1. Introduction

As a developing nation, Indonesia is currently undergoing a period of swift infrastructure development, with a particular emphasis on prioritizing elements such as roads and bridges. These endeavors reflect the government’s commitment to enhancing logistical efficiency across different regions. With a large number of road and bridge assets across Indonesia, there is a need for asset manager to provide precise information on the number of assets, condition, and maintenance plans. The abundance of assets is accompanied by a myriad of challenges, posing a significant concern for researchers striving to devise pertinent solutions. The current nationwide adoption of the road and bridge data management system by the Indonesian government remains underutilized, particularly in the context of decision-making, with a noticeable gap in the effective utilization of bridge-related data. This raises important questions, which this study answers, regarding the factors that contribute to the suboptimal implementation of bridge asset management in Indonesia. Moreover, this research aims to elucidate the motivations underlying the actions of asset managers in Indonesia who have not demonstrated their intention in executing bridge asset management.

Bridge asset management implementation is a widely adopted practice globally, with many bridge agencies transitioning to Bridge Management Systems (BMS) [

1]. The primary objective of implementing a BMS is to optimize costs over the lifespan of a bridge while ensuring user safety and maintaining the asset value of the infrastructure [

2]. This is achieved by making data-driven decisions based on the condition and performance of the bridges [

3]. However, in its course, the implementation does not always proceed seamlessly and frequently encounters various impediments.

In the context of a successful Bridge Asset Management implementation, the U.S. Department of Transportation (DOTs) (2017), acknowledges challenges in the implementation process, particularly when an asset management decision-making framework is shaped by the establishment of strategic objectives [

4]. Government agencies, including the DOTs, face the complexity of serving diverse stakeholders, each with strong opinions grounded in their comprehension of asset management. Moreover, the persistent emphasis on short-term budgets poses a challenge in meeting the extensive capital investment planning requirements integral to effective asset management. Additionally, in the face of the escalating imperative to achieve more with limited resources, including technological, financial, and staff resources, there is a discernible constraint in adequately fulfilling the demands of a robust Bridge Asset Management system.

The ultimate objective of bridge management should be to ascertain and execute the most optimal strategy that ensures an adequate level of safety while concurrently minimizing life-cycle costs [

5]. This highlights the importance of meticulously balancing safety and cost considerations throughout the implementation process. To enhance the effectiveness of BMS implementation, Rashidi and Lemass (2010) propose the development of a Decision Support System (DSS) customized for bridge maintenance [

6]. Such a system empowers asset managers to select the most appropriate course of action by accounting for specific constraints and needs, thus elevating the decision-making process. Additionally, Xu and Turkan (2020) delve into the application of advanced technologies, such as Building Information Modeling (BIM) and Unmanned Aerial Systems (UAS), for bridge inspections and management, underlining the pivotal role of these advanced tools in augmenting the efficiency and effectiveness of BMS implementation, particularly in the domains of inspections and data management [

7].

To ensure the effective implementation of a Bridge Management System (BMS), the adoption of a BMS entails substantial organizational transformation, and the formulation of an all-encompassing change management strategy is imperative. This strategy should encompass well-defined objectives, lucid communication plans, structured training initiatives, and robust stakeholder engagement [

8]. The involvement of key stakeholders, including bridge engineers, asset managers, maintenance personnel, and decision-makers, throughout the implementation process is essential. Their insights and active participation substantially enhance the effectiveness and acceptance of the system [

8]. Offering comprehensive training programs to bridge personnel is essential to ensure their proficiency in comprehending the BMS and employing its features effectively. Additionally, ongoing technical support should be made available to address any issues or challenges that may arise [

8].

The situation is exacerbated when asset managers often need to make decisions on basis of incomplete and uncertain information due to the lack of a robust and unified national bridge database or bridge management system (BMS) and inadequate information on the condition of the bridge due to lack of continuous monitoring [

9]. A meticulous implementation plan must be devised, delineating the requisite steps, timelines, and responsibilities for the BMS deployment. This plan should be tailored to meet the specific needs and requirements of the organization [

10]. To ensure the successful implementation and sustained operation of the management system, it is imperative to allocate ample resources, encompassing financial, human, and technological assets [

11].

The seamless integration of the BMS with existing organizational systems and processes is critical. This integration streamlines data sharing, optimizes workflows, and enhances overall operational efficiency [

12]. Moreover, continuous monitoring and evaluation of the BMS’s performance are essential. This ongoing assessment identifies areas for enhancement and ensures alignment with the organization’s objectives [

12]. Additionally, recognizing that bridge management practices and technologies have evolved, it is imperative to periodically review and update the BMS. This encompasses the incorporation of new advancements, industry best practices, and lessons learned from prior implementation and operation [

12]. Furthermore, the cultivation of a culture that encourages knowledge-sharing and collaboration among bridge personnel is vital. This fosters the effective utilization of the BMS and how it can facilitate the development and assessment of core competencies and skills for bridge management professionals, such as technical knowledge, communication skills, leadership skills, and problem-solving skills [

13].

The implementation of asset management in government agencies faces various issues, such as ineffective maintenance practices, misuse and theft of government assets, and inadequate knowledge of the asset management procedure, affecting asset management performance’s effectiveness, efficiency, and economics in government agencies [

14]. Additionally, reducing available resources would negatively affect the organization’s ability to achieve its goals set out in its vision, mission, and policy statements. Furthermore, wastefulness, extravagance, and mismanagement have been detected, indicating that public money had not been wisely spent [

14]. The problem with implementing asset management is that governments are increasingly attracted to new emerging technologies but lack clear knowledge/guidelines on technology implementation, resulting in a higher number of unsuccessful technology implementations. This indicates a need to understand the factors for successful technology implementation better [

15]. According to Bennetts et al. (2019), there are three fundamental processes at the high level of bridge management: understanding the stock, making decisions, and implementing interventions. Asset managers perform these three fundamentals by carefully considering the operating environment. Some aim to exert control over the operating environment by justifying budget increases, contributing to standards, and informing objectives [

16].

Drawing upon the cited references, it is evident that asset managers play a significant role in steering asset management toward improved conditions. The current condition of asset managers has a different understanding of the existing asset management system, so that the implementation of bridge asset management has not run optimally. The difficulty in providing an even understanding to each asset manager, makes this research necessary to be raised to the surface, so it is hoped that this research will provide an overview of the model of an asset manager needed for the implementation of bridge asset management.

However, a noticeable gap exists as there is currently no existing research model providing insights into the preferences of asset managers regarding the implementation of bridge asset management. Consequently, it is deduced that there is a pressing need for more comprehensive research endeavors to delve into the factors that influence the successful implementation of bridge asset management. This aspect has not been examined in previous studies, indicating the need for further exploration that will result in unique research in the academic realm.

2. Literature review and hypothesis development

The implementation of bridge asset management is fraught with numerous challenges, as highlighted by Hooper (2009) that asset management comprises key elements, including enabler and control elements such as financial parameters (budget allocation), information management (data and systems), and training, awareness, and competence for human resource development [

17]. Additionally, policy elements constitute an integral part of the asset management system. The challenges identified encompass financial constraints hindering the effective execution of bridge asset management, intricacies involved in acquiring and validating data to meet specific requirements, policies established by the government that regulate the execution of bridge asset management, limitations in human resource supporting the implementation of bridge asset management, and the systems utilized as tools for effective bridge asset management. These challenges collectively underscore the multifaceted nature of issues that need to be addressed for successful bridge asset management implementation.

In infrastructure asset management, the relationship between budget availability and asset management implementation is highly significant [

18]. The presence of available budgets alongside asset management plays a crucial role in ensuring optimal conditions in infrastructure asset management and maintenance [

19]. Limited budget availability, resources, skilled personnel, and technological capabilities pose challenges to asset management implementation [

20]. Budget allocation plays a pivotal role in bridge asset management for bridge maintenance and rehabilitation to ensure integrity and structural functionality [

21]. With this foundation, H1: budgeting becomes one of the critical factors and maintains a significant relationship in the implementation of bridge asset management.

