Submitted:

21 October 2023

Posted:

23 October 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Literature Review

2.1. Related Studies

3. Methods and Data

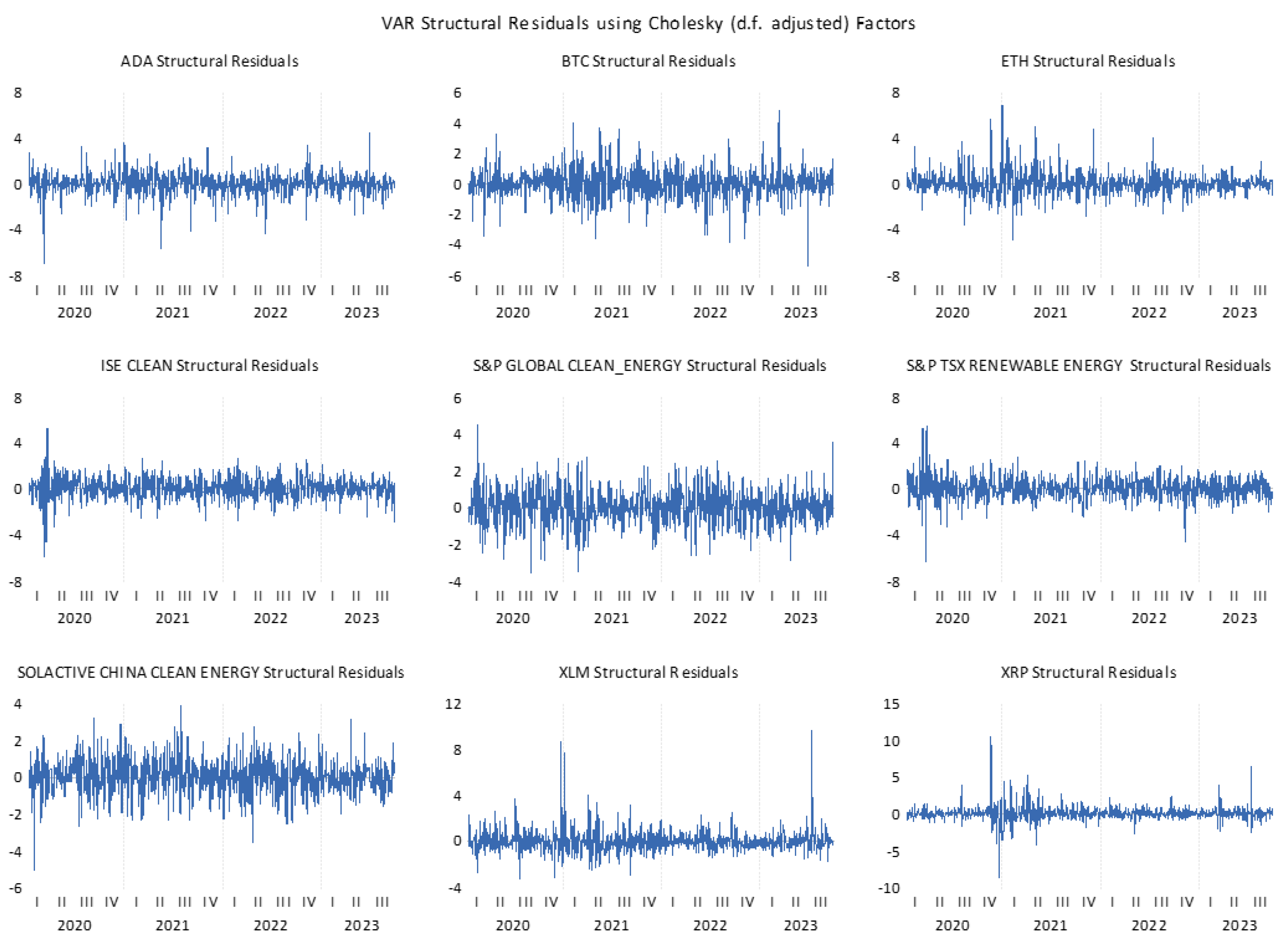

4. Results

4.1. Descriptive Statistics

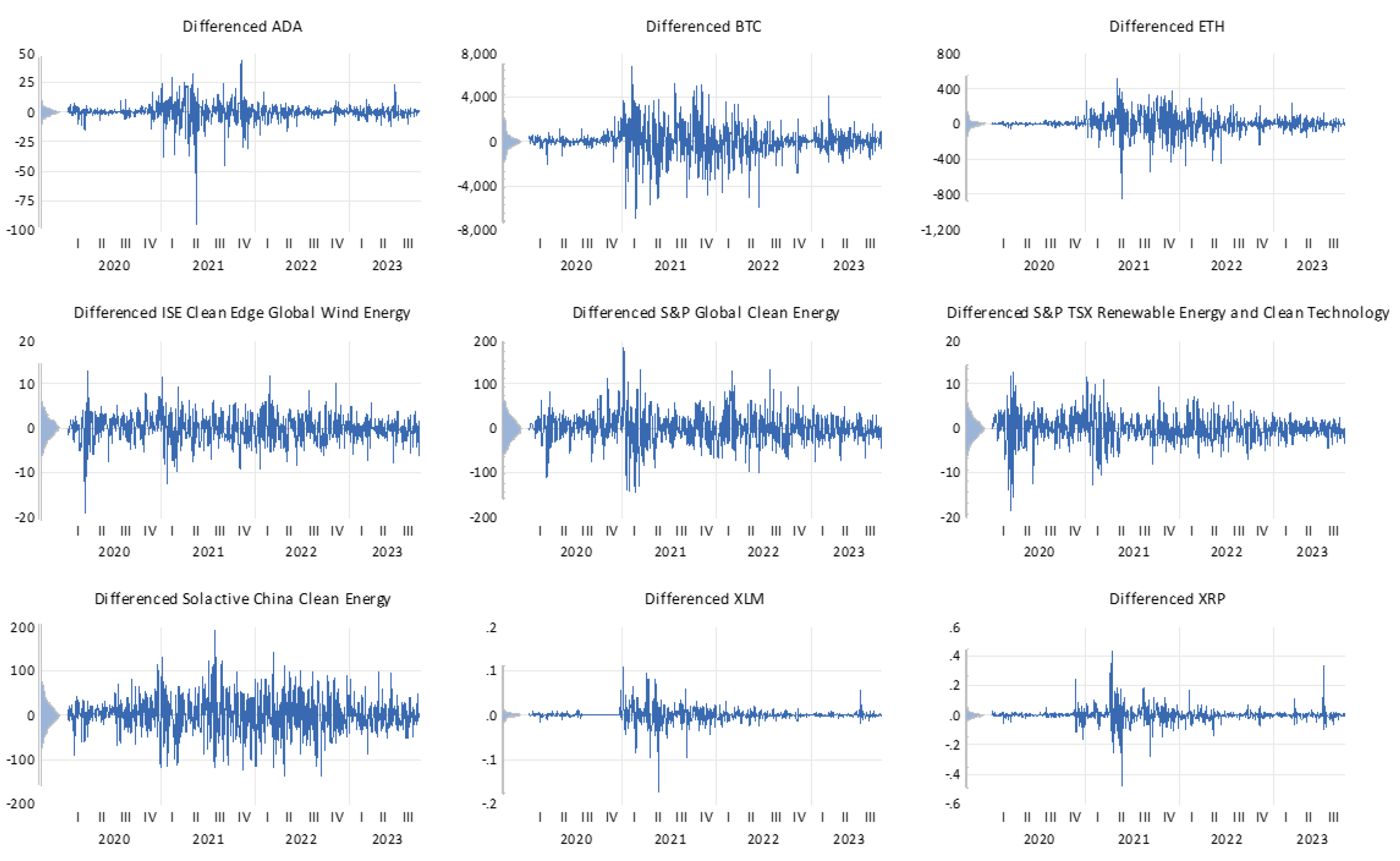

4.2. Time Series Stationarity

Unit Root Test with Structure Break

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Imbulana Arachchi, J.; Managi, S. Preferences for energy sustainability: Different effects of gender on knowledge and importance. Renewable and Sustainable Energy Reviews 2021, 141. [CrossRef]

- Xu, M.; David, J.M.; Kim, S.H. The fourth industrial revolution: Opportunities and challenges. International Journal of Financial Research 2018, 9, 90–95. [CrossRef]

