1. Introduction

The progress of science and technology and the recruitment of scientific and technological talents have an important impact on the development of innovation capabilities. Research and development activities are the basis for cultivating and developing a company's own innovation capabilities. In the face of increasingly fierce market competition, companies must increase the scale and intensity of their research and development activities to cultivate sustainable competitiveness, so that they can achieve long-term and sustainable development. In other words, a company's technological innovation promotes the input of R&D expenditures, and the input of R&D expenditures enhances the core competitiveness of the company. Chinese companies are also taking research investment seriously, with executives recognizing that R&D is critical to the future of their companies. In response, Chinese companies are gradually expanding their R&D efforts. In addition, companies are more transparent about their research and development than ever before. As a result, it is now possible to obtain the necessary data on issues such as how the company's R&D activities are being carried out, what the profit margins are, and what the economic impact is on the company. We chose to study companies in Shandong, China, for the following reasons.

First, Chinese enterprises' investment in research and development has been growing rapidly, according to statistics, in 2018, enterprises nationwide invested a total of 19,677.9 billion yuan in research and development (R&D), an increase of 11.8% year-on-year. Second, the top three provinces, cities, and districts in China in terms of R&D spending are Guangdong, Jiangsu, and Shandong, all of which exceeded 150 billion yuan. Third, state-owned enterprises and private enterprises coexist in China. Of these, SOEs make up a very large portion of the Chinese economy. The political relationship between SOEs and the Chinese government is crucial for financing investment, which is why China has allowed SOEs to invest more in R&D. In China, the number of listed companies in a province indicates the economic status of the region, and the more listed companies, the more developed the industrial production economy of the region. There are 211 listed companies in Shandong, which ranks sixth in the country. Fourth, the development of research and development activities and the investment of research and development expenditures will bring new products to the enterprise, create new industries, explore new markets, obtain more profits, and promote the improvement of enterprise value. Fifth, in a market environment driven by information and knowledge, a company's R&D expenditures have already come to promote science and technology. The drive for innovation and economic development simultaneously provides external investors with a yardstick for measuring firm value and corporate performance, so empirical research on the impact of R&D spending on firm value has important theoretical and practical implications.

Many studies that have examined the relationship between R&D expenditures and firm value have generally found that R&D expenditures have a significant positive impact on firm value [

1]. Based on this review of previous studies, this study is organized as follows to analyze the reasons for the rapid growth of R&D expenditures in Shandong Province and how R&D expenditures affect firm value.

2. Materials and Methods

Lev found that R&D investments positively affected the value of the firm by increasing future firm profitability [

2]. Eberhart found a significant association between increased R&D spending and operating performance for U.S. firms [

3]. Hirschey an alyzed the relationship between firm value and book value, accounting profit, research and development expenditures, and advertising expenditures [

4].

The analysis shows that accounting profit, R&D expenses, and advertising expenses have a significant positive impact on firm value. Chauvin and Hirschey analyzed the relationship between advertising expenditures and R&D investment and firm value [

5]. The dependent variable is the market value of the stock. The results of the analysis show that only advertising expenditures and R&D expenditures have a positive effect on firm value.

Yuk, Geun-Hyo analyzed the impact of R&D investment on accounting profit and Tobin Q using a profit model and a valuation model for 126 firms from 1987 to 1998. The analysis shows that R&D investment has a positive impact on firm value in the two years following the current year [

6]. Jung and Park analyze whether R&D investment has a significant impact on firm value. The analysis shows that current R&D investment is positively related to firm value, while non-current R&D investment is mostly non-significant [

7]. Park and Yang analyze the impact of R&D investment on firm performance before and after an IPO (Initial Public Offering using 311 KOSPI listed firms [

8]. Our analysis shows that pre-IPO R&D investment has a significant positive effect on post-IPO firm performance, average market capitalization, but only R&D investment in the year prior to IPO has a significant positive effect on the year of IPO. Lee and Ha examined the relationship between R&D expenditures and firm value using 104 firms from the KSE (Korea Stock Exchange) and 71 firms from the KOSDAQ (Korea Securities Dealers Automated Quotation) [

9]. The analysis shows that R&D investment has a positive impact on firm value for both the Korea Composite Stock Price Index (KOSPI) and the KOSDAQ. The model that includes R&D as an asset and the model that includes R&D as an expense also shows a significant positive sign on firm value. Jung et al analyze how R&D investment affects firm value using the KOSDAQ [

10]. The analysis shows that R&D investment in KOSDAQ firms has a positive effect on firm value. Kang analyzed the relationship between R&D investment and firm value. The results showed that R&D investment is significantly related to firm value [

11].

