4.2. Definition of the Variables

Dependent Variable

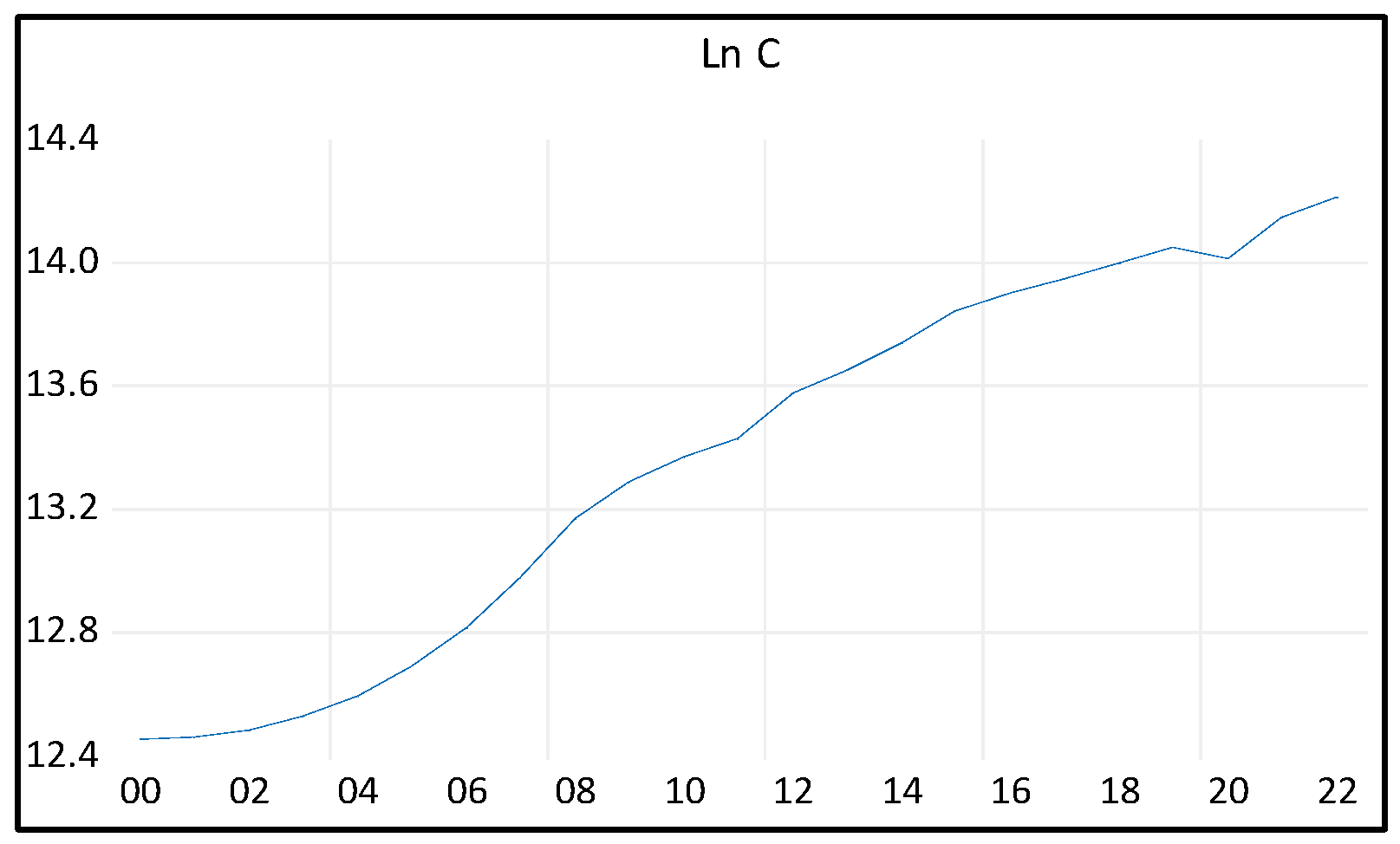

Aggregate Consumption (C): The Gross Final Consumption Expenditure denoted by (C) is the dependent variable. It encompasses the total value of goods and services acquired by households, including durable products. This measure does not include the purchase of dwellings but does include imputed rent for owner-occupied dwellings. Furthermore, it covers government payments and fees for permits and licenses. Importantly, this indicator includes the expenditures of nonprofit institutions serving households, even if they are reported separately by the country.

