1. Introduction

COVID-19, which originated in China in late 2019, was declared a pandemic by the World Health Organization on March 11, 2020. Several measures were gradually implemented to contain its spread, involving the closure of various economic activities, leading to an economic shutdown [

1]. A severe negative economic impact is caused on the activity of companies and, consequently, in their liquidity. The objective of this study is to investigate this impact.

In Portugal, a state of emergency was declared on March 18, 2020, and remained in effect until May 2. Schools and universities were closed on March 16, and the temporary suspension of activities in various public and private services was decreed. Subsequently, a state of calamity was implemented, which lasted until June 30, when the initially imposed containment measures began to be gradually eased. In December of the same year, the vaccination campaign began in Portugal.

The aim is to study the effect of the pandemic, focusing on the financing policy of companies, as the decrease in business volume may lead to financing needs for a large portion of them in order to compensate for the decline in activity. The support measures established by the government have a direct impact on the indebtedness of companies, such as the moratoriums and state-guaranteed credit lines [

2]. Companies that have a corporate sustainability strategy can sustain their operations over an extended period, taking into account economic fluctuations, which is crucial in a crisis situation such as the COVID-19 pandemic.

To analyze this effect, this study examines the results of the COVID-IREE survey, conducted by the Banco de Portugal (Portuguese Central Bank) and the Instituto Nacional de Estatística (National Institute of Statistics), to assess the impact on the Portuguese business sector [

3]. This survey enabled monitoring of the economic situation, allowing for an analysis of the effectiveness of the measures implemented.

This study aims to investigate whether the government measures were sufficient to address the needs of businesses sustainability and whether the moratoriums applied to existing loans and the grace period for new credit lines became advantageous for less affected sectors. Additionally, it seeks to analyze the proportion of companies that closed and the sectors of activity that were most affected. For business sustainability to be effective, the company must adopt ethical attitudes and practices that stimulate its economic growth, in order to reduce the damage from its negative externalities.

2. The effect of the pandemic on corporate financing policy

We know that it is crucial for companies to maintain financial balance by aligning the maturity of their liabilities with that of their assets. Additionally, capital structure is relevant for determining the value of a company and is analyzed through various theories, such as the trade-off theory and the pecking order theory.

Economic recovery and tourism in Portugal were heavily affected by a worsening of the pandemic activity. On January 13, 2021, a new state of emergency was declared along with the implementation of new restrictive measures. There was a severe increase in COVID-19 related mortality, which was mitigated through the implemented measures and the start of vaccination, resulting in a significant reduction in new cases, hospitalizations and deaths starting from February 8. In October 2021, when 85% of the population is vaccinated, restrictions that were in place are lifted [

4].

The economic crisis triggered by the onset of the pandemic hits Small and Medium-Sized Enterprises (SMEs) with greater intensity. As the Portuguese business landscape is predominantly composed of SMEs, Portugal is one of the countries most affected by the crisis [

5]. Additionally, export activities account for approximately 44% of Portugal's Gross Domestic Product (GDP), making the country particularly sensitive to the impact of the crisis. In 2020, the GDP experienced a significant year-on-year decline of 7,6% due to the pandemic [

6].

In order to mitigate the economic impact resulting from the epidemiological situation and the contingency measures imposed by the government in the short and medium term, a set of policies were adopted. These included the moratorium on interest and capital payments for loans, access to state-guaranteed credit lines and an extension of deadlines for tax and contribution obligations. Furthermore, in order to maintain employment and alleviate the business crisis, on March 15, extraordinary and temporary support measures were defined and regulated for workers and employers affected by the pandemic through simplified layoff arrangements [

7].

One of the most widely adopted measures by companies as a consequence of the COVID-19 pandemic was the moratorium on existing loans predating the onset of the disease. Due to the sharp decline in business turnover and disposable income of households, there is a high risk of default on loan obligations. Consequently, similar to other countries, the Portuguese government established a public moratorium regime through Decree-Law no. 10-J/2020. This moratorium entails the suspension of capital and interest payments due until the end of the moratorium. As a result, the loan term is extended by a period equal to the duration of the moratorium, without resulting in a contractual default.

