Submitted:

08 January 2024

Posted:

10 January 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. The Model and Estimates

2.1. The Model

2.2. Estimation

3. Asymptotic Results

4. Monte Carlo Simulation

- DGP1:

5. Empirical Results

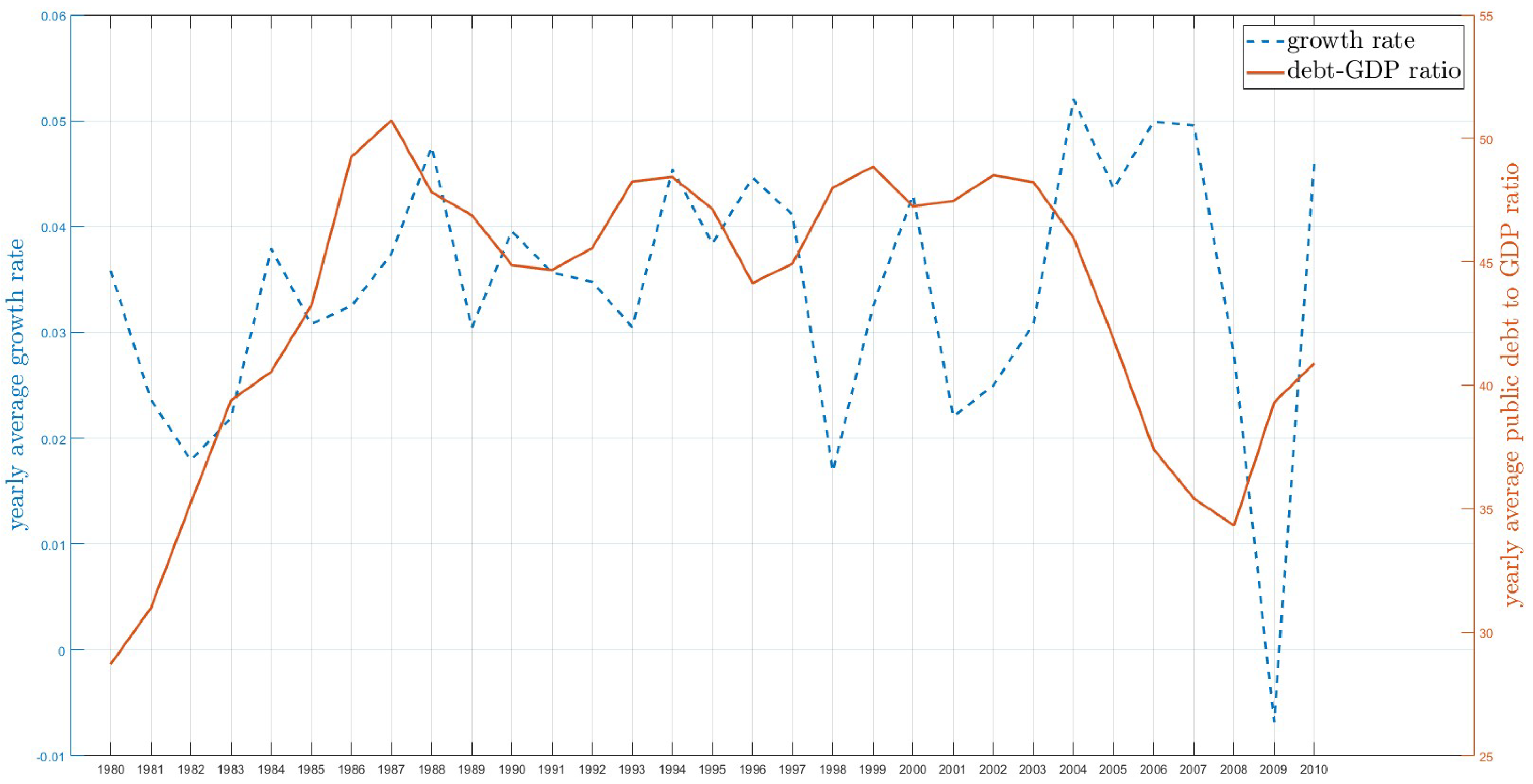

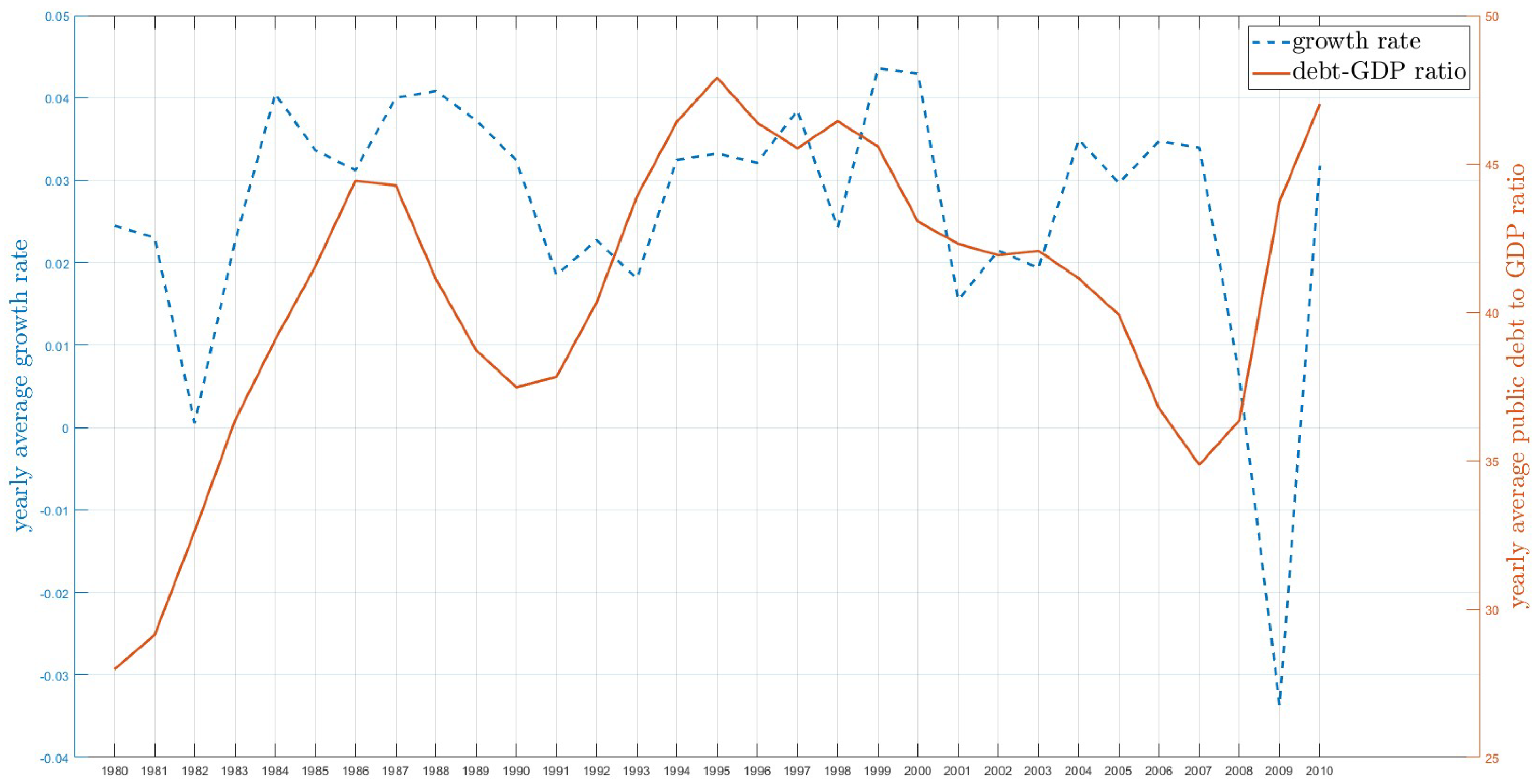

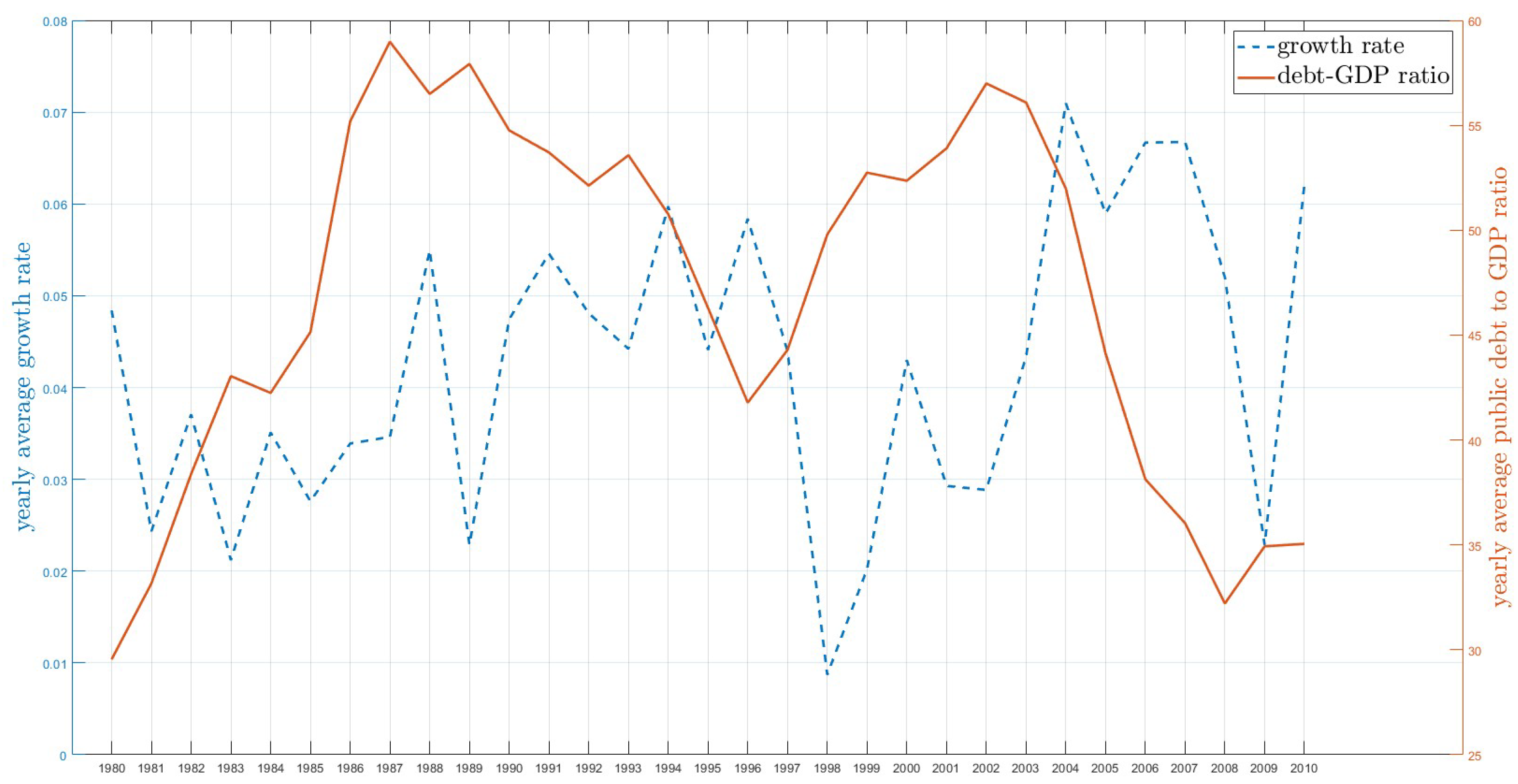