R&D expenditures are known to have a positive impact on future accounting earn ings and market value [

1]. Hirschey and Weygandt and Bublitz and Ettredge show that R&D expenditures ultimately have a positive effect on firm value [

12,

13]. Chan, Martin, and Kensinger also find a significant positive effect of stock price on R&D expenditure disclosure [

14]. In their analysis of the relationship between R&D expenditures and firm value, Kim and Seo found a significant positive relationship between capitalized R&D expenditures and stock returns and reported earnings in subsequent periods [

15].

3. Results

3.1. Set Hypothesis

In this study, we review the existing studies and formulate hypotheses to analyze the impact of a firm's R&D expenditure on firm value. As shown in the previous study, Hirschey analyzed the relationship between R&D expenditures and firm value and found that accounting profit, R&D expenditures, and advertising expenditures have a positive and significant effect on firm value [

12]. Studies such as Lee and Ha and Kang (2015) also found a significant relationship between R&D expenditures and firm value [

9,

11]. By investing in R&D activities, companies can infer that positive expectations of future cash flows and operating performance are expected, which will lead to an increase in firm value. This study aims to verify the asset quality of R&D expenditures by empirically analyzing how R&D expenditures affect the firm value of listed firms and sets the following research hypotheses.

Hypothesis: R&D expenditures will have a positive impact on firm value.

3.2. Selecting Variables

3.2.1. Dependent Variable

Yuk, Geun-Hyo used Tobin Q to analyze the impact of R&D investment on accounting earnings [

6]. Therefore, in this study, we measure firm value using TQ as used in Yuk-Kun Hyo [

6]. TQ is defined as the book value of total assets minus the book value of equity, plus the market value of equity, divided by the book value of total assets.

3.2.2. Independent Variable

In this study, we include the following independent variables that can affect firm value in the research model based on previous studies, such as the study by Kim, Jung-Kyo and Seo, Ji-Sung [

15]. TRD is R&D divided by revenue.

3.2.3. Control Variables

In this study, we include the following control variables in our model that may affect firm value. First, GROWTH is expressed as an annualized revenue growth rate. Second, financial leverage (LEV) is the debt budget divided by total assets. Third, the natural logarithm of sales (LNAGE) is the natural logarithm of firm age. Fourth, the natural logarithm of sales (LNSALE) is the natural logarithm of sales. Fifth, LOSS is the value of whether or not a loss was incurred. Sixth, the market value of equity/book value of equity (MB) was calculated by di viding the market value of equity by the book value of equity (total equity). Seventh, OWNER is a variable that indicates the percentage of majority ownership (including related parties) of the analyzed company. Eighth, return on equity (ROA) is a variable that represents the return on total assets. Ninth, return on equity (ROE) is a variable that represents the return on equity. Tenth, the firm size (SIZE) variable is measured by taking the natural logarithm of total assets. The existing literature on firm value considers the SIZE variable for firm size as a control variable in the model [

2]. We also include a year dummy (YEAR) and an industry dummy (IND) as control variables to control for differences in the year and industry characteristics of the sample.

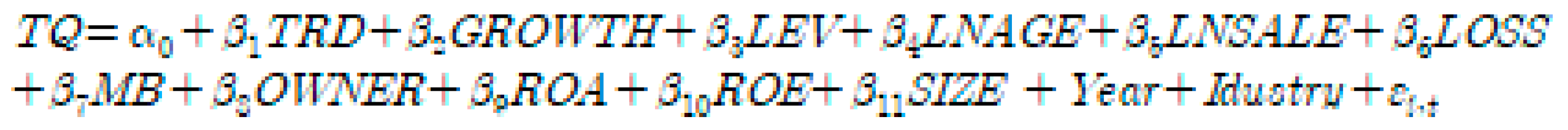

3.3. Analytical Models

To analyze how R&D expenditures affect firm value, we further run Ordinary Least Squares (OLS) and fixed effects panel regressions as alternative valuation norms because there may be a connection between the firm's specific impact and the variables of interest. To test our hypothesis, we set up the following Equation (1) as in previous studies:

Variable definitions

: TQ: Enterprise Value, TRD: R&D expenses/sales, GROWTH: Sales growth rate, LEV: Financial leverage, LNAGE: Natural logarithm of company age, LNSALE: Natural logarithm of sales, LOSS: Whether a loss occurred, MB: Market value of equity/Book value of equity, OWNER: Majority ownership, ROA: Return on Total Assets, ROE: Return on equity, SIZE: Business size, YEAR: Year dummy, IND: Industry Dummy,

: Residuals.