Independent Variables

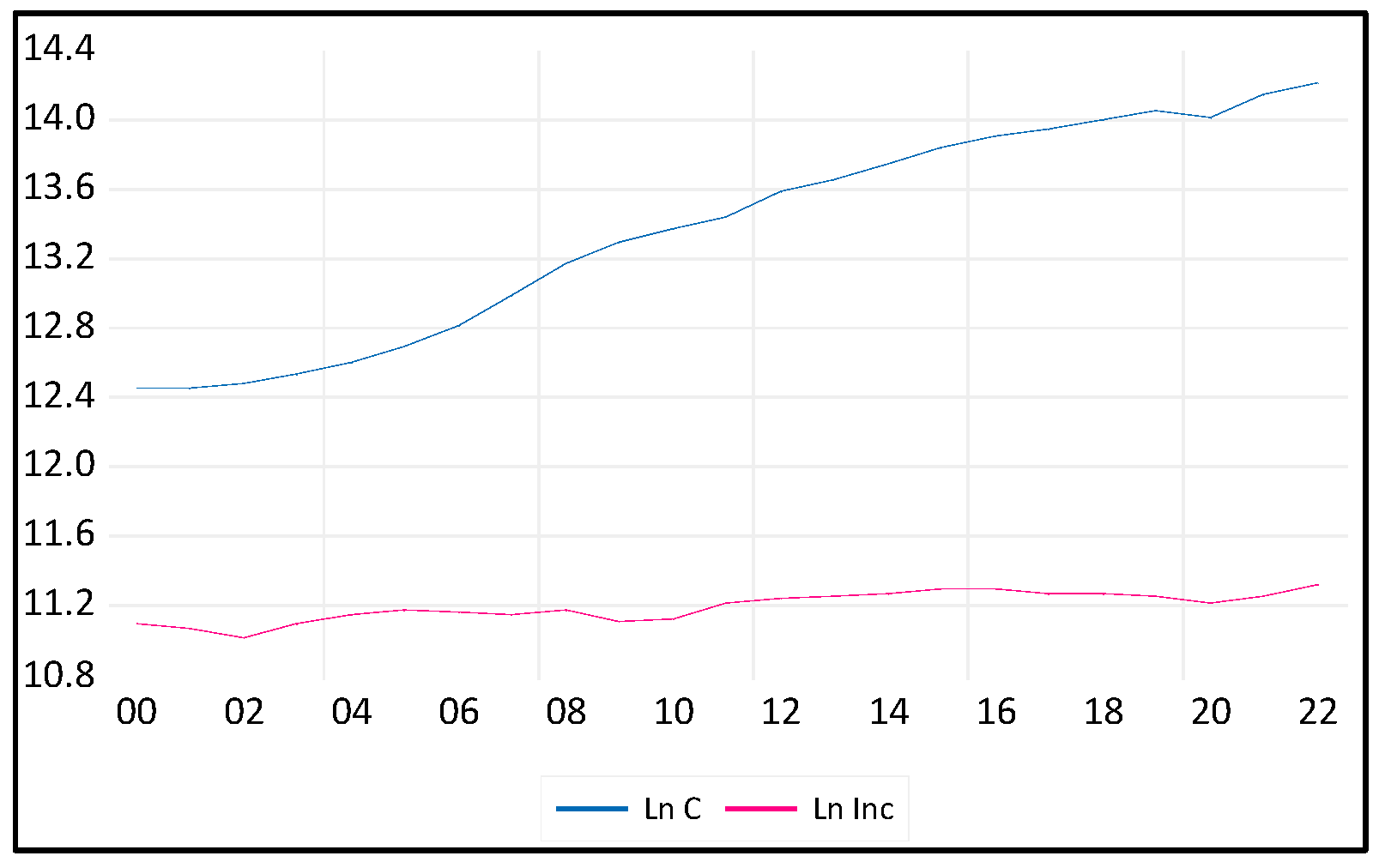

1. Disposable income, denoted by (Yd), is the amount of money households have available for spending and saving after income taxes have been accounted for. It is calculated as the gross income of households minus direct taxes, and it includes earnings from employment, self-employment, investments, and any other sources of income.

