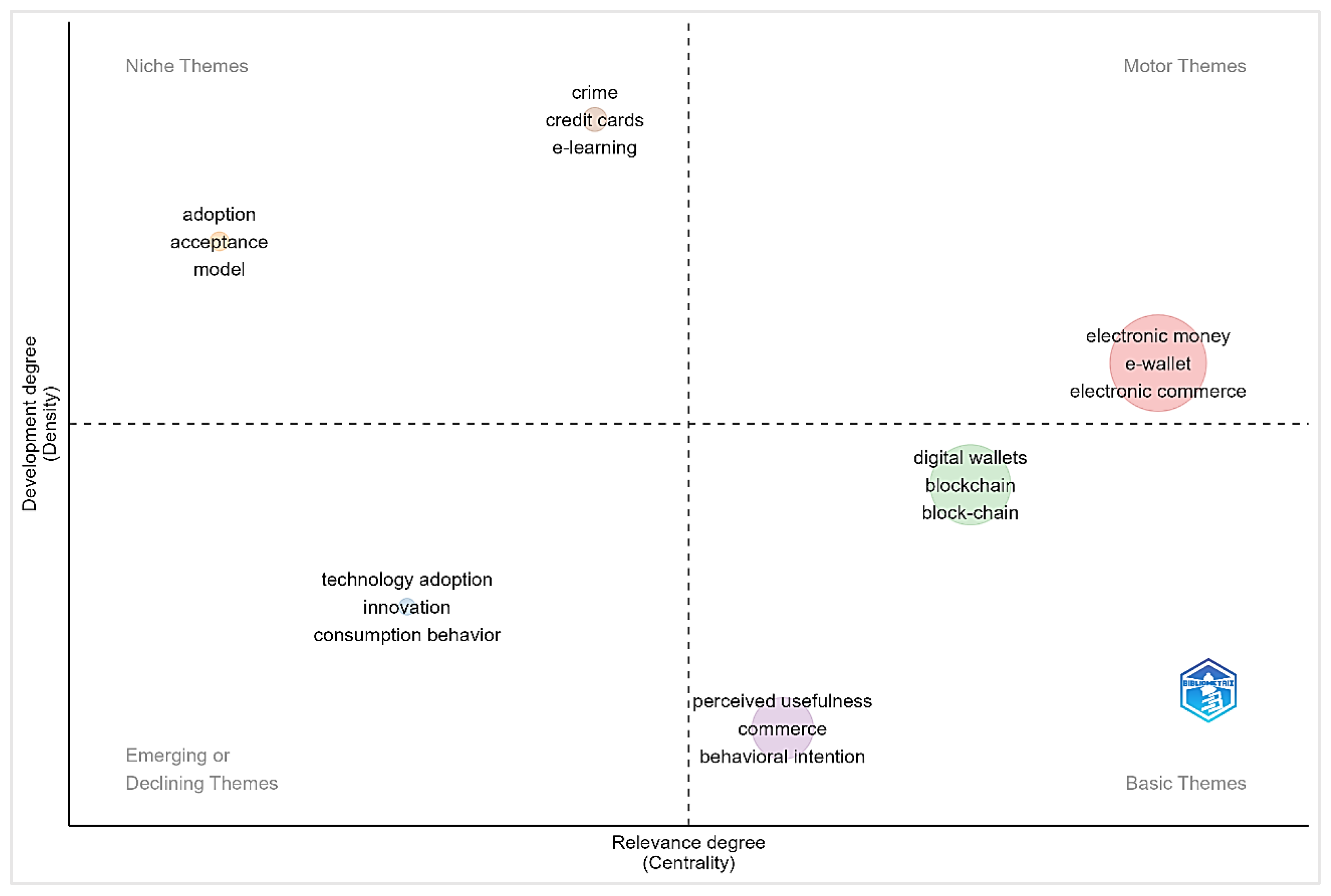

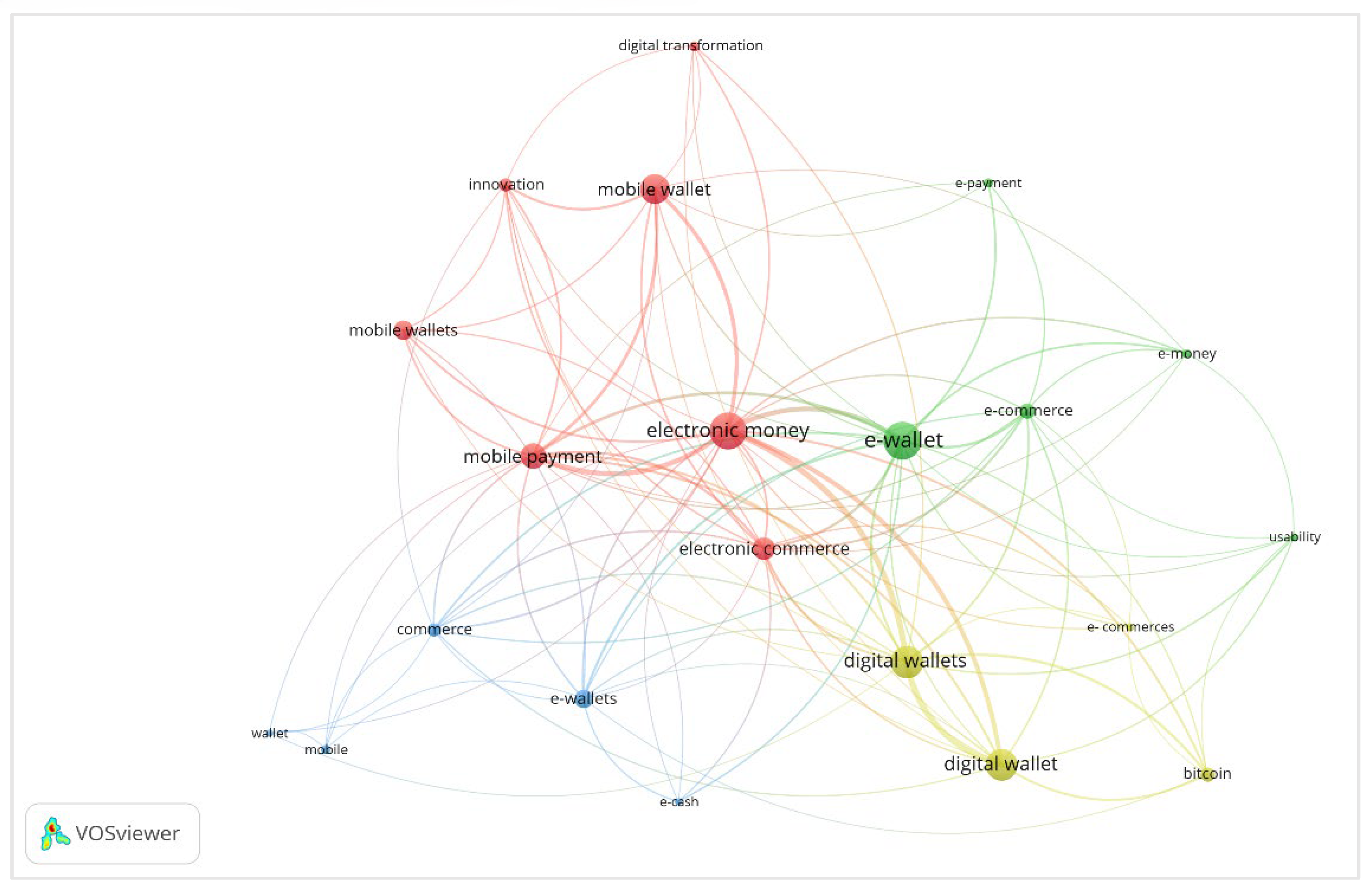

Bibliometric Analysis

4. Discussion

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Sankaran, R.; Chakraborty, S. Factors Impacting Mobile Banking in India: Empirical Approach Extending UTAUT2 with Perceived Value and Trust. IIM Kozhikode Soc. Manag. Rev. 2021, 11, 7–24. [Google Scholar] [CrossRef]

