2.1.1. Foreign Direct Investment in Africa

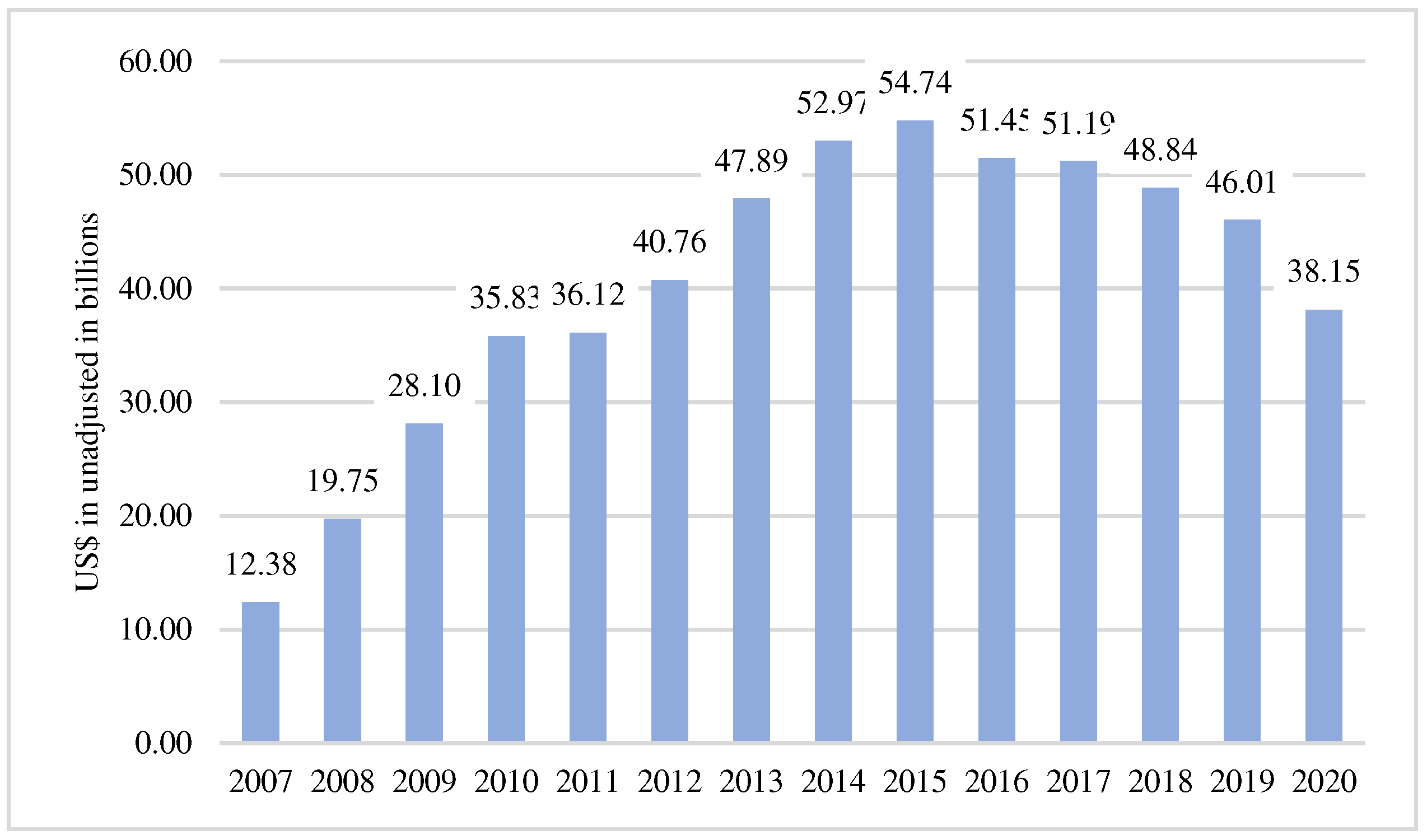

Annual flows of Chinese FDI to Africa have increased dramatically since 2003, the earliest year for which official statistics is available(bank 2021), rising from $74.8 million in 2003 to $5.4 billion in 2018. Chinese FDI into Africa fell to $2.7 billion in 2019, but rebounded to $4.2 billion in 2020, despite the COVID-19 outbreak. Over the same time span, Chinese FDI stocks in Africa increased over 100-fold, from $490 million in 2003 to $43.4 billion in 2020, with a high of $46.1 billion in 2018. Since 2014, China has been Africa's fourth largest investor, surpassing the United States. China's loans to Africa have dominated headlines, with a total value of $153 billion between 2000 and 2019. Investment flows, on the other hand, receive significantly less attention despite accounting for a third of all loans.

Figure 1.

Chinese FDI stock and flows to Africa in billions USD. Source: China Statistical Yearbook

Figure 1.

