Submitted:

24 March 2024

Posted:

16 April 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Methodology

2.1. Typical Questions on Individual Management and Budgeting

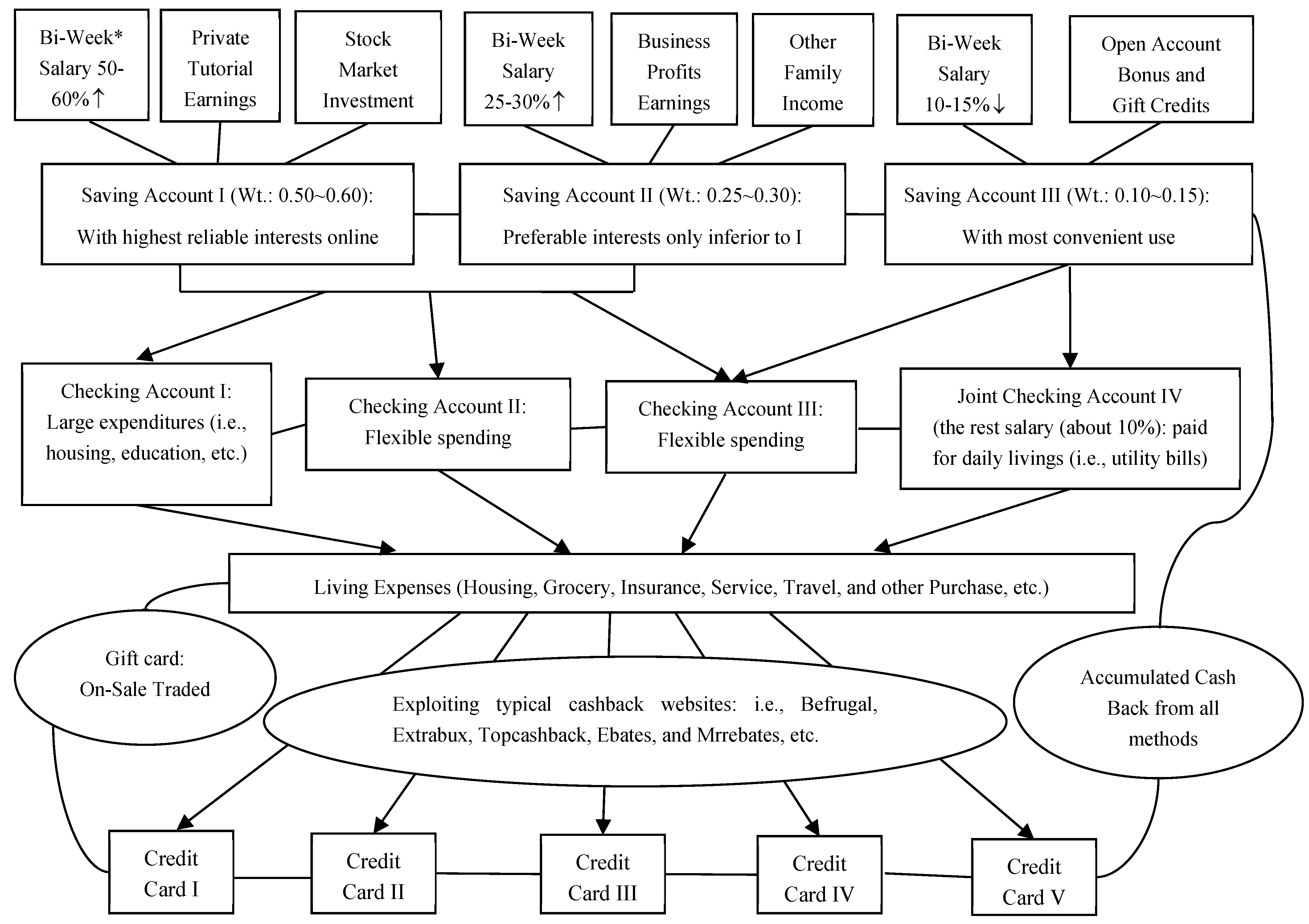

2.2. Proposed Static Fiscal Model to Distribute Income When Sharing Graduate Students’ Perspective

2.3. Proposed Dynamic Fiscal Strategy to Increase Income When Surviving COVID-19 and Post-Era under the Risk of Higher Financial Inflation