5.1. Data

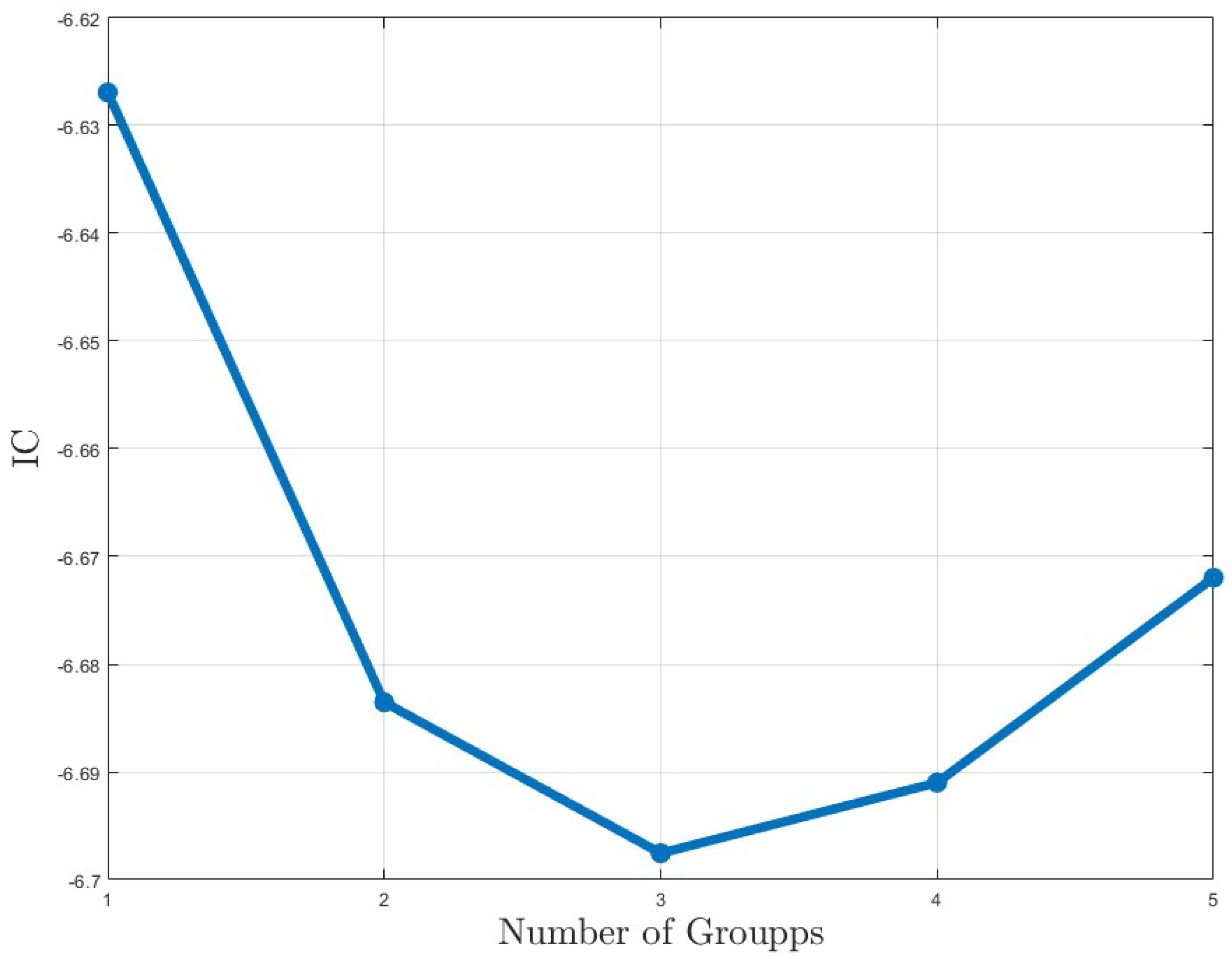

5.2. Determining the Number of Groups

5.3. Estimation Results

6. Conclusion

Appendix A. Lemmas

Appendix B. Theorem

References

- Barro, R.J. Are government bonds net wealth? Journal of Political Economy 1974, 82, 1095–1117. [Google Scholar] [CrossRef]

- Blanchard, O.J. Debt, deficits, and Finite Horizons. Journal of Political Economy 1985, 93, 223–247. [Google Scholar] [CrossRef]

- Elmendorf, D.W.; Gregory Mankiw, N. Chapter 25 Government debt. In Handbook of Macroeconomics; 1999; pp. 1615–1669. [Google Scholar]

- Reinhart, C.M.; Rogoff, K.S. Growth in a Time of Debt. American Economic Review 2010, 100, 573–578. [Google Scholar] [CrossRef]

- Cecchetti, S.G.; M S, M.; Fabrizio, Z. The Real Effects of Debt. Bank For International Settlements Working Papers 2011, 352. [Google Scholar]

- Caner, M.; Grennes, T.; Koehler-Geib, F. Finding the Tipping Point: When Sovereign Debt Turns Bad. Sovereign Debt and the Financial Crisis 2010, 63–75. [Google Scholar]