Chinese FDI stock and flows to Africa in billions USD. Source: China Statistical Yearbook

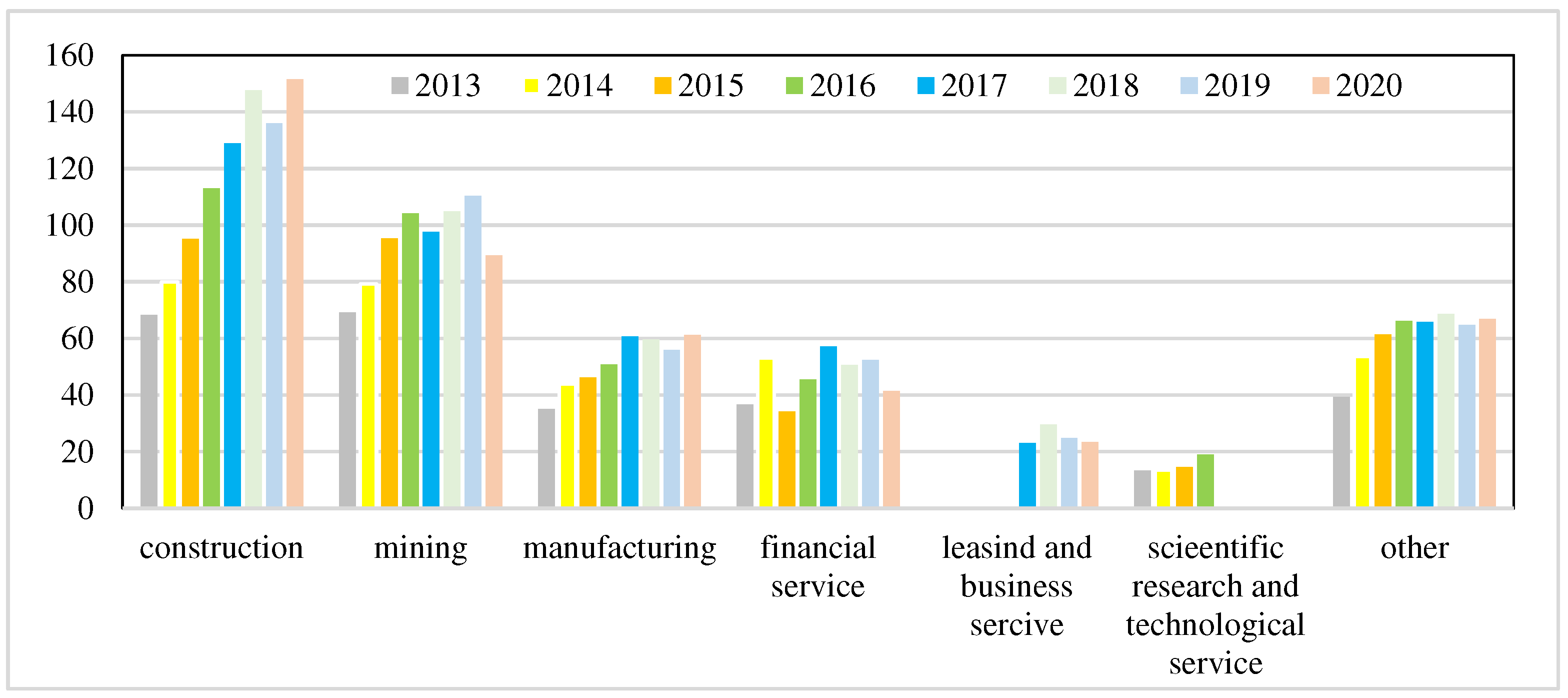

Figure 2.

Top 5 industries for Chinese FDI stock in Africa. Source: China Statistical Yearbook

Figure 2.

Top 5 industries for Chinese FDI stock in Africa. Source: China Statistical Yearbook

Annual Chinese FDI flows to Africa, officially termed in Chinese official publications as OFDI ("Overseas Foreign Direct Investment"), have been gradually increasing since 2003.Flows increased from 75 million dollars in 2003 to 4.2 billion dollars in 2020. They reached a high of US$ 5.5 billion in 2008, thanks to the purchase of 20% of Standard Bank of South Africa's shares by the Industrial and Commercial Bank of China (ICBC).

