Submitted:

22 March 2024

Posted:

25 March 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Some stylized facts

3. A regime switching DSGE model

3.1. The model

3.2. The Markov switching rational expectation framework

4. Data and Bayesian estimation

4.1. Data

4.2. Priors and estimation

5. Results

5.1. Time invariant rational expectations

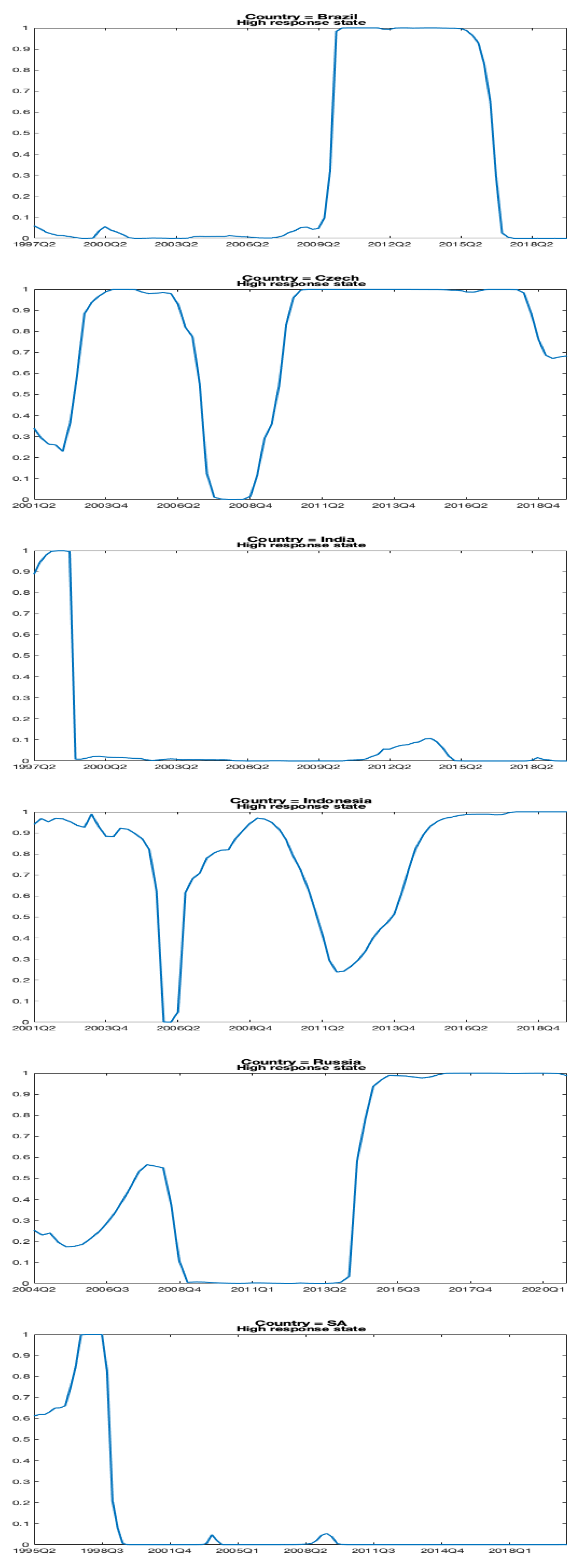

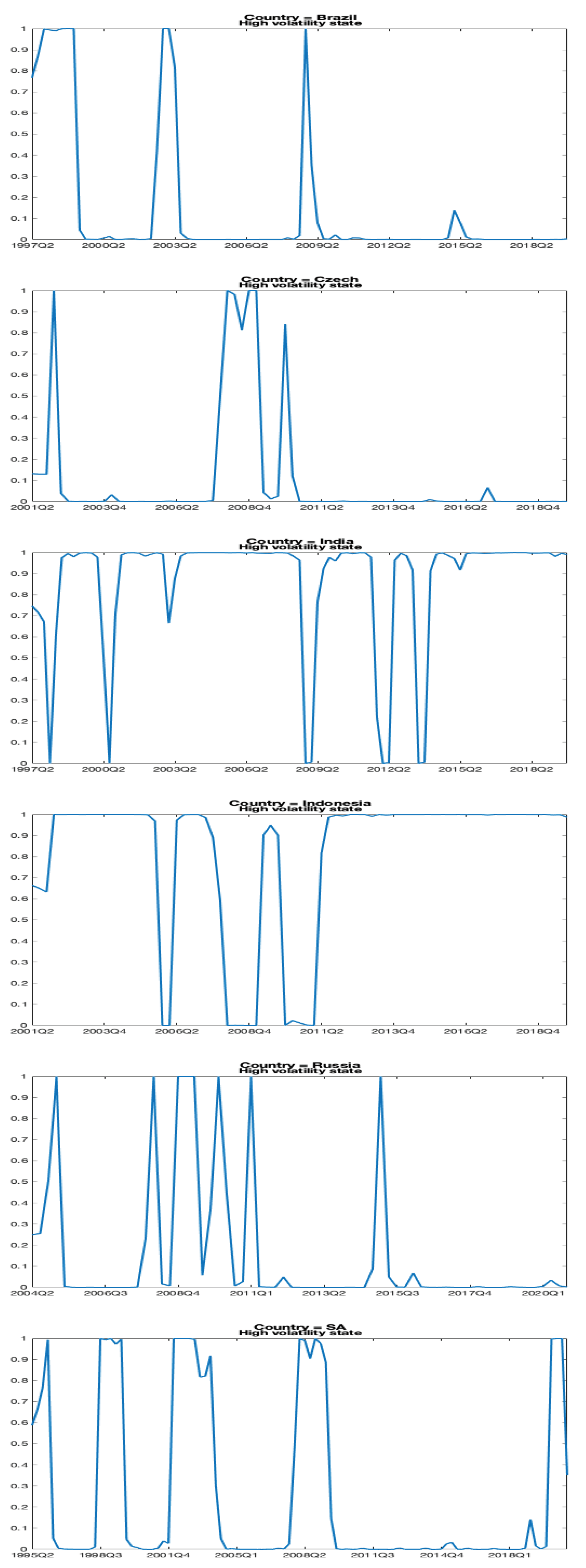

5.2. Regime switching rational expectations

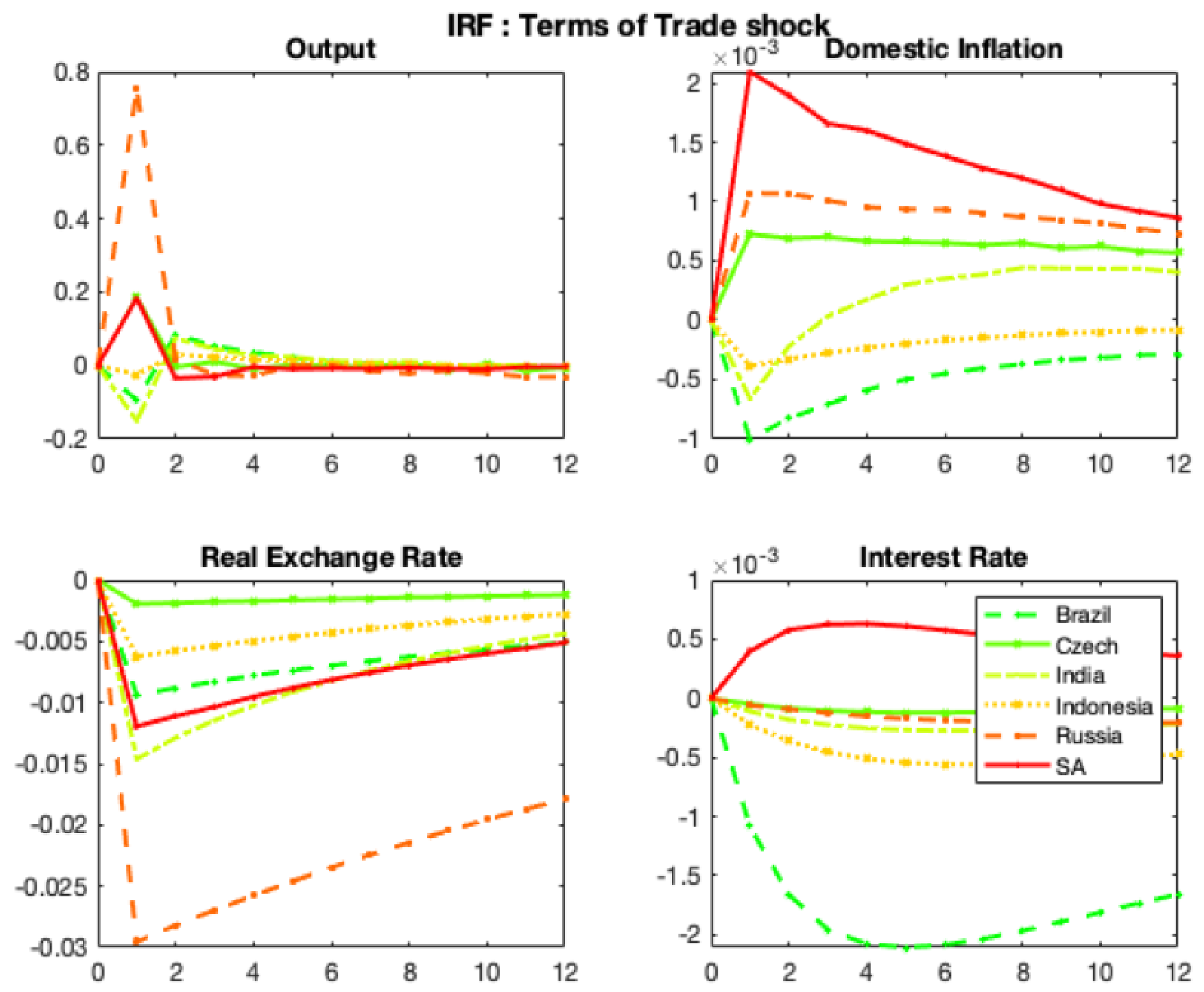

5.3. Impulse response functions

5.4. Variance decompositions

6. Conclusion

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| BRA | Brazil |

| CZE | Czech Republic |

| IND | India |

| INDO | Indonesia |

| RUS | Russia |

| SA | South Africa |

| I. Gamma | Inverse Gamma |

| 1 | The de jure is the announced exchange rate regime while the de facto is the actual regime implemented. |

| 2 | Our focus in this article is on research using structural models. |