- Bañales, S. The enabling impact of digital technologies on distributed energy resources integration. Journal of Renewable and Sustainable Energy 2020, 12. [CrossRef]

- Rotatori, D.; Lee, E.J.; Sleeva, S. The evolution of the workforce during the fourth industrial revolution. Human Resource Development International 2021, 24, 92–103. [CrossRef]

- Zhang, Y.J.; Da, Y.B. The decomposition of energy-related carbon emission and its decoupling with economic growth in China, 2015. [CrossRef]

- Wang, J.; Yang, Y. A regional-scale decomposition of energy-related carbon emission and its decoupling from economic growth in China. Environmental Science and Pollution Research 2020, 27, 20889–20903. [CrossRef]

- Jardón, A.; Kuik, O.; Tol, R.S. Economic growth and carbon dioxide emissions: An analysis of Latin America and the Caribbean. Atmosfera 2017, 30, 87–100. [CrossRef]

- Dong, K.; Hochman, G.; Zhang, Y.; Sun, R.; Li, H.; Liao, H. CO2 emissions, economic and population growth, and renewable energy: Empirical evidence across regions. Energy Economics 2018, 75, 180–192. [CrossRef]

- Olivera, M.; Segarra, V. Environmental quality and economic growth: Dynamic analysis for Latin America and the Caribbean. Revista de Economia del Rosario 2021, 24, 1–40. [CrossRef]

- Wang, P.; Zhang, H.; Yang, C.; Guo, Y. Time and frequency dynamics of connectedness and hedging performance in global stock markets: Bitcoin versus conventional hedges. Research in International Business and Finance 2021, 58. [CrossRef]

- Danino-Perraud, R. The Recycling of liThium-ion BaTTeRies A Strategic Pillar for the European Battery Alliance études de l’Ifri Raphaël Danino-PeRRauD Center for Energy; Number March, 2020.

- Xiong, G.; Deng, J.; Ding, B. Characteristics, decoupling effect, and driving factors of regional tourism’s carbon emissions in China. Environmental Science and Pollution Research 2022, 29, 47082–47093. [CrossRef]

- Santos, M.R.; Rolo, A.; Matos, D.; Carvalho, L. The Circular Economy in Corporate Reporting: Text Mining of Energy Companies’ Management Reports. Energies 2023, 16, 1–16. [CrossRef]

- Georgeson, L.; Maslin, M. Estimating the scale of the US green economy within the global context. Palgrave Communications 2019, 5. [CrossRef]

- Fekete, H.; Kuramochi, T.; Roelfsema, M.; den Elzen, M.; Forsell, N.; Höhne, N.; Luna, L.; Hans, F.; Sterl, S.; Olivier, J.; van Soest, H.; Frank, S.; Gusti, M. A review of successful climate change mitigation policies in major emitting economies and the potential of global replication. Renewable and Sustainable Energy Reviews 2021, 137. [CrossRef]

- Giglio, E.; Pedro, F.; Cagica, L.; Xara, D. The governance of E-waste recycling networks: Insights from São Paulo City. Waste Management 2023, 161, 10–16. [CrossRef]

- Baruník, J.; Křehlík, T. Measuring the frequency dynamics of financial connectedness and systemic risk. Journal of Financial Econometrics 2018, 16, 271–296, [1507.01729]. [CrossRef]

- Arif, M.; Hasan, M.; Alawi, S.M.; Naeem, M.A. COVID-19 and time-frequency connectedness between green and conventional financial markets. Global Finance Journal 2021, 49. [CrossRef]

- Sharma, G.D.; Sarker, T.; Rao, A.; Talan, G.; Jain, M. Revisting conventional and green finance spillover in post-COVID world: Evidence from robust econometric models. Global Finance Journal 2022, 51. [CrossRef]

- Silva, A.F.; Carvalho, L.; Sánchez-Hernández, M.I., Social Innovation: Insights in the Fourth Sector in Portugal. In Studies on Entrepreneurship, Structural Change and Industrial Dynamics; Sánchez-Hernández, M.I.; Carvalho, L.; Rego, C.; Lucas, M.R.; Noronha, A., Eds.; Springer International Publishing: Cham, 2021; pp. 255–281. [CrossRef]