- Afonso, A.; Jalles, J.T. Growth and productivity: The role of government debt. International Review of Economics & Finance 2013, 25, 384–407. [Google Scholar]

- Kourtellos, A.; Stengos, T.; Tan, C.M. The effect of public debt on growth in multiple regimes. Journal of Macroeconomics 2013, 38, 35–43. [Google Scholar] [CrossRef]

- Chudik, A.; Mohaddes, K.; Pesaran, M.H.; Raissi, M. Is There a Debt-Threshold Effect on Output Growth? Review of Economics and Statistics 2017, 99, 135–150. [Google Scholar] [CrossRef]

- Chan, K.S.; Tsay, R.S. Limiting properties of the least squares estimator of a continuous threshold autoregressive model. Biometrika 1998, 85, 413–426. [Google Scholar] [CrossRef]

- Hansen, B.E. Regression kink with an unknown threshold. Journal of Business & Economic Statistics 2017, 35, 228–240. [Google Scholar]

- Miao, K.; Su, L.; Wang, W. Panel threshold regressions with latent group structures. Journal of Econometrics 2020, 214, 451–481. [Google Scholar] [CrossRef]

- Bonhomme, S.; Manresa, E. Grouped patterns of heterogeneity in panel data. Econometrica 2015, 83, 1147–1184. [Google Scholar] [CrossRef]

- Su, L.; Shi, Z.; Phillips, P.C. Identifying latent structures in panel data. Econometrica 2016, 84, 2215–2264. [Google Scholar] [CrossRef]

- Bonhomme, S.; Lamadon, T.; Manresa, E. Discretizing unobserved heterogeneity. Econometrica 2022, 90, 625–643. [Google Scholar] [CrossRef]

- Panizza, U.; Presbitero, A.F. Public debt and economic growth in Advanced Economies: A Survey. Swiss Journal of Economics and Statistics 2013, 149, 175–204. [Google Scholar] [CrossRef]

- Frankel, J.A.; Romer, D. Does trade cause growth? American Economic Review 1999, 89, 379–399. [Google Scholar] [CrossRef]

- Zhang, J.; Chen, C.; Sun, Y.; Stengos, T. Endogenous Kink threshold regression. 2023. [Google Scholar]

- Su, L.; Chen, Q. Testing homogeneity in panel data models with interactive fixed effects. Econometric Theory 2013, 29, 1079–1135. [Google Scholar] [CrossRef]

- Baum, A.; Checherita-Westphal, C.; Rother, P. Debt and growth: New evidence for the euro area. Journal of International Money and Finance 2013, 32, 809–821. [Google Scholar] [CrossRef]

| 1 | Zhang et al. [18] study the endogenous kink regression model by applying a nonparametric control function approach. Their method can be extended to our latent structure model. We leave this for future study. |

| 2 | Given the asymptotic equivalence holds, the asymptotic normality of the slope and kink threshold estimators can be derived by following Hansen [11]. We will not go through the details here. |