| 3 | The emerging economies are those classified as emerging markets as per the FTSE Russel index. It distinguishes between developped, emerging (primary and secondary) and frontier markets. The economies used in this article fall under both primary and secondary emerging markets. They were selected based on data availability. |

| 4 | We split the sample into pre and post-IT adoption. The date of the adoption corresponds, for most, to a move to a flexible exchange rate regime. Due to lack of data pre-IT, we do not comment for the Czech Republic. However, a regime switching can still capture changes in policy and volatility even during the IT era. |

| 5 | The cutoff date is explained by the lack of recent data on terms of trade. |

| 6 | All the series, except the nominal effective exchange rates, are seasonally adjusted. |

| 7 | We have used the broad weights set as it provides the largest sample size for the economies under study. |

| 8 | Except for South Africa, the terms of trade for the remaining economies are only available in annual frequency. |

| 9 | Contrary to Alstadheim et al. [7] who use a tight prior for , the openness parameter, we allow a loose one given that open DSGE models literature for emerging economies is still at its infancy stage. |

| 10 | Author’s own calculations using the quartlery Real GDP of South Africa in domestic currency and seasonally adjusted from the Federal Reserve Bank of St Louis. |

References

- Levy-Yeyati, E.; Sturzenegger, F. Classifying exchange rate regimes: Deeds vs. words. European economic review 2005, 49, 1603–1635. [CrossRef]

- Jahan, S. Inflation targeting: Holding the line. Finance & Development 2012, 4, 72–73.

- Lubik, T.A.; Schorfheide, F. Do central banks respond to exchange rate movements? A structural investigation. Journal of Monetary Economics 2007, 54, 1069–1087. [CrossRef]

- Uribe, M.; Schmitt-Grohé, S. Open economy macroeconomics; Princeton University Press, 2017.

- Kose, M.A. Explaining business cycles in small open economies: ‘How much do world prices matter?’. Journal of International Economics 2002, 56, 299–327.

