1. Introduction

There is a significant impact of exchange rate volatility on South Africa's exports (see Nyahokwe and Ncwadi, 2013; Ishimwe and Ngalawa, 2015). Exchange rate fluctuations can have a significant impact on the competitiveness of South African goods on the international market. As a result, increasing the risk of exchange rate volatility should encourage trade (Nyahokwe & Ncwadi, 2013), according to theoretical models. When the local currency falls in value, exports become less expensive and more appealing, resulting in an increase in exports. In contrast, Hooper and Kohlhagen (1978) and Clark (1973), among others, reinforce the argument that volatility reduces trade. The appreciation of the currency may make exports more expensive, resulting in a decline in exports. As a result, regulating exchange rate volatility is critical for South Africa's export-driven economy. South Africa, on the other hand, has a fragile economy and is prone to global trade (Oseni 2016). Exchange rate volatility produces a risk cost for long-term contracts, escalates production costs, restricts trade, and causes real-economy changes (see Oseni 2016). January 2016 saw the rand's (ZAR) greatest depreciation, which contributed to South Africa's ongoing experience of exchange rate volatility. During 1994 and 2001, South Africa experienced similar currency depreciations. The Rand dropped from ZAR3.56 per US dollar to ZAR10.5 per dollar in January 2016, an 180% decline. The South African monetary authority's practice of floating the exchange rate on foreign exchange markets is what has led to this ongoing volatility (Phiri et al. 2016). Considering how strongly South Africa depends on imports for basic commodities and services, this might be very harmful. Foreign trade is essential for a nation's economic growth and development; thus, any interruptions brought on by exchange rate swings may have far-reaching effects. Additionally, changes in the real economy might have an impact on investment choices since businesses may be hesitant to make investments in an uncertain market. To guarantee sustainable economic growth, South Africa must maintain stable trade ties and efficiently manage exchange rate risks. South Africa can reduce the risks posed by currency volatility and preserve a stable export market by adopting effective exchange rate controls.

Numerous empirical and theoretical investigations have been conducted on this subject both nationally and globally. The findings of these studies are mixed. Some scholars, such as Zhang, and Buongiorno (2010), Khosa et al. (2015), Thuy and Thuy (2019), discover a negative link between exchange rate volatility and exports; while a few studies, such as Serenis and Tsounis (2014), find a positive link. Furthermore, prior research assumed a linear and symmetric relationship between exchange rate volatility and exports. However, this study has begun to question this assumption and investigates the possibilities of nonlinear and asymmetric interactions. The study argues that the impact of exchange rate volatility on South Africa’s exports is possible asymmetrically and non-linearly. This is due to the possibility that exchange rate volatility can have both positive and negative effects on exports.

On the one hand, a weakening of the South African Rand might make exports more affordable to international buyers, resulting in increased demand and export volumes. Excessive volatility and uncertainty in the currency rate, on the other hand, can deter international investors and buyers, significantly harming export performance. Furthermore, the study argues that the relationship between exchange rate volatility and exports may differ based on the level of exchange rate stability and the specific characteristics of the export industry. For example, if the South African Rand is stable, foreign investors and purchasers may have confidence in the currency and wish to engage in export operations. However, in highly volatile exchange rate conditions, international purchasers may be hesitant to make transactions due to uncertainty about the currency's future worth. Furthermore, some export industries, such as those that focus on vital items or have long-term contracts with stable pricing systems, may be more resilient to exchange rate fluctuations than others. As a result, the study employs nonlinear autoregressive distributed lag (NARDL) and smooth transition regression (STR) models to assess the impact of exchange rate volatility on South African exports. These models have the potential to capture non-linear correlations between exchange rate volatility and exports, as well as the flexibility to account for variable threshold levels. By considering both the short-term and long-term dynamics of currency fluctuation, these models provide a more detailed understanding of South African exports.

Furthermore, these models produce more robust results than standard linear regression models (see, Kriskkumar et al., 2022), providing useful insights for policymakers and researchers in managing exchange rate risks and encouraging export-led growth. To the best of the author's knowledge, this is the first study that utilizes threshold regression models to investigate the impact of exchange rate volatility on South Africa's exports. This study adds to the existing literature on the subject by adding non-linear correlations and considering multiple threshold levels. It also provides a more accurate portrayal of the complicated dynamics between exchange rate volatility and export performance. The findings of this study have important implications for policymakers and suggest the need for targeted interventions and strategies to mitigate the adverse effects of exchange rate volatility on the country's exports.

The rest of the paper is structured as follows:

Section 2 reviews the theoretical foundations and empirical studies on the impact of exchange rate volatility on exports.

Section 3 then describes how to calculate exchange rate volatility. In

Section 4, the model, technique, and pertinent data utilized for quantitative analysis of South Africa are described.

Section 5 discusses the estimated results. Lastly,

Section 6 concludes with a summary of the study's findings and policy recommendations, as well as its original contribution.

2. Literature Review

2.1. Theorical Framework

In the literature, there are several theories that explain how exchange rate volatility affects exporter behaviour (see Clark, 1973). According to certain perspectives, exchange rate volatility can negatively affect exporter behaviour by increasing uncertainty and making it difficult for exporters to plan and estimate their sales and earnings. Exporters may become more cautious and conservative in their business decisions because of this uncertainty, such as by lowering their export volumes or diversifying into new markets. Other theories contend that exchange rate volatility can also be advantageous for exporters, particularly those that have effective hedging methods in place, as it enables them to profit from currency changes and possibly boost their competitiveness on global markets. Exporters can lessen the negative effects of exchange rate volatility and even take advantage of it by actively managing their hedge methods. For instance, when the exporter's home currency depreciates versus the foreign currency, their goods are more competitive because they are more accessible on overseas markets. Exchange rate changes can also open previously unprofitable markets or let exporters explore niche areas where their products might be more in demand, which might lead to new market opportunities. Exporters can therefore manage exchange rate volatility to safeguard their sales and profits as well as grow their businesses globally by implementing strong hedge techniques.