Mutual Guarantee Societies (MGS) aim to provide financial guarantees to facilitate credit acquisition based on the conditions and activities of businesses. When companies secure credit using mutual guarantees, they obtain more favorable terms, meaning that the cost of this financing is lower compared to bank financing without the guarantee, given that limits on the spread to be applied are imposed. Despite the commission payable to the MGS the total cost for the company, which includes financing costs owed to the bank, is lower, considering that the bank offers a lower interest rate due to the capital savings resulting from the fact that the borrowed amount is guaranteed by the MGS [

8].

In order to access credit lines, companies must meet certain conditions. They should have a positive net equity position in the latest approved balance sheet. If this is not the case, they might still be eligible if they provide an interim balance sheet at the application date with a regularized situation. Additionally, they should have no defaults with banks or MGS, and their status must be in good standing with the Tax Authority and Social Security at the time of financing. Access to certain credit lines has been restricted to companies experiencing a revenue decline of 25% to 40%. Lastly, companies deemed in distress are not eligible and they must commit to maintaining the employment positions they had on February 1, 2020, until December 31, 2020 [

9]. This extraordinary measure to support job retention is intended for employers subject to the obligation to close their facilities and establishments, fully or partially, due to the COVID-19 outbreak [

10]. This support is financial and allocated exclusively to cover employee salaries. Workers covered by this scheme receive two-thirds of their salary, or the national minimum wage if higher. The employer pays 30% of this amount, while the remaining 70% is covered by the government.

This simplified and temporary version of the layoff scheme was one of the most significant measures during the initial phase of the pandemic, leading to high participation and budgetary impact. Two months after the pandemic's onset, almost 83 000 companies submitted around 100 000 applications, totaling payments of 284 million euros, covering approximately 681 000 workers.

In cases where there is neither partial nor complete closure of a company's facilities or establishments, nor a suspension of its activities, if there is a proven sharp and substantial decline of at least 40% in revenue, this provides a basis for a situation of business crisis. Consequently, the entity can join the simplified layoff scheme and benefit from the suspension of Social Security contributions.

On May 11, 2020, a survey was conducted among companies to gather credible and updated information. The renewal of the simplified layoff support measure is requested by one-third of the companies, demonstrating its continued necessity. Among the companies utilizing this measure, 25% place all employees under this scheme, while 75% do so only partially [

11].

The supports for the economy and employment in 2020 amount to around 22 billion euros, with non-repayable grants totaling 279 billion euros [

7]. Most of these supports are allocated to assist liquidity, achieved through tax and contribution relief, bank moratoriums, deferred tax payments and credit lines, accounting for about 19 billion euros. The remaining support is divided among job maintenance, including the simplified layoff scheme, support for gradual resumption, and incentive for normalization; investment, particularly through programs like Adaptar, COVID R&D and COVID Progressive Innovation and, finally, non-salary fixed cost support through the Apoiar program.

The number of companies benefiting from these measures increases over time, with the suspension of tax and contribution obligations being the most commonly used measure, followed by moratoriums on pre-pandemic existing loans.

In a statement from May 4th, 84% of the surveyed companies believe that the government-announced supports are insufficient to meet their needs [

12]. Among the companies using credit lines, only 3% have access to the funds within a month and a half from the start of the programs. Additionally, 46% of these companies state that they need additional financing to sustain their business crisis.

To ensure the competitiveness of companies, access to financing is crucial as their investment is constrained by their ability to secure credit. Moreover, the cost of financing is essential, as it impacts prices and the capacity to maintain competitive pricing.

As companies opt for credit lines with subsidized interest rates and state guarantees, the total debt of Non-Financial Corporations (NFC) as a percentage of GDP increases from 92,70% in 2019 to 100,90% in the second quarter of 2021. This percentage has decreased by 34 percentage points between 2013 and 2019. In 2020, Portuguese NFC increased their debt-to-equity ratio by 8,2 percentage points, surpassing the European average of 6,9 percentage points [

13].

According to the Financial Stability Report of December 2021 [

14], following the onset of the pandemic crisis, the ratio of cash and deposits to financial debt increased to 32,60% in June 2021, from a percentage of 27,30% in March 2020. This indicates an average increase in the liquidity of NFCs due to the pandemic-originated crisis. The highest increase in this financial debt-to-assets ratio occurs in companies that had lower debt ratios before the pandemic. Sectors most affected by the pandemic, such as accommodation and catering, experience a generalized increase in the financial debt ratio.