3. Case Study and Quantitative Analysis

3.1. Assumption

3.2. Case study and Quantitative Results of the Proposed Static Fiscal Model

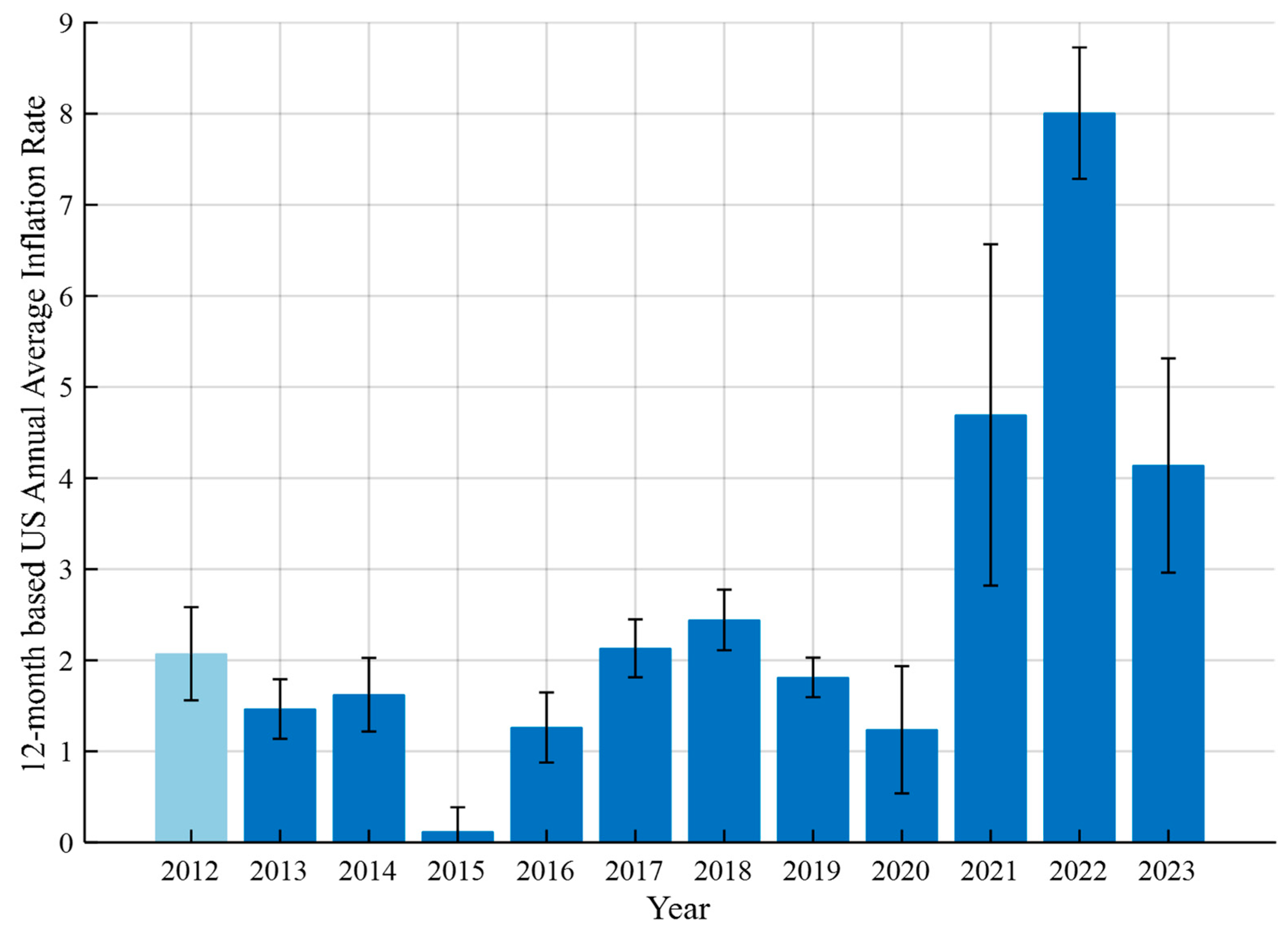

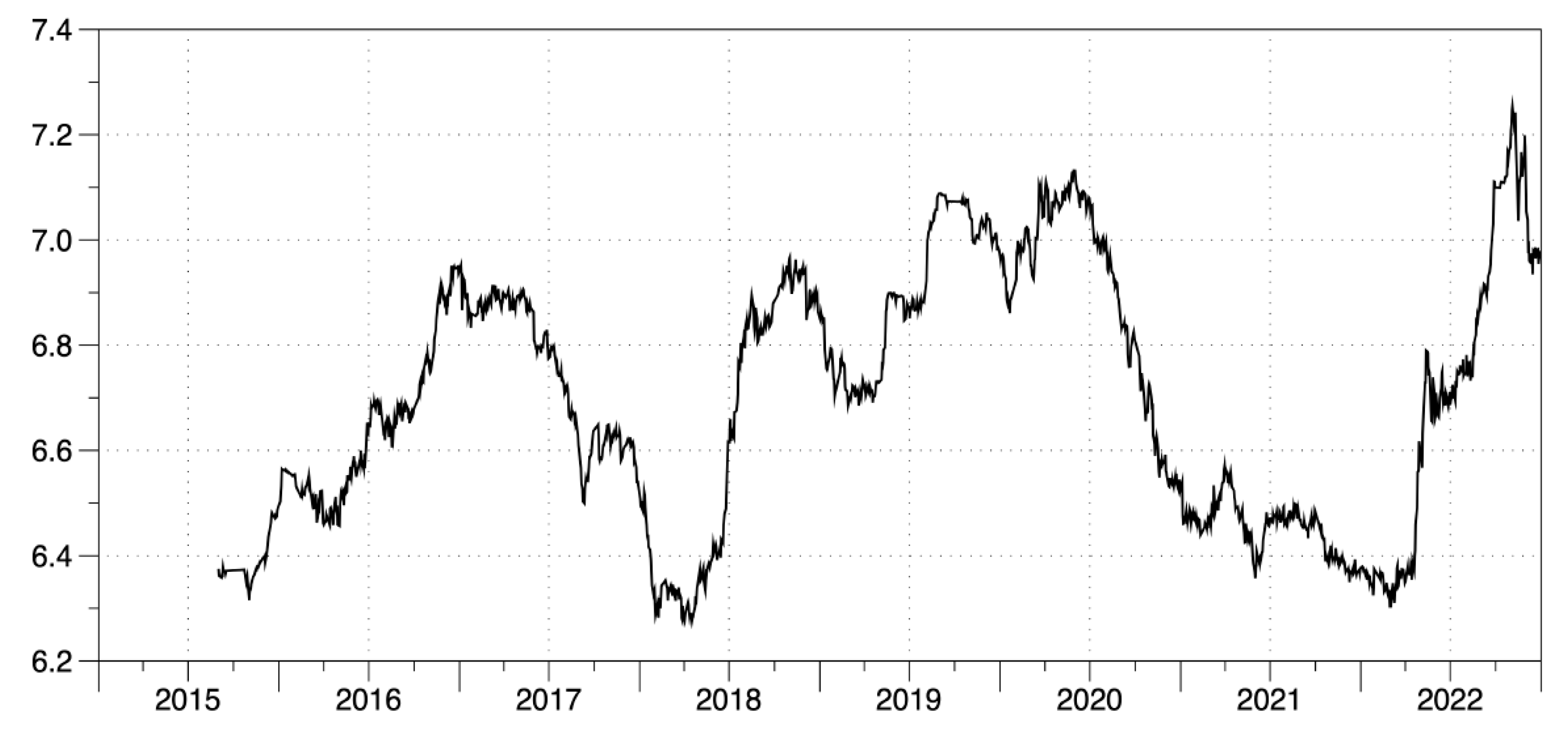

3.3. Dynamic Strategic Approaches for Asset Appreciation under Higher-Level Inflation

4. Discussions

4.1. Limitations of Our Study

4.2. Summary of Research Challenges

5. Conclusions and Future Work

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. MATLAB Simulation Example: Three Cases of a Ph.D. Student’s Financial Status with the Proposed Static and Dynamic Strategic Approaches

Appendix B. Possible Options for Choosing Banking Service

References

- Anzuimi, Alessio, Marco J. Lombardi, and Patrizio Pagano 2010. The impact of monetary policy shocks on commodity prices. SSRN Electronic Journal 9, 1232.

- Al Ali, Amal, Ahmed M. Khedr, Magdi El Bannany, and Sakeena Kanakkayil 2023. GALSTM-FDP:A time-series modeling approach using Hybrid GA and LSTM for financial distress prediction. Int. J. Financial Studies 11, 38. https://doi.org/ 10. Int. J. Financial Studies; //doi: 11, 38. https, 3390. [Google Scholar] [CrossRef]