Furthermore, data is one of the critical factors in supporting asset management implementation, where validated data ensures accuracy, completeness, and consistency in the information provided [

22]. By validating data, asset managers can make decisions based on reliable information, which is crucial for the effectiveness of infrastructure asset maintenance and management [

23]. Data validation plays a critical role in asset management to ensure the reliability and safety of infrastructure assets [

24]. The availability and quality of data are essential for effective asset management [

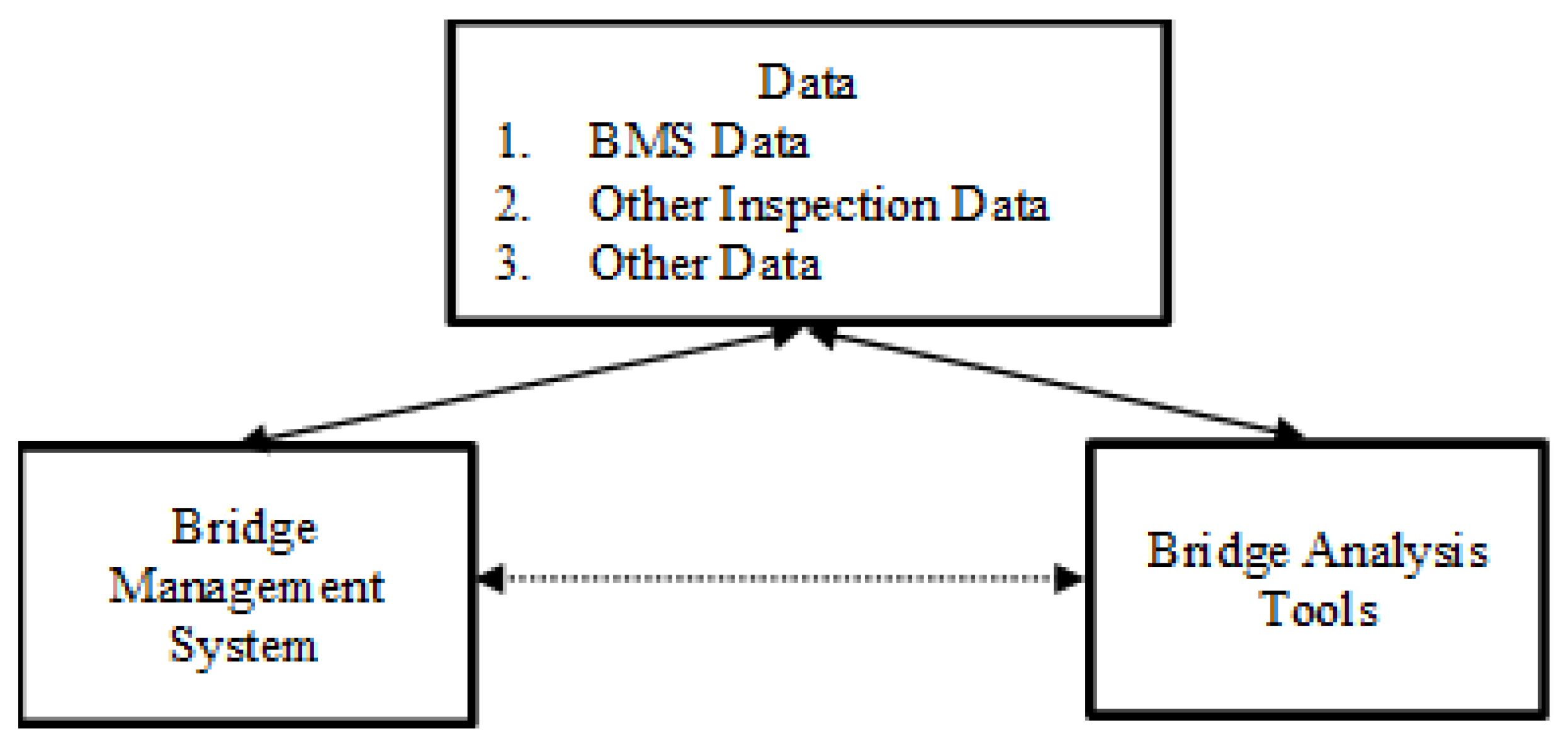

25]. The relationship between data and management systems is very close, as stated by Sanford et. al., (1999), where this relationship will have a real causal impact as shown in

Figure 1. This indicates that the presence of inaccurate data can result in compromised outputs within the bridge management system [

26]. H2: Access to accurate and up-to-date data on infrastructure assets is crucial for informed decision-making and prioritization of maintenance and investment activities.

The correlation between policy and asset management in infrastructure is crucial for ensuring the long-term resilience and sustainability of our urban environments [

27], it is crucial for ensuring the resilience and sustainability of essential infrastructure assets [

28]. Policy provides the framework and guidelines for asset management practices, while asset management ensures that infrastructure assets are properly maintained and utilized by policy objectives [

29]. The presence of supportive regulatory and policy frameworks can facilitate the implementation of asset management practices [

20]. H3: Clear guidelines, standards, and regulations can provide a framework for asset management implementation and ensure consistency across organizations.

Effective and efficient operations in the realm of infrastructure asset management hinge on the vital correlation between human resources and asset management [

30]. There is a strong correlation between Human Resources and asset management in infrastructure [

31]. In the infrastructure sector, the effective management and maintenance of assets heavily rely on the pivotal role played by Human Resource Management [

32]. The availability of technical expertise and appropriate tools for asset management, such as data management systems, modeling software, and risk assessment tools, can influence the implementation process [

33]. H4: Access to these resources can support effective decision-making and analysis in asset management.

The correlation between system and asset management in infrastructure is a critical aspect that ensures the efficient and effective management of physical assets [

34]. Infrastructure asset management involves the strategic planning, acquisition, operation, maintenance, and disposal of physical assets such as buildings, roads, bridges, and utilities [

35]. The correlation between system and asset management in infrastructure is crucial for effective planning, maintenance, and long-term sustainability [

36]. Management systems have been widely applied in various aspects of infrastructure, including pavement, rebuilding of infrastructures, human resources, bridges, traffic, and safety [

37]. H5: The system plays a pivotal role with robust support in ensuring the success of asset management implementation.

By the extant body of literature, the execution of asset management, in its overarching scope, can be subject to diverse determinants encompassing budget availability, data quality, governmental policies, resource availability, and system support. Nonetheless, such determinants may assume a distinctive complexion within the Indonesian context, where practical outcomes have hitherto failed to harmonize adequately with the exigencies of bridge maintenance and rehabilitation. Consequently, this imbues researchers with the impetus to undertake more exhaustive scrutiny of the intricate interplay between these determinants and the proclivities of bridge asset managers in Indonesia vis-à-vis the effective implementation of asset management.