In 2021, in comparison to 2020, the increases in new bank loans to companies decreased. The amount of credit granted to NFC increased significantly due to credit lines with public guarantees [

14]. As these loans come with a long maturity and a capital grace period of up to 18 months, companies don't feel the need to seek short-term financing again. Additionally, the implementation of moratoriums on pre-existing loans was another measure to mitigate the negative effects of the pandemic. These moratoriums are more prominently granted to sectors most affected by the pandemic. Although it was a measure that helped companies in the face of the crisis, there were companies that closed their activities, proving that the government was unable to adopt sustainable measures that would guarantee their continuity.

Excessive reliance on external financing can become concerning, as it can lead to the default of a company's responsibilities and is one of the primary reasons behind many business closures. To prevent such a scenario, it's essential to analyze the debt-to-equity ratio, which indicates the proportion of debt compared to equity capital. This ratio essentially measures the level of dependence on external financing [

15].

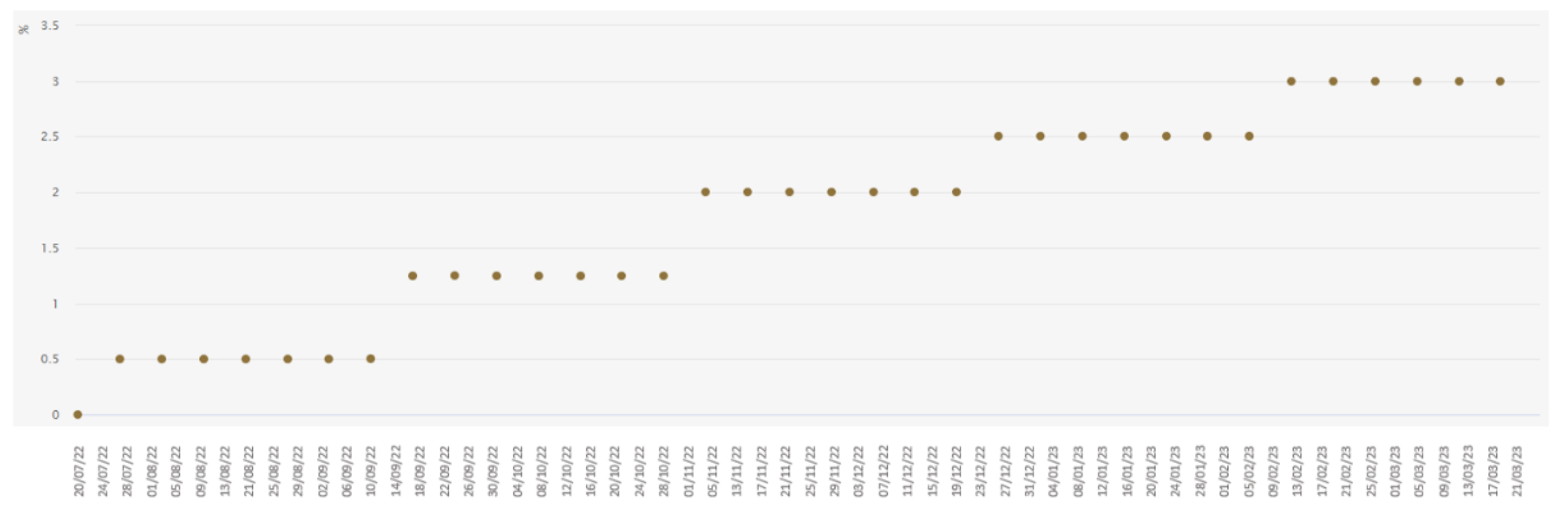

Interest rates in the Eurozone had been decreasing since 2008 until the first half of 2022. The Euribor, the reference rate for various types of loans, transitioned from values exceeding 5% to negative values, reaching as low as -0,518%, and remained negative for the past six years (until early 2022). As a consequence of rising energy and food prices and disruptions in supply chains, associated with an imbalance between supply and demand, inflation increases. This imbalance initially stems from the pandemic but has been exacerbated by Russia's invasion of Ukraine. The European Central Bank (ECB) maintained interest rates unchanged until July 2022, arguing that price changes are transitory. Over time, it becomes evident that these changes are not temporary but rather persistent and lasting. Consequently, on July 21, the ECB decides to raise the interest rates of main financing operations by 50 basis points, marking the first increase in over a decade. Since then, in anticipation of inflation persisting for some time, the ECB has continued to raise interest rates.