- Jadil, Y.; Rana, N. P.; Dwivedi, Y. K. A Meta-Analysis of the UTAUT Model in the Mobile Banking Literature: The Moderating Role of Sample Size and Culture. J. Bus. Res. 2021, 132, 354–372. [Google Scholar] [CrossRef]

- Yang, M.; Al Mamun, A.; Mohiuddin, M.; Nawi, N. C.; Zainol, N. R. Cashless Transactions: A Study on Intention and Adoption of e-Wallets. Sustain. 2021, 13, 1–18. [Google Scholar] [CrossRef]

- Uribe-Linares, G. P.; Ríos-Lama, C. A.; Vargas-Merino, J. A. Is There an Impact of Digital Transformation on Consumer Behaviour? An Empirical Study in the Financial Sector. Economies 2023, 11, 1–16. [Google Scholar] [CrossRef]

- Gasanov, E. A.; Krasota, T. G.; Kulikov, A. V.; Pitsuk, I. L.; Primachenko, Y. V. A New Model Of Consumer Behaviour In The Digital Economy. AmurCon 2021 Int. Sci. Conf. 126. Eur. Proc. Soc. Behav. Sci. 2022, 126, 314–322. [Google Scholar] [CrossRef]

- Dahlberg, T.; Mallat, N.; Ondrus, J.; Zmijewska, A. Past, Present and Future of Mobile Payments Research: A Literature Review. Electron. Commer. Res. Appl. 2008, 7, 165–181. [Google Scholar] [CrossRef]

- Amoroso, D.; Magnier-Watanabe, R. Building a Research Model for Mobile Wallet Consumer Adoption: The Case of Mobile Suica in Japan. J. Theor. Appl. Electron. Commer. Res. 2012, 7, 94–110. [Google Scholar] [CrossRef]

- Hossain, A.; Quaresma, R.; Rahman, H. Investigating Factors Influencing the Physicians’ Adoption of Electronic Health Record (EHR) in Healthcare System of Bangladesh: An Empirical Study. Int. J. Inf. Manage. 2019, 44, 76–87. [Google Scholar] [CrossRef]

- Singh, N.; Sinha, N.; Liébana-Cabanillas, F. J. Determining Factors in the Adoption and Recommendation of Mobile Wallet Services in India: Analysis of the Effect of Innovativeness, Stress to Use and Social Influence. Int. J. Inf. Manage. 2020, 50, 191–205. [Google Scholar] [CrossRef]

- Nileshkumar, R. Digital Payment System in India- Pathway to Digital India. Peer Rev. Ref. J. 2024, 1, 55–58. [Google Scholar] [CrossRef]

- Deng, Z.; Lu, Y.; Deng, S.; Zhang, J. Exploring User Adoption of Mobile Banking: An Empirical Study in China. Int. J. Inf. Technol. Manag. 2010, 9, 289–301. [Google Scholar] [CrossRef]

- Bellido, G.; Bartolo, E. Billeteras Electrónicas: Una Herramienta Para El Emprendimiento En La Era Digital. Interconectando Saberes 2023, 15, 9–21. [Google Scholar] [CrossRef]

- Aji, H.; Adawiyah, W. How E-Wallets Encourage Excessive Spending Behavior among Young Adult Consumers? J. Asia Bus. Stud. 2022, 16, 868–884. [Google Scholar] [CrossRef]

- Ilieva, G.; Yankova, T.; Dzhabarova, Y.; Ruseva, M.; Angelov, D.; Klisarova-Belcheva, S. Customer Attitude toward Digital Wallet Services. Systems 2023, 11. [Google Scholar] [CrossRef]