2.2. Empirical Studies

A country's economic activity is affected by exchange rate volatility, according to the literature. Previous research found contradictory evidence about the relationship between exchange rate volatility and exports.

2.2.1. International Studies

Empirical studies that support the first category by demonstrating a positive association between exchange rate volatility and global trade. Serenis and Tsounis (2014), for instance, looked at the impact of exchange rate volatility on total exports for two small nations, Croatia, and Cyprus, from the first quarter of 1990 to the first quarter of 2012. The standard deviation of the moving average of the exchange rate's logarithm is a common metric used by empirical researchers to gauge exchange rate volatility. The findings imply that volatility has a favourable impact on Croatian and Cypriot exports.

The empirical studies fit into the second group because they demonstrate a bad correlation between exchange rate volatility and global trade. Using quarterly statistics from the first quarter of 2000 to the fourth quarter of 2014, for instance, Thuy and Thuy (2019) used an autoregressive distributed lag (ARDL) bounds testing approach to examine the effect of currency rate fluctuation on exports in Vietnam. According to the findings, exchange rate volatility has a long-term detrimental impact on export volumes. Exports are impacted negatively in the short term but favourably in the long term when the domestic currency appreciates. Vietnamese export volume decreases when foreign countries' real incomes increase.

Leveraging a sample of nine emerging economies from 1995 to 2010, Khosa et al. (2015) used panel data analysis to examine the impact of exchange rate volatility on emerging market exports. Using generalized autoregressive conditional heteroscedasticity and conventional standard deviation, volatility was measured to determine if the instrument used affected the nature of the relationship between exchange rate volatility and exports. The findings established that, regardless of the volatility measure utilized, exchange rate volatility had a considerable negative impact on the performance of exports. Moreover, it was clear that there was a long-term connection.

Using monthly data on US exports and prices to fourteen nations for eight commodity clusters, Zhang and Buongiorno (2010) assessed the impact of this exchange rate volatility on export quantity and price. The variance of residuals in a GARCH (1,1) model of the exchange rate was used to gauge the volatility of exchange rates. According to the findings, a rise of 1% in exchange rate volatility caused a 0.3%–0.4% short-term decline in export quantity and a 0.1% short-term drop in export price.

Using the GMM-IV estimate, Chiah et al. (2023) looked at the effects of bilateral real exchange rate volatility on the real exports of five emerging East Asian nations, both among themselves and to 13 industrialized nations. The findings offer compelling evidence that exchange rate volatility has a detrimental effect on the exports of developing East Asian nations. Although the effect is very slight, a country's exports to a target market suffer when other emerging East Asian nations' prices become more competitive.

The effect of exchange rate volatility on exports from five Asian nations was studied by Doanlar in 2002. Pakistan, Malaysia, Indonesia, South Korea, Turkey, and South Korea are the nations in question. A cointegrating method based on Engle-Granger residuals is used to investigate the effect of a volatility term on exports. According to the findings, these countries' real exports were hampered by exchange rate volatility.

For a panel of 19 COMESA member nations, Njoroge (2020) estimated pooling, fixed, and random effects models by utilizing a panel gravity model encompassing the years 1997–2019 to assess the effects of exchange rate volatility on exports. Evidence shows that exchange rate volatility appears to impair both internal and extra-COMESA trade.

There have also been numerous empirical studies that reveal varying results on the link between exchange rate volatility and exports. For instance, from 2004 to 2018, Tarasenko (2021) examined the impact of currency rate volatility on the exports and imports of a variety of items between Russia and its 70 trading partners. Eight product categories can be used to group the products in question: (i) agricultural raw materials; (ii) substances; (iii) foodstuffs; (iv) fuels; (v) industrial goods; (vi) ores and minerals; (vii) textiles; and (viii) equipment and transport devices. The standard deviation of the initial difference in the logarithm of the daily nominal exchange rate is used to calculate. The study concludes that fluctuations in exchange rates hurt exports of industrial items, equipment, and transport machinery. However, it was discovered to have a favourable and large effect on the importation of substances, textiles, and fuels.

Jyoti and Bhatt (2020) used the ARDL bound test approach to conduct an empirical analysis of disaggregated quarterly data from the Indian manufacturing sector from 2004Q2 to 2018Q2 to examine the impact of exchange rate volatility on exports. The findings of the ARDL-bound test demonstrate that changes in real exports are co-integrated with changes in real exchange rates and global real GDP. The research also shows that the short- and long-term impacts of currency rate volatility on the exports of manufactured goods are inconsistent. Actual-world GDP (WGDP) has been proven to have a positive and large long-term impact on actual exports, except for leather and leather producers, where it has a negative and significant impact. Real WGDP has conflicting effects on exports in the short term.

In the context of West African exports, imports, and the trade balance, Fofanah (2020) examined the effects of exchange rate volatility on trade. Implementing the pooled ordinary least square, fixed effect, and random effect models. Empirical findings demonstrate how little effect exchange rate fluctuations have on exports and imports. A positive and strong correlation between exchange rate volatility and the trade balance is revealed by the trade balance model's results, nonetheless. Therefore, it implies that when currency rate volatility rises, traders tend to participate in more export-related activity. Additionally, according to research, a decline in exports will result from the actual exchange rate's decline.

A threshold regression model was used by Hsu and Chiang (2011) to investigate the effect of this on bilateral exports between the US and its top 13 trading partners. The estimated results show that threshold effects occur if the threshold variable is the real gross domestic product (GDP) per capita of partner nations relative to US GDP per capita. Exports from the US to partners with comparable high incomes are decreased by exchange rate volatility, whereas exports to partners with comparable low incomes are increased.