The average interest rate on new loans to businesses increases from 2,00% in December 2021 to 4,44% in December 2022. Given this abrupt rise in interest rates, it's expected that this upward trend will persist. The financing costs for companies are rapidly increasing, which will have an immediate impact on new borrowing and gradually affect existing loans, posing a risk to debt servicing capacity.

From the Eurozone crisis starting in 2009 to the COVID-19 pandemic crisis, corporate indebtedness has decreased while capital has increased. These factors help mitigate defaults in a situation of rising interest rates, along with the fact that liquidity has been reinforced by deposit accumulation during the pandemic and the economic recovery following the pandemic shock.

According to the European Central Bank, its primary objective is to maintain price stability [

16]. When prices rise too quickly, leading to increased inflation, the way to address this situation is by raising interest rates, thereby reducing inflation back to the medium-term target of 2%. In this manner, the ECB increases its policy rates, making loans more expensive for banks, which subsequently results in higher interest rates for loans to businesses. This reduces demand and encourages saving. As a result, overall demand decreases and inflation is brought under control.

In the November 2022 Financial Stability Report [

17], an estimation model of financial statements per company is employed to analyze the impact on the Interest Coverage Ratio (ICR), measured as the ratio of EBITDA to interest expenses. Additionally, the number of vulnerable companies (those with ICR less than 2) is assessed, compared to the sovereign debt crisis, which is also influenced by rising interest rates. To mitigate the increased financing costs resulting from higher interest rates, companies can utilize liquidity surpluses to reduce debt, as well as decrease dividend distribution.

Companies classified as vulnerable exhibit lower levels of liquidity and capitalization compared to those that are not classified as such. The risk for companies rendered vulnerable by the impact of the COVID-19 pandemic is heightened by their struggle to generate results and maintain a low level of liquidity and capitalization, which are critical factors for determining their ability to service debt [

18].

3. Methodology

The effects of the pandemic on Portuguese businesses are analyzed through the results of the COVID-IREE survey, conducted by the Instituto Nacional de Estatística and the Banco de Portugal. Gathering this information is essential to understand trends and formulate strategies to alleviate the business crisis [

3]. With the collected data, it becomes possible to comprehend the proportion of companies that have closed, both temporarily and permanently. Moreover, insights into the impact on their turnovers can be gleaned. The survey also addresses the utilization of public support measures, the number of employees working and financial liquidity. All this data is gathered by sector of activity and the size of the surveyed companies.

It's evident that over the weeks, the percentage of companies closing either permanently or temporarily decreases. This analysis is conducted over the second quarter of 2020, during which the state of emergency was in effect and subsequently, there was a gradual lifting of containment measures. This led companies to gradually resume their activities. This is reflected in the increasing percentage of operational companies, which went from 82,16% in April to 96,30% in June.

The accommodation and restaurant sector has the highest closure rate, particularly among smaller businesses. On the other hand, the information and communication sector experienced the lowest closures. Temporary closures on average last around 5 weeks. In the first week, the most cited reasons for permanent closure were the restrictions during the state of emergency and the lack of orders/customers. In the second and third weeks, about 40% of respondents reported not diversifying or altering their production, while approximately 24% did so partially. Additionally, around 17% mentioned partially changing or reinforcing distribution channels, such as implementing takeout and online sales.

The majority of companies experienced a significant reduction in their turnover. On average, for businesses negatively impacted in the first four weeks, 31,73% saw a reduction in turnover of over 75%, 41,53% experienced a reduction between 26% and 75%, and 26,74% had a decrease of less than 25%. In the months of May and June, when asked about the pandemic's impact on turnover compared to pre-pandemic expectations, on average 64,78% of respondents reported a reduction, while 20,93% claimed no impact.

Regarding the reasons cited for the initial-week turnover reduction, the restrictions stemming from the state of emergency and the absence of orders/customers were the most frequently mentioned in the second half of June.

In the second half of June, in a scenario without the pandemic, around 60% of companies reported a negative impact on turnover, compared to 62% in the preceding fortnight. The accommodation and restaurant sector has the highest proportion of companies reporting a decrease in turnover, with an average of 78% over the two fortnights. This is followed by the transport and storage sector, with an average of 74%.