| 3 | In the empirical application, as suggested by Miao et al. [12], we use . |

| Group 1 | Group 2 | Group 3 | ||||||||

| MSE | ||||||||||

| N=50 | T=30 | 0.014 | 0.030 | 0.209 | 0.007 | 0.017 | 0.126 | 0.458 | 0.035 | 0.336 |

| N=100 | T=30 | 0.010 | 0.007 | 0.107 | 0.005 | 0.003 | 0.065 | 0.007 | 0.010 | 0.118 |

| N=50 | T=60 | 0.043 | 0.141 | 0.173 | 0.004 | 0.003 | 0.051 | 0.007 | 0.186 | 0.170 |

| N=100 | T=60 | 0.002 | 0.002 | 0.027 | 0.002 | 0.001 | 0.030 | 0.003 | 0.003 | 0.033 |

| BIAS | ||||||||||

| N=50 | T=30 | -0.019 | 0.049 | 0.030 | -0.014 | 0.030 | 0.010 | -0.069 | 0.054 | 0.064 |

| N=100 | T=30 | -0.021 | -0.011 | -0.037 | -0.006 | 0.002 | -0.003 | -0.010 | 0.015 | 0.019 |

| N=50 | T=60 | -0.030 | 0.053 | 0.012 | -0.012 | 0.001 | -0.049 | -0.010 | 0.069 | 0.018 |

| N=100 | T=60 | 0.001 | 0.009 | 0.024 | 0.001 | 0.005 | 0.009 | -0.013 | 0.004 | -0.026 |

| STD | ||||||||||

| N=50 | T=30 | 0.118 | 0.166 | 0.457 | 0.085 | 0.127 | 0.355 | 0.673 | 0.180 | 0.576 |

| N=100 | T=30 | 0.100 | 0.081 | 0.325 | 0.067 | 0.057 | 0.254 | 0.081 | 0.098 | 0.343 |

| N=50 | T=60 | 0.205 | 0.371 | 0.416 | 0.066 | 0.053 | 0.219 | 0.082 | 0.426 | 0.412 |

| N=100 | T=60 | 0.042 | 0.042 | 0.163 | 0.040 | 0.037 | 0.173 | 0.051 | 0.050 | 0.179 |

| Group 1 | Group 2 | Group 3 | ||||||||

| MSE | ||||||||||

| N=50 | T=30 | 0.139 | 0.731 | 0.391 | 0.024 | 0.401 | 0.288 | 0.011 | 0.043 | 0.255 |

| N=100 | T=30 | 0.016 | 0.003 | 0.099 | 0.003 | 0.003 | 0.035 | 0.006 | 0.033 | 0.144 |

| N=50 | T=60 | 0.028 | 0.010 | 0.135 | 0.005 | 0.004 | 0.074 | 0.036 | 0.034 | 0.173 |

| N=100 | T=60 | 0.007 | 0.001 | 0.055 | 0.001 | 0.001 | 0.020 | 0.001 | 0.010 | 0.072 |

| BIAS | ||||||||||

| N=50 | T=30 | -0.100 | 0.112 | 0.008 | -0.016 | 0.122 | 0.065 | -0.028 | 0.051 | -0.044 |

| N=100 | T=30 | -0.025 | 0.017 | 0.021 | -0.003 | 0.006 | 0.018 | -0.018 | 0.030 | -0.005 |

| N=50 | T=60 | -0.036 | 0.008 | -0.013 | -0.018 | 0.005 | -0.046 | -0.019 | 0.031 | 0.008 |

| N=100 | T=60 | -0.010 | 0.009 | 0.020 | 0.001 | 0.004 | 0.002 | -0.004 | 0.025 | -0.005 |

| STD | ||||||||||

| N=50 | T=30 | 0.164 | 0.098 | 0.368 | 0.069 | 0.062 | 0.268 | 0.188 | 0.182 | 0.416 |

| N=100 | T=30 | 0.085 | 0.035 | 0.233 | 0.036 | 0.036 | 0.140 | 0.033 | 0.097 | 0.268 |

| N=50 | T=60 | 0.359 | 0.847 | 0.625 | 0.153 | 0.622 | 0.533 | 0.102 | 0.200 | 0.504 |

| N=100 | T=60 | 0.124 | 0.056 | 0.314 | 0.059 | 0.052 | 0.186 | 0.076 | 0.179 | 0.380 |

| N=50 | N=100 | N=50 | N=100 | |

| T=30 | 0.0036 | 0.0021 | 0.0114 | 0.0088 |

| T=60 | 0 | 0 | 0.004 | 0.002 |

| Group 1 | Group 2 | Group 3 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MSE | 0.001 | 0.009 | 0.023 | 0.004 | 0.000 | 0.011 | 0.017 | 0.003 | 0.000 | 0.016 | 0.027 | 0.002 |

| 0.001 | 0.005 | 0.011 | 0.002 | 0.000 | 0.006 | 0.013 | 0.002 | 0.000 | 0.014 | 0.015 | 0.002 | |

| 0.000 | 0.002 | 0.006 | 0.002 | 0.000 | 0.003 | 0.007 | 0.001 | 0.000 | 0.004 | 0.007 | 0.001 | |

| 0.000 | 0.002 | 0.004 | 0.001 | 0.000 | 0.002 | 0.004 | 0.000 | 0.000 | 0.003 | 0.005 | 0.001 | |