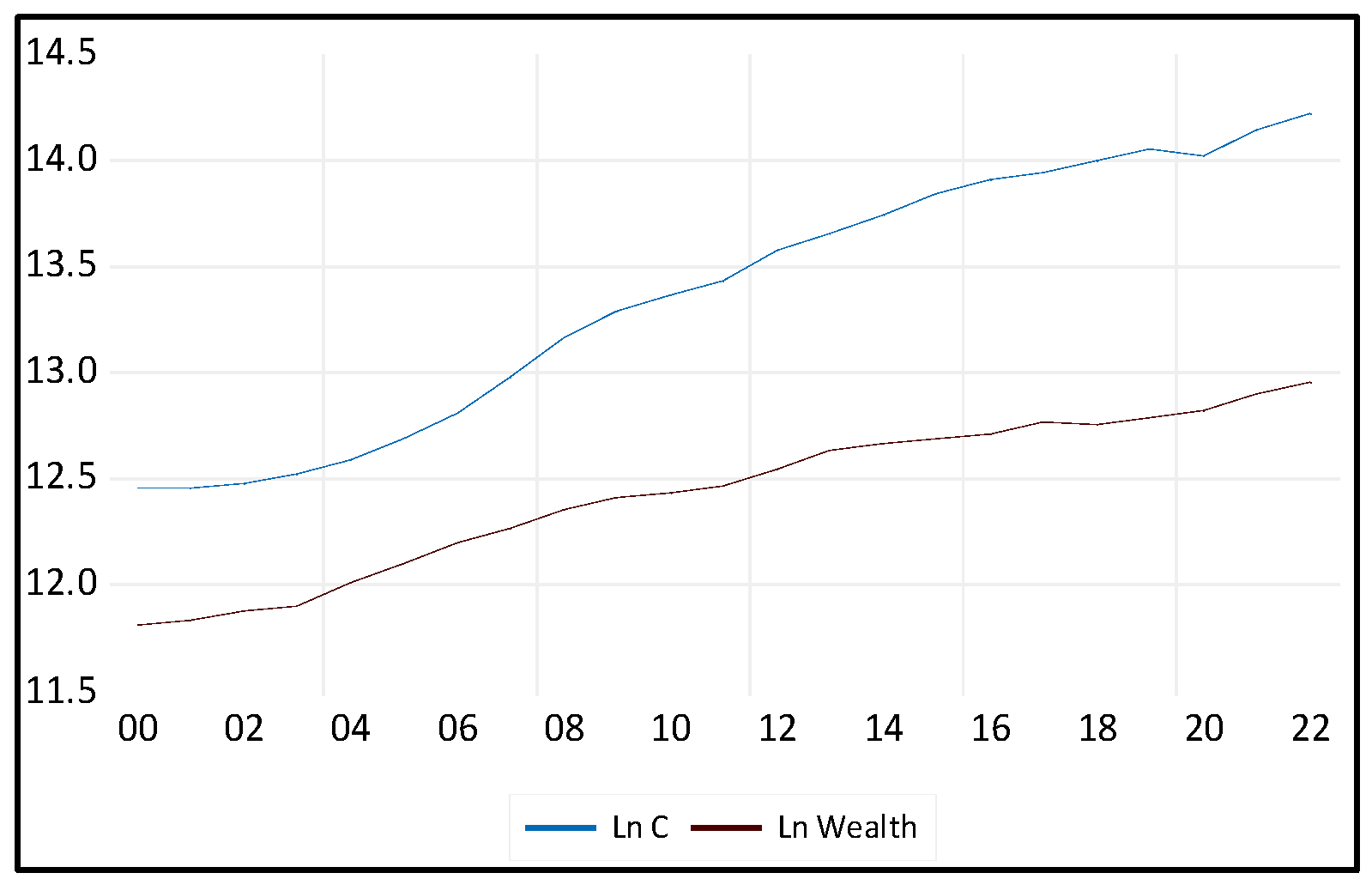

2. Household wealth, denoted by (W), is the total value of financial and nonfinancial assets owned by households minus their liabilities. This study measures household wealth using Real estate properties.