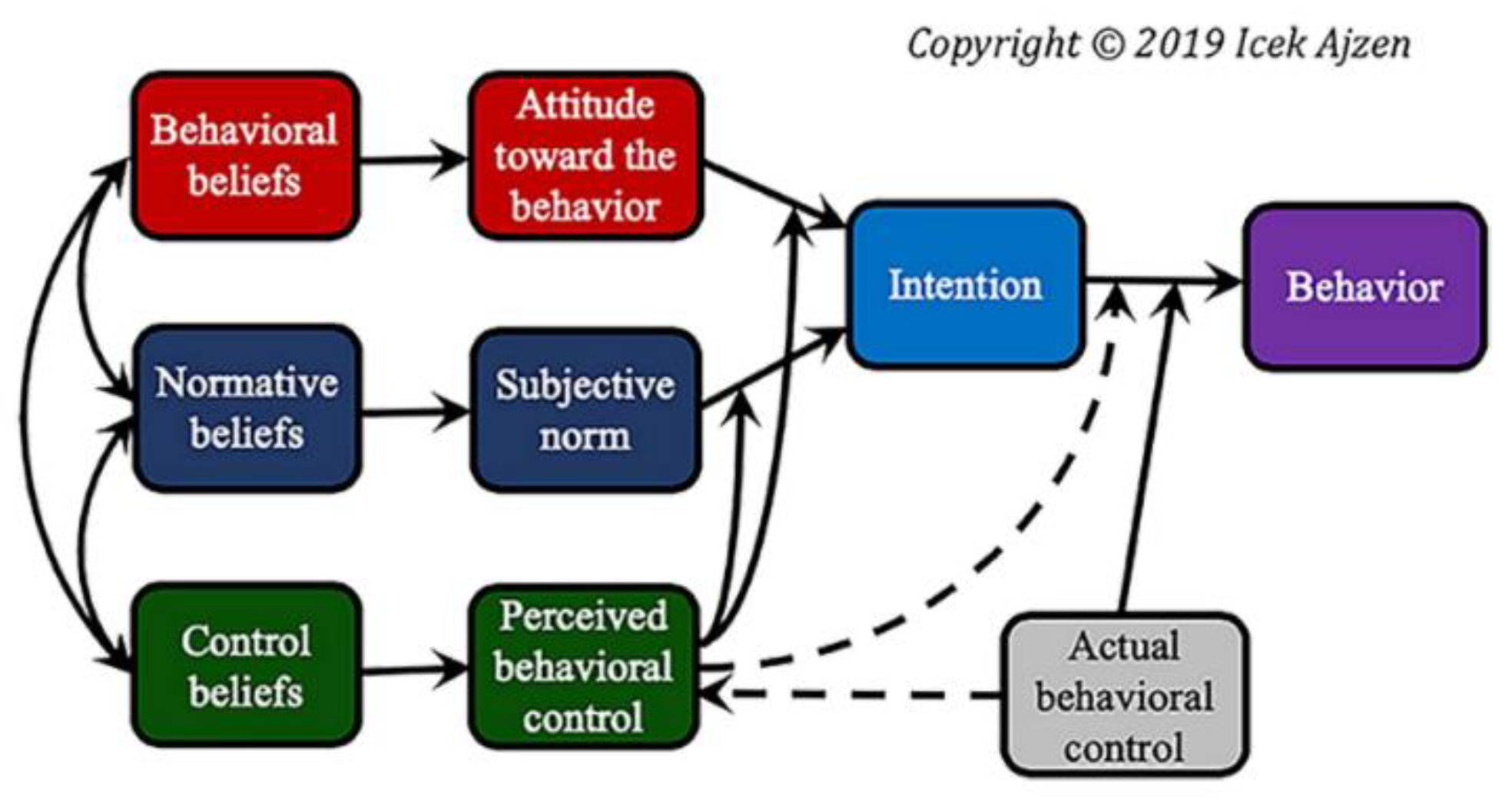

This study also employs the Theory of Planned Behavior as shown on (

Figure 2.), which has not been previously utilized by researchers, to examine the correlation between the intentions of bridge asset managers to adopt bridge asset management in Indonesia. The goal is to ascertain the pivotal factors that impact the intentions of bridge asset managers, to ensure the efficacy and precision of bridge asset management in Indonesia.

The Theory of Planned Behavior (TPB) is a widely recognized and influential framework for predicting and explaining human behavior in various domains [

38]. It was proposed in 1985 as an expansion of the Theory of Reasoned Action [

39]. The TPB integrates various factors, including individual attitudes, subjective norms, and perceived behavioral control, to understand and predict behavioral intentions [

40]. According to the TPB, behavioral intentions are influenced by three main factors: attitudes, subjective norms, and perceived behavioral control [

41]. Attitudes refer to an individual’s evaluation of the behavior and its outcomes, subjective norms involve the perceived social pressure to perform or not perform the behavior, and perceived behavioral control relates to the individual’s perception of their ability to perform the behavior [

41]. These factors collectively shape an individual’s intention to engage in a particular behavior. The TPB has been widely applied in various fields, including psychology, sociology, medicine, and environmental studies [

42,

43]. It has been used to study and predict behaviors such as recycling intention, green purchase intention, and environmentally responsible behavior [

42,

43]. The TPB provides a systematic analysis framework for understanding individual or organizational behavioral intentions [

40].

Asset management implementation requires the allocation of resources and decision-making regarding the management of assets [

44]. The TPB can help organizations understand the factors that influence decision-making and resource allocation in asset management. For example, attitudes towards asset management can influence the prioritization of resources and the level of investment in asset management activities [

44]. Subjective norms can also play a role, as the expectations and opinions of stakeholders may influence decision-making regarding asset management. Perceived behavioral control is important in asset management implementation, as it reflects the belief in one’s ability to effectively manage assets and overcome potential challenges [

40].

In summary, the Theory of Planned Behavior can provide valuable insights into the implementation of asset management within organizations. By considering attitudes (H6), subjective norms (H7), and perceived behavioral control (H8) as factors that influence the individual intention of bridge asset managers, organizations can better understand the factors that influence decision-making, resource allocation, and the development of competencies related to asset management. This understanding can inform strategies to promote positive intentions and behaviors, ultimately leading to more effective asset management practices.

3. Research methodology

3.1. Methodology

This study aims to develop a model for understanding the intention of bridge asset managers and their willingness to implement bridge asset management in Indonesia, particularly within the context of national road segments. To achieve this goal, a mixed-method approach combining qualitative and quantitative techniques is employed. Qualitative methods involve conducting interviews with senior bridge asset managers in Indonesia to gain insights into the reasons behind the suboptimal implementation of bridge asset management in the country. The interviews yield various factors contributing to the limited motivation of asset managers in fulfilling their roles in bridge asset management in Indonesia, ultimately providing a general framework for modeling attitudes, subjective norms, perceived behavioral control, and influencing factors. This framework serves as the basis for constructing a model to assess the extent of these factors’ influence on asset managers’ willingness to engage in bridge asset management in Indonesia.

Interviews were conducted with 14 senior bridge asset managers at the Directorate General of Highways, each with over 15 years of experience in bridge asset management. The interviews took the form of structured questions concerning the current state of bridge asset management in Indonesia, identifying both strengths and weaknesses and soliciting participants’ aspirations for the future. These interviews were conducted in person and took place between July and September 2023.

In the quantitative research methodology, a survey was conducted by administering questionnaires to representatives of bridge asset management in Indonesia. The questionnaire was carefully constructed with a series of questions explicitly crafted for the assessment and quantification of components within the Theory of Planned Behavior model. These components encompass attitude, subjective norms, and perceived behavioral control. After data collection, a rigorous statistical analysis, including regression analysis, was executed to unveil the relationships between each factor and the propensity to implement bridge asset management. This combined utilization of qualitative and quantitative data facilitates a comprehensive comprehension of the factors influencing the intentions and behaviors of asset managers within the domain of bridge asset management. Additionally, the research methodology may entail an examination of pertinent literature, policy documents, and best practices to provide an extensive contextual foundation for the study. Ultimately, this research methodology enhances our understanding of how the Theory of Planned Behavior can be employed to enhance bridge asset management practices in Indonesia.

Due to the limited number of bridge asset managers at the Directorate General of Highways, purposive sampling was employed in this study. The selection of respondents was based on their relevance and suitability to complete the questionnaire according to their work experience. The target respondents for this research were bridge asset managers from both the Directorate (central office) and the National Road Agency (provincial management areas). The questionnaire was distributed online through a dedicated social network group for bridge asset managers at the Directorate General of Highways, with a total of 65 respondents participating, representing 26 respondents from the central office and 29 respondents from the provincial regions. Data were subsequently analyzed using Multiple Regression Analysis and Quantitative Comparative Analysis (QCA) to determine correlation values among the variables. Multiple Regression Analysis was utilized to quantify the relationships between a dependent variable (Y) and multiple independent variables (X1, X2, X3,… Xn). The objective was to comprehend how these independent variables collectively influence the dependent variable [

45]. Meanwhile, QCA was applied due to the limited sample size, aiming to elucidate relationships among specific groups, where the outcomes might differ from one group to another [

46].