- Dong, W. Do central banks respond to exchange rate movements? Some new evidence from structural estimation. Canadian Journal of Economics/Revue canadienne d’économique 2013, 46, 555–586. [CrossRef]

- Alstadheim, R.; Bjørnland, H.C.; Maih, J. Do central banks respond to exchange rate movements? A markov-switching structural investigation of commodity exporters and importers. Energy Economics 2021, 96, 105138. [CrossRef]

- Mohanty, M.S.; Klau, M. Monetary policy rules in emerging market economies: Issues and evidence. In Monetary policy and macroeconomic stabilization in Latin America; Springer, 2005; pp. 205–245.

- Ortiz, A.; Sturzenegger, F. Estimating SARB’s policy reaction rule. South African Journal of Economics 2007, 75, 659–680.

- Alpanda, S.; Kotzé, K.; Woglom, G. The role of the exchange rate in a New Keynesian DSGE model for the South African economy. South African Journal of Economics 2010, 78, 170–191. [CrossRef]

- Lubik, T.A.; Schorfheide, F. Testing for indeterminacy: An application to US monetary policy. American Economic Review 2004, 94, 190–217. [CrossRef]

- Gali, J.; Monacelli, T. Monetary policy and exchange rate volatility in a small open economy. The Review of Economic Studies 2005, 72, 707–734. [CrossRef]

- Grivoyannis, E. The New Brazilian Economy; Springer, 2017.

- Da Fonseca, M.A. Brazil’s Real plan. Journal of Latin American Studies 1998, 30, 619–639.

- Clements, B. Development focus: The Real plan, poverty and income distribution in Brazil. Finance & Development 1997, 34.

- Afonso, J.R.; Araújo, E.C.; Fajardo, B.G. The role of fiscal and monetary policies in the Brazilian economy: Understanding recent institutional reforms and economic changes. The Quarterly Review of Economics and Finance 2016, 62, 41–55. [CrossRef]

- Coats, W.L.; Laxton, D.; Rose, D. The Czech National Bank’s Forecasting and Policy Analysis System; Czech National Bank, 2003.

- Mohan, R.; Patra, M. Monetary policy transmission in India. In Monetary policy frameworks for emerging markets; Edward Elgar Publishing, 2009.

- Balakrishnan, P.; Parameswaran, M. What lowered inflation in India: Monetary policy or commodity prices? Indian Economic Review 2022, 57, 97–111.

- Dua, P. Monetary policy framework in India. Indian Economic Review 2020, 55, 117–154. [CrossRef]

- McLeod, R.H. Towards improved monetary policy in Indonesia. Bulletin of Indonesian Economic Studies 2003, 39, 303–324. [CrossRef]

- Ramayandi, A.; Rosario, A. Monetary policy discipline and macroeconomic performance: The case of Indonesia. Asian Development Bank Economics Working Paper Series 2010.

- Chowdhury, A.; Siregar, H. Indonesia’s monetary policy dilemma: Constraints of inflation targeting. The Journal of Developing Areas 2004, pp. 137–153. [CrossRef]

- Ahokpossi, M.C.; Isnawangsih, A.; Naoaj, M.S.; Yan, T. The Impact of Monetary Policy Communication in an Emerging Economy: The Case of Indonesia; International Monetary Fund, 2020.

- Granville, B.; Mallick, S. Monetary Policy in Russia. In Return to Growth in CIS Countries; Springer, 2006; pp. 73–89.

- Hanson, P. Russian Economic Policy and the Russian Economic System: Stability versus Growth 2019.

- Kumo, W.L. Inflation Targeting Monetary Policy, Inflation Volatility and Economic Growth in South Africa. Technical report, African Development Bank, 2015.

- Mandeya, S.M.T.; Ho, S.Y. Inflation, inflation uncertainty and the economic growth nexus: An impact study of South Africa. MethodsX 2021, 8, 101501. [CrossRef]

- Bonga-Bonga, L. Assessing the effectiveness of the monetary policy instrument during the inflation targeting period in South Africa. International Journal of Economics and Financial Issues 2017, 7, 706–713.

- Fraga, A.; Goldfajn, I.; Minella, A. Inflation targeting in emerging market economies. NBER macroeconomics annual 2003, 18, 365–400. [CrossRef]

- Holland, M. Exchange rate volatility and the fear of floating in Brazil. Revista EconomiA 2006.