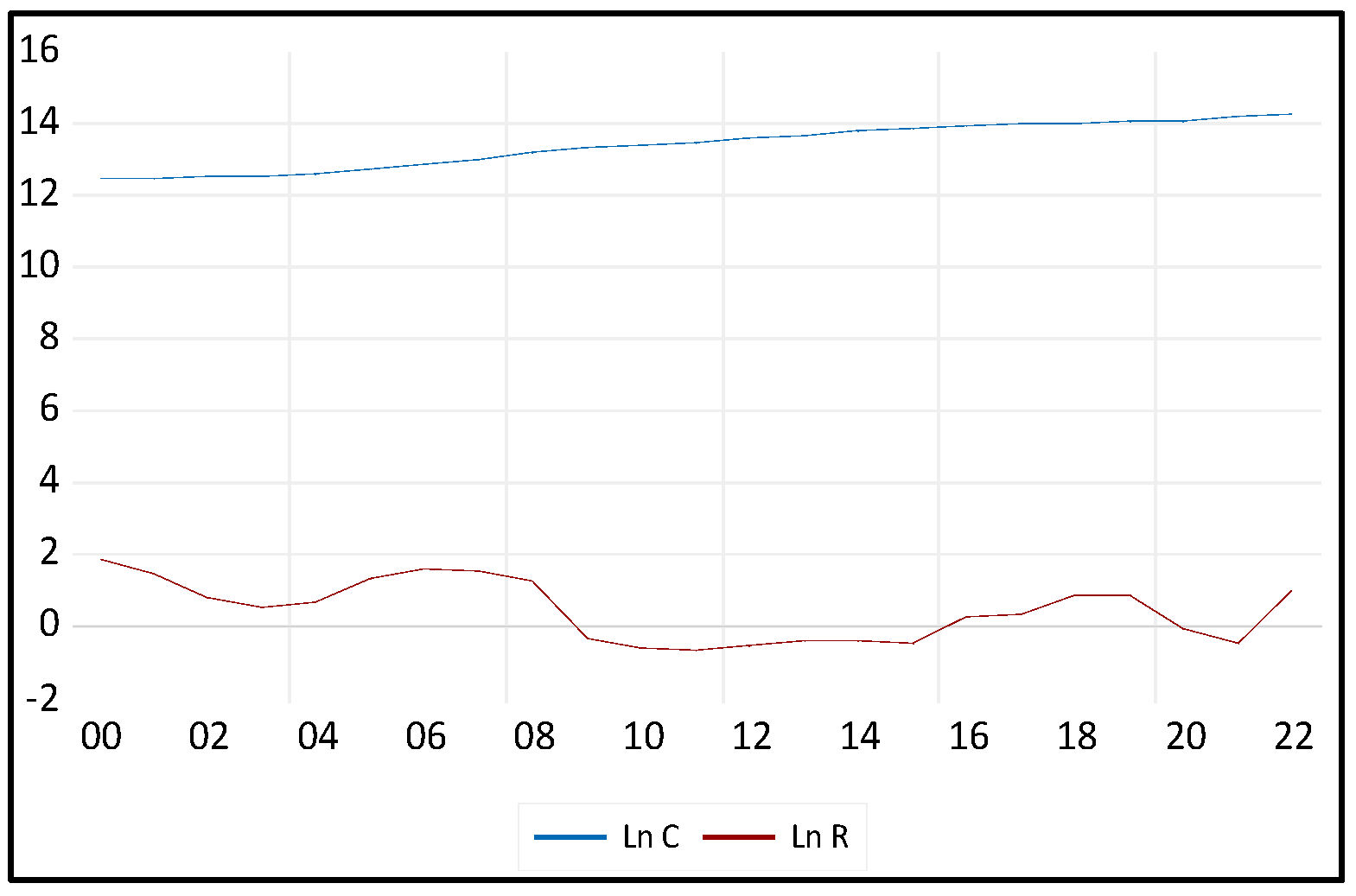

3. Interest rates, denoted by (R), refer to the cost of borrowing or the return on savings. Specifically, it is the proportion of a loan charged as interest to the borrower, typically expressed as an annual percentage of the loan amount.