- Silva, A.F.; Carvalho, L.; Sánchez-Hernández, M.I., Social Innovation: Insights in the Fourth Sector in Portugal. In Studies on Entrepreneurship, Structural Change and Industrial Dynamics; Sánchez-Hernández, M.I.; Carvalho, L.; Rego, C.; Lucas, M.R.; Noronha, A., Eds.; Springer International Publishing: Cham, 2021; pp. 255–281. [CrossRef]

- Haq, I.U. Cryptocurrency Environmental Attention, Green Financial Assets, and Information Transmission: Evidence From the COVID-19 Pandemic. Energy Research Letters 2022, 4, 1–6.

- Bejan, C.A.; Bucerzan, D.; Crăciun, M.D. Bitcoin price evolution versus energy consumption; trend analysis. Applied Economics 2023, 55, 1497–1511. [CrossRef]

- Putri, D.E.; Ilham, R.N.; Sinurat, M.; Lilinesia, L.; Saragih, M.M.S. Analysis of Potential and Risks Investing in Financial Instruments and Digital Cryptocurrency Assets during the Covid-19 Pandemic. Jurnal SEKURITAS (Saham, Ekonomi, Keuangan dan Investasi) 2021, 5, 1. [CrossRef]

- O’Dwyert, K.J.; Malone, D. Bitcoin mining and its energy footprint. IET Conference Publications, 2014, Vol. 2014, pp. 280–285. [CrossRef]

- Ghosh, B.; Bouri, E. Is Bitcoin’s Carbon Footprint Persistent? Multifractal Evidence and Policy Implications. Entropy 2022, 24, 5. [CrossRef]

- Merza, S.A. Economic Risks Associated with Bit Coin: A Comprehensive Analysis. Journal of Corporate Finance Management and Banking System 2023, pp. 1–12. [CrossRef]

- Polemis, M.L.; Tsionas, M.G. The environmental consequences of blockchain technology: A Bayesian quantile cointegration analysis for Bitcoin. International Journal of Finance and Economics 2023, 28, 1602–1621. [CrossRef]

- Sarkodie, S.A.; Amani, M.A.; Ahmed, M.Y.; Owusu, P.A. Assessment of Bitcoin carbon footprint. Sustainable Horizons 2023, 7. [CrossRef]

- Ren, B.; Lucey, B. A clean, green haven?—Examining the relationship between clean energy, clean and dirty cryptocurrencies. Energy Economics 2022, 109. [CrossRef]

- Ren, B.; Lucey, B. Do clean and dirty cryptocurrency markets herd differently? Finance Research Letters 2022, 47. [CrossRef]

- Bouri, E.; Das, M.; Gupta, R.; Roubaud, D. Spillovers between Bitcoin and other assets during bear and bull markets. Applied Economics 2018, 50, 5935–5949. [CrossRef]

- Kakinuma, Y. Nexus between Southeast Asian stock markets, bitcoin and gold: spillover effect before and during the COVID-19 pandemic. Journal of Asia Business Studies 2022, 16, 693–711. [CrossRef]

- Klein, T.; Pham Thu, H.; Walther, T. Bitcoin is not the New Gold – A comparison of volatility, correlation, and portfolio performance. International Review of Financial Analysis 2018, 59, 105–116. [CrossRef]

- Shahzad, S.J.H.; Bouri, E.; Roubaud, D.; Kristoufek, L.; Lucey, B. Is Bitcoin a better safe-haven investment than gold and commodities? International Review of Financial Analysis 2019, 63, 322–330. [CrossRef]

- Dias, R.; Alexandre, P.; Teixeira, N.; Chambino, M. Clean Energy Stocks: Resilient Safe Havens in the Volatility of Dirty Cryptocurrencies. Energies 2023, 16. [CrossRef]

- Dias, R.; Horta, N.; Revez, C.; Heliodoro, P.; Alexandre, P. The Evolution of the Cryptocurrency Market Is Trending toward Efficiency? 8th International Scientific ERAZ Conference – ERAZ 2022 – Conference Proceedings 2022, pp. 87–94. [CrossRef]