2.2.2. South Africa Studies

Todani and Munyama (2005) explored how exchange rate volatility affected South Africa's overall exports to the rest of the world as well as its exports of products, services, and gold. Based on quarterly data covering the years 1984 to 2004, Pesaran et al.'s (2001) ARDL bounds testing methodologies were used. The findings imply that, depending on the measure of volatility employed, either there is no statistically significant relationship between South African export flows and exchange rate volatility or, if there is a significant association, it is positive. There was no proof of a long-term link between demand for service exports and gold. These findings, however, are not reliable because of their high sensitivity to the various definitions of the variables that were utilized.

For the years 1990Q1 to 2014Q1, Ishimwe and Ngalawa (2015) studied how exchange rate volatility affected South Africa's exports of manufactured goods to the US. To assess exchange rate volatility, the study uses the EGARCH model, and Pesaran, Shin, and Smith's ARDL bounds tests are used to analyse both the long- and short-term effects of exchange rate volatility on the exports of manufactured goods from the nation. Additionally, the study tests the causal relationship between exports of manufactured goods and real exchange rates. According to the study's findings, exports of manufactured goods are significantly boosted over time by an increase in exchange rate volatility. But in the short term, the outcomes are not substantial. Additionally, Granger real exchange rates are proven to be a contributing factor to manufacturing exports. Real currency rates are not, however, caused by manufacturing exports.

For the years 2000–2009, Nyahokwe and Ncwadi (2013) looked into the effects of exchange rate volatility on total exports from South Africa to the rest of the globe. The findings point to an uncertain association between South African export flows and exchange rate volatility, or a lack of a statistically meaningful link. The study discovered a certain susceptibility of South African exports to changes in the exchange rate, even if the results were not conclusive.

To determine how real exchange rate volatility affected South Africa's exports to the United States (U.S.), which is the country's main trading partner, Bah and Amusa (2003) employed the autoregressive conditional heteroscedastic (ARCH) and general ARCH (GARCH) models. The findings show that the real exchange rate volatility of the Rand has a large, adverse impact on exports both in the short and long terms, while the real exchange rate fall has a favourable effect on export activity. To ensure that South Africa's exports are more widely accepted in global markets, stable, competitive currency rates and solid macroeconomic fundamentals are therefore essential.

Sekantsi (2011) conducted an empirical analysis of real exchange rate volatility's effects on trade in the context of South Africa's exports to the United States from January 1995 to February 2007 during the country's floating period. This study used GARCH to calculate the volatility of real exchange rates. The findings show that South Africa's exports to the US are significantly and negatively impacted by actual exchange rate volatility.

The Engle-Granger and Johansen cointegration methodologies were used by Ndou (2022) to analyse the long-term effects of exchange rate fluctuations on export volumes in South Africa during the inflation targeting period. The results of both studies support the existence of an ongoing link between export volumes, exchange rates, and foreign revenue. Greater than the short-term consequences are the long-term implications of exchange rates. More so than the currency rate, foreign income demand affects export quantities.

Using the ARDL method, Ngondo and Hlalefang (2018) examined the effects of the exchange rate on South African exports between 1994 and 2016 to determine whether there is a statistically significant association between exports and the exchange rate. The findings show that South Africa's exports and the exchange rate have a significant inverse relationship.

According to the literature, there is no clear evidence of the direction of the relationship between exchange rate volatility and export performance; nonetheless, the main findings in the literature do show a negative relationship. This lack of agreement underscores the relationship's complexities and the need for additional research to properly understand the dynamics of exchange rate volatility and export performance.

3. Exchange Rate Volatility Measurement

Exchange rate volatility denotes the amount of uncertainty or risk about the size of changes in the exchange rate. It is typically measured by GARCH (1.1), or the standard deviation or variance of the exchange rate. This study used GARCH (1.1) to measure the volatility of the exchange rate. The usage of GARCH (1.1) as the volatility measurement method in this study is consistent with previous research conducted by Zhang and Buongiorno (2010), Sekantsi (2011), and Khosa et al. (2015). By employing this widely accepted approach, the study contributes to the existing body of knowledge about exchange rate volatility and ensures comparability with previous findings. This allows for a comprehensive analysis of exchange rate dynamics and enhances the robustness of the results obtained.

4. Empirical Investigation

4.1. Econometric Model

The study analysed the impact of exchange rate volatility on South Africa's export performance using nonlinear autoregressive distributed lag (NARDL) and smooth transition regression (STR) over a period spanning from 1994 Q1 to 2023 Q2. By utilizing data sourced from the South Africa Reserve Bank (SARB), the research endeavours to provide valuable insights into the effects of exchange rate volatility on South Africa's export sector. These findings will contribute to a better understanding of the country's economic dynamics and potentially inform policymakers on strategies to mitigate the adverse effects of currency volatility on exports.

The above equation allows us to capture the effects of both positive and negative exchange rate fluctuations on exports. The positive increment, EXRVt+, represents favourable exchange rate movements that can enhance export competitiveness and boost trade. On the other hand, the negative increment, EXRVt-, captures adverse exchange rate fluctuations that may lead to reduced export competitiveness and hinder trade. t represents time . The coefficients β0, β1+, and β2- represent the impact of these variables on EXP, and the error term u captures any other factors affecting export performance not accounted for in the equation.