- Maih, J. Efficient Perturbation Methods for Solving Regime-Switching DSGE Models. Technical report, working paper 2015/1, Norges Bank, 2015.

- Kim, C.J.; Nelson, C.R. Has the US economy become more stable? A Bayesian approach based on a Markov-switching model of the business cycle. Review of Economics and Statistics 1999, 81, 608–616. [CrossRef]

- Karaboga, D.; others. An idea based on honey bee swarm for numerical optimization. Technical report, Technical report-tr06, Erciyes university, engineering faculty, computer …, 2005.

- Karaboga, D.; Akay, B. A comparative study of artificial bee colony algorithm. Applied mathematics and computation 2009, 214, 108–132. [CrossRef]

- Liu, Z.; Waggoner, D.F.; Zha, T. Sources of macroeconomic fluctuations: A regime-switching DSGE approach. Quantitative Economics 2011, 2, 251–301. [CrossRef]

- Debortoli, D.; Maih, J.; Nunes, R. Loose commitment in medium-scale macroeconomic models: Theory and applications. Macroeconomic Dynamics 2014, 18, 175–198. [CrossRef]

- Sandri, D. FX intervention to stabilize or manipulate the exchange rate? Inference from profitability. Journal of International Money and Finance 2023, 131, 102786. [CrossRef]

- Hajkova, D. Monetary Policy and Exchange Rate Commitment in the Czech Republic. In Negative Euro Area Interest Rates and Spillovers on Western Balkan Central Bank Policies and Instruments; International Monetary Fund, 2017.

- Tripathy, R. Intervention in foreign exchange markets: The approach of the Reserve Bank of India. BIS Papers 2013, 73.

- Viktorov, I.; Abramov, A. The 2014-15 financial crisis in Russia and the foundations of weak monetary power autonomy in the international political economy. New political economy 2020, 25, 487–510. [CrossRef]

| BRA | CZE | IND | INDO | RUS | SA | |

| GDP | 1.61/8.78 | 5.12 | 3.61/1.98 | 1.05/12.46 | 7.25/8.37 | 5.28/6.80 |

| Inflation | 5.48/3.29 | 2.11 | 3.87/3.55 | 3.74/5.04 | 3.42/5.05 | 3.77/3.31 |

| Interest rate | 4.08/5.39 | 1.50 | 0.61/0.73 | 0.69/3.07 | 3.01/2.99 | 2.24/1.97 |

| Exchange rate | 0.02/0.07 | 0.02 | 0.03/0.02 | 0.04/0.04 | 0.04/0.07 | 0.04/0.05 |

| Terms of trade | 1.36/1.85 | 0.52 | 0.85/1.71 | 2.23/1.30 | 6.05/5.28 | 5.65/2.73 |