3.4. Sampling

The sample for this study consists of listed companies in China's Guotai'an database from 2010 to 2018. The data required to measure the presence of dual directorships in the firm and the other variables were collected using Stata 15. The study sample is a total of 1,382 firms, excluding 828 missing firm years, resulting in a final study sample of 554 firm years. The following table [

Table 1] shows the selection of the study sample and the results.

4. Discussion

4.1. Results of Empirical Analysis

The descriptive statistics of the main variables are shown in

Table 2.

As shown in [

Table 2], the sample size of listed companies analyzed is 554, and the mean of total value (TQ) is 2.416, the minimum value is 0.785, and the maximum value is 10.01. TRD is a variable measured by a company's R&D expenses divided by operating revenue, and the mean is 0.026, and the minimum and maximum values are 0 and 0.241. The sample companies in this study spend an average of 2.6% on R&D as a per centage of revenue. The mean for GROWTH is 0.160, with minimum and maximum values of -0.914 and 5.981. The mean of financial leverage (LEV) is 0.434, with minimum and maximum values of 0.026 and 1.306. The mean of the natural logarithm of sales (LNAGE) is 2.702, with minimum and maximum values of 1.386 and 3.367. The mean of the natural logarithm of sales (LNSALE) is 21.343, with maximum values of 15.715 and 25.017. The mean of LOSS is 0.104, with minimum and maximum values of 0 and 1. MB is the market value of equity divided by the book value of equity (total capitalization), with a mean of 3.313 and minimum and maximum values of -49 and 52.5. This means that on average, the market value of equity is 3.3x for the companies in our sample, with a maximum of 52.5x.

The mean of the majority shareholder (OWNER) is 0.316, with minimum and maximum values of 0.041 and 0.864. You'll also notice that the average majority shareholder ownership is 31%, with some companies holding as much as 86%. The average return on equity (ROA) is 0.040, with minimum and maximum values of -0.287 and 0.277. The average return on equity (ROE) is 0.086, with minimum and maximum values of -1.311 and 12.733. The mean for SIZE is 21.931, with minimum and maximum values of 19.574 and 25.657.

4.2. Correlation Analysis

The correlations between the variables in the sample of 554 companies in this study are shown in [

Table 3]. As shown in [

Table 3], the correlation coefficient between TQ and TRD is 0.451, which is a significant positive correlation at 1% significance level. This means that as R&D expenditures increase, so does the company's valuation. The correlations between TQ and GROWTH, OWNER, ROA, and ROE are 0.202, 0.009, 0.423, and 0.330, respectively, which are significant and positive at the 1% significance level. In other words, the higher the R&D expenditure, operating income growth rate, majority shareholder ownership, return on total assets, and return on equity, the higher the firm's valuation.

The results of this analysis show that accumulated R&D expenditures con tribute to firm value in a lagged manner, indicating that R&D expenditures play a role in enhancing the information value to the firm's stakeholders and can significantly explain the variation in firm value.

Table 3.

Correlation Analysis.

Table 3.

Correlation Analysis.