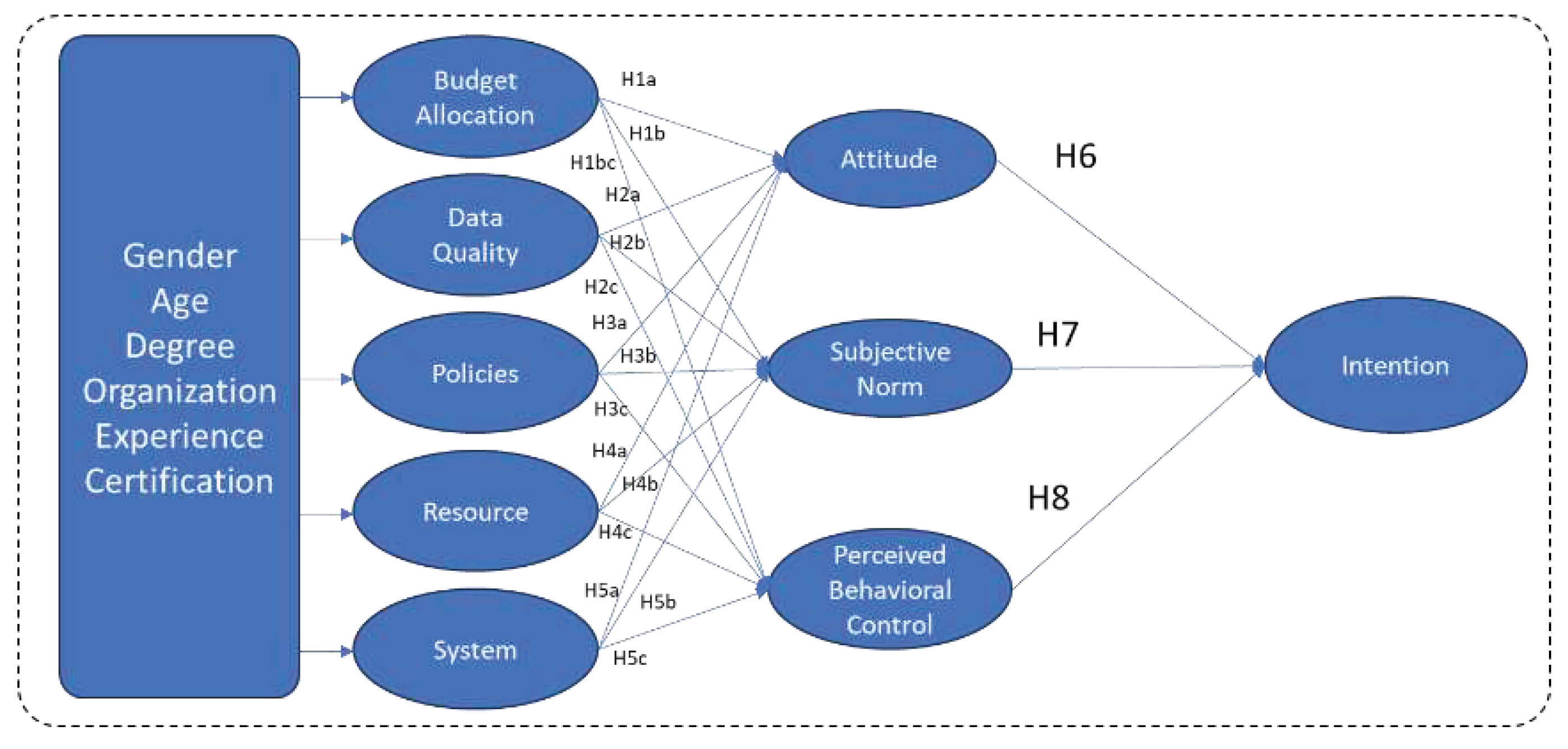

3.1. Theoritical structure of framework

Based on an extensive review of relevant literature, it is evident that the implementation of bridge asset management does not always proceed as smoothly as planned. This comprehensive analysis has identified several factors that could potentially influence a bridge asset manager’s inclination to engage in asset management. Among these factors are limited budget allocation, insufficiently validated bridge condition data quality, policies lacking full support and effective implementation, a dearth of human resources and tools, and an underutilized bridge management system. In a general sense, these elements present obstacles to the successful execution of bridge asset management. However, it is imperative to ascertain the extent to which these factors impact a bridge asset manager’s intent to manage bridge assets effectively. These factors will be integrated into a conceptual research model using the Theory of Planned Behavior, where they are expected to influence the attitude, subjective norms, and perceived behavioral control of individual asset managers, as depicted in

Figure 3.

These five factors influencing the attitude, subjective norms, and perceived behavioral control of bridge asset managers and their inclination to engage in bridge asset management have been identified. These factors serve as the foundation for developing a model that elucidates the influence of a bridge asset manager’s intent. The first factor for measurement is the budget availability for bridge asset management. The second is data quality, followed by the impact of policies, the availability of resources (both human and equipment), and the effectiveness of the bridge asset management system used. The forthcoming section details each of the five hypotheses presented in the literature review and hypothesis development chapter.

4. Result

4.1. Data collection

The data collection process for this study employed a questionnaire method, which was meticulously designed based on the theoretical framework aligned with the Theory of Planned Behavior. The questionnaire was specifically tailored for asset managers directly involved in the management of bridges within the jurisdiction of national roads. Each factor influencing Attitude, Subjective Norm, and Perceived Behavioral Control served as a measuring tool to predict a manager’s inclination toward bridge asset management. The initial segment of the questionnaire encompassed demographic information about the respondents, including gender, age, education, organizational affiliation, experience, and certification ownership. The second section consisted of various statements derived from Attitude, Subjective Norm, Perceived Behavioral Control, and Intention. These statements were formulated to gauge the intentions of asset managers in effectively administering bridge asset management.

Based on demographic data, 65 participants were included in the study, consisting of 57 males (87.69%) and 8 females (12.31%). The age distribution revealed that 41 individuals (63.07%) were aged between 21 and 40 years, 21 (32.31%) belonged to the 40 to 60 years age range, primarily representing senior managers, and 3 (4.62%) were aged 60 and above. Educational backgrounds were diverse, with 27 participants (41.54%) holding undergraduate degrees and 38 (55.38%) possessing graduate degrees. Affiliation data indicated that 29 respondents (44.62%) were associated with the National Road Implementation Agency, while 36 (55.38%) were linked to the Directorate. Concerning work experience, 34 participants (52.31%) had less than 10 years, and 31 (47.69%) had over 10 years of experience. Furthermore, 35 respondents (53.85%) held certifications, while 30 (46.15%) did not.

Table 2.

Respondent demographics.

Table 2.

Respondent demographics.

| Variable |

Category |

Frequency |

Percentage (%) |

| Gender |

Male |

57 |

87.69 |

| |

Female |

8 |

12.31 |

| Age |

21-40 |

41 |

63.07 |

| |

41-60 |

21 |

32.31 |

| |

>60 |

3 |

4.62 |

| Education |

Undergraduate |

27 |

41.54 |

| |

Graduate |

38 |

58.46 |

| Organization |

National Road Implementation Agency |

29 |

44.62 |

| |

Directorate |

36 |

55.38 |

| Experience |

< 10 Year |

34 |

52.31 |

| |

≥ 10 Year |

31 |

47.69 |

| Certification |

Certified |

35 |

53.85 |

| |

Not Certified |

30 |

46.15 |

In this questionnaire, several questions are presented using a Likert scale measurement (ranging from Strongly Disagree to Strongly Agree) with values ranging from 1 to 5. The questionnaire comprises statements depicting the relationships between factors and Attitude, Subjective Norms, as well as Perceived Behavioral Control. The aim is to capture the intentions of bridge asset managers concerning achieving optimal outcomes in bridge asset management. Responses from participants to the statements presented in the questionnaire are illustrated in

Table 3.

Based on

Table 3, it is evident that respondents generally tend to agree with the statements provided in the questionnaire. This is apparent from the average response values falling within the range of 3.8 to 4.82. Furthermore, the statement regarding data quality’s impact on attitude attains the highest average score and the lowest standard deviation. This indicates a trend among respondents towards their inclination to enhance data quality, demonstrating a collective willingness to contribute to the improvement of data quality in support of bridge asset management.

To optimize the analysis based on the available questionnaire results and the limited number of respondents holding managerial positions within the scope of bridge asset management, two analytical approaches will be employed: Multiple Regression Analysis and Quantitative Comparative Analysis (QCA). Multiple Regression Analysis will be conducted using the SPSS software to examine the relationships between predictors and the targeted dependent variable. This will be illustrated through Standardized Coefficients Beta values, with statistical significance represented by values <0.05. The aim is to discern the extent to which each predictor contributes to the dependent variable. Concurrently, QCA will be executed using the fsQCA software to determine the data coverage most supportive of the intentions of managers. This analysis will explore various combinations of factors and variables, providing insights into the configurations that best align with managerial intentions. The utilization of both methodologies will enhance the comprehensiveness and depth of the analytical process, considering the nuanced aspects of the data and ensuring a robust exploration of potential relationships.

4.2. Multiple Regression Analysis

Based on the results of the Multiple Regression analysis, the relationship between several predictors and the dependent variable is revealed, as depicted in

Table 4. Among the various predictors influencing the Attitude variable, Budget emerges as the primary determinant for a bridge asset manager, with a β* value of 0.382 and a P value of <0.001. This suggests that, as the budget increases, there is an anticipated moderate improvement in Attitude. Additionally, the Data variable exhibits a statistically significant and weak positive effect on Attitude, with a β* value of 0.252 and a P value of 0.004. This indicates that an increase in data corresponds to a weak positive change in Attitude. Moreover, Policies demonstrate a statistically significant and moderate positive impact on Attitude, with a β* value of 0.267 and a P value of 0.003. This implies that reinforcing policies is associated with a moderate increase in Attitude. Conversely, both Resource and System show a non-significant effect on Attitude, with β* values of 0.087 and 0.105, and P values of 0.381 and 0.376, respectively. This suggests a weak and inconclusive relationship with Attitude for these variables.