| Parameters | Prob. Dist | Low | High | BRA | CZE | IND | INDO | RUS | SA |

| Beta | 0.500 | 0.950 | 0.855 | 0.940 | 0.949 | 0.799 | 0.941 | 0.924 | |

| I. Gamma | 0.800 | 3.000 | 1.780 | 1.183 | 1.146 | 2.008 | 1.137 | 1.455 | |

| I. Gamma | 0.005 | 3.000 | 0.490 | 0.023 | 0.985 | 0.005 | 1.874 | 0.516 | |

| I. Gamma | 0.005 | 3.000 | 1.435 | 3.000 | 0.101 | 0.092 | 1.830 | 0.005 | |

| I. Gamma | 1.e-05 | 10.00 | 0.007 | 0.001 | 0.001 | 0.001 | 0.014 | 0.002 | |

| I. Gamma | 0.005 | 15.00 | 0.012 | 0.005 | 0.005 | 0.008 | 0.005 | 0.006 | |

| I. Gamma | 1.e-05 | 10.00 | 0.002 | 0.001 | 0.006 | 0.005 | 0.006 | 0.005 | |

| I. Gamma | 1.e-05 | 10.00 | 0.008 | 0.001 | 0.014 | 0.004 | 0.021 | 0.014 | |

| I. Gamma | 1.e-05 | 10.00 | 0.011 | 0.004 | 0.015 | 0.007 | 0.036 | 0.017 |

| Model | BRA | CZE | IND | INDO | RUS | SA |

| Constant | -1450.1 | -833.4 | -1442.3 | -1176.6 | -1266.5 | -1662.4 |

| Switching | -1409.3 | -816.5 | -1342.2 | -1131.0 | -1126.2 | -1528.0 |

| Parameters | Prob. Dist. | Low | High | BRA | CZE | IND | INDO | RUS | SA |

| Beta | 0.010 | 0.999 | 0.074 | 0.858 | 0.192 | 0.201 | 0.881 | 0.495 | |

| Gamma | 0.010 | 10.00 | 0.024 | 0.030 | 0.054 | 0.010 | 0.010 | 0.084 | |

| Beta | 0.010 | 0.999 | 0.217 | 0.224 | 0.118 | 0.117 | 0.038 | 0.066 | |

| Beta | 0.010 | 0.999 | 0.951 | 0.964 | 0.907 | 0.932 | 0.956 | 0.925 | |

| Beta | 0.010 | 0.999 | 0.611 | 0.895 | 0.986 | 0.545 | 0.986 | 0.992 | |

| Beta | 0.010 | 0.999 | 0.580 | 0.986 | 0.875 | 0.480 | 0.552 | 0.498 | |

| Beta | 0.010 | 0.999 | 0.591 | 0.500 | 0.319 | 0.512 | 0.491 | 0.186 | |

| coef_tp_L_H | Beta | 0.010 | 0.500 | 0.017 | 0.055 | 0.010 | 0.024 | 0.037 | 0.011 |

| coef_tp_H_L | Beta | 0.010 | 0.500 | 0.041 | 0.010 | 0.061 | 0.062 | 0.028 | 0.018 |

| Beta | 0.500 | 0.950 | 0.624 | 0.813 | 0.950 | 0.860 | 0.922 | 0.908 | |

| Beta | 0.500 | 0.950 | 0.878 | 0.932 | 0.935 | 0.747 | 0.891 | 0.761 | |

| I. Gamma | 0.800 | 3.000 | 1.512 | 1.438 | 0.993 | 1.511 | 1.284 | 1.365 | |

| I. Gamma | 0.800 | 3.000 | 1.339 | 0.982 | 1.658 | 1.351 | 1.613 | 1.403 | |

| I. Gamma | 0.005 | 3.000 | 0.124 | 0.146 | 0.085 | 0.056 | 0.136 | 0.398 | |

| I. Gamma | 0.005 | 3.000 | 0.027 | 0.395 | 0.395 | 0.503 | 0.390 | 0.853 | |

| I. Gamma | 0.005 | 3.000 | 0.184 | 0.205 | 0.074 | 0.048 | 0.036 | 0.106 | |

| I. Gamma | 0.005 | 3.000 | 0.263 | 1.930 | 0.611 | 0.467 | 0.352 | 0.731 | |

| vol_tp_L_H | Beta | 0.001 | 0.500 | 0.027 | 0.019 | 0.244 | 0.120 | 0.080 | 0.053 |

| vol_tp_H_L | Beta | 0.010 | 0.500 | 0.125 | 0.159 | 0.053 | 0.043 | 0.257 | 0.138 |