- Pal, D.; Vanijja, V.; Papasratorn, B. An Empirical Analysis towards the Adoption of NFC Mobile Payment System by the End User. Procedia Comput. Sci. 2015, 69, 13–25. [Google Scholar] [CrossRef]

- Soodan, V.; Rana, A. Modeling Customers’ Intention to Use e-Wallet in a Developing Nation: Extending UTAUT2 with Security, Privacy and Savings. J. Electron. Commer. Organ. 2020, 18, 89–114. [Google Scholar] [CrossRef]

- Ajina, A.; Javed, H.; Ali, S.; Zamil, A. Are Men from Mars, Women from Venus? Examining Gender Differences of Consumers towards Mobile-Wallet Adoption during Pandemic. Cogent Bus. Manag. 2023, 10, 2178093. [Google Scholar] [CrossRef]

- Baxi, C.; Patel, K.; Patel, K.; Patel, V.; Acharya, V. Consumers’ Digital Wallet Adoption: Integration of Technology Task Fit and UTAUT. Int. J. Asian Bus. Inf. Manag. 2023, 15, 1–23. [Google Scholar] [CrossRef]

- Zaidan, H.; Shishan, F.; Al-Hasan, M.; Al-Mawali, H.; Mowafi, O.; Dahiyat, S. E. Cash or Cash-Less? Exploring the Determinants of Continuous Intention to Use e-Wallets: The Moderating Role of Environmental Knowledge. Compet. Rev. 2024, ahead-of-p (ahead-of-print).

- Bagla, R. K.; Sancheti, V. Gaps in Customer Satisfaction with Digital Wallets: Challenge for Sustainability. J. Manag. Dev. 2018, 37, 442–451. [Google Scholar] [CrossRef]

- Apanasevic, T.; Markendahl, J.; Arvidsson, N. Stakeholders’ Expectations of Mobile Payment in Retail: Lessons from Sweden. Int. J. Bank Mark. 2016, 34, 37–61. [Google Scholar] [CrossRef]

- Al-Okaily, M.; Lutfi, A.; Alsaad, A.; Taamneh, A.; Alsyouf, A. The Determinants of Digital Payment Systems’ Acceptance under Cultural Orientation Differences: The Case of Uncertainty Avoidance. Technol. Soc. 2020, 63, 101367. [Google Scholar] [CrossRef]

- Gupta, S.; Xu, H. Examining the Relative Influence of Risk and Control on Intention to Adopt Risky Technologies. J. Technol. Manag. Innov. 2010, 5, 22–37. [Google Scholar] [CrossRef]

- Johnson, V. L.; Kiser, A.; Washington, R.; Torres, R. Limitations to the Rapid Adoption of M-Payment Services: Understanding the Impact of Privacy Risk on M-Payment Services. Comput. Human Behav. 2018, 79, 111–122. [Google Scholar] [CrossRef]

- Alfie, N.; Sidi, J.; Junaini, S.; Chai, W.; Mit, E.; Gedat, R. Bridging the Digital Gap: A Systematic Review on UI/UX Design Considerations for Elderly-Friendly Digital Wallets. 2023 6th Int. Conf. Appl. Comput. Intell. Inf. Syst. Intell. Resilient Digit. Innov. Sustain. Living, ACIIS 2023 - Proc. 2023, Begawan. [CrossRef]

- Behera, C.; Kumra, R. Two Decades of Mobile Payment Research: A Systematic Review Using the TCCM Approach. Int. J. Consum. Stud. 2024, 48, e13003. [Google Scholar] [CrossRef]

- Iscan, C.; Kumas, O.; Akbulut, F.; Akbulut, A. Wallet-Based Transaction Fraud Prevention Through LightGBM With the Focus on Minimizing False Alarms. IEEE Access 2023, 11, 131465–131474. [Google Scholar] [CrossRef]

- Oliveira, T.; Thomas, M.; Baptista, G.; Campos, F. Mobile Payment: Understanding the Determinants of Customer Adoption and Intention to Recommend the Technology. Comput. Human Behav. 2016, 61, 404–414. [Google Scholar] [CrossRef]