In determining the subjective norm of a bridge asset manager, Policies emerge as the most dominant determinant with a β* value of 0.408 and a P value of <0.001. This signifies that higher scores in Policies are strongly associated with an increased Subjective Norm, indicating a robust relationship. Additionally, Resource shows a statistically significant and moderately positive effect on Subjective Norm, with a β* value of 0.274 and a P value of <0.001. This implies that higher Resource scores are moderately linked to an elevated Subjective Norm, indicating a moderate relationship. Moreover, Budget and System exhibit statistically significant but weak positive effects on Subjective Norm, with β* values of 0.138 and 0.091, and P values of 0.021 and 0.007, respectively. Furthermore, Data has a non-significant and very weak influence on Subjective Norms, with a β* value of 0.026 and a P value of 0.676.

Perceived Behavioral Control is determined by three predictors: Budget, Data Quality, and Resource, with respective β* values of 0.258, 0.264, and 0.276, and P values of <0.001 and 0.001. This suggests that an increase in Budget, Data Quality, and Resources is moderately associated with a significant increase in Perceived Behavioral Control. Additionally, the System exhibits a less significant but moderately strong positive effect on Perceived Behavioral Control, with a β* value of 0.274 and a P value of 0.008. It appears that an increase in system-related factors is moderately associated with a significant increase in Perceived Behavioral Control. On the other hand, Policies have a non-significant and very weak influence on Perceived Behavioral Control, with a β* value of 0.005 and a P value of 0.944. This lack of statistical significance indicates that Policies do not have a meaningful effect on Perceived Behavioral Control.

Based on the analysis presented in

Table 4, it is evident that the predictor with the highest impact on Intention is Perceived Behavioral Control, having a β* value of 0.574 with a P value of <0.001. This implies a robust relationship, suggesting that higher scores in Perceived Behavioral Control are strongly associated with elevated Intention. Furthermore, the Attitude variable shows a non-significant but weakly positive relationship with Intention, having a β* value of 0.219 with a P value of 0.071. Although the relationship lacks statistical significance, it suggests that higher Attitude scores may weakly contribute to a slight increase in Intention. On the other hand, Subjective Norm demonstrates a non-significant and weak negative influence on Intention, with a β* value of -0.065 and a P value of 0.536. This indicates that variations in Subjective Norm scores are weak and non-significantly related to Intention.

4.3. QCA

To determine the most optimal model configuration that yields the highest values for coverage and consistency, calculations were conducted using the fsQCA application with truth table analysis on the parsimonious and intermediate solutions. In this computation, Intention serves as the output variable incorporating budget, data quality, policies, resources, and system as factors. Additionally, attitude, subjective norm, and perceived behavioral control are included as causal conditions, with the results presented in

Table 5. According to Fiss (2011), the categorization of causal conditions into core or peripheral configurations is based on the parsimonious solution and intermediate solution: core conditions are those present in both parsimonious and intermediate solutions, while peripheral conditions are eliminated in the parsimonious solution and only appear in the intermediate solution. Thus, this approach defines causal coreness in terms of the strength of evidence relative to the outcome, rather than connectedness to other configurational elements.

According to the results of the fsQCA calculations presented in

Table 5, the core conditions that emerge are data quality and system, along with Attitude, Subjective Norm, and Perceived Behavioral Control, as indicated in the solution column. This occurrence is due to these condition configurations appearing in both parsimonious and intermediate solutions. Based on

Table 5, two dominant patterns emerge for solutions that an asset manager can employ in bridge asset management, namely solutions three and fifteen. The third solution exhibits the highest coverage value at 71.6%, coupled with a consistency value of 0.961. This finding indicates that Budget, Data, Resources, and Systems positively influence the Intention of a bridge asset manager, with Data and System serving as core conditions. Additionally, both Attitude and Perceived Behavioral Control contribute to this positive influence. Another notable solution is found in the 15th configuration, which has a coverage value of 57.6% and a consistency value of 0.929. In this five-tenth configuration, Budget, Policies, Resources, and System exhibit positive influences, along with Attitude, Subjective Norm, and Perceived Behavioral Control, on the Intention of a bridge asset manager.

In the analysis phase using QCA, a more in-depth investigation is also conducted regarding the preferences of a manager in implementing bridge asset management. In this stage, data is categorized into three detailed scopes. Firstly, a comparison is made between Certified Bridge Asset Managers and Non-Certified Bridge Asset Managers. The term "Certified" here refers to asset managers who have obtained certification in the field of bridge expertise. Secondly, a comparison is made between Bridge Asset Managers with less than 10 years of experience and those with more than 10 years of experience. Lastly, a comparison is made between Directorate-level Bridge Asset Managers (central) and Bridge Asset Managers at the National Road Agency (regional). The results of these comparisons aim to identify the factors that tend to influence the intention of a bridge asset manager to effectively implement bridge asset management.

Certified bridge asset managers exhibit nearly uniform values for coverage and consistency across each predictor. Specifically, the coverage values for Attitude, Subjective Norm, and Perceived Behavioral Control are 90.5%, 70.9%, and 82.1%, respectively, with corresponding consistency values of 0.801, 0.843, and 0.904, as illustrated in

Table 6. The model for Certified Asset Managers, developed through the Quine-McCluskey algorithm, highlights robust relationships between key predictor variables (Attitude, Subjective Norm, and Perceived Behavioral Control) and Intention. Conversely, in the model for Non-Certified Asset Managers, it is evident that only Attitude tends to influence Intention, with a coverage value of 88.41% and a consistency value of 0.764. This comparison underscores the nuanced differences in the factors influencing the intention of certified versus non-certified bridge asset managers in the context of bridge asset management.

In

Table 7, it is evident that managers with more than 10 years of experience show Attitude as the dominant predictor, exerting a remarkably high influence on Intention, supported by a high raw coverage of 93.2% and a consistency level of 0.808. On the other hand, managers with less than 10 years of experience indicate that all three predictor variables—Attitude, Subjective Norm, and Perceived Behavioral Control—play significant roles in predicting Intention. The respective coverage values for these predictors are 85.7%, 67.6%, and 81.4%, each with consistency values above 0.75. This suggests a nuanced relationship between experience level and the influencing factors on the intention of bridge asset managers, emphasizing the varying dynamics within different experience cohorts.

As explained in

Table 8, bridge asset managers at the Directorate (central) level tend to have high values for the predictor’s Attitude and Perceived Behavioral Control to Intention. The respective coverage values for these predictors are 90.7% and 83.8%, with consistency values surpassing 0.8. These findings illustrate significant and consistent relationships with Intention, underscoring their reliability in forecasting this dependent variable. Conversely, bridge asset managers at the National Road Agency (regional) level emphasize the dominance of Attitude as a predictor of Intention, with a coverage value of 88.1% and a consistency value of 0.757. This suggests a nuanced variation in the influential factors on the intention of bridge asset managers based on their organizational roles within the central or regional structure.

From the QCA calculations, measurements of the variables Attitude, Subjective Norm, and Perceived Behavioral Control towards Intention were conducted.

Table 9 observed that Attitude dominates the intention of a bridge asset manager at 89.52%. However, its consistency value is slightly lower compared to Perceived Behavioral Control, with values of 0.783 (below 0.8) for Attitude and 0.872 for Perceived Behavioral Control. On the other hand, Subjective Norm exhibits the lowest coverage value at 69.97%, with a consistency value of 0.803. This condition indicates that the perceived behavioral control of asset managers has a strong influence on their inclination to implement bridge asset management, emphasizing its pivotal role in shaping intention.

4.4. Interview

The results of interviews conducted with several experts in bridge asset management in Indonesia align with the findings of the data analysis. In general, respondents expressed a predominantly negative view regarding the implementation of bridge asset management in Indonesia, indicating that the current state of asset management in the country has not met expectations. Existing challenges include unmet needs in bridge asset management, particularly concerning the perceived inadequacy of funding for bridge asset management activities by requirements. This deficiency has implications for the quality of bridge condition data, which is observed to deviate from the actual conditions in the field. The uneven distribution of bridge inspection experts across Indonesia is also evident, with a concentration in the western region. Some respondents emphasized the need for clear policies to ensure that every bridge asset manager understands their responsibilities and is equipped with sufficient Standard Operating Procedures. Additionally, the presence of the bridge asset management system in Indonesia, which is relatively new, requires comprehensive adaptation among all stakeholders, especially bridge asset managers.

In general, financing needs in the management of bridge assets are paramount, as this funding is crucial for the availability of resources and reliable systems to support bridge asset management. Financing for bridge asset management in Indonesia currently does not hold a priority status, as stability targets for strategic plans are still prioritized for road construction and preservation. Consequently, the financial requirements for bridge asset management remain inadequately fulfilled in line with on-site needs. The allocation of funds for bridge asset management is yet to be fully realized, given the prevailing focus on strategic plans emphasizing road development and preservation over comprehensive asset management for bridges.