| I. Gamma | 1.e-05 | 10.00 | 0.002 | 0.001 | 0.003 | 0.003 | 0.002 | 0.001 | |

| I. Gamma | 1.e-05 | 20.00 | 0.011 | 0.002 | 0.001 | 0.002 | 0.011 | 0.002 | |

| I. Gamma | 0.005 | 15.00 | 0.005 | 0.005 | 0.005 | 0.007 | 0.006 | 0.005 | |

| I. Gamma | 0.005 | 20.00 | 0.007 | 0.008 | 0.005 | 0.008 | 0.007 | 0.007 | |

| I. Gamma | 1.e-05 | 10.00 | 0.004 | 0.001 | 0.026 | 0.017 | 0.006 | 0.003 | |

| I. Gamma | 1.e-05 | 20.00 | 0.017 | 0.009 | 0.012 | 0.002 | 0.021 | 0.024 | |

| I. Gamma | 1.e-05 | 10.00 | 0.007 | 0.001 | 0.026 | 0.013 | 0.014 | 0.013 | |

| I. Gamma | 1.e-05 | 20.00 | 0.010 | 0.007 | 0.012 | 0.003 | 0.054 | 0.021 | |

| I. Gamma | 1.e-05 | 10.00 | 0.010 | 0.003 | 0.020 | 0.016 | 0.022 | 0.013 | |

| I. Gamma | 1.e-05 | 20.00 | 0.012 | 0.008 | 0.015 | 0.003 | 0.059 | 0.020 | |

| I. Gamma | 1.e-05 | 15.00 | 0.004 | 0.031 | 0.008 | 0.008 | 0.037 | 0.014 | |

| I. Gamma | 1.e-05 | 20.00 | 0.037 | 0.125 | 0.003 | 0.034 | 0.164 | 0.099 | |

| I. Gamma | 1.e-05 | 15.00 | 0.003 | 0.001 | 0.006 | 0.005 | 0.003 | 0.002 | |

| I. Gamma | 1.e-05 | 20.00 | 0.008 | 0.005 | 0.003 | 0.002 | 0.005 | 0.004 | |

| stderr y | I. Gamma | 1.e-05 | 20.00 | 5.347 | 5.286 | 2.462 | 10.00 | 7.556 | 7.487 |

| stderr | I. Gamma | 1.e-05 | 20.00 | 1.366 | 1.331 | 3.408 | 2.853 | 0.007 | 0.035 |

| stderr | I. Gamma | 1.e-05 | 20.00 | 3.463 | 0.006 | 3.013 | 4.887 | 0.007 | 2.132 |

| stderr | I. Gamma | 1.e-05 | 20.00 | 0.007 | 0.705 | 0.007 | 0.007 | 0.007 | 0.007 |

| Shocks | Policy | Terms of Trade | Technology | World output | World inflation |

| BRAZIL | |||||

| Output | 1.443 | 1.205 | 3.052 | 92.598 | 0.029 |

| Inflation | 3.605 | 6.998 | 2.465 | 3.415 | 0.094 |

| Interest rate | 15.419 | 63.859 | 2.708 | 5.560 | 0.115 |

| Exchange rate | 0.184 | 92.662 | 0.126 | 0.174 | 2.606 |

| CZECH | |||||

| Output | 18.039 | 30.969 | 0.783 | 4.289 | 38.991 |

| Inflation | 1.558 | 13.436 | 0.007 | 0.266 | 83.378 |

| Interest rate | 2.717 | 0.772 | 0.013 | 0.027 | 96.360 |

| Exchange rate | 2.094 | 71.774 | 0.010 | 0.358 | 23.943 |

| INDIA | |||||

| Output | 11.272 | 1.209 | 8.775 | 73.292 | 0.215 |

| Inflation | 24.451 | 2.913 | 1.421 | 60.680 | 0.750 |

| Interest rate | 6.611 | 3.644 | 0.216 | 89.117 | 0.064 |

| Exchange rate | 1.661 | 89.751 | 0.097 | 4.122 | 3.704 |

| INDONESIA | |||||

| Output | 3.272 | 1.130 | 4.993 | 81.085 | 0.029 |

| Inflation | 1.078 | 1.739 | 0.213 | 0.854 | 0.009 |

| Interest rate | 29.985 | 24.167 | 2.366 | 17.711 | 0.217 |

| Exchange rate | 0.101 | 87.487 | 0.020 | 0.080 | 3.307 |

| RUSSIA | |||||

| Output | 44.237 | 32.203 | 16.346 | 0.275 | 0.044 |

| Inflation | 2.726 | 12.191 | 0.107 | 0.606 | 0.003 |

| Interest rate | 82.073 | 0.684 | 4.658 | 1.182 | 0.051 |

| Exchange rate | 0.034 | 98.757 | 0.001 | 0.007 | 0.162 |

| SA | |||||

| Output | 0.788 | 0.425 | 0.518 | 94.648 | 0.028 |

| Inflation | 0.244 | 1.988 | 0.023 | 90.882 | 0.010 |

| Interest rate | 0.199 | 1.175 | 0.032 | 97.874 | 0.005 |

| Exchange rate | 0.107 | 56.414 | 0.010 | 39.923 | 0.534 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).