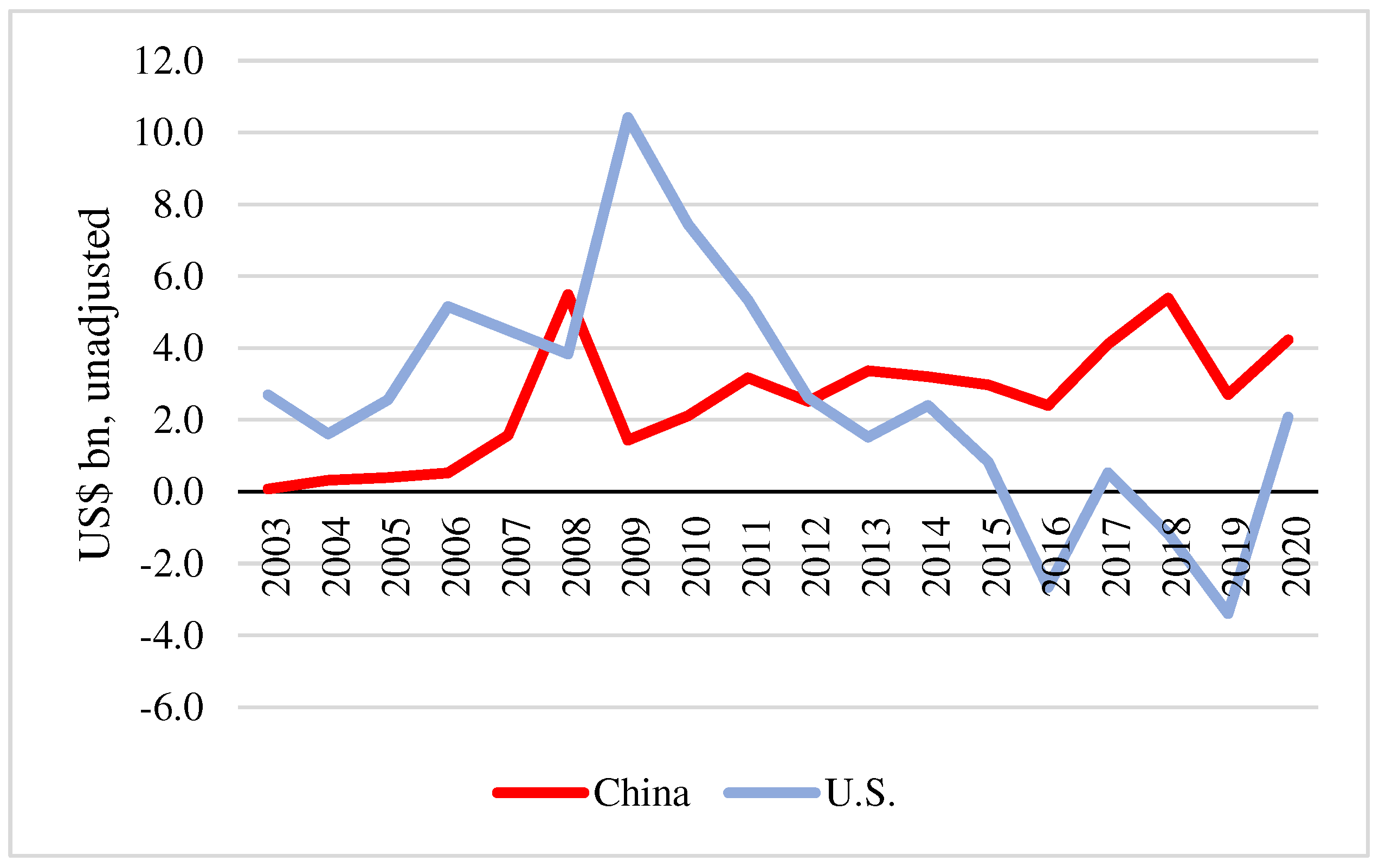

Figure 3.

Chinese FDI vs. US FDI to Africa. Source: The statistical bulletin of China’s outward foreign direct investment, U.S. bureau of economic analysis.

Figure 3.

Chinese FDI vs. US FDI to Africa. Source: The statistical bulletin of China’s outward foreign direct investment, U.S. bureau of economic analysis.

Since 2003, Chinese FDI flows to Africa have outpaced those from the United States, as seen in the graph below, despite the fact that U.S. FDI flows have been dropping since 2010. Kenya, the Democratic Republic of Congo, South Africa, Ethiopia, and Nigeria were the top five African locations for Chinese FDI in 2020.

Figure 4.

Gross annual revenues of Chinese construction projects in Africa. Source: National Bureau of Statistics of China.

Figure 4.

Gross annual revenues of Chinese construction projects in Africa. Source: National Bureau of Statistics of China.