Furthermore, a key issue in the implementation of bridge asset management in Indonesia is the insufficient resources for bridge asset managers. This inadequacy has a significant impact on the suboptimal programming of interventions due to a lack of knowledge about the planned action strategies that should be executed in the field. The availability of competent human resources and suitable tools to support bridge asset management is a recurring concern voiced by respondents. Currently, both human resources and tools for bridge asset management are centralized, resulting in a high dependence of regional managers on central management. This leads to overlapping work in the validation of bridge condition values due to the limited capabilities in the regions to independently evaluate the condition of bridges.

The current system utilized as a programming tool for cost planning and prioritization of bridges for intervention is a focal point. Some experts in bridge asset management highlight that the existing system is still under development, rendering it difficult to objectively assess as the system’s outputs have not yet been utilized as the basis for annual programming. Presently, programming is conducted manually using Microsoft Excel applications, resulting in bridge intervention priorities being determined based on condition values and budget availability. Experts observe that this situation limits asset managers to mainly engaging in corrective maintenance, where a significant portion of the budget is allocated to bridges classified as severely damaged or critical. In this scenario, the allocation for preventive bridge maintenance is sacrificed for more extensive interventions. Such management practices raise concerns among experts as they may lead to inflated bridge intervention costs in the future.

The need for high-quality data is highlighted as a significant concern by experts in bridge asset management in Indonesia. Quality data is derived from field inspections of bridges conducted by established examination procedures. However, the current reality faced by bridge asset managers is the absence of certification for bridge inspectors, casting doubt on the validity of the resulting bridge condition data. This situation is exacerbated by the fact that asset managers in various regions still lack a comprehensive understanding of bridge damage, leading to a preference for corrective maintenance actions over preventive maintenance. The absence of certified bridge inspectors and the limited knowledge of bridge damage among asset managers contribute to the challenges in obtaining reliable and accurate bridge condition data, thus impacting the effectiveness of bridge asset management practices in the country.

From a policy perspective, bridge asset management experts in Indonesia unanimously agree on the necessity of guidelines governing the analysis of bridge asset management needs in the country. These guidelines should stipulate minimum standards for human resources, equipment, systems, and information data required to support the successful implementation of bridge asset management in Indonesia. Experts contend that this is a crucial factor influencing the cost requirements for the execution of bridge asset management in the country. The leadership’s policy in prioritizing bridge asset management is considered a key success factor, ensuring that bridge asset managers, both at the central (directorates) and regional levels, receive clear guidance and achieve the expected targets. Establishing guidelines and policies is deemed essential for creating a standardized and effective framework for bridge asset management, providing a clear roadmap for resource allocation, and fostering a unified approach toward achieving the goals of the asset management program.

In the pursuit of effective bridge asset management, several recommendations are provided by bridge asset management experts. Firstly, there is a need for an enhancement of the competencies of bridge asset managers in Indonesia. Profiling asset managers is essential to ensure the quality of implementation by confirming competencies that align with the requirements of bridge asset management. The improved competence of asset managers is expected to enhance the quality of data management, enabling it to be effectively utilized as input for systems and providing accurate information outputs. Additionally, it is recommended to establish policies regarding the implementation of a simple bridge asset management system, categorized for specific conditions, making it easier to manage. Moreover, the current system should continue to be developed to align with evolving needs, ensuring that interventions applied to each bridge are more precise. These recommendations include competent management, simplified system implementation policies, and ongoing system development for effective and precise bridge asset management.

The interviews yielded several conclusions regarding the challenges in implementing bridge asset management in Indonesia, which currently faces impediments. In general, the availability of budgetary allocations for the execution of bridge asset management remains a crucial factor for the implementation of activities. Budget constraints may result in suboptimal outcomes in the evaluation of programming and bridge intervention activities. Additionally, poor data quality significantly influences decision-making by bridge managers. Therefore, there is a need to enhance the capacity of bridge asset managers in evaluating implementation and processing bridge data to provide assessments aligned with on-site requirements. Furthermore, the utilized system requires further development to ensure that programming outcomes serve as a useful basis for decision-making by asset managers in budgeting and executing bridge preservation activities.

5. Discussion

The intention of asset managers may be influenced by attitude, subjective norm, and perceived behavioral control. In this context, these three variables are additionally substantiated by five pivotal factors, namely budget, data quality, policies, resources, and systems. Subsequently, this discourse will explicate the outcomes of conducted calculations, aiming to discern the correlations between variables and factors. This analysis seeks to address inquiries pertaining to the current misalignment between expectations and the implementation of asset management.

Moreover, the results of the Multiple Regression and Qualitative Comparative Analysis (QCA) calculations will be elucidated. The Multiple Regression calculations will depict the relationships among variables, as indicated by the magnitudes of the Standardized Coefficients Beta (β*) and significance values (P). The results of the Multiple Regression analysis indicate a strong correlation between a bridge asset manager’s intention and their perceived behavioral control. This finding is further supported by the outcomes of the QCA, where the perceived behavioral control of a manager plays a significant role in determining their intention. Perceived behavioral control represents the belief of an asset manager in carrying out bridge asset management activities, supported by the availability of various influencing factors. The strong link identified through both Multiple Regression and QCA underscores the importance of a manager’s perception of their ability to control and execute bridge asset management tasks, highlighting it as a crucial factor in shaping their intentions.

Furthermore, this perceived behavioral control is reinforced by three factors that have a strong connection with the intentions of the asset manager. The intention of a bridge asset manager to engage in bridge asset management is likely influenced by their belief in the availability of supporting factors such as budget, data quality, and resources. This condition is also substantiated by statements from interviews with bridge asset management experts, indicating that these three factors are believed to provide positive support for high-quality bridge asset management outcomes. According to Bush S, et al. (2012), the budget reflects the priorities and objectives of bridge owners and managers, influencing the trade-offs and choices they make regarding service levels and life cycle costs of bridge assets [

52]. This statement supports the research findings that the availability of funds specifically allocated for bridge asset management significantly impacts bridge managers positively. According to Omettezer P, et al. (2011), poor data quality can lead to erroneous decisions, inefficient resource allocation, increased risks, and reduced performance of bridge assets, affecting the belief of a bridge asset manager in executing bridge asset management [

53]. According to Gavrikova E., et al. (2020) the knowledge and skills of the staff involved in asset management activities, as well as the organizational culture and support that enable effective asset management [

54]. Additionally, the necessary tools also need to be updated and maintained regularly to ensure their functionality and performance.

Based on the results of the Multiple Regression analysis, it is indicated that Attitude and Subjective Norms do not support the intention of bridge asset managers to carry out their tasks. The lack of alignment in the attitude of an asset manager towards this intention is likely due to the inadequacy of the budget provided for allocation to the bridge asset management team. Additionally, poor-quality data serves as one of the reasons why asset managers still hesitate to execute bridge asset management. Furthermore, unclear policies that do not align with the target achievements of bridge asset management also serve as another reason why the attitude of asset managers does not positively support their intention.

The Subjective Norm of asset managers appears to be inversely related to their intention, prompting a need to elucidate the factors contributing to this condition. Based on the results of the Multiple Regression analysis, this situation is likely influenced by two factors. Firstly, it may be due to the lack of updated bridge asset management policies, leaving asset managers confused in seeking guidelines that align with current needs. Another factor influencing this condition is the inability of asset managers to manage bridge assets due to the unavailability of suitable and reliable resources. This aligns with the findings from interviews indicating that the current human resources and tools are perceived as needing improvement in quality.

In the QCA analysis, the solution with the highest coverage and consistency involves the availability of budget, data quality, resources, and system, along with the conditions of Attitude and Perceived Behavioral Control of an asset manager to trigger their intention in implementing bridge asset management. This solution takes the top position in the QCA results, surpassing the coverage values of other configurations. Its consistency value is above 0.9, confirming that this solution yields highly reliable outcomes. The analysis also reveals core conditions where data quality and the system appear in both parsimonious and intermediate solutions, suggesting a close association of these two factors with the variables of Attitude and Perceived Behavioral Control.