- Bailey, Martin J. The welfare cost of inflationary finance. Journal of Political Economy 1956, 64, 93–110. [Google Scholar] [CrossRef]

- Barro, Robert J. Inflationary finance and the welfare cost of inflation. Journal of Political Economy 1972, 80, 978–1001. [Google Scholar] [CrossRef]

- Belke, A. H., I. G. Bordon, and T. W. Hendricks 2014. Monetary policy, global liquidity and commodity prices dynamics. The North American Journal of Economics and Finance 28, 1–16.

- Chen, Yi-Chang, Shih-Ming Kuo, Yonglin Liu, Zeqiong Wu, and Fang Zhang 2022. Improving returns on strategy decisions through integration of neural networks for the valuation of asset pricing: the case of Taiwanese stock. Int. J. Financial Studies. 2022, 10, 99. [CrossRef]

- Chang, Kuang-Liang and Chi-Wei He, 2010. Does the magnitude of the effect of inflation uncertainty on output growth depend on the level of inflation? The Manchester School 78, 126–148.

- Chen, Liang and Xia Chen 2011. Review and research comments of research abroad on inflation. Economic Theory and Business Management 2, 50–58.

- Cukierman, Alex and Allan H. Meltzer 1986. A theory of ambiguity, credibility, and inflation under discretion and asymmetric information. Econometrica 54, 1099–1128.

- Fan, Fangzhi, Studies on Inflation 2011. Social Sciences in Ningxia 165, 25–33.

- Friedman, Milton 1977. Nobel lecture: inflation and unemployment. Journal of Political Economy 85, 451–472.

- Holland, A. S 1995. Inflation and uncertainty: tests for temporal ordering. Journal of Money, Credit and Banking 27, 727–837.

- Kumar, Manmohan S. and Tatsuyoshi Okimoto 2007. Dynamics of persistence in international inflation rates. Journal of Money, Credit and Banking 39, 1457–1479.

- Liu, Xichun 2023. Prediction of exchange rate on RMB under the influence of US monetary policy. Thesis, Nanjing University of Information Science and Technology.

- Lu, Yanchun and Gongzheng Zhao 2017. New changes of international commodity prices towards the transmission effects of PPI and CPI in China. Prices: Theory and Practice 7, 25–28.