4.2. Unit Root Test

According to earlier research, the Augmented and Dickey Fuller (ADF) test and the Philips-Perron (P.P.) test are typically used to determine if time series data are stationary. Dickey and Fuller (1979) and Philips and Perron (1988), respectively, provide these two tests. To determine the stationarity of time series data, these tests have been widely employed in econometric studies. While the P.P. test is a non-parametric test that does not rely on any distributional assumption, the ADF test is predicated on the idea that the time series has a unit root. The two tests offer valuable insight into the behaviour of time series data and aid this study in selecting the best modelling approaches. Researchers can assess if a time series is stationary or not by running these tests. Stationary time series have a constant mean and variance over time, while non-stationary time series exhibit trends or changes in their statistical properties. ADF and P.P. tests can be used to determine whether there are unit roots or structural breaks in the data, which are crucial factors to consider when choosing the best modelling strategies. Overall, by offering a strong framework for the analysis of time-series data, these tests play a critical role in assuring the robustness and reliability of econometric investigations.

4.3. Non-linear Autoregressive Distributed Lag (NARDL) Model

NARDL is used to investigate the impact of exchange rate volatility on South Africa's exports. Shin et al. (2014) developed NARDL based on ARDL specifications. As a result, NARDL is an asymmetric version of the linear autoregressive distributed lag cointegration model (ARDL) proposed by Pesaran et al. (2001). NARDL enables the analysis to consider both short-term and long-term processes. This method is especially effective for investigating the relationship between exchange rate volatility and exports since it captures any non-linearities or asymmetry in the data. Using NARDL, this study developed a more thorough understanding of how exchange rate fluctuation affects South Africa's exports, considering both immediate and long-term implications. Shin et al. (2014) claim that the NARDL model is based on the following asymmetric long-run equilibrium correlation.

where we can see that the equilibrium link between y and x is split into positive (β+xt +) and negative (β−xt−) effects, as well as the error term (ut), which represents potential departures from the long equilibrium. These split effects indicate that an increase in x (represented by xt+) will have a positive impact on y, as captured by the positive coefficient β+. On the other hand, a decrease in x (represented by xt-) will have a negative impact on y, as captured by the negative coefficient β-. The error term ut captures any random or unexplained factors that may affect the relationship between y and x, causing deviations from the long-term equilibrium.

We decompose our independent variable of interest. EXRV, into two sets of negative and positive signals denoted by EXRV- and EXRV+ respectively. Thus, the decomposition series can be expressed as follows:

Where EXRV

- represents the negative signals of the independent variable, indicating a decrease or lower value, and EXRV

+ represents the positive signals, indicating an increase or higher value. By decomposing EXRV into these two sets, we can analyse the impact of each signal separately and better understand the factors influencing EXP. This decomposition allows for a more comprehensive examination of the relationship between EXRV and EXP. By isolating the negative and positive signals of the independent variable, the decomposition of EXRV allows researchers to discern the specific effects of increases and decreases on EXP. This analysis enables a deeper understanding of the underlying factors that drive EXP, shedding light on which variables have the greatest impact. By considering both the positive and negative signals, the study gains a more holistic view of the relationship between EXRV and EXP, allowing for more accurate predictions and informed decision-making. EXRV

+ + EXRV

- denote partial sum processes which accumulate positive and negative changes, respectively, and are defined as

Where ΔEXRV

i = EXRV

i - EXRV

i-1, we reconstruct a NARDL model based on equation (5):

The NARDL model has several benefits, but the standard Wald test can also be used to determine whether long- and short-run asymmetry exists. The long-term null hypothesis is θ2 = θ3. In the long run, an asymmetric relationship would be confirmed by a large difference between these two values. Similarly, the equation φ2i = φ3i shows that there is no asymmetry in the short run. Additionally, the bounds test, in which the null hypothesis is true if (θ1 = θ2 = θ3 = 0), can be used to determine whether cointegration exists.

4.4. Smooth Threshold Regression (STR) Model

To explain the nonlinear interaction between time series data, the STR model is frequently utilized. To discover the probable non-linear influence of exchange rate volatility on South African exports, we employ Terasvirta's (1994) smooth transition regression (STR) model. This model allows us to capture the non-linear relationship between exchange rate volatility and export performance. By incorporating a threshold variable, we can identify the level of exchange rate volatility at which the impact on South Africa's exports becomes significant. This method provides a more in-depth understanding of exchange rate shifts and their impact on the country's export sector. Teräsvirta (1994) specifies the STR model as Equation (6).

In equation (6), Xt is a vector of independent variable (exchange rate volatility), σ'=(σ0,σ1,…,σz)' is the vector of the linear part's coefficients and Ω'=(Ω0,Ω1,…,Ωz)' is a vector representing the coefficients of the nonlinear part. c is the threshold level, γ is the rate of transition between regimes, st is the transition variable, T is the transition function.

5. Empirical Results and Discussion

5.1. Descriptive Statistics Results

Table 1: Descriptive statistics shows that the mean value of exports is 85.40 and the mean value of exchange rate volatility is 33.55. These figures indicate that the average exports from the specified dataset amount to

$85.40 million. Furthermore, it indicates that the exchange rate for the observed period has experienced volatility, with an average of 33.55%. The descriptive statistics shed light on the overall pattern and dispersion of the data for both exports and exchange rate volatility. We can learn about the typical level of economic activity in terms of global trade by observing the average value of exports. Similarly, the mean value of exchange rate volatility reflects the average amount of volatility in the currency market for the observed period.

The standard deviation of exports is 13.65, and the exchange rate volatility is 27.45. These figures reflect a relatively high level of variability in both exports and exchange rate volatility. The export standard deviation indicates a broad range of values around the mean, reflecting changes in the level of economic activity in international trade. Similarly, the standard deviation of exchange rate volatility indicates that there is substantial volatility in the currency market, with frequent variations in exchange rates throughout the observed period.

The skewness of exports is -0.393826 and the exchange rate volatility is 3.272483, as shown in

Table 1. The negative skewness of exports indicates that the distribution is slightly asymmetric, with a longer left tail suggesting occasional severe negative values. The positive value of exchange rate volatility skewness, on the other hand, suggests that there is a proclivity for more frequent, smaller positive changes in exchange rates as opposed to bigger negative variations. Overall, these statistics show that both exports and exchange rates have large volatility with occasionally extreme values, emphasizing the importance of firms properly managing their exposure to global markets.