| Distinguish |

TQ |

TRD |

GROWTH |

LEV |

LNAGE |

LNSALE |

LOSS |

MB |

OWNER |

ROA |

ROE |

SIZE |

| TQ |

1.000 |

|

|

|

|

|

|

|

|

|

|

|

| TRD |

0.451**

|

1.000 |

|

|

|

|

|

|

|

|

|

|

| GROWTH |

0.202**

|

0.108 |

1.000 |

|

|

|

|

|

|

|

|

|

| LEV |

-0.469**

|

-0.466**

|

-0.090*

|

1.000 |

|

|

|

|

|

|

|

|

| LNAGE |

-0.089 |

-0.115**

|

-0.072 |

0.199**

|

1.000 |

|

|

|

|

|

|

|

| LNSALE |

-0.500**

|

-0.359**

|

0.036 |

0.427**

|

0.213**

|

1.000 |

|

|

|

|

|

|

| LOSS |

-0.058 |

-0.175**

|

-0.280**

|

0.330**

|

0.055 |

-0.085 |

1.000 |

|

|

|

|

|

| MB |

0.906**

|

0.323**

|

0.220**

|

-0.183**

|

-0.007 |

-0.377**

|

0.025 |

1.000 |

|

|

|

|

| OWNER |

0.009 |

-0.126**

|

0.022 |

-0.050 |

-0.231**

|

0.077 |

-0.144**

|

-0.045 |

1.000 |

|

|

|

| ROA |

0.423**

|

0.352**

|

0.361**

|

-0.641**

|

-0.090 |

-0.044 |

-0.530**

|

0.267**

|

0.080 |

1.000 |

|

|

| ROE |

0.330**

|

0.222**

|

0.374**

|

-0.346**

|

-0.008 |

0.118**

|

-0.456**

|

0.216**

|

0.097 |

0.897**

|

1.000 |

|

| SIZE |

-0.535**

|

-0.292**

|

-0.002 |

0.382**

|

0.230**

|

0.875**

|

-0.052 |

-0.428**

|

0.043 |

-0.105 |

0.022 |

1.000 |

4.3. Regression Analysis

The purpose of this study is to analyze the impact of R&D expenditures on firm value (TQ) of listed firms. [

Table 4] shows the regression results of the impact of R&D expenditure on firm value. The analysis shows that the regression model is significant at the 1% level, with a correction of 0.679, which gives the model an explanatory power of 67.9%. After analyzing the impact of the variable of interest, R&D expenditure, on firm value, we find that R&D expenditure (TRD) has a positive impact on firm value (TQ) at a significance level of 1%. This means that as R&D expenditures increase, firm value increases, as in a correlation analysis, which is a univariate analysis.

The correlation analysis without controlling for other variables affecting firm value shows that R&D expenditure has a positive effect on firm value, and the multivariate regression analysis controlling for other variables affecting firm value also shows that R&D expenditure has a significant positive effect on firm value at the 1% level, suggesting that managers of listed firms in Shandong Province of China need to actively engage in R&D activities to increase firm value.

Specifically, GROWTH is positively correlated with TQ at the 5% significance level, and LOSS is positively correlated with TQ at the 1% significance level. In addition, market value of equity/book value of equity (MB), return on assets (ROA), and return on equity (ROE) are all positively correlated with firm value (TQ) at the 1% significance level. On the other hand, financial leverage (LEV) is negatively related to TQ at the 10% significance level, and the natural logarithm of total assets (SIZE) is negatively related to TQ at the 1% significance level. On the other hand, the natural logarithm of firm age (LNAGE), natural logarithm of sales (LNSALE), and majority ownership (OWNER) are all unrelated to firm value (TQ).

Based on the results of these regressions, the hypothesis that R&D expenditure (TRD) of listed firms has a positive effect on firm value (TQ) is accepted. This provides indirect evidence that R&D is critical to increasing firm value in publicly traded companies with high R&D expenditures.

Table 4.

Regression results of the impact of R&D expenditure on firm value.

5. Conclusions

Based on a review of previous studies that show that R&D expenditures have a positive impact on firm value, this study analyzes how R&D expenditures affect firm value for listed firms in Shandong Province, China, which have a high proportion of R&D expenditures. To this end, we conducted an empirical analysis on 554 sample firms listed from 2010 to 2018, and the results of the correlation test between R&D expenditure and firm value (TQ) showed that R&D expenditure (TRD) has a 1% significant positive impact on firm value (TQ). This means that as R&D expenditures increase, firm value increases, as in a correlation analysis, which is a univariate analysis.

Implications of this research include. First, this study analyzes the relationship between R&D expenditure and firm value for the first time for listed companies in Shandong Province. We believe this can help analyze the effectiveness of innovation investment in listed companies in Shandong Province. Second, our results show that R&D expenditures have a positive relationship with firm value. In other words, the more a company spends on R&D, the more it positively affects firm value. Third, we believe that our findings can help decision-makers by providing insights into the relationship between R&D expenditures and firm value for listed companies in Shandong Province.

Author Contributions

Conceptualization, K.S., R.X. and X.Y.; methodology, K.S., R.X. and X.Y.; software, K.S., R.X. and X.Y.; validation, K.S., R.X. and X.Y.; formal analysis, K.S., R.X. and X.Y.; investigation, K.S., R.X. and X.Y.; resources, K.S., R.X. and X.Y.; data curation, K.S., R.X. and X.Y.; writing—original draft preparation, K.S.; writing—review and editing, K.S., R.X. and X.Y.; visualization, K.S.; supervision, K.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by Chungbuk National University Korea National University Development Project (2022).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The sample for this study is listed companies in China's Guotai'an database.

Conflicts of Interest

The author declares no conflict of interest.