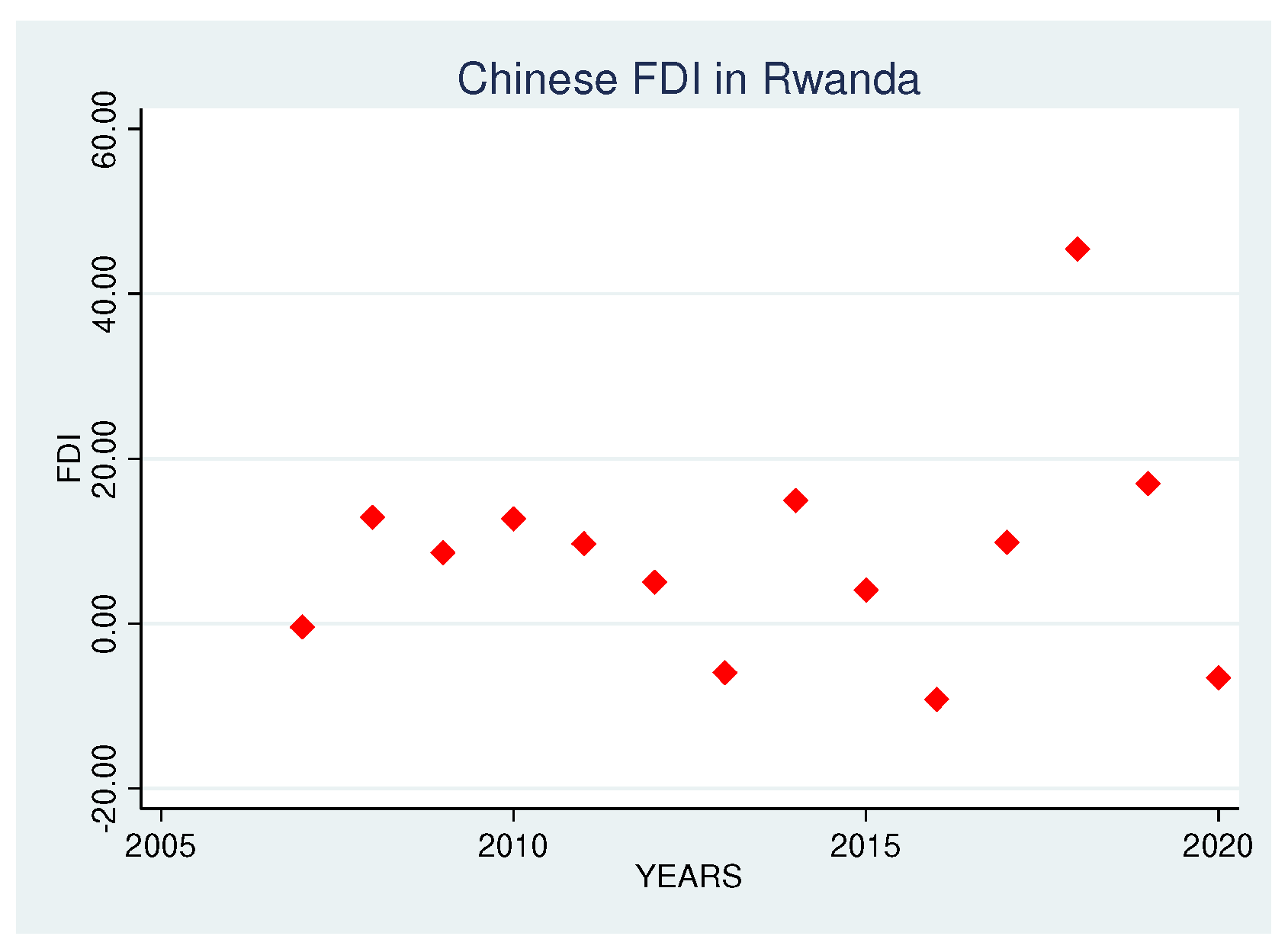

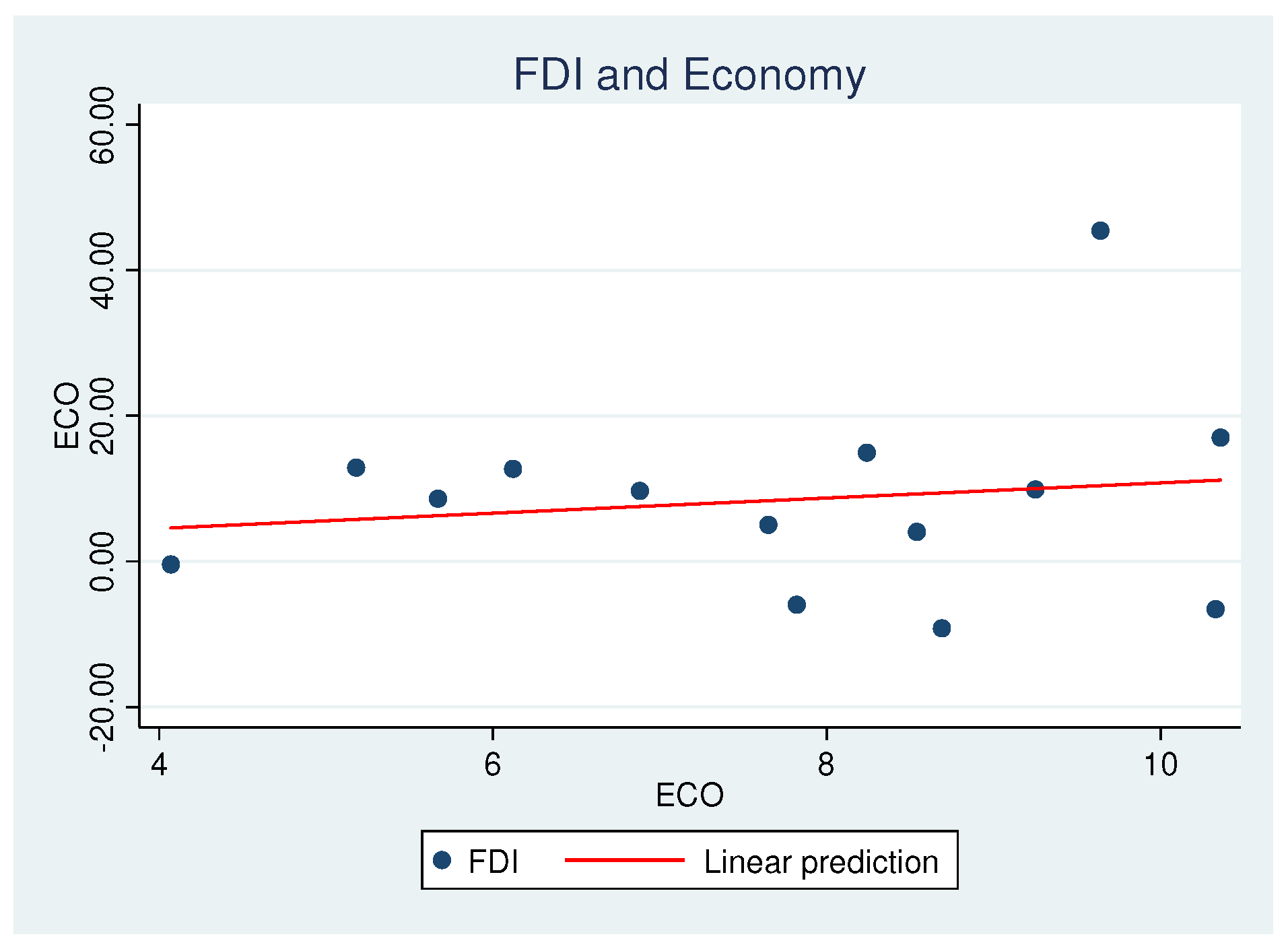

2.1.2. Foreign Direct Investment in Rwanda

The East African Community (EAC) is comprised of six member states: Burundi, Rwanda, Kenya, Tanzania, South Sudan, and Uganda, with its headquarters in Arusha, Tanzania. When yearly FDI flows as a proportion of GDP of EAC nations are compared over the last decade (2008-2018), Rwanda emerges as the leader from 2015 to 2018.