The kurtosis of exports is 2.100316, and the exchange rate volatility is 16.43781, as shown in

Table 1. These statistics imply that the distribution of export values is somewhat peaked relative to a normal distribution, indicating a higher possibility of extreme values. However, the kurtosis of exchange rate volatility suggests a marginally more leptokurtic distribution, implying a larger risk of extreme swings in exchange rates. As a result, enterprises should implement risk management methods to limit potential losses caused by these rare extremes in exports and exchange rates.

5.2. Regression Results

The study conducted on the impact of exchange rate volatility on South Africa's exports using NARDL and STR models revealed interesting findings. These findings highlight the importance of South African authorities maintaining competitive exports by efficiently managing exchange rate volatility. NARDL results are presented in

Section 5.2.1, and STR results are presented in

Section 5.2.2.

5.2.1. NARDL Results

We used Zaghdoudi's (2021) R package 'nardl' to implement the estimation processes for the impact of exchange rate volatility on South African exports. The 'nardl’ package allowed us to analyse the relationship between exchange rate volatility and South Africa's exports with its non-linear autoregressive distributed lag model. . By utilizing this package, we were able to identify the extent to which exchange rate volatility affects the country's export levels. The results from the estimation process provided valuable insights into the dynamics between exchange rate volatility and South Africa's export performance.

According to

Table 2's estimation results, the NARDL model shows that

lnEXRV_p is 0.0092184 and

lnEXRV_n is -0.0197431. These results indicate that positive shocks in the exchange rate volatility have a positive long-term effect on the level of exports, as

lnEXRV_p is positive. On the other hand, negative shocks in exchange rate volatility have a positive long-term effect on exports. This suggests that higher exchange rate volatility can potentially boost exports in both cases. However, the scale of the effect differs depending on whether it is a positive or negative shock. Furthermore, the magnitudes of

lnEXRV_p and

lnEXRV_n indicate that the insignificant effect of positive shocks on exports is larger than the insignificant effect of negative shocks, which further emphasizes the role of positive exchange rate volatility in boosting export performance. These findings imply that exchange rate volatility does not have a significant impact on the level of exports in the long run. While positive shocks in exchange rate volatility may slightly increase exports, the effect is not statistically significant. Similarly, negative shocks in exchange rate volatility also do not have a significant long-term effect on exports. Thus, it can be concluded that exchange rate volatility alone does not play a crucial role in determining export levels.

The adjusted R-squared is 0.5051. This means that approximately 50.51% of the variation in the dependent variable can be explained by the independent variables included in the model. A higher adjusted R-squared value implies a better fit of the model to the data, implying that the factors included have a stronger association with the dependent variable.

F-statistic is 8.355 with a p-value of 6.363e-06. These results indicate that there is a statistically significant relationship between the variables being studied. The F-statistic of 8.355 suggests that there is a significant overall effect of the independent variable on the dependent variable. This suggests that the model can explain a significant amount of the variation in the dependent variable.

The LM test (2 lag) is 0.7703597 with a p value of 0.6273670. Therefore, we do not reject the null hypothesis, indicating that there is no autocorrelation present in the residuals. This suggests that the current model adequately captures the dependencies in the data, and the estimated coefficients are not biased due to autocorrelation.

ARCH test (2 lag) is 0.009688228 with a p value of 0.995167600. This indicates that there is no significant autocorrelation present in the residuals of the model. Therefore, we can conclude that the model adequately captures the temporal dependency in the data and that the residuals are not affected by any form of serial correlation.

Long-Run Asymmetry Test W. Statistic is 47.51067 with a p value of 4.821569e-11. This indicates strong evidence against the null hypothesis of no long-run asymmetry. The W. statistic value of 47.51067 suggests a significant departure from symmetry in the long run. Additionally, the extremely low p value of 4.821569e-11 further strengthens the conclusion that there is a significant long-run asymmetry present in the data.

Short-run asymmetry test W-stat is 11.83391 with a p-value of 0.002693386. The short-run asymmetry test results indicate a statistically significant W-stat value of 11.83391, implying the presence of asymmetry in the short-run dynamic relationships. Furthermore, the associated p-value of 0.002693386 indicates that there is significant evidence to reject the null hypothesis of no asymmetry. These findings shed light on the non-linear behaviour of the variables under consideration, indicating potential asymmetrical effects in the short run.

The bounds F test is used to determine if the variances of two groups are significantly different. In this case, with a test statistic of 8.35, we reject the null hypothesis and conclude that there is a significant difference between the variances. The critical values, 3.79 and 4.85, represent the bounds within which we would fail to reject the null hypothesis. The critical value of 3.79 represents the lower bound, meaning that if the test statistic falls below this value, we would fail to reject the null hypothesis. On the other hand, the critical value of 4.85 represents the upper bound, indicating that if the test statistic exceeds this value, we would also fail to reject the null hypothesis. However, since our test statistic of 8.35 is beyond both critical values, we reject the null hypothesis and conclude that there is indeed a significant difference between the variances of the two groups.