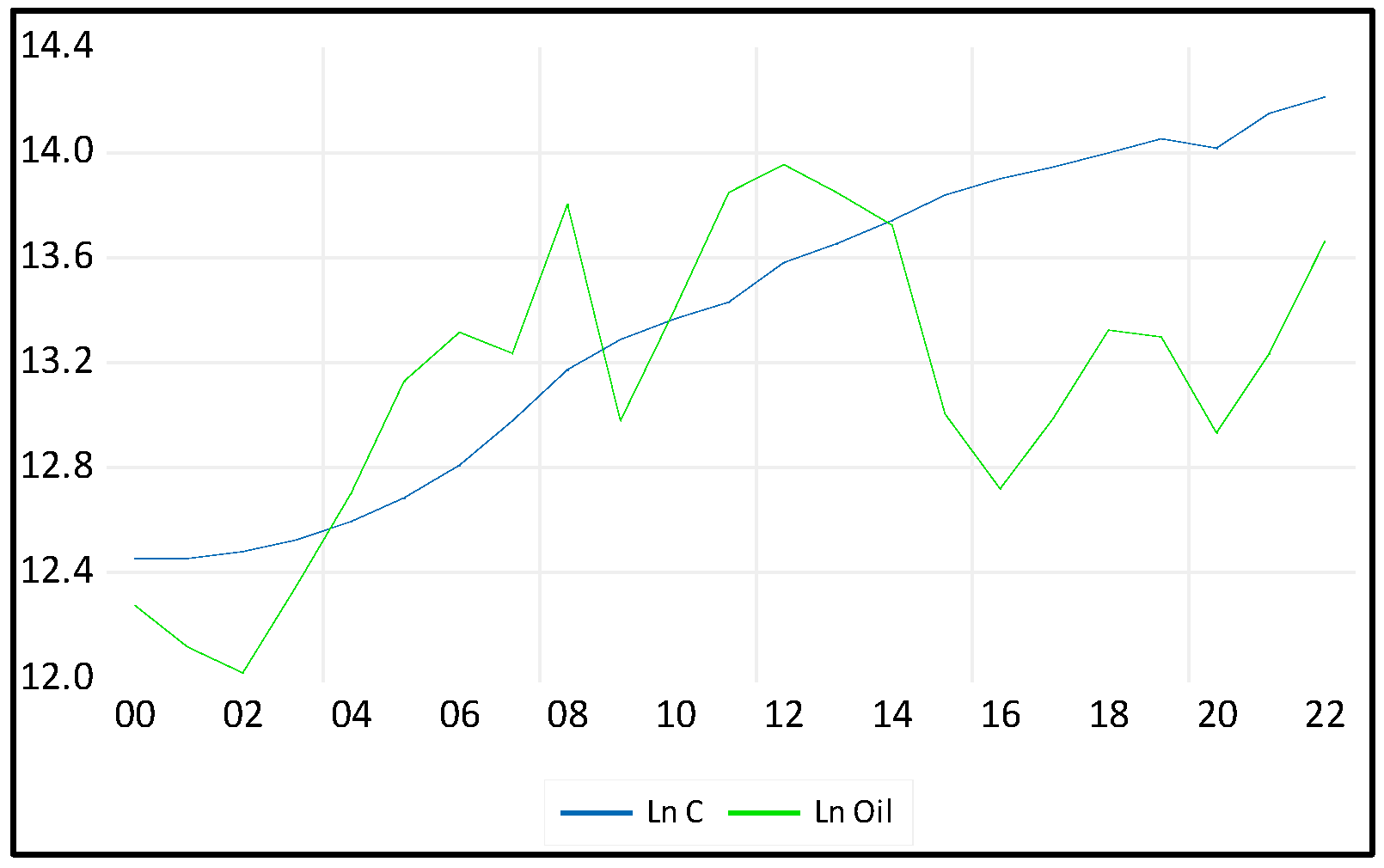

4. Oil revenues, denoted by (O), refer to the income a country earns from oil extraction, production, and sale. This includes export revenues, domestic sales, taxes and royalties, and government participation.