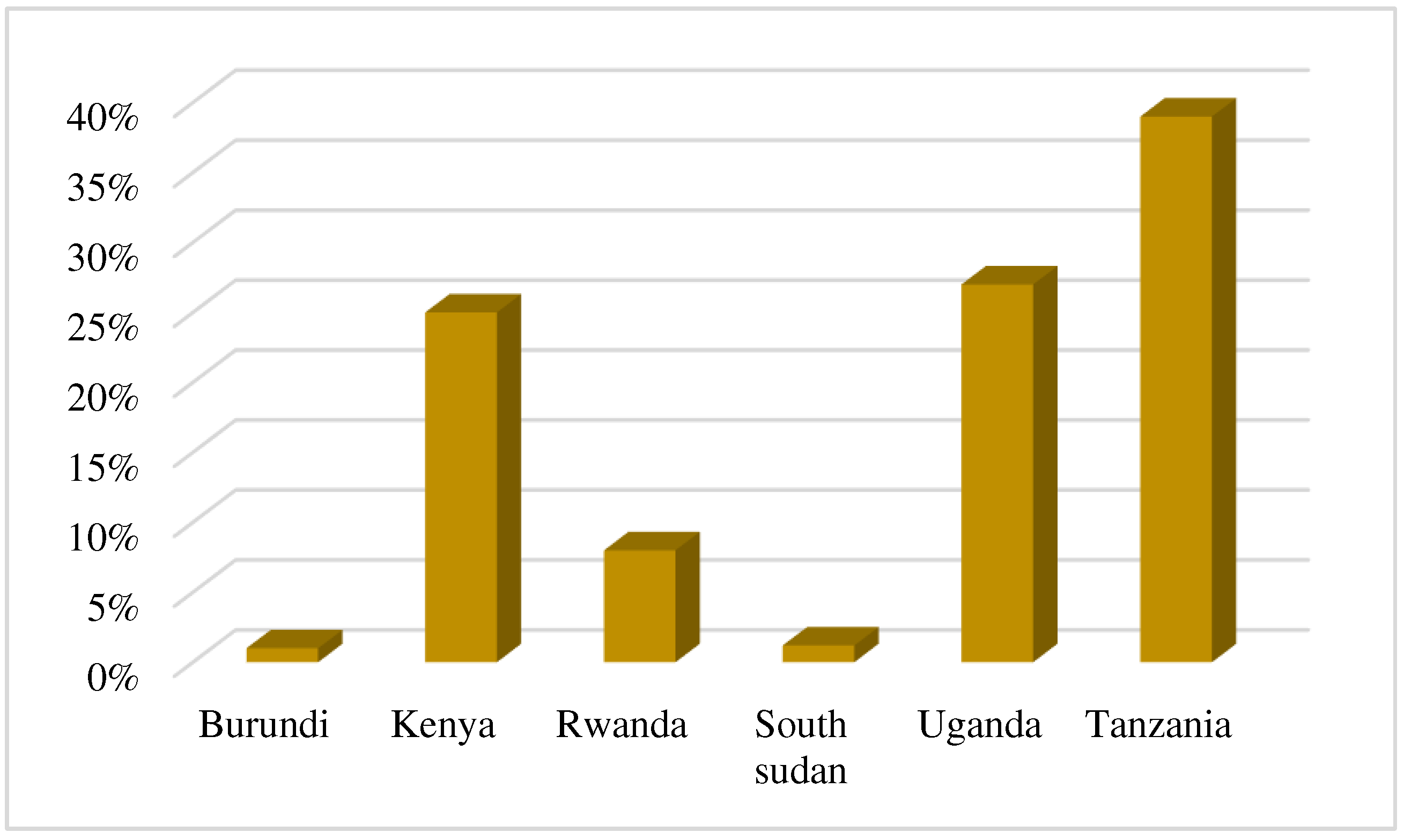

Figure 5.

EAC FDI inflows percent share. Source: east African community data.

Figure 5.

EAC FDI inflows percent share. Source: east African community data.

Previously, we saw a continuous increase in FDI inflow to Rwanda from 2002 to 2010, with a dip between 2011 and 2015, but a consistent increase in the years in between. However, Rwanda's share of total FDI inflow to the EAC remains low, at 8.05 percent, compared to 25 percent, 26.46 percent, and 39.69 percent for Kenya, Uganda, and Tanzania, respectively. receives 0.38 percent of FDI, whereas South Sudan receives 0.40 percent.