- Gao, L.; Guo, K.; Wei, X. Dynamic relationship between green bonds and major financial asset markets from the perspective of climate change. Frontiers in Environmental Science 2023, 10. [CrossRef]

- Lorente, D.B.; Mohammed, K.S.; Cifuentes-Faura, J.; Shahzad, U. Dynamic connectedness among climate change index, green financial assets and renewable energy markets: Novel evidence from sustainable development perspective. Renewable Energy 2023, 204, 94–105. [CrossRef]

- Jiang, S.; Li, Y.; Lu, Q.; Wang, S.; Wei, Y. Volatility communicator or receiver? Investigating volatility spillover mechanisms among Bitcoin and other financial markets. Research in International Business and Finance 2022, 59. [CrossRef]

- Kuang, W. Are clean energy assets a safe haven for international equity markets? Journal of Cleaner Production 2021, 302. [CrossRef]

- Angelini, E.; Birindelli, G.; Chiappini, H.; Foglia, M. Clean energy indices and brown assets: an analysis of tail risk spillovers through the VAR for VaR model. Journal of Sustainable Finance and Investment 2022. [CrossRef]

- Ozdurak, C.; Umut, A.; Ozay, T. The Interaction of Major Crypto-assets, Clean Energy, and Technology Indices in Diversified Portfolios. International Journal of Energy Economics and Policy 2022, 12, 480–490. [CrossRef]

- Kamal, J.B.; Hassan, M.K. Asymmetric connectedness between cryptocurrency environment attention index and green assets. Journal of Economic Asymmetries 2022, 25. [CrossRef]

- Arfaoui, N.; Naeem, M.A.; Boubaker, S.; Mirza, N.; Karim, S. Interdependence of clean energy and green markets with cryptocurrencies. Energy Economics 2023, 120. [CrossRef]

- Sharif, A.; Brahim, M.; Dogan, E.; Tzeremes, P. Analysis of the spillover effects between green economy, clean and dirty cryptocurrencies. Energy Economics 2023, 120. [CrossRef]

- Naeem, M.A.; Gul, R.; Farid, S.; Karim, S.; Lucey, B.M. Assessing linkages between alternative energy markets and cryptocurrencies. Journal of Economic Behavior and Organization 2023, 211, 513–529. [CrossRef]

- Anwer, Z.; Farid, S.; Khan, A.; Benlagha, N. Cryptocurrencies versus environmentally sustainable assets: Does a perfect hedge exist? International Review of Economics and Finance 2023, 85, 418–431. [CrossRef]

- Jarque, C.M.; Bera, A.K. Efficient tests for normality, homoscedasticity and serial independence of regression residuals. Economics Letters 1980, 6, 255–259. [CrossRef]

- Breitung, J. The local power of some unit root tests for panel data. Advances in Econometrics 2000, 15, 161–177. [CrossRef]

- Clemente, J.; Montañés, A.; Reyes, M. Testing for a unit root in variables with a double change in the mean. Economics Letters 1998, 59, 175–182. [CrossRef]

- Gregory, A.W.; Hansen, B.E. Residual-based tests for cointegration in models with regime shifts. Journal of Econometrics 1996, 70, 99–126. [CrossRef]

| ADA | BTC | ETH | XLM | XRP | |

|---|---|---|---|---|---|

| Mean | 0.000514 | 0.001397 | 0.002610 | 0.000918 | 0.001020 |

| Std. Dev. | 0.057312 | 0.040735 | 0.053197 | 0.057453 | 0.067312 |

| Skewness | -0.962139 | -0.679045 | -0.661853 | 1.175606 | 0.723799 |

| Kurtosis | 9.719497 | 9.499837 | 10.65963 | 17.79364 | 19.44905 |

| Jarque-Bera | 1990.820 | 1796.761 | 2462.201 | 9143.484 | 11111.17 |

| Probability | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| Observations | 978 | 978 | 978 | 978 | 978 |