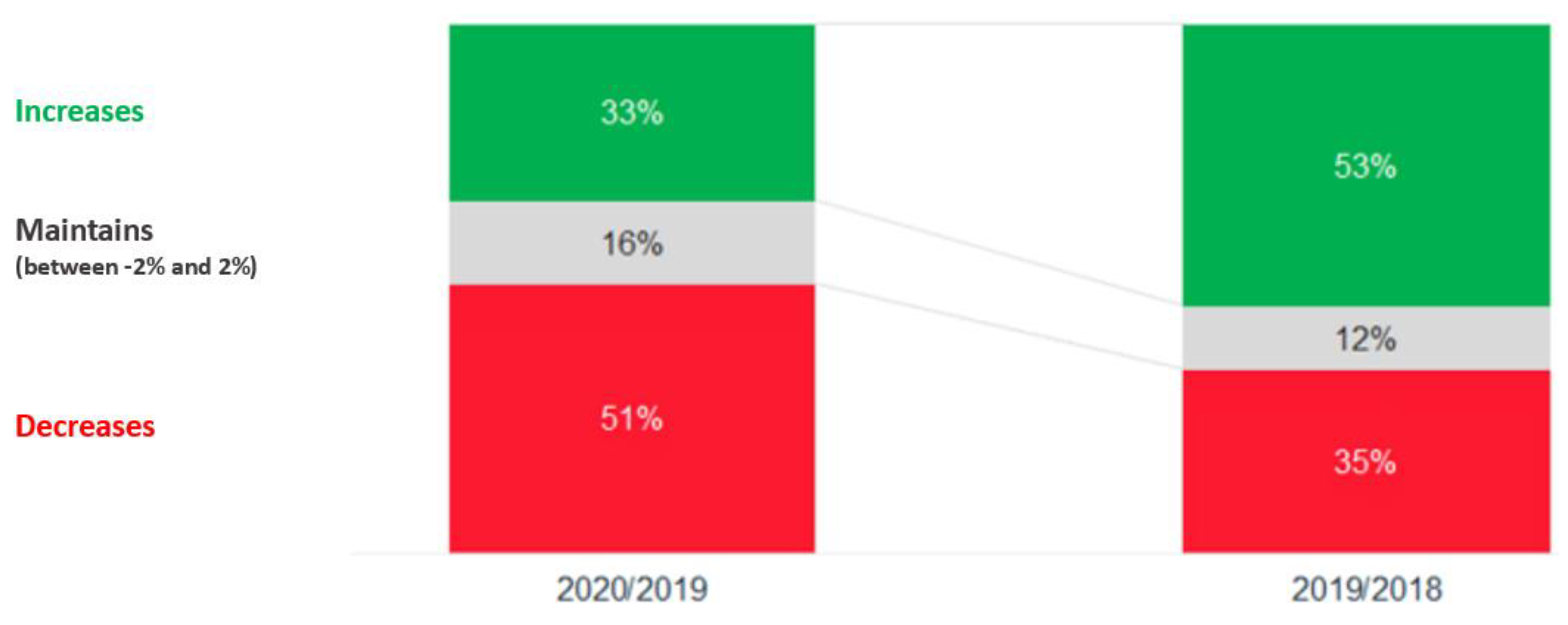

Based on an analysis of companies' financial data for 2019 and 2020, more than half of the companies, 51%, experienced a decrease in turnover in 2020, while a third reported an increase [

19]. This is a reversal from the trend observed in 2019.

Among the companies that experienced an increase in turnover, the sectors of retail trade, certain activities in the construction sector and information and communication technologies predominate. This is attributed to the increased demand for telecommunications and information technology solutions due to the pandemic. On the other hand, all subsets of the accommodation and restaurant sector experienced a decline, as did subsets related to tourism services and textile and fashion retail [

19].

3. Results

This study aimed to examine the impact of the COVID-19 pandemic on companies, specifically focusing on their financing policies. The study began by detailing the onset and progression of the pandemic in Portugal, followed by an exploration of the measures implemented by the government to curb the disease's spread. Lastly, the study analyzed the pandemic's effects on Portuguese businesses, drawing on the findings from the COVID-IREE survey.

Companies have increasingly turned to alternative sources of funding beyond traditional bank loans, although bank financing remains the primary funding source for SME. This enables diversification of their sources of financing, not relying on a single financial institution or type of financing, constituting a strategy that contributes to their economic sustainability.