- Sakalauskas, E.; Bendoraitis, A.; Lukšaite, D.; Butkus, G.; VitkutE- -Adzgauskiene, D. Tax Declaration Scheme Using Blockchain Confidential Transactions. Inform. 2023, 34, 603–616. [Google Scholar] [CrossRef]

- Lo, W. W.; Kulatilleke, G. K.; Sarhan, M.; Layeghy, S.; Portmann, M. Inspection-L: Self-Supervised GNN Node Embeddings for Money Laundering Detection in Bitcoin. Appl. Intell. 2023, 53, 19406–19417. [Google Scholar] [CrossRef]

- Iscan, C.; Akbulut, F. Fraud Detection Using Recurrent Neural Networks for Digital Wallet Security. UBMK 2023 - Proc. 8th Int. Conf. Comput. Sci. Eng. 2023, 538–542. [CrossRef]

- Kapoor, A.; Sindwani, R.; Goel, M.; Shankar, A. Mobile Wallet Adoption Intention amid COVID-19 Pandemic Outbreak: A Novel Conceptual Framework. Comput. Ind. Eng. 2022, 172, 108646. [Google Scholar] [CrossRef]

- Michell, C.; Winarto, C. N.; Bestari, L.; Ramdhan, D.; Chowanda, A. Systematic Literature Review of E-Wallet: The Technology and Its Regulations in Indonesia. 2022 Int. Conf. Inf. Technol. Syst. Innov. ICITSI 2022 - Proc. 2022, 64–69. [CrossRef]

- Ellegaard, O.; Wallin, J. A.; Dk, S. The Bibliometric Analysis of Scholarly Production: How Great Is the Impact? Scientometrics 2015, 105, 1809–1831. [Google Scholar] [CrossRef]

- Waltz, M.; Matos, R.; Braga, L. A.; Batista, F.; Galvão, C. A Bibliometric and Descriptive Analysis of Inclusive Education in Science Education. Stud. Sci. Educ. 2021, 57, 241–263. [Google Scholar] [CrossRef]

- Niknejad, N.; Ismail, W.; Bahari, M.; Hendradi, R.; Salleh, A. Z. Mapping the Research Trends on Blockchain Technology in Food and Agriculture Industry: A Bibliometric Analysis. Environ. Technol. Innov. 2021, 21, 101272. [Google Scholar] [CrossRef]

- Farisyi, S.; Musadieq, M. Al; Utami, H. N.; Damayanti, C. R. A Systematic Literature Review: Determinants of Sustainability Reporting in Developing Countries. Sustain. 2022, 14, Page 10222 2022, 14, 10222. [Google Scholar] [CrossRef]

- Van, N.; Waltman, L. Software Survey: VOSviewer, a Computer Program for Bibliometric Mapping. Scientometrics 2010, 84, 523–538. [Google Scholar] [CrossRef] [PubMed]

- Aria, M.; Cuccurullo, C. Bibliometrix: An R-Tool for Comprehensive Science Mapping Analysis. J. Informetr. 2017, 11, 959–975. [Google Scholar] [CrossRef]

- Sahi, A. M.; Khalid, H.; Abbas, A. F.; Khatib, S. F. A. The Evolving Research of Customer Adoption of Digital Payment: Learning from Content and Statistical Analysis of the Literature. J. Open Innov. Technol. Mark. Complex. 2021, 7, 230. [Google Scholar] [CrossRef]

- Loh, X. M.; Lee, V. H.; Tan, G. W. H.; Ooi, K. B.; Dwivedi, Y. K. Switching from Cash to Mobile Payment: What’s the Hold-Up? Internet Res. 2021, 31, 376–399. [Google Scholar] [CrossRef]

- Hassan, M.; Iqbal, A.; Iqbal, Z. Factors Affecting the Adoption of Internet Banking in Pakistan: An Integration of Technology Acceptance Model and Theory of Planned Behaviour. Int. J. Bus. Inf. Syst. 2018, 28, 342–370. [Google Scholar] [CrossRef]