| ISE CLEAN | S&P GLOBAL CLEAN | S&P TSX RENEWABLE ENERGY | SOLACTIVE CHINA CLEAN ENERGY | |

|---|---|---|---|---|

| Mean | -7.41E-05 | 0.000228 | -0.000391 | 0.000517 |

| Std. Dev. | 0.014401 | 0.020064 | 0.017327 | 0.017442 |

| Skewness | -0.660691 | -0.380926 | -0.846904 | -0.097354 |

| Kurtosis | 12.64018 | 8.237000 | 13.55373 | 4.533476 |

| Jarque-Bera | 3862.119 | 1142.436 | 4660.460 | 97.47009 |

| Probability | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| Observations | 978 | 978 | 978 | 978 |

| Null Hypothesis: Unit root (common unit root process) | ||||

|---|---|---|---|---|

| Method | Statistic | Prob.** | ||

| Breitung t-stat | -59.2910 | 0.0000 | ||

| Intermediate regression results on D(UNTITLED) | ||||

| Series | S. E. of Regression | Lag | Max Lag | Obs |

| D(ADA) | 8.51370 | 3 | 21 | 974 |

| D(BTC) | 1875.57 | 0 | 21 | 977 |

| D(ETH) | 112.877 | 3 | 21 | 974 |

| D(ISE CLEAN) | 3.96089 | 0 | 21 | 977 |

| D(S&P GLOBAL CLEAN) | 43.3593 | 0 | 21 | 977 |

| D(S&P TSX) | 3.62919 | 1 | 21 | 976 |

| D(SOLACTIVE CHINA) | 56.1901 | 0 | 21 | 977 |

| D(XLM) | 0.02157 | 0 | 21 | 977 |

| D(XRP) | 0.06707 | 0 | 21 | 977 |

| Coefficient | t-Stat | SE Reg | Obs | |

| Pooled | -0.69822 | -59.291 | 0.012 | 8777 |

| Market | t-stat | Crash |

|---|---|---|

| ADA | -34.10615 (0)*** | 19/05/2021 |

| BTC | -31.85679 (0)*** | 23/02/2021 |

| ETH | -33.47025 (0)*** | 19/05/2021 |

| XLM | -32.94326 (0)*** | 19/05/2021 |

| XRP | -33.19744 (0)*** | 13/04/2021 |

| ISE Clean | -27.32536 (0)*** | 12/03/2020 |

| S&P Global Clean | -27.75393 (0)*** | 07/01/2021 |

| S&P TRX Clean | -31.27196 (0)*** | 08/02/2021 |

| Solactive China Clean | -31.97915 (0)*** | 29/07/2021 |

| Market | t-stat | Results |

| ADA | BTC | -5.45** | Shock L/ Time |

| ADA | ETH | -5.95*** | Shock L/ Time |

| ADA | XLM | -5.59*** | Shock L/ Time |

| ADA | XRP | -5.43** | Shock L/ Time |

| ADA | ISE Clean | -5.71*** | Shock L/ Time |

| ADA | S&P Global Clean | -4.87* | Shock L/ Time |

| ADA | S&P TRX Clean | -4.85* | Shock L/ Time |

| ADA | Solactive China Clean | -4.73* | Shock L/ Time |

| Market | t-stat | Results |

| BTC | ADA | -4.91* | Shock L/ Time |

| BTC | ETH | -4.92* | Shock L/ Time |

| BTC | XLM | -4.50 | Non-existent |

| BTC | XRP | -4.85* | Shock L/ Time |

| BTC | ISE Clean | -4.07 | Non-existent |

| BTC | S&P Global Clean | -3.68 | Non-existent |

| BTC | S&P TRX Clean | -3.61 | Non-existent |

| BTC | Solactive China Clean | -3.33 | Non-existent |

| Market | t-stat | Results |

| ETH | ADA | -4.55 | Non-existent |

| ETH | BTC | -5.71*** | Shock L/ Time |

| ETH | XLM | -4.37 | Non-existent |

| ETH | XRP | -5.18** | Shock L/ Time |

| ETH | ISE Clean | -4.31 | Non-existent |

| ETH | S&P Global Clean | -4.04 | Non-existent |

| ETH | S&P TRX Clean | -4.18 | Non-existent |

| ETH | Solactive China Clean | -4.70 | Non-existent |

| Market | t-stat | Results |

| XLM | ADA | -5.18** | Shock L/ Time |

| XLM | BTC | -4.82* | Shock L/ Time |

| XLM | ETH | -4.29 | Non-existent |