There are two dominant patterns among the total of eighteen solutions derived from the QCA calculations. In the first dominant pattern, it is observed that asset managers engage in bridge asset management without considering policies. This condition suggests that, under such circumstances, an asset manager operates voluntarily without supportive policies. As long as the budget is available, data is of high quality, resources are fulfilled, and the system is available, it is sufficient to influence their attitude and perceived behavioral control in conducting asset management. In the second dominant pattern, it is evident that asset managers implement bridge asset management by adhering to policies. However, in this scenario, asset managers disregard the existing data conditions, and regardless of the received data conditions, they continue to carry out bridge asset management. Both of these conditions are substantiated by factual evidence, as revealed in expert interviews. Currently, asset managers lack clear guidelines for implementing bridge asset management, primarily because the target for the stability of bridge conditions is not clearly outlined in the national strategic plan. Additionally, the quality of data, which is not well-validated, compels asset managers to entirely delegate data validation to the central directorate. This situation is also attributed to the uneven capabilities of asset managers in managing bridge assets.

The QCA calculations also indicate differences in factors influencing the intentions of Certified and Non-Certified asset managers. Certified asset managers exhibit supportive attitudes, subjective norms, and perceived behavioral control toward their intention to implement bridge asset management. In contrast, non-certified managers are only influenced by their attitude in supporting their intention. This discrepancy may be attributed to a knowledge and skill gap between certified and non-certified engineers. Therefore, it is highly recommended that all bridge asset managers obtain the appropriate certification aligned with their needs.

QCA also demonstrates that a bridge asset manager with more than 10 years of experience will determine their attitude toward their intention to implement bridge asset management. This is in contrast to asset managers with less than 10 years of experience, where their perceived behavioral control significantly influences their intention to carry out bridge asset management. This condition may be attributed to differences in experience in handling issues related to bridge asset management, where experienced managers are likely to have better strategies.

Another fact revealed by the QCA calculations is that bridge asset managers in the Directorate rely on the strength of their attitude and perceived behavioral control. Meanwhile, asset managers in the regions lean on their attitude to carry out bridge asset management. This condition may occur due to a lack of resource support in the regions, requiring them to still depend on the Directorate in the central office to address existing asset management issues.

6. Conclusion

The present state of bridge asset management implementation in Indonesia remains unsatisfactory, falling short of expectations. The apparent lack of commitment among asset managers to execute effective bridge asset management can be attributed to the suboptimal quality of data that does not align with actual field conditions and a limited comprehension of the bridge asset management system by these managers. This situation is further compounded by the scarcity of asset managers, including insufficient resources, knowledge, and experience in the domain of asset management. Additionally, the constrained budgetary support for bridge asset management impedes efforts to enhance resource capacity and support activities related to bridge asset management.

The research findings suggest that the inclination of a bridge asset manager to oversee assets is likely influenced by their perceived behavioral control. This condition arises from an increased level of confidence in a manager when significant contributing factors to asset management, such as budget availability, high-quality data, reliable resources, and a robust system, are present. The assurance in the availability of these factors emerges as a pivotal element supporting their intention to enhance bridge asset management practices in Indonesia. In this context, policies are overlooked by asset managers due to the absence of government targets in planning the level of service for bridges. Unlike roads, where government policies have formulated strategies, such as annual percentage targets for achieving good road conditions, a similar approach has not been established for bridges.

The attitudes and subjective norms of an asset manager have not yet provided impetus to their intention. This condition is likely attributed to the asset manager’s lack of confidence in the outcomes of the asset management process, which is perceived to be inadequately understood. The limited knowledge of the asset manager regarding the assets under their purview has resulted in the bridge asset management process falling short of expectations. Additionally, the work environment of the asset manager has not fully developed due to the insufficient availability of human resources with reliable competencies to assist in the bridge asset management process.

Moreover, the asset manager’s intention to engage in bridge asset management is significantly influenced by the robustness of data quality and systems, acting as the foundational support. Additionally, the current available resources require enhancement through the screening of managers possessing sufficient experience and certifications. Establishing an optimal environment for effective bridge asset management is imperative, particularly for national road asset managers. On the other hand, budget, policy, and resources have yet to emerge as driving factors for an asset manager in managing bridge assets. The government’s allocated budget for bridge asset management is currently directed towards asset improvement, lacking specific details for the needs of the asset management team, such as human resource development and tools. This extends to the placement of competent personnel in their respective fields to effectively manage bridge assets. Recognizing the importance of bridge asset management knowledge seems crucial to prevent undesirable outcomes related to bridge failures. This circumstance demonstrates that an elevated quality of received data and the utilization of a superior asset management system will augment the intention of asset managers to engage in bridge asset management.

Furthermore, this study posits a novel hypothesis, suggesting that achieving effective implementation of bridge asset management necessitates the undertaking of suitable measures, encompassing activities such as data validation, data enhancement, and regular updates to both data and systems. This is essential to mitigate errors generated by the bridge asset management system during the execution of bridge intervention programs. Otherwise, regular socialization sessions on the utilization of the bridge asset management system should be conducted to enhance the capabilities of existing resources. By upgrading the asset manager’s ability to process and interpret the available data, the results of the system-based bridge preservation program will be more in line with the actual bridge conditions.

Author Contributions

Conceptualization, R.P. and N.S.; methodology, R.P. and N.S.; software, R.P. and N.S.; validation, R.P. and N.S.; formal analysis, R.P.; investigation, R.P.; resources, R.P.; data curation, R.P.; writing—original draft preparation, R.P.; writing—review and editing, R.P.; visualization, R.P.; supervision, N.S.; project administration, N.S.; funding acquisition, N.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

In this section, you can acknowledge any support given which is not covered by the author contribution or funding sections. This may include administrative and technical support, or donations in kind (e.g., materials used for experiments).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Lee, J., Sanmugarasa, K., Blumenstein, M., & Loo, Y. C. (2008). Improving the reliability of a Bridge Management System (BMS) using an ANN-based Backward Prediction Model (BPM). Automation in Construction, 17(6), 758-772.

- Saback, V., Popescu, C., Blanksvärd, T., & Täljsten, B. (2022). Asset Management of Existing Concrete Bridges Using Digital Twins and BIM: a State-of-the-Art Literature Review. Nordic Concrete Research, 66(1), 91-111.

- Omenzetter, P., Bush, S., Henning, T., & McCarten, P. (2011, April). Risk based bridge data collection and asset management and the role of structural health monitoring. In Nondestructive Characterization for Composite Materials, Aerospace Engineering, Civil Infrastructure, and Homeland Security 2011 (Vol. 7983, pp. 173-185). SPIE.

- Asset Management Overview (2017). Federal Highway Administration, Washington, DC. https://www.fhwa.dot.gov/asset/if08008/assetmgmt_overview.pdf.

- Frangopol, D. M., Gharaibeh, E. S., Kong, J. S., & Miyake, M. (2000). Optimal network-level bridge maintenance planning based on minimum expected cost. Transportation Research Record, 1696(1), 26-33.

- Rashidi, M., Lemass, B., & Gibson, P. (2010). A decision support system for concrete bridge maintenance. Proceedings Of The 2Nd International Symposium On Computational Mechanics And The 12Th International Conference On The Enhancement And Promotion Of Computational Methods In Engineering And Science, Hong Kong-Macau, China, 30 Nov.-3 Dec. 2009, 1372-1377. [CrossRef]

- Xu, Y., & Turkan, Y. (2020). BrIM and UAS for bridge inspections and management. Engineering, Construction and Architectural Management, 27(3), 785-807.

- Aladwani, A. M. (2001). Change management strategies for successful ERP implementation. Business Process management journal, 7(3), 266-275.

- Dikanski, H., Imam, B., & Hagen-Zanker, A. (2018). Effects of uncertain asset stock data on the assessment of climate change risks: A case study of bridge scour in the UK. Structural Safety, 71, 1-12.

- Garg, P., & Agarwal, D. (2014). Critical success factors for ERP implementation in a Fortis hospital: an empirical investigation. Journal of Enterprise Information Management, 27(4), 402-423.

- Shah, R., McMann, O., & Borthwick, F. (2017). Challenges and prospects of applying asset management principles to highway maintenance: A case study of the UK. Transportation Research Part A: Policy and Practice, 97, 231-243.

- Karaaslan, E., Bagci, U., & Catbas, N. (2021). A novel decision support system for long-term management of bridge networks. Applied Sciences, 11(13), 5928.

- Wei, J., Chen, G., Huang, J., Xu, L., Yang, Y., Wang, J., & Sadick, A. M. (2021). BIM and GIS applications in bridge projects: A critical review. Applied Sciences, 11(13), 6207.

- Ahmad, T., Khan, N. I., & Ismail, A. H. (2023). The role of accrual accounting and information systems on asset management practice in the Malaysian public sector: A conceptual paper. IPN JOURNAL OF RESEARCH AND PRACTICE IN PUBLIC SECTOR ACCOUNTING AND MANAGEMENT, 11(1), 39-60.