- Balakrishnan, V.; Shuib, N. L. M. Drivers and Inhibitors for Digital Payment Adoption Using the Cashless Society Readiness-Adoption Model in Malaysia. Technol. Soc. 2021, 65, 101554. [Google Scholar] [CrossRef]

- Teng, S.; Khong, K. W. Examining Actual Consumer Usage of E-Wallet: A Case Study of Big Data Analytics. Comput. Human Behav. 2021, 121, 106778. [Google Scholar] [CrossRef]

- Sedlmeir, J.; Buhl, H. U.; Fridgen, G.; Keller, R. The Energy Consumption of Blockchain Technology: Beyond Myth. Bus. Inf. Syst. Eng. 2020, 62, 599–608. [Google Scholar] [CrossRef]

- Ramayanti, R.; Rachmawati, N. A.; Azhar, Z.; Nik Azman, N. H. Exploring Intention and Actual Use in Digital Payments: A Systematic Review and Roadmap for Future Research. Comput. Hum. Behav. Reports 2024, 13, 100348. [Google Scholar] [CrossRef]

- Chawla, D.; Joshi, H. Role of Mediator in Examining the Influence of Antecedents of Mobile Wallet Adoption on Attitude and Intention. Glob. Bus. Rev. 2023, 24, 609–625. [Google Scholar] [CrossRef]

- Chawla, D.; Joshi, H. Consumer Perspectives about Mobile Banking Adoption in India – a Cluster Analysis. Int. J. Bank Mark. 2017, 35, 616–636. [Google Scholar] [CrossRef]

- Adiani, W.; Aprianingsih, A.; Fachira, I.; Debby, T.; Maharatie, A. P. Social Influence, Financial Benefit, and e-Wallet Multi-Brand Loyalty: The Mediating Impact of Commitment. Cogent Bus. Manag. 2023, 11. [Google Scholar] [CrossRef]

- Sharma, P.; Sharma, S. Mapping the Intellectual Structure of Mobile Payment Research: A Bibliometric Analysis. SAGE Open 2023, 13. [Google Scholar] [CrossRef]

| Author | Institution | Country | Number of publications on the subject in both databases | Number of publications Scopus (S) WoS (W) | Number of citations Scopus (S) WoS (W) | Índice H Total Scopus (S) WoS (W) |

|---|---|---|---|---|---|---|

| RAO H. | The University of Texas | USA | 8 | 320(S) 231(W) | 14.350(S) 9.505(W) | 54(S) 45(W) |

| SEDLMEIR J. | University of Luxembourg | Luxembourg | 8 | 36(S) 21(W) |

689(S) 360(W) |

14(S) 9(W) |

| LOVING D. | Auburn University, Montgomery | USA | 7 | 80(S) 21(W) |

813(S) 307(W) |

12(S) 9(W) |

| CHAWLA D. | Government Medical College and Hospital | India | 7 | 173(S) 21(W) | 1732(S) 360(W) |

23(S) 9(W) |

| HASAN M. | Hashemite University | Jordan | 7 | 3(S) 2(W) |

0(S) 0(W) |

1(S) 0(W) |

| JOSHI H. | Institute of Technology Roorkee | India | 7 | 63(S) 190(W) | 724(S) 3121(W) |

15(S) 29(W) |

| SHARMA S. | Central Drug Research Institute India | India | 7 | 56(S) 46(W) |

1415(S) 361(W) |

20(W) 10(W) |

| SINGH A. | University of Delhi | India | 7 | 151(S) 3(W) |

6039(S) 36(W) |

41(S) 3(W) |

| GOEL M. | Pomona College | USA | 6 | 4(S) 2(W) |

39(S) 1(W) |

3(S) 1(W) |

| KAPOOR A. | University of Science & Technology | India | 6 | O(S) 5(W) |

0(S) 40(W) |

0(S) 3(W) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).