| XLM | XRP | -4.56 | Non-existent |

| XLM | ISE Clean | -4.79* | Shock L/ Time |

| XLM | S&P Global Clean | -4.59 | Non-existent |

| XLM | S&P TRX Clean | -4.61 | Non-existent |

| XLM | Solactive China Clean | -4.89* | Shock L/ Time |

| Market | t-stat | Results |

| XRP | ADA | -6.29*** | Shock L/ Time |

| XRP | BTC | -5.69*** | Shock L/ Time |

| XRP | ETH | -5.60*** | Shock L/ Time |

| XRP | XLM | -4.81* | Shock L/ Time |

| XRP | ISE Clean | -5.12** | Shock L/ Time |

| XRP | S&P Global Clean | -4.82* | Shock L/ Time |

| XRP | S&P TRX Clean | -4.86* | Shock L/ Time |

| XRP | Solactive China Clean | -4.37 | Non-existent |

| Market | t-stat | Results |

| ISE Clean | ADA | -5.16** | Shock L/ Time |

| ISE Clean | BTC | -4.38 | Non-existent |

| ISE Clean | ETH | -4.04 | Non-existent |

| ISE Clean | XLM | -4.49 | Non-existent |

| ISE Clean | XRP | -4.42 | Non-existent |

| ISE Clean | S&P Global Clean | -3.72 | Non-existent |

| ISE Clean | S&P TRX Clean | -3.64 | Non-existent |

| ISE Clean | Solactive China Clean | -4.34 | Non-existent |

| Market | t-stat | Results |

| S&P Global Clean | ADA | -4.03 | Non-existent |

| S&P Global Clean | BTC | -4.26 | Non-existent |

| S&P Global Clean | ETH | -4.41 | Non-existent |

| S&P Global Clean | LTC | -4.37 | Non-existent |

| S&P Global Clean | XLM | -4.24 | Non-existent |

| S&P Global Clean | XRP | -4.49 | Non-existent |

| S&P Global Clean | ISE Clean | -3.39 | Non-existent |

| S&P Global Clean | S&P TRX Clean | -4.26 | Non-existent |

| S&P Global Clean | Solactive China Clean | -5.21** | Shock L/ Time |

| Market | t-stat | Results |

| S&P TRX Clean | ADA | -4.40 | Non-existent |

| S&P TRX Clean | BTC | -4.09 | Non-existent |

| S&P TRX Clean | ETH | -4.31 | Non-existent |

| S&P TRX Clean | LTC | -4.28 | Non-existent |

| S&P TRX Clean | XLM | -4.30 | Non-existent |

| S&P TRX Clean | XRP | -4.33 | Non-existent |

| S&P TRX Clean | ISE Clean | -3.81 | Non-existent |

| S&P TRX Clean | S&P Global Clean | -4.68 | Non-existent |

| S&P TRX Clean | Solactive China Clean | -5.27** | Shock L/ Time |

| Market | t-stat | Results |

| Solactive China Clean | ADA | -3.30 | Non-existent |

| Solactive China Clean | BTC | -3.21 | Non-existent |

| Solactive China Clean | ETH | -3.40 | Non-existent |

| Solactive China Clean | LTC | -3.30 | Non-existent |

| Solactive China Clean | XLM | -4.44 | Non-existent |

| Solactive China Clean | XRP | -3.19 | Non-existent |

| Solactive China Clean | ISE Clean | -4.79* | Shock L/ Time |

| Solactive China Clean | S&P Global Clean | -5.57*** | Shock L/ Time |

| Solactive China Clean | S&P TRX Clean | -5.52*** | Shock L/ Time |

| Market | F-Statistic | Results |

| BTC | ADA | 1.58 | Non-existent |

| ADA | BTC | 1.46 | Non-existent |

| ETH | ADA | 0.99 | Non-existent |

| ADA | ETH | 1.08 | Non-existent |

| ISE CLEAN | ADA | 1.35 | Non-existent |

| ADA | ISE CLEAN | 0.94 | Non-existent |

| S&P Global Clean | ADA | 1.08 | Non-existent |