The capital structure of a company is determined by decisions made regarding its funding sources, specifically whether to rely more on debt or equity financing. To reduce financing costs and increase a company's value, thereby enhancing shareholder returns, an analysis of the capital structure is essential.

Companies must maintain financial equilibrium, necessitating constant monitoring of their cash flow. Given that a significant and widespread reduction in a company's turnover within a short period can impact its liquidity, effective financial management becomes crucial. In times of crisis, having a cash flow forecast through a statement of cash flows is critical for adequately addressing potential cash flow shortages.

Among the government measures established to combat the pandemic, this study focused on three specific measures. Firstly, there were the moratoriums on existing credits, which entailed postponing loan installment payments. This led to an accumulation of internal cash flows that allowed companies to allocate these funds to other obligations. Additionally, the government's credit lines with state guarantees provided companies access to financing with lower costs compared to regular bank loans without guarantees. The simplified layoff scheme was also examined, as it provided financial support that helped companies maintain employment. In summary, companies generally found these measures insufficient and required additional financing means to weather the business crisis.

Table 1 outlines the utilization of these support measures by companies.

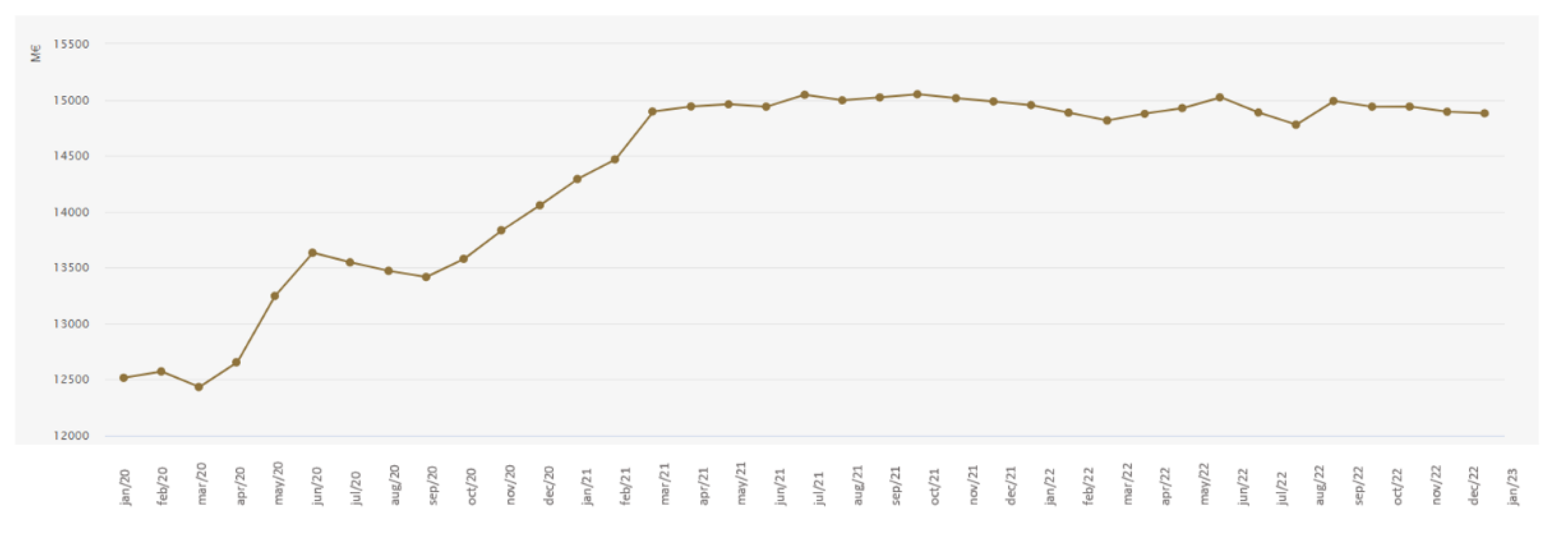

In addition to internal management and control, macroeconomic factors also exert influence on companies' profitability, exemplified by the significant impact of the COVID-19 pandemic on business activities. It can be inferred that NFC with lower pre-pandemic debt ratios experienced an average increase in liquidity of around 5,3% from March 2020 to June 2021. Conversely, the accommodation and food service sectors, which were most affected by the pandemic, observed an escalation in the financial leverage ratio, as depicted in

Figure 1. These sectors also exhibited a higher propensity to engage with debt moratorium measures.