- Tripathi, A., Dadi, G. B., Nassereddine, H., Sturgill, R. E., & Mitchell, A. (2023). Assessing Technology Implementation Success for Highway Construction and Asset Management. Sensors, 23(7), 3671.

- Bennetts, J., Vardanega, P. J., Taylor, C. A., & Denton, S. R. (2020, December). Survey of the use of data in UK bridge asset management. In Proceedings of the Institution of Civil Engineers-Bridge Engineering (Vol. 173, No. 4, pp. 211-222). Thomas Telford Ltd.

- Hooper, R., Armitage, R., Gallagher, A., & Osorio, T. (2009). Whole-life infrastructure asset management: good practice guide for civil infrastructure. Construction Industry Research and Information Association report C, 677.

- Javid, M. (2019). Public and private infrastructure investment and economic growth in Pakistan: An aggregate and disaggregate analysis. Sustainability, 11(12), 3359.

- Marović, I., Androjić, I., Jajac, N., & Hanák, T. (2018). Urban road infrastructure maintenance planning with application of neural networks. Complexity, 2018, 1-10.

- Beitelmal, W., Molenaar, K., Javernick-Will, A., & Smadi, O. (2017). Strategies to enhance implementation of infrastructure asset management in developing countries. Transportation Research Record Journal of the Transportation Research Board, 2646(1), 39-48. [CrossRef]

- Sasidharan, M., Parlikad, A. K., & Schooling, J. (2021). A business case for risk-informed bridge monitoring using the value of information.

- Karami, S., Madani, H., Katibeh, H., & Fatehi Marj, A. (2018). Assessment and modeling of the groundwater hydrogeochemical quality parameters via geostatistical approaches. Applied water science, 8, 1-13.

- Garramone, M., Moretti, N., Scaioni, M., Ellul, C., Re Cecconi, F., & Dejaco, M. C. (2020). BIM and GIS integration for infrastructure asset management: a bibliometric analysis. ISPRS annals of the photogrammetry, remote sensing and spatial information Sciences, 6, 77-84.

- Caldera, S., Mostafa, S., Desha, C., & Mohamed, S. (2021). Exploring the role of digital infrastructure asset management tools for resilient linear infrastructure outcomes in cities and towns: a systematic literature review. Sustainability, 13(21), 11965.

- Halfawy, M. (2008). Integration of municipal infrastructure asset management processes: challenges and solutions. Journal of Computing in Civil Engineering, 22(3), 216-229. [CrossRef]

- Sanford, K. L., Herabat, P., & McNeil, S. (1999). Bridge management and inspection data: Leveraging the data and identifying the gaps. In Proc., 8th Int. Bridge Management Conf (Vol. 1, pp. 1-15).

- Wang, J., & Maduako, I. N.. (2018, January 1). Spatio-temporal urban growth dynamics of Lagos Metropolitan Region of Nigeria based on Hybrid methods for LULC modeling and prediction.

- Pradana, Y., Adi, T. J. W., & Budianto, H. (2019, October). Determining National Road Performance and Sustainability Indicators. In Third International Conference on Sustainable Innovation 2019–Technology and Engineering (IcoSITE 2019) (pp. 95-100). Atlantis Press.

- Batac, T., Brown, K., Brito, R. S., Cranston, I., & Mizutani, T. (2021). An Enabling Environment for Asset Management through Public Policy: The Benefits of Standardization and Application to the Water Sector. Water, 13(24), 3524.

- Sycheva, E., Budagov, A., & Novikov, A.. (2020, January 1). Urban infrastructure development in a global knowledge-based economy.

- Aurangzeb, A. (2021). M., & Amin, MK (2021). RESOURCES MANAGEMENT AND SME’S PERFORMANCE. Humanities & Social Sciences Reviews, 9(3), 679-689.

- Lorincová, S., Hitka, M., Štarchoň, P., & Stachová, K. (2018). Strategic instrument for sustainability of human resource management in small and medium-sized enterprises using management data. Sustainability, 10(10), 3687.

- Brous, P., Janssen, M., & Herder, P. (2019). Next generation data infrastructures: towards an extendable model of the asset management data infrastructure as complex adaptive system. Complexity, 2019.

- Rasoulkhani, K., & Mostafavi, A. (2018). Resilience as an emergent property of human-infrastructure dynamics: A multi-agent simulation model for characterizing regime shifts and tipping point behaviors in infrastructure systems. PLoS One, 13(11), e0207674.

- Kim, T., Shin, J., Hyung, J., Kim, K., Koo, J., & Cha, Y. (2021). Willingness to pay for improved water supply services based on asset management: A contingent valuation study in South Korea. Water, 13(15), 2040.

- Alnoaimi, A., & Rahman, A. (2019). Sustainability assessment of sewerage infrastructure projects: A conceptual framework. International Journal of Environmental Science and Development, 10(1), 23-29.

- Pérez-Acebo, H., Linares-Unamunzaga, A., Abejón, R., & Rojí, E.. (2018, June 26). Research Trends in Pavement Management during the First Years of the 21st Century: A Bibliometric Analysis during the 2000–2013.

- Ajzen, I. (2012). The theory of planned behavior. In P. A. M. Van Lange, A. W. Kruglanski, & E. T. Higgins (Eds.), Handbook of theories of social psychology (pp. 438–459). Sage Publications Ltd. [CrossRef]

- Akulume, M., & Kiwanuka, S. N. (2016). Health care waste segregation behavior among health workers in Uganda: an application of the theory of planned behavior. Journal of environmental and public health, 2016.

- Xie, L., Huang, M., Xia, B., & Skitmore, M. (2022). Megaproject environmentally responsible behavior in China: a test of the theory of planned behavior. International Journal of Environmental Research and Public Health, 19(11), 6581v.

- Conner, M., & Armitage, C. J. (1998). Extending the theory of planned behavior: A review and avenues for further research. Journal of applied social psychology, 28(15), 1429-1464.

- Wan, C., Shen, G. Q., & Choi, S. (2017). Experiential and instrumental attitudes: Interaction effect of attitude and subjective norm on recycling intention. Journal of environmental psychology, 50, 69-79.

- Ruangkanjanases, A., You, J. J., Chien, S. W., Ma, Y., Chen, S. C., & Chao, L. C. (2020). Elucidating the effect of antecedents on consumers’ green purchase intention: an extension of the theory of planned behavior. Frontiers in Psychology, 11, 1433.

- Dalbor, M. C., & Upneja, A. (2004). The investment opportunity set and the long-term debt decision of US lodging firms. Journal of Hospitality & Tourism Research, 28(3), 346-355.

- Moore, A. W., Anderson, B., Das, K., & Wong, W. K. (2006). Combining multiple signals for biosurveillance. Handbook of biosurveillance, 235.

- Devers, K. J., Lallemand, N. C., Burton, R. A., & Zuckerman, S. (2016). Using qualitative comparative analysis (QCA) to study patient-centered medical homes.

- Ali, N., Nakayama, S., & Yamaguchi, H. (2023). Using the extensions of the theory of planned behavior (TPB) for behavioral intentions to use public transport (PT) in Kanazawa, Japan. Transportation Research Interdisciplinary Perspectives, 17, 100742.

- Okwori, E., Viklander, M., & Hedström, A. (2020). Performance assessment of Swedish sewer pipe networks using pipe blockage and other associated performance indicators. h2oj, 3(1), 46-57.

- Savari, M., & Khaleghi, B. (2023). Application of the extended theory of planned behavior in predicting the behavioral intentions of Iranian local communities toward forest conservation. Frontiers in Psychology, 14, 1121396.

- Raut, R. K., Kumar, R., & Das, N. (2021). Individual investors’ intention towards SRI in India: an implementation of the theory of reasoned action. Social Responsibility Journal, 17(7), 877-896.

- Dunbar, R. V. (2017). The Correlation between Reasoned Actions of Leadership and Intentions to Commit Corruption (Doctoral dissertation, Capella University).

- Bush, S., Omenzetter, P., Henning, T., & McCarten, P. (2012). Data collection and monitoring strategies for asset management of New Zealand road bridges: Research report RR 475. New Zealand Transport Agency.

- Omenzetter, P., Bush, S., Henning, T., & McCarten, P. (2011, April). Risk based bridge data collection and asset management and the role of structural health monitoring. In Nondestructive Characterization for Composite Materials, Aerospace Engineering, Civil Infrastructure, and Homeland Security 2011 (Vol. 7983, pp. 173-185). SPIE.

- Gavrikova, E., Volkova, I., & Burda, Y. (2020). Strategic aspects of asset management: An overview of current research. Sustainability, 12(15), 5955.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).