Abbreviations

List of abbreviatons used in the arricle (in alphabetical order).

| R&D |

Research and Development |

| ROA |

Return on Total Assets |

| ROE |

Return on equity |

References

- Cho, S. P.; Chung, J. Y. The effect of R&D expenditures on subsequent earnings. Korean Management Review, 2001, 30, 289–313. [Google Scholar]

- Lev, B, Sougiannis, T. The capitalization, amortization, and value-relevance of R&D. J. Account. Econ, 1996, 21, 107–138. [CrossRef]

- Eberhart, A. C, Maxwell, W. F, Siddique, A.R, An examination of long-term abnormal stock returns and operating performance following R&D increases. J. Financ, 2004, 59, 623–650. [Google Scholar] [CrossRef]

- Hirschey, N.J. Weygandt “Amortization Policy for Advertising and Research and Development Expenditures,” Journal of Accounting Research, 1985, 326-335. Journal of Accounting Research 1985, 335, 326. [Google Scholar] [CrossRef]

- Chauvin, K.W.M. Hirschey "Advertising, R&D Expenditures, and the Market Value of the Firm. Financial Management 1993, 24, 128–140. [Google Scholar]

- Yuk, Geun-Hyo. Reexamination of the Economic Effects of R&D and Advertising Expenditure. Journal of Business Research 2003, 18, 219–251. [Google Scholar]

- Cheong, J. S.; Park, J. Y. The impact of R&D expenses on business value in the KOSDAQ firms. Review of Business & Economics, 2004, 17, 1273–1289. [Google Scholar]

- Park, K.J.; Yang, D.W. An Empirical Study on the IPO Firms' Financial Performance Achieved by R&D Expenditures Using Statistical Models (IPO Affect Firm's Performance after IPO, between KOSPI). Journal of Korea Technology Innovation Society 2006, 9, 842–864. [Google Scholar] [CrossRef]

- Lee, H. Y.; Ha, K. S. The Effect of Research and Development Expenditure on Corporate Value. Journal of the Korea Academia-Industrial cooperation Society, 2008, 9, 822–830. [Google Scholar] [CrossRef]

- Jeong, J. G. , Jo, H. J., Kwak, J. M.; Bae, K. S. R&D cost of kosdaq-listed companies and firm value. Journal of finance and accounting information, 2012, 12, 57–71. [Google Scholar] [CrossRef]

- Kang, K. H. A Study on Effect of R&D Investments and Corporation Valuation in KOSDAQ Listed Companies. The Journal of Business Education, 2015, 29, 351–371. [Google Scholar]

- Hirschey, M. Intangible Capital Aspects of Advertising and R&D Expenditures. Journal of Industrial Economics 1982, 30, 375–390. [Google Scholar] [CrossRef]

- Bublitz, B.M. Ettredge, “The information in Discretionary Outlays: Advertising, Research, and Development. The Accounting Review 1989, 108–124. [Google Scholar]

- Chan, S. J. Martin; J. Kensinger. Corporate Research and Development Expenditures. Journal of Accounting Research 18, Supplement. 1990, 27–37. [Google Scholar] [CrossRef]

- Kim, J. K.; Seo, J. S. The effects of R&D expenditures on the firm’s value. Korea International Accounting Review, 2007, 20, 207–229. [Google Scholar]

Table 1.

Selection of the study sample.

Table 1.

Selection of the study sample.

| Publicly traded company based in Shandong, China, 2010-2018 |

1,382 |

| Missing values |

(828) |

| Final study sample size |

554 |

Table 2.

Descriptive Statistics.

Table 2.

Descriptive Statistics.

| Variable |

N |

Mean |

Std |

Min |

Median |

Max |

| TQ |

554 |

2.416 |

1.495 |

0.785 |

1.951 |

10.010 |

| TRD |

554 |

0.026 |

0.028 |

0.000 |

0.017 |

0.241 |

| GROWTH |

554 |

0.160 |

0.440 |

-0.914 |

0.112 |

5.981 |

| LEV |

554 |

0.434 |

0.216 |

0.026 |

0.414 |

1.306 |

| LNAGE |

554 |

2.702 |

0.379 |

1.386 |

2.772 |

3.367 |

| LNSALE |

554 |

21.343 |

1.291 |

15.715 |

21.161 |

25.017 |

| LOSS |

554 |

0.104 |

0.306 |

0 |

0 |

1 |

| MB |

554 |

3.313 |

4.527 |

-49.000 |

2.733 |

52.592 |

| OWNER |

554 |

0.316 |

0.149 |

0.041 |

0.298 |

0.864 |

| ROA |

554 |

0.040 |

0.060 |

-0.287 |

0.034 |

0.277 |

| ROE |

554 |

0.086 |

0.574 |

-1.311 |

0.066 |

12.733 |

| SIZE |

554 |

21.931 |

1.032 |

19.574 |

21.789 |

25.657 |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

: Residuals.

: Residuals.