- Lu, Yanchun, Gongzheng Zhao, Chao Zhang, Xianfeng Zhu, Mijia Zhong, and Rui Guo 2022. Research on the formation and governance of current global inflation. Price: Theory and Practice 9, 5–9.

- James E. Payne 2009. Inflation targeting and the inflation-inflation uncertainty relationships: evidence from Thailand. Applied Economics Letters 16, 233–238. [CrossRef]

- Pourgerami, Abbas and Keith E. Maskus 1987. The effects of inflation on the predictability of price changes in Latin America: some estimates and policy implications. World Development 15, 287–290.

- Ross, Stephen A. The arbitrage theory of capital asset pricing. Journal of Economic Theory 1976, 13, 341–360. [Google Scholar] [CrossRef]

- Ben Salem, Salha, Sonia Sayari, and Moez Labidi 2024. Effect of financial frictions on monetary policy conduct: a comparative analysis of DSGE models with and without financial frictions. Economies 12, 72.

- Shi, Tingting 2021; 108-110: Prediction of RMB exchange rate fluctuation trend under COVID-19 epidemic based on ARIMA model. Modern Business.

- Shiyyab, Fadi Shehab, Abdallah Bader Alzoubi, Qais Mohammad Obidat, and Hashem Alshurafat 2023. The impact of artificial intelligence disclosure on financial performance. Int J. Finance Studies 11, 115. [CrossRef]

- Ungar, Meyer and Ben-Zion Zilberfarb 1993. Inflation and its unpredictability theory and empirical evidence. Journal of Money, Credit and Banking 25, 709–720.

- Xiao, Long 2020. Predicting the regulations and trends on variations of exchange rate under the Sino-US trade war: empirical ressearch based on ARIMA model. Jilin Financial Studies 6, 12–15.

- Xu, Tao, Yinjie Zhao, and Ziyou Zhou 2021. Combined forecasting of exchange rates based on ARIMA-GARCH model. Economic Horizon 15, 126–128.

- YI, Danhui and Yan Wang 2021. Applied Times Series Analysis, Fifth Edition. Remin University of China Edition.

- Zhang, Yuanping and Yuan Zhou 2021; 77-82: Fundamentals of Mathematical Finance, 3rd Edition. Peking University Press.

- Zhu, Shuzhen, Chenglong Li, and Yufeng Ji 2022; 234-236: Financial Risk Management, 4th Edition. Peking University Press.

| Fiscal Statistic Metrics | Half-Time RA / TA | Quarter RA / TA | Self-Support |

|---|---|---|---|

| Original annual income | $ 18,000 | $ 10,950 | $ 1,000 (other $ 16,000 self-support per year) |

| Updated after modeling | $ 19,053 | $ 11,726 | $ 17,977 |

| Total annual expense | $ 13,138 | $ 10,710 | $ 14,030 |

| Remaining asset values after multi-level fiscal modeling | $ 5,915.9 | $ 1,016.2 | $ 3,946.8 |

| Original percentage of balance to expenditures | 28.79 % | 4.58 % | 19.18 % |

| Upgraded percentage of balance to expenditures | 32.06 % | 9.05 % | 22.74 % |

| Percentage of difference with/without strategy | 3.27 % | 4.48 % | 3.55 % |

| Year | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Ave |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2023 | 6.41 | 6.04 | 4.98 | 4.93 | 4.05 | 2.97 | 3.18 | 3.67 | 3.70 | 3.24 | 3.14 | 3.35 | 4.10 |

| 2022 | 7.48 | 7.87 | 8.54 | 8.56 | 8.28 | 9.06 | 8.52 | 8.26 | 8.20 | 7.75 | 7.11 | 6.45 | 8.01 |

| 2021 | 1.40 | 1.68 | 2.62 | 4.16 | 4.99 | 5.39 | 5.37 | 5.25 | 5.39 | 6.22 | 6.81 | 7.04 | 4.70 |