| BIAS | 0.006 | 0.018 | -0.068 | 0.016 | 0.005 | -0.029 | -0.037 | 0.036 | -0.001 | -0.095 | 0.007 | 0.040 |

| 0.009 | 0.007 | -0.060 | 0.020 | 0.006 | -0.036 | -0.062 | 0.031 | 0.001 | -0.096 | -0.015 | 0.041 | |

| 0.001 | -0.011 | -0.021 | 0.015 | 0.002 | -0.022 | -0.031 | 0.016 | 0.001 | -0.047 | -0.021 | 0.019 | |

| 0.001 | -0.015 | -0.026 | 0.013 | 0.002 | -0.019 | -0.036 | 0.013 | 0.000 | -0.040 | -0.034 | 0.017 | |

| STD | 0.031 | 0.094 | 0.134 | 0.058 | 0.017 | 0.099 | 0.125 | 0.038 | 0.015 | 0.081 | 0.163 | 0.029 |

| 0.021 | 0.072 | 0.085 | 0.044 | 0.012 | 0.068 | 0.094 | 0.026 | 0.010 | 0.068 | 0.123 | 0.024 | |

| 0.020 | 0.048 | 0.077 | 0.039 | 0.011 | 0.047 | 0.078 | 0.024 | 0.009 | 0.047 | 0.079 | 0.018 | |

| 0.013 | 0.036 | 0.054 | 0.028 | 0.008 | 0.036 | 0.048 | 0.017 | 0.007 | 0.042 | 0.064 | 0.015 | |

| Group 1 | Group 2 | Group 3 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MSE | 0.001 | 0.016 | 0.011 | 0.005 | 0.000 | 0.007 | 0.018 | 0.002 | 0.001 | 0.012 | 0.053 | 0.006 |

| 0.001 | 0.006 | 0.005 | 0.003 | 0.000 | 0.006 | 0.010 | 0.002 | 0.001 | 0.007 | 0.045 | 0.004 | |

| 0.000 | 0.006 | 0.004 | 0.002 | 0.000 | 0.003 | 0.007 | 0.001 | 0.000 | 0.003 | 0.026 | 0.002 | |

| 0.000 | 0.002 | 0.002 | 0.001 | 0.000 | 0.002 | 0.004 | 0.001 | 0.000 | 0.002 | 0.012 | 0.001 | |

| BIAS | 0.017 | -0.036 | -0.046 | 0.030 | 0.003 | -0.050 | -0.053 | 0.032 | -0.022 | -0.080 | -0.089 | 0.068 |

| 0.017 | -0.015 | -0.045 | 0.025 | 0.001 | -0.059 | -0.042 | 0.035 | -0.020 | -0.067 | -0.105 | 0.061 | |

| 0.011 | -0.015 | -0.021 | 0.015 | 0.001 | -0.027 | -0.037 | 0.015 | -0.011 | -0.041 | -0.046 | 0.034 | |

| 0.010 | -0.004 | -0.025 | 0.011 | 0.001 | -0.025 | -0.036 | 0.015 | -0.010 | -0.035 | -0.048 | 0.029 | |

| STD | 0.028 | 0.123 | 0.095 | 0.061 | 0.016 | 0.069 | 0.125 | 0.035 | 0.015 | 0.071 | 0.213 | 0.036 |

| 0.018 | 0.075 | 0.059 | 0.044 | 0.011 | 0.046 | 0.091 | 0.025 | 0.011 | 0.050 | 0.184 | 0.025 | |

| 0.017 | 0.076 | 0.062 | 0.042 | 0.011 | 0.048 | 0.078 | 0.023 | 0.009 | 0.040 | 0.154 | 0.020 | |

| 0.014 | 0.046 | 0.038 | 0.028 | 0.007 | 0.035 | 0.052 | 0.016 | 0.007 | 0.033 | 0.097 | 0.016 | |