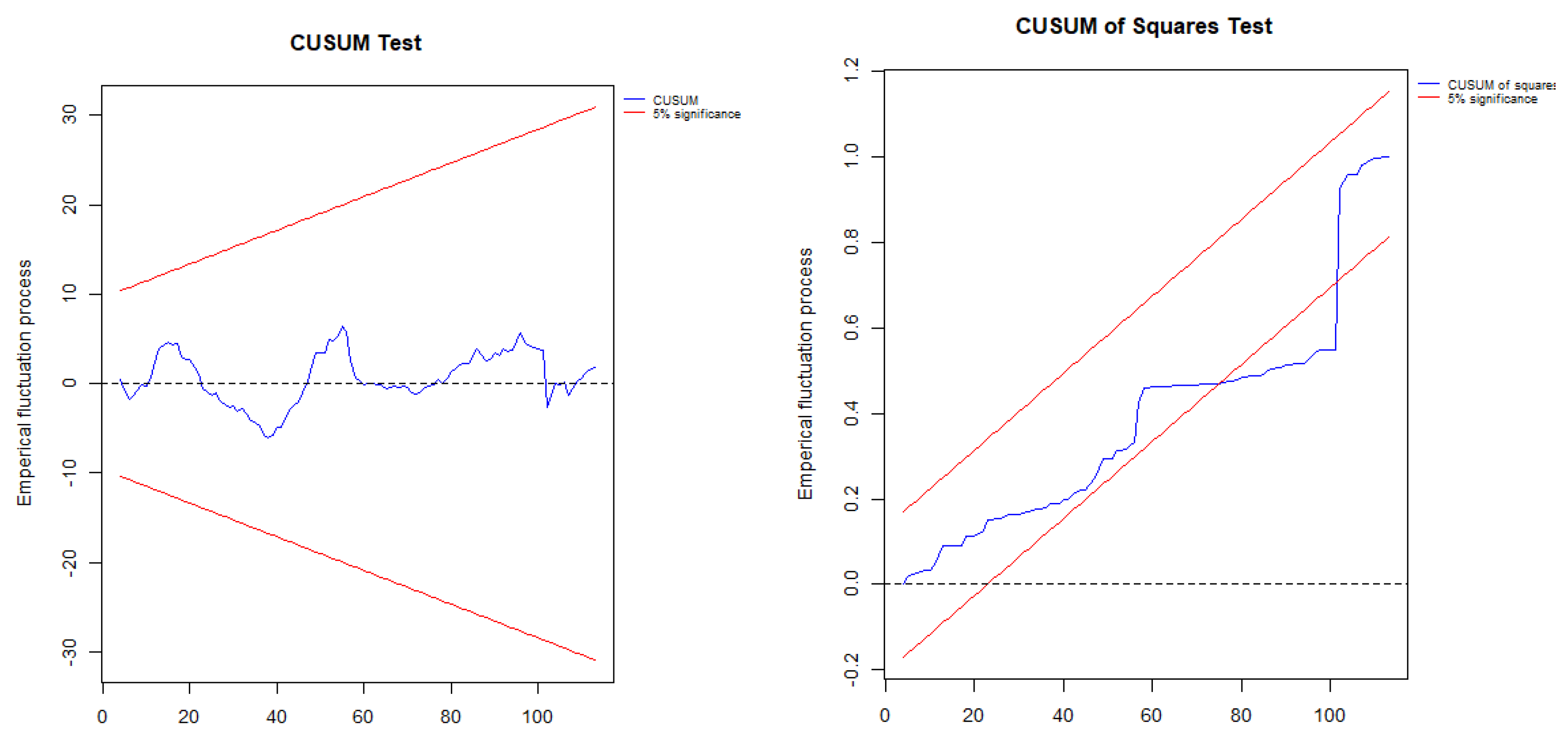

Figure 1 plots the CUSUM test and the CUSUM of squares test of the residuals. In time series analysis and statistical process control, the CUSUM test and the CUSUM of squares test of residuals are both extensively used approaches. These tests help in the detection of shifts or changes in the mean or variance of the data.

Figure 1 shows the behaviour of these tests over time, allowing us to see if there are any noteworthy changes or trends in the residuals. Both tests imply that there is no significant autocorrelation in the residuals. The CUSUM test computes the cumulative sum of the residuals' deviations from their mean, whereas the CUSUM of squares test computes the cumulative sum of squared deviations. The plots show that the residuals are randomly distributed about zero, indicating that there is no regular pattern or trend. As a result, we can conclude that the model captures the underlying data patterns adequately.

5.2.2. Smooth Threshold Regression (STR) Results

The study investigated the impact of exchange rate volatility on South Africa's exports using smooth transition regression (STR). This model has the advantage of allowing for non-linear connections between variables, which is significant in reflecting the complex dynamics of exchange rate volatility and its impact on exports. Furthermore, the STR model considers the possibility of regime shifts, where the link between exchange rate volatility and exports may differ depending on the amount of volatility. This makes the model useful in understanding how South African exports respond to varying levels of exchange rate volatility and can provide insights for policymakers in managing and encouraging exports.

Table 3 shows the threshold variable (linear part) of the model exchange rate volatility is -0.006706 with a p value of 0.8607. This suggests that there is no statistically significant linear relationship between exchange rate volatility and South Africa's exports. Therefore, changes in exchange rate volatility do not have a significant impact on the level of South Africa's exports.

The threshold variable (non-linear part) of the model exchange rate volatility is 0.023124 with a p value of 0.6782. This indicates that there is also no statistically significant non-linear relationship between exchange rate volatility and South Africa's exports. Therefore, based on these findings, it can be concluded that exchange rate volatility does not have a significant impact on the country's exports, regardless of whether the relationship is linear or non-linear. These results suggest that other factors may have a stronger influence on South Africa's exports. It is important for policymakers to consider these factors to promote and support export growth in the country. Moreover, further research could be conducted to explore the potential impact of other variables on South Africa's exports, such as global demand and domestic economic conditions.

The smooth threshold regression slope is 0.082245 with a p-value of 0.0016. This means that for every unit increase in the predictor variable, a 0.082245 unit increase in the responder variable is expected. The low p-value indicates that this slope is statistically significant, implying that the relationship between the predictor and response variables is supported. Furthermore, the low p value of 0.0016 suggests that there is strong evidence against the null hypothesis, implying that the observed link between the predictor and response variable is unlikely to have occurred by coincidence. As a result, we can conclude that the link is not due to random variation and that there is a genuine relationship between the two variables. This observation contributes to the validity and dependability of the smooth threshold regression model.