| ADA | S&P Global Clean | 1.68 | Non-existent |

| S&P TRX Clean | ADA | 1.42 | Non-existent |

| ADA | S&P TRX Clean | 1.57 | Non-existent |

| Solactive China Clean | ADA | 0.46 | Non-existent |

| ADA | Solactive China Clean | 1.37 | Non-existent |

| XLM | ADA | 1.29 | Non-existent |

| ADA | XLM | 1.07 | Non-existent |

| XRP |ADA | 2.68*** | Shock |

| ADA | XRP | 3.36*** | Shock |

| ETH | BTC | 1.82* | Shock |

| BTC | ETH | 1.89* | Shock |

| ISE CLEAN | BTC | 1.60 | Non-existent |

| BTC | ISE CLEAN | 0.80 | Non-existent |

| S&P Global Clean | BTC | 0.68 | Non-existent |

| BTC | S&P Global Clean | 1.29 | Non-existent |

| S&P TRX Clean | BTC | 1.04 | Non-existent |

| BTC | S&P TRX Clean | 1.51 | Non-existent |

| Solactive China Clean | BTC | 0.41 | Non-existent |

| BTC | Solactive China Clean | 1.74* | Shock |

| XLM | BTC | 2.01** | Shock |

| BTC | XLM | 2.30** | Shock |

| XRP | BTC | 1.24 | Non-existent |

| BTC | XRP | 1.77* | Shock |

| ISE CLEAN | ETH | 1.49 | Non-existent |

| ETH | ISE CLEAN | 0.86 | Non-existent |

| S&P Global Clean | ETH | 0.64 | Non-existent |

| ETH | S&P Global Clean | 0.64 | Non-existent |

| S&P TRX Clean | ETH | 1.12 | Non-existent |

| ETH | S&P TRX Clean | 1.51 | Non-existent |

| Solactive China Clean | ETH | 0.28 | Non-existent |

| ETH | Solactive China Clean | 1.17 | Non-existent |

| XLM | ETH | 0.66 | Non-existent |

| ETH | XLM | 1.90* | Shock |

| XRP | ETH | 1.58 | Non-existent |

| ETH | XRP | 2.42** | Shock |

| S&P Global Clean | ISE CLEAN | 5.66*** | Shock |

| ISE CLEAN | S&P Global Clean | 1.84* | Shock |

| S&P TRX Clean | ISE CLEAN | 3.43*** | Shock |

| ISE CLEAN | S&P TRX Clean | 3.82*** | Shock |

| Solactive China Clean | ISE CLEAN | 0.65 | Non-existent |

| ISE CLEAN | Solactive China Clean | 3.92*** | Shock |

| XLM | ISE CLEAN | 0.17 | Non-existent |

| ISE CLEAN | XLM | 2.40** | Shock |

| XRP | ISE CLEAN | 0.19 | Non-existent |

| ISE CLEAN | XRP | 2.42** | Shock |

| S&P TRX Clean | S&P Global Clean | 2.18** | Shock |

| S&P Global Clean | S&P TRX Clean | 3.77*** | Shock |

| Solactive China Clean | S&P Global Clean | 0.42 | Non-existent |

| S&P Global Clean | Solactive China Clean | 5.33*** | Shock |

| XLM | S&P Global Clean | 0.62 | Non-existent |

| S&P Global Clean | XLM | 1.64 | Non-existent |

| XRP | S&P Global Clean | 0.50 | Non-existent |

| S&P Global Clean | XRP | 1.72* | Shock |

| Solactive China Clean | S&P TRX Clean | 0.68 | Non-existent |

| S&P TRX Clean | Solactive China Clean | 3.96*** | Shock |

| XLM | S&P TRX Clean | 0.61 | Non-existent |

| S&P TRX Clean | XLM | 1.23 | Non-existent |

| XRP | S&P TRX Clean | 0.34 | Non-existent |

| S&P TRX Clean | XRP | 1.46 | Non-existent |

| XLM | Solactive China Clean | 2.82*** | Shock |

| Solactive China Clean | XLM | 0.76 | Non-existent |

| XRP | Solactive China Clean | 1.60 | Non-existent |

| Solactive China Clean | XRP | 0.65 | Non-existent |

| XRP | XLM | 3.13*** | Shock |

| XLM | XRP | 2.04** | Shock |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).