The European Central Bank raised interest rates in the second half of 2022, after a 10-year period, aiming to counter inflation. The trend in interest rate changes is depicted in

Figure 2.

As a consequence, the financing costs for companies started to increase rapidly, gradually impacting existing loans and immediately affecting new loans. It can be inferred that this escalation poses a risk to companies in terms of ensuring their ability to meet debt servicing obligations. To mitigate the effects of rising interest rates, companies can choose to use surplus cash to repay debt or alternatively reduce dividend distributions. Furthermore, companies should define their sustainability strategy in a way that allows them to conduct their operations while considering environmental, social, and governance factors, sustainable continuity and growth of the business. For example, by adopting sustainable energy sources, a company reduces its production costs, increases profitability, and subsequently decreases its environmental impact, assuming a positive stance in society.

When analyzing the impact of the COVID-19 pandemic through the results of COVID-IREE, it is evident that the accommodation and restaurant sector suffered the most, especially among smaller companies. The information and communication sector experienced the lowest closure rate. Overall, the most frequently cited reasons by respondents for the permanent closure of businesses were the restrictions imposed during the state of emergency and a lack of orders/customers. The state of business activity is outlined in

Table 2.

The majority of surveyed companies experienced a decrease in turnover, with around 32% reporting a decrease of over 75%. The accommodation and restaurant sector had the highest percentage of decrease, followed by the transportation and storage sector. It can also be concluded that some companies managed to increase their turnover, particularly in the retail trade, construction and information and communication technology sectors, due to their adoption of technological solutions to address pandemic-related challenges, as depicted in the distribution illustrated in

Figure 3 [

19].

4. Conclusions

This paper investigated the impact of the COVID-19 pandemic on companies, particularly in their financing policy. The effects of the pandemic on Portuguese companies were examined based on the results of COVID-IREE.

Three government measures to address the pandemic were studied, including credit moratoriums, state-guaranteed credit lines and simplified layoff. The challenge posed by the pandemic emphasized the importance of corporate sustainability. Despite government measures being implemented, they proved insufficient, leading companies to seek additional means of financing. In summary, companies should adopt sustainable financial strategies to overcome both short-term and long-term crises, ensuring their financial stability. Additionally, governments should have a sustainable strategy to provide adequate support to the economy in times of crisis.

This work also analyzed the impact of the European Commercial Bank's interest rates, which increased in the second half of 2022, posing a risk to companies and necessitating consideration of strategies such as debt amortization and dividend reduction to address this challenge.

Finally, this study examined the impact of the pandemic on companies, with the accommodation and restaurant sector being the hardest hit, and many companies reporting significant reductions in turnover. However, some industries, such as retail and information technology, managed to increase their turnover by adopting technologies to address pandemic-related challenges. Overall, companies faced increased indebtedness due to the pandemic and additional challenges arising from the rise in interest rates in 2022. Therefore, it is concluded that the sustainability of companies should be studied at the corporate level, through the adoption of strategies that ensure the stability of companies and, consequently, the global economy.

Author Contributions

Conceptualization, G.C. and P.P.; methodology, G.C. and P.P.; software, A.M.; validation, G.C. and P.P.; formal analysis, A.M.; investigation, A.M.; resources, G.C and P.P.; data curation, A.M., G.C.; writing—original draft preparation, A.M.; writing—review and editing, A.M., G.C. and P.P.; visualization, G.C. and A.M.; supervision, G.C. and P.P.; project administration, P.P.; funding acquisition, G.C. and P.P. All authors have read and agreed to the published version of the manuscript.

Funding

This paper is financed by Portuguese national funds through FCT–Fundação para a Ciência e a Tecnologia, I.P., project number UIDB/00685/2020. We also thank to the Funded by national funds through FCT—Portuguese Science and Technology Foundation, within the project reference UIDB/04470/2020.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Research data is openly available. Furthermore, it is possible to contact one the correspondence author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Mamede, R. P.; Pereira, M.; António, S. Portugal: Uma análise rápida do impacto da COVID-19 na economia e no mercado de trabalho. Organização Internacional do Trabalho. 2020. https://www.ilo.org/wcmsp5/groups/public/---europe/---ro-geneva/---ilo-lisbon/documents/publication/wcms_754606.pdf. /.