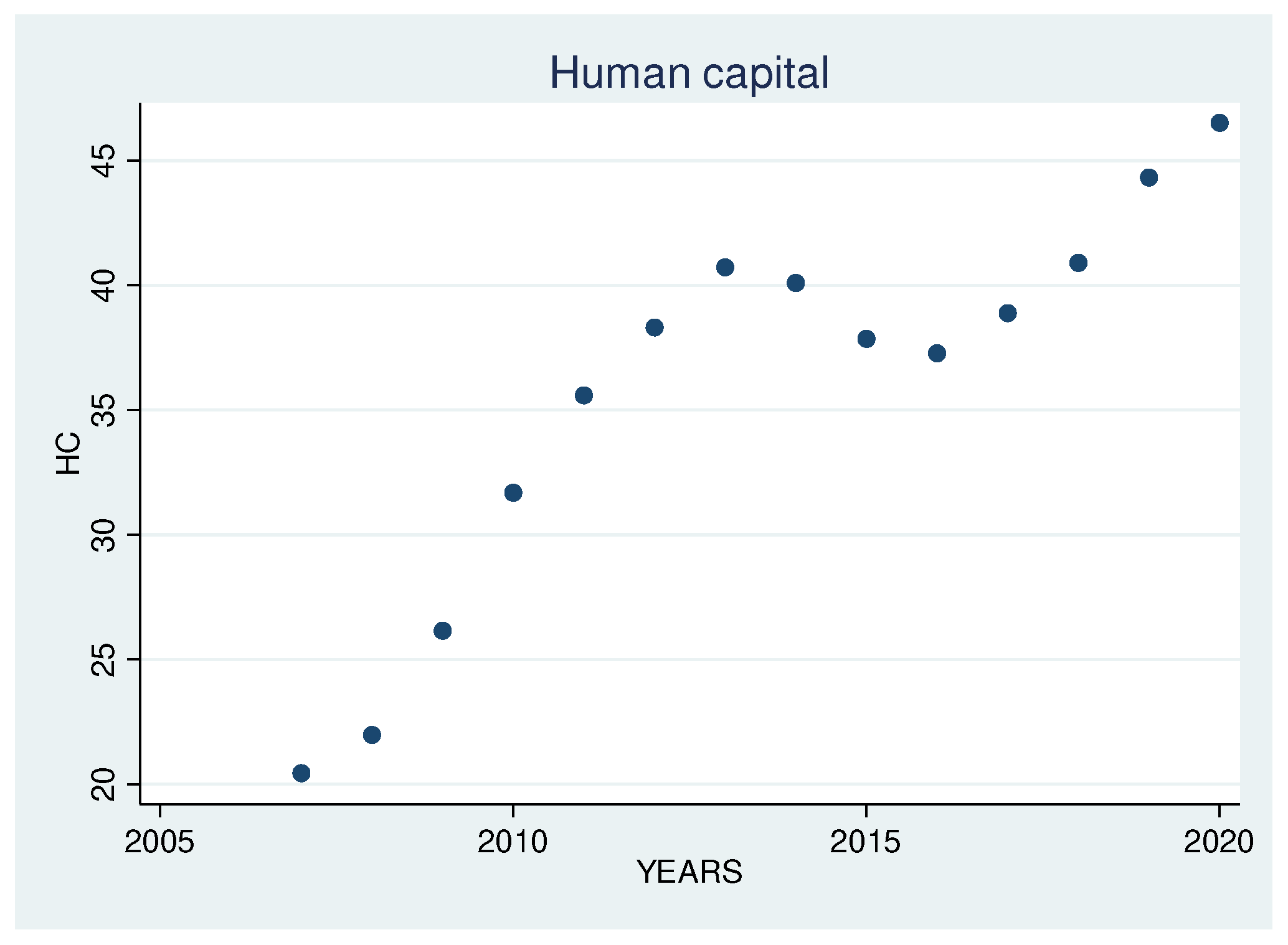

The increase of FDI (as well as foreign portfolio investment) in Rwanda has been phenomenal during the last two decades. FDI inflows climbed from USD 382 million in 2018 to USD 420 million in 2019, according to statistical records, and stocks were assessed at USD 2.6 billion at the end of 2019. In addition, according to a report published by the Rwanda Development Board(RDB) (Kaberuka 2012), the economy received 2.46 billion USD in investment, a record high, with FDI accounting for 37% of the total. Mining, construction and real estate, infrastructure, and information and communication technologies are the main sectors targeted by investors, according to a report by the Rwanda Development Board (RDB). The major investing countries, according to the RDB report, are India, the UAE, Portugal, the United Kingdom, and France.

Rwanda's government has made a concerted attempt to attract more FDI through a variety of policies aimed at improving the country's business climate. Various supportive mechanisms have been put in place, including a one-stop canter where new enterprises may be registered and any information on investment can be obtained, as well as exchange platforms between senior management and business leaders. In 2015, policymakers approved a new investment code aimed at providing incentives to investors, such as a preferential corporate tax rate of 0% for international companies with their headquarters or regional offices in Rwanda, a preferential corporate tax rate of 15% for any investor, a corporate income tax holiday of up to 7 years, capital gains exemption, customs tax exemption for products used in export processing zones, and so on. Various special economic zones, such as the Kigali free zone and the Kigali industrial park free-trade zone, have also been established by the government. This has helped Rwanda become one of the most popular investment locations in recent years, as indicated by a World Bank 2020 report that ranks Rwanda 38th out of 190 countries in terms of ease of doing business, making it the highest-ranked country on the African continent. Ameliorating Investment is one of the methods aimed at guiding Rwanda's economy toward its goal of being a middle-income country by 2035 and a high-income country by 2050.