The threshold is 81.35945 with a p-value of 0.0000. This indicates that when the predictor variable exceeds the threshold of 81.35945, it significantly influences the response variable. The p value of 0.0000 suggests that the probability of obtaining such a strong relationship by chance alone is extremely low. These results reinforce the robustness of the smooth threshold regression model and provide substantial evidence for the existence of a meaningful association between the two variables. Furthermore, the significant p-value indicates that the predictor variable has a substantial impact on the response variable beyond what can be explained by random chance. This strengthens the validity of using the threshold value of 81.35945 as a cutoff point for determining the influential effect. These findings support the idea that there is a distinct relationship between the predictor and response variable when the threshold is surpassed, making the smooth threshold regression model a reliable tool for studying their association.

Based on the result of the LM test (3 lags), which yielded a test statistic of 0.866703 and a p-value of 0.6625, there is insufficient evidence to reject the null hypothesis of no autocorrelation. This suggests that there is no significant serial correlation present in the data. Therefore, we can assume that the observations are independent, and the model's assumptions are met.

ARCH test (3 lag) is 0.362606 with a p value of 0.9982. Based on the ARCH test results, there is no evidence of conditional heteroscedasticity in the data. The test statistic of 0.362606 is far below the critical value, indicating that the null hypothesis of no ARCH effects cannot be rejected. Additionally, the high p-value of 0.9982 further supports the conclusion that there is no significant ARCH effect present in the model.

The heteroskedasticity test using Breusch-Pagan-Godfrey F-stats is 0.036201 with a p value of 0.8494. Therefore, we fail to reject the null hypothesis, indicating that there is no significant evidence of heteroskedasticity in the model. This suggests that the assumption of constant variance is upheld and that the model's standard errors are reliable for making accurate inferences. Consequently, our regression results can be considered robust and trustworthy.

6. Summary and Conclusion

The purpose of this study is to examine the impact of exchange rate volatility on South Africa’s exports using a timeseries data from 1994Q1 to 2023Q2. This study applied NARDL and STR models to analyse the relationship between exchange rate volatility and exports. The NARDL model allows for asymmetrical effects of exchange rate volatility on exports, considering both positive and negative shocks. By integrating both positive and negative shocks, the NARDL model provided a broad framework for understanding the impact of exchange rate volatility on South Africa's exports. The STR model allows for a non-linear relationship between the two variables by identifying different thresholds at which the impact of exchange rate volatility on exports may change. By utilizing this approach, it is possible to gain a deeper understanding of how fluctuations in the exchange rate impact South Africa's export levels over the long term. The findings of this study will provide valuable insights for policymakers and businesses in mitigating the potential risks associated with exchange rate volatility and enhancing export competitiveness.

The NARDL model results show that lnEXRV_p is 0.0092184 and lnEXRV_n is -0.0197431. These values indicate a positive long-run relationship between the explanatory variable and the dependent variable. For every unit increase in lnEXRV_p, there is an expected increase of 0.0092184 in the dependent variable. Conversely, for every unit decrease in lnEXRV_n, there is an expected increase of 0.0197431 in the dependent variable. These results suggest that positive changes in the explanatory variable (lnEXRV_p) have a positive impact on the dependent variable, while negative changes in the explanatory variable (lnEXRV_n) also have a positive impact on the dependent variable. However, it is important to note that these effects are statistically insignificant. These results indicate that both positive and negative changes in the explanatory variable can potentially influence the dependent variable positively, although not significantly. To make informed decisions, it is crucial to understand and consider the effects of both lnEXRV_p and lnEXRV_n on the dependent variable. Overall, the NARDL model results highlight the importance of considering the impact of both lnEXRV_p and lnEXRV_n on the dependent variable for effective decision-making.

The threshold variable (linear part) of the model exchange rate volatility is -0.006706, with a p value of 0.8607. This implies that there is no statistically significant linear link between exchange rate volatility and South African exports. As a result, fluctuations in exchange rate volatility have no substantial impact on the volume of South Africa's exports. The threshold variable (non-linear part) of the model exchange rate volatility is 0.023124, with a p value of 0.6782. This suggests that there is no statistically significant non-linear link between exchange rate volatility and South African exports. Based on these findings, it is possible to conclude that exchange rate volatility has no major impact on the country's exports, regardless of whether the impact is linear or non-linear.

Policy Recommendation

Research results suggest that policymakers may need to focus on other factors, such as improving competitiveness and domestic production, rather than solely relying on exchange rate volatility to boost exports. Additionally, implementing measures to stabilize the exchange rate can help mitigate any negative effects on the economy, such as inflation or uncertainty in the international market. Overall, policymakers should adopt a balanced and cautious approach when addressing exchange rate volatility to maximize its positive effects while minimizing its potential drawbacks.

Originality/value

A new feature of this paper is that it utilizes both the NARDL and STR models to examine the impact of exchange rate volatility on exports. To the best of the authors’ knowledge, such a methodology has not been adopted before in such a relationship. This unique approach allowed the study to capture the asymmetric effects of exchange rate volatility on exports, providing a more comprehensive understanding of this relationship. Consequently, this paper contributes to the existing literature by offering a novel methodology to assess the influence of exchange rate volatility on export performance.