- Manteu, C.; Monteiro, N.; Sequeira, A. O impacto de curto prazo da pandemia covid-19 nas empresas portuguesas. Banco de Portugal. 2020. https://www.bportugal.pt/sites/default/files/anexos/papers/op202003_pt.pdf.

- Banco de Portugal e Instituto Nacional de Estatística. Inquérito Rápido e Excecional às Empresas – COVID-19. 2021. https://www.bportugal.pt/sites/default/files/iree_20210226.pdf.

- Silva, R. F.; Macedo, M.; Conceição, J. A pandemia de COVID-19 em Portugal: Evolução, Vacinação e Farmacovigilância. Revista Multidisciplinar 2022, 4, 135–154. [Google Scholar] [CrossRef]

- Fernandes, N. Economic effects of coronavirus outbreak (COVID-19) on the world economy. Social Science Research Network (SSRN). 2020. [Google Scholar] [CrossRef]

- Gabinete do Ministro de Estado e das Finanças. Pandemia provoca queda acentuada do PIB em Portugal e na Europa. Press realese. 2021, February 2th. https://www.portugal.gov.pt/pt/gc22/comunicacao/comunicado?i=pandemia-provoca-queda-acentuada-do-pib-em-portugal-e-na-europa.

- Rosa, M. M. A pandemia e as PME portuguesas: o impacto e a gestão da crise em 2020. Master’s degree, Universidade Lusófona, Lisboa, 2021. http://hdl.handle.net/10437/12136.

- Garval. Garantia Mútua. 2023, March 27th. https://www.garval.pt/pt/institucional/sobre-nos/garantia-mutua/.

- SPGM – Sociedade de Investimento. Linha de Apoio à Economia COVID-19. 2023, March 27th. https://www.spgm.pt/pt/catalogo/linha-de-apoio-a-economia-covid-19/.

- Segurança Social. Layoff Simplificado. 2022. https://www.seg-social.pt/layoff-simplificado.

- Confederação Empresarial de Portugal. Um terço das empresas que recorreram ao “layoff simplificado” já pediram a sua renovação. Press realease. 2020, May 11th. https://cip.org.pt/covid-19-informacoes-as-empresas/.

- Confederação Empresarial de Portugal. Só 3% das empresas receberam apoio das linhas da covid-19. Press realese. 2020, May 4th. https://cip.org.pt/covid-19-informacoes-as-empresas/.

- Pereira, E.; Mariana, C.; Rita, T. S.; Rebelo, T. Pilar de Competitividade: Financiamento, Endividamento e Investimento das Empresas. Gabinete de Estratégia e Estudos. 2022. https://www.gee.gov.pt/pt/?option=com_fileman&view=file&routed=1&name=GEE_FC_Financiamento_Endividamento_Investimento_2021.pdf&folder=estudos-e-seminarios%2Fcompetitividade&container=fileman-files.

- Banco de Portugal. Relatório de Estabilidade Financeira. 2021, December. https://www.bportugal.pt/publications/banco-de-portugal/all/120.

- Thomas-Bryant, K. Rácio de endividamento de uma empresa: Como interpretá-lo? Sage Advice. 2022, October 12th. https://www.sage.com/pt-pt/blog/racio-de-endividamento-de-uma-empresa-como-interpreta-lo/.

- Banco Central Europeu. Aumentámos as taxas de juro. O que significa esta decisão para si? Explanatory note. 2022. https://www.ecb.europa.eu/ecb/educational/explainers/tell-me-more/html/interest_rates.pt.html.

- Banco de Portugal. Relatório de Estabilidade Financeira. 2022, November. https://www.bportugal.pt/publications/banco-de-portugal/all/120.

- Augusto, F.; Mateus, M. A vulnerabilidade financeira e a dívida em excesso das empresas em Portugal: uma aplicação ao choque COVID-19. Gabinete de Estratégia e Estudos. 2021. https://www.gee.gov.pt/pt/estudos-e-seminarios/seminarios-gee/31362-a-vulnerabilidade-financeira-e-a-divida-em-excesso-das-empresas-em-portugal-uma-aplicacao-ao-choque-covid-19. /.

- Informa D&B. Avaliação dos impactos da pandemia no volume de negócios das empresas em 2020. 2021, August 4th. https://www.informadb.pt/geral/documentos/Desempenho-2020.pdf.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).