| N=50 | N=100 | N=50 | N=100 | |

| T=30 | 0.0038 | 0.005 | 0.057 | 0.0539 |

| T=60 | 0 | 0 | 0.005 | 0.0064 |

| Latent group | ✓ | |||

|---|---|---|---|---|

| G1 | G2 | G3 | ||

| 3.7020 | 3.7773 | 3.7906 | 4.0630 | |

| (0.0023) | (0.0055) | (0.0053) | (0.0026) | |

| -0.0842 | ||||

| (0.0388) | (0.0775) | (0.0626) | (0.0579) | |

| (0.0028) | (0.0044) | (0.0044) | (0.0029) | |

| 0.0022 | 0.0061 | 0.0032 | ||

| (0.0037) | (0.0083) | (0.0077) | (0.0066) | |

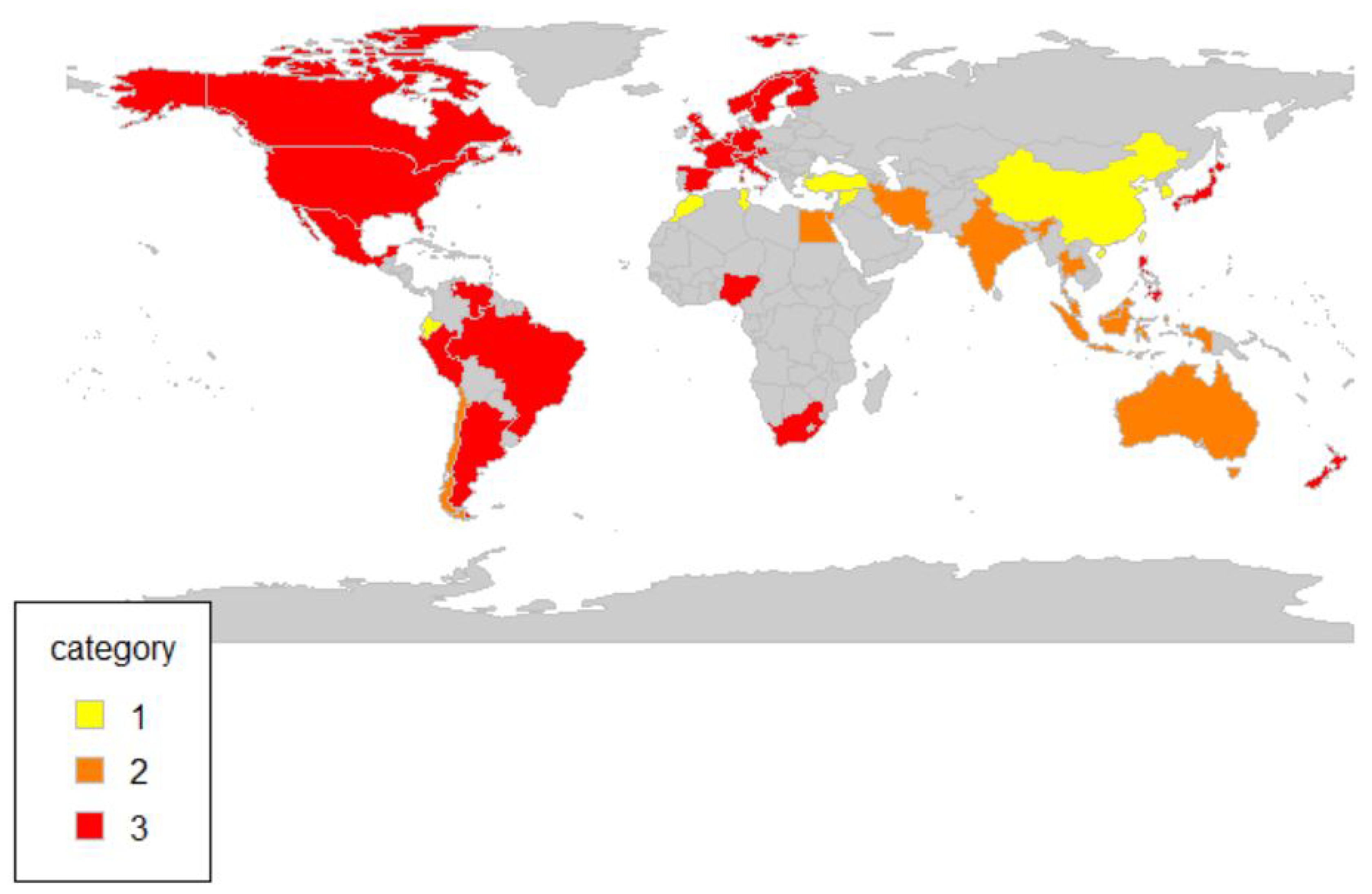

| Country | 40 | 7 | 9 | 24 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).