| 2020 | 2.49 | 2.33 | 1.54 | 0.33 | 0.12 | 0.65 | 0.99 | 1.31 | 1.37 | 1.18 | 1.17 | 1.36 | 1.23 |

| 2019 | 1.55 | 1.52 | 1.86 | 2.00 | 1.79 | 1.65 | 1.81 | 1.75 | 1.71 | 1.76 | 2.05 | 2.29 | 1.81 |

| 2018 | 2.07 | 2.21 | 2.36 | 2.46 | 2.80 | 2.87 | 2.95 | 2.70 | 2.28 | 2.52 | 2.18 | 1.91 | 2.44 |

| 2017 | 2.50 | 2.74 | 2.38 | 2.20 | 1.87 | 1.63 | 1.73 | 1.94 | 2.23 | 2.04 | 2.20 | 2.11 | 2.13 |

| 2016 | 1.37 | 1.02 | 0.85 | 1.13 | 1.02 | 1.00 | 0.83 | 1.06 | 1.46 | 1.64 | 1.69 | 2.07 | 1.26 |

| 2015 | -0.09 | -0.03 | -0.07 | -0.20 | -0.04 | 0.12 | 0.17 | 0.20 | -0.04 | 0.17 | 0.50 | 0.73 | 0.12 |

| 2014 | 1.58 | 1.13 | 1.51 | 1.95 | 2.13 | 2.07 | 1.99 | 1.70 | 1.66 | 1.66 | 1.32 | 0.76 | 1.62 |

| 2013 | 1.59 | 1.98 | 1.47 | 1.06 | 1.36 | 1.75 | 1.96 | 1.52 | 1.18 | 0.96 | 1.24 | 1.50 | 1.46 |

| 2012 | 2.93 | 2.87 | 2.65 | 2.30 | 1.70 | 1.66 | 1.41 | 1.69 | 1.99 | 2.16 | 1.76 | 1.74 | 2.07 |

| Period | Nov-16 | Dec-16 | Jan-17 | Mar-17 | Apr-17 | May-17 | Jun-17 | Aug-17 | Sep-17 |

|---|---|---|---|---|---|---|---|---|---|

| Buy ($) | 2081 | 1684 | 2516 | 2830 | 1047 | 1829 | 1345 | 2264 | 1701 |

| Sell ($) | 2426 | 1919 | 2770 | 3100 | 1312 | 2151 | 1669 | 2611 | 2078 |

| Return/% | 16.58 | 13.96 | 10.10 | 9.54 | 25.31 | 17.61 | 24.09 | 15.33 | 22.16 |

| Period | Oct-17 | Dec-17 | Feb-18 | Jun-19 | Dec-19 | Dec-20 | Aug-21 | Mar-22 | Sum |

| Buy ($) | 1543 | 1711 | 2563 | 2140 | 3148 | 2397 | 2176 | 1825 | 34900 |

| Sell ($) | 1902 | 2211 | 2948 | 2472 | 4030 | 3235 | 2735 | 2403 | 41972 |

| Return/% | 23.27 | 29.22 | 15.02 | 15.51 | 28.02 | 34.96 | 25.69 | 31.67 | 20.26 |

| Fiscal Statistic Metrics | Current API | 1-year CD | Reduced API |

|---|---|---|---|

| Annual net assets | $ 53,100 | $ 53,100 | $ 53,100 |

| Delta_M0 | $ 2,077.5 | $ 2,077.5 | $ 2,077.5 |

| Delta_M1 | $ 798 | $ 798 | $ 798 |

| Delta_M2 | $ 1,847.9 | $ 2,230.2 | $ 1,529.3 |

| Delta_M3 | $ 4,723.4 | $ 5,105.7 | $ 4,404.8 |

| Percentage of annual net asset appreciation | 8.90 % | 9.62 % | 8.30 % |

| Lower and upper bounds of estimated percentage | [8.03 %, 9.92 %] | [8.75 %, 10.64 %] | [7.43 %, 9.32 %] |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).