References

- Bah, I and Amusa, H.A. Real exchange rate volatility and foreign trade : evidence from South Africa's exports to the United States. African Finance Journal 2003, 5(2). [Google Scholar]

- Chiah, M, Long, H, Zaremba, A and Umar, Z. 2023. Trade competitiveness and the aggregate returns in global stock markets. Journal of Economic Dynamics, and Control 4618, 148, (104618), (2023). [Google Scholar] [CrossRef]

- Clark, Peter B. Uncertainty, exchange risk, and the level of international trade. Economic Inquiry 1973, 11, 302–13. [Google Scholar] [CrossRef]

- Dickey, D.A. and Fuller, W.A. Estimators for Autoregressive Time Series with a Unit Root. Journal of the American Statistical Association 1979, 74, 427–431. [Google Scholar]

- Doğanlar, M. Estimating the impact of exchange rate volatility on exports: evidence from Asian countries. Applied Economics Letters 2002, 9(13), 859–863. [Google Scholar] [CrossRef]

- Fofanah, P. Effects of Exchange Rate Volatility on Trade: Evidence from West Africa. Journal of Economics and Behavioral Studies 2020, 12(3(J)), 32–52. [Google Scholar] [CrossRef] [PubMed]

- Hooper P, Kohlhagen S. The Effect of Exchange Rate Uncertainty on the Prices and Volume of International Trade. Journal of International Economics 1978, 8, 483–511. [Google Scholar] [CrossRef]

- Ishimwe, A., and Ngalawa, H. Exchange rate volatility and manufacturing exports in South Africa. Banks and Bank Systems 2015, 10(3), 29–38. [Google Scholar]

- Jyoti and Bhatt, K. N. Effect of Exchange Rate Volatility on Exports: An Empirical Analysis of Disaggregated Data of the Indian Manufacturing Sector. Arthaniti: Journal of Economic Theory and Practice 2022, 0(0). [Google Scholar] [CrossRef]

- Khosa, J.K., Botha, I and Pretorius, M. The impact of exchange rate volatility on emerging market exports. Acta Commercii 2015, 15(1), 257. [CrossRef]

- Kriskkumar, K., Naseem, N.AM., and Azman-Saini, W.N. Investigating the Asymmetric Effect of Oil Price on the Economic Growth in Malaysia: Applying Augmented ARDL and Nonlinear ARDL Techniques. SAGE Open 2022, 1–17. [CrossRef]

- Kuang-Chung Hsu & Hui-Chu, Chiang. The threshold effects of exchange rate volatility on exports: Evidence from US bilateral exports. The Journal of International Trade & Economic Development 2011, 20:1, 113–128. [Google Scholar] [CrossRef]

- Lucas, Njoroge. The Effects of Exchange Rate Volatility on Exports in COMESA: A Panel Gravity Model Approach. Journal of Applied Finance & Banking 2020, SCIENPRESS Ltd. 10(6), 1–10. [Google Scholar]

- Ndou, E. Exchange rate changes on export volumes in South Africa under the inflation targeting period. SN Bus Econ 2, 59 (2022). [CrossRef]

- Ngondo, M and Hlalefang, K. 2018. The impact of exchange rate on exports in South Africa. Online at https://mpra.ub.uni-muenchen.de/85079/MPRA Paper No. 85079, posted 22 Mar 2018 17:02 UTC.

- Nyahokwe, O and Ncwadi, R. The Impact of Exchange Rate Volatility on South African Exports. Mediterranean Journal of Social Sciences 2013, 4(3), 507–513. [Google Scholar] [CrossRef]

- Oseni, I.O. Exchange Rate Volatility and Private Consumption in Sub-Saharan African Countries: A System-GMM Dynamic Panel Analysis. Future Business Journal 2016, 2(2), 103–15. [Google Scholar] [CrossRef]

- Pesaran, M. H., Shin, Y., Smith, R. J. Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics 2001, 16(3), 289–326. [CrossRef]

- Phillips, P.C.B. and Perron, P. Testing for a Unit Root in Time Series Regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Phiri, A., J. Fourie, P. Theuns, H. Rhett, and H. Van Niekerk (2016). ‘Nonlinear Relationship between Exchange Rate Volatility and Economic Growth: A South African Perspective’. MPRA Paper 75671. Munich: University Library of Munich.

- Sekantsi, L. 2011. The Impact of Real Exchange Rate Volatility on South African Exports to the United States (U.S.): A Bounds Test Approach, Review of Economic and Business Studies, Alexandru Ioan Cuza University, Faculty of Economics and Business Administration, 8, 119-139.

- Serenis, D and Tsounis, N. 2014. Exchange Rate Volatility and Aggregate Exports: Evidence from Two Small Countries, International Scholarly Research Notices, vol. 2014, Article ID 839380, 1-10, 2014. [CrossRef]

- Shin, Y., Yu, B., Greenwood-Nimmo, M. (2014). Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In Festschrift in Honor of Peter Schmidt, Springer, New York, 281–314.

- Tarasenko, I. The impact of exchange rate volatility on trade: The evidence from Russia. Russian Journal of Economics 2021, 7(3), 213–232. [Google Scholar] [CrossRef]

- Terasvirta, T. Specification Estimation and Evaluation of Smooth Transition Autoregressive Models. Journal of the American Statistical Association 1994, 89, 208–218. [Google Scholar]

- Thuy, Vinh Nguyen Thi, and Duong Trinh Thi Thuy. The Impact of Exchange Rate Volatility on Exports in Vietnam: A Bounds Testing Approach. Journal of Risk and Financial Management 2019, 12(no. 1), 6. [Google Scholar] [CrossRef]

- Todani, K.R. and Munyama, T.V. (2005). Exchange Rate Volatility and Exports in South Africa. Retrieved from: http://www.tips.org.za/files/773.pdf.

- Zaghdoudi, Taha. nardl: Nonlinear Cointegrating Autoregressive Distributed Lag Model. R Package Version 0.1.6. 2021. Available online: https://CRAN.R-project.org/package=nardl (accessed on 03 October 2023).

- Zhang, S and Buongiorno, J. Effects of exchange rate volatility on export volume and prices of forest products. Canadian Journal of Forest Research 2010, 40(11). [Google Scholar] [CrossRef]

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).