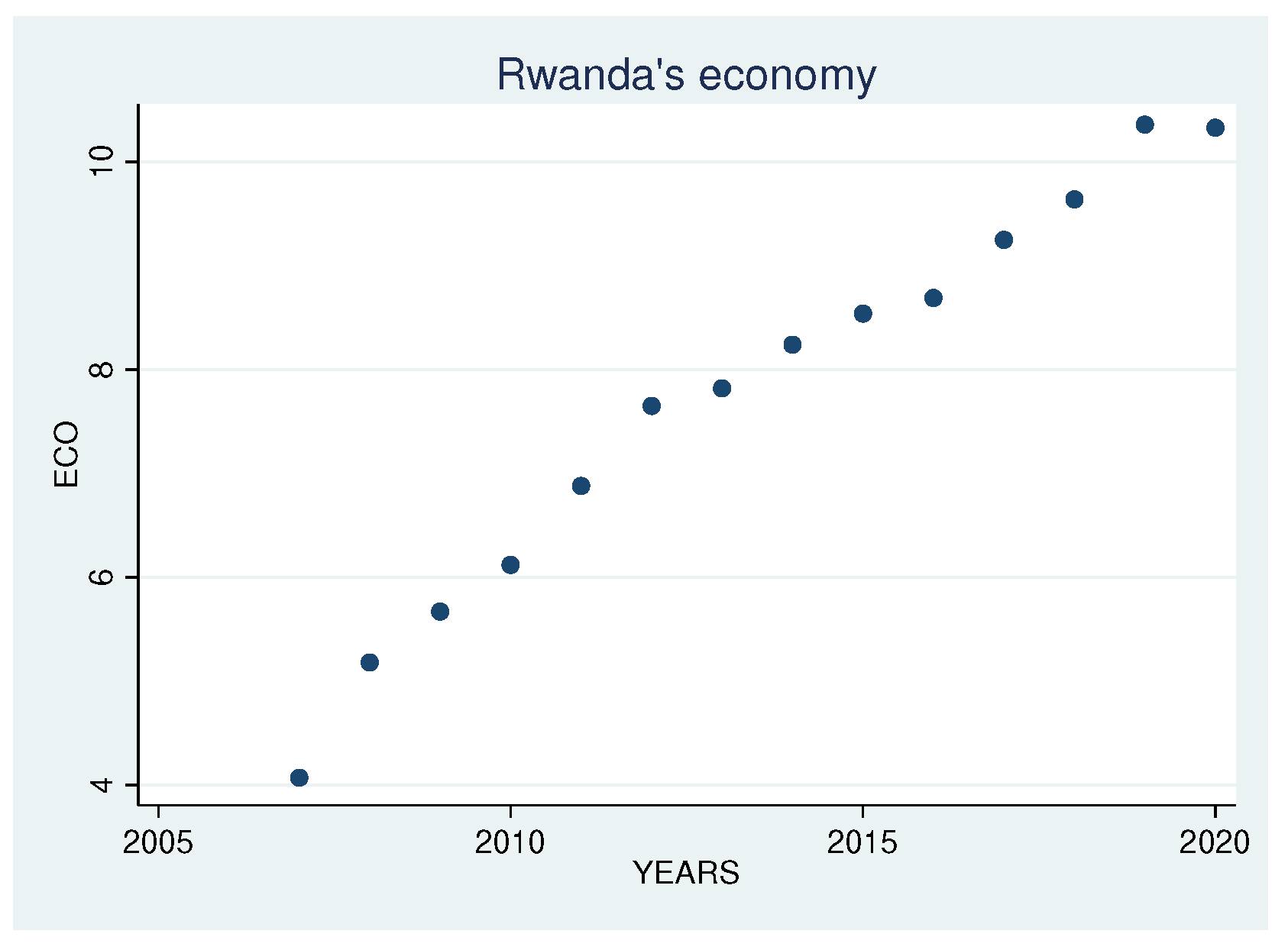

Rwanda had a spectacular economic performance during the last two decades, with an average GDP growth rate of 8%. It contributes to an annual rate of 8% since its productivity is higher than the economy's average. This trend continued in 2015, with a 6.9% increase in GDP. However, it has grown from a meager 5% of the total in 1990 to 20% now. The economy is dominated by services, which account for 0.33 percent of GDP. At the same time, the country is rapidly urbanizing, with 80 percent of the population still farming, and the average farm size has shrunk. The country is a small, poor, land-locked country with one of the highest population densities in the world. The economy has been continuously growing. Even as on-farm reduction Policy 2013-2018, published at the top of the commodities boom, envisioned expedited the Vision 2020 strategy, which planned for export growth of 15% each year, the government's strategy understands that off-farm jobs must be generated promptly. National exports are increasing at a rate of 28% per year. The updated national export plan for 2015-18 suggests a slightly less ambitious yearly rate of exports-to-GDP (14 percent), based on a sector-by-sector study of potential. The country must learn to sell more to the rest of the world. The national strategy also emphasizes the importance of foreign direct investment, which has been pushed up to 18 percent annually in the strategy for 2010-15. Poverty productivity and economic development must both be enhanced. Given the tiny domestic market of 12 million people and the low growth rate of 20% in Africa, the development of non-traditional exports has been crucial. International regional-integration agreements can be a powerful policy tool for attracting FDI (which necessitates relatively open regional agreements) as well as enhancing government cooperation to limit the negative effects of policy competition, such as downward pressures on labor and environmental standards, as well as costly beggar-thy-neighbor policy wars and incentive wars. Rwanda joined the East African Community (EAC) and the Common Market for Eastern and Southern Africa (COMESA) in order to put this plan.

2.1.3. economic growth theory

Most developing economies, including Rwanda, have experienced significant growth in recent decades, reflecting the Solow growth model. "The growth model relies on 8 the assumption of a constant saving rate, which attracts to understand the nature of the country's growth in terms of labor, capital, and technology," (Romer, 2010) said. However, the model explicitly explains to understand the welfare of people, in which the model explains the relationship between the aggregate variable and individual's satisfaction outcome." "Economic growth should be designed in such a way that capital stock, labor force, and advanced technology interact with the economy's growth, as well as how individuals are able to access goods and services within a nation," according to (Mankiw, 2015).