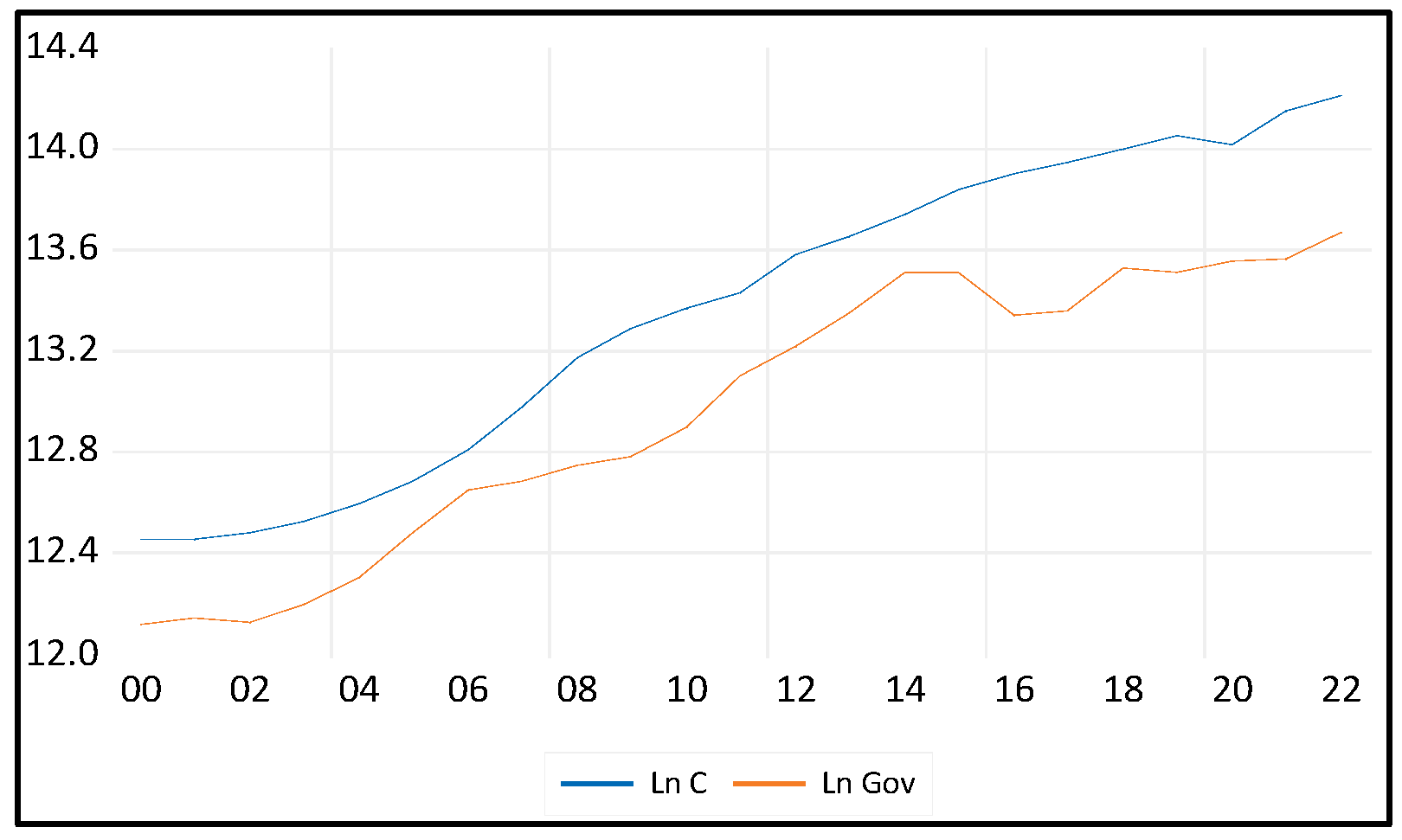

5. Government spending, denoted by (G), includes public service, defense education, health, social security and welfare services, housing and community amenities, other community and social services, and economic services.

4.3. Econometric Methodology

This study employs various econometric techniques to address the challenges posed by time series data, causality, and cointegration. Furthermore, the Autoregressive Distributed Lag (ARDL) methodology is commonly employed in econometrics to estimate and analyze the enduring relationships between variables, particularly in the context of time series data analysis (Mohammed, 2024). This approach frequently simulates cointegration and dynamic connections among economic factors. Additionally, the model specification in the ARDL model, as opposed to traditional regression models, includes lagged values of both the dependent and independent variables to capture the evolution of the relationship over time. However, using differences helps to prevent the problem of false correlations caused by shared trends. However, it also risks overlooking the long-term equilibrium (cointegrating) connections that could be present between the levels of these variables. Various econometric methods can be employed for analysis, such as the dynamic ordinary least squares (DOLS) estimation technique, the Johansen cointegration test, and the error correction model (ECM). These approaches are well-suited for examining the long-term relationships, short-term dynamics, and causal links between variables of Saudi consumption function.

DOLS is a statistical technique used to estimate parameters in dynamic regression models that involve time series data with potential integration. MacKinnon et al. (1999) emphasized that the DOLS method is widely used to examine cointegrated time series.

The general formula for DOLS is:

where:

∆It is the dependent variable at time t;

∆Xt is the independent variable(s) that exists at time t;

α is the intercept.

β is/are the coefficients of the independent variables;

εt is the error term at time t.

Furthermore, the Johansen cointegration test involves the estimation of a vector autoregressive (VAR) model followed by the conduction of likelihood ratio tests to assess the model's suitability. The equation for the Johansen cointegration test can be expressed as:

where:

Δyt is the difference vector of time series variables at time t.

Π represents the matrix of cointegration coefficients.

Γi is the matrices of adjustment coefficients.

p is the lag length of the VAR model.

ϵt is the error term.

Besides, ECM is a theoretical framework utilized to examine the short-term and long-term interactions between variables in a cointegrated relationship. The core equation of ECM can be expressed as:

where:

∆Yt: represents the short-term changes in the dependent variable at time "t,"

∆Xt: indicates the short-term variations in the independent variable(s) at time "t."

α: is the intercept term that signifies the constant effect on the dependent variable,

β1: measures the speed of the adjustment process in response to deviations from the long-term balance observed in the previous period.

β2: is the coefficient associated with the lagged difference in the independent variable(s) to adjust for deviations from the equilibrium condition.

γ: is the coefficient that represents the initial modification in the explanatory variable's coefficient, reflecting the direct impact of variations in the explanatory variable on the response variable. Additionally.

δ1: captures any persistence or autocorrelation through the coefficient of the lagged first difference in the dependent variable.

δ2: is a potential persistence or autocorrelation effect by including the lagged first difference coefficient within the independent variable(s).

εt: represents the error term signifying the unaccounted variability in the dependent variable at time "t."

For the analysis of the Saudi consumption function, the ECM can be specified to include the following components based on the critical determinants identified:

where:

∆Ct = change in aggregate consumption

∆Ydt = change in disposable income.

∆Wt = change in household wealth.

∆Rt = change in interest rates.

∆Ot = change in oil revenues.

∆Gt = change in government spending

λ = coefficient of the Error Correction Term (speed of adjustment).

ECTt−1 = lagged error correction term (deviation from long-term equilibrium).

εt = error term.